Adtran showcases coherent innovation at OFC 2023: FSP 3000 open line system & coherent 100ZR

Adtran®, Inc., a leading provider of open and disaggregated networking solutions, today announced that its latest coherent innovation is being showcased at OFC 2023, as part of OFCnet. The demo reveals how the Adtran FSP 3000 open line system (OLS) can bring new levels of flexibility to optical networks by enabling optimized, tailored spectrum services. In collaboration with Acacia, Cisco, Coherent Corp., Corning, EXFO, Nokia and VIAVI Solutions, Adtran will showcase 100ZR, 200Gbit/s, 400Gbit/s OpenZR+ and 800Gbit/s connectivity. The FSP 3000 DCI OLS is also playing a key role in the OIF 400ZR demo at OFC.

“Our demo shows how the spectrum-as-a-service concept has the potential to revolutionize the way operators utilize their fiber resources. It highlights how it’s possible to slice up the network even in a metro environment. With fully flexible spectrum allocation, operators can provide a wide variety of differentiated services and ensure they leverage the full capacity of their infrastructure. Not only will this help tackle ever-increasing data demand, but it also offers a new route to revenue growth. Our compact FSP 3000 OLS is the key to realizing the full benefits of this open and flexible approach. It removes the limits of fixed channel grids so that untapped spectrum can be put to work,” said Jörg-Peter Elbers, head of advanced technology at Adtran.

…………………………………………………………………………………………………………………………..

Adtran also demonstrated its QSFP28 pluggable Coherent 100ZR [1.], which provides 100G coherent edge network connectivity. There was a live display of a 100ZR QSFP28 pluggable operating over a DWDM metro ring. The objective was to show how fiber based network operators can benefit from efficient and cost-effective deployment of coherent 100Gbit/s services with minimal power consumption and low footprint increase. The trial uses the multi-vendor OFCnet network setup with equipment at the Adtran booth as well as the Coherent and OFCnet booths.

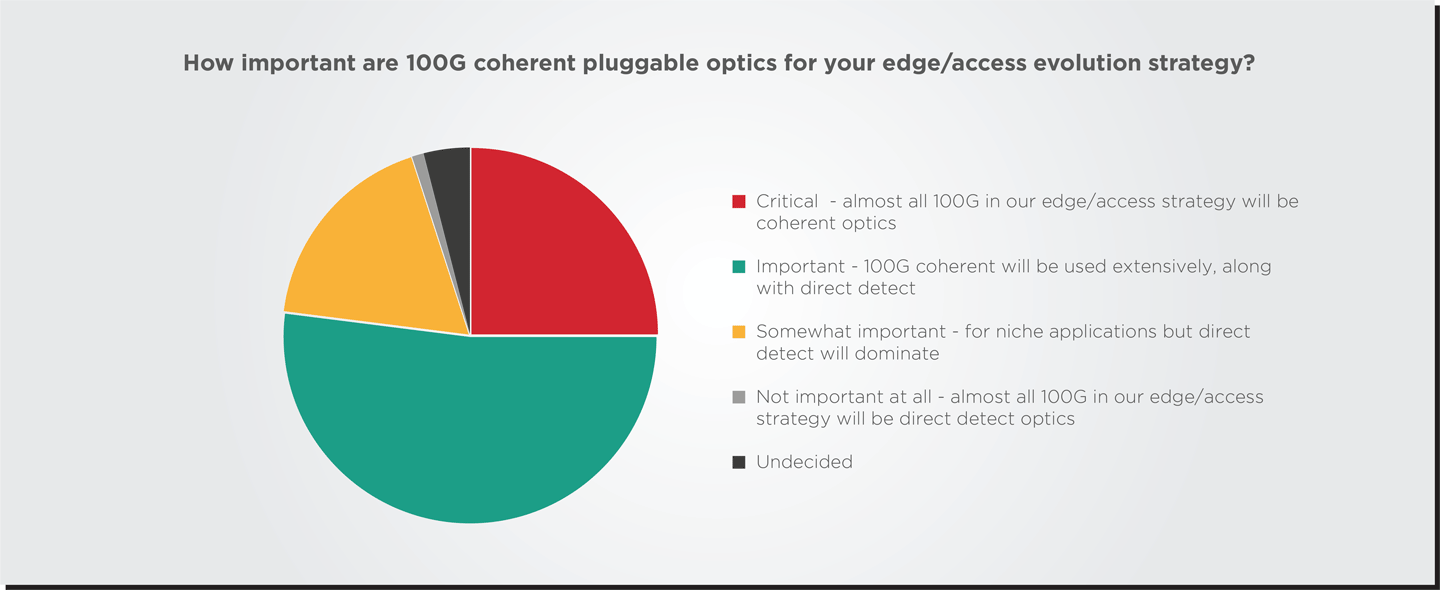

Note 1. In June 2022, transceiver developer II‐VI Incorporated (now Coherent Corp.) and optical networking solutions provider ADVA (now owned by Adtran) announced the launch of the industry’s first 100ZR pluggable coherent transceiver. A recently released Heavy Reading survey (see pie chart below) revealed that over 75% of network operators surveyed believe that 100G coherent pluggable optics will be used extensively in their edge and access evolution strategy. However, this interest had not really materialized into a 100ZR market because no affordable or power-efficient products were available. The most the industry could offer was 400ZR pluggables that were “powered-down” for 100G capacity.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Adtran’s Coherent 100ZR is purpose-built for the optical network edge. With its QSFP28 form factor and power specification, it enables easy and cost-effective upgrades to 100Gb/s data rates by plugging directly into existing head-ends, switches and routers. Co-developed by Adtran and Coherent, the DSP offers a range of deployment options, from local exchanges and central offices to harsh outdoor conditions such as street cabinets. These benefits are achieved thanks to the transceiver‘s features, which include a cost-, space- and power-optimized DSP specifically engineered for 100ZR. Adtran is also developing low-power silicon photonics integrated circuits that will enable faster and more energy-efficient solutions across a wide range of applications.

Quotes:

Saeid Aramideh, VP of Business Development at Optical Engines, Adtran said: “This demo is a significant milestone for network operators looking to expand their business capabilities. It highlights how our Coherent 100ZR can be easily and affordably integrated into a metro aggregation network, eliminating the need for costly infrastructure changes. This showcase reveals a valuable solution for operators seeking to support higher data rates at the network edge and highlights the potential for widespread adoption of 100Gbit/s coherent technology. We can’t wait to bring these benefits to our customers.”

Ross Saunders, GM of Optical Engines, Adtran said: “The technology we’re showcasing here will be a game-changer for service providers. It offers the ability to easily deploy coherent 100Gbit/s connectivity with compact footprint and lowest power consumption. By bringing coherent technology to the optical edge, we’re providing operators with a cost-efficient solution to upgrade edge aggregation networks to 100Gbit/s. Our Coherent 100ZR will also boost sustainability by lowering our customers’ carbon footprint. What’s more, it offers a way to deliver an improved experience for end-users by supporting higher data rates and improved service reliability.”

…………………………………………………………………………………………………………………………………………….

According to a recent Heavy Reading survey, 75% of operators believe that 100G coherent pluggable optics will be used extensively in their edge and access evolution strategy. However, market adoption has yet to materialize since affordable and power-efficient 100ZR-based products are currently not available due to stringent size and power consumption requirements that cannot be fulfilled by today’s tunable laser solutions.

Distribution of responses to a Heavy Reading survey question: How important are 100G coherent pluggable optics for your edge/access evolution strategy? The sample was composed of 87 people who work for network operators worldwide and are involved in network planning or purchasing network equipment.

Source: Heavy Reading

References:

https://www.fibre-systems.com/news/ofc-2023-adtran-demonstrates-coherent-100zr-qsfp28

China Tower had ~2.1M telecom towers installed with 3.36M tower tenants at end of 2022

China Tower ended 2022 with 2.05 million telecom towers installed, representing a net increase of 17,000 sites from the end of 2021. The company installed approximately 745,000 5G base-stations during the year, with more than 96 percent of sites delivered through sharing existing network infrastructure. Through the end of 2022, China Tower reported that it has received cumulative orders of nearly 1.8 million new 5G cell sites. The total tower tenants rose by 102,000 in the year to 3.36 million, pushing the average number per tower from 1.62 as of the end of 2021 to 1.65 at end-2022.

China Tower primarily serves the country’s state-owned telecommunications service providers (TSP) – China Mobile, China Telecom, China Unicom, and China Broadnet. The four TSPs accounted for a total of nearly 3.4 million tower tenants, a 102,000 year-over-year increase. The TSP tenancy ratio increased from 1.60 to 1.65 over the same period last year, showing a continuous increase in the level of site colocation.

Operating revenue for 2022 reached $13.4 billion, up 6.5 percent YoY. Revenue from the TSP segment was $12.0 billion, up by 3.5 percent over the same period last year, and accounting for 90 percent of operating revenue. The TSP business comprises revenue from towers and indoor distributed antenna system (DAS) business. Towers contributed $11.3 billion, up nearly 2 percent, while DAS revenue was $845 million, a 34 percent YoY increase. Capital expenditures for new tower builds and site augmentation was $3.0 billion in 2022, up 5 percent over nearly $2.9 billion in 2021.

The company sees “5G + DAS” as its dual-growth engines, with DAS as the fastest growing segment. The DAS business focuses on providing 5G coverage under various scenarios in key sectors including education, cultural tourism, transportation, and healthcare, with an integrated approach to coordinating resources and demands.

At year-end 2022, China Tower’s DAS deployments covered buildings with a cumulative area of 7,390 million square meters, representing a 48 percent YoY increase. The company expanded DAS coverage to 10,429 kilometers in high-speed railway tunnels and to 9,611 kilometers in subways, coverage reaching a cumulative length of 20,040 kilometers, up 19 percent from a year ago.

China Tower has Commercial Pricing Agreements and Service Agreements with each of the TSPs. In a statement, the company reiterated its commitment to meeting its TSP customer network construction needs using innovative construction and service models that provide low-cost and efficient coverage.

Zhang Zhiyong, chairman of China Tower said: “Looking ahead, we will remain focused on grasping the opportunities brought by the development of 5G new infrastructure, the digital economy, and the green-oriented transition of energy. With a focus on “Digital Tower,” our Smart Tower business growth accelerated. Serving the national strategic goals.”

Tower business. China Tower advocated for the inclusion of 5G base-station sites in development planning and played an active role in setting the wireless communications specifications for buildings. Complying with these specifications, we have been included in the administrative approval process for new construction projects, further strengthening our ability to coordinate and share resources. We launched innovative low-cost construction solutions to sharpen our capability in providing integrated wireless communications coverage solutions. A higher level of resource sharing enabled us to comprehensively satisfy customer demand for 5G construction. We completed approximately 745,000 5G base-stations during the year, of which more than 96% were delivered through sharing existing resources. In addition, we focused our efforts on tackling difficult sites and continued to enhance our service quality. Alongside an improving capability in site maintenance, customer satisfaction grew. In 2022, our Tower business generated revenue of RMB77,204 million, or year-on-year growth of 1.8%. As of 31 December 2022, we managed 2.055 million tower sites, representing a net increase of 17,000 sites from the end of 2021. The number of TSP tenants reached 3.362 million, an increase of 102,000 from the end of 2021, and the TSP tenancy ratio also increased from 1.60 to 1.65 over the same period of last year, showing a continuous increase in the level of site co-location.

DAS business. China Tower focused on providing 5G coverage for key scenarios and key sectors including education, cultural tourism, transportation and healthcare, with an integrated approach to coordinating resources and demands. Playing an important role in coordinating site entry and construction, we were able to take up all DAS construction demand for key venues, scenarios and sectors, providing customers with differentiated and diversified indoor coverage solutions. In addition, we stepped up innovation to develop sharable DAS products and solutions. We enhanced our professional capabilities to optimize our advantages in providing low-cost and green and low-carbon DAS solutions, complemented by our quality services, driving accelerated growth in the DAS business. This business has increasingly become the second growth engine of our development. In 2022, our DAS business recorded revenue of RMB5,827 million, representing a year-on-year increase of 34.3%. As of 31 December 2022, we had covered buildings with a cumulative area of 7,390 million square meters, representing a year-on-year increase of 48.1%. Our high-speed railway tunnels and subway coverage reached a cumulative length of 20,040.2 kilometers, a year-on-year increase of 18.5%.

Grasping strategic opportunities to boost strong growth in Two Wings business:

By leveraging the opportunities brought forth by the growth of the “digital economy” and the “dual carbon” goals, we focused on product innovation and business optimization to fortify our competitive advantages. As a result, the Two Wings business sustained a robust growth trajectory with revenue in 2022 reaching RMB8,904 and accounting for 9.7% of our overall operating revenue, an increase of 2.6 percentage points from the same period in 2021. The business contributed 49.7% to our incremental operating revenue for the year, an increase of 9.7 percentage points year-on-year, further solidifying our multi-pillar business development structure.

