European Commission DESI report reveals broadband network status is lagging

European Union member states are still lagging behind most of the world when it comes to the deployment of 5G networks. That’s one of the findings in the latest Digital Economy and Society Index (DESI), published by the European Commission. “Efforts need to be stepped up to ensure the full deployment of connectivity infrastructure (notably 5G) that is required for highly innovative services and applications,” the Commission wrote. DESI also found that businesses’ adoption of key digital technologies – such as artificial intelligence and “big data” analytics – remains worryingly low.

Mobile broadband is still mainly complementary to fixed broadband, when it comes to subscriptions for households. Europeans primarily use fixed technologies at home to access the internet (even if using a mobile device). In 2021, 13% of EU households accessed the internet only through mobile technologies.

->Finland (34% of households), Latvia (24%), Poland (23%), Romania (22%) and Bulgaria (21%) were the leaders in mobile-only access.

With respect to connectivity, Denmark has the highest score, followed by the Netherlands and Spain. Belgium and Estonia have the weakest performance on this dimension of the DESI. Coverage of Next generation access (NGA) technologies (VDSL, VDSL2 vectoring, FTTP, DOCSIS 3.0, DOCSIS 3.1) capable of delivering download speeds of at least 30 Mbps reached 90% in 2021, following a slight increase of 2.9 percentage points compared to the previous year. This mainly resulted from a 7-point growth in FTTP. VDSL coverage remained stable, while cable DOCSIS 3.0 declined slightly (by 0.8 percentage points).

Fixed very high capacity networks (VHCN) covered 70% of EU homes in 2021, up from 60% in the previous year. FTTP deployments were mainly responsible for this increase. Regarding mobile technologies, while 4G coverage of populated areas is almost universal, reaching 99.8%, 5G commercial services were launched in all but two Member States (Latvia and Portugal) by mid-2021. 5G coverage grew substantially from 14% in 2020 to 66% of populated areas in 2021.

The report further states:

“The connectivity dimension of the DESI looks at both the demand (take-up) and the supply side (coverage) of fixed and mobile broadband. Under fixed broadband, it assesses the take-up of overall, at least 100 Mbps and at least 1 Gbps broadband, the coverage of fast broadband (next generation access of at least 30 Mbps) and of fixed very high capacity networks (VHCNs) . Under mobile broadband, it includes the population coverage of 5G networks, the assignment of radio spectrum for 5G (5G spectrum indicator) as well as the take-up of mobile broadband6 . In addition, it captures the retail prices of fixed and mobile offers (price plans) and also those of converged bundles (consisting of fixed and mobile service components).

Broadband coverage of rural areas remains challenging, as 8.5% of households are not covered by any fixed network, and 32.5% are not served by any NGA technology. However, 4G is widely available also in rural areas (99.6%). On fixed technologies, there was a marked increase in the rural coverage of FTTP (from 26% in 2010 to 34% in 2021).

In the next 10 years a whole generation of new quantum technologies is likely to emerge, with far reaching impacts on many activities. The first devices, in the form of experimental physical platforms or advanced simulators, are already in use. Researchers are starting to build pilot quantum computers to act as accelerators interconnected with supercomputers, forming ‘hybrid’ machines that blend the best of quantum and classical computing technologies. Quantum computing facilitates innovation in complex fields of research (e.g., climate change, health, brain science, biology, sustainable energy, materials, etc.) and industrial development (e.g., simulation sciences, data analytics, AI, digital twins, etc.). The Digital Decade target ist that by 2025, the EU has its first computer with quantum acceleration, paving the way for the EU to be at the cutting edge of quantum capabilities by 2030.”

References:

https://digital-strategy.ec.europa.eu/en/policies/desi-connectivity

FCC launches new 5G mid-band wireless spectrum auction (FCC Auction 108)

The U.S. Federal Communications Commission (FCC) said Friday it had opened bidding in its latest mid-band spectrum auction (FCC Auction 108) to boost next generation 5G wireless services. The new round will auction about 8,000 county-based licenses in the 2.5 GHz spectrum band in mostly rural parts of the U.S. FCC Chairwoman Jessica Rosenworcel said Friday, “We all know there are gaps in 5G coverage, especially in rural America, and this auction is a unique opportunity to fill them in.”

Auction 108, which started at 10am ET on Friday, July 29, utilizes a “clock-1” auction format. This format is similar to the clock phase of past FCC auctions, but rather than offering multiple generic spectrum blocks in a category in a geographic area, it will offer only a single frequency-specific license in a category in a county.

The U.S. Congress last year approved $42.5 billion for Commerce Department grants to expand physical broadband deployment in places like rural areas without access to high-speed service. The FCC has been auctioning spectrum in recent years to help address the rising demand for wireless connectivity as the number of internet-connected devices rises sharply.

In January, AT&T Inc led bidders in the 3.45 GHz mid-band spectrum auction, winning $9.1 billion, while T-Mobile won $2.9 billion and Dish Network spent $7.3 billion. In 2021, the three largest U.S. wireless companies won $78 billion in bids in an FCC C-Band spectrum auction. Verizon Communications ultimately paid $52 billion for 3,511 licenses and to quickly clear its use, while AT&T won $23.4 billion in licenses and T-Mobile won $9.3 billion.

FCC Commissioner Brendan Carr in March said the FCC should move to expand spectrum use and consider auctioning other spectrum including looking at the “Lower 3 GHz band and several additional spectrum bands.”

In February, the FCC and National Telecommunications and Information Administration (NTIA) vowed to improve coordination on spectrum management after a 5G aviation dispute threatened flights earlier this year. The agencies said they will work cooperatively to resolve spectrum policy issues and are holding formal, regular meetings to conduct joint spectrum planning.

Addendum:

Here are the (disappointing) results of FCC Auction 108:

References:

https://www.fcc.gov/document/fcc-announces-next-5g-mid-band-spectrum-auction-start-july-29

https://www.reuters.com/technology/us-launches-new-5g-mid-band-wireless-spectrum-auction-2022-07-29/

https://www.tvtechnology.com/news/fcc-starts-5g-mid-band-spectrum-auction

Liberty Global, Telefónica and InfraVia in new UK fiber optic deal; VMO2 is the wholesale client

Liberty Global and Telefónica together will own 50% of the joint venture while InfraVia Capital Partners will own the other 50%. VMO2 will be the anchor wholesale client and provide technical services.

The new (unnamed) entity will roll out fibre-to-the-home to greenfield premises across the UK, with an initial target of 5 million homes not currently served by VMO2’s network by 2026, and an opportunity to expand to an additional 2 million premises. Liberty Global, Telefónica and InfraVia Capital Partners are putting £4.5 billion behind the project, partly through borrowing (more details below).

Liberty Global and Telefónica will jointly have a 50% stake in the JV through a holding company, with InfraVia owning the remaining 50%. VMO2 is acting as the acting as the anchor client, and has apparently pledged to enter into an agreement with the JV upon closing of the transaction. The company will target homes across the UK, both adjacent to the existing VMO2 footprint and new areas. It will seek to attract additional third-party wholesale clients later down the line.

The business plan for the initial rollout of 5 million homes envisages an investment of approximately £4.5 billion, which includes investments related to the roll-out, envisaged connection capex and other related set-up costs. The three partners will fund their pro rata share of equity funding for the build, up to £1.4 billion in aggregate, phased over 4-5 years. In addition, the JV has obtained £3.3billion of fully underwritten debt financing from a consortium of financing banks, including a £3.1bn capex facility. As part of the transaction, InfraVia will make certain payments to Liberty Global and Telefónica, a portion of which will be linked to the progression of the network build-out.

“Telefónica has a recent track record of successfully developing broadband connectivity in many markets through strategic partnerships,” said José María Alvarez-Pallete, Chairman and CEO of Telefónica. “These deals help each country firmly increase their competitiveness and digital infrastructure to help their companies and economy thrive. The UK is, indeed, a growth market for us and we are very excited to be partnering with InfraVia to accelerate access to next generation broadband connectivity to a larger number of UK households and adding to Telefónica Infra’s growing portfolio.”

