T-Mobile US

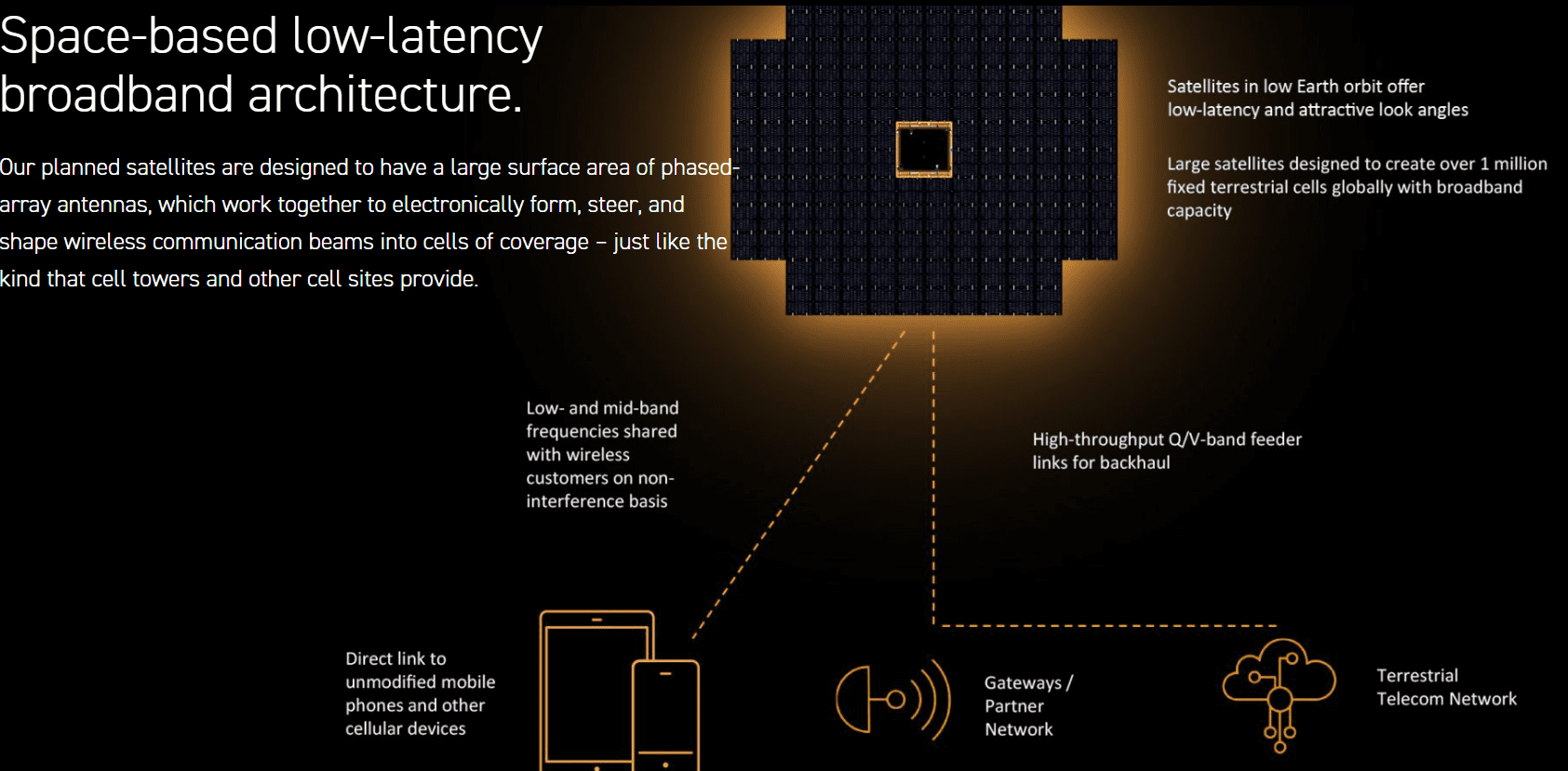

AST SpaceMobile to deliver U.S. nationwide LEO satellite services in 2026

LEO satellite broadband startup AST SpaceMobil Inc. has secured over $1 billion in total contracted revenue commitments from commercial partners, demonstrating strong commercial traction. The company has signed definitive commercial agreements with major telecom operators such as Verizon, AT&T and Saudi Telecom Group (stc) for direct-to-device (D2D) services, thereby expanding its commercial ecosystem. All told, AST has commercial agreements with over 50 mobile network operators with nearly 3 billion subscribers globally.

The company has strengthened its financial position with over $3.2 billion in cash and liquidity, ensuring funding for its satellite constellation and global service expansion. While it has yet to generate revenue from its LEO satellite broadband service, it reported $14.7 million revenue in the third quarter, up from $1.1 million in the previous year, driven by gateway sales to operators and US government contracts.

Importantly, AST said it expects to deliver “intermittent nationwide” LEO satellite service in selected markets in early 2026 with “continuous” service planned for later in 2026 as more satellites are added, according to CEO Abel Avellan, speaking on the company’s third quarter earnings call. In particular:

“We expect to continue scale deployment efforts early next year as we progress activation of an intermittent nationwide service by early 2026 and prepare for continued service later in 2026.”

AST remains committed to its target to have 45 to 60 BlueBird satellites in orbit by the end of 2026, which would enable continuous service across the US, Europe, Japan and “other strategic markets.” Longer-term, the aim is to expand the service to “all targeted” markets with 90 satellites.

Five launches for AST’s next generation BlueBird satellites are planned to take place by the end of the first quarter in 2026, after which launches will be once every one or two months to meet the goal of 45 to 60 satellites in orbit. Of the initial five launches, the first is scheduled for mid-December from India and the remaining four will be from Cape Canaveral with partners SpaceX and Jeff Bezos’ Blue Origin. The latter’s New Glenn rocket can take up to eight BlueBird satellites while SpaceX’s Falcon 9 can carry up to three satellites.

Source: AST SpaceMobile website

……………………………………………………………………………………………………………………………………………………………….

Avellan also said on the call:

“We showcased Canada’s first successful space-based direct-to-cell voice-over LTE call, video call, and other broadband data and video streaming activations. We believe Canada will represent another attractive market for our direct-to-device cellular broadband service. Space-based cellular broadband connectivity is an industry that we invented, and a recent technology milestone with Verizon and Bell follows several breakthroughs using our direct-to-device technology, including the first-ever 4G and 5G voice calls, voice-over LTE calls, live video calls, streaming, full internet access, and tactical non-terrestrial network connectivity for military and defense purposes, from space to modified smartphones.”

“Our direct-to-device cellular broadband network will help our partners deliver on one of their highest priorities, which is extending connectivity for their customers as part of our effort to deliver on those priorities. We are advancing partners and ecosystem network integration as we progress towards service activation in key partner markets.”

AST has ramped up manufacturing capacity so that it will produce six satellites per month from December, adding that these are “the largest satellites ever launched” into low Earth orbit (LEO). “We’re breaking a world record every time that we take a satellite out of the factory,” Avellan said.

The AST CEO is “very confident in the launch campaign.” The company has built 19 satellites so far and will have built 40 by around the end of March next year. “That matches very well with the launches that we had already financially committed and are in the manifest of our launch partners to take them,” Avellan added.

……………………………………………………………………………………………………………………………………………

It should be noted that T-Mobile US started offering Starlink-based D2D services (called T-Satellite) in July this year. Therefore, AT&T and Verizon D2D services with AST will be many months behind their arch rival.

……………………………………………………………………………………………………………………………………………

Andy Johnson, AST’s chief financial officer, described the company’s performance in 2025 as a time of “rapid growth” as it gets closer to its ambition to build its broadband satellite constellation. “The transition from an emerging R&D-focused startup to an operating company on the path to optimizing our manufacturing and launch cadence has been hard yet invigorating and gratifying work for our now nearly 1,800-person worldwide workforce,” he added.

………………………………………………………………………………………………………………………………………………

References:

https://investors.ast-science.com/quarterly-results

https://ast-science.com/spacemobile-network/our-technology/

AT&T deal with AST SpaceMobile to provide wireless service from space

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

AST SpaceMobile achieves 4G LTE download speeds >10 Mbps during test in Hawaii

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

FCC Grants Experimental License to AST SpaceMobile for BlueWalker 3 Satellite using Spectrum from AT&T

T-Mobile’s new CEO Srini Gopalan faces fierce competition from AT&T, Verizon and MVNOs

Today, T-Mobile US promoted Srini Gopalan, from chief operating officer (COO) to CEO. Gopalan is a veteran of parent company Deutsche Telekom as the head of its German home market. He has also held executive roles at Indian telecom company Bharti Airtel, Capital One and Vodafone.

Current CEO Mike Sievert will move into a newly created vice-chairman position. He said in a WSJ interview that he would continue to influence the company’s strategy. “I recruited Srini starting about a year ago with the idea that this day would come,” Sievert said.

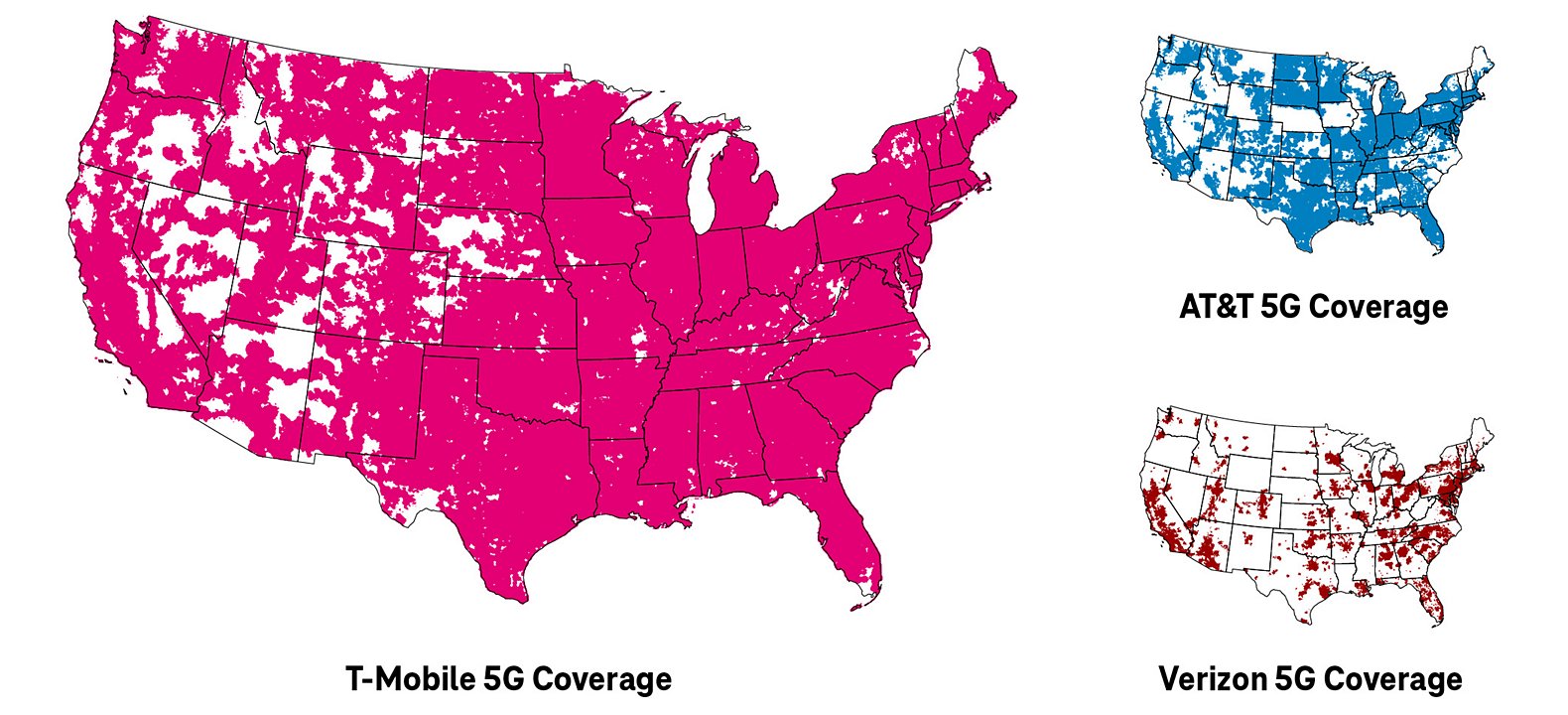

T-Mobile has often been recognized for its high-speed 5G network and standalone 5G network capabilities. The “un-carrier” capitalized on the Sprint merger (announced in April 19, 2018; finalized April 1, 2020) to grow its customer base, winning share in both postpaid and prepaid markets and positioning itself as the industry’s fastest-growing carrier. Under Sievert’s tenure, T-Mobile drew millions of broadband customers from cable industry-dominated markets by using its 5G network to beam internet service into homes and businesses. The company is also exploring the wired-broadband business, including through a roughly $5 billion investment in a joint venture with investment company KKR.

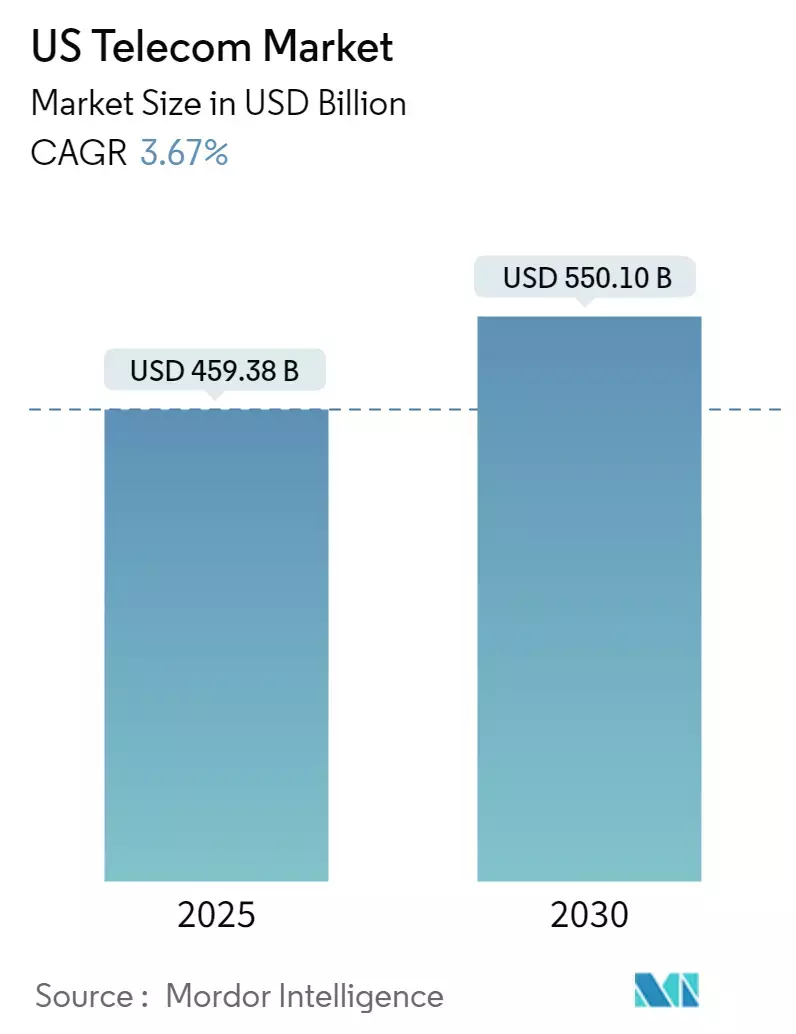

Wireless carriers have been grappling with slowing subscriber growth, rising competition and increasingly cautious consumers unwilling to pay for premium plans. T-Mobile’s strongest competitors have been the other two major nationwide mobile carriers Verizon and AT&T. However, the growing market for Mobile Virtual Network Operators (MVNOs), especially from cablecos like Comcast and Charter, has also introduced a new, significant competitive challenge.

Yet both Gopalan and Sievert said the business can keep up the pace as the mobile-phone market matures. “We really like wireless as a neighborhood in the U.S., and we have clearly outperformed everyone else,” Gopalan said in an interview, adding that T-Mobile’s home broadband business has more room to grow. “We’ve shown our hand in fiber. We like pure-play fiber, we like the idea of scaling that business, got two acquisitions already and we’re looking at what other value-creator deals are there.”

Gopalan “brings a wealth of experience and is a very impressive leader, and they’ve handled this transition exceptionally well. I don’t expect there to be any fall-off at all in T-Mobile’s performance,” MoffettNathanson analyst Craig Moffett said.

Craig wrote in a research note that a new wholesale deals with Comcast and Charter could give those cable operators an even stronger price edge in business wireless — a market where T-Mobile has been clawing share. “Cable wins. And T-Mobile wins as well,” Moffett wrote, while raising questions about whether the tie-up could lead to deeper partnerships that would reshape the sector. He added that, while T-Mobile is well-positioned in consumer wireless, cable’s entry into enterprise could spark new price wars, making execution under new leadership even more critical.C

T-Mobile has made several acquisitions since it acquired Sprint in 2020. It spent $1.35 billion to acquire Ryan Reynolds’s Mint Mobile in May 2024, giving the company access to more value-conscious phone plan shoppers.

The company has also closed deals for fiber-optic plays Metronet ($4.9 billion), US Cellular ($4.4 billion), and Lumos ($950 million).

References:

https://www.wsj.com/business/telecom/t-mobile-names-telecom-veteran-as-next-ceo-abb4194b

T-Mobile’s growth trajectory increases: 5G FWA, Metronet acquisition and MVNO deals with Charter & Comcast

Evercore: T-Mobile’s fiber business to boost revenue and achieve 40% penetration rate after 2 years

WSJ: T-Mobile hacked by cyber-espionage group linked to Chinese Intelligence agency

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

T-Mobile & EQT Joint Venture (JV) to acquire Lumos and build out T-Mobile Fiber footprint

T-Mobile’s growth trajectory increases: 5G FWA, Metronet acquisition and MVNO deals with Charter & Comcast

T-Mobile US is having a banner year. The “uncarrier” has again increased its annual earnings outlook, supported by the acquisition of fiber network operator Metronet and strong mobile customer growth in Q2. After gaining another 1.73 million postpaid customers in the quarter, T-Mobile now expects total postpaid net additions this year of 6.1-6.4 million, up from its previous guidance of 5.5-6.0 million. Postpaid customer growth strengthened compared to the first quarter and included 830,000 new phone customers and 902,000 other devices, while churn was little changed at 0.90 percent. Prepaid growth was more muted, with just 39,000 net additions. T-Mobile counted 132.778 million mobile customers at the end of June, up by around 1.9 million from a year ago. 5G broadband customers rose by 454,000 in the three months to 7.308 million.

In the three months to June, the company posted service revenues up 6% year-on-year to $17.4 billion, and core adjusted EBITDA (after leases) also was up 6% to $8.5 billion. The net profit rose 10 percent to a record $3.2 billion, and adjusted free cash flow increased 4% to $4.6 billion. Cash CAPEX rose 17.5 percent to $2.4 billion in Q2 and is still expected to reach $9.5 billion over the full year. The company also spent $2.5 billion buying back its own shares in Q2.

“T-Mobile crushed our own growth records with the best-ever total postpaid and postpaid phone nets in a Q2 in our history,” said Mike Sievert, CEO of T-Mobile. “T-Mobile is now America’s Best Network. When you combine that with the incredible value that we have always been famous for, it should surprise no one that customers are switching to the Un-carrier at a record pace. These durable advantages enabled us to once again translate customer growth into financial growth, with the industry’s best service revenue growth by a wide mile and record Q2 Adjusted Free Cash Flow.”

The new forecast includes the expected close of the Metronet acquisition on July 24th (today). The Metronet deal – crafted as a joint venture with KKR – will expand T-Mobile’s fiber reach by about 2 million homes across 17 states. It follows the completion of the deal with EQT to buy fiber operator Lumos.

T-Mobile plans to close the UScellular buyout and “become one team” on August 1st. “The combination gives us an expected 50% or more increase in capacity, in the combined footprint, and our site coverage will expand by a third from 9,000 to 12,000 sites,” CEO Mike Sievert said, noting that this will be in addition to 4,000 greenfield sites planned for this year, of which 1,000 have already been “lit up” to date.

T-Mobile stands at a critical juncture in its history, as it prepares to absorb more wireless and fiber assets, build a fiber network access business and enter a new market with the launch of T-Satellite in collaboration with Elon Musk’s Starlink. T-Mobile has already launched T-Mobile Fiber Home Internet and has forecast 100,000 fiber net customer adds in the second half of 2025 following the Lumos and Metronet deals. Sievert also reiterated that T-Mobile would continue to “keep an open mind” about any further fiber M&A.

T-Mobile is now the market’s fifth-largest ISP. Currently, the operator’s goals are to reach 12 million fixed wireless access subscribers by 2028 and to pass 12 million to 15 million households with fiber by the end of 2030, through both the fiber joint ventures and wholesale partnerships.

COO Srini Gopalan said on the earnings call, “We’re positioned to be a scale player in broadband,” claiming that the combined FWA and fiber targets would be equivalent to 40 million to 45 million homes passed as a broadband player, “and that’s before we go make other investments. As we’ve said before, we’re very open to looking at investments in fiber,” he added.

Separately, Charter Communications and Comcast announced Tuesday that they’ve cut a multi-year MVNO agreement with T-Mobile focused on their respective business customers. As the telecom industry growth rate is very low (real growth rate is barely positive), this additional source of revenue will be most welcome by the uncarrier. T-Mobile is expected to generate $850 million in incremental after tax income from its MVNO deals with Charter and Comcast. This revenue is included in the company’s updated guidance, but that guidance excludes the planned acquisition of UScellular assets.

T-Mobile Recognized as Network Leader by Third Parties:

- Ookla awarded T-Mobile as the only carrier in the country to win back-to-back Best Mobile Network awards in the largest, most-comprehensive tests of their kind, each leveraging half a billion real world data points on millions of devices measuring speed and experience

- Recognized by Opensignal for best Overall Experience for the fourth consecutive year and blew away the competition in best download speeds, nearly 200% faster than the nearest competitor, and upload speeds, approximately 65% faster than the nearest competitor

References:

https://www.lightreading.com/fttx/t-mobile-readies-for-the-next-stage-after-a-record-breaking-q2

Evercore: T-Mobile’s fiber business to boost revenue and achieve 40% penetration rate after 2 years

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

T-Mobile & EQT Joint Venture (JV) to acquire Lumos and build out T-Mobile Fiber footprint

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

Evercore: T-Mobile’s fiber business to boost revenue and achieve 40% penetration rate after 2 years

T-Mobile’s fiber business could serve about 5 million U.S. customers and generate up to $5 billion in revenue during the next five years, according to financial analysts at Evercore. That call is the investment advisor firm’s first take at evaluating the maturation of T-Mobile’s fiber plans. It’s based on the assumption that T-Mobile will close its deal to acquire fiber operator Metronet, following the recent closure of another deal with EQT for fiber operator Lumos. Evercore’s projections do not assume that T-Mobile will make a play for another fiber operator like Lumen Technologies.

“Looking to 2030, we expect 14 million [fiber] passings … and 4.8 million subscribers,” the analysts wrote in a note to investors this week. “Assuming a $75 ARPU [average revenue per user] growing 4% year over year implies ~$5 billion of revenue in 2030. “While it hasn’t shared subscriber targets, [T-Mobile] management has expressed confidence that it would see higher long-term market penetration than typical [fiber] overbuilders (e.g., ~35%) benefitting from its national brand and advertising, digital and retail distribution, ability to take advantage of the waiting list it has for FWA [fixed wireless access] in markets where demand outstrips supply,” the Evercore analysts added.

Evercore assumes that T-Mobile Fiber (see plans below) will be able to capture 10% market share within six months of launch and 20% within a year. After two years, the analysts predict T-Mobile Fiber will command 40% penetration (meaning, 40% of the customers reached by its fiber connections will subscribe to those connections).

T-Mobile Fiber Plans:

- Fiber 500 (500 Mbps): Superfast performance for gaming, streaming, and more.

- Fiber 1 Gig (1000 Mbps): Blistering speeds for every device and user in your home.

- Fiber 2 Gig (2000 Mbps): Our fastest speeds and largest capacity for more devices and users.

……………………………………………………………………………………………………………………………………….

……………………………………………………………………………………………………………………………………….“For now, until there’s greater color from management, we’ve assumed T-Mobile will see 25% EBITDA [earnings before interest, taxes, depreciation and amortization] margins on its Fiber revenue. This could be conservative over time,” the Evercore analysts wrote. They predicted overall EBITDA from T-Mobile Fiber of around $340 million in 2026, growing to $1.24 billion in 2030. And that, they said, would equate to free cash flow of $270 million in 2026, growing to $1 billion by 2030.

“Pricing will evolve as T-Mobile acquires and operates Metronet and Lumos’ subscribers along with the competitive dynamics across the broadband market. T-Mobile has a clear history of being a disruptor, so it could be more aggressive on pricing than we expect, resulting in downside to our ARPU and revenue estimates,” the Evercore analysts warned. They noted that T-Mobile Fiber in some Colorado markets today costs $55 per month for 500 Mbit/s connections. That’s similar to local incumbents Lumen Technologies ($50 for 500 Mbit/s) and Comcast ($55 per month for 600 Mbit/s).

Convergence of mobile and fiber access will provide a tailwind for T-Mobile, potentially driving increased postpaid phone share and revenue. “Despite management’s tone around the benefits of convergence, we believe there will clearly be an opportunity to drive higher postpaid phone share across the growing number of households that ultimately end up taking T-Mobile fiber,” according to the Evercore analysts. They predicted that T-Mobile’s fiber operations would eventually help improve the operator’s postpaid smartphone net customer additions by up to 650,000 per year, and that it will drive the operator’s annual wireless service revenues up by $200 million to $350 million.

An important insight into T-Mobile’s convergence strategy emerged in the wake of its acquisition of Lumos. “New and existing customers will enjoy VIP treatment through Magenta Status, which includes exclusive benefits like discounts on food, gas, entertainment and top brands, plus freebies every Tuesday in the T-Life app. All with T-Mobile’s standard ‘no exploding bills’ pricing structure,” T-Mobile said of its new Lumos customers.

“One app. All the things,” T-Mobile proclaims of the T-Life app it launched roughly a year ago. The app is available to all T-Mobile smartphone customers – and now its new fiber customers.

“Get the latest exclusive perks from T-Mobile Tuesdays, and take advantage of all your Magenta Status benefits,” T-Mobile said of its T-Life app. “You can also pay your bill, add a line to your account, and track orders straight from the app. And you can manage your account, configure your T-Mobile Home Internet gateway, and more. If you need help with anything, customer care is available at the tap of a button.”

The analysts expect T-Mobile’s fixed wireless access business to continue gaining traction, potentially reaching 7% of the total broadband subscriber base by 2025.

Separately, Verizon is now Evercore’s top pick among wireless network operators and is its top value idea.

…………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.lightreading.com/fttx/t-mobile-fiber-could-see-5m-customers-and-5b-in-revenue-by-2030

T‑Mobile and EQT close JV to acquire FTTH network provider Lumos

T-Mobile and EQT (a purpose-driven global investment organization) announced the successful close of their joint venture (JV) to acquire fiber-to-the-home provider Lumos. As part of the transaction, many Lumos customers will soon become T-Mobile Fiber customers and begin enjoying new offers and benefits as they’re welcomed into the Magenta family.

This deal marks a major milestone in T-Mobile’s broadband growth and builds on the Un-carrier’s success in delivering best-in-class connectivity. By bringing more value and choice to the millions of Americans who have previously been underserved, T-Mobile continues to deliver on its mission to change broadband for good. T-Mobile will take full ownership of the customer experience, using its proven brand, nationwide retail footprint, differentiated marketing and customer-first service model to attract new subscribers.

Currently, Lumos operates a 7,500-mile fiber network, providing high-speed connectivity to 475,000 homes across the Mid-Atlantic. The joint venture combines the Un-carrier’s unique assets with EQT’s fiber infrastructure expertise, and Lumos’ scalable build capabilities to drive rapid network expansion, with the goal of reaching 3.5 million homes by the end of 2028. To fuel this growth, T-Mobile invested $950 million into the joint venture, with an additional $500 million planned between 2027 and 2028 to support further expansion. T-Mobile will provide an update to its full year 2025 guidance resulting from this transaction during its Q1 earnings call.

“T-Mobile is already the fastest-growing broadband provider in America, and expanding into fiber helps us take the next big step in delivering what customers truly want – faster, more reliable internet that simply works,” said Mike Katz, T-Mobile President of Marketing, Strategy and Products. “People deserve better when it comes to their home internet: fewer disruptions, more value, and support that actually feels supportive. We’re excited to welcome Lumos customers to the T-Mobile family and bring them the Un-carrier experience – built around their needs, fueled by innovation, and focused on making life easier.”

As Lumos customers continue to enjoy the same high-speed fiber internet they rely on today at low monthly prices, they’ll now also enjoy the value-add benefits they get from simply being a part of the T-Mobile family. They will have access to T-Mobile’s best-in-class customer experience and nationwide retail presence. Every plan also comes with unlimited data plus Wi-Fi equipment and installation included, so customers can enjoy the freedom and flexibility of reliable internet. Additionally, new and existing customers will enjoy VIP treatment through Magenta Status, which includes exclusive benefits like discounts on food, gas, entertainment and top brands, plus freebies every Tuesday in the T-Life app. All with T-Mobile’s standard ‘no exploding bills’ pricing structure.

“We’re excited to begin this joint venture and even more energized about what’s ahead,” said Brian Stading, CEO of Lumos. “Partnering with EQT and T-Mobile, we’re ready to scale faster, deliver cutting-edge fiber technology to more people, and change even more lives. This is about more than just internet – it’s about building the infrastructure of the future and creating lasting opportunity, connection, and impact for communities.”

“We are thrilled to officially embark on this next chapter of growth with Lumos alongside our partners at T-Mobile,” said Nirav Shah, Partner within EQT’s Infrastructure Advisory team. “This joint venture represents a powerful combination of EQT’s digital infrastructure expertise, Lumos’ proven fiber deployment capabilities, and T-Mobile’s customer-first approach and national reach. Together, we are well-positioned to accelerate access to high-quality fiber broadband to millions of underserved Americans and look forward to executing on our plans to deliver the critical connectivity that empowers communities across the country.”

As the fifth-largest and fastest-growing Internet service provider in the U.S., T-Mobile offers 5G Home Internet to 70 million homes, serving more than 6.4 million customers nationwide as of the end of 2024, and has introduced T-Mobile Fiber in parts of 32 U.S. markets. Fiber-to-the-home complements T-Mobile’s successful 5G Home Internet offering, which currently has over 1 million customers on its waitlist. This expansion in fiber opens an additional avenue to meet the growing demand for T-Mobile broadband. Through its strategic fiber partnerships and joint ventures, the Un-carrier expects to reach 12 to 15 million households, or more, with fiber by the end of 2030.

References:

https://www.t-mobile.com/news/business/t-mobile-eqt-close-lumos-fiber-jv

T-Mobile & EQT Joint Venture (JV) to acquire Lumos and build out T-Mobile Fiber footprint

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

AT&T’s leads the pack of U.S. fiber optic network service providers

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

One NZ launches commercial Satellite TXT service using Starlink LEO satellites

New Zealand telco One NZ has commercially launched its Satellite TXT service to eligible phone customers [1.] enabling them to communicate via Starlin/SpaceX’s network of Low Earth orbit (LEO) satellites at no extra cost as long as they have a clear line of sight to the sky. The initial TXT service will take longer to send and receive TXT messages. In many cases, TXT messages will take 3 minutes. However, at times it may take 10 minutes or longer, especially during the first few months. As the service matures and more satellites are launched, we expect delivery times to improve. The type of eligible phone you are using, where you are in New Zealand and whether a satellite is currently overhead will all have an impact on whether your TXT is sent or received and how long it takes.

Note 1. There are only four handsets that can currently use of Satellite TXT: Samsung’s Galaxy Z Flip6, Z Fold6, and S24 Ultra, plus the OPPO Find X8 Pro. One NZ said the handset line-up will expand during the course of next year (2025).

“We have lift-off! I’m incredibly proud that One NZ is the first telecommunications company globally to launch a nationwide Starlink Direct to Mobile service, and One NZ customers are among the first in the world to begin using this groundbreaking technology,” exclaimed Joe Goddard, experience and commercial director at One NZ. He said coverage is available across the whole of New Zealand including the 40% of the landmass that isn’t covered by terrestrial networks – plus approximately 20 km out to sea. “Right from the start we’ve said we would keep customers updated with our progress to launch in 2024 and as the technology develops. Today is a significant milestone in that journey,” he added.

April 2023’s partnership with Starlink coincided with the beginning of a new era for One NZ, which up until that point had operated under the Vodafone brand. At the time, One NZ tempered expectations by making it clear the service wouldn’t launch until late 2024.

SpaceX in October finally received permission to begin testing Starlink’s direct-to-cell capabilities with One NZ. Later that same month, One NZ reported that its network engineers in Christchurch were successfully sending and receiving text messages over the network. “We continue to test the capabilities of One NZ Satellite TXT, and this is an initial service that will get better. For example, text messages will take longer to send but will get quicker over time,” said Goddard. He also went to some lengths to point out that Satellite TXT “is not a replacement for existing emergency tools, and instead adds another communications option.”

One NZ offered a few tips to help their customers use the service:

- To TXT via satellite, you need a clear line of sight to the sky. Unlike other satellite services, you don’t need to hold your phone up towards the sky.

- Keeping your TXT short will help. You can also prepare your TXT and press send as soon as you see the One NZ SpaceX banner appear on-screen.

- To check if your TXT has been delivered, check the time stamp next to your TXT. On a Samsung or OPPO, tap on the message.

- Remember to charge your phone or take a battery pack if you are out adventuring.

One NZ vs T-Mobile Direct to Cell Service:

New Zealand’s terrain – as varied and at times challenging as it is – can be covered by far fewer LEO satellites than the U.S. where T-Mobile has announced Direct to Cell service using Starlink LEO satellites. T-Mobile was granted FCC approval for the service in November, and is now signing up customers to test the US Starlink beta program “early next year.”

References:

https://one.nz/why-choose-us/spacex/

https://www.telecoms.com/satellite/one-nz-claims-direct-to-cell-bragging-rights-over-t-mobile-us

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

RWA, CWA and EchoStar file FCC petitions against T-Mobile’s acquisition of UScellular

The Rural Wireless Association (RWA), Communications Workers of America (CWA), and EchoStar (owns Dish Network) all filed FCC petitions requesting the agency reject T-Mobile’s proposed acquisition of “substantially all” of UScellular’s wireless operations, including some spectrum.

The proposed transaction would remove UScellular from the U.S. telecom market, thereby eliminating one of the last few remaining regional wireless network operators and strengthening T-Mobile’s position across the 21 states where UScellular maintains operations.

Public interest and consumer groups (include Public Knowledge, New America’s Open Technology Institute and Community Broadband Networks Initiative) also opposed approval. They argued that the proposed merger between T-Mobile and UScellular would “result in the loss of the fifth largest marketplace competitor with a network covering approximately 10 percent of the country’s population, reallocate spectrum resources predominantly to the three top wireless carriers only to make it nearly impossible for a fourth competitor to emerge in the market, and waste valuable funding secured for building out 5G networks.”

The deal is relatively small as telecom mergers go — valued at about $4.4 billion, including $2 billion in assumed debt — but has ignited substantial opposition. UScellular is the nation’s fifth-largest wireless carrier.

“T-Mobile is asking for the commission’s blessing to further entrench its dominance over the wireless voice and broadband markets, making it harder for others (like EchoStar) to compete. The commission should deny this transaction, which threatens to substantially harm competition while offering only illusory public interest benefits,” EchoStar wrote in a new filing to the FCC.

“The merger would substantially lessen competition in local markets where UScellular operates, hurting workers, consumers and other rural carriers. The commission should reject the proposed transaction as currently structured and require specific enforceable measures … to ensure that the merger remains in the public interest,” wrote the Communications Workers of America (CWA), a union that counts thousands of members inside AT&T and Verizon but has struggled to unionize workers in T-Mobile. The Rural Wireless Association also voiced its opposition.

This past May, T-Mobile said it would purchase around 30% of UScellular’s spectrum holdings, all of its 4.5 million customers and its retail stores in a deal worth $4.4 billion. T-Mobile has also said it will make job offers to “a significant number” of UScellular’s employees as part of the transaction. Following T-Mobile’s announcement, both AT&T and Verizon inked deals to acquire roughly $1 billion each worth of UScellular’s spectrum. T-Mobile officials still expect to close the UScellular transaction next year.

“I don’t know how many mergers you’ve heard of in the past that are like, yeah, I can promise you better networks and lower prices right from the get-go, and the company, of course, will benefit from the synergies, and it’s highly accretive. So this is going to be a win all the way around, and I’m confident the government will see it that way as well,” T-Mobile CEO Mike Sievert said this week at an investor event.

However, the U.S. Department of Justice (DoJ) advised a deeper review of T-Mobile’s UScellular proposed acquisition due to T-Mobile’s foreign owner Deutsche Telekom, which indirectly holds 50.42% of T-Mobile’s stock and also holds a proxy agreement that authorizes it to vote additional shares.

Many pundits expect T-Mobile to ultimately close on its purchase of UScellular thanks to the incoming Trump administration, which is expected to be more friendly to acquisitions than the Biden administration has been. As a precedent, Donald Trump’s first administration immediately approved T-Mobile’s $26 billion purchase of Sprint in 2020.

References:

https://www.fcc.gov/ecfs/document/1209299836114/1

https://www.fcc.gov/ecfs/document/120973502037/1

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

T‑Mobile achieves record 5G Uplink speed with 5G NR Dual Connectivity

T-Mobile US claims it broke a world record with its 5G standalone (SA) network via a new feature called New Radio Dual Connectivity (5G DC) [1.]. With 5G DC. The so called “Un-carrier” was able to massively increase uplink throughput and capacity, reaching peak speeds of 2.2 Gbps — that’s the fastest recorded anywhere in the world — and demonstrates the technology’s potential to create serious efficiencies in how data is transmitted from devices to the network.

Note 1. New Radio Dual Connectivity (NR-DC) is a dual connectivity configuration that uses the 5G standalone core (specified by 3GPP but not standardized by ITU-R or ITU-T). In this configuration, both the primary and secondary RAN nodes are 5G gNBs. NR-DC was was specified in 3GPP Release 15 along with simultaneous receive (Rx) / transmit (Tx) band combinations for NR CA/DC.

…………………………………………………………………………………………………………………………………..

To put T-Mo’s 2.2 Gbps uplink speed into context, the latest report from connectivity data specialist Ookla puts the median mobile upload speed in the U.S. at 8.41 Mbps, although that’s across networks. T-Mobile is ahead of major rivals AT&T and Verizon with a median upload speed of 12.19 Mbps.

In June Ookla stated that while U.S. network operators have invested heavily in improving 5G download speeds, “5G upload and latency performance need more attention.” Its data at the time showed Verizon and T-Mobile had comparable 5G upload at just above 15 Mbps, while AT&T lagged somewhat at closer to the 10 Mbps mark.

5G DC enables the Un-carrier to aggregate 2.5 GHz and mmWave spectrum, allowing for an insane boost to uplink throughput and capacity. In this test, T-Mobile was able to allocate 60% of the mmWave radio resources for uplink where previous use cases typically allowed up to 20%. Completed on T-Mobile’s 5G SA production network in SoFi Stadium in Southern California with equipment and 5G DC solution from Ericsson and a mobile test smartphone powered by a flagship Snapdragon® X80 5G Modem-RF System from Qualcomm Technologies, Inc., this test changes the game for providers looking to offer customers and businesses the best experience possible at crowded events.

“With 5G DC, T-Mobile is pushing the boundaries of what’s possible to create better experiences in the places that matter most to our customers,” said Ulf Ewaldsson, President of Technology at T-Mobile. “This accomplishment is a testament to the network we’ve built over the last five years and our ability to deliver unparalleled capabilities that extend beyond the devices in our pockets.”

For those in the know, download speeds typically reign as the top network performance metric, but with recent strides in uplink capabilities and increasingly demanding tasks, upload speed is becoming more important than ever, especially for live events, mobile gaming and extended reality applications.

Because of this, SoFi Stadium served as the perfect test site for 5G DC. Every year, millions of people flock to the stadium for the latest football game or to catch their favorite artists in concert. Naturally, all these people want to post, livestream and share their experiences in real-time, which can sometimes be a challenge at crowded events with limited capacity. Not to mention broadcast crews who need to upload high-definition content to production teams in real-time for those watching at home. With 5G DC and T-Mobile, all of this gets done faster than ever, alleviating posting FOMO and production crew headaches.

Mårten Lerner, Head of Product Area Networks at Ericsson, said: “High uplink speeds are essential for delivering immersive experiences and reliable 5G connectivity. This mirrors one of our key objectives with the recent launch of Ericsson 5G Advanced, which is to elevate user experience by enhancing network performance for more interactive applications. This 5G uplink speed milestone, achieved with T-Mobile and Qualcomm, underscores our commitment to taking user experience to unprecedented levels.”

“We are incredibly proud to achieve yet another world record with T-Mobile. This groundbreaking achievement shows what could be possible with 5G DC and how it can bring new, unparalleled experiences to consumers, especially at large events like football games and concerts,” said Sunil Patil, Vice President, Product Management, Qualcomm Technologies, Inc. “We will continue our close collaboration with global innovators like T-Mobile and Ericsson to push the boundaries and unlock the full potential of 5G.”

5G network covers more than 330 million people across two million square miles. More than 300 million people nationwide are covered by T-Mobile’s super-fast Ultra Capacity 5G with over 2x more square miles of coverage than similar mid-band 5G offerings from the Un-carrier’s closest competitors.

For more information on T-Mobile’s network, visit T-Mobile.com/coverage.

References:

https://www.t-mobile.com/news/network/t-mobile-shatters-for-5g-uplink-speed

https://www.telecoms.com/5g-6g/t-mobile-us-uses-5g-dc-to-claim-uplink-speed-record

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

Finland’s Elisa, Ericsson and Qualcomm test uplink carrier aggregation on 5G SA network

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

Samsung-Mediatek 5G uplink trial with 3 transmit antennas

Dish Wireless with Qualcomm Technologies and Samsung test simultaneous 5G 2x uplink and 4x downlink carrier aggregation

BT, Nokia and Qualcomm demonstrate 2CC CA on uplink of a 5G SA network

U.S. Cellular to Sell Spectrum Licenses to Verizon in $1 Billion Deal

The WSJ reports that U.S. Cellular is selling a portion of its retained spectrum licenses to Verizon for $1 billion in cash as it looks to monetize the spectrum that wasn’t included in the proposed sale to T-Mobile. The Chicago-based telco, which caters to a base of mostly rural customers (approximately 4.5 million) across several states, on Friday said the deal includes the sale of 663 million megahertz point-of-presences of its cellular spectrum licenses. The deal is expected to close in mid-2025.

Under the terms of the agreement, U.S. Cellular will also sell 11 million megahertz point-of-presences of its advanced wireless services, and 19 million megahertz point-of-presences of its personal communications services licenses. The company said it has entered into additional agreements with two other mobile operators for the sale of other selected spectrum licenses.

TDS, the majority shareholder of U.S. Cellular, has delivered its written consent to approve the Verizon transaction.

Each transaction is dependent upon the closing of the proposed sale of the company’s cellular wireless operations and select spectrum assets to T-Mobile.

In May, T-Mobile agreed to buy much of U.S. Cellular’s operations which included about 30% of UScellular spectrum holdings, all of its customers and its retail stores in a deal worth $4.4 billion. That deal still requires regulatory approvals. It would give T-Mobile more than four million new customers and a trove of valuable spectrum rights to carry more of their data over the air.

According to the financial analysts at New Street Research, UScellular managed to score a higher-than-expected sale price to Verizon. “We valued these licenses at $812 million, and so this transaction is a 23% premium,” they wrote in a note to investors Friday morning.

Importantly, they argued that, as a result, the low band spectrum owned by EchoStar’s Dish Network might be worth more than they had previously calculated. “If we apply the premium to lowband licenses, based on this new mark, Dish’s 600 MHz portfolio would be worth $16 billion, up from $12 billion currently,” they wrote.

The New Street analysts speculated that UScellular’s remaining spectrum holdings will eventually be sold.

“This spectrum transaction took longer than we expected, and it is for fewer of the licenses than we expected,” they wrote of UScellular’s new deal with Verizon. “The monetization of the remaining [UScellular] spectrum could take time, but it will all be sold eventually.”

They argued that UScellular’s remaining, unsold spectrum holdings – which stretch across lowband holdings like 700MHz as well as mid band spectrum like C-band – could be worth as much as $3.2 billion.

But the analysts cautioned that it can be difficult to extrapolate spectrum values from just one transaction alone. For example, the licenses involved in the transaction between Verizon and UScellular are mostly located in smaller markets and therefore may not be directly comparable to spectrum licenses located in bigger cities. Further, most of the spectrum involved in the deal is low band, and so values might be different for large chunks of mid band spectrum.

References:

https://www.lightreading.com/5g/how-verizon-s-1b-uscellular-spectrum-deal-affects-echostar-s-dish

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

UScellular adds NetCloud from Cradlepoint to its 5G private network offerings; Buyout coming soon?

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

UScellular’s Home Internet/FWA now has >100K customers

UScellular Launches 5G Mid-Band Network in parts of 10 states

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

T-Mobile US today reported a 4% year-over-year YoY) increase in service revenues, to about $16.4 billion, for the recent second quarter. Total sales increased 3%, to almost $19.8 billion. The un-carrier’s profitability metrics were even better. Adjusted earnings (before interest, tax, depreciation and amortization) rose 9%, to nearly $8.1 billion. T-Mobile’s adjusted free cash flow rocketed 54%, to about $4.4 billion. There were also several positive changes to full-year guidance, which included raising the outlook for free cash flow by $150 million (at the midpoint), to $16.8 billion.

“It was another industry-leading quarter for T-Mobile as our continued focus on delivering customers more value and a superior network experience enabled us to outperform our peers in the marketplace and translated into outsized financial growth,” said Mike Sievert, CEO of T-Mobile. “Our formula is continuing to work and we’ve got a lot of room to run including pursuing new growth opportunities that bring the Un-carrier experience to more customers and new markets. This incredible momentum makes us even more excited for what’s next for T-Mobile, and our confidence is reflected in our raised guidance for the full year ahead.”

Peter Osvaldik, T-Mobile’s chief financial officer, boasted “unmatched capital efficiency” on today’s call with analysts. “While our longer-term expectations continue to be in the $9 to $10 billion range annually, as we discussed before, 2024 is a bit lower given certain capital-efficient network activities such as spectrum re-farming and deploying additional 2.5GHz licenses from Auction 108, benefiting from the significant 5G radio deployments during our merger integration,” he said, referring to a previous frequency sale and the $26 billion merger with Sprint in 2020. Site upgrades and build activity is planned in the fourth quarter, he said.

Other T-Mo Highlights:

Industry-Leading Customer Growth Fueled by Best Network and Best Value Combination (1)

- Postpaid net account additions of 301 thousand, best in industry

- Postpaid net customer additions of 1.3 million, best in industry, crossed 100 million postpaid customers milestone

- Postpaid phone net customer additions of 777 thousand, best in industry, highest Q2 in company history, and postpaid phone churn of 0.80%

- High Speed Internet net customer additions of 406 thousand, best in industry, highest share of industry net additions ever

Translating Industry-Leading Customer Growth Into Industry-Leading Financial Performance

- Service revenues of $16.4 billion grew 4% year-over-year, best in industry growth

- Postpaid service revenues of $12.9 billion grew 7% year-over-year, best in industry growth

- Net income of $2.9 billion grew 32% year-over-year, best in industry growth

- Diluted earnings per share (“EPS”) of $2.49 grew 34% year-over-year, best in industry growth

- Core Adjusted EBITDA (2) of $8.0 billion grew 9% year-over-year, best in industry growth

- Net cash provided by operating activities of $5.5 billion, record high and grew 27% year-over-year

- Adjusted Free Cash Flow (2) of $4.4 billion, record high and grew 54% year-over-year

- Returned $3.0 billion to stockholders in Q2 2024, including repurchases of $2.3 billion of common stock and a quarterly dividend payment of $759 million

Overall Network Leader with Largest, Fastest and Most Advanced 5G Network:

T-Mobile’s network breadth, depth and technology leadership is expected to keep the company years ahead of the competition with total 5G and Ultra Capacity 5G coverage area that continues to far exceed that of the next closest competitor. The company’s unique multi-layer approach to 5G, with dedicated standalone 5G deployed nationwide across 600MHz, 1.9GHz, and 2.5GHz, delivers customers a consistently strong experience and 87% of 5G traffic is on sites with all three spectrum bands deployed.

T-Mobile’s 5G leadership has translated into overall network leadership, with the company continuing to earn third-party recognition for its overall network performance:

- Ookla: In its Speedtest Connectivity United States 1H 2024 report, T-Mobile ranked as the top network performer in seven categories, including wins for fastest overall and 5G network and most consistent overall network, along with best overall and 5G mobile video experience, best gaming experience and highest ranking consumer sentiment.

- Opensignal: In its latest USA Mobile Network Experience report, T-Mobile ranked first for all overall network experience metrics while also earning additional wins for 5G with the fastest 5G download speeds, best 5G coverage experience and best 5G availability.

|

Notes: See 5G device, coverage, and access details at T-Mobile.com. Ookla awards: Based on analysis by Ookla® of Speedtest Intelligence® data for the U.S., 1H 2024. Ookla trademarks used under license and reprinted with permission. Opensignal Awards: USA: Mobile Network Experience Report July 2024, based on independent analysis of mobile measurements recorded during the period March 1 – May 29, 2024. © 2024 Opensignal Limited. |

- The 5G availability gap between T-Mobile and its competitors measures “what proportion of time people have a network connection, in places they most commonly frequent.” T-Mobile scored 67.9% on average. AT&T managed only 11.8%, while Verizon was on a lousy 7.7%. That gap between one player and the other two on such a seemingly important metric may concern investors in AT&T and Verizon.

- 87% of T-Mo’s 5G traffic is now carried at sites where equipment supports all three of the 600MHz, 1.9GHz and 2.5GHz spectrum bands. AT&T and Verizon, by contrast, rely partly on airwaves in much higher ranges, including frequencies in and around the 3.5GHz band. Often described as a sweet spot for 5G, combining decent propagation with sufficient capacity, this “C-band” has come in for heavy criticism from Moffett. “Put simply, C-band isn’t very good spectrum,” he said in a research note issued earlier this month.

- T-Mo’s CAPEX had decreased and likely will continue to do so. That’s partly why free cash flow is high and rising. Capital expenditure fell from $14 billion in 2022, to $9.8 billion last year, and a dip below the $9 billion mark is now forecast for 2024.

- Net postpaid phone additions were up 777,000 in the second quarter, which resulted in T-Mobile having more than 77.2 million postpaid subs in total. For comparison, AT&T has 88 million postpaid subscribers and 19.3 million prepaid subscribers. Verizon has 94 million wireless retail +30.2 million business postpaid connections for a total of 124.2 million postpaid subs.

………………………………………………………………………………………………………………………………………………………..

Fiber Optic Network Opportunity:

Historically a pure-play wireless company, T-Mobile is on a fiber binge. In April, it announced intentions to acquire Lumos through a joint venture with investment firm EQT. More recently, it’s teaming with KKR to invest $4.9 billion for a 50% equity stake in Metronet in a joint venture with KKR. When combined, these deals position T-Mobile to reach about 10 million homes with fiber by the end of 2030. That’s on top of the fiber foray it’s doing with open access network operators like Intrepid Fiber, SiFi Networks and Tillman FiberCo.

T-Mo’s fiber appetite is an adjunct to its fixed wireless access (FWA) service. That’s its high-speed internet service that uses extra capacity on its mobile network. T-Mobile ended Q2 with 5.6 million high-speed internet customers. “We sell fixed wireless access in places in the network where we have excess capacity that won’t be consumed either now or in the future by normal mobile usage,” said T-Mobile Marketing President Mike Katz on the earnings call.

“That’s where we sell fixed wireless. In places where we deploy fiber, there’s an opportunity for us take some of the demand that we’re seeing in fixed wireless where those excess capacity pockets don’t exist and move them to fiber, so there’s really a bunch of complementary features to it,” he continued.

“One thing we feel very strongly about is that these (fiber optic network) transactions are not defensive of our mobile business,” CEO Sievert said. “We believe that our mobile business stands strongly alone. Consumer choice has been made very clear that wireless is a deeply considered sale. It’s the primary purchase decision in a connected life and that people will choose the wireless company that is right for them and we believe we will compete effectively as a pure play wireless company regardless of our simultaneous participation in broadband.”

Put together with its 5G broadband service, T-Mobile’s expanding web of physical fiber lines could help the company reach more than 17 million homes by 2030, according to New Street Research. That would trail AT&T and Verizon, which could respectively cover 38 million and 25 million homes with a fixed-line or wireless broadband offering, the research firm says.

“Because they’re in the game, they’re closing the gap with Verizon and AT&T, but they’re well behind,” New Street analyst Jonathan Chaplin said of T-Mobile. “If they really want to build a business the size of AT&T, they’d have to buy a Comcast or a Charter [Communications].”

“It’s kind of a land grab,” said BNP Paribas telecom analyst Sam McHugh, adding that telecom companies are rushing into neighborhoods where residents aren’t happy with their cable provider and don’t yet have fiber-optic service available. “Investors are worried that the more they invest in fiber, the more they become like AT&T and Verizon both in terms of financial profile and business mix,” McHugh said. Any aggressive moves could also drive up the prices of potential deal targets.

“If the whole fiber industry realizes, ‘Hey we have this big monster coming in and buying up fiber,’ it’s probably not the word they want on the street,” said Armand Musey, president of telecom advisory firm Summit Ridge Group. “Suddenly, all the sellers would have their antennas up.”

………………………………………………………………………………………………………………………………………………………..

References:

https://www.lightreading.com/5g/t-mobile-results-pile-5g-humiliation-onto-at-t-and-verizon

https://www.verizon.com/about/sites/default/files/Verizon_Fact_Sheet.pdf

https://www.t-mobile.com/news/network/t-mobile-kkr-joint-venture-to-acquire-metronet

https://www.wsj.com/business/telecom/t-mobile-fiber-optic-internet-connection-380957ef