PwC report on Monetizing 5G should be a wake up call to network operators!

A PwC report titled, “The challenge of monetizing 5G,” states that capital expenditures and operating expenses will likely be very high with the deployment of 5G standalone networks and their fully virtualized, cloud-native architectures. Yet returns have been anemic across all generations, ranging from 1.5% to 4.5% of return on assets.

PwC’s 26th Annual Global CEO Survey found that 46% of telco CEOs believe that if their companies continue on their current paths, their businesses would not be economically viable in 10 years.

Source: PwC

As 5G becomes an everyday reality for both investors and consumers, carriers are going to face increasing pressure on two fronts:

1. Improve return on assets

As capital markets and stakeholders begin to focus on investment returns in a high-inflation environment, there will be growing scrutiny on telcos and wireless carriers, especially in comparison to other capital-intensive investment opportunities. An exemplar cloud services provider (CSP) has demonstrated ROA of 17% to 20%+ over the past five years, which compares to the 2% to 3% ROA range of MNOs. The ROA of MNOs approximates that of regulated entities like utilities, which explains investor angst.

2. Deliver on demanding service-level agreements to support 5G “killer apps,” such as metaverse applications (really?)

Improving ROA is intrinsically tied to successfully managing the costs and revenues of 5G applications. Many operators face a growing clamor from application providers and up-stack players to create “metaverse-capable networks,” without much clarity on how application revenue will be shared with them. Network operators risk becoming trapped in a “give more, get less” scenario of providing pure-play connectivity, while up-stack companies monetize the 5G applications.

……………………………………………………………………………………………………………………………………………………………………

For those who believe 5G FWA is the way to monetize 5G, PwC warned that’s not likely. The market research firm’s analysis showed FWA services could cost more than 22-times as much as mobile connectivity services. That’s due to costs associated with delivering data tied to specific latency or QoS service-level agreements (SLAs). Immersive and augmented experiences — such as virtual-reality apps, mobile metaverse and gaming — could cost three to four times as much. Network costs related to the Internet of Things (IoT) are even more challenging to estimate and track, primarily because of the extremely wide range of connected devices and applications available.

The report also found that FWA services could have up to 40-times less revenue potential. This is due to FWA services being price limited by competing fiber or cable internet options.

“Most FWA subscribers are willing to pay only as much as wireline plans cost, yet they expect a similar quality of service for internet connectivity,” the report notes.

PwC Partner Dan Hays explained during an interview with SDx Central at the MWC Barcelona 2023 event that operators should approach FWA and other alternative 5G connection services like IoT with reasonable financial and operational expectations. “Fixed-wireless access is a great way to fill out excess capacity, if you have it,” Hays said. “You see some of the carriers making that play.”

“It’s not a cure all by any means,” Hays said, explaining, “we look at it as not a business model but really a technology. It’s a technology choice that you can use.”

Hays said that operators are indeed being “really thoughtful” in managing capacity to serve FWA customers, but that can potentially run into a problem down the road where a particular site can no longer support a high-bandwidth FWA connection. “Do they fire you as a customer at some point,” he said.

In conclusion, PwC states:

Carriers will be increasingly challenged to demonstrate better returns on invested capital for massive 5G capital outlays, while simultaneously meeting the demanding service-level agreements of future 5G applications. Network costs are likely higher — and revenue potential is likely lower — than carriers understand for these applications. Critical strategies for improving ROA and monetizing 5G successfully involve accurately valuing network features, quantifying network costs and communicating them to all stakeholders, as well as improving 5G offer management, pricing and service evolution.

References:

https://www.pwc.com/us/en/tech-effect/emerging-tech/5g-monetization.html

TM and ZTE Malaysia to develop next-gen hybrid cloud 5G core network

Telekom Malaysia Berhad (TM) and ZTE have entered into a new strategic partnership to build out a hybrid cloud 5G core network in Malaysia which is designed for future technologies and will lead the way for next-generation networks. It’s a three year strategic partnership and the hybrid cloud aspect is part of a plan to ‘foster innovation and advancement of state-of-the-art technologies’ for TM’s 5G Core project, which includes bare metal containers, SDN-based architecture, hardware acceleration, CUPS, and 3-layer decoupling.

As well as generally improving network bandwidth and speed in Malaysia, it’s also pitched as a means to which TM can provide new connectivity services to healthcare, finance, transportation, and education, develop smart city and IoT applications, and it is ‘anticipated to revolutionize Malaysia’s telecommunications industry.

The integration of this converged network will strengthen TM’s capabilities to provide seamless connectivity and exceptional network performance, serving a diverse range of industries, including healthcare, finance, transportation, and education. Additionally, the hybrid cloud 5G core network will aid in the growth of smart cities, Internet of Things (IoT), and other next-generation technologies that necessitate rapid, low-latency connectivity.

This collaboration marks a significant achievement in the advancement of 5G technology in Malaysia, with the novel hybrid cloud 5G core network anticipated to revolutionize Malaysia’s telecommunications industry. With the deployment of these sophisticated technologies, customers will gain unparalleled user experience, while also improving the network’s dependability, safety, and efficiency.

Source: Jordi Boixareu/Alamy Live News

“TM is pleased to partner ZTE in building a hybrid cloud 5G core network that is designed to meet the rising needs for future technologies,” said Jasmine Lee Sze Inn, TM’s Executive Vice President for Mobile. “This strategic partnership will transform 5G-enabled networks to deliver innovative solutions and services through our state-of-the-art network and infrastructure, and enable seamless connectivity and exceptional network performance.”

Steven Ge, ZTE Malaysia’s Chief Executive Officer added: “We’re excited to strengthen our partnership with TM through the development of a hybrid cloud 5G core network. This will accelerate the launch of 5G network across Malaysia, which will bring forth new innovation into the market. As a global leading provider of information and communication technology solutions, we are confident that the advancement of our hybrid cloud 5G core network will be the model for future networks. ZTE is committed in this collaboration that will put Malaysia as one of the leading countries in the region to roll-out its 5G network.”

It’s broadly the same pitch as was delivered in places where the 5G rollout is more advanced, such as the US and Western Europe. While we don’t appear to be much closer to the utopian vision of smart cities over here, there has been some progress in private 5G networks in enterprise and industry settings – though much the emphasis now is on things like 5G SA and mmWave to bring the initial promises over the line.

East Asian contracts may be increasingly important for ZTE following U.S. led bans on Chinese vendor (Huawei and ZTE) equipment and phones. As a result of sanctions, ZTE has become more reliant on its home market. It increased domestic sales 9.2% last year compared to 3.4% offshore, with the China market now accounting for 69% of the total, up from 64% three years ago.

Chairman Li Zixue said 2022 was the start of ZTE’s “strategic expansion phase.” He said the company had achieved good growth from innovative products including server and storage, 5G industry applications, auto electronics, digital energy and smart home. “We firmly grasped the opportunities presented by the global trend of digitalization and low-carbon green principles,” he said.

The company further ramped up R&D spending. Research outlays rose 14.9%, mostly on 5G-related products, chip, server and storage businesses. R&D spending accounts for 17.6% of revenue, up from 13.8% three years ago, with the research division now totaling 49% of total headcount.

Li added that ZTE would seek opportunities for industrial transformation presented by new energy and digitalized industries. While the external environment would likely become more unpredictable, “the digital economy has grown into an irreversible trend.” He also said ZTE would “persist in an approach of precision and pragmatism in 2023,” targeting domestic opportunities in the digital economy and seeking breakthroughs in large telco customers offshore.

“We will strengthen our corporate resilience and control operating risks to achieve prudent growth,” Li concluded.

References:

https://telecoms.com/520567/tm-and-zte-team-up-on-hybrid-cloud-5g-core-network-in-malaysia/

https://www.lightreading.com/asia/zte-hikes-full-year-earnings-by-19-/d/d-id/783787?

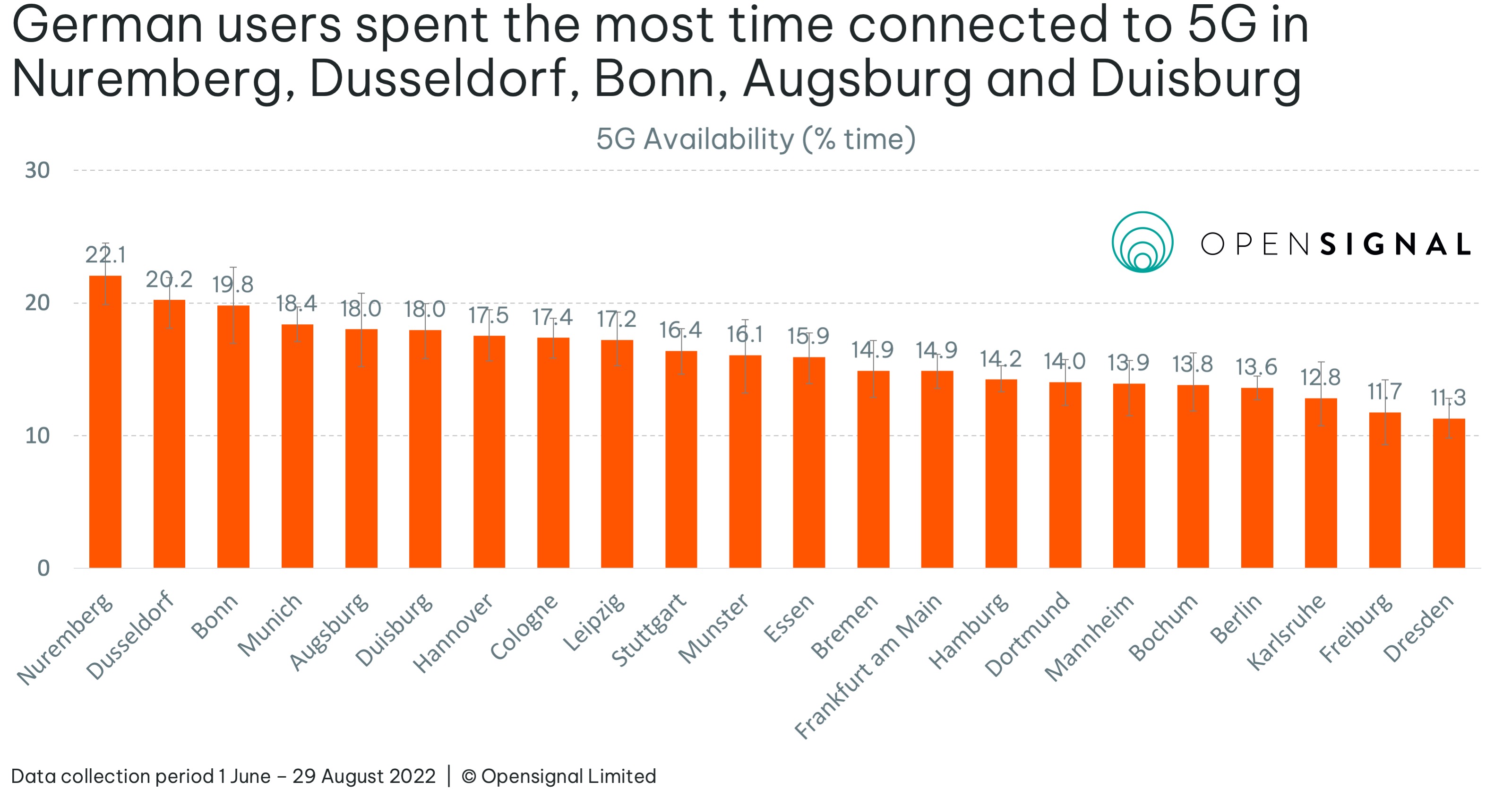

With 85% 5G coverage in Germany; only 40% have used a 5G network

At least half of the population in Germany has never used a 5G mobile network. That is the result of a representative opinion poll published on Saturday by Innofact AG, which was commissioned by comparison portal Verivox. In the survey, 40 percent of people in Germany said they had already used the 5G network once or several times. 49 percent have never been on the 5G network, and 10 percent are not sure. They have either been in the 5G network unknowingly or belong to the group that has not yet transmitted data in a 5G network.

The 5G mobile network is faster than previous network generations (LTE or UMTS). It also has lower latency, which means that the connection responds faster when accessing websites or apps. This plays a role in online gaming, for example. 5G also allows for a greater number of devices to be connected simultaneously. This is important, for example, at major events such as a soccer match, when many fans in the stadium are uploading or watching videos at the same time.

According to the latest statistics from the Federal Network Agency, around 85 percent of Germany is currently covered by 5G networks. In the city states of Berlin, Hamburg and Bremen there is virtually full coverage, while in the territorial states the figures are lower. Baden-Württemberg, Hesse, Rhineland-Palatinate and Thuringia have the lowest rollout rates, at just under 80 percent. Deutsche Telekom recently said its 5G network already reaches 94% of the overall population in Germany. During 2022, Germany’s largest operators have been focusing on the expansion of their 5G networks, with some operators already offering coverage to more than 80% of the country’s population.

The expansion rate also varies among the four 5G network providers. As stated, Deutsche Telekom reported 94 percent household coverage for 5G. Vodafone ‘s 5G household coverage is 80 percent, while Telefónica (O2) is at 75 percent. New entrant 1&1 operates only a few of its own 5G radio masts so far. Large discounter brands such as Aldi Talk, which mainly operate on Telefónica networks, do not yet offer any 5G rates.

“That 5G network usage remains below its potential is no surprise in times of high inflation,” said Jens-Uwe Theumer, Vice President Telecommunications at Verivox. “After all, anyone who wants to surf via 5G needs an appropriate smartphone as well as a 5G-compatible rate plan. Both components are comparatively expensive.” Recently, however, prices for 5G smartphones had dropped sharply. Entry-level models are available from around 200 euros.

The Verivox survey showed no urban-rural divide in 5G usage, although the 5G network is better developed in urban regions than in rural areas. For example, 20 percent of residents of rural communities and smaller towns say they have already been on the 5G network several times – among residents of large cities (100,000 inhabitants or more), the figure is only slightly higher at 25 percent. There is also a small difference in the number of non-users, which is 50 percent in smaller towns and communities and 47 percent in large cities.

However, 5G use declines with increasing age. Young people under 30 say they have already used the 5G network at least once. Among respondents over 70, this figure is only 17 percent. Among respondents aged 50 to 69, 29 percent say they have already surfed via 5G. Across age groups, more than one in four men use the 5G network more often, but only 17 percent of women.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

UAE’s “etisalat by e&” announces first software defined quantum satellite network

Dubai’s etisalat by e& today announced the implementation of the Eutelsat quantum satellite solution, becoming the first telco in the country to expand “5G” network capabilities (NOTE: there are no standards for satellite 5G RAN- only for terrestrial RAN, e.g. ITU-R M.2150 and 3GPP Release 15-17) over a software-defined satellite network.

This deployment was a result of rigorous testing with customers for over a year to rapidly scale up the 5G mobile network deployment. etisalat by e& implemented Eutelsat’s latest technology Quantum satellite with the recently installed state-of-the-art Newtech Dialog Hub enhancing the mobile network capability.

“With the demand for ‘always-on’ connectivity as technologies like IoT, AI and blockchain make a bigger impact on consumer lives, satellite connectivity can empower communities and business in this rapidly evolving digital landscape,” said Khalid Murshed, Chief Technology and Information Officer, etisalat by e& UAE. “With the deployment of this satellite solution and technology, our customers will be able to access their data at 5G speeds even when terrestrial connectivity is unavailable, marking another important step towards the regions’ 5G adoption and bridging the digital divide,” he added.

Image Credit: e&, formerly known as Etisalat Group

………………………………………………………………………………………………………………………………………………………………………

“Eutelsat are proud to partner with etisalat by e& to deploy this 5G use case on the world’s first Software Defined satellite network,” said Ghassan Murat, Head of Connectivity Business Unit for Middle East, Africa and Asia Pacific, Eutelsat. “Our fully steerable beams are capable of meeting the most rigorous demands of Next Generation mobile and satellite networks.”

Oscar Garcia, Business Marketing and Product Innovation, etisalat by e&, said, “The need for connectivity has grown beyond traditional communications with customers wanting to access the highest speeds in the network to meet their requirements and demands for bandwidth-intensive applications such as GSM services, Remote IT, Unified communications, OTT, and media streaming among others.. The testing and implementation of this satellite solution greatly enhances the mobile network capability to address the futuristic development of new age applications while being able to build and deploy 5G use cases for various industry verticals and business.”

References:

https://eand.com/en/etisalat-uae.jsp

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

European Space Agency & UK Space Agency chose EnSilica to develop satellite communications chip for terminals

FCC grants Amazon’s Kuiper license for NGSO satellite constellation for internet services

Bullitt Group & Motorola Mobility unveil satellite-to-mobile messaging service device

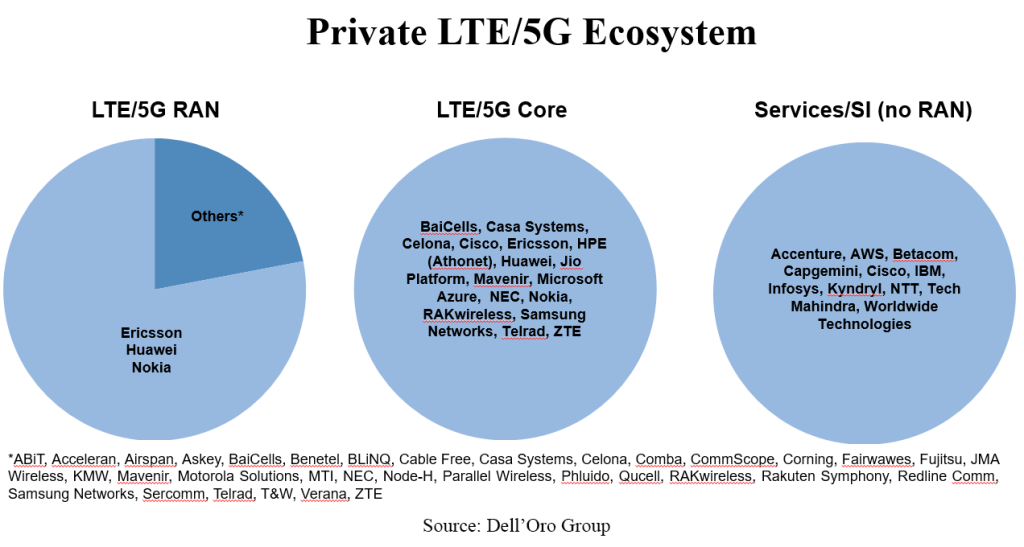

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Private 5G ecosystem is evolving:

Private 5G is running behind schedule. Dell’Oro’s VP Stefan Pongratz adjusted the firm’s private wireless forecast downward to reflect the current state of the market. Still, the slow uptake is not dampening the enthusiasm for private wireless. If anything, the interest is growing and the ecosystem is evolving as suppliers with different backgrounds (RAN, core, Wi-Fi, hyperscaler, in-building, SI) are trying to solve the enterprise puzzle.

According to Dell’Oro’s data, the total private wireless small cell market outside of China exceeds $100 million. But Pongratz indicated that’s not very much. “Commercial private wireless revenues are still so small. We estimate private wireless small cells is still less than 1% of the overall public-plus-private RAN market in 2022.”

He did concede that the private wireless small cell market outside of China is growing at double digits. “It’s heading in the right direction,” said Pongratz. “A lot of suppliers see good things for 2023.”

According to Stefan, the top three private wireless vendors in the world are Nokia, Huawei and Ericsson. Celona has said that its goal is to overtake Nokia in private wireless. Celona CEO Rajeev Shah said that based on Nokia’s public earnings reports, the company seems to be garnering about 30-35 private wireless customers a quarter and has about 515 of these customers in total. Shah said these numbers aren’t huge, and the industry has a long way to go.

Below is a summary of the private RAN, core, and SI/services providers that Stefan is currently monitoring.

Pongratz said the private wireless market can also be segmented by macro versus small cell. He said private wireless has been around for quite some time — since 2G. But traditionally, it was used as a wide area network (WAN), using the 3GPP definition for non-public networks. Often these networks deployed macros for very large organizations such as utility companies.

“The shiny new object is really the local campus deployments; that’s really small cells,” said Pongratz. “There will be a component of the new shiny that is also WAN, like a car manufacturer that could use both macros and small cells.”

But regardless, whether the private wireless market is segmented by macro or small cell, Dell’Oro still finds the top three suppliers are Huawei, Ericsson and Nokia.

………………………………………………………………………………………………………………………………………………………………………..

Virtualized RAN is gaining momentum:

As we now know, vRAN started out slow but picked up some speed in 2022 in conjunction with the progress in the US. The challenge from a forecasting perspective is that the visibility beyond the greenfields and the early brownfield adopters is limited, primarily because purpose-built RAN still delivers the best performance and TCO. As a result, there is some skepticism across the industry about the broader vRAN growth prospects.

During MWC, Steffan learned four things: 1) Near-term vRAN visibility is improving – operators in South Korea, Japan, US, and Europe are planning to deploy vRAN in the next year or two. 2) vRAN performance is firming up. According to Qualcomm, Vodafone (and Qualcomm) believes the energy efficiency and performance gap between the traditional and new Open vRAN players is shrinking (Vodafone publicly also praised Mavenir’s OpenBeam Massive MIMO AAU). Samsung also confirmed (again) that Verizon is not giving up any performance with Samsung’s vRAN relative to its purpose-built RAN. 3) vRAN ecosystem is expanding. In addition to existing vRAN suppliers such as Samsung, Ericsson, Mavenir, Rakuten Symphony, and Nokia announcing improvements to their existing vRAN/Cloud RAN portfolios, more RAN players are jumping on the vRAN train (both NEC and Fujitsu are expecting vRAN revs to ramp in 2023). And perhaps more interestingly, a large non-RAN telecom vendor informed us they plan to enter the vRAN market over the next year. 4) The RAN players are also moving beyond their home turf. During the show, Nokia announced it is entering the RAN accelerator card segment with its Nokia Cloud RAN SmartNIC (this is part of Nokia’s broader anyRAN strategy).