Vincent Levita, CEO and Founder of InfraVia said: “We are excited to be partnering with VMO2, Liberty Global and Telefónica to build and operate up to 7 million premises FTTH in the UK. The combination of our respective expertise in fibre network deployment, financing and operations in the UK, together with VMO2’s industrial scale and network construction know-how will be key to creating the undisputed second national fibre network in the UK providing access to broadband connectivity to millions of UK households. InfraVia has been a leading investor in digital infrastructure for the past decade. Attracted by the long-term trends of ever-increasing data usage and increased need for home connectivity, this would represent our 5th investment in fibre network deployment in Europe through strategic partnerships. We look forward to working with VMO2, Liberty Global and Telefonica in this partnership in the years ahead.”

Mike Fries, CEO and Vice Chairman, Liberty Global, comments: “This landmark agreement with Liberty Global, Telefonica and InfraVia will expand our FTTH footprint to millions of new UK homes, creating the undisputed second national fibre network in the UK. VMO2 has already committed to upgrading its entire existing 16 million footprint to FTTH. This JV will take our aggregate FTTH footprint to up to 23 million homes, reaching around 80% of the UK. VMO2 will bring significant build expertise, and will benefit from a meaningful off-net growth opportunity and as the anchor client will support attractive returns for the JV – a winning combination. Finally, we are very excited to be working with InfraVia who we already partner with in Germany, and welcome the expertise they bring to the JV.”

The transaction is subject to the usual regulatory approval, and is expected to close in Q4 2022. It seems there is a very high ceiling for the amount of investment money available for fibre rollouts, this new JV represents just one of many recent announcements that involve cash outlays measured in the multiple billions. Whether the ongoing cost of living crisis has any impact on projected consumer upgrades remains to be seen.

References:

Liberty Global, Telefónica and InfraVia Form Joint Venture to Build a New Fibre Network in the UK

Liberty Global, Telefónica and InfraVia plough £4.5 billion into new UK fibre JV

Point Topic: Global fixed broadband connections up 1.7% in 1Q-2022, FTTH at 58% market share

Global fixed access broadband subscribers reached nearly 1.3 billion at the end of Q1 2022, up by 1.7 percent from the previous quarter, according to the latest figures from Point Topic. The market research firm said the number of connections increased in 90 percent of the 131 countries researched, including the 20 largest markets. The global growth rate remains slightly less than a year ago.

For the first time ever, Fiber to the Home (FTTH) connections were more than half of all fixed broadband connections. Indeed, the share of FTTH in the total fixed broadband subscriptions continued to increase to 58 percent at the end of March 2022. Cable broadband connections were the next most common technology with a 17 percent share, while connections over all other technologies lost market shares to fibre. Compared to the end of 2021, FTTH connections increased 13.5 percent, while copper broadband lines were down 9.8 percent.

Main trends in Q1 2022:

-

Fixed broadband subscriber numbers grew in 90 per cent of the 131 countries covered in this report.

-

The share of FTTH in the total fixed broadband subscriptions continued to increase and stood at 58 per cent. Superfast and ultrafast cable broadband connections followed with an 17 per cent share. Connections over all other technologies lost market shares to fibre.

-

Between Q1 2022 and Q4 2021, the number of copper lines fell by 9.8 per cent, while FTTH connections increased by 13.5 per cent.

-

China added 14 million, Brazil 1.1 million and France a million fibre broadband subscriptions.

In Q1 2022, the quarterly fixed broadband subscriber growth rate stood at 1.7 per cent, with the number of connections reaching 1.3 bn (Figures 1 and 2). Similarly to Q4 2021, the growth rate was slightly lower than in the respective quarter a year ago.

Nokia and CityFibre sign 10 year agreement to build 10Gb/second UK broadband network

UK wholesale fiber network operator CityFibre [1.] is building an open access network which will connect up to 8 million premises in 285 cities, towns and villages, reaching a third of the country. Nokia’s Lightspan access nodes will be used by CityFibre to offer its wholesale customers multi-gigabit/sec residential broadband (up to 10Gb/s in both directions) and higher bandwidth services such as connecting enterprises and providing backhaul for mobile networks.

Note 1. CityFibre operates the UK’s largest and finest independent Full Fibre platform. Their high quality digital infrastructure enables wholesale customers to serve ultra-reliable, gigabit speed and futureproof broadband, ethernet and 5G services to homes, businesses, schools, hospitals and GP surgeries – plus anything else that need a digital connection.

