RAN market

Analysis: Rakuten Mobile and Intel partnership to embed AI directly into vRAN

Today, Rakuten Mobile and Intel announced a partnership to embed Artificial Intelligence (AI) directly into the virtualized Radio Access Network (vRAN) stack. While vRAN currently represents a small percentage of the total RAN market (Dell’Oro Group recently forecasts vRAN to account for 5% to 10% of the total RAN market by 2026), this partnership could boost increase that percentage as it addresses key adoption hurdles—performance, power, and AI integration. Key areas of innovation include:

- Enhanced Wireless Spectral Efficiency: Optimizing spectrum utilization for superior network performance and capacity.

- Automated RAN Operations: Streamlining network management and reducing operational complexities through intelligent automation.

- Optimized Resource Allocation: Dynamically allocating network resources for maximum efficiency and subscriber experience.

- Increased Energy Efficiency: Significantly reducing power consumption in the RAN, contributing to sustainable network operations.

The partnership essentially aims to make vRAN superior in performance and TCO (Total Cost of Ownership) compared to traditional, proprietary, purpose built RAN hardware.

“We are incredibly excited to expand our collaboration with Intel to pioneer truly AI-native RAN architectures,” said Sharad Sriwastawa, co-CEO and CTO, Rakuten Mobile. “Together, we are validating transformative AI-driven innovations that will not only shape but define the future of mobile networks. This partnership showcases how intelligent RAN can be achieved through the seamless and efficient integration of AI workloads directly within existing vRAN software stacks, delivering unparalleled performance and efficiency.”

Rakuten Mobile and Intel are engaged in rigorous testing and validation of cutting-edge RAN AI use cases across Layer 1, Layer 2, and comprehensive RAN operation and network platform management. A core objective is the seamless integration of AI directly into the RAN stack, meticulously addressing integration challenges while upholding carrier-grade reliability and stringent latency requirements.

Utilizing Intel FlexRAN reference software, the Intel vRAN AI Development Kit, and a robust suite of AI tools and libraries, Rakuten Mobile is collaboratively training, optimizing, and deploying sophisticated AI models specifically tailored for demanding RAN workloads. This collaborative effort is designed to realize ultra-low, real-time AI latency on Intel Xeon 6 SoC, capitalizing on their built-in AI acceleration capabilities, including AVX512/VNNI and AMX.

“AI is transforming how networks are built and operated,” said Kevork Kechichian, Executive Vice President and General Manager of the Data Center Group, Intel Corporation. “Together with Rakuten, we are demonstrating how AI benefits can be achieved in vRAN. Intel Xeon processors power the majority of commercial vRAN deployments worldwide, and this transformation momentum continues to accelerate. Intel is providing AI-ready Xeon platforms that allow operators like Rakuten to design AI-ready infrastructure from the ground up, with built-in acceleration capabilities.”

Rakuten says they are “poised to unlock new levels of RAN performance, efficiency, and automation by embedding AI directly into the RAN software stack, this AI-native evolution represents the future of cloud-native, AI-powered RAN – inherently software-upgradable and built on open, general-purpose computing platforms. Additionally, the extended collaboration between Rakuten Mobile and Intel marks a significant step toward realizing the vision of autonomous, self-optimizing networks and powerfully reinforces both companies’ commitment to open, programmable, and intelligent RAN infrastructure worldwide.”

……………………………………………………………………………………………………………………………………………………………………..

- AI-Native Efficiency & Performance: The collaboration focuses on integrating AI to improve network performance and energy efficiency, which is a major pain point for operators. By embedding AI directly into the vRAN stack, they are enhancing wireless spectral efficiency, reducing power consumption, and automating RAN operations.

- Leveraging High-Performance Hardware: The initiative utilizes Intel® Xeon® 6 processors with built-in vRAN Boost. This eliminates the need for external, power-hungry accelerator cards, offering up to 2.4x more capacity and 70% better performance-per-watt.

- Validation of Large-Scale Commercial Viability: Rakuten Mobile operates the world’s first fully virtualized, cloud-native network. Its continued collaboration with Intel to make the vRAN AI-native provides a proven blueprint for other operators, reducing the perceived risk of adopting vRAN, particularly in brownfield (existing) networks.

- Acceleration of Open RAN Ecosystem: The collaboration supports the broader push towards Open RAN, which is expected to see a significant rise in market share, doubling between 2022 and 2026.

………………………………………………………………………………………………………………………………………………………………

- Market Share Shift: Omdia forecasts that vRAN’s share of the baseband subsector will reach 20% by 2028, a significant jump from its current low single-digit percentage.

- Explosive CAGR: The global vRAN market is projected to grow from approximately $16.6 billion in 2024 to nearly $80 billion by 2033, representing a 19.5% CAGR.

- Small Cell Dominance: By the end of 2026, it is estimated that 77% of all vRAN implementations will be on small cell architectures, a key area where Rakuten and Intel have demonstrated success.

References:

https://corp.mobile.rakuten.co.jp/english/news/press/2026/0210_01/

Virtual RAN gets a boost from Samsung demo using Intel’s Grand Rapids/Xeon Series 6 SoC

RAN silicon rethink – from purpose built products & ASICs to general purpose processors or GPUs for vRAN & AI RAN

vRAN market disappoints – just like OpenRAN and mobile 5G

LightCounting: Open RAN/vRAN market is pausing and regrouping

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

https://www.mordorintelligence.com/industry-reports/virtualized-ran-vran-market

https://www.grandviewresearch.com/industry-analysis/virtualized-radio-access-network-market-report

Vodafone Spain (Zegona), MasOrange and Telefonica in possible RANco joint venture

In an interview with Expansion published on January 26, 2026, Zegona [1.] CEO Eamonn O’Hare revealed that Vodafone Spain, MasOrange and Telefonica have been holding talks on the possibility of joining their mobile networks together since late last year. “We are talking with Orange and Telefónica to create a RANco,” he said.

Note 1. Zegona owns 100% of Vodafone Spain.

However, Zegona was unable to give the potential joint venture its full attention due to demands of its ongoing fiber projects. Telefonica and Vodafone created their Fiberpass joint venture (JV) in 2025 and agreed to sell a 40% stake to AXA in November. Meanwhile, Vodafone and MasOrange brought in GIC as an investor in their PremiumFiber JV last summer.

Eamonn O’Hare, president and CEO of Zegona

“The whole team was so involved in the fibercos that we didn’t have the time or energy to thoroughly develop the project,” O’Hare told the Expansion. Instead, his staff focused on tying up the fiber optic projects and then took a break over the Christmas period, he explained. “And now we’re back with more energy.”

Why a JV rather than a merger of telcos: “Mergers and acquisitions are not a priority in Spain and the regulatory risk is very high,” he said. Zegona has a greater motivation to make the RANco a reality. “Today there are three companies…that manage three national mobile networks with exactly the same fixed costs, but Orange and Telefónica have twice as many customers as us,” O’Hare explained. “Therefore, our national mobile network is inefficient. Just as our fixed infrastructure was inefficient and unprofitable, [and] that’s why we powered the fibercos.”

“It would be easier to broker a deal with MasOrange to share the network in certain areas, so the synergies would be in urban areas. But we don’t have anything with Telefónica, so there it would all be synergies.” Telefonica already has a mobile network sharing deal in place with Vodafone in sparsely populated areas, and was rumoured to be in talks with the telco on a broader RANco arrangement this time last year.

As a result, a partnership with Telefonica would bring greater synergies as there are no existing arrangements in place in the mobile space, but any deal would be a more difficult deal to hammer out and it would be trickier to bring in an investor, O’Hare added. Zegona has three priorities in Spain: to align its valuation with those of its competitors; to boost its cash flow to €1 billion; and to develop a RANco. “As long as we are in the middle of that transformation, we have no interest in mergers and acquisitions,” he said. And in addition, “the regulatory obstacle is…too big.”

“Historically, these small businesses have grown and then tried to sell themselves to MásMóvil. But MásMóvil no longer buys. Neither do we or Telefónica,” O’Hare said. “No one is buying. So they… will just be devoured by us and by Digi, as in the Pac-Man game.”

Would Huawei network equipment be used in the proposed Spanish RanCo? Vodafone is the mobile operator with the largest network provided by Huawei. Orange is reducing its share, and Telefónica only uses Huawei in part of its core network in Spain and not at all in its radio network. If the Brussels Cybersecurity Act mandates the replacement of this Chinese equipment, what will Vodafone Spain (Zegona) do?

“If Europe is more aggressive on the Huawei issue , I suppose we should accelerate efforts to reduce the amount of Huawei equipment in the network… should we accelerate RANco for this reason? Officially, the answer is no.”

……………………………………………………………………………………………………………….

References:

https://www.expansion.com/empresas/tecnologia/2026/01/26/6973ab17468aebd1418b4590.html

SNS Telecom & IT: Private 5G Market Nears Mainstream With $5 Billion Surge

España hit with major telecom blackout after power outage April 28th

Orange Spain & Ericsson to build 5G Infrastructure for 3 High-Speed Rail Lines

Telefónica and Nokia partner to boost use of 5G SA network APIs

Telefónica launches 5G SA in >700 towns and cities in Spain

Telefónica – Nokia alliance for private mobile networks to accelerate digital transformation for enterprises in Latin America

Ericsson and O2 Telefónica demo Europe’s 1st Cloud RAN 5G mmWave FWA use case

Telecom and AI Status in the EU

RAN silicon rethink – from purpose built products & ASICs to general purpose processors or GPUs for vRAN & AI RAN

The global RAN market has been declining for several years, putting pressure on network equipment vendors to cut costs and rethink their commitment to purpose built/custom RAN silicon products or ASICs. In 2022, the market for RAN equipment and software generated about $45 billion in revenues, according to research by Omdia, an Informa company. By 2024, annual revenue had tumbled to $35 billion – a 22.22% drop (and even worse in real dollars when you include inflation). As a result. it has become harder to justify the cost of expensive purpose-built silicon for the shriveling RAN market sector.

The Radio Access Network (RAN) is the segment of the mobile network interfacing the end-users and the mobile core network. In it’s IMT 2020 and IMT 2030 recommendations, ITU-R refers to the interface between a wireless endpoint and RAN equipment (base station or small cell) as the Radio Interface Technology or RIT). The core network specifications all come from 3GPP which has ETSI rubber stamp them.

……………………………………………………………………………………………………………………………………………………………………..

Ericsson and Samsung appear increasingly reliant on Intel for RAN silicon, while Nokia has been dependent on Marvell, but is planning to use NVIDIA GPUs in the near future (much more below). Let’s look at RAN silicon offerings from Intel, Marvell and NVIDIA:

-

Key RAN silicon offerings from Intel include:

- Intel Xeon with Intel vRAN Boost: The primary processors for network and edge applications include specific Intel Xeon 6 SoCs (System-on-Chips) that integrate Intel’s vRAN Boost accelerators directly on the die. This integration helps offload demanding Layer 1 (physical layer) processing, such as forward error correction, from the general-purpose CPU cores.

- Integrated Accelerators: These built-in accelerators are designed to improve performance-per-watt and increase capacity for RAN workloads. Intel’s approach is to provide high performance using common, off-the-shelf hardware with specialized acceleration, contrasting with other approaches that might rely entirely on general-purpose CPUs.

- FPGAs (Field Programmable Gate Arrays): Through its acquisition of Altera, Intel offers FPGAs which can also be used in some RAN applications, allowing for flexible, programmable hardware solutions.

- Intel has a significant market share in 5G base station silicon and its upcoming Granite Rapids processors (part of the Xeon 6 family) are being developed to maintain its strong position in this market, including for Massive MIMO applications. The company faces strong competition, but its next-generation processors aim to improve performance and efficiency for both core and edge computing in 5G networks. massive MIMO into future chips, such as the upcoming Granite Rapids generation.

- OCTEON Fusion Processors: These are baseband processors optimized for cost, power, and programmability, widely used in both traditional and Open RAN (O-RAN) architectures. The latest iteration, the OCTEON 10 Fusion processor, provides comprehensive in-line 5G Layer 1 acceleration, enabling RAN virtualization in cloud data centers.

- OCTEON Data Processing Units (DPUs): The OCTEON TX2 and OCTEON 10 families are multi-core ARM-based processors that handle 5G transport processing, security, and edge inferencing for the RAN Intelligent Controller (RIC). They incorporate hardware accelerators for AI/ML functions, enabling optimized edge processing.

- AtlasOne Chipset: This is a 50Gbps PAM4 DSP (Digital Signal Processor) and TIA (Transimpedance Amplifier) chipset solution for 5G fronthaul, optimized for high performance and power efficiency in integrated, O-RAN, and vRAN architectures.

- Ethernet Switches and PHYs: Marvell’s Prestera switches and Alaska Ethernet physical layer (PHY) devices are used in carrier infrastructure to provide the necessary networking connectivity for 5G base stations and data centers.

- Marvell also works with partners to integrate its technology into accelerator cards, such as the Dell Open RAN Accelerator Card powered by the OCTEON Fusion platform, to provide carrier-grade vRAN solutions. Furthermore, Marvell offers custom ASIC design services for hyper-scalers and telecom customers who need highly optimized, specific silicon solutions for their unique 5G and AI infrastructure requirements.

3. NVIDIA’s new silicon platform for AI Radio Access Networks (AI-RAN) is the NVIDIA Aerial RAN Computer, which is built on the next-generation Blackwell architecture. The primary system for AI-RAN deployment is the NVIDIA Aerial RAN Computer-1, which utilizes the NVIDIA GB200 NVL2 platform.

Key NVIDIA RAN components and features include:

- NVIDIA Blackwell GPU: The core graphics processor that features 208 billion transistors and provides significant performance improvements for AI and data processing workloads compared to previous generations.

- NVIDIA Grace CPU: The GB200 NVL2 platform combines two Blackwell GPUs with two NVIDIA Grace CPUs, connected by a high-speed NVLink-C2C (Chip-to-Chip) interconnect to form a powerful, unified superchip.

- NVIDIA Aerial Software: The hardware runs a full software stack that includes NVIDIA Aerial CUDA-Accelerated RAN libraries and NVIDIA AI Enterprise software for 5G and future 6G networks.

- Specialized Networking: The platform uses NVIDIA BlueField-3 Data Processing Units (DPUs) for real-time data transmission and precision timing, and NVIDIA Spectrum-X Ethernet for high-speed networking, which are critical for RAN performance.

- The goal of this platform is to enable wireless telcos to run both traditional RAN and AI workloads concurrently on a common, energy-efficient, software-defined infrastructure, thereby creating new revenue opportunities and preparing for 6G.

……………………………………………………………………………………………………………………………………………….

To many stakeholders, piggybacking on the general purpose processors used in PCs and data centers might be more sensible, but that would require Virtual RAN (vRAN), which replaces custom silicon with such general-purpose processors. However, it is a very small share of the RAN compute or baseband subsector. Omdia says it was just 10% in 2023, but the market research firm expects that share to more than double by 2028. It that forecast pans out, vRAN could conceivably replace some of the custom RAN silicon business with general purpose processors.

Lat year, Ericsson allocated approximately $5.7 billion of its R & D budget to design and development of ASICs for Layer 1 (PHY), the most demanding part of the baseband. It relies on Intel for other RAN silicon functionality. If virtual RAN claims a bigger share of a low- or no-growth market, Ericsson’s returns on the same level of investment in ASICs would decline because they wouldn’t be needed for vRAN. Also, Intel’s Granite Rapids could markedly narrow the performance and cost gap with purpose-built RAN chips.

“We are doing trials on many platforms,” said Per Narvinger, the head of Ericsson’s mobile networks business group, in reference to that taste testing of different chips. “But the more important thing is that we have actually created this disaggregation of and separation of hardware and software.”

The aim is to have a set of RAN software deployable on multiple hardware platforms. However, that is not achievable with ASICs, which create a tight union between hardware and software (they are inextricably tied together). The general-purpose options identified by Narvinger were AMD, Intel and Nvidia. Currently, Intel remains Ericsson’s sole silicon commercial vendor. Despite Ericsson’s professed enthusiasm for )single vendor) open RAN, its business today is nearly all about purpose-built 5G.

In sharp contrast, Samsung’s retreat from custom RAN silicon has appeared rapid. It is without doubt the biggest mainstream vendor of virtual RAN products, and there is barely interest in the purpose-built 5G technology it has developed with Marvell. The RAN that Samsung has built for Verizon in the US is entirely virtual. It is about to do the same in parts of Europe for Vodafone. Canada’s Telus purchases both virtual and purpose-built 5G products from Samsung. But Bernard Bureau, the operator’s vice president of wireless strategy, says the virtual now outperforms the traditional and is also significantly less expensive. The processors, as in the case of Ericsson, come exclusively from Intel.

- Ericsson’s primary concern likely centers on the hardware architecture utilized for Forward Error Correction (FEC), a resource-intensive Layer 1 function. While Intel’s Granite Rapids and preceding platforms integrate the FEC accelerator directly within the main processor, AMD provides this functionality via an external accelerator card. Ericsson has historically favored integrated solutions, citing the use of separate cards as an added expense.

- Samsung is evaluating virtualized RAN software that potentially obviates the need for a dedicated hardware accelerator when deployed on AMD’s high-core-count processors. Samsung is confident that the increased core density of AMD’s offerings can manage the computational load of a software-only FEC implementation, and a commercial offering may be imminent. Samsung’s transition to AMD processors from Intel would require minimal changes to existing software written for Intel’s x86 instruction set architecture.

Nokia’s situation is more complicated due to NVIDIA’s recent $1 billion investment in the company. An apparent condition is that Nokia will designing 5G and 6G network equipment that uses Nvidia’s GPUs. As we noted in yesterday’s IEEE Techblog post, many telcos regard those GPUs as an expensive and energy-hungry component, which makes using them a risky move by Nokia. Presumably, Nokia cannot use the money it has received from NVIDIA to develop 5G Advanced and 6G software specifically for Marvell’s special purpose RAN silicon. If Nokia develops RAN software that runs on NVIDIA GPUs it conceivably could be repurposed for another GPU platform rather than specialized RAN silicon or an ASIC. And the only viable GPU alternative to NVIDIA at this time (outside of China) is AMD.

References:

https://www.lightreading.com/5g/slow-death-of-custom-ran-silicon-opens-doors-for-amd

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

China gaining on U.S. in AI technology arms race- silicon, models and research

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

Analysis: Nokia and Marvell partnership to develop 5G RAN silicon technology + other Nokia moves

Ericsson’s revenue drops, profits soar; deal with Vodafone and partnership with Export Development Canada look promising

Ericsson’s 3rd quarter 2025 results released today showed a 9% drop in revenues, to 56.2 billion Swedish kronor (US$5.9 billion), compared with the same period last year. Ericsson’s gross margin rose 2% to 47.6%. U.S. sales fell by as much as 17% year-over-year for the 3rd quarter, to about SEK22.5 billion ($2.4 billion), after an especially busy period in 2024. And the only region where Ericsson realized any growth was northeast Asia, and that was due to Japan’s new 5G rollout.

At Ericsson’s big mobile networks unit, sales fell 11% year-over-year, to SEK35.4 billion ($3.7 billion), while the decline on a constant-currency basis was just 4%. The division’s operating income also slid by 6%, to SEK7.1 billion ($740 million).

Sales were much better at the company’s cloud software and services group, responsible for the development of Ericsson’s core network software as well as its business and operational support systems. Reported sales rose 3%, to SEK15.3 billion ($1.6 billion), while Ericsson put the organic improvement at 9%. More importantly, it swung from an operating loss of SEK400 million ($42 million) a year earlier to a profit of SEK1.7 billion ($180 million).

Net income soared by an astonishing 191%, to SEK11.3 billion ($1.2 billion). That sharp increase in net income was due to Ericsson’s recent sale of iconectiv, a provider of number-portability and data-exchange services, to a private equity firm. The deal landed Ericsson a capital gain of SEK7.6 billion ($800 million) that flattered its profits at the operating income level. In Stockholm, Ericsson’s share price soared more than 14% in mid-morning trade, although it remained almost 2% below its level at the start of the year.

CEO Börje Ekholm said on today’s earnings call: “The margin expansion reflects actions we’ve taken over the last years to increase operational excellence and efficiency, including the work we’ve done on our cost base. Over the last year, we’ve reduced our headcount by some 6,000, leveraging new ways of working, and that of course includes AI.”

Since the end of 2022, the year Ericsson acquired VoIP software developer Vonage for $6.2 billion, headcount has fallen by more than 15,600, to just 89,898 at the end of June, the company revealed in its latest earnings report.

The Vonage business suffered a 17% drop in sales, to SEK3.2 billion ($330 million), and saw its loss widen by 50%, to SEK600 million ($63 million). It is where Ericsson believes it can monetize the network application programming interfaces (APIs) that will link software apps to networks and hopefully revitalize the 5G market. However, that’s not happening yet.

“The geopolitical situation has required us to shift resources a bit politically. As we went through that transition, we duplicated a large part of the R&D spend. We don’t need to have that anymore as we have relocated R&D,” said Ekholm. “We are not going to jeopardize technology leadership and if we feel there is any risk – and that is a risk I don’t see today – then we would of course need to reassess.”

After years of growth, R&D spending fell by 10% year-over-year for the first nine months of 2025, to SEK35.8 billion ($3.8 billion), prompting concern among analysts that Ericsson could lose competitiveness versus Chinese rivals.

AI is now being used to refine the algorithms that are fed into Ericsson’s software products, said Per Narvinger, the head of Ericsson’s mobile networks business group, on a call with Light Reading. No indication was given if that would reduce headcount any further.

Ericsson hopes the new 5G contract it announced with Vodafone earlier today will boost sales in Europe, where underinvestment in midband 5G coverage and the “standalone” variant of 5G have been constant bugbears for the company. After the rollout of “non-standalone” 5G, which maintains the 4G core, operators just continued to sell a “4G plus” service, Ekholm said.

“It was the established business model of most operators around the world, so it became very natural to take that step and then use 5G almost as a marketing icon on the phone, but, in reality, it didn’t give the extra capabilities,” he added. Standalone features such as low latency and network slicing will be critical in future apps, Ekholm correctly said, arguing that 6G will necessitate edge cloud and AI investments that have also not yet happened.

In summing up, Ericsson said “Increased uncertainty remains on the outlook, both in terms of potential for further tariff changes as well as in the broader macroeconomic environment.”

Looking ahead:

– Continue to invest in technology leadership to strengthen competitive position

– Future-proofed Open RAN-ready portfolio

– New use cases to monetize network investments taking shape

● AI applications becoming a key driver for network investments

● Structurally improving the business through rigorous cost management

……………………………………………………………………………………………………………………………………………………….

Separately,

Ericsson today announced the signing of a USD $3 billion partnership agreement with Export Development Canada (EDC) to expand investment in Canadian research and development, deepen domestic supply chains, and accelerate next-generation technologies including 5G, Cloud RAN, AI, and quantum innovation.

Börje Ekholm, President and CEO, Ericsson, says: “Canada is one of Ericsson’s most important hubs for global research and development, and this partnership with Export Development Canada will allow us to scale that leadership even further. By strengthening our collaboration with Canadian businesses, universities and government partners, we can accelerate breakthroughs in 5G, quantum, and Cloud RAN that will drive growth, create opportunities, and reinforce Canada’s position as a global leader in next generation networks.”

With more than 3,100 employees nationwide and R&D centres in Ottawa, Montreal, and Toronto, Ericsson Canada is at the heart of the company’s global innovation footprint. Canadian teams are driving advancements in 5G, 5G Advanced, and 6G, while also contributing to new research in quantum communications and AI-powered network management.

The three-year partnership will enable Ericsson to expand its Canadian-led innovation and global projects with the support of financial and insurance solutions from EDC. By reinforcing Ericsson’s Canadian supply chain and connecting the company with innovative domestic businesses, the agreement will also amplify Ericsson’s ability to bring Canadian technology to the world, strengthen competitiveness, and create new opportunities for Canadian companies within Ericsson’s global network of partners.

Across all wireless network equipment vendors, annual sales of RAN products fell from $45 billion in 2022 to $35 billion last year, according to Omdia, a Light Reading sister company. Market research firms Omdia and Dell’Oro have encouragingly guided for a more stable market this year.

Most wireless network providers have seen no incentive to spend more on 5G when their returns to date have been so disappointing. And there is skepticism about the business case for low latency services and network slicing. Telcos increasingly sell large bundles of gigabytes to their customers and have struggled to monetize other features.

References:

https://www.lightreading.com/5g/ericsson-says-world-is-flat-amid-us-gloom-and-keeps-cutting

https://www.ericsson.com/en/press-releases/6/2025/ericsson-edc-advance-canadas-technology-leadership

Ericsson integrates agentic AI into its NetCloud platform for self healing and autonomous 5G private networks

Ericsson CEO’s strong statements on 5G SA, WRC 27, and AI in networks

Ericsson completes Aduna joint venture with 12 telcos to drive network API adoption

Ericsson reports ~flat 2Q-2025 results; sees potential for 5G SA and AI to drive growth

Ericsson revamps its OSS/BSS with AI using Amazon Bedrock as a foundation

Ericsson’s sales rose for the first time in 8 quarters; mobile networks need an AI boost

Beyon partners with Ericsson to build energy-efficient wireless networks in Bahrain

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

Ericsson and e& (UAE) sign MoU for 6G collaboration vs ITU-R IMT-2030 framework

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

Market research firm Omdia (owned by Informa) says Huawei remains the number one RAN vendor in three out of five large geographical regions. Far from being fatally weakened by U.S. government sanctions, Huawei today looks as big and strong as ever. Its sales last year were the second highest in its history and only 4% less than it made in 2020, before those sanctions took effect. In three out of the five global regions studied by Omdia – Asia and Oceania, the Middle East and Africa, and Latin America and the Caribbean – Huawei was the leading RAN vendor. While third in Europe, it was absent from the top three only in North America where it is banned.

Spain’s Telefónica remains a big Huawei customer in Brazil and Germany, despite telling Krach in 2020 that it would soon have “clean networks” in those markets. Deutsche Telekom and Vodafone, two other European telco giants, are also still heavy users of Huawei. Ericsson and Nokia have noted Europe’s inability to kick out Huawei while alerting investors to “aggressive” competition from Chinese vendors in some regions.

“A few years ago, we were all talking about high-risk vendors in Europe and I think, as it looks right now, that is not an opportunity,” said Börje Ekholm, Ericsson’s CEO, on a call with analysts last month. The substitution of the Nordic vendors for Huawei has not gone as far as they would have hoped. Ekholm warned analysts one year ago about “sharply increased competition from Chinese vendors in Europe and Latin America” and said there was a risk of losing contracts. “I am sure we’ll lose some, but we do it because it is right for the overall gross margin in the company. Don’t expect us to be the most aggressive in the market.”

There are few signs of European telcos replacing one of the Nordic vendors with Huawei, or of big market share losses by Ericsson and Nokia to Chinese rivals. Nokia’s RAN market share outside China did not materially change between the first and second quarters, says Remy Pascal, a principal analyst with Omdia (quarterly figures are not disclosed but Nokia held 17.6% of the RAN market including China last year). Huawei appears to have overtaken it because of gains at the expense of other vendors and a larger revenue contribution from Huawei-friendly emerging markets in the second quarter. Seasonality and the timing of revenue recognition were also factors, says Pascal.

Huawei is still highly regarded by chief technology officers for the quality of its products. It was a pioneer in the development of 5G equipment for time division duplex (TDD) technology, where uplink and downlink communications occupy the same frequency channel, and in massive MIMO, an antenna-rich system for boosting signal strength. It beat Ericsson and Nokia to the commercialization of power amplifiers based on gallium nitride, an efficient alternative to silicon, according to Earl Lum, the founder of EJL Wireless Research.

Sanctions have not held back Huawei’s technology as much as analysts had expected. While the company was cut off from the foundries capable of manufacturing the most advanced silicon, it managed to obtain good-enough 7-nanometer chips in China for its latest smartphones, spurring its resurgence in that market. Network products remain less dependent on access to cutting-edge chips, and sales in that sector do not appear to have suffered outside markets that have imposed restrictions.

Alternatives to Huawei’s dominance have not materialized in a RAN sector that was already short of options. Besides evicting Huawei from telco networks, U.S. authorities hoped “Open RAN” would give rise to American developers of RAN products. That has failed badly.

- Mavenir, arguably the best Open RAN hope the U.S. had, became emblematic of the Open RAN market gloom after it recently withdrew from the market for radio units as part of a debt restructuring. The company has sold its Open RAN software to DISH Network and Vodafone, it has not achieved the market penetration it initially targeted. Mavenir has faced significant financial challenges that led to a restructuring in 2025, significant layoffs and a major shift in strategy away from developing its own hardware.

- Parallel Wireless makes Open RAN software and also provides Open RAN software-defined radios (SDRs) as part of its hardware ecosystem, focusing on disaggregating the radio access network stack to allow operators flexibility and reduced total cost of ownership. Their offerings include a hardware-agnostic 5G Standalone (SA) software stack and the Open RAN Aggregator software, which manages and converges multi-vendor RAN interfaces toward the core network.

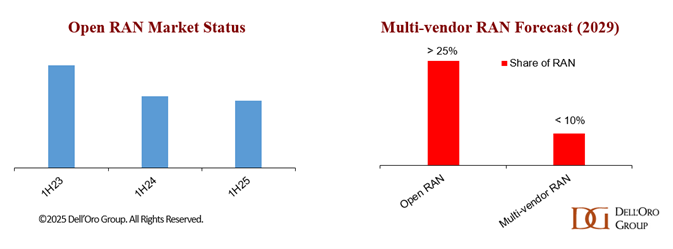

Stefan Pongratz of Dell’Oro Group forecasts annual revenues from multi-vendor RAN deployments – where telcos combine vendors instead of buying from a single big supplier – will have reached an upper limit of $3 billion by 2029, giving multi-vendor RAN less than 10% of the total RAN market by that date. He says five of six tracked regions are now classed as “highly concentrated,” with an Herfindahl-Hirschman Index (HHI) score of more than 2,500. “This suggests that the supplier diversity element of the open RAN vision is fading,” Stefan added.

Preliminary data from Dell’Oro indicate that Open RAN revenues grew year-over-year (Y/Y) in 2Q25 and were nearly flat Y/Y in the first half, supported by easier comparisons, stronger capex tied to existing Open RAN deployments, and increased activity among early majority adopters.

Open RAN used to mean alternatives to Ericsson and Nokia. Today, it looks synonymous with the top 5 RAN vendors (Huawei, Ericsson, Nokia, ZTE, and Samsung). In such an environment of extreme market concentration and failed U.S. sanctions, the appeal of Huawei’s RAN technology is still very much intact.

……………………………………………………………………………………………………………………………………………………………………….

Omdia’s historical data shows that RAN sales fell by $5 billion, to $40 billion, in 2023, and by the same amount again last year. In 2025, it is guiding for low single-digit percentage growth outside China, implying the RAN market has bottomed out. This stabilization suggests the market may be transitioning into a phase of flat-to-modest growth, though risks such as operator capex constraints and uneven regional demand remain. However, concentration of RAN vendors

…………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g/huawei-overtakes-nokia-outside-china-as-open-ran-stabilizes-

Omdia: Huawei increases global RAN market share due to China hegemony

Malaysia’s U Mobile signs MoU’s with Huawei and ZTE for 5G network rollout

Dell’Oro Group: RAN Market Grows Outside of China in 2Q 2025

Dell’Oro: AI RAN to account for 1/3 of RAN market by 2029; AI RAN Alliance membership increases but few telcos have joined

Network equipment vendors increase R&D; shift focus as 0% RAN market growth forecast for next 5 years!

vRAN market disappoints – just like OpenRAN and mobile 5G

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

Huawei launches CloudMatrix 384 AI System to rival Nvidia’s most advanced AI system

U.S. export controls on Nvidia H20 AI chips enables Huawei’s 910C GPU to be favored by AI tech giants in China

Dell’Oro Group: RAN Market Grows Outside of China in 2Q 2025

Following two years of steep declines, initial estimates by Dell’Oro Group reveal that total RAN revenues—including baseband, radio hardware, and software, excluding services—advanced for a third consecutive quarter outside of China in 2Q 2025.

“Our initial assessment confirms that the narrative we’ve been discussing for some time is now coming to fruition. Market conditions have continued to stabilize, resulting in growth for three consecutive quarters outside of China,” said Stefan Pongratz, Vice President of RAN market research at the Dell’Oro Group. “However, broader market sentiment remains subdued, and a rapid rebound is not anticipated. The industry acknowledges that short-term fluctuations are unlikely to alter the market’s generally flat long-term trajectory,” Pongratz added.

Additional highlights from the 2Q 2025 RAN report:

- Growth in Europe, as well as the Middle East and Africa, nearly offset declines in the Caribbean and Latin America, as well as the Asia Pacific region.

- RAN vendor dynamics are gradually shifting, driven by three major trends: the strong are getting stronger, laggards are not improving, and the market is becoming increasingly divided.

- Ericsson and Huawei together accounted for more than 60 percent of the 1H25 market in North America and China, respectively.

- The top 5 RAN suppliers, based on worldwide revenues for the trailing four quarters, are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- The short-term outlook remains unchanged, with total RAN expected to stabilize in 2025.

For sure, RAN is not a growth market (+1% CAGR between 2000 and 2023). However, underneath that flattish topline over time, RAN revenues fluctuate significantly as new spectrum/technologies become available. After a massive RAN surge between 2017 and 2021, RAN revenues declined sharply in 2023 and the fundamental question now is fairly straightforward – how will the slowdown in mobile data traffic impact the RAN market over the next five years? The constantly changing and increasingly demanding end-user expectations in combination with the search for growth present opportunities and challenges for incumbent RAN suppliers and new entrants.

………………………………………………………………………………………………………………………………………………………………………………………………

Huawei’s ability to sustain growth during a period of industry volatility can be attributed to several key factors:

- Strong Presence in China: Huawei maintains a commanding position in its home market, which remains one of the largest and most competitive globally. Despite external pressures and restrictions, its domestic strength provides stability and scale.

- Expanding Global Footprint: Growth in regions such as Europe, the Middle East, and Africa helped Huawei offset weaker performance in Asia Pacific, the Caribbean, and Latin America. These markets have been central to Huawei’s strategy of diversifying its global presence.

- Technological Advancements in 5G: Huawei has continued to invest heavily in 5G RAN innovation, leveraging advanced radio hardware, AI-driven network optimization, and energy-efficient base stations. These capabilities strengthen its competitive edge in delivering cost-effective and high-performance solutions.

- Resilient Business Strategy: Despite global challenges, including regulatory restrictions in certain markets, Huawei has adapted by strengthening local partnerships, investing in regional ecosystems, and optimizing supply chain resilience.

………………………………………………………………………………………………………………………………………………………………………………………………….

According to the recent Omdia report, Ericsson is the top RAN vendor in both business performance and portfolio strength in 2025, thanks in part to its energy-efficient products, comprehensive support across radio technologies, and Open RAN–ready offerings.

Ericsson also continues expanding its enterprise solutions, with integrated strategies that include private 5G, Cradlepoint, and cloud-native cores. In India, Ericsson signed a multi-billion-dollar 4G/5G equipment deal with Bharti Airtel to enhance network coverage using Open RAN-ready solutions.

Nokia is actively replacing Huawei in key European deployments—securing a major Open RAN contract to supply Deutsche Telekom across 3,000 German sites. In the U.S., Nokia signed a multi-year deal with AT&T to provide cloud-based voice core and 5G network automation solutions powered by AI/ML. Nokia is gaining ground in Europe and the U.S. through modernization and automation contracts. Samsung is leveraging Open RAN partnerships for a comeback, and overall vendor competition is shaped by technology shifts toward cloud-native, AI-enabled, and multi-vendor architectures.

Samsung is stepping up in the Open RAN ecosystem — as illustrated by a successful joint demonstration between Samsung, Vodafone, and AMD showcasing a full Open RAN voice call using AMD processors and Samsung’s O-RAN vRAN software. Despite its RAN equipment revenues falling 25% in 2024, Samsung remains well positioned in Europe and Africa, particularly in Vodafone tenders for replacing Huawei, which may drive recovery through expanded vRAN/Open RAN adoption.

In summary, the global RAN market is stabilizing after a steep downturn in 2024. Huawei holds steady in core markets like China and parts of Europe, while Ericsson leads globally on portfolio strength and new deals — particularly Open RAN and enterprise solutions.

………………………………………………………………………………………………………………………………………………………………………………………………………

References:

RAN Market Grows Outside of China, According to Dell’Oro Group

https://telecomlead.com/telecom-equipment/huawei-achieves-growth-in-global-ran-market-amid-industry-stabilization-122275

https://www.ericsson.com/en/ran/omdia-2025

Dell’Oro: AI RAN to account for 1/3 of RAN market by 2029; AI RAN Alliance membership increases but few telcos have joined

Dell’Oro: RAN revenue growth in 1Q2025; AI RAN is a conundrum

Omdia: Huawei increases global RAN market share due to China hegemony

Network equipment vendors increase R&D; shift focus as 0% RAN market growth forecast for next 5 years!

vRAN market disappoints – just like OpenRAN and mobile 5G

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Omdia: Huawei increases global RAN market share due to China hegemony

Due to China’s enormous mobile network market (where foreign vendors are mostly shut out), Huawei remained the world’s largest vendor of radio access network (RAN) equipment – a market worth about $35 billion last year – according to Omdia (an Informa owned company). In 2023, the Chinese behemoth had a 31.3% share of the global RAN market. Omdia says Huawei’s market share was up by an unspecified amount in 2024, due to “a more favorable regional mix as well as market share gains in emerging markets,” according to Remy Pascal, principal analyst at Omdia.

Huawei recently reported a 22% increase in sales last year, to 860 billion Chinese yuan (US$ 118.6 billion), and it looks in better shape than its ailing western rivals. Its share of the global 5G networks market appears to have grown, according to the market research firm.

Omdia’s findings seems further to highlight the futility of U.S. sanctions against Huawei, originally imposed by Donald Trump in his first term as U.S. President and then expanded by President Joe Biden.

Image Credit: Huawei

China still lacks the ability to make the most advanced chips featuring the tiniest transistors. But technical workarounds or loopholes in trade rules have enabled Huawei to revive its smartphone business and remain competitive in networks. Late last year, telco executives who spoke on condition of anonymity said there had been no discernible impact on the quality of its products. And Ericsson continues to regard Huawei as its chief rival.

……………………………………………………………………………………………………………………………………….

“After two years of significant acceleration and exceptionally high investment in 2021 and 2022, and two years of steep decline in 2023 and 2024, Omdia expects 2025 to be a year of stabilization for the RAN market,” said Remy Pascal of Omdia. “Different regions will follow different trajectories, but at a global level, the market is expected to be flattish. North America has returned to growth in 2024 and we expect this to continue, we also expect a positive trajectory in some emerging markets.”

……………………………………………………………………………………………………………………………..

Other results and forecasts from Omdia:

- The total global RAN market (which includes hardware and software but not services) was just over $35 billion last year, which represented a 12 percent decline on the previous year.

- There was a very slight drop in the aggregate market share of the top five RAN equipment vendors – Huawei, Ericsson, Nokia, ZTE and Samsung. In 2023, Omdia had that figure at about 95%. In 2024, it was roughly 94%.

- Ericsson was one of the main gainers last year thanks to its huge AT&T (non) OpenRAN contract.

- As a result, Nokia lost market share in the U.S., but claims that its global RAN footprint grew by 18,000 sites in 2024.

- Tejas Networks, an Indian RAN equipment vendor (not in the top five) that landed a large 4G contract with state-owned BSNL was another winner.

- Global RAN revenue will be “essentially flat” this year and marked by “low single digit percentage growth” outside China.

- A “positive trajectory” in emerging Asian markets as well as Africa, the Middle East and Latin America is forecast. Europe risks falling behind other parts of the world in mobile network markets.

Top RAN vendors, full year 2024 RAN revenue:

|

Global |

Global ex-China |

|---|---|

|

Huawei |

Ericsson |

|

Ericsson |

Nokia |

|

Nokia |

Huawei |

|

ZTE |

Samsung |

|

Samsung |

ZTE |

Top RAN vendors, full year 2024 RAN revenue, top 3 by region:

|

North America |

Asia & Oceania |

Europe |

Middle East and Africa |

Latin America & the Caribbean |

|---|---|---|---|---|

|

Ericsson |

Huawei |

Ericsson |

Huawei |

Huawei |

|

Nokia |

ZTE |

Nokia |

Nokia |

Ericsson |

|

Samsung |

Ericsson |

Huawei |

Ericsson |

……………………………………………………………………………………………………………………………………….

Dell’Oro Group’s most recent RAN report a few weeks ago stated that the global RAN market is expected to improve slightly over the short term, but the long-term outlook remains subdued. “The underlying message we have communicated for some time has not changed,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “Regional imbalances will impact the market dynamics over the short term while the long-term trajectory remains flat. This is predicated on the assumption that new RAN revenue streams from private wireless and FWA, taken together with MBB-based capacity growth, are not enough to offset slower MBB coverage-based capex,” said Dell’Oro’s Stefan Pongratz.

References:

https://www.lightreading.com/5g/huawei-defies-us-to-grow-market-share-as-ran-decline-ends-omdia

RAN Equipment Market to Remain Uninspiring, According to Dell’Oro Group

Network equipment vendors increase R&D; shift focus as 0% RAN market growth forecast for next 5 years!

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

vRAN market disappoints – just like OpenRAN and mobile 5G

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

Network equipment vendors increase R&D; shift focus as 0% RAN market growth forecast for next 5 years!

In 2024, Ericsson’s R&D spending was SEK53.5 billion ($4.8 billion). “It is our firm commitment to really ensure that we have capacity to do the investments in R&D over time,” said Lars Sandström, Ericsson’s chief financial officer. “I think that has been the guiding star for the company for quite some years and I think, if you go long back into history, we felt that has been hurting our ability to invest when not having the right cash position.” Meanwhile, Nokia’s R&D spending rose 5% on the year, to about €4.5 billion ($4.6 billion).

Combined, that was only one-third of Huawei’s projected 2024 R&D spending of around 197.8 billion yuan or $27.3 billion which was ~20% higher than 2023. Huawei’s R&D spending has increased in recent years, from 102 billion yuan in 2018 to 164.7 billion yuan in 2023. It invests more than 10% of its sales revenue into R&D each year. In addition to telecom and IT equipment/software, Huawei is a leader in China’s efforts to develop advanced chips and technology. The company is involved in a government-funded project to develop memory units for AI chips.

Mobile network market shrinkage has not helped ROI in wireless network R&D projects. Overall RAN sales fell 11% in 2023, to about $40 billion, said researchers at Informa owned Omdia. At the midpoint of its most recently published data, Omdia was anticipating another contraction of 15% in 2024 to ~$35 billion.

Stefan Pongratz of Dell’Oro said that mobile infrastructure investments slowed significantly in 2024. Preliminary findings indicate that the Radio Access Network (RAN) market contracted by 10 to 20% year-over-year (YoY) during the 1Q24 to 3Q24 period (final 4Q24 and full-year data expected around mid-February). Network operators in many countries paused spending after their initial 5G rollouts did not lead to meaningful improvements in sales or profitability.

Following the intense 5G acceleration phase from 2017 to 2022, RAN investments declined sharply in 2023 and 2024, with the exception of India where RAN market growth is now tapering off.

While data for 2024 is unavailable, the top five vendors – Huawei, Ericsson, Nokia, ZTE and Samsung – served ~95.1% of the global RAN market in 2023, according to Omdia. That doesn’t leave much room for start-up or other RAN equipment makers (like Fujitsu, NEC, Datang Mobile, Mavenir, CICT Mobile, Comba, and other small players).

“The underlying message we have communicated for some time has not changed,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “Regional imbalances will impact the market dynamics over the short term while the long-term trajectory remains flat. This is predicated on the assumption that new RAN revenue streams from private wireless and FWA, taken together with MBB-based capacity growth, are not enough to offset slower MBB coverage-based capex,” continued Pongratz.

Additional highlights from Del’Oro’s Mobile RAN 5-Year January 2025 Forecast Report:

- Worldwide RAN revenues are projected to grow at a 0% CAGR over the next five years, as rapidly declining LTE revenues will offset continued 5G investments.

- Medium-term risks to the baseline are balanced, while the long-term risks are tilted to the downside and characterized by the data growth uncertainty with the existing MBB use case. As the investment focus gradually shifts from coverage to capacity, one of the most significant forecast risks is slowing mobile data traffic growth. Given current network utilization levels and data traffic trends in more advanced markets, there are serious concerns about the timing of capacity upgrades.

- The mix between existing and new use cases has not changed. Private/enterprise RAN is expected to grow at a 20 percent plus CAGR while public RAN investments decline. At the same time, because of the lower starting point, it will take some time for private RAN to move the broader RAN needle.

- 5G-Advanced positions remain unchanged. The technology will play an essential role in the broader 5G journey. However, 5G-Advanced is not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets.

- RAN segments that are expected to grow over the next five years include 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

…………………………………………………………………………………………………………………………………………………………..

So how do incumbent RAN vendors cope? Ericsson is becoming more heavily reliant on software sales. CEO Börje Ekholm told analysts on the company’s last earnings call: “It is going to take some time for customers to realize we are increasingly becoming a software business. If you go back 15 years, we were much more hardware-centric, and then it was a bigger question for customers. As you move into becoming a software vendor, the working capital becomes less and less and less.”

Nokia is turning to data center connectivity for growth. CEO Pekka Lundmark declared that data centers are now the company’s top growth target, shifting away from its traditional focus on telecommunications networks and services. Nokia is developing and promoting data center switching platforms, IP networking solutions, and automation technologies to cater to the needs of hyperscalers and enterprise customers. The company has secured notable contracts with companies like CoreWeave, a leading AI hyperscaler, which demonstrates their growing presence in the data center space. It’s also in the process of acquiring fiber optic equipment company Infinera which will enhance both inter and intra- data center connect capabilities. Nokia is emphasizing open-source software like SONiC alongside its own SR Linux operating system to provide flexibility and cater to diverse customer requirements.

References:

https://www.lightreading.com/5g/ericsson-and-nokia-flaunt-cash-as-open-ran-pack-struggles

RAN Equipment Market to Remain Uninspiring, According to Dell’Oro Group

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Highlights of Dell’Oro’s 5-year RAN forecast

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

Dell’Oro: OpenRAN revenue forecast revised down through 2027

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Telco spending on radio access network (RAN) infrastructure, which is the largest share of capex, has dropped sharply in the last couple of years. It fell 11% in 2023, to about $40 billion, according to Informa owned market research firm Omdia (see References below for Dell’Oro’s numbers).

For 2024, Omdia predicts another decline of between 7% and 9%. Instead of buying new equipment, telcos have used existing supplies in their where houses.

Traffic growth rates also appear to have slowed. The graphic used in Ericsson’s latest mobility report pictures this very clearly, showing a church steeple of a traffic spike in 2019 and 2020 before a shallower downward-sloping gradient to the first half of 2024. That’s shown in this chart:

.jpg?width=700&auto=webp&quality=80&disable=upscale)

Source: Ericsson

Ericsson’s latest numbers, available through its mobility visualizer tool, shows the monthly volume of global mobile data rose by just 4.34% in the second quarter of 2024, compared with the first quarter. This is much lower than the rate of 10.76% Ericsson observed in the corresponding quarter four years earlier. The actual increase in 2024 was 6.27 exabytes. In 2020, it was 4.86 exabytes.

RAN product revenues have been falling at their sharpest rate in many years despite the 6.27-exabyte increase in monthly data volumes that happened in the second quarter. There are no signs that current 4G and 5G networks are about to keel over beneath an avalanche of data. It remains to be seen whether mobile networks are sufficiently robust to cope with many more exabytes of mobile data traffic or if telcos care about any service problems caused by congestion due to increased traffic.

There is also no obvious correlation between traffic growth and expenditure, according to Coleago Consulting. Spain’s Telefónica supported 17,054 petabytes of data on its global networks in 2015, its annual reports show. By 2023, the amount had rocketed to 146,074. Yet its capital intensity has fallen from more than 17% to just 14% over this period. Energy use, a proxy for operating costs, is also down, dropping from about 6,578 gigawatt hours in 2015 to 6,012 last year. Despite all that data consumption by its customers, Elisa’s capital intensity last year was less than 15%.

In Germany, the average monthly data usage per mobile customer (rather than per capita) amounted to 7.4 Gbytes and this may have risen to around 8 Gbytes in 1H 2024. In 2024, mobile data consumption in Finland was around 10 times higher compared to Germany. In Finland mobile operators have implemented 5G-SA and sell a user experience in terms of speed (Mbits/s) as opposed to data volume (Gbytes). As of October 2024, Elisa Finland offered a speed of 300 Mbits/s with unlimited data volume for €34.99. By contrast, in Germany, Telekom’s offer for 20 Gbytes is priced at €39.95 per month. For unlimited data usage Telekom charges €84.95, which is 2.5 times more costly than Elisa’s unlimited offer. It is unreasonable to assume that there is no price elasticity of demand. Surely, if prices in Germany were like those in Finland, monthly mobile data usage per customer would be much higher.

Monthly average revenue per user (ARPU) for a postpaid customer of Deutsche Telekom, Germany’s biggest telco, has fallen from €22 (US$23.7) before the launch of 5G to about €20 ($21.6) for the most recent quarter. Clearly, cost realities are especially awkward for Europe’s telcos, which have refused to give up their “fair share” argument that big content companies should pay for network usage because of all the traffic they supposedly generate. Critics disagree, saying that the telco’s own customers are the traffic generators, and they have already paid for it, even if pricing schemes do not help telcos to grow their sales.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.lightreading.com/5g/data-traffic-growth-or-decline-there-s-no-upside-for-telecom

https://www.coleago.com/insights/the-end-of-telecoms-history-not-really/

Analysys Mason & Light Reading: cellular data traffic growth rates are decreasing

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

According to a new report from Dell’Oro Group, the overall RAN market is now facing a second consecutive year of steep declines. That follows 40 to 50% revenue growth between 2017 and 2021. While the pace of decline is expected to moderate after 2024, downward pressure is likely to persist until 6G becomes a reality.

In addition to the typical market fluctuations that have shaped the RAN landscape over the past 30-plus years, the overpromising of 5G and its inability to significantly alter the flat revenue trend among operators are fueling increased skepticism regarding the need for substantial investments in new technologies (like 5G Advanced, 5G RedCap or O-RAN).

“Some skepticism is warranted. After all, operators invested over $2 trillion in wireless capex between 2010 and 2023 to build out 4G and 5G, yet revenues remain flat,” said Stefan Pongratz, Vice President of RAN and Telecom Capex research at Dell’Oro Group. “Looking ahead, operators will need to optimize their spectrum roadmaps to address various data traffic scenarios. Our base case assumes that mobile data traffic growth will continue to slow, enabling operators to improve their capital intensity ratios, which will in turn put further downward pressure on the RAN market. However, additional capacity will eventually be required, and at that point, leveraging larger spectrum bands and the existing macro grid will likely offer the most cost-effective solution,” Pongratz added.

Additional highlights from the new 6G Advanced Research Report:

- Total RAN revenues are projected to trend downward until 2029

- 6G RAN revenues to approach $30 B by 2033

- Sub-7 GHz and CM-wave macros are expected to dominate the 6G mix by 2033

Dell’Oro Group’s 6G Advanced Research Report offers a complete overview of the RAN market by region and by technology, with tables covering manufacturers’ revenue for 5G NR and 6G by frequency, including Sub-7 GHz, cmWave, and mmWave. The report also covers Cloud RAN, small cells, and Massive MIMO. To purchase this report, please contact by email at [email protected].

References:

6G RAN to Approach $30 B by 2033, According to Dell’Oro Group

https://www.ericsson.com/en/blog/2023/6/cm-wave-spectrum-6g-potent-enabler

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Highlights of Dell’Oro’s 5-year RAN forecast

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position