Author: Alan Weissberger

Vertical Systems Group’s 2022 U.S. Wavelength Services Leaderboard

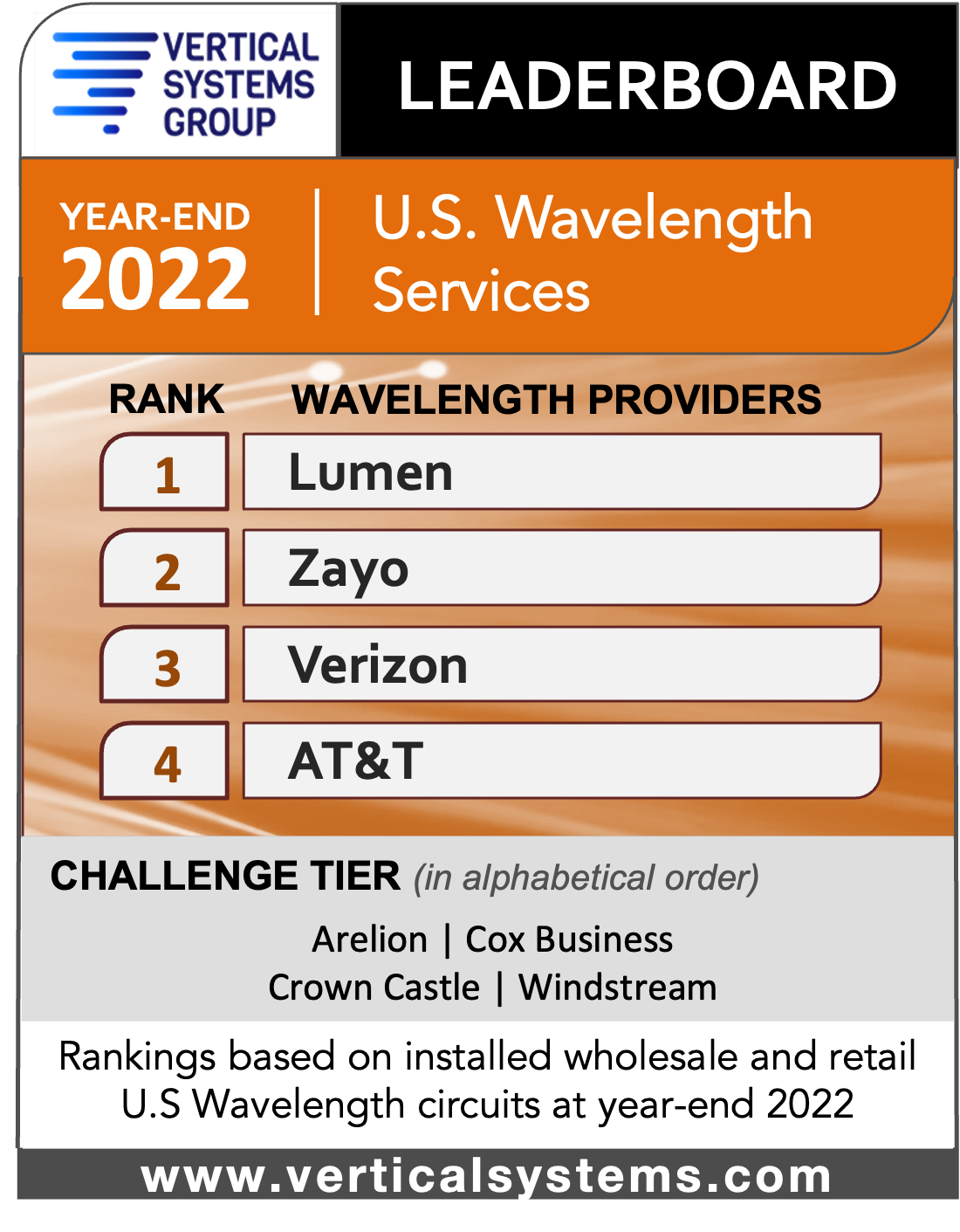

Lumen, Zayo, Verizon and AT&T topped Vertical Systems Group’s Wavelength Services Leaderboard [1.] for 2022 as they did the previous year. Those companies each have 4% or more of the U.S. market for retail and wholesale wavelength services — which involve the allocation of capacity on an optical network, essentially creating dedicated highways for data.

……………………………………………………………………………………………………………………………………………………………

Note 1. A Wavelength Service is a large bandwidth connection providing high-speed Internet or data service delivered over lit fiber-optic lines using Dense Wave Division Multiplexing (DWDM) to create wavelengths or optical channels.

……………………………………………………………………………………………………………………………………………………………

Vertical Systems Group found that expansion of the U.S. base of wavelength circuits is being driven by double-digit growth for 100+ Gbps connections and expects that to continue through 2027.

High bandwidth requirements are driving the growth of wavelength services in the U.S., according to Vertical Systems Group Principal Rick Malone. Telecom carriers use wavelength services to extend their core backbone networks, connect mobile towers and strengthen the resiliency of their network infrastructures, while hyperscale network operators employ wavelengths for data center interconnectivity, cloud computing, business continuity and backup/disaster recovery.

“Enterprises are purchasing wavelength services for their backbone networks, driven by IT cloud transformations, and for specific applications requiring predictable latency and low jitter,” Malone stated. U.S. network providers have upgraded their fiber footprints to support wave services above 10 Gbps, with general availability of 100 Gbps circuits nationwide.

“At the same time, fiber footprints have been expanded to include buildings that previously may have had only a single fiber provider,” he told Fierce Telecom. “And with multiple wavelength providers in a building, customers are negotiating more favorable pricing terms.”

Market Players include all other wavelength providers with U.S. circuit share below the one percent (1%) threshold. For year-end 2022, Market Players include the following wavelength providers (in alphabetical order): 11:11 Systems, Armstrong Business Solutions, Astound Business Solutions, Breezeline Business, Brightspeed Business, Cogent, Colt, Consolidated Communications, C Spire, Comcast Business, DQE Communications, Epsilon, Everstream, Exa Infrastructure (formerly GTT), ExteNet Systems, Fatbeam, FiberLight, First Digital, FirstLight, Frontier, Great Plains Communications, Horizon, Lightpath, Logix Fiber Networks, LS Networks, Midco, Ritter Communications, Segra, Shentel Business, Silver Star Telecom, Sparklight Business, Spectrum Enterprise, Syringa, T-Mobile, TDS Telecom, Unite Private Networks, Uniti, U.S. Signal, WOW!Business, Ziply Fiber and others.

Billable installations of 400+ Gbps services are emerging as wavelength providers expand availability and roll out new services to support higher speeds across a wider footprint. Many are actively planning for 400 and 800 Gbps service deployment in response to “early adopter requirements,” according to Malone.

Zayo recently debuted a new Waves on Demand product for customers looking to rapidly light up added bandwidth, for example. Waves on Demand will initially focus on providing 100G services across eight routes, though a 400G route between Newark, NJ and New York is available.

References:

https://www.fiercetelecom.com/broadband/lumen-and-zayo-hold-strong-us-wavelength-service-leaders

Lumen Technologies tops Vertical Systems Group’s 2021 U.S. Wavelength Services Leaderboard

China Mobile to deploy 400G QPSK by the end of 2023

China Mobile is preparing to deploy 400G optical links and expects to call its first tenders by the end this year. At the 2023 China Optical Network Symposium on Thursday, Li Han, director of the Basic Network Technology Research Institute of China Mobile Research Institute , gave a speech and revealed that China Mobile has confirmed the availability of 400G technology and will start the centralized procurement of 400G products at the end of this year to promote 400G to enter the commercial stage. “It’s time for 400G, and the industry is looking forward to it.”

China Mobile completed the world’s first 400G QPSK pilot with vendor partner ZTE in March, achieving high-speed transmission over 5,616 kilometers of ultra-long-distance land real-time live network transmission. The verified computing power network 400G all-optical network technology is the core technology of the next-generation intergenerational evolution of the backbone transport network.

China Mobile completed the world’s first 400G QPSK pilot with vendor partner ZTE in March, achieving high-speed transmission over 5,616 kilometers of ultra-long-distance land real-time live network transmission. The verified computing power network 400G all-optical network technology is the core technology of the next-generation intergenerational evolution of the backbone transport network.

Li Han believes that 400G is an intergenerational technology of optical communication and a disruptive technology. The reason is that 400G optical communication has entered the broadband era, and the C6T+L6T band is disruptive to the entire system including core optical devices. Specific to the application scenario, the backbone network considers the long distance and adopts the QPSK method, and the metropolitan area network considers the cost, and mainly deploys 16QAM-PCS or 16QAM. In different scenarios, different techniques are used.

China Mobile’s 400G research and development has gone through 5 years. From 2018 to 2021, it will mainly study 16QAM-PCS or 16QAM; in 2022, with the development of 130G baud rate optical modules, the industry chain will turn to QPSK driven by the three major manufacturers. This is of decisive significance to the development trend of 400G.

Li Han finally emphasized that 400G still needs to continue to improve technology, such as EDFA, which needs to substantially integrate C-band and L- band . In terms of optical fiber , research on anti-resonant hollow-core optical fiber should be promoted.

In a white paper, China Mobile said Jiuzhou would encompass 400G optical connectivity and a distributed cloud architecture, with edge computing and three levels of latency, from 1 millisecond in the city to 20 milliseconds in the countryside. The paper said the 400G OTN would initially be deployed at major computing hub nodes, then in the backbone.

A major driver of China Mobile’s optical plans is a government scheme to build out China’s national “computing power network” – a chain of data centers and high-speed fiber links that will support the new computer-intensive era of AI, deep learning, 5G Advanced and the industrial Internet.

One key part of this is the East-West plan, in which data from the industrialized eastern seaboard is being hauled to lower cost, renewables-powered data centers in the less developed west over high-speed links. So far China Mobile has deployed more than 40 super-large data centers with more than 1.3 million racks and over 1,000 edge nodes.

Li said the telco’s 400G R&D had initially focused mainly on 16QAM-PCS and 16QAM, but last year had turned to QPSK, driven by breakthroughs from three domestic vendors.

Zhang Bin, vice president of FiberHome’s network business unit, said he believes 400G OTN will dominate optical fiber for the next ten years. But he said Chinese manufacturers would need to invest more in R&D to keep pace with the large-scale rapid rollout

References:

https://www.c114.com.cn/news/22/c22780.html

Omdia: China Mobile tops 2023 digital strategy benchmark as telcos develop new services

China Mobile explores buyout of Hong Kong telecom firm HKBN

China Mobile Partners With ZTE for World’s First 5G Non Terrestrial Network Field Trial

China Mobile and ZTE complete commercial trial of optical network co-routing detection

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

Nokia, China Mobile, MediaTek speed record of ~3 Gbps in 3CC carrier aggregation trial

StrandConsult Analysis: European Commission second 5G Cybersecurity Toolbox report

by John Strand, StandConsult (edited by Alan J Weissberger)

European Commissioner Thierry Breton presented the European Commission’s plan for banning High-Risk Suppliers like Huawei and ZTE from European telecommunications networks. Here is the first portion:

The security of 5G networks is essential. They are critical infrastructures in their own right and for other sectors that depend on them, such as energy, transport, health and finance.

This is why, in January 2020, the EU unanimously adopted a toolbox on the security of 5G networks. The “5G cybersecurity toolbox” defined the risks and the measures to be taken by Member States and telecoms operators to address them.

In particular, it recommended that the use of equipment in the core and access (RAN) parts of the networks should be restricted or prohibited for entities considered to be “high-risk suppliers”, notably because they are subject to highly intrusive third-country laws on national intelligence and data security.

3 years on, almost all Member States have transposed the toolkit’s recommendations into their national law. In other words, they can now decide to restrict or exclude suppliers on the basis of security risk analysis. But to date, only 10 of them have used these prerogatives to restrict or exclude high-risk vendors.

……………………………………………………………………………………………………………………………………………..

The Commission also released a status report on “Member States’ Progress in implementing the EU Toolbox on 5G Cybersecurity.”

Breton’s message is that the member must move more quickly to implement the 5G toolbox.

Image Credit: European Union

Here are Breton’s key points with Strand Consult’s assessment (SC):

- All EU member states are committed to implementing the EU´s 5G Toolbox. To date, 24 Member States have adopted or are preparing legislative measures giving national authorities the powers to perform an assessment of suppliers and issue restrictions.

- SC: This means that all EU countries support the 5G Toolbox, the implement of which will work to remove Huawei and ZTE from European networks.

- 10 Member States have imposed such restrictions, and an additional 3 Member States have relevant national legislation underway.

- SC: This is a significant improvement compared to a few months ago when Strand Consult’s released its report The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries. Given the Commission’s communication we the remaining more operators in 14 countries to move more expeditiously to remove Huawei and ZTE equipment.

- The Commission considers that decisions adopted by Member States to restrict or exclude Huawei and ZTE from 5G networks are justified and compliant with the 5G Toolbox.

- SC: This statement is very important to support the member states where Huawei and China attempt to thwart the implementation of the toolbox. China has made unseemly threats in certain members states. Now these states have meaningful European Commission support. For example, in December 2019, Wu Ken, the Chinese ambassador to Germany, was quoted as threatening the German auto manufacturing industry that access to the Chinese market could be restricted should Chinese Huawei be excluded from participating in contracts to build Germany’s 5G networks. The statement dampened Germany’s enthusiasm for opening its EU toolbox and examining its requirements.

- The Commission will take measures to avoid conducting its official communications via mobile networks built with Huawei and ZTE equipment.

- SC: If an EU mobile operator uses Huawei or ZTE equipment in its 5G network, the European Commission will not do business with that operator. In practice EU operators which use Huawei and ZTE will be labeled as “non-trusted operators.” This will likely accelerate the exodus of corporate customers from European operators which don’t want to conduct their business on Chinese networks. Strand Consult described this in its 2019 research note The pressure to restrict Huawei from telecom networks is driven not by governments, but the many companies which have experienced hacking, IP theft, or espionage. This is a needed and important step from the Commission.

- The Commission also intends to reflect this decision in all relevant EU funding programs and instruments.

- SC: The EU will further restrict grants, subsidies, and financing to European entities which use Huawei and ZTE equipment. This will have consequences for rural EU operators which receive EU money and recipients of European Investment Bank (EIB) loans.

Strand Consult is not surprised by today’s announcements. They are consistent with the security analyses and recommendations Strand Consult has published for years.

Some EU countries and operators will find it difficult to implement the EU’s new security and procurement policy. However Strand Consult believes that it is good business for an operator communication that it takes security seriously and backs it up with a clean network free of Huawei and ZTE equipment.

Strand Consult predicts that Huawei will make the road ahead difficult and will attempt to sabotage the European Commission’s efforts. Nations and operators should prepare for pushback by reading Strand Consult’s reports on Huawei’s tactics. Moreover, non-Chinese employees will likely find that working for Huawei has reputational risks.

How foreign network equipment is treated in China.

The foundation of any economy, be it the EU, the US or China, is national security. Some may find the EU approach tough, but it pales in comparison the blockade that China has imposed on foreign technology providers for years.

China restricts these technologies for ideological and economic reasons. Most people take for granted that the websites and media they access everyday are not available in China. These foreign technologies and their operators have been denied access to the world’s single largest online market, hundreds of millions of internet users, and a multi-trillion-dollar opportunity. Moreover, the Chinese people are denied to freedom to engage on an open internet.

Building upon censorship frameworks in traditional media which had been in place for decades in China, its State Council adopted rules and regulations to control internet traffic beginning in 1996.

The media focuses mainly on US and EU network security and associated vendor policies. However few if any investigate the rules in China.

A detailed review is available from White & Chase, February 2022. In general, China’s rules are significantly more rigid than those of the US and EU. These rules do not entail the same process and transparency which are standard and expected in the West.

The New Measures list the following main factors for assessing national security risk during cybersecurity review.

- The risk of any critical information infrastructure being illegally controlled, tampered with or sabotaged after any product or service is used.

- The risk of an interruption in the supply of any product or service endangering the continuity of any critical information infrastructure.

- The security, openness, transparency, diversity of sources and reliability of any supply channel of any product or service, and the risk of its supply being interrupted due to political, diplomatic, trade or other factors.

- The compliance of the provider of any product or service with the laws, administrative regulations, and departmental rules of China.

- The risk of any core data, important data or a large amount of personal information being stolen, leaked, destroyed, illegally used, or illegally transferred abroad.

- The risk of any critical information infrastructure, core data, important data, or a large amount of personal information being affected, controlled, or maliciously used by foreign governments, as well as any network information security risk.

- Any other factor that may endanger the security of any critical information infrastructure, network security or data security.

The effect of these rules is to limit foreign providers from the market from the start and to favor Chinese providers.

While the media sensationalizes cases like Huawei and TikTok, these pale in comparison to the systematic restriction undertaken by China against foreign technology for the last 20 years. Moreover, Chinese technology companies enjoy more freedom abroad than foreign technologies do in China.

Conclusions:

Technological and informational control and restriction are widely practiced across China. This fulfills many political, social, cultural, economic, and religious objectives for the PRC,and is practiced by the government, corporations, and individual themselves. It has increased under General Secretary Xi. This Censorship is coupled with pervasive surveillance of people. Meanwhile PRC has attempted to export this “new world media order.”

Strand Consult addresses Chinas restrictions in its 2020 report You Are Not Welcome: An Analysis of Thousands Foreign Technology Companies Blocked by China Since 1996. It describes how and why China has systematically restricted thousands of foreign internet technologies like online news and media outlets, social media platforms, virtual private networks, content delivery networks, mobile applications, telecommunications equipment, cloud services, and other technologies.

With its new 2023 report The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries, Strand Consult brings valuable evidence of the location, amount, and share of Chinese and non-Chinese equipment in European telecom networks. This report, the second of its kind, describes the respective amounts of 5G equipment from Huawei, ZTE, and non-Chinese vendors in European mobile networks and the share of such in equipment in the 5G Radio Access Network (RAN).

References:

https://ec.europa.eu/commission/presscorner/detail/en/statement_23_3312

StrandConsult: 2022 Year in Review & 2023 Outlook for Telecom Industry

IEEE ComSoc/SCU SoE March 22, 2022 event: OpenRAN and Private 5G – New Opportunities and Challenges. Video: https://www.youtube.com/watch?v=i7QUyhjxpzE

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Dish says its 5G network now covers 70% of the U.S. population

Dish Network says its 5G network is available to more than 240 million people and covers 70% of the U.S. population. That 70% threshold is what regulators demanded for it to keep valuable spectrum licenses. Dish says it has satisfied all June 14th deadlines set by the FCC, including having launched over 15,000 5G sites. Dish will continue to face 5G buildout deadlines set by federal regulators, including one in 2025 that Dish will likely need to invest billions in a rural buildout to meet. Investors have punished the stock, sending shares to near their lowest level since around 1999 amid worries that the company is struggling to stand up its wireless network without a partner.

Dish is also the first wireless service provider to launch 5G voice service – called voice over new radio (VoNR) – in the U.S. Since going live in Las Vegas last year, Dish steadily increased VoNR functionality to additional markets. Our VoNR service now covers more than 70 million people across the U.S. through both Boost Mobile and Boost Infinite. Dish plans to continue rolling out VoNR service as the network is further optimized for this next-generation voice technology.

Image Credit: Dish Networks

“As a leader in Open RAN technology, Dish is playing a major role in the transformation of America’s wireless infrastructure and the way the world communicates,” said John Swieringa, president and chief operating officer, Dish Wireless. “We have made significant progress on our network buildout, and can now focus on monetizing the network through retail and enterprise growth. With more markets across the country offering the Dish 5G network for voice, text and data services, our business can start realizing the benefits of owner economics.”

The company “can now focus on monetizing the network through retail and enterprise growth,” COO John Swieringa said in a news release, a nod to shareholder impatience with a costly project. Dish now has a month to prove it to the Federal Communications Commission with detailed documentation. Dish will file its FCC buildout report no later than July 14, 2023.

LightShed Partners analyst Walt Piecyk notes that confirmation that regulators are satisfied might soothe investors, but he doesn’t expect the FCC to comment “for the foreseeable future, if ever,” a silence that poses an “incremental hurdle for Dish to raise needed capital.”

References:

For a complete list of DISH’s wireless partners, please visit DISHWireless.com/home

Dish Network to FCC on its “game changing” OpenRAN deployment

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

T-Mobile and Google Cloud collaborate on 5G and edge compute

T-Mobile and Google Cloud announced today they are working together to combine the power of 5G and edge compute, giving enterprises more ways to embrace digital transformation. T-Mobile will connect the 5G Advanced Network Solutions (ANS) [1.] suite of public, private and hybrid 5G networks with Google Distributed Cloud Edge (GDC Edge) to help customers embrace next-generation 5G applications and use cases — like AR/VR experiences.

Note 1. 5G ANS is an end-to-end portfolio of deployable 5G solutions, comprised of 5G Connectivity, Edge Computing, and Industry Solutions – along with a partnership that simplifies creating, deploying and managing unique solutions to unique problems.

More companies are turning to edge computing as they focus on digital transformation. In fact, the global edge compute market size is expected to grow by 37.9% to $155.9 billion in 2030. And the combination of edge computing with the low latency, high speeds, and reliability of 5G will be key to promising use cases in industries like retail, manufacturing, logistics, and smart cities. GDC Edge customers across industries will be able to leverage T-Mobile’s 5G ANS easily to get the low latency, high speeds, and reliability they will need for any use case that requires data-intensive computing processes such as AR or computer vision.

For example, manufacturing companies could use computer vision technology to improve safety by monitoring equipment and automatically notifying support personnel if there are issues. And municipalities could leverage augmented reality to keep workers at a safe distance from dangerous situations by using machines to remotely perform hazardous tasks.

To demonstrate the promise of 5G ANS and GDC Edge in a retail setting, T-Mobile created a proof of concept at T-Mobile’s Tech Experience 5G Hub called the “magic mirror” with the support of Google Cloud. This interactive display leverages cloud-based processing and image rendering at the edge to make retail products “magically” come to life. Users simply hold a product in front of the mirror to make interactive videos or product details — such as ingredients or instructions — appear onscreen in near real-time.

“We’ve built the largest and fastest 5G network in the country. This partnership brings together the powerful combination of 5G and edge computing to unlock the expansion of technologies such as AR and VR from limited applications to large-scale adoption,” said Mishka Dehghan, Senior Vice President, Strategy, Product, and Solutions Engineering, T-Mobile Business Group. “From providing a shopping experience in a virtual reality environment to improving safety through connected sensors or computer vision technologies, T-Mobile’s 5G ANS combined with Google Cloud’s innovative edge compute technology can bring the connected world to businesses across the country.”

“Google Cloud is committed to helping telecommunication companies accelerate their growth, competitiveness, and digital journeys,” said Amol Phadke, General Manager, Global Telecom Industry, Google Cloud. “Google Distributed Cloud Edge and T-Mobile’s 5G ANS will help businesses deliver more value to their customers by unlocking new capabilities through 5G and edge technologies.”

T-Mobile is also working with Microsoft Azure, Amazon Web Services and Ericsson on advanced 5G solutions.

References:

https://www.t-mobile.com/news/business/t-mobile-and-google-cloud-join-5g-advanced-network-solutions

https://www.t-mobile.com/business/solutions/networking/5G-advanced-solutions

USDA awards $714M for high speed internet access in rural areas

The U.S. Department of Agriculture (USDA) has awarded $714 million worth of grants and loans to small telecom companies for the provision of high-speed Internet in rural areas in 19 states. This award forms part of the fourth round of funding allocation under the ReConnect program, whose remit is to financially support the build out or improvement of infrastructure required to provide decent broadband in rural communities. The multi-billion-dollar program has been ongoing for around five years and this latest award is the third to take place under round four, the other two much smaller awards having happened earlier this year.

Essentially, the money is going into full fiber deployments. All of the 33 projects receiving funding in this latest allocation centre on the build out of fiber-to-the-premises (FTTP) infrastructure.

As noted by a USDA press release, connecting all communities across the United States to high-speed internet is a central part of President Biden’s ‘Investing in America’ agenda to rebuild the national economy “from the bottom up and middle out” by rebuilding the nation’s infrastructure, which the agency notes “is driving over $470 billion in private sector manufacturing investments and creating good-paying jobs.”

To add some colour, there are three projects receiving grants of just under the $35 million mark: two are in Alaska and involve the Interior Telephone Company and Mukluk Telephone Company, while a third will see the Nemont Telephone Cooperative roll out FTTP to homes, businesses, farms and schools in Montana.

The biggest loan, at just shy of $50 million, will go to the Craw-Kan Telephone Cooperative in Kansas, where a new FTTP network will reach 4,189 people, 149 businesses, 821 farms and three educational facilities in five counties.

The government itself highlighted the Kansas projects, as well as others in South Carolina, Arkansas, Oregon, California and Missouri that will all reach significant numbers of people. In all, the grants and loans will go to telcos serving communities in 19 states.

“High-speed internet is a key to prosperity for people who live and work in rural communities,” said U.S. Department of Agriculture (USDA) Secretary Tom Vilsack. “Thanks to President Biden’s Bipartisan Infrastructure Law, we can ensure that rural communities have access to the internet connectivity needed to continue to expand the economy from the bottom up and middle out and to make sure rural America remains a place of opportunity to live, work, and raise a family.”

The Bipartisan Infrastructure Law, inked in late 2021, provides $550 billion in investment in infrastructure over the 2022-2026 period into transport, waterways, power and broadband; the last has $65 billion allocated to it. Companies awarded grants and/or loans under the ReConnect program are required to apply to participate in the Bipartisan Infrastructure Law’s Affordable Connectivity Program (ACP), which provides discounts on Internet connectivity for low-income households.

Naturally, the announcement of the latest funding round under ReConnect is peppered with rhetoric on the current administration’s efforts to plough money into connectivity and ignores any part played by the previous administration in the project. ‘Twas ever thus in politics. However, the important point here is that those in the White House at present are showing a strong commitment to pushing on with funding broadband network rollout in those areas that are uneconomic to the big telcos, and that has to be a good thing.

References:

https://www.usda.gov/reconnect

https://telecoms.com/522239/us-throws-700-million-at-rural-fibre/

Astound Broadband to launch MVNO service powered by T-Mobile

Astound Broadband (Astound), the sixth-largest U.S. cable provider, will soon debut its new Astound Mobile service, powered by T-Mobile. Known for its award-winning customer service, Astound will make its mobile offering available to customers in approximately 4 million homes currently passed by the company across 12 states.

The service will be exclusively available to Astound home internet customers who are eligible residents in Massachusetts and Corpus Christi, Midland-Odessa, Temple, and Waco Texas in June. The company plans to continue to launch Astound Mobile in its remaining markets by the end of the year.

“Astound’s entrance into the wireless market comes at a time when the need for fast, reliable, high-value broadband and mobile services is at an all-time high and more critical than ever,” said Jim Holanda, Astound CEO. “Through our relationship with T-Mobile, we’ll bring exceptional choice, value and savings, and competitive, award-winning services that customers need to stay connected to their world.”

“Astound has a collective commitment to serving customers with innovative technologies and award-winning customer service in the regional broadband marketplace. By choosing the T-Mobile nationwide network, Astound will further their commitment by creating custom applications that benefit their customers beyond their home or business on T-Mobile’s nationwide 5G network,” said Dan Thygesen, Senior Vice President of T-Mobile Wholesale and head of T-Mobile’s growing wholesale business.

Astound’s mobile product will leverage the nation’s largest, fastest and most awarded 5G network through T-Mobile and will offer a variety of plans that when bundled with Astound’s ultra-fast, award-winning internet service, customers will have access to savings and competitive offerings. Astound will offer two “pay by the gig” plans and two unlimited talk and text plans. Customers can choose a plan whereby they only pay for the data they need or they can expand to an unlimited plan with data allotted to each user. Customers will be able to stream, browse, talk and text with confidence knowing Astound Mobile runs on T-Mobile’s powerful network with 5G service in all 50 states.

Astound didn’t reveal the price of its mobile plans today but said it will offer a variety of plans bundled with its internet service, including two “pay by the gig” plans and two unlimited talk and text plans. Customers can choose a plan whereby they only pay for the data they need or they can expand to an unlimited plan with data allotted to each user, according to the press release.

Astound Broadband is comprised of organizations formerly known as RCN, Grande Communications, Wave Broadband and enTouch. The company’s markets include Chicago, Indiana, eastern Pennsylvania, Massachusetts, New York City, Maryland, Washington, D.C., Texas and regions throughout California, Oregon and Washington.

Last month, Astound, which is the sixth largest U.S. cable provider, announced that it had partnered with Reach, the software-as-a-service company, to offer mobile service.

On a net basis, cable accounted for about 75% of total industry phone net additions in Q1 2023, according to analyst Craig Moffett. Combined, cable now serves nearly 12 million wireless subscribers.

Earlier this year, the National Content & Technology Cooperative (NCTC) made arrangements with AT&T to provide its members with a white-label MVNO service. Reach also is involved in that deal.

About Astound Broadband:

Astound Broadband (astound.com) is the sixth largest cable operator in the U.S., providing award-winning high-speed internet, broadband communications solutions, TV, phone services, and fiber optic solutions for residential and business customers across the United States. Astound Broadband is comprised of organizations formerly known as RCN, Grande Communications, Wave Broadband, and enTouch. The company services Chicago, Indiana, Eastern Pennsylvania, Massachusetts, New York City, Maryland, Washington, D.C., Texas, and regions throughout California, Oregon, and Washington.

References:

Comcast launches symmetrical 10-Gigabit speeds over Ethernet FTTP

Comcast has announced a new symmetrical 10-Gigabit service tier for its Gigabit Pro fiber customers and reiterated a plan to bring multi-gigabit options to millions of cable internet customers. The move comes as Comcast prepares to launch DOCSIS 4.0 capabilities for cable customers by the end of the year.

Launched as a 2-Gig residential broadband service back in 2015, Gigabit Pro has been upgraded in recent years. Before heading to 10-Gig, the service delivered symmetrical speeds of 6 Gbit/s. Billed as a premium offering, Gigabit Pro runs $299 per month, plus installation costs. Comcast has not announced how many of its 32.32 million broadband subscribers have opted for Gigabit Pro.

Comcast began field testing 10-Gig capabilities for customers shortly thereafter, with some users stating on Reddit in October 2022 that they were starting to see these speeds.

According to the latest data from the Federal Communications Commission (FCC), Comcast today primarily offers fiber to the premises in the areas around Chicago, Detroit, Indianapolis, Nashville, Knoxville, Atlanta, Jacksonville, Miami and West Palm Beach.

Comcast Cable EVP and Chief Network Officer Elad Nafshi told Fierce that the product is technically available nationwide, not just in areas where it has fiber. If a cable customer decides they want 10G, Comcast will come in and upgrade their drop from coaxial cable to fiber, he said. The “highly-targeted” Gigabit Pro service continues to be delivered on an Ethernet-based FTTP platform.

Nafshi told Fierce in February that the operator isn’t planning to overlay its cable network with fiber anytime soon. However, he noted the distributed access architecture it is adopting ahead of its DOCSIS 4.0 rollout is opening the door for more fiber deployments.

Comcast said it is still planning to make multi-gig speeds available to more than 50 million locations by the end of 2025 and expects to begin rolling out DOCSIS 4.0 before the end of this year.

Nafshi told Fierce it is “heads down hardening and operationalizing products to meet the target deadline” for DOCSIS 4.0 and said the launch will by its nature include the introduction of a new speed tier.

“DOCSIS 4.0 will enable us to launch greater speeds and more speed symmetry when we launch, which by definition means it’s going to be a new tier service because we don’t currently offer those symmetrical tiers,” he concluded. “A lot more to come.”

References:

https://www.fiercetelecom.com/broadband/comcast-debuts-symmetrical-10-gig-fiber-broadband-tier

https://www.xfinity.com/support/articles/requirements-to-run-xfinity-internet-speeds-over-1-gbps

Comcast demos 10Gb/sec full duplex with DOCSIS 4.0; TDS deploys symmetrical 8Gb/sec service

Ethernet Alliance multi-vendor interoperability demo (10GbE to 800GbE) at OFC 2023

Huawei forecast to increase mobile phone shipments despite Android ban

According to the China media outlet STN, Huawei has raised its mobile phone shipment target for 2023 to 40 million units. Huawei had set this target at 30 million units at the beginning of the year. In this regard, a relevant person from Huawei told the “Securities Daily” reporter that this adjustment is a normal (shipment) target adjustment. That projected increase in mobile phone sales comes despite the ban preventing Huawei from using the Android OS. Instead, Huawei uses its home made HarmonyOS which is based upon micro kernel based distributed system whereas Android OS is based upon Linux kernel at its core.

People close to Huawei said that the current sales of Huawei smartphones are improving, and the recent sales of P60, MateX3 and other mobile phones are relatively satisfactory. “We have indeed raised our mobile phone shipment target for this year. But the specific number is inconvenient to disclose.”

A person in the supply chain said, “Huawei set its mobile phone shipment target for this year at 30 million units at the beginning of the year. As sales rebounded and market demand increased, Huawei recently adjusted its mobile phone shipment target to 40 million units this year, an increase of over 30%. ”

“If the news is true, it means that Huawei has confidence in the company’s mobile phone shipments in 2023. According to market research firm Omdia, Huawei’s mobile phone shipments in 2022 will be 28 million units,

“The shipment target for this year has been raised by nearly 43%.” A market source who did not want to be named told the reporter. That’s in sharp contrast to the global mobile phone market, which Omdia said declined 12.7% in Q1-2023. Samsung sales contracting 18% and Xiaomi’s falling by 22%. Despite the large year-on-year fall Samsung has experienced, it still had the most shipments in 1Q23, reporting 60 million shipments. It has seen a small 3.2% rise in shipments compared to the previous quarter.

Omdia noted Huawei’s quarterly sales had dipped sequentially in the last two quarters but, thanks to a year of growth from Q4 2021 to Q3 2022, the company “is still in a better position now versus a year ago.”

Huawei ranks tenth on Omdia’s list of global handset vendors with just 2% of the market. Honor, the mid and low-end smartphone brand it sold off two years ago, has a 4% share.

Industry insiders believe that if Huawei raises its shipment target, it is also related to its product market performance. Counterpoint data shows that in the first quarter of 2023, Huawei’s domestic smartphone shipments bucked the trend and increased by 41%, with a domestic market share of 9.2%, a year-on-year increase of 3 percentage points.

“Huawei’s folding screen mobile phone shipments have continued to increase this year and the supply is in short supply. Therefore, Huawei needs to increase its stocking.” Yang Siliang, a partner of Zhou Yan Consulting, said in an interview with a reporter from the “Securities Daily.”

Source: Karlis Dambrans on Flickr, CC 2.0

…………………………………………………………………………………………………………………………………………………………….

Meanwhile in its core carrier equipment business, Huawei continues to dominate the Chinese market. It has just won 7.9 billion Chinese yuan (US$1.1 billion) in orders from China Mobile in China’s largest telecom tender so far this year. Huawei was the dominant supplier in both parts of the tender, which was divided into 2.6GHz and 4.9GHz on one side and 700MHz gear on the other. Huawei was awarded contracts to supply just over half of the 64,000-basestation deployment, worth CNY3.76 billion ($530 million).

For China Mobile’s joint rollout with China Broadnet in the 700MHz band, Huawei won contracts for half of the 23,140 basestations with a total value of around CNY1.74 billion ($243 million), local website C114 calculated.

ZTE won the second largest volume of orders, worth CNY2.1 billion ($294 million), followed by Ericsson with CNY630 million ($88 million), Datang Mobile with CNY550 million ($77 million) and Nokia Bell with CNY400 million ($56 million).

References:

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI is probably the most hyped technology in the last 60 years [1.]. While the potential and power of microprocessors, Ethernet, WiFi, Internet, 4G, and cloud computing all lived up to or exceeded expectations, generative AI has yet to prove itself worthy of its enormous praise. Simply put, Generative AI is a type of artificial intelligence that can create new content, such as text, images, and audio.

Note 1. This author has been observing computer and communications technologies for 57 years. His first tech job for pay was in the summer of 1966 in Dallas, TX. He did mathematical simulations of: 1.) Worst Case Data Load on 3 Large Screen Displays (LSDs)-each 7 ft x 7 ft. and 2.) Efficiency of Manual Rate Aided Radar Tracking. In the summer of 1967 he helped install and test electronic modules for the central command and control system for the Atlantic Fleet Weapons Range at Roosevelt Roads Naval Air station in Puerto Rico. While there also did a computer simulation of a real time naval air exercise (battle ships, aircraft carriers, jets, helicopters, drones, etc) and displayed the results on the 3 LSDs. Skipping over his career in academia, industry and as a volunteer officer/chairman at IEEE ComSoc and IEEE SV Tech History, Alan has overseen the IEEE Techblog for over 14 years (since he was asked to do so in March 2009 by the IEEE ComSoc NA Chairman at that time).

………………………………………………………………………………………………………………………………………………………………………………..

Interest in Generative A.I. has exploded. Tech giants have poured effort and billions of dollars into what they say is a transformative technology, even amid rising concerns about A.I.’s role in spreading misinformation, killing jobs and one day matching human intelligence.

It’s been claimed that Generative AI can be used to optimize telecom networks and make them more efficient. This can lead to faster speeds, better reliability, and lower costs. Another way that generative AI is changing telecommunications is by improving customer service. Generative AI can be used to create virtual assistants that can answer customer questions and provide support. This can free up human customer service representatives to focus on more complex issues.

Generative AI is also being used to improve network security. Generative AI can be used to detect and prevent fraud and other security threats. This can help to protect customers and their data.

Here are some specific examples of how generative AI is planning to be used in the telecommunications industry:

- Network optimization: Generative AI can be used to analyze network traffic and identify patterns. This information can then be used to optimize the network and improve performance. For example, generative AI can be used to route traffic more efficiently or to add capacity to areas of the network that are experiencing congestion.

- Predictive maintenance: Generative AI can be used to analyze data from network equipment to identify potential problems before they occur. This information can then be used to schedule preventive maintenance, which can help to prevent outages and improve reliability. For example, generative AI can be used to monitor the temperature of network equipment and identify components that are at risk of overheating.

- Fraud detection: Generative AI can be used to analyze customer behavior and identify patterns that may indicate fraud. This information can then be used to prevent fraud and protect customers. For example, generative AI can be used to identify customers who are making suspicious calls or sending large amounts of text messages.

- Customer service: Generative AI can be used to create virtual assistants that can answer customer questions and provide support. This can free up human customer service representatives to focus on more complex issues. For example, generative AI can be used to create a virtual assistant that can answer questions about billing or troubleshoot technical issues.

Postscript: Gary Marcus, a well-known professor and frequent critic of A.I. technology, said that OpenAI hasn’t been transparent about the data its uses to develop its systems. He expressed doubt in CEO Sam Altman’s prediction that new jobs will replace those killed off by A.I.

“We have unprecedented opportunities here but we are also facing a perfect storm of corporate irresponsibility, widespread deployment, lack of adequate regulation and inherent unreliability,” Dr. Marcus said.

References:

The AI-native telco: Radical transformation to thrive in turbulent times; https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/the-ai-native-telco-radical-transformation-to-thrive-in-turbulent-times#/

Generative AI in Telecom Industry | The Ultimate Guide; https://www.xenonstack.com/blog/generative-ai-telecom-industry#:~:text=Generative%20AI%20can%20predict%20equipment,equipment%20failures%20before%20they%20occur.

Microsoft dangles generative AI for telcos and slams ‘DIY’ clouds; https://www.lightreading.com/aiautomation/microsoft-dangles-generative-ai-for-telcos-and-slams-diy-clouds/d/d-id/783438

Deutsche Telekom exec: AI poses massive challenges for telecom industry

Arista Networks unveils cloud-delivered, AI-driven network identity service

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

ChatGPT (from OpenAI) is the poster child for Generative AI. Here is a study which showed in many ways in which Generative AI can not properly replace a manager. JobSage wanted to see how ChatGPT performed when it comes to sensitive management scenarios and had responses ranked by experts.

Key takeaways:

-

Sensitive management scenarios: 60% found to be acceptable while 40% failed.

-

ChatGPT was better at addressing diversity and worse at addressing compensation and underperforming employees.

-

ChatGPT earned its strongest marks addressing an employee being investigated for sexual harassment and a company switching healthcare providers to cut costs.

-

ChatGPT performed weakest when asked to respond to an employee concerned about pay equity, a company that needs people to work harder than ever, and a company’s freeze of raises despite record payout to the CEO.

ChatGPT showed inconsistent performance in management situations:

Using the same scoring scale, ChatGPT revealed that while it could provide balance and empathy with some employee-specific and company-wide communication, at other times that empathy and balance was missing, making it appear tone deaf.

ChatGPT even gave responses that many would deem inappropriate while other responses highlighted a more broad limitation of ChatGPT: its inability to provide detailed, tailored information about company policies and scenarios that occur.

This section details where this chatbot failed to deliver by responses scored from negative to very negative.

Negative: Notifying an employee they were being terminated for not working hard enough

Our experts had issues with ChatGPT’s response in this scenario. It emphasized the employee’s performance as compared to peers and offered an overall negative tone that would potentially make its recipient feel quite terrible about themself.

Negative: Notifying an employee that a complaint had been filed against them for being intoxicated on the job

For this response, ChatGPT employs a severe tone, which may discourage the employee from sharing the underlying issue that is motivating them to drink on the job. Management did deem this to be an outstanding response, though one wonders if this would be a conversation better conducted in person than over email.

Negative: Notifying an employee that they’ve worn clothing that’s revealing and inappropriate

ChatGPT failed to understand how language can be judgmental, and its response was less than informative. Its use of the word “revealing” to describe the clothing is subjective and the human resources expert provided the feedback that it “screams sexism and provides no meaningful detail about what the policy is and what part they violated.”

Very negative: Notifying the company to let them know they need to work harder

ChatGPT again came up short on necessary detail. The email neglects to include examples or benchmarks of what working harder actually looks like, which sets an unrealistic bar to measure employees against. And according to the human resources expert, “it assumes individuals aren’t already striving for excellence.”

Very negative: Notifying a company about a freeze on raises despite a record payout to the CEO

Legal found ChatGPT’s response “too direct in summarizing the record compensation received by the CEO.” With a very personal issue like compensation at play, an employee would hope this would be dealt with more empathy than what’s displayed here.

Very negative: Addressing an employee’s concerns about pay equity.

ChatGPT’s response focuses primarily on the company’s situation while failing to show empathy for the employee’s situation. It also discloses details about another’s employee’s compensation and how it was determined, which many would consider inappropriate. Since compensation was found to be the top factor of work-related stress in a 2023 survey, trusting this to ChatGPT would not be wise.

Conclusions:

Based on the Jobsage.com study, one might find ways to utilize ChatGPT to draft emails that serve as announcements or notifications. However, those emails still need a human touch. If you trust ChatGPT to draft correspondence, be sure those are reviewed by the company’s internal team to ensure they accurately reflect the company’s protocols and policies.

While ChatGPT may be useful in some ways, it simply can’t replace the empathy and human touch of a good manager, especially when dealing with sensitive situations. Employees want to feel respected, and receiving a blanket response full of corporate jargon likely won’t make them feel that way. Employees want to know a human is communicating with them, not a computer.

If you want to find a workplace that treats you with empathy and provides a safe, inclusive workspace that addresses your unique needs, JobSage provides an open forum for employees to leave honest, authentic company reviews. You can really get to know a company’s culture and see if its style of management and communication carves a meaningful place for you.

Addendum – ChatGPT vs Google Search Engine:

I asked ChatGPT: “What is the IEEE Techblog?” Here is the result I got:

“As of my last knowledge update in September 2021, the IEEE (Institute of Electrical and Electronics Engineers) Techblog was not a specific entity or platform associated with IEEE. However, IEEE is a renowned professional association dedicated to advancing technology and innovation across various fields, including electrical engineering, computer science, and telecommunications.”

When I did a Google search on the same keywords, I got the CORRECT answer as the 1st search result:

Technology Blog – ComSoc Technology Blog – IEEE …

IEEE Communications Society

About the BlogNOTE: IEEE Techblog posts may not be reposted without …

|

|

About the Techblog Editorial …Alan J Weissberger, ScD. Content Manager and principal …

|

|

IEEE Techblog recognized by …The IEEE ComSoc Techblog was voted #2 best broadband blog …

|

|

Contact UsIEEE websites place cookies on your device to give you the best …

|

|

“The IEEE ComSoc Techblog features contributions from various authors who are experts, researchers, and professionals in the field of communications engineering. The blog does not have a single author, but rather includes posts from multiple individuals who are associated with the IEEE Communications Society (ComSoc) and its technical community.” No mention of Alan J Weissberger!

When I asked Google the same thing, I got:

Content Manager and principal contributing author to IEEE ComSoc blog sites since March 2009. IEEE volunteer and technical conference session organizer since March 1974.

About the Techblog Editorial Team – Technology Blog

References:

Curmudgeon/Sperandeo: Impact of Generative AI on Jobs and Workers

:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/tgam/Z46YWTAR7JGZBDY3RHYZPBSGLM.JPG)