Forbes: Cloud is a huge challenge for enterprise networks; AI adds complexity

Survey data and discussions with enterprise networking professionals reveal they are still grappling with many networking issues spawned by the expansion of the cloud – the most common of which include securing connections for remote work, implementing zero-trust security strategies, and integrating myriad cloud and wide-area networks (WANs).

For example, in Futuriom’s latest survey of 196 enterprise IT and networking professionals, more than 80% said the complexity of connecting the wide variety of networks was a large challenge. At nearly 70% of responses, expertise and knowledge was the second-largest challenge (multiple responses were allowed), and cost was cited by 60%. Please refer to survey highlights below.

Contributing to that complexity is the ephemeral nature of both cloud connectivity and hybrid work. Workers are now moving around more than ever, and cloud services can change and scale nearly every day (or minute).

Survey Highlights:

- Survey respondents indicate strong demand for SD-WAN and SASE managed services. Our survey data and discussions with end users indicate that SD-WAN/SASE technology helps professionals with network and security challenges, including the growing complexity created by distributed applications, cloud connectivity, and sprawling security risks.

- Managing network complexity is the largest challenge driving managed services demand. When asked about the largest challenges in managing WANs, 85% of respondents identified complexity, followed by expertise and knowledge (68%). Rounding out the responses were cost (60%) and time (47%). (Multiple responses were allowed.)

- Hybrid work and the need for zero-trust network access (ZTNA) are key drivers of SD-WAN/SASE technology. In the survey, 98% of respondents said that hybrid work has increased demand for SASE and ZTNA. When we asked respondents if ZTNA is a crucial component of SASE and SD-WAN offerings, 92% said yes.

- Hybrid (cloud/edge deployment) and single-pass architectures will be important components of SASE/SD-WAN services going forward. When respondents were asked if they wanted a hybrid solution that can accommodate networking and security both on premises and using cloud points of presence (PoPs), 98% said yes. In addition, 94% of respondents said they prefer a single-pass architecture.

- There will continue to be a diversity of SD-WAN/SASE deployment models. The two most popular models for deployment are best-of-breed combination (34%) and single-vendor (23%), but survey results show a wide diversity of deployment models.

AI increases complexity as enterprises need to figure out how to store, connect, and move their data in hybrid clouds that will leverage AI.

This complexity, along with the rapid shift to hybrid work spurred by COVID, has triggered a wave of innovation in networking – perhaps more innovation than we have seen in decades. Startups are drawing large funding rounds. Best-of-breed established networking players such as Arista Networks, Extreme Networks, Juniper Networks, and HPE are building new networking and security products and chipping away at the market share of market leader Cisco. Cisco is responding in kind. Sources tell me they think Cisco’s acquisition of Valtix may be the most interesting in years.

All of this sets the stage for the most dynamic networking environment I’ve seen in decades. And it’s only going to get more interesting, as the AI and hybrid work wave makes networking more crucial.

The melding of security and networking remains hot. In the software-defined networking (SD-WAN) and Secure Access Service Edge market, potential Initial Public Offering (IPO) companies such as Aryaka Networks, Cato Networks, and Versa Networks are building our product suites to help secure remote workers and cloud connectivity. These companies will also help enterprises connect to cloud on-ramps and consolidate security functions with a SASE approach. Versa last October tanked up with $120 in funding in what it called a “pre-IPO round.”

Many of the cloud networking startups that are included in the Futuriom 50 list of promising cloud innovators are using this chaotic moment to shore up strategies, raise money — or both.

For example, just this week, cloud-native networking start-up Arrcus announced that Hitachi Ventures would invest additional capital, raising its Series D to $65 million before it closes. Arrcus says its Arrcus Connected Edge (ACE) platform will be more economical for cloud providers and service providers deploying services such as 5G and AI. It claims it is growing revenue 100% year-over-year.

Other cloud networking startups are also going after AI. DriveNets recently announced that its Network Cloud-AI solution, which uses cloud-based Ethernet-based networking to boost the performance of AI clouds, is in trials with major hyperscalers.

Cost optimization, one of the strongest themes of the year in cloud technology, is another focus for cloud networking players. Cloud networking pioneer Aviatrix has beefed up security and cost-optimization features and launched a distributed firewall to help enterprises reduce the costs of cloud networking infrastructure. Prosimo last week made an interesting play to get its application-layer cloud networking suite in the hands of more users by launching a free, introductory-level version of its product called MCN Foundation.

Yes, there is a trend to all these announcements. They are focused on return on investment (ROI) and cost savings. This is the right message for the era we are in. Enterprise tech planners not only want to shift to more flexible cloud-based services, they need to do so to save money.

For example, in its new product release, Prosimo said customers can achieve a 30%-50% reduction in total cost of ownership (TCO) by optimizing cloud network connectivity. With its distributed firewall, Aviatrix says network pros will save money by reducing the expense of additional firewall instances, which many enterprises must buy to support additional cloud connectivity and scaling. (But they may not want to stack firewall upon firewall into the cloud, which after all can function as a firewall itself.) DriveNets says its trials have reduced the idle time of AI clouds by as much as 30%.

Integrating all of this stuff isn’t easy either. That’s the value proposition of Itential, a plucky Georgia-based startup with a set of low-code automation tools that streamline networking for integrations in hybrid networking and cloud environments.

It’s no coincidence that the marketing messages have all shifted toward ROI, which is the mother’s milk of technology. It’s the reason we all use cloud-based software-as-a-service and iPhones instead of minicomputers and rotary dial phones. Innovation is about efficiency.

This makes me very optimistic about cloud networking – and the networking market in general. After decades of stagnation, the cloud has woken up the industry. In addition to innovation, there is also a surge in competition — which will put more efficient and affordable technology into the hands of the users.

