Lumen: “We’re Building the Backbone for the AI Economy” – NaaS platform to be available to more customers

“Lumen is determined to lead the transformation of our industry to meet the demands of the AI economy,” said Lumen Technologies CEO Kate Johnson. “With ubiquitous reach and a digital-first platform, we are positioned to deliver next-gen connectivity, power enterprise innovation, and secure our own growth. This is how we build the trusted network for AI and deliver exceptional value to our customers and shareholders.”

Highlights included keynote remarks from Johnson, who outlined the three pillars of the company’s strategy:

- Building the backbone for the AI economy with a physical network designed for scale, speed, and security – delivering connectivity anywhere and for everything customers want to do.

- Cloudifying and agentifying telecom to reduce complexity and simplify the network for customers as an intelligent, on-demand, consumption-based digital platform.

- Creating a connected ecosystem with partnerships that extend Lumen’s reach, accelerate customer-first, AI-driven innovation, and unlock new opportunities across industries.

Johnson noted how Lumen’s growth is powered by a set of unique enablers that turn the company’s network into a true digital platform. With near-term product launches like self-service digital portal Lumen Connect, a universal Fabric Port, and new innovations in development that extend intelligence into the network edge, Lumen is making connectivity programmable and effortless. Combined with the company’s Network-as-a-Service business model and a connected ecosystem of data centers, hyper-scalers and technology partners, these enablers give customers the speed, security, and simplicity they need to thrive in the AI economy.

Lumen Technologies CEO Kate Johnson spotlights the company’s bold strategy, financial progress, and early look at product roadmap to reimagine digital networking for the AI economy at a gathering of industry analysts.

………………………………………………………………………………………………………………………………………………………………………………………………………

Chief Financial Officer Chris Stansbury said 2026 is expected to mark an inflection point as new digital revenues, growth in IP and Wavelengths, and long-term hyper-scaler contracts begin to outpace legacy declines – setting up what he called a “trampoline moment” for expansion. Lumen projects business segment revenue growth in 2028 and a return to overall top-line growth in 2029, establishing a clear path from stabilization to value creation.

With a strengthened balance sheet and greater financial freedom, executives highlighted the bold investment in the company’s three strategic pillars, each designed to accelerate innovation and position Lumen for long-term industry leadership.

Lumen’s strategy begins with the physical network, which carries a significant portion of the world’s internet traffic. With construction underway coast-to-coast, the company is executing a multi-billion-dollar program to expand its intercity and metro fiber backbone:

- Adding 34 million new fiber miles by the end of 2028 for a total of 47 million intercity and metro miles.

- Connecting data centers, clouds, edge, and enterprise locations in any combination.

- Delivering 400G today and plans to scale to 1.6 terabits in the future.

Lumen’s substantial investments to expand high-speed connectivity ensures customers have the network scale, speed, and reliability to confidently innovate and grow without constraints.

The rise of AI is driving unprecedented demands for a new, Cloud 2.0 architecture with distributed, low-latency, high-bandwidth networks that can move and process massive amounts of data across multi-cloud, edge, and enterprise locations. Lumen is meeting this challenge by cloudifying and agentifying telecom, turning its expansive fiber footprint into a programmable digital platform that strips away the complexity of legacy networking.

Lumen plans to make its network-as-a-service (NaaS) platform [1.] available to more customers, regardless of their existing internet connection. At the company’s Analyst Forum, The NaaS platform includes new innovations like Lumen Fabric Port (Q4 2025), Lumen Multi-Cloud Gateway (Q4 2025), and Lumen Connect (Q1 2026). Together, these technologies digitize the entire service lifecycle, so customers can provision, manage, and scale thousands of services across thousands of locations, within minutes.

Note 1. Network as a Service (NaaS) is a cloud-based model that allows businesses to rent networking services from a provider on a subscription or pay-per-use basis, instead of building and maintaining their own network infrastructure. NaaS provides scalable and flexible network capabilities, shifting the cost from a capital expense (CapEx) to an operational expense (OpEx). NaaS functions by using a virtualized, software-defined network, meaning the network capabilities are abstracted from the physical hardware. Businesses access and manage their network resources through a web-based interface or portal, and the NaaS provider manages the underlying infrastructure, including hardware, software, updates, and troubleshooting.

Lumen CTO Dave Ward unveiled “Project Berkeley,” a network interface device that essentially expands the company’s NaaS services, like on-demand internet, Ethernet and IP VPN, to off-net sites using any access type. Those access types can be 5G, fiber, copper, fixed wireless access, satellite and more. Project Berkeley leverages digital twin technology, which lets Lumen have “a full replicate understanding of exactly what’s going on in this device running out of our cloud.”

Ward said on the company’s website:

“Lumen is taking the network out of its hardware box and transforming it into a true digital platform. Technology and Product Officer Dave Ward. “By cloudifying our fiber assets into software and disrupting cloud economics, we’re giving customers the ability to turn up services within minutes, scale as their AI workloads demand, and innovate at cloud speed. This is what the future of digital networking should deliver.”

Lumen has been growing its NaaS platform for some time. It launched its first offering in 2023 and now counts over 1,000 enterprise NaaS customers. The company now plans to bring its connectivity products to over 10 million off-net buildings, said Ward. The device will also allow hyper-scalers to integrate and sell these products in their respective marketplaces.

In closing the Analyst session, CEO Johnson underscored that Lumen’s strategies are the foundation of the company’s momentum today – transforming the industry with innovation to fuel growth, strengthening financial performance, and positioning the company as a critical enabler in the digital economy.

“We’re thrilled by the energy and engagement we’ve seen from the analyst community. The discussions around how Lumen is delivering an expansive network, digital platform, connected ecosystem and winning culture to meet the exponential enterprise demands of AI demonstrate the urgent need for innovation in our industry, and we’re proud to be at the forefront of that conversation.”

About Lumen Technologies:

Lumen is unleashing the world’s digital potential. We ignite business growth by connecting people, data, and applications – quickly, securely, and effortlessly. As the trusted network for AI, Lumen uses the scale of our network to help companies realize AI’s full potential. From metro connectivity to long-haul data transport to our edge cloud, security, managed service, and digital platform capabilities, we meet our customers’ needs today and as they build for tomorrow.

For news and insights visit news.lumen.com, LinkedIn: /lumentechnologies, X: lumentechco, Facebook: /lumentechnologies, Instagram: @lumentechnologies and YouTube: /lumentechnologies. Lumen and Lumen Technologies are registered trademarks of Lumen Technologies LLC in the United States. Lumen Technologies LLC is a wholly owned affiliate of Lumen Technologies, Inc.

References:

For a replay of the webcast, visit Lumen’s investor website

https://www.fierce-network.com/broadband/lumen-says-its-taking-its-naas-new-level

Lumen deploys 400G on a routed optical network to meet AI & cloud bandwidth demands

Dell’Oro: Bright Future for Campus Network As A Service (NaaS) and Public Cloud Managed LAN

NaaS emerges as challenger to legacy network models; likely to grow rapidly along with SD WAN market

Verizon and WiPro in Network-as-a-Service (NaaS) partnership

ABI Research: Network-as-a-Service market to be over $150 billion by 2030

Cisco Plus: Network as a Service includes computing and storage too

Gartner: changes in WAN requirements, SD-WAN/SASE assumptions and magic quadrant for network services

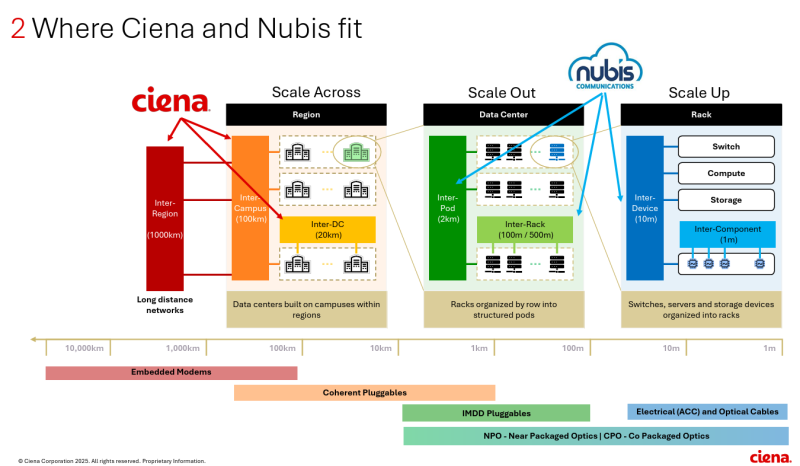

Ciena to acquire Nubis Communications for high performance optical and electrical interconnects to support AI workloads

New Ciena Acquisition:

Today, Ciena announced it will acquire electronics startup Nubis Communications, a privately-held company headquartered in New Providence, New Jersey for $270 million. Nubis specializes in high-performance, ultra-compact, low-power optical and electrical interconnects tailored to support AI workloads. The Nubis acquisition will give Ciena access to technology that supports a wider range of data center use cases. It is is expected to close during Ciena’s fiscal 4th quarter.

Nubis’ solutions complement Ciena’s existing high-speed interconnects portfolio and will enable new capabilities to support growing AI workloads by significantly increasing scale up and scale out capacity and density inside the data center. The Nubis portfolio includes two key technologies:

- Co-Packaged Optics (CPO) / Near Packaged Optics (NPO): Nubis’ compact, high-density optical modules deliver ultra-fast data transfer using light instead of traditional electrical signals. Supporting up to 6.4 Tb/s full-duplex bandwidth, these modules are optimized for low-latency, low-power operation – making them ideal for scaling AI systems. Combined with Ciena’s high-speed SerDes, Nubis’ optical engines enable differentiated CPO solutions to address high-performance connectivity needs inside and between racks.

- Electrical ACC: Nubis’ advanced analog electronics enable Active Copper Cables (ACC) to support high-speed data transmission, allowing data to travel up to 4 meters at speeds of 200 Gb/s per lane. This low-power, low-latency solution helps customers connect more AI accelerators across racks without the limitations of traditional copper or DSP-based solutions

Nubis has developed two products to increase bandwidth and reduce latency within and between data center racks:

- XT Optical Engines is a series of optical modules that support up to 6.4 Tbps of full-duplex bandwidth while using light instead of traditional electrical signals.

- Nitro Linear Redriver aims to improve the performance of all the copper cables that are wired into the data center. Bloomberg has predicted copper usage in North American data centers could increase by 1.1-2.4 million tons by 2030 as “AI demands mount.”

“The acquisition of Nubis represents a significant step forward in Ciena’s strategy to address the rapidly growing demand for scalable, high-performance connectivity inside the data center, driven by the explosive growth of AI-related traffic,” said David Rothenstein, Chief Strategy Officer at Ciena. “With ownership of these key technologies for a wider range of use cases inside the data center, we are expanding our competitive advantage by advancing development of differentiated solutions, reducing development costs, and driving long-term efficiency and profitability. Nitro also supports up to 4m of reach for 200G per lane active copper cables, far beyond the limits of passive copper and legacy analog solutions. This is a game-changer for AI infrastructure, where short-reach, high-bandwidth copper is preferred for cost and latency reasons,” Rothenstein added.

“The Nubis team is thrilled to join Ciena and enhance its industry-leading portfolio with our breakthrough interconnect technologies,” said Dan Harding, CEO of Nubis. “Together, we will advance Ciena’s data center strategy by delivering reliable, high-quality, and high-performance interconnect solutions to support the next generation of AI workloads.”

Dell’Oro VP Jimmy Yu said Nubis is probably “one of [Ciena’s] most forward-looking” acquisitions, since the company is assembling the pieces it thinks are necessary to support future data center networking. “This acquisition aligns well with Ciena’s overall strategy to expand into the data center market, and it likely played a role in their decision to exit future investments in broadband PON,” Yu said.

……………………………………………………………………………………………………………………………………………………………..

Ciena Cutting Back on Residential Broadband Access investments to focus on AI and Coherent Optics:

The Nubis takeover comes shortly after Ciena announced it will reduce investment in residential broadband access (e.g. 25G PON) to focus more on AI applications and its coherent optics business. Ciena CEO Gary Smith said on the company’s Q3 2025 earnings call:

“Folks are more concentrated on 10-gig and driving that out, and there’s a good market for that. As we looked at our overall portfolio and our investments in [25-gig], we see so much opportunity in these different AI workloads that we want to continue to really make sure we’re heavily invested in that….To be clear, we will continue to sell and support our existing broadband access products. However, we will be limiting our forward investments only to strategic areas such as DCOM [1.].”

Note 1. DCOM refers to Ciena’s data center out-of-band management solution, which involves replacing bulky legacy hardware like copper cabling and console servers with passive optical network (PON) technology.

Dell’Oro Group’s Jimmy Yu thinks Ciena’s move to re-allocate R&D dollars makes sense so that the company is not spread too thin and [misses] out the biggest opportunity sitting in front of them. “My guess is that to address the future of AI workloads and AI data center interconnect, Ciena will need to not only maintain their cadence on launching new high performance coherent optics like the WaveLogic 6e for long distance 1.6 Tbps connections, but also optical devices for shorter distances like 800 ZR/ZR+ plugs and even shorter distances that take them inside the data center,” Yu explained.

Ciena considers the WaveLogic series its bread-and-butter for coherent optics. The company in Q3 gained 11 new customers for its WaveLogic 6 Extreme product, bringing its total customer tally to 60. Companies deploying WaveLogic 6 include operators such as Arelion, Lumen and Telstra, which are upgrading their networks to support demand from cloud customers.

Supplemental Materials:

In conjunction with this announcement, Ciena has posted to the Events and Presentations page of the Investor Relations section of its website a recorded transaction overview presentation and accompanying transcript.

About Ciena:

Ciena is the global leader in high-speed connectivity. We build the world’s most adaptive networks to support exponential growth in bandwidth demand. By harnessing the power of our networking systems, components, automation software, and services, Ciena revolutionizes data transmission and network management. With unparalleled expertise and innovation, we empower our customers, partners, and communities to thrive in the AI era. For updates on Ciena, follow us on LinkedIn and X, or visit the Ciena Insights webpage and Ciena website.

About Nubis Communications:

Nubis says they innovate across photonics, electronics, packaging and manufacturing to create optics significantly more dense, scalable and lower power than existing solutions, breaking the I/O wall in data centers and enabling more advanced compute, AI and machine learning. The startup has raised over $50 million in funding with the help of investors such as Ericsson and Marvell Technology co-founders Weili Dai and Sehat Sutardja.

Nubis has just over 50 employees including a seasoned executive team. Founder Peter Winzer previously led fiber optic transmission research at Nokia’s Bell Labs, while CEO Dan Harding spent over 15 years at Broadcom.

References:

https://www.nubis-inc.com/about-us/

https://www.nubis-inc.com/products/

https://www.fierce-network.com/broadband/ciena-ramps-data-center-focus-new-270m-deal

https://www.fierce-network.com/broadband/ciena-pulls-back-broadband-focus-more-ai

AI infrastructure investments drive demand for Ciena’s products including 800G coherent optics

Lumen and Ciena Transmit 1.2 Tbps Wavelength Service Across 3,050 Kilometers

Ciena CEO sees huge increase in AI generated network traffic growth while others expect a slowdown

Summit Broadband deploys 400G using Ciena’s WaveLogic 5 Extreme

DriveNets and Ciena Complete Joint Testing of 400G ZR/ZR+ optics for Network Cloud Platform

Ciena acquires 2 privately held companies: Tibit Communications and Benu Networks

T-Mobile’s new CEO Srini Gopalan faces fierce competition from AT&T, Verizon and MVNOs

Today, T-Mobile US promoted Srini Gopalan, from chief operating officer (COO) to CEO. Gopalan is a veteran of parent company Deutsche Telekom as the head of its German home market. He has also held executive roles at Indian telecom company Bharti Airtel, Capital One and Vodafone.

Current CEO Mike Sievert will move into a newly created vice-chairman position. He said in a WSJ interview that he would continue to influence the company’s strategy. “I recruited Srini starting about a year ago with the idea that this day would come,” Sievert said.

T-Mobile has often been recognized for its high-speed 5G network and standalone 5G network capabilities. The “un-carrier” capitalized on the Sprint merger (announced in April 19, 2018; finalized April 1, 2020) to grow its customer base, winning share in both postpaid and prepaid markets and positioning itself as the industry’s fastest-growing carrier. Under Sievert’s tenure, T-Mobile drew millions of broadband customers from cable industry-dominated markets by using its 5G network to beam internet service into homes and businesses. The company is also exploring the wired-broadband business, including through a roughly $5 billion investment in a joint venture with investment company KKR.

Wireless carriers have been grappling with slowing subscriber growth, rising competition and increasingly cautious consumers unwilling to pay for premium plans. T-Mobile’s strongest competitors have been the other two major nationwide mobile carriers Verizon and AT&T. However, the growing market for Mobile Virtual Network Operators (MVNOs), especially from cablecos like Comcast and Charter, has also introduced a new, significant competitive challenge.

Yet both Gopalan and Sievert said the business can keep up the pace as the mobile-phone market matures. “We really like wireless as a neighborhood in the U.S., and we have clearly outperformed everyone else,” Gopalan said in an interview, adding that T-Mobile’s home broadband business has more room to grow. “We’ve shown our hand in fiber. We like pure-play fiber, we like the idea of scaling that business, got two acquisitions already and we’re looking at what other value-creator deals are there.”

Gopalan “brings a wealth of experience and is a very impressive leader, and they’ve handled this transition exceptionally well. I don’t expect there to be any fall-off at all in T-Mobile’s performance,” MoffettNathanson analyst Craig Moffett said.

Craig wrote in a research note that a new wholesale deals with Comcast and Charter could give those cable operators an even stronger price edge in business wireless — a market where T-Mobile has been clawing share. “Cable wins. And T-Mobile wins as well,” Moffett wrote, while raising questions about whether the tie-up could lead to deeper partnerships that would reshape the sector. He added that, while T-Mobile is well-positioned in consumer wireless, cable’s entry into enterprise could spark new price wars, making execution under new leadership even more critical.C

T-Mobile has made several acquisitions since it acquired Sprint in 2020. It spent $1.35 billion to acquire Ryan Reynolds’s Mint Mobile in May 2024, giving the company access to more value-conscious phone plan shoppers.

The company has also closed deals for fiber-optic plays Metronet ($4.9 billion), US Cellular ($4.4 billion), and Lumos ($950 million).

References:

https://www.wsj.com/business/telecom/t-mobile-names-telecom-veteran-as-next-ceo-abb4194b

T-Mobile’s growth trajectory increases: 5G FWA, Metronet acquisition and MVNO deals with Charter & Comcast

Evercore: T-Mobile’s fiber business to boost revenue and achieve 40% penetration rate after 2 years

WSJ: T-Mobile hacked by cyber-espionage group linked to Chinese Intelligence agency

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

T-Mobile & EQT Joint Venture (JV) to acquire Lumos and build out T-Mobile Fiber footprint

AI Data Center Boom Carries Huge Default and Demand Risks

“How does the digital economy exist?” asked John Medina, a senior vice president at Moody’s, who specializes in assessing infrastructure investments. “It exists on data centers.”

New investments in data centers to power Artificial Intelligence (AI) are projected to reach $3 trillion to $4 trillion by 2030, according to Nvidia. Other estimates suggest the investment needed to keep pace with AI demand could be as high as $7 trillion by 2030, according to McKinsey. This massive spending is already having a significant economic impact, with some analysis indicating that AI data center expenditure has surpassed the total impact from US consumer spending on GDP growth in 2025.

U.S. data center demand, driven largely by A.I., could triple by 2030, according to McKinsey. That would require data centers to make nearly $7 trillion in investment to keep up. OpenAI, SoftBank and Oracle recently announced a pact to invest $500 billion in A.I. infrastructure through 2029. Meta and Alphabet are also investing billions. Merely saying “please” and “thank you” to a chatbot eats up tens of millions of dollars in processing power, according to OpenAI’s chief executive, Sam Altman.

- OpenAI, SoftBank, and Oracle pledging to invest $500 billion in AI infrastructure through 2029.

- Nvidia and Intel collaborating to develop AI infrastructure, with Nvidia investing $5 billion in Intel stock.

- Microsoft spending $4 billion on a second data center in Wisconsin.

- Amazon planning to invest $20 billion in Pennsylvania for AI infrastructure.

Compute and Storage Servers within an AI Data Center. Photo credit: iStock quantic69

The spending frenzy comes with a big default risk. According to Moody’s, structured finance has become a popular way to pay for new data center projects, with more than $9 billion of issuance in the commercial mortgage-backed security and asset-backed security markets during the first four months of 2025. Meta, for example, tapped the bond manager Pimco to issue $26 billion in bonds to finance its data center expansion plans.

As more debt enters these data center build-out transactions, analysts and lenders are putting more emphasis on lease terms for third-party developers. “Does the debt get paid off in that lease term, or does the tenant’s lease need to be renewed?” Medina of Moody’s said. “What we’re seeing often is there is lease renewal risk, because who knows what the markets or what the world will even be like from a technology perspective at that time.”

Even if A.I. proliferates, demand for processing power may not. Chinese technology company DeepSeek has demonstrated that A.I. models can produce reliable outputs with less computing power. As A.I. companies make their models more efficient, data center demand could drop, making it much harder to turn investments in A.I. infrastructure into profit. After Microsoft backed out of a $1 billion data center investment in March, UBS wrote that the company, which has lease obligations of roughly $175 billion, most likely overcommitted.

Some worry costs will always be too high for profits. In a blog post on his company’s website, Harris Kupperman, a self-described boomer investor and the founder of the hedge fund Praetorian Capital, laid out his bearish case on A.I. infrastructure. Because the building needs upkeep and the chips and other technology will continually evolve, he argued that data centers will depreciate faster than they can generate revenue.

“Even worse, since losing the A.I. race is potentially existential, all future cash flow, for years into the future, may also have to be funneled into data centers with fabulously negative returns on capital,” he added. “However, lighting hundreds of billions on fire may seem preferable than losing out to a competitor, despite not even knowing what the prize ultimately is.”

It’s not just Silicon Valley with skin in the game. State budgets are being upended by tax incentives given to developers of A.I. data centers. According to Good Jobs First, a nonprofit that promotes corporate and government accountability in economic development, at least 10 states so far have lost more than $100 million per year in tax revenue to data centers. But the true monetary impact may never be truly known: Over one-third of states that offer tax incentives for data centers do not disclose aggregate revenue loss.

Local governments are also heralding the expansion of energy infrastructure to support the surge of data centers. Phoenix, for example, is expected to grow its data center power capacity by over 500 percent in the coming years — enough power to support over 4.3 million households. Virginia, which has more than 50 new data centers in the works, has contracted the state’s largest utility company, Dominion, to build 40 gigawatts of additional capacity to meet demand — triple the size of the current grid.

The stakes extend beyond finance. The big bump in data center activity has been linked to distorted residential power readings across the country. And according to the International Energy Agency, a 100-megawatt data center, which uses water to cool servers, consumes roughly two million liters of water per day, equivalent to 6,500 households. This puts strain on water supply for nearby residential communities, a majority of which, according to Bloomberg News, are already facing high levels of water stress.

“I think we’re in that era right now with A.I. models where it’s just who can make the bigger and better one,” said Vijay Gadepally, a senior scientist at the Lincoln Laboratory Supercomputing Center at the Massachusetts Institute of Technology. “But we haven’t actually stopped to think about, Well, OK, is this actually worth it?”

Postscript: November 23, 2025:

In this new AI era, consumers and workers are not what drives the economy anymore. Instead, it’s spending on all things AI, mostly with borrowed money or circular financing deals.

BofA Research noted that Meta and Oracle issued $75 billion in bonds and loans in September and October 2025 alone to fund AI data center build outs, an amount more than double the annual average over the past decade. They warned that “The AI boom is hitting a money wall” as capital expenditures consume a large portion of free cash flow. Separately, a recent Bank of America Global Fund Manager Survey found that 53% of participating fund managers felt that AI stocks had reached bubble proportions. This marked a slight decrease from a record 54% in the prior month’s survey, but the concern has grown over time, with the “AI bubble” cited as the top “tail risk” by 45% of respondents in the November 2025 poll.

JP Morgan Chase estimates up to $7 trillion of AI spending will be with borrowed money. “The question is not ‘which market will finance the AI-boom?’ Rather, the question is ‘how will financings be structured to access every capital market?’ according to strategists at the bank led by Tarek Hamid.

As an example of AI debt financing, Meta did a $27 billion bond offering. It wasn’t on their balance sheet. They paid 100 basis points over what it would cost to put it on their balance sheet. Special purpose vehicles happen at the tail end of the cycle, not the early part of the cycle, notes Rajiv Jain of GQG Partners.

References:

What Wall Street Sees in the Data Center Boom – The New York Times

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Gartner: AI spending >$2 trillion in 2026 driven by hyperscalers data center investments

Analysis: Cisco, HPE/Juniper, and Nvidia network equipment for AI data centers

Cisco CEO sees great potential in AI data center connectivity, silicon, optics, and optical systems

Networking chips and modules for AI data centers: Infiniband, Ultra Ethernet, Optical Connections

Superclusters of Nvidia GPU/AI chips combined with end-to-end network platforms to create next generation data centers

Lumen Technologies to connect Prometheus Hyperscale’s energy efficient AI data centers

Gartner: AI spending >$2 trillion in 2026 driven by hyperscalers data center investments

According to Gartner, global AI spending will reach close to US$1.5 trillion this year and will top $2 trillion in 2026 as ongoing demand fuel IT infrastructure investment. This significant growth is driven by hyperscalers’ ongoing investments in AI-optimized data centers and hardware, such as GPUs, along with increased enterprise adoption and the integration of AI into consumer devices like smartphones and PCs.

| Market | 2024 | 2025 | 2026 |

| AI Services | 259,477 | 282,556 | 324,669 |

| AI Application Software | 83,679 | 172,029 | 269,703 |

| AI Infrastructure Software | 56,904 | 126,177 | 229,825 |

| GenAI Models | 5,719 | 14,200 | 25,766 |

| AI-optimized Servers (GPU and Non-GPU AI Accelerators) | 140,107 | 267,534 | 329,528 |

| AI-optimized IaaS | 7,447 | 18,325 | 37,507 |

| AI Processing Semiconductors | 138,813 | 209,192 | 267,934 |

| AI PCs by ARM and x86 | 51,023 | 90,432 | 144,413 |

| GenAI Smartphones | 244,735 | 298,189 | 393,297 |

| Total AI Spending | 987,904 | 1,478,634 | 2,022,642 |

Source: Gartner (September 2025)

…………………………………………………………………………………………………………………………………………………….

Hyperscaler Investments:

Cloud service providers are heavily investing in data centers and AI-optimized hardware to expand their services at scale. Amazon, Google and Microsoft are all ploughing massive sums into their cloud infrastructure, while reaping the benefits of AI-driven market growth, as Canalys’s latest data showed last week.

Businesses are increasingly investing in AI infrastructure and services, though there’s a shift towards using commercial off-the-shelf solutions with embedded GenAI features rather than solely developing custom solutions.

A growing number of consumer products, including smartphones and PCs, are incorporating AI capabilities by default, contributing to the overall spending growth. IDC forecasts GenAI smartphones* to reach 54% of the market by 2028, while Gartner projects nearly 100% of premium models to feature GenAI by 2029, driving significant increases in both shipments and end-user spending.

* A GenAI smartphone is a a mobile device featuring a system-on-a-chip (SoC) with a powerful Neural Processing Unit (NPU) capable of running advanced Generative Artificial Intelligence (GenAI) models directly on the device. It enables features like content creation, personalized assistants, and real-time task processing without needing constant cloud connectivity. These phones are designed to execute complex AI tasks faster, more efficiently, and with enhanced privacy compared to standard smartphones that rely heavily on the internet for such functions.

AI hardware, particularly GPUs and other AI accelerators, accounts for a substantial portion of the growth, with hyperscaler spending on these components nearly doubling, according to a story at CIO Drive.

About Gartner AI Use Case Insights:

Gartner AI Use Case Insights is an interactive tool that helps technology and business leaders efficiently discover, evaluate, and prioritize AI use cases to potentially pursue. Clients can search over 500 use cases (applications of AI in specific industries) and over 380 case studies (real world examples) based on industry, business function, and Gartner’s assessment of potential business value.

……………………………………………………………………………………………………………………………………………

Postscript: November 23, 2025:

In this new AI era, consumers and workers are not what drives the economy anymore. Instead, it’s spending on all things AI, mostly with borrowed money or circular financing deals.

BofA Research noted that Meta and Oracle issued $75 billion in bonds and loans in September and October 2025 alone to fund AI data center build outs, an amount more than double the annual average over the past decade. They warned that “The AI boom is hitting a money wall” as capital expenditures consume a large portion of free cash flow. Separately, a recent Bank of America Global Fund Manager Survey found that 53% of participating fund managers felt that AI stocks had reached bubble proportions. This marked a slight decrease from a record 54% in the prior month’s survey, but the concern has grown over time, with the “AI bubble” cited as the top “tail risk” by 45% of respondents in the November 2025 poll.

JP Morgan Chase estimates up to $7 trillion of AI spending will be with borrowed money. “The question is not ‘which market will finance the AI-boom?’ Rather, the question is ‘how will financings be structured to access every capital market?’ according to strategists at the bank led by Tarek Hamid.

As an example of AI debt financing, Meta did a $27 billion bond offering. It wasn’t on their balance sheet. They paid 100 basis points over what it would cost to put it on their balance sheet. Special purpose vehicles happen at the tail end of the cycle, not the early part of the cycle, notes Rajiv Jain of GQG Partners.

AI spending is surging; companies accelerate AI adoption, but job cuts loom large

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Canalys & Gartner: AI investments drive growth in cloud infrastructure spending

AI Echo Chamber: “Upstream AI” companies huge spending fuels profit growth for “Downstream AI” firms

AI wave stimulates big tech spending and strong profits, but for how long?

Deutsche Telekom selects Iridium for NB-IoT direct-to-device (D2D) connectivity

Low Earth orbit (LEO) satellite operator Iridium Communications Inc announced a new partnership with Deutsche Telekom to deliver global connectivity to their customers through the Iridium NTN DirectSM service. Deutsche Telekom will gain roaming access to Iridium’s forthcoming 3GPP 5G NTN specification-based service, providing NB-IoT direct-to-device (D2D) connectivity that will keep customers, and their assets, connected from pole to pole. The two companies will be collaborating to integrate Iridium NTN Direct with Deutsche Telekom’s terrestrial global IoT network.

Deutsche Telekom is among the first mobile network operators to begin integrating Iridium NTN Direct with terrestrial infrastructure, positioning it at the forefront of standards-based IoT innovation in areas beyond the reach of traditional mobile networks and competing satellite networks. The launch of NTN Direct was made possible by Project Stardust. Launched in early 2024, it has enabled Iridium to upgrade its existing L-band LEO network to support narrowband non-terrestrial-networking (NB-NTN).

“Iridium NTN Direct is designed to complement terrestrial networks like Deutsche Telekom and provide seamless global coverage, extending the reach of their own infrastructure,” said Matt Desch, CEO, Iridium. “This partnership underscores the power of creating a straightforward, scalable solution that builds on existing technology to enable global service expansion.”

“We look forward to integrating Iridium as our next non-terrestrial roaming partner for IoT connectivity. By providing our customers with access to Iridium’s extensive LEO satellite network, they will benefit from broadened global NB-IoT coverage to reliably connect sensors, machines and vehicles,” said Jens Olejak, Head of Satellite IoT, Deutsche Telekom. “This convergence is now possible through affordable, 3GPP-standardized 5G devices that function across both terrestrial and non-terrestrial networks.”

Planned for commercial launch in 2026, the service will allow Deutsche Telekom’s IoT customers to roam onto the Iridium network to support use cases such as messaging, tracking, and status updates for IoT, automotive, and industrial devices, with applications spanning international cargo logistics, remote utility monitoring, smart agriculture, and emergency response.

The Iridium constellation is the only network delivering truly global coverage using L-band spectrum, providing reliable connectivity through both routine and extreme weather events, like hurricanes and blizzards. Its LEO orbit provides superior coverage, look angles and lower latency compared to geostationary systems. Upon successful integration and testing, Iridium and Deutsche Telekom plan to execute a roaming agreement to support full commercial service launch.

https://www.iridium.com/ntn-direct/

About Iridium Communications Inc:

Iridium® is the only mobile voice, data, and PNT satellite network that spans the entire globe. Iridium enables connections between people, organizations, and assets to and from anywhere, in real time. Together with its ecosystem of partner companies, Iridium delivers an innovative and rich portfolio of reliable solutions for markets that require truly global communications. In 2024, Iridium acquired Satelles and its positioning, navigation, and timing (PNT) service. Iridium Communications Inc. is headquartered in McLean, Va., U.S.A., and its common stock trades on the Nasdaq Global Select Market under the ticker symbol IRDM. For more information about Iridium products, services, and partner solutions, visit www.iridium.com.

…………………………………………………………………………………………………………………………………..

Activity at other LEO Operators:

- SpaceX/Starlink agreed to acquire AWS-4 and H-block spectrum from EchoStar for 17 billion last week. The frequencies will be used to strengthen the company’s direct-to-cell (D2C) business.

- Globalstar, has ratcheted up its ambitions by initiating a plan to bolster its upcoming C-3 network through the addition of another complementary constellation called HIBLEO-XL-1. Details are scant, but a Space Intel report from May 2022 revealed that Globalstar had registered with regulators in Europe its intention to launch 3,080 satellites at altitudes of between 485-700 km.

- SES has struck a deal with space technology specialist to K2 Space to develop a new generation of medium Earth orbit (MEO) satellites. An on-orbit mission is planned for Q1 2026. SES has also partnered with France-based laser specialist Cailabs to test optical ground stations that use lasers to transmit and receive data from space.

- “Our future MEO network will evolve through agile innovation cycles,” said SES CEO Adel Al-Saleh. “By collaborating with K2 Space and other trusted innovative partners, we’re combining our solutions development experience and operational depth with NewSpace agility to develop a flexible, software-defined network that adapts to customer requirements.”

References:

Huge significance of EchoStar’s AWS-4 spectrum sale to SpaceX

Qualcomm and Iridium launch Snapdragon Satellite for 2-Way Messaging on Android Premium Smartphones

Iridium Introduces its NexGen Satellite IoT Data Service

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

SatCom market services, ITU-R WP 4B, 3GPP Release 18 and ABI Research Market Forecasts

Economic Times: Qualcomm, MediaTek developing chipsets for Satcom services

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

Qualcomm announces 4 new SoC’s for IoT applications and use cases

FCC proposes regulatory framework for space-mobile network operator collaboration

Nokia & Deutsche Bahn deploy world’s first 1900 MHz 5G radio network meeting FRMCS requirements

Nokia and Deutsche Bahn (Germany’s national railway company), today announced they have deployed the first commercial 1900 MHz 5G railway network with a 5G SA core. The new network meets Future Railway Mobile Communication System (FRMCS) requirements by supporting automated, resilient rail operations. The rollout marks a transition away from legacy GSM-R [1.], adding self-healing, failover, real-time monitoring, and low latency to enable smarter stations, infrastructure, and safety-critical applications. Built to support full railway automation, FRMCS integrates advanced technologies like AI and underpins a more competitive, capable and future-ready industry.

………………………………………………………………………………………………………………………………………………………………………………………

Note 1. Global System for Mobile Communications-Railway (GSM-R) is a digital, cellular telecommunications system designed specifically for railways to provide reliable voice and data services for operations, such as communication between drivers and signalers and for systems like European Train Control System (ETCS). Based on the public GSM standard, it includes railway-specific features like advanced speech services and is known for its secure and dependable performance at high speeds, supporting trains up to 500 km/hr without losing communications.

………………………………………………………………………………………………………………………………………………………………………………………

The new technology is being implemented at DB’s digital railway test field in the Ore Mountains (Erzgebirge, Germany), running on live trains. Key features include built-in failover, self-healing capabilities and real-time monitoring to ensure high availability and efficiency. The solution will also be used for the European FP2-MORANE-2 project, which evolves from earlier FRMCS initiatives to advance the digitalization of rail across Europe. The contract extends Deutsche Bahn’s ongoing test trials with Nokia’s 5G SA core and 3700 MHz (n78) radio network, while upgrading to a new solution that includes Nokia’s 1900 MHz (n101) 5G radio network equipment from its AirScale portfolio and optimized 5G SA core. Designed for a smooth migration from GSM-R to FRMCS, it delivers the high reliability and low latency needed for modern rails.

DB Test Track in Erzgebirge, Germany. Photo Credit: Copyright Deutsche Bahn

Quotes:

Rainer Fachinger, Head of Telecom Platforms at DB InfraGO, said: “Deutsche Bahn wants to benefit from modern 5G-based telecommunications to upgrade the railway communication infrastructure. Collaborating with technology experts like Nokia is key for DB to bring the latest innovations into our real-world operations. This deployment on test tracks builds on a successful pre-FRMCS 5G trial conducted with Nokia and aims to standardize our private mobile network as a foundation for further pilots and future rollout.”

Rolf Werner, Head of Europe at Nokia, said: “Nokia and DB have been frontrunners in advancing FRMCS. We are proud to deliver the first-ever commercial 5G solution that utilizes the 1900 MHz spectrum band on the rail track. This is a milestone that will unlock key benefits for DB, including automated train operations, smart maintenance, and intelligent infrastructure and stations. We believe this launch will serve as an important benchmark for FRMCS upgrades in rail networks around the world in the coming years.”

………………………………………………………………………………………………………………………………………………………….

Nokia is also working with ProRail in the Netherlands on the first cloud-native GSM-R core, building a bridge to FRMCS and lowering long-term costs across European rail networks.

………………………………………………………………………………………………………………………………………………………….

References:

Nokia, Deutsche Bahn claim world’s first 5G railway network in n101 band

Multimedia, technical information and related news

Web Page: FRMCS

Product Page: AirScale Radio Access

Product Page: Core Enterprise Solution for Railways

Blog: Laying the tracks for digital railways

Social Media Post: Nokia at EU FP2-MORANE2

Web Page: Deutsche Bahn

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

SNS Telecom & IT: Private 5G Market Nears Mainstream With $5 Billion Surge

Samsung & SK Telecom offer Korea’s first LTE-Railway network

Google’s Internet Access for Emerging Markets – Managed WiFi Network for India Railways

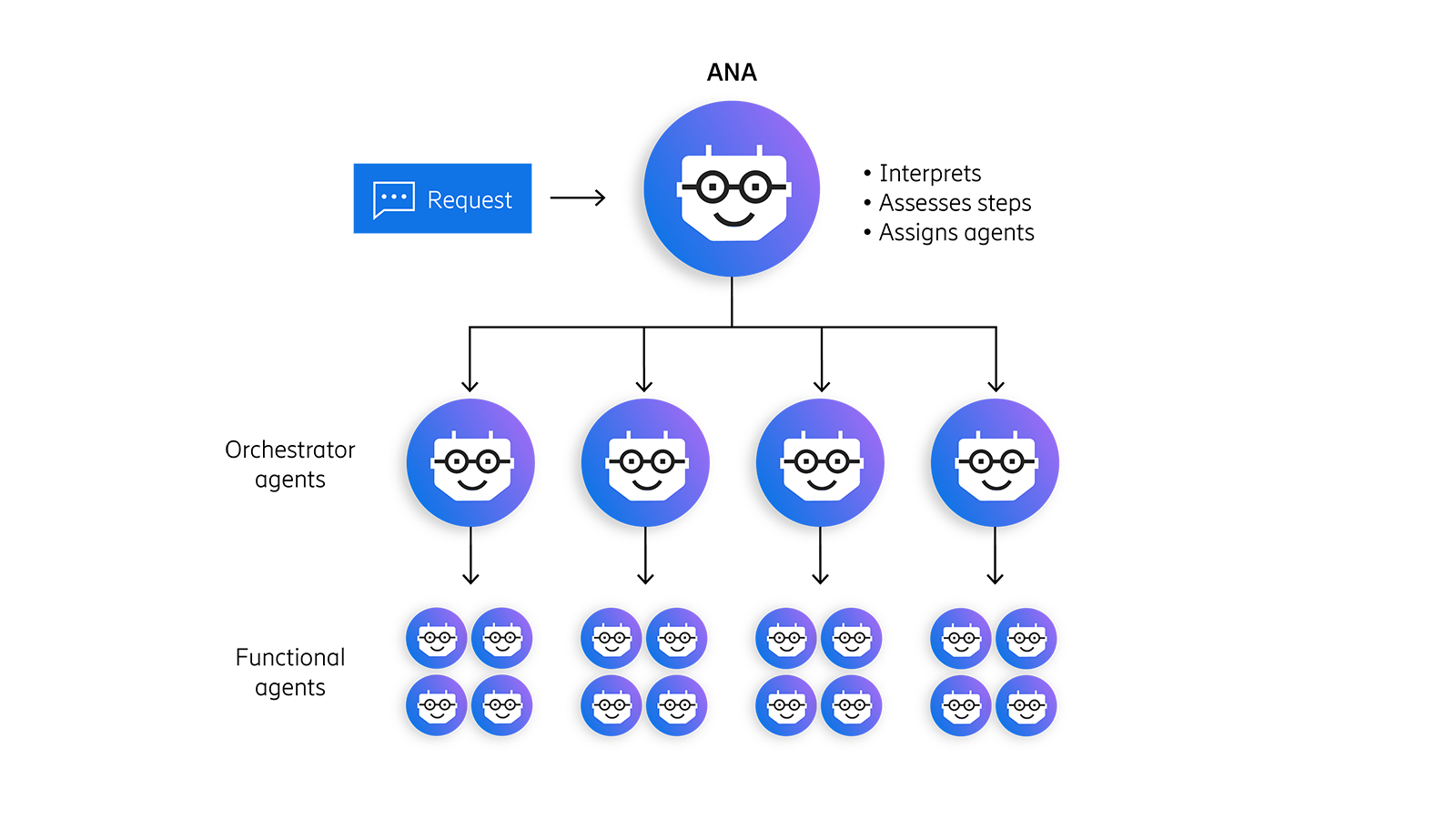

Ericsson integrates Agentic AI into its NetCloud platform for self healing and autonomous 5G private networks

Ericsson is integrating Agentic AI into its NetCloud platform to create self-healing and autonomous 5G private (enterprise) networks. This initiative upgrades the existing NetCloud Assistant (ANA), a generative AI tool, into a strategic partner capable of managing complex workflows and orchestrating multiple AI agents. The agentic AI agent aims to simplify private 5G adoption by reducing deployment complexity and the need for specialized administration. This new agentic architecture allows the new Ericsson system to interpret high-level instructions and autonomously assign tasks to a team of specialized AI agents.

Key AI features include:

- Agentic organizational hierarchy: ANA will be supported by multiple orchestrator and functional AI agents capable of planning and executing (with administrator direction). Orchestrator agents will be deployed in phases, starting with a troubleshooting agent planned in Q4 2025, followed by configuration, deployment, and policy agents planned in 2026. These orchestrators will connect with task, process, knowledge, and decision agents within an integrated agentic framework.

- Automated troubleshooting: ANA’s troubleshooting orchestrator will include automated workflows that address the top issues identified by Ericsson support teams, partners, and customers, such as offline devices and poor signal quality. Planned to launch in Q4 2025, this feature is expected to reduce downtime and customer support cases by over 20 percent.

- Multi-modal content generation: ANA can now generate dynamic graphs to visually represent trends and complex query results involving multiple data points.

- Explainable AI: ANA displays real-time process feedback, revealing steps taken by AI agents in order to enhance transparency and trust.

- Expanded AIOps insights: NetCloud AIOps will be expanded to provide isolation and correlation of fault, performance, configuration, and accounting anomalies for Wireless WAN and NetCloud SASE. For Ericsson Private 5G, NetCloud is expected to provide service health analytics including KPI monitoring and user equipment connectivity diagnostics. Planned availability Q4 2025.

Manish Tiwari, Head of Enterprise 5G, Ericsson Enterprise Wireless Solutions, adds: “With the integration of Ericsson Private 5G into the NetCloud platform, we’re taking a major step forward in making enterprise connectivity smarter, simpler, and adaptive. By building on powerful AI foundations, seamless lifecycle management, and the ability to scale securely across sites, we are providing flexibility to further accelerate digital transformation across industries. This is about more than connectivity: it is about giving enterprises the business-critical foundation they need to run IT and OT systems with confidence and unlock the next wave of innovation for their businesses.”

Pankaj Malhotra, Head of WWAN & Security, Ericsson Enterprise Wireless Solutions, says: “By introducing agentic AI into NetCloud, we’re enabling enterprises to simplify deployment and operations while also improving reliability, performance, and user experience. More importantly, it lays the foundation for our vision of fully autonomous, self-optimizing 5G enterprise networks, that can power the next generation of enterprise innovation.”

Agentic AI and the Future of Communications for Autonomous Vehicle (V2X)

Ericsson completes Aduna joint venture with 12 telcos to drive network API adoption

Ericsson reports ~flat 2Q-2025 results; sees potential for 5G SA and AI to drive growth

Ericsson revamps its OSS/BSS with AI using Amazon Bedrock as a foundation

Ericsson’s sales rose for the first time in 8 quarters; mobile networks need an AI boost

Elon Musk: Starlink could become a global mobile carrier; 2 year timeframe for new smartphones

Yesterday, during a segment of the All-in Podcast dedicated to the SpaceX-EchoStar spectrum sales agreement [1.], Space X/Starlink boss Elon Musk was asked if this sets the industry down a path where Starlink’s end goal is to emerge as a global carrier that, effectively, would limit the role of regional carriers. “That would be one of the options,” Musk responded. Musk downplayed any threat against AT&T, Verizon and T-Mobile. The podcast section dedicated to the EchoStar agreement starts around the 16:50 mark. You can start watching at that point via this YouTube link.

Note 1. SpaceX’s $17 billion agreement with EchoStar includes $8.5 billion in stock, plus $2 billion of cash interest payments payable on EchoStar debt. Separately, AT&T’s is paying $23 billion – all in cash – for its acquisition of EchoStar’s spectrum.

Regarding the EchoStar spectrum deal, Musk said, “This is kind of a long term thing. It will allow SpaceX to deliver high bandwidth connectivity directly from the satellites to the phones.”

Musk said that deal would not seriously challenge the big three U.S. mobile carriers. He said:

“To be clear, we’re not going to put the other carriers out of business. They’re still going to be around because they own a lot of spectrum. But, yes, you should be able to have a Starlink, like you have an AT&T or T-Mobile or Verizon, or whatever. You can have an account with Starlink that works with your Starlink [satellite] antenna at home with … Wi-Fi, as well as on your phone. We’d be a comprehensive solution for high bandwidth at home and high bandwidth for direct-to-cell.”

“Could you buy Verizon?” Musk was asked. “Not out of the question. I suppose that may happen,” Musk said with a chuckle.

That idea at least “highlights the possibility that SpaceX could pursue additional spectrum,” LightShed Partners analysts Walter Piecyk and Joe Galone explained in this blog post. “We highly doubt SpaceX has any interest in the people or infrastructure of a telco, there are plenty of compelling spectrum assets in and outside of those carriers to consider.”

Getting smartphones equipped with chips to support those new frequency bands will take some time. Musk estimated that’s “probably a two-year timeframe.” LightShed Partners analysts agreed, “On devices, Elon’s two-year timeline for a Starlink phone isn’t surprising given spectrum banding, chip development, and satellite integration. He’s mused before that if phone manufacturers continued to hinder his technology that he “would make a phone as a forcing function to compete with them.”

Some analysts view MVNO agreements as Starlink’s best route to becoming a full scale mobile carrier of satellite and terrestrial wireless services.

“The most plausible business model is that Starlink partners with MNOs for them to resell the service or embed the service as part of their plans,” Lluc Palerm Serra, research director at Analysys Mason, told PCMag.

LightShed Partners agreed. Musk’s point that SpaceX isn’t out to displace the incumbent carriers “reinforced our view that securing an MVNO deal will be essential if SpaceX wants to deliver a Starlink phone directly to consumers,” LightShed’s Walter Piecyk and Joe Galone explained in this blog post.

“In parallel, we’re working on the satellites and working with the handset makers to add these frequencies to the phones,” Musk said. “And the phones will then handshake well to achieve high-bandwidth connectivity. The net effect is that you should be able to watch videos anywhere on your phone.”

AT&T CEO John Stankey addressed Starlink’s “mobile-first” possibility earlier this week at an investor conference. Starlink’s current access to spectrum, including what is coming way of EchoStar, isn’t enough to create a “robust terrestrial replacement,” he said. But he acknowledged that, with the right type of commitments, perhaps it could happen someday.

“EchoStar still owns the highly lucrative 700 and AWS-3 spectrum, in which we note that all three wireless carriers have a robust ecosystem,” TD Cowen analyst Gregory Williams wrote in a note earlier this week. “Whether EchoStar sells more [spectrum] in short order remains to be seen,” TD Cowen’s Williams wrote Monday, explaining that, with the FCC dispute resolved, it may hold onto its portfolio longer. “EchoStar is not a forced seller, now has an excellent balance sheet and liquidity, and may desire to hold onto the spectrum as long as possible for higher sale valuations at a later date,” he added.

References:

https://www.lightreading.com/5g/turning-starlink-into-a-global-carrier-one-of-the-options-musk-says

Elon Talks Starlink Phone. Disruption Looms for Telcos and Apple

Huge significance of EchoStar’s AWS-4 spectrum sale to SpaceX

U.S. BEAD overhaul to benefit Starlink/SpaceX at the expense of fiber broadband providers

Telstra selects SpaceX’s Starlink to bring Satellite-to-Mobile text messaging to its customers in Australia

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

SpaceX has majority of all satellites in orbit; Starlink achieves cash-flow breakeven

Highlights of Nokia’s Smart Factory in Oulu, Finland for 5G and 6G innovation

Nokia has opened a Smart Factory in Oulu, Finland, for 5G/6G design, manufacturing, and testing, integrating AI technologies and Industry 4.0 applications. It brings ~3,000 staff under one roof and is positioned as Europe’s flagship site for radio access (RAN) innovation.

The Oulu campus will initially focus on 5G, including: Standardization, System-on Chips as well as 5G radio hardware and software and patents. Oulu Factory, part of the new campus, will target New Production Introduction for Nokia’s 5G radio and baseband products. The new campus strengthens Oulu’s ecosystem as a global testbed for resilient and secure networks for both civilian and defense applications.

At Oulu “Home of Radio” campus, Nokia’s research and innovation underpins high quality, tested world class products readymade for customers across markets. Nokia’s experts will continue to foster innovation, from Massive MIMO radios like Osprey and Habrok to next-generation 6G solutions, creating secure, high-performance, future-proof connectivity.

Sustainability is integral to the facility. Renewable energy is used throughout the site, with additional energy used to heat 20,000 households in Oulu. The on-site energy station is one of the world’s largest CO2-based district heating and cooling plants.

Active 6G proof-of-concept trials will be tested using ~7 GHz and challenging propagation scenarios.

“Our teams in Oulu are shaping the future of 5G and 6G developing our most advanced radio networks. Oulu has a unique ecosystem that integrates Nokia’s R&D and smart manufacturing with an ecosystem of partners – including universities, start-ups and NATO’s DIANA test center. Oulu embodies our culture of innovation and the new campus will be essential to advancing connectivity necessary to power the AI supercycle,” said Justin Hotard, President and CEO of Nokia

Nokia Oulu Facts:

- Around 3,000 employees and 40 nationalities working on the campus.

- Oulu campus covers the entire product lifecycle of a product, from R&D to manufacturing and testing of the products.

- Footprint of the building is overall 55,000 square metres, including manufacturing, R&D and office space.

- Green campus with all energy purchased green and all surplus energy generated fed back into the district heating system and used to heat 20,000 local households.

- The campus boasts 100% waste utilization rate and 99% avoidance in CO2 emissions.

- Construction started in the second half of 2022, with the first employees moving into the facility in the first half of this year.

- YIT constructed the site and Arkkitehtitoimisto ALA were the architects.

References:

https://www.sdxcentral.com/analysis/behind-the-scenes-at-nokias-new-home-of-radio/

Will the wave of AI generated user-to/from-network traffic increase spectacularly as Cisco and Nokia predict?

Nokia’s Bell Labs to use adapted 4G and 5G access technologies for Indian space missions

Indosat Ooredoo Hutchison and Nokia use AI to reduce energy demand and emissions

Verizon partners with Nokia to deploy large private 5G network in the UK

Nokia selects Intel’s Justin Hotard as new CEO to increase growth in IP networking and data center connections

Nokia sees new types of 6G connected devices facilitated by a “3 layer technology stack”

Nokia and Eolo deploy 5G SA mmWave “Cloud RAN” network