Author: Alan Weissberger

Meta (Facebook) announces 200G/400G switch fabrics and Network OS with open API at 2021 OCP Summit

Next-generation 200G and 400G switch fabrics:

Meta’s data center fabrics have evolved from 100 Gbps to the next-generation 200 Gbps/400 Gbps. Meta has already deployed 200G-FR4 optics at scale in their data centers and contributed to specifications for 400G-FR4 optics that will be deployed in the future.

Meta has developed two next-generation 200G fabric switches, the Minipack2 [1.]. It is the latest version of Minipack, Meta’s own modular network switch) and the Arista 7388X5, in partnership with Arista Networks. Both of which are also backward compatible with previous 100G switches and will support upgrades to 400G.

Note 1. Minipack2 is Facebook’s 200G fabric switch (leaf/spine switch) that provides 128 x 200G Ethernet ports by a single 25.6Tbps switch ASIC. It supports 128 QSFP56 ports or 64 QSFP-DD ports when deployed in Facebook’s F16 data center networks. Similar to Minipack (128x 100G), Minipack2 has a modular architecture that supports multiple port interface types. The specification and the hardware design package of Minipack2 will be contributed to OCP. This workshop will go over hardware architecture of Minipack2 and details on key design decisions, including functional block diagrams, chassis architecture, external and internal interfaces, etc.

The Minipack2 is based on the Broadcom Tomahawk4 25.6T switch ASIC and Broadcom re-timer. The Arista 7388X5 is also based on the Broadcom Tomahawk4 25.6T switch ASIC, with versions of the 7388X5 also utilizing a Credo chipset. They’re high-performance switches that transmit up to 25.6 Tbps and 10.6 Bpps with modular line cards. They support 128x 200G-FR4 QSFP56 optics modules and can maintain a consistent SerDes speed at the switch ASIC, the optics host interface, and on the optics line/wavelength. They simplify connectivity without needing a gearbox to convert data streams. They also have significantly reduced power per bit compared with their previous models (the OCP-accepted Meta Minipack and OCP-Inspired Arista 7368X4, respectively).

Meta has deployed 200G optics (modules pictured above) in their data centers

………………………………………………………………………………………………………………………………………

The Minipack2, Meta’s own modular network switch, developed in partnership with Broadcom

………………………………………………………………………………………………………………………………………….

Meta’s network operating system now powered by an open API:

Meta’s network operating system for controlling the network, Facebook Open Switching System, traditionally used the specific API provided by the chip manufacturer. Now, FBOSS (Meta’s own network operating system for controlling network switches) has been adapted to use the Open Compute Project Switch Abstraction Interface, a standard and open API.

Additionally, Meta has worked with Cisco Systems to support FBOSS with SAI (Switch Abstraction Interface) with their ASICs. Adapting and migrating FBOSS to SAI enables Meta to onboard multiple ASICS from different vendors more quickly and easily onboard new ones in the future. SAI’s API lets engineers configure new networking hardware without needing to delve into the specifics of the underlying chipset’s SDK. Furthermore, SAI has been extended to even the PHY layer, with Credo Semi supporting FBOSS with their own SAI implementation.

That means data centers can quickly and easily migrate FBOSS across multiple ASICs from different manufacturers with greater ease. It also allows engineers to rapidly configure new networking hardware without the need to tinker with chipset development kits.

Meta expects that with hardware being shared through OCP, supporting SAI will also mean closer collaboration with and feedback from the wider industry. Developers and engineers from across the world will have a chance to work with this open hardware and contribute their own software that can be shared with the industry.

The Metaverse and More:

The metaverse will rely on many technologies, including advanced AI at scale. To deliver a diversity of new workloads that will be created as a result, we continue down the path of disaggregated global networks and data centers that will underpin all of this. The technologies that Meta and the wider industry will create will, of course, need to be fast and flexible, but more than that, they will need to operate efficiently and sustainably — from the data center all the way to edge devices. The only way to achieve this will be through collaboration through communities like OCP and other partnerships.

Open hardware drives the innovation necessary to reach these goals. And our collaborations with both long-standing and new vendors to create open designs for racks, servers, storage boxes, motherboards, and more will help push Meta and the wider industry onto the next major computing platform. We’re only about one percent along on the journey, but the road to the metaverse will be paved with open advanced networking hardware.

References:

OCP Summit 2021: Open networking hardware lays the groundwork for the metaverse

https://siliconangle.com/2021/11/09/meta-announces-next-gen-networking-hardware-2021-ocp-summit/

The 5G Spectrum Conundrum for South Africa and GCC countries; 5G Status Report

According to IDC, there is a dire need to ensure that 5G spectrum policies in the Gulf Cooperation Council (GCC) [1.] region and South Africa include effective spectrum allocation and management strategies. This is key to ensuring that the evolution from 3G and 4G networks to 5G networks and capabilities is seamless, viable for ecosystem players, and accelerates digital transformation imperatives.

Note 1. The Gulf Cooperation Council (GCC) is a regional, intergovernmental political and economic union that consists of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

Over the past few years, national regulatory authorities (NRAs) in the GCC region have allocated significant quantities of spectrum, particularly in the mid-band of 1-6GHz, to accelerate 5G deployments and adoption. What happens next needs to be the introduction of policies and practices that create a healthy and competitive ecosystem designed to accelerate the achievement of key national development imperatives, says Keoikantse Marungwana, IDC’s senior research and consulting manager and telecom and IoT lead for Sub-Saharan Africa.

“The NRAs have also made limited allocations of mmWave spectrum to support 5G growth, and this needs to be supported by telecom operators and tech suppliers who should focus on increasing and diversifying their capabilities and skill sets to ensure a successful transition to 5G,” adds Marungwana. “The 5G ecosystem is going to be more complex, it is going to include features such as 5G network slicing, spectrum sharing, and open RAN architectures along with 5G private networks and significant innovation. The innovation and market opportunity ushered in by 5G will require robust and forward-looking policies and regulatory frameworks that enhance this potential, not limit it.”

As the world shifts on its digital axis, many organizations have adopted tech and connectivity platforms designed to enhance collaboration and efficiencies, embarking on initiatives that deploy solutions that use the Internet of Things (IoT), artificial intelligence (AI), and more. They are focusing on platforms, systems, and solutions that enable them to leverage widely deployed 34G and LTE networks, and they are focused on sustainable investments that will allow them to transition to 5G and accelerate their initiatives. The potential of 5G is significant – it can enable innovation, transform use cases, and allow digital laggards to leapfrog into the future.

“Already, there have been some remarkable use cases across multiple industry verticals,” says Marungwana. “5G deployments worldwide have enabled use cases in manufacturing, mining, transportation, sports, and entertainment. The emerging spectrum allocation strategies currently on the table are set to create new excitement and new business models for an already flourishing ecosystem.”