References:

Networking Startups Jump On Cloud Costs And AI (forbes.com)

https://www.futuriom.com/articles/news/results-from-our-sd-wan-sase-managed-services-survey/2023/06

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

Allied Market Research: Global AI in telecom market forecast to reach $38.8 by 2031 with CAGR of 41.4% (from 2022 to 2031)

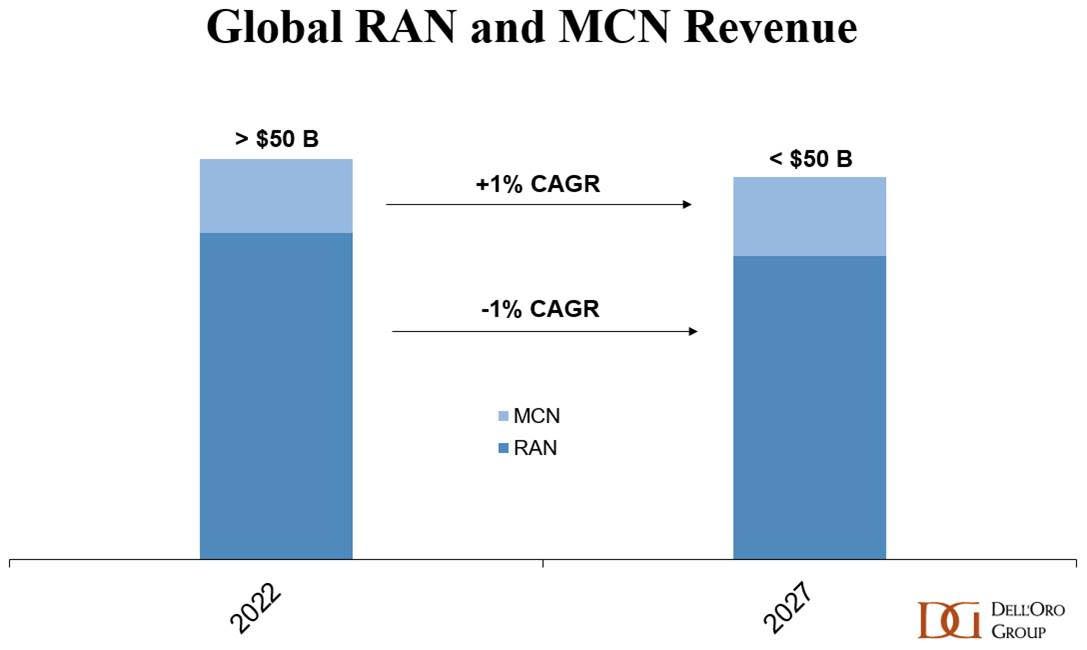

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

According to a newly published forecast report by Dell’Oro Group,the Radio Access Network (RAN) market is done expanding for now. Following the 40% to 50% ascent between 2017 and 2021, RAN revenues flattened out in 2022 and these trends extended to 1Q 2023.

“Even if it is early days in the broader 5G journey, the challenge now is the comparisons are becoming more challenging in the more mature 5G markets and the upside with the slower-to-adopt 5G regions is not enough to extend the growth streak,” said Stefan Pongratz, Vice President at Dell’Oro Group.

“Meanwhile, growth from new revenue streams including Fixed Wireless Access and enterprise LTE/5G is not ramping fast enough to change the trajectory. With 5G-Advanced not expected to trigger a new capex cycle, the question now is no longer whether RAN will grow. The question now is, rather, how much will the RAN market decline before 6G comes along?” Pongratz added.

Additional highlights from the Mobile RAN 5-Year July 2023 Forecast Report:

- Global RAN is projected to decline at a 1 percent CAGR over the next five years.

- The less advanced 5G regions are expected to perform better while the more developed 5G regions, such as North America and China, are projected to record steeper declines.

- LTE is still handling the majority of the mobile data traffic, but the focus when it comes to new RAN investments is clearly on 5G. Even with the more challenging comparisons, 5G is projected to grow another 20 percent to 30 percent by 2027, which will not be enough to offset steep declines in LTE.

- With mmWave comprising a low single-digit share of the RAN market and skepticism growing about the MBB business case, it is worth noting that our position has not changed. We still envision that the mmWave spectrum will play a pivotal role in the long-term capacity roadmap.

……………………………………………………………………………………………………………………….

Separately, Dell’Oro again lowered its forecasts for the Mobile Core Network market (which is now 5G SA core network), this time citing a slowdown in customer growth. It now predicts that the worldwide market for mobile core networks will expand at a CAGR of 1% over the next five years, having previously forecast a 2% CAGR as recently as January.

“We have reduced our forecast for the third consecutive time, primarily caused, this time, by an expected slowdown in subscriber growth,” said Dave Bolan, Research Director at Dell’Oro Group.

Dave said that Dell’Oro has reduced its expectations for the Multi-Access Edge Computing (MEC) market (which requires 5G SA core network). It now anticipates MEC will have a CAGR of 31%, noting that commercially-viable enterprise applications are taking much longer to come to fruition than many had hoped.

“Mobile Network Operators (MNOs) are concerned about inflation, a possible recession, and political conflicts. They are therefore being restrained in their capital expenditures, another factor weighing in on a more conservative forecast,” said Bolan. “As we continue refining our count of MNOs that have launched 5G Standalone (5G SA) eMMB networks, we note that only 4 MNOs have commercially deployed new 5G SA networks compared to six in the first half of 2022,” he added.

Additional highlights from the Mobile Core Network & Multi-Access Edge Computing 5-Year July 2023 Forecast Report:

- Year-over-year MCN revenue growth rates are projected to be flat in 2026 and turn negative in 2027.

- The North America and China regions are expected to have negative CAGRs, while Europe, Middle East, and Africa (EMEA), and Asia Pacific excluding China regions are expected to have the highest positive CAGRs.

Vodafone became one of those first-half 2023 launches, when it brought 5G Ultra to market in the UK in late June. In its latest Mobility Report, published around the same time, Ericsson noted that while around 240 telcos have launched commercial 5G services, only 35 of them have brought standalone 5G to market.

That should bode well for the mobile core market, and indeed it is faring better than the RAN space, in growth potential terms, at least.

Nonetheless, Dell’Oro predicts that year-on-year growth rates in mobile core network revenues will be flat by 2026 and turn negative the following year.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the RAN market by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 6 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group’s Mobile Core Network & Multi-Access Edge Computing 5-Year July Forecast Report offers a complete overview of the market for Wireless Packet Core including MEC for the User Plane Function, Policy, Subscriber Data Management, and IMS Core with historical data, where applicable, to the present. The report provides a comprehensive overview of market trends by network function implementation (Non-NFV and NFV), covering revenue, licenses, average selling price, and regional forecasts for various network functions. To learn more about this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

RAN Market to Decline at a 1 Percent CAGR Through 2027, According to Dell’Oro Group

Slower Subscriber Growth to Cut Mobile Core Network Market Growth, According to Dell’Oro Group

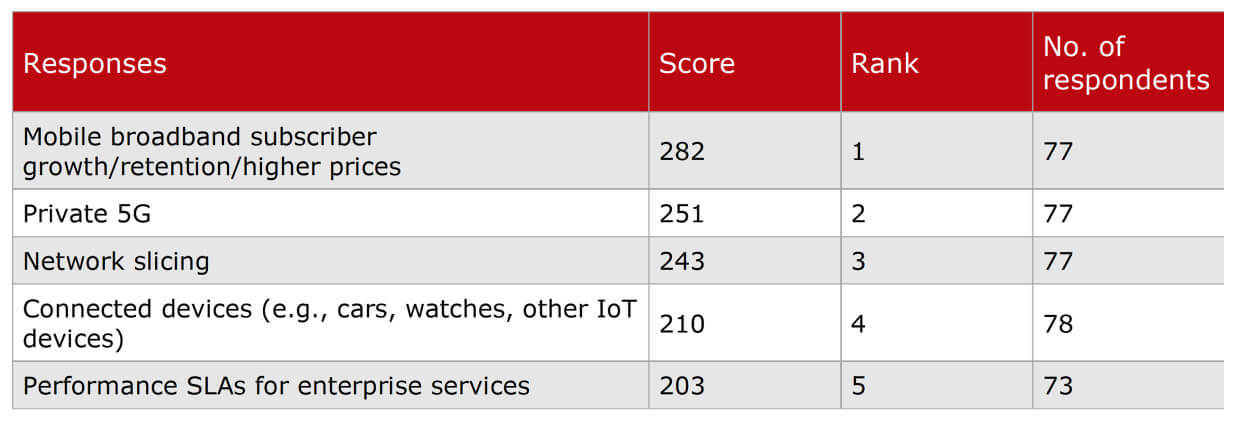

Heavy Reading Survey: 5G services require network automation

Heavy Reading’s 2023 5G Network Analytics and Automation Operator Survey aims to help the industry better understand the status of network analytics and automation and provide insights into operators’ strategies. (To download a copy, click here.) At the start of the survey, one question looks to understand which 5G services network operators believe to be the most valuable in supporting revenue growth.

Editor’s NOTE: It’s important to understand that ALL 5G SERVICES/FEATURES (such as network slicing) require a 5G SA core network rather than 5G NSA which uses 4G-LTE infrastructure for everything other than the 5G NR RAN.

……………………………………………………………………………………………………………………………

The table below shows the weighted average scores across several 5G services, with operators ranking “mobile broadband subscriber growth/retention/high prices” first and ahead of the other options.

Enhanced mobile broadband (eMBB) is the anchor service for 5G NSA and generates nearly all 5G revenue today. This scoring infers that operators are keen to grow their core businesses, which will involve greater efficiencies and new mobile packages that offer superior or premium features at an added cost.

“Private 5G” and “network slicing” rank second and third, respectively. Heavy Reading expects their importance and popularity to increase as additional operators deploy 5G SA and can support full autonomy. “Performance SLAs for enterprise services” is currently the lowest ranking (fifth) of all service choices but is likely to be a valuable market, especially for network slicing and private 5G.

“Connected devices (e.g., cars, watches, other IoT devices)” ranks just above performance SLAs in fourth. Internet of Things (IoT) is a sizeable market within 4G, but the massive machine-type communications (mMTC) use case has yet to be realized in 5G, as technologies such as RedCap remain underdeveloped.

Smaller network operators have a different opinion than larger operators on the revenue growth question.

For mobile operators with less than 9 million subscribers, private 5G ranks first. This result perhaps indicates that smaller operators feel they are already exploiting eMBB services and see little scope for further revenue growth with 5G SA.

Which services are the most attractive for 5G revenue growth in your organization? (Rank in order, where 1 = the most attractive)

Given the survey results above and the desire for operators to grow their revenue and retain customers, it is evident that automation will play a fundamental role in future 5G services underpinning cost efficiencies and quality of service. Service diversity and the 5G disaggregated cloud native infrastructure will mandate automation across the network (i.e., provisioning, testing, operation, fault resolution and maintenance), specifically for the following aspects:

Automated configuration: Automation tackles the scale and complexity of administration, management and lengthy configuration across large networks with multiple service solutions (e.g., private networks, network slicing, performance SLAs, etc.), offering significant time savings over manual effort.

- End-to-end 5G monitoring and visibility: 5G network visibility requires a dynamic and layered approach to monitor 5G cloud infrastructure, orchestration/containerized environments and the network domains and services. Service insights and SLA monitoring will be more granular. Examples include network slicing visibility per slice, user, session, location, etc., across KPIs like latency, jitter, packet drop and data rate.

- Network probes and testing: Active test agents provide near real-time visibility, making them better equipped to monitor dynamic cloud native environments and workload changes than more traditional reactive methods.

- Lifecycle and test management: Automated software deployment cycles (CI/CD) will be critical due to the increased cadence of software updates across virtual machines or cloud native deployments. In addition, automating network and service testing could enable the validation of services and configuration while assessing the perceived end-user quality of service.

- Artificial intelligence/machine learning (AI/ML): These technologies will contribute heavily to automated processes, optimization and efficiencies, with AIOps processes assuring the network and its services. For example, AI/ML can help forecast network resources, user mobility patterns, RAN optimization, security anomaly prevention, fault prediction, etc.

Operators are highly motivated to deliver advanced services and drive business growth and revenue to recoup the costs of their significant 5G spectrum and network investments. However, supporting a diverse and evolving portfolio of 5G network services will require automation to provide service visibility, efficiencies and network performance excellence.

References:

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

5G SA networks (real 5G) remain conspicuous by their absence

Swisscom, Ericsson and AWS collaborate on 5G SA Core for hybrid clouds

New IEEE 802.11bb standard to significantly boost LiFi market

The IEEE Standards Board has approved IEEE 802.11bb as the latest global light communications standard. The bb standard marks a significant milestone for the LiFi market, as it provides a globally recognized framework for deployment of LiFi technology.

IEEE 802,11, the working group which developed the Wi-Fi standards, formed the Light Communications 802.11bb Task Group in 2018, chaired by pureLiFi and supported by Fraunhofer HHI, two entities that have been at the forefront of LiFi development efforts. LiFi, which stands for “light fidelity,” is a wireless technology that uses light rather than radio frequencies to transmit data. Ratification of the standard was concluded in June 2023.

The IEEE 802.11bb standard defines the physical layer specifications and system architectures for wireless communication using light waves. This new standard sets the foundation for the widespread adoption of LiFi technology and paves the way for the interoperability of LiFi systems with the successful WiFi standard.

The technology has been in development for years now, but the lack of a globally-recognized standard to go with it means there has been little enthusiasm from OEMs to develop and commercialise LiFi-enabled products. That could all change now, thanks to the release of the official LiFi standard.

“The release of the IEEE 802.11bb standard is a significant moment for the wireless communications industry,” said Nikola Serafimovski, VP of standardisation at pureLiFi, in a statement on Wednesday.

LiFi is a wireless technology that uses light rather than radio frequencies to transmit data. By harnessing the light spectrum, LiFi can unleash faster, more reliable wireless communications with unparalleled security compared to conventional technologies such as WiFi and 5G. The Light Communications 802.11bb Task Group was formed in 2018 chaired by pureLiFi and supported by Fraunhofer HHI, two firms which have been at the forefront of LiFi development efforts. Both organisations aim to see accelerated adoption and interoperability not only between LiFi vendors but also with WiFi technologies as a result of these standardisation efforts.

Richard Webb, Director, Network Infrastructure at industry analyst firm CCS Insights, “The IEEE 802.11bb standard is an important milestone for LiFi technology placing LiFi as a complementary and integrated technology alongside the highly successful WiFi standard. This opens-up exciting new opportunities for LiFi to work seamlessly with WiFi and make communications better in a range of applications, from high-speed, secure internet access in the home and office to expanding next generation experiences to wider markets such as XR and spatial computing.”

“The release of the IEEE 802.11bb standard is a significant moment for the wireless communications industry,” said pureLiFi’s VP of Standardisation, Nikola Serafimovski, who chaired the 802.1bb Task Group.

“Through the activity of the 802.11bb task group, LiFi attracted interest from some of the biggest industry players ranging from semiconductor companies to leading mobile phone manufacturers. We worked with these key stakeholders to create a standard that will provide what the industry needs to adopt LiFi at scale. I would like to thank the support of Tuncer Baykas as Vice-Chair, and Volker Jungnickel as technical editor for helping make this process so successful.”

Volker Jungnickel from Fraunhofer HHI, technical editor of the task group, commented on the importance of a global LiFi standard: “The IEEE 802.11bb standard is a critical step to enable interoperability between multiple vendors. It allows for the first time LiFi solutions inside the WiFi ecosystem. This is essential for the development of new and innovative applications. LiFi can replace cables by short-range optical wireless links and connect numerous sensors and actuators to the Internet. We believe that this will create a future mass market. Fraunhofer HHI is looking forward to work with LiFi vendors from lighting and communication industries to make this a reality.”

pureLiFi, a pioneering company in the development of LiFi technology, has already developed the world’s first standards-compliant devices including the recently released Light Antenna ONE.

Analogous to the antenna chain in a radio frequency (RF) system such as WiFi, Light Antenna ONE inherently enables 802.11bb compliance. It can be integrated with existing WiFi chipsets that ship in the billions annually. With Light Antenna ONE, LiFi simply appears to the system as if it were another band of WiFi.

“pureLiFi is delighted to see the release of the IEEE 802.11bb standard,” said Alistair Banham, CEO of pureLiFi. “This is a significant moment for the LiFi industry, as it provides a clear framework for the deployment of LiFi technology on a global scale. We are proud to have played a leading role in its creation and to be ready with the world’s first standards-compliant devices. The existence of a global standard gives confidence to device manufacturers who will deploy LiFi at scale.”

With the release of the IEEE 802.11bb standard, pureLiFi believes that LiFi as a complimentary and additive solution to RF communications is now poised to take its place in the wireless communication market, offering unprecedented speed, security, and reliability to users around the world.”

Fraunhofer HHI is a world leader in the development of mobile and optical communication networks and systems as well as processing and coding of video signals. HHI has studied use cases for indoor and outdoor applications with early adopters and made sustainable contributions to standards. HHI offers all building blocks for state-of-the-art LiFi systems, tailors prototypes for special applications and conducts field trials in real scenarios.

“Fraunhofer HHI welcomes the new IEEE 802.11bb,” said Dominic Schulz, lead of LiFi development at Fraunhofer HHI.

“ LiFi offers high-speed mobile connectivity in areas with limited RF, like fixed wireless access, classrooms, medical, and industrial scenarios. It complements or serves as an alternative to WiFi and 5G. 802.11bb integrates easily with existing infrastructures. Operating in an exclusive optical spectrum ensures higher reliability and lower latency and jitter. Light’s line-of-sight propagation enhances security by preventing wall penetration, reducing jamming and eavesdropping risks, and enabling centimetre-precision indoor navigation.”

With IEEE Std 802.11bb, LiFi has a first solution addressing mass-market requirements, such as low cost, low energy and high volumes. Industry can fully reuse WiFi protocols over the light medium. This will bring traffic offloading, security and navigation capabilities of WiFi to the next level.”

References:

https://telecoms.com/522689/ieee-puts-the-spotlight-on-lifi-tech/

https://www.fiercewireless.com/tech/ieee-standardization-shines-spotlight-lifi

China Mobile verifies optimized 5G algorithm based on universal quantum computer

China has achieved the country’s first algorithm verification of a communication network optimization based on a universal quantum computer, according to the Quantum Computing Engineering Research Center in east China’s Anhui Province.

China Mobile, the country’s largest mobile carrier, is currently in the stage of 5G network operation and 6G research and development. Compared with 5G, 6G will face computing problems such as larger-scale business optimization, network optimization, signal processing and machine learning, bringing about great pressure to the classical computation and algorithms, said Cui Chunfeng, an official from the China Mobile Research Institution (CMRI).

The tremendous computing power is the main characteristic of quantum computers. “We try to start from small-scale problems in some typical scenarios to evaluate and verify the application feasibility of quantum computing in communication networks, especially in 6G,” Cui said.

The CMRI and the Origin Quantum Computing Technology Corporation signed a cooperation memorandum on June 30 to jointly promote the integration of quantum computing into the communication network and arithmetic network as the core of the mobile information network.

Aiming at the optimization of large-scale antenna parameters of 5G base stations, the Origin Quantum has preliminarily proved the feasibility of quantum algorithm in the specific problem through effective modeling, algorithm design and real-machine verification, said Dou Manghan, director of the software center of the Origin Quantum.

He noted that the company has the country’s first case of using quantum computers with real machines for communication network algorithm verification, achieving a good start for the application of quantum computing.

A quantum computer in China Photo: VCG

In the future, China Mobile will design quantum algorithms with better performance, boost the integrated development of quantum computing and communication industry, and explore a leapfrog path for the development of mobile information networks, Cui said.

Source(s): Xinhua News Agency

References:

Orange Business tests new 5G hybrid network service in France

Orange Business said that it has carried out tests of a new 5G service called “Mobile Private Network hybrid“at its office in Arcueil (Ile-de-France region). The telco claims the hybrid private network has several applications and is able to connect industrial equipment, tablets and autonomous vehicles, among other end points. It cited the example of ports as an area particularly suitable for hybrid network deployments.

Orange said it is “actively investing in the construction” of hybrid 5G networks in France. Its two units have been “constantly innovating to continue to develop services and use [cases],” the company added.

The new 5G service has been tested with a router from Ericsson owned Cradlepoint which is connected to both networks simultaneously and assigns data flows to the appropriate network based on predefined use cases and the application being used. The Cradlepoint router supports 5G SA and network slicing technology for business premises, with a hardened version available for industrial settings.

The test project hosted two use cases in two network slices, running on a laptop (“behind the router”): transmission of a video feed to the cloud on the public network to support a remote assistance use case, and an edge-based supervision application for an industrial process where all the data circulated on the private network. “The separation of data flows is complete from the application on the terminal to the core network.”

(Source: l_martinez / Alamy Stock Photo)

The network is operated by Orange in full and does not require the use of multiple SIM cards. Companies can use the solution for both critical and non-critical applications, with data flows isolated from the application on the terminal all the way to the core, and service quality adapted to each application. The company says it relies on local break-out technology, which allows for local routing of data flows, to offer stable low latencies. Orange also says the private network guarantees performance and offers higher data security than the public network.

Orange is one of few European operators that have started rolling out 5G SA networks, it has not yet officially launched one in France. In March, it announced it would start offering 5G SA in a handful of Spanish cities later this year. The telco will rely on Ericsson’s core technology, which will also be used in Belgium, Luxembourg and Poland.

References:

Orange intros managed hybrid-private 5G service for French enterprises

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

The GSMA and the European Space Agency (ESA) on Wednesday announced the signing of a memorandum of intent (MoI) that covers collaboration on new satellite and terrestrial network technologies. GSMA’s Foundry innovation accelerator will work closely with the ESA’s 5G/6G Hub based at the ESA’s European Centre for Space Applications and Telecommunications in Harwell, Oxfordshire.

Non-terrestrial networking (NTN) has been incorporated into the 3GPP’s 5G specification since Release 17 (but not in the ITU-R M.2150 5G RIT/SRIT standard which covers only terrestrial networks), and work is already well underway to turn it into a commercial reality. The partnership between the GSMA and the ESA represents a more coordinated effort in that direction. What’s more, when it comes to 6G, non-terrestrial networking is expected to be baked in from the start. Again, cooperation between these two sectors will be invaluable.

The GSMA and ESA’s goal then is to create an ecosystem that can fast-track the development of new complimentary solutions for businesses and consumers. They also aim to accelerate the integration of satellite communications with 5G and, when the time comes, 6G networks.

“By collaborating more closely with the European Space Agency, and its satellite network operator ecosystem, we hope to accelerate the immense potential satellite and terrestrial telecommunications networks can create for consumers and businesses when they are more closely connected. By working together, we can help the communications industry bring innovative solutions to market, which in turn will create tremendous benefits to society by connecting even more people, wherever they are in the world,” said GSMA CTO Alex Sinclair, in a statement.

What the MoI means in practical terms is that the GSMA and ESA’s respective innovation hubs plan to start working together, sharing knowledge, ideas, and the outcomes of trials with one another.

On the telecoms side, the GSMA has the Foundry, which fosters collaboration between telcos and various industries with the aim of developing initial ideas into globally-scalable, commercial solutions. Completed projects include using 5G to enable drones to fly beyond visual line of sight (BVLOS), a 5G broadcast solution, and using 5G for automated farming solutions, among others.

Similarly, on the satellite side of the equation, the ESA has its 5G/6G Hub. Opened in February 2022, it provides a space where new 5G and satcom technologies can be developed and integrated. Developers can also use it to test and verify their 5G converged network applications and services. The ESA announced in January that it is expanding the facility to accommodate new areas of research, which it aims to identify via a consultation with industry experts.

Recent research findings by GSMAi showed that the increased adoption and integration of satellite technologies by the communications industry could lead to potential revenue gains of $35bn by 2035 (a 3% uplift on telecommunications industry revenues).

Speaking following the signing of the MOI at ECSAT in Oxfordshire, Alex Sinclair, Chief Technology Officer at the GSMA said: “By collaborating more closely with the European Space Agency, and its satellite network operator ecosystem, we hope to accelerate the immense potential satellite and terrestrial telecommunications networks can create for consumers and businesses when they are more closely connected. By working together, we can help the communications industry bring innovative solutions to market, which in turn will create tremendous benefits to society by connecting even more people, wherever they are in the world.”

Antonio Franchi, Head of Space for 5G and 6G Strategic Programme, ESA, said: “Collaboration is key to telecommunications innovation and, from our 5G/6G Hub, we are fostering industry partnerships to advance the 5G digital transformation of society and industry. We look forward to working with GSMA to explore and realise the huge potential of next-generation satellite-enabled connectivity.”

ABI Research predicts that global 5G non-terrestrial networking (NTN) service revenue will achieve a compound annual growth rate (CAGR) of 59% between 2024 and 2031, reaching $18 billion. By then, connections are expected to number 200 million.

About GSMA

The GSMA is a global organisation unifying the mobile ecosystem to discover, develop and deliver innovation foundational to positive business environments and societal change. Our vision is to unlock the full power of connectivity so that people, industry, and society thrive. Representing mobile operators and organisations across the mobile ecosystem and adjacent industries, the GSMA delivers for its members across three broad pillars: Connectivity for Good, Industry Services and Solutions, and Outreach. This activity includes advancing policy, tackling today’s biggest societal challenges, underpinning the technology and interoperability that make mobile work, and providing the world’s largest platform to convene the mobile ecosystem at the MWC and M360 series of events.

We invite you to find out more at gsma.com

For more information on GSMA Foundry, please visit: gsma.com/foundry

About the European Space Agency

The European Space Agency (ESA) provides Europe’s gateway to space.

ESA is an intergovernmental organisation, created in 1975, with the mission to shape the development of Europe’s space capability and ensure that investment in space delivers benefits to the citizens of Europe and the world.

ESA has 22 Member States: Austria, Belgium, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Luxembourg, the Netherlands, Norway, Poland, Portugal, Romania, Spain, Sweden, Switzerland and the United Kingdom. Slovenia, Latvia and Lithuania are Associate Members.

ESA has established formal cooperation with five Member States of the EU. Canada takes part in some ESA programmes under a Cooperation Agreement.

By coordinating the financial and intellectual resources of its members, ESA can undertake programmes and activities far beyond the scope of any single European country. It is working in particular with the EU on implementing the Galileo and Copernicus programmes as well as with Eumetsat for the development of meteorological missions.

References:

GSMA AND EUROPEAN SPACE AGENCY LAUNCH NEW COMMUNICATIONS INNOVATION PARTNERSHIP

https://telecoms.com/522665/gsma-esa-forge-stronger-ties-between-satellite-and-cellular-industries/

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

Grand View Research: 5G New Radio Market to be Worth $251.37B by 2030

The global 5G New Radio (5G NR) market size is expected to reach $251.37 billion by 2030, registering a CAGR of 29.1% from 2023 to 2030, according to a new report by Grand View Research, Inc.

The market research firm says the 5G New Radio (NR) market is being driven by a number of factors, including the increasing demand for high-speed and low-latency connectivity, the growth of the Internet of Things (IoT) and Machine-to-Machine (M2M) communications, and the increasing adoption of cloud-based technologies.

Additionally, the need for faster and more reliable communication networks to support emerging applications such as autonomous vehicles, augmented reality and virtual reality, and remote healthcare is also driving the growth of the 5G New Radio market.

Key Industry Insights & Findings from the report:

- The hardware segment dominated the market in 2022 owing to the growing need for sophisticated radio units like as massive MIMO and beamforming, which provide higher coverage and capacity while also assisting in resource optimization, is a crucial element driving the segment growth.

- The Sub-6 GHz segment dominated the market in 2022 owing to Sub-6 GHz spectrum bands ability to provide a strong combination of coverage and capacity, making them suited for offering high-speed connection to large numbers of users, is a primary driver driving sector expansion.

- The Standalone (SA) segment is projected to expand at the highest CAGR owing to the advantages over Non-Standalone (NSA), including faster network performance and lower latency.

- The Ultra-reliable Low-latency Communications (URLLC) segment is expected to grow significantly over the forecast period. The growing need for mission-critical applications requiring high reliability and low latency is propelling the URLLC segment in the 5G New Radio (NR) market.

- However, neither the current 3GPP specs or ITU-R M.2150 standards meet the URLLC performance requirements in ITU-R M.2410. That is because 3GPP Release 16 URLLC in the RAN has yet to be completed and performance tested.

- The manufacturing segment is projected to expand at the highest CAGR over the forecast period. The potential of 5G NR technology to provide real-time monitoring and management of industrial processes, which leads to higher efficiency and productivity, is a key element influencing the segment growth.

- Asia Pacific dominated the regional market in 2022. The region has a sizable population and a rising number of mobile customers, which is fueling demand for innovative apps and high-speed internet services.

Industry Insights:

The telecom and IT segment dominated the market in 2022 and accounted for more than 30.0% share of the global revenue. The growing adoption of cloud-native technologies, which allow operators to virtualize network functions and deploy them on cloud infrastructure, is a significant factor contributing to segment growth. With the increased speed, bandwidth, and capacity of 5G, telecommunication companies can offer faster and more reliable mobile connectivity to their customers, enabling new applications and services that were not possible with previous generations of wireless technology. This includes things like virtual and augmented reality, high-definition video streaming, and real-time gaming. Additionally, 5G networks are highly customizable, allowing telecommunication and IT companies to tailor their services to meet the specific needs of different industries and use cases.

To learn more about this report, request a free sample copy

To learn more about this report, request a free sample copy

The manufacturing segment is projected to expand at the highest CAGR over the forecast period. The ability of 5G NR technology to enable real-time monitoring and control of manufacturing processes, leading to greater efficiency and productivity is a significant factor contributing to the segment growth. For instance, 5G NR can facilitate the use of Industrial Internet of Things (IIoT) sensors and devices, which can provide real-time data on machine performance, production line throughput, and other critical metrics. This data can be used to optimize processes, reduce downtime, and improve quality control. Additionally, 5G NR can enable remote access and control of manufacturing equipment, allowing for greater flexibility and responsiveness in managing production processes. These benefits can lead to increased profitability and competitiveness for manufacturers, driving the adoption of 5G NR solutions in the manufacturing industry.

Regional Insights:

The Asia Pacific region dominated the market in 2022 and accounted for more than 38.0% share of the global revenue. The increasing adoption of 5G technology in countries such as China, Japan, South Korea, and India is a major factor contributing to the regional growth. The region has a large population and a growing number of mobile subscribers, which is driving the demand for high-speed internet services and advanced applications. The governments in these countries are also investing heavily in the development of 5G infrastructure, which is expected to provide significant opportunities for telecom companies and network equipment providers in the region. Additionally, the region is witnessing a significant increase in the use of smartphones and other mobile devices, which is driving the demand for 5G-enabled devices and services.

To learn more about this report, request a free sample copy

To learn more about this report, request a free sample copy

The North America region is projected to expand at the highest CAGR over the forecast period. Significant investment is being made in the development and implementation of 5G infrastructure in the area, owing to the growing demand for high-speed internet access, IoT applications, and cloud services. Furthermore, the use of technologies such as artificial intelligence, edge computing, and big data analytics is increasing, which is pushing the demand for high-performance 5G networks. Collaborations between telecom firms and technological behemoths to build and implement 5G networks and services are also developing in the area. In addition, the area has been an early user of 5G-enabled smartphones and other gadgets, which is projected to boost market development in the future years. Furthermore, the region has been an early adopter of 5G-enabled smartphones and other devices, which is expected to further drive the growth of the market in the coming years.

Key Companies & Market Share Insights:

Leading industry players are investing heavily in R&D to expand their product lines, which will help the 5G New Radio (NR) market thrive. Participants in the market are also expanding their global presence through a variety of strategic initiatives such as new product launches, collaborations, mergers and acquisitions, and cooperation. For instance, in February 2023, Telefonaktiebolaget LM Ericsson, a telecommunication technology company, introduced new 5G indoor radio equipment and software to offer corporate use cases and monetization potential. Additionally, the telecom equipment manufacturer unveiled ten new radio devices spanning RAN and Transport to expand its range, with the goal of reaching net zero emissions in networks.Telefonaktiebolaget LM Ericsson has also introduced the IRU 8850 radio for single or multi-operator deployment in medium to large venues such as airports, workplaces, and stadiums. The system can service up to eight venues from a single centralized site, with a 10km fiber reach.

Competitors in the 5G New Radio (NR) industry must provide cost-effective solutions in order to thrive and grow in a more competitive and evolving market environment. In the market, many companies are forming partnerships and working together with other market participants. They may take use of one other’s skills and resources in this way, giving their clients more comprehensive and integrated solutions. In order to expand into new areas and attract more customers, businesses are also expanding their geographical presence. Collaborations with regional players, investments in network infrastructure, and targeted marketing initiatives are all options. Some of the prominent players in the global 5G New Radio market include:

- Huawei Technologies Co., Ltd.

- Qualcomm Technologies, Inc

- Telefonaktiebolaget LM Ericsson

- Samsung

- Intel Corporation

- Cisco Systems Inc.

- Fujitsu

- NEC Corporation

- Verizon Communications Inc.

- Keysight Technologies

5G New Radio Market Report Scope:

| Report Attribute | Details |

| Market size value in 2023 | USD 42.16 billion |

| Revenue forecast in 2030 | USD 251.37 billion |

| Growth rate | CAGR of 29.1% from 2023 to 2030 |

| Base year of estimation | 2022 |

| Historical data | 2019 – 2021 |

| Forecast period | 2023 – 2030 |

| Quantitative units | Revenue in USD billion, and CAGR from 2023 to 2030 |

| Report coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Segments covered | Offering, operating frequency, architecture, application, industry, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; UK; Germany; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa . |

| Key companies profiled | Huawei Technologies Co., Ltd.; Qualcomm Technologies, Inc; Telefonaktiebolaget LM Ericsson; Samsung; Intel Corporation; Cisco Systems Inc.; Fujitsu; NEC Corporation; Verizon Communications Inc.; Keysight Technologies. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

References:

https://www.grandviewresearch.com/industry-analysis/5g-new-radio-nr-market-report

Omdia forecasts weaker 5G market growth in near term, 4G to remain dominant

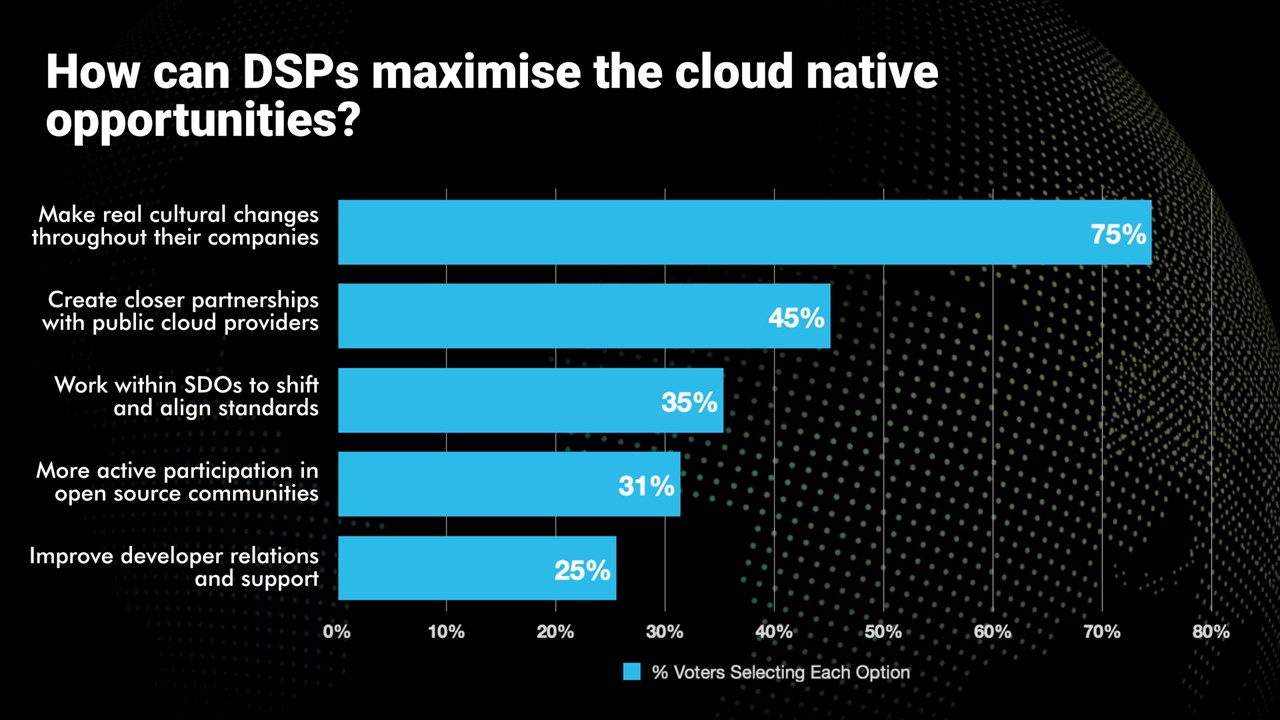

Telecom TV Poll: How to maximize cloud-native opportunities?

The adoption of cloud-native methodologies, processes and tools has been a challenge for communications service providers (CSPs), aka telcos or network operators.

- Telcos are embracing cloud-native processes and tools

- It’s part of their evolution towards being digital service providers

- But the cloud-native journey is still in its early stages

- Real cultural change is needed if telcos are to capitalise fully on the cloud-native opportunities

Alongside a a session, Why cloud native is essential to delivering the automation, agility and innovation needed to support new services, at Telco TV’s DSP Leaders World Forum event in Windsor, UK, a poll was taken. The following question was asked, “How can Digital Service Providers maximize the cloud-native opportunities?” Respondents were able to select all the options they deemed relevant. Here are the results:

Please check out the upcoming Cloud Native Telco Summit session on cloud-native application development to see what the industry experts have to say.

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Huawei Connect 2022: It’s Cloud Native everything!

Mediatek Dimensity 6000 series with lower power consumption for affordable 5G devices

MediaTek [1.] today officially launched its new Dimensity 6000 series along with a chipset designed to enhance the next generation of mainstream 5G devices. The Dimensity 6100+ SoC delivers premium features—including exceptional power efficiency, vivid displays, high frame rates, AI-powered camera technologies, leading low power consumption, and reliable Sub-6 5G connectivity—at an accessible price point.

The ‘Enhanced’ 5G modem on the chip supports 3GPP Release 16, with up to 140 MHz 2CC 5G Carrier Aggregation (more details below). The SoC also uses MediaTek’s UltraSave 3.0+ technology that the company claims “significantly reduces 5G power consumption” by up to 20% when compared to other available solutions in the market.

Note 1. Taiwan based Mediatek is one of 3 fabless semiconductor companies making and selling 5G baseband silicon. The other 2 are Qualcomm and Unisoc (China). In addition, Huawei and Samsung make 5G chips which are embedded in their 5G endpoint products, but not sold on the merchant semiconductor market.

…………………………………………………………………………………………………………………………

“As developing markets continue rolling out 5G networks at a rapid pace and operators in developed markets work to finish transitioning consumers from 4G LTE to 5G, there has never been a more vital need for chipsets that cater to the growing number of mainstream mobile devices that feature next-generation connectivity,” said CH Chen, Deputy General Manager of MediaTek’s Wireless Communications Business Unit. “The MediaTek Dimensity 6000 series makes it possible for device makers to stay ahead of the curve with impressive upgrades that boost performance, increase power efficiency and reduce material costs,” Chen added.

The Dimensity 6100+ integrates an enhanced 5G modem supporting 3GPP Release 16 with up to 140MHz 2CC 5G Carrier Aggregation, significantly reducing power consumption contributed by MediaTek UltraSave 3.0+ technology. This chip features two Arm Cortex-A76 big cores and six Arm Cortex-A55 efficiency cores, offering notable enhancements, including support for AI-powered cameras, 10-bit displays, outstanding UX and GPU performance, and rich peripheral features.

Other key features of the Dimensity 6100+ chipset include:

- Up to 108MP Non-ZSL camera support.

- Up to 2K 30fps video capture.

- UltraSave 3.0+ technology offers 20% reduced 5G power consumption compared to competitive solutions.

- Powerful camera features including AI-bokeh for stunning portraits and selfies; working with Arcsoft, MediaTek is also bringing AI-color technology to mainstream devices so users can showcase their creativity.

- Premium 10-bit display support: Reproduces more than one billion colors for vibrant images and videos, along with support for 90Hz to 120Hz frame rates for a smooth user experience.

MediaTek’s broad 5G portfolio expands across different price tiers to make great mobile experiences more accessible. The Dimensity 9000 series is designed for flagship smartphones and tablets; the Dimensity 8000 family is geared for premium mobile devices; and the Dimensity 7000 lineup expands the company’s range of high-tech devices. The new Dimensity 6000 series will now democratize higher-end features to mainstream 5G devices.

MediaTek’s broad 5G portfolio expands across different price tiers to make great mobile experiences more accessible. The Dimensity 9000 series is designed for flagship smartphones and tablets; the Dimensity 8000 family is geared for premium mobile devices; and the Dimensity 7000 lineup expands the company’s range of high-tech devices. The new Dimensity 6000 series will now democratize higher-end features to mainstream 5G devices.

The first smartphones featuring the Dimensity 6100+ chipset will be available in the third quarter of 2023.

References:

https://i.mediatek.com/mediatek-5g