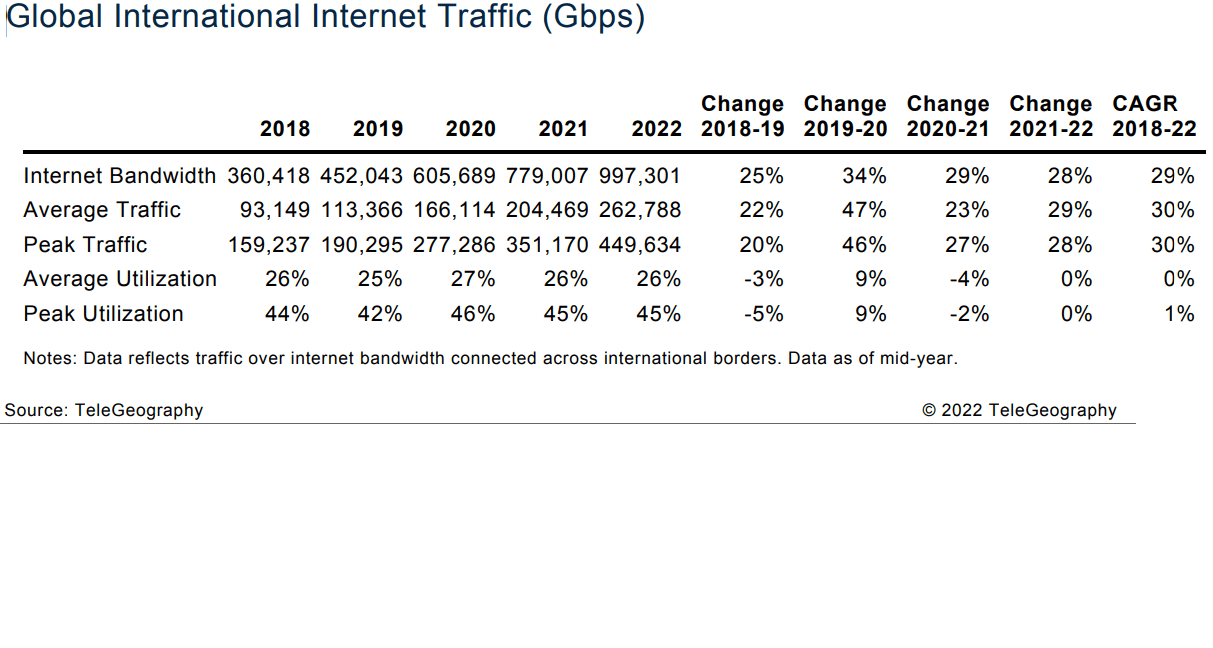

Telegeography: Global internet bandwidth rose by 28% in 2022

According to Telegeography, Global internet bandwidth rose by 28% in 2022, continuing the return to “normal” from the pandemic-generated bump of 2020.

Total international bandwidth now stands at 997 Tbps, representing a 4-year CAGR of 29%. COVID bump aside, the pace of growth has been slowing. Still, we do see a near tripling of bandwidth since 2018.

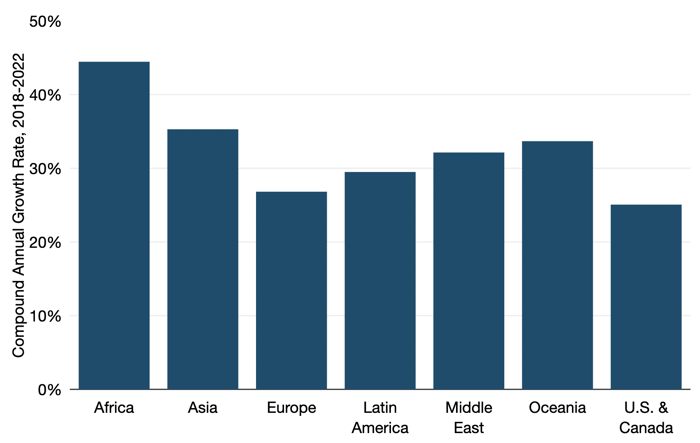

Strong capacity growth is visible across regions. Africa experienced the most rapid growth of international internet bandwidth, growing at a compound annual rate of 44% between 2018 and 2022. Asia is behind Africa, rising at a 35% compound annual rate during the same period.

Source: Telegeography

Both average and peak international internet traffic increased at a compound annual rate of 30% between 2018 and 2022—slightly above the 29% compounded annual growth rate in bandwidth over the same period. All the stay-at-home activity associated with COVID-19 resulted in a spike in traffic from 2019 to 2020. Average traffic growth dropped from 47% between 2019-2020 to 29% between 2021-2022, while peak traffic growth dropped from 46% to 28% over the same time period.

Prices for Internet Service:

ISPs shift to predominantly 100 Gbps internet backbones continues to reduce the average cost of carrying traffic and enables profitability at lower prices. As a result, price erosion remains the universal norm. It reflects the introduction of competition into new markets and the response of more expensive carriers to lower prices. Trends in the IP transit market generally follow regional trends of the transport market. And while some have suggested that price erosion may slow as a result of recent inflation and supply chain constraints (as it has in the wavelength market), we have not seen this trend make its way into the IP transit market.

Across the cities included in the figure below, 10 GigE prices fell 16% compounded annually from Q2 2019 to Q2 2022. Over the same period 100 GigE port prices fell 25%. In Q2 2022, the lowest 10 GigE prices on offer were at the brink of $0.09 per Mbps per month. The lowest for 100 GigE were $0.06 per Mbps per month.

The sharper decline in 100 GigE reflects the advanced maturity of 10 GigE, as well as more carriers offering it and more competition. While 10 GigE remains a relevant increment of IP transit, particularly in more emerging markets, its share of the transaction mix continues to yield to 100 GigE. In 2022, providers indicated that a majority of their sales mix in key U.S. and European hubs was now 100 GigE. On average, across the cities noted, the Monthly Recurring Charge (MRC) for a 100 GigE port was 6.7 times the MRC for a 10 GigE port. Operators are poised to adopt 400 GigE IP transit ports as the next fundamental upgrade from multiple 100 GigE ports.

Outlook:

The combined effects of new internet-enabled devices, growing broadband penetration in developing markets, higher broadband access rates, and bandwidth-intensive applications will continue to fuel strong internet traffic growth. While end-user traffic requirements will continue to rise, not all of this demand will translate directly into the need for new long-haul capacity.

A variety of factors shape how the global internet will develop in coming years:

• Post-COVID-19 growth trajectory. Initial evidence suggests that the spike in the rate of bandwidth and traffic growth in 2020 from the pandemic was a one-time event and we have largely returned to more traditional rates of growth. Operators we spoke to indicated they no longer see the pandemic leading to upward adjustments to their demand forecasts.

• IP Transit Price Erosion. International transport unit costs underlay IP transit pricing. As new international networks are deployed, operational and construction costs are distributed over more fiber pairs and more active capacity, making each packet less expensive to carry.

• We already see a major shift from 10 GigE requirements to 100 GigE requirements and expect that 400 GigE will emerge in two to three years as a significant part of the market.

• The introduction of new international infrastructure also creates opportunities for more regional localization of content and less dependence on distant hubs. As emerging markets grow in scale, they too will benefit from economies of scale, even if only through cheaper transport to internet hubs.

• International versus domestic. While there’s little doubt that enhanced end-user access bandwidth and new applications will create large traffic flows, the challenge for operators will be to understand how much of this growth will require the use of international links. In the near-term, the increased reliance on direct connections to content providers and the use of caching will continue to have a localizing effect on traffic patterns and dampen international internet traffic growth.

• Bypassing the public internet. The largest content providers have long operated massive networks, these companies continue to experience more rapid growth than internet backbones and they are expanding into new locations. Many other companies, such as cloud service providers, CDNs, and even some data center operators, are also building their own private backbones that bypass the public internet. As a result, a rising share of international traffic may be carried by these networks.

References:

https://blog.telegeography.com/internet-traffic-and-capacity-remain-brisk

Verizon launches 5G Ultra Wideband Innovation Hub with the University of South Carolina; Spectrum Update

Verizon and the University of South Carolina are exploring how 5G Ultra Wideband (mmWave) can transform industries including manufacturing, healthcare and civil infrastructure, among others. To do this, Verizon and the university launched the Innovation Experience Hub, powered by Verizon 5G housed in the McNair Center in Columbia, SC where students, faculty, entrepreneurs, and corporate partners can collaborate to test and create new solutions powered by Verizon 5G Ultra Wideband, which is available in select areas.

Innovators at the hub will leverage 5G connectivity and solutions to help improve manufacturing processes with quality sensing and defect detection. In healthcare, they’ll test how 5G can enhance emergency response by enabling remote health monitoring and real-time analysis of patient vitals, as well as hospital connected asset management, to streamline asset retrieval and dispatch operations. When it comes to civil infrastructure, researchers will examine how 5G communications can enhance monitoring of roads and bridges with condition analytics and reporting, as well as drone-based visual inspection of roads, bridges and buildings, using AI-driven computer vision.

- Verizon brings 5G Ultra Wideband service to Innovation Hub at University of South Carolina housed in the McNair Center.

- With Verizon 5G Ultra Wideband, innovators can develop and test real-world 5G solutions for use cases such as manufacturing, healthcare and civil infrastructure.

- Initial projects will include manufacturing quality inspection and defect detection, healthcare connected asset management, and drone-based visual inspection of roads and bridges.

“Working with the University of South Carolina, we have a great opportunity to collaborate with dozens of partners to ideate and develop new 5G-powered solutions leveraging the latest technologies, including large-scale IoT, artificial intelligence, computer vision and augmented reality,” said Jennifer Artley, Verizon Business Senior Vice President of 5G Acceleration. “Verizon is the network America relies on. Giving researchers access to Verizon 5G Ultra Wideband, with its high bandwidth and low latency, can accelerate the innovation process, leading to new solutions that will transform how enterprises operate and grow.”

“Our relationship with Verizon exemplifies the benefits of partnerships between the University of South Carolina and the business community,” university president Michael Amiridis said. “This aligns with our focus on expanding research opportunities that solve problems and accelerate discoveries.”

This engagement is part of Verizon’s broader strategy to partner with enterprises, startups, universities, national labs and government/military organizations, to explore how 5G can disrupt and transform nearly every industry. Verizon operates several 5G Labs in the U.S. that specialize in developing use cases in industries ranging from healthcare to public safety to entertainment. In addition, Verizon is collaborating with various customers to establish 5G Innovation Hubs on-premises as part of an ongoing initiative to co-innovate and create new 5G applications.

Regarding Verizon’s wireless spectrum deployments, CEO Hans Vestberg told a Goldman Sachs Investor Conference last week:

“We have US 150 million POPs (Points of Presence) with the C-band and just reminder to all, we started in the first quarter deploying the C-band. That’s the pace we have right now and we have said that we’re going to pass plus or more than 175 million POPs by year end.

So this is going faster, but as you rightfully said, we’re using — we have 161 megahertz nationwide. We’re so far using 60 megahertz. We’re getting into 100 megahertz. We’ve talked a little bit about some market have 200 megahertz. So we have so much way to go here and improving the network. And what we see so far is of course, where we launch a C-band, we have a much higher step up ratio in those markets, which is a good indicator of that the C-band is really making difference.”

References:

https://www.verizon.com/about/news/verizon-launches-5g-innovation-hub-university-south-carolina

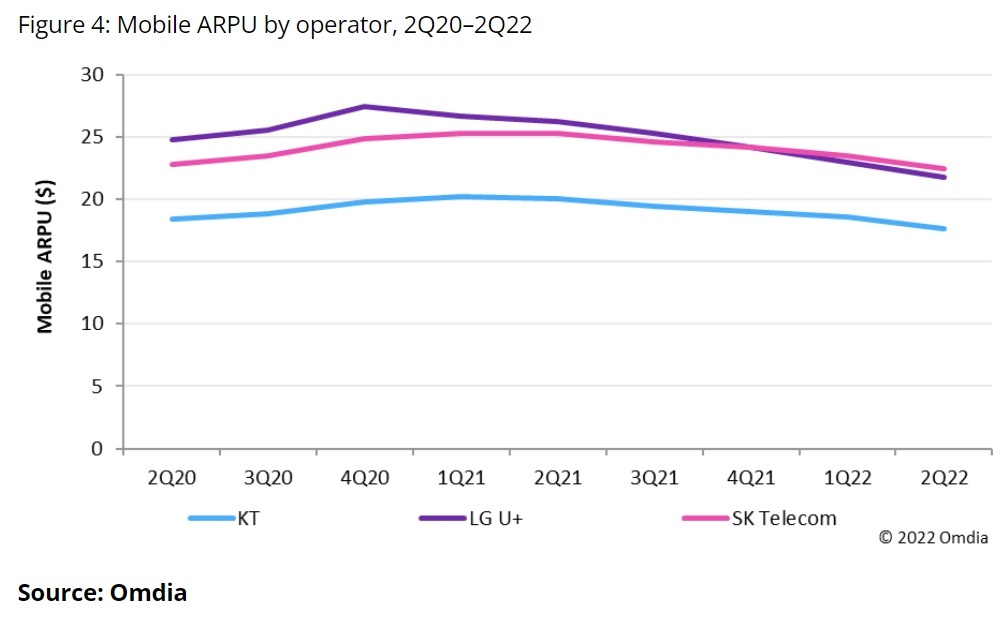

Omdia: ARPU declining or flat for South Korean 5G network operators

A new research report from Informa owned consulting firm Omdia finds that the average revenues per user (ARPU) are now falling for the three big South Korean 5G network providers. That follows two previous years of rising ARPU.

“After two years of consistent growth, mobile ARPU is back in decline for KT Corp and LG U+ while maintaining relatively flat for SK Telecom, with 5G subscription growth and revenue growth stalled,” wrote Omdia analyst Anshika Gandotra in a recent report.

“Initially, the launch of 5G stopped the declining ARPU trend. However, mobile ARPU has been declining since 1Q21. Mobile operators made diverse efforts to meet customers’ varying needs. SK Telecom started offering new 5G price plans at a 30% cut in rates for online-only mobile plans.”

“Additionally, LG U+ reduced the cost of 5G plans. South Korea has shown early signs of 5G market maturation because the top-tier customers have now upgraded to 5G services. Other customers seem more resistant to upgrading at the moment, thereby slowing down 5G growth.”

South Korea is often viewed as a bellwether for the 5G business, largely because the country was first in widescale 5G deployment and its regulator collects detailed information about the adoption of the technology. As of August 2022, there were 24.53 million 5G subscribers in South Korea, accounting for around 33% of all mobile subscriptions in South Korea. Perhaps more importantly, 5G networks are now carrying roughly 70% of all mobile data traffic in the country. That’s mainly because the average 5G user consumes around 27GB per month, or nearly 3.1x the average 4G user.

This September, Mobile World reported that ARPU at:

- SK Telecom, with the highest 5G penetration (38.7 per cent), was flat in Q2-2022.

- LG U+, with 34 per cent on 5G plans, posted a third consecutive quarterly dip in ARPU in the quarter, falling 4.1 per cent.

- KT with 32 per cent of subscribers using 5G services bucked the downward trend. ARPU rose for the fourth straight quarter, increasing 3.2 per cent.

Loud and Clear Message:

Obviously, there is no pent up demand for faster 5G services. App makers have not brought to mass market services like autonomous driving that would require more firepower. Customers can watch Netflix and surf the net well enough with existing 5G technology. Telcos have adapted by diversifying. To make the quantum leap to the highest-speed 5G will require the roll-out of essential services that need such fast connections.

“When households begin to have robots at their homes, for instance, telcos would then start ramping up infrastructure investments, so the highest-speed 5G will be partially available around 2025,” said Kim Hyun-yong, an analyst at Hyundai Motor Securities.

The lesson for other countries racing toward 5G may be: curb your enthusiasm. The new technology holds great promise, but for now there will still be as much evolution as revolution in the high-speed internet future.

References:

https://omdia.tech.informa.com/OM025134/5G-in-South-Korea–2022

https://www.lightreading.com/5g/a-concerning-arpu-trend-shows-up-in-south-koreas-5g/d/d-id/780403?

AT&T CEO at Goldman Sachs Conference: Fiber and 5G are huge growth drivers

AT&T CEO recently spoke at the Goldman Sachs Communicopia + Technology Conference. Stankey reiterated that AT&T continues to take a disciplined and return-focused approach to growth and investment and made the following points:

- The company continues to add customers in its strategic focus areas of 5G and fiber. Stankey shared he feels comfortable with AT&T’s business trajectory and the continued customer demand it is seeing. Overall industry postpaid phone volumes remain healthy, and AT&T’s consistent go-to-market approach, along with an improved customer experience, is attracting high-value customers. That’s in sharp contrast to Verizon which is losing post paid mobile customers. “We are still going to have a negative net adds on phones in the third quarter,” Verizon CEO Hans Vestberg said Wednesday at the Goldman event.

- Stankey said AT&T is developing diversified sources of growth, with wireless share gain in specific customer cohorts, such as the public sector and large and mid-sized business. He expects this momentum to continue thanks to a strong distribution ecosystem, a high-performing workforce and enhanced network quality strengthened by recent mid-band 5G spectrum deployments. He also added that recent pricing actions are performing as anticipated, supporting the company’s view that these actions will be accretive in the latter half of the year.

- Stankey shared that AT&T Fiber continues to deliver the best customer experience in the marketplace and that he’s pleased with the penetration rates for new fiber build. As AT&T expands to new markets, the company has seen first-year penetration rates about two times greater than historical norms. Stankey expects subscriber momentum and current penetration rates to continue based on the company’s improved ability to build fiber effectively and the strong customer demand for the product. Fiber ARPU continues to grow, and the company is seeing higher than anticipated uptake of its multi-gig fiber offerings.

- At the end of the last quarter, AT&T had over 6.5 million fiber customers. The company continues to expand its fiber footprint and has the ability to serve 18 million customer locations in more than 100 metro areas with AT&T Fiber. Stankey shared there may be an opportunity to expand the company’s fiber footprint based on the attractiveness of returns and that government subsidies supporting public-private partnership are expected to help drive broadband expansion.

-

There are three major sensitivities in a fiber business case. One is the rate of penetration, one is the ARPU and one is the cost to build. Cost to build isn’t going to move dramatically typically speaking. Nobody is going to come out with a new way to put fiber out that takes 30% out of the cost of building fiber. It uses relatively mature technologies like digging trenches that aren’t going to see that kind of rapid change. ARPUs are not only strong. They’re stronger than what we expected. We’re seeing higher uptakes when we offer 5 gig in the market than what we would have expected when we put a 5-gig product out there. And if the rate of penetration is twice as fast as we expected, that will tell you that there are homes that in previously, two years ago when we did this, we said maybe weren’t economical that now because of our execution in the market and we sustain that become economical.

Second point, government has brought in a pretty substantial amount of public subsidy, $45 billion-ish. And remember, that’s just the public portion of the subsidy. What people miss is nobody expects that when one of those locations get built, that it’s going to be done on a 100% public financing, it’s going to be done on a public private partnership.

And right now, on public monies that are coming in, for example, when we’re participating, oftentimes, $3 of private capital come in to match $1 of public capital. I don’t expect that, that ratio will probably hold as we get to some of these more difficult areas to build. But $45 billion, if it’s 1:1, could be $90 billion, right? And when you start thinking about that dynamic of how that opens up an opportunity in the market previously uneconomic areas to build. If that starts to work its way through the process next year, I would expect that AT&T is going to be an active participant in that process. And we’re going to look at it based on what I described earlier is we’re looking at places where we’re turning down existing copper infrastructure, where we have opportunity to keep scale and go in and fill in holds, that’s going to naturally cause us to lean in to doing some of that stuff going forward. And I would expect that will probably alter the number.

And then finally, I think we’re in a place in the market right now, where I believe all the fundamentals are that customers need more skilled connectivity in their home. And if I look out over five years, and I think about building a durable and sustainable franchise at AT&T, I think fiber is a key element to that.

- Fiber is also a key element for getting the kind of dense infrastructure that’s necessary for the next generation of wireless technology for backhaul. And having that owned and operated economics where you’ve got that backhaul and that transport densely out on a network is going to be a key determiner being a successful wireless business over time. And so when I step back and I think about that opportunity right now, are there other markets maybe outside of our operating footprint, given our success and what we’re seeing in rate of penetration, receptivity of the product, our ability to cross-sell both fixed and wireless, we should understand whether or not there’s something there.

- AT&T has been deploying their mid-band spectrum. We were a little bit later to that dynamic than some in the industry because of where we were in the auction and equipment availability. It is now up and starting to make its appearance. In metropolitan areas, the performance we’re getting out of it is really, really good. I think that will be a big lift on what is already a strong network.

- The CEO says AT&T has the best performing 4G LTE network in the country now paired with what we can do in 5G mid-band spectrum, I think that’s only going to be a positive for customers as we move through this.

- AT&T remains focused on its cost transformation program and its efforts to achieve more than $4 billion of its $6 billion run-rate cost savings target by the end of the year. Stankey noted that he’s comfortable with AT&T’s cost structure, and believes the company can continue to drive out costs as it exits portions of its legacy businesses. This includes efforts to transition from its legacy copper network to fiber.

- Stankey shared that AT&T is investing at a record clip to fuel growth in core connectivity, while continuing to pay an attractive dividend, and that the company is focused on building a sustainable and durable connectivity operation with improved cash generation. AT&T is pleased with the return profile of its fiber and 5G investments and continues to expect 2022 and 2023 to be the peak of this capital investment cycle with capital intensity moderating in 2024 and beyond. Overall, the company’s long-term capital allocation priorities remain unchanged, and it expects to use cash after dividends to reduce debt with a goal of reaching a net debt-to-adjusted EBITDA range of 2.5x.

References:

AT&T CEO Updates Shareholders at Goldman Sachs Communicopia + Technology Conference | Business Wire

Altice USA bets on FTTP with multi-gigabit speeds by 2025; MVNO with T-Mobile

Dexter Goei, Altice USA’s outgoing CEO, continues to strongly defend the company’s decision to upgrade large portions of its network to fiber, stating that the product and business performance of the move make dollars and sense. Altice USA’s current plan is to upgrade about 6.5 million passings to fiber-to-the-premises (FTTP) by 2025 and back that up with multi-gigabit speeds, which Altice USA has begun to soft-launch in parts of its fiber upgrade areas.

At the Goldman Sachs Communacopia + Technology conference in San Francisco, Goei said while the company has made strides in deploying its fiber network — it expects to finish 2022 with up to 2.3 million homes passed with the technology — it is still seeing customer declines in its former Cablevision and Suddenlink footprints.

In Altice’s former Cablevision systems in metropolitan New York City, gross additions are lower, there is less move activity and churn levels are low, but the company also is competing against a telco — Verizon Communications — that has been extremely aggressive on price. In its Suddenlink markets mainly in the Midwest, gross addition activity is high but churn is high, especially in markets where it is being overbuilt.

“We’re still losing subs in both markets but for different reasons,” Goei said. “We feel good about the fourth quarter turning around and looking better next year.”

Altice USA lost about 3,000 subscribers in 2021 — the only major cable operator to do so — and shed more than 50,000 broadband customers in the first half of this year.

Altice began accelerating its fiber rollout last year, with a goal of passing 6.5 million homes by 2025. At the Goldman conference, Goei said the company expects to end 2022 with 2.2 million to 2.3 million homes passed with fiber (an increase of about 1 million homes), and should add another 1.6 million to 1.8 million households by the end of 2023.

While other cable operators have seen an increase in competition from fixed wireless access providers from telcos, Goei said most of Altice USA’s telco competition is replacing slower DSL lines with fiber, hence the acceleration of its own fiber buildout plans. But he shared his peers’ disdain for fixed wireless access (FWA), agreeing with some pundit predictions that the technology will reach a performance and penetration plateau in the next two or three years.

Goei announced his intention to step down as CEO earlier this month, and will become executive chairman of Altice USA on October 3. In his place the company named Comcast executive Dennis Mathew as CEO, also effective October 3. Mathew has 17 years of experience with Comcast, most recently as senior VP of its Freedom Region (Southeast Pennsylvania, New Jersey and Northern Delaware). He earlier served as senior VP for its Western New England Region (Connecticut, Vermont, Western Massachusetts and areas of New York and New Hampshire) and has extensive experience in running cable businesses.

Goei said at the Goldman conference that his main motivation for stepping down was a desire to return to Europe, where he spent his childhood and most of his professional career, with his family. He added that he notified the Altice USA board of his decision about a year ago, starting the search process for a replacement about six months ago. He believes he’s leaving Altice USA in capable hands.

“I interviewed many, many people during the process; Dennis fits the bill across the board,” Goei said, adding that Mathew has a proven track record in operations, running one of Comcast’s most high-profile regions (the Freedom Region) and will fit in well with the Altice team. “He’s just a great guy, a team player, will focus on the prize and is someone who would do very well with the executive team at Altice USA.”

The average revenues per user (ARPU) on Altice USA’s fiber-based products are 7% to 8% higher than ARPU on cable-based services, he said. Additionally, churn rates on fiber services are also coming in about 6% to 8% lower than on HFC, and the NPS (net promoter score) for the fiber product is also coming in higher.

“Every single metric that you can imagine – that you would anticipate – are better” on the fiber product, Goei said. He acknowledged, however, that the installation process for fiber customers getting a triple-play bundle that includes pay-TV and voice could be better.

As for Altice USA’s fiber network build update, the company finished almost 270,000 new homes in the second quarter of 2022, a record the company expects to beat in Q3 and, weather permitting, in Q4.

For 2022, Altice USA expects to complete an additional 1 million fiber passings, with 1.2 million as its “stretch target.” That will put Altice USA in a position to end the year with 2.2 million to 2.3 million homes passed with fiber.

In 2023, Goei said Altice USA expects to ratchet up the build to 1.6 million to 1.8 million homes passed as the operator starts to push fiber upgrades into the Suddenlink footprint.

Altice USA is also doing edge-out builds to areas adjacent to existing facilities and pursuing grants for fiber builds in underserved and unserved areas. Altice USA has won grants or subsidies covering 40,000 to 45,000 homes, a number that Goei predicts could rise to about 200,000 in the next 12 to 24 months.

Altice USA, which has been fielding M&A inquiries about the Suddenlink properties, believes its fiber focus will set the stage for a return to broadband subscriber growth as early as Q4 2022, and certainly by sometime in 2023.

Goei said 80% of gross broadband subscriber adds in fiber areas take a fiber-based service. Though Altice USA is trying to convert HFC customers to fiber proactively, exceptions include customers who want to keep their existing setup or who are in homes and locations where a landlord won’t allow a new fiber drop.

Altice USA has been building a fiber broadband network in its Optimum territory in the New York tri-state area (New York, New Jersey, Connecticut) with 1.2 million fiber passings available for sales as of December 31, 2021. For Suddenlink, construction is expected to begin this year in areas of Texas. Additional states in the Suddenlink footprint that will benefit from this fiber expansion plan include areas of Arizona, California, Louisiana, Missouri, North Carolina, New Mexico, Oklahoma, and West Virginia.

“Altice USA is proud to announce plans to invest further in our fiber deployment strategy by accelerating the build of a 100% fiber broadband network capable of delivering multi-gig speeds across our Optimum and Suddenlink footprint,” said Dexter Goei, Altice USA Chief Executive Officer. “Fiber is the future and given the progress we have made at Optimum with our fiber expansion, we’re excited to build on that success and break ground later this year at Suddenlink to bring our advanced network to more customers and communities.”

Goei touched briefly on Altice USA’s Optimum Mobile product, which is supported by an MVNO deal with T-Mobile. He agreed that there are benefits to bundling mobile with home broadband but lamented that mobile EBIDTA is challenged by “thin margins” being driven by a mobile marketplace that’s seeing falling ARPU and rising levels of promotions.

With that backdrop, Altice USA expects to market fiber more aggressively than mobile this year and into 2023. “For the balance of this year, I don’t think you should expect real big waves in the mobile product,” Goei said.

Goei also offered some additional commentary on the recent announcement that he will be stepping down as CEO to become executive chairman of the board. Comcast exec Dennis Mathew has been tapped to take the CEO slot effective October 3.

Goei reiterated that he is shifting gears for personal reasons, as he and his family want to return to Europe. He said he informed the board of his decision about a year ago. Altice USA started its CEO search roughly six months ago.

In his new role, Goei said he will focus on “large strategic stuff” and external elements such as government affairs and conversations with the financial community, so that Mathew can focus squarely on operations.

References:

Emergency SOS: Apple iPhones to be able to send/receive texts via Globalstar LEO satellites in November

Apple finally confirmed a longstanding rumor that its new iPhones will be able to connect directly to LEO satellites to send and receive text messages. The feature, called Emergency SOS, will allow iPhone 14 models to message from remote locations not covered by traditional cellular infrastructure. Apple says the service launches in November and will be free to iPhone 14 buyers for two years. It didn’t specify what it might cost after that. Apple noted at Wednesday’s Cupertino, CA HQ event that its smartphone would need to be pointed directly at a satellite to work, and that even light foliage could make texts a few minutes to send.

Globalstar confirmed in a filing Wednesday that it will be operating the service through a partnership with Apple. Under that agreement, Apple will cover 95% of the capital expenditures made by Globalstar to build up its network, including new satellites, to provide the service. It will require Globalstar to allocate 85% of its “current and future network capacity” to support the service, which analyst Mike Crawford of B. Riley describes as “in one fell swoop converting an underutilized asset to a productive asset.”

The deal will include service fees and potential bonus payments, allowing Globalstar to project total revenue in a range of $185 million to $230 million for next year and $250 million to $310 million for 2026, which is expected to be the first full year that all of the company’s new satellites are operational. Even the low end of the near-term target would be a record high for the satellite-service provider, representing a gain of 44% above the annual revenue Globalstar has averaged for the past three years. Globalstar notably broke from the traditionally dry language of SEC filings to describe the deal as “transformational.”

Globalstar, currently offers SPOT X which provides 2-way satellite messaging so users can stay connected whenever you’re outside of cellular range, including direct communication with search & rescue services in case of a life-threatening emergency. SPOT X provides your own personal U.S. mobile number so others can message you directly from their mobile phone or SMS devices at any time.

Globalstar Satellite System:

Like “bent-pipes” or mirrors in the sky, the Globalstar satellites pick up signals from over 80% of the Earth’s surface. Our satellites transmit customer signals via CDMA technology to antennas at the appropriate terrestrial gateway, then the signals are routed through the local networks. This highly effective design offers the shortest connectivity latency and enables Globalstar to upgrade our system with the latest technology on the ground.

Globalstar’s new satellite constellation of Low Earth Orbit (LEO) satellites and second generation ground infrastructure deliver exceptional quality, reliable coverage and high quality service to its customers.

Image Credit: Globalstar

The company’s patented satellite path and gateway diversity technologies allow customers to stay connected in the event of a single satellite failure by automatically transmitting to the next available satellite. This ensures uninterrupted communication in even the most suboptimal conditions like mountainous areas or urban canyons.

……………………………………………………………………………………………………………………………

There is increasing competition for LEO satellite based internet access from smartphones:

- Starlink/SpaceX, announced a deal last month with T-Mobile to launch a text-based service by the end of next year. The Apple-Globalstar service might have cooled some enthusiasm. It is designed for emergency texting only, as opposed to providing a more typical smartphone experience in the wild.

- In addition to T-Mobile’s venture with SpaceX, the Globalstar rival Iridium announced in July that it has entered a development agreement with an unnamed company for a smartphone service that it expects to complete by the end of the year. Ric Prentiss of Raymond James wrote Thursday that the total addressable market “for satellite-smartphone off-the-grid connectivity is quite large with room for several initiatives globally.”

References:

https://www.wsj.com/articles/apple-will-keep-globalstar-in-orbit-11662698148?mod=markets_major_pos3

https://www.globalstar.com/en-us/solutions/emergency-remote-communications

https://www.globalstar.com/en-us/about/our-technology

Musk’s SpaceX and T-Mobile plan to connect mobile phones to LEO satellites in 2023

OneWeb to test satellite-based 5G backhaul with CGI and University of Surrey

OneWeb is teaming with the University of Surrey and IT services company CGI to test the integration of satellite communications and mobile 5G networks. The LEO satellite internet provider is still 220 satellites short of its 648 target.

OneWeb CTO Massimiliano Ladovaz said: “Creating an interoperable low Earth orbit (LEO) satellite communications and mobile 5G network is critical to achieve a ubiquitous, affordable, fast and consistent connectivity experience to businesses, users and governments.”

In July Eutelsat, which has a fleet of geostationary satellites, announced an agreed takeover of OneWeb in a deal that values the LEO company at US$3.4 billion.

OneWeb’s launch programme was brought a halt by Russia’s war on Ukraine: the company used a Russian launcher and Russian launch sites, including Vostochny in the Russian far east (pictured).

Ladovaz said: “This pilot is an important step in our mission to connect people everywhere, on land, at sea and in the air, providing the opportunity for people to realise their full potential even in the remotest reaches of the planet.”

OneWeb’s partner in the project is the 5G Innovation Centre (5GIC) at the University of Surrey, which is in Guildford, south-west of London.

The project will test the use of OneWeb’s low-latency satellite network capability to transport 5G services in backhaul, and to backhaul from a mobile 5G base station to a 5G core network.

Professor Rahim Tafazolli, head of the Institute for Communications at the University of Surrey, said: “Satellite systems are key enablers for 5G services and they will become increasingly integrated with communications networks as we progress beyond 5G towards 6G in solving cost-effectively the societal challenge of the digital divide.”

At the other partner, CGI, Shaun Stretton, senior VP for space control and information solutions, said: “Fully integrated 5G hybrid networks bring the promise of ubiquitous, seamless and high-speed connectivity to us all. … At CGI we have been leading the way in making these complex integrated networks a reality and we are very much looking forward to working with our world class partners to further address these challenges so that we can bring these game changing capabilities to market.”

References:

Lockheed Martin, AT&T Demonstrate High Speed Transfer of Black Hawk Data on AT&T 5G Private Network and 5G.MIL® Pilot Network

Lockheed Martin and AT&T securely and rapidly transferred UH-60M Black Hawk health and usage data through an AT&T 5G private cellular network and Lockheed Martin’s 5G.MIL® multi-site pilot network in a test conducted Aug. 4 at Lockheed Martin’s Sikorsky headquarters in Stratford, Connecticut.

The test demonstrated that wireless 5G technologies on the flight line can support accelerated maintenance operations and improved aircraft readiness to support our service members. It also proved highly secure interoperability between the AT&T millimeter wave 5G private cellular network and the 5G.MIL pilot network.

- Technology reduced data transfer time for military helicopters by more than 80%

- Using 5G capabilities, network engineers transfer health and usage data from a Sikorsky UH-60M Black Hawk to Waterton, Colorado, for real-time analysis

“These 5G capabilities deployed at scale are expected to enable high-speed, secure-data transfer on virtually any flight line, providing another example of how we’re advancing our 21st Century Security vision by improving customer readiness and operations,” said Dan Rice, vice president of 5G.MIL Programs at Lockheed Martin. “In collaboration with commercial 5G leaders, an interoperable 5G.MIL multi-site, multi-vendor network is another step closer to reality.”

The AT&T 5G millimeter wave private cellular network wirelessly transferred data to the 5G.MIL network through ground support equipment from the Black Hawk’s Integrated Vehicle Health Management System (IVHMS). The data was then routed to local Sikorsky networks for processing and distribution through the secure Lockheed Martin 5G.MIL pilot network to the Waterton, Colorado, 5G test range site.

Image Credit: AT&T

Currently, it takes Black Hawk crews about 30 minutes to remove the IVHMS data cartridge from the helicopter, transport it to an operations center and extract the data for analysis. Lockheed Martin used AT&T 5G private cellular technologies to reduce the time required to less than 5 minutes including cartridge removal, demonstrating the potential benefits in time and cost for military and commercial helicopter operations.

The IVHMS provides monitoring and diagnostic capabilities to ensure a more reliable aircraft. It monitors, captures and evaluates detailed aircraft-generated data as a result of flight maneuvers. It also captures aircraft limit exceedances on airframe and dynamic components and monitors temperature and vibration of key components on the aircraft. It does this through hundreds of on-board sensors that report the status of the aircraft by monitoring the airframe, engines, and other dynamic components. Operators assess these thousands of data points to ensure the aircraft is safe, reliable and ready to fly.

“Timely and secure transfer and analysis of mission and operations data are critical to military readiness and effectiveness,” said Lance Spencer, client executive vice president, Defense, AT&T Public Sector and FirstNet. “This is one of many areas of commercial 5G innovation we are exploring to support defense, commercial aviation, and related fields where our 5G-related services can modernize legacy processes and help deliver truly transformational benefits.”

Lockheed Martin and AT&T also are working with other leading companies in networking and defense to modernize and transform communications capabilities for defense purposes. Future demonstrations are expected to further enhance 5G wireless technology communications solutions for flight lines, aiming to continually shorten aircraft turnaround times to reduce costs and improve military operational readiness. These capabilities deployed at scale can support high-speed, secure-data transfer on both commercial and military flight lines.

AT&T’s 5G and private cellular Multi-access Edge Computing (MEC) capabilities are deployed together by multiple industrial customers in factories nationwide where they enable ultra-fast, highly secure wireless processing and information transfer.

References:

https://www.business.att.com/products/att-private-cellular-networks.html

For additional information about Lockheed Martin, visit www.lockheedmartin.com/5G.

For more information about AT&T’s work in Defense, click here.

AT&T remains a fiber first network provider with FWA in rural areas

AT&T remains a fiber-first broadband broadband network provider. The carrier’s CFO Pascal Desroches told investors that the most likely instance for AT&T to use FWA (fixed wireless access) would be in rural areas where deploying fiber could prove too costly.

“We think in certain instances FWA makes sense,” Desroches said during an interview at this week’s Bank of America Media, Communications, and Entertainment Conference, according to a transcript. “If you’re in a rural area where it does make – where the economics don’t pan out for fiber, fixed wireless will be an interesting solution.”

AT&T’s transition end game is predicated on the carrier’s belief that fiber is a better long-term solution for customers and its operations. Desroches explained that FWA extracts a “very expensive” toll on the carrier’s mobile operations.

“Long term, we don’t believe it will be good enough,” Desroches said of FWA. “And that’s why we think it is really important to start to place our bets now with fiber because by the time fiber becomes the only acceptable solution, it will be too late to start to build out because of the long lead times.”

Editor’s Note: This is what investors are missing about AT&T – it’s growing fiber footprint (#1 in the U.S.) which is probably the biggest growth area in all of telecom!!!

…………………………………………………………………………………………………………………………………………………….

“With connectivity increasing at what we estimate will be a fivefold increase between 2021 and 2025, fiber will be the solution of choice. And given the long lead times, the long payback periods, if you decide you want to do fiber 4 to 5 years from now, it’s too late. And this is why we think we are building a strategy for long-term sustainable earnings with the best possible technology.”

To support that need, AT&T recently signed a long-term deal with fiber builder Corning, which is using that deal as the basis to build a new cable manufacturing facility in Gilbert, Arizona. AT&T also formed a “Fiber Optic Training Program” with Corning targeted at training 50,000 people to design, install, and maintain fiber networks.

“This investment is a significant step forward for our country and building world-class broadband networks that will help narrow the nation’s digital divide,” AT&T CEO John Stankey noted in a statement tied to the Corning deal. “This new facility will provide additional optical cable capacity to meet the record demand the industry is seeing for fast, reliable connectivity.”

“The market demand remains really healthy. We’re continuing to see good demand for subscriber — for new subscribers coming into the service. And also, look, our churn levels are at really low levels. You look at all that together, we have a mobility business now that we expect service revenues to grow 4.5% to 5%. And we expect profitability to accelerate in the back half of the year. So all indications are green and that we are performing really well.”

“We’re going to be competitive. For years, AT&T was not competitive, and we’re going to be competitive, and we’re capitalists. At the end of the day, if there are opportunities to grow subscribers in a more efficient way, we’re going to seize those. But at the same time, we’re no longer going to be the share donor to the industry.”

“We have relationships with virtually over 90% of the Fortune 1000. And it’s a core competency that we have, and it’s one that has served us well. But it is very much in transition, and we’re — what we have to do is to grow our small, mid-business connectivity solutions.”

“There will be a very attractive market for 5G-enabled IoT solutions. There is — it will come. It is nascent today. It will come and the relationships that we have among the Fortune 1000 is critical to — is critical in serving — in helping exploit that opportunity. And again, our wireless relationships. The big part of the growth in wireless is also the ability to surgically attack our enterprise base and partner with different organizations to really drive increased subscriber adoption.”

References:

Corning to Build New Fiber Optic Plant in Phoenix, AZ for AT&T Fiber Network Expansion

AT&T continues to add customers in key focus areas- 5G and fiber

AT&T added 813K mobile postpaid subscribers & >300K net fiber subs during 2Q-2022

Mavenir and NEC deploy Massive MIMO on Orange’s 5G SA network in France

Mavenir and NEC Corporation (NEC) have deployed massive MIMO (mMIMO) on Orange’s 5G standalone (SA) experimental network in France.

Mavenir’s cloud-native Open virtualized Radio Access Network (Open vRAN) software has been deployed on Orange’s cloud infrastructure with NEC’s 32T32R mMIMO active antenna unit (AAU) to deliver high capacity and enhanced coverage. Interoperability between radios and virtualized Distributed Units (vDUs) over the O-RAN Alliance Open Fronthaul Interface is key to Open RAN’s ability to simplify the deployment of multi-vendor networks and eliminate vendor lock-in.

The technologies have been deployed at the Orange Gardens campus in Chatillon near Paris, and are part of the extension of project Pikeo – Orange’s cloud-based and fully automated 5G SA experimental network, also called Pikeo at this site.

“Mavenir and NEC’s successful Open RAN deployment of mMIMO on Orange’s Innovation 5G SA experimental network is a major stepping stone on the road towards Open RAN deployments and illustrates Orange’s commitment to support the development of multi-vendor Open RAN solutions with innovative partners. Our Open RAN Integration Centre, open to our partners worldwide, contributes to the development of a strong Open RAN ecosystem in Europe,” said Arnaud Vamparys, SVP Radio Access Networks and Microwaves at Orange.

The deployment includes Mavenir’s cloud-native Open virtualized Radio Access Network (Open vRAN) software rolled out across Orange’s cloud infrastructure with NEC’s 32T32R mMIMO active antenna unit (AAU) to deliver high capacity and enhanced coverage.

“Deploying 5G SA mMIMO is a significant milestone in developing Open RAN and transitioning from virtualized to cloudified networks,” said Hubert de Pesquidoux, executive chairman of Mavenir.

“We are very proud of our continuing collaboration with Orange, NEC and other companies that are proving the potential of the multi-vendor, cloud-native, standards-based approach.”

The deployment forms part of the extension of project Pikeo – Orange’s cloud-based and fully automated 5G SA experimental network.

“The latest deployment of Open RAN mMIMO in Europe is another milestone for Open RAN and one that required close collaboration and tight integration between multiple vendors. This synergy is exactly what Open RAN needs to successfully deliver on its promise of a truly open multi-vendor ecosystem,” said Naohisa Matsuda, general manager of NEC’s 5G strategy and business.

“Forward-thinking mobile operators like Orange are showcasing the potential of Open RAN mMIMO. This is the right time for the mobile industry to follow the blueprint set by industry-leading operators to move to the new era of Open RAN-powered connectivity.”

About Mavenir:

Mavenir is building the future of networks and pioneering advanced technology, focusing on the vision of a single, software-based automated network that runs on any cloud. As the industry’s only end-to-end, cloud-native network software provider, Mavenir is focused on transforming the way the world connects, accelerating software network transformation for 250+ Communications Service Providers and Enterprises in over 120 countries, which serve more than 50% of the world’s subscribers.

About NEC Corporation:

NEC Corporation has established itself as a leader in the integration of IT and network technologies while promoting the brand statement of “Orchestrating a brighter world.” NEC enables businesses and communities to adapt to rapid changes taking place in both society and the market as it provides for the social values of safety, security, fairness and efficiency to promote a more sustainable world where everyone has the chance to reach their full potential. For more information, visit NEC.

References: