Kuwait stc/Huawei deploy 5G Redcap FWA in Kuwait; Huawei’s 5G core wins

Kuwait Telecommunications Company – stc [1.], which provides innovative services and platforms to customers that enable digital transformation in Kuwait, announced the Middle East’s first commercial deployment of 5G RedCap Fixed Wireless Access (FWA) using Huawei network equipment. The announcement was made at the second forum of the ELITE FWA Club, held on the sidelines of MWC 2024.

Note 1. stc is Saudi Telecom Group, Kuwait Telecoms parent organization.

The service represents a transformative advancement in high-speed, reliable internet access for both residential and commercial clientele. The forum attracted founding members alongside an array of global telecom leaders and ecosystem stakeholders.

5G RedCap FWA heralds a new era in broadband services, offering users unparalleled, seamless connectivity. It stands out for its ability to provide stable, reliable speeds while ensuring cost-effectiveness. This innovation is achieved through optimized hardware design, which includes extended battery life, reduced power consumption, and improved spectrum efficiency on 5G CPE routers, making high-quality 5G technology accessible at significantly lower costs. Consequently, it not only enhances customer experience but also lowers the barriers to 5G adoption, encouraging the transition from 4G to 5G.

Key features of 5G RedCap FWA service include:

- High-Speed Connectivity: Delivers robust and consistent internet speeds, catering to the digital needs of today’s lifestyle.

- Unmatched Reliability: Ensures a stable and dependable home broadband connection, providing uninterrupted access to online services.

- Innovation Leadership: Demonstrates stc’s dedication to leading innovation in the region, introducing the latest technological breakthroughs to its customers.

Eng. Amer Atoui, Chief Consumer Officer of stc Kuwait, stated, “Launching 5G RedCap FWA ushers in a groundbreaking chapter for internet connectivity in the Middle East. We take pride in being the region’s pioneer, reaffirming our commitment to delivering innovative solutions that enrich our customers’ lives.”

…………………………………………………………………………………………………………

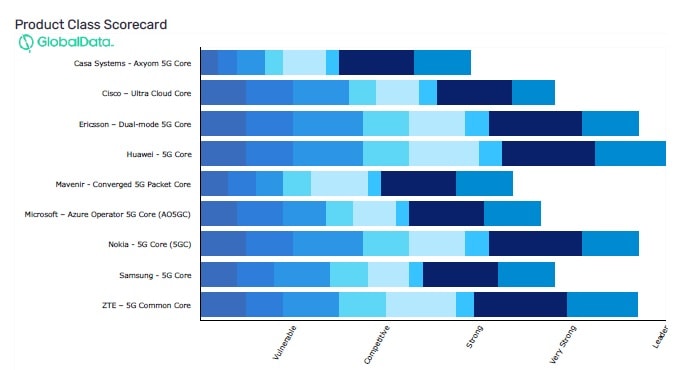

Separately, GlobalData’s “5G Mobile Core: Competitive Landscape Assessment report” rated Huawei 5G Core as a “Leader” in the 5G mobile core network field for the sixth consecutive year. Huawei’s 5G Core was also awarded full scores in all dimensions for the first time. Since the inception of this report in 2018, Huawei is the only vendor to ever get perfect scores in all dimensions.

Source: 5G Mobile Core: Competitive Landscape Assessment, by GlobalData

…………………………………………………………………………………………………………….

The GlobalData report highlights the competitive advantages of Huawei 5G Core products. By leveraging Cloud Native architecture, Huawei 5G Core converges full-range services across the 2G to 5G spectrum, marking an industry first. The solution also stands out with an innovative disaster recovery (DR) architecture for high reliability. And on top of this, Huawei provides professional integration and O&M services with extensive experience. All of the above capabilities have made Huawei 5G Core a market leader in terms of the in-depth and broad commercial use.

References:

Nokia and du (UAE) complete 5G-Advanced RedCap trial; future or RedCap?

Ericsson, Vodafone and Qualcomm: 1st Reduced Capability (RedCap) 5G data call in Europe

https://www.huawei.com/en/news/2024/3/leader-5g-core

GlobalData: MWC 2024 roundup + More balanced IT workforces

MWC 2024 Roundup:

Huawei, Qualcomm, and Ericsson, were singled out for praise, recognized for their groundbreaking work in advancing 5G technology. Their contributions were seen as pivotal in propelling the widespread adoption and ongoing development of 5G, setting new benchmarks for the future of tech innovation.

Huawei Technologies

Huawei took center stage at MWC 2024 with its pioneering 5.5G products, including the Telecom Foundation Model and the industry’s first 5.5G intelligent core network. Influencers applauded the innovative all-optical products like the OptiX OSN 9800 K36, OptiXaccess MA5800T, and iFTTR OptiXstar F50, highlighting Huawei’s foresight in enhancing network capabilities and digital transformation. The reception was largely positive, underscoring Huawei’s role in the next generation of connectivity.

Qualcomm

Qualcomm unveiled its latest Snapdragon processors, which powered the highly discussed OnePlus Watch 2, at MWC 2024. Influencers praised the new chipset for its efficiency and performance, emphasizing Qualcomm’s pivotal role in advancing the wearable tech space. The buzz reflects Qualcomm’s successful push towards more powerful and energy-efficient chip designs, which are set to redefine user experiences across devices.

Telefonaktiebolaget LM Ericsson

Ericsson showcased its commitment to advancing 5G infrastructure and network capabilities, earning positive reactions for its efforts to enhance global connectivity. Ericsson’s innovations in network evolution and digital transformation were recognized as key to the future of telecommunications, with influencers noting the company’s significant contributions to a more connected world.

……………………………………………………………………………………………………………………………

A More Balanced IT Workforce:

With a focus on creating more inclusive work environments, telecommunications firms are not only fostering a culture of acceptance but also reaping significant financial rewards in the process, says GlobalData, a leading data and analysis company.

Robert Pritchard, Principal Analyst, Enterprise Technology and Services at GlobalData: “With the tech sector being driven at high pace by change and innovation, recruiting teams that more closely resemble the world at large has become more of a priority amongst leading companies. It is telling that 60% of Fortune 500 companies were founded by immigrants.”

GlobalData analysis reveals that more balanced (by gender, race, and disability) workforces are emerging over time, often led by the C-Suite and the Board, but also in the wider employee base.

“With Indian-born CEOs at Google and Microsoft, ever more women CEOs across telecoms and tech companies, and a gay man in charge at Apple, the sector is again leading the way.

“DEI has largely moved from a tick-box exercise to a key strategic management consideration. The companies that are more advanced have been proven to be more successful, with their customers preferring brands and organizations that align with their values and identities.”

Studies by Boston Consulting Group and Harvard Business Review have found that companies with more diverse management teams have 19% higher revenues and 9 percentage points higher EBIT margin. In addition, in the battle for scarce talent in tech, DEI is seen as a key deciding factor for potential recruits – especially amongst Generation Z.

Pritchard concludes: “In terms of rebalancing the overall workforce, it is a long journey as most employees stay in post for over four years. Nevertheless, demonstration of a cultural shift and a more inclusive approach is vital. This can be helped in the short-term through training, mentoring, cross-team building, volunteering, and commitment to employee wellbeing. Success in DEI is reflected in commercial success in the long-run.”

EdgeQ’s breakthrough demos and partnerships showcased at MWC 2024 & MWC 2023

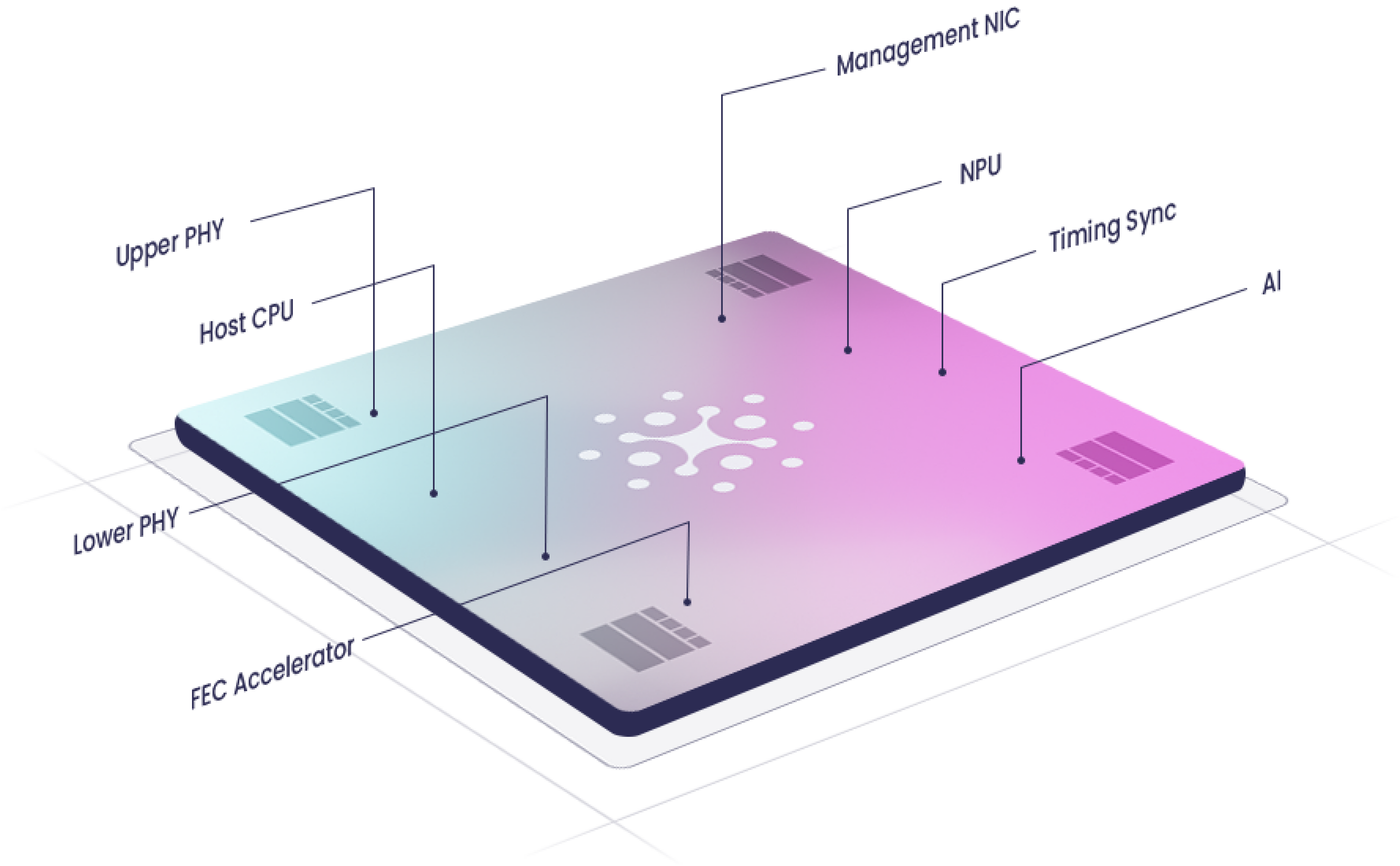

EdgeQ Inc, an innovative 4G/5G System on a Chip (SoC) semiconductor startup, had several defining showcases at MWC 2024 as well partnership announcements which included:

1. A partnership with DenseAir and Radisys to deliver industry’s first cloud-native, neutral host solution for mobile networks. It’s the world’s first O-RAN split 6 solution where multiple operators and multiple data streams are all supported off a common platform – single box, single silicon.

- EdgeQ fundamentally enabled DenseAir to deliver a solution that converged 4G+5G on a single silicon, while providing elastic scaling up to 4 component carriers and 256 users, with software-defined O-RAN split 6.

2. EdgeQ and BlinQ showcased a single integrated 5G+WiFi platform (PCW-400i), running simultaneously 5G at 3.3-4.2GHz frequency band spectrum and Wi-Fi 2.4GHz and 6GHz spectrum. This fully integrated small cell solution by BlinQ operates in bands n48, n77 and n78 along with the three bands from the Wi-Fi 7 standard. Using EdgeQ’s SoC, BlinQ enables novel deployment schemes like completely 5G cable-less backhaul, while enabling PoE++ (IEEE 802.3bt is the latest and most powerful Power over Ethernet standard. It provides up to 100 watts of power per port. at affordable unit economics).

- “Not only does the PCW-400i provide incredible capacity, it also incorporates BLiNQ’s enterprise-level management suite and zero-touch provisioning, making it easy to install and operate in any size organization,” says Pete Vavra, VP of Sales at BLiNQ. “The product was designed with scalability and ease of deployment in mind without taking the focus away from performance,” Vara added.

- “Our collaboration with BLiNQ is about massively converging two major wireless protocols into a single platform that give customers flexibility and freedom of choice. This is a phenomenal achievement delivering state-of-the art 5GNR and Wi-Fi 7 in a sleek, compact form factor that can elastically scale with connection density and capacity demands while maintaining breakthrough unit economics at unprecedented low power,” says Ziyao Xu, Director of Product Management at EdgeQ. “This will compel the market with novel use cases for enterprise, private networks, and home,” Xu added.

3. EdgeQ’s silicon was featured by both ARM and Analog Devices. Two landmark capabilities were revealed:

- Multi-Operator, Multi-Carrier 4cc Aggregation Running on a Single SoC Converging 4G+5G+AI.

- Industry First 5G PHY + 5G L2/L3 + Embedded User Plane Function (UPF) running on EdgeQ’s SoC:

-

Local Processing of UPF reduces the WAN tax, allowing for a lighter, less burdened core network. Having an embedded UPF can save cost, reduce latency, and maintains the pilot data from needing to leave the premise.

-

At the same time, there is enough headroom in EdgeQ’s processor architecture to run other edge applications (DPDK, virtualization, containers, etc…etc…).

-

4. Actiontec and EdgeQ announced the commercial release of ASC-308: Revolutionizing Network Flexibility, Performance and Future-Proofing 4G & 5G Small Cell.

- Enabled by EdgeQ SoC, Actiontec’s ASC-508 offers a programmable architecture, 4G & 5G multi-technology support, and ease of deployment to empower operators to build future-proof networks. The ASC-508 boasts a programmable and modular architecture, allowing operators to adapt easily the platform to their band support, specific use cases, and evolving network requirements.

- Support for various O-RAN compliant Split options, including All-in-One Split 0, Split 2, and Split 6, ensures future-proof adaptability. This is all due to the programmable nature of EdgeQ’s “Base Station-on-a-Chip.”

–>Significantly, EdgeQ’s SoC product entered production last year and has generated meaningful revenue with customers worldwide.

Image Credit: EdgeQ Inc.

……………………………………………………………………………………………………………………

At MWC 2023, EdgeQ collaborated with Vodafone, a leading telecommunications mobile operator in Open Radio Access Network (O-RAN), and Dell Technologies to debut a state-of-the-art O-RAN-based, massive MIMO solution at last year’s Mobile World Congress (MWC 2023) in Barcelona, Spain. As a result, the company received the prestigious “CTO Choice Award for Outstanding Mobile Technology” and “Best Digital Technology Breakthrough.”

The collaboration and design between the three companies is a massive MIMO 5G network that leverages in line acceleration technologies to deliver high user capacity, high network bandwidth at relatively low power for the new O-RAN based deployments.

Hosted at the Vodafone stand, the live system comprised of a Dell PowerEdge XR11 server and an EdgeQ M-Series L1 accelerator will demonstrate impressive throughput of 5Gbps, with the accelerator drawing less than 50 watts. The collaboration and design between the three companies demonstrate the principles of a 5G O-RAN infrastructure solution on a standard server, an inline acceleration, a Radio Unit (RU) system, and third party L2/L3 software stack from collaborating companies.

“Vodafone is committed to driving 5G O-RAN deployments at scale. Our showcase with EdgeQ and Dell Technologies validates how open innovation can drive better performance and cost efficiencies. Technologies such as EdgeQ’s high capacity in-line L1 acceleration should enable Vodafone to scale our macro cell infrastructure to new levels of performance and efficiency without compromise,” said Paco Martin, Head of OpenRAN Product Team, Network Architecture, Vodafone.

EdgeQ’s multi-node 4G/5G Base Station-on-a-Chip solution [1.] converges connectivity, compute, and networking in a disruptively innovative software-defined platform. The highly scalable, flexibly adaptive EdgeQ platform solution uniquely features a production-grade L1 stack that is open and customizable. The scalable architecture maximizes throughput performance, compute processing, across a large range of concurrent users and multiple carriers, all within a compact power and cost envelope.

“EdgeQ was founded on the belief of reconstituting the network in simple and intuitive terms. Together with Vodafone and Dell Technologies, we have shown the first instantiation of a new market paradigm that scales openly and flexibly, without the cost burden and power penalties of traditional platform approaches,” said Vinay Ravuri, CEO and Founder at EdgeQ.

Note 1. In December 2023, EdgeQ announced a converged 4G, 5G, and AI base station SoC at 1/2 cost, 1/3 the power, and 1/10 the space of previous designs. EdgeQ’s 4G/5G base station SoC features:

- 3 to 4 Multi-carrier operation on a 4T4R small cells for enterprise private networks.

- Asymmetric carrier aggregation across multiple bandwidths – ex: 100+20, 20+10, …….

- Asymmetric carrier aggregation between licensed bands and PAL/GAA spectrum assets.

EdgeQ is the only company providing an integrated 4G+5G solution, complete with a multi-mode L1 (Physical Layer), an interoperable L2/L3 software stack, all on a single chip. Telcos and private network customers can leverage a single converged solution, upgrade over-the-air at compelling unit economics of 1/2 the cost and 1/3 the power of previous base station designs.

……………………………………………………………………………………………………………………….

On March 22, 2022, EdgeQ’s Product Development Manager Adil Kidwai participated in an IEEE ComSocSCV virtual panel session, organized by this author, where he discussed the benefits of his company’s 4G/5G SoC solution for O-RAN and private 5G networks. That virtual panel session was summarized in the November 2022 IEEE Global Communications Newsletter which was published in the November 2022 IEEE Communications magazine. You can watch a video of that very informative session here.

About EdgeQ:

EdgeQ is a leading innovator in 5G systems-on-a-chip. The company is headquartered in Santa Clara, CA, with offices in San Diego, CA and Bangalore, India. Led by executives from Qualcomm, Intel, and Broadcom, EdgeQ is pioneering converged connectivity and AI that is fully software-customizable and programmable.

The company is backed by world-renowned investors. To learn more about EdgeQ, visit www.edgeq.io. Media Contact: [email protected] 804-612-5393

References:

https://www.edgeq.io/edgeq-wins-multiple

https://www.edgeq.io/edgeq-debuts-worlds-first

EdgeQ Samples World’s 1st Software-Defined 5G Base Station-on-a-Chip

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

https://ieeexplore.ieee.org/stamp/stamp.jsp?tp=&arnumber=9946966

SoC start-up EdgeQ comes out of stealth mode with 5G/AI silicon for 5G private networks/IIoT

https://ieeexplore.ieee.org/document/6736761

Vodafone UK report touts benefits of 5G SA for Small Biz; cover for proposed merger with Three UK?

A new Vodafone report claims that small businesses in the UK could be missing out on up to £8.6 billion (US $10.8 billion) a year in productivity savings due to the very slow rollout of 5G standalone (5G SA) [1.]. The report states:

• Based on current progress rates, and without further action, by 2030 the UK would rank 5th on this index, scoring lower that Denmark, Finland, Sweden and the Netherlands. The UK would lose its position as one of the foremost places in Europe to start a new business.

• But an accelerated rollout of standalone 5G (5GSA) would allow the UK to jump three places from its current position by 2030, becoming the second-best place in Europe for business to secure the connectivity and digital competitiveness needed to grow.

Note 1. Vodafone defines 5G SA as follows:

Standalone 5G (5G SA) refers to the rollout of 5G connectivity on an entirely new network, as opposed to building upon the existing 4G network. Whilst this enables the network to enjoy some of the benefits of superfast connectivity, 5G SA is not subject to the limitations of the 4G networks, and is therefore able to support high-density deployments, such as smart sensors and real time data sharing.

……………………………………………………………………………………………………………….

The report cites agriculture as an example, where the use of 5G SA for activities such as real-time data monitoring and AI-based forecasting could help those laboring in the industry save on average at least 6% of their working hours.

In particular, the report’s sidebar on Agriculture states:

With agricultural activities tending to be much more spread out than other SME business operations, this means that having a reliable 5G-supported network is especially needed to reap the productivity rewards across new and exciting technological frontiers:

• Real-time data monitoring: Technologies like the Internet of Things (IoT) and real-time data sensors on a standalone 5G network can capture the status of virtually everything that farmers typically spend the most time on assessing: the weather, soil quality, and crop health.

By seeing data in real time, farmers can access the information they need and use technology to support decision-making for when to water crops or use pesticides – greatly reducing working hours and costs.

• AI decision-making and forecasting: With the wealth of uninterrupted data that can be collected on a standalone 5G network by smart technology, this enhances the information that AI can use to make more informed, faster recommendations to farmers than manually. AI programs can forecast things such as future crop health and optimised farming schedules to maximise crop yields.

• Precision machinery: New machine technology can also use data to determine more precise amounts of resources to use in the field for crop health, reducing wastage and saving time than if completed manually. Pioneering unmanned machinery, including for weeding and seeding, can save farmers more hours in the field to focus on other areas of the agricultural business.

Through a meta-analysis of surveys on how the 296,000 workers employed by agriculture SMEs typically spend their working times, we expect that they can save on average at least 6% of their working hours – or over 3.1 working weeks per worker – through a national standalone 5G network and the technologies it enables. This equates to all these workers collectively saving over 37.7 million working hours per year – delivering productivity savings of £112 million per year.

………………………………………………………………………………………………………..

A possible motivator of this report is Vodafone’s desire to complete its proposed merger with the UK’s Three, a deal that would allow Vodafone to rollout a nationwide 5G SA network. The report contends that a merger with Three would lift Vodafone from fifth to second place in a “European Index” that compares and ranks the competitiveness of each country’s 5G offerings for small businesses across 17 countries.

During a keynote at MWC Barcelona 2024, Vodafone Group CEO Margherita Della Valle commented that the proposed merger with Three will drive 5G “to all the areas that need it so badly.” She added “It will have a very positive impact on the U.K. economy. And we’ve also said it very clearly, we’re not going to change our pricing policies as a consequence.”

Vodafone said that it has committed to invest £11 billion ($13.9 billion) in 5G SA to cover 99% of the UK population by 2034 — should the merger with Three be approved by the regulators.

References:

https://www.fiercewireless.com/5g/vodafone-uk-sees-ps86bn-gain-smes-faster-5g-sa-rollout

https://www.fiercewireless.com/5g/three-ireland-launches-5g-standalone-ericsson

https://dgtlinfra.com/5g-standalone-sa/

Building and Operating a Cloud Native 5G SA Core Network

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Ericsson Mobility Report touts “5G SA opportunities”

Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

5G SA networks (real 5G) remain conspicuous by their absence

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

Highlights of GSMA study: Mobile Net Zero 2024, State of the Industry on Climate Action

Reducing carbon emissions has been a top priority for global network operators and equipment vendors for the past few years. Many have published net zero targets and use every opportunity to include their sustainability agenda into their public announcements. In 2019, the mobile industry set a goal to reach net zero by 2050, becoming one of the first sectors in the world to set such an ambitious target.

A new GSMA study titled Mobile Net Zero 2024, State of the Industry on Climate Action, the fourth of its kind, provides a glimpse of how they are progressing.

Over the past year, eight network operators submitted new near-term targets to the Science Based Targets Initiative (SBTi), bringing the total to 70 operators and

representing nearly half of global mobile connections. Fifty-three operators have also

committed to net zero targets.

GSMA found that European telcos are leading the way forward. Operational emissions in Europe fell by half in the 2019-2022 period, with some telcos getting a special mention for exceeding that 50% level; Tele2, Telefónica, Telenor, Telia and Vodafone all achieved deeper reductions.

North America also performed well, with operational emissions falling by around 30% over the period, as did Latin America, where TIM Brasil and Telefonica got a shout-out for driving a 22% reduction. And Turkcell was credited as the main orchestrator of a decline of around a fifth in emissions in the Middle East and North Africa (MENA).

However, emissions from operators in Greater China rose by 3% and those from the Asia-Pacific by 10%. While those numbers are not huge, the relative sizes of those markets mean there is a significant impact on the overall figures.

“While this appears challenging, recent progress shows this is within reach,” the report reads. Yet the target reduction rate for operational emissions was exceeded for the past three years in Europe (21% per year), North America (11%), Latin America (8%) and MENA (8%).

Three-quarters of the mobile industry’s carbon emission come from its value chain (Scope 3), highlighting the importance of engaging supply chains and customers. More than 90% of Scope 3 emissions came from just five Scope 3 categories: 1) Purchased goods and services; 2) Capital goods; 3) Fuel- and energy-related activities; 11) Use of sold products; and 15) Investments.

GSA says there is an urgent need for improved data and further analysis to better understand Scope 3 trends.

“The evidence shows that the mobile industry’s commitment to net zero by 2050 is paying off. Despite surging demand for connectivity and data, the global carbon emissions of operators continued to fall,” said John Giusti, Chief Regulatory Officer at the GSMA.

The number of mobile connections globally rose by 7% between 2019 and 2022, and Internet traffic more than doubled, the GSMA said. As such, the industry’s carbon reductions were mainly driven by energy efficiency and the use of renewable energy.

“Although we see the strongest early lead from Europe in the race to net zero, and encouraging progress in the Americas and MENA, this is a race that everybody needs to win – or else we all lose,” Giusti said, assiduously avoiding naming those trailing markets.

References:

Mobile Net Zero 2024: State of the Industry on Climate Action

NTT DOCOMO & SK Telecom Release White Papers on Energy Efficient 5G Mobile Networks and 6G Requirements

NGMN Alliance: Green benchmark for mobile networks

Huawei Execs: ICT Industry Initiatives for 5G and Green 5G Networks for a Low-Carbon Future

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

During MWC 2024, Huawei held a new product solution launch event, where George Gao, President of Huawei Cloud Core Network Product Line, released the 5.5G (aka 5G Advanced) intelligent core network solution.

Huawei claims 2024 is the first year for commercialization of 5.5G (this author strongly disagrees- 3GPP 5G Advanced specs are not nearly complete and ITU-R standards work hasn’t even started yet).

“The first year of commercial use of 5.5G has officially arrived, and the commercial rollout of 5.5G is accelerating worldwide,” the China based vendor said. “While Middle Eastern operators have achieved scaled 5.5G commercialization, operators across Europe, Asia Pacific, and Latin America are verifying 10 Gbps [1.], preparing for 5.5G commercialization in 2024,” Huawei added.

Note 1. CCS Insight wrote last month, “operators are deploying greenfield networks in new cities, such as STC in Bahrain and Zain in Saudi Arabia, both of which have achieved 10 Gbps downlink speeds on their 5G-Advanced test networks.”

The company says announced their 5.5G intelligent core network as an important part of 5.5G, incorporating service intelligence, network intelligence, and O&M intelligence.

The claim is that 5.5G technology will improve both business value and development potential. We seriously doubt that!

Service Intelligence Expands the Profitability of Calling Services:

In 2023, New Calling [2.] was put into commercial use for serving up to 50 million subscribers across 31 provinces in China. It has also been verified in Europe, Latin America, the Middle East, and Asia Pacific, and is set to be commercialized in these regions in 2024.

Note 2. New Calling essentially combines voice calls with other elements – fun calling with avatars, for example, or calling with real-time translation or speech-to-text. It is backed by the GSMA (which is NOT a standards body), but to date has been deployed only in China.

As stated by George, the industry’s first New Calling-Advanced solution launched by Huawei embraces enhanced intelligence and data channel-based interaction capabilities. Huawei says that will take us to a multi-modal communication era and helping operators reconstruct their service layout. In addition, Huawei also introduced the Multi-modal Communication Function (MCF) to allow users to control digital avatars through voice during calls, delivering a more personalized calling experience. An enterprise can also customize their own avatar as an enterprise ambassador to promote their branding.

Network Intelligence Enables Experience Monetization and Differentiated Operations:

For a long period of time, operators have strived to realize traffic monetization on MBB networks. However, there are three technical gaps: not assessable user experience, no dynamic optimization, and no-closed-loop operations. To bridge these gaps, Huawei has launched the industry’s first Intelligent Personalized Experience (IPE) solution, aiming to help operators add experience privileges to service packages and better monetize differentiated experiences.

In the industry, the user plane on the core network usually processes and forwards one service flow using one vCPU. As heavy-traffic services increase, such as 2K or 4K HD video and live streaming, microbursts and elephant flows frequently occur. It is, therefore, more likely that a vCPU will become overloaded, causing packet loss. To address this issue, Huawei releases the Intelligent UDG. According to George, this is the industry’s first Intelligent UDG product that can deliver ubiquitous 10 Gbps superior experiences.

O&M Intelligence Achieves High Network Stability and Efficiency:

Empowered by the multi-modal large model, the Digital Assistant & Digital Expert (DAE) reduces O&M workload and improves O&M efficiency. It reshapes cloud-based O&M from “experts+tools” to intelligence-centric “DAE+manual assistance”. With DAE, 80% of trouble tickets can be automatically processed, which is much more efficient than 100% manual processing as it used to be. DAE also enables intent-driven O&M, avoiding manual decision-making. Before, it usually took over five years to cultivate experts in a single domain, however, the multi-modal large model is now able to be trained and updated within just weeks.

Huawei published eight innovation practices which cover key 5.5G technology areas, including antenna evolutions, mmWave bandwidth, network intelligence in the RAN, and energy efficiency. The full list is here, along with details of Huawei’s proposed 5.5G offerings.

With the 2024 commercial launch of 5.5G, Huawei is collaborating with wireless network operators and partners around the world to pursue exciting new innovation in networks, cloud, and intelligence. Huawei plans to drive its 5G business and foster a thriving industry ecosystem, creating a new era for intelligent digital transformation.

For more information, please visit: https://carrier.huawei.com/en/events/mwc2024.

Closing Comments:

This author feels it’s extremely dangerous to announce any IMT products in advance of 3GPP specifications and ITU-R standards. It unrealistically raises expectations and of course there’s no interoperability without specs/standards.

References:

https://www.huawei.com/en/news/2024/2/5ga-practices-multipath

What is 5G Advanced and is it ready for deployment any time soon?

Nokia plans to investment €360 million in microelectronics & 5G Advanced/6G technology in Germany

Nokia exec talks up “5G Advanced” (3GPP release 18) before 5G standards/specs have been completed

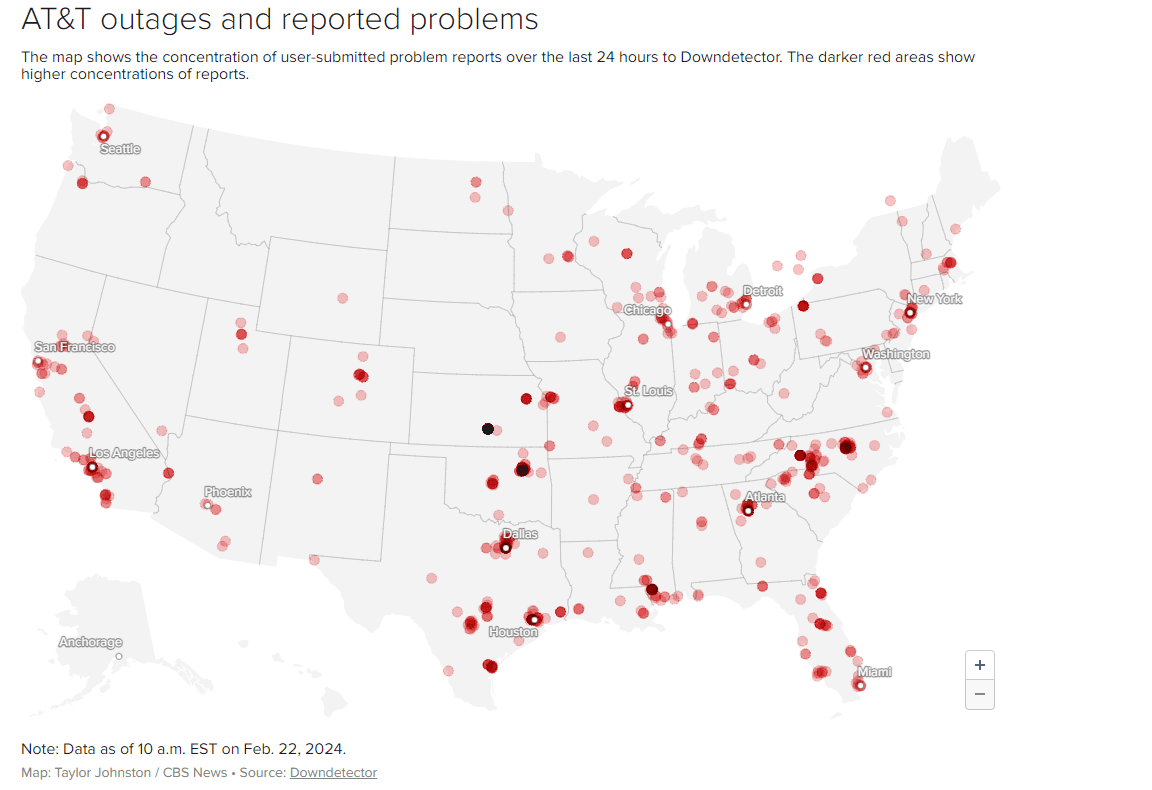

AT&T wireless outage effected more than 74,000 U.S. customers with service disruptions lasting up to 11 hours for some

AT&T’s cellular network went down for many of its customers across the United States Thursday morning, leaving its wireless customers unable to place calls, text or access the internet. Thursday morning, more than 74,000 AT&T customers reported outages on digital-service tracking site DownDetector, with service disruptions beginning around 4 a.m. ET. Most of the complaints were focused on problems with mobile phones or wireless service.

At 3:10 p.m. EST, roughly 11 hours after reports of the outage first emerged, the company said that it had restored service to all impacted customers. “We have restored wireless service to all our affected customers. We sincerely apologize to them,” AT&T said in a statement. The company added that it is “taking steps to ensure our customers do not experience this again in the future.” AT&T hasn’t disclosed the cause of the outages, but the problem snarled 911 centers, with some law enforcement officials noting that some people were calling the emergency number to test whether their phones worked.

The Federal Communications Commission confirmed Thursday afternoon that it is investigating the outage. The White House says federal agencies are in touch with AT&T about network outages but that it doesn’t have all the answers yet on what exactly led to the interruptions.

Earlier Thursday, AT&T acknowledged that it had a widespread outage and suggested a ridiculous alternative. “Some of our customers are experiencing wireless service interruptions this morning. We are working urgently to restore service to them,” AT&T said in a statement at 11:15 a.m. ET. “We encourage the use of Wi-Fi calling until service is restored.” AT&T says on its website that there is no extra cost for WiFi calling. Once set up, Wi-Fi calling works automatically when you’re connected to a Wi-Fi network that you choose. The catch here is that if your away from home, there probably won’t be WiFi hot spot you can connect with or you end up paying for that WiFi Internet service. You are in luck if you’re an Xfinity home internet customer, in which case you can use Xfinity WiFi hotspots for free once you sign in using your Xfinity account log-in credentials.

Initially, AT&T provided no official reason for the outage, but provided an update at 7.46pm EST: “Based on our initial review, we believe that today’s outage was caused by the application and execution of an incorrect process used as we were expanding our network, not a cyber attack. We are continuing our assessment of today’s outage to ensure we keep delivering the service that our customers deserve.” That sounds like a flimsy excuse to this author. The software update went wrong, according to preliminary information from two anonymous sources familiar with the situation.

The U.S. Cybersecurity and Infrastructure Security Agency is “working closely with AT&T to understand the cause of the outage and its impacts, and stand[s] ready to offer any assistance needed,” Eric Goldstein, the agency’s executive assistant director for cybersecurity, said in a statement to CNN.

White House National Security spokesman John Kirby said Thursday afternoon that the Department of Homeland Security and the FBI were looking into the matter and working with partners in the tech industry to “see what we can do from a federal perspective to lend a hand to their investigative efforts to figure out what happened here. The bottom line is we don’t have all the answers,” he said. “We’re working very hard to see if we can get to the ground truth of exactly what happened.”

Several police departments and municipalities warned local residents of what they described as a nationwide outage. In turn, officials urged callers to contact emergency services by alternative means but did not specify what those means were?

……………………………………………………………………………………………………………………………………………………………………………..

References:

https://about.att.com/pages/network-update

https://www.wbaltv.com/article/report-nationwide-outage-atandt-users/46900396

https://www.cbsnews.com/news/outage-map-att-where-cell-phone-service-down/

https://abcnews.go.com/US/att-outage-impacting-us-customers-company/story?id=107440297

Rogers Telecommunications restores service after 19 hour outage disrupting life in Canada

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

SK Telecom, DOCOMO, NTT and Nokia develop 6G AI-native air interface

SK Telecom, DOCOMO, NTT and Nokia today announced they have partnered to develop the 6G AI-native air interface (AI-AI), a critical next-generation technology that could greatly boost network performance while increasing energy efficiency. The four companies will show video demonstration of an AI-AI proof of concept at SKT’s booth at Mobile World Congress in Barcelona, Feb. 26-29.

This new 6G collaboration builds on an existing relationship between DOCOMO, NTT and Nokia targeted at 6G innovation. With the addition of SKT, the four companies will be able to expand the scope and scale of 6G AI-AI testing and validation as well as explore a broader range of business use cases for the technology.

The collaboration is developing future proof-of-concept 6G AI-AI systems, which will then be put to the test using selected use cases and real environmental scenarios. These over-the-air validation tests will be conducted both in the lab and outdoors to best simulate real network results. SKT, NTT, DOCOMO and Nokia will cooperate on improving AI model performance by utilizing data generated from real networks or through simulation. This will be instrumental in developing AI training models for a best-in-industry AI-AI solution.

By working together, SKT, DOCOMO, NTT and Nokia will be able to combine their research efforts and bring their core areas of expertise to the table. SKT, DOCOMO and NTT are recognized worldwide for their successful adoption of every generation of networking and their ability to create new business value from advanced technologies, while Nokia’s industrial research arm, Nokia Bell Labs, is a leader in 6G innovation.

Yu Takki, Vice President and Head of Infra Tech at SKT, said: “ This milestone represents a significant step forward in collaborative efforts towards the development of 6G core technology involving technology leaders from Korea, Japan, Europe and the United States. SKT will maintain its momentum in its R&D efforts of applying AI technology to network infrastructure as we move forward to become a global AI company.”

Takaaki Sato, Executive Vice President and Chief Technology Officer at DOCOMO said: “DOCOMO and NTT are delighted to advance this project with Nokia, a global vendor leading the world, and SKT, a mobile operator co-leading Asia. Through this collaboration, we will take the lead in innovative technology development and standardization of 6G, and focus on building a global ecosystem that includes future industries and technologies.”

Peter Vetter, President of Bell Labs Core Research at Nokia, said: “For Nokia to create a world-class 6G system, it’s critical we get input from the service providers that will one day deploy 6G. SKT, NTT and DOCOMO are among the most innovative service providers in the world, which gives us the perfect partners to design the networks of the future.”

Editor’s Note: This 6G AI initiative has NOT yet been submitted to ITU-R WP 5D for inclusion in any IMT 2030 related draft document.

…………………………………………………………………………………………………

About SK Telecom:

SK Telecom has been leading the growth of the mobile industry since 1984. Now, it is taking customer experience to new heights by extending beyond connectivity. By placing AI at the core of its business, SK Telecom is rapidly transforming into an AI company with a strong global presence. It is focusing on driving innovations in areas of AI Infrastructure, AI Transformation (AIX) and AI Service to deliver greater value for industry, society, and life.

References:

https://www.sktelecom.com/en/press/press_detail.do?idx=1602¤tPage=1&type=&keyword=

https://www.kedglobal.com/tech,-media-telecom/newsView/ked202402220013

https://www.sktelecom.com/en/press/press_detail.do?idx=1601¤tPage=1&type=&keyword=

SK Telecom, Intel develop low-latency technology for 6G core network

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific Large Language Models (LLMs)

NTT DOCOMO successful outdoor trial of AI-driven wireless interface with 3 partners

Nokia utilizes Intel technology to drive greater 5G SA core network energy savings

Nokia and Intel today announced that they are targeting greater energy efficiency improvements in 5G networks by using Xeon processors and power management software from Intel that will power Nokia’s cloud-native 5G Core solutions [1.] The two companies’ advances, building on years of innovation, will give communication service providers (CSPs) more leverage in reducing electricity usage and costs in their networks.

Note 1. The Nokia packet core provides key components needed for a webscale-class evolved packet core (EPC) and 5G core system (5GC). With its virtualized, cloud-native disaggregated and state-efficient design, it is well suited for multi-cloud environments. It is also infrastructure agnostic and independent of the underlying cloud infrastructure used for orchestration, lifecycle management (LCM) and infrastructure resource management.

…………………………………………………………………………………………………………………….

In testing demonstrations, Nokia achieved approximately 40% runtime power savings using Nokia’s cloud-native 5G Core, integrated with Intel Infrastructure Power Manager (IPM) software and 4th Gen Intel Xeon Scalable Processors*, while maintaining key network performance metrics.

Such energy savings are achieved through the careful integration of Nokia’s Core with Intel’s power modulation capabilities, which result in the energy consumption of the chips being proportional to the amount of traffic on the network – which varies considerably during any 24-hour period. Nokia intends to deliver these energy savings capabilities to the market as early as the second half of 2024, starting with Nokia’s Cloud Packet Core. Nokia and Intel will demonstrate these capabilities at MWC Barcelona at Intel’s booth 3E31.

The announcement underscores Nokia’s ongoing broader efforts to help CSPs and other network-dependent industries reduce their environmental footprint, become more resource efficient, and drive increased value from their networks. Nokia has set its key greenhouse gas (GHG) emissions reduction target through the Science Based Targets (SBT) initiative, which is aligned with the goal of limiting global warming to 1.5°C. Nokia was the first telecoms equipment vendor to have a science-based target accepted by the SBT initiative in 2017.

Marcelo Madruga, Head of Technology and Platforms, Products & Engineering, Cloud and Network Services at Nokia, said: “I am very pleased with the brilliant work that Nokia and Intel are doing to deliver very meaningful reductions in the energy footprint of 5G networks. Network data and computation usage only continues to grow, with the clear implication that has for continued energy demand growth. What we are doing today demonstrates not only superior software and technology but delivering on our broader commitments to cut carbon emissions across value chains.”

Alex Quach, Vice President & GM, Wireline and Core Network Division at Intel, said: “This is another solid proof point in the long-standing Intel-Nokia collaboration that highlights the strength of our teams in empowering CSPs with innovative solutions. Integrating the Intel Infrastructure Power Manager into Nokia’s widely deployed packet core software will help deliver the power savings CSPs require and strengthens network operations through intelligent resource allocation.”

Stéphane Demartis, VP Telco Cloud Infrastructure at Orange, said: “We are delighted to start a collaboration with Nokia and Intel to optimize our power consumption. This will provide a major step forward in delivering energy efficient solutions in the core network infrastructure. Orange is looking forward to working with Nokia and Intel to explore implementation of these innovations for a sustainable 5G Core network through the #Sylva project.”

References:

https://www.nokia.com/networks/core-networks/cloud-packet-core/

https://www.intel.com/content/www/us/en/newsroom/resources/2024-mwc-barcelona.html#gs.5dbwdb

https://www.nokia.com/events/mobile-world-congress/

China backed Volt Typhoon has “pre-positioned” malware to disrupt U.S. critical infrastructure networks “on a scale greater than ever before”

On Sunday, FBI Director Christopher Wray said Beijing’s efforts to covertly plant offensive malware inside U.S. critical infrastructure networks [1.] is now at “a scale greater than we’d seen before,” an issue he has deemed a defining national security threat. He said that China backed Volt Typhoon was pre-positioning malware that could be triggered at any moment to disrupt U.S. critical infrastructure. “It’s the tip of the iceberg…it’s one of many such efforts by the Chinese,” he said on the sidelines of the security conference.

Wray had earlier told conference delegates, that China was increasingly inserting “offensive weapons within our critical infrastructure poised to attack whenever Beijing decides the time is right.” The FBI chief said the U.S. is particularly focused on the threat of pre-positioning, which some European officials have described as the cyber equivalent of pointing a ballistic missile at critical infrastructure. “Those attacks are now being amplified by artificial intelligence tools. The word ‘force multiplier’ is not really enough,” Wray added.

Note 1. The FBI Director declined to elaborate on what other critical infrastructure had been targeted, stressing that the Bureau had “a lot of work under way.”

Image Credits: imaginima / Getty Images

Machine learning translation has helped Chinese security operatives to more plausibly recruit assets, steal secrets and rapidly process more of the information they are collecting, the Wray said. “They already have built economic espionage and theft of personal and corporate data as a kind of a bedrock of their economic strategy and are eagerly pursuing AI advancements to try to accelerate that process,” Wray added.

FBI Director Christopher Wray PHOTO: KEVIN DIETSCH/GETTY IMAGES

……………………………………………………………………………………………………………………………

Western intelligence officials say China’s scale and sophistication of cyberattacks has accelerated over the past decade. Officials have grown particularly alarmed at Beijing’s interest in infiltrating U.S. critical infrastructure networks, planting malware inside U.S. computer systems responsible for everything from safe drinking water to aviation traffic so it could detonate, at a moment’s notice, damaging cyberattacks during a conflict.

In California, Wray met with counterparts from the Five Eyes intelligence community—which encompasses the U.S., Australia, New Zealand, Canada and the U.K.—to share respective strategies for cyber defense. He has also traveled to Malaysia and India to discuss China’s hacking campaign with authorities in both countries.

“I am seeing more from Europe,” he said. “We’re laser focused on this as a real threat and we’re working with a lot of partners to try to identify it, anticipate it and disrupt it.”

The Netherlands’ spy agencies said earlier this month that Chinese hackers had used malware to gain access to a Dutch military network last year. The agency, considered to have one of Europe’s top cyber capabilities, said it made the rare disclosure to show the scale of the threat and reduce the stigma of being targeted so allied governments can better pool knowledge.

A report released this month by agencies including the FBI, the Cybersecurity and Infrastructure Agency and the National Security Agency said Volt Typhoon hackers had maintained access in some U.S. networks for five or more years, and while it targeted only U.S. infrastructure directly, the infiltration was likely to have affected “Five Eyes” allies.

Author’s Note:

……………………………………………………………………………………………………………………………

Volt Typhoon, the China-sponsored hacking group, has been targeting U.S. critical infrastructure, including satellite and emergency management services and electric utilities, according to a new report from the industrial cybersecurity firm Dragos. That report outlines how the notorious hacking group is positioning themselves to have disruptive or destructive impacts on critical infrastructure in the U.S.

Robert M. Lee, founder and CEO of Dragos, warned during a media briefing that Volt Typhoon is not an opportunistic group, but is instead targeting specific sites that assist U.S. adversaries “trying to hurt or cripple U.S. infrastructure. It’s hitting the specific electric and satellite communication providers that would be important for disrupting major portions of the U.S. electric infrastructure,” Lee added.

The report comes shortly after the National Security Agency, FBI, and Cybersecurity and Infrastructure Security Agency, revealed that Volt Typhoon has been in some critical infrastructure networks for at least five years. That alert warned of Volt Typhoon operations that targeted the aviation, railways, mass transit, highway, maritime, pipeline, and water and sewage sectors.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The NSA, CISA and FBI said in a joint advisory report that Volt Typhoon has been burrowing into the networks of aviation, rail, mass transit, highway, maritime, pipeline, water and sewage organizations — none of which were named — in a bid to pre-position themselves for destructive cyberattacks, published on February 7th. The release of the advisory, which was co-signed by cybersecurity agencies in the United Kingdom, Australia, Canada and New Zealand, comes a week after a similar warning from FBI Director Christopher Wray. Speaking during a U.S. House of Representatives committee hearing on cyber threats posed by China, Wray described Volt Typhoon as “the defining threat of our generation” and said the group’s aim is to “disrupt our military’s ability to mobilize” in the early stages of an anticipated conflict over Taiwan, which China claims as its territory.

According to Wednesday’s technical advisory, Volt Typhoon has been exploiting vulnerabilities in routers, firewalls and VPNs to gain initial access to critical infrastructure across the country. The China-backed hackers typically leveraged stolen administrator credentials to maintain access to these systems, according to the advisory, and in some cases, they have maintained access for “at least five years.”

This access enabled the state-backed hackers to carry out potential disruptions such as “manipulating heating, ventilation, and air conditioning (HVAC) systems in server rooms or disrupting critical energy and water controls, leading to significant infrastructure failures,” the advisory warned. In some cases, Volt Typhoon hackers had the capability to access camera surveillance systems at critical infrastructure facilities — though it’s not clear if they did.

Volt Typhoon also used living-off-the-land techniques, whereby attackers use legitimate tools and features already present in the target system, to maintain long-term, undiscovered persistence. The hackers also conducted “extensive pre-compromise reconnaissance” in a bid to avoid detection. “For example, in some instances, Volt Typhoon actors may have abstained from using compromised credentials outside of normal working hours to avoid triggering security alerts on abnormal account activities,” the advisory said.

Earlier this year, the FBI and U.S. Department of Justice announced that they had disrupted the “KV Botnet” run by Volt Typhoon that had compromised hundreds of U.S.-based routers for small businesses and home offices. The FBI said it was able to remove the malware from the hijacked routers and sever their connection to the Chinese state-sponsored hackers.

According to a May 2023 report published by Microsoft, Volt Typhoon has been targeting and breaching U.S. critical infrastructure since at least mid-2021.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

Volt Typhoon targeted emergency management services, per report

US disrupts China-backed hacking operation amid warning of threat to American infrastructure

https://www.controlglobal.com/home/blog/11293192/information-technology