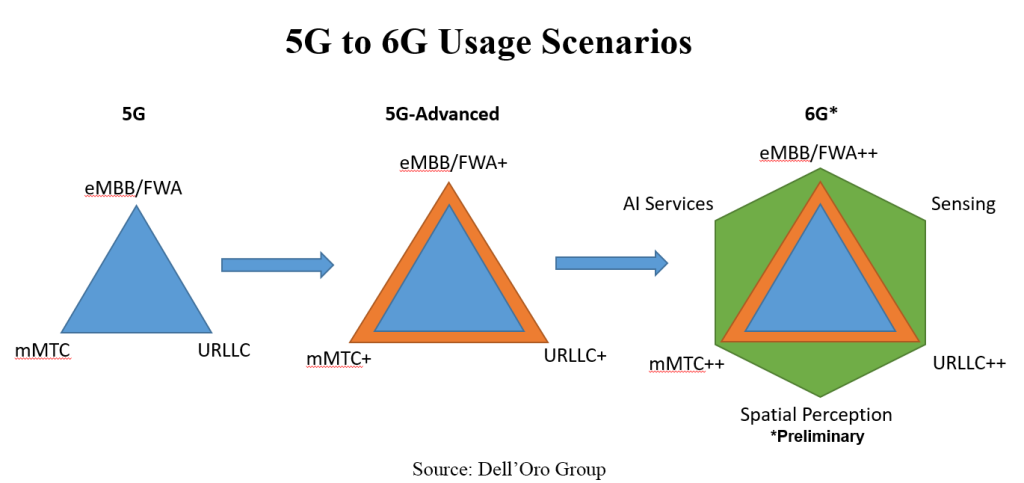

Skepticism is on the rise

Not surprisingly, disconnects between vision and reality are common when new technologies are introduced. Even if this is expected, we are sensing more frustration across the board this time around, in part because RAN growth is slowing and 5G still has mostly only delivered on one out of the three usage scenarios outlined in the original 5G use case triangle. With 5G-Advanced/5.5G and 6G starting to absorb more oxygen, people are asking if mMTC+/mMTC++ and URLLC+/URLLC++ are really needed given the status of basic mMTC and URLLC. Taking into consideration the vastly different technology life cycles for humans and machines, there are more questions now about this logic of assuming they are the same and will move in tandem. If it is indeed preferred to under-promise and over-deliver, there might be some room to calibrate the expectations with 5G-Advanced/5.5G and 6G.

References:

Ranovus Monolithic 100G Optical I/O Cores for Next-Generation Data Centers

Ranovus Inc. (“RANOVUS”) [1.] has announced the availability of its protocol-agnostic Odin™ 100G optical I/O cores based on GF Fotonix™, GlobalFoundries’ recently announced next generation, monolithic platform. GF Fotonix™ is the first in the industry to combine its differentiated 300mm photonics and RF-CMOS features on a silicon wafer, delivering best-in-class performance at scale. The announcement was made at OFC 2023 in San Diego.

Note 1. RANOVUS, founded in 2012, develops and manufactures advanced photonics interconnect solutions to support the next generation of AI/ML workloads in data centers and communication networks. Its current portfolio includes Multi-Wavelength Quantum Dot Laser technology and advanced digital and silicon photonics integrated circuit technologies that set a new industry benchmark for the lowest power dissipation, size, and cost for the next generation of optical interconnect solutions. RANOVUS’ Odin™ platform is claimed to be the enabling technology for a new data center architecture optimized for AI/ML workloads.

………………………………………………………………………………………………………………………………………………………………….

Odin 100G optical I/O chiplets and IP cores can be integrated with processors, switches, and memory appliances to enable new data centre architectures for machine learning, artificial intelligence, metaverse, cloud, 5G communications, and defence and aerospace. Data centres are increasingly demanding efficient and cost-effective high-capacity interconnect solutions to meet the exponential growth in data-driven applications like ML/AI and metaverse. Odin 100Gbps optical I/O scales from 8- to 32-cores in the same footprint by combining RANOVUS’ 100G bps per wavelength monolithic EPIC (Electro-Photonic Integrated Circuit) cores with its proprietary laser and advanced packaging technologies.

“We are delighted to share our multi-disciplinary silicon-photonics IP cores and chiplets, and advanced packaging solutions with our customers who are driving the adoption of novel data centre architectures based on integrating best-in-class chiplets and co-packaged optics”, said Hojjat Salemi, Chief Business Development Officer of RANOVUS. “Our close collaboration with GlobalFoundries underlines our joint commitment to deliver a fully featured set of qualified IP cores and chiplets with OSAT-ready high-volume manufacturing flows and supporting ecosystem to enable the huge potential of monolithic silicon photonics.”

As previously announced, RANOVUS has developed a highly flexible co-packaged optics architecture (Analog-Drive CPO 2.0) together with a Tier 1 ecosystem for high volume manufacturing of Odin chiplets. The first customer co-packaged solution with 800Gbps Odin optical I/O is also being demonstrated at OFC 2022 with samples based on the GF Fotonix platform shipping now.

“Data centers, computing and sensing applications require incredible processing, transmission and power efficiency as the world’s data needs soar dramatically.” Ranovus’ IP cores, chiplets and advanced packaging solutions, combined with GF Fotonix, provide customers a complete solution to develop the chips needed solve some of the biggest challenges facing data centers today,” commented Anthony Yu, vice president, Computing and Wired Infrastructure Strategic Business Unit at GF.

Image Credit: RANOVOUS

Previously at OFC 2023, RANOVUS announced interoperability of AMD Versal adaptive SoCs with the co-packaged Odin® 800G direct-drive optical engine and third party 800G DR8+ retimed pluggable modules. The interoperability demonstration is part of OFC 2023, the leading optical networking event in North America, and highlights the versatility of RANOVUS’s Odin® portfolio for AI/ML and communications applications.

“We announced the first generation of our Odin® optical interconnect at OFC 2022 for proprietary AI/ML applications. We are thrilled to showcase our standards-based Odin® optical interconnect product with 5pJ/bit for a direct-drive CPO solution,” said Dr. Christoph Schulien, head of Systems and High-Speed IC R&D of RANOVUS. “Its inherent versatility enables hyperscale data center providers to drastically reduce power consumption and optimize density and cost as they deploy novel hybrid data center architectures in response to the insatiable growth in AI/ML workloads.”

“RANOVUS’ demonstration of interoperability between our Versal™ adaptive SoCs co-packaged with Odin® 800G direct-drive CPO 2.0 and third party 800G DR8+ retimed pluggable modules underlines the flexibility and scalability of RANOVUS’ technology,” said Yohan Frans, vice president, Engineering at AMD. “We are proud of our collaboration with RANOVUS in demonstrating the performance and versatility of monolithic silicon photonics interconnects as data center and 5G customers deploy highly efficient and cost-effective systems for next generation workloads.”

“RANOVUS’ demonstration of interoperability between CPO and pluggable modules is a key proof point that their interconnect technology supports the flexibility and scalability with the lowest power consumption sought by hyperscalers as they optimize their data centers for AI/ML workloads,” said Vladimir Kozlov the founder and CEO of LIGHT COUNTING.

About Ranovus

RANOVUS, with operations in Ottawa, Canada (headquarters), Nuremberg, Germany and Sunnyvale, CA, develops and manufactures advanced photonics interconnect solutions to support the next generation of AI/ML workloads in data centers and communication networks. Our team has extensive experience in product development and commercialization of optoelectronics subsystems for the information technology industry. RANOVUS’ current disruptive portfolio of IP cores includes multi-wavelength quantum dot laser technology and advanced digital and silicon photonics integrated circuit technologies that set a new industry benchmark for the lowest power dissipation, size, and cost for the next generation of optical interconnect solutions. RANOVUS’ Odin™ platform is the enabling technology for a new data center architecture optimized for AI/ML, metaverse, cloud and 5G communications workloads. The company has received funding from leading venture capital firms, strategic investors, Sustainable Development Technology Canada, and Strategic Innovation Fund of Canada.

References:

Ziply® Fiber agrees to acquire Ptera as U.S. fiber buildouts slow

Ziply® Fiber [1.] has announced an agreement to acquire Ptera, Inc, a fiber internet and fixed wireless internet service provider (WISP) serving four counties across Eastern Washington and Northern Idaho. The acquisition, Ziply’s fourth since June 2022, is scheduled to close later this year, pending regulatory approvals. Financial terms of the buyout were not disclosed.

Note 1. Ziply was created in May 2020 after Frontier Communications sold its operations and assets in Washington, Oregon, Idaho and Montana to WaveDivision Capital in partnership with Searchlight Capital Partners for $1.35 billion. Ziply won just over $57 million in Rural Digital Opportunity Fund (RDOF) support to build fiber to more than 21,000 locations. It has also been working with state and local broadband officials on additional opportunities and plans to participate in the Broadband Equity, Access, and Deployment (BEAD) Program.

Image Credit: Ziply® Fiber

……………………………………………………………………………………………………………………

Founded in 2001 and headquartered in Liberty Lake, WA, Ptera serves more than 4,000 customers in the cities of Airway Heights, Cheney, Liberty Lake, Medical Lake, Otis Orchards and more. All Ptera employees will join the Ziply Fiber team as part of the acquisition.

“Both Ptera and Ziply Fiber were born here in the Northwest, and both of our companies have been focused on a similar mission to connect communities that have been underserved when it comes to reliable, high-speed internet,” said Harold Zeitz, CEO of Ziply Fiber. “We look forward to having the Ptera employees join the Ziply Fiber team and continue the work underway to expand their fiber network to reach more addresses in the region.”

Zeitz told Fierce Wireless the deal will not only help fill in a gap in its fiber map, but will also give it fixed wireless access expertise which may help it secure more customers in the future. Zeitz said, “We’re not going to build fiber generally where there is fiber. So, rather than skip those areas that we think fit what we ultimately want as our network, it makes sense ultimately to join forces rather than skip an area or build over fiber.”

Zeitz told Fierce Wireless on Friday that it now serves fiber to approximately 800,000 locations – and remains on track to hit its goal to deploy fiber to 80% to 85% of its territory. But for the 15% to 20% of locations that fall outside its economic threshold for building fiber, Zeitz said it will either use grants to help fund its build or just use fixed wireless. Its recent acquisitions “give us an opportunity to have teams that are experienced with that.”

“There’s definitely a part of the footprint that’s just too expensive to get to but they deserve better internet, so fixed wireless is a good alternative for that cross section of the population,” he said. “We may build fiber where there is fixed wireless [today] but we’ll likely have some fixed wireless and we may extend the fixed wireless. We’re in the process of thinking through how we would do that.”

Steven Wilson, CEO of Ptera, said, “Ptera has been a family-owned business for more than 20 years, and I’m very proud of the work our team has done to earn the trust and support of our customers across the Inland Northwest. I’m excited about this next chapter for the company and our future together with Ziply Fiber.”

Current Ptera customers will not see any immediate changes to their service or working relationships. Once the acquisition officially closes (which can take months), customers will benefit from expanded customer service capabilities and access to new products such as SD-WAN and improved network management capabilities.

……………………………………………………………………………………………………………………………

Meanwhile, the fiber buildout boom shows signs of slowing due to inflationary pressures for labor and equipment with a higher interest rates (i.e. cost of capital). In a new report to MoffettNathanson clients, Craig Moffett found that incremental telco fiber passings in 2022 were about 500,000, roughly 8% below year-ago expectations. Meanwhile, combined guidance for 2023 has dipped by 3.1 million, or 40%, he added, noting that this doesn’t include the build activities of private companies such as Windstream, Brightspeed, Ziply Fiber and Cincinnati Bell (altafiber).

AT&T has reduced the pace of future fiber buildouts to 2 million to 2.5 million per year, down from the prior suggested run-rate of 3.5 million to 4 million. That doesn’t include the AT&T-BlackRock joint venture initially targeting the buildout of 1.5 million fiber locations outside AT&T’s current footprint.

Lumen’s build also dropped about 33% from its year-ago guidance amid a broader company “reset”. Frontier Communications’ expected 2023 build has been cut back by about 300,000 passings, though its target to build fiber to 10 million locations by 2025 hasn’t changed.

Altice USA has also reduced its original fiber upgrade plans, putting more emphasis on DOCSIS upgrades in rural footprint.

Moffett doesn’t see any near-term relief as more government funds are released to support rural builds. “We expect labor cost pressures, in particular, to worsen,” he wrote. “We are inching ever closer to the allocation of rural subsidy BEAD [Broadband Equity, Access, and Deployment] funds to states, and then to individual grantees. Those projects will introduce an enormous new source of demand for labor (and for crews from contract builders such as Dycom).”

……………………………………………………………………………………………………………………………….

About Ziply Fiber:

Ziply Fiber is local in the Northwest, headquartered in Kirkland, Washington, and has major offices in Everett, Washington; Beaverton, Oregon; and Hayden, Idaho. Most of Ziply Fiber’s executive team, which consists of former executives from AT&T, CenturyLink, and Wave Broadband, either grew up in the Northwest or have spent the better part of 30 years living here. That local ownership and market familiarity is an important part of the company mindset and culture. Ziply Fiber’s primary service offerings are Fiber Internet and phone for residential customers, Business Fiber Internet and Ziply Voice services for small businesses, and a variety of Internet, networking, and voice solutions for enterprise customers. The company also continues to support Ziply Internet (DSL) customers and its TV customers in Washington and Oregon.

Ziply Fiber has committed to invest hundreds of millions of dollars to build an advanced, 100-percent fiber network to both suburban and rural communities across the Northwest that have been underserved when it comes to internet access. The company has been actively building fiber across the Northwest since June 2020 and has plans to build and deploy new fiber-optic cables, local hubs, new offices, and new hardware to run the network as part of hundreds of additional projects across its 250,000-square-mile footprint.

A full listing of products and services can be found at ziplyfiber.com.

About Ptera:

Ptera, a Liberty Lake, WA based telecommunications corporation, was founded in 2001 as a family-owned business. Today, Ptera is a pioneering wireless internet service provider operating a network with coverage in four counties across Eastern Washington and Northern Idaho. Ptera also offers hosted voice over IP phone solutions serving customers across the country. The company’s service has no data caps on fiber internet and the lowest latency in town, even lower than DSL or cable providers. Ptera’s VoIP service offers crystal clear digital phone calls over an Internet connection utilizing your current handset or Cisco office phone.

For more, visit ptera.com.

References:

https://www.fiercetelecom.com/telecom/ziply-buys-ptera-fiber-expansion-rolls-mulls-fwa-strategy

https://www.lightreading.com/broadband/spotlight-turns-to-arpu-in-us-broadband-battle/d/d-id/783742?

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

PLDT, vHive & Amdocs Launch Drone-Aided Site and Inventory Audits

Amdocs, a leading provider of software and services to communications and media companies, today announced that it has completed, in a collaboration with Amdocs partner vHive, a proof of concept (PoC) with Philippines-based PLDT’s wireless subsidiary Smart Communications, Inc. (Smart) that showcases how service providers can harness autonomous drone technology to transform how they manage and maintain network towers, while also reducing their carbon footprint.

The PoC provided Smart with an advanced, safe, sustainable way to replicate their network towers by digitizing Smart’s portfolio. Working with vHive, Amdocs’ Drone-Aided Site and Inventory Audits solution powers autonomous drone flights to simplify data capturing, effectively creating a digital twin of towers quicker than manual inspections.

Multiple teams such as network planning, optimization, engineering, and operations typically send out tower-climbing teams when they need to survey a site. This leads to duplication of effort and unnecessary truck rolls. Through the PoC, Smart was able to dramatically reduce truck rolls, minimizing its environmental impact while achieving greater operational efficiency and improved data accuracy and analysis in support of its vision of transitioning to AIOps and Autonomous Network Operations.

By leveraging the digital twin and wider solution, which integrates with Amdocs’ network inventory offering to ensure a single source of truth for the tower, Smart can also gain ongoing value around other use cases, from planning and design to compliance reviews and mount mapping/inspections.

“As we maximize the network we have put in place across the country and aim for better customer experience – we also need to empower our people and processes with the right technology to continuously improve. Digital Inspection is a good example of how we are holistically transforming every aspect of our network to a future state through new ways of working and using automation to evolve our operations,” said Eric Santiago, FVP and Head of Network at PLDT and Smart. “This is a step towards Smart’s vision of being the best in customer experience by building a fully automated, intelligent, highly efficient network, and putting in place sustainable network and operations.”

“We are excited to work with Smart to showcase this innovative solution and empower Smart on its automation and digitization journey,” said Anthony Goonetilleke, Group President of Technology and Head of Strategy at Amdocs. “At a time when service providers across the globe are looking to reduce their carbon footprint and become more efficient, this project highlights the vast potential of new technologies to enable agility and accelerate business outcomes.”

About Amdocs:

Amdocs helps those who build the future to make it amazing. With our market-leading portfolio of software products and services, we unlock our customers’ innovative potential, empowering them to provide next-generation communication and media experiences for both the individual end user and enterprise customers. Our 31,000 employees around the globe are here to accelerate service providers’ migration to the cloud, enable them to differentiate in the 5G era, and digitalize and automate their operations. Listed on the NASDAQ Global Select Market, Amdocs had revenue of $4.58 billion in fiscal 2022. For more information, visit Amdocs

References:

Learn more about Amdocs Drone-Aided Site Audits

Keep up with Amdocs news by visiting the company’s website

Ethernet Alliance multi-vendor interoperability demo (10GbE to 800GbE) at OFC 2023

The Ethernet Alliance, a global consortium dedicated to progressing Ethernet technologies (albeit, only the MAC frame format is left from the original 10BaseT Ethernet standard), this week exhibited a multivendor interoperability demonstration at the OFC 2023 conference and exhibition in San Diego, CA.

–>Please see References 1. and 2. below for the detailed multi-vendor interoperability demo diagrams.

Featuring 18 different participating member companies, the Ethernet Alliance interoperability demo spans diverse Ethernet technologies ranging from 10 Gigabit Ethernet to 800GbE. The interoperability display features a live network between the booths of Ethernet Alliance and the Optical Internetworking Forum, Exfo, Spirent Communications, and Viavi Solutions.

The network leverages single-mode optical fibers with high-speed traffic originating from an array of switches, routers, interconnects, including copper and optical cables. It also employs various interconnects using multiple pluggable form factors such as OSFP, QSFP-DD, QSFP, and SFP, and multiple interface types including OIF 400ZR, OpenZR+ MSA 400ZR+, and 800G-ETC-CR8.

The Ethernet Alliance also spent time highlighting its roadmap, which sees continued advancement in the speed, reliability, and use cases for the networking protocol across multiple sectors. The goal of the organization is not to invent new standards, but rather to help foster their adoption and deployment in an interoperable approach.

Source: Ethernet Alliance

……………………………………………………………………………………………………………………………….

“We’re now at the half-century mark, and Ethernet’s star continues to rise. As a profoundly resilient technology that’s getting progressively faster, it is an innovation engine that drives market diversification and fuels business growth. If you think about the journey from invention to deployment, what we do is we try to show that the technology does work and it is mature enough that it can be deployed,” said Peter Jones, chairman, Ethernet Alliance.

In the enterprise market, demand for 10 GbE-based Ethernet remains strong and there is also some growth for 25 GbE, which is intended more for servers. Ethernet also has 100 GbE and 400 GbE speeds to support larger enterprise and campus needs.

Network operators are always looking for more network capacity and speed and to that end 800 GbE and soon 1.6 Tb/s Ethernet (TbE) will fit the bill.

Jones said that in the early days, the goal for each new set of specifications was to provide 10-times the speed, at only three-times the price of the existing specification. Over time what has occurred is the standards have not just been racing forward to ever faster speeds, but rather are being tailored to meet the price and performance characteristics that a given use case requires.

For example, work is ongoing to help bring Ethernet into more industrial use cases as a solution for serial connections. Ethernet is also increasingly finding its way into automotive use cases as modern vehicles rely on growing levels of compute capacity to operate and communicate.

The Ethernet Alliance is also working on certification efforts for Power-over-Ethernet (PoE). While there have long been PoE standards, there hasn’t been a full-scale certification effort in the same way that there is for Wi-Fi in the wireless world. Jones said that while PoE mostly works today, there have been some instances of vendor technologies that weren’t interoperable.

“We really want people to be able to buy certified devices because we want to preserve the idea that Ethernet just works and we were starting to see that breaking down with PoE,” Jones said. “Ethernet is the most important technology that no one ever sees. Very few people that use the internet understand that Ethernet is the key part of it,” he added.

“One of OFC’s highlights was live interoperability demonstrations from leading optics companies running over OFCnet,” said OFC chairs Chris Cole, Coherent Corporation; Ramon Casellas, Centre Tecnològic de Telecomunicacions de Catalunya; and Ming-Jun Li, Corning Incorporated.

References:

https://ethernetalliance.org/wp-content/uploads/2022/09/EA_Ecosystem-Demo.pdf

https://optics.org/news/14/3/17

https://www.sdxcentral.com/articles/analysis/why-you-should-never-bet-against-ethernet/2023/03/

Russia’s Digital Ministry plans pilot 5G launch in 2025 with locally built base stations

According to Russian news agency Tass, Russia expects to conduct pilot testing of 5G networks in 2025 using “home grown”/ locally built base stations. Russia’s Ministry of digital development, communications and mass media Maksut Shadayev said, “We expect a pilot test to begin in 2025 in cities with more than one million people.”

Russia has fallen far behind in the 5G race due to sanctions following its invasion of Ukraine. High-profile network equipment vendors Ericsson and Nokia have left the country. Chinese vendor Huawei hasn’t exited the Russian market, but has set out plans to separate its Russian and Belarusian business units from the rest of the countries in the CIS (Commonwealth of Independent States) block, and has moved thousands of employees out of the country and closed down its local Enterprise Business Group. Prior to Russia’s invasion of Ukraine, foreign vendors previously helped with limited 5G test zones in the country.

In January 2023, Russian telecom operators entered into forward contracts with Russian manufacturers of base stations for communication networks for over 100 Billion rubles ($1.32 Billion). The total volume of deliveries until 2030 will include around 75,000 base stations, and starting from 2028 operators will have to purchase domestic base stations only. Currently, 5G zones have been launched in an experimental mode in several Russian regions. The 5G base station vendors were not disclosed!

Image Credit: Getty Images

In a blog post last September, Counterpoint Research wrote: “Russia might have to wait to get 5G services, as the government hasn’t finalized the spectrum band for the auction, although the ministry concerned is moving towards mmWave in the 24.25GHz-27.5GHz band from existing radio relay stations and 4GHz. The plan is expected to be finalized not before 2023.”

References:

https://tass.com/russia/1584229

Russian government to allocate 24.25-27.5 GHz band for 5G services (Russian made base stations)

Russia’s Norilsk Nickel to deploy private 5G network without a network operator

Russia Joint Venture with Beeline, Rostelecom and Megafon to focus on 5G spectrum

Only domestic network equipment may be used for 5G in Russia; Revision of ITU-R M.1036 urgently needed

Cybersecurity threats in telecoms require protection of network infrastructure and availability