CES 2024 major themes: sustainability and “right to repair” user devices

A big change for the just concluded CES 2024 was a focus on sustainability (as to what goes into smart devices) and the ability to repair user owned devices. The tech industry is now finally becoming more aware of the importance of sustainability — either because it’s recognizing that it needs to account for all the ways producing new technologies contributes to climate change, or because the growing public awareness of industrial impact on climate change means they can’t ignore their own contribution.

At the end of the show, Google announced its new policy supporting the Right to Repair movement and the user’s right to fix their own devices. This includes making tools, parts and repair manuals available to device owners — including Pixel phone owners. Combined with Google’s commitment to supply the latest Pixel 8 series with seven years of software updates, it seems like more device manufacturers are acknowledging consumer desire to keep their devices around for longer, which means fewer old devices thrown away into landfills and contributing to climate woes.

Over 70% of companies surveyed by IDC moved beyond the early stages of talking about sustainability and now need to make measurable progress on their set targets to please shareholders. Companies are reliably reporting their environmental impact data and using sustainability measures to find cost savings. Their next task is to stand out from the competition with their sustainability approaches. For IT professionals who can see the scaled impact of replacing products, using sustainable materials and recycling equipment is attractive. But consumers are still waking up to the impact of their frequent device upgrades.

“[Device] buyers are still asking about carbon emissions (upstream and downstream) but they also want to know about the materials that are being used, the recyclability of the product that they buy, etc.,” said Bjoern Stengel, Global Sustainability Research lead at the IDC. Getting the most use out of devices and reuse of their materials is becoming a major differentiator for those buying tech, especially in commercial uses like information technology.

More companies are pledging to use recycled materials in their products, which could help reduce emissions and waste by finding second lives for parts of old devices that would otherwise be headed for landfills, including metals and rare earth materials whose extraction and integration contribute to climate change.

Companies have been slowly shifting where they used recycled materials:

- Samsung Electronics emphasized how sustainability is driving business activities at CES 2024. The Sustainability Zone at Samsung’s booth ushered in visitors to discover how the company is promoting resource circularity and collaboration in addition to providing various accessibility services. Samsung had previously committed toward more recycled material in their product packaging by 2025, the company’s CES 2024 keynote reinforced its efforts to use recycled ocean plastic in phone and TV components. Samsung also pledged to reach net zero carbon emissions company-wide by 2050 with the device experience division using 100% renewable energy by 2027.

- Panasonic pledged to reduce its use of resin plastic in its products and develop a system that blends recycled plastic with antioxidants and other materials in order to form new plastics ready to be included in products.

- Dell has been using recycled materials since 2007 and recycled 2.5 billion pounds of materials since. The company is starting with plastics because, as Product Sustainability Lead Katie Green explained, those are the heaviest and highest-volume materials in the company’s products. The second heaviest and most prevalent material category — metals — became the next to be recycled into new products, including rare earth magnets and aluminum. Last year, the company began using 50% recycled copper in some of its charging cables that will soon expand to the XPS laptop line, and in 2024, will use recycled cobalt in laptop batteries and recycled steel in desktop displays. “[We are] understanding if we’re prioritizing the right, sustainable materials and the right components, and doing it in a way that dematerializes as much as possible,” Green said.

Dell first introduced its Concept Luna laptop in December 2021 (and updated it a year later in 2022) as a testbed for sustainable design which has trickled into its main products, from trying out modular parts to reducing material waste. For instance, Dell first tried removing the plastic Dell logo on the laptop lid in Luna in favor of a stenciled logo straight on the aluminum chassis, then used that process in its Inspiron line of computers — a small change that’s multiplied by the scale of Dell product manufacturing.

However, there are limits to how much some recycled materials can be used in a product, Dell discovered. For instance, the company found a maximum of 35 to 40% post consumer recycled plastic in its current method, Green said. Like Panasonic, Dell developed a method to blend the old plastic with something new — in Dell’s case, a bio-based plastic that’s renewable. One composition could be 30% post-consumer plastic, 20% bio-based plastic and 20% recovered aerospace plastic, a blend that’s found in Dell’s Latitude 5000 and Precision 3000 series of laptops. By 2030, Dell wants half of the materials it uses in products to be recycled or renewable.

Dell introduced its third year of ideas that it’s exploring with Concept Luna via a blog post in December. New this year is using predictive analytics, AI and machine learning to better anticipate component problems. Even without diagnostics, these could anticipate if your device’s hard drive may fail or battery capacity may be depleted.

Dell also expanded the number of products able to be represented by its augmented reality app, first introduced in June 2022, to help guide consumers in their own personal repairs in far more immersive ways than a simple device manual can do.

But for all these neat technological advances in diagnosing, harvesting and guiding repairs, Dell had a simpler longevity bottleneck it’s tried to fix: Making it easier for users to get spare parts. The other big pillar of sustainability is simply making sure devices last longer by ensuring the process is less painful for users.

Dell is in the process of adding QR codes on the back of its products, starting with this year’s XPS line, that users can quickly scan to get to a “personalized support experience,” as Green calls it. In short, it pre-enters your device info to Dell’s support network to provide users with access to repair manuals, spare parts and driver updates.

Admittedly, Green says Dell is implementing the QR codes in anticipation of the European Commission’s Digital Product Passport initiative, which requires more transparency in consumer tech products’ sustainability footprint. But it will still make it easier for laptop and PC owners to access the tech support they need to potentially keep devices running for longer and out of landfills when possible.

References:

https://www.ces.tech/topics/topics/sustainability.aspx

Taiwan’s ITRI integrates virtual and real technologies on display at CES 2024

Vodafone Germany deploys Ericsson 5G radio to cut energy use up to 40%

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Executive Summary:

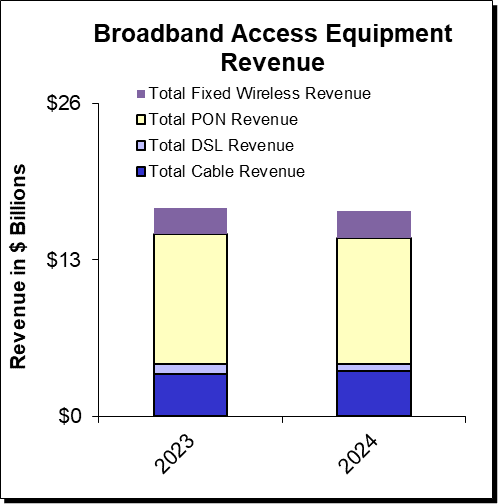

Operator spending on broadband network equipment will remain sluggish well into 2024, forecasts Dell’Oro’s Jeff Heynen. “Inventory Correction, Inventory Realignment,” or whatever term you prefer to call the root cause of 2023’s broadband spending slowdown will likely persist well into 2024, he wrote. Without the benefit of fourth quarter numbers, total spending on broadband equipment in 2023 is expected to show a decline of around 10%. Early projections for 2024 indicate an additional 5% year-over-year decrease, as the lagging impact of interest rate increases to curb inflation will be felt more acutely. This additional 5% decrease would put total spending to around $16.5 B—roughly equal to 2021 spending levels.

The expected declines in 2023 and 2024 follow three straight years of white-hot growth in broadband network and service investments from 2020 to 2022. During this period, year-over-year growth rates reached 9%, 15%, and 17%, respectively. Similar periods of growth from 2003-2006 and 2010-2014 were both followed by two subsequent years of reduced spending, as operators—particularly in China—shifted their capital expenditure focus from broadband to mobile RAN.

However, there are signs of a return to growth in 2025 as money from BEAD and other broadband subsidy programs trickle down to broadband equipment suppliers. Well before that, pockets of growth in fixed wireless CPE, cable DAA equipment and CPE, and continued spending on PON equipment by tier 2 and tier 3 operators should make the broadband market one in which the headlines might communicate malaise, but a peek under the hood shows clear signs of resilience powering an inevitable return to growth.

Cable Operators Travel Different Paths to Fend off Fixed Wireless and Fiber:

Just like last year, in the minds of cable consumers, cable operators find themselves stuck battling against the perception that they are the provider with inferior copper technology that can’t be flexible when it comes to offering plans that meet a consumer’s budget, like fixed wireless currently can. As a result of this situation, larger cable operators are seeing increased broadband subscriber churn and quarters of net subscriber losses.

Comcast is pushing hard to counter those perceptions and is already offering its X-Class Internet tiers, which offer symmetrical speeds of 2 Gbps in Atlanta, Colorado Springs, and Philadelphia. Additional cities are expected to roll out these service tiers in 2024. Comcast’s use of full-duplex DOCSIS 4.0 (FDX), including brand new CPE using Broadcom’s D4.0 silicon in a two-box configuration. Later this year, we expect to see a combined gateway that also incorporates Wi-Fi 7, as Comcast looks to battle back against FTTH providers by providing the most advanced residential gateway to customers.

Meanwhile, in 2024, Charter’s Remote PHY and vCMTS rollouts will kick into high gear. (At the time of this publication, we are awaiting fourth quarter earnings from both Harmonic and Vecima, the announced RPD partners for Charter’s buildout to determine how much equipment the operator purchased in advance of this significant deployment.) For Charter, which is employing Extended Spectrum DOCSIS 4.0, 2024 will also bring much wider availability of 1.8 GHz amplifiers and taps, as well as a choice of CPE with dedicated silicon for ESD, as well as silicon that combines both FDX and ESD variants.

Charter will likely also announce additional vendors for its upgrade efforts, as the operator has been public about its desire for a multi-vendor environment.

Cox will also begin rolling out 1.8 GHz amplifiers this year but, like Charter, will likely run those at 1.2 GHz until taps and CPE become more widely available.

Meanwhile, for those operators that weren’t part of the initial DOCSIS 4.0 Joint Development Agreement (JDA) with Broadcom (and for some of those who were), DOCSIS 3.1 Plus is quickly becoming an important stopgap measure to help increase throughput within the existing DOCSIS 3.1 framework by leveraging additional OFDM channels. Operators can either use existing integrated CCAP chassis (with either legacy line cards supporting 3 OFDM blocks or newer cards supporting 4 OFDM blocks) or vCMTS platforms. This can be combined with either DOCSIS 4.0 modems or modems designed specifically for D3.1 Plus deployments, which won’t require the additional gain amplifier (and cost) needed for full DOCSIS 4.0.

While it remains to be seen which type of CPE operators deploying DOCSIS 3.1 Plus will move forward with, the fact that there is significant interest in the technology means that there will now be additional operators who will likely move on from DOCSIS 4.0 and instead buy themselves time with DOCSIS 3.1 Plus before moving forward with fiber overbuilds. The biggest question here is just how many operators will do so.

As Light Reading previously reported, Broadcom and MaxLinear are working on new D3.1 chipsets that can beef up downstream capacity and speed through the support of additional OFDM (orthogonal frequency-division multiplexing) channels. Some operators are likewise exploring the deployment of new D4.0 modems on their D3.1 networks to achieve similar capacity gains.

That approach could extend the life of DOCSIS 3.1 networks, delay D4.0 upgrades or become an interim step before a future leap to fiber-to-the-premises. But it’s still not clear how many operators will pursue this path.

Heynen expects to see additional FTTH deployments—both greenfield and overbuild—by cable operators around the world. Whether using Remote OLT platforms or more traditional OLT platforms, cable operators will take advantage of work being done at CabeLabs to standardize the integration of ITU-T PON recommendations into existing DOCSIS management frameworks. This will make it far easier for MSOs (aka Cablecos) to deploy XGS-PON, as well as 25GS-PON and, potentially 50G- and 100G-PON.

XGS-PON to Dominate Fiber Spend This Year:

The PON equipment market will be the most dynamic this year, with tier 1 operators besides of BT OpenReach and Deutsche Telekom, all continuing to better align their inventories with anticipated subscriber growth, as well as reduced homes passed goals. For larger tier 1s, the short-term reduction in homes passed goals will ultimately give way to a renewed construction phase beginning in 2025 that should propel the overall PON market through the end of the decade.

But while the tier 1s slow, there will be no slowing the continued efforts by tier 2 and tier 3 operators in both North America and Europe to both upgrade and expand their fiber networks. In fact, the same dynamic that played out in North America in 2023 will likely repeat in 2024, as tier 2, tier 3, utilities, municipalities, and co-ops all continue their buildouts.

The technology beneficiary will be XGS-PON, which already surpassed 2.5 Gbps GPON revenue back in 2022, but will more than double it in 2024. And in markets where operators are beginning to see cable operators deliver symmetric 2 Gbps services, there is a strong chance they will also sprinkle in some 25GS-PON to comfortably deliver symmetric 5-10 Gbps services.

Meanwhile in China, which is expected to show a marked decline in new OLT port shipments in 2023, will likely see another decline until 50G-PON rollouts begin in earnest later this decade. On the flip side, ONT unit shipments in China are expected to increase as FTTR (Fiber to the Room) deployments expand, delivering 2-3 ONTs per home as opposed to the traditional architecture of using a single ONT to terminate fiber.

Wi-Fi 7 Progress Will Accelerate:

With the Wi-Fi Alliance recently announcing the opening of certification testing for Wi-Fi 7 products, don’t be surprised to see dozens of Wi-Fi 7 residential routers and broadband CPE models being deployed by operators by the end of this year. Early gateway models, though pricey, have already been introduced to the market and will become much more widely available this Spring, and then well before the Holiday season. As of our July 2023 forecast, we expect over 2.5 million residential Wi-Fi routers and broadband gateways to ship in 2024, though we are undoubtedly increasing this forecast based on the certification testing opening up.

Operators can’t wait to deploy Wi-Fi 7 products to help differentiate themselves in increasingly crowded broadband markets and to eliminate much of the confusion in the market with the coexistence of Wi-Fi 6 and Wi-Fi 6E.

References:

2024 Outlook: Broadband Market Faces Challenge Amidst Lower Spending from 2023

https://www.lightreading.com/broadband/broadband-equipment-spending-to-dip-again-in-2024-dell-oro

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

MTN Consulting: Top Telco Network Infrastructure (equipment) vendors + revenue growth changes favor cloud service providers

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: Worldwide Telecom Equipment Market Growth +3% in 2022; MTN: +2% Network Infrastructure Growth in 2022

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Taiwan’s ITRI integrates virtual and real technologies on display at CES 2024

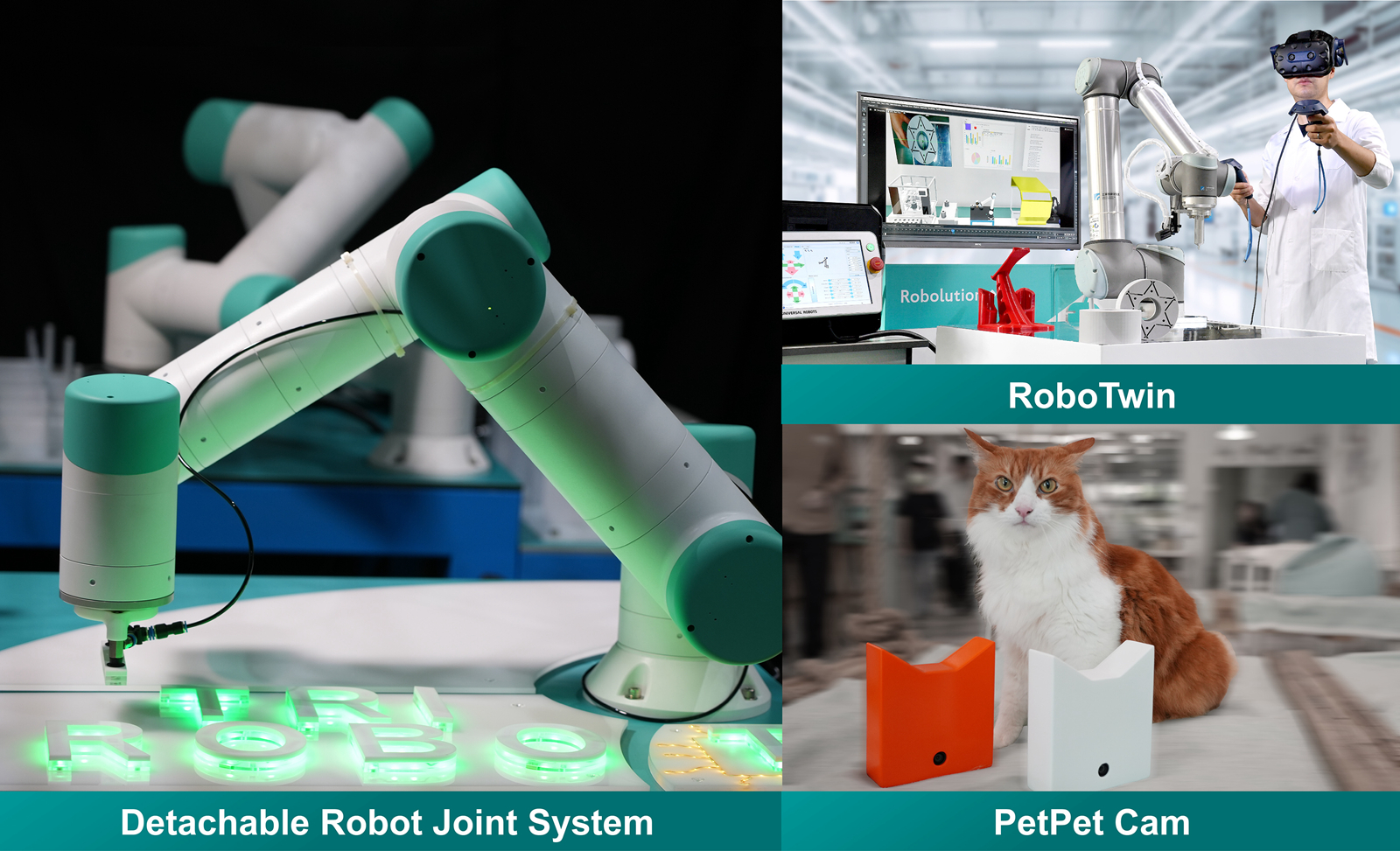

Major international manufacturers such as NVIDIA, Meta, and Microsoft are actively building a new generation virtual ecosystem. With the support of the Industrial Technology Department of the Ministry of Economic Affairs, ITRI (Taiwan’s largest high-tech applied research institutions) has continued to develop an interactive experience that integrates virtual and real, and launched its first interactive experience at the US Consumer Electronics Show (CES 2024).

ITRI announced the introduction of AI-incorporating display and entertainment technologies along with robotics innovations at CES 2024. ITRI presented 10 groundbreaking innovations spanning AI robotics, smart sports, digital health, and AI display and entertainment.

ITRI partnered with Lianjia Optoelectronics, a major automotive LED module manufacturer, to launch a “high-fidelity 3D interactive system ” to seize 3D entertainment business opportunities.

Director of Market Research at the Consumer Technology Association (CTA), Jessica Boothe, praised ITRI’s exhibits for embodying the CES 2024 trends of AI, sustainability, and inclusivity. Expressing her enthusiasm, Boothe highlighted one of the showcased innovations, the Hyper-realistic 3D Interactive System, which was poised to launch a collaboration with Excellence Optoelectronics Inc. (EOI), a prominent automobile LED module manufacturer.

“I must say, very exciting showcase this year. We find everything to be on-trend. The CES 2024 trends were predicted to be AI, sustainability, and inclusivity. And we have all of that right here in your booth,” remarked Boothe. “We’re really excited that ITRI has been here since 2017. As we’re celebrating CTA’s 100-year anniversary, it’s nice to say that we have exhibitors like ITRI coming back every year to CES, and we continue to see ITRI continue to innovate,” she added.

“CES is the most influential tech event in the world, and this is the eighth time ITRI has participated,” said ITRI President Edwin Liu. “To be at CES, we have two main purposes: to showcase ITRI on the global stage and to provide our team with valuable exposure to the latest advancements worldwide. Through CES, ITRI is opening up even more collaboration opportunities, engaging with potential investors, and exploring tech licensing and ventures,” he added.

“ITRI has worked on smart interactive display technology for years, and our collaboration with EOI on the Hyper-Realistic 3D Interactive Display is one of the best successes. This also allows us to strategically deploy diversified product lines in Taiwan, the United States, and Europe,” said President Liu. ITRI also promoted the Institute’s strategic partnerships with Light Matrix and its investor ADATA Technology on iGolfPutter, an intelligent interactive golf simulator. Utilizing Light Matrix’s smart sports training and teaching system called SyncShot360 in iGolfPutter, targeting the global sports technology market. Notably, iGolfPutter has been named by Forbes Magazine as one of the technologies to look for at CES 2024.

EOI Chairman, Dr. Kuohsin Huang, elaborated on their collaboration project with ITRI, stating, “Unlike traditional methods relying on multiple cameras, the Hyper-realistic 3D Interactive System (ChartBox) can generate a personal, interactive 3D digital avatar from a 2D photograph. This 2D-to-3D process integrates various technologies, including real-time image matting, backside model generation, expression changes, natural speech, AI response, and facial recognition.” He added, “Furthermore, its next-generation display technology positions EOI to enter the new market of audio-video entertainment and artistic performances.”

Simon Chen, Chairman of ADATA, emphasized, “Beyond our commitment to providing top-notch memory solutions, ADATA is venturing into cutting-edge sports technology through cross-industry collaboration. Our goal is to offer an optimal training environment for athletes and an innovative experience for spectator sports. Leveraging ADATA’s well-established global distribution channels, we can actively promote Taiwan’s sports industry on the international stage.”

Commenting on iGolfPutter and SyncShot360, Light Matrix CEO Joe Chen said, “The combination of fast 3D modeling, volumetric capture, and virtual-real fusion in the metaverse creates never-before-seen services that the sports and art industry would love. Our volumetric view technology, born out of collaboration with ITRI, allows for a more precise, 360-degree intelligent analysis of golf and other sports. It holds the promise of applications in sporting events and stage performances, setting an excellent foundation for future expansion in the global market.”

From left to right in the above photo are Lin Zhaoxian, vice president of ITRI and director of the International Institute of Obstetrics and gynecology, Liu Wenxiong, president of ITRI, Huang Guoxin, chairman of Lianjia Optoelectronics, and Huang Fangyu, general manager of Lianjia Optoelectronics.

About ITRI:

Industrial Technology Research Institute (ITRI) is one of the world’s leading technology R&D institutions aiming to innovate a better future for society. Founded in 1973, ITRI has played a vital role in transforming Taiwan’s industries from labor-intensive into innovation-driven. To address market needs and global trends, it has launched its 2035 Technology Strategy and Roadmap that focuses on innovation development in Smart Living, Quality Health, Sustainable Environment, and Resilient Society.

Over the years, ITRI has been dedicated to incubating startups and spinoffs, including well-known names such as UMC and TSMC. In addition to its headquarters in Taiwan, ITRI has branch offices in the U.S., Europe, and Japan in an effort to extend its R&D scope and promote international cooperation across the globe. For more information, please visit https://www.itri.org/eng.

References:

ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

DISH Wireless Awarded $50 Million NTIA Grant for 5G Open RAN Center (ORCID)

DISH Wireless, a subsidiary of EchoStar, was awarded a historic $50 million grant from the U.S. Department of Commerce’s National Telecommunications and Information Administration (NTIA) to establish the Open RAN Center for Integration & Deployment (ORCID). ORCID will allow participants to test and validate their hardware and software solutions (RU, DU and CU) against a complete commercial-grade Open RAN network deployed by DISH.

“The Open RAN Center for Integration and Deployment (ORCID) will serve a critical role in strengthening the global Open RAN ecosystem and building the next generation of wireless networks,” said Charlie Ergen, co-founder and chairman, EchoStar. “By leveraging DISH’s experience deploying the world’s first standalone Open RAN 5G network, ORCID will be uniquely positioned to test and evaluate Open RAN interoperability, performance and security from domestic and international vendors. We appreciate NTIA’s recognition of DISH and ORCID’s role in driving Open RAN innovation and the Administration’s ongoing commitment to U.S. leadership in wireless connectivity.”

To date, this grant represents NTIA’s largest award under the Public Wireless Supply Chain Innovation Fund (Innovation Fund). ORCID will be housed in DISH’s secure Cheyenne, Wyoming campus and will be supported by consortium partners Fujitsu, Mavenir and VMware by Broadcom and technology partners Analog Devices, ARM, Cisco, Dell Technologies, Intel, JMA Wireless, NVIDIA, Qualcomm and Samsung.

NTIA Administrator Alan Davidson and Innovation Fund Director Amanda Toman will join EchoStar Co-Founder and Chairman Charlie Ergen, EchoStar CEO Hamid Akhavan, EVP and Chief Network Officer Marc Rouanne and other stakeholders to announce the grant and tour a DISH 5G Open RAN cell site later today in Las Vegas. Mr. Davidson announced the award, part of an almost $80 million allocation under the administration’s Public Wireless Supply Chain Innovation Fund, at an event staged at a Dish open RAN 5G cell site.

“Just a few firms today provide the full set of radios and computers that power mobile phones, and some of those equipment vendors pose national security risks to the US and our allies around the world,” Davidson said. “The result is that we have a wireless equipment market where costs are high, resilience is low and American companies are increasingly shut out.”

During this event, DISH will outline ORCID’s unique advantages, including that it will leverage DISH’s experience as the only operator in the United States to commercially deploy a standalone Open RAN 5G network. DISH and its industry partners have validated Open RAN technology at scale across the country; today DISH’s network covers over 246 million Americans nationwide.

At ORCID, participants will be able to test and evaluate individual or multiple network elements to ensure Open RAN interoperability, performance and security, and contribute to the development, deployment and adoption of open and interoperable standards-based radio access networks. ORCID’s “living laboratory” will drive the Open RAN ecosystem — from lab testing to commercial deployment.

Highlights of ORCID:

- ORCID will combine both lab and field testing and evaluation activities. ORCID will be able to test elements brought by any qualified vendor against DISH’s live, complete and commercial-grade Open RAN stack.

- ORCID will use DISH’s spectrum holdings, a combination of low-, mid- and high-band frequencies, enabling field testing and evaluation.

- ORCID will evaluate Open RAN elements through mixing and matching with those of other vendors, rather than validating a single vendor’s stack. DISH’s experience in a multi-vendor environment will give ORCID unique insights about the integration of Open RAN into brownfield networks.

- ORCID’s multi-tenant lab and field testing will occur in DISH’s secure Cheyenne, Wyoming facility, which is already compliant with stringent security protocols in light of its satellite functions.

About DISH Wireless:

DISH Wireless, a subsidiary of EchoStar Corporation, is changing the way the world communicates with the Boost Wireless Network. In 2020, the company became a nationwide U.S. wireless carrier through the acquisition of Boost Mobile. The company continues to innovate in wireless, building the nation’s first virtualized, Open RAN 5G broadband network, and is inclusive of the Boost Infinite, Boost Mobile and Gen Mobile wireless brands.

SOURCE: DISH Network Corporation

References:

Dish Network to FCC on its “game changing” OpenRAN deployment

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Wireless with Qualcomm Technologies and Samsung test simultaneous 5G 2x uplink and 4x downlink carrier aggregation

Justice Dept approves the “New T-Mobile” via Sprint merger; Dish Network becomes 4th U.S. wireless carrier with focus on 5G

“SK Wonderland at CES 2024;” SK Group Chairman: AI-led revolution poses challenges to companies

On Tuesday at CES 2024, SK Group [1.] displayed world-leading Artificial Intelligence (AI) and carbon reduction technologies under an amusement park concept called “SK Wonderland.” It provided CES attendees a view of a world that uses the latest AI and clean technologies from SK companies and their business partners to a create a smarter, greener world. Highlights of the booth included:

- Magic Carpet Ride in a flying vehicle embedded with an AI processor that helps it navigate dense, urban areas – reducing pollution, congestion and commuting frustrations

- AI Fortune Teller powered by next-generation memory technologies that can help computers analyze and learn from massive amounts of data to predict the future

- Dancing Car that’s fully electric, able to recharge in 20 minutes or less and built to travel hundreds of miles between charges

- Clean Energy Train that’s capable of being powered by hydrogen, whose only emission is water

- Rainbow Tube that shows how plastics are finding a new life through a technology that turns waste into fuel

Note 1. SK Group is South Korea’s second-largest conglomerate, with Samsung at number one.

SK’s CES 2024 displays include participation from seven SK companies — SK Inc., SK Innovation, SK Hynix, SK Telecom, SK E&S, SK Ecoplant and SKC. While the displays are futuristic, they’re based on technologies that SK companies and their global partners have already developed and are bringing to market.

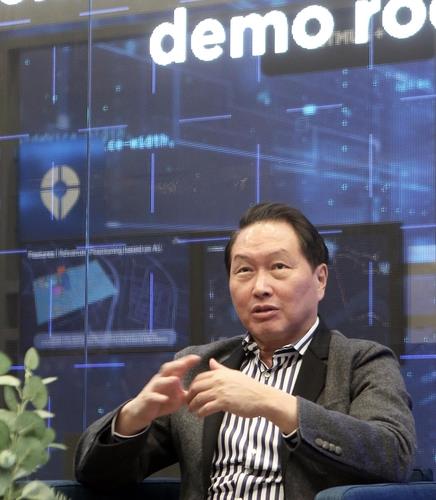

SK Group Chairman Chey Tae-won said that companies are facing challenges in navigating the transformative era led by artificial intelligence (AI) due to its unpredictable impact and speed. He said AI technology and devices with AI are the talk of the town at this year’s annual trade show and companies are showcasing their AI innovations achieved through early investment.

“We are on the starting line of the new era, and no one can predict the impact and speed of the AI revolution across the industries,” Chey told Korean reporters after touring corporate booths on the opening day of CES 2024 at the Las Vegas Convention Center in Las Vegas. Reflecting on the rapid evolution of AI technologies, he highlighted the breakthrough made by ChatGPT, a language model launched about a year ago, which has significantly influenced how AI is perceived and utilized globally. “Until ChatGPT, no one has thought of how AI would change the world. ChatGPT made a breakthrough, and everybody is trying to ride on the wave.”

SK Group Chairman Chey Tae-won speaks during a brief meeting with Korean media on the sidelines of CES 2024 at the Las Vegas Convention Center in Las Vegas on Jan. 9, 2024

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

SK Hynix Inc., SK Group’s chipmaking unit, is one of the prominent companies at CES 2024, boasting its high-performance AI chips like high bandwidth memory (HBM). The latest addition is the HBM3E chips, recognized as the world’s best-performing memory product. Mass production of HBM3E is scheduled to begin in the first half of 2024.

SK Telecom Co. is also working on AI, having Sapeon, an AI chip startup under its wing. Chey stressed the importance of integrating AI services and solutions across SK Group’s diverse business sectors, ranging from energy to telecommunications and semiconductors. “It’s crucial for each company to collaborate and present a unified package or solution rather than developing them separately,” Chey said. “But I don’t think it is necessary to set up a new unit for that. I think we should come up with an integrated channel for customers.”

SK Telecom and Deutsche Telekom are jointly developing Large Language Models for generative AI to be used by telecom network providers.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://en.yna.co.kr/view/AEN20240110001900320#

https://eng.sk.com/news/ces-2024-sk-to-showcase-world-class-carbon-reduction-and-ai-technologies

SK Telecom inspects cell towers for safety using drones and AI

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific Large Language Models (LLMs)

SK Telecom and Thales Trial Post-quantum Cryptography to Enhance Users’ Protection on 5G SA Network

Neos Networks launches 10Gbps Managed Dedicated Internet Access (DIA)

UK business network operator Neos Networks today announced a major upgrade of its Managed Dedicated Internet Access (Managed DIA) service to provide capacities up to 10Gbps as standard. Previously available up to 1Gbps, the upgrade provides a fully managed, enterprise-grade fibre solution for UK organisations grappling with ever-increasing bandwidth demand and the need for reliable access to the internet.

The latest upgrade means Neos Networks customers across the UK can access the same bandwidths across its Wires-only DIA, and Managed DIA variants, with a clearer upgrade path. The upgrade also promises to simplify the hardware and support available for customers. Neos Networks manages both the maintenance and break/fix of the router, meaning the customer’s network or IT team can focus on other areas of their business.

Neos Networks’ extensive network infrastructure underpins the UK’s digital economy, powering the UK’s critical infrastructure, and connecting public services, telcos and enterprises of all shapes and sizes. This latest upgrade gives such organisations more flexible and scalable options to meet their unique connectivity needs. Devices are monitored and managed 24/7 by Neos, and the service is also optimised for reduced energy consumption and rack space when combined with services such as Neos Networks access tails.

The UK’s connectivity demands are continuously increasing, spurred by ongoing digital transformation and new technology like 5G, IoT and artificial intelligence. In 2020, Neos Networks launched a 10Gbps Wires-only DIA service in readiness for this increasing customer demand. This latest upgrade of Managed DIA means customers who are currently making use of a large number of 1Gbps circuits can look to scale their bandwidth as part of the same service. Neos is making this easier than ever and is poised to deliver across UK telcos, enterprises and critical and national infrastructure.

Mark Charlesworth, Director of Product, at Neos Networks, said: “Our continued investment in our business internet proposition means Neos Networks is now able to provide the same scalable bandwidth across a range of different service models throughout the UK. This provides a much-simplified upgrade path for customers with increasing bandwidth requirements, delivering the level of service they need in a flexible and scalable way”.

Through Managed DIA, Neos Networks steps closer to the customer’s environment, beyond a traditional wholesale fibre infrastructure role. This includes more proactive monitoring, and advanced analytics to support network maintenance and availability. With the impact of the loss of service only becoming more critical for organisations across the UK, Neos Networks’ MPLS core network also ensures that services via Managed DIA are highly resilient.

Neos Networks offers a Managed DIA service supported by 24/7 technical assistance, providing businesses with a broad selection of last-mile connectivity providers, along with diverse and resilient options. The strength of this service lies in Neos Networks’ extensive network coverage, which includes more than 676 high-speed Ethernet Points of Presence across the nation. This expansive reach enhances the quality of its DIA services, ensuring businesses have reliable access. Importantly, all traffic to and from a business’s network is securely transported over Neos Networks’ robust network and IP platform. This guarantees instantaneous access and a high-quality service experience, making it an ideal choice for businesses with data-intensive, real-time applications.

References:

Neos Networks launches 10Gbps Managed Dedicated Internet Access

Nokia and CityFibre sign 10 year agreement to build 10Gb/second UK broadband network

STELLAR Broadband offers 10 Gigabit Symmetrical Fiber Internet Access in Hudsonville, Michigan

Orange España: commercial deployment of 10 Gbps fiber in 5 cities

Comcast launches symmetrical 10-Gigabit speeds over Ethernet FTTP

Comcast demos 10Gb/sec full duplex with DOCSIS 4.0; TDS deploys symmetrical 8Gb/sec service

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

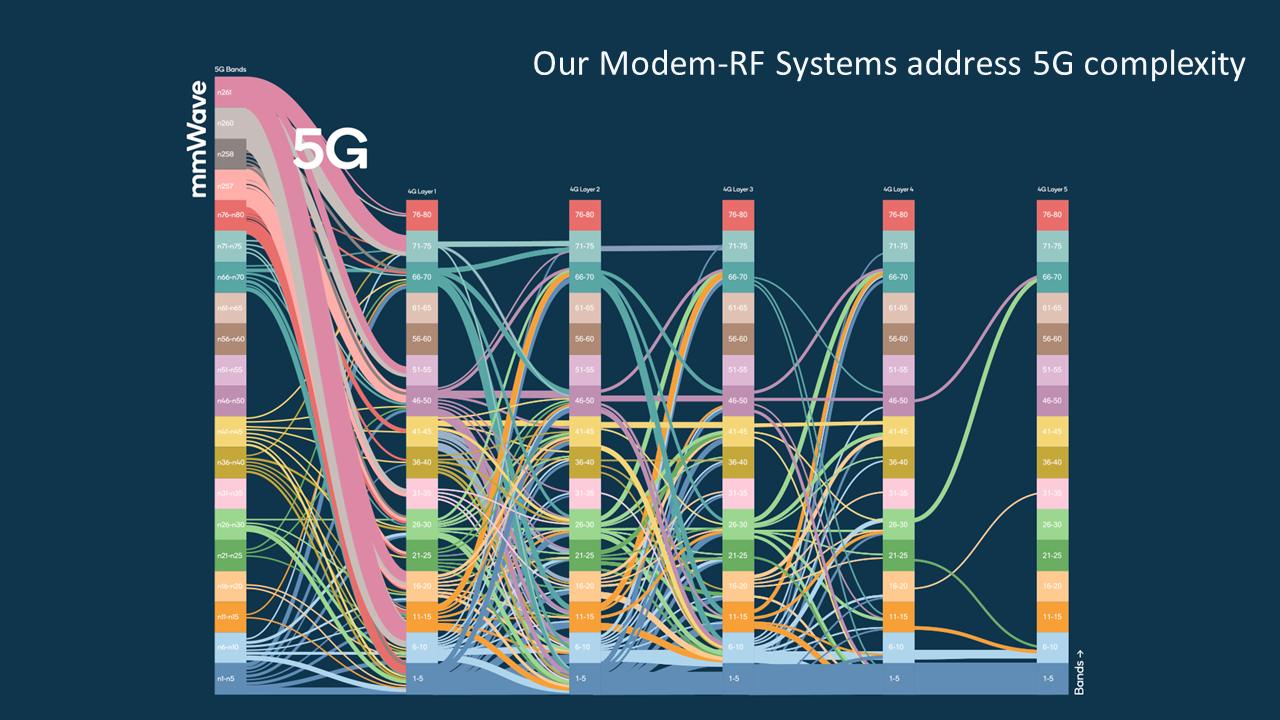

T-Mobile US, in a partnership with Ericsson and Qualcomm Technologies, has successfully tested the aggregation of six component carriers in sub-6 GHz spectrum in its live production 5G network.

The test involved aggregating two channels of 2.5 GHz, two channels of PCS spectrum and two channels of AWS spectrum, according to T-Mobile US, which produced an “effective 245 MHz of aggregated 5G channels.”

T-Mo said that they were able to “achieve download speeds of 3.6 Gbps in sub-6 GHz spectrum. That’s fast enough to download a two-hour HD movie in less than 7 seconds!”

5G carrier aggregation allows T-Mobile to combine multiple 5G channels (or carriers) to deliver greater speed and performance. In this test, the Un-carrier merged six 5G channels of mid-band spectrum – two channels of 2.5 GHz Ultra Capacity 5G, two channels of PCS spectrum and two channels of AWS spectrum – creating an effective 245 MHz of aggregated 5G channels.

Image Courtesy of Qualcomm Technologies

“We are pushing the boundaries of wireless technology to offer our customers the best experience possible,” said Ulf Ewaldsson, President of Technology at T-Mobile. “With the first and largest 5G standalone network in the country, T-Mobile is the only mobile provider serving 10s of millions of customers to unleash new capabilities like 5G carrier aggregation nationwide, and I am so incredibly proud of our team for leading the way.”

T-Mobile US announced in May of 2023 that it was rolling out four component-carrier aggregation across its 5G Standalone network, which it said at the time can achieve peak speeds of 3.3 Gbps. In that case, T-Mobile US relies on two 2.5 GHz channels, one 1.9 GHz channel and one 600 MHz channel. The first device able to access 4CA capabilities was the Samsung Galaxy S23.

The carrier also touted its testing of five-component-carrier aggregation in sub-6 GHz spectrum at last year’s Mobile World Congress Barcelona. In that trial, working with Nokia and Qualcomm, T-Mo aggregated two FDD and three TDD carriers and achieved peak downlink throughput speeds that exceeded 4.2 Gbps.

T-Mobile claims to be the leader in 5G, delivering the country’s largest, fastest and most awarded 5G network. The Un-carrier’s 5G network covers more than 330 million people across two million square miles — more coverage area than AT&T and Verizon combined. 300 million people nationwide are covered by T-Mobile’s super-fast Ultra Capacity 5G with over 2x more square miles of coverage than similar offerings from the Un-carrier’s closest competitors.

References:

https://www.ericsson.com/en/ran/carrier-aggregation

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

T-Mobile combines Millimeter Wave spectrum with its 5G Standalone (SA) core network

Verizon, T-Mobile and AT&T brag about C-band 5G coverage and FWA

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

T-Mobile US at “a pivotal crossroads” CEO says; 5,000 employees laid off

Ookla Q2-2023 Mobile Network Operator Speed Tests: T-Mobile is #1 in U.S. in all categories!

T-Mobile and Google Cloud collaborate on 5G and edge compute

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

T-Mobile US today said that SpaceX launched a Falcon 9 rocket on Tuesday with the first set of Starlink satellites that can beam phone signals from space directly to smartphones. The U.S wireless carrier will use Elon Musk-owned SpaceX’s Starlink satellites to provide mobile users with network access in parts of the United States, the companies had announced in August 2022. The direct-to-cell service at first will begin with text messaging followed by voice and data capabilities in the coming years, T-Mobile said. Satellite service will not be immediately available to T-Mobile customers; the company said that field testing would begin “soon.”

/cloudfront-us-east-2.images.arcpublishing.com/reuters/73PVHSXKT5LIHDTFDWHUSDQTL4.jpg)

SpaceX plans to “rapidly” scale up the project, according to Sara Spangelo, senior director of satellite engineering at SpaceX. “The launch of these first direct-to-cell satellites is an exciting milestone for SpaceX to demonstrate our technology,” she said.

Mike Katz, president of marketing, strategy and products at T-Mobile, said the service was designed to help ensure users remained connected “even in the most remote locations”. He said he hoped dead zones would become “a thing of the past”.

Other wireless providers across the world, including Japan’s KDDI, Australia’s Optus, New Zealand’s One NZ, Canada’s Rogers will collaborate with SpaceX to launch direct-to-cell technology.

References:

https://www.theguardian.com/science/2024/jan/03/spacex-elon-musk-phone-starlink-satellites

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Could Transpositional Modulation be used to solve the “spectrum crunch” problem

Transpositional Modulation (TM) permits a single carrier wave to simultaneously transmit two or more signals, unlike other modulation methods. It does this without destroying the integrity of the individual bit streams.

TM Technologies (TMT) is a wireless technology company offering dramatic data throughput increases for existing wireless and wired networks, using TM.

TMT’s In Band Full Duplex (IBFD) is a MIMO-compatible antenna and software technology providing signal interference cancellation via its Adaptive-Array Antenna which allows simultaneous transmit and Receive = Doubling Data Rates. TM-IBFD development has shown a combined 120 db noise reduction in two-way communications, which provides up to a 100% gain in wireless data transport efficiency.

TMT believes that the use of its patented methods can prevent or delay the onset of a wireless “bandwidth crunch” and focuses on developing products for a range of applications. These products will use core technology to provide solutions and create value for customers, the economy, and the global wireless infrastructure. The company says that the TM-IBFD is backwards compatible and complimentary with existing beam forming or beam shaping installations.

Image Courtesy of TM Technologies (TMT)

……………………………………………………………………………………………………………………………………..

Using the latest Xilinx RFSoC devices, TMT has produced a Software Defined Radio (SDR) format with OFDM as primary modulation with multiple TM channel overlays. This is applicable to nearly any access or backhaul radio device with adequate head-space and operating within the 3GPP Rel 16 specifications.

Industry analyst Jeff Kagan wrote: “Spectrum shortage remains a problem that is not going to solve itself. That’s why new solutions like this are necessary….In the case of solving this spectrum crisis, there are two different groups to focus on. One, is the wireless carriers. Two, are wireless network builders. Either, the customer, which is the wireless network needs to demand this from their network builders. Or the network builders need to embrace this as a competitive advantage and as a solution to their customers.”

Jeff Kagan

References:

Kagan: Could TM Technologies help solve wireless spectrum shortage?

IEEE 5G/6G Innovation Testbed for developers, researchers and entrepreneurs

Courtesy of IEEE member David Witkowski (see his bio below the article):

David’s career began in the US Coast Guard where he led deployment and maintenance programs for mission-critical telecom, continuity of government, and data networking systems. After earning his B.Sc. in Electrical Engineering from University of California @ Davis, he held managerial and leadership roles for high technology companies ranging from Fortune 500 multi-nationals to early-stage startups.

David serves as Executive Director of the Civic Technology Program at Joint Venture Silicon Valley, Senior Advisor for Broadband at Monterey Bay Economic Partnership, and is a Fellow of the Radio Club of America and a Senior Member of the IEEE. He previously served as as Co-Chair of the GCTC Wireless SuperCluster at NIST, on the Board of Expert Advisors for the California Emerging Technology Fund.

David’s IEEE activities include:

-

Co-Chair of the Deployment Working Group at IEEE Future Networks (FNTC)

-

Life Member of the IEEE Microwave Theory and Techniques Society (MTT-S)

-

Member of the IEEE International Committee on Electromagnetic Safety (ICES)

-

Member of the IEEE Committee on Man and Radiation (COMAR)