Month: June 2023

Nokia achieves extended range mmWave 5G speed record in Finland

Nokia today announced it has achieved sustained average downlink speeds of over 2 Gigabits per second (Gbps) using millimetre wave (mmWave) spectrum and 5G Fixed Wireless Access (FWA), over a distance of 10.86 kilometres. This milestone download speed, the fastest recorded worldwide to date, was accomplished using Nokia’s 5G extended range mmWave solution at the OuluZone test facility in Oulu, Finland.

The test utilised Nokia’s AirScale baseband and AirScale 24GHz (n258 band) mmWave radio and a Nokia FastMile 5G PoC CPE (customer premises equipment). Testing involved eight component carriers (8CC) in the downlink, aggregating 800MHz of mmWave spectrum. This enabled a top downlink speed of 2.1 Gbps, and an uplink speed of 57.2 Mbps.

This achievement, which builds on a previous world record announced by Nokia in 2021, demonstrates the reach and connectivity speeds that 5G mmWave can deliver. It also lays the foundations for high-quality internet connectivity solutions delivered via FWA to areas where wired connections are not always possible.

Nokia’s mmWave radio portfolio is comprised of compact, high- and medium-power solutions, offering a wide range of deployment options that provide flexibility in ensuring service continuity across a wide variety of environments.

The Nokia FastMile 5G PoC device used in these tests is currently being trialed by major operators globally. High speeds over significant distances can be achieved with its high-gain 360° antenna (27dBi), which dynamically adapts to changing conditions to overcome mmWave deployment challenges.

Source: Nokia

Ari Kynäslahti, Head of Strategy and Technology at Nokia Mobile Networks, said: “We just set a new speed record for extended range 5G mmWave. This demonstrates that mmWave solutions will be an essential building block for operators to efficiently deliver widespread, multi-gigabit 5G broadband coverage to their customers in urban, suburban, and rural areas, complementing sub-6 GHz spectrum assets. This is a substantial achievement that reflects how we are constantly innovating and evolving our 5G services and solutions.”

References:

Resources and additional information

Nokia AirScale

AirScale mmWave Radio

5G mmWave for Fixed Wireless Access

Fixed Wireless Access

Nokia FastMile

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

AST SpaceMobile achieves 4G LTE download speeds >10 Mbps during test in Hawaii

AST SpaceMobile has announced a significant achievement during its testing phase with the BlueWalker 3 Low Earth Orbit (LEO) satellite. Engineers successfully conducted download speed tests on off-the-shelf smartphones, surpassing speeds of 10 Mbps. This achievement paves the way for space-based cellular communications at 4G speeds, marking another major milestone, according to the company. AST SpaceMobile says it is building the first and only global cellular broadband network in space to operate directly with standard, unmodified mobile devices.

In a press release, AST SpaceMobile Chairman and CEO Abel Avellan called this latest achievement another groundbreaking moment in telecom history and an important step toward AST SpaceMobile’s goal of bringing broadband services to parts of the world where cellular coverage is either unreliable or doesn’t exist today.

The 4G LTE download speed testing, which used AT&T spectrum and Nokia Radio Access Network (RAN) technology, reached initial speeds up to 10.3 Mbps, with further testing of voice calls to AT&T employees.

“Successfully reaching double-digit download speeds during satellite-to-smartphone testing takes us one step closer to ensuring people across the United States will be able to stay connected no matter their location,” said Chris Sambar, head of AT&T Network, in a statement. “This milestone wouldn’t be possible without the overall focus and determination of the teams working daily to achieve our shared space-based vision of connectivity.”

The next major test activity involves the enablement of 5G broadband.

AST SpaceMobile expects to begin initial non-continuous commercial service in 2024 after the launch of its first five planned BlueBird 1 satellites, followed by the launch of 90 satellites for global, continuous broadband and direct-to-device service.

This achievement demonstrates the feasibility of accessing broadband services in areas where cellular coverage is unreliable or nonexistent, bringing connectivity to parts of the world previously underserved.

AST SpaceMobile emphasized the significance of this milestone and its impact on global connectivity: “Achieving this milestone from an unmodified, standard cell phone on the ground connecting through our low Earth orbit satellite is another groundbreaking moment in telecommunications history and an important step toward AST SpaceMobile’s goal of bringing broadband services to parts of the world where cellular coverage is either unreliable or simply does not exist today.”

AST SpaceMobile announced on April 25th that they completed the first-ever space-based voice calls using unmodified smartphones. They achieved this through the successful deployment of BlueWalker 3, which is the largest commercial communications array ever deployed in low-Earth orbit.

According to the statement, BlueWalker 3 is designed to communicate directly with cellular devices using standard frequencies, including 5G speeds. The satellite is now fully unfolded, spanning a size of 693 square feet, which is crucial in supporting a cellular broadband network in space.

The AST SpaceMobile technology helps wireless companies improve their coverage by filling in gaps and dead zones in their networks. AST SpaceMobile has agreements and understandings with over 35 mobile network operators around the world.

References:

AST SpaceMobile Achieves Download Speeds Above 10 Mbps During Testing in Hawaii

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

FCC Grants Experimental License to AST SpaceMobile for BlueWalker 3 Satellite using Spectrum from AT&T

Qualcomm CEO: AI will become pervasive, at the edge, and run on Snapdragon SoC devices

Cristiano Amon, President & CEO, Qualcomm discusses Qualcomm’s role in the AI evolution and how AI will impact our workplaces and homes in the near future with Bloomberg’s Ed Ludlow at the Bloomberg Technology Summit.

“If AI becomes pervasive (which we believe it will), it’s going to happen at the edge. That’s how you should think about Qualcomm. If AI is going to get scale, you’re going to see it running on Qualcomm Snapdragon (SoC) devices, whether it’s on your phone, in your car, in your PC or in other machines.”

“For generative AI to become truly mainstream, much of the inferencing will need to be executed on edge devices,” said Ziad Asghar, senior vice president of product management, Qualcomm Technologies, Inc. “Our best-in-class AI hardware and software empowers developers to make full use of our powerful AI capabilities, delivering incredible new user experiences on laptops, phones and other devices powered by Snapdragon.”

Qualcomm’s Sascha Segan explains on-device generative AI and Stable Diffusion in this video.

…………………………………………………………………………………………………………………………………………………

“Generative artificial intelligence” is set to add up to $4.4 trillion of value to the global economy annually, according to a report from McKinsey Global Institute, in what is one of the rosier predictions about the economic effects of the rapidly evolving technology.