To fully realize the value of this changing landscape, operators and buyers will need to establish clear business objectives and quantifiable outcomes if they are to benefit from this network evolution. Companies should focus on developing research-backed and insights-led investment propositions for spectrum and 5G adoption, whether this is for a 5G or IoT network rollout, an investment into a private LTE/5G network service, or the implementation of a popular use case that has proven value and legitimacy for the sector.

“Spectrum will remain highly contested and heavily monitored to ensure efficient utilization,” says Marungwana. “However, operators have a massive opportunity to transform business through new capabilities that are enabled by 5G networks across the various spectrum bands. They also have a responsibility as ecosystem anchors to support national imperatives and to lead the ecosystem by launching new solutions.”

Operators should look to creating innovative partnership frameworks that accelerate new use cases and business models. Many companies are looking for inventive ways to transform their businesses and they are turning to telecom providers for support, insights, and skilled expertise. Organizations sitting on the cusp of the 5G revolution want partners who can help them implement end-to-end value propositions that start at the factory or shop floor on industrial machines, and that move to the edge to the cloud and beyond.

“The telecom provider of today is a digital transformation partner that leads the business value discussion and uses spectrum, IoT, AI, edge, network, and cloud capabilities as the means, not the end,” says Marungwana. “However, there are challenges that have to be overcome before 5G and its burgeoning potential can be fully realized. While regulators, operators, and technology buyers are learning from previous experiences they need to accelerate 5G adoption while addressing multiple regulatory objectives – and this is a difficult balancing act.”

This is one challenge, as is the reality that incumbent providers may not have realized a return on their previous investments and are now expected to make further investments into 5G infrastructure and spectrum. For technology buyers, previous investments into emerging technologies may also not have reflected positively on their financial statements to date. Both these factors may yet play a role in delaying 5G adoption.

“However, the highlight is that new spectrum management approaches have been introduced worldwide, and this has led to new ecosystem players, innovative business models, and new solutions,” concludes Marungwana. “Stakeholders in the GCC, South Africa, and even other African markets can research these and evaluate the various deployment models and customer use cases; these will, in turn, inform their technology and business strategies for 5G going forward.”

IDC in the Middle East, Turkey, and Africa:

For the Middle East, Turkey, and Africa region, IDC retains a coordinated network of offices in Riyadh, Nairobi, Lagos, Johannesburg, Cairo, and Istanbul, with a regional center in Dubai. Our coverage couples local insight with an international perspective to provide a comprehensive understanding of markets in these dynamic regions. Our market intelligence services are unparalleled in depth, consistency, scope, and accuracy. IDC Middle East, Africa, and Turkey currently fields over 130 analysts, consultants, and conference associates across the region. To learn more about IDC MEA, please visit www.idc.com/mea. You can follow IDC MEA on Twitter at @IDCMEA.

………………………………………………………………………………………………………………………………………………………………………………………………………..

Meanwhile, the Qatar Tribune says that GCC countries are poised to benefit from the expansion of their 5G networks:

Earlier this month the UAE unveiled its “Industry 4.0” initiative, which aims to increase innovation and productivity, lower the industrial sector’s carbon footprint and add some $6.8bn to the economy by 2031. Industry 4.0 is a cornerstone of the government’s roadmap to ensure that the economy remains dynamic over the next half century. The plan will leverage Fourth Industrial Revolution technologies such as automation, additive manufacturing, blockchain, artificial intelligence (AI) and internet of things (IoT).

In the UAE, as elsewhere, such technologies often depend on 5G connectivity to generate optimum value. For this reason, a significant aspect of Industry 4.0 is a plan for Abu Dhabi-based ICT giant Etisalat to expand 5G coverage in the country, in partnership with Swedish multinational, Ericsson, which has been working in the UAE since the 1970s.

In fact, the 5G rollout in the UAE is already under way, thanks in part to Etisalat’s efforts to develop ICT infrastructure: the country boasts the world’s fastest mobile network and the GCC’s fastest fixed network. In addition, for three years it has had the highest fibre-to-the-home (FTTH) penetration rate in the world.

Ericsson has highlighted that one area in which 5G could add significant value is in smart agriculture in Al Ain, where industrial farmers are keen to bolster digitalization, for example by expanding the use of remote sensors and robotics. This is one of the ways in which 5G can potentially make industry more sustainable and productive in the region.

“Increasingly clients want to feel they are part of sustainability efforts, and that these efforts lead to tangible realities. In this regard, 5G can be a key enabler, thanks to the decentralized control and monitoring it can provide across facilities and systems,” Feras Albanyan, acting CEO at real estate development company Aqalat, told Oxford Business Group (OBG).

5G elsewhere in the GCC:

Several GCC countries – e.g. Saudi Arabia – began expanding 5G coverage in 2019. In a recent report, Ericsson anticipated that 5G will account for 73 percent of all mobile subscriptions in the GCC by 2026. This will represent the world’s second-highest 5G market penetration (behind South Korea).

Saudi Arabia’s Salam – known as the Integrated Telecom Company until June this year – is expanding its 5G and FTTH in the Kingdom, in line with Vision 2030 digital transformation plans. “As increasing numbers of devices are plugged into 5G networks, enhanced connectivity and higher speeds will generate an enormous wealth of data. This will lead to new insights and functionalities through AI-powered analytics and cloud services,” Essam Alshiha, CEO of Saudi Business Machines, told OBG.

Despite this momentum, there are certain question marks associated with wholesale 5G rollout:

“5G is far superior to 4G, but operators are often trapped by a purely marketing-driven approach to investments in 5G,” Osama Al Dosary, CEO of Salam, told OBG.

“The fear of telecom services being perceived as utilities generates enormous pressure on operators to seek ways to differentiate themselves. Yet it is important to prevent a disconnect between marketing discourse over what 5G means in terms of added functionalities and the real return on investment.”

Another cautionary tale comes from China, where, after years of investment, many major 5G operators have recently begun to dial back and focus on commercial apps that can be replicated at scale. A further challenge is the perennial question of ICT infrastructure and access.

“While many cloud services only require 4G connectivity, the merging of cloud computing and the IoT can be a driver of growth. However, this depends on telecoms companies managing to provide large-scale 5G connectivity in a financially sustainable way, which remains a challenge in Oman and elsewhere,” Maqbool Al Wahaibi, CEO of Oman Data Park, told OBG.

Lastly, there are some doubts as to whether customers themselves appreciate the benefits of 5G. For example, a recent survey found that U.S. consumers were largely ambivalent about 5G, with some 67 percent saying they are not likely to change from 4G, and a further 19 percent saying that they simply did not care.

It remains to be seen whether 5G will face similar issues in the GCC, although it should be highlighted that the region is already a world leader in terms of internet usage: by the end of 2020, it had the highest average monthly data traffic per smartphone in the world.

References:

https://www.idc.com/getdoc.jsp?containerId=prMETA48365921

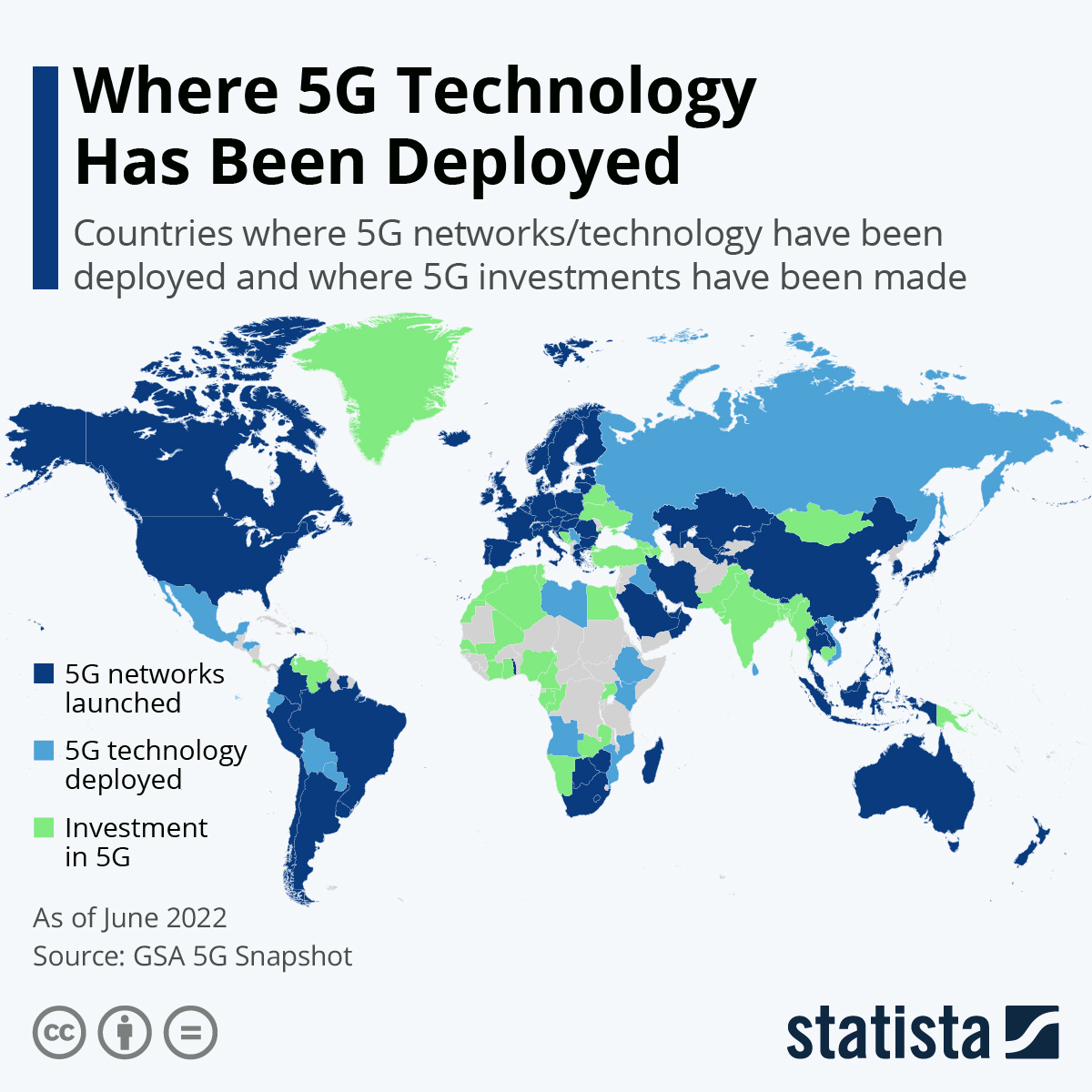

https://www.statista.com/chart/23194/5g-networks-deployment-world-map/

Right click to get Power options then select Advanced Options

Telecom Italia on the ropes: merge with Open Fiber or be bought by KKR? Magnifica?

Telecom Italia (aka TIM) Chief Executive Officer Luigi Gubitosi is preparing to relinquish control of the company’s physical network in a bid to revive an on-again, off-again deal with rival Open Fiber SpA and extract value from the company’s multi-billion euro network, its most valuable asset, Bloomberg reported.

The revised merger plan comes in the wake of pressure from the Italian government, which has warned that previous versions of the deal could return the country’s telecommunications industry to a near-monopoly, the people said, asking not to be named because the new project isn’t public.

TIM CEO Gubitosi now plans for Telecom Italia to hold a minority stake in a merged entity that will pool the company’s FiberCop landline unit with that of Open Fiber, a smaller, state-backed rival, the people said. Gubitosi last month discussed the revised deal with top government officials in Rome, laying out his vision for a single network that would avoid duplications of investments and help accelerate a national fiber roll-out, the people said.

Italy’s state-backed lender Cassa Depositi e Prestiti SpA, known as CDP, owns about 10% of Telecom Italia and controls Open Fiber. More on their importance for any deal is detailed below.

The change in plan could also help Telecom Italia placate its biggest investor, France’s Vivendi SE which is reportedly disappointed with the company’s performance.

Vivendi has stepped up pressure on the Italian executive after an October profit warning, and a group of directors led by CEO Arnaud de Puyfontaine asked Telecom Italia Chairman Salvatore Rossi to convene a meeting to discuss the company’s plans on Nov. 11, people familiar with the matter said last week.

…………………………………………………………………………………………………………………………………………..

Bloomberg reports that U.S. private equity firm KKR & Co. is considering a takeover of Telecom Italia SpA’s network unit as one of its strategic options for the former Italian telecoms monopoly, according to people familiar with the matter.

KKR’s future plans for Telecom Italia would be an alternative to the long-discussed merger of FiberCop with its smaller, state-backed rival, Open Fiber SpA. The private equity firm may be concerned it would be diluted in a possible deal involving Open Fiber, especially after Telecom Italia Chief Executive Officer Luigi Gubitosi revised his project to combine with the company following strong pushback from the Italian government over antitrust concerns.

KKR is looking at alternatives ranging from raising its stake in Telecom Italia’s grid operations — although the carrier says it has no plan to reduce its holding — to pursuing a full takeover of the unit, said the people, who asked not to be named because the discussions aren’t public.

The deliberations by KKR, which owns more than 37% of Telecom Italia’s FiberCop grid company, are preliminary and it hasn’t yet decided what course to take, the people said. Telecom Italia isn’t presently contemplating a reduction of its stake in FiberCop, according to a spokesman.

KKR Infrastructure last year agreed to pay about 1.8 billion euros ($2.1 billion) for a 37.5% stake in FiberCop, which operates the portion of the Telecom Italia grid that includes cables running from street cabinets to end-user premises — the so-called secondary network.

Getting the Italian government onboard will also be essential to the success of any plans for the company. State-backed lender Cassa Depositi e Prestiti SpA owns about 10% of Telecom Italia, and Rome could invoke a so-called Golden Power ruling on a proposed deal if it’s concerned about a strategic asset potentially falling into foreign hands.

Telecom Italia’s response via a press release was as follows:

With reference to today’s press rumors about possible corporate structures relating to the network, TIM specifies that the subject has not been discussed in the Board of Directors nor have any decisions been made in this regard.

All these rumors come less than one week after Telecom Italia announced Magnifica, which offers FTTH “ultrabroadband” connections on the company’s XGS-PON network. The new network offering was said to achieve ten times the speed achievable by TIM’s current GPON (Gigabit Passive Optical Networks). Magnifica provides a connection with speeds of up to 10 Gbps in download and 2 Gbps in upload.

References:

https://www.gruppotim.it/en/press-archive/corporate/2021/CS-TIM-Precisazione-en.html

Starlink to explore collaboration with Indian telcos for broadband internet services

SpaceX subsidiary Starlink is planning to explore collaboration with telecom companies in India to expand broadband internet services in the country with a focus on rural areas, a top company official said on Friday. Starlink Country Director India Sanjay Bhargava told that discussions with broadband service providers will start once the 12 Phase-1 aspirational districts are identified by the Niti Aayog and the company will see the interest levels of the various players and the USOF (universal service obligation fund).

“I am hoping that we will get a time-bound 100 per cent broadband plan that can serve as a model for other districts but the devil is in the details and there may be many good reasons why one or more broadband providers do not want to collaborate, though to me that seems unlikely,” Bhargava said.

Starlink claims to have received over 5,000 pre-orders from India. The company is charging a deposit of $99 or Rs 7,350 per customer and claims to deliver data speeds in the range of 50-150 megabits per second in the beta stage.

Bhargava had earlier announced that the company will focus on 10 rural Lok Sabha constituencies to provide internet services for 80 per cent of the Starlink terminals shipped to India. “At Starlink, we can roll out fast if we have licensing approval and…the Starlink’s could move to other remote areas,” Bhargava said. In a social media post, Bhargava said the company wants to collaborate with all. “We want to collaborate with all and have others besides us licensed to provide satellite broadband so that satellite plus terrestrial together can provide 100 per cent broadband, especially in rural districts,” he said. There have been some reports of Starlink considering manufacturing of terminals to provide satellite broadband services in India, but Bhargava said the company is not actively thinking about making terminals for broadband locally.

…………………………………………………………………………………………………………………………………………………….

Tech billionaire Elon Musk has said on Twitter that his aerospace company SpaceX may soon launch satellite-based internet service Starlink in India. Musk responded to a Twitter post that the company is exploring how the regulatory approval process in the country will work for Starlink. Musk said, “The regulatory approval process is being explored.”

Starlink recently shipped 100,000 terminals to customers. The objective of this project is to provide global broadband connectivity through a cluster of satellites. SpaceX began satellite launches in November 2019 and opened its $99 (Rs 7,223) per month beta program to select customers about a year later.

References:

Dish loses MVNO subs; cost of 5G buildout much higher than $10B stated by the company

Dish Network reported a small drop in third-quarter revenues after losing both pay-TV and mobile subscribers. Revenue dropped to $4.45 billion from $4.53 billion a year earlier, while net profit improved over the same period to $557 million from $505 million, helped by improved profitability at the mobile business following the integration of various acquisitions.

DISH Network’s 2021 revenue through the third quarter totaled $13.43 billion, compared to $10.94 billion in revenue from the same period last year. In the first nine months of 2021, net income attributable to DISH Network totaled $1.86 billion, compared with $1.03 billion during the same period last year.

Dish said it lost 13,000 pay-TV subscribers in the quarter, compared to a net increase of 116,000 in the year-ago quarter. It ended September with a total 10.98 million TV customers, including 8.42 million Dish satellite users and 2.56 million subscribers for the streaming service Sling TV. That compares to 8.55 million Dish TV subscribers and 2.44 million Sling TV subscribers at the end of June.

At the mobile (MVNO) business, the company lost 121,000 retail customers in Q3, less than the drop of 212,000 in the year-ago quarter. The company blamed the decline on device shortages, ongoing integration and optimization of operations and the pending closure of T-Mobile’s CDMA network. Dish closed the quarter with 8.77 million retail wireless subscribers, down 6.8 percent from a year earlier, and Q3 wireless service revenue was down 4.1 percent to $1.04 billion.

Dish said the construction of its 5G Open RAN network is underway in 35 markets across the U.S. and confirmed it’s started a consumer beta service on the network in Las Vegas. Capex for the network build jumped to $281 million in the third quarter from $22 million a year ago, and Dish said spending will ramp up further in the rest of 2021 to support the roll-out.

Analyst Craig Moffett isn’t able to evaluate Dish’s wireless business at this time. He wrote in a note to clients:

We’re still years away from any real understanding of Dish’s wireless prospects. A discounted cash flow would be utterly absurd (How many subscribers? In what business segments? At what ARPU? At what margin? After what capex?).

We still don’t even know what or where they are building, so answering any of those questions would be little more than throwing darts. In the dark. And what will we learn from their Las Vegas beta? Nothing important, in all likelihood, other than “yes, the equipment seems to work.” Spectrum-based valuations that assume that Dish is a liquidation play aren’t much better. Sure, they’re easier to ground in some sort of reality (there are, at least, comps). But this methodology is all but impossible to reconcile with use-it-or-lose-it FCC buildout requirements that come before the window to sell opens.

Well, consider that Dish’s long-term tower lease obligations now total more than $13.6B [1.]. For a 5G network that is supposedly only going to cost $10B to build [2.] – and, yes, they haven’t even started really “building” yet – they are already $14B underwater. And that doesn’t count the $62M of EBITDA losses on the segment this quarter… and whatever they might have spent on the ongoing 3.45 GHz spectrum auction.

Note 1. Dish has signed tower lease agreements with each of the big four tower companies. Dish Network’s 10-Q report details their “other long-term obligations,” which represent minimum payments related to tower obligations, certain 5G Network Deployment commitments, obligations under the NSA with AT&T, and satellite-related and other obligations.” The total tower lease obligation is currently $13.6B. It is notable that this obligation now far exceeds the $10B Dish said would be the total 5G network cost. Yet Dish has barely started spending on the network yet.

Note 2. Boost Mobile America founder Peter Adderton said the the actual cost to build Dish’s 5G network may be closer to $20 billion, according to a Seeking Alpha article.

Amazon’s Sidewalk Low Power WAN is a dud, despite four announced partnerships

Amazon Sidewalk, quietly announced at Amazon’s annual hardware conference in Seattle in September 2019, is a shared network that is claimed to help its devices work better. Specifically, it’s a 900MHz-based low power wireless area network (LPWAN) to connect trackers, sensors, lightbulbs and other IoT devices. Amazon says you can use Sidewalk to simplify device setup, find lost items, and more. However, Amazon’s website only refers to Echo (“smart” speaker) devices as Sidewalk endpoints when BlueTooth is enabled.

Note that Amazon Sidewalk is optional and can be turned off at any time. Instructions to enable or disable Sidewalk for your Amazon devices is here. It comes at no additional cost and has a capped data usage of 500 MB per month, per account. To learn more, go to Welcome to Amazon Sidewalk. Amazon said that Sidewalk will have more range than Bluetooth and use less power than 5G.

“We’re going to build a reference design called Ring Fetch — a dog tracker that will use Sidewalk and ping you if your dog leaves a certain perimeter,” said Dave Limp, senior vice president of devices for Amazon at that conference. “This will be coming next year,” he added. Really?

Over two years later, there are no tangible benefits, visible results or new information about Sidewalk deployment in the U.S. or anywhere else. Sidewalk remains a mysterious mesh network with no coverage maps anywhere to be found on the amazon.com website.

“A lot of people might not even know it’s there,” said analyst Carolina Milanesi, president and principal analyst of Creative Strategies. “It’s not like Alexa, where you see a prompt for it.”

The Sidewalk network – which relies on Bluetooth Low Energy for short-range communication, 900MHz LoRa or frequency-shift keyring over longer distances – is set to max out at 80 Kbit/s on any one Amazon device operating as a Sidewalk “bridge.” And Amazon caps Sidewalk’s per-customer data usage at 500MB a month.

The fact that Amazon turned on Sidewalk without notification, much less permission, continues to draw complaints. “I think there’s value in the Sidewalk concept,” said analyst Mark Vena, president and CEO of SmartTech Research. “The problem is that Amazon conducted a Biblically disastrous rollout of this.” He added that Amazon “would have really put themselves in a much better position” if they’d made Sidewalk opt-in.

“I was very critical of their rollout,” emailed Jennifer King, a privacy and data policy fellow at the Stanford Institute for Human-Centered Artificial Intelligence, adding that she remains uneasy about it. “I have deep concerns about their practices.”

Privacy advocates point to the enormous amount of data Amazon collects about the tastes of its customers and also to its late adoption of such common trust-building measures as releasing transparency reports documenting how it responds to government requests for that data; Amazon’s reports remain remarkably thin compared to those of the other tech giants.

Amazon did not answer a Light Reading question about its Sidewalk opt-out rate, but provided a statement attesting to Sidewalk’s “strong coverage across major U.S. metro areas.” It did not include any individual user success stories, because Sidewalk’s encryption and data-minimization techniques obscure those details. This author opted out of Sidewalk a long time ago.

No security vulnerabilities seem to have been reported for Sidewalk thus far – the major criticism made in a report from Cato Networks released this summer was that IT admins would struggle to keep track of all the Sidewalk devices in an enterprise.

Amazon’s initial sales pitch for Sidewalk included a detailed white paper on its privacy and security features but suffered further from a lack of specific upsides for customers, leaving too much to their imagination.

In May 2021, Amazon announced a first set of partners that would use Sidewalk’s shared bandwidth for their own services: San Mateo, California, Tile; CareBand (a Chicago developer of senior-care systems); and Level (a smart-lock firm in Redwood City, California).

Image Credit: Amazon.com

Light Reading says that the Tile integration seems particularly significant “Expanding the area in which these device-tracking fobs can phone home can address a competitive disadvantage Tile faces against Apple’s AirTags, which can tap into Apple’s vast Find My network. But with Tile’s Sidewalk integration only live since June, Tile isn’t ready to talk details yet.”

“It’s been going well, but I can’t share any specific numbers,” Mira Dix, a Tile spokesperson, emailed Light Reading.

One analyst wondered how many Tile owners know of this new connectivity. “Sidewalk is still mostly promise, and I’d be shocked if most Tile buyers are aware of the partnership,” emailed Avi Greengart, president and lead analyst at Techsponential.

CareBand CEO Adam Sobol also said it was too soon to talk, adding “There should be more news in Q1/Q2 or next year.”

In September, Amazon announced a fourth partnership with Life360, a San Francisco firm that provides family-safety tools. Vena, of SmartTech Research, suggested more partnerships along the lines of the Tile deal would be in order and suggested one in particular with another vendor of device-tracking fobs. “I think you might see them partner with Samsung,” he said. “I think that would make logical sense.”

Ms. Milanesi suggested watching to see hyperlocal use cases get built out. “Instead of thinking about a neighborhood, you can think about a campus or a large manufacturing facility or whatever the case might be,” she said. “The technology behind it might be used in different ways.”

Analysts all agree that Amazon is overdue to persuade its customers to use Sidewalk.

“The idea that Amazon is building a crowdsourced network would be a lot easier for consumers to accept if Amazon could show concrete benefits to Echo owners,” said Greengart of Techsponential. “People are happy to participate in crowdsourced systems, like Waze’s traffic data, when the benefit to the user is clear.”

Author’s Note:

While not a Sidewalk user, I actively use many other Amazon devices (I have 3 echo “smart” speakers, 3 fire tablets, 2 fire tv sticks, a Toshiba Fire TV, and a Kindle eReader in my home).

In over 60 years of using tech devices, I have NEVER had as many PROBLEMS with the Fire TV/stick and Alexa on Echo devices.

The Fire TV/Fire TV stick issues seem to be due to very badly written Fire OS code (updated several times per week), while the Alexa issues are due to terrible voice recognition (which has incredibly deteriorated over the years, i.e. machine UNLEARNING) and back end communications failures (where the connection between the Amazon compute server terminating Alexa voice recognition loses the connection to an Amazon music server or 3rd party server (e.g. Sirius XM, Pandora, Spotify, etc).

The customer feels helpless as there is no serious Amazon tech support to resolve any of these problems. These problems have nothing to do with WiFi, Internet download speed/latency, IP address, etc. Yet Amazon tech support people always deflect blame for their bad software to your WiFi/Internet connection.

References:

https://www.amazon.com/gp/help/customer/display.html?nodeId=GZ4VSNFMBDHLRJUK

https://www.lightreading.com/iot/amazon-sidewalk-quietly-walks-on/d/d-id/773150?

https://www.aboutamazon.com/news/devices/echo-tile-and-level-devices-join-amazon-sidewalk

https://m.media-amazon.com/images/G/01/sidewalk/final_privacy_security_whitepaper.pdf

BT in new distribution partner agreement with OneWeb for LEO satellite connectivity

BT has announced a new distribution partner agreement with OneWeb for LEO satellite network and connectivity services. The agreement covers BT’s global footprint and supports the UK government’s National Space Strategy.

OneWeb will provide LEO satellite communication services across BT Group’s Global, Enterprise and Consumer divisions. The new agreement expands a MoU signed between the companies in July 2021. BT will test how LEO satellite technology can be integrated with its existing terrestrial capabilities to meet the communications needs of consumer and business customers. Once the network integration tests are completed successfully, BT expects to start live trials with customers in early-2022.

BT will test capabilities at its Bristol lab to show how LEO solutions can integrate with existing services. Due to the current capacity levels of OneWeb satellites, this will focus on the role of LEO as a supplementary, low latency backhaul solution to sites needing extra capacity or a back-up solution, as well as to provide business customers with improved resilience. Once the tests are complete, BT will start early adopter trials with UK and international customers. As the capacity of the OneWeb system expands, the future use cases could extend to include the use of satellite for IoT backhaul and fixed wireless access (FWA) in rural areas.

Business Secretary Kwasi Kwarteng said: “I am thrilled to see the UK at the forefront of this emerging technology thanks to the Government’s investment in OneWeb – a crucial part of our plans to cement our status as a global science and technology superpower.”

Digital Secretary Nadine Dorries said: “The agreement between OneWeb and BT will help bring fast and reliable global connectivity, from the Highlands to the Himalayas. I’m delighted these two British companies have joined forces to research the technological benefits of working together, and I look forward to exploring how this could play a role in our mission to put hard-to-reach areas in the digital fast lane.”

Philip Jansen, Chief Executive of BT Group, said: “Space is an emerging and enormous digital opportunity, and this is an important step towards harnessing its potential for BT’s customers across the globe. We will put OneWeb’s technology through its paces in our UK labs with the goal of delivering live trials in early 2022. Delivered securely and at scale, satellite solutions will be an important part of our plans to expand connectivity throughout the UK and globally, and to further diversify the range of services we can offer our customers.”

OneWeb’s Chief Executive Officer Neil Masterson said: “BT has taken the lead in the recognition of LEO satellite’s advantage. We are delighted as this agreement with BT Group represents an important strategic partnership for OneWeb as we continue to make progress towards our operational launch. We are excited to be playing such a key role in improving the resilience of the overall telecom infrastructure in the UK. OneWeb’s connectivity platform will help bridge the last digital divides across the country and enhance the nation’s digital infrastructure.”

OneWeb is expected to deliver global coverage by June 2022 through a constellation of 648 LEO satellites and is poised to deliver services from the North Pole to the 50th parallel, covering the entire United Kingdom, later this year. The new partnership supports BT’s wider network ambition, set out in July this year, to deliver digital solutions across the entire UK by 2028, through a combination of an expanded network and ‘on demand,’ requestable solutions anywhere beyond. In building a converged, software-defined network, BT will leverage and integrate both terrestrial and non-terrestrial technologies to deliver on the goal of seamless, ubiquitous connectivity.

This agreement marks a clear path towards the first LEO solutions being available for customers within a year. As the next step, BT will test capabilities in its Bristol lab to demonstrate how they integrate with existing services. Current capacity levels within OneWeb satellites mean initial trials will focus on its role as a supplementary, low latency backhaul solution to sites where additional capacity or a back-up solution is required, and to deliver improved resilience for business customers. On successful completion, BT will begin early adopter trials for UK and international customers, expected early next year. As OneWeb grows their capacity, the list of future use cases could also widen, opening up the opportunity to explore the use of satellite for IoT backhaul and Fixed Wireless Access in rural areas.

The work with OneWeb shows the capabilities being developed by UK businesses in the pioneering area of space technology and follows the UK Government’s recently published National Space Strategy, which recognizes the enormous strategic opportunities on offer. BT, which boasts a heritage of nearly 60 years in space and satellite communication innovation, continues to explore a diverse range of partners across all its services, including space, to ensure the latest and best connectivity solutions are available for customers.

*The deal encompasses BT’s Enterprise, Consumer and Global units, serving UK and multinational organizations.

References:

Cable broadband subscriber growth slows while FTTx and FWA gain ground

Cable network operators (cablecos or MSOs) are losing ground to FTTP/FTTx (fiber to the premises/ cabinet/ home) and FWA (fixed wireless access).

- Bloomberg reports that cable broadband growth is sputtering and no one knows why.

- GlobalData agrees, but forecasts a solid increase in U.S. fixed-broadband lines.

Broadband internet subscriber growth at Comcast Corp. and Charter Communications Inc has decreased, raising concerns about an end to what has been a huge growth business, with explanations ranging from a slowdown in consumer spending to competition from phone giants.

Charter on Friday reported 25% fewer new broadband subscribers than analysts estimated and said the overall number of new customers would fall back to 2018 levels. Charter had 1.27 million new broadband customers in 2018 compared with 2.2 million last year. Analysts predict it will add 1.4 million subscribers this year, according to estimates compiled by Bloomberg.

Comcast, which had earlier cut its subscriber forecast, reported 300,000 new internet customers Thursday, less than half the number added a year ago.

Analysts were expecting some slowdown in demand coming off 2020, a year when broadband sign-ups spiked as the pandemic shifted people to working and schooling from home. Still, with Charter echoing Comcast’s gloomy picture from Thursday, suddenly there’s a chill on the cable broadband front, which became the most prized segment of the business as consumers cut traditional TV service.

Charter’s shortfall raises “questions about whether this is the beginning of the end of the cable broadband story,” said Geetha Ranganathan, an industry analyst at Bloomberg Intelligence.

GlobalData forecasts that cable’s share of total U.S. fixed broadband subscriptions will decline to 67.1% by the end of 2026, from 68% in 2021, as other technologies such as fiber and fixed wireless expand their presence. Total U.S. fixed-broadband lines, including fiber, fixed wireless and cable, will increase from 103.1 million in 2021 to 112.3 million by 2026 says the market research firm.

No one has been able to identify the exact reason why the wind has gone out of the sails for big cable. Both Charter and Comcast blamed a slower new home market for some of the slack in demand, leaving the companies to try and squeeze more business out of their saturated markets. Other factors could include a drop off in lower-paying customers as government assisted broadband funds dry up.

Even as Comcast and Charter deploy new faster network technology to attract more lucrative customers, cable’s share of the market is starting to shrink, according to Tammy Parker, a senior analyst with GlobalData.

Total U.S. broadband lines will increase to 112.3 million by the end of 2026 from 103.1 million in 2021, including new wireless internet customers, the market research firm predicts.

The number of U.S. fiber lines will grow at a CAGR of 10.8% to reach 28.2 million lines by the end of 2026. This growth will be due to rising demand for high-speed internet services in the nation, and efforts by the government and operators to expand FTTx networks.

References:

https://www.telecomlead.com/broadband/number-of-us-fiber-lines-to-reach-28-2-mn-by-2026-102290

Open RAN: A game-changer for mobile communications in India?

The author is a former Advisor, Department of Telecommunications (DoT), Government of India

The mobile network comprises two domains: The Radio Access Network (RAN) and the Core Network. The RAN is the final link between the network and the phone. It includes an antenna on the tower plus the base station. Though it was possible for the operators to have one vendor for the core and a separate vendor for the RAN, the same was not done because of interoperability issues.

Open RAN is the hot topic now-a-days and most talked about technology, both in diplomatic and technical circles. This is a three year old technology and fifty operators in more than two fifty countries have deployed open RAN. First it was deployed in the network of Rakuten mobile, a Japanese telecom service provider. This technology makes RAN agnostic to vendors, programmable and converts it to plug & play type. Open RAN is at the epicentre of the digital transformation and plays a critical role in bringing more diversity to the 5G ecosystem. It is required for faster 5G rollout. Domestic (India) vendors may get the opportunity to supply the building blocks of RAN and so it is an initiative towards ‘self-reliant India.’

The RAN accounts for 60 per cent of capex/opex of mobile networks and so a lot of focus is there to reduce RAN costs. 5G signals have a shorter range than previous generation signals. As a result 5G networks require more base stations to provide the required coverage. So in 5G networks this percentage may be still higher.

Open RAN implementation reduces RAN costs. Instead of concentrating on making end-to-end open, opening the RAN ecosystem is given priority by the operators. The open RAN standards aim to undo the siloed nature of the RAN market where a handful of RAN vendors only offer equipment and software that is totally proprietary. Proprietary products are typically more expensive than their generic counterparts. Cellular networks have been evolving with various innovations. It has evolved from 1G to 5G. With these evolutions networks are evolving towards open networks having open interface and interoperability. Open RAN is a term used for industry wide standards for RAN interfaces that support interoperation between different vendor’s equipment and offer network flexibility at a lower cost. The main purpose of open RAN is to have an interoperability standard for RAN elements including non-proprietary hardware and software from different vendors. An open environment means an expanded ecosystem, with more vendors providing the building blocks. Open RAN helps the operators to overcome “Vendor lock in” introducing ‘best of breed’ network solutions.

There will be more innovations and more options for the operators. With a multi -vendor catalog of technologies, network operators have the flexibility to tailor the functionality of their RANs to the operators’ needs. They can add new services easily. Open RAN gives new equipment vendors the chance to enter the market with Commercial off the shelf (COTS) hardware. An influx of new vendors will spur competition. Cell site deployment will be faster. Third Party products can communicate with the main RAN vendor’s infrastructure. New features can be added more quickly for end users.

Current RAN technology is provided as a hardware and software integrated platform. The aim of open RAN is to create a multi supplier RAN solution that allows for the separation or disaggregation between hardware and software with open interface. Open RAN is about disaggregated RAN functionality built using open interface specifications between blocks. It can be implemented in vendor neutral hardware and software based on open interfaces and community developed standards.

In an open RAN environment, the RAN is disaggregated into three main building blocks:

- Radio Unit (RU)

- Distribution unit (DU)

- Centralized unit(CU)

The RU is where the radiofrequency signals are transmitted, received, amplified and digitized. It is located near or integrated into the antenna. The DU and CU are parts of the base station that send the digitized radio signal into the network. The DU is physically located at or near the RU whereas the CU can be located nearer the Core. DU is connected with RU on Optical Fiber cable. The concept of open RAN is opening the protocols and interfaces between these building blocks (radio, hardware and software) in the RAN.

Another feature of Open RAN is the RAN Intelligent Controller (RIC) which adds programmability to the RAN. For example, Artificial Intelligence can be introduced via the RIC to optimise the performance of the network in the vicinity of a cricket stadium on a match day. The RIC works by exposing an API (Application Programming Interface) which lets software talk to each other. There are two types of RIC: near-real time and non real time. Both perform logical functions for controlling and optimizing the elements and resources of open RAN. A near-real time RIC (response time on the order of 10’s of milliseconds) controls and optimizes elements and resources with data collection and communication. A non-real time RIC (response time greater than one second) uses AI and Machine Learning (ML) workflows that include model training, where the workflows learn how to better control and optimize the RAN elements and resources.

The O-RAN alliance has defined eleven different interfaces within the RAN including those for:

Front haul between RU and DU Mid haul between DU and CU Backhaul connecting the RAN to the Core (also called as transport network)

O-RAN alliance is a specification group defining next generation RAN infrastructures, empowered by principles of intelligence and openness. Openness allows smaller players in the RAN market to launch their own services. It was founded in 2018.

O-RAN alliance is a worldwide community of around two hundred mobile operators, vendors and research and academic institutions operating in the Radio Access Network industry. Its goals include to build mechanisms for enabling AI and ML for more efficient network management and orchestration. It supports its members in testing and implementation of their open RAN implementation. O-RAN conducts world wide plug tests to demonstrate the functionality as well as the multi vendor interoperability of open network equipment. O-RAN alliance develops, drives and enforces standards to ensure that equipment from multiple vendors interoperate with each other. It creates standards where none are available, for example Front haul and creates profiles for interoperability testing where standards are available.

Open RAN challenges:

1. Integration of equipment from multiple vendors

2. Since equipment is from different vendors, operators have to have multiple Service Level Agreements (SLAs)

3. Network latency may increase

4. Reliability and availability may be a challenge

5. Staff has to acquire multiple skill sets

6. Security Concerns

Open RAN offers a golden opportunity for software developers to become a global hub for offering RAN solutions. This technology leads to a great disruption to the traditional ecosystem and accelerates the adoption of more innovative technologies. The disaggregation of RAN has also added further advantages by enabling better network slicing and edge compute capabilities.

References:

https://www.telecomtv.com/content/open-ran/how-vran-can-be-a-game-changer-for-5g-40019/

https://techblog.comsoc.org/?q=Open%20RAN#gsc.tab=0&gsc.q=Open%20RAN&gsc.page=1

6 GHz band proposed for WiFi/5G in Asia Pacific region, but it’s not in ITU-R M.1036

It’s well known that mid-band spectrum is very important in the on-going digital evolution as it strikes a good technical trade-off between coverage and capacity. Without adequate spectrum, ubiquitous 5G connectivity fundamental to the digital economy will not materialize.

In his published paper entitled “Optimizing IMT and Wi-Fi mid-band spectrum allocation: The compelling case for 6 GHz band partitioning in Asia-Pacific,” Scott Minehane called on policymakers, regulators, and mobile network operators (MNOs) in Asia Pacific to allocate adequate mid-band spectrum for both IMT and Wi-Fi services. Findings in this paper were also presented in the ITU Regional Radiocommunication Seminar 2021 for Asia-Pacific.

What Scott failed to mention is that neither WRC or ITU-R WG 5D have approved the use of 6 GHz (C-band spectrum) for terrestrial IMT (3G, 4G, 5G) as that band is NOT in the proposed revision to ITU-R M.1036. After 4.800-4.990 GHz, the next band in M.1036 is 24.25-27.5 GHz.

In the United States in April 2020, the FCC made a massive 1200 MHz of bandwidth available in this band for Wi-Fi and other unlicensed technologies such as 5G New Radio/ITU M.2150 in unlicensed bands (not an official ITU-R standard).

Nonetheless, here is Minehane’s case for 6 GHz as published earlier this week in Telecom Review Asia:

In Asia, where more than 4.3 billion people reside in areas subject to monsoons and frequent heavy rainfall, C-Band spectrum is crucial as it is not susceptible to rain attenuation. However, with C-Band being the preferred spectrum widely used by satellite operators in the region, many countries do not have enough 3.5 GHz band to allocate to mobile operators in order to support advanced 5G and future 6G deployments.

As mobile data consumption surge in populous capital cities such as Jakarta, Bangkok, Hanoi, Kuala Lumpur, and Phnom Penh, there is a real threat that spectrum demand would outstrip spectrum supply in the near future. In fact, the GSMA has projected that countries require 2 GHz of mid-band spectrum over the next decade to deliver the full potential of 5G networks.

With spectrum demand on the rise, and competition for frequency bands intensifying, the 6 GHz band has been identified as the ideal substitute for 3.5 GHz because of its good propagation properties and large contiguous bandwidth of 1200 MHz. Comparatively, mmWave is an ill fit in the region as rain attenuation results in significant path loss. Commercially, utilizing 6 GHz for 5G deployment is also more viable (then mmWave) as capex and opex costs are foreseen to be much lower.

Noting that there is no one-size-fits-all approach for the 6 GHz band allocation in a heterogeneous region like the Asia Pacific, Minehane said, “The key is having a customized approach for the 6 GHz band in the Asia Pacific, where emphasis is placed on the early partitioning of the 6 GHz band between IMT and Wi-Fi, as this is the largest remaining single block of spectrum which could be allocated for mobile services in the mid-band.”

Partitioning of the 6 GHz band for IMT and Wi-Fi would balance competing demands for spectrum. To secure the short- and long-term economic benefits of both services, Minehane proposed allocating 500 MHz of the lower 6 GHz band (5925-6425 MHz) for Wi-Fi and 700 MHz of the upper band (6425-7125 MHz) for IMT.

“Making about 700 MHz of 6 GHz spectrum available for IMT services is a good start towards future-proofing 5G advanced and 6G services. Moreover, adequate IMT spectrum fosters healthy competition in the sector, where say 3 to 4 providers prioritize delivering superior customer services and experiences to differentiate themselves,” said Minehane. “From an economic perspective, IMT services also generate greater benefits than Wi-Fi services.”

Source: Qualcomm

Amid uncertainties in how new technologies unravel in the long-term, diversification of the 6 GHz band offers flexibility in future decision-making. Apart from addressing the spectrum demands set out by the GSMA, Minehane recommended making provision for more IMT spectrum as it offers the flexibility to be upgraded to the future 6G or switched to Wi-Fi. However, switching from unlicensed Wi-Fi use to licensed IMT uses will be impossible owing to the proliferation of user-based equipment.

Minehane noted that allocating the entire 6 GHz band to Wi-Fi to bridge the digital divide is futile, as low band spectrum is most suited to deliver connectivity to the underserved in rural areas.

Besides, better, faster, and more secure experiences with 4G or 5G, compounded with more affordable, unlimited data plans result in consumers using less Wi-Fi and data offloading. In South Korea, for instance, about 52% of mobile data traffic was handled by 5G. In Canberra, supported by Australia’s largest free public Wi-Fi network, Wi-Fi usage declined sharply when prices in mobile data dropped even during the pandemic. Similarly, enterprises are likely to rely more on 5G than Wi-Fi 6.

Effective spectrum management is instrumental to economic recovery, growth, and resilient. One of the biggest challenges regulators face is the refarming of spectrum to tap onto the potential of emerging innovations. To this end, regulators need to formulate a long-term spectrum roadmap and strategy to chart progress. Another challenge is keeping spectrum auctions affordable, so that operators can invest in upgrading network infrastructure.

Despite these prevailing challenges, Minehane stressed that collectively, the region is forward-looking. Individual countries are stepping up on initiatives and engaging in ongoing dialogues to discuss spectrum management approaches. The 3GPP has also embarked on standardization work to grow the 6 GHz band ecosystem.

Concluding, Minehane expressed hopes that policymakers would increase IMT spectrum allocations and maximize the value created by key spectrum in the years and decades to come.

Addendum: 14 Oct 2021 Email from Joanne Wilson, Deputy to the Director ITU Radio Communications Bureau (ITU-R) who spoke at SCU:

“ITU-R Recommendations are voluntary (non-binding) unless they, or parts thereof, have been incorporated by reference (IBR) into the Radio Regulations. Rec ITU-R M.1036 has not been incorporated by reference into the Radio Regulations and its implementation is voluntary. As a recommendation that addresses the frequency arrangement for an application (not a service!), there would be no context under which M.1036 would be considered for IBR. Still, M.1036 is one of the most heavily debated recommendations because most countries follow it as the basis for their subsequent domestic rulemakings.”

References:

https://www.fcc.gov/document/fcc-opens-6-ghz-band-wi-fi-and-other-unlicensed-uses-0

https://www.itu.int/dms_pubrec/itu-r/rec/m/R-REC-M.1036-6-201910-I!!PDF-E.pdf