Image courtesy of China Tower

…………………………………………………………………………………………………………………………………………………………………………………………

China’s wireless network operators had deployed a total of 2.29 million 5G base stations nationwide as of the end of November, according to the latest available data from China’s Ministry of Industry and Information Technology. This figure represents an increase of 862,000 compared to the end of 2021 and accounts for 21.1% of all mobile base stations in the country.

Chinese operators recorded a net gain of 16.53 million 5G subscribers in January, according to the operators’ latest available statistics. China Mobile, the world’s largest operator in terms of subscribers, added a total of 8.46 million 5G subscribers during the first month of the year. The carrier said it ended last month with 622.47 million 5G subscribers. China Mobile added a total of 227.2 million subscribers in the 5G segment during 2022.

Meanwhile, China Telecom added 5 million 5G subscribers last month to take its total 5G subscribers base to 273 million. During 2022, the telco added a total of 80.16 million 5G subscribers.

Rival operator China Unicom said it added a total of 3.07 million 5G subscribers during last month. The carrier ended January with 215.8 million 5G subscribers. China Unicom added over 42 million subscribers in the 5G segment during 2022.

…………………………………………………………………………………………………………………………………………………………………………………………

References:

China MIIT claim: 475M 5G mobile users, 1.97M 5G base stations at end of July 2022

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

Leichtman Research Group: Fixed Wireless Services Accounted for 90% of the Broadband Net Adds in 2022!

Leichtman Research Group, Inc. (LRG) found that the largest cable and wireline phone providers and fixed wireless services in the U.S. – representing about 95% of the market – acquired about 3,500,000 net additional broadband Internet subscribers in 2022, compared to a pro forma gain of about 3,725,000 subscribers in 2021.

These top broadband providers account for about 110.5 million subscribers, with top cable companies having 75.6 million broadband subscribers, top wireline phone companies having 30.8 million subscribers, and top fixed wireless services having 4.1 million subscribers.

LRG’s findings for 2022 include:

- Overall, broadband additions in 2022 were 94% of those in 2021.

- The top cable companies added about 515,000 subscribers in 2022 – compared to about 2.8 million net adds in 2021.

- The top wireline phone companies lost about 180,000 total broadband subscribers in 2022 – compared to about 210,000 net adds in 2021.

- Wireline Telcos had about 2.4 million net adds via fiber in 2022, offset by about 2.6 million non-fiber net losses.

- Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,170,000 subscribers in 2022 – compared to about 730,000 net adds in 2021.

“Top broadband providers added about 3.5 million subscribers in 2022. Fixed wireless services (FWA) accounted for 90% of the net broadband additions in 2022, compared to 20% of the net adds in 2021,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Total broadband net adds in 2022 were slightly lower than last year, and down from about 5 million in 2020, but were more than in any year from 2012-2019.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

FWA in the Spotlight:

A recent survey of some T-Mobile fixed wireless customers, conducted by the financial analysts at Wolfe Research, “T-Mobile Fixed Wireless Consumer Survey & Broadband Industry Implications,” found that 90% rated their service as “good enough.” The firm surveyed Facebook’s T-Mobile FWA user group, totalling over 15,000 members, in December 2022. Based on the 60 replies it received, 90% said they were mostly satisfied. The firm also found that 42% of respondents previously subscribed to a cable connection, 37% hailed from DSL operators, and 6% previously used fiber. Around 8% had no prior broadband service. Moreover, the financial analysts at Evercore expect T-Mobile to accumulate around 450,000 new fixed wireless customers in the first quarter of 2023, down from the 524,000 the operator reported in the fourth quarter of 2022.

Verizon added 262,000 residential FWA customers in Q4, up from +38,000 in the year-ago period, to end 2022 with 884,000 residential FWA subscribers. The company also signed on 117,000 business FWA subs in the quarter, up from +40,000 in the year-ago period, ending 2022 with 568,000 business FWA customers. About 70% of the consumer fixed wireless gross additions have come from bundling an existing wireless service, while 30% are new to Verizon. Interestingly, the experience is flipped for Verizon Business, where 70% of FWA customers were new to Verizon.

In contrast to the widely-held view that FWA is a “lower quality” service than wired broadband, Verizon says their principal selling point is FWA network’s greater reliability versus wireline alternatives. Cable’s outside plant issues can take days to resolve, a particularly critical issue in B2B, where cablecos (like Comcast Business) have increased their market share.

Image Credit: Verizon

The Wireless Internet Service Providers Association (WISPA) kicked off its annual trade show this week in Louisville, Kentucky, stating that WISPs service a total of 9 million Americans, many of whom live in the hardest to reach and serve parts of the country

According to Fierce Wireless, Cox is using 5G technology to test FWA services near Macon, Georgia; Tucson, Arizona; and Oklahoma City, Oklahoma.

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

| Broadband Providers | Subscribers at end of 2022 | Net Adds in 2022 |

| Cable Companies | ||

| Comcast | 32,151,000 | 250,000 |

| Charter | 30,433,000 | 344,000 |

| Cox* | 5,560,000 | 30,000 |

| Altice | 4,282,900 | (103,300) |

| Mediacom* | 1,468,000 | 5,000 |

| Cable One** | 1,060,400 | 14,400 |

| Breezeline** | 693,781 | (22,997) |

| Total Top Cable | 75,649,081 | 517,103 |

| Wireline Phone Companies | ||

| AT&T | 15,386,000 | (118,000) |

| Verizon | 7,484,000 | 119,000 |

| Lumen^ | 3,037,000 | (253,000) |

| Frontier | 2,839,000 | 40,000 |

| Windstream* | 1,175,000 | 10,300 |

| TDS | 510,000 | 19,700 |

| Consolidated** | 367,458 | 724 |

| Total Top Wireline Phone | 30,798,458 | (181,276) |

| Fixed Wireless Services | ||

| T-Mobile | 2,646,000 | 2,000,000 |

| Verizon | 1,452,000 | 1,171,000 |

| Total Top Fixed Wireless | 4,098,000 | 3,171,000 |

| Total Top Broadband | 110,545,539 | 3,506,827 |

* LRG estimate

** Includes LRG estimate of pro forma net adds

^ Includes the impact of a divestiture completed in October 2022

- TDS residential subscribers, includes 305,200 wireline subscribers and 204,800 cable subscribers

- Company subscriber counts may not solely represent residential households – about 6.5% of the total are non-residential

- Top broadband providers represent approximately 95% of all subscribers

- Net additions reflect pro forma results from system sales and acquisitions, reporting adjustments, and the addition of new providers to the list – therefore, comparing totals in this release to prior releases will not produce accurate findings

About Leichtman Research Group, Inc:

Leichtman Research Group, Inc. (LRG) specializes in research and analysis on broadband, media and entertainment industries. LRG combines ongoing consumer surveys with industry tracking and analysis, to provide companies with a richer understanding of current market conditions, and the potential impact and adoption of new products and services. For more information about LRG, please call (603) 397-5400 or visit www.LeichtmanResearch.com

References:

https://wispa.org/news_manager.php?page=29725

https://www.verizon.com/about/blog/fixed-wireless-access

Broadcom: 5nm 100G/lane Optical PAM-4 DSP PHY; 200G Optical Link with Semtech

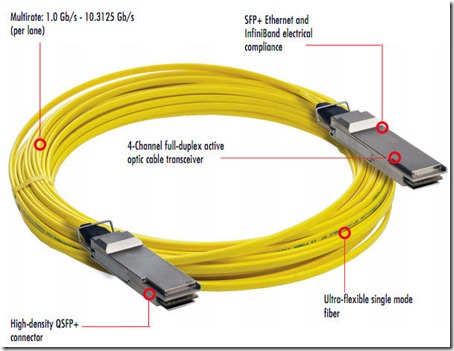

Broadcom Inc. today announced the availability of its 5nm 100G/lane optical PAM-4 DSP PHY with integrated transimpedance amplifier (TIA) and laser driver, the BCM85812, optimized for 800G DR8, 2x400G FR4 and 800G Active Optical Cable (AOC) [1.] module applications. Built on Broadcom’s proven 5nm 112G PAM-4 DSP platform, this fully integrated DSP PHY delivers superior performance and efficiency and drives the overall system power down to unprecedented levels for hyperscale data center and cloud providers.

Note 1. Active Optical Cable (AOC) is a cabling technology that accepts same electrical inputs as a traditional copper cable, but uses optical fiber “between the connectors.” AOC uses electrical-to-optical conversion on the cable ends to improve speed and distance performance of the cable without sacrificing compatibility with standard electrical interfaces.

BCM85812 Product Highlights:

- Monolithic 5nm 800G PAM-4 PHY with integrated TIA and high-swing laser driver

- Delivers best-in-class module performance in BER and power consumption.

- Drives down 800G module power for SMF solutions to sub 11W and MMF solutions to sub 10W.

- Compliant to all applicable IEEE and OIF standards, capable of supporting MR links on the chip to module interface.

- Fully compliant with OIF 3.2T Co-Packaged Optical Module Specs

- Capable of supporting optical modules from 800G to 3.2T

Demo Showcases at OFC 2023:

Broadcom will demonstrate the BCM85812 in an end-to-end link connecting two Tomahawk 5 (TH5) switches using Eoptolink’s 800G DR8 optical modules. Attendees will see live traffic stream of 800GbE data running between two TH5 switches. Broadcom will showcase various 800G DR8, 2x400G FR4, 2x400G DR4, 800G SR8, and 800G AOC solutions from third party transceiver vendors that interoperate with each other, all using Broadcom’s DSP solutions. Following are module vendors that will be participating in a multi-vendor interop plug-fest on the latest Tomahawk 5 switch platform: Eoptolink, Intel, Molex, Innolight, Source Photonics, Cloud Light Technology Limited and Hisense Broadband.

Additionally, Broadcom in collaboration with Semtech and Keysight will demonstrate a 200G per lane (200G/lane) optical transmission link leveraging Broadcom’s latest SerDes, DSP and laser technology. These demonstrations will be in Broadcom Booth 6425 at the Optical Fiber Communication (OFC) 2023 exhibition in San Diego, California from March 7th to 9th.

“This first-to-market highly integrated 5nm 100G/lane DSP PHY extends Broadcom’s optical PHY leadership and demonstrates our commitment to addressing the stringent low power requirements from hyperscale data center and cloud providers,” said Vijay Janapaty, vice president and general manager of the Physical Layer Products Division at Broadcom. “With our advancement in 200G/lane, Broadcom continues to lead the industry in developing next generation solutions for 51.2T and 102.T switch platforms.”

“By 2028, optical transceivers are projected to account for up to 8% of total power consumption in cloud data centers,” said Bob Wheeler, principal analyst at Wheeler’s Network. “The integration of TIA and driver functions in DSP PHYs is an important step in reducing this energy consumption, and Broadcom is leading the innovation charge in next-generation 51.2T cloud switching platforms while also demonstrating a strong commitment to Capex savings.”

Availability:

Broadcom has begun shipping samples of the BCM85812 to its early access customers and partners. Please contact your local Broadcom sales representative for samples and pricing.

……………………………………………………………………………………………………………………………………….

Separately, Semtech Corp. with Broadcom will demonstrate a 200G per lane optical transmission link that leverages Semtech’s latest FiberEdge 200G PAM4 PMDs and Broadcom’s latest DSP PHY. The two companies plan to recreate the demonstration this week at OFC 2023 in San Diego in their respective booths. Such a capability will be useful to enable 3.2-Tbps optical modules to support 51.2- and 102.4-Tbps switch platforms, Semtech points out.

The two demonstrations will leverage Semtech’s FiberEdge 200G PAM4 EML driver and TIA and Broadcom’s 5-nm 112-Gbaud PAM4 DSP platform. Instrumentation from Keysight Technologies Inc. will verify the performance of the links.

“We are very excited to collaborate with Broadcom and Keysight in this joint demonstration that showcases Semtech’s 200G PMDs and their interoperability with Broadcom’s cutting-edge 200G/lane DSP and Keysight’s latest 200G equipment,” said Nicola Bramante, senior product line manager for Semtech’s Signal Integrity Products Group. “The demonstration proves the performance of a 200G/lane ecosystem, paving the way for the deployment of next-generation terabit optical transceivers in data centers.”

“This collaboration with Semtech and Keysight, two of the primary ecosystem enablers, is key to the next generation of optical modules that will deliver increased bandwidth in hyperscale cloud networks. This achievement demonstrates our commitment to pushing the boundaries of high-speed connectivity, and we are excited to continue working with industry leaders to drive innovation and deliver cutting-edge solutions to our customers,” added Khushrow Machhi, senior director of marketing of the Physical Layer Products Division at Broadcom.

“Semtech’s and Broadcom’s successful demonstration of the 200-Gbps optical link is another important milestone for the industry towards ubiquitous future 800G and 1.6T networks. Keysight’s early engagement with leading customers and continuous investments in technology and tools deliver the needed insights that enable these milestones,” said Dr. Joachim Peerlings, vice president and general manager of Keysight’s Network and Data Center Solutions Group.

…………………………………………………………………………………………………………………………………………………………………….

About Broadcom:

Broadcom Inc. is a global technology leader that designs, develops and supplies a broad range of semiconductor and infrastructure software solutions. Broadcom’s category-leading product portfolio serves critical markets including data center, networking, enterprise software, broadband, wireless, storage and industrial. Our solutions include data center networking and storage, enterprise, mainframe and cyber security software focused on automation, monitoring and security, smartphone components, telecoms and factory automation. For more information, go to https://www.broadcom.com.

Broadcom, the pulse logo, and Connecting everything are among the trademarks of Broadcom. The term “Broadcom” refers to Broadcom Inc., and/or its subsidiaries. Other trademarks are the property of their respective owners.

About Semtech:

Semtech Corporation is a high-performance semiconductor, IoT systems and Cloud connectivity service provider dedicated to delivering high quality technology solutions that enable a smarter, more connected and sustainable planet. Our global teams are dedicated to empowering solution architects and application developers to develop breakthrough products for the infrastructure, industrial and consumer markets.

References:

https://www.broadcom.com/company/news/product-releases/60996

https://www.fiberoptics4sale.com/blogs/archive-posts/95047430-active-optical-cable-aoc-explained-in-details

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

ZTE, in partnership with China Telecom, has released a 5G-Advanced solution, named Cluster DFS at Mobile World Congress 2023 in Barcelona, Spain. According to ZTE, the new offering will facilitate the development of specific B2B and B2C services using a single 5G network.

China Telecom claims to have deployed the world’s largest 5G SA network with more than 1 million 5G base stations based on a RAN-sharing strategy. The Chinese carrier noted it continues to focus in the B2B segment, with the number of private 5G networks hitting over 3,000, and commercial projects in this segment totaling 9,000 by the end of 2022.

Image Credit: ZTE

ZTE explained that that the new solution will be key as the service-level agreements (SLAs) requirements for the provision of 5G for industrial verticals such as smart manufacturing or smart grid are different from the requirements for the provision of 5G services for consumers. ZTE further explained that it launched the new solution given to the increasing complexity of 5G networks and to enable a coordinated development of B2B and B2C services on a single network and deliver differentiated service experiences.

To adapt to vertical application traffic dynamics on uplink and downlink, China Telecom and ZTE have introduced the innovative Cluster DFS, by which, base stations with same heavy uplink characteristics are intelligently formed as “cluster” to implement accurate adaptation between frame structure and services requirements. Consequently, a 5G network can synergize B2B and B2C services with optimal user experiences.

Li Peng, Director of Network Development and Sharing Department of China Telecom, said, “5G has become an important driving force of digital economy development. China Telecom is continuously exploring and promoting innovative technologies and solutions that combine the development of 5G high-quality networks and industrial applications.”

“Based on previous successful experience of Cluster DSS, China Telecom further extends ‘cluster-level’ radio resource management mechanism from ‘frequency domain’ to ‘time domain’, which provides more flexible radio resource strategy and promotes the development of fully-connected factories. The commercial trial of Lierda shows that Cluster DFS has increased the uplink throughput of B2B applications by 60~80% while ensuring stable B2C experiences, significantly improving network performance and efficiency, ” added Huang Lilian.

Tang Xue, VP of RAN Products, said, “B2B and B2C coordinated development on one network requires more flexible and more intelligent resource management strategy, therefore, RAN intelligence is of great importance. ZTE uses RAN native-AI to enable adaptive radio resource adjustment, including spectrum, frame structure, power and beams. With four key features, specifically, intelligent traffic prediction, cluster self-generating, intra-cluster traffic shaping and inter-cluster coordination, the potential of commercial 5G networks can be fully unlocked to offer optimal experiences for both industrial applications and consumer users.”

Cluster DFS provides precise and on-demand user experiences for both consumers and enterprises based on AI capability, enabling network policy shift from “one-size-fit-all” to “context-aware” and coordinating the development of B2B and B2C on 5G commercial networks.

Moving forward, ZTE and China Telecom will continue working together to carry out innovative practices and facilitate the development of 5G-Advanced applications for a digital, intelligent and green future.

ZTE said Cluster DFS provides precise on-demand user experiences for consumers and enterprises based on its AI capability to coordinate the development of B2B and B2C on 5G commercial networks.

China Telecom and rival network operator China Unicom had previously signed an agreement to co-build and co-share their 5G networks. According to the latest available statistics, China Telecom added a total of 5 million 5G subscribers during the first months of the year to take its total 5G subscribers base to 273 million. During 2022, the telco added a total of 80.16 million 5G subscribers.

References:

https://www.zte.com.cn/global/about/news/china-telecom-and-zte-release-cluster-dfs-at-mwc-2023.html

https://www.zte.com.cn/global/about/news/20220526e2.html

NTT to offer optical technology-based next-generation network services under IOWN initiative; 6G to follow

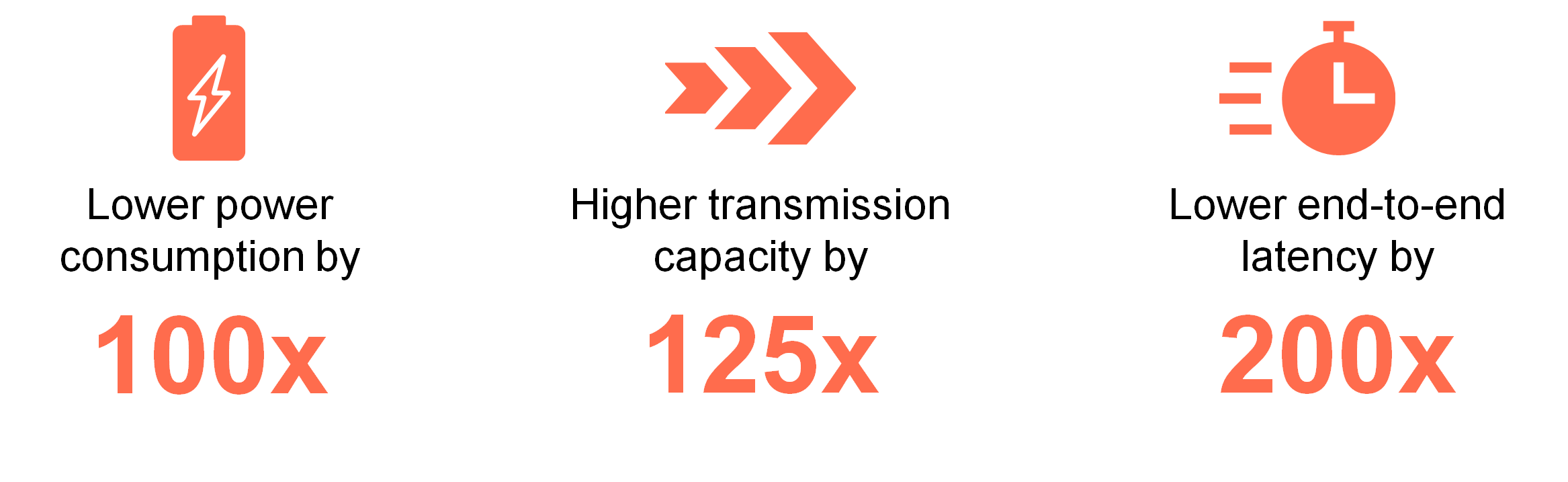

Japan’s Nippon Telegraph and Telephone Corp. (NTT) said it will start providing its first services under an optical technology-based next-generation network initiative to its corporate clients. The major Japanese telecommunications company plans to start offering the services from March 16 for a monthly fee of 1.98 million yen through its regional arms Nippon Telegraph and Telephone East Corp. and Nippon Telegraph and Telephone West Corp.

NTT rival telco KDDI Corp. will also take part in the Innovative Optical and Wireless Network (IOWN) initiative which was first announced by NTT in 2019. It’s goal is to reduce electricity consumption (power) and achieve high-capacity communication by converting electric signals into optical ones to cope with surging network traffic. It will join the IOWN Global Forum, comprising over 100 members including NTT and many information technology companies in and outside Japan. Founding IOWN members are NTT, Sony and Intel. The forum will be discussing technical specifications for optical and wireless networks with a view to developing an international standard for 6G communications.

Source: IOWN Global Forum

……………………………………………………………………………………………………………………………………………………………………

The two Japanese rival firms will work together to make IOWN a 6G platform, pundits said. That’s amazing as all previous IMT standards (3G, 4G, 5G) were developed by 3GPP and then ITU-R WP 5D.

At a news conference, NTT Senior Executive Vice President Katsuhiko Kawazoe said: “We hope [IOWN] will help resolve social issues and create new value.”

NTT plans to announce the second round of IOWN services as early as 2025.

References:

https://www.nippon.com/en/news/yjj2023030200965/

https://www.japantimes.co.jp/news/2023/03/03/business/ntt-6g-network/

ASPI’s Critical Technology Tracker finds China ahead in 37 of 44 technologies evaluated

The Australian Strategic Policy Institute (ASPI finds that China is further ahead in more technologies than has been realized. It’s the leading country in 37 of the 44 technologies evaluated, often producing more than five times as much high-impact research as its closest competitor. This means that only seven of the 44 analysed technologies are currently led by a democratic country, and that country in all instances is the U.S. Of the ten AI and ICT-related technologies examined, China dominates in seven, the study concluded.

The ASPI study is based on an analysis of the top 10% most-cited papers in each area of research published between 2018 and 2022 – a total of 2.2 million papers. It acknowledges that a widely cited piece of research does not automatically translate into successfully deployed technology. The study also does not reflect the current state of commercialization or of technology diffusion. Here’s a table showing China leading technologies:

![]()

Source: Australian Strategic Policy Institute

……………………………………………………………………………………………………………………………………………

China leads globally in photonic sensors (43% of world’s top 10% high-impact research, 3.41 times the US), quantum communications (31%, 1.89 times the US), advanced optical communications (38%, 2.95 times the US) and post-quantum cryptography (31%, 2.3 times the US). Taken together, these observations increase the risk of Chinese communications going dark83 to the efforts of western intelligence services. This reduces the capacity to plan for contingencies in the event of hostilities85 and tensions.

China has reportedly built the physical infrastructure to claim the world’s largest quantum communication network,86 and has even established quantum communication with moving drones87 and satellites.88 As with many things, the risk is cumulative—the risk increases as China leads in both cryptography resistant to decryption by quantum computers and the ability to share encryption keys via quantum communication. One mitigating factor is the current US lead in quantum computing (34% of world’s top 10% high-impact research output, 2.26 times China).

Here are three key tech areas where China dominates in high-impact research papers:

- In advanced radiofrequency communications, including 5G and 6G, (there is no such thing as 6G radio) China ranks 1st with 29.65% vs 9.50% for the U.S. and 5.2% for the UK.

- In advanced optical communications, China ranks 1st with 37.69% vs. 12.76% for the U.S.

- In artificial intelligence (AI) algorithms and hardware accelerators, China ranks 1st with 36.62% vs. 13.26% for the U.S.

The ASPI report designates China’s lead in these technologies as “high-risk,” meaning it is a long way ahead of its closest competitor and that it is home to most of the world’s leading research bodies in that field.

Quantum communications is another area of strength for China. USTC is the top institution irrespective of the quality metrics, and a total of eight out of 20 top institutions are based in China (see Figure 9). Tsinghua University and Delft University of Technology in the Netherlands occupy the second and third places depending on the quality metrics. China’s lead in quantum communications is especially prominent in the proportion of publications in the top 10% of highly cited papers. China’s quantum research was spearheaded by the Xiangshan Science Forum for quantum information in Beijing in 1998, which resulted in experimental research in quantum information within several Chinese universities and research institutes, including USTC, Shanxi University and the Chinese Academy of Sciences’ Institute of Physics.

USTC scientist Jian-Wei Pan to demonstrate the potential of quantum communications to Xi Jinping and other Politburo members, and he became known as the founder of Chinese quantum science. In China’s Thirteenth Five-Year National Science and Technology Innovation Plan announced in August 2016,163 the CCP strengthened its quantum strategy further by listing quantum communications and computing as major science and technology projects for advances by 2030. USTC demonstrated China’s dominance in quantum communication by building the first fibre-based ‘Beijing–Shanghai Quantum Secure Communication Backbone’ in 2013, connecting Beijing, Shanghai, Jinan Hefei and 32 reliable nodes over a total transmission distance of more than 2,000 kilometres.164 The strength of quantum communications is that it ensures secure communication due to quantum entanglement, which effectively ensures that any quantum information is modified when observed. This effectively makes it difficult to amplify quantum signals in the conventional way used for current optical communications. Pan’s research team made another significant breakthrough in 2017 by using the first quantum satellite (Micius, launched in 2016), and the free space reduced attenuation to transmit image and sound information using quantum keys over 7,600 kilometres between Austria and China.

………………………………………………………………………………………………………………………………………………………………………..

ASPI warns that China’s advanced research “at the intersection of” photonic sensors, quantum communications, optical communications and post-quantum cryptography could undermine the U.S. led “Five Eyes” global intelligence network.

“Taken together, these observations increase the risk of Chinese communications going dark to the efforts of western intelligence services,” the report said. ASPI said its research will be updated with the aim of assessing the future tech capabilities of nations and to highlight long-term strategic trends.

………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.aspi.org.au/report/critical-technology-tracker

https://techtracker.aspi.org.au/

https://www.lightreading.com/6g/china-dominates-research-in-6g-and-optical-report/d/d-id/783630?

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

With no 5G standard (IMT 2020) China is working on 6G!

Swisscom, Ericsson and AWS collaborate on 5G SA Core for hybrid clouds

Swiss network operator Swisscom have announced a proof-of-concept (PoC) collaboration with Ericsson 5G SA Core running on AWS. The objective is to explore hybrid cloud use cases with AWS, beginning with 5G core applications. The plan is for more applications to then gradually be added as the trial continues. With each cloud strategy (private, public, hybrid, multi) bringing its own drivers and challenges the idea here seems to be enabling the operator to take advantage of the specific characteristics of both hybrid and public cloud.

The PoC reconfirms Swisscom and Ericsson’s view of the potential hybrid cloud has as a complement to existing private cloud infrastructure. Both Swisscom and Ericsson are on a common journey with AWS to explore how use cases can benefit telecom operators.

The PoC will examine use cases that take advantage of the particular characteristics of hybrid and public cloud. In particular, the flexibility and elasticity it can offer to customers which can mean deployment efficiencies for use cases where capacity is not constantly needed. An example of this could be when maintenance activities are undertaken in Swisscom’s private cloud, or when there are traffic peaks, AWS can be used to offload and complement the private cloud.

Swisscom had already been collaborating with AWS on migrating its 5G infrastructure towards standalone 5G. In addition, it has also used the hyperscaler’s public cloud platform for its IT environments. Telco concerns linger [1.] around the use of public cloud in telecoms infrastructure (especially the core networks) for some operators, hybrid cloud is seemingly gaining momentum as a transitional approach.

Note 1. Telco concerns over public cloud:

- In a recent survey by Telecoms.com more than four in five industry respondents feared security concerns over running telco applications in the public cloud, including 37% who find it hard to make the business case for public cloud as private cloud remains vital in addressing security issues. This also means that any efficiency gains are offset by the IT environment and the network running over two cloud types.

- Many in the industry also fear vendor lock-in and lack of orchestration from public cloud providers. Around a third of industry experts from the same survey find it a compelling reason not to embrace and move workloads to the public cloud unless applications can run on all versions of public cloud and are portable among cloud vendors.

- There’s also a lack of interoperability and interconnectedness with public clouds. The services of different public cloud vendors are indeed not interconnected nor interoperable for the same types of workloads. This concern is one of the drivers to avoid public cloud, according to some network operators.

–>PLEASE SEE THE COMMENT ON THIS TOPIC IN THE BOX BELOW THE ARTICLE.

Quotes:

Mark Düsener, Executive Vice President Mobile Network & Services at Swisscom, says: “By bringing the Ericsson 5G Core onto AWS we will substantially change the way our networks will be built and operated. The elasticity of the cloud in combination with a new magnitude in automatization will support us in delivering even better quality more efficiently over time. In order to shape this new concept, we as Swisscom believe strategic and deep partnerships like the ones we have with Ericsson and AWS are the key for success.”

Monica Zethzon, Head of Solution Area Core Networks, Ericsson says: “5G innovation requires deep collaboration to create the foundations necessary for new and evolving use cases. This Proof-of-Concept project with Swisscom and AWS is about opening up the routes to innovation by using hybrid cloud’s flexible combination of private and public cloud resources. It demonstrates that through partnership, we can deliver a hybrid cloud solution which meets strict telecoms industry requirements and security while making best use of HCP agility and cloud economy of scale.”

Fabio Cerone, General Manager AWS Telco EMEA at AWS, says: “With this move, Swisscom is opening the door to cloud native networks, delivering full automation and elasticity at scale, with the ability to innovate faster and make 5G impactful to their customers. We are committed to working closely with partners, such as Ericsson, to explore new use cases and strategies that best support the needs of customers like Swisscom.”

“How to deploy software in different cloud environments – at a high level, it is hard making that work in practice,” said Per Narvinger, the head of Ericsson’s cloud software and services unit. “You have hyperscalers with their offering and groups trying to standardize and people trying to do it their own way. There needs to be harmonization of what is wanted.”

https://telecoms.com/520337/swisscom-ericson-and-aws-collaborate-on-hybrid-cloud-poc-on-5g-core/

https://telecoms.com/520055/telcos-and-the-public-cloud-drivers-and-challenges/

AWS Telco Network Builder: managed network automation service to deploy, run, and scale telco networks on AWS

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

SKT with Global Telcos to Expand Metaverse Platform in US, Europe and Southeast Asia

On February 27 at MWC Barcelona 2023, South Korean network operator SK Telecom (SKT) signed a memorandum of understanding (MOU) with Deutsche Telekom and T-Mobile US to jointly explore opportunities for expanding its metaverse platform ifland into Germany and the U.S.

Image Credit: SKT

The three companies will begin to conduct market tests in the U.S. and Germany in the second quarter of this year, with the main goal of the trials being to try “more diverse metaverse services in Europe and the U.S.”

SKT, Deutsche Telekom and T-Mobile US will also produce content tailored to local preferences, and will jointly promote the metaverse offering.

The ifland platform is also set to be made available to more countries in South East Asia, and the telco has agreed a partnership with its Malaysian partner CelcomDigi to boost its ifland user numbers in the country and develop new business models. It will also be made available to all 11 subsidiaries of Axiata operating in the ASEAN (Association of South-east Asian Nations) and South Asian regions, including Malaysia, Indonesia, Sri Lanka, Cambodia, Bangladesh and Nepal.

SKT and Axiata also plan to develop “metaverse platform-related business models” and create business opportunities based on artificial intelligence (AI) to enhance the competitiveness of these models.

By expanding its metaverse service into the Southeast Asian market, where Korean culture such as K-content is gaining popularity, SKT expects to expand ifland’s services and develop new business opportunities.

“As we advance into the global market with our metaverse platform ifland, major telecommunications companies in each country and region play an important role as our partners,” said Ryu Young-sang, CEO of SKT. “Going forward, we will continue to work closely with diverse global companies to expand the scope of our metaverse service.”

“The collaboration between the leading Malaysian telecoms operator serving more than 20 million customers and global ICT leader SKT will set the stage for the nation’s metaverse development, and drive growth and digitalisation within the digital economy,” said Datuk Idham Nawawi, CEO of CelcomDigi. “We look forward to working together on leveraging innovative technologies and practices particularly in virtual spaces to develop and deliver a wider range of innovative solutions for our customers and Malaysian businesses.”

“Axiata is deeply committed to leveraging emerging technologies towards the inclusive advancement of Societies and Economies across Asia,” said Dr Hans Wijayasuriya, CEO of Axiata. “We are proud to partner with SKT and the ifland platform and consider the partnership a significant component of our participation in the metaverse going forward.”

SKT pointed out that each of the three operator partners has more than 100 million customers, giving it a solid foundation on which to expand the international impact of ifland. The company’s CEO, Ryu Young-sang, pointed out that partnering with major telcos “in each country and region” plays a key role in advancing ifland’s influence, so it plans to continue working closely with global companies to broaden the scope of the service.

SKT’s metaverse platform launched in June 2021 and after an initial collaboration with Deutsche Telekom, it aggressively moved to global expansion across North America, Europe, the Middle East and Asia in November 2022.

References:

https://www.sktelecom.com/en/press/press_detail.do?idx=1560

SK Telecom launches its metaverse platform ‘ifland’ in 49 countries and regions

NTT Docomo will use its wireless technology to enter the metaverse

Cloud RAN with Google Distributed Cloud Edge; Strategy: host network functions of other vendors on Google Cloud

At MWC 2023 Barcelona, Google Cloud announced that they can now run the radio access network (RAN) functions as software on Google Distributed Cloud Edge, providing communications service providers (CSPs- AKA telcos) with a common and agile operating model that extends from the core of the network to the edge, for a high degree of programmability, flexibility, and low operating expenses. CSPs have already embraced open architecture, open-source software, disaggregation, automation, cloud, AI and machine learning, and new operational models, to name a few. The journey started in the last decade with Network Functions Virtualization, primarily with value added services and then deeper with core network applications, and in the past few years, that evolved into a push towards cloud-native. With significant progress in the core, the time for Cloud RAN is now, according to Google. However, whether for industry or region-specific compliance reasons, data sovereignty needs, or latency or local data-processing requirements, most of the network functions deployed in a mobile or wireline network may have to follow a hybrid deployment model where network functions are placed flexibly in a combination of both on-premises and cloud regions. RAN, which is traditionally implemented with proprietary hardware, falls into that camp as well.

In 2021,the company launched Google Distributed Cloud Edge (GDC Edge), an on-premises offering that extends a consistent operating model from our public Google Cloud regions to the customer’s premises. For CSPs, this hybrid approach makes it possible to modernize the network, while enabling easy development, fast innovation, efficient scale and operational efficiency; all while simultaneously helping to reduce technology risk and operational costs. GDC Edge became generally available in 2022.

Google Cloud does not plan to develop its own private wireless networking services to sell to enterprise customers, nor does the company plan to develop its own networking software functions, according to Gabriele Di Piazza, an executive with Google Cloud who spoke at MWC 2023 in Barcelona. Instead, Google Cloud would like to host the networking software functions of other vendors like Ericsson and Mavenir in its cloud. It would also like to resell private networking services from operators and others.

Rather than develop its own cloud native 5G SA core network or other cloud networking software (like Microsoft and AWS are doing), Google Cloud wants to “avoid partner conflict,” Di Piazza said. Google has been building its telecom cloud story around its Anthos platform. That platform is directly competing against the likes of AWS and Microsoft for telecom customers. According to a number of analysts, AWS appears to enjoy an early lead in the telecom industry – but its rivals, like Google, are looking for ways to gain a competitive advantage. One of Google’s competitive arguments is that it doesn’t have aspirations to sell network functions. Therefore, according to Di Piazza, the company can remain a trusted, unbiased partner.

Image Credit: Google Cloud

Last year, the executive said that moving to a cloud-native architecture is mandatory, not optional for telcos, adding that telecom operators are facing lots of challenges right now due to declining revenue growth, exploding data consumption and increasing capital requirements for 5G. Cloud-native networks have significant challenges. For example, there is a lack of standardization among the various open-source groups and there’s fragmentation among parts of the cloud-native ecosystem, particularly among OSS vendors, cloud providers and startups.

In recent years, Google, Microsoft, Amazon, Oracle and other cloud computing service providers have been working to develop products and services that are specifically designed to allow telecom network operator’s to run their network functions inside a third-party cloud environment. For example, AT&T and Dish Network are running their 5G SA core networks on Microsoft Azure and AWS, respectively.

Matt Beal, a senior VP of software development for Oracle Communications, said his company offers both a substantial cloud computing service as well as a lengthy list of network functions. He maintains that Oracle is a better partner for telecom network operators because of it. Beal said Oracle has long offered a wide range of networking functions, from policy control to network slice management, that can be run inside its cloud or inside the cloud of other companies. He said that, because Oracle developed those functions itself, the company has more experience in running them in a cloud environment compared with a company that hasn’t done that kind of work. Beal’s inference is that network operators ought to partner with the best and most experienced companies in the market. That position runs directly counter to Google’s competitive stance on the topic. “When you know how these things work in real life … you can optimize your cloud to run these workloads,” he said.

While a number of other telecom network operators have put things like customer support or IT into the cloud, they have been reluctant to release critical network functions like policy control to a cloud service provider.

References:

https://cloud.google.com/solutions/telecommunications

https://cloud.google.com/blog/topics/telecommunications