5G private networks

Deloitte’s 2022 telecom industry outlook, questions and recommendations for telcos

Executive Summary:

In 2022, the telecom industry will face new opportunities and challenges presented by a dynamic regulatory, technological, and competitive environment. Deloitte’s annual telecom outlook dials into the biggest trends shaping the telecommunications industry, from more competitive broadband markets to cybersecurity in the 5G era.

The telecom sector continued to make progress in augmenting its network capacity with additional fiber and wireless deployments to meet the constant demand for higher-speed networks in 2021. However, as we start the new year, we see an emerging set of issues and opportunities presented by a dynamic regulatory, technological, and competitive environment that may influence the sector’s progress in the coming year:

- The potential for more competitive broadband markets. Faster mobile and fixed wireless connections create more viable alternatives to wired connections and new opportunities for bundled service offerings and business models for service providers. With ever-expanding options for high-quality communication and internet services from telecom, cable, wireless, and satellite internet providers, consumers will enjoy enhanced flexibility in purchasing and consuming services in the new year. However, these trends may also lead to a more competitive environment in 2022.

- A shift to more decentralized government broadband infrastructure funding. The $1 trillion Infrastructure Investment and Jobs Act (IIJA) passed in November earmarks $65 billion for continued broadband adoption and deployment. While government programs dedicated to expanding and improving telecommunication infrastructure and services have traditionally been managed at the federal level, it appears the bulk of the bill’s federally allocated broadband dollars will flow through more decentralized state-based models.

- Rising interest in multi-access edge computing (MEC) and private cellular networks. The enterprise market for private cellular networks and edge computing is gaining momentum. The market is still nascent but promises to be competitive, with many different players vying for their share. Network operators will have to compete against other players, who may prove key partners in delivering their solutions. Ecosystem players will likely begin to stake out and define their role in this emerging but rapidly evolving market in the coming year.

- The need to reassess cybersecurity and risk management in the 5G era. While the widespread adoption of 5G offers many benefits, it also creates new security concerns and challenges. As operators have taken steps to evaluate and minimize threats arising from 5G and software-centric networks in their own organizations, they are in a unique position to offer 5G security services to enterprises seeking to deploy their own advanced wireless networks.

Strategic Questions for telcos to consider:

• With spectrum being a scarce resource, how can operators prioritize its use to maximize its value? • How can operators use FWA to create additional synergies between their wireless and fiber asset deployments to improve their cost structure and benefit customers?

• While telcos may initially benefit as a wholesale provider of wireless capacity, what are the long term consequences if mobile virtual network operators begin using their wireless scale to build out their own networks?

• What should the telco’s role be in developing and delivering 5G private cellular networks and enterprise-oriented edge solutions? Will it take the form of spectrum leases, fiber backbone, and backhaul, or something more?

• What are the telco’s core competencies and value proposition in delivering 5G enterprise networks? Which business models will allow telcos to optimize value?

• What capabilities are required to execute on a given strategy or business model? Can telcos develop new capabilities internally? To what extent should they do so?

• How can telcos use their approach to cybersecurity as an opportunity to differentiate themselves and capture value in the 5G enterprise market?

• Where can telcos switch from reactive security mechanisms to more proactive ones?

• As telcos migrate from legacy networks to modern architectures, do they have appropriate risk management and governance organizations in place?

Recommendations for Telcos:

• Reassess core value proposition in an evolving competitive landscape with more players vying for the same customers.

• Reevaluate how and where to participate in terms of both service offerings and geographies. • Look for ways to differentiate services on non-performance attributes since consumers perceive minor differences among provider offerings.

• Determine organizational effectiveness in monitoring and responding to more distributed, state-based mechanisms for awarding federally allocated broadband funds.

• Monitor ecosystem and business model development in the emerging 5G enterprise edge compute and private cellular network markets.

• Build on the unique position to offer differentiated 5G security and risk management services to enterprises seeking to deploy advanced wireless networks.

References:

BT and Ericsson in partnership to provide commercial 5G private networks in the UK

BT and Ericsson have entered a new multi-million-pound joint partnership to provide commercial 5G private networks for the UK market – the first agreement of its kind. The multi-year contract will enable BT to sell 5G services to businesses and organizations in industries like manufacturing, defense, education, retail, healthcare, transport and logistics. It’s critically important to note that to be effective, a 5G private network requires a 5G Core which facilitates all the 5G features and essentials, e.g. network slicing, automation, MEC, security, etc.

The agreement comes just after BT confirmed it was investing close to £100m over the next three years to accelerate the development of customer solutions which integrate emerging technologies like 5G, IoT, Edge Compute, Cloud and AI.

5G Private Networks provide secure indoor and outdoor 5G cellular coverage, making them suitable for a range of uses – particularly in environments such as factories, education campuses and other large sites where security and ultra-low latency connectivity are important.

New innovative applications and IoT capabilities can be enabled through a private 5G network to improve productivity, optimise operations and drive cost savings, such as asset tracking, predictive maintenance, connected sensors, real-time data processing, automation and robotics.

According to a forecast from MarketResearch.com, 5G Private Networks are predicted to grow at an average rate of 40 per cent a year between 2021 and 2028, by which time the market will be worth $14bn (£10.7bn). Both BT and Ericsson believe there is significant demand from UK businesses looking to take advantage of the benefits the new technology can provide.

From MarketResearch.com:

“Key market players are strategically building partnerships with industry giants to set up a private 5G network to provide high-speed secure connectivity to their customers. For instance, in Feb 2020, Nokia Corporation deployed a private 5G network infrastructure for Lufthansa Technik for virtual inspection of engine parts remotely for its civil aviation clients. Moreover, the rising demand for enhanced bandwidth connectivity for secured enterprise applications is anticipated to fuel the adoption of private 5G services globally.”

Marc Overton, BT’s Managing Director for Division X, Enterprise, said: “This UK-first we have signed with Ericsson is a huge milestone and will play a major role in enabling businesses’ transformation, ushering in a new era of hyper-connected spaces.

“We have combined our skill and expertise at building converged fixed and mobile networks with Ericsson’s leading, sustainable and secure 5G network equipment, to offer a pioneering new proposition that will be attractive to many industries. 5G private networks will also support smart factory processes and the advancement of Industry 4.0 which can realise significant cost savings and efficiencies for manufacturers.

“Unlike a public network, a private 5G network can be configured to a specific business’s needs, as well as by individual site or location. They also provide the foundation to overlay other innovative technologies such as IoT, AI, VR and AR, opening up a multitude of possibilities.”

Katherine Ainley, CEO Ericsson UK & Ireland said: “This ground-breaking agreement with BT means we are together taking a leading role in ensuring 5G has a transformative impact for the UK. The high quality, fast and secure connectivity provided by Ericsson Private 5G can help organisations make all-important efficiency gains that can create safer, more productive, and sustainable business operations and help the country build global leaders in the industries and technologies of the future.”

Case study: BT and Ericsson have already worked together on several major projects incorporating private 5G networks, including Belfast Harbour in Northern Ireland, as they accelerate its ambition to become the world’s best regional smart port.

The partners have installed a 5G private network across 35 acres of operational port. This is helping to drive operational efficiencies and accelerate its digital transformation through optimising processes across transport, logistics, supply chain and shipping, as well as boosting productivity through the smooth-running of the Port’s operations.

Every year more than 1.75 million people and over half a million freight vehicles arrive and depart through the Port every year. While 24 million tonnes of goods are managed and carried by ferries, container ships and cargo vessels.

“With activity on that scale you need smart technology that can really make a difference. And that’s what our standalone private 5G network is enabling at the Port,” added Marc Overton.

“We’re now into phase two of the project and this includes various use cases such as teleoperation of heavy plant machinery, artificial reality (AR) for remote maintenance, as well as enhanced video AI analytics and the use of drones for surveillance and inspections.”

The partnership is also exploring how 5G and other emerging technologies such as AI, IoT and Connected Autonomous Vehicles can be used together to enhance public safety, physical security, and address climate change across the Port and other parts of Belfast City.

Mike Dawson, Corporate Services Director, Belfast Harbour Commissioners, said: “Throughout 2021 and to the end of 2022, we will have completed the implementation of both Public and Private 5G Networks. These are the foundation for several Smart and Green port initiatives, including CCTV cameras, Air Quality Monitors, Drones, MiFi units to maximise operational efficiencies and a Digital Twin. The technologies have supported our data collection on the movement of people and things through our Road Traffic Screens, Wayfinding App and a Community App for Traffic.”

BT Group is the UK’s leading provider of fixed and mobile telecommunications and related secure digital products, solutions and services. We also provide managed telecommunications, security and network and IT infrastructure services to customers across 180 countries.

BT Group consists of four customer-facing units: Consumer serves individuals and families in the UK; Enterprise and Global are our UK and international business-focused units respectively; Openreach is an independently governed, wholly owned subsidiary, which wholesales fixed access infrastructure services to its customers – over 650 communication providers across the UK.

British Telecommunications plc is a wholly-owned subsidiary of BT Group plc and encompasses virtually all businesses and assets of the BT Group. BT Group plc is listed on the London Stock Exchange.

For more information, visit www.bt.com/about

References:

https://www.marketresearch.com/Grand-View-Research-v4060/Private-5G-Network-Size-Share-14553525/

India Telcos say private networks will kill 5G business

India’s top tier wireless network operators have called on the Telecom Regulatory Authority of India (Trai) – India’s telecom sector regulator – to scrap the proposed move to administratively allocate 5G spectrum on demand for private enterprise networks through a publicized online portal-based process, warning that such a step could destroy the 5G business case in the country.

The businesses have mentioned that such a proposal, if accepted by the federal government, might probably rob telcos of their future 5G enterprise revenues – estimated at round 40% of the whole for 5G. Revenue loss to such an extent won’t justify needed capital expenditure in establishing 5G networks, they’ve argued.

In its newest suggestions on 5G spectrum pricing, the Trai has advised that non-public enterprises straight acquire 5G spectrum from the federal government and set up their very own captive wi-fi non-public community (CWPNs). It has additionally beneficial a “gentle contact’ on-line portal-based regime” for buying such permissions/licences for establishing CWPNs. Trai has additionally advised that non-public enterprises have the choice to lease spectrum from telcos to arrange their very own captive non-public 5G networks.

“By permitting non-public captive networks for enterprises, Trai is dramatically altering the trade dynamics and hurting the monetary well being of the telecom trade reasonably than bettering it,” the Mobile Operators Affiliation of India (COAI) said in an announcement Tuesday, April 12th.

The COAI represents Reliance Jio, Bharti Airtel and Vodafone Thought (Vi). It added that “enterprise companies represent 30-40% of the (telecom) trade’s total revenues…non-public networks as soon as once more dis-incentivises the telecom industry to spend money on networks and in addition proceed paying excessive levies and taxes.”

The COAI has urged Trai to revisit its newest suggestions and disallow non-public enterprise networks to make sure monetary viability and orderly progress of the telecom trade that, it mentioned, is greater than able to delivering these companies to companies.

India’s mobile carriers had earlier advised Trai that any proposal to put aside 5G spectrum for personal enterprise networks for captive use both at no cost or at an administrative worth would even be legally untenable.

Trai has beneficial that the spectrum for personal networks be assigned administratively on demand by way of a extensively publicized on-line portal-based course of in a good and clear method. However the regulator has left it to the telecom division to determine whether or not such administrative allocation can be legally tenable or not, based mostly on DoT’s spectrum allocation coverage.

In its 5G dialogue paper, Trai had mentioned the likes of Germany, Finland, UK, Brazil, Australia, Hong Kong and Japan had put aside spectrum within the mmWave band for personal captive 5G networks, whereas Slovenia, Sweden and Korea deliberate to put aside each mmWave and mid-band 5G spectrum for such captive networks.

Subsequently, Tata Communications (TCL), Larsen & Toubro (L&T) and cigarette maker ITC had strongly countered the telcos’ place, and known as on Trai to again earmarking devoted spectrum non-public captive networks and undertake international practices to create a personal 5G ecosystem for enterprises to drive the federal government’s Make in India imaginative and prescient.

However one other high telco government mentioned that if operators’ potential 5G income flows from the profitable enterprise enterprise vertical dry up, they might see little enterprise sense in bidding aggressively for 5G airwaves within the upcoming sale.

Bulk of the bidding urge for food for 5G airwaves, he mentioned, stems from the sturdy income potential of the B2B enterprise enterprise. But when that income stream disappears, telcos gained’t have a viable enterprise case to splurge huge cash on 5G spectrum, particularly as they’ve sufficient spectrum to proceed their current cellular broadband companies operations.”

Know-how corporations, although, have strongly backed Trai’s name to permit non-public enterprises to straight acquire 5G spectrum from the federal government by way of the executive route.

“By way of non-public networks, Trai’s suggestions handle the pursuits of TSPs (telecom service suppliers), enterprises and the general public as extra non-public networks would result in extra employment alternatives and enterprise, and translate into larger financial output and advantages,” mentioned the Broadband India Discussion board (BIF), which counts Cisco, Amazon, Google, Microsoft, Fb-owner Meta, Qualcomm and Intel amongst its key members.

Earmarking unique spectrum for personal 5G networks, it mentioned, would additionally present an “enchancement over common SLAs (service level agreements) of public networks, moreover guaranteeing full lack of interference between them”.

BIF added that Trai’s name for task of spectrum administratively for personal 5G networks “is most acceptable” because it has thought of that captive wi-fi non-public networks should not public networks and don’t have any market prospects, and are restricted to a selected location.”

Trai chairman PD Vaghela termed the 5G spectrum rates “reasonable”, saying they have been arrived at after considering various factors including quantum of spectrum offered, competition in the market and profitability.

……………………………………………………………………………………………………

April 18, 2022 Addendum:

Spectrum users have started squabbling over the telecom regulator’s recommendation to earmark certain bands for captive wireless private networks.

The cellular operators under the COAI have opposed regulator suggestions of allowing enterprises to build their own private 5G networks for captive purposes.

Technology players such as Facebook, Google, Indian Space Association (ISpA) want the 28.5GHz band spectrum to be reserved and allocated exclusively for satellite communications (satcom) services.

The COAI said “by allowing private captive networks for enterprises, telecom regulator Trai is dramatically altering the industry dynamics and hurting the financial health of the industry rather than improving it”.

“Telecom service providers have and going forward will invest lakhs of crore rupees in network rollouts. Enterprise services constitute 30-40 per cent of the industry’s overall revenues. Private networks once again disincentivises the telecom industry to invest in networks and continue paying high levies and taxes.”

The Broadband India Forum (BIF), the industry body of tech players such as Facebook and Google, welcomed the recommendations to allow private networks.

Telcos flay plan for private 5G networks

Spectrum users have started squabbling over the telecom regulator’s recommendation to earmark certain bands for captive wireless private networks.

The cellular operators under the COAI have opposed regulator suggestions of allowing enterprises to build their own private 5G networks for captive purposes.

The suggestion has been welcomed by the Broadband India Forum (BIF).

Technology players such as Facebook, Google, Indian Space Association (ISpA) want the 28.5GHz band spectrum to be reserved and allocated exclusively for satellite communications (satcom) services.

The COAI said “by allowing private captive networks for enterprises, telecom regulator Trai is dramatically altering the industry dynamics and hurting the financial health of the industry rather than improving it”.

“Telecom service providers have and going forward will invest lakhs of crore rupees in network rollouts. Enterprise services constitute 30-40 per cent of the industry’s overall revenues. Private networks once again disincentivises the telecom industry to invest in networks and continue paying high levies and taxes.”

The Broadband India Forum (BIF), the industry body of tech players such as Facebook and Google, welcomed the recommendations to allow private networks.

The Indian Space Association (IsPA) said “we welcome Trai’s recommendation that calls for coexistence of satellite communications and IMT in the 27.5-28.5GHz band. We also appreciate recommending an exclusion zone for satellite earth stations in the 27.5-28.5GHz band.”

IsPA opposed the inclusion of all spectrum in the 24.25-28.5GHz bands along with low and mid bands in the auction as it was a case of oversupply to the telecom operators at the cost of the satellite industry.

“The 24.25-27.5GHz bands along with 3.3-3.67GHz bands would be more than sufficient for 5G. Therefore, in line with the global best practices, the 28GHz band should be allocated exclusively for satellite communications,” it added.

In its recent recommendations, telecom regulator Trai said spectrum in three bands – 3700-3800MHz, 4800-4990MHz and 28.5-29.5GHz band – could be earmarked for captive wireless private networks which, it felt, could co-exist with non-IMT services.

In the 28.5-29.5 MHz band, Trai said: “A software based transparent system should be built to permit the establishment of private networks and satellite earth Stations based on the geo-coordinates of the proposed location on interference free co-existence basis.”

The regulator added: “DoT should develop a digital map with geographic coordinates of all the existing and future satellite earth stations as well as geographic coordinates of the premises of Private Network locations. Based on this database, permissions for establishment of new installations may be provided to the licensees.”

https://www.telegraphindia.com/business/telcos-flay-plan-for-private-5g-networks/cid/1861119

References:

https://economictimes.indiatimes.com/topic/telecom-regulatory-authority-of-india

Related: IEEE/SCU SoE Panel Session on Open RAN and 5G Private Networks:

Capgemini: Enterprises with spectrum to have better control with 5G Private networks

French technology company Capgemini said that enterprises owning 5G spectrum will give them better control over their plans, thereby reducing dependency. It added that telecom operators will have a role to play for private enterprise networks as managing networks aren’t core competencies of enterprises.

“…even if the spectrum is available with an industry player, I don’t see the situation where the telcos will not be working with the industry in facilitating that. The industry will use 5G as a connectivity, and it’s just not 5G, it is with hybrid cloud, edge computing, IoT, and all other technologies together,” said Monika Gupta – Vice President, Group 5G & Edge lead for Industries & Partnerships, Capgemini.

Industries have key requirements which are very specific including safety, security and the protection of their data. A 5G private network is one solution which ensures that all the data with the connectivity which is there in the particular enterprise campus stays within the campus and doesn’t go out.

Ms Gupta added: “This is not possible in a macro network or in a telco network because in a telco network, it will be ubiquitously available, and anybody can use it or latch it. And hence private networks are one of the key solution offerings with respect to 5G for its adoption towards industries. 5G connectivity is not their [enterprises’] core operations or their core business. And the telcos will always have a role and some contribution to make in this irrespective of whether they own the spectrum, or the spectrum is with the industry. The adoption of 5G for industries is an ecosystem play.”

Capgemini is currently working with Bharti Airtel under a strategic partnership to develop 5G use cases for enterprises. “…two of our use cases have actually been deployed in Airtel Manesar’s lab,” Gupta said.

Capgemini also works with many of the industry clients in India, many of them being our global MNC clients who have large R&D setups, global R&D IT hubs or operations based out of India, she informed.On 5G, she said that while the launch has been delayed, India can still leverage 5G adoption-related learnings from other countries in terms of adopting certain use cases by localizing.

“…the advantage which India has both for telcos and industries is that there is so much learning which can come to India. Capgemini and many of these global MNCs play a crucial role because when we work on similar projects in other countries and in other regions like Europe, America and Asia Pacific, all of this knowledge is then kind of readily available to us in India,” she added.

A lot of 5G projects in other countries have been delivered out of India, she said, adding that the country already has skill sets and people’s capability for 5G deployment.“…the fine tuning which is required is what works for India. The local customization will happen. India has had a very short phase of 5G trials. Now whenever 5G is commercially available India will go straight into a rollout of 5G and will see a quick adoption,” she added.

Capgemini has a global network of labs. It recently opened a 5G lab in a strategic partnership with Swedish telecom gear maker Ericsson to test enterprise use cases.The company also has a similar lab in Paris, which is our headquarters. It has the third lab in Portugal, while the fourth one is coming up in America. Capgemini has developed the 5G Labs to help strategize, build and monetize what 5G brings next for their businesses.

“All of these labs are primarily industry focused labs. With the industry focus lab, we are primarily experimenting with innovating the application of 5G into industrial operations. So these labs actually replicate a lab environment of an enterprise architecture and 5G becomes an integral connectivity piece in that architecture,” Gupta concluded.

……………………………………………………………………………………………………………….

References:

Video of IEEE ComSoc/SCU SoE panel on Open RAN and Private 5G:

UK’s Manufacturing Technology Centre (MTC) installs a standalone 5G private network from BT and Nokia

BT is participating in a UK publicly funded 5G Standalone (SA) core network testbed project with Nokia. Officially unveiled this week, the project involves installation of Nokia’s 5G SA equipment at Coventry’s Manufacturing Technology Center (MTC).

This project is part of the West Midlands 5G (WM5G) initiative, which is supported by the UK government’s 5G Test Beds and Trials funding program. It will give SMEs, corporate members, neighboring universities, and the wider industry the opportunity to explore private 5G and on-premises multi-edge computing to drive forward innovation in the region beyond the duration of the programme.

The goal is to “explore private 5G and on-premises multi-edge computing to drive forward innovation in the region beyond the duration of the program,” according to the group’s announcement.

Businesses and universities, along with “wider industry,” are given the chance to use MTC facilities to test the technology. This includes the center’s recently launched “5G-enabled demonstrator system,” which provides features such as 5G-connected robotics, computer vision and edge computing.

One use case under review is an “automated inspection process” to prove how intelligent automation and advanced connectivity could enable manufacturing sites to maximize productivity and utilization of inspection technology (while also reducing footprint and product waste).

MTC points out that traditional in-person inspections can be time consuming and prone to human error. Neither are they automatically recorded.

BT Enterprise CEO Rob Shuter told Light Reading: “It’s why 5G conversations in the enterprise space are more around deploying a private network over a manufacturing facility, a harbor, a military base etc,” he said. “I’d say we’re in the early stages of that. The technology is still maturing and customer needs are sort of emerging in a co-creation phase. I think we’ll be in that phase for most of this year, and it’ll probably be industrial scaling in ’23, ’24 and ’25.”

BT’s new Division X is spearheading the company’s efforts to sell new solutions to enterprise customers. Marc Overton, former Sierra Wireless SVP, was recently appointed Division X managing director.

Quotes:

Andy Street, Mayor of the West Midlands, said: “This innovative collaboration between WM5G and MTC will enable some of our region’s most cutting-edge businesses to power forward their pioneering work in computing and robotics alongside our dynamic universities. Given the commitment to Innovation Accelerators set out in the Levelling Up White Paper, this announcement is wonderfully timed”.

Robert Franks, Managing Director at WM5G, said: “Manufacturing is at the heart of the economy in the West Midlands, and at WM5G we are working collaboratively with our partners to ensure that public and private sector organisations can remain competitive in the global marketplace and develop cutting edge technologies to advance their capabilities.

“We are so pleased to have delivered a successful trial in partnership with nexGworx and BT at the MTC, driving forward the transformation of manufacturing productivity for the region. The learnings and outcomes from our demonstration will now be used and applied across the sector to ensure best practice is carried forward, and to accelerate the adoption of 5G technology more widely.”

Alejandra Matamoros, Technology Manager in the MTC’s Digital Engineering Group, said: “Our connected facility at the MTC will allow manufacturers of all sizes, research, and technology suppliers to explore the benefits of 5G in manufacturing. Through our enduring collaboration with nexGworx and BT we are now planning to further build on the initial capability we’ve created here at the MTC to push the boundaries of what can be achieved with the help of 5G technology.

“We hope that this project will inspire further development of innovative solutions to solve real business challenges and develop new opportunities through advanced wireless connectivity.”

https://www.lightreading.com/5g/bt-gets-into-5g-sa-testbed-with-nokia/d/d-id/776162?

IDC Worldwide Private LTE/5G Wireless Infrastructure Forecast reveals 4G-LTE Dominates

The global private LTE/5G wireless infrastructure market is forecast to reach revenues of $8.3 billion by 2026, an increase compared to revenues of $1.7 billion in 2021, according to new research from International Data Corporation (IDC). IDC said that this market is expected to achieve a five-year compound annual growth rate (CAGR) of 35.7% over the 2022-2026 forecast period.

The report, Worldwide Private LTE/5G Infrastructure Forecast, 2022-2026 (IDC #US48891622), presents IDC’s annual forecast for the private LTE/5G wireless infrastructure market. The forecast includes aggregated spending on RAN, core, and transport infrastructure as well as spending by region; it excludes services or publicly owned and operated networks that carry shared data traffic. The report also provides a market overview, including drivers and challenges for technology suppliers, communication service providers, and cloud providers.

IDC defines private LTE/5G wireless infrastructure as any 3GPP-based cellular network deployed for a specific enterprise/industry vertical customer that provides dedicated access to private resources. (Yet IDC does not state what 3GPP Release(s) or whether necessary 5G capabilities, like specs for URLLC have been completed and performance tested). This could include dedicated spectrum, dedicated hardware and software infrastructure, and which has the ability to support a range of use cases spanning fixed wireless access, traditional and enhanced mobile broadband, IoT endpoints/sensors, and ultra-reliable, low-latency applications.

“Enterprise or industry verticals, such as manufacturing, retail, utilities, transport, and public safety are leading the charge for private LTE, and eventually private 5G networks, driven by a desire to capture productivity gains, enable automation, and improve customer experience. While the demand metrics are relatively understood, the emerging private cellular ecosystem presents several road maps, each with particular advantages and disadvantages. While an enterprise (within any industry vertical) will eventually need to assess its own needs internally, understanding the implications from each road map can provide a starting point,” said Patrick Filkins, IDC senior research analyst, IoT and Mobile Network Infrastructure.

“The private LTE/5G wireless market showcased in 2021 that although its growth is somewhat immune to macro challenges associated with the global pandemic, it still requires a significant amount of market-level solutioning to address the pain points associated with unlocking the full 5G solution. This includes curating and scaling a robust set of 5G device platforms, which still requires more work across the ecosystem, particularly as it relates to vertical-specific solutioning,” Filkins added.

IDC noted that the worldwide market for private LTE/5G wireless infrastructure continued to gain traction throughout 2021. The research firm highlighted that private 4G-LTE remained the predominant private cellular network revenue generator during 2021. However, Private 5G marketing, education, trials, and new private 5G products and services also began to see market availability. IDC also said that most private 5G projects to date remain as either trials or pre-commercial deployments.

“Heightened demand for dedicated or private wireless solutions that can offer enhanced security, performance, and reliability continue to come to the fore as both current and future applications, particularly those in the industrial sector, require more from their network and edge infrastructure. While private LTE/5G infrastructure continues to see more interest, the reality is 5G itself continues to evolve, and will evolve for the next several years. As such, many organizations are expected to invest in private 5G over the coming years as advances are made in 5G standards, general spectrum availability, and device readiness,” Filkins said.

The report forecasts that the market for 5G private networks will reach $47.5 billion in 2030, up from $221 million last year, while the total market for 4G private networks will go from $3.54 billion in 2021 to $66.88 billion in 2030. IDC also noted that the global spending on smart manufacturing will expand from $345 billion in 2021 to more than $950 billion in 2030.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

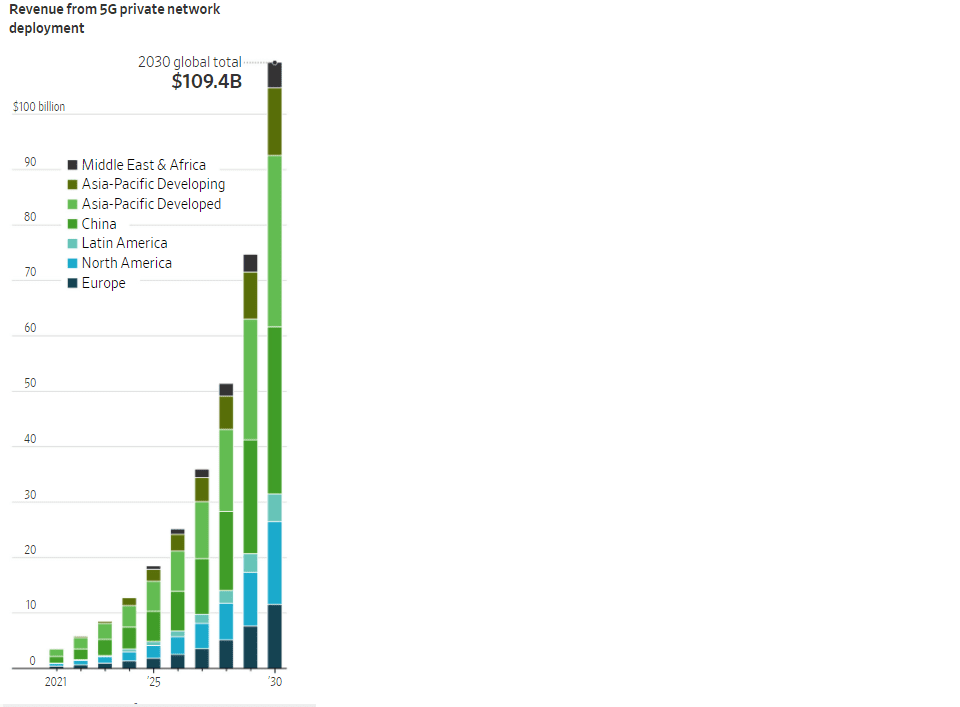

The total addressable market for private networks – including the Radio Access Network, Mobile-access Edge Computing (MEC), core, and professional services – is forecast to increase from $3.7 billion in 2021 to more than $109.4 billion in 2030, according to a recent report by ABI Research. However, a quote in the article introducing that report was dead wrong:

“While the Third Generation Partnership Project (3GPP) has frozen Release 16 (standardizing Ultra-Reliable Low-Latency Communication (URLLC)), Release 16-capable chipsets and devices have not yet emerged in the market. As enterprises require Time-Sensitive Networking (TSN), as well as high availability and reliability of their connection, they are reliant on Release 16 and are, therefore, waiting for compatible chipsets and infrastructure to enter the market. As this is not expected to happen until 2023, enterprise 5G will mature much more slowly than previously anticipate,” ABI Research said.

–>THAT IS BECAUSE EVEN THOUGH 3GPP RELEASE 16 WAS FROZEN IN JUNE 2020, “URLCC IN THE RAN” SPEC WAS NOT COMPLETED AT THAT TIME. Before that spec can be implemented, it must be independently tested to ensure it means the ITU-R M.2410 performance requirements for BOTH ultra high reliability and ultra low latency corresponding to the 5G URLLC use case. As of 16 March 2022 (today), 3GPP Release 16 URLLC in the RAN is only 74% complete!

| 830074 | NR_L1enh_URLLC | Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC) | 74% | Rel-16 | RP-191584 |

ABI also noted that the global spending on smart manufacturing will expand from $345 billion in 2021 to more than $950 billion in 2030.

Note: 2022 to 2030 are forecasts. Source: ABI Research

“As manufacturers advance their digital transformation initiatives, they drive up spending on smart manufacturing with investments in factories that adopt Industry 4.0 solutions like Autonomous Mobile Robots (AMRs), asset tracking, simulation, and digital twins,” ABI said. ” While most of the revenue today is attributed to hardware, the greater reliance on analytics, collaborative industrial software, and wireless connectivity (Wi-Fi 6, 4G, 5G) will drive value-added services revenue — connectivity, data and analytic services, and device and application platforms — to more than double over the forecast.”

Meanwhile, Dell’Oro Group VP Stefan Pongratz wrote in an email to this author,” We have talked about private cellular for a long time but the reality is that we have not yet crossed the enterprise chasm. Nevertheless, we have a very large market opportunity ($10B to $20B for just the private 4G/5G RAN) that is still up for grabs, hence the high level of interest.”

About IDC:

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,200 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48948422

https://www.idc.com/getdoc.jsp?containerId=US48891622

Global market for private networks to exceed $109 billion in 2030: Study

https://www.3gpp.org/DynaReport/GanttChart-Level-2.htm (Release 16)

Cisco’s 5G pitch: Private 5G, 5G SA Core network, optical backhaul and metro infrastructure

At MWC 2022 in Barcelona, Cisco revealed its Private 5G market strategy together with partners. It was claimed to usher in “a new wave of productivity for enterprises with mass-scale IoT adoption.” Cisco’s 5G highlights:

- Cisco Private 5G as-a-Service delivered with global partners offers enterprise customers reduced technical, financial, and operations risks with managing enterprise private 5G networks.

- Cisco has worked in close collaboration with two leading Open RAN vendors to include O-RAN technology as part of Cisco Private 5G and is currently in customer trials with Airspan and JMA.

- Multiple private 5G pilots and projects are currently underway spanning education, entertainment, government, manufacturing, and real estate sectors.

- 5G backhaul and metro infrastructure via routed optical networking (rather than optical transceivers like those sold by Ciena)

Cisco Private 5G:

The foundation of the solution is built on Cisco’s industry-leading mobile core technology and IoT portfolio – spanning IoT sensors and gateways, device management software, as well as monitoring tools and dashboards. Open Radio Access Network (ORAN) technology is a key component of the solution. Cisco is working in close collaboration with ORAN vendors, JMA and Airspan, and is currently in customer trials utilizing their technology.

Key differentiators of Cisco Private 5G for Enterprises:

- Delivered as-a-Service: Delivered together with global service providers and system integration partners, the offer reduces technical, financial, and operational risks for enterprise private 5G networks.

- Complementary to Wi-Fi: Cisco Private 5G integrates with existing enterprise systems, including existing and future Wi-Fi versions – Wi-Fi 5/6/6E, making operations simple.

- Visibility across the network and devices: Using a simple management portal, enterprise IT teams can maintain policy and identity across both Wi-Fi and 5G for simplified operations.

- Pay-as-you-use subscription model: Cisco Private 5G is financially simple to understand. With pay-as-you-use consumption models, customers can save money with no up-front infrastructure costs, and ramp up services as they need.

- Speed time to productivity: Businesses can spare IT staff from having to learn, design, and operate a complex, carrier class private network.

Key Benefits of Cisco Private 5G for Partners:

- Path to Profitability for Cisco Partners: For its channel partners, Cisco reduces the required time, energy, and capital to enable a faster path to profitability.

- Private Labeling: Partners can private label/use their own brand and avoid initial capital expenses and lengthy solution development cycles by consuming Cisco Private 5G on a subscription basis. Partners may also enhance Cisco Private 5G with their own value-added solutions.

“Cisco has an unbiased wireless strategy for the future of hybrid work. 5G must work with Wi-Fi and existing IT environments to make digital transformation easy,” said Jonathan Davidson, Executive Vice President and General Manager, Mass-Scale Infrastructure Group, Cisco. “Businesses continuing their digitization strategies using IoT, analytics, and automation will create significant competitive advantages in value, sustainability, efficiency, and agility. Working together with our global partners to enable those outcomes with Cisco Private 5G is our unique value proposition to the enterprise.”

The concept of private networks running on cellular spectrum isn’t new — about 400 private 4G LTE networks exist today — but Cisco expects “significantly more than that in the 5G world,” Davidson said. “We think that in conjunction with the additional capacity or also the need for high-value asset tracking is really important.”

During a MWC interview with Raymond James, Davidson said, “Mobile networks aren’t mobile for very long. They have to get to a wired infrastructure,” and therein lies multiple roles for Cisco to play in the telco market.

Cisco’s opportunity in the telco space includes the buildout of new backhaul and metro infrastructure to handle increased capacity and bandwidth, its IoT Control Center, private networks, and the core of mobile network infrastructure.

“We continue to be a market leader in that space,” Davidson said, referring to Cisco’s 4G LTE and 5G network core products. More than a billion wireless subscribers are connected to Cisco’s 4G LTE core, and it plays a central role on T-Mobile’s 5G standalone core, which serves more than 100 million subscribers on a converged 4G LTE and 5G core, he added.

Davidson also expects Cisco’s flattened infrastructure, or routed optical networking, to gain momentum in wireless networks. But first, a definition. For Cisco, optical refers to the technology that moves bits from point A to point B, not optical transceivers.

“Our belief is there is going to be a transition in the market towards what we call routed optical networking. And this means that takes traditional transponders and moves them from being a shelf, or a separate box, or a device, and turns them into a pluggable optic, which you then plug into a router,” he said.

That’s where Cisco’s $4.5 billion acquisition of Acacia Communications comes into play. In October 2021, we reported that Cisco’s Acacia unit is working together with Microschip to validate the interoperability of their 400G pluggable optics components – Microchip’s DIGI-G5 OTN processor and META-DX1 terabit secured-Ethernet PHY and Acacia’s 400G pluggable coherent optics.

The second phase of this type of network transformation involves the replacement of modems that exist in optical infrastructure with routers that carry pluggable transponders, Davidson added. The third phase places private line emulation onto that same infrastructure.

Supporting Comments:

“DISH Wireless is proud to partner with Cisco to bring smart connectivity to enterprise customers through dedicated private 5G networks. Together, we have the opportunity to drive real business outcomes across industries. We’re actively collaborating with Cisco on transformational projects that will benefit a variety of sectors, including government and education, and we’re working to revolutionize the way enterprises can manage their own networks. As DISH builds America’s first smart 5G network™, we’re offering solutions that are open, secure and customizable. Teaming with Cisco is a great next step, and we look forward to offering more innovative solutions for the enterprises of today and beyond.”

— Stephen Bye, Chief Commercial Officer, DISH Wireless

“Cisco is busting the myth that enterprises can’t cross Wi-Fi, private 5G and IoT streams. Enterprises are now tantalizingly closer to full visibility over their digital and physical environments. This opens up powerful new ways to innovate without compromising the robust control that enterprises require.”

— Camille Mendler, Chief Analyst Enterprise Services, Omdia

“Developing innovative, customized 5G private network solutions for the enterprise market is a major opportunity to monetize the many advantages of 5G technology. Airspan is proud to be one of the first leading Open RAN partners to participate in the Cisco Private 5G solution and offer our cutting edge 5G RAN solutions including systems and software that are optimized for numerous enterprise use cases.”

— Eric Stonestrom, Chairman and CEO, Airspan

“This partnership opens a world of new possibilities for enterprises. With simple downloaded upgrades, our all-software RAN can operate on the same physical infrastructure for 10+ years—no more hardware replacements every 36 months. And as the only system in the world that can accommodate multiple operators on the same private network, it eliminates the need to build separate networks for new licensed band operators.”

— Joe Constantine, Chief Technology & Strategy Officer, JMA

“5G marks a milestone in wireless networking. For organizations, it opens many new opportunities to evolve their business models and create a completely new type of digital infrastructure. We see strong demand in all types of sectors including manufacturing and mining facilities, the logistics and automotive industries, as well as higher education and the healthcare sector. As a leading Cisco Global Gold Partner, we are excited to help drive this evolution. Thanks to our deep expertise, international capability, and close partnership with Cisco, we can support companies in integrating Private 5G into their enterprise networks,”

— Bob Bailkoskiis, Logicalis Group CEO.

“NEC Corporation is working on multiple 5G initiatives with Cisco. We have a Global System Integrator Agreement (GSIA) partnership for accelerating the deployment of innovative 5G IP transport network solutions worldwide. Work is in progress to connect Cisco’s Mobile Core and NEC’s radio over Cisco’s 5G Showcase in Tokyo, a world leading 5G services incubation hub. Leveraging NEC’s applications, Cisco and NEC will investigate expanding the technical trials including Private 5G in manufacturing, construction, transportation, and others.”

—Yun Suhun, General Manager, NEC Corporation

Industry Projects Underway

Cisco is working together with its partners on Private 5G projects for customers across a wide range of industries including Chaplin, Clair Global, Colt Technology Services, ITOCHU Techno-Solutions Corporation, Madeira Island, Network Rail, Nutrien, Schaeffler Group, Texas A&M University, Toshiba, Virgin Media O2, Zebra Technologies and more. See news release addendum for project details and supporting comments.

Final Thoughts:

“Radio access networks themselves are between $30 billion and $40 billion a year. Depending on who you talk to, optical (networking) can be between $10 billion and $15 billion a year. And then routing is below $10 billion a year,” Davidson said. “Our belief is that the optical total addressable market will start to shift over time as routed optical networks become more prevalent, because it will move from the optical domain into the optic transceiver market,” he added.

Finally, although Cisco repeatedly insists it has no interest in becoming a RAN supplier, it remains strongly supportive of Open RAN. The RAN market “is still closed, it’s locked in, even though there are standards,” he said.

“People do not do any interoperability testing between vendors, which is fundamentally changing with open RAN” because operators are forcing vendors to make their equipment interoperate with open RAN implementations, Davidson concluded.

References:

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Additional Resources:

- Cisco Private 5G

- Blog: Private 5G Delivered on Your Terms, Masum Mir, Vice President and General Manager, Mobile, Cable and IoT

ONF’s Private 5G Connected Edge Platform Aether™ Released to Open Source

Furthering its mission to seed the industry with innovative open source platforms to advance 5G and software-defined open networking, the Open Networking Foundation (ONF) today announced that its Aether Private 5G + Edge Cloud platform, and related component projects SD-Core™, SD-RAN™ and SD-Fabric™ have now all been released under the permissive Apache 2.0 open source license.

Aether is the first open source 5G Connected Edge platform for enabling enterprise digital transformation. Aether provides 5G mobile connectivity and edge cloud services for distributed enterprise networks. Aether represents a complete, open 5G solution, addressing RAN through Core, democratizing availability of a robust and complete software-defined 5G platform for developers.

In just 2 years, Aether has achieved significant milestones and demonstrated numerous industry firsts:

- Aether was selected for the $30M DARPA Pronto project for building secure 5G

- Aether was deployed in an ongoing field trial with Deutsche Telekom in Berlin

- Aether has been deployed in over 15 locations, operating 7×24 and delivering production-grade uptime

- Aether is the only private 5G solution leveraging the benefits of open RAN for private enterprise use cases

In the process of achieving these remarkable milestones, Aether has matured to the point where it is ready to be released to the community for broad consumption.

Aether is built upon a number of world-class component projects that are each in their own right best-in-class. Today, all the component projects are also being open sourced, including:

SD-Core 4G/5G dual-mode cloud native mobile core

SD-Fabric SDN P4 Programmable Networking Fabric

SD-RAN Open RAN implementation with RIC and xApps

Demonstrating Aether at MWC:

The ONF stand #1F66 at Mobile World Congress (MWC) will showcase an Aether deployment, demonstrated as a cloud managed offering optimized for enterprise private networks. In the demo, devices (UEs), such as mobile phones, cameras, sensors and IoT devices, can be aggregated into device-groups, and each device-group assigned a 5G slice and connected to specific edge applications thereby extending the slicing concept to individual applications and services. Each slice is attached to specific Industry 4.0 application(s), thereby creating distinct slices for different use cases and guaranteeing each slice secure isolation for security along with bandwidth, latency, quality of service (QoS) and resource assurances.

Two Industry 4.0 applications are demonstrated running over the Aether Private 5G using Intel technologies enabling ONF SD-RAN and SD-Core ranging from Intel Xeon Scalable processors, Intel vRAN accelerator ACC100, Intel Tofino Intelligent Fabric Processors, to software offerings such as Intel’s FlexRAN reference architecture, Intel Smart Edge Open, and the Intel Distribution of OpenVINO. The first is a security application built on Intel’s Distribution of OpenVINO toolkit, an intelligent AI/ML edge platform running on Aether 5G and leveraging Aether’s Industry 4.0 APIs to dynamically change the network slice to suit the application’s real time requirements for connectivity. The demo first creates an application slice for video surveillance, grouping together a set of streaming cameras. Next, whenever a human is detected in the field of vision for a camera, the solution automatically increases the 5G bandwidth for the impacted camera and instructs the camera to increase its resolution so a high-def recording can be made. With this approach, 5G wireless capacity is reserved for mission critical applications, and bandwidth is dynamically allocated precisely when and where needed. All of this is performed in real time without human intervention.

Anomaly detection is featured in the second Industry 4.0 application. Based on Intel’s Anomalib, an Aether application slice carries a mission critical video feed of a manufacturing / packaging line which is channeled into an anomaly detection edge-app. The edge app is trained using defect free data and uses probabilistic AI to detect anomalies like spoiled fruit (bananas). Given the time critical nature of detecting faults early, the app is built to work in a real time fashion over Aether to deliver results at line rate for typical industrial and packaging production lines.

Getting Started with Aether:

It is easy to get started using Aether Private 5G. Aether can be deployed by developers on a laptop using Aether-in-a-Box, a simple pre-packaged end-to-end development environment including RAN through mobile core. By making such a complete solution available in a footprint that can run on a laptop, developers can get started with minimal friction. Developers can then organically grow the test deployment at their own pace into a fully disaggregated production-grade deployment, including production-grade RAN radios, disaggregated UPF edge processing and cloud-native mobile core. This makes it easy to get started with Aether, while assuring developers that Aether can scale to meet the needs of even the most demanding commercial applications.

The ONF Community:

Aether has been an amazing collaboration between ONF engineering resources and an active community that includes: Aarna Networks, AirHop, AT&T, Binghamton University, China Mobile, China Unicom, Ciena, Cohere Technologies, Cornell University, Deutsche Telekom, Edgecore Networks, Facebook Connectivity, Foxconn, Google, GSLab, HCL, Intel, NTT Group, Microsoft, Princeton University, Radisys, Sercomm, Stanford University and Tech Mahindra.

About the Open Networking Foundation:

The Open Networking Foundation (ONF) is an operator-led consortium spearheading disruptive network transformation. Now the recognized leader for open source solutions for operators, the ONF first launched in 2011 as the standard bearer for Software-Defined Networking (SDN). Led by its operator partners AT&T, China Unicom, Deutsche Telekom, Google, NTT Group and Türk Telekom, the ONF is driving vast transformation across the operator space. For further information visit http://www.opennetworking.org

References:

To learn more about the project and join our growing community by reviewing the Aether documentation, by visiting the ONF booth at MWC Barcelona (#1F66), or registering here to be sent a pointer to the recorded demo to be released after MWC. Developers can also easily get started by running Aether-in-a-Box on a bare metal machine or VM.

GSA: Private Mobile Networks Summary-2022

Introduction:

The demand for private mobile networks based on 4G LTE (and increasingly 5G) technologies is being driven by the spiralling data, security, digitisation and enterprise mobility requirements of modern business and government entities. Organisations of all types are combining connected systems with big data and analytics to transform operations, increase automation and efficiency or deliver new services to their users. Wireless networking with LTE or 5G enables these transformations to take place even in the most dynamic, remote or highly secure environments, while offering the scale benefits of a technology that has already been deployed worldwide.

The arrival of LTE-Advanced systems delivered a step change in network capacity and throughput, while 5G networks have brought improved density (support for larger numbers of users or devices), even greater capacity, as well as dramatic improvements to latency that enable use of mobile technology for time-critical applications.

Private mobile networks are often part of a broader digital transformation programme in an organisation. This could include the introduction or development of cloud networking and other digital technologies such as artificial intelligence and machine learning, and data analytics. More and more applications of the private mobile network will use these capabilities combined with mobile connectivity.

In addition to companies looking to deploy their own private mobile network for the first time, there is a large group of potential customers that currently operate private networks based on technologies such as TETRA, P25, Digital Mobile Radio, GSM-R and Wi-Fi. Many of these customers are demanding critical broadband services that are simply not available from alternative technologies, so private mobile networks based on LTE and 5G could eventually replace much of this market.

The exact number of existing private mobile network deployments is hard to determine, as details are not often made public. To improve information about this market, GSA is now maintaining a database of private LTE and 5G networks worldwide.

Since the last market update, GSA has been working with Executive Members Ericsson, Huawei and Nokia on harmonising definitions of what counts as a valid private mobile network, and on harmonising sector definitions. That work has led to a restatement of some of GSA’s market statistics.

The definition of a private mobile network used in this report is a 3GPP-based 4G LTE or 5G network intended for the sole use of private entities, such as enterprises, industries and governments. The definition includes MulteFire or Future Railway Mobile Communication System. The network must use spectrum defined in 3GPP, be generally intended for business-critical or mission-critical operational needs, and where it is possible to identify commercial value, the database only includes contracts worth more than €100,000, to filter out small demonstration network deployments.

Private mobile networks are usually not offered to the general public, although GSA’s analysis does include the following: educational institutions that provide mobile broadband to student homes; private fixed wireless access networks deployed by communities for homes and businesses; city or town networks that use local licences to provide wireless services in libraries or public places (possibly offering Wi-Fi with 3GPP wireless backhaul) which are not an extension of the public network.

Non-3GPP networks such as those using Wi-Fi, TETRA, P25, WiMAX, Sigfox, LoRa and proprietary technologies are excluded from the data set. Furthermore, network implementations using solely network slices from public networks or placement of virtual networking functions on a router are also excluded. Where identifiable, extensions of the public network (such as one or two extra sites deployed at a location, as opposed to dedicated private networks), are excluded. These items may be described in the press as a type of private network.

GSA has identified 58 countries and territories with private network deployments based on LTE or 5G, or where private network spectrum licences suitable for LTE or 5G have been assigned. In addition, there are private mobile network installations in various offshore locations serving the oil and gas industries, as well as on ships.

GSA has collated information about 656 organisations known to be deploying LTE or 5G private mobile networks. Since the last update of this report in November 2021, some organisations have been removed from the database and this analysis, owing to a lack of evidence that they met the definition criteria. These examples may be added again in the future.

GSA has counted over 50 equipment vendors that have been involved in the supply of equipment for private mobile networks based on LTE or 5G. Commercial availability of pre-integrated solutions from several equipment providers increased in 2021; these solutions aim to simplify adoption of private networks, which should add market impetus. In addition, GSA has identified more than 70 telecom network operators (counting national operators within the same group as distinct entities) involved with private mobile network projects. Also, global-scale cloud providers (often referred to as “hyperscalers”) are offering private mobile network solutions, sometimes in partnership with mobile operators or network suppliers. Their ability to exploit mass-scale cloud infrastructure and their existing presence in commercial enterprises is likely to drive additional growth in the private mobile network market.

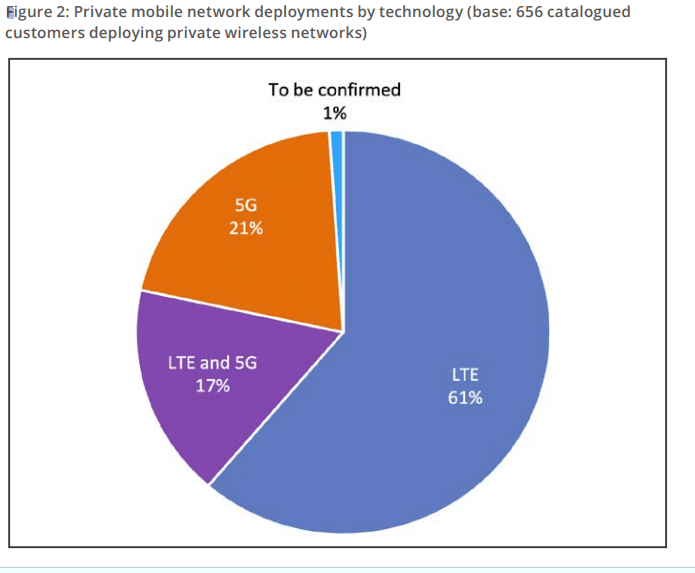

GSA has been able to categorise 656 customers deploying private mobile networks, which as Figure 1 shows, are located all around the world. Where organisations have subsidiaries in different countries or territories deploying their own networks, each subsidiary is counted separately. LTE is used in 78% of the catalogued private mobile network deployments for which GSA has data; 5G is being deployed in 38% of networks.

Dell’Oro Group forecasts a much smaller private wireless market share for 5G. They say LTE is dominating the private market in 2021 and 5G NR still on track to surpass LTE by the outer part of the forecast period, approaching 3 percent to 5 percent of the total 5G private plus public RAN market by 2026.

GSA also tracks the spectrum bands being used for deployments assigned specifically for local or private network purposes. Figure 4 shows that, including known spectrum assignments and deployments, C-band spectrum is the most widely assigned; TDD spectrum at 1.8 GHz comes second and is associated with the greatest number of identified deployments (more than 100 separate metro rail deployments in China). After that comes CBRS spectrum (also technically within the C-band but split out owing to the unusual way it has been assigned in the US).

There are more than 200 CBRS licensees, although they have not all been counted within the licence data, as it is not certain whether the spectrum will be used for public or private networks.

Telecom regulators are also showing signs of making increased allocations of dedicated spectrum available for private mobile networks — typically small tranches in specified locations. This could be acquired directly by organisations instead of by mobile operators, giving industries an alternative deployment model. Dedicated spectrum of this sort has already been allocated in France, the US, Germany and the UK, for example, and GSA expects this trend to be followed in other countries in 2022.

Note that owing to the removal of projects not meeting the new size requirement of at least €100,000, the counts are not directly comparable with those in the previous issue, although the patterns are the same.

GSA will be publishing further statistical updates covering the private mobile sector during 2022.

Acknowledgement: GSA would like to thank its Executive Members Ericsson, Huawei and Nokia for sharing general information about their network deployments to enable this dataset and report to be produced.

References:

https://gsacom.com/paper/private-mobile-networks-summary-february-2022/

NTT: Biggest challenges to effectively integrate private 5G into existing infrastructure and applications?

by Shahid Ahmed of NTT

Introduction:

For most countries, the public 5G networks are expected to enable users to experience a whole new level of connectivity. Enterprises are wanting to make the most of the network as well. While the public 5G networks do offer enterprise solutions and services, a private 5G network might just be the better option for them.

Why should enterprises consider a private 5G network?

Shahid Ahmed, Group EVP, New Ventures and Innovation at NTT Ltd.

…………………………………………………………………………………………………………………………….

As enterprises continue supporting wider digitization, the demands on secure and reliable connectivity solutions are increasing. NTT recently partnered with the Economist Impact and interviewed over 200 CIOs globally, and our findings show they expect to benefit from the improved data control, privacy, and security as the most anticipated outcomes of implementing private 5G networks followed closely by improving workforce productivity through automation.

Advanced connectivity is an essential element for industrial automation applications in manufacturing facilities, Automotive, Hospitals, and Warehousing Facilities. Hence, private 5G networks provide a single network for mission-critical operational technology (OT) using micro-slicing to support manufacturing workflow automation, autonomous guided robots, and machine vision AI applications.

For most industrial applications, the cost of ownership for private 5G wireless is better than alternative technologies operating in an unlicensed spectrum. The TCO of private 5G wireless networks is lower (when compared to WiFi) because these networks provide wider (especially outdoor) coverage requiring far fewer access points which means less overall infrastructure to install and manage.

What are the biggest challenges when it comes to effectively integrating private 5G into existing infrastructure and applications?

Through NTT’s recently conducted CIO survey alongside secondary research, our findings revealed that the most common (44%) barrier to deploying private 5G networks is integrating the technology with legacy systems and networks. The complexity surrounding the deployment and management of private 5G networks was also cited as another significant barrier by 37% of respondents given that 5G technology is still in the early stages of its adoption lifecycle. Employees lacking the technical skills and expertise to manage 5G networks was the third most common barrier facing 30% of firms.

In view of these challenges, organizations could consider outsourcing their private 5G deployment to a managed service provider who will have the expertise when it comes to implementing private 5G networks. This is likely to be the most common approach to private 5G adoption, preferred by 38% of survey respondents. Buying a private 5G network ‘as-a-service’ can accelerate the adoption process and offer a better end-user experience and return on investment for companies.

Additionally, it is important to integrate the private 5G network into business operational workflows. For example, in cases such as safety and maintenance, these business processes and employee and machine workflows must be directly integrated into the network.

Source – NTT

………………………………………………………………………………………………………………………

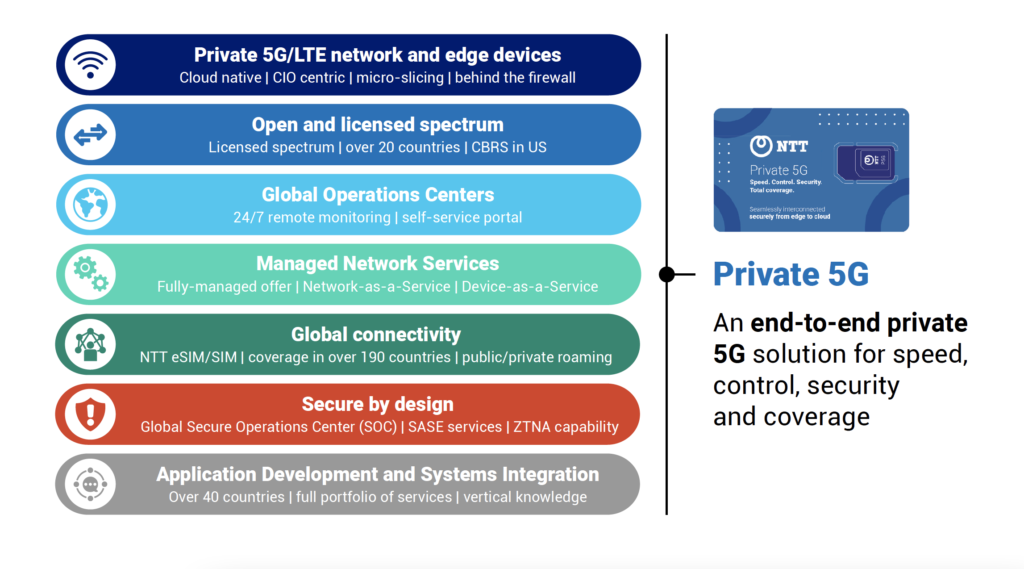

How is NTT helping enterprises with their private 5G adoption? Are there any use case examples to share?

We have a range of commercial out of the box use cases and device solutions available; for example, autonomous guided robots, machine vision worker safety PPE detection, machine vision AI smart factory and smart building solutions, group communication Push to Talk (PTT), AR/VR connected workforce, and automate manufacturing workflow solutions. These are just some examples of use cases NTT has curated internally or together with our partners.

NTT’s private 5G (P5G) fully managed Network as a Service (NaaS) solution is ideally suited for enterprises in need of better security, data management, and privacy supporting their wider enterprise digitization initiatives. NTT further provides system design and integration services to integrate the network existing systems and application and network management upon completion of the network. The solution is pre-integrated with leading network suppliers, offering clients the flexibility to seamlessly work with any industry-certified applications.

When it comes to cybersecurity, will private 5G enable enterprises to have better visibility and control over their network?

Security is the main draw for enterprises when it comes to private 5G adoption. This was also one of the key findings from the Economist Impact survey with 83% of executives citing it as the number one reason why they wanted to build a private 5G network.

Private 5G enabled networks are built around Zero Trust (ZTNA) principles leveraging SIM-based (multi-factor) authentication and authorization, enhanced end-user data encryption, enhanced authentication, and data encryption between network sub-components and network slicing.

Together, these enhancements provide end-to-end security and strict access control, through device authentication and protecting sensitive data with network isolation. It enables true granular micro[1]slicing capabilities where traffic within the facilities and warehouses can be segmented according to enterprise IT/OT SLA needs.

Lastly, the 5G network has been making headlines in the US over concerns it can affect aircraft radar. Should businesses be concerned if a private 5G network might affect other machinery in their plants?

With regards to concerns relating to 5G networks affecting aircraft radar, discussion among wireless carriers as well as the airline industry and regulators are still ongoing, and it is too early to speculate on the way forward.

Private 5G networks in the US are different than Public 5G. Additionally, most private networks in the US will leverage the CBRS band which is an FCC-approved and shared band, much further removed from the frequencies used for aviation altimeters systems while operating at much lower power than public 5G networks.

Similarly, the risks of deploying private 5G to an organization’s machinery is unlikely – and because the networks are custom, the individual network can be configured properly so there is ZERO RISK. Companies may benefit from leveraging a managed service provider who will be able to manage the infrastructure, implementation process, and any ongoing operational risks.

References:

https://techwireasia.com/2022/02/enabling-more-enterprise-use-cases-with-private-5g-networks/