Author: Alan Weissberger

Juniper Research: Global 6G Connections to be 290M in 1st 2 years of service, but network interference problem looms large

A new study from Juniper Research, a leading telecommunications research firm, forecasts 290 million connections globally by 2030; the year after its initial expected launch in 2029 (this author doesn’t think standards for 6G will be completed by 2030). To achieve this early growth, the report cautions operators must solve various technological challenges, including the issue of network interference arising from the use of high-frequency spectrum.

This use of high-frequency spectrum in 6G will be the key enabling technology to provide throughput speeds 100 times greater than current 5G networks. However, as cellular technologies have never used spectrum bands in this range before, the most pressing concern for operators is minimizing this network interference, or risk creating an unreliable 6G network.

RIS Identified as Key Emerging 6G Technology:

To achieve this, the report urges operators to invest in RIS (Reconfigurable Intelligent Surfaces); a technology that will mitigate the impact of interference from large obstacles, including buildings, on network services. This is accomplished by purposefully reflecting and refracting 6G mobile signals to enable data packets to move around physical obstacles.

As 6G standards become clearer in 2025, RIS technology must become an immediate priority for development. However, the report warns that given the wide geographical areas of some 6G networks, operators must implement AI to monitor and adjust RIS configuration in real-time to maximize the technology’s benefits.

Research author Alex Webb remarked: “Initial 6G coverage will occur in the most densely populated geographical areas to serve as many users as possible. Therefore, RIS technology will be key to providing a valuable 6G service to both consumer and enterprise customers in the first few years of network operation.”

In 2030, when Juniper Research expects 6G to reach 290 million connections, GSMA Intelligence predicts in its 2023 mobile economy report that 5G will have surpassed 5 billion connections. We believe both of those forecasts are way off the mark. In fact, we forecast ZERO 6G subscribers in 2030, because the ITU-R IMT 2030 radio standards and 3GPP 6G specs won’t be completed by then.

About the Research Suite:

The new research suite offers the most comprehensive assessment of 6G development to date, including insightful market analysis, and in-depth forecasts for 60 countries. The dataset contains almost 21,000 market statistics over a nine-year period.

Juniper Research has, for two decades, provided market intelligence and advisory services to the global telecommunications sector, and is retained by many of the world’s leading network operators and communications platforms.

Find out more about the new report: Global 6G Development 2024-2032, or download a free sample.

References:

Global 6G Connections to Reach 290m in First Two Years of Service (juniperresearch.com)

Juniper Research: 5G to Account for 80% of Operator Revenue by 2027; 6G Requires Innovative Technologies

SK Telecom, Intel develop low-latency technology for 6G core network

Ericsson and IIT Kharagpur partner for joint research in AI and 6G

Nokia plans to investment €360 million in microelectronics & 5G Advanced/6G technology in Germany

IEEE 5G/6G Innovation Testbed for developers, researchers and entrepreneurs

WRC-23 concludes with decisions on low-band/mid-band spectrum and 6G (?)

ETSI Integrated Sensing and Communications ISG targets 6G

Ericsson’s India 6G Research Program at its Chennai R&D Center

Big 5G Conference: 6G spectrum sharing should learn from CBRS experiences

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

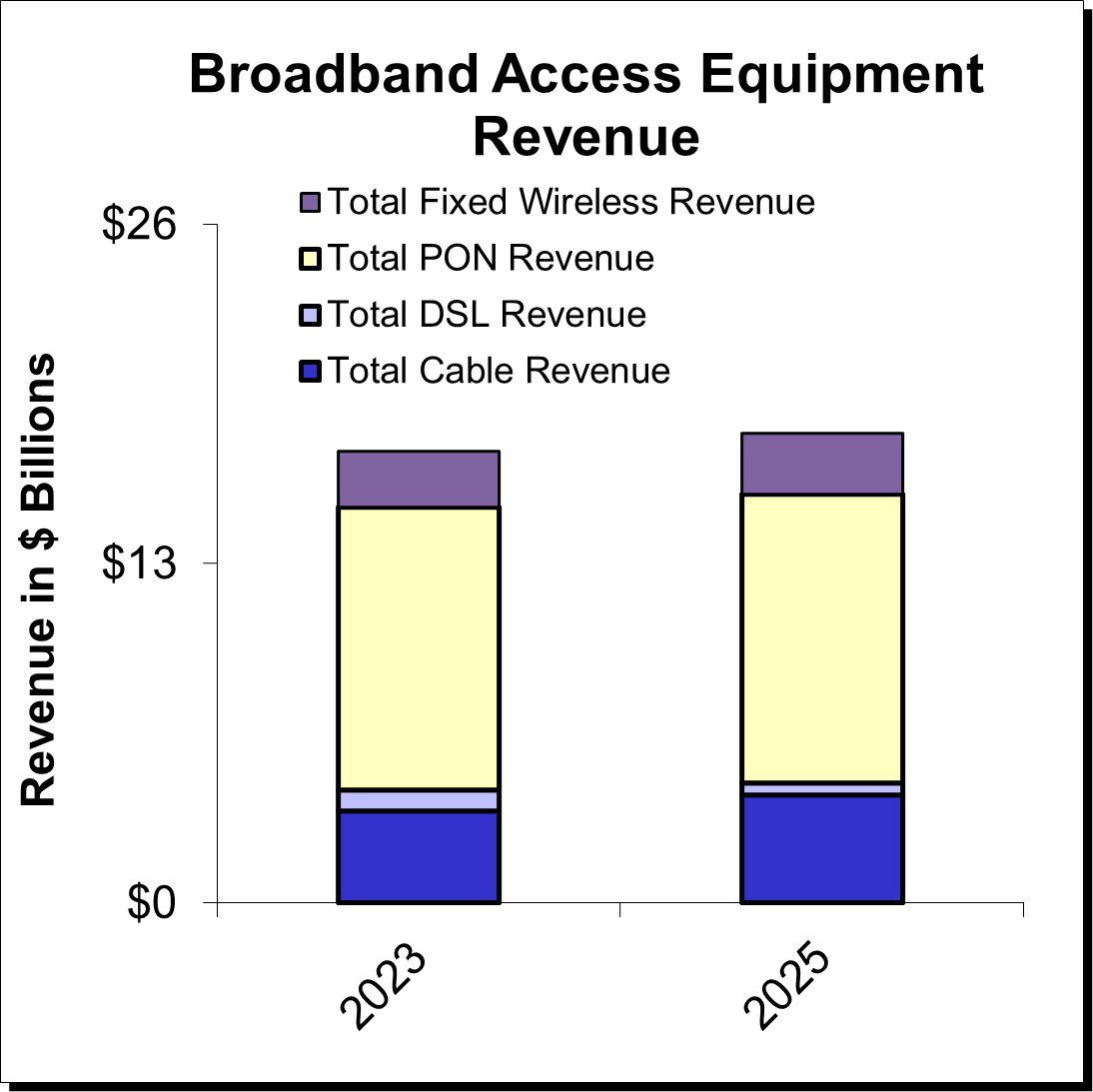

Dell’Oro Group expects broadband access equipment sales to decline by 1% in 2024 versus 2023, with the first half of 2024 seeing continued weakness followed by a surge in spending in the second half of the year. The first half of 2024 will continue to see some of the inventory corrections that marked a tough 2023 that saw a spending decline of 8% to 10%, according to Dell’Oro VP Jeff Heynen.

“Although the inventory corrections seen in 2023 will continue through the first half of 2024, the second half of the year is expected to be the turning point towards renewed growth,” said Jeff Heynen, Vice President at Dell’Oro Group. “Service providers still have the same goals of increasing their fiber footprint, increasing the bandwidth they can offer their customers, and improving the reliability of their broadband services through the distribution of intelligence closer to subscribers,” added Heynen.

Additional highlights from the Broadband Access & Home Networking 5-Year January 2024 Forecast Report:

- PON equipment revenue is expected to grow from $10.8 B in 2023 to $11.8 B in 2028, driven largely by XGS-PON deployments in North America, EMEA, and CALA and early 50 Gbps deployments in China.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MAC/PHY Devices, and Remote OLTs) is expected to reach $1.3 B by 2028, as operators continue their DOCSIS 4.0 and early fiber deployments.

- Revenue for Fixed Wireless CPE is expected to reach $2.5 B by 2028, led by shipments of 5G sub-6GHz and a growing number of 5G Millimeter Wave units.

- Revenue for Wi-Fi 7 residential routers and broadband CPE with WLAN will reach $9.3B by 2028, as the technology is rapidly adopted by consumers and service providers alike.

Source: Dell’Oro Group

About the Report:

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

References:

Calix and Corning Weigh In: When Will Broadband Wireline Spending Increase?

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Alaska Communications uses XGS-PON, FWA, DSL in ~5K homes including Fairbanks and North Pole

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

Telefonica España to activate XGS-PON network in 2022; DELTA Fiber to follow in Netherlands

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Charter Communications posted a surprise drop in broadband subscribers in the Q4-2023, the company announced on Friday. Charter’s internet customers decreased by 61,000 (-62,000 residential and +1,000 business) in the 4th quarter, with nearly all of the decline from residential customers. That was much worse than expectations for 17,290 additions, according to Visible Alpha and a year-ago gain of +105,000. The broadband subscriber drop was especially disappointing given Charter’s homes passed growth accelerated to 2.5% year-over-year, Craig Moffett said in a research note.

“Internet growth in our existing footprint has been challenging, driven by admittedly more persistent competition from fixed wireless and similar levels of wireline overbuild activity,” CEO Chris Winfrey said on a post-earnings call, adding that new investments will help drive growth despite the “temporary challenges.” Chief Financial Officer Jessica Fischer had warned in December that the company could lose internet customers in the quarter. At the time, speaking at an analyst conference, she said the company was facing short-term challenges and that results would be in line with the rest of the industry.

Charter was not the only cableco/MSO to report decreased broadband internet subscribers in the 4th quarter. Last week, rival Comcast reported a loss of 34,000 broadband customers, fewer than expectations, but exceeding the 18,000 broadband customers it lost in the previous quarter.

Stiff competition across broadband and wireless mobile and the decline of traditional television have been causes of concern, with Charter trying to expand its reach into rural areas in an effort to boost subscriber and earnings growth. Charter is facing heightened competition from Verizon and T-Mobile’s wireless home internet offerings, and the cable company could soon lose even more subscribers when a key government program runs out of funding in April, JPMorgan analysts say in a research note. In particular, the end of the Affordable Connectivity Program (ACP), which provided up to $30 per month to eligible customers to put toward their internet bills, could hurt Charter more than its peers. If ACP is not refunded, “we’ll work very hard to keep customers connected,” Winfrey said. Charter has more than 5 million ACP recipients, the highest in the industry. The majority of them were Charter broadband subscribers before the program began.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 142,000 broadband subs via its rural subsidy program in Q4, for a total of 420,000, and an overall penetration rate of 33.8% – up from 27.2% in the year-ago quarter. The company posted $74 million in rural revenues, up from $39 million a year earlier. Charter pulled in subsidy revenues of $29 million in Q4. Total capex for the project in Q4 was $426 million, down from $567 million in the year-ago quarter. Charter plans to activate 450,000 new subsidized rural passings in 2024. With all programs rolled up, Charter has committed to build 1.75 million subsidized rural passings.

Charter expects to complete its Rural Digital Opportunity Fund (RDOF) builds by the end of 2026 – two years ahead of schedule. Charter also intends to participate in the much larger $42.45 billion Broadband Equity Access and Deployment (BEAD) program.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Completion of Charter’s hybrid fiber/coax (HFC) network upgrade has been delayed to 2026 due in part to a lengthier certification process for distributed access architecture (DAA) technology. Charter’s original plan was to complete its HFC upgrades by the end of 2025. Charter’s HFC evolution plan consists of three steps:

- An upgrade to 15% of its network to 1.2GHz with an upstream-enhancing “high-split” using traditional integrated cable modem termination systems (CMTSs). That enables multi-gigabit downstream speeds and upstream speeds up to 1 Gbit/s.

- An upgrade to 1.2GHz with DAA and a virtual CMTS in 50% of the HFC footprint, enabling downstream speeds up to 5 Gbit/s and upstream speeds up to 1 Gbit/s.

- A full DOCSIS 4.0 upgrade by deploying 1.8GHz with DAA and a vCMTS to 35% of the HFC footprint. That’ll put Charter in position to deliver up to 10 Gbit/s downstream and at least 1 Gbit/s upstream.

Speaking on today’s Q4 2023 earnings call, Charter CEO Chris Winfrey said the operator has launched symmetrical speed tiers in two markets (Reno and Rochester, Minnesota, an official confirmed), with deployments in six additional markets underway that, once completed, will fulfill the phase one plan. Charter expects to start DAA deployments in its phase two markets later this year, Winfrey said.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 546,000 mobile lines in Q4, down from a gain of +615,000 in the year-ago quarter and +594,000 in the prior quarter. Analysts were expecting Charter to add 594,000 mobile lines in the 4th quarter and +2.5 million lines for full 2023, up from 1.7 million in full 2022. The MSO ended 2023 with 7.76 million mobile lines. Charter is also expanding its deployment of CBRS spectrum to help the company offload MVNO costs in high-usage areas. Winfrey said “thousands” of CBRS units have been deployed in one “large” market (believed to be Charlotte, North Carolina). Charter expects to roll CBRS to an additional market later this year, he said.

References:

Charter Communications adds broadband subs and raises CAPEX forecast

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

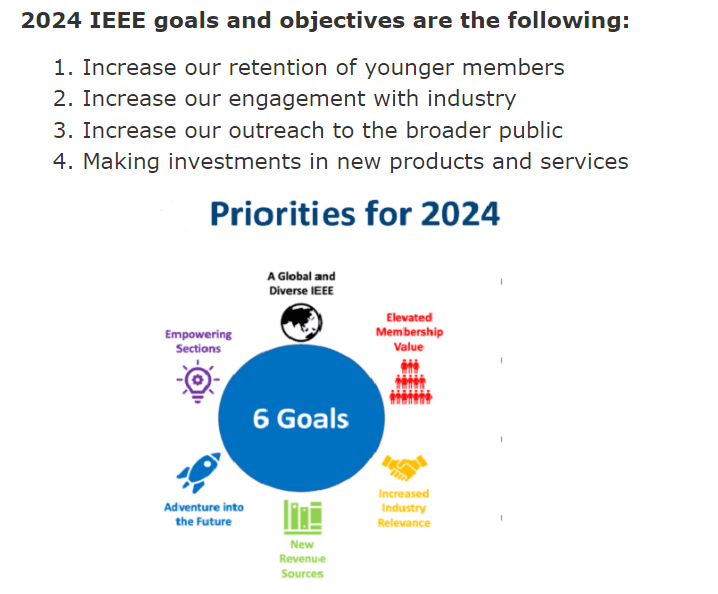

IEEE President’s Priorities and Strategic Direction for 2024

by Tom Coughlin, 2024 IEEE President; edited & augmented by Alan J Weissberger, IEEE Techblog Content Manager

Let’s examine each of these issues and initiatives for IEEE this year:

Let’s examine each of these issues and initiatives for IEEE this year:

1. IEEE has a lot of college student members but, like many other professional organizations, the majority of these student members don’t continue as full IEEE members. One reason is the much higher cost – $218/yr for full IEEE membership vs. $32/yr for IEEE student membership. This is a big financial burden as many college graduates carry student loans after graduation. Another reason is they don’t see much if any value in being an IEEE member. We need to change that perception by revitalizing IEEE such that is relevant to young members careers in both industry and academia.

In order for the IEEE to remain vital and relevant we need to convert more of our student members to full IEEE members and then engage and retain them. One thought is to encourage them to volunteer at the section, chapter, or global level.

I am creating a special task force in the IEEE to address this problem and do surveys, focus groups and pilot programs to find ways that we can attract and retain our younger members.

2. IEEE needs to create stronger ties and provide greater value to industry and to those engineers and scientists who work in industry. This goal is closely related to the first goal since most of our student members end up working in industry.

IEEE has an Industry Engagement Committee and I have asked them to work with the IEEE Student Activities Committee and IEEE Young Professionals to find value in the IEEE for younger people working in industry. In addition, I am personally reaching out to companies to speak with senior technical people about how IEEE is useful now and what else we can do to provide value, particularly for younger people working in industry.

3. IEEE needs to reach out to the broader world to let them know who we are and what we do. Today, most people that have heard of IEEE think of it as ONLY a standards organization, e.g. for IEEE 802.11 WiFi and IEEE 802.3 Ethernet. They don’t realize that IEEE is by far, the largest tech non-profit organization.

We have in our IEEE membership experts in all technologies, who can provide insights and guidance for public policy, convene meetings and create new and valuable standards.

IEEE is by far the most cited source for prior art in patents worldwide, it has created documents and standards on ethical design of intelligent and autonomous systems (AI) and our volunteers write, review and publish much of the worlds technical literature and put on conferences on every conceivable technical topic.

IEEE also creates future directions committees on emerging technologies, pursue technical megatrends and create and publish technology roadmaps on semiconductor and other important technologies.

4. IEEE needs to invest in new products and services. In particular, applying AI and other computer algorithms to IEEE content that will enable new ways to find, understand and advance technologies that can serve our members and our customers.

In 2024, IEEE will start an Ad hoc committee, working with relevant groups outside of the IEEE, on educating future generations of workers who will be using new tools such as AI, working in outer space and in virtual environments and who will work for many organizations and technologies during their career.

IEEE should be able to leverage technical tools to help people learn in the best way for them and to provide lower costs for continuous education which can enable those from underserved communities to participate in and benefit from technical education.

……………………………………………………………………………………………………………………

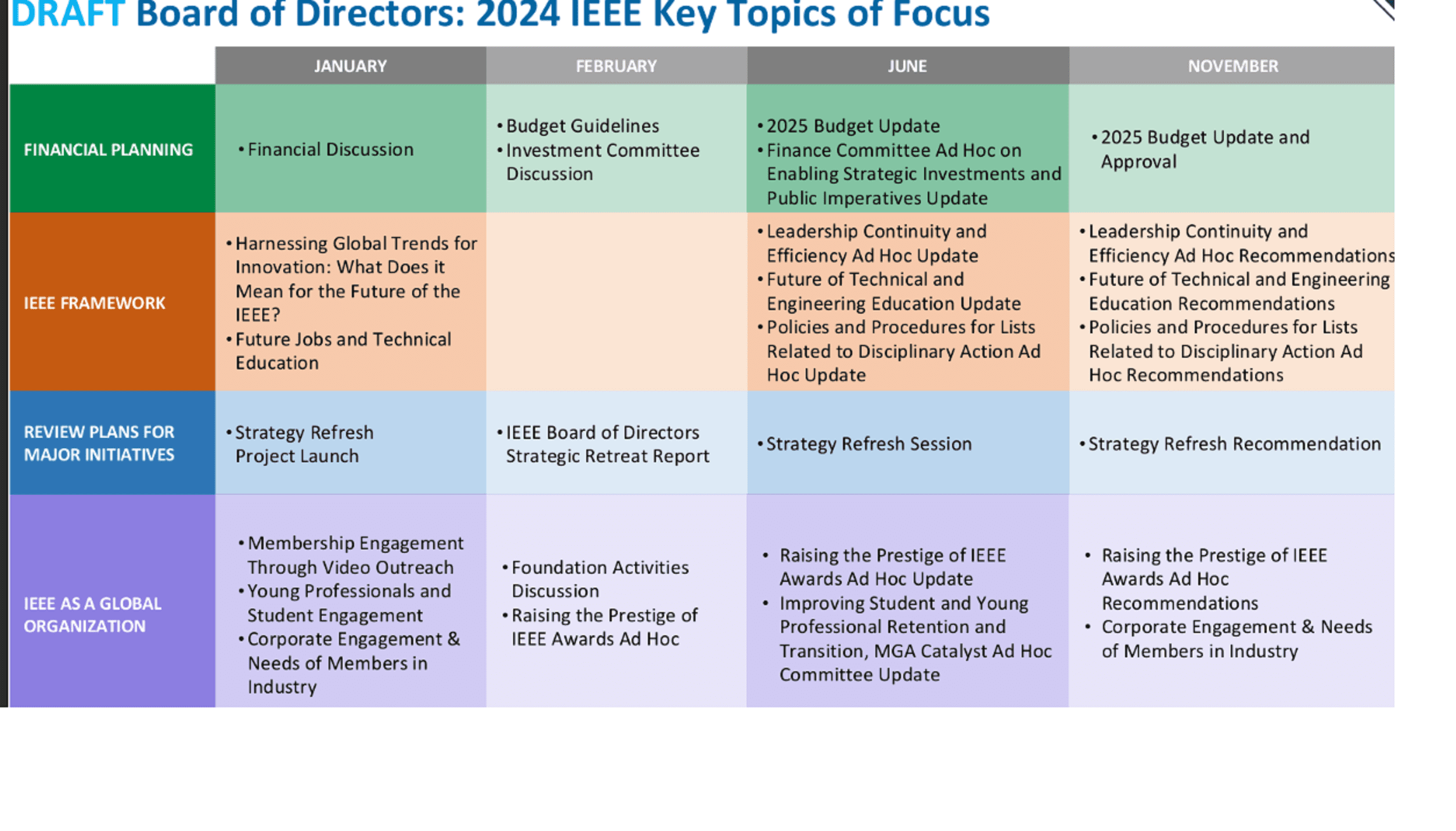

2024 IEEE Key Topics of Focus Overview:

- Provides a roadmap for the year in terms of areas of focus and provides year over year continuity.

- Discussed and adopted on an annual basis by the IEEE Board of Directors at the January meeting.

- A living document that evolves throughout the year and is updated for every Board meeting as progress is reported.

I know the time will go by fast in my one year term as IEEE President. I look forward to meeting more of our members in more places and having the chance to understand and support these members. I also hope that I can help create stronger ties to those who work in industry and keep more of our younger members and provide greater value to the world. Most of all I will support the IEEE’s mission to advance technology for the benefit of humanity!

……………………………………………………………………………………………………………….

References:

IEEE President Elect: IEEE Overview, 2024 Priorities and Strategic Plan

SK Telecom, Intel develop low-latency technology for 6G core network

In collaboration with Intel, SK Telecom (SKT) has successfully developed technology to reduce communication delays necessary for the evolution of 6G Core Network Architecture. The Core network is the gateway through which all voice and data traffic generated from a customer’s mobile device passes through to access the Internet network. It is a mobile communication service system that is responsible for security and service quality through the inter-connection of various systems.

Editor’s NOTE: Of course, 6G is currently undefined with only the features and functions being defined by ITU-R WP 5D which is meeting this week in Geneva. The 6G core network specifications will be done by 3GPP and NOT ITU-T as was the case for 5G core.

…………………………………………………………………………………………………………..

The 6G Core Architecture is required to have higher flexibility and safety than previous generations of wireless communications, and to provide stable AI service quality and technologies to customers by embedding intelligent and automation technologies.

As Core network technology continues to develop, the various systems that make up the network and the detailed functions that provide various services are also explosively increasing. As network complexity continues to increase, the process of sending and receiving messages is frequently recreated. Therefore, communication delays will increase compared to before. It is difficult to address these limitations with communication standard technologies (service communication proxies) for interconnection between unit functions within the existing Core network.

Inline Service Mesh, a low latency technology the two companies developed utilizing Intel Xeon processors with built in AI, is capable of increasing the communication speed within the Core network by reducing latency between unit function without Proxy.

Through this technology development, AI, which requires a large amount of computation, can be applied to the Core network in a wider variety of models. SKT has already commercialized a technology that reduces wireless resources by 40% and improves connectivity by analyzing movement patterns of real users in real time. Through this cooperation, the two companies will be able to reduce communication delays by 70% and increase service efficiency by 33% in the Core network through the application of the 6G Core Architecture.

SKT aims to apply the results of this study to commercial equipment next year. A technical white paper has been published by Intel that describes the technology, development process and benefits.

SKT and Intel have been continuing to cooperate for research on the development of key wired/wireless mobile communication technologies for the past 10 years. Based on the results of this study, the two companies plan to continue research and development for traffic processing improvement technologies incorporating AI technology in various areas of the Core network.

“We have made another technical achievement through continuous technology development cooperation with Intel to secure leadership in 6G,” said Yu Takki, Vice President and Head of Infra Tech at SKT. “We will continue our research and make efforts to commercialize AI-based 6G Core Architecture.”

“Our research and development efforts with SK Telecom continue to deliver innovations that have been deployed by Communications Service Providers worldwide”, said Dan Rodriguez, Corporate Vice President of Intel Network & Edge Solutions Group. “By leveraging the latest Intel Xeon processors with built in AI features, our companies are able to drive both performance and efficiency improvements that will be vital to the future Core networks.

Last March, SKT and NTT DOCOMO released a white paper addressing the requirements for future 6G networks.

The South Korean carrier said the new white paper contains its views on 6G key requirements and 6G evolution methodology, along with its opinions on the latest trends in frequency standardization. The 6G white paper also provides analysis, development directions and methodologies pertaining to promising 6G use cases, technology trends as well as and candidate frequencies.

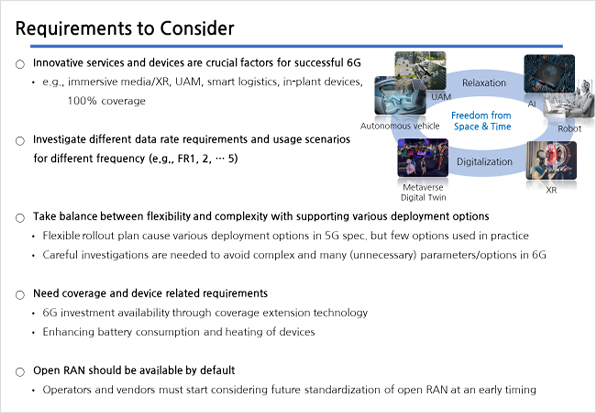

The 6G White Paper reviews the following:

- Performance requirements and implementation scenarios for each frequency band, taking into account the characteristics of each frequency

- Issues concerning coverage and devices in high-frequency bands

- Standardization for migration to 6G architecture and application of cloud-native / open architecture

References:

https://www.sktelecom.com/en/press/press_detail.do?idx=1597¤tPage=1&type=&keyword=

NTT DOCOMO & SK Telecom Release White Papers on Energy Efficient 5G Mobile Networks and 6G Requirements

https://www.docomo.ne.jp/english/corporate/technology/rd/docomo6g/whitepaper_dcmskt.html#title02

Ericsson and IIT Kharagpur partner for joint research in AI and 6G

Ericsson and the Indian Institute of Technology (IIT) Kharagpur have announced a partnership for a long-term cooperation for joint research in the area of radio, computing and AI (artificial intelligence). Both organisations have signed two milestone agreements. As part of the agreements, researchers from IIT Kharagpur and Ericsson will collaborate to develop novel AI and distributed compute tech for 6G. Leaders from IIT Kharagpur and Ericsson participated in discussing the developments and advancements for the future of networks and communications at the GS Sanyal School Telecommunications (GSSST).

Ericsson members from left: Rupa Deshmukh, Mikael Prtz, Kaushik Dey, Mikael Hook, Bo Hagerman,Magnus Frodigh, Director – Prof V. k Tewari, Deputy Director – Prof Amit Patra, Anil R Nair

……………………………………………………………………………………………………….

Two key initiatives finalized by Ericsson and IIT were:

a) Compute offload and Resource Optimisation at edge compute: The project aims to explore resource optimization, dynamic observability and sustainable distributed and Edge computing technologies.

b) RL-based Beamforming for JCAS: Safe, Causal, and Verifiable: The project aims to explore causal AI methods for joint communication and sensing (JCAS).

…………………………………………………………………………………………………………….

AI and Compute Research is instrumental to Ericsson’s 6G networks as the compute offload needs to be managed dynamically at edge and the policies would primarily be driven by AI. These themes of research are well aligned with IIT Kharagpur and both organizations view this partnership as a way to push the boundaries of fundamental and applied research in the Radio domain.

Editor’s Note:

Ericsson laid off 8,500 employees last year as part of its cost-cutting initiatives and reduced total costs by 12 billion Swedish crowns ($1.15 billion) in 2023.

Telecoms equipment suppliers are expecting a challenging 2024 as 5G equipment sales – a key source of revenue – are slowing in North America, while India, a growth market, may also see a slowdown. Ericsson’s fourth-quarter net sales fell 16% to 71.9 billion Swedish crowns ($6.89 billion), missing estimates of 76.64 billion.

……………………………………………………………………………………………………………..

Magnus Frodigh, Head of Ericsson Research, says: “This collaboration strengthens our R&D commitments in India and is pivotal to Radio, Compute and AI research. We are excited to partner with IIT Kharagpur and look forward to collaborative research in fundamental areas as well as translational research for our Future Network Platforms”. Dr Frodigh also presented Ericsson’s vision on 6G which aims to blend the physical and digital worlds enabling us to improve the quality of life by incorporating widespread Sensor-based communications between humans and machines through digital twins.

Nitin Bansal, Managing Director of Ericsson India said, “Ericsson is well poised to lead 6G innovation and we are making significant R&D investments in India in line with our commitment to the country. Given our 5G and technology leadership, our research initiatives are geared to provide affordable network platforms for ubiquitous connectivity all across the country.”

Virendra Kumar, Director at IIT Kharagpur, said, “In the commitment towards Digital India and making India the hub of technological innovation, this collaboration with Ericsson will be effective for next-generation technology significantly. 6G networks integrated with artificial intelligence will enable AI-powered applications to run faster and more efficiently. In the 6G era, IIT Kharagpur aims to contribute to Radio Access Technology and Network, Core Network, RF & Device Technologies, VLSI Design, Neuromorphic Signal Processing, Services and Applications.”

About Ericsson;

Ericsson enables communications service providers to capture the full value of connectivity. The company’s portfolio spans Networks, Digital Services, Managed Services, and Emerging Business and is designed to help our customers go digital, increase efficiency and find new revenue streams. Ericsson’s investments in innovation have delivered the benefits of telephony and mobile broadband to billions of people around the world. The Ericsson stock is listed on Nasdaq Stockholm and on Nasdaq New York. www.ericsson.com

About IIT Kharagpur:

Indian Institute of Technology Kharagpur (IIT KGP) is a higher educational and academic institute, known globally for nurturing industry ready professionals for the world and is a pioneer institution to provide Excellence in Education, producing affordable technology innovations. Set up in 1951 in a detention camp as an Institute of National Importance, the Institute ranks among the top five institutes in India and is awarded, “The Institute of Eminence”, by the Govt. of India in 2019. The Institute is engaged in several international and national mission projects and ranks significantly in research output with about 20 academic departments, 12 schools, 18 centers (including 10 Centre of Excellence) and 2 academies with vast tree-laden campus, spreading over 2100 acres having 16,000+ students. Currently, it has about 750+ faculty, 850+ employees and 1240+ projects.

To know more visit: [http://www.iitkgp.ac.in/]

Ericsson, IIT Kharagpur Partner to Joint Research in AI and 6G

Ericsson’s India 6G Research Program at its Chennai R&D Center

India unveils Bharat 6G vision document, launches 6G research and development testbed

India creates 6G Technology Innovation Group without resolving crucial telecom issues

https://www.cnbc.com/2024/01/23/ericsson-warns-of-2024-market-decline-despite-q4-earnings-beat.html

Calix and Corning Weigh In: When Will Broadband Wireline Spending Increase?

Broadband wireline network operators (telcos and MSOs/cablecos) have cutback on CAPEX with decreased spending for network equipment. In its latest earnings call, Calix warned that broadband operator spending might not increase until 2025, when BEAD subsidies have been allocated. However, fiber vendor Corning and others suggested spending might increase earlier than that.

Calix specializes in providing optical network access equipment to smaller broadband service providers and has seen significant revenue growth in recent years, but near-term growth will be challenged. Calix management’s guidance was that the 2024 fiscal year will be soft for its business. Despite that softness, the company still believes that it has years of growth ahead for itself starting in 2025 due to BEAD regulatory stimulus that should prove beneficial for the enterprise.

The U.S. government’s BEAD program promises to funnel a massive $42 billion in subsidies through US states to telecom companies willing to build networks in rural areas. However, allocation of those funds is taking longer than expected, forcing network operators to stall their deployment plans until they have a better sense of how much funding they might get.

“We have seen a significant broadening in the number of customers interested in competing for BEAD [Broadband Equity Access and Deployment program] funds. Today, nearly all our customers are either assembling a BEAD strategy or actively pursuing funds,” Calix CEO Michael Weening said during the company’s quarterly earnings call, according to Seeking Alpha.

“While they do this, they slow their new [network] builds as BEAD money could be used instead of consuming their own capital, and thus, we’ll slow our appliance shipments until decisions are made and funds are awarded,” Weening said. “At that point, the winners will move ahead and those who decided to skip the BEAD program or did not receive BEAD funding, we’ll begin investing to ensure that the winner does not impinge on their market. This represents a delay but also represents a unique opportunity for Calix.”

……………………………………………………………………………………………………..

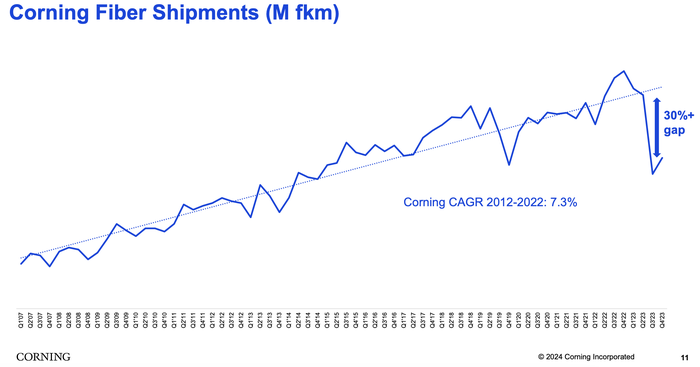

Corning manufactures and sells most of the physical fiber cabling used in U.S. fiber networks. Sales in Corning’s optical business unit – which houses its fiber products – continued to slide in the fourth quarter of 2023.

“We anticipate optical communications sales will spring back because we believe and our carrier customers have confirmed that they purchased excess inventory during the pandemic and that they’ve been utilizing this inventory to continue deploying their networks,” said Corning CEO Wendell Weeks during his company’s quarterly earnings call, according to Seeking Alpha.

“We believe these carriers will soon deplete their inventory and execute on the increased broadband deployment plans they’ve communicated to us over the last several months,” Weeks said. “As a result, we expect them to return to their normal purchasing patterns to service their deployments.”

He also noted that operators are waiting for BEAD funding. “We continue to expect BEAD funding really to start to translate into demand, the beginning of it, sort of late this year. They are progressing with awarding the grants and it will just take a bit for those to turn into real programs,” Weeks said.

Weeks suggested that the company is starting to see the glimmer of an uptick in demand from its broadband operator customers, but nothing definite yet. “We’ll know more in the coming months,” he said in his concluding remarks.

Meanwhile, executives at vendor Harmonic said this week they expect sales in the first half of this year to be relatively soft and then accelerate in the second half of the year as operators start to ramp up network upgrades, including moves to DOCSIS 4.0 technologies.

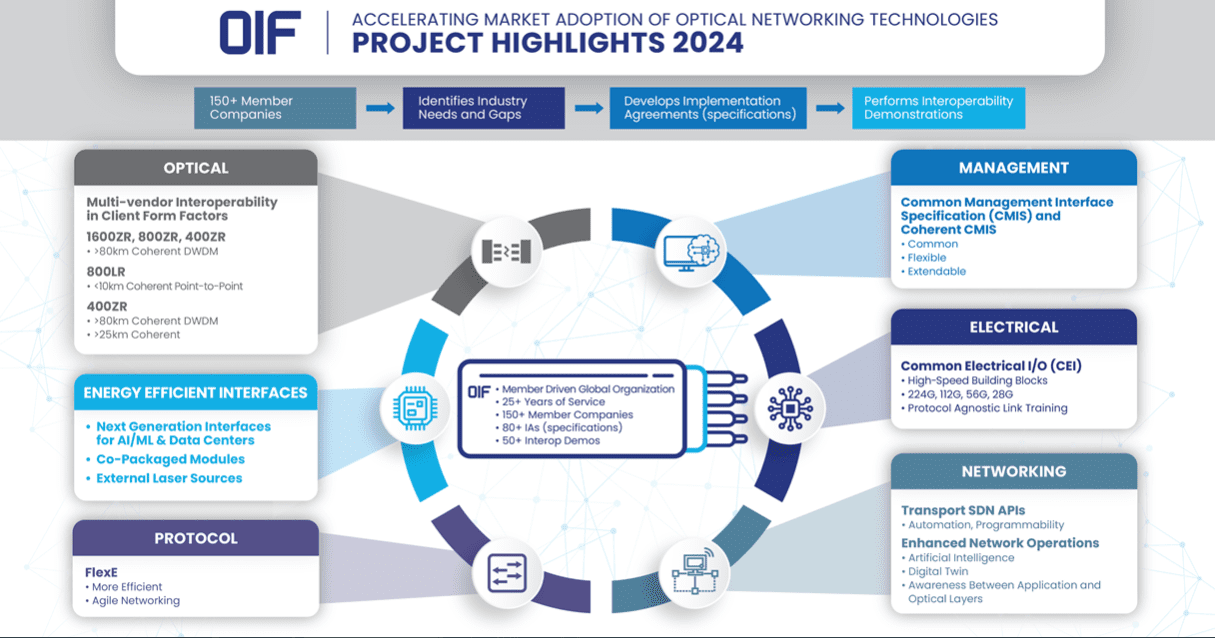

OIF Project Highlights: Interoperable 1600ZR+ & Retimed Tx Linear Rx Specs Energy Efficient Interfaces; Common Management Interface Specification (CMIS) Whitepaper

The Optical Internetworking Forum (OIF) concluded its Q1 2024 Technical and MA&E meeting in Jacksonville, Florida held January 16-18. The meeting resulted in the initiation of two new projects – the Interoperable 1600ZR+ and Retimed Tx Linear Rx Specs Energy Efficient Interfaces (EEI). Also, the reelection of the Physical and Link Layer (PLL) Working Group (WG) Chair and a white paper focused on advancing plug and play for Common Management Interface Specification (CMIS) modules. Andrew Schmitt, Cignal AI was a guest speaker.

“OIF’s quarterly membership meetings serve as a vital nexus for industry leaders to converge, collaborate and propel the field forward,” said Nathan Tracy, OIF President and TE Connectivity.

“These meetings are invaluable platforms for members to share insights, discuss and debate ongoing work and launch new projects. The synergy of minds and the shared commitment to innovation in these meetings not only ensures the timely execution of current initiatives but also lays the groundwork for solutions that have a tangible impact on the market now and in the years to come. It is through this collaborative spirit that OIF continues to be a driving force in advancing optical networking standards and technologies, fostering a community that thrives on the exchange of ideas and the collective pursuit of excellence.”

NEW PROJECTS:

Interoperable 1600ZR+:

The new OIF Interoperable 1600ZR+ project complements the 1600ZR project unveiled last September (2023). Responding to market demand for higher-performance (ZR+) modes, OIF is working towards integrating these modes into its application scope for 1600 Gb/s interfaces.

“OIF recognizes the importance of consolidated requirements in the ZR/ZR+ space to streamline development costs and enhance industry collaboration,” said Karl Gass, OIF PLL WG – Optical Vice Chair. “This project reinforces OIF’s role as the forum for coherent line interface discussions and demonstrates leadership by facilitating the evolution of next-generation technologies.”

Retimed Tx Linear Rx Specs EEI Project:

OIF has launched the Retimed Tx Linear Rx Specs EEI project, focusing on developing specifications for Retimed Tx Linear Rx (RTxLRx). The initial applications target Ethernet and Artificial Intelligence/Machine Learning (AI/ML), operating at 200G/lane over 500m single mode fiber (SMF) and 100G/lane over 30m multimode fiber (MMF), with potential for alternate applications. The project aims for full plug and play functionality in both electrical and optical domains, meeting the industry demand for power and latency savings. RTxLRx addresses constraints found in Linear Pluggable Optics (LPO) and provides flexibility, making it a candidate when LPO is not suitable.

“Embracing innovation, OIF maintains its pathfinder role in shaping new optical interface approaches,” said Jeff Hutchins, OIF Board Member and PLL WG – EEI Vice Chair and Ranovus. “Building upon the foundation laid by the ongoing work in the OIF PLL, our commitment extends to expanding the scope, diversity and standards of optical interfaces specified by OIF, ushering in a new era of connectivity and possibilities.”

White Paper: Path to CMIS Plug and Play:

In response to key challenges identified by members, OIF unveiled a white paper project on advancing plug and play for CMIS-managed modules. Feedback has emphasized difficulties in consistently managing modules from different vendors and the need for extensive host development with new module introductions. This white paper will provide practical recommendations to enhance plug and play. It focuses on creating guidelines that empower hosts to manage third-party modules effectively, with the goal of enabling seamless integration of new or unknown modules without requiring host software changes. The proposed guidelines will prioritize simplifying provisioning processes and improving module-to-host integration for enhanced efficiency in optical networking.

“This white paper will enhance the transformative power of CMIS, unveiling its capacity to revolutionize network management and interoperability,” said Ian Alderdice, OIF PLL Working Group – Management Co-Vice Chair and Ciena. “By providing valuable insights, it becomes a beacon guiding the evolution of optical networking standards, paving the way for a future where efficiency and seamless integration define the technological landscape.”

PLL WG Chair: OIF announced the reelection of David Stauffer, Kandou Bus, as PLL WG Chair.

Special Guest Speaker: Andrew Schmitt, Cignal AI:

The Q1 meeting featured guest speaker, Andrew Schmitt from Cignal AI, who shared valuable insights into the latest trends and developments in the optical networking industry. His presentation provided attendees with a comprehensive understanding of the current landscape and future possibilities within the field.

“OIF is an excellent forum for establishing standards on rapidly emerging technologies, and it is well-positioned to tackle the tough problems network operators and their suppliers face,” said Schmitt. “This meeting’s kick off of the 1600ZR+ process – a third generation follow up to the hugely successful 400ZR project – marks a major milestone for the industry. Further increasing the ease of deployment for 400ZR technology via CMIS is also a very valuable endeavor. I’m excited about these OIF initiatives and very pleased to offer Cignal AI’s current perspective on the market to such a capable and effective audience.”

………………………………………………………………………………………………………………..

OIF experts will provide valuable insights into the latest trends and developments in power consumption in optical AI networking and 224 Gbps Common Electrical I/O (CEI) at DesignCon 2024, taking place from January 30 to February 1, 2024, in Santa Clara, California.

About OIF:

OIF is where the optical networking industry’s interoperability work gets done. With more than 25 years of effecting forward change in the industry, OIF represents the dynamic ecosystem of 150+ industry leading network operators, system vendors, component vendors and test equipment vendors collaborating to develop interoperable electrical, optical and control solutions that directly impact the industry’s ecosystem and facilitate global connectivity in the open network world.

Editor’s Note:

This author participated in OIF meetings from its Sept 1998 inception till June 2003. Representing Ciena and NEC, he generated and presented contributions on the optical control plane (aka G.ASON and GMPLS) for SONET/SDH and the OTN.

Connect with OIF on LinkedIn, on X at @OIForum, at http://www.oiforum.com.

References:

Coherent Optics: Synergistic for telecom, Data Center Interconnect (DCI) and inter-satellite Networks

Ethernet Alliance multi-vendor interoperability demo (10GbE to 800GbE) at OFC 2023

University of Hawai’i and Ocean Networks collaborate for new $120M Undersea Cable Project

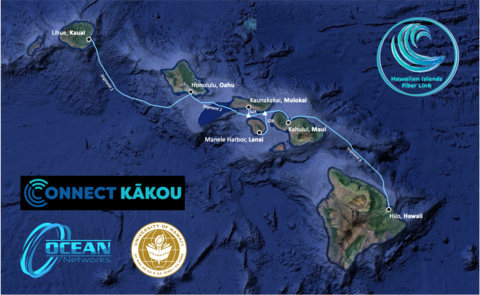

Honolulu-based University of Hawaiʻi and Ocean Networks, Inc. (ONI) has launched a $120m, public-private partnership to construct a submarine optical fiber cable system that will connect the Hawaiian Islands and improve and expand high-speed broadband internet throughout the state, the principals said.

The project, the Hawaiian Islands Fiber Link, is a key component of Connect Kākou, the state’s broadband initiative, a top priority of the Governor. Josh Green administration.

HIFL will be a carrier-neutral, open-access system with landing sites on Oʻahu, Hawaiʻi, Maui, Kauaʻi, Lānaʻi and Molokaʻi (graphic above) that will improve Hawaiʻi inter-island and regional connectivity. The system will have 24 fiber pairs with a design life of 25 years and is expected to be ready for service in late 2026. The project is being overseen by the UH System Office for Information Technology with support from the Research Corporation of the University of Hawaiʻi.

Under the direction of Lt. Governor Sylvia Luke, Connect Kākou will ensure that people from all walks of life have reliable and affordable access to high-speed internet.

ONI is responsible for the supply, construction, operations and maintenance of the inter-island cable system.

Partial funding will be provided through a federal grant, and the remaining funds will be secured by ONI through private equity and secured debt.

When it goes online, HIFL will be able to process a high volume of data with minimal delay and will be the inter-island backbone of Connect Kākou.

“We are very pleased to be partnering with Ocean Networks, Inc.,” said Garret Yoshimi, UH Vice President for Information Technology and CIO. “The Ocean Networks team has significant industry experience, specifically working here in Hawaiʻi. It’s an honor for UH to play an important role in connecting Hawaiʻi to the future.”

“We are delighted to collaborate with the UH and proud that ONI has been selected to build and operate the new HIFL submarine cable system,” said Cliff Miyake, VP Business Development of Ocean Networks, Inc. “The HIFL system will provide critical improvement to the broadband infrastructure for the State of Hawaiʻi.”

About Ocean Networks:

Ocean Networks, Inc. is a privately held telecom development and service company that is headquartered in Atlanta, Georgia (USA). Ocean Networks develops submarine cable systems for carriers, content providers, governments, as well as research and education groups. Under its subsidiary Submarine Cable Salvage, Ocean Networks repurposes Out of Service (OOS) submarine cable systems for ocean science. Ocean Networks currently owns 8,000+ km of submarine cable systems globally. Please visit www.OceanNetworks.com for more information.

About University of Hawaii:

Founded in 1907, the University of Hawaiʻi System includes three universities, and seven community colleges and community-based learning centers across Hawaiʻi. As the state’s public system of higher education, UH offers opportunities as unique and diverse as our island home.

References:

Telstra International partners with: Trans Pacific Networks to build Echo cable; Google and APTelecom for central Pacific Connect cables

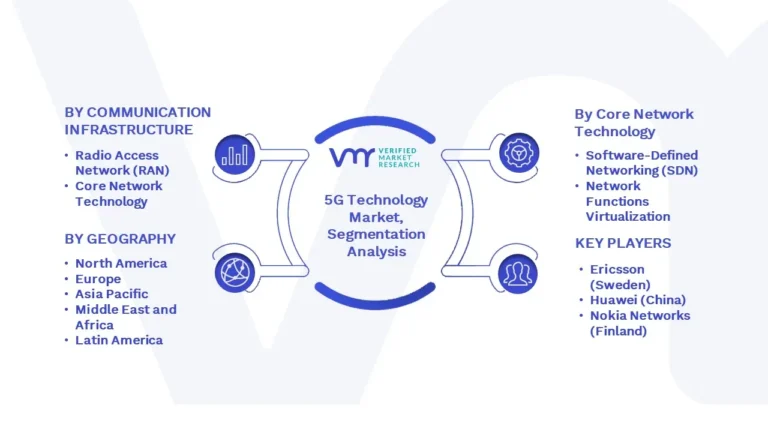

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

According to market research firm Omdia, there were 1.8 billion global 5G subscribers at the end of 2023 with 7.9 billion forecast by 2028. This growth trajectory, while substantial, is subject to various influencing factors such as infrastructure development, spectrum availability, device availability, and consumer demand. Kristin Paulin, Principal Analyst at Omdia, has a cautiously optimistic outlook for 5G. She emphasizes that innovation and cooperation are key to unlocking the full potential of 5G and its transformative impact.

Globally, the number of deployed 5G networks is now comparable to 4G LTE deployments. There are currently 296 commercial 5G networks worldwide, a number expected to grow to 438 by 2025.

In North America, 5G deployment was at 176 million connections as of the third quarter of 2023, a 14% increase from the previous quarter. This represents a 26% market share and a 46% penetration rate. However, there were only two U.S. 5G SA network providers – T-Mobile US and Dish Wireless– as of the end of 2023.

in contrast, Latin America and the Caribbean are still in the early stages of 5G adoption. However, the region shows promise with an expected quadrupling of 5G connections in 2023, reaching 46 million. By 2028, it is anticipated that the region will have 492 million 5G connections.

Jose Otero, Vice President of Caribbean and Latin America for 5G Americas, acknowledges the significance of 4G LTE and 5G as vital mobile communication technologies in Latin America. He anticipates more robust opportunities for 5G in the region, driven by upcoming spectrum auctions and wider access to 5G devices in 2024.

“The global 5G landscape shows positive momentum as innovation and collaboration continue to be the mainstays for long term progress.” said Chris Pearson, President of 5G Americas. “With the World Radio Conference wrapping up, it is important that international co-operation and efforts continue to ensure that spectrum and technology standards continue to propel this growth.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

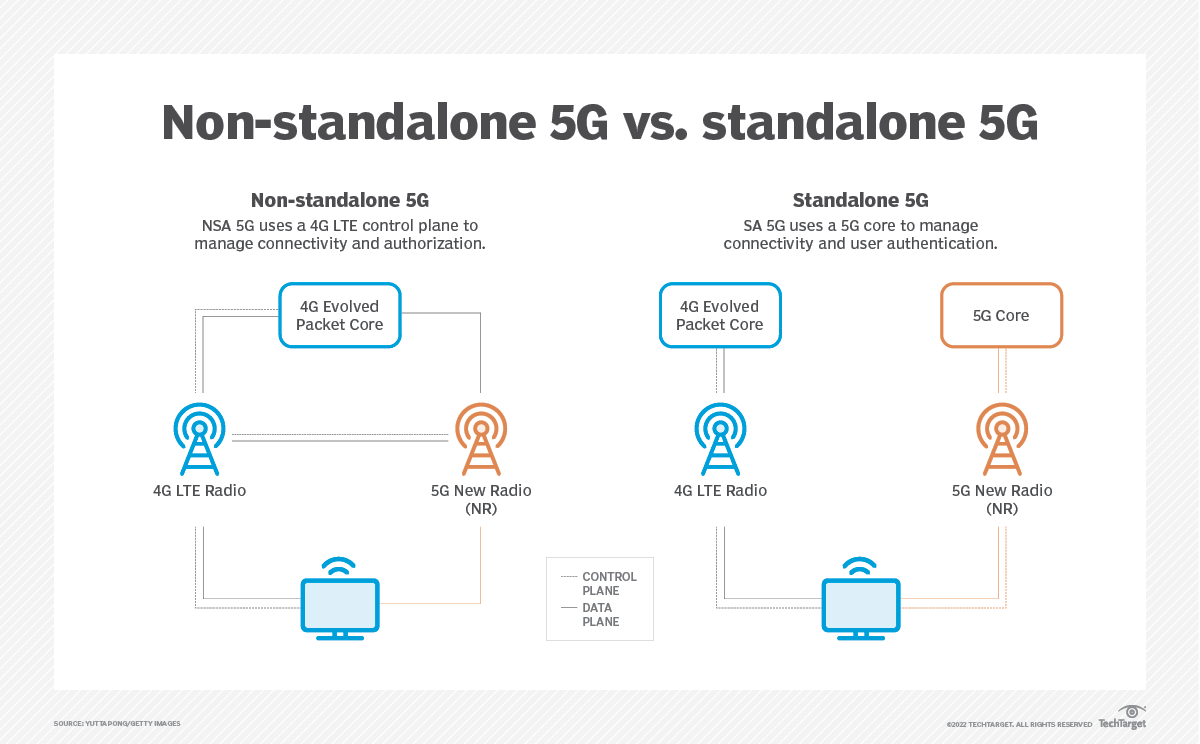

According to a recent report by Dell’Oro Group, the Mobile Core Network (MCN) market growth rate has been reduced to less than a 1% CAGR (2023-2028).

“This is the fourth consecutive time we reduced the growth rate of the MCN market as the build-out of 5G Standalone (5G SA) networks continues to wane compared to 5G Non-standalone (5G NSA) networks,” said Dave Bolan, Research Director at Dell’Oro Group. “The buildout of 5G SA networks is going slower than anticipated which is restraining growth in the marketplace. To date, we count fifty 5G SA eMBB (enhanced Mobile BroadBand) networks that have been commercially deployed worldwide by Mobile Network Operators (MNOs). We counted 18 new 5G SA networks in 2022, but only 12 were launched in 2023. On a positive note, we believe a lot of work has been done in the background, preparing for 5G SA launches by Mobile Network Operators (MNOs) and we expect 2024 to have more launches than 2022.”

Note 1. Importantly, a 5G SA core network is required to realize 3GPP defined 5G features, like 5G Security, Network Slicing (3GPP’s technical specification (TS) 23.501 defines 5G system architecture with slicing included. TS 22.261 specifies the provisioning of network slices, association of devices to slices, and performance isolation during normal and elastic slice operation).

The 5G SA core network relies on a “Service-Based Architecture” (SBA) framework, where the architecture elements are defined in terms of “Network Functions” (NFs) rather than by “traditional” Network Entities.

5G SA core networks require “cloud-native” hardware and software that has a service-based architecture and decentralized functions. A “cloud-native” 5G core allows for flexible and efficient operation, as well as the effective adoption of new services.

………………………………………………………………………………………………………..

According to Verified Market Research, when the full 5G SA feature set is supported, enterprises can realize the following benefits:

- Further improvements to speed and reach, beyond what 5G NSA brings.

- Support for higher-density deployments of devices.

- Support for low-latency and real-time use cases.

- Support for enhanced enterprise site connectivity via network slicing.

- Better security than 5G NSA (which uses 4G LTE security methods and procedures).

- Simplification of the RAN and core compared to 5G NSA since 5G SA supports only 5G and leaves 4G and older standards behind — and even though the 5G SA core alone is more complex than a pure 4G core alone.

GSA claims that more than 121 network operators in 55 countries and territories have invested in public 5G standalone (SA) networks (but they don’t disclose how many of those have been commercially deployed (for example, AT&T and Verizon have been talking up 5G SA for years, but have yet to deploy it!). We trust Dell’Oro’s number of 5G SA eMBB networks deployed.

Findings from the latest GSA update on the 5G SA ecosystem/devices [2.] include:

- There are 2,130 announced devices with claimed support for 5G SA, up 35.7% from 1,569 at the end of 2022.

- Devices with support for 5G SA account for 90.3% of all 5G devices, as of the end of 2023, up from 35.6% in December 2019.

- 93 modems or mobile processors/platform chipsets state support for 5G SA, 90 of which are understood to be commercially available.

Note 2. It’s crucially important to realize that since all 5G SA core networks are different, a 5G SA device that works on one carrier’s network won’t work on any other without a new 5G SA download.

By the end of December 2023, GSA had identified:

• 28 announced form factors • 261 manufacturers with announced available or forthcoming 5G devices

• 2,358 announced devices, including regional variants, but excluding operator-branded devices that are essentially rebadged versions of other phones. Of these, at least 1,964 are understood to be commercially available:

• 1,255 phones, up 34 from November 2023. At least 1,168 of these are now commercially available, up 56 from November 2023

• 308 fixed wireless access customer-premises equipment (CPE) devices for indoor and outdoor uses, at least 209 of which are now commercially available

• 243 modules • 64 tablets • 33 laptops or notebooks • 77 battery-operated hot spots

• 179 industrial or enterprise routers, gateways or modems

• 13 in-vehicle routers, modems or hot spots

• 29 USB terminals, dongles or modems

• 168 other devices, including drones, head-mounted displays, robots, TVs, cameras, femtocells/small cells, repeaters, vehicle on-board units, keypads, a snap-on dongle/adapter, a switch, a vending machine and an encoder

• 1,098 announced devices with declared support for standalone 5G in sub-6 GHz bands, 904 of which are commercially available.

According to Verified Market Research, the market drivers for the 5G Technology Market can be influenced by various factors. These may include:

- Enhanced Data Speed and Capacity: In comparison to its predecessors (4G/LTE), 5G technology offers far faster data rates and more network capacity. Supporting the increasing need for high-bandwidth applications like virtual reality (VR), augmented reality (AR), and Internet of Things (IoT) devices is imperative.

- Low Latency: The goal of 5G networks is to offer low-latency communication, which shortens the time it takes to send and receive data. This is critical for real-time interactive applications like industrial automation, remote surgery, and driverless cars.

- Growing Need for IoT Devices: One of the main factors driving 5G adoption is the spread of IoT devices across a number of industries, including manufacturing, healthcare, smart cities, and agriculture. 5G is ideally suited for Internet of Things applications due to its low latency and capacity to connect a large number of devices concurrently.

- Rise of Edge Computing: The growth of edge computing is intimately related to 5G networks. Edge computing improves speed and lowers latency by bringing computing resources closer to end users and devices; this makes it a crucial enabler for applications like driverless cars and smart cities.

- Industry 4.0 and Smart Manufacturing: By facilitating effective and dependable communication in smart factories, 5G is anticipated to play a significant role in the fourth industrial revolution, or Industry 4.0. It makes it easier to incorporate technology like automation, robotics, and artificial intelligence into production processes.

- Telecommunications Infrastructure Upgrade: on order to roll out 5G networks, telecommunications service providers are actively spending on infrastructure upgrades. To improve capacity and coverage, new base stations and tiny cells must be installed.

- Government Initiatives and Support: Through legislative frameworks, financial aid, and other means, numerous governments across the globe are actively promoting the rollout of 5G technology. In the global digital landscape, these programmes seek to promote innovation, economic growth, and competitiveness.

- Competitive Environment and Industry Cooperation: Businesses are investing in 5G technology to obtain a competitive advantage due to the highly competitive nature of the telecommunications sector. Furthermore, partnerships between IT firms, telecom service providers, and other relevant parties are quickening the creation and implementation of 5G networks.

Several factors can act as restraints or challenges for the 5G Technology Market. These may include:

- Infrastructure Costs: Given that a large-scale deployment of base stations and small cells is necessary to support 5G, telecom operators may be discouraged by the substantial upfront expenditure necessary for creating and upgrading infrastructure.

- Spectrum Allocation and Availability: The effective operation of 5G networks depends on the allocation and availability of appropriate spectrum bands. Regulatory and geopolitical obstacles can make it difficult to get the necessary spectrum, which can hinder the deployment of 5G services.

- Security Concerns: There are worries about possible cybersecurity attacks due to the vast number of devices connected to 5G networks and the increased connection. Building confidence and promoting wider adoption require overcoming these issues and guaranteeing the security of network infrastructure.

- Interoperability Problems: There are interoperability problems since different generations of cellular technologies coexist. A seamless transition and the prevention of service interruptions depend on the seamless integration of various technologies.

- Regulatory Obstacles: The implementation of 5G networks faces a number of regulatory obstacles, such as spectrum auctions, licence requirements, and local law compliance. Uncertainties surrounding regulations may cause hold-ups and impede the rapid deployment of 5G services.

- Public Health and Safety Concerns: The general public’s reception of 5G networks may be impacted by worries about the possible health impacts of increasing exposure to radiofrequency radiation. Building public trust requires resolving these issues and maintaining clear lines of communication.

- Absence of Killer Applications: The deployment of 5G may be slowed back by the absence of compelling and widely applicable use cases. Creating cutting-edge, impactful apps that take advantage of 5G’s special features is essential to increasing demand.

- Global Economic uncertainty: Businesses’ and operators’ willingness to invest in the rollout of 5G technology can be impacted by economic downturns and uncertainty. Delays in infrastructure upgrades could result from financial considerations and budgetary restrictions.

Charts courtesy of Verified Market Research

References:

5G Continues Robust Momentum Growth and Drives Demand for More Wireless Spectrum

https://www.3gpp.org/technologies/5g-system-overview

https://www.techtarget.com/searchnetworking/definition/5G-standalone-5G-SA