Fiber deployments

Bell Canada buying Ziply Fiber for C$7 billion; will become 3rd largest fiber ISP in U.S.

Bell Canada (owned by BCE) has entered into a definitive agreement to acquire Ziply Fiber in a deal with a transaction value of around C$7 billion (C$3.65 billion in cash plus the assumption of debt). The acquisition is expected to close in the second half of 2025, subject to certain customary closing conditions and the receipt of certain regulatory approvals. Following the deal closure, Ziply Fiber, a fiber Internet provider in the Pacific Northwest of the U.S, will operate as a separate business unit and will continue to be headquartered in Kirkland, Washington.

BCE said the acquisition enhances Bell’s growth profile and strategic position by giving it a foothold in the large, underpenetrated U.S. fiber market. The deal will increase its scale, diversify its operating footprint and unlock significant growth opportunities. This deal would make Bell Canada the third largest fiber internet services provider in North America, after AT&T and Verizon. It follows Verizon’s recent announcement that it’s acquiring Frontier Communications for $20 billion.

Currently, AT&T passes 28 million locations with fiber, and Verizon passes 17.8 million.

AT&T says it will pass 30 million locations by the end of 2025 and may ultimately choose to pass 45 million locations.

Verizon says it will pass 30 milli

on locations after the Frontier buyout closes.

When the Ziply buy-out is finalized, Bell Canada will have about 9 million fiber locations, combining its 7.7 million locations in Canada with Ziply’s 1.3 million in the U.S. Bell Canada said it has a goal of passing 12 million fiber locations in North America by 2028.

Lumen’s original target for its residential Quantum Fiber expansion was 12 million locations, but the company cut its target to between 8 million and 10 million. Lumen expects to exceed 500,000 new passings in 2024.

………………………………………………………………………………………………………………………………………………………………………………….

Ziply was founded in May 2020 when it purchased network assets from Frontier in the states of Washington, Oregon, Idaho and Montana. The company was founded by CEO Harold Zeitz and Steve Weed, who’s the executive chairman. Ziply’s current owners are Wave Division Capital and Searchlight Capital, which are selling to Bell Canada.

Zeitz told Fierce Network about two-thirds of Ziply’s broadband footprint is currently fiber, and it’s working to overbuild its remaining copper plant with fiber. “In addition to building in the ILEC footprint, we’re also building outside that footprint in adjacent markets,” said Zeitz. By “adjacent markets” he was referring to the many towns “adjacent” to Ziply markets where Lumen Technologies is the main broadband provider. Ziply has a goal to build fiber in about 80% of its footprint, but it may expand that. And under Bell’s ownership it plans to build 20% faster.

“We just want to deliver a refreshingly great experience to all the towns in our four-state area,” Zeitz said. “We think there’s tremendous opportunity organically. There are 50-60 million households that don’t have fiber. I think over time we’ll see more acquisitions,” he added.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Analysts at AlixPartners said there are more than 400 small fiber providers in the U.S. that could be acquired by investors or larger fiber optic telcos. The firm conducted a survey in August of 60 executives at different fiber companies and 1,000 U.S. residents. According to the survey, 93% of respondents said consolidation is happening or will happen soon. “It’s clear based on the results that this is a buyer’s market—but sellers can use this knowledge to their advantage as well, the firm noted.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.nasdaq.com/articles/bces-bell-canada-buy-ziply-fiber-around-c-7-bln-cash-debt-deal

Verizon to buy Frontier Communications

Wall Street Journal reported today that Verizon is on the verge of buying Frontier Communications for as much as $7 billion in a deal that would bolster the company’s fiber network to compete with rivals notably AT&T. With a market value of over $7 billion, Dallas, TX based Frontier provides broadband (mostly fiber optic) connections to about three million locations across 25 states. Frontier is in the midst of upgrading its legacy copper landline network to cutting-edge fiber. Rising interest rates sparked fears among investors, however, that the business would run out of cash and not be able to raise more before completing those upgrades. Frontier has a 25-state footprint and serves largely rural areas. It reported sales of $5.8 billion in 2023, with about 52% of total revenue from activities related to its fiber-optic products and bills itself as “largest pure-play fiber internet company in the US.”

An all-cash deal between the two companies could be announced as soon as Thursday, a person familiar with the negotiations told Bloomberg.

Fiber M&A has heated up as telecom companies and financial firms pour capital into neighborhoods that lack high-speed broadband or offer only one internet provider, usually from a cable-TV company. New fiber-optic construction is expensive and time-consuming, making existing broadband providers attractive takeover targets.

Verizon, with a market valuation of around $175 billion, will be under pressure from shareholders to justify any big purchase after the company paid more than $45 billion to secure C-band 5G wireless spectrum licenses and spent billions more to use them. Executives have said they are focused on trimming the telecom giant’s leverage to put it on a firmer financial footing.

Verizon, the top cellphone carrier by subscribers, has faced increased pressure from competitors and from cable-TV companies that offer discounted wireless service backed by Verizon’s own cellular network. Faced with slowing wireless revenue growth and an expensive dividend, Verizon has invested in expanding its home-internet footprint. It has both 5G fixed wireless access (FWA) and its Fios-branded fiber to the premises network.

T-Mobile is the only major U.S. cellphone carrier that lacks a large landline business. Since its 2020 takeover of rival carrier Sprint, the company has focused on 5G dominance and succeeded in growing its cellphone business faster than rivals. That network has also linked millions of customers to its fixed 5G broadband service, which offers cablelike service over the air. T-Mobile’s strategy has shifted in recent months, however, as the company dabbles in partnerships and wholesale leasing agreements with companies that build fiber lines to homes and businesses. The wireless “un-carrier” in July agreed to spend about $4.9 billion through a joint venture with private-equity giant KKR to buy Metronet, a Midwestern broadband provider.

Photo Credit: Jeenah Moon/Bloomberg News

…………………………………………………………………………………………………………………………………………………………

A deal for Frontier would be a round trip of sorts for some of the network infrastructure that Frontier bought from Verizon in 2016 for $10.54 billion in cash. Frontier later filed for Chapter 11 bankruptcy in April 2020 as it burned through cash and was burdened by a heavy debt load. It emerged as a leaner business in 2021 with about $11 billion less debt and focused on building a next-generation fiber optic network.

Frontier’s biggest investors today include private-equity firms Ares Management and Cerberus Capital Management. The company drew the attention of activist Jana Partners last year, which built a stake in the business. Jana delivered a letter to Frontier’s board late last year asking the company to take steps immediately to help reverse its sinking share price, including a possible outright sale.

…………………………………………………………………………………………………………………………………………………………..

AT&T has focused on expanding its fiber network since spinning off its WarnerMedia assets in 2022 to Warner Brothers Discovery. AT&T has 27.8 million fiber homes/businesses passed, growing at ~2.4 million per year, plus more locations passed via its Gigapower joint venture. AT&T’s fiber internet business is expected to contribute to an increase in consumer broadband and wireline revenue. AT&T expects broadband revenue to increase by at least 7% in 2024, which is more than double the rate of growth for wireless service revenue. In contrast, Verizon only has about 18 million fiber locations, growing at about 500,000 per year.

Other recent deals in the fiber transport market sector include the $3.1 billion acquisition, including debt, of fiber provider Consolidated Communications in late 2023 by Searchlight Capital Partners and British Columbia Investment Management.

………………………………………………………………………………………………………………………………………………………….

It’s All About Convergence (fiber based home internet combined with mobile service):

Speaking at a Bank of America investors conference today, Verizon’s CEO for the Consumer Group Sowmyanarayan Sampath said when Verizon bundles Fios with wireless, it sees a 50% reduction in mobile churn and a 40% reduction in broadband churn. He said they don’t see the same benefits with FWA. Sampath was scheduled to speak at the Mobile Future Forward conference tomorrow, but he canceled at the last minute, which may be a sign that this deal for Frontier is imminent.

The analysts at New Street Research led by Jonathan Chaplin said Verizon’s rationale for the purchase is “convergence baby.” They wrote, wrote, “Verizon seemed complacent. No longer.” Indeed, Verizon CEO Hans Vestberg was challenged on the company’s second quarter 2024 earnings call by analysts who questioned whether Verizon had a big enough fiber footprint to compete in the future. The New Street analysts said Sampath’s comments today “marked a shift in rhetoric from: ‘convergence is important, but we can do it with FWA.”

The analysts at New Street wrote today, “We have been arguing for a couple of years that all the fiber assets would eventually be rolled up into the three big national carriers (AT&T, Verizon, T-Mobile). We always knew that if one carrier started the process, others would have to follow swiftly because there are three wireless carriers and only one fiber asset in every market with a fiber asset.”

Other potential fiber companies that the big three national carriers might be eyeing include Google Fiber, Windstream, Stealth Communications and TDS Telecom.

After its annual summer conference in August in Boulder, Colorado, the analysts at TD Cowen, led by Michael Elias, said there was a lot of conversation about the wireline-wireless “convergence” frenzy. “We believe convergence is a race to the bottom, but if one player is going in with a slight advantage (AT&T), the others must reluctantly follow,” wrote TD Cowen. In the mid-term they speculated that T-Mobile might look at fiber roll-ups with Ziply or Lumen (formerly or other regional players.

References:

https://www.wsj.com/business/deals/verizon-nearing-deal-for-frontier-communications-9e402bb4

https://www.fierce-network.com/broadband/verizon-rumored-buy-frontier-its-convergence-game

https://finance.yahoo.com/news/verizon-talks-buy-frontier-communications-180419091.html

https://videos.frontier.com/detail/videos/internet/video/6322692427112/why-fiber

Building out Frontier Communications fiber network via $1.05 B securitized debt offering

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Verizon Q2-2024: strong wireless service revenue and broadband subscriber growth, but consumer FWA lags

Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

Highlights of FiberConnect 2024: PON-related products dominate

The Fiber Broadband Association’s flagship conference, FiberConnect 2024, concluded July 31, 2024, in Nashville, Tennessee. It featuring 275 speakers and 286 exhibitors in the Expo Hall, with about half the attendees from operators and half representing vendors. The show provided a great opportunity to gauge the pulse of the fiber based broadband industry in North America.

AT&T’s leads the pack of U.S. fiber optic network service providers

AT&T and Verizon are spending billions of dollars to grow their existing fiber-optic networks and add to the millions of broadband clients they already serve, mostly in regions covered by their historical landline-telephone infrastructure. Meanwhile, T-Mobile has five partnerships with fiber-optic internet providers that could serve millions of customers in the coming years. There are other fiber based internet providers that mostly serve business customers. Those include Comcast Business, Frontier Communications, Lumen, and Google Fiber (which also serves residential customers).

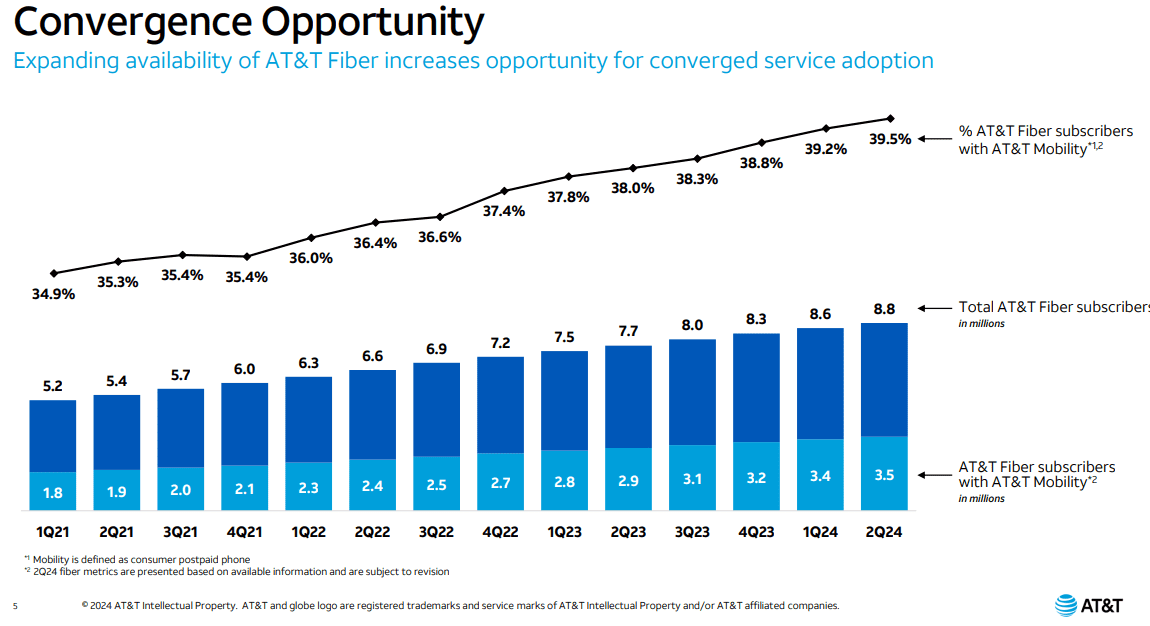

AT&T’s fiber business has remained incredibly strong, with fiber revenues growing almost 18% YoY. That led to strong top line EBITDA and EBITDA margin growth in 2Q-2024. There were 239,000 AT&T Fiber net adds in the quarter. AT&T has posted 200,000+ net fiber adds for 18 consecutive quarters – quite an enviable record. The company has managed to grow to 8.8 million total fiber subscribers, as average fiber revenue has gone up to almost $2 billion quarterly.

According to Seeking Alpha (subscription required), AT&T is substantially more reliable than Comcast, offers symmetric up and down bandwidth, and has no data caps. That makes it a much more pleasing experience. The company has worked to chase synergies with its AT&T mobility business, with not only fiber subscriptions growing, but the % of customers with AT&T mobility has grown as well. That ratio is now almost 40%.

“For the past four years, we’ve delivered consistent, positive results that have repositioned AT&T. Our solid performance this quarter demonstrates the durable benefits of our investment-led strategy,” said John Stankey, AT&T CEO. “AT&T is leading the way in converged connectivity as customers increasingly seek one provider who can seamlessly connect them in their home, at work and on the go. This is proving to be a winning strategy. Today, nearly four of every 10 AT&T Fiber households also choose AT&T wireless service. As the nation’s largest consumer fiber builder, we see this as an opportunity to continue to grow subscribers and revenues, while deepening customer relationships.”

Fiber investment drives valuable convergence opportunities:

• Wireless penetration of fiber subscribers has increased more than 400 bps since 2Q21

• Expansion of fiber footprint enables increased opportunities to sell into high quality cohort

• Converged customers are valuable and durable, with longer customer lives

“Our combined customers are happier customers,” AT&T CEO John Stankey said on a call with analysts. “Why a race to convergence? Because that’s a good way to make money, and it’s a good way to keep customers in the fold.”

AT&T CEO John Stankey meeting with fiber-optic workers at an Evansville, Ind., job site in 2022. Photo: Scotty Perry/Bloomberg News

References:

https://www.labs.att.com/story/2024/q2-earnings.html

https://seekingalpha.com/article/4708956-att-earnings-highlights-continued-recovery-potential

https://www.wsj.com/business/telecom/t-mobile-fiber-optic-internet-connection-380957ef

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

AT&T Internet Air FWA home internet service now available in 16 markets

China Telecom with ZTE demo single-wavelength 1.2T bps hollow-core fiber transmission system over 100T bps

China Telecom, along with its partners [1.], says it has launched the world’s first live single-wavelength 1.2T bps hollow-core fiber optics transmission system with unidirectional capacity over 100T bps.

Note 1. ZTE, Yangtze Optical Fibre, Cable Joint Stock Limited Company and Huaxin Design Institute were also involved in the project, which was deployed over a transmission distance of 20km in the live network of the All-Optical Network Technology and Application in the Intelligent Computing Era seminar of the CCSA TC618/NGOF.

ZTE optical transport equipment was used for project, alongside some improvements in spectral efficiency, baud rate optimization, and amplification optimization technologies. The system extends 41 C-band 1.2T bps and 64 L-band 800G bps wavelengths, and archives unidirectional transmission capacity of over 100T bps and a transmission distance of 20km in the field network.

This demonstration completed the hollow-core fiber deployment and large-capacity transmission between China Telecom’s Hangzhou Intelligent Computing Center and Yiqiao IDC. As a key node of China Telecom’s intelligent computing power layout “2+3+7+M”, the Hangzhou Intelligent Computing Center has been deployed with the 1k GPUs computing power of the China Telecom Cloud. It also hails ‘breakthroughs in hollow-core fiber fusion splicing technologies,’ such as low-power discharge and mode field matching related to the demonstration.

To meet the requirements for distributed computing power with large bandwidth and low latency of optical networks, ZTE used its advanced high-speed optical transport equipment. Combined with improvements in spectral efficiency, baud rate optimization, and amplification optimization technologies, the system extends 41 C-band 1.2Tbit/s wavelengths and 64 L-band 800Gbit/s wavelengths. It achieves a unidirectional transmission capacity of over 100Tbit/s and a transmission distance of 20km in the field network.

The hollow-core fiber cable, independently developed by YOFC, is deployed in the field network with multiple waterproofing solutions. For instance, water-blocking glue and double-layer plastic caps are used at the cable ends to isolate the atmosphere, a pulling unit with a swivel is employed for cable deployment to minimize wear on the end caps, and a horizontal waterproof cable closure is utilized at the fusion splice point. Additionally, breakthroughs in hollow-core fiber fusion splicing technologies, such as low-power discharge and mode field matching, have achieved 0.05dB fusion splice loss between hollow-core fibers and 0.25dB fusion splice loss with 54dB return loss between hollow-core fibers and standard solid-core single-mode fibers.

China Telecom’s Zhejiang branch said: “We have always maintained the leading position in the field of basic transmission networks. By undertaking the national key R&D project, we have demonstrated and verified the hollow-core fiber and 1.2Tbit/s transport system in the field network, and can offer detailed engineering data and demonstration applications. In the future, we will further cooperate with the industry to conduct research on a larger scope, and provide practical scenarios for the interconnection of distributed intelligent computing centers.”

China Telecom says they will continue to expand the hollow-core optical cable environment and build a platform for testing and verifying new technologies and applications oriented towards intelligent computing scenarios. This effort aims to continuously promote technological innovation and application expansion in the telecommunications industry.

……………………………………………………………………………………………………………………………………………

Separately, China Telecom received four awards at the “Asia’s Best Managed Companies Poll 2024” by FinanceAsia, a reputable financial magazine in Asia:

⚫ “Best Investor Relations in China” – Gold Award

⚫ “Best Managed Company in China” – Silver Award

⚫ “Best Telecommunication Services Company” – Silver Award

⚫ “Best Large-Cap Company in China” – Bronze Award

……………………………………………………………………………………………………………………………

References:

https://www.telecoms.com/fibre/china-telecoms-claims-a-world-s-first-hollow-core-fibre-demonstration

https://www.chinatelecom-h.com/en/media/news/p240730.pdf

ZTE reports higher earnings & revenue in 1Q-2024; wins 2023 climate leadership award

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

China Telecom, ZTE jointly build spatiotemporal cognitive network for digital transformation

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

Point Topic: FTTP broadband subs to reach 1.12bn by 2030 in 29 largest markets

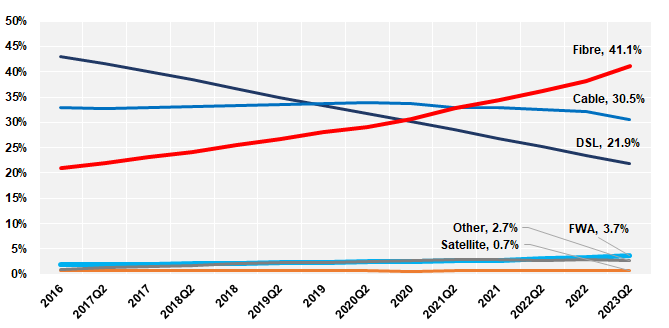

Point Topic forecasts 1.39 billion fixed broadband connections by the end of the decade in the 29 largest broadband markets in the world. Fiber to the Premises (FTTP) is already dominating most of the markets and it will be the preferred option for most consumers, where it is available.

Between 2023 and 2030 Point Topic projects a 15% growth in total fixed broadband subscribers in the top 29 markets. The growth will come mainly from FTTP – although the increase in the total fiber lines will be lower than that in Fixed Wireless Access lines – 25% and 61% respectively, the sheer number of already existing and new FTTP connections will drive the total growth.

Figure 1. Fixed broadband lines by technology (Top 29 markets)

………………………………………………………………………………………………………..

Split by technology we estimate that by 2030 there will be 1.12 billion FTTP, 149 million cable, 79 million FTTX, 16 million FWA[1] and only 28 million DSL lines in these markets.

Figure 2. Change in fixed broadband lines, 2023-2030 (Top 29 markets)

Figure 2. Change in fixed broadband lines, 2023-2030 (Top 29 markets)Cable is a term used as a proxy for those legacy MSOs/cablecos (e.g. Charter, VMO2, Comcast, etc.) that still have significant networks based on coaxial cable, mainly DOCSIS 3.0 and 3.1. We forecast some decline (-6%) in cable broadband lines by the end of the decade as these networks are being replaced with full fibre. The new generation DOCSIS4, which is in development, will match the capabilities of FTTH with XGPON, so markets with established cable networks will see a slight growth or stable take-up figures for ‘cable’ broadband lines.

FTTX (where fibre is present in the local loop with copper, mainly fiber to the cabinet) will decline over the next seven years (-19%). Some modest growth from new subscribers will remain in a few markets where legacy infrastructure is still widespread. Also, it will remain a cheaper option even where other technologies are available as it still offers enough bandwidth for some users.

DSL will see the largest decline at -44%. However, while being a slower and less reliable solution, it can provide enough bandwidth at a low price to some single or older households that are reluctant to upgrade. Besides, some of them will not have a choice of other technologies, especially in certain regions and markets.

………………………………………………………………………………………………………………

Figure 3. Fixed broadband penetration, 2023 and 2030 (top 29 markets)

…………………………………………………………………………………………………………………………

Point Topic only included FWA in its data in significant markets and where it was able to source reliable figures, such at the U.S., Canada, and Italy. Therefore, the total number of FWA subscribers could end up higher if FWA takes off in other markets.

In the U.S., T-Mobile US and Verizon are the FWA leaders with 8.6 million connections between them as of March 2024. T-Mobile recently added a new FWA service offer to its portfolio aimed at customers who might need a back-up for unreliable fiber or cable connections.

……………………………………………………………………………………………………………………..

China will be among the 16 markets with 90%-plus broadband penetration in seven years time. The potential for signing up new customers in those markets will shrink, leaving broadband providers with the task of converting existing customers to higher bandwidths and more advanced technologies for growth.

At the other end of the scale, there is still lots of room for broadband growth. India will have the lowest percentage of premises with a fixed broadband connection by 2030 at 33%, up from just 11% last year.

“There is significant growth to come in the ‘youthful’ markets with low fixed broadband penetration, with plenty of consumers in India, Indonesia and other fast-growing economies hungry for the advantages offered by fixed broadband and full fibre in particular,” Point Topic said.

……………………………………………………………………………………………………………………..

References:

https://www.point-topic.com/post/fttp-broadband-subscriber-forecasts-q4-2023

https://www.telecoms.com/fibre/fibre-to-drive-15-broadband-growth-by-2030

U.S. broadband subscriber growth slowed in 1Q-2024 after net adds in 2023

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

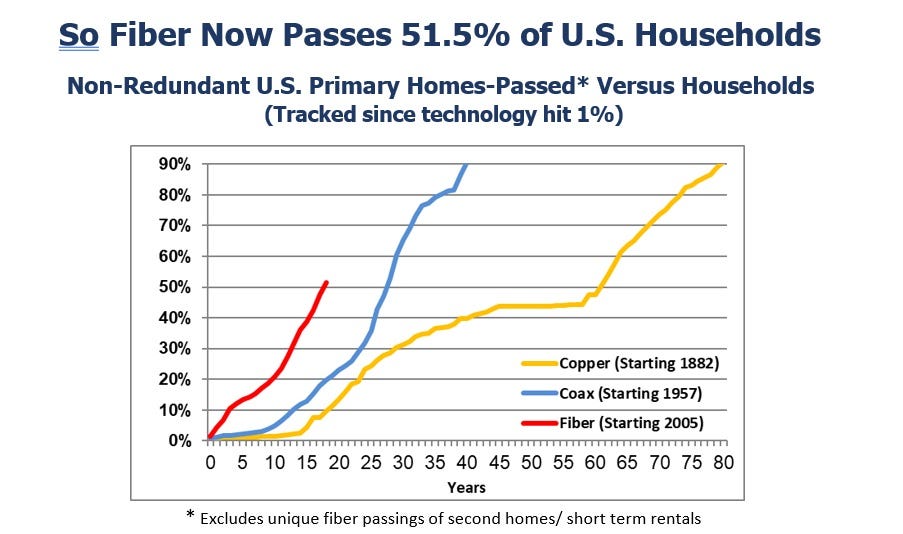

U.S. fiber rollouts now pass ~52% of homes and businesses but are still far behind HFC

Fiber optic network deployments have reached a milestone as they now pass more than 50% of U.S. households, according to recent report from the Fiber Broadband Association (FBA) [1.] and RVA Market Research and Consulting. Fiber broadband deployment set a new historical record in 2023, passing nine million new homes at a growth rate of 13% year-over-year. The 2023 North America Fiber Provider Survey, sponsored by the FBA, concluded that 77.9 million U.S. homes were passed with fiber, with nearly 52% of all the nation’s unique homes and businesses passed.

Note 1. The FBA is an all-fiber trade association that provides resources, education, and advocacy for companies, organizations, and communities that want to deploy fiber networks. The FBA’s goal is to raise awareness and provide education about the fiber deployment process, safe worksites, and effective fiber installs.

Image Credit: The Fiber Broadband Association (FBA)

………………………………………………………………………………………………………………………………………………………………………………………….

The last $10 billion U.S. Treasury American Rescue Plan (ARP) funding for infrastructure projects such as broadband networks is being distributed this year. The $42.5 billion in NTIA BEAD funding available over the next few years will significantly contribute to enabling and upgrading communities across America with the high-speed, low-latency broadband necessary for participation in today’s 21st-century society. We are seeing a steady stream of NTIA approvals and expect the first states to make BEAD awards in the second half of 2024.

Here’s how the growth of fiber has risen in recent years compared to coax cable (or hybrid fiber/coax, HFC) and the long history of copper.

“Thanks to this latest surge, fiber lines now pass nearly 78 million U.S. homes, up 13% from a year ago,” Alan Breznick, Heavy Reading analyst and the cable/video practice leader at Light Reading, explained in recorded opening remarks here at Light Reading’s 17th’s annual Cable Next-Gen event. Almost 69 million of those locations are “unique” fiber homes, meaning that about 9 million are passed by more than one fiber provider, Breznick added.

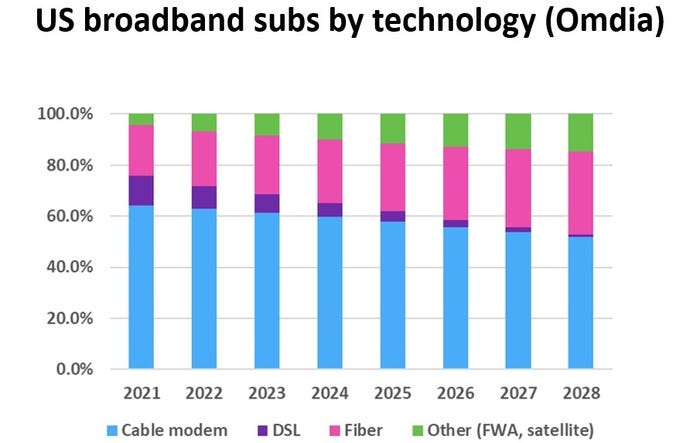

The share of broadband technology is also evolving. While HFC remains the primary way of delivering broadband, fiber-to-the-premises (FTTP) and fixed wireless access (FWA) will continue to make their presence felt in the coming years. Omdia (owned by Informa) expects cable’s share of that mix to drop over the next four years, hitting about 55% by 2028, while fiber’s share is expected to rise to 30% by that time, Breznick explained.

For the cable industry, fiber and FWA are not solely about competition. Many operators are also using FTTP extensively in greenfield deployments and subsidized rural buildouts. They are deploying it on a targeted basis via a new generation of nodes that can support multiple access technologies, including HFC and wireless.

CableLabs has put fiber-to-the-premises on the front burner via a pair of new working groups. A recent survey from Omdia shows that more than one-third of cable operators have already deployed passive optical networking (PON) in some form. That number will “undoubtedly keep rising” thanks to initiatives such as the Broadband Equity Access and Deployment (BEAD) program, Breznick said. Omdia expects spending on next-gen cable technologies to tick up in 2024 and 2025 and then reach a relatively steady annual state through 2029.

Meanwhile, operators such as Mediacom Communications have tapped into FWA to extend the reach of broadband in rural areas. Combined, they demonstrate some of the reasons why the industry has been shedding the “cable” label via rebranding efforts and name changes in recent years.

Cable’s broadband challenge is to grow broadband subscribers as it faces more broadband competition combined with historically low churn and a slow housing move market. “If it feels like an uphill battle for cable, maybe that’s because it is. But that doesn’t mean it has to be a losing battle,” Breznick said. “That’s because the cable industry still has plenty of tricks left up its sleeve.”

Those tricks include the use of next-generation DOCSIS 3.1 (sometimes called DOCSIS 3.1+ or extended DOCSIS 3.1) that can bump up speeds as high as 8 Gbit/s by opening up new orthogonal frequency division multiplexing (OFDM) channels. Some operators, including Comcast, Charter Communications, Rogers Communications, Cox Communications and Cable One, have begun to deploy DOCSIS 4.0 or have put it squarely on their network upgrade roadmaps.

And though cable operators’ network spending is expected to be down in the first half of 2024, vendors are optimistic that the spigots will start to open up again in the second half of the year as operators pick up the pace.

References:

https://www.lightreading.com/fttx/us-fiber-rollouts-reach-tipping-point-but-are-still-far-behind-hfc

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Nokia’s launches symmetrical 25G PON modem

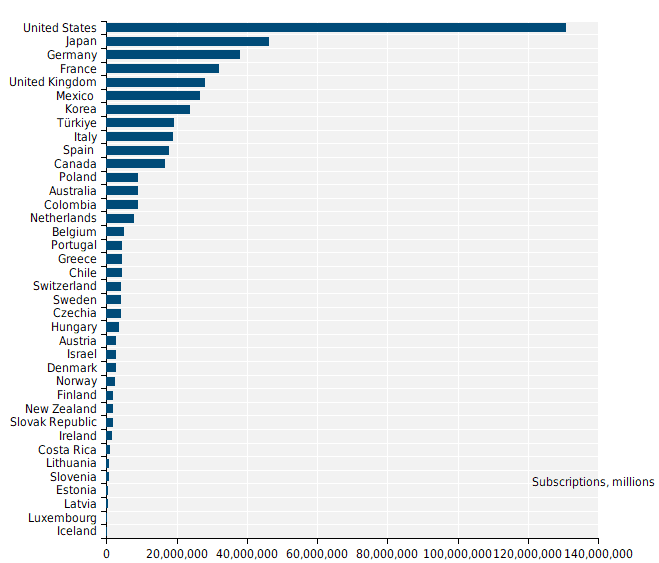

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

The latest OECD statistics show that Fiber and Fixed Wireless Access (FWA) have seen the strongest growth in fixed broadband technologies in three years. Fibre subscriptions have increased by 56% between June 2020 to June 2023, and FWA subscriptions have increased by 64%. The United States (252%), Estonia (153%), Norway (139%) and Spain (118%) led this FWA growth. The dynamism of fiber and FWA stands in stark contrasts to the decline in DSL (-24%).

Nine OECD countries have more than 70% of fibre connections over total broadband, with Korea, Japan, Iceland, Spain leading the way with the highest fibre penetration rates of 89%, 86%, 85% , and 84%, respectively. The highest fibre growth rates are in Europe, with Austria and Belgium having growth rates of 75% and 73% over the last year, closely followed by Mexico with a growth in fibre of 68%. Two other Latin American countries are in the top 7: Costa Rica and Colombia with fibre growth rates of 42% and 34%, respectively.

Mobile data usage per subscription grew substantially by 28% in one year passing from 10.2 GB to 13 GB per subscription per month in OECD countries as of June 2023. The amount of data consumed in countries vary greatly from 6 GB to 46 GB, with Latvia being the OECD leader.

Despite an already very high mobile broadband penetration in the OECD area, overall mobile subscriptions continue to grow by 4.6% over the last year, which totalled 1.8 billion as of June 2023, up from 1.74 billion a year earlier. Mobile broadband penetration is highest in Japan, Estonia, the United States and Finland, with subscriptions per 100 inhabitants at 200%, 192%, 183% and 161%, respectively.

Eighteen countries were able to provide the number of their 5G subscriptions separately from mobile broadband subscriptions. The share of 5G in total mobile broadband subscriptions is 23% on average for the OECD countries that provided this data.

Machine-to-machine (M2M) SIM cards grew 14% increase in one year. The two leading countries are Sweden with 238 M2M SIM cards per 100 inhabitants and Iceland (203), followed by Austria (179), the Netherlands (93) and Norway (76). Both Sweden and Iceland issue M2M SIM cards for international use.

Total number of fixed broadband subscriptions, by country, millions, June 2023:

……………………………………………………………………………………………………………………….

Bell and FirstLight: 3 new wavelength routes with triple redundancy and speeds up to 400G b/sec

In partnership with FirstLight Fiber, Bell Canada announced new, unique wavelength data routes this week with speeds up to 400G b/sec with triple redundancy between Secaucus, NJ, Toronto, and Montreal, Canada. These data routes, enabling triversity, are expected to be available in Q1 of 2024.

According to the statement, Bell launched 400G wavelength technology in April 2021, delivering increased speeds and the capacity required for large cloud and data centre providers. The technology is said to offer reliable, secure fibre-optic networks for the transport of voice, data, and video.

Additionally, Bell noted that, as Secaucus, NJ is a major data centre hub experiencing growth and increased customer demand, this development will support the company in enhancing network resilience. This improvement addresses the needs of customers requiring connectivity between Canada and the US.

The new routes will terminate at Equinix’s data centre campus in Secaucus, facilitating traffic flow into the U.S. and strengthening the networks for Bell customers.

The introduction of new routes brings triversity to Secaucus, offering alternative connections without the need to pass through New York City for two key routes.

The first route originates in Toronto, directly connecting to Secaucus. The second route from Montreal to Secaucus travels via Albany, creating a diverse pathway. The third route, also from Montreal to Secaucus through the Maritimes, passes through Manhattan.

These routes not only enhance accessibility to Secaucus but also contribute to triversity in New York City. Alongside the existing routes to New York City, these new connections with diverse paths include Toronto to Secaucus to NYC, Montreal to NYC via Albany, and Montreal to NYC via the Maritimes.

Bell Canada said these new routes will fortify its extensive footprint, enabling faster and more reliable data transport between major hubs in Secaucus, Toronto, and Montreal.

……………………………………………………………………………………………………………………………..

“With continued growth in data demand, – particularly because of cloud technology and AI delivered by leading telecom networks like Bell Canada – we are excited to fortify Bell’s extensive footprint further with these new routes, which will enable faster and more reliable data transport between the major hubs in Secaucus, Toronto, and Montréal.”

– Ivan Mihaljevic, SVP, Bell Wholesale

“Given the vast amount of bandwidth we expect AI will require, coupled with the criticality of network resilience, we are delighted to work with Bell Canada to offer these unique routes that provide bandwidth up to 400G, diversely routed between Canada and the United States.”

– Patrick Coughlin, Chief Development Officer for FirstLight.

Bell is Canada’s largest communications company,1 providing advanced broadband wireless, TV, Internet, media, and business communication services throughout the country. Founded in Montréal in 1880, Bell is wholly owned by BCE Inc. To learn more, please visit Bell.ca or BCE.ca.

Through Bell for Better, we are investing to create a better today and a better tomorrow by supporting the social and economic prosperity of our communities. This includes the Bell Let’s Talk initiative, which promotes Canadian mental health with national awareness and anti-stigma campaigns like Bell Let’s Talk Day and significant Bell funding of community care and access, research, and workplace leadership initiatives throughout the country. To learn more, please visit Bell.ca/LetsTalk.

|

1 Based on total revenue and total combined customer connections. |

FirstLight, headquartered in Albany, New York, provides fibre-optic data, Internet, data center, cloud, unified communications, and managed services to enterprise and carrier customers throughout the Northeast and mid-Atlantic connecting more than 15,000 locations in service with more than 125,000 locations serviceable by our more than 25,000-route mile network. FirstLight offers a robust suite of advanced telecommunications products featuring a comprehensive portfolio of high bandwidth connectivity solutions including Ethernet, wavelength and dark fibre services as well as dedicated Internet access solutions, data center, cloud and voice services. FirstLight’s clientele includes national cellular providers and wireline carriers and many leading enterprises, spanning high tech manufacturing and research, hospitals and healthcare, banking and financial, secondary education, colleges and universities, and local and state governments FirstLight was named a Top Workplace USA in 2022 and 2023.

………………………………………………………………………………………………………………………….

References:

Bell Canada Announces New High-Speed Data Routes With FirstLight

Bell MTS Launches 3 Gbps Symmetrical Internet Service in Manitoba, Canada

Bell Canada deploys the first AWS Wavelength Zone at the edge of its 5G network

Bell Canada Partners selects Google Cloud to Deliver Next-Generation Network Experiences

AWS deployed in Digital Realty Data Centers at 100Gbps & for Bell Canada’s 5G Edge Computing

Bell Canada Announces Largest 5G Network in Canada

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Rochester, N.Y., based Precision Optical Technologies (OT) has struck a multi-year “strategic partnership” with Charter Communications to upgrade the latter’s optical network. In alignment with Charter’s Distributed Access Architecture (DAA) network expansion and operational enhancement initiatives, this collaboration will see the deployment of nearly all of Precision OT’s active and passive portfolio of solutions; to include 10G DWDM tunable optics, 100G and 400G optics, Bluetooth® DWDM tuning modules, passive connectivity solutions and more. Precision OT didn’t announce the financial terms of the agreement.

Charter plans to upgrade about 85% of its HFC plant using a distributed architecture paired with a virtual cable modem termination system (vCMTS) and “high-split’ upgrades that dedicate more spectrum to the DOCSIS upstream. About 50% of Charter’s HFC plant will be upgraded to 1.2GHz of capacity and 35% will upgrade to 1.8GHz and a full deployment of DOCSIS 4.0. The remaining 15% of Charter’s footprint will be moved to 1.2GHz with a high-split but forgo DAA and a vCMTS.

Greg Mott, SVP Field Operations Engineering at Charter Communications said of the partnership, saying: “The team at Precision OT has a clear understanding of Charter’s broadband network evolution — cost, scale, and speed — and their mix of solutions will help us deliver on our commitments across our 41-state service area.”

Charter has also tapped Harmonic for the vCMTS component and selected Vecima Networks’ DAA platform, including remote PHY nodes. ATX Networks, which recently introduced a 1.8GHz platform that can be used to upgrade legacy Cisco nodes, is also expected to be in the mix at Charter. Teleste, a Finnish supplier that is boosting its investment in the North American cable market as operators push ahead with DAA and D4.0 upgrades, also has projects underway with Charter, according to industry sources.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

With a global footprint, Precision OT currently serves a diverse range of customers across various industries worldwide. Among its clientele are leading broadband service providers in North America, Europe, Latin America, and beyond. This partnership further solidifies Precision OT’s reputation as a trusted partner and solutions provider in the telecommunications and optical technology sectors.

“We are pleased that Charter Communications has chosen Precision OT as a trusted technology partner to deploy cutting-edge optical networking solutions,” said Keith Habberfield, SVP of Sales & Marketing at Precision OT. “Optics and their components are the integration point that enables networks to communicate. We provide a suite of solutions that work in all of Charter’s identified use-cases; this drives measurable operational simplicity and speeds deployments for their project.”

About Charter Communications:

Charter Communications, Inc. (NASDAQ:CHTR) is a leading broadband connectivity company and cable operator serving more than 32 million customers in 41 states through its Spectrum brand. Over an advanced communications network, the Company offers a full range of state-of-the-art residential and business services including Spectrum Internet®, TV, Mobile and Voice.

For small and medium-sized companies, Spectrum Business® delivers the same suite of broadband products and services coupled with special features and applications to enhance productivity, while for larger businesses and government entities, Spectrum Enterprise® provides highly customized, fiber-based solutions. Spectrum Reach® delivers tailored advertising and production for the modern media landscape. The Company also distributes award-winning news coverage and sports programming to its customers through Spectrum Networks. More information about Charter can be found at corporate.charter.com.

About Precision OT:

Precision OT is a systems integration company focused on end-to-end optical networking solutions, network design services and cutting-edge product development advancements. Backed by our extensive experience and robust R&D efforts, we play an integral role in enabling next-generation optical networks worldwide. For more information, visit www.precisionot.com.

References:

https://www.fiercetelecom.com/broadband/charter-plots-3-year-upgrade-deploy-docsis-40-2025

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers