T-Mobile US

UScellular adds NetCloud from Cradlepoint to its 5G private network offerings; Buyout coming soon?

UScellular has added NetCloud Private Networks from Cradlepoint (part of Ericsson) to expand its portfolio of private cellular solutions. The company now offers Ericsson Private 5G and Ericsson’s Mission Critical Networks to its customers. By building on these capabilities, UScellular is able to support even more customers across varying areas of business.

Some existing private cellular network ecosystems are pulled together piece by piece from different providers, which requires additional training and agreements. This makes it difficult for enterprise IT teams to have seamless visibility across the entire network. NetCloud Private Networks is an end-to-end private cellular network solution that removes these complexities to simplify building and operating 5G private networks.

“With the addition of NetCloud Private Networks to our portfolio, we can better address business challenges for customers of all sizes to connect business, industry and mission critical applications,” said Kim Kerr, senior vice president, enterprise sales and operations for UScellular. “The agility, flexibility and scalability of NetCloud Private Networks helps improve coverage, security, mobility, and reliability for applications where Wi-Fi may not be enough.”

NetCloud Private Networks supports enterprises who need more scalable, reliable and secure connectivity than they are getting today with traditional Wi-Fi solutions. There is significant opportunity in warehouses, logistics facilities, outdoor storage yards, manufacturing and retail operations environments to provide more connectivity. This will alleviate manual work, improve safety, and provide increased visibility.

“UScellular is a leader in this space by showing how a public carrier enhances the value of private network solutions,” said Manish Tiwari, head of private cellular networks, Cradlepoint and Ericsson Enterprise Wireless Networks.

“By adding NetCloud Private Networks to their portfolio of Ericsson private networks solutions, UScellular unlocks new opportunities for organizations to have local network coverage and address their reliability and security challenges. With solutions available to cater to both OT and IT in industrial and business environments, their customers have a choice in adopting the right private network solution for their use-cases with secure, policy-based wireless connectivity at scale.”

………………………………………………………………………………………………………………………..

Separately, The Wall Street Journal reported Thursday that T-Mobile is seeking to buy $2 billion worth of UScellular and take over some operations and wireless spectrum licenses. A deal could be announced this month, according to people familiar with the matter.

Meanwhile, Verizon is considering a deal for some of the rest of the company which is 80% owned by Telephone & Data Systems (TDS). Last year, TDS put the wireless company’s operations up for sale, as it struggled with competition from national wireless telco rivals and cable-broadband providers.

Verizon is the biggest U.S. cellphone carrier by subscribers, while T-Mobile became the second largest soon after it bought rival Sprint. T-Mobile gained more customers this month after it completed its purchase of Mint Mobile, an upstart brand.

The rising value of wireless licenses is a driving force behind the deal. U.S. Cellular’s spectrum portfolio touches 30 states and covers about 51 million people, according to regulatory filings.

U.S. companies have spent more than $100 billion in recent years to secure airwaves to carry high-speed fifth-generation, or 5G, signals and are hunting for more. But the Federal Communications Commission has lacked the legal authority to auction new spectrum for more than a year. The drought has driven up the price of spectrum licenses at companies that already hold them.

The U.S. wireless business has also matured: Carriers have sold a smartphone subscription to most adults and many children, which leaves less room for expansion as the country’s population growth slows. AT&T and Verizon have meanwhile retreated from expensive bets on the media business to focus on their core cellphone and home-internet customers.

A once-crowded field of small, midsize and nationwide cellphone carriers in the U.S. is now split among Verizon, T-Mobile and AT&T, leaving few players left to take over. As one of the last pieces left on the board, U.S. Cellular has long been an attractive takeover target. For many years, the home of the Chicago White Sox has been UScellular field.

………………………………………………………………………………………………………………………..

About UScellular:

UScellular offers wireless service to more than four million mostly rural customers across 21 states from Oregon to North Carolina. It also owns more than 4,000 cellular towers that weren’t part of the latest sale talks. The company has a market value of about $3 billion.

UScellular provides a range of solutions from public/private hybrid networks, MVNO models, localized data (aka CUPS) and custom VPN approaches. Private 5G offers unparalleled reliability, security and speed, enabling seamless communication and automation. For more information:

https://business.uscellular.com/products/private-cellular-networks/

References:

https://www.wsj.com/business/telecom/t-mobile-verizon-in-talks-to-carve-up-u-s-cellular-46d1e5e6

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

T-Mobile & EQT Joint Venture (JV) to acquire Lumos and build out T-Mobile Fiber footprint

T-Mobile and EQT, a purpose-driven global investment organization, today announced they have entered into a joint venture (JV) with EQT’s Infrastructure VI fund (EQT) that will acquire fiber-to-the-home platform Lumos from EQT’s predecessor fund EQT Infrastructure III.

The JV will bring T-Mobile’s retail, marketing, brand and customer experience strengths together with EQT’s fiber infrastructure investment expertise. Together they will acquire Lumos’ scalable fiber network build capabilities to deliver best-in-class high-speed fiber internet connectivity to customers across the U.S. without access to fiber today. After the transaction closes, Lumos, which currently reaches 320,000 households over 7,500 route miles with fiber optic internet and home wi-fi service in the Mid-Atlantic, will transition to a wholesale model with T-Mobile as the anchor tenant owning customer relationships and leveraging its brand to attract new subscribers. The JV will focus on market identification and selection, network engineering and design, network deployment, and customer installation.

“As the demand for reliable, low-latency connectivity rapidly increases, this deal is a scalable strategy for T-Mobile to take a significant step forward in expanding on our broadband success and continue shaking up competition in this space to bring even more value and choice to consumers,” said Mike Sievert, CEO of T-Mobile. “Together with EQT and Lumos, T-Mobile is building on our position as the fastest growing broadband provider in the country in a value-accretive way that complements our sustained growth leadership in wireless. Customers – homes and businesses – who get the fast, affordable, and reliable internet they need will be the real winners,” he added.

T-Mobile provides a unique value proposition and much-needed reliable connectivity to homes and businesses across the country through its 5G Internet, a fixed wireless internet service on its 5G network that is available to more than 50 million households and businesses nationwide and serves over 5 million customers, as well as T-Mobile Fiber, which has launched in parts of 16 U.S. markets. Those launches have shown consumer demand for broadband that T-Mobile cannot meet through its fallow capacity fixed wireless product alone, and many customers want the speed and reliability that only fiber can provide.

Jan Vesely, Partner within EQT’s Infrastructure Advisory Team said, “We are proud to have partnered with Lumos over the past six years to rapidly scale the company and roll out fiber to underserved markets, and we look forward to continuing to leverage EQT’s considerable digital infrastructure and fiber expertise to support the significant fiber buildout ambitions of T-Mobile and the JV. This new effort will build critical fiber broadband infrastructure that will enable remote work, education, and healthcare use cases across the country. We have worked with T-Mobile as a customer across many of our existing digital infrastructure investments and are delighted to build on that relationship and partner with T-Mobile on this opportunity to roll out fiber to underserved Americans.”

“Lumos takes great pride in our achievements, as we have successfully delivered fiber to hundreds of thousands of homes and businesses, marking a significant acceleration in our growth. Our commitment to enhancing customers’ lives through the development of a network prepared for the demands of tomorrow remains steadfast,” Brian Stading, CEO of Lumos. “With the support of our private equity partner, EQT, and leveraging the strength of the T-Mobile brand and unrivaled customer experience, Lumos is set to expedite our network expansion. This joint venture will amplify our ability to change lives through the transformative power of fiber optic internet.”

The transaction is expected to close in late 2024 or early 2025, subject to customary closing conditions and regulatory approvals. At closing, T-Mobile is expected to invest approximately $950 million in the JV to acquire a 50% equity stake and all existing fiber customers, with the funds invested by T-Mobile being used by Lumos for future fiber builds. The next capital contribution by T-Mobile out of an additional commitment of approximately $500 million is anticipated between 2027 and 2028. These combined investments are expected to allow Lumos to reach 3.5 million homes passed by the end of 2028. T-Mobile continues to expect to complete its remaining authorization for share repurchases and dividends in 2024.

With this transaction, EQT Infrastructure VI is expected to be 35-40% percent invested (including closed and/or signed investments, announced public offers, if applicable, and less any expected syndication) based on target fund size and subject to customary regulatory approvals.

References:

https://www.t-mobile.com/news/business/t-mobile-eqt-jv-to-acquire-lumos

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

T-Mobile combines Millimeter Wave spectrum with its 5G Standalone (SA) core network

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

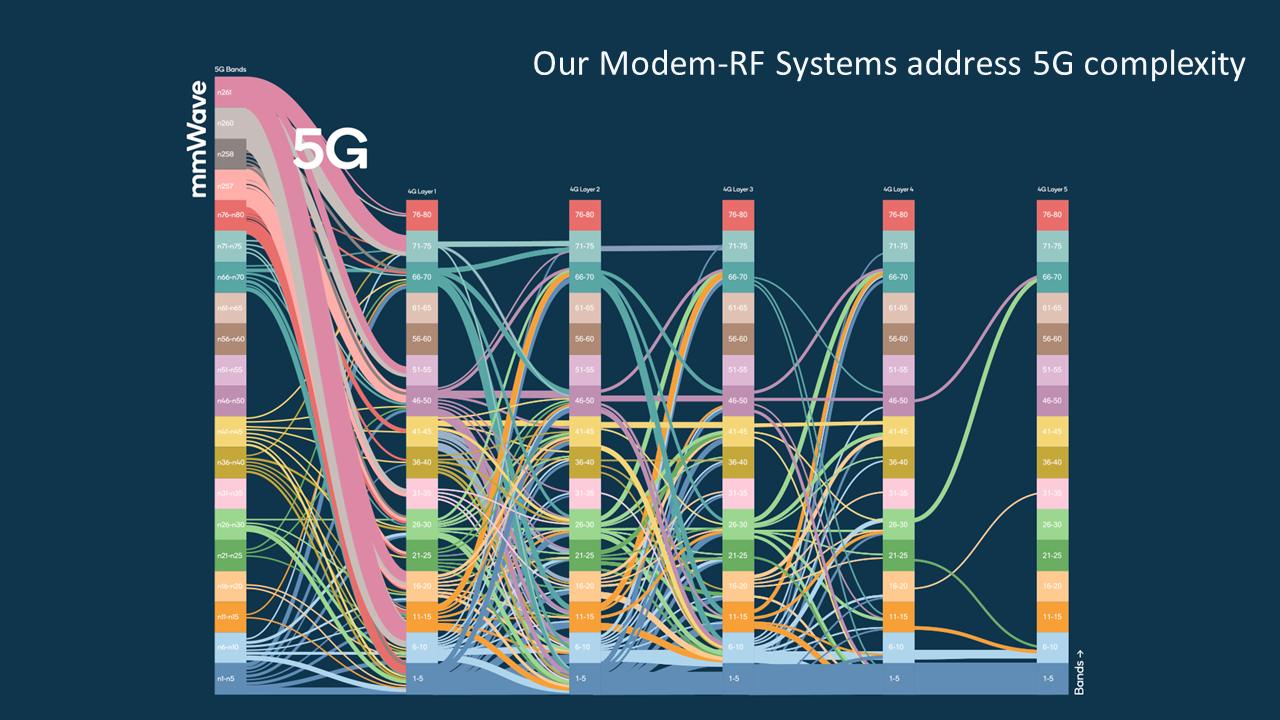

T-Mobile US, in a partnership with Ericsson and Qualcomm Technologies, has successfully tested the aggregation of six component carriers in sub-6 GHz spectrum in its live production 5G network.

The test involved aggregating two channels of 2.5 GHz, two channels of PCS spectrum and two channels of AWS spectrum, according to T-Mobile US, which produced an “effective 245 MHz of aggregated 5G channels.”

T-Mo said that they were able to “achieve download speeds of 3.6 Gbps in sub-6 GHz spectrum. That’s fast enough to download a two-hour HD movie in less than 7 seconds!”

5G carrier aggregation allows T-Mobile to combine multiple 5G channels (or carriers) to deliver greater speed and performance. In this test, the Un-carrier merged six 5G channels of mid-band spectrum – two channels of 2.5 GHz Ultra Capacity 5G, two channels of PCS spectrum and two channels of AWS spectrum – creating an effective 245 MHz of aggregated 5G channels.

Image Courtesy of Qualcomm Technologies

“We are pushing the boundaries of wireless technology to offer our customers the best experience possible,” said Ulf Ewaldsson, President of Technology at T-Mobile. “With the first and largest 5G standalone network in the country, T-Mobile is the only mobile provider serving 10s of millions of customers to unleash new capabilities like 5G carrier aggregation nationwide, and I am so incredibly proud of our team for leading the way.”

T-Mobile US announced in May of 2023 that it was rolling out four component-carrier aggregation across its 5G Standalone network, which it said at the time can achieve peak speeds of 3.3 Gbps. In that case, T-Mobile US relies on two 2.5 GHz channels, one 1.9 GHz channel and one 600 MHz channel. The first device able to access 4CA capabilities was the Samsung Galaxy S23.

The carrier also touted its testing of five-component-carrier aggregation in sub-6 GHz spectrum at last year’s Mobile World Congress Barcelona. In that trial, working with Nokia and Qualcomm, T-Mo aggregated two FDD and three TDD carriers and achieved peak downlink throughput speeds that exceeded 4.2 Gbps.

T-Mobile claims to be the leader in 5G, delivering the country’s largest, fastest and most awarded 5G network. The Un-carrier’s 5G network covers more than 330 million people across two million square miles — more coverage area than AT&T and Verizon combined. 300 million people nationwide are covered by T-Mobile’s super-fast Ultra Capacity 5G with over 2x more square miles of coverage than similar offerings from the Un-carrier’s closest competitors.

References:

https://www.ericsson.com/en/ran/carrier-aggregation

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

T-Mobile combines Millimeter Wave spectrum with its 5G Standalone (SA) core network

Verizon, T-Mobile and AT&T brag about C-band 5G coverage and FWA

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

T-Mobile US at “a pivotal crossroads” CEO says; 5,000 employees laid off

Ookla Q2-2023 Mobile Network Operator Speed Tests: T-Mobile is #1 in U.S. in all categories!

T-Mobile and Google Cloud collaborate on 5G and edge compute

T-Mobile combines Millimeter Wave spectrum with its 5G Standalone (SA) core network

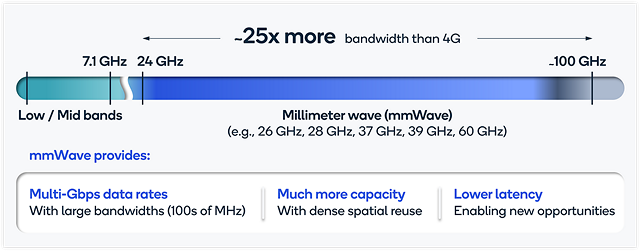

T-Mobile, with the help of with Ericsson and Qualcomm Technologies, Inc., has tested millimeter wave (mmWave) on its production 5G SA network (note that mmWave identifies higher frequencies used on a 5G RAN, while 5G SA refers to a true 5G core network). The Un-carrier aggregated eight channels of mmWave spectrum to reach download speeds topping 4.3 Gbps without relying on low-band or mid-band spectrum to anchor the connection. T-Mobile also aggregated four channels of mmWave spectrum on the uplink, reaching speeds above 420 Mbps.

In the latest revision of ITU-R M.1036- Frequency Arrangements for IMT-the following mmWave bands were approved:

-Frequency arrangements in the band 24.25-27.5 GHz

-Frequency arrangements in the band 45.5-47 GHz

-Frequency arrangements in the band 47.2-48.2 GHz

-Frequency arrangements in the band 66-71 GHz

In the U.S., Verizon has historically been the carrier promoting 5G mmWave, which they dubbed “5G Ultra Wideband.” The telco claims they’ve achieved 1.26 Gbps upload speed using 5G Ultra Wideband. With uploading data becoming increasingly important for video chats, uploading large files or live streaming video. “We have achieved remarkable speed in downloading using various combinations of spectrum in our world-class spectrum portfolio,” said Adam Koeppe, Senior Vice President of Technology Planning at Verizon. “This new achievement indicates how much additional performance we can unleash for our customers on the uplink as we aggregate different combinations of spectrum.”

T-Mobile took the opposite path, focusing on mid and low-band spectrum for its 5G network…until now. 5G mmWave can deliver very fast speeds because it offers massive capacity. But the signal doesn’t travel very well through obstacles, making it less ideal for mobile phone users who aren’t sitting still. That’s why T-Mobile has implemented a multi-band spectrum strategy using low-band to blanket the country and mid-band and high-band (Ultra Capacity) to deliver insanely fast speeds to nearly everyone. Now the Un-carrier is testing 5G mmWave on 5G SA for crowded areas like stadiums and, potentially, for fixed wireless service.

“We’ve been industry leaders – rolling out the first, largest and fastest 5G standalone network across the country – and now we’re continuing to push the boundaries of wireless technology,” said Ulf Ewaldsson, President of Technology at T-Mobile. “We’ve always said we’ll use millimeter wave where it makes sense, and this test allows us to see how the spectrum can be put to use in different situations like crowded venues or to power things like fixed-wireless access when combined with 5G standalone.”

T-Mobile is the U.S. leader in 5G [1.] delivering the largest, fastest and most awarded 5G network in the country. The Un-carrier’s 5G network covers more than 330 million people across two million square miles — more than AT&T and Verizon combined. 300 million people nationwide are covered by T-Mobile’s super-fast Ultra Capacity 5G with over 2x more square miles of coverage than similar mid-band 5G offerings from the Un-carrier’s closest competitors. According to Ookla’s quarterly speed test reports, T-Mobile’s 5G network has consistently outperformed AT&T’s and Verizon’s when it comes to median download speed.

Note 1. AT&T is the leading provider of mobile services in the U.S. with 229.1 subscribers as of Q2 2023, followed by: Verizon: 143.3 million (Q2 2023),,T-Mobile US: 117.9 million (Q3 2023), Dish Wireless: 7.5 million (Q3 2023), and uscellular: 4.6 million (Q3 2023).

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

T-Mobile also offers wireless solutions to connect homes and businesses. 5G Home Internet (FWA) is available to over 50 million homes today, plus Small Business Internet and Business Internet is available across the country. This means millions of homes and businesses can finally ditch traditional ISPs for fast, reliable and hassle-free internet service with T-Mobile. The telco’s FWA customer base increased by 557,000 during Q3, giving it a total of 4.2 million. It has allowed T-Mobile to offer a compelling alternative to fixed broadband, but its service comes with the caveat that speeds will fluctuate depending on demand.

The extra capacity offered by mmWave could help to offer a faster, more consistent connection, making it even more appealing. However, the propagation challenges of mmWave spectrum means customers will have to ensure their FWA hub is sitting on the right shelf or window sill to establish a fast, reliable connection. Addressing complaints as customers struggle to put their hub in the right spot may be a problem for the Un-carrier.

Editor’s Note:

The NTIA will study the following bands in the next two years, noting that the spectrum could support a range of uses, including mobile broadband (IMT), drones and satellite operations:

- 3.1 GHz-3.45 GHz

- 5.03 GHz-5.091 GHz

- 7.125 GHz-8.4 GHz

- 18.1 GHz-18.6 GHz

- 37.0 GHz-37.6 GHz

References:

https://www.t-mobile.com/news/network/t-mobile-revs-up-millimeter-wave-with-5g-standalone

https://www.verizon.com/about/news/verizon-achieves-upload-speeds-surpassing-1-gbps

https://www.telecoms.com/5g-6g/t-mobile-finally-puts-mmwave-to-work-in-5g-sa-network

https://www.telecoms.com/wireless-networking/t-mobile-network-speeds-still-way-ahead-of-verizon-at-t

U.S. Launches National Spectrum Strategy and Industry Reacts

Verizon, T-Mobile and AT&T brag about C-band 5G coverage and FWA

Verizon says it has approximtely 222 million people covered with its mid-band C-band network, [1.] a figure the company hopes to increase to 250 million by the end of next year. “C-band is a game change for our business,” CEO Hans Vestberg said on the telco’s 3rd quarter earnings call. “Our network is winning.”

Note 1. C-band sits between the two Wi-Fi bands, which are at 2.4GHz and 5GHz. It’s slightly above and very similar to the 2.6GHz band that Clearwire and then Sprint used for 4G starting in 2007, and which T-Mobile currently uses for mid-band 5G. And it adjoins CBRS, a band from 3.55 to 3.7GHz that’s currently being deployed for 4G. ITU-R divided C-band into three chunks, referred to as band n77, band n78, and band n79.

……………………………………………………………………………………………………………………………

Verizon officials said the company is using the capacity in its mid-band 5G network to pursue opportunities like fixed wireless access (FWA) and private wireless networks. “We see demand for the product continuing to grow,” Vestberg said of Verizon’s private wireless network offerings. He added that Verizon is working to transition its private wireless customers from pilots to commercial deployments. He also said the company is growing its ecosystem of suppliers for that business.

…………………………………………………………………………………………………………………………

T-Mobile announced Tuesday it now covers 300 million people with its 2.5GHz mid-band network, reaching that goal three months earlier than the company had planned. T-Mobile’s overall 5G footprint has expanded as well, now covering more than 330 million people or 98% of the population.

“We have been leaders in the 5G era from the start, deploying the largest, fastest, most awarded and most advanced 5G network in the country faster than anyone else,” said Ulf Ewaldsson, President of Technology at T-Mobile. “While the other guys are playing catch-up, finally beginning to build out their mid-band 5G networks, we are maintaining our lead and will continue offering customers the best network – paired with the best value – for years to come.”

“T-Mobile’s turnaround story is incredible, going from network underdog a decade ago to the undeniable network leader today,” said Anshel Sag, Principal Analyst at Moor Insights and Strategy. “T-Mobile has not only built out a robust 5G network with unmatched coverage and capacity, but the Un-carrier is also leading the way in rolling out new capabilities that will unlock the true promise of 5G.”

………………………………………………………………………………………………………………………..

Last week, AT&T said it ended the third quarter covering 190 million subscribers for its mid-band 5G network, and said it remains on track to cover 200 million by the end of the year. On the telco’s 3-2023 earnings call, CEO John Stankey said, “we continue to enhance the largest wireless network in North America and expand the nation’s most reliable 5G network. It’s no surprise that when you combine our high-value customer growth and rising revenues per user, we continue to grow profits in our wireless business.”

Regarding FWA, Stankey touted the company’s Internet Air offering. “We have no issues selling Internet Air into the business segment. It’s a really attractive thing for us to do. It’s a really helpful product on a number of different fronts. It meets a particular need.

……………………………………………………………………………………………………..

References:

https://www.lightreading.com/private-networks/verizon-jumps-too-as-mobility-biz-surprises-in-q3

https://www.pcmag.com/news/what-is-c-band

https://www.fool.com/earnings/call-transcripts/2023/10/19/att-t-q3-2023-earnings-call-transcript/

https://www.att.com/internet/internet-air/

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

This June, we noted that the FCC was exploring shared use of the 42 GHz band using in 500 megahertz of spectrum. Recently, T-Mobile and Charter voiced support for some kind of spectrum sharing scenario.

“While wireless carriers continue to require additional spectrum that is licensed on an exclusive-use basis, T-Mobile agrees that the technical characteristics of the 42GHz band, along with its separation from other millimeter wave spectrum that has already been licensed, means that the commission may wish to consider a different approach here,” T-Mobile wrote in an August 30th FCC filing.

“The commission, however, should avoid applying untested, novel sharing approaches to the 42GHz band. Instead, it should implement the nationwide non-exclusive licensing framework currently used in the 70/80/90GHz bands, with a few modifications to ensure that the spectrum will be used efficiently and may be deployed for [a] variety of advanced communications services.”

……………………………………………………………………………………………………………………….

Charter has long eyed the 37GHz band as a way to bolster mobile operations in its planned 3.5GHz CBRS network. The MSO/cableco has said it could offer speeds up to 1 Gbit/s via concurrent operations in the CBRS and 37GHz bands.

Charter’s FCC filing is similar to T-Mobile’s, as it supports a “unified nationwide, non-exclusive simple shared licensing regime.” The company urged the FCC to implement the same spectrum sharing design across both the lower 37GHz band and the 42GHz band.

“Allocating the lower 37GHz band for non-exclusive use would offer 600 megahertz for innovative new wireless connectivity in the United States,” Charter noted. “The allocation of the 42GHz band alongside the lower 37GHz band would of course increase the total spectrum available for innovative new deployments by 500 megahertz.”

……………………………………………………………………………………………………………….

Backgrounder:

The 42GHz band resides in what is known as millimeter wave (mmWave) spectrum. 5G transmissions in those bands are at very high speeds, but they typically travel just a few thousand feet, and generally cannot pass through obstructions like walls, trees, glass or concrete, i.e. they require line of sight communications.

WRC 19 identified mmWave frequencies for 5G, but ITU-R WP 5D did not complete and agree on the frequency arrangements for same (revision 6 of ITU-R M.1036) until very recently. WRC 19 identified the frequency bands: 24.25-27.5 GHz, 37-43.5 GHz, 45.5-47 GHz, 47.2-48.2 and 66-71 GHz for the deployment of 5G networks and the frequency arrangements for them is in draft recommendation ITU-R M.1036 which is expected to be approved this November. Note that 42GHz is not included!

Some analysts are quite positive on mmWave communications. For example, “mmWave 5G offers a way to improve on the current situation because the bands have extremely high capacity that are able to support very large amounts of data traffic and users, although in a small area,” wrote OpenSignal analyst Ian Fogg in a post on the network-monitoring firm’s website.

Qualcomm is also an advocate of spectrum sharing in mmWave bands since at least July 2022.

Image Credit: Qualcomm

Qualcomm’s filings to open the Lower 37 GHz band to shared licensed access ask the FCC to adopt a Notice of Proposed Rulemaking (NPRM) to allocate six 100-MHz-wide priority licenses in the Lower 37 GHz band and allow each priority operator—which may be a federal government or a commercial operator—to use the rest of the band on a secondary basis. To enable these secondary operations on an interference-free basis, each priority operator would implement a technology-neutral, equipment-based rule to provide coordinated, periodic listening of the channel, referred to as long term sensing (LTS), to determine whether its secondary operations on spectrum outside its priority licensed spectrum may cause harmful interference to the priority license holder of that swath of spectrum.

Secondary operations are only allowed for communications links that sensing determines will not cause interference to the priority licensee. The coordinated sensing procedure allows each priority license holder to access all other channels (i.e., the other 500 MHz) on a secondary – and interference-free – basis, increasing overall spectrum utilization while not degrading the QoS for the priority licensee.

References:

https://www.fcc.gov/ecfs/document/10830309419380/1

https://www.fcc.gov/ecfs/document/10830021467677/1

WRC 19 Wrap-up: Additional spectrum allocations agreed for IMT-2020 (5G mobile)

T-Mobile US at “a pivotal crossroads” CEO says; 5,000 employees laid off

T-Mobile US Chief Executive Mike Sievert says the company is at a “pivotal crossroads.” Sievert’s comments come in a letter to staff in which he says the company is laying off 5,000 employees, or some 7% of the company.

T-Mobile CEO Mike Sievert argued the new job cuts would better position T-Mobile for the future. Sievert also cited increasing customer acquisition and retention costs. He described the layoffs as a “large change, and an unusual one for our company.”

Sievert wrote in a letter to T-Mobile employees:

“What it takes to attract and retain customers is materially more expensive than it was just a few quarters ago. We’ve been out-running this trend by accelerating merger synergies, and building our high-speed Internet business faster than expected, and out-performing in a few other areas. However, it is clear that doing everything we are doing and just doing it faster is not enough to deliver on these changing customer expectations going forward.

Today’s changes are all about getting us efficiently focused on a finite set of winning strategies, so that we can continue to out-pace our competitors and have the financial capability to deliver a differentiated network and customer experience to a continually growing customer base, while simultaneously meeting our obligations to our shareholders.”

T-Mobile CEO Mike Sievert (Source: UPI/Alamy Stock Photo)

T-Mobile’s layoffs will come over the next five weeks. Sievert wrote that the cuts would primarily affect corporate and back-office roles, along with some technology positions. These job cuts should come as no surprise. T-Mobile has been steadily reducing the number of its employees since it merged with Sprint in 2020. Earlier this year T-Mobile laid off an unspecified number of employees as it worked to overhaul its retail sales strategy. Can Sievert be trusted when he wrote, “After this process is complete, I do not envision any additional widespread company reductions again in the foreseeable future.”???

Telecom layoffs this year are surging. AT&T, Verizon, Crown Castle, Ericsson, Airspan, Cambium Networks, Cisco Systems and Dish Network are among telecom companies cutting jobs. Moreover, both AT&T and Verizon have recently embarked on new cost-cuttingprograms on top of previous cost reduction campaigns.

The layoffs come as T-Mobile and its rival cell carriers face increased competition from cable companies that are offering mobile plans and piggybacking on the carrier’s networks via MVNO relationships. Other MVNOs, or mobile virtual network operators, unrelated to the cable companies are also offering lower-priced cell plans.

References:

https://www.sec.gov/Archives/edgar/data/1283699/000119312523219679/d507613dex991.htm

https://www.lightreading.com/5g-and-beyond/how-and-why-t-mobile-is-cutting-5000-jobs/d/d-id/786245?

https://www.wsj.com/business/telecom/t-mobile-us-to-lay-off-7-of-workforce-df368047

Inside AT&T’s newly expanded $8 billion cost-reduction program & huge layoffs

T-Mobile and Google Cloud collaborate on 5G and edge compute

Ookla Q2-2023 Mobile Network Operator Speed Tests: T-Mobile is #1 in U.S. in all categories!

T-Mobile and Google Cloud collaborate on 5G and edge compute

T-Mobile and Google Cloud announced today they are working together to combine the power of 5G and edge compute, giving enterprises more ways to embrace digital transformation. T-Mobile will connect the 5G Advanced Network Solutions (ANS) [1.] suite of public, private and hybrid 5G networks with Google Distributed Cloud Edge (GDC Edge) to help customers embrace next-generation 5G applications and use cases — like AR/VR experiences.

Note 1. 5G ANS is an end-to-end portfolio of deployable 5G solutions, comprised of 5G Connectivity, Edge Computing, and Industry Solutions – along with a partnership that simplifies creating, deploying and managing unique solutions to unique problems.

More companies are turning to edge computing as they focus on digital transformation. In fact, the global edge compute market size is expected to grow by 37.9% to $155.9 billion in 2030. And the combination of edge computing with the low latency, high speeds, and reliability of 5G will be key to promising use cases in industries like retail, manufacturing, logistics, and smart cities. GDC Edge customers across industries will be able to leverage T-Mobile’s 5G ANS easily to get the low latency, high speeds, and reliability they will need for any use case that requires data-intensive computing processes such as AR or computer vision.

For example, manufacturing companies could use computer vision technology to improve safety by monitoring equipment and automatically notifying support personnel if there are issues. And municipalities could leverage augmented reality to keep workers at a safe distance from dangerous situations by using machines to remotely perform hazardous tasks.

To demonstrate the promise of 5G ANS and GDC Edge in a retail setting, T-Mobile created a proof of concept at T-Mobile’s Tech Experience 5G Hub called the “magic mirror” with the support of Google Cloud. This interactive display leverages cloud-based processing and image rendering at the edge to make retail products “magically” come to life. Users simply hold a product in front of the mirror to make interactive videos or product details — such as ingredients or instructions — appear onscreen in near real-time.

“We’ve built the largest and fastest 5G network in the country. This partnership brings together the powerful combination of 5G and edge computing to unlock the expansion of technologies such as AR and VR from limited applications to large-scale adoption,” said Mishka Dehghan, Senior Vice President, Strategy, Product, and Solutions Engineering, T-Mobile Business Group. “From providing a shopping experience in a virtual reality environment to improving safety through connected sensors or computer vision technologies, T-Mobile’s 5G ANS combined with Google Cloud’s innovative edge compute technology can bring the connected world to businesses across the country.”

“Google Cloud is committed to helping telecommunication companies accelerate their growth, competitiveness, and digital journeys,” said Amol Phadke, General Manager, Global Telecom Industry, Google Cloud. “Google Distributed Cloud Edge and T-Mobile’s 5G ANS will help businesses deliver more value to their customers by unlocking new capabilities through 5G and edge technologies.”

T-Mobile is also working with Microsoft Azure, Amazon Web Services and Ericsson on advanced 5G solutions.

References:

https://www.t-mobile.com/news/business/t-mobile-and-google-cloud-join-5g-advanced-network-solutions

https://www.t-mobile.com/business/solutions/networking/5G-advanced-solutions

Astound Broadband to launch MVNO service powered by T-Mobile

Astound Broadband (Astound), the sixth-largest U.S. cable provider, will soon debut its new Astound Mobile service, powered by T-Mobile. Known for its award-winning customer service, Astound will make its mobile offering available to customers in approximately 4 million homes currently passed by the company across 12 states.

The service will be exclusively available to Astound home internet customers who are eligible residents in Massachusetts and Corpus Christi, Midland-Odessa, Temple, and Waco Texas in June. The company plans to continue to launch Astound Mobile in its remaining markets by the end of the year.

“Astound’s entrance into the wireless market comes at a time when the need for fast, reliable, high-value broadband and mobile services is at an all-time high and more critical than ever,” said Jim Holanda, Astound CEO. “Through our relationship with T-Mobile, we’ll bring exceptional choice, value and savings, and competitive, award-winning services that customers need to stay connected to their world.”

“Astound has a collective commitment to serving customers with innovative technologies and award-winning customer service in the regional broadband marketplace. By choosing the T-Mobile nationwide network, Astound will further their commitment by creating custom applications that benefit their customers beyond their home or business on T-Mobile’s nationwide 5G network,” said Dan Thygesen, Senior Vice President of T-Mobile Wholesale and head of T-Mobile’s growing wholesale business.

Astound’s mobile product will leverage the nation’s largest, fastest and most awarded 5G network through T-Mobile and will offer a variety of plans that when bundled with Astound’s ultra-fast, award-winning internet service, customers will have access to savings and competitive offerings. Astound will offer two “pay by the gig” plans and two unlimited talk and text plans. Customers can choose a plan whereby they only pay for the data they need or they can expand to an unlimited plan with data allotted to each user. Customers will be able to stream, browse, talk and text with confidence knowing Astound Mobile runs on T-Mobile’s powerful network with 5G service in all 50 states.

Astound didn’t reveal the price of its mobile plans today but said it will offer a variety of plans bundled with its internet service, including two “pay by the gig” plans and two unlimited talk and text plans. Customers can choose a plan whereby they only pay for the data they need or they can expand to an unlimited plan with data allotted to each user, according to the press release.

Astound Broadband is comprised of organizations formerly known as RCN, Grande Communications, Wave Broadband and enTouch. The company’s markets include Chicago, Indiana, eastern Pennsylvania, Massachusetts, New York City, Maryland, Washington, D.C., Texas and regions throughout California, Oregon and Washington.

Last month, Astound, which is the sixth largest U.S. cable provider, announced that it had partnered with Reach, the software-as-a-service company, to offer mobile service.

On a net basis, cable accounted for about 75% of total industry phone net additions in Q1 2023, according to analyst Craig Moffett. Combined, cable now serves nearly 12 million wireless subscribers.

Earlier this year, the National Content & Technology Cooperative (NCTC) made arrangements with AT&T to provide its members with a white-label MVNO service. Reach also is involved in that deal.

About Astound Broadband:

Astound Broadband (astound.com) is the sixth largest cable operator in the U.S., providing award-winning high-speed internet, broadband communications solutions, TV, phone services, and fiber optic solutions for residential and business customers across the United States. Astound Broadband is comprised of organizations formerly known as RCN, Grande Communications, Wave Broadband, and enTouch. The company services Chicago, Indiana, Eastern Pennsylvania, Massachusetts, New York City, Maryland, Washington, D.C., Texas, and regions throughout California, Oregon, and Washington.

References:

Leichtman Research Group: Fixed Wireless Services Accounted for 90% of the Broadband Net Adds in 2022!

Leichtman Research Group, Inc. (LRG) found that the largest cable and wireline phone providers and fixed wireless services in the U.S. – representing about 95% of the market – acquired about 3,500,000 net additional broadband Internet subscribers in 2022, compared to a pro forma gain of about 3,725,000 subscribers in 2021.

These top broadband providers account for about 110.5 million subscribers, with top cable companies having 75.6 million broadband subscribers, top wireline phone companies having 30.8 million subscribers, and top fixed wireless services having 4.1 million subscribers.

LRG’s findings for 2022 include:

- Overall, broadband additions in 2022 were 94% of those in 2021.

- The top cable companies added about 515,000 subscribers in 2022 – compared to about 2.8 million net adds in 2021.

- The top wireline phone companies lost about 180,000 total broadband subscribers in 2022 – compared to about 210,000 net adds in 2021.

- Wireline Telcos had about 2.4 million net adds via fiber in 2022, offset by about 2.6 million non-fiber net losses.

- Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,170,000 subscribers in 2022 – compared to about 730,000 net adds in 2021.

“Top broadband providers added about 3.5 million subscribers in 2022. Fixed wireless services (FWA) accounted for 90% of the net broadband additions in 2022, compared to 20% of the net adds in 2021,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Total broadband net adds in 2022 were slightly lower than last year, and down from about 5 million in 2020, but were more than in any year from 2012-2019.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

FWA in the Spotlight:

A recent survey of some T-Mobile fixed wireless customers, conducted by the financial analysts at Wolfe Research, “T-Mobile Fixed Wireless Consumer Survey & Broadband Industry Implications,” found that 90% rated their service as “good enough.” The firm surveyed Facebook’s T-Mobile FWA user group, totalling over 15,000 members, in December 2022. Based on the 60 replies it received, 90% said they were mostly satisfied. The firm also found that 42% of respondents previously subscribed to a cable connection, 37% hailed from DSL operators, and 6% previously used fiber. Around 8% had no prior broadband service. Moreover, the financial analysts at Evercore expect T-Mobile to accumulate around 450,000 new fixed wireless customers in the first quarter of 2023, down from the 524,000 the operator reported in the fourth quarter of 2022.

Verizon added 262,000 residential FWA customers in Q4, up from +38,000 in the year-ago period, to end 2022 with 884,000 residential FWA subscribers. The company also signed on 117,000 business FWA subs in the quarter, up from +40,000 in the year-ago period, ending 2022 with 568,000 business FWA customers. About 70% of the consumer fixed wireless gross additions have come from bundling an existing wireless service, while 30% are new to Verizon. Interestingly, the experience is flipped for Verizon Business, where 70% of FWA customers were new to Verizon.

In contrast to the widely-held view that FWA is a “lower quality” service than wired broadband, Verizon says their principal selling point is FWA network’s greater reliability versus wireline alternatives. Cable’s outside plant issues can take days to resolve, a particularly critical issue in B2B, where cablecos (like Comcast Business) have increased their market share.

Image Credit: Verizon

The Wireless Internet Service Providers Association (WISPA) kicked off its annual trade show this week in Louisville, Kentucky, stating that WISPs service a total of 9 million Americans, many of whom live in the hardest to reach and serve parts of the country

According to Fierce Wireless, Cox is using 5G technology to test FWA services near Macon, Georgia; Tucson, Arizona; and Oklahoma City, Oklahoma.

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

| Broadband Providers | Subscribers at end of 2022 | Net Adds in 2022 |

| Cable Companies | ||

| Comcast | 32,151,000 | 250,000 |

| Charter | 30,433,000 | 344,000 |

| Cox* | 5,560,000 | 30,000 |

| Altice | 4,282,900 | (103,300) |

| Mediacom* | 1,468,000 | 5,000 |

| Cable One** | 1,060,400 | 14,400 |

| Breezeline** | 693,781 | (22,997) |

| Total Top Cable | 75,649,081 | 517,103 |

| Wireline Phone Companies | ||

| AT&T | 15,386,000 | (118,000) |

| Verizon | 7,484,000 | 119,000 |

| Lumen^ | 3,037,000 | (253,000) |

| Frontier | 2,839,000 | 40,000 |

| Windstream* | 1,175,000 | 10,300 |

| TDS | 510,000 | 19,700 |

| Consolidated** | 367,458 | 724 |

| Total Top Wireline Phone | 30,798,458 | (181,276) |

| Fixed Wireless Services | ||

| T-Mobile | 2,646,000 | 2,000,000 |

| Verizon | 1,452,000 | 1,171,000 |

| Total Top Fixed Wireless | 4,098,000 | 3,171,000 |

| Total Top Broadband | 110,545,539 | 3,506,827 |

* LRG estimate

** Includes LRG estimate of pro forma net adds

^ Includes the impact of a divestiture completed in October 2022

- TDS residential subscribers, includes 305,200 wireline subscribers and 204,800 cable subscribers

- Company subscriber counts may not solely represent residential households – about 6.5% of the total are non-residential

- Top broadband providers represent approximately 95% of all subscribers

- Net additions reflect pro forma results from system sales and acquisitions, reporting adjustments, and the addition of new providers to the list – therefore, comparing totals in this release to prior releases will not produce accurate findings

About Leichtman Research Group, Inc:

Leichtman Research Group, Inc. (LRG) specializes in research and analysis on broadband, media and entertainment industries. LRG combines ongoing consumer surveys with industry tracking and analysis, to provide companies with a richer understanding of current market conditions, and the potential impact and adoption of new products and services. For more information about LRG, please call (603) 397-5400 or visit www.LeichtmanResearch.com

References:

https://wispa.org/news_manager.php?page=29725

https://www.verizon.com/about/blog/fixed-wireless-access