Month: August 2022

Vertical Systems Group: Mid-2022 U.S. Carrier Ethernet Leaders; Change is Coming

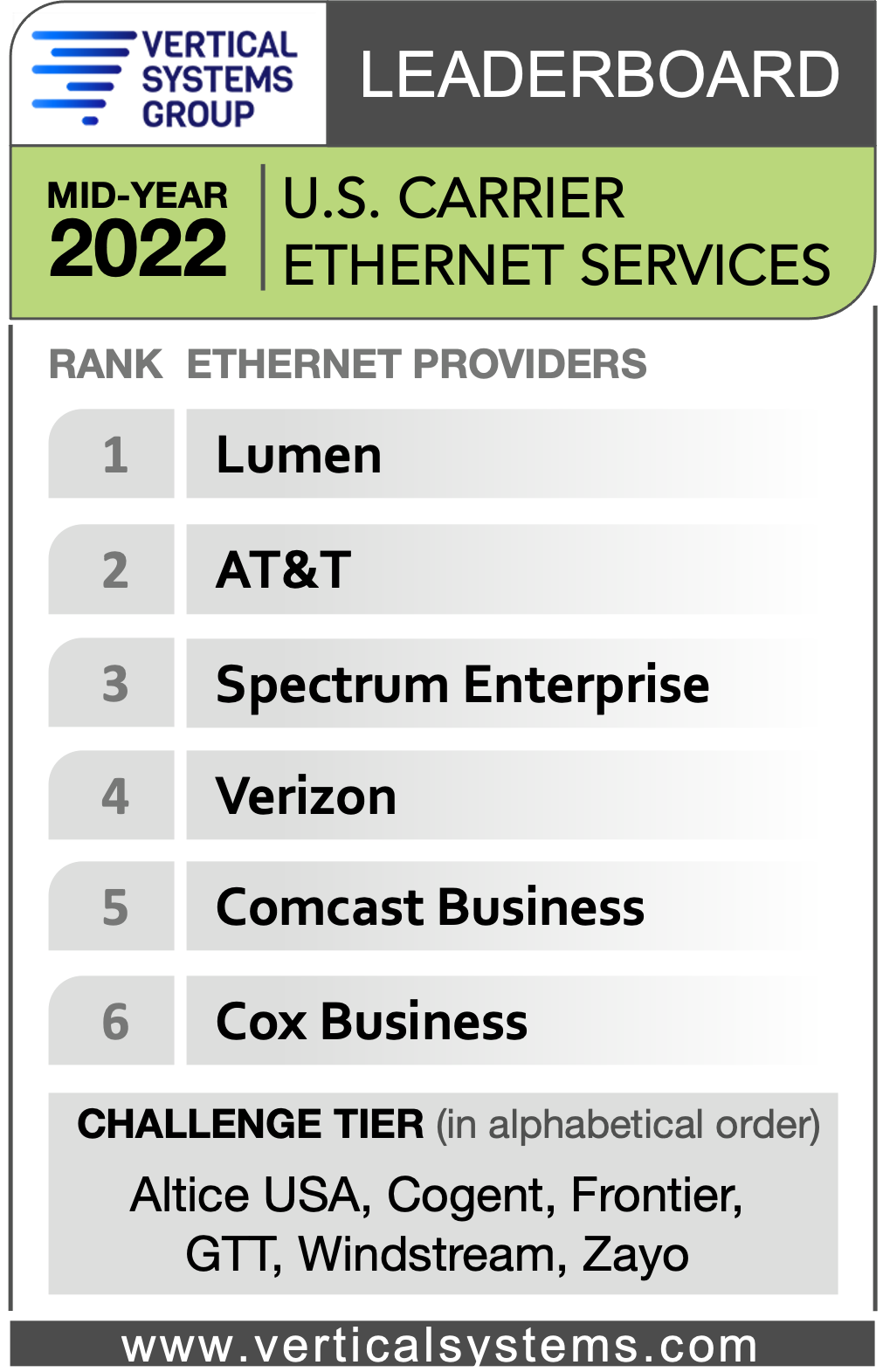

Vertical Systems Group (VSG) today revealed that seven companies achieved a rank on their Mid-2022 U.S. Provider Ethernet LEADERBOARD as follows (in order based on retail port share as of June 30, 2022): Lumen, AT&T, Spectrum Enterprise, Verizon, Comcast Business and Cox Business. To qualify for a rank on this LEADERBOARD, network providers must have four percent (4%) or more of the U.S. retail Ethernet services market.)

Research Highlights:

- Lumen continues to hold the top rank on the Mid-2022 U.S. Ethernet LEADERBOARD based on port share.

- Our latest Ethernet research shows that port shares are tightening between several of the market leading providers.

- Dedicated Internet/Cloud Access (DIA) was the fastest growing Ethernet service for the first half of 2022 and is on pace to be the largest Ethernet service overall by year-end based on billable U.S. customer installations. Primary Ethernet DIA applications are connectivity for Cloud services and Managed SD-WANs.

- Market demand is rising for Ethernet services ranging up to 100+ Gbps.

- Customers requiring higher bandwidth connectivity are also evaluating alternatives to Ethernet, including Wavelength and Dark Fiber services.

- Ethernet service providers continue to grapple with supply chain challenges, including lengthy lead times and shortages of the supplies necessary for customer deployments and backbone network operations.

- Lumen and Verizon are the only LEADERBOARD companies with MEF 3.0 Carrier Ethernet (CE) certification.

Challenge Tier citations were attained by the following six companies (in alphabetical order): Altice USA, Cogent, Frontier, GTT, Windstream and Zayo. The Challenge Tier includes providers with between 1% and 4% share of the U.S. retail Ethernet market.

The Market Player tier includes all providers with port share below 1%. Companies in the Market Player tier include the following providers (in alphabetical order): ACD, AireSpring, Alaska Communications, Alta Fiber, American Telesis, Arelion, Armstrong Business Solutions, Astound Business, Breezeline, BT Global Services, Centracom, Consolidated Communications, Conterra, Crown Castle, Douglas Fast Net, DQE Communications, ExteNet Systems, Fatbeam, FiberLight, First Digital, FirstLight, Flo Networks, Fusion Connect, Global Cloud Xchange, Great Plains Communications, Hunter Communications, Intelsat, Logix Fiber Networks, LS Networks, MetTel, Midco, Momentum Telecom, NTT, Orange Business, Pilot Fiber, PS Lightwave, Ritter Communications, Segra, Shentel Business, Silver Star Telecom, Sparklight Business, Syringa, T-Mobile, Tata, TDS Telecom, TPx, Unite Private Networks, Uniti, US Signal, WOW!Business, Ziply Fiber and other companies selling retail Ethernet services in the U.S. market.

“Share rankings on the U.S. Ethernet LEADERBOARD remain unchanged for the first half of 2022, however a shakeup is possible by the end of the year,” said Rick Malone, principal of Vertical Systems Group. “Escalating requirements for Gigabit Ethernet services – and particularly 100+Gbps – are spurring capacity upgrades and intensifying competition among fiber-based providers.”

In contrast, the 2021 Global Carrier Ethernet leaders are: Orange Business Services (France), Colt (U.K.), Verizon (U.S.), AT&T (U.S.), Lumen (U.S.), BT Global Services (U.K.) and NTT (Japan). This industry benchmark for multinational Ethernet network market presence ranks companies that hold a 4% or higher share of billable retail ports at sites outside of their respective home countries.

VSG Principal Rick Malone told Fierce Telecom that he expects a reshuffling in the order of the top six U.S. Carrier Ethernet operators by the end of this year. According to Malone, the U.S. Carrier Ethernet arena is a relatively mature market (this author says it is VERY MATURE as it’s >20 years old). Malone noted “there are multiple companies, not just the top two, but multiple companies that are fairly close together in share of those six” at the top of its leaderboard. Cox Business is the sixth company on the mid-2022 Leaderboard, ranking just behind Comcast.

Malone said VSG will be keeping a close eye on Lumen in light of the recent divestiture of its Latin America assets. While that move likely won’t have a direct impact on its number of Ethernet ports in the U.S., it could impact some of Lumen’s global customers, he said. Malone added that the market overall achieved a year-on-year port growth rate “in the low single digits,” so below 5%. But he noted only about half the companies VSG surveyed grew and that is to be expected in a mature market!

“There are quite a few of them (Carrier Ethernet service providers) that actually have lower port counts than they had previously. Some of that is that they’re consolidating lower speed circuits into higher speed circuits,” he explained. “But there are some that don’t view their Ethernet service as their lead strategic service when they go and talk to an enterprise. They are leading with SD-WAN and SASE and the security products that you’d expect.”

Some of the companies that have been successful in the Ethernet arena are those which have been migrating their customer base away from MPLS to SD-WAN and using Ethernet as a transport mechanism for the latter. “That managed migration is helping them sell additional Ethernet services as an underlay,” Malone concluded.

References:

https://www.fiercetelecom.com/telecom/shakeup-brewing-lumen-led-us-carrier-ethernet-market

Dell’Oro: Demand for Optical Transport equipment strong and headed for double-digit growth in NA

In a new report, the Dell’Oro Group states that the demand for Optical Transport equipment remained strong in North America during 2Q 2022. In the quarter, the North American market for Optical Transport grew 10 percent year-over-year.

“At this pace, we could be headed for another year of double-digit growth in North America,” said Jimmy Yu, Vice President at Dell’Oro Group. “While we expected another year of North American optical market expansion in 2022, we thought the growth rate could slow a bit after such a strong 2021. However, considering the first-half results and higher than usual backlog held by equipment manufacturers, we think a double-digit rate of growth could occur in 2022. Our biggest concern, however, remains to be the component shortage and supply chain issues that have limited revenue growth for the past couple years,” added Yu.

Additional highlights from the 2Q 2022 Quarterly Report:

- The worldwide Optical Transport market excluding China grew 2 percent in 2Q 2022 and is projected to grow a little over 4 percent in 2022.

- The region with the lowest year-over-year growth rate in the quarter was Asia Pacific due to lower demand in China.

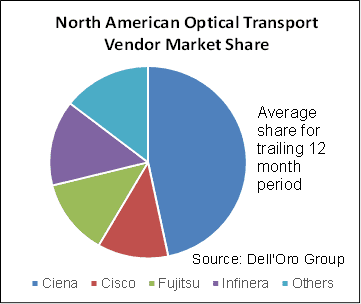

- The system manufacturers with the highest share of North America Optical Transport revenue in the quarter were Ciena, Infinera, Cisco, and Fujitsu. These four vendors held a combined market share of approximately 85 percent. Please see chart below:

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, and unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM.

To purchase this report, please contact us at [email protected].

Cable Labs: Interoperable 200-Gig coherent optics via Point-to-Point Coherent Optics (P2PCO) 2.0 specs

Cablecos use of 200-Gig coherent optical signals in their broadband access network progressed following a recent interop event at CableLabs that involved a five suppliers of coherent optical modules.

CableLabs confirmed that equipment and silicon from those players – Acacia (now part of Cisco), Ciena, Fujitsu Optical Components, Lumentum and Marvell – were found to interoperate with the organization’s Point-to-Point Coherent Optics (P2PCO) 2.0 specs [1.]. The number of participants might not be high, but what’s important is that the participants include DSP silicon from multiple manufacturers that represent the majority of the coherent optics industry.

Note 1. The P2PCO 2.0 specs doubled the operating capacity – from 100 Gbit/s per wavelength in the 1.0 specs, to 200 Gbit/s.

Demonstrating interoperability among so many different coherent DSP suppliers bodes incredibly well for network operators as it provides multi-vendor interoperability, which promotes scale and competition.

Image Courtesy of Cable Labs

Cable Labs conducted 100-Gig interops in 2018 and 2019. Those efforts tie into a broader initiative to use coherent optics technologies, typically used for long-haul, metro and submarine networks, to expand the capacity of fiber that’s already deployed on the hybrid fiber/coax (HFC) access network.

The CableLabs specs also describe a new technology called the Coherent Termination Device (CTD), which can be deployed in an outdoor aggregation node.

Matt Schmitt, a principal architect at CableLabs, said the scope of CableLabs’ interoperability efforts focus on the modules on the optical end – basically describing how a transceiver works at the physical layer.

And to help fit the cable network environment, the end of the network using the CTD is made to reside outdoors, rather than inside a facility.

“Almost every other application of coherent that you see, both ends of the link are in facilities,” such as a data center interconnect where many links are densely packed with racks and modules, Schmitt explained. The cable access application of coherent optics might involve one end that does sit at a facility, such as a hub site, with the other end involving the aforementioned field-deployed CTD.

“Those field boxes didn’t really exist when we started this,” he said.

The broader concept is to help cable operators improve the performance of their access network fibers situated between headends and hubs and fiber nodes for a range of use cases, and to do so without getting locked into one supplier.

CableLabs and its partners originally thought this 200-Gig interop would be completed sooner, but it was delayed a bit during the pandemic when travelling and in-person gatherings were limited or non-existent.

But Schmitt said the plus side of that intervening period meant that the interop ended up with wider supplier participation, particularly at the DSP (digital signal processor) level, than it might have otherwise.

Beyond raw capacity, the 200-Gig capability should help to support the new distributed access architecture (DAA), supported by multiple remote PHY or remote MAC/PHY devices, and the cable’s industry’s broader pursuit of delivering symmetrical 10Gbit/s performance to customers on the access network.

Schmitt said 200-Gig technology gets particularly interesting when operators look to support large, high-density areas that are being split into smaller service groups. It might also factor in as operators explore services beyond high-speed data over cable, such as mobile XHaul.

The use of CTDs with pluggable optics is also designed to support a relatively easy upgrade path. If an operator starts with 100-Gig, those modules can be swapped out for 200-Gig modules later.

This point-to-point P2P use case is just one aspect of coherent optics being explored by CableLabs. A separate-but-related coherent PON initiative still uses coherent signaling, but is focused on point-to-multipoint links.

For now, Schmitt said CableLabs doesn’t plan to hold another interop for P2PCO v2.0 products. “It really just worked so well. I’m not sure what more there will be to do in a follow-up interop,” he said.

CableLabs would be open to doing qualification testing for these new P2P coherent products if the market demands it. “Thus far, I haven’t been hearing of a big push for that,” Schmitt said. “I think people have been comfortable with what we’re getting from the interops and doing their own testing to see how it works.” As for next steps, this latest batch of handiwork will be showcased at the 10G Lab at CableLabs, Schmitt said.

Meanwhile, future commercial deployments will be determined by the availability of CPDs and interest form cable operators.

Among suppliers involved in the recent interop, Ciena confirmed that it currently has interoperable, CableLabs-compliant 200G coherent pluggables available as part of the supplier’s WaveLogic 5 Nano coherent pluggable portfolio.

Another factor for adoption will be costs compared to the 10-Gig DWDM tech that’s in use today. Schmitt acknowledges that the first endpoint is going to be greater with coherent technology, since it involves putting a switch or router in the field.

“Where it gets interesting is every time you need to add another device that’s sharing that same fiber run,” Schmitt said.

“With coherent, you have a higher upfront cost, but you’re going to have a much lower slope, because as you add more devices, all you have to do is add a pair of gray (standard) optics modules – very low cost … Where’s that crossover point in terms of number of endpoints? To me, is going to be one of the big deciders on when and how widespread the deployment of this technology gets.”

References:

A Jolt of Light: CableLabs Holds First 200G P2P Coherent Optics Interop

First Light for CableLabs® Point-to-Point Coherent Optics Specifications

MediaTek to expand chipset portfolio to include WiFi7, smart homes, STBs, telematics and IoT

Taiwanese fabless chipmaker MediaTek is gearing up to expand its customer base beyond the increasingly saturated smartphone segment to include connected devices for smart homes, electric vehicle (EV) manufacturers and the smart retail field.

Chunyan See, Thailand country manager for MediaTek, said the company is offering chipsets beyond the smartphone segment to WiFi 7-linked products, set-top boxes (with video streaming so popular aren’t STBs a thing of the past?), telematics, and Internet of Things. Some market leaders and mobile operators plan to launch WiFi 7 products in the first quarter of 2023. Mediatek previously announced chipsets for WiFi 6 and 6E.

“We see the gaps to change from WiFi 6 to WiFi 6E and WiFi 7 becoming shorter and shorter,” said Mr See. “Service operators typically take one to 1.5 years for internal testing to get the requirements finalized.”

Demand for higher wireless connection speed in Thailand is pushing local mobile operators to aggressively invest in 5G and fixed broadband services, he said. With rising inflation and a weaker baht, the overall smartphone market in Thailand will be tough this year, with the market size expected to drop to 19.2 million units, from 20-21 million last year, he said. In the second half of this year, 5G-enabled smartphones are expected to account for 40% of the total market, versus 32% in the first half and 24% in 2021, said Mr See.

MediaTek is also working with local partners beyond the smartphone segment in three fields — smart homes, smart retail, and smart logistics. For smart homes, the company will power the next generation of smart home accessories, including smart lighting and sensors. In smart retail, the firm supports smart point-of-sale devices that can cater for face payments, which is already the norm in China. Regarding smart logistics, 5G equipment powered by the firm’s chipsets can play a key role in telematics, which is a method of monitoring vehicles and other assets by using GPS technology, and can serve EVs. Chinlin Low, technical account manager for Asia-Pacific at MediaTek, said.

ASEAN (Association of Southeast Asian Nations) is expected see a compound annual growth rate (CAGR) of 83% for 5G subscriptions from 2021 to 2027, when they are forecast to reach 570 million.

Mobile data traffic per smartphone is expected to reach 45 gigabytes per month in 2027, up from 9.4GB in 2021, with a CAGR of 30%, driven by the rise of virtual and augmented reality services.

MediaTek has a broad range of chipsets to offer, including Dimensity 9000, 8100 and 8000 to cater for premium smartphones, he added.

Daniel Lin, MediaTek’s deputy director of corporate sales and emerging markets, said the company sees an opportunity to increase its share of the global premium smartphone segment. “MediaTek has a strong market share in smartphones costing between US$99 to $299, but the firm aims to increase its share in premium smartphones with the launch of new chipsets,” he said.

In 2021, the firm’s overall market share in the smartphone segment rose to 42%, from 32% in 2020. Its share in Android-powered handsets surpassed 50% in 2021, up from 38% in 2020.

MediaTek posted revenue of $17.6 billion in 2021, up from $10.9 billion a year earlier.

References:

https://www.bangkokpost.com/business/2373841/mediatek-explores-a-host-of-opportunities

Nokia, China Mobile, MediaTek speed record of ~3 Gbps in 3CC carrier aggregation trial

MediaTek Announces Filogic Connectivity Family for WiFi 6/6E

Nokia and MediaTek use Carrier Aggregation to deliver 3.2 Gbps to end users

Casa Systems and Google Cloud strengthen partnership to progress cloud-native 5G SA core, MEC, and mobile private networks

Andover, MA based Casa Systems [1.] today announced a strategic technology and distribution partnership with Google Cloud to further advance and differentiate Casa Systems and Google Cloud’s integrated cloud native software and service offerings. The partnership provides for formalized and coordinated global sales, marketing, and support engagement, whereby Casa Systems and Google Cloud will offer Communication Service Providers (CSPs) and major enterprises integrated Google Cloud-Casa Systems solutions for cloud-native 5G core, 5G SA multi-access edge computing (MEC), and enterprise mobile private network use cases. It’s yet another partnership between a telecom company and a cloud service provider (e.g. AWS, Azure are the other two) to produce cloud native services and software.

This new partnership enables Google Cloud and Casa Systems’ technical teams to engage deeply with one another to enable the seamless integration of Casa Systems’ cloud-native software solutions and network functions with Google Cloud, for best-in-class solution offerings with optimized ease-of-use and support for telecom and enterprise customers. Furthermore, Casa Systems and Google Cloud will also collaborate on the development of unique, new features and capabilities to provide competitive differentiation for the combined Google Cloud – Casa Systems solution offering. Additionally, this partnership provides the companies with a foundation on which to build more tightly coordinated and integrated sales efforts between Casa Systems and Google Cloud sales teams globally.

“We are delighted to formalize our partnership with Google Cloud and more quickly drive the adoption of our cloud-native 5G Core and 5G SA MEC solutions, as well as our other software solutions,” said Jerry Guo, Chief Executive Officer at Casa Systems. “This partnership provides the foundation for Casa Systems and Google Cloud’s continued collaboration, ensuring we remain at the cutting edge with our cloud-native, differentiated software solutions, and that the products and services we offer our customers are best-in-class and can be efficiently brought to market globally. We look forward to working with Google Cloud to develop and deliver the solutions customers need to succeed in the cloud, and to a long and mutually beneficial partnership.”

“We are pleased to formalize our relationship with Casa Systems with the announcement of this multifaceted strategic partnership,” said Amol Phadke, managing director and general manager, Global Telecom Industry, Google Cloud. “We have been working with Casa Systems for over two years and believe that they have a great cloud-native 5G software technology platform and team, and that they are a new leader in the cloud-native 5G market segment. The partnership will enable a much wider availability of premium solutions and services for our mutual telecommunications and enterprise customers and prospects.”

Casa also partnered with Google Cloud last year to integrate its 5G SA core with a hyperscaler public cloud, in order to deliver ultra-low latency applications.

Note 1. Casa Systems, Inc. delivers the core-to-customer building blocks to speed 5G transformation with future-proof solutions and cutting-edge bandwidth for all access types. In today’s increasingly personalized world, Casa Systems creates disruptive architectures built specifically to meet the needs of service provider networks. Our suite of open, cloud-native network solutions unlocks new ways for service providers to build networks without boundaries and maximizes revenue-generating capabilities. Commercially deployed in more than 70 countries, Casa Systems serves over 475 Tier 1 and regional service providers worldwide. For more information, please visit http://www.casa-systems.com.

Image Courtesy of Casa Systems

…………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.fiercetelecom.com/cloud/casa-systems-google-cloud-tout-combined-cloud-native-offering

Neos Networks and Giganet partner to deliver FTTP to millions of UK homes

Dark Fiber network operator Neos Networks has announced a new partnership with Giganet, aiming to support the ISP’s burgeoning FTTP rollout with backhaul and data centre services.

Giganet currently offers customers access to its gigabit services through a variety of network providers, including Openreach and CityFibre, reaching millions of homes across the UK. In fact, earlier this year, Giganet announced that they had extended their partnership with CityFibre, thereby making their services available to customers across the entirety of CityFibre’s UK network.

However, last year Giganet announced they would also be rolling out their own FTTP network directly, investing £250 million to cover underserved areas of Hampshire, Dorset, Wiltshire, and West Sussex.

In total, the company hopes to reach 300,000 premises with full fibre over the next four years, with its core network and first four exchange rings set to be live by the end of 2022.

As this new network grows, it will need additional backhaul capacity and support – something that Neos, with its 550 unbundled exchange network, is well positioned to provide.

“Neos Networks rose to the challenge of providing us with resilient and high capacity backhaul circuits across a wide range of exchanges as well as our core data centres,” explained Matthew Skipsey, Chief Technology Officer at Giganet. “Using Neos Networks, we have been able to secure connectivity to our points of presence faster than expected, initially enabling each of our first four regional rings with resilient 100Gb/s backhaul. This means our south coast roll-out is progressing at pace.”

This network expansion project will see Neos support Giganet to deliver a more than tenfold capacity increase.

“Both Neos Networks and Giganet have adopted a collaborative approach to this relationship. This has resulted not only in solutions being delivered faster than ever, as the Giganet network grows, it also gives us the ability to transition connectivity between points of presence without any disruption,” explained Sarah Mills, Chief Revenue Officer at Neos Networks. “There is no doubt that by working in partnership with alternative network providers, like Giganet, UK residents will benefit from a better, faster, and more resilient connectivity.”

Matthew Skipsey added: “The ready availability of high-quality resilient connections to our points of presence, undoubtedly enabled us to quickly roll-out hyperfast, full broadband to a marketplace hungry for improved connectivity.”

References:

https://totaltele.com/giganet-teams-up-with-neos-networks-to-support-new-fibre-rollout/

Bloomberg: Chip Sales to Slow Further as Global Recession Fears Mount

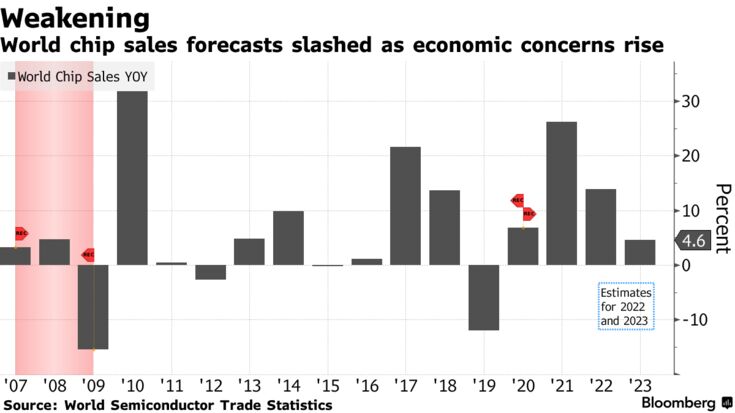

Semiconductor sales are set to grow more slowly than previously expected as the international economy struggles under the weight of rapid interest-rate increases and rising geopolitical risks, fueling fears of a global recession. That will adversely effect telecom equipment and handset vendors that depend on advanced semiconductors to build their products.

World Semiconductor Trade Statistics, a non-profit body that tracks shipments, lowered its market outlook to 13.9% growth this year from a previous 16.3%.

In 2023, it sees chip sales rising just 4.6%, the weakest pace since 2019.

The semiconductor market is still expected to surpass $600 billion this year, WSTS says. Next year’s forecast growth would be the weakest since a 12% drop in sales at the height of the U.S.-China trade war.

Chip sales are an important indicator of global economic activity as households and firms increasingly rely on digital devices and online services to consume and expand. President Joe Biden this month signed the so-called CHIPS and Science Act aimed at strengthening the U.S. semiconductor industry as China races to expand its own chip-making capacity. Semiconductor Manufacturing International Corporation (SMIC) is a partially state-owned publicly-listed Chinese pure-play semiconductor foundry company. It is the largest contract chip maker in mainland China and 5th largest globally behind TSMC, Samsung, United Microelectronics Corporation, and GlobalFoundries.

The International Monetary Fund (IMF) last month downgraded its global growth forecast and said 2023 may be tougher than this year. A Bloomberg Economics model sees a 100% probability of a US recession within the next 24 months.

Based in Morgan Hill, California, WSTS includes among its members Texas Instruments Inc., Samsung Electronics Co., Sony Semiconductor Solutions Corp and Yangzhou Yangjie Electronic Technology Co., according to its website.

References:

Tanzania Telecommunications Corporation (TTC) to provide Internet access on Mt. Kilimanjaro

The Tanzanian government has announced that state-owned mobile operator Tanzania Telecommunications Corporation (TTC) has begun connecting Mt. Kilimanjaro– Africa’s highest mountain – to the internet.

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Nokia today announced that it has successfully piloted its 4G and 5G Fixed Wireless Access (FWA) network slicing with mobile operator, Safaricom on its live commercial network. This is the first-time 4G/5G network slicing has been successfully achieved in Africa. The trial utilized a multi-vendor network environment and included RAN, transport and core as well as software upgrades to a range of Nokia’s products and services.

The successful trial demonstrates that Safaricom is now poised to support new types of enterprise network services, including fast lane internet access and application slicing. In addition, Nokia is enabling secured FWA slice connectivity to enterprise locations, as well as to private or public application clouds.

The multi-vendor pilot which took place in Kenya’s Western Region, strengthens the strategic partnership between the two companies, with Nokia already providing a wide variety of services and solutions. The pilot demonstrated a number of solutions including Nokia’s AirScale 4G/5G base stations, the NetAct network management and assurance system and Nokia’s FastMile 4G/5G CPE.

Network slicing (which requires a 5G SA Core Network) enables operators the ability to divide a network into multiple virtual slices, which can be optimized for a specific target application or service. The end user of each network slice can then be serviced with different priorities, routing, levels of network performance and security capabilities. Slices can be managed and deployed in minutes, and each one has key performance indicators used for service assurance.

Nokia’s 4G/5G network slicing solution (SORRY, no such thing as 4G network slicing), which received a prestigious award from GTI 2021 in the ‘Innovative Breakthrough in Mobile Technology’ category, supports LTE, 5G NSA and 5G SA technologies with slice service continuity between the networks. This enables slicing services for all LTE and 5G devices.

James Maitai, Network Director, Safaricom, said: “We are proud to have hosted Africa’s first successful pilot of 4G/5G FWA slicing on our network, and looking forward to tailoring our service offerings to individual customers and industries, to meet their needs for high-speed connectivity precisely and without unnecessary cost. Nokia’s expertise has been key to this success, and we anticipate many more strategic wins in this area as our business expands.”

Ramy Hashem, Head of Safaricom Customer Team at Nokia, said: “It is great to have successfully completed this pilot with Safaricom, which is a huge step forward in providing Safaricom with state-of-the-art connectivity. Early experience of new slicing technology is invaluable in understanding the new business opportunities it enables. Nokia was the first vendor to offer a slicing solution and we are looking forward to continuing our partnership with Safaricom in providing world-class 4G and 5G network slicing services to its customers.”

Resources:

Webpage: Automated network slicing

Webpage: 5G Edge Slicing

Webpage: Nokia AirScale

Webpage: Nokia FastMile

Webpage: Nokia 5G RAN

Webpage: Nokia NetAct

PLDT’s Smart Communications collaborates with Omispace for LEO based 5G technologies

Philippines PLDT’s wireless subsidiary Smart Communications is collaborating with U.S.-based Omnispace to explore and demonstrate the capabilities of space-based 5G communications using low earth orbit (LEO) satellites. That despite there are no standards or completed 3GPP specs for LEO satellite based 5G or any space based 5G.

The Omnispace 5G NTN global network will interconnect with terrestrial or land-based mobile networks to serve mobile subscribers utilizing the company’s 2 GHz mobile satellite spectrum allocation and operating in 3GPP band n256.

As the world’s first 3GPP-compliant 5G NTN system, the Omnispace network is expected to deliver the power of 5G directly to billions of devices everywhere, extending the reach of mobile connectivity to enable people and assets to communicate in real-time through a single, seamless global service.

“We are excited to announce this collaborative agreement with Smart Communications, which shares our vision of delivering reliable mobile connectivity to consumer, government and enterprise users, everywhere,” said Brian Pemberton, Omnispace. “Together with Smart, we seek to bridge the digital divide, while also providing the communications infrastructure to power the development of the Filipino economy of the future.”

PLDT and Smart’s pioneering foray into satellite-powered communication is part of their broader initiative to deliver world-class customer services across the country, complementing the nationwide rollout of their fiber infrastructure, and wireless networks based on 4G and 5G technologies.

References:

Smart, Omnispace team-up to explore space-based 5G technologies