Is 5G network slicing dead before arrival? Replaced by private 5G?

The telecom industry has been hyping 5G network slicing for several years now, asserting that carriers will be able to make money by selling “slices” of their networks to different enterprises for their exclusive use. Effectively, creating wireless virtual private networks.

Network slicing is a very complicated technology that must work across a 5G SA core, RAN, edge and transport networks. There are no standards for network slicing, which is defined in several 3GPP Technical Specifications.

From 3GPP TS 28.530:

Network slicing is a paradigm where logical networks/partitions are created, with appropriate isolation, resources and optimized topology to serve a purpose or service category (e.g. use case/traffic category, or for MNO internal reasons) or customers (logical system created “on demand”).

- network slice: Defined in 3GPP TS 23.501 v1.4.0

- network slice instance: Defined in 3GPP TS 23.501 V1.4.0

- network slice subnet: a representation of the management aspects of a set of Managed Functions and the required resources (e.g. compute, storage and networking resources).

- network slice subnet instance: an instance of Network Slice Subnet representing the management aspects of a set of Managed Function instances and the used resources (e.g. compute, storage and networking resources).

- Service Level Specification: a set of service level requirements associated with a Service Level Agreement to be satisfied by a network slice instance.

…………………………………………………………………………………………

An IEEE Techblog tutorial on network slicing is here.

………………………………………………………………………………………..

Yet despite all the pomp and circumstance, there are few if any instances of commercially available 5G SA core networks that support network slicing. Perhaps that’s because with the lack of standards there won’t be any interoperability or roaming from one 5G SA core network to another.

Meanwhile, private 5G is coming on strong, especially with Amazon’s announcement which we covered in this post:

Benefits of Private 5G Networks:

A private 5G network, also known as a local or non-public 5G network, is a local area network that provides dedicated bandwidth using 5G technology. Although the telecommunication industry is currently building the needed infrastructure and network gear to support 5G, there has not yet been a widespread rollout.

“5G deployment is still in its infancy, and we use movement from standardization bodies implementing models for Industry 4.0 or smart buildings as an indicator that the 5G private network is a foundational component for their future,” says Jon Abbott, EMEA technology director of Vertiv.

Many companies are working with service providers to use these developing networks, but some prefer the advantages that come with building their own private 5G systems.

A large component in the growth of private 5G networks is the release of an unlicensed spectrum for industry verticals. It gives businesses the option to deploy a private 5G network without having to work with an operator.

Because a private network can be designed for protection and human safety, sensor control, and security, the improved bandwidth is ideal for various use cases in multiple industries.

Benefits of a private network include:

- Reducing the company’s dependence on providers, thereby allowing full control over operating methods

- Separate data processing and storage

- Security policies can be designed and controlled within the organization, allowing companies to customize the network the way they want

- The overall high speeds, low latency, and application support of 5G

Risks of 5G:

Although there are many benefits, faster network do still come with risks. For example, the improved speed and latency can inadvertently create new avenues for cyber-criminals. As more systems go wireless, the more sources cyber criminals can attempt to hack. Furthermore, the growing adoption of 5G is increasing alongside the use of 5G-enabled devices. Because many of these devices are interconnected to various systems through the Internet of Things, the probability of a data leak increases.

Businesses need to take the proper steps to secure their systems in order to ward off cyber criminals as they attempt to take advantage of the fast speeds of 5G. When the implementation of 5G begins, organizations must have security systems, such as firewalls, VPNs, malware software, intrusion detection systems (IDS) and intrusion prevention systems (IPS), in place.

From a Dell’Oro Group report on Private Wireless Networks:

Private Wireless RAN and Core network Configurations:

There is no one-size-fits-all when it comes to private wireless. We are likely looking at hundreds of deployment options available when we consider all the possible RAN, Core, and MEC technology, architectures, business, and spectrum models. At a high level, there are two main private wireless deployment configurations, Shared (between public and private) and Not Shared:

- The shared configuration, also known as Public Network Integrated-NPN (PNI-NPN), shares resources between the private and public networks.

- Not shared, also known as Standalone NPN (SNPN), reflects dedicated on-premises RAN and core resources. No network functions are shared with the Public Land Mobile Network (PLMN).

Not surprisingly, there will be a plethora of deployment options to address the RAN domain. In addition to the shared vs. standalone configuration and LTE vs. 5G NR, private wireless RAN systems can be divided into two high-level RAN configurations: Wide-Area and Local-Area.

Dell’Oro Group continues to believe that it will take some time to realize the full vision with private wireless. Setting aside the more mature public safety market, we expect that some of these more nascent local private opportunities to support both Broadband and Critical IoT will follow Amara’s Law, meaning that there will likely be a disconnect between reality and vision both over the near and the long term.

References:

India creates 6G Technology Innovation Group without resolving crucial telecom issues

Having failed to hold the long promised 5G spectrum auction in 2021, India’s Department of Telecommunications (DoT) has authorized a 6G Technology Innovation Group (TIG) with the objective to co-create and participate in the development of the 6G technology ecosystem.

In a notification issued dated December 30, the Department mandated immediate deliverables by March 31, 2022 that included mapping of 6G activities and capabilities worldwide, and a white paper on India’s competencies. including research and pre-standardisation activities.

The new task groups are headed by Bhaskar Ramamurthy, director, Indian Institute of Technology (IIT)-Chennai, Abhay Karandikar, director, IIT-Kanpur, Bharadwaj Amrutur, director, Indian Institute of Science (IISc) Bangalore, Kiran Kumar Kuchi, director, IIT-Hyderabad on multi platform for next generation networks, spectrum policy, multi-disciplinary innovative solutions, and devices respectively.

The 6G TIG task force includes members from the government, academia, industry associations, and TSDSI (Telecom Standards Development Society of India).

“With a strong emphasis on technology commercialization, the work will encompass the full lifecycle of research and development, manufacturing, pre-standardisation and market readiness,” the department said in its memorandum.

“This would be necessary to prepare India’s manufacturing and services ecosystem to capitalize on 6G opportunity,” DoT added.

Last month, the government formed an innovation group headed by K Rajaraman, secretary, DoT to create a vision to develop a 6G roadmap in the country.

Bharti Airtel and Vodafone Idea said that an early start into local 6G development will result in IP or intellectual property creation for the Indian telecom ecosystem. They said that there is a need for the Indian telecom industry and academia to join forces with the telecom department and contribute towards the 6G standard building in cooperation with 3GPP.

“…getting into the journey of 6G is absolutely the right time. India has the brainpower which contributes to the R&D. We should bring telcos, the academia, all the brain we have in our very high standard academic institutions and the Indian government together for the development of IPR for technologies…we can actually really start building 6G standards, and in these 6G standards, we cooperate with 3GPP,” Randeep Sekhon, CTO of Bharti AIrtel told ET.

…………………………………………………………….

India’s 5G efforts to date have been restricted to 5G NSA trials. The DoT awarded spectrum to the telcos for six months to conduct 5G trials and develop India-specific use cases. That time period was later extended for another six months at the telcos’ request. The big three India wireless service providers, Reliance Jio, Bharti Airtel and Vodafone Idea, have conducted several 5G tests over the last few months.

The Indian government has announced that the repeatedly postponed 5G spectrum auction will be held in the April-May 2022 timeframe. As per media reports, the target is to launch 5G on August 15th, India’s Independence Day.

Typically, India lags behind developed countries in the adoption of new technologies. The much delayed 5G auction launch in 2022 puts it way behind other countries.

This 6G initiative is truly remarkable since India has not sorted out any of the critical 5G and satellite internet issues it has faced. Those include:

- 5G spectrum auction with fair prices to participants.

- Acceptance of the 5Gi standard within ITU-R M.2150.

- Reliance Jio’s boast of developing and deploying indigenous (made in India) 5G technology.

- Indian telco cooperation with hyperscale cloud service providers for 5G core network, Multi-access Edge Computing (MEC) and virtual RANs.

- Satellite internet services: Starlink was in the news for pre-booking clients even when it is yet to acquire required approvals from the DoT. The company has now suspended the sale of satellite services until it gets the license. Both SpaceX and OneWeb are likely to launch satellite services in the country in 2022.

- Spectrum allocation: A major controversy in this segment is the conflict between the three major telcos and satellite internet service providers regarding the spectrum. The telcos are asking for a level playing field with the satellite providers, which means that they should bid for spectrum, just like telcos. However, the satellite players disagree with this.

References:

https://smefutures.com/india-prepares-to-take-lead-in-6g-technology/

https://www.fiercewireless.com/wireless/indian-telecom-2022-faces-5g-auctions-satellite-competition

Microsoft and Telefonica Tech to deliver hybrid cloud services to public administrations

Microsoft and Telefonica Tech, Telefonica’s digital business unit, has signed a new deal with Microsoft, to supply confidential hybrid cloud services to public administrations and companies in regulated sectors. The focus will be on monitoring and encryption services to ensure the security and privacy of data in Microsoft Azure, Microsoft 365 and Microsoft Dynamics 365.

- The joint solutions of both companies will enable Spanish public administrations and companies in regulated sectors to respond to the needs of digital sovereignty.

- Telefónica Tech and Microsoft meet the most demanding legal and technical requirements for cloud trust principles, guaranteeing them with Microsoft’s Confidential Computing technology and Telefónica Tech’s cyber threat monitoring and management capabilities.

- Telefónica Tech will provide professional and managed advisory, implementation, and operational services to deploy and operate the cloud services, which will be marketed through Telefónica Empresas.

Under the latest agreement, Microsoft will deliver its privacy safeguards, technologies and certifications. The company has high-level National Security Scheme certification for Azure, Microsoft 365 and Dynamics 365 and has made a contractual commitment to legally oppose access to its enterprise and public sector customer data by any government. Microsoft has also announced the EU Data Boundary initiative to allow customers to store and process their personal data within the EU. This commitment applies to Microsoft Azure, Microsoft 365 and Dynamics 365 cloud services.

Telefonica Tech will provide consultancy, implementation and operation services that will enable the deployment of maximum security cloud services, guaranteeing compliance with information privacy, quality of service and regulatory compliance requirements at all times. The company will also deliver value-added services, such as the intelligent management of communications and infrastructures or the monitoring and management of cyber threats from its Cybersecurity Operations Centre, with the aim of guaranteeing a rapid and secure adoption of cloud services by the different organisations and institutions. It will in addition offer specialised consulting services for the design, deployment and operation of Big Data platforms on Microsoft Azure Cloud capabilities. Finally, specific services will be supplied to the Defence sector. These will include 5G connectivity services offered by Telefonica with Microsoft cloud services.

All of the services will be implemented in Microsoft’s current cloud environments and will be complemented by the upcoming availability of the new Cloud Region that Microsoft will open in Spain.

Telefonica joined Microsoft and Repsol in June to create an artificial intelligence consortium focused on the industrial sector in Spain.

Telefonica and Microsoft partnered in May to jointly develop private 5G connectivity and on-premises edge computing services for the industrial sector. The partners will now provide public sector organizations, including Defense, with cloud computing and infrastructure services to advance their digital transformation plans, while complying with data protection provisions and recommendations defined by the European Data Protection Board (EDPB).

José Cerdán, CEO of Telefónica Tech, assures: “We believe that the alliance between Microsoft and Telefónica represents a giant step forward in enabling the digital transformation of the public sector and, in general, of the country. The combination of Microsoft’s technology with Telefónica’s service, management and control capabilities guarantees sovereignty and privacy as well as scalability and evolution of infrastructure and citizen services, all with the highest level of quality“.

Alberto Granados, president of Microsoft Spain, remarks: “We at Microsoft have long demonstrated our commitment to meeting and exceeding the data protection requirements of the European Union. This joint value proposition with Telefónica to provide confidential hybrid cloud solutions responds to the needs of digital sovereignty and is evidence that we continue to advance this commitment.”

Regarding this alliance, Carme Artigas, Secretary of State for Digitalization and Artificial Intelligence, points out: “The proposal of confidential public cloud solutions together with hybrid cloud designed specifically for public administrations and companies in regulated sectors in Spain, responds to the important objective of digital sovereignty and constitutes a very relevant advance to accelerate the digitalization of our economy.”

Microsoft was the first hyperscale cloud provider to achieve certification for compliance with the high level of the National Security Scheme in 2016, demonstrating the company’s commitment to delivering cloud products with the highest security requirements. This certification is available for all three Microsoft public clouds: Microsoft Azure, Microsoft 365 and Dynamics 365. It has also been the first to provide Confidential Computing services working with Intel and AMD. These Microsoft cloud services add in-use protection to existing protections for data in transit and at rest, ensuring maximum privacy. In addition, the company offers advanced encryption services that complement the base encryption measures, allowing the implementation of encryption systems using keys provided and managed by the customer or a third party, in this case Telefónica, and managed and dedicated hardware security module (HSM) services.

Telefónica Tech, through its capabilities and experience, accelerates the implementation of technology through its Cybersecurity, Cloud, IoT, Big Data, Artificial Intelligence and Blockchain services. It has 12 specialized Digital Operations Centers (DOC) with 24×7 services from where more than 30,000 servers are managed and more than 100 million cybersecurity events per year are monitored. It also has more than 3,000 expert professionals with the highest certifications in cloud services and cybersecurity who serve the Telefónica Group’s 5.5 million B2B customers in 175 countries.

References:

Highlights of Cisco’s Internet Traffic Report & Forecast

According to statistics from Cisco Systems global average Internet traffic will increase 3.2-fold by 2021 and will reach 717 Tbps. Busy hour Internet traffic will increase 4.6-fold by 2021 and will reach 4.3 Pbps. Globally, the number of DDoS attacks greater than 1 Gbps will grow 2.5-fold from 2016 to 2021, a compound annual growth rate of 20%.

In 2021:

- Fixed access and Wi-Fi networks represented 52.6% of the world’s total Internet traffic in 2021.

- Mobile networks – including 4G and 5G networks – handled just 20.5% of the world’s total Internet traffic in 2021.

According to Cisco’s findings, future trends favor mobile. The firm reported that fixed and Wi-Fi networks were approximately 52.1% of total Internet traffic in 2016 – virtually the same number as 2021.

Global mobile networks handled just 9.8% of total Internet traffic in 2016, but that figure more than doubled in 2021.

It’s interesting that Cisco predicts an average WiFi speed of 92 Mbps by 2023, while the average mobile speed will then be less than half of that at 44 Mbps.

Global – 2021 Forecast Highlights:

Internet users by 2023:

66% of the population will be using the Internet up from 51% in 2018

……………………………………………………………………….

Mobile devices/ connections by 2023:

up from 1.2 in 2018

up from 2.4 in 2018

IP Traffic:

• Globally, IP traffic will grow 3-fold from 2016 to 2021, a compound annual growth rate of 24%.

• Globally, IP traffic will reach 278.1 Exabytes per month in 2021, up from 96.1 Exabytes per month in 2016.

• Global IP networks will carry 9.1 Exabytes per day in 2021, up from 3.2 Exabytes per day in 2016.

• Globally, IP traffic will reach an annual run rate of 3.3 Zettabytes in 2021, up from an annual run rate of 1.2

Zettabytes in 2016.

• Globally, IP traffic will reach 35 Gigabytes per capita in 2021, up from 13 Gigabytes per capita in 2016.

• Globally, average IP traffic will reach 847 Tbps in 2021, and busy hour traffic will reach 5.0 Pbps.

• In 2021, the gigabyte equivalent of all movies ever made will cross Global IP networks every 1 minutes.

Internet Traffic:

• Globally, Internet traffic will grow 3.2-fold from 2016 to 2021, a compound annual growth rate of 26%.

• Globally, busy hour Internet traffic will grow 4.6-fold from 2016 to 2021, a compound annual growth rate of 35%.

• Globally, Internet traffic will reach 235.7 Exabytes per month in 2021, up from 73.1 Exabytes per month in 2016.

• Global Internet traffic will be 7.7 Exabytes per day in 2021, up from 2.4 Exabytes per day in 2016.

• Global Internet traffic in 2021 will be equivalent to 707 billion DVDs per year, 59 billion DVDs per month, or 81 million DVDs per hour.

•In 2021, the gigabyte equivalent of all movies ever made will cross the Internet every 1 minutes.

• Global Internet traffic in 2021 will be equivalent to 135x the volume of the entire Global Internet in 2005.

• Globally, Internet traffic will reach 30 Gigabytes per capita in 2021, up from 10 Gigabytes per capita in

2016.

• Globally, average Internet traffic will increase 3.2-fold by 2021 and will reach 717 Tbps.

• Globally, busy hour Internet traffic will increase 4.6-fold by 2021 and will reach 4.3 Pbps.

• Globally, the number of DDoS attacks greater than 1 Gbps will grow 2.5-fold from 2016 to 2021, a

compound annual growth rate of 20%.

• Globally, the number of DDoS attacks greater than 1 Gbps will be 3.1 million per year in 2021, up from 1.3 million per year in 2016.

Fixed Wireless/Wi-Fi and Mobile Growth:

• Global Fixed/Wi-Fi was 41% of total IP traffic in 2016, and will be 46% of total IP traffic in 2021.

• Global Mobile was 7% of total IP traffic in 2016, and will be 17% of total IP traffic in 2021.

• Global Fixed/Wi-Fi was 52.1% of total Internet traffic in 2016, and will be 52.6% of total Internet traffic in 2021.

• Global Fixed/Wired was 38% of total Internet traffic in 2016, and will be 27% of total Internet traffic in 2021.

• Global Mobile was 9.8% of total Internet traffic in 2016, and will be 20.5% of total Internet traffic in 2021.

• Globally, mobile data traffic will grow 7-fold from 2016 to 2021, a compound annual growth rate of 46%.

• Globally, mobile data traffic will reach 48.3 Exabytes per month in 2021, up from 7.2 Exabytes per month in 2016.

• Global mobile data traffic will grow 2 times faster than Global fixed IP traffic from 2016 to 2021.

• Global Mobile was 7% of total IP traffic in 2016, and will be 17% of total IP traffic in 2021.

• Globally, mobile data traffic in 2021 will be equivalent to 23x the volume of the entire Global Internet in 2005.

Global Fixed/Wired:

51% of total IP traffic in 2016, and will be 37% of total IP traffic in 2021.

References:

https://www.cisco.com/c/en/us/solutions/executive-perspectives/annual-internet-report/index.html

Omdia: Big increase in Gig internet subscribers in 2022; Top 25 countries ranked by Cable

LG Electronics demos “6G” power amplifier and adaptive beamforming technology at South Korea trade show

South Korea’s LG Electronics showcased so called “6G” technology during the ‘2021 Korea Science and Technology Exhibition’ that was recently held at KINTEX in Ilsan, South Korea. Specifically, LG is unveiling a power amplifier for 6G, which is jointly developed by Germany’s Fraunhofer Research and Institute.

…………………………………………………………………………………………………………………………………………………………………………………………..

Author’s Note: This news comes despite there is no definition of 6G from either ITU-R or 3GPP. Further, 5G standards are in their infancy, with only the RAN standardized in ITU-R M.2150 (but not the frequency arrangements for terrestrial IMT in a yet to be completed revision of M.1036).

…………………………………………………………………………………………………………………………………………………………………………………………..

The power amplifier is the same one that was used by LG during its 6G demo in Berlin in August 2021. At that time, LG Electronics said it has successfully demonstrated the transmission and reception of wireless “6G” terahertz (THz) data over 100 meters in an outdoor setting. That was impressive because THz transmission is short-range and experiences power loss during transmission and reception between antennas. This is where the power amplifier proved crucial, as it was able to generate a stable signal across ultra-wideband frequencies.

The power amplifier is capable of generating stable signal output up to 15 dBm in the frequency range between 155 to 175 GHz. LG noted that it was also successful in demonstrating adaptive beamforming technology, which alters the signal’s direction in accordance with changes to the channel and receiver position; as well as high-gain antenna switching, which combines output signals of multiple power amplifiers and transmits them to specific antennas. LG also introduced the FDR full-duplex system which allows simultaneous transmission and reception across the same frequency band.

At the Korea exhibition, LG Electronics and Keysight Technologies (a global wireless communication test and measurement equipment manufacturer) also demonstrated ‘Adaptive beamforming’ technology that converts beam directions according to channel changes and receiver positions.

In 2019, LG established the LG-KAIST 6G Research Center in partnership with the Korea Advanced Institute of Science and Technology (KAIST). LG and KAIST had previously partnered with U.S.-based test and measurement firm Keysight Technologies with the aim of carrying out research on future 6G technologies.

Under the terms of the agreement, the three partners will cooperate in developing technologies related to terahertz frequencies, widely seen a key frequency band for 6G communications, which have not yet been standardized. The partners aim to complete 6G research by 2024.

LG previously said that 6G is expected to be commercialized in 2029. LG also noted that future 6G technologies will provide faster data speed, lower latency and higher reliability than 5G, and will be able to bring the concept of Ambient Internet of Everything (AIoE), which provides enhanced connected experience to users.

The government of South Korea previously said it aims to launch a pilot project for not-yet-standardized 6G mobile services in 2026. The Korean government expects 6G services could be commercially available in Korea between 2028 and 2030.

The Korean government’s strategy for 6G consists of preemptive development of next-generation technologies, securing standard and high value-added patents, and laying R&D and industry foundations. The government selected five major areas for the pilot project: Digital healthcare immersive content, self-driving cars, smart cities and smart factories.

LG expects 6G communication to be commercialized in 2029, with talks for standardization beginning in 2025. “6G will be a key component of Ambient Internet of Everything, the emerging technology that aims to improve living and business environments by making them more sensitive, adaptive, autonomous and personalized to consumers’ needs by recognizing human presence and preferences,” LG said.

References:

https://www.rcrwireless.com/20211227/wireless/lg-electronics-showcases-6g-tech-south-korea

https://www.techradar.com/news/lg-demonstrates-its-progress-in-6g-technology-at-a-korean-exhibition

Omdia: Big increase in Gig internet subscribers in 2022; Top 25 countries ranked by Cable

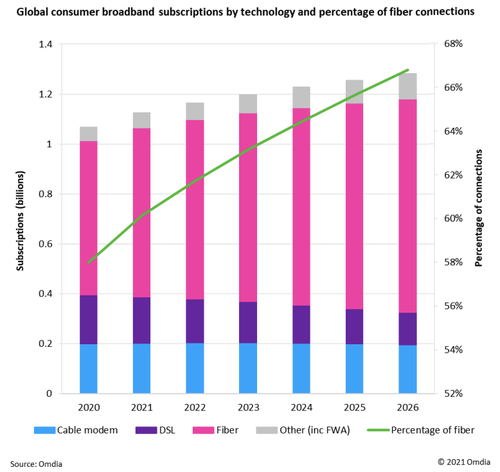

Global gigabit internet subscriptions are expected to increase to 50 million in 2022, more than doubling from 24 million at the end of 2020, according to a new report from market research firm Omdia (owned by Informa).

The Omdia report states that accelerated fiber deployments are helping to drive an increase in gigabit connectivity.

“Demand for reliable broadband is set to drive growth in gigabit services, with fiber playing a key role,” said Peter Boyland, principal analyst, broadband at Omdia.

“There were fewer than 620 million fiber subscriptions globally at the end of 2020, but we expect these to grow to 719 million in 2022, or 62% of total subscriptions.” The majority of fiber internet subscribers are expected to be in China.

However, Omdia warns that service providers must “carefully consider market demand” for their gigabit strategies and make targeted investments in fiber.

“Service providers need to carefully plan and execute gigabit network rollout, analyzing a number of factors, including infrastructure challenges, market competition, and expected demand,” writes Omdia. “But this does not stop with network rollout – operators need to continually monitor potential competitors and constantly innovate, refresh, and build service offerings so they stay ahead of rivals.”

The analysts also point out the opportunity for vendors in the market who can help service providers build “future proof” networks. “Vendors can offer long-term solutions such as monitoring and automation tools to extend the operator/vendor relationship beyond network rollouts,” the report recommends.

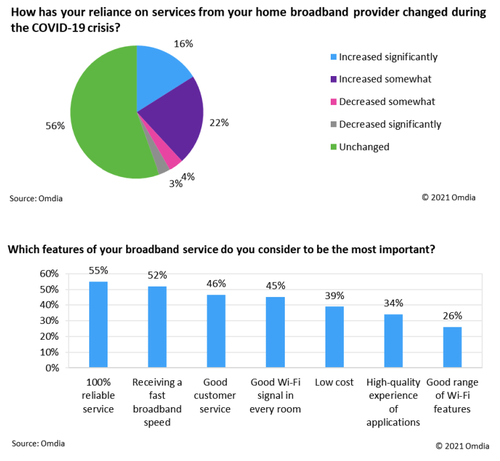

Of course, what matters most to consumers is reliable service. According to Omdia’s Digital Consumer Insights survey, 36% of respondents said they were more reliant on broadband services during COVID-19, and 55% of respondents said reliability ranked top among the most important home broadband features.

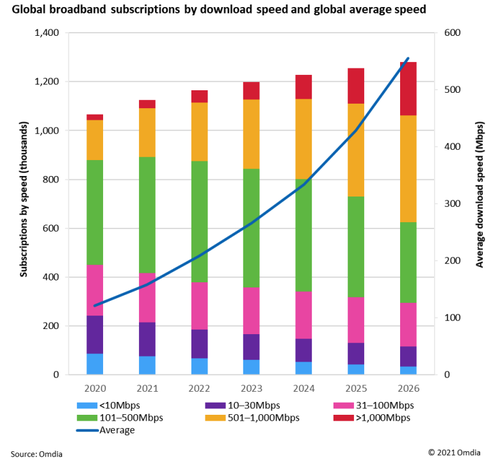

All of this gigabit and fiber growth will impact broadband speeds for years to come. According to Omdia:

“In 2020, just 2% of broadband subscriptions were more than 1Gbps, but this is expected to double to 4% in 2022.”

–>See table below for the 25 countries with the fastest AVERAGE internet speeds, ranked by Cable. Note that none of them is close to 1Gbps.

The report says that subscribers with access to 500 Mbit/s-1 Gbit/s will increase from 15% in 2020 to 21% in 202, with 17% of broadband subscriptions projected to reach speeds over 1 Gbit/s by 2026.

While high-bandwidth entertainment like augmented and virtual reality (AR/VR) and gaming were thought to be the main drivers for ever-faster home broadband speeds in pre-pandemic times, Omdia’s report doesn’t think they are significantly important for gigabit Internet growth, referring to them just once as “other drivers.”

……………………………………………………………………………………………

Internet comparison site Cable has ranked the countries with the fastest broadband internet in the world based on over 1.1 billion speed tests across 224 countries and territories.

“The acceleration of the fastest countries in the world has finally plateaued this year as they reach FTTP pure fibre saturation. Increases in speed among the elite performers, then, can be attributed in greater part to uptake in many cases than to network upgrades. Meanwhile, though the countries occupying the bottom end of the table still suffer from extremely poor speeds, 2021’s figures do indicate that the situation is improving,” said Dan Howdle of Cable.

Here are the 25 countries with the fastest download speeds:

| 1 | Jersey | JE | WESTERN EUROPE | 274.27 |

| 2 | Liechtenstein | LI | WESTERN EUROPE | 211.26 |

| 3 | Iceland | IS | WESTERN EUROPE | 191.83 |

| 4 | Andorra | AD | WESTERN EUROPE | 164.66 |

| 5 | Gibraltar | GI | WESTERN EUROPE | 151.34 |

| 6 | Monaco | MC | WESTERN EUROPE | 144.29 |

| 7 | Macau | MO | ASIA (EX. NEAR EAST) | 128.56 |

| 8 | Luxembourg | LU | WESTERN EUROPE | 107.94 |

| 9 | Netherlands | NL | WESTERN EUROPE | 107.30 |

| 10 | Hungary | HU | EASTERN EUROPE | 104.07 |

| 11 | Singapore | SG | ASIA (EX. NEAR EAST) | 97.61 |

| 12 | Bermuda | BM | NORTHERN AMERICA | 96.54 |

| 13 | Japan | JP | ASIA (EX. NEAR EAST) | 96.36 |

| 14 | United States | US | NORTHERN AMERICA | 92.42 |

| 15 | Hong Kong | HK | ASIA (EX. NEAR EAST) | 91.04 |

| 16 | Spain | ES | WESTERN EUROPE | 89.59 |

| 17 | Sweden | SE | WESTERN EUROPE | 88.98 |

| 18 | Norway | NO | WESTERN EUROPE | 88.67 |

| 19 | France | FR | WESTERN EUROPE | 85.96 |

| 20 | New Zealand | NZ | OCEANIA | 85.95 |

| 21 | Malta | MT | WESTERN EUROPE | 85.20 |

| 22 | Estonia | EE | BALTICS | 84.72 |

| 23 | Aland Islands | AX | WESTERN EUROPE | 81.31 |

| 24 | Canada | CA | NORTHERN AMERICA | 79.96 |

| 25 | Belgium | BE | WESTERN EUROPE | 78.46 |

It is the fourth year of the assessment and the latest ranking uses data collected in the 12 months up to 30th June 2021 to evaluate internet speed by country.

References:

https://www.cable.co.uk/broadband/speed/worldwide-speed-league/

Heavy Reading: How network operators will deploy Open RAN and cloud native vRAN

Heavy Reading conducted an operator survey in association with Quanta Cloud Technology (QCT) to explore how and why operators are likely to deploy Open RAN. The data was collected in November 2021 and includes North American, European and Asian operator respondents in roughly equal proportions.

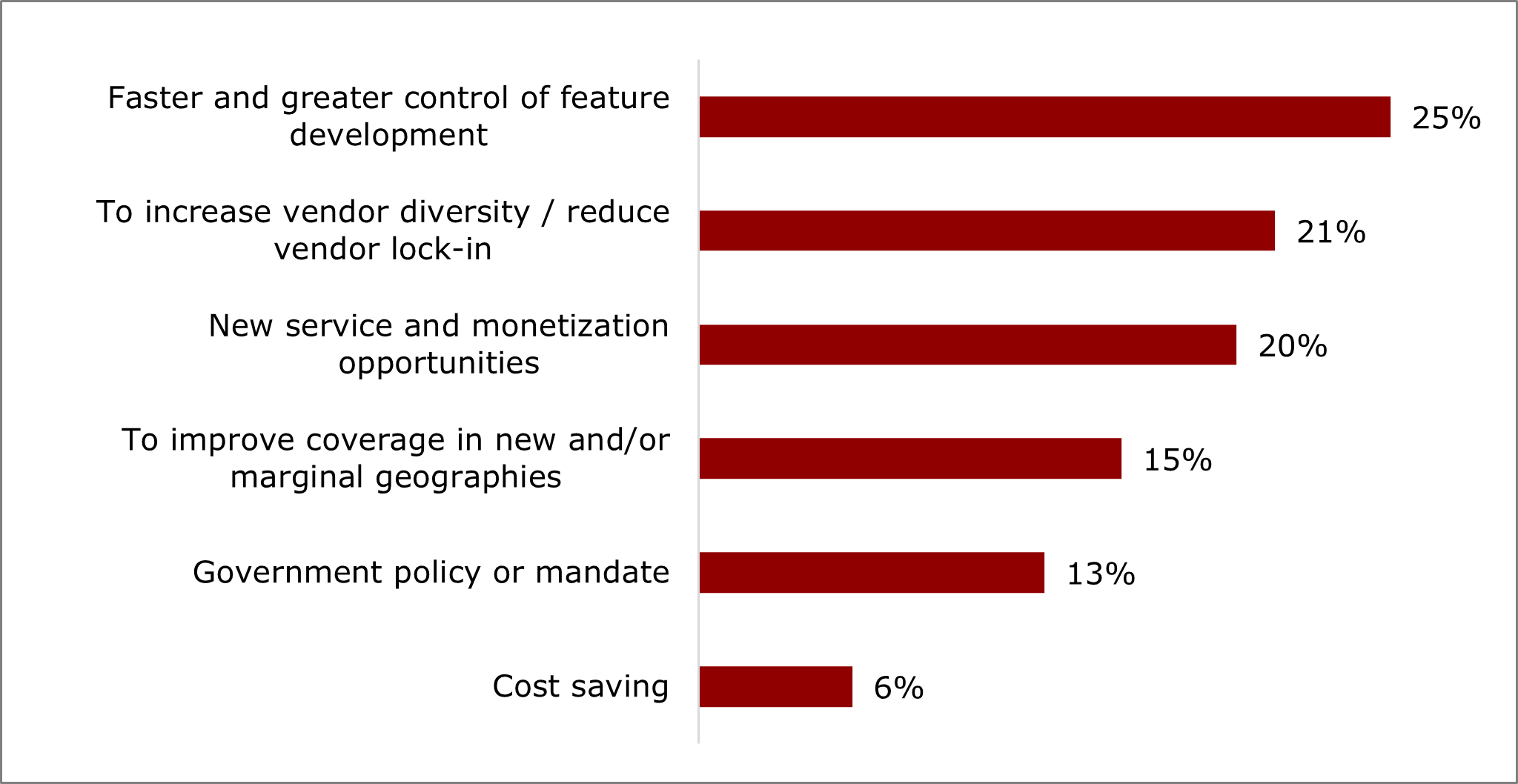

The first question in the survey that asked about the business justification for Open RAN. Here’s the result:

The lead response is for “faster greater control of feature development” with 25%, just ahead of “increase vendor diversity” at 21%, and “new service and monetization opportunities” at 20%.

The absence of an overriding reason to pursue open RAN is consistent with previous Heavy Reading operator surveys. These results indicate the business case will be founded on an accumulation of benefits that will deliver value relative to a classic, single-vendor RAN. They also point to the view that open RAN has not yet found — or at least, has not yet proven — a compelling business justification and that this diversity of views reflects an ongoing search for a business case.

Note that cost savings at 6% of respondents, indicates lower cost is not really a business reason to deploy Open RAN. There are likely two explanations for this:

- Open RAN has a similar bill of materials to classic single-vendor RAN. Ericsson and Nokia say Open RAN is more expensive than integrated, single vendor RAN.

- Operators in leading markets will not compromise on user experience simply to save a small percentage on RAN equipment costs.

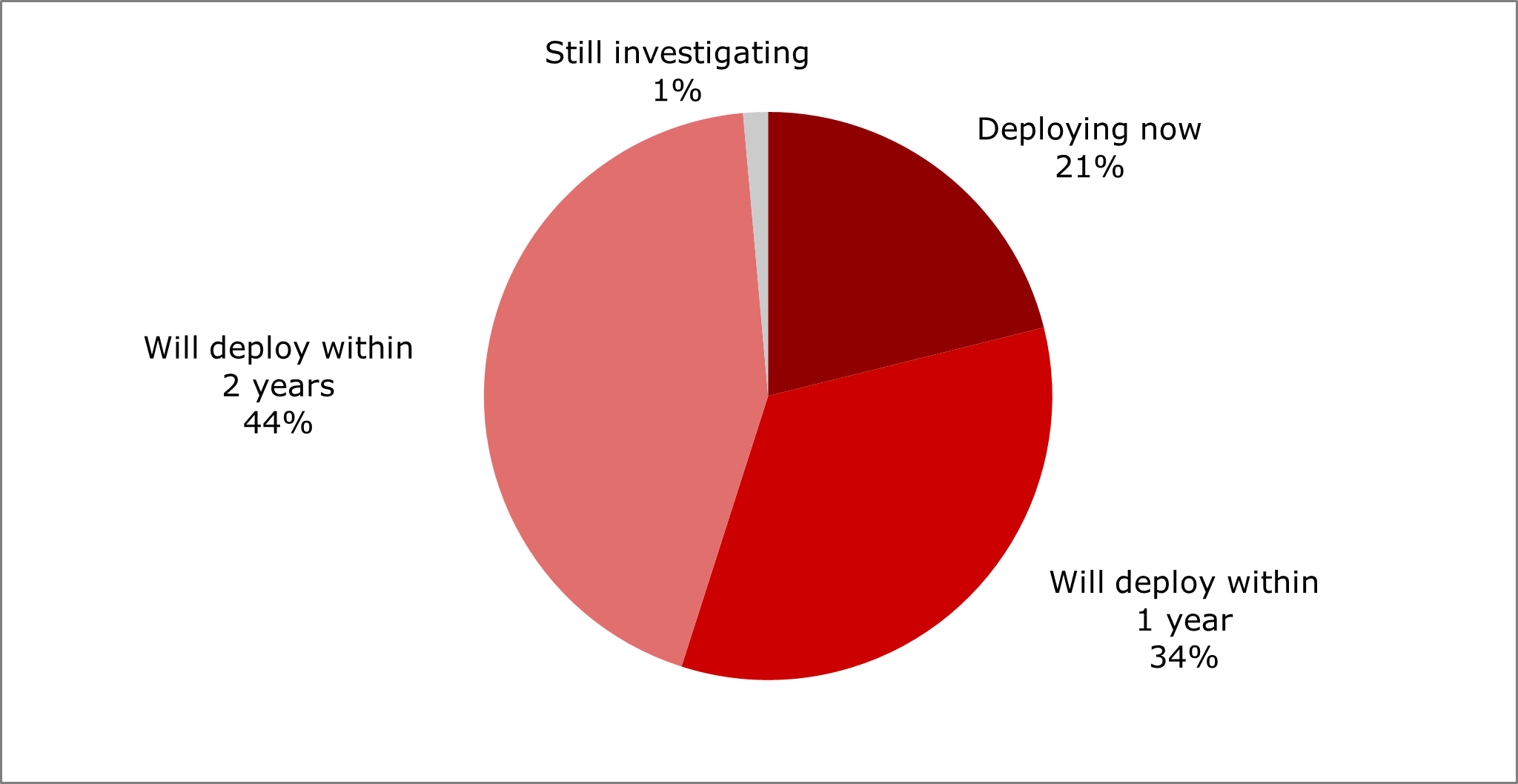

With respect to cloud native vRAN (RAN software that is deployed in containers and centrally orchestrated) the survey asked when operators plan to deploy a containerized Distributed Unit (DU) vRAN application in their commercial network. 21% of respondents said they are “deploying now,” and a further 34% “will deploy within 1 year.”

While this response this looks overly optimistic, containerized DU products are now available and are commercially deployed and operational. Heavy Reading expects deployment of this technology to scale quickly. So even if this data seems too optimistic on the timeline, it is a good indicator of sentiment among operators that are likely to already be positive on vRAN.

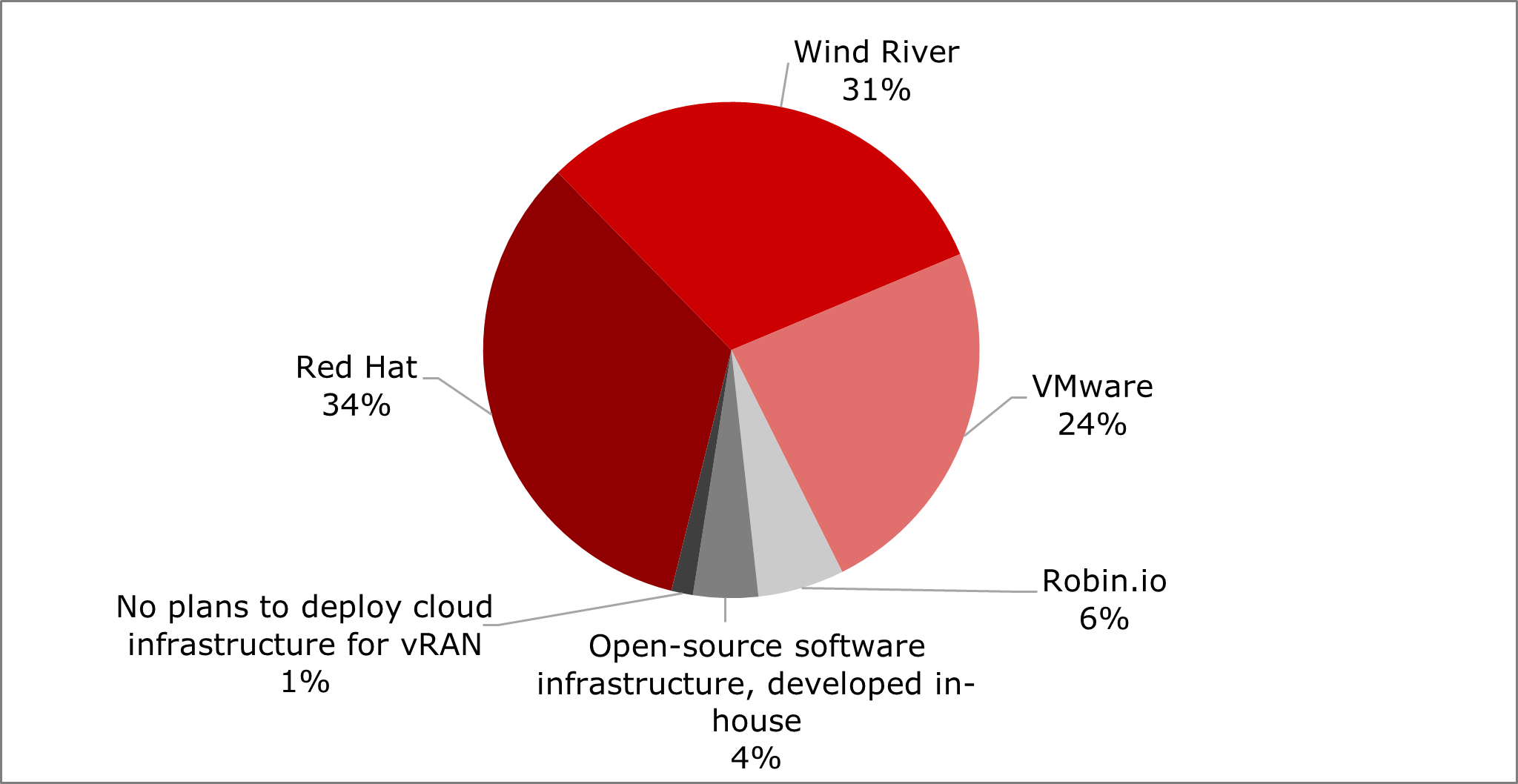

Network operators must deploy RAN software — either in virtual machines, containers or both — on cloud infrastructure. A key question is which software infrastructure platform to use?

The chart below shows three leading operator preferences:

For vRAN software suppliers and DU server vendors that want to help accelerate open vRAN deployments, the three main cloud environments to pre-integrate with appear to be Red Hat, Wind River and VMware.

These are well-known solutions in the telco cloud and core network, and it is logical operators will want to extend their existing telco cloud to the edge to support vRAN. An interesting third option also emerges from this data. Wind River, which offers cloud infrastructure software focused on smaller footprint edge devices that can be optimized for RAN applications, also scores highly at 31%. This is consistent with several Tier 1 operator vRAN deals that reference Wind River publicly.

To learn more about this Heavy Reading operator survey, register for the archived Light Reading webinar on Designing and Deploying Cloud Native Open RAN.

— Gabriel Brown, Principal Analyst, Heavy Reading

……………………………………………………………………………………………………………………………………………………..

A Red Hat survey found that communication service providers (CSPs) now realize the role and benefits of cloud-native network functions (CNFs) and container-based cloud platforms as the means to advance their infrastructures. Benefits include features and efficiency, automation, scalability, and flexibility that will help further lower overall costs. Respondents confirmed their rollout of 5G services would utilize container-based 5G infrastructure, with three-quarters of those respondents indicating the use of container-based platforms in over 25% of their networks by 2022.

In a recent report from Heavy Reading based on a survey of respondents from 77 CSPs, the steady uptick of service providers evolving their RAN has been significant, with the following observations:

-

50% of service providers have deployed a vRAN in over a quarter of their network compared to the fourth quarter of 2019, when only 35% of respondents had achieved the same rollout.

-

vRAN deployment has doubled in service provider 4G-only networks and vRAN in service provider 5G-only networks has increased by 66% since the survey in Q4 of 2019.

-

By the end of 2023 , the above numbers are expected to be flipped, with the majority of service providers deploying vRAN into both their 4G and 5G networks and not 4G alone.

As service providers’ experience with network transformation grows, they are embracing horizontal cloud platforms over vertically integrated solutions. The increased flexibility provided by containers, coupled with automation, can take full advantage of horizontal platforms.

A common cloud-native application platform deployed across any footprint and any cloud provides a simplified operational model and allows greater choice of CNFs. This is important to fit service providers’ business needs and to deploy and scale where needed, so they can make future additions and changes more easily. A Kuberenetes-based platform offers other direct benefits for RAN workloads, such as reduced latency, higher throughput and precision timing.

In summary, service providers are evolving their RAN to deliver new 5G services that are adaptable, scalable and efficient. Successful vRAN deployments will build upon a telco-grade container platform solution that takes automation and flexibility to the next level. With that, disaggregated vRAN architectures can be optimized to deliver the lowest latency and highest performance. This infrastructure needs to be a consistent cloud-native platform that can support multiple RAN functions and that spans the entire service provider network from edge to core to cloud.

Red Hat OpenShift is an application platform that not only boosts developer productivity but can orchestrate both containers and VMs in production environments. OpenShift helps simplify workflows and reduce overall total cost of ownership (TCO). As an answer to ever-changing marketplace demands, Red Hat’s extensive partner ecosystem provides choices to select software functions and hardware from multiple vendors, while accommodating present needs and anticipating those in the future.

References:

https://www.lightreading.com/open-ran/designing-and-deploying-cloud-native-open-ran/a/d-id/774302?

https://www.redhat.com/en/blog/adoption-evolved-vran-propels-network-enhancements

https://www.redhat.com/en/resources/virtualized-ran-insights-2021-analyst-paper

China’s telecom revenue: +8.1% YoY from Jan-Nov 2021

With the caveat that you can’t trust any economic numbers reported by China’s government………….

China’s Ministry of Industry and Information Technology says that the country’s telecommunications industry registered robust growth in revenue in the first 11 months of this year, according to “official data.”

The combined industrial revenue rose 8.1% year on year (YoY) to over 1.35 trillion yuan (about 212 billion U.S. dollars) in the January-November period.

The growth was down 0.1 percentage points from the figure for the January-October period, the data showed.

By the end of November, China’s three state owned telecom giants — China Telecom, China Mobile and China Unicom — had over 1.64 billion mobile phone users, a net increase of 47.92 million users compared with the end of last year. The number of 5G mobile subscribers reached 497 million, up 298 million from the end of last year, according to the ministry.

A poster of commercial 5G applications shown outside a branch of China Telecom in Beijing. Photo Credit: SHEN BOHAN/XINHUA

…………………………………………………………………………………………….

China’s big three telecom companies also saw a steady increase in the number of fixed broadband internet users by the end of November, with subscribers rising by 51.85 million from the end of last year to stand at 535 million.

……………………………………………………………………………………….

As of 2021, China is the only country known to work towards a single-stack IPv6 network. The country announced plans in 2017 to lead globally in IPV6 adoption by 2025, and achieve full nationwide rollout by 2030. Experts believe that such a plan to widely adopt IPv6 for the country’s internet infrastructure, can help China to increase its leadership in 5G and Internet of Things (IoT) across multiple varying industries.

References:

http://www.china.org.cn/business/2021-12/26/content_77953625.htm

https://en.wikipedia.org/wiki/Telecommunications_industry_in_China

Reliance Jio trials connected robotics on its “indigenously developed” 5G network

Aayush Bhatnagar, SVP, of Reliance Jio said in a Linkedin post Friday:

Jio has successfully performed trials of Connected Robotics over its indigenously developed 5G RAN and 5G SA core network. This underlines the true potential of 5G Standalone networks in realizing real-life industrial use cases.

Jio 5G Robotics have implemented a wide canvas of services – from heavy lifting and logistics at manufacturing warehouses, to healthcare robots assisting medical staff – from remote ultrasound enablement to industrial automation robots.

This development opens up exciting possibilities for value creation in Industry 4.0, with direct relevance to businesses and the economy.

Jio’s Bhatnagar has said India’s top telco has undertaken use case trials such as Voice and Messaging over 5G NR (VoNR) using its own home grown 5G RAN and Core network, which it plans to export or license once its 5G technology is tested and deployed throughout India. Of course, that can’t happen till after the repeatedly delayed 5G spectrum auction (now scheduled for April or May 2022 if not delayed yet again).

Earlier this month, Jio reported it successfully trialed connected drones on its indigenous 5G network, the telco’s senior vice president Aayush Bhatnagar said. The trial involved a precision command and control of drones over 5G using a fleet management system running in the Cloud to perform tasks such as image recognition, track-and-trace, discrete payload pickup, and delivery, drone route sorties, video imagery, real-time drone control, and other applications, the executive added.

“5G-connected drones will enable future use cases across industries and enterprises,” Bhatnagar said. “At Jio, we have taken another major stride in “Making 5G real” – beyond speed tests and demos. Jio has successfully conducted trials of connected drones on its indigenous 5G network,” Bhatnagar said in a Linkedin post.

Jio has not disclosed all the other companies are helping to design, develop and test their indigenous 5G RAN and Core network. In July, Intel said that it is helping Reliance Jio make the transition from 4G to 5G as part of their 5G infrastructure deal. Intel and Jio are collaborating in the areas of 5G radio, core, cloud, edge and artificial intelligence.

“…our collaboration spans those areas, and it’s co-innovation. So, we have got our engineering and business unit teams working closely with Reliance Jio in those areas. And we are committed towards helping customers and partners like Reliance Jio to make the transition from 4G to 5G,” Prakash Mallya, vice president and Managing Director of sales, marketing and communications group at Intel told Economic Times.

Intel’s investment arm, Intel Capital, had in 2020 invested Rs 1,894.50 crore to buy a 0.39% equity stake in Jio Platforms.

While speaking at Reliance Industries Ltd’s 44th AGM, RIL Chairman Mukesh Ambani said that:

“Jio’s engineers have developed a 100 per cent home-grown and comprehensive 5G solution that is fully cloud native, software defined, and digitally managed. Jio’s ‘Made in India‘ solution is complete and globally competitive.”

Ambani also said that his company has achieved 1Gbps download speed on its 5G trial network.

As for Jio’s 5G competitors:

- Bharti Airtel previously said that it was collaborating with global consulting firm Accenture, along with Amazon Web Service (AWS), Cisco, Ericsson, Google Cloud, Nokia, Tata Consultancy, and unnamed others to demonstrate enterprise-grade use cases using high-speed, low-latency 5G networks.

- Airtel has been working on the 5 G-based solutions with Apollo Hospitals, Flipkart, and other manufacturing companies.

- Vodafone Idea (VI) has partnered with Nokia and Ericsson to work on several 5 G-powered applications, including enhanced mobile broadband (emBB), ultra-reliable low latency communications (uRLLC), multi-access edge computing (MEC), and AR/VR.

5G trials began earlier this year in May and in June:

- Jio reported achieving speeds over 1Gbps during the trial.

- Airtel also reported achieving over 1Gbps peak speed during its 5G network trial.

- VI claims to achieve a peak 5G speed of 3.7Gbps on the mmWave spectrum during the network trials in Pune.

Last month, India’s Department of Telecom (DoT) granted a six-month extension for 5G trials in India to telecom operators, including Jio, Airtel, and VI, upon their request. The telecom operators are currently conducting 5G trials in various parts of the country and have achieved tremendous results. However, the extension means that the 5G spectrum auction won’t happen anytime soon. So any 5G commercial launch is still a long way off in India.

https://www.linkedin.com/feed/update/urn:li:activity:6879954283375267840/

Sequans clever CBRS module for Green-GO Digital’s Beltpack Sports

Paris, France based Sequans Communications, a leading provider of cellular IoT chips and modules for massive and broadband IoT, announced that Green-GO Digital is using its Cassiopeia CB410L CBRS module to connect its new Beltpack Sports wireless intercom communications device.

Cassiopeia CB410L Module Highlights:

- All-in-one standalone module

- Small 32 x 29 mm leadless chip carrier (LCC) package

- CBRS networks in USA on LTE band 48

- MNO networks worldwide on LTE bands 42/43

- FCC

- 3GPP Release 10

- Easy integration into IoT, M2M and broadband applications

- Drivers compatible with Linux, Android,Google Chrome, MAC OS, Windows and a wide range of embedded and realtime OSes

- Comprehensive set of interfaces

CB610L and CB410L are used to add LTE connectivity to electronics devices for industrial Internet of Things (IoT), Machine-to-Machine (M2M) and broadband consumer applications. The LCC package allows for a cost-efficient platform and simple PCB design. The modules support a wide variety of interfaces, including USB 2.0 device and UARTs.

…………………………………………………………………………………..

The Green-GO Beltpack Sports is designed to facilitate coach to coach communications in professional sports teams. It is connected by LTE technology and designed specifically to run on CBRS (citizens broadband radio service), a new block of spectrum allocated by the FCC to enable private LTE networks on a shared spectrum basis. CBRS provides enterprises in many sectors, including sports, government, education, industry, and agriculture, with an affordable way to set up private networks for their organizations without subscribing to commercial wireless service.

“It’s exciting to see our technology connecting the new Green-GO device now being used in the world of professional sports,” said Bertrand Debray, EVP of Sequans’ Broadband IoT division. “The Green-GO Beltpack is designed with features that facilitate ease of use on the playing field, and it shows how well a private LTE network using CBRS spectrum can meet the communications needs of enterprises like pro sports teams.”

“We selected Sequans’ technology to connect the Green-GO Beltpack Sports because Sequans is an expert in cellular IoT connectivity with particular expertise in solutions for 3.5 GHz, the frequency of CBRS, said Joost van Eenbergen, Principal and Founder of ELC Lighting BV, manufacturer of Green-GO! Digital Intercom. “Sequans’ IoT module is proven reliable in LTE devices and networks all over the world, and it has all the capabilities we required for design into the Beltpack, including small size, low power consumption for long battery life, and most important, reliability.”

The Green-GO CBRS/LTE Beltpack Sports has features designed specifically for use outdoors, including a backlit display for easier viewing in sunlight, weather-tight buttons for protection from rain and for use with gloves. Its four big buttons can be used all as talk buttons or as a combination of talk and call.

The Beltpack can be easily combined with a wired system by using a Green-GO Bridge. There is no need for a separate interface to connect the Beltpack to an existing wired network. By simply plugging in the bridge and cloning the configuration to the Beltpacks, the wireless device is fully integrated. Each Green-Go Beltpack connects to a port on a bridge as a remote user, providing the same user interface and audio quality of a wired beltpack, with the security and reliable connectivity of LTE.

“As the exclusive US distributor of Green-GO! Digital Intercom, we are excited to introduce this revolutionary product through our network of authorized dealers,” said Jim Casey, President of Nova Lume LLC. “Having worked with the premier professional sports league in the US for almost two years to implement this product across all 32 teams in time for the 2021 season, while dealing with the pandemic restrictions, was a remarkable accomplishment and prepared us to provide this solution to a wide range of use cases needing secure, reliable, wireless intercom.”

Sequans Cassiopeia CB410L/CB610L Modules:

Sequans’ Cassiopeia CBRS modules are available in two versions:

1) Cassiopeia CB410L with LTE Category 4 throughput, and

2) Cassiopeia CB610L with LTE Category 6 throughput.

Both modules are standalone all-in-one solutions delivering robust LTE network connectivity. The module design benefits from Sequans’ long and extensive experience in 3.5 GHz solutions. The module supports CBRS networks in the USA on LTE band 48 and MNO networks worldwide on LTE bands 42/43.

The Sequans Cassiopeia CBRS modules feature unique LCC (leadless chip carrier) packaging and a compact size, and they are OnGo certified.

The new Green-GO Digital Wireless Beltpack Sports will be on display at CES 2022 in Sequans meeting room at the Venetian at CES TECH WEST. For more information or to schedule a meeting at CES, please email [email protected].

About Sequans:

Sequans Communications S.A. is a leading developer and supplier of cellular IoT connectivity solutions, providing chips and modules for 5G/4G massive and broadband IoT. For 5G/4G massive IoT applications, Sequans provides a comprehensive product portfolio based on its flagship Monarch LTE-M/NB-IoT and Calliope Cat 1 chip platforms, featuring industry-leading low power consumption, a large set of integrated functionalities, and global deployment capability. For 5G/4G broadband IoT applications, Sequans offers a product portfolio based on its Cassiopeia Cat 4/Cat 6 4G and high-end Taurus 5G chip platforms, optimized for low-cost residential, enterprise, and industrial applications. Founded in 2003, Sequans is based in Paris, France with additional offices in the United States, United Kingdom, Israel, Hong Kong, Singapore, Finland, Taiwan, South Korea, and China.

References: