Facebook tests voice and video calls in its main app

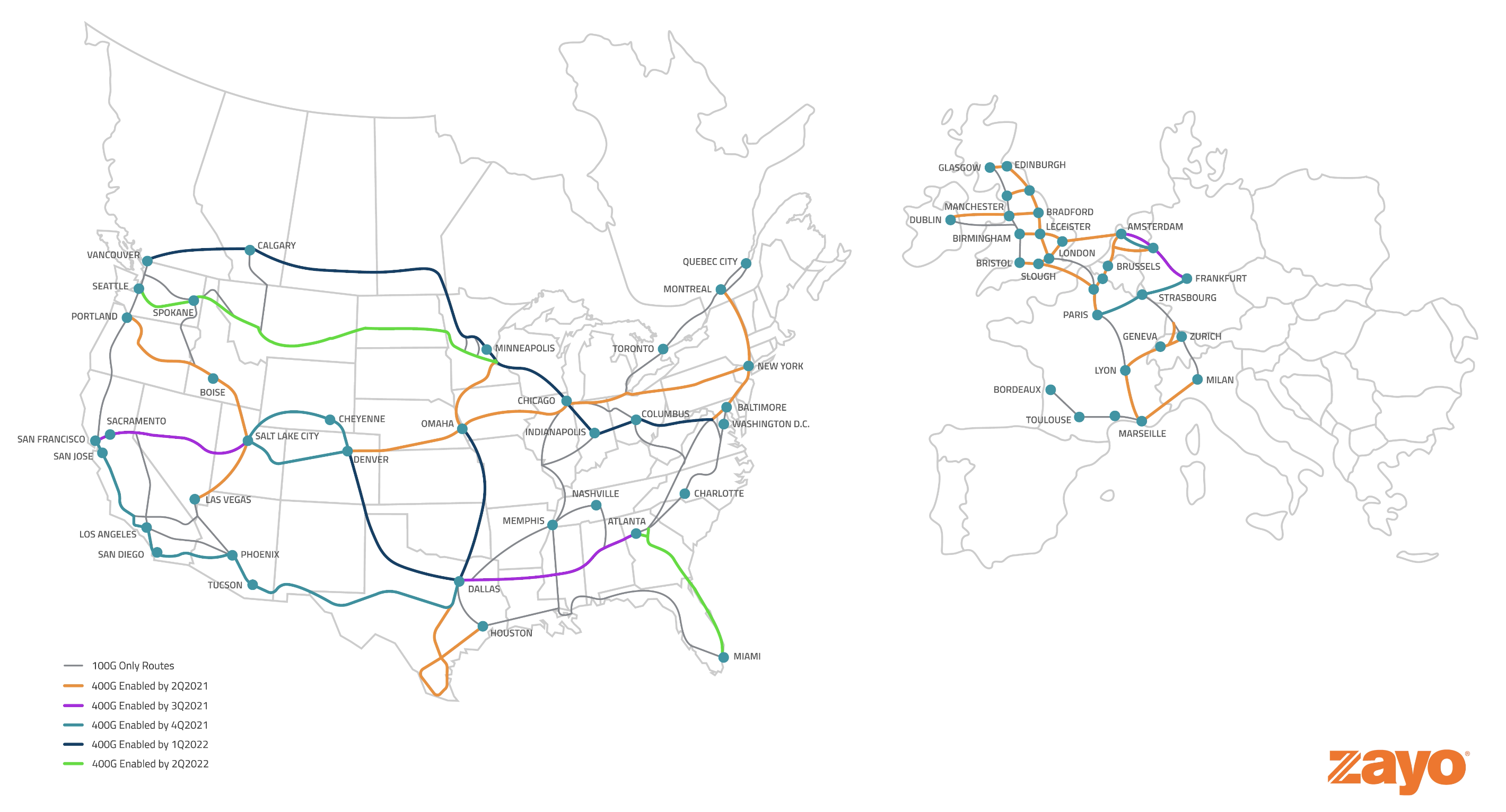

Zayo to deploy 400G b/s network across North America and Western Europe

Zayo Group Holdings today announced the planned deployment of 31 high capacity, 400G b/s enabled long haul routes across North America and Western Europe.

The availability of 400G b/s client-side wavelength capabilities will enable Zayo to deliver multi-terabit capacity across its underlying global network, enabling higher transmission rates, reduced cost per bit, increased data transfer speeds and significantly greater bandwidth capacity — key features that support enterprises on their digital transformation journeys. Up to 800G transmission will be available in select areas as Zayo deploys significant speed enhancements in anticipation of future network needs.

This optimized wavelength network is designed to provide a direct route for multi-cloud and multi-market connectivity, ideal for content providers, hyper-scalers, carriers and data centers. The upgrade will also enable reduced physical space requirements as well as reduced operation and maintenance costs resulting from a 40% reduction in power consumption.

The race to 400Gb/s has accelerated in recent years, with an increasing number of users, applications and devices driving exponential demand for increased bandwidth. Exceeding the current standard of 100G, Zayo’s new routes will provide a fourfold increase in maximum data transfer speed, supporting 5G technologies including Internet of Things, cloud-based computing, edge computing, virtual reality, high-definition video streaming and artificial intelligence.

“400G is rapidly becoming the prevailing requirement for networks and Zayo is breaking new ground with its 800G capabilities,” said Brian Lillie, Zayo Chief Product and Technology Officer. “This deployment underscores Zayo’s commitment to maintaining the leading edge of communications infrastructure and providing state-of-the art network solutions critical to our customers’ digital transformation journeys.”

C Chart courtesy of Avery Anderson of Zayo Group

Chart courtesy of Avery Anderson of Zayo Group

About Zayo Group:

Zayo’s 126,000-mile network in North America and Europe includes extensive metro connectivity to thousands of buildings and data centers. Zayo’s communications infrastructure solutions include dark fiber, private data networks, wavelengths, Ethernet, dedicated internet access and data center connectivity solutions.

Zayo owns and operates a Tier 1 IP backbone and through its CloudLink service, Zayo provides low-latency private connectivity that attaches enterprises to their public cloud environments. Zayo serves wireless and wireline carriers, media, tech, content, finance, healthcare and other large enterprises. For more information, visit https://zayo.com

References:

IDC: Global Managed Edge Services Market forecast ~$2.8B in 2025

According to IDC, Managed Edge Services [1.] will deliver worldwide revenues of about $445.3 million this year – a 43.5% increase over 2020. In addition, the IT market research firm forecasts that managed services revenues will hit nearly $2.8 billion in 2025. Over the 2021-2025 forecast period, the compound annual growth rate (CAGR) for managed edge services is expected to be 55.1%.

Note 1. Managed Edge Services seems to be a misnomer or at least a redundant term. That’s because all Multi-Access Edge Compute (MEC) services will be managed by a service provider (telco, cloud, or CDN) or network equipment vendor/managed services provider for on-premises edge computing.

“Managed edge services represent an emerging market opportunity that promises to provide a wide variety of low-latency services with the potential to enhance customer experience, drive operational efficiencies, and improve performance. It is a highly contested marketplace among key providers including communications SPs, hyper-scalers, CDN providers, and managed SPs with strategic partnerships and alliances forming to establish early commercial success and leadership,” said Ghassan Abdo, research VP, Worldwide Telecommunications at IDC.

“At the same time, service providers are keenly aware of the potential impact of the edge on their current market position and are watching closely for unforeseen competition from adjacent markets and new disruptors. Technology vendors including network equipment providers (NEPs) and software, datacenter, and networking vendors are vying to shape this market and play a significant role in delivering innovative edge services. Technical challenges abound including interoperability, open interfaces, and varying standards. The potential, however, is there to positively transform industries and user experiences,” he added.

IDC has identified three primary deployment models for managed edge services.

- On-premises deployment: This represents managed edge use cases where the edge compute infrastructure is deployed at the enterprises’ premises, also referred to as private deployment. This deployment model is intended to address the need for extra low latency and is applicable to industrial use cases, healthcare, and AR/VR applications.

- Service provider edge deployment: This represents managed edge services provided by edge compute deployed at the provider edge, both fixed and mobile. IDC expects this deployment model to spur development of a wide range of vertical use cases.

- CDN edge deployment: This represents managed edge services provided by edge compute deployed at the CDN POPs or edge locations. These use cases will enhance content delivery with personalized, high-fidelity, and interactive rich media customer experience.

IDC projects the on-premises edge to be the fastest growing segment with a five-year CAGR of 74.5%. The service provider edge will be the second-fastest growing segment with a CAGR of 59.2%, which will enable it to become the largest market segment by 2022. The CDN edge segment is expected to have a five-year CAGR of 41.9%.

The IDC report, Worldwide Managed Edge Services Forecast, 2021–2025 (IDC report #US47308121), provides a worldwide forecast for managed edge services covering 2021–2025. The forecast quantifies the revenue opportunities for service providers (SPs) that offer managed edge services on a monthly recurring revenue contractual arrangement. Service providers, in this context, comprise communications SPs, content delivery network (CDN) providers, public cloud providers or hyper-scalers, and managed service providers. This is the first forecast provided by IDC on this new and developing market.

For more information, contact:

Michael Shirer [email protected] or 508-935-4200

………………………………………………………………………………………………………………………………………

June was a busy month for managed edged compute deals:

- Vodafone outsourced its European MEC infrastructure to Amazon Web Services (AWS);

- Ericsson and Google agreed to collaborate on edge compute solutions for mutual benefit; and

- AT&T sold its Network Cloud technology to Microsoft which will also provide Azure (public cloud) based 5G SA/core network for AT&T.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48179321

https://telecoms.com/511025/managed-edge-services-revenue-expected-to-hit-2-8-billion-by-2025/

Dell’Oro: MEC Investments to grow at 140% CAGR from 2020 to 2025

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

Juniper Research: 5G smartphone trends

A new study by Juniper Research has found that 5G‑compatible smartphones will account for over 50% of smartphone sales revenue by 2025; rising to $337 billion from $108 billion in 2021. It urged mobile handset vendors to ensure hardware maximizes the benefits of future mobile cloud computing solutions. Mobile cloud computing enables service providers to offload intensive tasks to the cloud; freeing on-device resources for essential device processes.

The new research, 5G Smartphones: Trends, Regional Analysis & Market Forecasts 2021-2026, predicts that successful handset vendors will include radios that are able to process large bandwidths and ultra-low latency to ensure that handset users are able to use cloud computing services efficiently, whilst remaining price competitive.

Android OS Handsets to Dominate in Emerging Regions

The report anticipates that increasing the availability of lower-tier 5G smartphones is crucial to propagate 5G handset adoption in emerging markets. It predicts that by 2025, global Android smartphone prices will be 65% lower than global iOS smartphone prices. It also highlights that this lower average cost of Android devices will lead to Android dominating 5G handset markets in regions such as Latin America.

Conversely, the research expects that the enduring popularity of iOS devices in developed markets will make 40% of global 5G smartphone revenue attributable to North America and Europe by 2025.

Development of 5G Handsets:

It is likely that the smartphone market will not see meaningful growth until another significant upgrade becomes available to the majority of consumers, not just those capable of purchasing high-end premium handsets. In addition to developments such as foldable handsets and biometrics, smartphone manufacturers are anticipating that the widespread introduction of 5G handsets will serve to reinvigorate the market, in the same way that the introduction of 4G in 2010 boosted the sales of OEMs, such as HTC and Samsung.

‘Right-to-Repair’ Laws to Impact Shipments

The report warns that long-term 5G smartphone shipment revenue will be limited by impending ‘right-to-repair’ legislation in North America and Europe, as more handset users choose to repair older models rather than upgrading to newer generation devices.

Research author Adam Wears explained:

‘The effect of these laws will not be felt initially, as consumers adopt 5G smartphones to leverage the high speeds and reduced latency of 5G networks. Hardware vendors must use this opportunity to build out new device capabilities to encourage consumers to continue regularly upgrading and avoid churn to competitors.’

References:

https://www.juniperresearch.com/document-library/white-papers/how-to-monetise-future-5g-services

https://www.juniperresearch.com/researchstore/devices-technology/5g-smartphones-research-report

Triangle Communications replaces Huawei gear with Mavenir 4G/5G Open RAN radios and software

Montana service provider Triangle Communications is swapping out Huawei gear from its network and implementing 4G/5G open RAN products from upstart tech vendor Mavenir.

Late October is the target timeline as to when the FCC’s rip and replace reimbursement program opens. However, Triangle Communications is already at work to overhaul equipment for its fixed wireless access service. Texas-based Mavenir was chosen for Triangle’s entire network replacement and will act as systems integrator for the project, which qualifies for the FCC funding.

“This is a complete network swap out, so everything in the entire network from core to RAN [radio access network] and replacing it all with virtualized solutions,” Mavenir’s Sr VP John Baker said in an interview with Fierce Wireless.

Mavenir is providing a containerized evolved packet core (vEPC) IMS, open virtualized RAN (Open vRAN) compliant with O-RAN Alliance specifications for open interfaces, and the Mavenir Webscale platform that will enable Triangle to run applications on private, public or hybrid clouds.

It’s deploying the O-RAN Alliance 7.2 open interfaces for the 4G-LTE radios. All of the equipment will also be 5G ready. Triangle is using band 12/700 MHz spectrum.

Once Triangle gets equipment that’s virtualized up and running, Mavenir said the operator’s ability to respond to changes and the market should be significantly faster. It’s notable that the Triangle is planning to deploy open RAN architecture and technology.

In filings with the FCC, Triangle said that it doesn’t see any disadvantages in taking an open RAN approach. According to an April filing (PDF), the service provider’s own research “found ORAN equipment to be competitively priced and fully functional compared to legacy vendors’ equipment options which lock you into always using their equipment.”

“This will be the first network that will be deployed using Mavenir designed radios,” Baker said, and the first of several Mavenir-branded commissioned radios the software vendor plans to introduce over the next couple of quarters. Mavenir has done radios before, but it’s the first the vendor commissioned, designed, manufactured, and deployed in the U.S. market and for U.S. frequency bands.

As an open RAN vendor, and vocal champion, Mavenir has been clear on its stance of the need for U.S.-based radio suppliers in a market currently dominated by Ericsson and Nokia as RAN vendors.

Triangle and Mavenir did not disclose the value of their new deal, but the companies said Triangle’s core network swap-out is underway and that work on the radio access network (RAN) would stretch into next year.

Perhaps the most noteworthy element in Mavenir’s deal with Triangle is that it encompasses both the company’s hardware and software. Mavenir entered the RAN hardware business (mostly radios which are outsourced to Asian suppliers) in order to complement its existing software offerings.

Mavenir last year described its new open RAN hardware strategy as an attempt to “break the incumbent’s monopoly in the global market.” But the company’s efforts also highlight the complexity of the open RAN market considering open RAN technologies are intended to allow operators to mix and match equipment from a variety of vendors rather than buying everything from one source.

This could be the first of many U.S. ongoing “rip and replace” program as the FCC’s program to eliminate Huawei equipment gathers steam.

……………………………………………………………………………………….

Triangle Communications Serving Area in Montana:

Triangle Telephone Cooperative (TTC) is a company owned by its members. The cooperative was incorporated on March 24, 1953 in Havre, Montana by rural residents of Central Montana. In 1994, TTC purchased 13 exchanges from US West (now CenturyLink/Lumen Technologies) and formed a subsidiary named Central Montana Communication (CMC). Triangle Communications is the name TTC and its subsidiaries have chosen to do business as since 2008.

………………………………………………………………………………………….

References:

https://www.fiercewireless.com/tech/mavenir-swaps-out-triangle-s-huawei-gear-for-open-ran

https://itstriangle.com/about-us

Kagan: U.S. Broadband Market Continues to Grow

The U.S. is still experiencing robust growth in fixed broadband connections, driven predominately by the cable market, according to a new report published this week. Meanwhile, download speeds are increasing faster than expected due to cable companies and new telco FTTH deployments.

U.S. broadband gains illustrated durable demand for wireline connections in the second quarter, allaying fears of a 2021 hangover, according to Kagan, a media research group within S&P Global Market Intelligence. While the 945,000 new broadband subs in second quarter 2021 fall short of the year-ago boom, that increase far exceeds the second-quarter 2019 figure that cable operators have been pointing to as a more likely template for current-year success.

The combined residential cable, telco and satellite broadband subscribers topped 109.2 million at the end of the second quarter, up 4.3% annually with nearly 4.5 million net adds year over year, according to Kagan’s full industry estimates.

The U.S. broadband market soared in the first half of 2020 as Covid-19 drove working from home to new levels and customers felt the need for more reliable – and faster – Internet connections. Kagan last year noted that the number of residential wireline subscribers with a broadband service of 100 Mbps or more increased by 5.5% in the first six months of 2020, compared with end-2019.

Additional takeaways from Kagan’s Q2 2021 report:

- Cable subscriber growth in the first half was down from the outsized gains of the pandemic-boosted demand for connectivity. But with 1.9 million residential and commercial net adds year-to-date, cable accounted for 96% of broadband customer gains across the U.S. cable, telco and satellite segments in the first six months of 2021.

- The surging enthusiasm for FTTH upgrades is boosting telco wireline broadband net adds, albeit at relative magnitudes. While the segment’s residential net adds in the second quarter pale in comparison to cable’s growth, it represents a dramatic improvement over the second quarter track record since 2016.

- Combined, the established satellite broadband providers lost 24,000 U.S. subscribers while Starlink begins to establish early momentum.

Kagan declined to share figures for growth in net broadband additions for Q2 last year, simply stating that the 2021 numbers “fall short of the year-ago boom.” However, Q2 this year was far ahead of the same period in 2019, which it – and the industry itself – would serve as a more accurate benchmark for future growth. In the second quarter of 2019, wireline broadband net adds came in at 339,000.

The overall residential broadband market in the US reached 109.2 million subscribers at the end of June, an increase of 4.3% year-on-year; net adds over the 12 months hit nearly 4.5 million. Again, Kagan did not provide comparative figures. As per the above chart, residential broadband penetration is now above 83%, rising to 84.5% if satellite broadband is included.

The cable companies are still leading the U.S. broadband market. 1.9 million net additions in the first half of the year across the residential and commercial sectors give cablecos/MSOs a 96% share, leaving the telco and satellite providers sharing the remaining 4%, or just under 80,000 customers.

With the satellite broadband companies together losing 24,000 customers over that period, that means the telcos probably signed up at least 100,000 new customers in the first half of 2021.

The Need for Speed:

As of June 30, Kagan estimates that 78.4% of residential wireline subscribers took download speeds of 100Mbps and above. With speed and bandwidth at the forefront of consumers’ minds, the 1Gbps tier logged the largest increase.

Subscribers taking 1 Gig or higher rose to an estimated 7.8% of the residential broadband universe in the second quarter of 2020, up from 4.3% at year-end 2019.

The under 25 Mbps tier fell to 2.7% of wireline broadband households or 2.8 million subscribers for whom slower speeds likely impeded in-home online activities, including entertainment, during the pandemic. The telco sector, still somewhat held back by legacy copper systems, accounted for the vast majority of the lower end speed category, with an estimated 87.2% of all wireline broadband subscribers in the below 25 Mbps category.

References:

https://telecoms.com/511015/no-covid-hangover-in-us-broadband-market-yet/

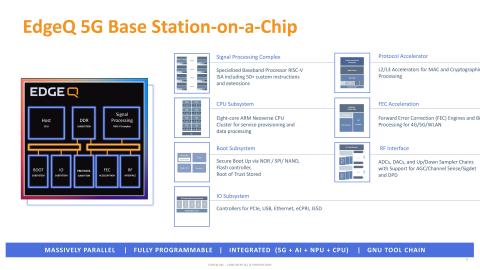

EdgeQ Samples World’s 1st Software-Defined 5G Base Station-on-a-Chip

EdgeQ Inc, a leader in 5G wireless infrastructure, today announced sampling of its revolutionary 5G Base Station-on-a-Chip to Tier 1 customers deploying next-generation wireless edge networks for the enterprise, telco and cloud markets. EdgeQ is sampling the full suite solution to customers developing enterprise-grade 5G access points, Open-Radio Access Network (O-RAN) based Radio Unit (RU) and Distributed Unit (DU).

Successful deployment of Radio Access Networks (RAN) requires the availability and access to production-ready Physical Layer (PHY) hardware and software that governs all the essential protocols and features of 4G/5G. Traditional merchant silicon vendors offer the PHY as a reference software, placing the development burden on customers to invest years of effort to operationalize into production. By abstracting this friction with a total platform solution including a production-readied 5G PHY software, EdgeQ says that frees customers from the substantial investments, resources and time typically associated with productizing the 4G/5G PHY layer.

“Traditional market approaches offer baseband processing hardware and PHY software as separate topics, where the burden of proof rests on customers to fully productize and enable. EdgeQ has the ability and completeness to accelerate the market with a production-grade RAN stack that is also customizable and programmable,” said Chris DePuy, Technology Analyst at 650 Group. “The linchpin to lowering the 5G entry barrier is enabling operators and organizations with a total turnkey solution that is at the same time agile, flexible, and complete.”

Three years in the making, EdgeQ has been collaborating with market-leading wireless infrastructure customers to architect a highly optimized 5G baseband, networking, compute and AI inference system-on-a-chip. By coupling a highly integrated silicon with a production-ready 5G PHY software, EdgeQ uniquely enables a frictionless operating model where customers can deploy all key functionalities and critical algorithms of the radio access network such as beamforming, channel estimation, massive MIMO and interference cancellation out of the box.

For customers looking to engineer value-adds into their 5G RAN designs, the EdgeQ PHY layer is completely programmable and extensible. Customers can leverage an extendable nFAPI interface to add their custom extensions for 5G services to target the broad variety of 5G applications spanning Industry 4.0 to campus networks and fixed wireless to telco-grade macro cells. As an industry first, the EdgeQ 5G platform holistically addresses the pain point of deploying 5G PHY and MAC software layers, but with an open framework that enables a rich ecosystem of L2/L3 software partners.

“Since day one, EdgeQ has been relentless about redefining the consumption and deployment model of 5G with its RISC-V based open architecture that converges connectivity, networking, and compute. How we elegantly club the hardware, the deployable RAN software, and an innovative chipset-as-a-service business model all together is what crystallizes the vision in a disruptively compelling way,” said Vinay Ravuri, CEO and Founder, EdgeQ. “Our sampling announcement today signifies that all this is a market reality.”

About EdgeQ

EdgeQ is a leading innovator in 5G systems-on-a-chip. The company is headquartered in Santa Clara, CA, with offices in San Diego, CA and Bangalore, India. Led by executives from Qualcomm, Intel, and Broadcom, EdgeQ is pioneering a converged connectivity and AI that is fully software-customizable and programmable. The company is backed by leading investors, including Threshold Ventures, Fusion Fund and AME Cloud Ventures, among others.

To learn more about EdgeQ, visit www.edgeq.io.

References:

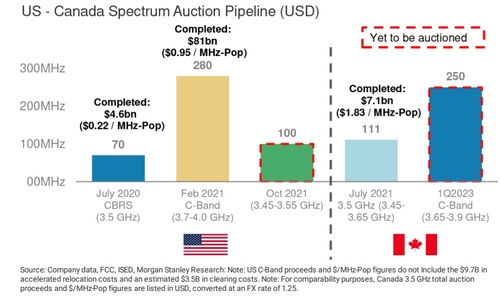

Big U.S. Wireless Carriers to bid at FCC mid-band auction; cablecos missing in action

The FCC will conduct another 5G spectrum auction on October 5th. FCC Auction 110 will be for 100MHz in the 3.45GHz to 3.55GHz band for flexible use of wireless services.

Full Title: Auction of Flexible-Use Service Licenses in the 3.45-3.55 GHz Band for Next-Generation Wireless Services; Status of Short-Form Applications to Participate in Auction 110

Auction 110 will offer approximately 4,060 new flexible‐use licenses of 100Mhz within the 3.45–3.55 GHz band (3.45 GHz Service) throughout the contiguous United States. Bidding in Auction 110 is scheduled to begin on October 5, 2021.

…………………………………………………………………………………………….

Analysis:

AT&T, T-Mobile, US Cellular and Dish Network are among the 42 different entities that registered interested in participating in Auction 110, based on the roster contained in FCC filings related to the auction (attachments A & B in References below). Verizon’s application is listed as incomplete.

We’ve never heard of most of the other companies bidding, but note that the big cablecos/MSOs (Comcast, Charter Communications, Altice USA and Cox Communications) are not listed.

3.45 GHz spectrum up for auction is in the mid-band range seen as key for 5G by offering a mix of coverage and capacity, and sits nearby the 3.7 GHz C-band and the shared 3.5 GHz Citizen Broadband Radio Service (CBRS) band.

Financial analysts at New Street Research say that Auction 110 will increase the total overall amount of spectrum in circulation in the US from 1023MHz to 1123MHz. They believe that AT&T and T-Mobile to be the big winners with Dish Network an also ran.

“We think that AT&T, T-Mobile and Dish each want 40MHz in the 3.45GHz auction (the limit any one company can buy), but there is only 100MHz to go around,” the analysts wrote in a note to investors in July. “Based on visible resources, AT&T and T-Mobile are best positioned to end up with 40MHz each, leaving 20MHz for Dish (and other participants).”

Analysts at Morgan Stanley offered a their perspective at how the upcoming 3.45GHz-3.55GHz FCC auction compares with recently completed spectrum auctions in the U.S. and Canada.

Source: Morgan Stanley

“AT&T will be keen to get the maximum 40MHz allowable on a quasi-nationwide basis, while T-Mobile has said they will be opportunistic, although they and Verizon already have some 200MHz of midband spectrum. Dish is another wild card, although it lacks the financial resources of the larger wireless players,” wrote the financial analysts at Morgan Stanley in a note to investors this week.

…………………………………………………………………………………………….

Recent FCC auctions have included the 37GHz, 39GHz and 47GHz spectrum bands in Auction 103, Auction 101 of 28GHz spectrum and Auction 102 of 28GHz spectrum, Auction 105 for 3.5GHz CBRS spectrum licenses, and Auction 107 -the C-band auction (which ended earlier this year and generated an astounding $81 billion in winning bids).

“We think Auction 110 looks much more similar to the smaller, cheaper CBRS auction that had $4.5 billion in net bids for 70MHz of spectrum ($0.215 per MHz POP), than the larger, more expensive C-band auction that ended with $81 billion in net bids for 280MHz of spectrum ($0.945 per MHz POP),” wrote the financial analysts with Raymond James in a note to investors this week. (The per MHz-POP calculation is applied to most spectrum transactions and reflects the number of people covered compared with the amount of spectrum available, though it can be affected by a wide variety of factors.) The Raymond James analysts cited Andromeda’s 40MHz ownership cap and military sharing zones as reasons for their conclusions.

“Still, midband spectrum remains crucial in densifying 5G networks, and while we do not expect anywhere close to C-band-like prices, this is a good opportunity for price-conscious bidders (e.g. Dish) to augment spectrum holdings,” the Raymond James analyst team concluded.

………………………………………………………………………………..

Terms & Conditions for Auction 110:

Upfront payments for Auction 110 are due in the proper account at the U.S. Treasury by 6:00 p.m. Eastern Time (ET) on Thursday, September 2, 2021. In order to meet the Commission’s upfront payment deadline, an applicant’s payment must be credited to the Commission’s account by the deadline.

Due Diligence: The FCC reminds each potential bidder that it is solely responsible for investigating and evaluating all legal, technical, and marketplace factors and risks associated with the licenses that it is seeking in Auction 110; evaluating the degree to which those factors and risks may have a bearing on the value of the licenses being offered and/or affect the bidder’s ability to bid on, otherwise acquire, or make use of such licenses; and conducting any technical analyses necessary to assure itself that, if it wins any license(s), it will be able to build and operate facilities in accordance with the Commission’s rules.

Non Disclosure Rules: Bidding applicants must take care not to communicate non-public information to the public, financial analysts, or the press.45 Examples of communications raising concern, given the limited information procedures in effect for Auction 110, would include an applicant’s statement to the press or other public statement (for example, a statement on social media) about its upfront payment or bidding eligibility, an applicant’s statement to the press or other public statement that it is or is not interested in bidding in the auction, or an applicant’s statement to the press or other public statement prior to the down payment deadline that it is the winning bidder in any particular geographic areas.

References:

https://www.fcc.gov/auction/110

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status/attachment-a

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status/attachment-b

https://www.fcc.gov/document/facilitating-5g-345-355-ghz-band

https://www.lightreading.com/5g/what-to-expect-from-upcoming-345ghz-auction-for-5g/d/d-id/771612?

https://www.lightreading.com/5g/cable-may-miss-americas-next-big-5g-spectrum-auction/d/d-id/771578?

https://www.benton.org/headlines/big-wireless-carriers-apply-fccs-mid-band-spectrum-auction

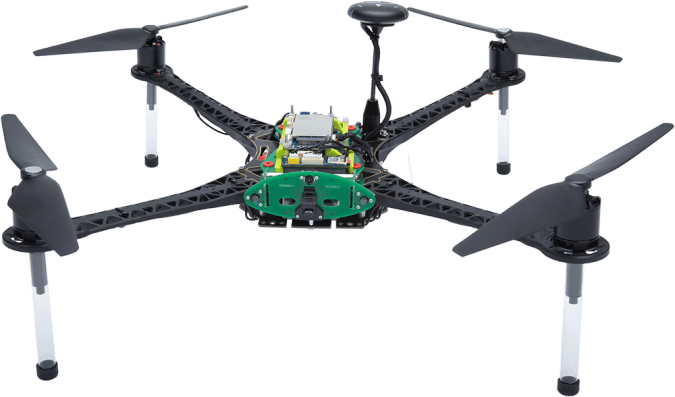

Qualcomm unveils 5G and AI-Enabled Drone Platform

Qualcomm Technologies, Inc. is showing off what is says is the world’s first drone platform and reference design to offer both 5G and AI-capabilities, the Qualcomm Flight RB5 5G Platform.

The company says the drone reference design helps accelerate development for commercial, enterprise, and industrial drones, and unleashes innovative possibilities for industries looking to adopt drone solutions and realize the benefits of the intelligent edge. 5G connectivity — including mmWave and sub-6 GHz bands — and WiFi 6. The chip-maker says the networking tech can help support drone-to-drone communications and drone swarms. Both use cases are being explored across industries, from delivering and transporting goods to aerial light displays to military warfare.

The drone model below is includes an embedded Qualcomm® QRB5165 processor and a Qualcomm Spectra 480 Image Signal Processor that can capture 200 megapixel photos and 8K video at 30 FPS. In addition, the drone can record in 4K at 120 FPS with support for HDR.

Image Credit: Qualcomm

………………………………………………………………………………………………..

The company says that the Qualcomm Flight RB5 5G Platform brings cutting-edge capabilities to the drone industry by condensing multiple complex technologies into one tightly integrated drone system to support evolving applications and new use cases in sectors including film and entertainment, security and emergency response, delivery, defense, inspection, and mapping.

At its core, the Flight RB5 5G platform uses the QRB5165 processor and Kryo 585 CPU and Adreno 650 GPU, based on the Snapdragon 865 CPU. The AI enhancements come by way of the Hexagon Tensor Accelerator in the Hexagon 698 DSP. Third-parties that use the platform will also get access to a trio of software development kits for neural processing, computer vision and multimedia applications.

The Qualcomm Flight RB5 5G Platform’s high-performance and heterogeneous computing at ultra-low power consumption provides power efficient inferencing at the edge for AI and Machine Learning (ML) enabling fully autonomous drones. Breakthrough camera capabilities deliver premium image capabilities and performance. With 5G and Wi-Fi 6 connectivity, this platform enhances critical flying abilities beyond visual line-of-sight (BVLOS) to support safer, more reliable flight. In addition, safety controls alone can no longer assure industrial and commercial drone safety, especially when scaling to Beyond Visual Line of Sight operations. The Qualcomm Flight RB5 5G Platform is equipped with a Qualcomm® Secure Processing Unit to support modern drone demands for cybersecurity protections as a key enabler of data-protection and safety requirements.

Qualcomm Technologies is working with Verizon to complete network testing of the Qualcomm Flight RB5 5G Platform for the Verizon 5G network, and expects the platform, which is 5G mmWave capable, will be offered via the Verizon Thingspace Marketplace.

The Qualcomm Flight RB5 5G drone reference design is available for pre-sale now through ModalAI. The Qualcomm Flight RB5 5G development kit is expected to be available in Q4 of 2021. For more information on the platform, including technical features, please visit the product details page here.

Backgrounder:

Qualcomm first got involved in drones in 2015, then ventured into robotics in 2019. Last year it combined the two technologies in its RB5 platform. Chad Sweet’s ModalAI, which in 2018 spun out of Qualcomm, will manufacture and distribute the drone platform, and says the first development kits will ship in the last three months of this year.

Qualcomm, which already commands a huge lead in the 4G/5G smartphone industry, is hoping its Snapdragon chipsets can be the silicon that pushes 5G into a wider range of other devices. The company has made a series of drone platforms since its first, Qualcomm Flight, in 2018.

…………………………………………………………………………………………

Global carriers and IoT ecosystem leaders showcase validation and support for Qualcomm Technologies latest drone solution:

Asia Pacific Telecom

“As the leader in innovative telecom services in Taiwan, Asia Pacific Telecom Co., Ltd (APT) is excited to work with one of our most important strategic collaborators, Qualcomm Technologies on the support of 5G and AI-enabled drones. APT provides 5G and application integration services to advance the performance of robots and drones in different perspectives. We truly believe that 5G capabilities built into the platform will enable new autonomous drone experiences,” said Mr. Shang-Chen Kao, chief technology officer, network and technology center, Asia Pacific Telecom.

AT&T

“Many of the anticipated benefits of drones will be further accelerated and strengthened with 5G, including delivery, inspections, and search and rescue, which will require a highly secure and reliable connection. We are excited to see Qualcomm Technologies continue to innovate with their latest announcement on a platform for 5G drones,” said Kevin Hetrick, vice-president, access construction and engineering, AT&T.

China Unicom

“The 5G-enabled digital era has brought wider boundaries for every industry and China Unicom is committed to pushing the boundaries of the traditional communications ecosystem and working together with the industrial chain to realize mutual complementarity. As one of our important collaborators, Qualcomm Technologies has been working with China Unicom to drive integration of 5G and IoT into vertical use cases and provide products such as 5G modules and 5G industrial gateways for automation and robotics use cases, with focused areas including industrial equipment, iron and steel manufacturing, transportation and port, mining and energy, and healthcare,” said Li Kai, chief product officer, IoT division, China Unicom Digital Technology Company Limited. “We believe the announcement of the Qualcomm Flight RB5 5G Platform will benefit more use cases. China Unicom is looking forward to deepening collaborations with Qualcomm Technologies in IoT and jointly creating a new blueprint for 5G in the future.”

Everguard.ai

“Use of drones to capture imagery for construction site topographic mapping, construction progress tracking, security surveillance and equipment tracking in combination with IoT sensors that are deployed on construction sites are revolutionizing how construction projects are delivered! 5G enabled data from drones can be leveraged to unleash the power of artificial intelligence and machine learning algorithms yielding massive improvements in the safety, efficiency and productivity of construction projects,” said Sandeep Pandya, chief executive officer, Everguard.ai.

FlightOps

“By working with Qualcomm Technologies, we have seamlessly installed the FlightOps onboard software on the Qualcomm Flight RB5 5G Platform, allowing for unparalleled performance, compute power, low energy footprint, high quality video processing and high speed 5G connectivity to achieve high levels of autonomy and mission scalability,” said Shay Levy, chief executive officer, FlightOps.

Juganu

“Qualcomm Technologies has been a leader of breakthrough technologies for years and their announcement of the world’s first 5G, AI-enabled drone platform – the Qualcomm Flight RB5 5G Platform – is the latest example of their continued innovation. We at Juganu are excited to work with Qualcomm Technologies as they continue to push the boundaries of technology and look forward to using these technologies to innovate across our own smart technology quickly, safely and securely,” said chief strategy officer, Eran Efrati, Juganu.

KT Corporation

“KT is excited to see Qualcomm Technologies bringing cutting-edge 5G drone technology based on the Qualcomm Flight RB5 5G Platform. We’re leveraging our deep expertise in translating diverse services and use cases into reality across vertical industries,” said Byungkyun Kim, head of device business unit, KT. “We expect Qualcomm Technologies will expand the 5G–based drone industry and pave a way to the development of the drones based on the Qualcomm Flight RB5 5G Platform.”

LG Uplus

“Qualcomm Technologies’ launch of the Qualcomm Flight RB5 5G Platform has great significance to the drone ecosystem as the integration of drones with 5G communication and AI technology can maximize drone usability and convenience,” said Youngseo Jeon, B2B service development director, LG Uplus. “We are expecting U+ smart drone service which contains telecommunication, control, and video will combine with the Qualcomm Flight RB5 5G Platform and play a key role across diverse drone industry fields.”

MITRE

“The reliability, availability, and low latency of 5G enable previously unavailable command and control of UAS, solving critical UAS safety considerations and enabling operation beyond visual line of sight (BVLOS). With this connectivity and the added benefit of moving intelligence to the edge, we are now beginning to realize real solutions with significant impact on business and our everyday lives,” said Rakesh Kushwaha, managing director, MITRE Engenuity Open Generation. “The Qualcomm Flight RB5 5G Platform brings advanced intelligence to autonomous decisions, enabling detect and avoid (DAA) even beyond network connectivity. It is a game changer. We are looking forward to having Qualcomm Technologies participate in the MITRE Engenuity Open Generation.”

ModalAI

“ModalAI accelerates autonomy by providing innovators with robot and drone perception and communications systems. Since our founding, we have committed to enabling aerial and ground robot manufacturers with capabilities that can excel a broad set of industries. We are thrilled to collaborate with Qualcomm Technologies to bring the first purpose-built 5G drone that opens cutting-edge computing to a broad set of integrators who can build their applications that take advantage of the coming aerial 5G wave,” said Chad Sweet, chief executive officer, co-founder, ModalAI.

Taiwan Mobile

“We are glad to see Qualcomm Technologies innovate on the 5G drone application continuously, including enterprise-related solutions. Taiwan Mobile offers “real 5G” services with safer and faster advantages to support creative development, and get together with Open Possible,” said Mr. C. H. Wu, vice president, chief enterprise business officer, Taiwan Mobile.

TDK

“TDK is extremely excited to join with Qualcomm Technologies on such a state-of-the-art drone platform,” said Peter Hartwell, chief technology officer, InvenSense, a TDK Group Company. “TDK has a multi-technology focus on Robotics across a robust product portfolio – much of which can be found on the Qualcomm Flight RB5 5G Platform and TDK Mezzanine platforms. Our decision to collaborate with Qualcomm Technologies to utilize breakthrough sensor technology alongside the Qualcomm Flight RB5 5G Platform, which I believe to be most innovative drone reference design in the world.”

Veea

“Many of the anticipated benefits of drones will be further accelerated and strengthened with 5G, including monitoring critical infrastructure, crowd management, and emergency response which includes detection, containment and extinguishing of wildfires, reporting on crop health, monitoring of livestock and irrigation systems at large acreage farms, and much more. The large majority of these use cases require a highly secure and reliable connection that can be more readily supported with 5G connections. We are excited to see Qualcomm Technologies continuing to push the boundaries of innovation with their latest announcement on the Qualcomm Flight RB5 5G Platform and we at Veea are looking forward to using these technologies to innovate across our deployments of hybrid edge-cloud solutions such as at large farms, wildlife parks, stadiums, smart cities, large construction sites and similar projects,” said Allen Salmasi, chief executive officer, Veea.

Verizon Skyward

“The Qualcomm Flight RB5 5G Platform provides a robust hardware platform that can be certified for the Verizon 5G network, offering the ecosystem of drone developers a simple path to get connected. That means drones built with the Qualcomm Flight RB5 5G Platform can leverage the massive capacity of Verizon 5G Ultra-Wideband to navigate the National Airspace System in safer and more productive ways than ever before,” said Eric T. Ringer, co-founder, chief of staff, Skyward, a Verizon company.

Zyter

“Many of the anticipated benefits of drones will be further accelerated and strengthened with 5G, which provides a high bandwidth connection that is secure and reliable,” said Sanjay Govil, founder and chief executive officer, Zyter, Inc. “We are excited to begin leveraging and integrating the Qualcomm Flight RB5 5G Platform for 5G drones into our own SmartSpaces™ IoT solutions for smart campuses and cities, smart construction, and other applications.”

About Qualcomm (from the company):

Qualcomm is the world’s leading wireless technology innovator and the driving force behind the development, launch, and expansion of 5G. When we connected the phone to the internet, the mobile revolution was born. Today, our foundational technologies enable the mobile ecosystem and are found in every 3G, 4G and 5G smartphone. We bring the benefits of mobile to new industries, including automotive, the internet of things, and computing, and are leading the way to a world where everything and everyone can communicate and interact seamlessly.

Qualcomm Incorporated includes the company’s intellectual property licensing business, QTL, and the vast majority of their patent portfolio. Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of our engineering, research and development functions, and substantially all of our products and services businesses, including the QCT semiconductor business.

…………………………………………………………………………………

References:

ABI Research and Mobile Experts: Fixed Wireless Access CAGR >=70%

ABI Research and Mobile Experts forecast that 5G FWA connections will increase at a compound annual growth rate of 71% and “over 70%,” respectively.

Fixed Wireless Access (FWA) will be among the most valuable use cases for LTE and 5G network operators, according to two new reports that predict compound annual growth rates in excess of 70%.

- ABI Research expects global 5G fixed wireless access to exceed 58 million residential subscribers by 2026.

- Mobile Experts predicts 5G fixed wireless access to serve 66.5 million customers by 2026.

FWA is a decades-old technology (that’s how WiMAX was deployed), but its prominence and rate of growth grew substantially during the last year amid the ongoing COVID-19 pandemic, which has forced billions of people worldwide to stay home (“shelter in place”).

Image Credit: Upward Broadband

…………………………………………………………………………………..

ABI Research:

Remote working, online learning, e-commerce, and virtual healthcare drove high-speed broadband demand throughout 2020. The significant increase in the use of internet-based home entertainment such as video streaming and online gaming also pushed existing broadband users to upgrade their broadband service to a higher-tier package, while households without broadband access signed up for new subscriptions.

“Increasing adoption of internet-connected devices, smart TVs, and smart home devices, as well as consumers’ media consumption through internet applications, will continue to drive high-speed broadband adoption in the years to come. In addition, many businesses are allowing remote working for some of their employees after the pandemic, which will boost the need for home broadband services even further,” explains Khin Sandi Lynn, Industry Analyst at ABI Research.

FWA will be the fastest-growing residential broadband segment, forecast to increase at a CAGR of 71%, exceeding 58 million subscribers in 2026.

As residential broadband penetration saturates mature markets, competition among broadband operators is likely to create challenges to maintain market shares. “In addition to network upgrades, broadband operators need to invest in cutting-edge software and hardware to optimize network performance and support better user experiences. Providing advanced home networking devices, internet security, and home network self-diagnosis tools can help service providers reduce churn and improve average revenue per user,” Lynn concluded.

……………………………………………………………………………….

Mobile Experts:

Mobile Experts forecasts the number of global fixed wireless access connections will more than double to 190 million by 2026. FWA services grew almost 20% yearly to over 80 million in 2020—Mobile Experts sees that number rocketing to almost 200 million by 2026. Around 8-11% of FWA connections over the next five years will be served via proprietary technology primarily deployed by small operators.

FWA equipment sales, including IEEE 802.11 based proprietary, LTE, and 5G CPE revenue, are projected to grow from $4.0 billion this year to over $5.5 billion in 2026. Meanwhile, the proprietary equipment market, including both access point and CPE sales, is expected to stay elevated around $880–$940 million per annum over the next five years.

“Large mobile operators will leverage LTE and 5G for FWA services, and we expect the 5G mm-wave will become a key aspect of their long-term FWA plans—especially in ‘fiber-rich’ markets in the APAC region. That said, large and small operators will benefit from government funding to help build out hybrid fiber plus FWA networks for the next 5-10 years,” said Principal Analyst Kyung Mun.

This report includes 41 charts and diagrams, including a five-year forecast illustrating the growth of the market for infrastructure and customer premise equipment and fixed wireless access connections by technology. Key details such as technical breakdowns, equipment revenue, and market shares are included.

………………………………………………………………………………………..

References:

https://www.mobileexperts.org/reports/p/virtual-mobile-networks-pt3na-zrw9g

https://www.sdxcentral.com/articles/news/5g-fixed-wireless-rides-pandemic-related-shift/2021/08/