Generative A.I., which includes chatbots such as ChatGPT that can generate text in response to prompts, can potentially boost productivity by saving 60 to 70 percent of workers’ time through automation of their work, according to the 68-page report, which was published early Wednesday. Half of all work will be automated between 2030 and 2060, the report said.

McKinsey had previously predicted that A.I. would automate half of all work between 2035 and 2075, but the power of generative A.I. tools — which exploded onto the tech scene late last year — accelerated the company’s forecast.

“Generative A.I. has the potential to change the anatomy of work, augmenting the capabilities of individual workers by automating some of their individual activities,” the report said.

McKinsey’s report is one of the few so far to quantify the long-term impact of generative A.I. on the economy. The report arrives as Silicon Valley has been gripped by a fervor over generative A.I. tools like ChatGPT and Google’s Bard, with tech companies and venture capitalists investing billions of dollars in the technology.

https://www.nytimes.com/2023/06/14/technology/generative-ai-global-economy.html

References:

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Curmudgeon/Sperandeo: Impact of Generative AI on Jobs and Workers

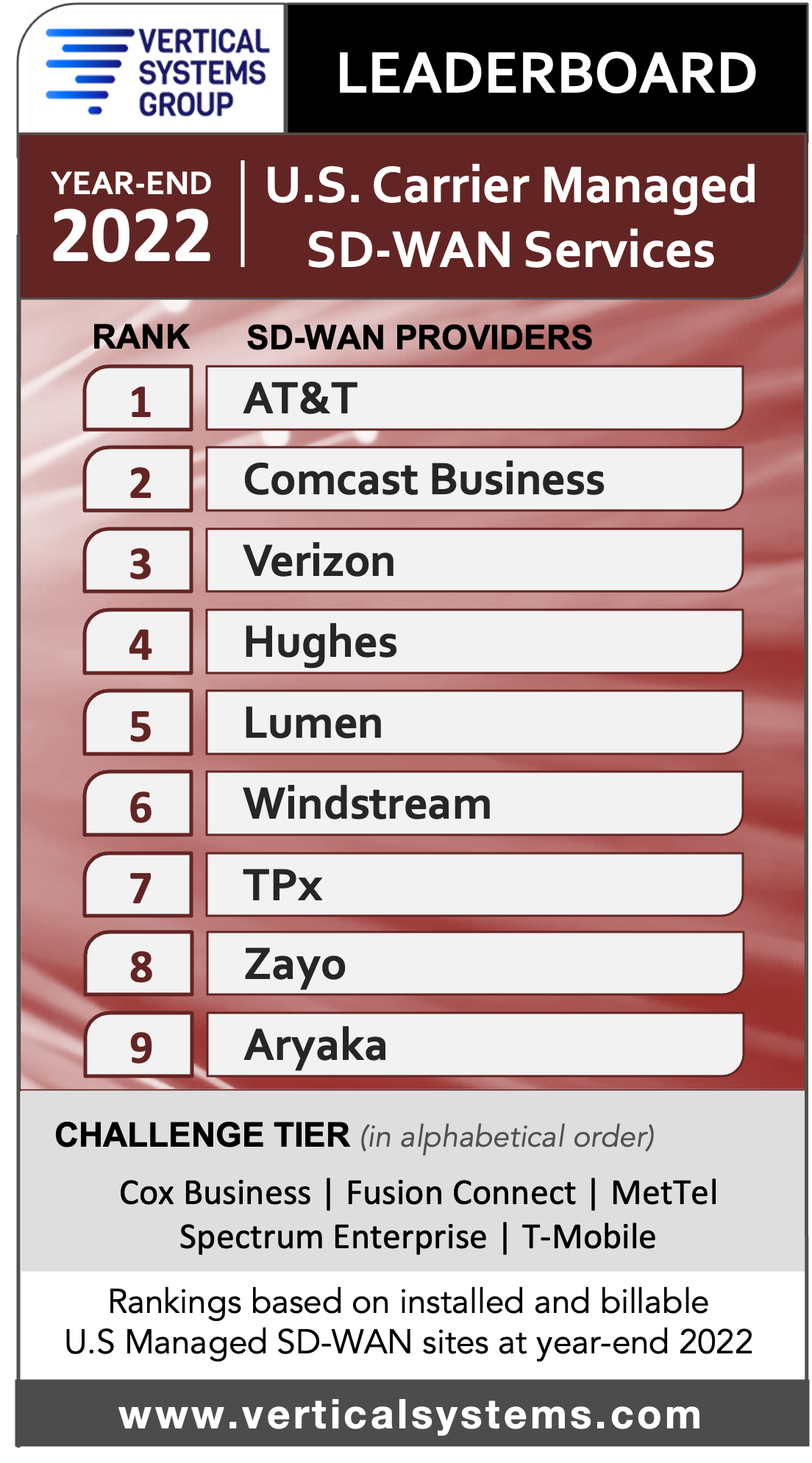

AT&T Tops VSG 2022 Global Provider Carrier Managed SD-WAN Leaderboard

AT&T attained first place on Vertical Systems Group’s (VSG) 2022 Global Provider Carrier Managed SD-WAN Leaderboard, followed by Orange Business, Verizon, BT Global Services, NTT, Telefonica Global Solutions, Hughes and Vodafone. AT&T bumped Orange out of first place on the 2022 leaderboard. No surprise as AT&T continues to top VSG’s 2022 U.S. Carrier Managed SD-WAN Leaderboard for five consecutive years!

BT Global Services overtook NTT for 4th place. Hughes moved out of the Challenge Tier and onto the leaderboard. The top three service providers – AT&T, Orange Business and Verizon – also have MEF 3.0 SD-WAN certification.

This leaderboard includes service providers with 4% or more billable retail site share outside their home countries, which are shown in the graphic below:

Twelve companies qualify for the 2022 Global Provider Managed SD-WAN Challenge Tier (in alphabetical order): Aryaka (U.S.), Colt (U.K.), Comcast Business (U.S.), Deutsche Telekom (Germany), Global Cloud Xchange (India), GTT (U.S.), Liberty Networks [formerly Cable & Wireless] (Barbados), PCCW Global (Hong Kong), Singtel (Singapore), Tata (India), Telia (Sweden), and Telstra (Australia). The Challenge Tier includes companies with site share between 1% and 4% of this defined SD-WAN segment.

“Leading global SD-WAN providers continued to expand their footprints into dozens of new countries during 2022, with the goal of providing multinational customers with seamless connectivity,” said Rosemary Cochran, principal of Vertical Systems Group. “There was some shuffling of provider rankings since our last Leaderboard release, as competition for global customers is intense and share differentials in this segment are extremely tight.”

Research Highlights:

- Share results for this new Global Provider Managed SD-WAN LEADERBOARD include each provider’s installed year-end 2022 base of multinational customer sites, excluding home country. Vertical’s initial benchmark for this specialized segment was the Mid-2021 Global Provider Managed SD-WAN LEADERBOARD, which included site installations as of June, 30 2021. The share comparisons provided in this analysis are based on these two time periods.

- The roster of companies ranked on the LEADERBOARD increased to eight in 2022, up from seven previously.

- AT&T advances to first position on the LEADERBOARD, up from second and displacing Orange Business. AT&T also ranks first on the 2022 U.S. Carrier Managed SD-WAN LEADERBOARD.

- BT Global Services moves up to the fourth LEADERBOARD position, which drops NTT to fifth position.

- Hughes enters the LEADERBOARD in seventh position, moving up from the Challenge Tier. Vodafone dips from seventh to the eighth and final position.

- The 2022 Challenge Tier remains at twelve companies, however with lineup changes. Lumen drops from the Challenge Tier into the Market Player tier, and Comcast Business (includes Masergy) moves up from the Market Player tier.

- Carrier Managed SD-WAN solutions for multinational customers are typically custom hybrid network configurations that require global infrastructures and technical expertise, and may incorporate MPLS VPNs bundled with cloud connectivity, plus advanced security that is integral or provided with technology partners.

- MEF 3.0 SD-WAN certification has been attained by the top three companies ranked on the 2022 Global Provider Carrier Managed SD-WAN LEADERBOARD – AT&T, Orange Business, and Verizon. Additionally, five companies cited in the Challenge Tier have MEF 3.0 SD-WAN certification as follows: Colt, Comcast Business, PCCW Global, Tata and Telia.

- The primary technology suppliers utilized by the Global Provider SD-WAN LEADERBOARD and Challenge Tier companies are as follows (in alphabetical order): Cisco, Fortinet, HPE Aruba, Nuage Networks from Nokia, Palo Alto, Versa and VMware.

The Market Player tier includes all other companies with Global Provider SD-WAN site share below one percent (1%), including the following companies (in alphabetical order): Batelco (Bahrain), China Telecom (China), Cirion (Argentina), Claro Enterprise Solutions (Mexico), CMC Networks (South Africa), Cogent (U.S.), Embratel (Brazil), Epsilon (Singapore), Etisalat (Abu Dhabi), Exponential-e (U.K.), Flo Networks (Mexico), Fusion Connect (U.S.), HGC Global (Hong Kong), Intelsat (U.S.), KDDI (Japan), Lumen (U.S.), Meriplex (U.S.), PLDT Enterprise (Philippines), Retelit (Italy), SES (Luxembourg), Sparkle (Italy), StarHub (Singapore), T-Mobile (U.S.), Telenor (Norway), Telin (Singapore), TelMex (Mexico), Transtelco (U.S.), Virgin Media (U.K.), Zayo (U.S.) and other providers selling SD-WAN services outside their home country.

Vertical Systems Group’s Definition: Carrier Managed SD-WAN Service:

Vertical Systems Group defines a Carrier Managed SD-WAN Service for segment analysis and share calculations as a carrier-grade offering for business customers that is managed by a network operator. Required components and functionality for these offerings include an SDN service architecture that provides dynamic optimization of traffic flows, a purpose-built SD-WAN appliance or CPE-hosted SD-WAN VNF at each customer edge site, support for multiple active underlay connectivity services, automated failover fast enough to maintain active sessions, and centralized network orchestration with traffic and application visibility end-to-end. Security is the most essential additional managed SD-WAN service capability that may be provided or integrated based on specific customer requirements.

References:

Kearney’s “5G Readiness Index 2022” and How to Monetize 5G

A new report from management consultancy Kearney analyzes a year of 5G progress across 33 countries around the world. The Kearney “5G Readiness Index 2022” assesses 5G and how close countries are to realizing all the potential and benefits of widespread 5G in the context of the overall maturity of a country’s telecoms market and its socio-economic position. The report covers 33 countries, all of which had launched 5G by the third quarter of 2022. To be included, countries must have launched 5G by the fourth quarter of 2021.

“Europe is falling behind on 5G!” is a cry we heard at the latest Mobile World Congress. The Kearney 5G Readiness Index 2021 reflected it, and our 2022 Index confirms it, at least for now (see Figure 1).

11 out of 28 countries tracked have at least one operator with a standalone 5G core network launched. Asia leads with seven countries, while Europe trails with just Finland and Germany reaching this point. Only in two countries have all operators launched standalone cores—Singapore and China—opening up their markets for a 5G transformation.

This year’s Index reveals that only 10 countries have made high band spectrum available, and operators in just five of them (the United States, Australia, South Korea, Thailand, and Japan) have launched full commercial services within it. So far, no European countries have gotten this far, although select services have been launched on limited mmWave licenses, including in Germany. The lack of availability of mmWave spectrum is disappointing because its advantages are the cornerstone of new, high speed 5G-enabled services.

The Index identified more key developments during the past year:

- The United States continues to push ahead of other countries. Its regulator has provided spectrum in all three band classes, and national operators have made the most of it by launching services. One operator has launched a standalone 5G core. Canada also has an operator offering 5G services via its new standalone core.

- South Korea, which ranked second in the 2021 Index, has dropped to fifth because it has not made low band spectrum available, despite high subscriber penetration.

- Most Nordic countries are pulling ahead, thanks to wider spectrum availability and broader deployment across bands, but Sweden is held back by the lack of mmWave spectrum as full availability of 26 GHz isn’t planned before 2025. This slows Sweden down and risks muting consumer excitement.

- Germany moved from laggard to leader of the EU4 (France, Germany, Italy, and Spain) plus the United Kingdom, thanks to operators launching 5G in multiple bands. Only one operator has launched a 5G standalone core.

- France now trails other larger European countries because of its late launch of 5G (November 2020) and customers’ apparent limited interest in it.

- A strong showing in the Middle East (Saudi Arabia, United Arab Emirates, and Qatar) is a testament to their networks’ quality and strong rollouts. Penetration is 9 to 11 percent. A Saudi operator has launched a standalone 5G core.

- Australia was one of the first countries to launch 5G, has continuously expanded spectrum access across all bands, and enjoys successful commercialization. It has 18 percent 5G penetration, the second highest in the Index.

Kearney also uncovered the following findings:

- Take-up (as a percentage of total subscribers in the first quarter, 2022) is paltry across Europe. Switzerland is the best with 13 percent but launched in April 2019. Belgium is the worst offender at 1.7 percent of connections. Take-up is 31 percent in South Korea.

- In South Korea, the government has announced a push for creating an ecosystem of companies that innovate and leverage 5G (aiming for 1,800 5G service firms by 2026). They understand operators won’t be solo drivers but enablers.

- Rollout of new capacity in the United States allows operators to launch impactful services, such as 5G fixed wireless access (FWA). One operator is using

- 5G to equip ambulances with high-quality video feeds that medical professionals can view while patients are en route.

Europe is behind, but not irreparably so. Vigilance and focus are required, together with operators’ preparation to win with 5G when their countries have reached ready status.

Monetize 5G step-by-step, building up to an ecosystem of products, services, and partners:

Currently, 5G lacks killer uses cases to drive customer uptake. Without seductive 5G products or services, people won’t see its benefits. Yet, operators wonder whether advancing investment in 5G is wise. It’s classic chicken-and-egg, but it will start somewhere, spearheaded by first-mover operators along with third-party providers that will figure out what will make everyone want 5G. Plan monetization first with small steps, and then plan the ecosystem to realize its potential.

It still may seem like early days in the 5G journey, but time grows shorter for European telcos to catch up with the United States and other markets. Getting your strategy rolling now is the only way to take advantage of the European market when it becomes fully 5G ready.

References:

Ericsson Mobility Report: 5G monetization depends on network performance

Moody’s skeptical on 5G monetization; Heavy Reading: hyperscalers role in MEC and telecom infrastructure

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

PwC report on Monetizing 5G should be a wake up call to network operators!

How 5G network operators can stay competitive and grow their business

UScellular Launches 5G Mid-Band Network in parts of 10 states

UScellular today announced the launch of its 5G mid-band network, with customers in parts of 10 states who now have access to the benefits of the company’s faster and stronger network. UScellular’s 5G mid-band technology combined with a mid-band enabled device can provide up to 10x faster speeds than its 4G LTE network and low-band 5G. This technology has more capacity, enhances the mobile experience, and has business and fixed wireless applications.

By the end of June, UScellular’s 5G mid-band network will be available mainly in parts of Illinois, Iowa and Wisconsin, including sections of Rockford, Ill., Des Moines, Iowa and Milwaukee. Communities in Maine, Missouri, Nebraska, Oklahoma, Oregon, Virginia and Washington are also included in the initial rollout. By the end of the year, the company plans to cover more than 1 million households in its operating footprint with its 5G mid-band network. The company is using 5G network equipment from Nokia and Ericsson.

“We view mid-band as the sweet spot of 5G because it provides broad coverage, low latency and fast speeds – enabling more people to connect to what matters most at home or on-the-go,” said Mike Irizarry, executive vice president and chief technology officer for UScellular. “As we approach serving 100,000 High-Speed Internet customers later this summer, mid-band will play an important role in furthering the reach and enhancement of that product. We’ve made it a priority to expand the technology to more communities in the coming years.”

Broader 5G coverage (see map) with mid-band technology provides customers and businesses with even faster data connection speeds for a better experience. UScellular will continue to expand its device portfolio, including adding more options for its High-Speed Internet product and additional IoT devices, to further enhance its mobile and fixed connectivity offerings.

UScellular now offers customers low-band, mid-band and high-band mmWave 5G speeds and services. The company expects nearly 3 million households in its operating footprint will have access to 5G mid-band connectivity by the end of 2024.

UScellular’s 5G mid-band network is using 3.45 GHz spectrum that was purchased through Auction 110 granted in 2022. The company is partnering with Nokia and Ericsson for its mid-band buildout. The company was among the top five bidders in the FCC’s 3.45 GHz Auction 110, where it spent over $579 million. It also acquired C-band spectrum for about $1.46 billion in 2021; that spectrum starts to become available later this year.

UScellular did not need to coordinate with the Department of Defense (DoD) for the 3.45 GHz sites that are part of this launch, but DoD coordination is needed for some sites that are to be deployed in the future, according to a company spokesperson.

Speaking at the Wireless Infrastructure Association’s Connect(X) conference in New Orleans last month, Irizarry said the company expects a “rapid acceleration” of its mid-band spectrum 5G deployment to occur in 2024.

About UScellular:

UScellular is the fourth-largest full-service wireless carrier in the United States, providing national network coverage and industry-leading innovations designed to help customers stay connected to the things that matter most. The Chicago-based carrier provides a strong, reliable network supported by the latest technology and offers a wide range of communication services that enhance consumers’ lives, increase the competitiveness of local businesses and improve the efficiency of government operations.

Through its After School Access Project, the company has pledged to provide hotspots and service to help up to 50,000 youth connect to reliable internet. Additionally, UScellular has price protected all of its plans, promising not to increase prices through at least the end of 2024.

To learn more about UScellular, visit one of its retail stores or www.uscellular.com.

References:

https://www.uscellular.com/coverage-map

https://www.fiercewireless.com/5g/uscellular-lights-345-ghz-parts-10-states

US Cellular touts 5G millimeter wave and cell tower agreement with Dish Network

IDC IoT investment forecast: 10.4% CAG over 2023-2027

Worldwide spending on the Internet of Things (IoT) is forecast to grow 10.6% this year to a value of $805.7 billion, according to the latest forecast from IDC. Investments in the IoT ecosystem are expected to surpass $1 trillion in 2026 with a compound annual growth rate (CAGR) of 10.4% over the 2023-2027 forecast period.

“The last few years have shown that connecting with a digital infrastructure is no longer a luxury, but a necessity,” said Carlos M. González, research manager for the Internet of Things at IDC. “For organizations to excel in data-driven operations, investing in IoT projects is essential. Connecting devices to data networks to gather insight, expand operations, and increase performance are the hallmarks of executing an IoT ecosystem.”

Discrete and Process Manufacturing are the industries that will see the largest investment in IoT solutions in 2023 and throughout the forecast period, accounting for more than one third of all IoT spending worldwide. Professional Services, Utilities, and Retail are the next largest industries in terms of overall IoT spending with roughly 25% of the worldwide total. State/Local Government and Telecommunications will deliver the fastest spending growth over the five-year forecast with CAGRs of 12.0% and 11.7% respectively.

IoT investment is a key building block to supporting an increasingly digital and distributed organizational footprint. Most of these investments are seeking solutions that can help organizations achieve a specific business goal or customer challenge, such as cost savings or supply chain efficiency. As such, use cases are the focus of most IoT investment plans.

The two IoT use cases that will receive the most investment in 2023 are both closely tied to the manufacturing industries: Manufacturing Operations ($73.0 billion) and Production Asset Management ($68.2 billion). The next largest use cases – Inventory Intelligence ($37.6 billion), Smart Grid (Electricity) ($36.9 billion), and Supply Chain Resilience ($31.6 billion) – will benefit from strong investments from the Retail and Utilities industries. The use cases that will experience the fastest spending growth represent the diverse application of IoT technologies – Electric Vehicle Charging (30.9% CAGR), Next Generation Loss Prevention (14.5% CAGR), Agriculture Field Monitoring (13.9% CAGR), and Connected Vending and Lockers (13.8% CAGR).

“Updates to the IoT use case taxonomy in this release of the IoT Spending Guide reflect the evolving Digital Transformation investment objectives of enterprises. Thematically, greater investment in goods production and supply chains resulting from the COVID-19 pandemic and global reactions that caused massive business and societal disruptions are evident in the new use cases. These production and supply chain related use cases can be seen in the Discrete Manufacturing, Process Manufacturing, Retail, and Transportation industries,” said Marcus Torchia, research vice president with IDC’s Data & Analytics Group. “Meanwhile, digital business investments are ramping up in other industries such as the Resource Industries. For example, IoT is helping to improve upstream supply chain processes in Agriculture, such as growing, harvesting, and delivering higher quality produce to market.”

This release of the IoT Spending Guide also includes a Video Analytics overlay forecast that is intended to provide high-level insight into a broadly adopted use case (i.e., found in most or all enterprise industries). Video analytics refers to the use of artificial intelligence (AI) and other advanced algorithms to recognize, detect and analyze live or stored video feeds in a variety of uses, including business analytics, security surveillance, and other rapidly evolving adaptations of this technology. These uses are found in numerous settings (e.g., business analytics in manufacturing and retail, in government for crowd management and traffic congestion management, and broadly for security surveillance). Video analytics requires IP networked capable cameras to support the advanced software whether embedded in hardware or provided by third party vendors.

IDC expects spending on Video Analytics solutions across all industries to be more than $23.5 billion this year. Future releases of the IoT Spending Guide will include additional broadly adopted use cases, such as smart buildings.

From a technology perspective, IoT services will be the largest area of spending in 2023 and through the end of the forecast, accounting for nearly 40% of all IoT spending worldwide. Hardware spending is the second largest technology category, dominated by module/sensor purchases. Software will be the fastest growing technology category with a five-year CAGR of 11.0% and a focus on application and analytics software purchases.

Western Europe, the United States, and China will account for more than half of all IoT spending throughout the forecast. Although Western Europe and the United States currently have similar levels of spending, Western Europe will expand its lead with an 11.0% CAGR over the 2023-2027 forecast, compared to an 8.0% CAGR for the United States. China’s IoT spending is forecast to surpass the United States by the end of the forecast due to its 13.2% CAGR.

The Worldwide Internet of Things Spending Guide (V1 2023) forecasts IoT spending for 18 technology categories and 70 named use cases (87 including sub-use cases) across 19 industries in nine regions and 53 countries. The spending guide also includes an IoT connectivity forecast for cellular, Low-Power Wide Area Networks, and other connectivity (e.g. wired, satellite). This provides tech buyers and providers with a tool to understand how the plethora of IoT use cases call for multiple connectivity types, driven by different expectations in terms of latency, bandwidth, and data frequency.

……………………………………………………………………………………………………………………………………………………………

Separately, Rational Stats says the global IoT platforms market was estimated at a market value of $15.3 billion in 2022 and is expected to grow at a significant CAGR of over 15.2% over the forecast period of 2023-2028.

The main drivers of this expansion are the increased availability of inexpensive sensors and the rising need for connected devices across a range of sectors, including manufacturing, healthcare, and retail. IoT platforms must be scalable to handle the rising number of connected devices and the growing volume of generated data.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS50936423#

https://www.idc.com/getdoc.jsp?containerId=US49578922

https://www.openpr.com/news/3094459/global-iot-platforms-market-analysis-and-forecast-2023-2028

European Internet Exchange operators to use new 100G LR-1 (single laser/PAM4) transceivers

With the increasing demand for higher bandwidth and better performance, the world’s leading Internet Exchange (IX) operators DE-CIX, LINX, AMS-IX & BCIX, will be introducing a new generation of optical transceivers, the 100G LR-1 (referred to as LR), to their platforms, starting in Frankfurt, London, Amsterdam, and Berlin.

While the existing 100G LR-4 uses four lasers, each carrying a signal of 25 Gbps, the new 100G LR technology uses only a single laser and uses pulse amplitude modulation (PAM4) to transmit data at 100 Gbps. The reduction in transceiver design complexity of the increasingly deployed 100G LR technology will result in power savings as well as better transceiver pricing. These advances not only provide advantages in the short to mid-term but will also unlock new transceiver form factors that open up the potential for even greater performance and efficiency improvements in the future. The 100G LR technology is already available with a wide range of compatible routers from all major vendors and is compatible with current fiber technology. In order to satisfy today’s customer demand for 100G LR, DE-CIX, LINX, AMS-IX, and BCIX will provide support in the upcoming months.

“With the new 100G LR technology, we are paving the way for the next generation of transceiver technology that will dominate the market for years to come. The future design of our DE-CIX interconnection platform will not only bring better programmability and higher scalability, commercial flexibility, and wider geographical reach, it will also make interconnection even easier for our customers through simplified technical processes,” says Dr. Thomas King, Chief Technology Officer at DE-CIX.

Richard Petrie, CTO at LINX stated, “For LINX, we will be enabling our London locations first after approving the solution in our lab. We will roll out as demand grows and as we see that LINX members need support in the shift to the improved optics. This will realise both benefits in cost and power for us and the LINX member base.”

Ruben van den Brink, CTO at AMS-IX says, “Offering 100G LR makes perfect sense, both for AMS-IX and for its customers. The lab tests proved that the new optics can be used for all the switches that are currently deployed in our Amsterdam PoPs. I appreciate the fact that we were able to collaborate with our partners in pushing this new standard. When Internet Exchanges join efforts, customers benefit, so I hope many more exchanges will start offering 100G LR soon.”

“After testing 100G LR and other 100G single-lambda standards in our lab, we have already introduced this new technology into our production network. By doing so we have built a very cost-efficient interconnection between data centers on the same campus. Offering the same benefits to our peers is just the next logical step,” says André Grüneberg, CTO at BCIX.

……………………………………………………………………………………………………………………………………………………………

About DE-CIX:

DE-CIX (German Commercial Internet Exchange) is the world’s leading operator of Internet Exchanges (IXs). DE-CIX offers its interconnection services in more than 50 metro-markets in Europe, Africa, North America, the Middle East, and Asia. Accessible from data centers in over 600 cities world-wide, DE-CIX interconnects thousands of network operators (carriers), Internet service providers (ISPs), content providers and enterprise networks from more than 100 countries, and offers peering, cloud, and interconnection services. DE-CIX in Frankfurt, Germany, is one of the largest Internet Exchanges in the world, with a data volume of almost 34 Exabytes per year (as of 2022) and close to 1100 connected networks. More than 200 colleagues from over 30 different nations form the foundation of the DE-CIX success story in Germany and around the world. Since the beginning of the commercial Internet, DE-CIX has had a decisive influence – in a range of leading global bodies, such as the Internet Engineering Task Force (IETF) – on co-defining guiding principles for the Internet of the present and the future. As the operator of critical IT infrastructure, DE-CIX bears a great responsibility for the seamless, fast, and secure data exchange between people, enterprises, and organizations at its locations around the globe. Further information at www.de-cix.net.

About the London Internet Exchange (LINX):

With over 900 ASNs connecting from over 80 different countries worldwide, members of The London Internet Exchange (LINX) have access to direct routes from a large number of diverse international peering partners. LINX is much more than just the UK’s leading peering community. LINX can also connect you to cloud services, help you create closed user groups and private VLANs, and gain access to colocated infrastructure. With direct routes between your infrastructure and your most important customers and services, you can manage all your connectivity instances with confidence. Discover the flexibility and transparency of a member-owned organisation, and the reliability of trusting your traffic to critical national infrastructure. For additional information about LINX, please visit linx.net

About AMS-IX:

AMS-IX (Amsterdam Internet Exchange) is a neutral member-based association that operates multiple interconnection platforms around the world. Our leading platform in Amsterdam has been playing a crucial role at the core of the internet for almost 30 years and is one of the largest hubs for internet traffic in the world with over 11 Terabits per second (Tbps) of peak traffic. Connecting to AMS-IX ensures customers such as internet service providers, telecom companies and cloud providers that their global IP traffic is routed in an efficient, fast, secure, stable and cost-effective way. This allows them to offer low latency and engaging online experiences for end-users. AMS-IX interconnects more than 1000 IP-networks in the world. AMS-IX also manages the world’s first mobile peering points: the Global Roaming Exchange (GRX), the Mobile Data Exchange (MDX) and the Internetwork Packet Exchange (I-IPX) interconnection points.

About BCIX:

BCIX is the leading Internet Exchange Point in Berlin, Germany. We operate a distributed infrastructure between 11 data centers across the city of Berlin, providing peering and interconnection services to our partners. We serve nearly 150 connected networks with a peak bandwidth of 900 Gigabits per second (Gbps). As a community we form a nexus for Berlin’s rapidly growing and highly creative Internet scene, organized in a neutral, not-for-profit association. Our friends and associates from businesses and academic institutions support us in serving the internet at large. We are pleased to meet each other regularly at our roundtables.

References:

https://www.de-cix.net/en/about-de-cix/media/press-releases/next-generation-ix

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

Introduction:

Despite mounting pressure on venture capital in a difficult economic environment, money is still flowing into generative Artificial Intelligence (AI) startups. Indeed, AI startups have emerged as a bright spot for VC investments this year amid a wider slowdown in funding caused by rising interest rates, a slowing economy and high inflation.

VCs have already poured $10.7 billion into Generative AI [1.] start-ups within the first three months of this year, a thirteen-fold increase from a year earlier, according to PitchBook, which tracks start-ups.

Note 1. Generative AI is a type of artificial intelligence that can create new content, such as text, synthetic data, images, and audio. The recent buzz around Generative AI has been driven by the simplicity of new user interfaces for creating high-quality content in a matter of seconds.

….………………………………………………………………………………….

Tech giants have poured effort and billions of dollars into what they say is a transformative technology, even amid rising concerns about A.I.’s role in spreading misinformation, killing jobs and one day matching human intelligence. What they don’t publicize is that the results (especially from ChatGPT) may be incorrect or inconclusive.

We take a close look at Generative AI Unicorns with an emphasis on OpenAI (the creator of ChatGPT) and the competition it will face from Google DeepMind.

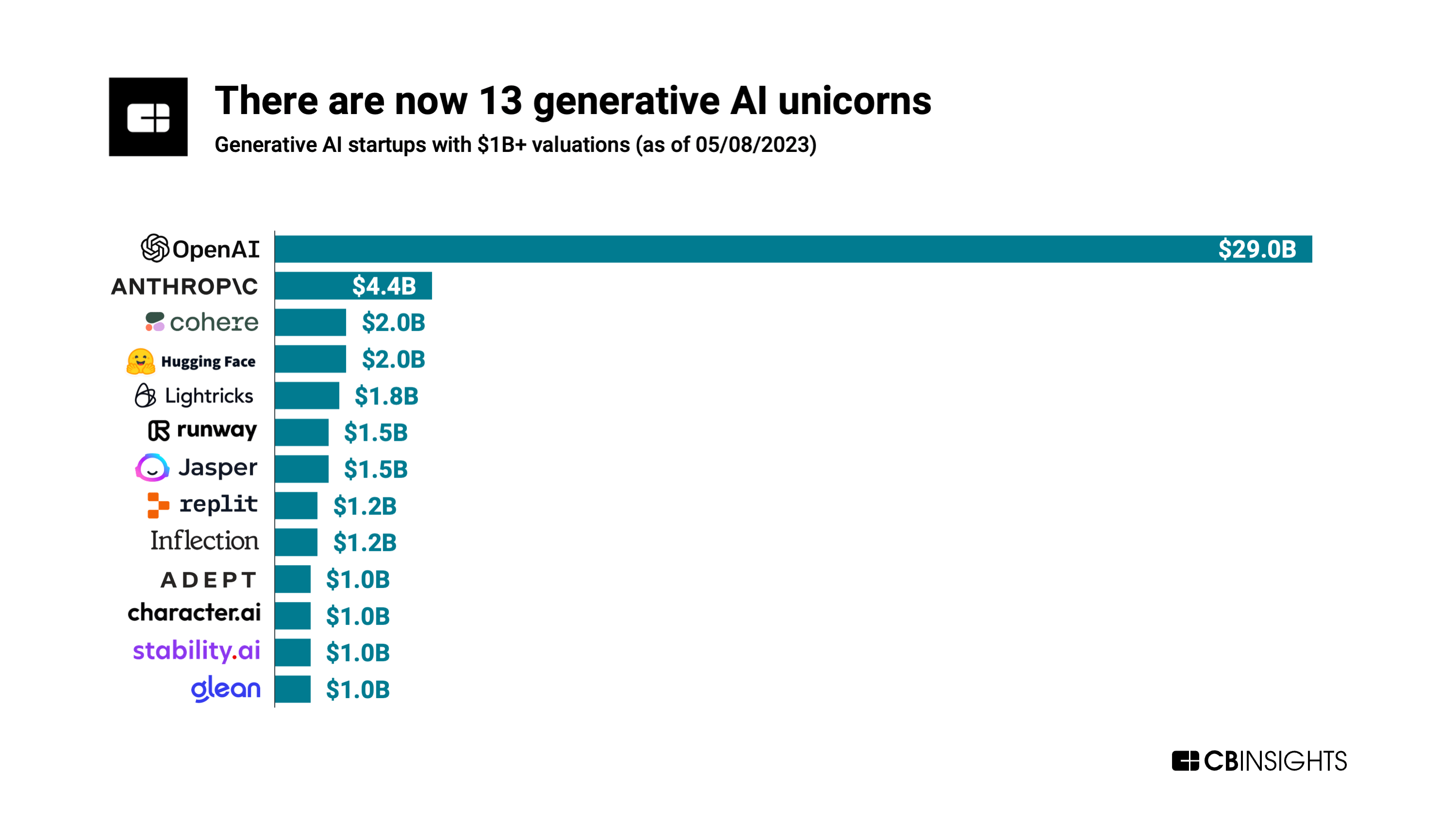

Generative AI Unicorns and OpenAI:

AI startups make up half of all new unicorns (startups valued at more than $1B) in 2023, says CBInsights.

At Generative AI firms, startups are reaching $1 billion valuations at lightning speed. There are currently 13 Generative AI unicorns (see chart below), according to CBInsights which said they attained their unicorn status nearly twice as fast as the average $1 billion startup.

Across the 13 Generative AI unicorns, the average time to reach unicorn status was 3.6 years but for the unicorn club as a whole the average is 7 years — almost twice as long.

OpenAI, the poster child for Generative AI with its Chat GPT app, tops the list with a valuation of almost $30 billion. Microsoft is the largest investor as it provided OpenAI with a $1 billion investment in 2019 and a $10 billion investment in 2023. Bloomberg reported that the company recently closed an investment fund, exceeding expectations with a value that surpasses $175 million.

However, OpenAI may have a formidable competitor in Google DeepMind (more details in DeepMind section below).

….……………………………………………………………………………………………………………………………………………………….

Anthropic is #2 with a valuation of $4.4B. It’s an AI safety and research company based in San Francisco, CA. The company says they “develop large-scale AI systems so that we can study their safety properties at the technological frontier, where new problems are most likely to arise. We use these insights to create safer, steerable, and more reliable models, and to generate systems that we deploy externally, like Claude (to be used with Slack).”

In Q1-2023, Generative AI companies accounted for three of the entrants to the unicorn club with Anthropic, Adept, and Character.AI all gaining valuations of $1B or above.

New Generative AI Unicorns in May:

Ten companies joined the Crunchbase Unicorn Board in May 2023 — double the count for April 2023. Among them were several AI startups:

- Toronto-basedCohere, a generative AI large language model developer for enterprises, raised $270 million in its Series C funding. The funding was led by Inovia Capital valuing the 4-year-old company at $2.2 billion.

- Generative video AI company Runway, based out of New York, raised a $100 million Series D led by Google. The funding valued the 5-year-old company at $1.5 billion.

- Synthesia, a UK-based artificial intelligence (AI) startup, has raised about $90 million at a valuation of $1 billion from a funding round led by venture capital firms Accel and Nvidia-owned NVentures. “While we weren’t actively looking for new investment, Accel and NVIDIA share our vision for transforming traditional video production into a digital workflow,” said Victor Riparbelli, co-founder and CEO of Synthesia.

….…………………………………………………………………………………………………………………………………………………..

Google DeepMind:

Alphabet CEO Sundar Pichai said in a blog post, “we’ve been an AI-first company since 2016, because we see AI as the most significant way to deliver on our mission.”

In April, Alphabet Inc. created “Google DeepMind,” in order to bring together two leading research groups in the AI field: the Brain team from Google Research, and DeepMind (the AI startup Google acquired in 2014). Their collective accomplishments in AI over the last decade span AlphaGo, Transformers, word2vec, WaveNet, AlphaFold, sequence to sequence models, distillation, deep reinforcement learning, and distributed systems and software frameworks like TensorFlow and JAX for expressing, training and deploying large scale Machine Learning (ML) models.

By launching DeepMind as Google’s Generative AI solution, there could be a new battle front opening in quantum computing, machine learning perception, gaming and mobile systems, NLP and human-computer interaction and visualization.

A recent DeepMind paper says the Alphabet unit has extended AI capabilities with faster sorting algorithms to create ordered lists. Their paper says it shows “how artificial intelligence can go beyond the current state of the art,” because ultimately AlphaDev’s sorts use fewer lines of code for sorting sequences with between three elements and eight elements — for every number of elements except four. And these shorter algorithms “do indeed lead to lower latency,” the paper points out, “as the algorithm length and latency are correlated.”

Their researchers created a program based on DeepMind’s AlphaZero program, which beat the world’s best players in chess and Go. That program trained solely by playing games against itself, getting better and better using a kind of massively automated trial-and-error that eventually determines the most optimal approach.

DeepMind’s researchers modified into a new coding-oriented program called AlphaDev, calling this an important next step. “With AlphaDev, we show how this model can transfer from games to scientific challenges, and from simulations to real-world applications,” they wrote on the DeepMind blog. The newly-discovered sorting algorithms “contain new sequences of instructions that save a single instruction each time they’re applied. AlphaDev skips over a step to connect items in a way that looks like a mistake, but is actually a shortcut.”

….………………………………………………………………………………………………………………………………………………………..

Conclusions:

While many luminaries, such as Henry Kissinger, Eric Schmidt and Daniel Huttenlocher, have lauded Generative AI as the greatest invention since the printing press, the technology has yet to prove itself worthy of the enormous praise. Their central thesis, that a computer program could “transform the human cognitive process” in a way tantamount to the Enlightenment, is a huge stretch.

Gary Marcus, a well-known professor and frequent critic of A.I. technology, said that OpenAI hasn’t been transparent about the data its uses to develop its systems. He expressed doubt in CEO Sam Altman’s prediction that new jobs will replace those killed off by A.I.

“We have unprecedented opportunities here but we are also facing a perfect storm of corporate irresponsibility, widespread deployment, lack of adequate regulation and inherent unreliability,” Dr. Marcus said.

The promise and potential of Generative AI will not be realized for many years. Think of it as a “research work in progress” with many twists and turns along the way.

….………………………………………………………………………………………………………………………………..

References:

https://www.cbinsights.com/research/generative-ai-unicorns-valuations-revenues-headcount/

https://pitchbook.com/news/articles/Amazon-Bedrock-generative-ai-q1-2023-vc-deals

Curmudgeon/Sperandeo: Impact of Generative AI on Jobs and Workers

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

ITU-R report: Applications of IMT for specific societal, industrial and enterprise usages

At its June 2023 meeting (#44), ITU-R WP 5D has completed its work towards the development of a new report: ITU-R M.[IMT.APPLICATIONS] on Applications of IMT for specific societal, industrial and enterprise usages. WP5D agreed to elevate this PDNR to a Draft New Report (DNR).

Backgrounder:

Enterprises can generally expect reliable and secure network services with IMT (4G LTE and 5G) for fixed and mobile broadband applications across a wide coverage area. While there are subtle differences across different industrial sectors, IMT applications typically involve the following: video surveillance, remote control, autonomous vehicles and robots, automation, and immersive experiences.

The emergence of IMT-2020 “5G RAN” technologies provides manufacturers with the much-needed reliable connectivity solutions, enabling critical communications for wireless control of machines and manufacturing robots, and IoT sensor solutions, which will unlock the full potential of Industry 4.0.

Apart from manufacturing, many other industries are also looking at IMT-2020 technologies as the backbone for their equivalent of the Fourth Industrial Revolution. The opportunity to address industrial connectivity needs of a range of industries includes diverse segments with diverse needs, such as those in the mining, port, energy and utilities, automotive and transport, public safety, media and entertainment, healthcare, agriculture and education industries, among others.

Some recent trials of IMT-2020 technologies in port operations demonstrated the “3GPP 5G” capabilities for critical communications enablers such as ultra-reliable low-latency communication (URLLC), enhanced mobile broadband (eMBB) to support traffic control, AR/VR headsets and IoT sensors mounted on mobile barges and provided countless possibilities to improve efficiency and sustainability in the complex and changing industrial environments, e.g., ports and mining. Some ports are increasing/accelerating their adoption of digital processes, automation and other technologies to enhance efficiency and resiliency to crises such as a global COVID-19 pandemic.

Similarly, in mining exploration sites, the drilling productivity could be substantially increased through automation of its drills and other technologies. Additional savings from improved efficiency and sustainability could also lead to lower capital expenditures for mines (CapEx) as well as a better safety and working environments for their personnel.

An example of an application in health care that need critical communications supported by the capabilities of IMT-2020 is remote robotic surgery. A latency of one millisecond is critical in providing haptic feedback to a surgeon that is connected through a mobile connection to a surgical robot. A high data rate is needed to transfer high-definition image streams. As an ongoing surgery cannot be interrupted an ultra-reliable communication is needed to keep connection down-time and packet loss very low.

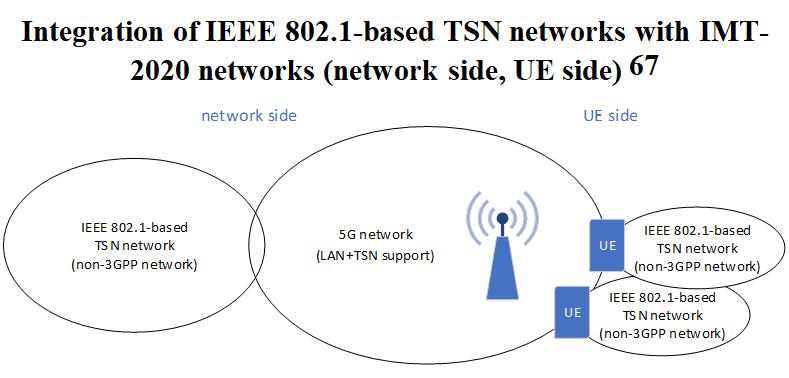

Integration of IMT-2020 networks with industrial communication networks:

‘Industrial 5G’ networks need to be integrated in existing industrial communication networks. In order to support this, a ‘5G LAN’ interface is necessary, that supports Virtual LANs and Ethernet. Furthermore, support of Time-Sensitive Networking (TSN) and integration of IMT-2020 in industrial TSN networks is of importance. Time-Sensitive Networking (TSN) is an important functionality of IEEE 802.1-based industrial communication networks in order to provide deterministic, reliable, real-time communication, and the integration of IMT-2020 networks and IEEE 802.1-based TSN networks is very beneficial.

The integration between the IEEE 802.1-based networks and the IMT-2020 networks can be through the ‘5G LAN’ service of the IMT-2020 network on the network side and/or on the UE side (see below Figure).

The integration on the UE side is used, for instance, in use cases where machinery, AGVs, or robots with their own internal network (wired, TSN) are connected to the backhaul part of the industrial communication network through an IMT-2020 link in order to enable mobility or tether less movements.

IEEE 802.1AS-based time synchronization is an important functionality in such industrial TSN communication networks. The accuracy of the time synchronization between the time transmitter (sync master) and any time receiver (sync device) needs to be in the range of 1 µs. The clock synchronization accuracy of the IMT-2020 system needs to be smaller than this value, since IMT-2020 network is only a part in this integrated industrial network.

Depending on the actual physical process, the actual cyber-physical control application, the design of the machinery, AGVs, and robots, and the design of the integrated industrial communication network, different mappings of TSN/time synchronization functionalities to IMT-2020 network elements are possible.

……………………………………………………………………………………………………………………………………………….

Other important outputs from the June 2023 ITU-R WP 5D meeting:

- A related Draft New Report in the works: ITU-R M.[IMT.MULTIMEDIA] – Capabilities of the terrestrial component of IMT-2020 for multimedia communications.

- SWG IMT 2030 has submitted one draft new Recommendation ITU-R M. [IMT.FRAMEWORK FOR 2030 AND BEYOND] – Framework and overall objectives of the future development of IMT for 2030 and beyond together with the relevant Liaison Statements.

- The long delayed revision of ITU-R M.1036 Frequency Arrangements for Terrestrial IMT was agreed upon and will be forwarded to ITU-R SG 5 for approval.

References:

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/default.aspx