Fiber to the building

Neos Networks and Giganet partner to deliver FTTP to millions of UK homes

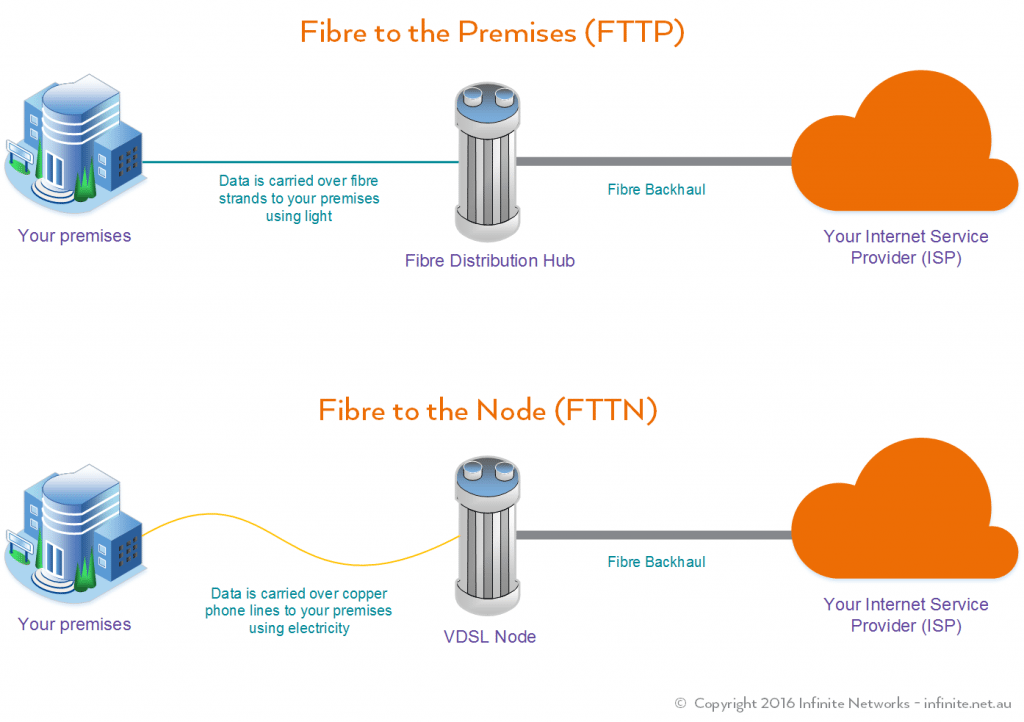

Dark Fiber network operator Neos Networks has announced a new partnership with Giganet, aiming to support the ISP’s burgeoning FTTP rollout with backhaul and data centre services.

Giganet currently offers customers access to its gigabit services through a variety of network providers, including Openreach and CityFibre, reaching millions of homes across the UK. In fact, earlier this year, Giganet announced that they had extended their partnership with CityFibre, thereby making their services available to customers across the entirety of CityFibre’s UK network.

However, last year Giganet announced they would also be rolling out their own FTTP network directly, investing £250 million to cover underserved areas of Hampshire, Dorset, Wiltshire, and West Sussex.

In total, the company hopes to reach 300,000 premises with full fibre over the next four years, with its core network and first four exchange rings set to be live by the end of 2022.

As this new network grows, it will need additional backhaul capacity and support – something that Neos, with its 550 unbundled exchange network, is well positioned to provide.

“Neos Networks rose to the challenge of providing us with resilient and high capacity backhaul circuits across a wide range of exchanges as well as our core data centres,” explained Matthew Skipsey, Chief Technology Officer at Giganet. “Using Neos Networks, we have been able to secure connectivity to our points of presence faster than expected, initially enabling each of our first four regional rings with resilient 100Gb/s backhaul. This means our south coast roll-out is progressing at pace.”

This network expansion project will see Neos support Giganet to deliver a more than tenfold capacity increase.

“Both Neos Networks and Giganet have adopted a collaborative approach to this relationship. This has resulted not only in solutions being delivered faster than ever, as the Giganet network grows, it also gives us the ability to transition connectivity between points of presence without any disruption,” explained Sarah Mills, Chief Revenue Officer at Neos Networks. “There is no doubt that by working in partnership with alternative network providers, like Giganet, UK residents will benefit from a better, faster, and more resilient connectivity.”

Matthew Skipsey added: “The ready availability of high-quality resilient connections to our points of presence, undoubtedly enabled us to quickly roll-out hyperfast, full broadband to a marketplace hungry for improved connectivity.”

References:

https://totaltele.com/giganet-teams-up-with-neos-networks-to-support-new-fibre-rollout/

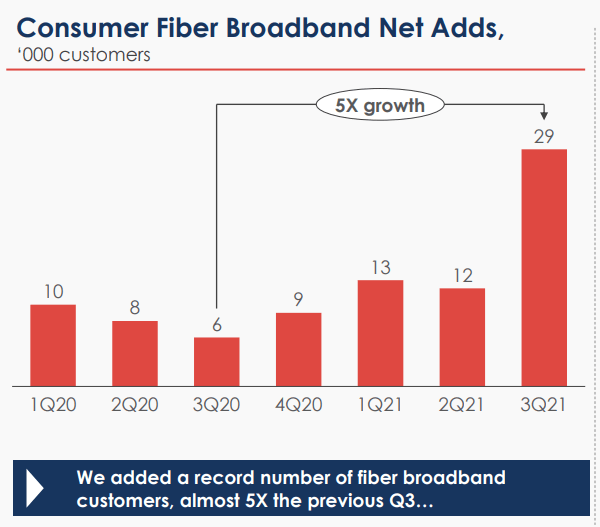

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

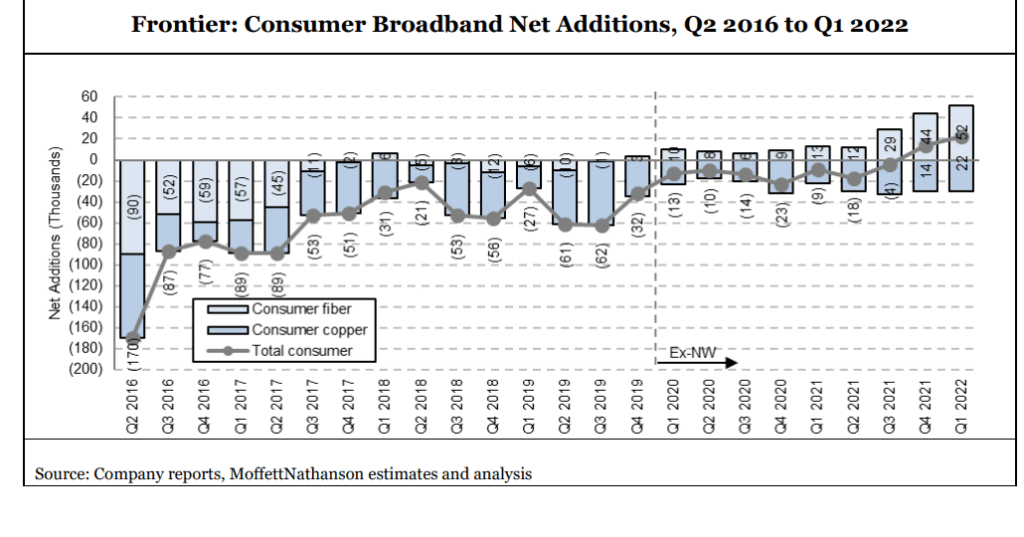

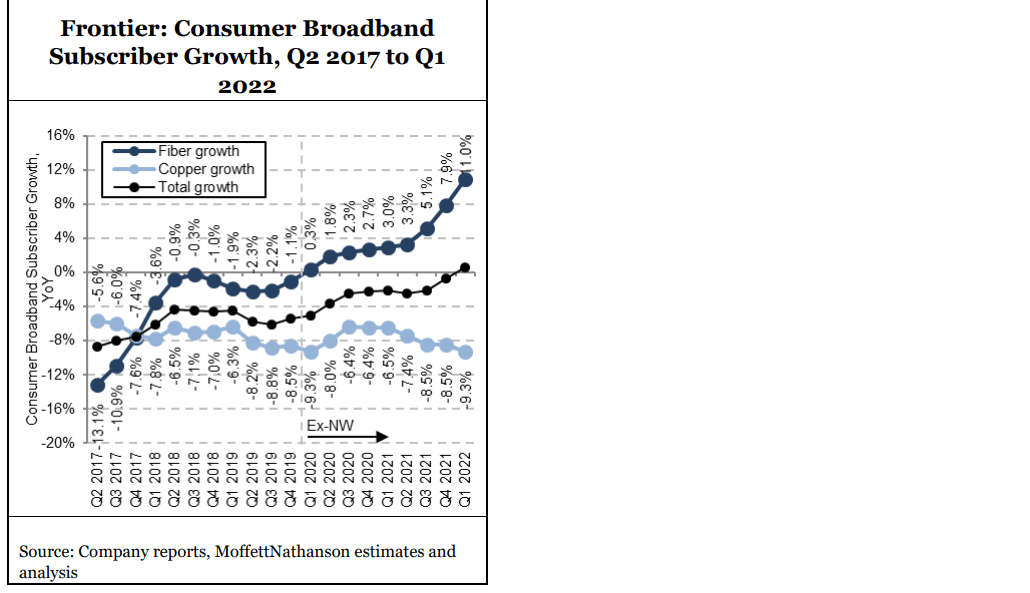

Frontier Communications added a record 54,000 fiber broadband customers in the first quarter of 2022, a 20% gain over the previous record set in Q4 2021 and somewhat higher than expectations coming in to the quarter. These fiber customer adds are coming from both new and existing fiber markets. Frontier’s data continues to track nicely: 22% penetration at the 12-month mark for its 2020 cohort and 18% for its larger 2021 cohort, and 44% at the 24-month mark for its (admittedly small and probably not broadly representative) 2020 cohort. Base market penetration was up 50 basis points in the quarter and 90 basis points over the past two quarters.

Frontier’s aggressive fiber network buildout and a record low churn of 1.19%, enabled the telco to offset copper losses and add 20,000 net broadband subs for Q1 2021. That’s a record nearly two times higher than that set in the prior quarter. Frontier ended the quarter with 1.38 million residential fiber broadband subs, up 11% YoY.

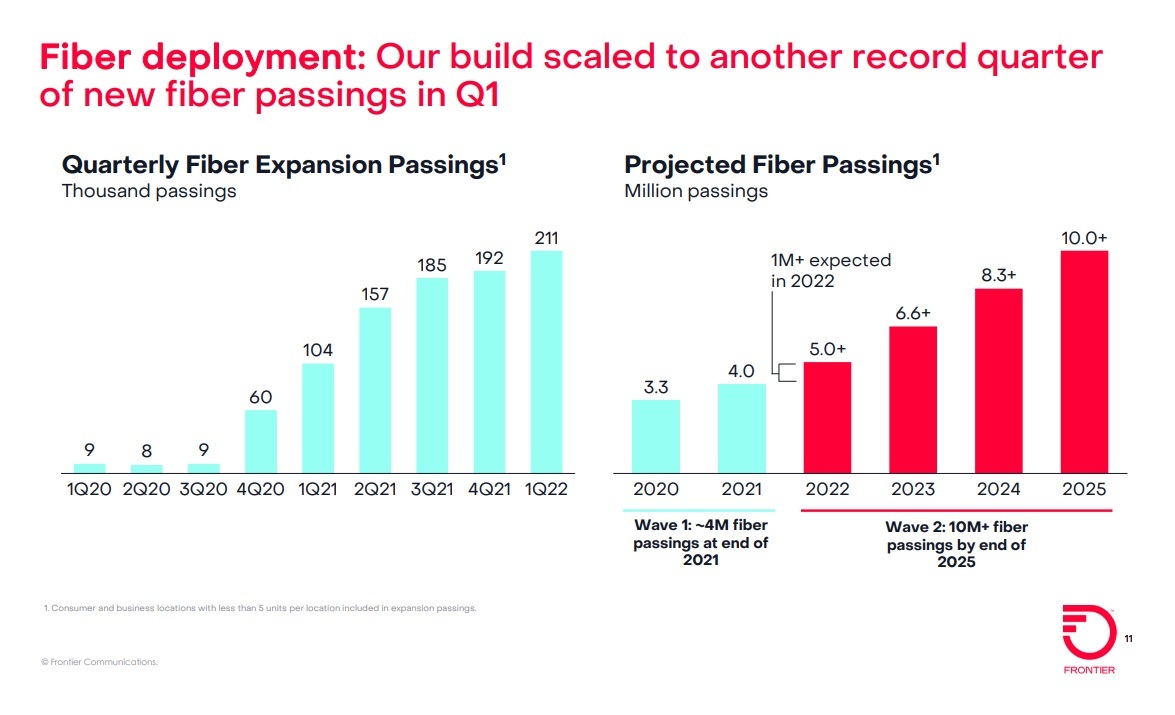

Frontier plans to expand its fiber-to-the-premises (FTTP) footprint to 10 million locations by 2025 – a figure that includes the company’s “Wave 1” and “Wave 2” builds. Frontier built fiber out to another 211,000 locations in the first quarter of 2022, and says it’s on track to add more than 1 million FTTP locations for all of 2022, and another 1.6 million in 2023.

Frontier passed another 211K locations with fiber in the quarter, up from the ~190K level of the prior two quarters, a nice accomplishment in light of the disruptions associated with Omicron early in the quarter (100K of the 211K passings were achieved in March alone). Management continues to expect to add at least 1M fiber locations in 2022, and it seems on track to meet or exceed that target.

“Positive net adds is the new normal,” Nick Jeffery, Frontier’s president and CEO, declared on Friday’s earnings call. The CEO continued:

“We gained momentum in business and wholesale, reaching a key inflection point in SMB and we made progress improving our employee engagement. And last week, we unveiled our new Frontier brand. A year ago, we said we will take a long and hard look at our brand and its future and after a thorough data-driven evaluation I am delighted with the results. Our new brand is modern, more relevant, more tech-oriented, and reflects our commitment to relentlessly being better in our business and for our customers. We also gained customers in our mature fiber market, what we refer to as our base fiber footprint. In our base fiber footprint, penetration increased 50 basis points sequentially to 42.4%. And our base fiber footprint serves as a target for where we expect to drive penetration in our expansion fiber footprint and we expect to steadily grow penetration to at least 45% over time.

In our expansion fiber footprint, we are also making excellent progress. At the 12-month mark, our 2021 build cohort reached penetration of 18%, consistent with our target range of 15% to 20%. And at the 24-month mark, our 2020 build cohort reached penetration of 44%, significantly outperforming our target range of 25% to 30%. As larger builds are pulled into our 2020 cohort throughout the year, we continue to expect penetration of 25% to 30% at the 24-month mark.”

Indeed, Frontier’s operations and service levels have improved dramatically over the past two years. Our colleague Nick Del Deo at MoffettNathanson wrote in a research note to clients:

By some measures, Frontier is now operating at as high a level as key competitor Charter in the California market. And this is having an effect on its customer perceptions and market traction. Its American Consumer Satisfaction Index scores are slowly moving up, while its net promoter score has surged, especially where it has rolled out FTTH. Churn has fallen, as have customer care call volumes.

Frontier’s post-emergence management team has taken a data-driven approach to running the business and making key decisions. Put simply, the choice to refresh the company’s font and logo rather than totally rebrand is further evidence that changes to the business are working.”

To reiterate, 1Q-2022 fiber penetration rates rose to 42.45% in the company’s base fiber footprint. Frontier expects to reach penetration rates of at least 45% over time.

In the expansion areas, Frontier realized a penetration rate of 12% at the 12-month mark in its 2021 fiber build cohort – within its target range of 15%-20%. In the 2020 FTTP build cohort, Frontier is seeing a 44% penetration rate at the 24-month mark, outperforming its target range of 25%-30%.

Source: Frontier Communications Q1 2022 earnings presentation

CEO Jeffery said Frontier’s fiber-powered services are taking share from incumbent cable operators, but didn’t elaborate on how much damage Frontier is inflicting. He also acknowledged that fixed wireless access (FWA) could present an attractive option in rural areas where fiber isn’t present. Jeffery also believes fiber represents “a fundamentally different proposition” over FWA, given current data usage trends. In March, the average Frontier fiber subscriber consumed about 900 gigabytes of data, up 30% from pre-pandemic levels, with a portion consistently consuming more than 1 terabyte per month.

Significantly, Frontier gained new customers in areas where fiber is being built out. “This is critical because we know our future is fiber and fiber customers are the ones that will drive our growth in the years to come,” said Jeffery, a former Vodafone UK exec who took the helm of Frontier in March 2021.

For the full 2022 year, Frontier is targeting adjusted EBIDTA of $2 billion to $2.15 billion, and capital expenditures in the range of $2.4 billion to $2.5 billion, the same as guidance issued last quarter. This implies $2,003M for the remainder of the year at the midpoint. Management continues to target FTTH builds in 2022 of at least 1,000K vs. 638K built in 2021.

References:

https://s1.q4cdn.com/144417568/files/doc_financials/2022/q1/Frontier-First-Quarter-2022-Results.pdf

MoffettNathanson: Robust broadband and FWA growth, but are we witnessing a fiber bubble?

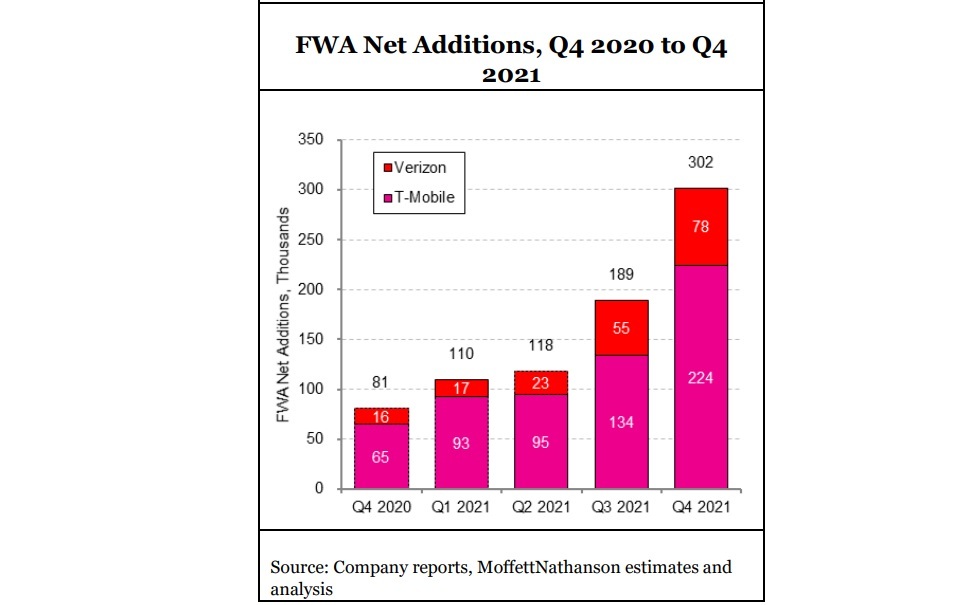

According to a new comprehensive, market research report from MoffettNathanson (written by our colleague Craig Moffett), Q4 2021 broadband growth, at +3.3%, “remains relatively robust,” and above pre-pandemic levels of about +2.8%.

Meanwhile, the U.S. fixed wireless access (FWA market) captured ~ 38% share of broadband industry net adds in the fourth quarter of 2021. Approximately half of Verizon’s FWA customers are coming from commercial accounts, T-Mobile has indicated that about half its FWA customers are coming from former cable Internet subscribers. FWA’s strong Q4 showing left cable’s flow share at just 66%, about the same as cable’s share of installed US broadband households. “In other words, Cable likely neither gained nor lost share during the quarter, and instead merely treaded water,” Moffett noted. FWA “has gone from low-level background noise to suddenly a major force, with Verizon and T-Mobile alone capturing more than 300K FWA subscribers in the fourth quarter,” Craig noted. However, he isn’t sure that wireless network operators will allocate enough total bandwidth capacity for FWA to fully scale.

In 2020, a year that witnessed a surge in broadband subs as millions worked and schooled from home, the growth rate spiked to 5%. Here’s a snapshot of the broadband subscriber metrics per sector for Q4 2021:

Table 1:

| Sector | Q4 2021 Gain/Loss | Q4 2020 Gain/Loss | Year-on-Year Growth % | Total |

| Cable | +464,000 | +899,000 | +3.8% | 79.43 million |

| Telco | -26,000 | +21,000 | -0.4% | 33.51 million |

| FWA* | +302,000 | +81,000 | +463.9% | 869,000 |

| Satellite | -35,000 | -35,000 | -6.6% | 1.66 million |

| Total Wireline | +437,000 | +920,000 | +2.8% | 112.95 million |

| Total Broadband | +704,000 | +966,000 | +3.3% | 115.48 million |

| * Verizon and T-Mobile only (Source: MoffettNathanson) |

||||

U.S. broadband ended 2021 with a penetration of 84% among all occupied households. According to US Census Bureau data, new household formation, a vital growth driver for broadband, added just 104,000 to the occupied housing stock in Q4 2021, versus +427,000 in the year-ago period. Moffett said the “inescapable conclusion” is that growth rates will continue to slow, and that over time virtually all growth will have to stem from new household formation.

Factoring in competition and other elements impacting the broadband market, MoffettNathanson also adjusted its subscriber forecasts for several cable operators and telcos out to 2026. Here’s how those adjustments, which do not include any potential incremental growth from participation in government subsidy programs, look like for 2022:

- Comcast: Adding 948,000 subs, versus prior forecast of +1.25 million

- Charter: Adding 958,000 subs, versus prior forecast of +1.22 million

- Cable One: Adding 39,000, versus prior forecast of +48,000

- Verizon: Adding 241,000, versus prior forecast of +302,000

- AT&T: Adding 136,000, versus prior forecast of +60,000

Are we witnessing a fiber bubble?

“The market’s embrace of long-dated fiber projects rests on four critical assumptions. First, that the cost-per-home to deploy fiber will remain low. Second, that fiber’s eventual penetration rates will be high. Third, that these penetration gains can be achieved even at relatively high ARPUs. And fourth, that the capital to fund these projects remains cheap and plentiful.

None of these assumptions are clear cut. For example, there is an obvious risk that all the jostling for fiber deployment labor and equipment will push labor and construction costs higher. More pointedly, we think there is a sorely underappreciated risk that the pool of attractive deployment geographies – sufficiently dense communities, preferably with aerial infrastructure – will be exhausted long before promised buildouts have been completed.

Revenue assumptions, too, demand scrutiny. Cable operators are increasingly relying on bundled discounts of broadband-plus-wireless to protect their market share. What if the strategy works, even a little bit? And curiously, the market’s infatuation with fiber overbuilds comes at a time when cable investors are growing increasingly cautious about the impact of fixed wireless. Won’t fixed wireless dent the prospects of new overbuilds just as much (or more) as those of the incumbents.”

Moffet estimates that about 30% of the U.S. population has been overbuilt by fiber over the past 20 years, and that the number is poised to rise as high as 60% over the next five years. But the big question is whether there’s enough labor and equipment to support this magnitude of expansion. “Our skepticism about the prospects for all of the fiber plans currently on the drawing board is not born of doubt that there is enough labor to build it all so much as it is that the cost of building will be driven higher by excess demand,” Moffett explained. “There are already widespread reports of labor shortages and attendant higher labor costs,” he added.

“The outlook for broadband growth for all the companies in our coverage, particularly the cable operators, is more uncertain than at any time in memory. IMarket share trends are also more uncertain that they have been in the past. Cable continues to take share from the telcos, but fixed wireless, as a new entrant, is now taking share from all players. Share shifts between the TelCos and cable operators are suppressed by low move rates, likely due in part to supply chain disruptions in the housing market. This is likely dampening cable growth rates. In at least some markets, returns will likely be well below the cost of capital,” Moffett forecasts.

References:

U.S. Broadband: Are We Witnessing a Fiber Bubble? MoffetNathanson research note (clients and accredited journalists)

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications says it’s on track with a plan to add 1 million fiber-to-the-premises (FTTP) locations in 2022. Under the plan, Frontier expects to expand its FTTP footprint to 10 million locations by 2025, up from about 4 million today. However, fiber-related revenue growth has yet to match up to recent fiber subscriber and NPS gains. Frontier reported Q4 2021 fiber revenues of $675 million, down from $684 million in the year-ago period.

“We’ve got good supply resilience. We’ve expanded the number of vendors in every category, and we’ve got good forward cost visibility as well,” Nick Jeffery, Frontier’s president and CEO, said Wednesday on the company’s 4th quarter 2021 earnings call.

But he acknowledged that Frontier, which has taken on a “fiber first” posture, was “lucky,” in that the company started to accelerate its fiber build ahead of many other telcos and cable operators.

“We’re in relatively good and insulated position because, frankly, we got there first and we signed up the terms before anyone else had a chance to do so,” Jeffery said.

Supply chain constraints didn’t slow Frontier’s fiber build in Q4 2021, as the company added a record 192,000 FTTP passings in the quarter, improving on the 185,000 new fiber passings built in Q3 2021. Last month Frontier announced that it added a record 45,000 fiber broadband subscribers in the fourth quarter of 2021, beating its prior record in Q3 2021 by more than 50%. That was also enough to overtake subscriber losses from Frontier’s legacy copper broadband business, as the company posted a Q4 net gain of 14,000 consumer broadband subs. Frontier ended 2021 with 1.33 million fiber broadband customers, up 8% year-over-year. About half of Frontier’s consumer broadband sub base is now served by fiber.

Frontier, which launched a symmetrical 2-Gig fiber service on February 22nd, is seeing solid penetration in its existing “base” FTTP markets and positive signs in newer fiber buildout areas. Penetration in Frontier’s relatively mature base-fiber footprint rose to nearly 42%, and the company expects that to eventually increase to 45%.

In its FTTP expansion effort, Frontier is seeing penetrations of 22% at the 12-month mark, expecting that to rise to 25% to 30% at 24 months. In later years, the company expects the percentage to jump to a terminal penetration of 45%.

“We’re now, I believe, gaining market share in all of our fiber markets against every single one of our competitors,” Jeffery said. “That is not a moment in time or an aberration. That’s the result of strong operational execution across many different dimensions, and I think we’ll see that carry forward into the future.”

Frontier said its fiber-related net promoter score (NPS) went positive for the first time in November 2021, while fiber churn dropped to 1.32% in Q4 2021, improved from 1.56% in the year-ago quarter.

Scott Beasley, Frontier’s CFO, said Frontier expects fiber revenues to reach positive territory as 2022 progresses, driven by the growth of its consumer fiber segment and a stabilization of the company’s business and wholesale units.

MoffetNathanson analyst Nick Del Dio had this to say in a research note to clients:

“Large scale network upgrade projects take years to complete. Achieving targeted levels of penetration once the network in a given geography has been upgraded takes years, too. By our estimates, it will be about a decade before Frontier’s potential will be fully realized.”

“Frontier’s operating metrics continue to move in the right direction. Total consumer broadband net adds were positive for the first time in many, many years; copper losses were stable, while the company gained fiber subscribers in both new and existing markets. Fiber gross adds and churn both improved in Q2. Frontier’s fiber NPS scores have improved dramatically over the past year, going from -24 in January 2021 to +9 in December 2021, a 33 point swing, with NPS scores associated with new customers better than those associated with old customers. The company expects continued strength in fiber and better churn in copper in coming periods. Consumer fiber broadband ARPU declined about $1 sequentially, which management attributed to promoting autopay adoption and giving gift cards for new customers.”

……………………………………………………………………………………………………………………………………………………………………………………………

Frontier’s plan to bring FTTP to 10 million locations by 2025 includes what the company calls Wave 1 and Wave 2 builds. Wave 3 includes another 5 million locations that might be built out using supplemental government funding and partnerships, or could be tied to potential divestments or system swaps. Frontier’s analysis of the Wave 3 section continues, and the company should have some specific guidance in the coming months, said John Stratton, Frontier’s executive chairman of the board.

Q4 2021 was the last quarter in which Frontier received subsidy revenues from the Connect America Fund (CAF) II program. Yet they hope President Biden’s infrastructure bill passes and directs revenues to telcos to help them build out their networks.

“It’s complicated,” Stratton said with respect to government stimulus funding, noting that Frontier expects to be an active participant in the new infrastructure bill. “The rules of engagement, both at the federal and state level, are still being worked… Our thought process is that this a 2023 and onward in terms of it becoming something that starts to scale.”

References:

Lumen Technologies Fiber Build Out Plans Questioned by Analysts

Lumen Technologies is one of a large and growing number of telecom companies counting on a broad expansion of its fiber network. The Fiber Broadband Association (FBA) recently reported that the fiber industry is entering its “largest investment cycle ever” thanks to the efforts of companies like AT&T, Verizon and Lumen.

Lumen hopes to build its fiber network to 12 million new locations over the coming years. But it won’t be easy, according to Lumen CEO Jeff Storey.

“Supply chains are stressed, and we continue working very closely with our diverse and valued suppliers to mitigate risk as we execute on our growth objectives,” Storey said this week during his company’s quarterly conference call, according to a Seeking Alpha transcript. Others have issued similar warnings.

“I don’t want to overstate the issue, but it’s something that we are really paying attention to and working with vendors. We are starting to see some companies hold off on taking new orders. And as we see that, then we are working to put in our mitigation plans to make sure it’s factored into our build plan. But it is an issue that I will highlight as a real one that we have to mitigate.”

Lumen Technologies reported fourth-quarter results and 2022 expectations that generally fell below the forecasts of some financial analysts.

“Lumen’s 2022 guidance will fuel concerns that the company will have no choice but to eventually let leverage rise to inappropriate levels, dial back on investment, cut the dividend, or choose some combination thereof,” wrote the financial analysts at MoffettNathanson. “In particular, 2022 EBITDA [earnings before interest, taxes, depreciation, and amortization] guidance was noticeably below expectations at a time when capex will be elevated.”

“Results at this stage don’t give investors confidence in the company’s ability to earn an adequate return,” wrote the financial analysts at New Street Research.

Lumen and other fiber providers like Frontier Communications and AT&T are moving forward with their fiber buildout plans. Some, like AT&T and Frontier, are reporting big gains in the number of their new fiber customers. But others, like Lumen, are not.

“The past few quarters have been relatively weak for broadband net additions for Lumen, even for its higher-speed fiber offering,” MoffettNathanson said of Lumen’s consumer broadband business. “This quarter’s broadband net adds were at the low end of what the company has reported over the past few years and were shy of consensus estimates.”

The financial analysts at Evercore wrote that Lumen’s business segment drives three-quarters of the company’s revenue, and that too remains stressed. “The jury remains very much out on the company’s prospects in this sector,” they wrote, noting that sales in the company’s business segment declined slightly in the fourth quarter when compared with the third quarter of last year.

New Street analysts say a key metric for Lumen will be the percentage of customers in a given area who opt to purchase its new fiber optic access. If Lumen gets 40% of potential customers to sign up, the company likely will generate profits. “At 30%, the company would likely destroy value,” they warned.

Lumen CEO Storey stated that the company has already managed to get an average of around 29% of customers in its new fiber markets to sign up for its service. And that, he said, is with relatively little marketing.

He expects that number to be above 40% in the months and years to come. “If you look at the quality of the product that we have, we have a very effective competitive product and even with the limited marketing, we are doubling our penetration rates in our traditional copper areas,” Storey said.

New findings from the financial analysts at Cowen are supportive of Lumen’s fiber optic build out plans. The Cowen analysts recently conducted a nationwide survey of more than 1,000 respondents and found that fiber-to-the-home (FTTH) “take rates” reached 56% among those surveyed.

“Take rate, or more specifically, market penetration, is a key driver of the FTTH business case,” they wrote. “We have previously noted that a penetration rate of 30-35% is the typical minimum break-even threshold when underwriting FTTH projects. When there is one broadband competitor, fiber penetration can approach high-50s and even 60% penetration levels in mature markets.”

Lumen CMO Shaun Andrews said: “One of the things that really differentiates us right now is our focus on fiber as part of the core infrastructure to an edge experience versus a distraction with 5G or content. And being able to look an enterprise in the eye and say ‘Not only do we have these capabilities, but we will build the fiber to you where you are.’ That resonates with customers, and I think that’s a differentiator.”

…………………………………………………………………………………………………………………………

Last month, Lumen reported that they secured a massive $1.2 billion contract with the U.S. Department of Agriculture (USDA), setting it up to give one of the biggest government agency networks a major makeover.

Under the contract, Lumen will “completely transform” the USDA’s network covering 9,500 locations across the country. It will provide a range of services, including SD-WAN, managed trusted internet protocol, zero-trust networking, edge computing, remote access, virtual private networking, cloud connectivity, unified communications and collaboration, contact center, voice-over-internet protocol, ethernet transport, optical wavelength, and equipment and engineering.

References:

https://www.lightreading.com/opticalip/analysts-fret-over-lumens-fiber-plans/d/d-id/775229?

https://www.fiercetelecom.com/telecom/lumen-reels-12b-contract-overhaul-usdas-legacy-network

Lumen’s big fiber roll-out push from 2.5M to 12M locations passed in the next few years

Lumen Technologies to empower customers to set up the wavelength subnetworks

CenturyLink rebrands as LUMEN for large enterprise customers; adds Quantum Fiber

Deutsche Telekom expands its fiber optic network in 78 cities and communities

Deutsche Telekom said it has expanded its fiber optic network for almost 7,000 companies in 78 cities and communities. Telekom is providing the companies with up to 1 Gbps speeds. The German based telco has connected industrial parks in the municipalities of Ahrensburg, Deggendorf, Lastrup, Lauf, Mainz and Mannheim among others.

Telekom is laying 560 km of fiber-optic networks to carry out the project and to connect the companies. It is using a trenching process to expand its fiber network.

“Telekom is Germany’s digital engine. That is why we are building our network seven days a week, 24 hours a day. In the city as well as in the countryside. We are massively accelerating our roll-out. In the coming year, we will go one better and invest around six billion euros in Germany. By 2030, every household and every company in Germany should have a fiber-optic connection. We will build a large part of this. But our competitors are also in demand,” said Srini Gopalan, Member of the Board of Management of Telekom Deutschland.

He also commented on the new German government’s plans in terms of digitization: “The new coalition is focusing on FTTH as THE technology of digitization. We explicitly welcome this. Faster processes – including for applications and approvals – will also help us to speed up fiber roll-out. We support the digital set off in our country. Digital networks should bring people together. Their roll-out should no longer be stuck in paper files.”

References:

https://www.telecompaper.com/news/deutsche-telekom-expands-network-for-7000-companies–1413189

https://www.telekom.com/en/media/media-information/archive/turbo-for-fiber-and-5g-643014

MetroNet’s FTTP buildout in Florida; Merger with Vexus Fiber

Continuing with the massive U.S. fiber to the premises (FTTP) movement, regional fiber carrier MetroNet (headquartered in Evansville, Indiana) said it will bring fiber-optic internet access directly to homes and businesses throughout the Deltona, FL and neighboring communities, including DeBary and Orange City.

Deltona marks the third community in Florida that will have access to MetroNet services through a fully funded $35 million investment in the community. The three-year construction project is set to begin in the summer of 2022, with the first customers able to receive service as early as the fall of 2022.

Once completed, Deltona will join the country’s internet elite as a Gigabit City. Only about 40 percent of households in the U.S. have access to symmetrical upload and download gigabit (1,000 mbps) speeds that only fiber optic networks can provide.

“MetroNet is thrilled for Deltona residents and businesses to have access to our future-proof services that will allow sparkling 4k video streaming, glitch-free gaming, crystal-clear virtual meetings, and internet experiences of the future that we can only begin to imagine,” said John Cinelli, MetroNet’s CEO. “MetroNet is proud to soon be able to add Deltona to our growing list of Gigabit Cities.”

MetroNet plans to hire local market management positions, sales and customer service professionals, and service technicians to support the Deltona area. Those interested in joining the MetroNet team can visit MetroNetInc.com/careers to search available positions and to submit applications.

………………………………………………………………………………………………………………………

Last week, Metronet announced it has merged with fellow independent fiber based network provider Vexus Fiber. The combined companies will continue to operate under their existing brands and with their existing executive roster. Financial terms of the deal were not disclosed.

Vexus, based in Lubbock, TX, deploys and operates FTTP networks in Texas and Louisiana, with plans for expansion in New Mexico. Markets currently serving those states include Lubbock, Amarillo, Wichita Falls, Abilene and surrounding areas of Texas, as well as Hammond, Covington and Mandeville in Louisiana. New FTTP networks in the Rio Grande Valley are in various stages of deployment (see “Vexus Fiber to Build FTTH Network in Rio Grande Valley Region of Texas”), Tyler, Nacogdoches, and San Angelo, TX; Lake Charles, LA; and Albuquerque and Santa Fe, NM. Investors in the company included Pamlico Capital and Oak Hill Capital.

Metronet is operating or building FTTP networks in more than 120 communities in Indiana, Illinois, Iowa, Kentucky, Michigan, Minnesota, Ohio, Florida, North Carolina, Virginia, Texas, Wisconsin, and Missouri. It had received cash from KKR last April (see.) “KKR will take stake in Metronet as part of new funding round”) Oak Hill Capital is also an investor. Both companies provide gigabit or faster broadband services to their residential and business customers.

“We are very excited to welcome Vexus Fiber and their partners to Metronet,” said Metronet CEO John Cinelli. “Vexus has rapid growth and a high-customer-service mindset, similar to Metronet, and joining them allows us to expand our service area to even more Americans.”

“At Wexus, our mission is to bring our high-quality service to as many homes and businesses as possible in the Southwest,” said Jim Gleeson, president and CEO of Wexus. “With this merger, we can reach even more people faster.”

About MetroNet:

MetroNet is the nation’s largest independently owned, 100 percent fiber optic company headquartered in Evansville, Indiana. The customer-focused company provides cutting-edge fiber optic communication services, including high-speed Fiber Internet and full-featured Fiber Phone with a wide variety of programming.

MetroNet started in 2005 with one fiber optic network in Greencastle, Indiana, and has since grown to serving and constructing networks in more than 150 communities across Indiana, Illinois, Iowa, Kentucky, Louisiana, Michigan, Minnesota, Ohio, Florida, North Carolina, Virginia, Texas, Wisconsin, Missouri, and New Mexico. MetroNet is committed to bringing state-of-the-art telecommunication services to communities — services that are comparable or superior to those offered in large metropolitan areas.

MetroNet has been recognized by PC Mag as one of the Top 10 Fastest ISPs in North Central United States in 2020 and Top 10 ISPs with Best Gaming Quality Index in 2021. Broadband Now has recognized MetroNet as the Top 3 Fastest Internet Providers and Fastest Fiber Providers in the Nation in 2020, and #1 Fastest Mid-Sized Internet Provider in two states in 2020. In 2020, MetroNet was awarded the Vectren Energy Safe Digging Partner Award from Vectren. For more information, visit www.MetroNetinc.com.

Media Contact: Katie Custer [email protected] 502.821.6784

References:

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

Ziply Fiber has launched two multi-gigabit, symmetrical broadband Internet tiers– at 2 Gbit/s and 5 Gbit/s – in 60 cities and towns in parts of Washington, Oregon, and Idaho. The two new fiber Internet service plans will initially be available to nearly 170,000 physical addresses in those three states. This comes after Ziply conducted a successful small market test in Kirkland, Washington. Customers in Montana will gain access to the multi-gig options later this quarter, with availability expected across most of the company’s existing footprint by the middle of the year.

Pricing for the 2-Gig tier runs $120 per month while the 5-Gig tier costs $300 per month. Both multi-gig tiers will require users to get a special router that includes WiFi 6 compatibility, a 10G WAN port and either a 2.5G LAN port for the 2-gig plan or a greater than 5G LAN port for the 5-gig option.

Ziply is the first among regional and national residential providers — those with a customer base of more than 1% of the US population — to deliver these speeds. By doing so, Ziply has become the fastest major internet provider not only in the Northwest, but across the entire U.S.

Ziply Fiber, formed in 2020 via the acquisition of Frontier Communications’ operations in Washington, Oregon, Idaho and Montana, expects to launch the new multi-Gig tiers to the rest of its footprint by the second quarter of 2022, and to make them available in every new fiber market launched thereafter, said Harold Zeitz, Ziply Fiber’s CEO.

Zeitz told Fierce Telecom that more than half of Ziply’s customers already take its 1 Gbps plan, “so we already have customers who seem to want faster speeds compared to others.” He added the December trial covered five markets across Washington and Oregon and included a sample group of “tens of customers” who proactively sought access to the faster speed tiers. “There were no problems whatsoever,” Zeitz said of the trial. “We were able to demonstrate measured speed and it gave us confidence to go ahead and launch it broadly.”

Ziply Fiber’s new uncapped and no-contract tiers follow the company’s ongoing deployment of a 10-Gig capable XGS-PON access network and underlying core network. Zeitz said the launches prove that consumers don’t have to live in a big city to get big speeds. “It’s a revitalization opportunity,” he said. “It demonstrates the future-proof element of the technology.”

The company also sells a 50Mbit/s tier for $20 per month and a 200Mbit/s service for $40 per month. Zeitz estimates that “well over half” of Ziply Fiber’s broadband customers choose the 1-Gig tier.

Zeitz said offering broadband without a cap or a contract puts welcome pressure on the company. “Yes, we think it’s a differentiator, but I also think it helps motivate us to make sure we’re delivering great service, he said.

Other Gig FTTP Internet competitors:

Ziply Fiber’s 5-Gig service appears to raise the bar on a fiber-to-the-premises (FTTP) residential broadband offering offered in multiple states. With the exception of Google Fiber and Xfinity, none of the top internet providers have dared to push the internet speed limit past a single gig. Google Fiber offers a 2-gigabit plan throughout most service areas while a limited few Xfinity customers can sign up for 3 gigs, but no 5 Gig yet. Among smaller regional players, EPB of Chattanooga, Tennessee, currently offers a residential 10-Gig service starting at $299 per month in select areas.North Dakota’s MLGC debuted a 5 Gbps service tier in 2020, while TDS rolled out a 2-gig offering and Dobson Fiber launched a 10 Gbps offering last year.

Here’s the current competitive status from nationwide FTTP providers:

- Comcast’s targeted residential FTTP service, Gigabit Pro, was recently upgraded to deliver speeds of 3 Gbit/s for $299.95 per month (with a two-year contract).

- Google Fiber has been expanding the availability of a fiber-based service that delivers 2 Gbit/s down by 1 Gbit/s up.

- AT&T has hinted that a multi-gigabit service is in the works, but has not announced pricing or launch timing.

Analysis:

The burning question this author has is how will Zipply customers use even a fraction of their allotted 2 Gig or 5 Gig upload and download speeds? I have over 10 connected WiFi devices in my home where my 100 Mb/sec download speed is sufficient.

“This is for people to develop new use cases, et cetera,” Zeitz concluded. “I think we don’t know all the things that people will do and so we’re an enabler.”

Also, the extra gear needed won’t be cheap. To open up any potential in-home bottlenecks, Ziply Fiber is recommending an Asus AX6000 Wi-Fi 6 router or a similar device. Customers will also need an SFP+ (enhanced small form-factor pluggable) with an RJ-45 connector that’s compatible with the router to deliver up to 5-Gig. Ziply Fiber is also selling such products online – an Asus router for $449.95, and the SFP+ for $42.99, or both bundled together for $492.94.

For the full 5-Gig, customers will need a wired Ethernet connection to the router. Depending on the performance capabilities the computer, a customer on Ziply Fiber’s multi-gig service will likely need an Ethernet adapter/dongle that supports 2.5-Gig or 5-Gig.

……………………………………………………………………………………………………………………………………………………..

24 January 2022 Update: AT&T can now equal 2 Gig and 5 Gig FTTP speeds

AT&T has boosted its existing fiber in parts of more than 70 metro areas around the U.S. to offer 2-Gig and 5-Gig symmetrical upload and download speeds.

“Where we’re launching 2-Gig and 5-Gig, we previously had 1-Gig speeds available,” said AT&T’s SVP of Broadband Product Development Cheryl Choy. The upgrades announced today affect about 5.2 million people out of about 16 million households that AT&T currently passes with gigabit speeds.

Asked why AT&T isn’t increasing speeds for all 16 million households that it passes with fiber, Choy said it’s because the company is “on a PON evolution.” It is in the process of moving from GPON to XGS PON via card upgrades and software improvements. These upgrades allow it to boost speeds above 1-Gig. Choy said that since 2019 all of AT&T’s newly laid fiber has been capable of multi-gig speeds.

Although the news of multi-gig fiber today did not require any new fiber to be laid, the company is also laying new fiber, and its goal is to cover 30 million customer locations with fiber by year-end 2025.

Pricing:

AT&T also announced it’s rolling out “straightforward pricing” across its AT&T Fiber portfolio. The 2-Gig fiber service costs $110 per month plus taxes with autopay; and the 5-Gig service costs $180 per month plus taxes with autopay.

Prices are a little higher for businesses at $225 per month for 2-Gig; and $395 per month for 5-Gig.

The company will not charge any equipment fees, nor will it require an annual contract or implement any data caps. The service also includes Wi-Fi.

Choy said, “We’ve amped up our Wi-Fi technology.” In late 2020 AT&T launched its Wi-Fi 6 enabled gateway, which provides more capacity for more connected devices. Those Wi-Fi devices will be able to take advantage of the new multi-gig speeds. AT&T’s Wi-Fi currently uses 2.4 Ghz and 5 Ghz spectrum.

According to a survey conducted in 2021 by Recon Analytics on behalf of AT&T, the average consumer has 13 connected devices in their home. But that’s expected to boom in the coming years, which will require more bandwidth.

Finally, as part of today’s news, AT&T said it has achieved up to 10-Gig speeds on fiber in its labs.

https://www.fiercetelecom.com/broadband/att-upgrades-its-fiber-network-offer-2-gig-5-gig-speeds

Ziply Fiber References:

https://www.fiercetelecom.com/broadband/ziply-debuts-2-gig-5-gig-internet-tiers-60-cities

https://www.broadbandworldnews.com/author.asp?section_id=733&doc_id=774718&

https://ziplyfiber.com/news/release/735

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

Frontier Communications added 45,000 fiber broadband subscribers in the fourth quarter, its best performance gains in five years, Frontier’s Scott Beasley said at the 2022 Citi Apps Economy Virtual Conference. The company hopes to expand by 1 million fiber locations this year as part of plan to reach 6 million by 2025.

Comment: That’s great progress for a company that filed for bankruptcy in April 2020 with a plan to cut more than $10 billion of its $17 billion debt load by handing ownership to bondholders. It was the biggest telecom filing since WorldCom in 2002, reflecting years of decline in its business of providing internet, TV and phone service in 29 states.

When combined with legacy DSL losses, Frontier added 9K net new broadband subscribers. Frontier is currently on an aggressive fiber build strategy that aims to add a total of 6 million locations by the end of 2025, resulting in 10 million locations reached in total. Beasley reports the company added 600K new fiber locations in 2021, with a goal of adding another million locations by the end of 2022. Beasley reports that the much discussed supply chain challenges facing the broadband industry have not had a significant impact at Frontier.

“We’ve managed through supply chain constraints and been able to perform very well in our fiber build and continue to ramp that up for 2022,” he said.

- This marked the first time in more than five years that the Company has posted total broadband customer growth in a quarter.

- The Company expects to continue growing the total broadband customer base as its fiber build accelerates.

Source: Frontier Communications Q3 2021 earnings presentation

Frontier has completed ‘wave 1’ of this fiber expansion. The company is now beginning ‘wave 2,’ which will take them through 2025, getting them to 6 million new locations. Build costs in wave 2 are a bit higher at $900 to $1,000 per fiber location.

Frontier envisions a ‘wave 3’ coming, but that’s outside the scope of their current committed-to fiber build. Beasley says Frontier will look to leverage government funding programs and other partnerships to help fund wave 3 fiber builds.

“There could be scenarios where we accelerate the build of some locations in wave 3 into wave 2,’ he said in discussing Frontier broadband growth. “That will likely be a destination of significant government funding as the roughly $45 billion of infrastructure bill funding that goes to broadband will be targeted at locations like wave 3.”

Asked about potential competition from fixed wireless access (FWA) and satellite broadband services, Beasley said neither presents a material threat just yet. While FWA may gain traction in some ultra-dense urban locations and satellite in extremely rural areas, Beasley asserted neither technology will be able to stand up against Frontier’s gigabit fiber offerings. The company already offers 1 Gbps and is planning the rollout of a 2 Gbps plan in the first half of this year as well as a 10 Gbps tier somewhere down the line. “It’s a technology we’re watching closely but don’t think it can compete with our core symmetrical speeds in fiber,” Beasley said of FWA.

“Against our core gigabit plus offers, 1 gig symmetrical speeds now, we’ve said we’re going to launch 2 gig in the first half of 2022, eventually we’ll move to 10 gig, the core network is 10 gig capable now, we’ve trialed 25 gig successfully in certain parts of the network,” he said. “I don’t think fixed wireless has the capacity to compete with that core infrastructure. It will be competitive in certain niches of the market…but I don’t think it can compete with our core symmetrical speeds and fiber,” he added.

References:

https://kvgo.com/citi-apps-economy-conference/frontier-jan-2022

With 45K New Fiber Subscribers, Frontier Sees First Positive Broadband Growth in 5 Years

Cable One joint venture to expand fiber based internet access via FTTP

Cable One [1.] (aka Sparklight) has announced a joint venture (JV) with three private equity firms, seeking to speed its expansion of fiber based Internet access to underserved markets.

The joint venture reflects a shared commitment from Cable One and the investors to provide fast and reliable connectivity via FTTP internet to underserved markets and will allow for more rapid expansion of fiber internet to homes and businesses in small cities and big towns. Cable One owns a majority of Clearwave Fiber and the private equity investors are committed to make substantial cash investments to support the acceleration of Clearwave Fiber’s expansion.

Clearwave Fiber will be led by Executive Chairman Michael Gottdenker and CEO David Armistead, both of whom were part of Hargray’s executive leadership team from 2007 until its 2021 sale to Cable One, providing continuity of proven leadership and a continued commitment to Cable One’s shared culture, purpose, and values.

“This strategic investment will help accelerate the deployment of fiber-based broadband services to a range of markets, including underserved areas of the country,” said Michael Gottdenker, Executive Chairman of Clearwave Fiber. “Our team is motivated by our shared core values of customer service and improving lives through connectivity and is excited to bring fast and reliable Clearwave Fiber broadband to homes and businesses across the country. We are thrilled to welcome GTCR, Stephens, and TPO to the Clearwave Fiber family and look forward to our continued partnership with Cable One.”

Julie Laulis, Cable One President and CEO said:

“We look forward to supporting and sharing in Clearwave Fiber’s growth over the coming years while remaining focused on our primary business, increasing penetration rates, integrating recently acquired companies and driving higher margins and greater free cash flow. We did not take lightly our choice of partners in this transaction and are excited to be working with like-minded individuals who share our core principles.”

“Five years ago, Gig speeds were virtually unheard of in non-urban markets across the U.S. We are proud to have been able to launch Gig service and level the playing field for rural markets where access to affordable, high-speed internet is just as vital as in more urban markets. A fast and reliable internet connection means rural residents can telecommute rather than having to move to find work. It means access to medical care via telehealth services; the ability to achieve a higher education online; and the cultivation of entrepreneurship and economic growth.”

…………………………………………………………………………………………………………….

KeyBanc Capital Markets analysts indicated in a research note the deal is a positive for Cable One, noting it will allow the company to effectively offload heavy investment in fiber to the JV while maintaining majority ownership. They drew a comparison to WideOpenWest’s recently announced fiber expansion plan, writing that “in contrast to CABO, WOW will fund the expansion on-balance sheet, while CABO’s transactions move off-balance sheet, neither being wrong, in our view.”

“We believe this shows there is a lot of FTTP build opportunity within and around CABO’s footprint (likely more than one Company can handle),” Keybanc’s team conclude

……………………………………………………………………………………………………………….

About Cable One:

Cable One, Inc. (NYSE:CABO) is a leading broadband communications provider committed to connecting customers and communities to what matters most. Through Sparklight® and the associated Cable One family of brands, the Company serves more than 1.1 million residential and business customers in 24 states. Over its fiber-optic infrastructure, the Cable One family of brands provide residential customers with a wide array of connectivity and entertainment services, including Gigabit speeds, advanced WiFi and video. For businesses ranging from small and mid-market up to enterprise, wholesale and carrier, the Company offers scalable, cost-effective solutions that enable businesses of all sizes to grow, compete and succeed.

References:

https://www.fiercetelecom.com/telecom/cable-one-targets-rapid-fiber-expansion-jv-deal