fiber optics

AT&T Communications CEO optimistic about wireless revenue and fiber buildout

Speaking at Wells Fargo (Virtual) TMT Summit, AT&T Communications CEO Jeff McElfresh discussed momentum in AT&T’s wireless business, noting that AT&T’s consistent go-to-market strategy has driven improved market position supported by healthy wireless service revenue and EBITDA growth. McElfresh noted that over the past five quarters the company has delivered its best subscriber results in a decade, with nearly 4 million postpaid phone net additions, and 1.4 million fiber net additions. At the same time, wireless delivered its best-ever EBITDA in the third quarter of 2021, up 3.6% year over year.

McElfresh said his company added over 1.4 million fiber net adds in the last five quarters. That was based on AT&T’s conviction to reinvest in what they believe is a very future-forward technology in fiber that’s got superior advantages to any other kind of broadband connectivity offering (e.g. FWA, bundled copper pairs, cable, etc).

McElfresh told the audience that the company’s fiber expansion is “rekindling” its consumer broadband business and that he has a high degree of confidence that the company is hitting “game speed” when it comes to the number of homes passed with fiber that it is achieving every month.

AT&T had approximately 14 million homes passed with fiber as of year-end 2020 and is expected to increase that to 16.5 million homes passed by the end of this year. The company now has 5.7 million fiber to the premises/home customers, including Internet access, VPN, private line, virtual private line, etc.

McElfresh said that he believes AT&T has enough “weight” in the industry that it can work with vendors to overcome any supply chain delays (which the company warned about in July). He added that he has no concerns about achieving the 30 million locations by 2025 goal based upon the company’s current buildout pace. “I have no concerns about hitting the pace that we need to reach that,” he said.

“What I am focused on more than penetration levels is that we are demonstrating that we can step up our net add performance quarter to quarter.” In the third quarter, AT&T added 289,000 fiber customers which was down year-on-year from 357,000. However, the company also said that 70% of its net adds were new to AT&T.

To help entice consumers to switch to AT&T’s fiber network, McElfresh said that the company has a dedicated fiber team within its consumer wireline business that is working in neighborhoods to sell fiber optic based Internet access. He added that the telco is measuring the number of fiber net adds they can achieve in 30 days, 60 days and 90 days in those local markets. The company sees those fiber net add numbers accelerating during each of those time periods.

……………………………………………………………………………………………….

Looking forward, McElfresh is encouraged by underlying mobile industry trends and sees limited signs that suggest a near-term shift in demand levels. He said he believes AT&T’s momentum is sustainable with the company’s simplified plans, targeted subsegment approach, improved customer experience and network performance all helping AT&T retain and attract subscribers, leading to lower churn and increased customer lifetime value. Reiterating recent comments by CFO Pascal Desroches, McElfresh indicated that AT&T’s outlook for 2022 and beyond does not assume a continuation of outsized industry net adds. Should recent mobile industry trends continue, he believes the changes made to AT&T’s go-to-market strategy puts the company in a better position to capitalize on healthier than anticipated demand.

McElfresh noted that AT&T continues to see postpaid phone ARPU stabilizing in 2022 with an improvement in international roaming and subscribers adopting higher-ARPU plans balancing the impact of amortization accounting for device promotions. McElfresh said that fewer than a quarter of gross adds and upgrades in the third quarter traded in newer devices for premium promotional offers. As previously noted, only about 20% of AT&T’s postpaid smartphones are on Unlimited Elite – the company’s highest-ARPU and fastest-growing rate plan.

With postpaid phone ARPU stabilizing in 2022, AT&T expects higher wireless service revenues from a growing postpaid subscriber base. McElfresh also indicated that he believes AT&T can continue to profitably increase its wireless market share going forward and reiterated that the company continues to expect fourth-quarter EBITDA growth to exceed third-quarter levels.

When asked about fiber penetration levels, McElfresh responded, “What I am focused on more than penetration levels is that we are demonstrating that we can step up our net add performance quarter to quarter.” In the third quarter, AT&T added 289,000 fiber customers which was down year-on-year from 357,000. However, the company also said that 70% of its net adds were new to AT&T.

To help entice consumers to switch to AT&T’s fiber network, McElfresh said that the company has a dedicated fiber team within its consumer wireline business that is working in neighborhoods to sell fiber. He added that they are measuring the number of net adds they can achieve in 30 days, 60 days and 90 days in those local markets and they are seeing those numbers accelerate.

References:

https://about.att.com/story/2021/mcelfresh-wells-fargo-conference.html

https://www.fiercetelecom.com/broadband/atts-mcelfresh-company-hitting-game-speed-fiber-build

https://techblog.comsoc.org/2021/09/21/att-ceo-john-stankeys-30m-locations-could-be-passed-by-fiber/

Cowen Analysts: Telcos to lead FTTH buildout; total 82M homes to be passed by 2027

According to a new report titled Fiber to the Home: Navigating the Road to Gigabit America, a multi-sector by Cowen analysts, forecasts that telco fiber-to-the-home (FTTH) lines will pass 82 million American households by 2027, nearly double the 44 million households passed today. The four biggest U.S. wireline telcos (AT&T, Verizon, Frontier and Lumen) will account for the lion’s share of those deployments, together passing more than 71 million homes with fiber.

The Cowen report also projects that cable operators (cablecos or MSOs) will pass another 5 million homes with fiber lines over the next six years, largely because of Altice USA’s current big push in the New York metro area to match Verizon’s Fios rollout. Cable operators already pass about 5 million homes with fiber.

Overall, Cowen estimates that the US now has 50 million homes passed by fiber lines, with the telcos accounting for most of them. Here are a few other highlights from the report:

- Cowen expects state/federal funding of $130B for various broadband initiatives.

- That will close the digital divide and expand the addressable market for broadband access.

- FTTH will gain market share (compared to other fixed broadband access) to take ~70% of the net positive broadband subscriber adds by 2027.

- As a result, 35M FTTH subscribers (26% market share) are expected by 2027; up from 16M (14%) today.

- FTTH subs take speeds that are 54% faster than non-FTTH broadband subs.

- The increase in FTTH subs will lead to exciting next-gen home applications (not specified) and ARPU growth.

- FTTH subs have 13% higher ARPU compared to non-FTTH subs.

Large, midsized and small telcos will all participate in this massive fiber deployment, using FTTH to reverse nearly two decades of broadband market share losses to the cable industry, the Cowen analysts say. For instance, they project the nation’s biggest telcos will add a combined 7.7 million fiber subs over the next five years.

“The next few years will be historic in terms of telco FTTH upgrades, providing consumers speeds of 1 Gbit/s, closing the digital divide, expanding the total addressable market and achieving a ‘Gigabit America’,” the analysts wrote. “After years of hemorrhaging subscribers, we expect Big Telco to stem the tide of losses to Cable…”

However, the report does not say that telcos will be gaining broadband customers from cable operators. Instead, telcos will achieve broadband subscriber gains mainly by upgrading their own remaining 15 million DSL subs to FTTH.

“The cable decade of dominance of DSL-share stealing is over,” the analysts wrote, forecasting that the telcos will overtake the cable companies in broadband sub net gains by 2024. “Cable’s days of stealing DSL subs are over, though only losing modest share (DSL taking the brunt), as the focus will be on defense.”

The Cowen analysts expect cable’s broadband market share to drop very slightly from 61% today to 58% in 2027 while the telcos’ market share creeps up from 25% now to 27% in 2027.

“It’s far from doom-and-gloom for cable operators,” the analysts note. “With cable’s effective marketing plan and speed upgrades, the vast majority of subscriber losses will be from the 15 million DSL subscribers, not cable.”

The analysts expect fixed wireless access (FWA) to play a notable tole in the US broadband market by the middle of the decade, accounting for a small but increasing fraction of high-speed data customers throughout the 2020s. “FWA will establish a solid but niche foothold,” they wrote.

Cowen now expects U.S. service providers to add a collective 17 million broadband subs by 2027, enough to reach 97% penetration of occupied homes and 90% penetration of overall homes, up from 90% and 82% today. The analysts believe that broadband could achieve utility-like penetration levels of 98% or more, like wired phone service did at its peak last century.

All this fiber optic spending will be a boon for optical network equipment vendors. Specifically, the Cowen analysts single out Calix, Adtran, Ciena, Cisco, MasTec, Nokia and Juniper as likely beneficiaries.

The analysts also see potential for further market consolidation. Some scenarios they envision are Charter buying the Suddenlink portion of Altice USA’s footprint and Charter or Altice USA merging with T-Mobile to form a third converged player in the national market.

References:

Orange and Nokia demo 600Gb/sec transmission over a 914 km optical network; Nokia 25G PON

Nokia and Orange announced the completion of a network trial using the Nokia PSE-Vs, its fifth generation super coherent optics. With this field trial, Orange has successfully validated a planned upgrade of its long-haul backbone networks to support new high-bandwidth 400 Gb/sec services, and the ability to scale fiber capacity up to 600Gb/sec. This represents an increase in spectral efficiency by 50% compared to prior technologies on its long distance optical network.

The trial was performed in real-world conditions using Nokia PSE-Vs super coherent optics in production-ready optical transport hardware, just 16 months after the lab prototype trial done on Orange’s live network. Orange and Nokia demonstrated error-free performance at a data rate of 600Gb/sec over a 914 km network between Paris and Biarritz, under challenging live network conditions. The fiber network consisted of 13 spans of Orange’s existing network, through multiple cascaded reconfigurable optical add/drop multiplexers (ROADM), using 100GHz WDM spectrum channels.

Jean-Luc Vuillemin, Vice President of International Networks and Services at Orange, said: “With the booming market bandwidth requirement and need for scalability and flexibility, it is important that Orange continues to support an ever-greater network scale and new high-bandwidth services across our terrestrial and subsea global footprint.

Validating super coherent optics with Nokia represents an important enabler for future-proof networks which will bring spectral efficiency and operational deployment flexibility to our customer solutions. Furthermore this technology will allow for power savings by nearly 50%, which is key to our objective of developing greener networks for our customers. ”

James Watt, Head of Optical Networks Division, Nokia, said: “We are delighted to work with Orange in continued support of their network upgrade plans. With the introduction of the PSE-Vs super coherent capabilities across our entire 1830 portfolio, Nokia enables spectrally-efficient transport at 600Gb/sec over real-world long haul networks, and 400Gbps services over ultra long haul networks spanning multiple 1000’s of kilometers.”

Nokia 1830 Photonic Service Interconnect (PSE)

The Nokia PSE-V

The Nokia PSE-V is the industry’s most advanced family of digital coherent optics (DCO), powering the next generation of Nokia high-performance, high-capacity transponders, packet-optical switches, disaggregated compact modular and subsea terminal platforms. The PSE-V Super Coherent DSP (PSE-Vs) implements the industry’s only 2nd generation probabilistic constellation shaping (PCS) with continuous baud rate adjustment, and supports higher wavelength capacities over longer distances – including support for 400G over any distance – over spectrally efficient 100GHz WDM channels while further reducing network costs and power consumption per bit.

Further resources:

• Web page: Nokia 1830 Photonic Service Interconnect (PSI)

• Web page: Nokia Photonic Service Engine (PSE) Coherent DSPs

• Web page: 400G Everywhere

……………………………………………………………………………………………………………………..

Earlier this week, Nokia and Bell Canada announced the first successful test of 25G PON fiber broadband technology in North America at Bell’s Advanced Technical Lab in Montréal, Québec.

The trial validates that current GPON and XGS-PON broadband technology and future 25G PON can work seamlessly together on the same fiber hardware, which is being deployed throughout the network today. 25G PON delivers huge symmetrical bandwidth capacity that will support new use cases such as premium enterprise service and 5G transport. Nokia’s 25G PON solution utilizes the world’s first implementation of 25G PON technology and includes Lightspan and ISAM access nodes, 25G/10G optical cards and fiber modems.

For the past decade, Bell has been rolling out fiber Internet service to homes and businesses across the country, a key component in the company’s focus on connecting Canadians in urban and rural areas alike with next-generation broadband networks. With this successful trial, Bell can be confident that its network will absorb the increased capacity of future technologies and connect Canadians for generations to come.

Stephen Howe, EVP & Chief Technology Officer, Bell, said:

“As part of Bell’s purpose to advance how Canadians connect with each other and the world, we embrace next-generation technologies such as 25G PON to ensure we remain at the forefront of broadband innovation. Our successful work with Nokia to deliver the first 25G PON trial in North America will help ensure we maximize the Bell fiber advantage for our customers in the years to come.”

Jeffrey Maddox, President of Nokia Canada, said: “Nokia innovations powered the fiber networks and the connectivity lifeline that carried Canadian homes and businesses through the pandemic. 25G PON innovations will drive the next generation of advances in our connected home experience.”

Bell and Nokia have closely collaborated over the years on many industry breakthroughs, such as the first Canadian trial of 5G mobile technology in 2016. Bell continues to work with Nokia to build and expand its 5G network across Canada.

References:

Open Access Fiber Networks Explained; Underline’s Intelligent Community Network

In Open Access Fiber networks, the same physical network infrastructure is utilized by multiple providers delivering services to subscribers. The Open Access business model has been drawing attention globally as governments and municipalities find the concept of offering competition between providers and the freedom of choice for the subscriber is essential. It has also proved to be a feasible way to connect rural areas where service providers might have a hard time generating enough revenue to justify investing in their own network infrastructure.

Open access fiber networks can be the foundation for distributed healthcare, 5G, and resilient, modernized infrastructure—including responsible energy creation and secure community smart grids.

For subscribers to benefit from the freedom of choice and competition between providers that are delivering services using the same network infrastructure they will need a comprehensive way to browse the assortment of services offered.

Open Access network operators must keep track of:

- Every single subscriber in the network, their physical address, their “technical address” (switch, switch port, etc.).

- Which services they are buying from which provider/s.

- The total number of customers and/or services bought if you’re operating in a three-layer model where you have to report back to the network owners how their network is utilized.

……………………………………………………………………………………………………………………………………….

Already common in Europe with Sweden as the best known example, open access networks are just beginning to gain market traction in the U.S. While U.S. community-wide network operators like SiFi Networks and UTOPIA Fiber (Utah) have adopted a wholesale-like business model, newcomer Underline is taking a bit more of a direct approach.

“When people say open access in this country, they typically mean ISPs can come in and lease fiber and choose to build a given neighborhood that hasn’t been overbuilt yet. We mean something very different,” Underline CEO Robert Thompson told Fierce Telecom. “We are not a wholesale leaser of fiber. We are the fiber network literally to the doorbell.”

Underline isn’t just providing physical fiber-to-the-home infrastructure, but also a unified billing system and cybersecurity layer. The latter will allow the communities it serves to deploy smart city applications over an on-demand Layer 2 (Data Link layer) connection that will never touch the Layer 3 (Network layer) public internet, Thompson said.

“On the one hand, we directly face consumers and businesses, schools and so forth and we provide them network access connectivity and technology for a monthly connection fee. On the other hand, we look like a network infrastructure-as-a-service provider to the ISPs or content community,” Thompson said.

“We don’t provide IP,” he continued. “We’re going to move your traffic from your house ultrafast over fiber and we’re going to hand off you and your traffic to the internet service provider of your choosing. That ISP is then your IP, the routing of your traffic. They’re connecting you to that glorious world wide web,” he added.

Thompson said Underline will charge users directly on a monthly basis for connectivity, with their chosen ISP getting a portion of that cost. So, for instance, in the case where a subscriber takes a $65 per month symmetric gigabit plan, the ISP will get a $15 cut. Underline also plans to charge licensing and per subscriber fees for use of its technology stack.

Underline is now initiating construction in its first market: Colorado Springs, CO. The company will offer residential speeds up to 10 Gbps and enterprise service up to 100 Gbps, with qualifying households eligible to receive a discounted rate on Underline’s bottom tier symmetrical 500 Mbps plan.

The project will be completed in several stages, with a Phase I build set to connect 24,000 homes and 4,000 businesses with 225 route miles of fiber plant. Initial customers will include the the National Cybersecurity Center, the new Space Information Sharing and Analysis Center and Altia Software.

Thompson says that Phase II will cover roughly the same amount of ground and Underline also has a build agreement with an unnamed city “immediately surrounding” Colorado Springs. Taken together, construction in both phases and the second city will amount to “an exercise of approximately $125 million in total capital.”

“We are after this with a vengeance, and we are very thankfully supported by very strong capital,” Thompson said, noting a “drumbeat of steady announcements of drills in the dirt in new communities” is on the way.

Thompson said Underline is targeting communities with populations between 20,000 and 750,000. He noted that such communities have “historically been basically ignored by the incumbents (large telcos) and which by and large will not qualify” for federal support for broadband deployments.

Beyond that, he said Underline’s market assessments include factors like demand point density per fiber route mile, a population productivity ratio, a competition index and a social equity analysis. The latter is a key priority for Underline and “part of our social purpose,” Thompson explained.

“We want to understand and we actually want to target communities that have a significant portion of their demand points that have no internet at all or very poor internet at home because of socio economic status. This country’s got to have internet that’s fast, affordable and fair,” he concluded.

References:

https://www.fiercetelecom.com/operators/underline-has-a-different-vision-for-open-access-fiber-u-s

https://www.cossystems.com/about/open-access/

https://www.foresitegroup.net/what-you-need-to-know-about-open-access-networks-2/

Comcast Business Announces $28 Million Investment to Expand Fiber Broadband Network in Eastern U.S.

Comcast Business today announced a two-year $28 million project to expand its network across four Mid-Atlantic states is well underway, touting it as part of an effort to bring 1 to 100Gbps service to thousands of additional enterprises in the region.

Once completed, Comcast Business will have committed a total of more than $110 million in area network expansions since 2015, to benefit nearly 35,000 of the region’s largest companies and organizations.

The operator said that work is focused on deploying new and densifying existing fiber across parts of Delaware, Maryland, Virginia and West Virginia, as well as the District of Columbia. Approximately $13 million was already invested in the extensions in 2020, with an additional $15 million set to be spent this year to deliver service to a total of nearly 7,000 new businesses.

The network expansion delivers speeds up to 1 Gigabit per second (Gbps) for small and medium-sized businesses and up to 100 Gbps for larger enterprises and will support the ability to bring new customers online quickly with advanced services, including fast business Wi-Fi for employees and guests, cybersecurity solutions, 4G LTE backup, business TV and more. Additionally, businesses of all sizes now will have access to a comprehensive portfolio of Comcast Business products and services to help meet the day-to-day demands that require large amounts of bandwidth, linking multiple sites or branch locations or connecting offices to third-party data centers.

The latest expansion deploys new fiber optic cable or densifies existing fiber services across the following areas:

- Delaware: Georgetown, Ocean View, Rehoboth Beach and Smyrna

- Maryland: Eastern Shore, Frederick and Montgomery County

- Virginia: Ashburn, Dulles, Harrisonburg, Leesburg, Lynchburg and Richmond; planned investments include Front Royal, Tysons Corner and Warrenton

- Washington, D.C.

- West Virginia: Huntington and Martinsburg

“Comcast’s infrastructure investment in Virginia supports our business community and helps us attract new businesses to the Commonwealth,” said Brian Ball, Virginia Secretary of Commerce and Trade.

Ed Rowan, senior director of Comcast Business Sales Operations in the Beltway Region, said in a press release:

“The ability to offer both diversity of network and carrier is becoming increasingly important to help drive economic development and transformation. Connectivity is at the core of this and, more than ever, is an integral factor as businesses expand and prepare for what’s next. Our network expansions across Comcast’s Beltway Region are the latest example of the significant technology investments we’ve made to increase the availability of our multi-Gigabit Ethernet services. These investments will help foster economic development, transform our local communities, and better meet next-generation capacity needs across the region.”

Comcast’s vast and growing fiber footprint spans 29 regional networks in 39 states and includes:

- An enhanced fiber optic network, with more than 150,000 miles of fiber, that provides high- speed, high quality, and high-definition services to a number of large companies

- A support structure made up of thousands of professionals with the knowledge and experience to handle any situation

- MEF-certified carrier class Ethernet that delivers standardized, scalable, and reliable Metro Ethernet solutions – at a service and hardware level

Comcast’s nationwide fiber optic network:

References:

Orange España: commercial deployment of 10 Gbps fiber in 5 cities

Orange’s new 10Gbps fiber access will be at Love Total Plus and Love Total Plus 4 rates for residential customers, and at Love Empresa 3 and 5 rates for freelancers and small businesses. Adopting this speed will mean an increase of 10 euros /month on the price of the same.

In the 10Gbps offered by Digi, only 8Gbps was obtained, and it is expected that in the case of Orange it might be similar. It remains to be seen, what actual performance it offers.

References:

Orange launches 10Gbps symmetric fiber for individuals and companies, first in five major cities

STL Launches Accellus End-To-End Fiber Broadband And 5G Wireless Solution; India’s PLI scheme explained

India based telecom equipment company STL (Sterlite Technologies Limited) has launched Accellus, its flagship solution for 5G-ready, open and programmable networks. This new product line raises the position of STL as a provider of disruptive solutions for Access and Edge networks. For the past 5 years, STL has been investing in research and development to expand its capabilities in converged networks based on fiber optic broadband and Open RAN.

………………………………………………………………………………………………………………………………………………

India’s PLI Scheme

The Cellular Operators Association of India (COAI), which represents service providers and network equipment vendors, said that the production-linked incentive (PLI) scheme will boost local manufacturing, exports and also create employment opportunities. STL plans to take advantage of that initiative. Nokia (through its India subsidiary) said the guidelines were an encouraging initiative by the government towards making India a global manufacturing hub. “Nokia is committed to this vision with our Chennai factory that manufactures telecom equipment from 2G to 5G-making for India and the world.”

“India is already the second largest telecom market globally and this will go a long way in making the country a global hub for telecom innovation,” said SP Kochhar, director general, COAI.

………………………………………………………………………………………………………………………………………………..

STL’s Accellus is built on this industry-leading converged optical-radio architecture. The company expects the global adoption of this decision to accelerate at a rate of 250% on an annual basis, stimulating better TCO for customers and gross margin for shareholders. Accellus will allow four main benefits for network builders – scalable and flexible operations, faster time to market, lower TCO and greener networks.

Accellus will lead the industry’s transition from tightly integrated, proprietary products to neutral and programmable converged wireless and optical networking solutions. It offers wireless and fiber-based solutions:

1. 5G multiband radios: Exhaustive portfolio of RAN radios with single and multiband macro radios. Co-developed in partnership with Facebook Connectivity to build total availability for Open RAN-based radios

2. Internal small cells: O-RAN compliant, highly efficient internal 5G small cell solution, with level 1 edge treatment

3. Wi-Fi 6 access solutions: Outdoor Wi-Fi 6 solutions providing carrier-class public connectivity in dense environments

4. Intelligent RAN Controller (RIC): An Open RAN 5G operating system that allows the Open RAN ecosystem to use third-party applications to improve performance and save costs

5. Programmable FTTx (pFTTx): A complete solution that offers programmability and software-defined networks in large-scale FTTH, business and cellular sites (FTTx) networks

Commenting on the launch of Accellus, Philip Leidler, Partner and Consulting Director, STL Partners, said: “One of the goals of the O-RAN alliance was to expand the RAN ecosystem and encourage innovation from a wider base of technology companies worldwide. the message is the last indication that this goal has been achieved. “

Commenting on the launch of Accellus, Chris Rice, CEO of Access Solutions at STL, said: “Disaggregated 5G and FTTx networks based on open standards are becoming more common for both greenfield and brownfield deployments. These networks will require unprecedented scalability and flexibility, possible through an open and programmable architecture. STL’s Accellus will unlock business opportunities for our customers and provide a immersive digital experience worldwide.”

Optical fiber has evolved in its maturity and in its form factors to drive the infrastructure medium for the “wireline” side of the network. It continues to be the preferred medium for high-speed network delivery, Rice said.

“What network infrastructure is needed for 5G to become a reality and deliver expected Performance?”

Answer: “Upgrade the network backhaul and core IP infrastructure for the expected growth in bandwidth that 5G Applications will enable. The necessity of wireline 5G upgrades sometimes does not get the attention it deserves; this includes IP equipment (e.g. cell site routers) and the necessary fiber upgrades to the cell sites.

Perform the network planning for the new cell site builds required to get the coverage and capacity required for ubiquitous 5G at the speeds users expect. For 5G to pay off for Telcos, there have to be new capabilities and services to sell that deserve higher price points from consumers and business users.

Ensure that operational automation is available to keep operating costs reasonable, especially as the number of cell sites grows. CAPEX is typically only 20 to 25% of the Total Cost of Ownership (TCO) for a RAN, meaning that operating costs are 3X to 4X what CAPEX is. The RAN Intelligent Controller (RIC) is an example in ORAN / Open RAN that helps Telcos fulfil this need in an open way. It is essentially the operating system for Open RAN. It provides a platform for third-party applications to deliver these operational benefits and automation.”

How Is STL Helping Industry Stakeholders to Explain to Government Officials the Importance of Fiber for 5G or High-Speed Broadband?

Answer: “Network speed in the RAN air interface is essentially meaningless without the ability to ensure that the connected IP network can backhaul the required bandwidth. This fact necessitates additional fiber deployments to the existing cell sites (where it does not exist) and to new cells sites.”

In conclusion, Rice opined, “Our (STLs) newest business unit, the Access Solutions BU, focuses on fiber broadband and 5G wireless products. These products are based on open networking principles and give STL the opportunity to participate in the disruption that is occurring in the open networking markets, like ORAN and Open RAN initiatives. While Access Solutions BU is new, it has an R&D and innovation heritage of almost four years. During that time, a top talent team has been put in place, fundamental technology and innovation have been developed and matured, and now a well-defined product roadmap has been put in place as the BU launches many new products in its Accellus product line.”

References:

https://telecomtalk.info/5g-ecosystem-in-india-to-pli-scheme/468656/

IQ Fiber to launch service in Jacksonville, FL after majority investment from SDC Capital Partners

Start-up network operator IQ Fiber has received a majority investment from SDC Capital Partners, which also owns a 48% stake in Midwest fiber provider Allo Communications. The transaction provides IQ Fiber with significant equity funding to complete the first phase of its all-fiber network build, passing more than 60,000 homes in the Jacksonville area.

“Consumers deserve a smarter internet choice,” said IQ Fiber CEO Ted Schremp. “High-speed internet has become a necessity and is truly the heartbeat of the modern home. With the launch of IQ Fiber, Jacksonville residents will soon have access to a state-of-the-art, 100% fiber-optic network with gigabit upload and download speeds, simple subscription plans and service experts who live and work in our community.”

“We are thrilled to partner with IQ Fiber in its initial launch in Jacksonville and are excited about the larger opportunity in Northeast Florida and beyond,” said Clinton Karcher, partner at SDC. “IQ Fiber’s commitment to providing exceptional customer service, coupled with state-of-the-art fiber network infrastructure in an underserved market, creates a formula for success.”

IQ Fiber plans to offer simple month-to-month rates with no hidden fees, surcharges or surprise price increases. IQ Fiber’s three service plans will deliver symmetrical internet speeds between 250 and 1,000 Mbps, with whole-home Wi-Fi service always included.

Fiber to the home represents the state-of-the-art for the delivery of broadband services, yet it is accessible to only 36% of the U.S. population. Compounding the consumer challenge, approximately 83 million Americans can only access broadband through a single provider. With today’s announcement, Jacksonville will soon have the freedom to choose a 100% fiber-optic network with simple, no-hassle plans, supported by local experts.

Though its initial plan will see it offer service in Jacksonville starting in early Q2 2022, CEO Ted Schremp said the company is eyeing an opportunity to expand across at least four counties, including Duval (where Jacksonville is located), Clay, Nassau and St. Johns.

“That four county area represents an opportunity for us that is five times bigger than our initial Phase I build,” he said. “So we know we’ve got not just opportunity to get this first 60,000 that we’ve announced, but plenty of additional opportunity as we go forward just inside this little corner of Florida that’s growing as quickly as it is.”

The company is deploying an XGS-PON fiber network and plans to offer three service tiers with symmetrical speeds of 250 Mbps for $65 per month, 500 Mbps for $75 per month and 1 gig for $85 per month. Those prices include taxes as well as whole-home Wi-Fi, Schremp said. While it’s not alone in providing the latter, he pitched it as a differentiator for consumers who just want simplicity and a good customer experience. The company states on its website:

Our 100% fiber-optic network is built for the modern home. With symmetrical speeds, your entire can stream, game, and work from home all at the same time and it won’t slow you down.

“A gig to the side of your house is useless if you went to Best Buy and bought a router five years ago and are just bumping along, and the average consumer just really doesn’t know how to contend with that,” he said. “The reality is they’re looking at the service provider to solve that for them and certainly that’s good for us in terms of the management of churn and the delivery of the full speeds.”

More than anything, Schremp said IQ Fiber is “trying to be what the incumbents are not. The incumbents here are Comcast with their traditional HFC [hybrid fiber coax] service, AT&T with some fiber build and a lot of legacy DSL and we know it can be done better,” the CEO said. “We certainly know that consumers react positively to choice. They certainly are irritated by the practices of many of the incumbent providers. And we’re trying to deliver the converse of that.”

References:

https://www.fiercetelecom.com/operators/iq-fiber-prepares-to-take-at-t-comcast-florida

Analysts: Combined ADTRAN & ADVA will be a “niche player”

ADTRAN is positioning its acquisition of ADVA as building a complementary combination of assets that can better capitalize on what it sees as an unprecedented investment cycle in fiber. However, analysts argue that the new combined company would still be just a “niche player” in the market.

On Monday, ADTRAN wrote in an email to this author (and many others):

ADTRAN has entered into a business combination agreement with ADVA, a Germany-based global leader in business ethernet, metro WDM, Data Center Interconnect and network synchronization solutions, to combine our two companies.We believe our combination will create many opportunities to better serve end-to-end fiber networking solutions spanning metro edge, aggregation, access and subscriber connectivity. Additionally, we anticipate that by utilizing our collective world-class R&D teams, we will be better positioned to accelerate innovation and offer differentiated solutions.Going forward, it will be business as usual and all existing customer, partner and supplier relationships will remain intact. Until we receive all required regulatory approvals and close the transaction, ADVA and ADTRAN will continue to operate as separate companies. As we integrate the two companies, we will be focused on the best ways to offer our enhanced value proposition and partner with you.

Highlights of the Deal:

- Combination expands product offering and strengthens position as a global fiber networking innovation leader with combined revenue of $1.2B

- Highly complementary businesses create a global, scaled end-to-end provider to better serve customers with differentiated fiber networking solutions, spanning metro edge, aggregation, access and subscriber connectivity

- Creates a stronger and more-profitable company, poised to benefit from the unprecedented investment cycle in fiber, an expanded market opportunity and increased scale

- Meaningful value creation with over $50 million in annual run-rate cost synergies

- All-stock transaction with ADTRAN shareholders to own approximately 54% and ADVA shareholders to own approximately 46% of the combined company, assuming a tender of 100% of ADVA shares

- Combined company to be dual-listed on the NASDAQ and Frankfurt Stock Exchange

The two vendors produced a combined $1.2 billion in revenues last year. However, ADTRAN’s presentation in support of the deal showed that market heavyweights Nokia, Ciena, and smaller player Infinera had much higher revenues over that same time period.

The two vendors produced a combined $1.2 billion in revenues last year. However, ADTRAN’s presentation in support of the deal showed that market heavyweights Nokia, Ciena, and smaller player Infinera had much higher revenues over that same time period.

“It’s not going to reshape the optical networking industry,” John Lively, principal analyst at LightCounting, told SDxCentral about the deal. “ADTRAN and ADVA are going to improve their position in combination, [but] don’t really threaten the large players.”

Companies that are potentially threatened by this deal are smaller competitors such as Infinera ($1.4 billion in 2020 revenues) and Calix ($500 million in 2020 revenues), Lively noted.

“The challenges pressured by the global pandemic have clearly shown that fiber connectivity has become an essential foundation for the modern digital economy,” ADTRAN Chairman and CEO Thomas Stanton explained to investors about the deal. “This transformation will significantly increase the scale of the combined businesses, enhancing our ability to serve as a trusted supplier to our customers and worldwide.”

Stanton added that “our combination will make us one of the largest western suppliers for the markets we serve. Our greater size will increase cross-selling opportunities to existing customers, accelerating our combined growth, and allowing us to further penetrate our target markets.”

Although ADTRAN will remain a mid-tier player after the deal closes, LightCounting’s Lively and Dell’Oro Group VP Jimmy Yu both think in general, “it’s a good move.”

Yu noted that industry mergers can destroy value if too many products and workforces overlap. But in this case, ADTRAN and ADVA are from adjacent markets of fixed access and optical layer, and both sides will help each other grow the product line, so “it seems like a complementary combined company that’s going to come out of this,” he added.

Jimmy had this general comment on optical network trends:

“Disaggregated DWDM systems outperformed the broader market, demonstrating the growing adoption of this platform type. Really what we see is that this type of platform architecture, where transponder units are independent of the line systems, is being more widely embraced beyond the Internet content providers. Also, it is no longer just for metro applications. Recently, the highest growth rates have been from long-haul applications,”

Lively noted that there is almost no overlap in the product line, and “for the networks, the two companies logically fit together [as] ADTRAN makes access to equipment and ADVA makes the gear that connects the access equipment to the core.”

“So if you are a smaller service provider, and you want to upgrade to 10 Gb/s internet service for your customers, you could potentially buy everything you need from the new ADTRAN, from the passive optical networking, all the way through to connect to the core,” he said.

Yu also mentioned that the deal will help increase the scale and diversity in products as ADTRAN will be able to offer access and a backhaul solution, especially in tier-two and tier-three markets where most service providers want to work with one solution company instead of multiple vendors.

“2022 should be positive for sales,” argued the analysts at WestPark Capital in a note to investors earlier this month, following the release of Adtran’s second quarter results.

The WestPark Capital analysts pointed out that ADTRAN stands to gain ground in part from government broadband funding, as well as moves by some American and European network operators away from China’s Huawei.

The Raymond James analysts concurred on the Huawei opportunity. “We believe that the Huawei backlash outside of China presents among the largest opportunities,” they wrote on Monday.

The combined company will maintain ADTRAN’s global headquarters in Huntsville, Alabama. It will maintain ADVA’s headquarters in Munich, Germany, as its European base. Currently, ADTRAN has a geographical revenue split of 74% in the Americas, 21% in Europe, the Middle East, and Africa, and 5% in Asia Pacific, while ADVA is split 62% in EMEA, 29% in the Americas, and 9% in Asia Pacific, according to Stanton.

The deal expands ADVA’s presence in North America and ADTRAN’s ability to reach the European market more effectively, Lively said. One of the drivers for this combination is “we see our customers making significant capital investments to transition their supply chains to trusted vendors with our roots in the U.S. and Germany, our company will be viewed favorably by customers who increasingly specify Western vendors,” Stanton explained.

“It’s kind of a race to build out their digital infrastructure to make the country competitive,” which presents a real opportunity for the new ADTRAN and also its competitors, Lively added.

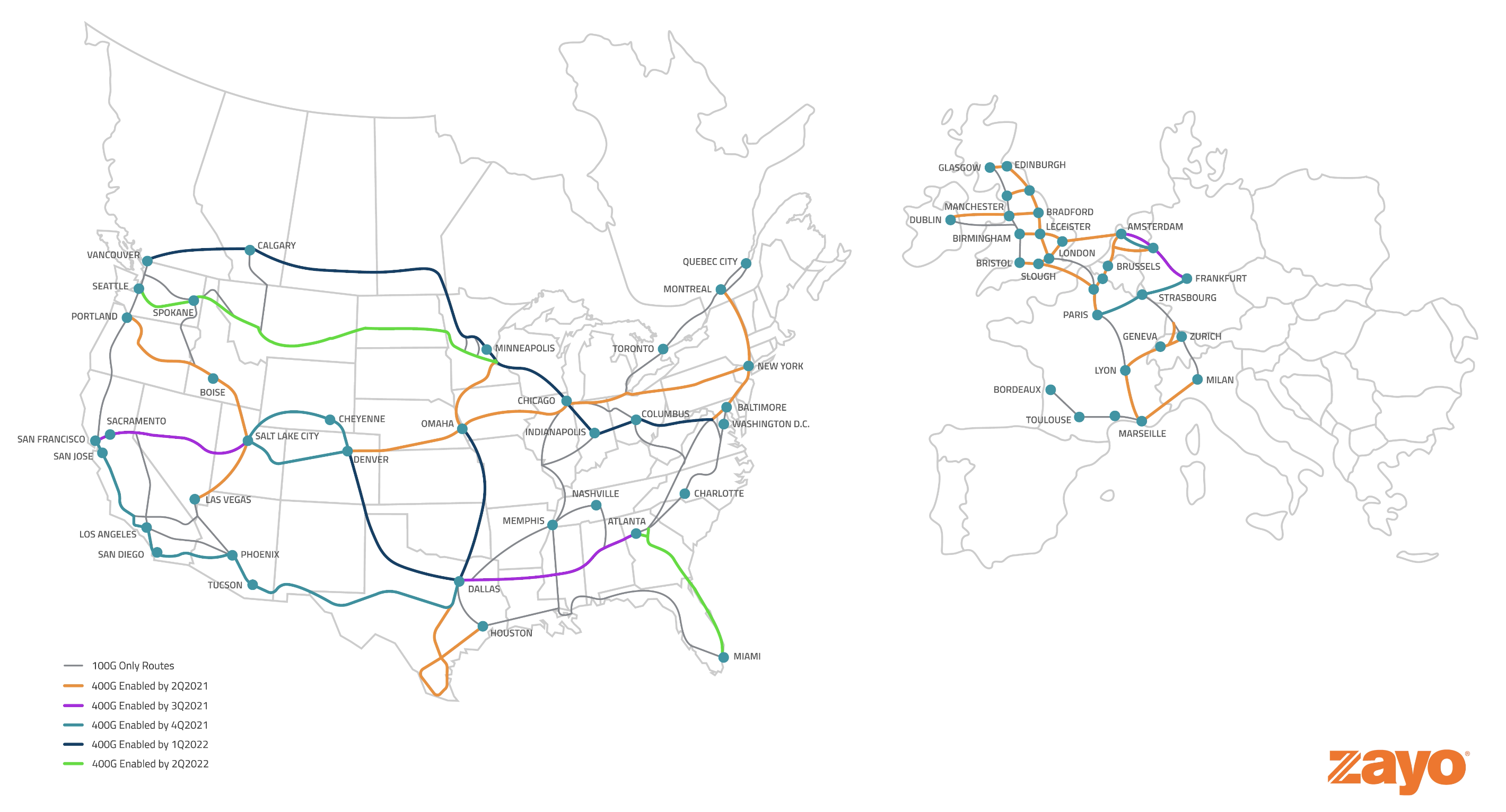

Zayo to deploy 400G b/s network across North America and Western Europe

Zayo Group Holdings today announced the planned deployment of 31 high capacity, 400G b/s enabled long haul routes across North America and Western Europe.

The availability of 400G b/s client-side wavelength capabilities will enable Zayo to deliver multi-terabit capacity across its underlying global network, enabling higher transmission rates, reduced cost per bit, increased data transfer speeds and significantly greater bandwidth capacity — key features that support enterprises on their digital transformation journeys. Up to 800G transmission will be available in select areas as Zayo deploys significant speed enhancements in anticipation of future network needs.

This optimized wavelength network is designed to provide a direct route for multi-cloud and multi-market connectivity, ideal for content providers, hyper-scalers, carriers and data centers. The upgrade will also enable reduced physical space requirements as well as reduced operation and maintenance costs resulting from a 40% reduction in power consumption.

The race to 400Gb/s has accelerated in recent years, with an increasing number of users, applications and devices driving exponential demand for increased bandwidth. Exceeding the current standard of 100G, Zayo’s new routes will provide a fourfold increase in maximum data transfer speed, supporting 5G technologies including Internet of Things, cloud-based computing, edge computing, virtual reality, high-definition video streaming and artificial intelligence.

“400G is rapidly becoming the prevailing requirement for networks and Zayo is breaking new ground with its 800G capabilities,” said Brian Lillie, Zayo Chief Product and Technology Officer. “This deployment underscores Zayo’s commitment to maintaining the leading edge of communications infrastructure and providing state-of-the art network solutions critical to our customers’ digital transformation journeys.”

C Chart courtesy of Avery Anderson of Zayo Group

Chart courtesy of Avery Anderson of Zayo Group

About Zayo Group:

Zayo’s 126,000-mile network in North America and Europe includes extensive metro connectivity to thousands of buildings and data centers. Zayo’s communications infrastructure solutions include dark fiber, private data networks, wavelengths, Ethernet, dedicated internet access and data center connectivity solutions.

Zayo owns and operates a Tier 1 IP backbone and through its CloudLink service, Zayo provides low-latency private connectivity that attaches enterprises to their public cloud environments. Zayo serves wireless and wireline carriers, media, tech, content, finance, healthcare and other large enterprises. For more information, visit https://zayo.com

References: