Private 5G

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT‘s latest research report indicates that global spending on private LTE and 5G network infrastructure for vertical industries – which includes RAN (Radio Access Network), mobile core and transport network equipment – will account for more than $6.4 Billion by the end of 2026.

Private cellular networks – also referred to as NPNs (Non-Public Networks) in 3GPP terminology – have rapidly gained popularity in recent years due to privacy, security, reliability and performance advantages over public mobile networks and competing wireless technologies as well as their potential to replace hardwired connections with non-obstructive wireless links.

With the 3GPP-led standardization [1.] of features such as MCX (Mission-Critical PTT, Video & Data), URLLC (Ultra-Reliable, Low-Latency Communications), TSC (Time-Sensitive Communications), SNPNs (Standalone NPNs), PNI-NPNs (Public Network-Integrated NPNs) and network slicing, private networks based on LTE and 5G technologies have gained recognition as an all-inclusive connectivity platform for critical communications, Industry 4.0 and enterprise transformation-related applications. Traditionally, these sectors have been dominated by LMR (Land Mobile Radio), Wi-Fi, industrial Ethernet, fiber and other disparate networks.

Note 1. 3GPP specs become standards when they are “rubber stamped” by ETSI. Some are also contributed to ITU-R WP5D by ATIS, e.g. 3GPP NR became the essence of ITU-R M.2150 recommendation for 5G RANs.

The liberalization of spectrum is another factor that is accelerating the adoption of private LTE and 5G networks. National regulators across the globe have released or are in the process of granting access to shared and local area licensed spectrum.

Examples include, but are not limited to, the three-tiered CBRS (Citizens Broadband Radio Service) spectrum sharing scheme in the United States, Canada’s planned NCL (Non-Competitive Local) licensing framework, United Kingdom’s shared and local access licensing model, Germany’s 3.7-3.8 GHz and 28 GHz licenses for 5G campus networks, France’s vertical spectrum and sub-letting arrangements, Netherlands’ geographically restricted mid-band spectrum assignments, Finland’s 2.3 GHz and 26 GHz licenses for local 4G/5G networks, Sweden’s 3.7 GHz and 26 GHz permits, Norway’s regulation of local networks in the 3.8-4.2 GHz band, Poland’s spectrum assignment for local government units and enterprises, Bahrain’s private 5G network licenses, Japan’s 4.6-4.9 GHz and 28 GHz local 5G network licenses, South Korea’s e-Um 5G allocations in the 4.7 GHz and 28 GHz bands, Taiwan’s provision of 4.8-4.9 GHz spectrum for private 5G networks, Hong Kong’s LWBS (Localized Wireless Broadband System) licenses, Australia’s apparatus licensing approach, India’s CNPN (Captive Non-Public Network) leasing framework and Brazil’s SLP (Private Limited Service) licenses. Even China – where mobile operators have been at the forefront of initial private 5G installations – has started allocating private 5G spectrum licenses directly to end user organizations.

Vast swaths of globally and regionally harmonized license-exempt spectrum are also available worldwide that can be used for the operation of unlicensed LTE and 5G NR-U equipment for private networks. In addition, dedicated national spectrum in sub-1 GHz and higher frequencies has been allocated for specific critical communications-related applications in many countries.

LTE and 5G-based private cellular networks come in many different shapes and sizes, including isolated end-to-end NPNs in industrial and enterprise settings, local RAN equipment for targeted cellular coverage, dedicated on-premise core network functions, virtual sliced private networks, secure MVNO (Mobile Virtual Network Operator) platforms for critical communications, and wide area networks for application scenarios such as PPDR (Public Protection & Disaster Relief) broadband, smart utility grids, railway communications and A2G (Air-to-Ground) connectivity.

However, it is important to note that equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players have slightly different perceptions as to what exactly constitutes a private cellular network. While there is near universal consensus that private LTE and 5G networks refer to purpose-built cellular communications systems intended for the exclusive use of vertical industries and enterprises, some industry participants extend this definition to also include other market segments – for example, 3GPP-based community and residential broadband networks deployed by non-traditional service providers. Another closely related segment is multi-operator or shared neutral host infrastructure, which may be employed to support NPN services in specific scenarios.

Key findings:

-

SNS Telecom & IT estimates that global spending on private LTE and 5G network infrastructure for vertical industries will grow at a CAGR of approximately 18% between 2023 and 2026, eventually accounting for more than $6.4 Billion by the end of 2026.

-

As much as 40% of these investments – nearly $2.8 Billion – will be directed towards the build-out of standalone private 5G networks that will become the predominant wireless communications medium to support the ongoing Industry 4.0 revolution for the digitization and automation of manufacturing and process industries.

-

This unprecedented level of growth in the coming years is likely to transform private LTE and 5G networks into an almost parallel equipment ecosystem to public mobile operator infrastructure in terms of market size by the late 2020s.

-

Existing private cellular network deployments range from localized wireless systems in industrial and enterprise settings to sub-1 GHz private wireless broadband networks for utilities, FRMCS-ready networks for train-to-ground communications, and hybrid government-commercial public safety broadband networks, as well as rapidly deployable LTE/5G systems that deliver temporary or on-demand cellular connectivity.

-

As for the practical and quantifiable benefits of private LTE and 5G networks, end user organizations across manufacturing, mining, oil and gas, ports and other vertical industries have credited private cellular network installations with productivity and efficiency gains in the range of 30 to 70%, cost savings of more than 20%, and an uplift of up to 80% in worker safety and accident reduction.

-

Spectrum liberalization initiatives – particularly shared and local spectrum licensing frameworks – are playing a pivotal role in accelerating the adoption of private LTE and 5G networks. Telecommunications regulators in multiple national markets – including the United States, Canada, United Kingdom, Germany, France, Netherlands, Finland, Sweden, Norway, Poland, Bahrain, Japan, South Korea, Taiwan, China, Hong Kong, Australia, India and Brazil – have released or are in the process of granting access to shared and local area licensed spectrum.

-

By capitalizing on their extensive licensed spectrum holdings, infrastructure assets and cellular networking expertise, national mobile operators have continued to retain a strong foothold in the private LTE and 5G network market. With an expanded focus on vertical B2B (Business-to-Business) opportunities in the 5G era, mobile operators are actively involved in diverse projects extending from localized 5G networks for secure and reliable wireless connectivity in industrial and enterprise environments to nationwide public safety broadband networks.

-

New classes of private network operators have also found success in the market. Notable examples include but are not limited to Celona, Betacom, Kajeet, BearCom, Ambra Solutions, iNET (Infrastructure Networks), Tampnet, Smart Mobile Labs, MUGLER, Telent, Logicalis, Citymesh, Netmore, RADTONICS, Combitech, Grape One (Japan), NS Solutions, OPTAGE, Wave-In Communication and the private 4G/5G business units of neutral host infrastructure providers such as Boingo Wireless, Crown Castle, Cellnex Telecom, BAI Communications/Boldyn Networks, Freshwave and Digita.

-

NTT, Kyndryl and other global system integrators have been quick to seize the private cellular opportunity with strategic technology alliances and early commercial wins. Meanwhile, hyperscalers – most notably AWS (Amazon Web Services), Google and Microsoft – are offering managed private 5G services by leveraging their cloud and edge platforms.

-

Although greater vendor diversity is beginning to be reflected in infrastructure sales, larger players are continuing to invest in strategic acquisitions as highlighted by HPE’s (Hewlett Packard Enterprise) recent acquisition of Italian mobile core technology provider Athonet.

-

The service provider segment is not immune to consolidation either. For example, in Australia, mobile operator Telstra – through its Telstra Purple division – has acquired industrial private wireless specialist Aqura Technologies. More recently, specialist fiber and network solutions provider Vocus has acquired Challenge Networks – another Australian pioneer in private LTE and 5G networks.

Summary of Private LTE/5G Engagements:

Some of the existing and planned private LTE and 5G engagements are in the following industry verticals:

-

Agriculture: Private cellular network installations in the agriculture industry range from custom-built 250 MHz LTE networks that provide wide area cellular coverage for agribusiness machinery, vehicles, sensors and field workers in Brazil to Japan’s standalone local 5G networks supporting 4K UHD (Ultra-High Definition) video transmission, mobile robotics, remote-controlled tractors and other advanced smart agriculture-related application capabilities.

-

Aviation: Private LTE and 5G networks have been deployed or are being trialed to support internal operations at some of the busiest international and domestic airports, including Hong Kong, Shanghai Pudong and Hongqiao, Tokyo Narita, London Heathrow, Paris-Charles de Gaulle, Orly and Le Bourget, Frankfurt, Cologne Bonn, Brussels, Amsterdam Schiphol, Vienna, Athens, Oslo, Helsinki, Bahrain, Chicago O’Hare, DFW (Dallas Fort Worth), Dallas Love Field and MSP (Minneapolis-St. Paul). Lufthansa Technik and JAL (Japan Airlines), among others, are leveraging private 5G connectivity for aircraft maintenance operations. In addition, national and cross-border A2G (Air-to-Ground) networks for inflight broadband and critical airborne communications are also beginning to gain significant traction.

-

Broadcasting: Within the broadcasting industry, FOX Sports, BBC (British Broadcasting Corporation), BT Group, RTÈ (Raidió Teilifís Éireann), Media Broadcast, WDR (Westdeutscher Rundfunk Köln), RTVE (Radiotelevisión Española), SVT (Sveriges Television), NRK (Norwegian Broadcasting Corporation), TV 2, TVBS, CMG (China Media Group) and several other media and broadcast players are utilizing private 5G networks – both temporary and fixed installations – to support live production and other use cases.

-

Construction: Mortenson, Ferrovial, BAM Nuttall (Royal BAM Group), Fira (Finland), Kumagai Gumi, Obayashi Corporation, Shimizu Corporation, Taisei Corporation, Takenaka Corporation, CSCEC (China State Construction Engineering Corporation), Hoban Construction, Hip Hing Engineering, Gammon Construction and Hyundai E&C (Engineering & Construction) are notable examples of companies that have employed the use of private LTE and 5G networks to enhance productivity and worker safety at construction sites.

-

Education: Higher education institutes are at the forefront of hosting on-premise 5G networks in campus environments. Tokyo Metropolitan University, McMaster University, Texas A&M University, Purdue University, Cal Poly (California Polytechnic State University), Northeastern University, UWM (University of Wisconsin-Milwaukee), RWTH Aachen University, TU Kaiserslautern (Technical University of Kaiserslautern) and CTU (Czech Technical University in Prague) are among the many universities that have deployed private 5G networks for experimental research or smart campus-related applications. Another prevalent theme in the education sector is the growing number of purpose-built LTE networks aimed at eliminating the digital divide for remote learning – particularly CBRS networks for school districts in the United States.

-

Forestry: There is considerable interest in private cellular networks to fulfill the communications needs of the forestry industry for both industrial and environmental purposes. For example, Swedish forestry company SCA (Svenska Cellulosa Aktiebolaget) is deploying local 5G networks to facilitate digitization and automation at its timber terminals and paper mills, while Tolko Industries and Resolute Forest Products are utilizing portable LTE systems to support their remote forestry operations in remote locations in Quebec and British Columbia, Canada, where cellular coverage has previously been scarce or non-existent.

-

Healthcare: Dedicated 5G campus networks have been installed or are being implemented to support smart healthcare applications in many hospitals, including Nagasaki University Hospital, West China Second University Hospital (Sichuan University), SMC (Samsung Medical Center), Ewha Womans University Mokdong Hospital, Bethlem Royal Hospital, Frankfurt University Hospital, Helios Park Hospital Leipzig, UKD (University Hospital of Düsseldorf), UKSH (University Hospital Schleswig-Holstein), UKB (University Hospital Bonn), Cleveland Clinic’s Mentor Hospital and Hospital das Clínicas (São Paulo). In addition, on-premise LTE networks are also operational at many hospitals and medical complexes across the globe.

-

Manufacturing: AGC, Airbus, Arçelik, ASN (Alcatel Submarine Networks), Atlas Copco, BASF, BMW, BorgWarner, British Sugar, Calpak, China Baowu Steel Group, COMAC (Commercial Aircraft Corporation of China), Del Conca, Delta Electronics, Dow, Ford, Foxconn, GM (General Motors), Gerdau, Glanbia, Haier, Holmen Iggesund, Inventec, John Deere, Logan Aluminum, Magna Steyr, Mercedes-Benz, Midea, Miele, Navantia, Renault, Ricoh, Saab, SANY Heavy Industry, Schneider Electric, SIBUR, Whirlpool, X Shore and Yara International and dozens of additional manufacturers – including LTE/5G equipment suppliers themselves – have already integrated private cellular connectivity into their production operations at their factories. Many others – including ArcelorMittal, Bayer, Bosch, Hyundai, KAI (Korea Aerospace Industries), Nestlé, Nissan, SEAT, Siemens, Stellantis, Toyota, Volkswagen and WEG – are treading cautiously in their planned transition from initial pilot installations to live 5G networks for Industry 4.0 applications.

-

Military: Led by the U.S. DOD’s (Department of Defense) “5G-to-Next G” initiative, several programs are underway to accelerate the adoption of private 5G networks at military bases and training facilities, defense-specific network slices and portable cellular systems for tactical communications. The U.S. military, Canadian Army, Bundeswehr (German Armed Forces), Italian Army, Norwegian Armed Forces, Finnish Defense Forces, Latvian Ministry of Defense, Qatar Armed Forces, ADF (Australian Defence Force), ROK (Republic of Korea) Armed Forces and Brazilian Army are among the many adopters of private cellular networks in the military sector.

-

Mining: Mining companies are increasingly deploying 3GPP-based private wireless networks at their surface and underground mining operations to support mine-wide communications between workers, real-time video monitoring, teleoperation of mining equipment, fleet management, self-driving trucks and other applications. Some noteworthy examples include Agnico Eagle, Albemarle, Anglo American, AngloGold Ashanti, Antofagasta Minerals, BHP, Boliden, Codelco, China Shenhua Energy, China National Coal, Eldorado Gold, Exxaro, Fortescue Metals, Freeport-McMoRan, Glencore, Gold Fields, Jiangxi Copper, Metalloinvest, Newcrest Mining, Newmont, Northern Star Resources, Nornickel (Norilsk Nickel), Nutrien, Polyus, Polymetal International, Rio Tinto, Roy Hill, Severstal, Shaanxi Coal, South32, Southern Copper (Grupo México), Teck Resources, Vale, Yankuang Energy and Zijin Mining.

-

Oil & Gas: Arrow Energy, BP, Centrica, Chevron, CNOOC (China National Offshore Oil Corporation), ConocoPhillips, Equinor, ExxonMobil, Gazprom Neft, Neste, PCK Raffinerie, Petrobras, PetroChina/CNPC (China National Petroleum Corporation), Phillips 66, PKN ORLEN, Repsol, Santos, Schlumberger, Shell, Sinopec (China Petroleum & Chemical Corporation), TotalEnergies and many others in the oil and gas industry are utilizing private cellular networks. Some companies are pursuing a multi-faceted approach to address their diverse connectivity requirements. For instance, Aramco (Saudi Arabian Oil Company) is adopting a 450 MHz LTE network for critical communications, LEO satellite-based NB-IoT coverage to enable connectivity for remote IoT assets, and private 5G networks for advanced Industry 4.0-related applications.

-

Ports & Maritime Transport: Many port and terminal operators are investing in private LTE and 5G networks to provide high-speed and low-latency wireless connectivity for applications such as AGVs (Automated Guided Vehicles), remote-controlled cranes, smart cargo handling and predictive maintenance. Prominent examples include but are not limited to APM Terminals (Maersk), CMPort (China Merchants Port Holdings), COSCO Shipping Ports, Hutchison Ports, PSA International, SSA Marine (Carrix) and Steveco. In the maritime transport segment, onboard private cellular networks – supported by satellite backhaul links – are widely being utilized to provide voice, data, messaging and IoT connectivity services for both passenger and cargo vessels while at sea.

-

Public Safety: A myriad of fully dedicated, hybrid government-commercial and secure MVNO/MOCN (Multi-Operator Core Network)-based public safety LTE networks are operational or in the process of being rolled out throughout the globe, ranging from national mission-critical broadband platforms such as FirstNet, South Korea’s Safe-Net, France’s RRF (Radio Network of the Future), Spain’s SIRDEE and Finland’s VIRVE 2.0 to the Royal Thai Police’s 800 MHz LTE network and Halton-Peel region PSBN (Public Safety Broadband Network) in Canada’s Ontario province. 5G NR-equipped PPDR (Public Protection & Disaster Relief) broadband systems are also starting to be adopted by first responder agencies. For example, Taiwan’s Hsinchu City Fire Department is using an emergency response vehicle – which features a satellite-backhauled private 5G network based on Open RAN standards – to establish high-bandwidth, low-latency emergency communications in disaster zones.

-

Railways: Although the GSM-R to FRMCS (Future Railway Mobile Communication System) transition is not expected until the late 2020s, a number of LTE and 5G-based networks for railway communications are being deployed, including Adif AV’s private 5G network for logistics terminals, SGP’s (Société du Grand Paris) private LTE network for the Grand Paris Express metro system, PTA’s (Public Transport Authority of Western Australia) radio systems replacement project, NCRTC’s (National Capital Regional Transport Corporation) private LTE network for the Delhi-Meerut RRTS (Regional Rapid Transit System) corridor, KRNA’s (Korea Rail Network Authority) LTE-R network and China State Railway Group’s 5G-R program. DB (Deutsche Bahn), SNCF (French National Railways), Network Rail and others are also progressing their 5G-based rail connectivity projects prior to operational deployment.

-

Utilities: Private cellular networks in the utilities industry range from wide area 3GPP networks – operating in 410 MHz, 450 MHz, 900 MHz and other sub-1 GHz spectrum bands – for smart grid communications to purpose-built LTE and 5G networks aimed at providing localized wireless connectivity in critical infrastructure facilities such as power plants, substations and offshore wind farms. Some examples of end user adopters include Ameren, CNNC (China National Nuclear Corporation), CPFL Energia, CSG (China Southern Power Grid), E.ON, Edesur Dominicana, EDF, Enel, ESB Networks, Bahrain EWA (Electricity and Water Authority), Evergy, Fortum, Hokkaido Electric Power, Iberdrola, Kansai Electric Power, KEPCO (Korea Electric Power Corporation), LCRA (Lower Colorado River Authority), Osaka Gas, PGE (Polish Energy Group), SDG&E (San Diego Gas & Electric), SGCC (State Grid Corporation of China), Southern Company, Tampa Electric (Emera) and Xcel Energy.

-

Other Sectors: Private LTE and 5G networks have also been deployed in other vertical sectors, extending from sports, arts and culture to retail, hospitality and public services. From a horizontal perspective, enterprise RAN systems for indoor coverage enhancement are relatively common and end-to-end private networks are also starting to be implemented in office buildings and campuses. BlackRock, Imagin’Office (Icade), Mitsui Fudosan, NAVER, Rudin Management Company and WISTA Management are among the companies that have deployed on-premise private 5G networks in office environments.

References:

https://www.snstelecom.com/private-lte

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

Telefónica – Nokia alliance for private mobile networks to accelerate digital transformation for enterprises in Latin America

Telefonica d’Espagne wants to pursue private mobile networks for businesses in the Latin American region and has enlisted Nokia assist. The Spain-based telecoms group and its network equipment vendor partner are talking up their ability to bring about digital transformation for enterprises in Latin America. Through their newly-announced partnership the pair intend to offer Nokia’s portfolio of industrial-grade private wireless network and digitalization platform solutions, concentrating primarily on what they describe as “the most promising industries in the region;” that’s ports, mining, energy and manufacturing.

Juan Vicente Martín, Director for B2B at Telefonica Movistar Empresas Hispanoamérica, said: “In this unprecedented alliance, the benefits of LTE & 5G private wireless will enable Industry 4.0 across industries. With our strategic partner Nokia, we provide the best connectivity, enable greater optimization of operations, achieving important productivity and efficiency rates and contributing to the digitalization of the industrial sectors throughout Latin America.”

Néstor González, Head of Customer Team for Telefonica Corporate, Nokia, said: “We are thrilled to partner with Telefonica, combining our leading Industrial-grade private wireless solutions with Telefónica Hispanoamérica’s growing B2B solutions and services footprint, to jointly reach a wide variety of enterprises and industries throughout the region. We are very excited to be at the forefront of digital transformation for enterprises in Latin America which have tremendous potential for productivity gains from Industry 4.0. We thank Telefónica Hispanoamérica for their confidence in Nokia and we are looking forward to jointly deploying many new networks”.

Nokia has deployed mission-critical networks to more than 2,600 leading enterprise customers in the transport, energy, large enterprise, manufacturing, webscale, and public sector segments around the globe. It has also extended its footprint to more than 595 private wireless customers worldwide across an array of industrial sectors and has been cited by numerous industry analysts as the leading provider of private wireless networking worldwide.

Nokia has statistics to help encourage enterprises to make the leap into private wireless. According to a late 2022 survey by Nokia and GlobalData there were 79 multinationals that have deployed Nokia industrial-grade private wireless solutions. Nearly 80 percent of survey respondents expected to achieve ROI within six months of deployment.

Currently, private mobile networks based on 4G are probably more of an opportunity for Telefonica than 5G-based rollouts, the latest generation of mobile technology being still very much in its infancy in the region.

Indeed, according to the latest iteration of Ericsson’s mobility report, published a week ago, 4G subscriptions accounted for a massive 74% of total mobile connections in the region at the end of last year, with 5G barely figuring at all. The Swedish vendor calculated that there were just 7 million 5G subscriptions in total in Latin America at year-end, while operators added over 60 million 4G subs over the 12 months.

However, Ericsson predicts that 5G uptake will become more meaningful from 2024 onwards and that by the end of 2028 the technology will account for 42% of all mobile subscriptions in the region.

Consumer uptake of 5G does not necessarily directly translate to the state of play in the private wireless market, of course. But it gives us an idea of the maturity of the overall market.

Last September, Ericsson declared a “digital revolution…underway in Latin America,” when it announced the deployment of what it said was the region’s first private 5G standalone network with a wholly on-premises network architecture, operating completely separately from the public mobile network. The customer was conglomerate Nestlé, in Brazil, and the pair worked with network operators Claro and Embratel.

While Nestlé might be the kind of customer telcos and vendors dream about, there is clearly an opportunity to serve smaller and less well-known outfits too, regardless of the state of deployment of 5G.

Nokia noted that it has more the 595 private wireless customers worldwide across various industrial sectors, although it did not mention how many of those are in Latin America. Quite likely a few at most, but as the technology develops in the region, so will the market opportunity.

References:

https://telecoms.com/522425/telefonica-and-nokia-partner-to-target-private-5g-market-in-latam/

HPE acquires private cellular network provider Athonet (Italy) to strengthen HPE Aruba’s networking portfolio

Hewlett Packard Enterprise (HPE) today announced the expansion of its connected edge-to-cloud offering with the acquisition of Athonet, a private cellular network technology provider that delivers mobile core networks to enterprises and communication service providers. Combined with the HPE telco and Aruba networking portfolios, Athonet will put HPE at the forefront of a growing market that is predicted by IDC to increase to more than $1.6 billion1 by 2026.

Based in Vicenza, Italy, Athonet has more than 15 years of experience delivering 4G and 5G mobile core solutions to customers and partners globally. Athonet is an award-winning technology pioneer with more than 450 successful customer deployments in various industries, including leading mobile operators, hospitals, airports, transportation ports, utilities, government and public safety organizations.

With enterprises facing complex connectivity challenges across large and remote sites, private 5G offers high levels of coverage, reliability and mobility across campus and industrial environments. It also augments the cost-effective, high-capacity connectivity provided by Wi-Fi. The incorporation of Athonet’s technology will allow HPE to deliver private networking capabilities directly to enterprises as part of HPE’s Aruba networking portfolio, while also enabling communications service providers (CSPs) to quickly deploy private 5G networks for their customers.

“Telco customers are looking for simpler ways to deploy private 5G networks to meet growing customer expectations at the connected edge,” said Tom Craig, global vice president and general manager, Communications Technology Group at HPE. “At the same time, enterprise customers are demanding a customized 5G experience with low-latency, segregated resources, extended range and security across campus and industrial environments that complement their existing wireless networks. With the acquisition of Athonet, HPE now has one of the most complete private 5G and Wi-Fi portfolios for CSP and enterprise customers – and we will offer it as a service through HPE GreenLake.”

HPE expands private 5G solutions for both telcos and the enterprise:

HPE will integrate Athonet’s technology into its existing CSP and Aruba networking enterprise offerings to create a private networking portfolio that accelerates digital transformation from edge-to-cloud. The networking portfolio will provide the following benefits:

- Enhanced private networks that combine the high capacity of Wi-Fi with the coverage and mobility of 5G

- Accelerated private 5G deployments that improve agility and innovation to help telco B2B teams and enterprise customers

- New enterprise revenue streams for telcos with differentiated services leveraging 5G and Wi-Fi

- Alignment of costs to revenues with consumption-based models for enterprises and telcos through HPE GreenLake, reducing the risk of entering new markets

- Management of operational complexity and cost efficiency with 5G orchestration and zero-touch automation to deliver new workloads from edge-to-cloud

With 5G investments running into the billions of dollars, CSPs are looking for simple ways to meet customer needs and drive new B2B revenue by deploying both edge compute and private 5G networks. The addition of Athonet’s software to HPE’s telco portfolio enhances one of the broadest communications portfolios in the market, which serves a base of more than 300 customers across 160 countries and connects more than one billion mobile devices worldwide. Building on its existing private 5G solutions, HPE’s enhanced offering for CSPs will support private 4G and 5G networks and include telco-grade orchestration and automation capabilities. These capabilities will help launch new B2B services that meet growing customer expectations for the connected edge.

“Athonet was founded to provide customers with private 4G and 5G solutions that deliver carrier-grade reliability and performance to suit their increasing and more challenging connectivity needs,” said Gianluca Verin, CEO and co-founder of Athonet. “We are excited to join HPE and combine our highly skilled teams as we expand our joint service provider offerings for the rapidly growing private 5G market and build on HPE’s strategy to be the leading edge-to-cloud solutions provider.”

Private 5G offers enterprises new capabilities that are ultra-secure, easy to deploy and manage, ready for highly specialized applications such as robotics and industrial IoT, data networks and pipelines, and security systems facilitation. The acquisition of Athonet strengthens Aruba’s connected edge portfolio, providing the unique and highly sought-after ability to deliver fully integrated Wi-Fi and private 5G networks. Integration with Aruba Central will enable network managers to administer Wi-Fi and private 5G through a single pane of glass and bring to bear the power of AI-powered insights, workflow automation, and robust security.

HPE GreenLake, HPE’s edge-to-cloud platform, will offer Athonet private 5G offerings, combining all costs for Wi-Fi and private 5G into one single monthly subscription with no capital expenditure. Flexible consumption options, including HPE’s networking as a service, mean private 5G networks can be deployed with reduced risk, little upfront investment and scaled according to demand.

HPE portfolio integration and availability:

HPE will integrate Athonet’s solutions with its existing telco software assets and plans to make them available to customers some time following the close of the transaction. HPE will also integrate the solutions with the Aruba networking portfolio in the near future. The transaction is expected to close at the beginning of the third quarter of HPE’s 2023 fiscal year, subject to regulatory approvals and other customary closing conditions.

About Hewlett Packard Enterprise:

Hewlett Packard Enterprise is the global edge-to-cloud company that helps organizations accelerate outcomes by unlocking value from all of their data, everywhere. Built on decades of reimagining the future and innovating to advance the way people live and work, HPE delivers unique, open and intelligent technology solutions as a service. With offerings spanning Cloud Services, Compute, High Performance Computing & AI, Intelligent Edge, Software, and Storage, HPE provides a consistent experience across all clouds and edges, helping customers develop new business models, engage in new ways, and increase operational performance. For more information, visit: www.hpe.com

Media Contacts for U.S. & Canada:

Ben Stricker [email protected]

…………………………………………………………………………………………………………………………………………

Analysis from Channel Futures:

While HPE already offers a 5G cloud-native software core, Athonet gives deeper in-house capabilities to more quickly and directly deploy private 5G networks.

“Given HPE’s Wi-Fi and security assets – like Aruba – I’d say this makes a clear play to simplify management for key enterprise digital assets. And this is the kind of issue that enterprises are often bringing up to us,” Omdia chief analyst of enterprise services Camille Mendler told Channel Futures. (Omdia and Channel Futures share a parent company, Informa.)

Patrick Filkins, IDC‘s research manager for IoT and telecom network infrastructure, said Athonet can give HPE customers an improved option for deploying a private 5G network together with Wi-Fi. Filkins said that integrated portfolio could well serve an enterprise that has already done the heavy legwork of building a Wi-Fi network.

“This is a very complicated task, and one the enterprise itself controls. They don’t want to start from scratch or be forced to have someone else tinkering in their systems, so this acquisition will hopefully provide some assurance to enterprise customers that the vendors will help ensure their customers can repurpose work they’ve already done to integrate a new network technology, and hopefully new use cases,” Filkins said.

Filkins said the acquisition will immediately improve the HPE 5G core and gradually work its way into Aruba portfolio improvements. For example, HPE will integrate Athonet into the Aruba Central network management platform.

“Specifically, we expect HPE/Aruba to over time release follow-on solutions which help enterprises manage the two technologies seamlessly. Enterprises are not interested in deploying both 5G and Wi-Fi networks in a silo. They want a combined solution that can help tackle the integration and management issues from a single pane. This means you’ll see HPE’s telco and Aruba teams working together more closely over time,” Filkins said.

Mendler said one might see a U.S. equivalent in Celona, despite Athonet’s age (founded 2004) compared to that of Celona (founded in 2019). Filkins added that although many vendors provide private and public LTE/5G cores in the U.S., most run their headquarters abroad. He pointed to Cisco and Microsoft-acquired Mavenir, Affirmed Networks and MetaSwitch as 5G core providers in the U.S.

“However, from a competitive standpoint, Athonet competes globally against Nokia, Ericsson, Mavenir, Microsoft Azure, Cisco, etc., among others,” Filkins told Channel Futures. He described Athonet as “no slouch” in the wireless market. He calls the company’s customer base deep, though consisting of smaller customers. HPE said in an announcement that Athonet has performed 450 customer deployments in various verticals. Athonet’s customers include SpaceX, which uses a private cellular network in Antarctica.

Filkins called the Athonet technology offerings “relatively advanced for 5G.” For example, the cloud-native 5G core meets almost all of 3GPP‘s listed functions. He also said Athonet’s core augments HPE’s 5G core offerings.

“The cloud-native part means it can be deployed fully on-site, fully in the cloud, or in a hybrid format. This should cover any scenario the customer wants. [Athonet] has specialized in selling mobile core software to enterprises, and smaller, regional operations for years. It knows the needs of the enterprise well,” Filkins said.

Athonet CEO and co-founder Gianluca Verin said his team looks forward to joining HPE. Moreover, he said he wants to enhance HPE’s goal of being “the leading edge-to-cloud solutions provider.” Verin worked in support and solution engineer positions at Ericsson for eight years before starting Athonet.

HPE’s GreenLake edge-to-cloud services platform will host the private 5G service. HPE executives have said GreenLake as-a-service consumption model will “simplify” enterprises’ entrance into 5G and lower risk.

“I think this is an important step HPE is taking. For the most part, private 5G and Wi-Fi networks have been offered as point solutions, but HPE/Aruba intend to do the ‘under-the-hood’ work to make them as integrated as possible, which is what enterprise customers want,” Filkins said.

In December, HPE said 80% of its top 100 customers have adopted the GreenLake platform. The vendor is also equipping Aruba partners to deliver its network-as-a-service offering.

When HPE unveiled a private 5G offering one year ago, an executive said HPE preferred to go to market though system integrators, telcos and service providers rather than straight to the enterprise. HPE’s telco business serves 300 customers across the world, the company said.

……………………………………………………………………………………………………………………………………………….

References:

AWS Integrated Private Wireless with Deutsche Telekom, KDDI, Orange, T-Mobile US, and Telefónica partners

In addition to Telco Network Builder, AWS today announced its Integrated Private Wireless that acts as an infrastructure bridge for network operators that want to offer a private network service tapping into AWS’ infrastructure to end users. This allows AWS to connect incoming customers interested in a private network platform with the #1 cloud service provider’s telecom partners.

“We are really just connecting the customer with the telco, then that relationship is between the two of them,” said Jan Hofmeyr,VP of Amazon EC2. Initial telecom partners include Deutsche Telekom, KDDI, Orange, T-Mobile US, and Telefónica. Enterprise customers shopping for private wireless services will be able to purchase an installation from one of those participating operators. “The relationship is directly between the customer and the telco,” Hofmeyr said, noting that the resulting private wireless network will then run atop the AWS cloud.

Hofmeyr said that AWS’ goal is to provide customers with an easy set of options that will allow them to deploy or operate a private network in a manner that meets their needs and abilities. “Right now this is their ask, [it’s] helping us make this onboarding easier, and that’s exactly what we’re focusing on. In the future, we’ll continue to listen to what their needs are and continue to support that,” Hofmeyr added.

This new private network offering is different from AWS’ Private 5G platform that it initially unveiled in late 2021, and has since updated. That platform integrates small cell radio units, AWS’ Outposts servers, a 5G core, and radio access network (RAN) software running on AWS-managed hardware. AWS also handles the spectrum management of this service.

AWS will act as the portal, but telcos will be the managed service providers for the network on behalf of those enterprises or smaller service providers, the company said. As with the telco network builder, AWS will provide a dashboard for monitoring performance and modifying it as needed.

“That’s one of the friction points we saw as we started looking at the private network space,” said Ishwar Parulkar, chief technologist for the telco industry at AWS, in an interview. “There are a lot of enterprise customers who really don’t care about all of this. They just want to be able to use the network and run some applications on top. That’s one of the primary values that we bring with this: lifting that undifferentiated work away from them and managing it in the cloud.”

For Amazon, telcos represent a prime business opportunity: as carriers build new networks with increasing reliance on software and cloud services, Amazon is positioning itself as a tech and cloud partner to help run those services better and more cheaply. It’s been interesting to watch how it has worked to build trust among a group of businesses that have at times been very wary of big tech and the threat of being reduced to “dumb pipes” as tech companies lean on their own architecture and technology advances to build faster and cheaper services that compete directly with what carriers have and plan to roll out. As one example, the company is clear to call these new products “offerings” and not services to make clear that it is not the managed service provider, the carriers’ role.

“We’ve been on this journey for a few years now in terms of really getting the cloud to run telco networks,” said Parulkar. “Our goal here is to make AWS the best place to host 5g networks for both public and private. And on that journey, we’ve been making steady progress.”

For carriers, they are now in a world where arguably communications is just another tech service, so many of them believe that running them with less costs and in more flexible ways will be the key to winning more business, introducing more services and getting better margins. Whether carriers want to wholesale work closer with Amazon, or with any of the cloud providers, for such services, will be the big question.

References:

https://www.sdxcentral.com/articles/news/aws-expands-5g-telecom-private-wireless-work/2023/02/

https://au.finance.yahoo.com/news/amazons-aws-cozies-carriers-launches-170645578.html

AWS Telco Network Builder: managed service to deploy, run, and scale telco networks on AWS

NTT, VMware & Intel collaborate to launch Edge-as-a-Service and Private 5G Managed Services

Japan’s NTT Ltd. today announced the launch of Edge-as-a-Service, a managed edge compute platform that gives enterprises the ability to deploy quickly, manage and monitor applications closer to the edge.

NTT and VMware, in collaboration with Intel (whose role was not specified), are partnering to innovate on edge-focused solutions and services. NTT uses VMware’s Edge Compute Stack to power its new Edge-as-a-Service offering. Additionally, VMware is adopting NTT’s Private 5G technologies as part of its edge solution. The companies will jointly market the offering through coordinated co-innovation, sales, and business development.

NTT’s Edge-as-a-Service offering is a globally available integrated solution that accelerates business process automation. It delivers near-zero latency for enterprise applications at the network edge, optimizing costs and boosting end-user experiences in a secure environment.

NTT’s Edge-as-a-Service offering, powered by VMware’s Edge Compute Stack, includes Private 5G connectivity and will be delivered by NTT across its global footprint running on Intel network and edge technology. This work is an extension of NTT’s current membership in VMware’s Cloud Partner Program. VMware and NTT will each market their corresponding new services to their respective customer bases.

“Combining Edge and Private 5G is a game changer for our customers and the entire industry, and we are making it available today,” said Shahid Ahmed, Group EVP, New Ventures and Innovation CEO, NTT.

“The combination of NTT and VMware’s Edge Compute Stack and Private 5G delivers a unique solution that will drive powerful outcomes for enterprises eager to optimize the performance and cost efficiencies of critical applications at the network edge. Minimum latency, maximum processing power, and global coverage are exactly what enterprises need to accelerate their unique digital transformation journeys.”

“The whole premise behind it is that many of our customers are looking for an end-to-end solution when they’re buying either edge or private 5G architectures as opposed to buying edge compute from XYZ and then a private 5G from somebody else and an IoT solution from someone else. So we thought we would do a full one-stop solution for our customers, particularly those that are in manufacturing and industrial sectors.” Ahmed also said that NTT will also be able to break these services apart for customers that just want one of the services, but they will all be managed by NTT.

Ahmed added: “We have a very simple pricing structure, which is predictable and tier-based so the customer doesn’t have to put up upfront capex, it’s all opex based. Obviously, some verticals like to purchase or acquire technology as a capex, so we can do that as well.”

As factories increase their reliance on robotics, vehicles become autonomous, and manufacturers move to omnichannel models, there is a greater need for distributed compute processing power and data storage with near-instantaneous response times. VMware’s secure application development, resource management automation, and real-time processing capabilities combined with NTT’s multi-cloud and edge platforms, creates a fully integrated Edge+Private 5G managed service. VMware and NTT’s innovative offering resides closer to where the data is generated or collected, enabling enterprises to access and react to information instantaneously.

This solution, which leverages seamless multi-cloud and multi-tenant connectivity, combined with NTT’s capabilities in network segmentation, and expertise with movement from private to public 5G, provides critical benefits for multiple industries, including manufacturing, retail, logistics, and entertainment.

“Enterprises are increasingly distributed — from the digital architecture they rely on to the human workforce that powers their business daily. This has spurred a sea change across every industry, altering where data is produced, delivered, and consumed,” said Sanjay Uppal, senior vice president and general manager, service provider, and edge business unit, VMware. “Bringing VMware’s Edge Compute Stack to NTT’s Edge-as-a-Service will enable our mutual customers to build, run, manage, connect and better protect edge-native applications at the Near and Far Edge while leveraging consistent infrastructure and operations with the power of edge computing.”

NTT’s Edge-as-a-Service platform was developed to help secure, optimize and simplify organizations’ digital transformation journeys. Edge-as-a-Service is part of NTT’s Managed Service portfolio, which includes Network-as-a-Service and Multi-Cloud-as-a-Service, all designed for enterprises to focus on their core business.

References:

https://www.sdxcentral.com/articles/news/ntt-vmware-intel-team-for-private-5g-edge-tasks/2022/08/

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

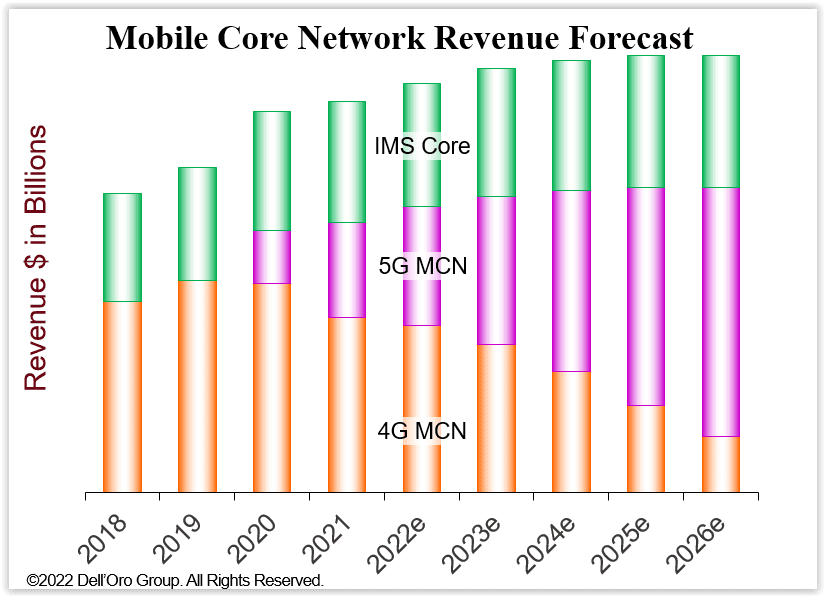

According to a newly published Dell’Oro Group report, Mobile Core Network (MCN) market growth will be decreasing. Worldwide MCN 5-year growth is now forecasted at a 2% compounded annual growth rate (CAGR), compared to our January 2022 forecast of 3% CAGR.

“The July 2022 forecast is more conservative than the January 2022 forecast due to industry headwinds, including supply chain challenges, higher inflation, an impending recession, Mobile Network Operators’ (MNO) challenges to increase revenues, and regional political conflicts,” said Dave Bolan, Research Director at Dell’Oro Group. “As a result, we reduced the 2022 to 2026 cumulative revenue forecast by 6 percent, decreasing revenues by $3.2 B. The July 2022 cumulative revenue forecast (2022-2026) is now $50.3 B resulting in a 2 percent CAGR.

“We are tracking the number of 5G Standalone (5G SA) MBB networks that have been launched commercially by MNOs. In the first half of 2022, only three new 5G SA networks were launched, KDDI in Japan, DISH Wireless in the US, and China Broadnet in China bringing the total deployed around the world to 27 MNO 5G SA MBB networks,” Bolan added.

Additional highlights from the MCN 5-Year July 2022 Forecast report:

- Year-over-year (Y/Y) MCN revenue growth rates for each year in the forecast are positive but will decrease each year; by 2026, Y/Y revenues will be essentially flat.

- MCN market CAGR forecast by industry segments we expect 5G MCN to be 21 percent, 4G MCN -20 percent, IMS Core 2 percent, and the User Plane Function (UPF) required for Multi-access Edge Computing (MEC) 67 percent.

- The North America and China regions are expected to have the lowest CAGRs, while Europe, Middle East, and Africa (EMEA), and Asia Pacific without China regions are expected to have the highest CAGRs.

Dell’Oro Group’s Mobile Core Network & Multi-Access Edge Computing 5-Year January Forecast Report offers a complete overview of the market for Wireless Packet Core including MEC for the User Plane Function, Policy, Subscriber Data Management, and IMS Core with historical data, where applicable, to the present. The report provides a comprehensive overview of market trends by network function implementation (Non-NFV and NFV), covering revenue, licenses, average selling price, and regional forecasts for various network functions. To learn more about this report, please contact us at [email protected]

………………………………………………………………………………………………………………………………………………

In a related Dell’Oro “Private Wireless Advanced Research Report,” Stefan Pongranz states that private wireless radio access network (RAN) shipments and revenues are coming in below expectations, resulting in another decreased forecast.

“We have not made any changes to the potential market calculations and still estimate private wireless is a massive opportunity,” said Stefan Pongratz, Vice President at Dell’Oro Group. “At the same time, the message we have communicated for some time still holds – we still envision the enterprise and industrial play is a long game. This taken together with the fact that the standalone LTE/5G market is developing at a slower pace than previously expected forms the basis for the near-term downgrade,” continued Pongratz.

Additional highlights from the Private Wireless Advanced Research Report:

- Private wireless projections have been revised downward to reflect weaker than expected progress with private wireless LTE and 5G small cells.

- Total private wireless RAN revenues, including macro and small cells, are projected to roughly double between 2022 and 2026.

- Standalone private LTE/5G is now expected to account for a low single-digit share of the total RAN market by 2026.

Dell’Oro Group’s Private Wireless Advanced Research Report with a 5-year forecast includes projections for Private Wireless RAN by RF Output Power, technology, spectrum, and region. To purchase this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, enterprise networks, data center infrastructure, and network security markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

Industry Headwinds to Decrease Mobile Core Network Market Growth, According to Dell’Oro Group

Private Wireless Forecast Adjusted Downward, According to Dell’Oro Group

Intel quietly acquires private 5G software provider Ananki

Intel has acquired private 5G network provider Ananki, several months after the startup spun out of the non-profit Open Networking Foundation (ONF) to commercialize open-source network technologies.

The acquisition was confirmed Monday on LinkedIn by Guru Parulkar, PhD, who was co-founder and CEO of Ananki and executive director of the Open Networking Foundation.

–>His ONF successor was not disclosed, despite my LI comment enquiring about it.

Intel declined to comment on the Ananki acquisition and instead only confirmed a development that Parulkar said was related: that the ONF’s development team has joined Intel’s Networking and Edge Group. Intel’s statement echoed a quote provided by top Intel networking executive and former Stanford Professor Nick McKeown, PhD in a press release published by the non-profit. McKeown was previously a part-time Intel Senior Fellow who joined the company after its 2019 acquisition of Barefoot Networks, which he co-founded.

“The addition of these developers will support [Intel’s Network and Edge Group’s] mission to drive the shift toward software-defined and fully programmable infrastructure – from the cloud, through the Internet and 5G networks, all the way out to the Intelligent Edge. Intel intends to continue to support and contribute to ONF’s open-source efforts,” an Intel spokesperson said. No financial terms were disclosed.

Ananki provides an open-source, software-defined service that aims to make private 5G networks “as easy to consume as Wi-Fi” for enterprises working on so-called Industry 4.0 projects. This involves connecting a variety of things, including cameras, sensors, robots, and autonomous vehicles, over high-speed networks in various settings, from factories to retail stores.

Ananki has a diverse range of products, including a SaaS-based 5G software stack, small cell radios, SIM cards, and a dashboard for monitoring and analyzing network activity. These are provided through a subscription-based service that charges organizations based on how much 5G coverage they need.

Source: Ananki

If Intel continues to offer Ananki’s products as a subscription service, it would fall in line with the semiconductor giant’s plan to buoy hardware sales with a significant increase in software revenue, as The Register has previously reported. Less than two weeks ago, The Register reported that Intel plans to offer the cloud optimization software of Granulate, another startup it plans to acquire, in Xeon CPU sales pitches.

The Ananki transaction is part of a broader effort by the Open Networking Foundation to support the increasing commercialization of its open-source, software-defined networking technologies, which it originally developed with the financial support of its more than 100 members. Those include Intel as well as several other prominent tech companies, such as AMD, AT&T, Broadcom, Cisco, Google, Microsoft, Nvidia, and T-Mobile.

The Open Networking Foundation said this new commercialization shift involves open-sourcing the entirety of its production-ready software, which includes private 5G, SD-RAN, SD-Fabric and SD-Core technologies that serve as the basis of Ananki’s products. The nonprofit has also made its software-defined broadband and P4 programmable network technologies available as open source.

“We have built platforms that naysayers said were doomed to fail, we’ve proven what’s possible, and today a number of our platforms have been deployed in production networks and others are now production ready and expected to be broadly adopted,” said Parulkar, who is now vice president of software within Intel’s Network and Edge Group.

The ONF seems to want to move development from internal open source teams to member organizations. As such, the nonprofit is transitioning a majority of its development team to Intel’s Network and Edge Group, which is also the new home of Ananki.

References:

https://www.theregister.com/2022/04/12/intel_ananki_5g/

https://www.intel.com/content/www/us/en/edge-computing/what-is-the-network-edge.html

https://networkbuilders.intel.com/events2022/big-5g-event

ONF Enters a New Era Focused on Growing Adoption and Community for its Leading Open Source Projects

IBD – Controversy over 5G FWA: T-Mobile and Verizon are in; AT&T is out

Two of the three biggest U.S. telecom network providers, T-Mobile US and Verizon Communications, contend that selling 5G FWA (Fixed Wireless Access) broadband services to homes will prove to be a good business. However, AT&T has no plans to make a big push into that space. We wrote about this topic earlier this year, but it remains a conundrum as debate continues.

Whether these 5G FWA services will heat up broadband competition with cable TV companies — who dominate in high-speed internet services — is a controversial issue for telecom stocks. The fixed 5G wireless services also may compete with local phone companies in areas still served by copper line-based “DSL” services.

“Verizon and T-Mobile think the service can be a growth driver and will have attractive economics,” UBS analyst John Hodulik told Investor’s Business Daily (IBD). “FWA (fixed wireless access) is likely to do better where there are limited options for broadband and among subscribers used to lower speeds, so that means legacy DSL subscribers and slower speed cable. The big question is whether FWA has staying power over the next 5 to 10 years given necessary speed increases.”

AT&T has downplayed the potential of fixed 5G wireless. AT&T contends that as data usage surges over time, FWA will become increasingly uneconomic vs. fiber-optic landline alternatives.

“I think it stems from a genuinely different view of the engineering and capacity constraints,” MoffettNathanson analyst Craig Moffett told IBD. “The divergence in views about fixed wireless access between AT&T and Verizon or T-Mobile speaks to a genuine controversy in the telecom industry.” Craig added that telecom companies are scrambling to make money from huge investments in 5G radio spectrum.

Moffett said: “The renewed appetite for FWA may be a sign of a dawning realization that the gee-whizzy use cases of 5G may never materialize. That could be forcing operators to revisit every possible source of incremental revenue in a bid to earn at least some return on their huge investments in 5G spectrum.”

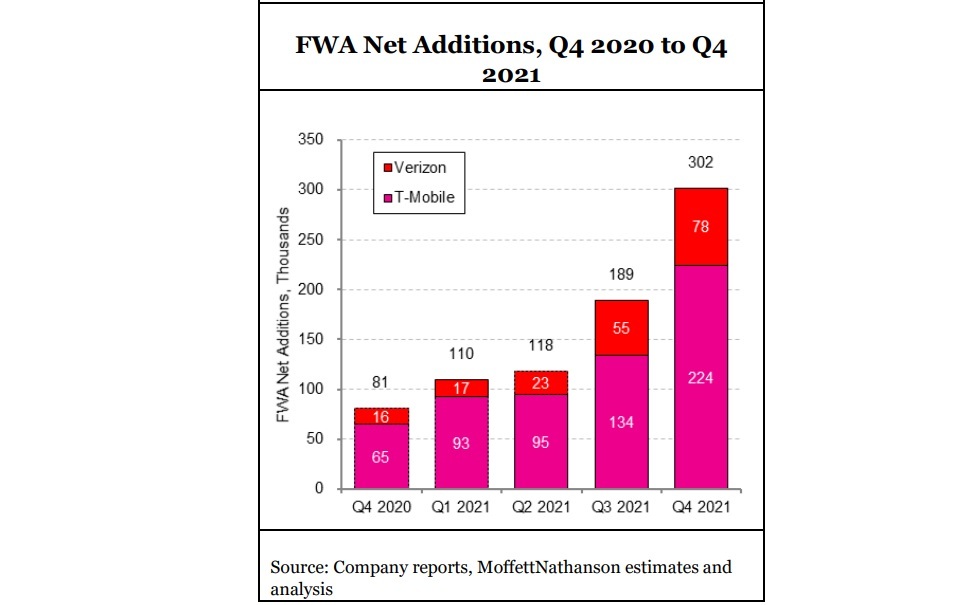

U.S. fixed wireless access (FWA market) captured ~ 38% share of broadband industry net adds in the fourth quarter of 2021. Approximately half of Verizon’s FWA customers are coming from commercial accounts, T-Mobile has indicated that about half its FWA customers are coming from former cable Internet subscribers. FWA’s strong Q4 showing left cable’s flow share at just 66%, about the same as cable’s share of installed US broadband households. “In other words, Cable likely neither gained nor lost share during the quarter, and instead merely treaded water,” Moffett noted. FWA “has gone from low-level background noise to suddenly a major force, with Verizon and T-Mobile alone capturing more than 300K FWA subscribers in the fourth quarter,” Craig noted. However, he isn’t sure that wireless network operators will allocate enough total bandwidth capacity for FWA to fully scale.

In a government auction that ended in early 2021, Verizon spent $45.45 billion on 5G “C-band” airwaves while T-Mobile invested $9.3 billion. AT&T spent $23.4 billion on the auction but it’s putting its 5G investments in areas other than FWA, like industrial 5G applications.

Meanwhile, there are cable TV firms looming with high-speed, coaxial cable. Comcast says it’s not worried about broadband competition from fixed 5G wireless services to homes.

“Time will tell, but it’s an inferior product,” Comcast Chief Executive Brian Roberts said at a recent Morgan Stanley conference. “And today, we can say we don’t feel much impact from (it). It’s lower speeds. And in the long run, I don’t know how viable the technology holds up.”

Cable companies offer hard landlines while 5G wireless services provide high-speed internet to homes mainly via indoor antennae that consumers self-install.

Eighty-seven percent of U.S. households subscribe to an internet service at home, compared with 83% in 2016, according to Leichtman Research Group. Also, cable TV firms comprise 70% of the broadband market, LRG said.

Verizon ended 2021 with 223,000 fixed wireless broadband customers, but most connected via 4G wireless networks. Meanwhile, T-Mobile had 646,000 fixed 5G broadband subscribers.

T-Mobile has told Wall Street analysts it expects to serve in a range of 7 million to 8 million fixed 5G wireless subscribers by 2025. Verizon has projected 3 million to 4 million subscribers over the same period.

T-Mobile charges $50 monthly for its home internet service. Verizon’s pricing starts at $50 or $70 monthly, depending on the data speeds provided. Verizon mobile phone customers with unlimited data plans get a discount.

T-Mobile’s 5G internet to home services provides data speeds up to 115 megabits per second, or Mbps. Verizon plans to provide speeds up to 300 Mbps.

T-Mobile uses mid-band radio spectrum to deliver fixed 5G broadband to homes. Verizon uses a mix of mid-band and high-band radio spectrum. In urban areas, Verizon may be able to deliver higher internet speeds with high-band spectrum, analysts say.

One area of debate remains whether fixed 5G broadband finds more success in suburban/urban markets or in rural areas.

“FWA is definitely a threat to cable companies,” Peter Rysavy, head of Rysavy Research, said in an email. “Particularly with (high frequency) mmWave, 5G can compete directly with cable. Mid-band spectrum is also effective but is best suited for lower density population areas. In these deployments, even T-Mobile limits the number of fixed wireless subscribers it can support in any geographical area.”

At UBS, Hodulik says that even if positioned as a low-end service, fixed 5G broadband still has a potential market of 20 million to 30 million homes.

AT&T, whose forerunner was regional Bell SBC Communications, has a sizable wireline local service area in 22 states. So it will face competition from fixed 5G broadband, just like cable TV firms. Verizon is based mainly in the northeast. T-Mobile doesn’t sell local phone services.

“AT&T has a huge wireline asset base that is only 25% upgraded to fiber,” Oppenheimer analyst Tim Horan told IBD. “So they are very exposed to competition from fixed wireless.”

At an analyst day on March 11, AT&T said it plans to upgrade 50% of its local markets, about 30 million customer locations, to high-speed fiber-optic broadband service by year-end 2025.

Meanwhile, AT&T CEO John Stankey commented on the controversy over FWA. AT&T sees FWA as playing a limited role for mobile small business and enterprise applications as well as in rural areas.

“We’re not opposed to fixed wireless, and I’m sure there’s going to be segments of the market where it’s going to be acceptable and folks are going to find it to be adequate right now,” Stankey said.

Fixed 5G broadband services to homes isn’t the only potential moneymaker for telecom network providers. Verizon, AT&T and T-Mobile aim to upgrade mobile phone users to unlimited data plans. They also plan to sell “private 5G” connections to businesses, Internet of Things (IoT) and 5G connections to industrial devices.

References:

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

MoffettNathanson: Robust broadband and FWA growth, but are we witnessing a fiber bubble?

Nokia to provide 5G SA core network for Volkswagen (private) and KDDI (public)

Nokia has deployed a 5G standalone (SA) core network at Volkswagen’s plant in Wolfsburg, Germany. The 5G private campus network covers the production development center and pilot hall at the plant. This network uses the Nokia Digital Automation Cloud (DAC) system to provide reliable and secure connectivity. Nokia’s DAC provides high-bandwidth and low-latency connectivity for sensors, machines, vehicles and other equipment.

Volkswagen will use the network to improve efficiency in production. The company is initially testing the wireless upload of data to manufactured vehicles and intelligent networking of robots and wireless assembly tools.

“By deploying private wireless to explore and develop its potential in manufacturing, Volkswagen underscores its leading position in leveraging digitalization to enhance efficiency and productivity,” commented Chris Johnson, head of Global Enterprise business for Nokia. “We are delighted to support this effort with the Nokia Digital Automation Cloud and our extensive experience in private wireless networks.”

The pilot network will allow Volkswagen to test whether 5G technology helps the company meet the demanding requirements of vehicle production, as well as increases efficiency and flexibility in series production of the future.

“Predictable wireless performance and the real-time capabilities of 5G have great potential for smart factories in the not-so-distant future. With this pilot deployment, we are exploring the possibilities 5G has to offer and are building our expertise in operating and using 5G technology in an industrial context,” said Dr.-Ing. Klaus-Dieter Tuchs, network planning at Volkswagen.

Nokia’s work with Volkswagen at its main German plant aligns with the vendor’s private 5G ambitions, as reported by German newspaper Handelsblatt in 2019. The company said at the time that it expects to provide 5G networks for German companies following the opening of the application procedure for local firms intending to use 5G frequencies on industrial campuses, highlighting not only its intention to offer its service for network planning, but also aims to operate the networks.

Nokia’s private network reach extends beyond Germany of course. The vendor has worked with industrial-type partners on LTE, 5G-ready and IP/MPLS networks around the world including at the Zeebrugge port in Belgium, the Irish Aviation Authority and the Société du Grand Paris (SGP), the state owned industrial company responsible for the Grand Paris Express metro project.

Resources:

Nokia Industrial Private Wireless

https://www.nokia.com/networks/industry-solutions/private-wireless/industry/

Nokia Digital Automation Cloud | Nokia

……………………………………………………………………………………………………………………….

On December 2nd, Nokia announced that Japanese network operator KDDI selected Nokia’s 5G Core and Converged Charging software to support its transition to a fully automated, cloud-native 5G SA Core network architecture.

Nokia’s cloud-native 5G Core’s near zero-touch automation capabilities help operators drive greater scale and reliability. Following the evolution of KDDI’s networks to 5G standalone core, subscribers will experience lower latency, increased bandwidth and higher capacity.

Nokia’s open 5G Core architecture gives KDDI the flexibility to be responsive to market demands while controlling costs by streamlining operations and unlocking crucial capabilities, such as network slicing. Developed around DevOps principles, Nokia’s 5G Core will automate the lifecycle management of KDDI’s networks, as well as enable continuous software delivery and integration.

Nokia will also deploy 5G monetization and data management software solutions including cloud-native Converged Charging, Signaling, Policy Controller, Mediation and Registers to capture new 5G revenue opportunities, enhance business velocity and agility, and streamline the operator’s network operations.

References:

Nokia deploys 5G private network at Volkswagen plant in Germany

Quortus: IT Decision Makers Very Interested in Private Cellular Networks

New research commissioned by LTE and 5G network solutions provider Quortus indicates that enterprise IT decision makers are becoming increasingly interested in private networks as an answer to productivity and efficiency woes caused by poor connectivity. Almost two-thirds (63%) of US and European enterprises have suffered reduced productivity and efficiency due to weak and unreliable public network connectivity.

Private cellular networks are 3GPP-based cellular networks offering a combination of low-power wide-area (LPWA), broadband LTE and even “massive” scale, ultra-reliable 5G connectivity for exclusive use by private parties. Deployed and managed separately of public cellular networks, they offer improved security, reliability and control.

The research, which surveyed 260 IT decision makers from the U.S., U.K., Germany and France, found that nearly two thirds (63%) of respondents said that weak and unreliable connectivity results in reduced productivity and efficiency at their enterprise. Further, a staggering 91% of them believe such limitations are directly tied to the limitations of macro public networks.

The research concluded that a fifth of enterprises do not believe the quality of their existing connectivity will support their future digital ambitions. Many enterprise IT leaders are looking for alternative options. 97% of them are ready to invest more money to ensure better connectivity.

The survey findings, published in an exclusive report ‘Build, don’t buy: the road to private networks‘ highlight the perceived inadequacies of public fixed and mobile networks:

- 91% of enterprise respondents believe the limitations of their existing connectivity is squarely tied to the limitations of macro public networks

- The major limitations of public networks frustrating enterprises include weak security, restricted network speeds and limited available network capacity limiting innovation

- 97% of organizations are ready to invest more money to ensure better connectivity, and almost half (47%) would increase current budgets by 10% if it reduced existing fears and limitations and helped drive operational efficiency

- A fifth of enterprises do not believe the quality of their existing connectivity will support the achievement of their future digital ambitions

“Enterprises, until recently, have had to rely on public macro networks for broadband connectivity,” said Neil Dunham, VP of sales at Quortus. “Our study reveals significant levels of frustration with the inherent limitations of macro networks. Too often global enterprises are finding that the quality of connectivity they receive is decided by an enterprise’s location, relative to network sites and the number of users relying on them.”

Dunham continues: “This burgeoning excitement towards private networks is seeing enterprises consider their options when it comes to build, design, and deployment. The key areas of motivation amongst enterprise IT decision makers include a willingness to benefit from specialist vertical knowledge and expertise, not being limited by a public operator’s footprint or service capability and need for bespoke requirements now and in the future. Only private networks can offer a truly bespoke connectivity solution to guarantee appropriate levels of performance, reliability, security and control for all global enterprises.”

Quortus also explored how those enterprises already working on establishing private networks at their facilities are doing so or intend to do, finding that 23% of enterprises surveyed currently operate their own network, while third (33%) would prefer to build their own network with the help of specialist partners, rather than buy it directly from a public operator.

Some of the major findings include a mission to build and not buy

The Quortus study revealed that many global enterprises are taking the safeguarding of high-quality connectivity into their own hands by building and operating private cellular networks.

- Almost a quarter (23%) of enterprises surveyed currently operate their own network

- A third (33%) would prefer to build their own network with the help of specialist partners, rather than buy it directly from a public operator

- The top perceived enterprise benefits of private networks include greater security, increased performance and tighter network control.

Reports from industry organization Global mobile Suppliers Association (GSA) supports Quortus’ research. The GSA in August said it is tracking at least 370 companies around the world that have been or are investing in private mobile networks, with 5G deployments beginning to gain momentum. The data suggests that manufacturing is an early adopter of local area private mobile networks, with 79 identified companies holding suitable licenses or involved in known pilots or deployments of LANs or probable LANs. Mining follows second, with ports also actively trialing/deploying local area private mobile networks.

“Our study reveals significant levels of frustration with the inherent limitations of macro networks. Too often global enterprises are finding that the quality of connectivity they receive is decided by an enterprise’s location, relative to network sites, and the number of users relying on them.”

“As this study shows, strong and reliable connectivity is a significant enabler to greater operational efficiency, enhanced service innovation and better productivity. It is therefore no surprise that enterprises are evaluating their future needs so closely and evaluating alternative means of supply.”

About Quortus:

Quortus is a pioneering UK company that is changing the mobile communications world using the best IT principles to create innovative mobile communication software that is easy to deploy, manage and scale. The company has created a software defined core network technology platform and a suite of products that covers 3GPP 4G, 3G and GSM standards, in addition to taking the lead with emerging technologies such as 5G, Mobile Edge Computing (MEC), Private LTE and cellular core network virtualization.

References:

Majority of global enterprises suffer reduced productivity and efficiency due to poor connectivity

Quortus research indicates ‘burgeoning excitement’ for private networks

Quortus Partners with TLC Solutions for Private 5G Network Radio Solution