……………………………………………………………………………………………………………………………………………………

Nokia recently announced a 10-year XGS-PON broadband equipment agreement with CityFibre including access nodes for its nationwide network of purpose-built Fibre Exchanges, fiber modems for customer homes and IP aggregation switches.

Using Nokia’s Quillion chipset, the same access nodes can be used for both XGS-PON and 25G PON (25Gb/s) on the same fiber, should CityFibre wish to do this in the future. Successful delivery of 25G PON for 5G transport using the same Lightspan access node has already been proven by CityFibre, Nokia and the University of Glasgow during a trial undertaken at the end of 2021.

John Franklin, Chief Technology and Information Officer at CityFibre said: “CityFibre is committed to building a Full Fibre network that is ”Better By Design”, providing our partners and their customers with the fastest and most reliable services at the best value. By partnering with Nokia we have enlisted a trusted and market-leading technology vendor to help support a nationwide 10Gbps XGS-PON technology deployment programme.”

Sandy Motley, President, Fixed Networks at Nokia, said: “The demand for ever-faster speeds continues and we’re delighted that our 25G ready solution has been chosen by CityFibre to enable their GPON to 10G XGS-PON national network upgrade program, supporting their mission to offer the highest capacity wholesale services into the UK market.”

John Franklin, Chief Technology and Information Officer at CityFibre said: “CityFibre is committed to building a Full Fibre network that is ”Better By Design”, providing our partners and their customers with the fastest and most reliable services at the best value. By partnering with Nokia we have enlisted a trusted and market-leading technology vendor to help support a nationwide 10Gbps XGS-PON technology deployment programme.”

Sandy Motley, President, Fixed Networks at Nokia, said: “The demand for ever-faster speeds continues and we’re delighted that our 25G ready solution has been chosen by CityFibre to enable their GPON to 10G XGS-PON national network upgrade program, supporting their mission to offer the highest capacity wholesale services into the UK market.”

Usually located in fiber exchanges, Nokia’s high-capacity optical line terminals are deployed for massive scale fiber roll-outs. They connect thousands of users via optical fiber, aggregate their broadband traffic and send it deeper in the network. The fiber access nodes can support multiple fiber technologies including GPON, XGS-PON, 25G PON and Point-to-Point Ethernet to deliver a wide range of services with the best fit technology.

Nokia ONT (Optical Network Termination) devices, or fiber modems, are located at the user location. They terminate the optical fibre connection and delivers broadband services within the user premises or cell sites.

Included in the deal:

- Lightspan MF optical line terminals family (access nodes)

- XS-010X-Q optical network terminations (fiber modems)

- 7220 IXR-D3L IP Aggregation Switch

References:

France’s Eutelsat nears deal to buy UK satellite internet company OneWeb

From the Financial Times:

The UK government is set to become a minority shareholder in a listed French business, as France’s Eutelsat nears a deal to acquire OneWeb, the satellite internet company rescued from bankruptcy by Boris Johnson’s government. According to people involved, a deal will be announced as soon as Monday and involve a takeover of OneWeb by Eutelsat, which already owns a 24 per cent stake in the UK-based company.

Expecting heavy political scrutiny, the deal will be presented publicly as a merger of equals. Combining the two companies will bring together the UK, French and Chinese governments as well as Indian billionaire Sunil Bharti Mittal as common shareholders in one of the world’s biggest satellite operators. Recommended The Big Read The corporate feud over satellites that pitted the west against China The French state owns a 20 per cent stake and China’s sovereign wealth fund owns 5 per cent in Eutelsat.

The UK has just under 18 per cent of OneWeb. After the deal, shareholders from both sides will be diluted. Paris-listed Eutelsat has a market value of €2.4bn and has roughly €3bn of net debt. In its most recent funding round, OneWeb was valued at $3.4bn. The deal values the UK government’s OneWeb stake at $600mn, two people with knowledge of the details said, which is $100mn more than it initially invested in 2020. Mittal, who has a 30 per cent stake in OneWeb, will be one of the largest shareholders in the combined group.

The UK will retain its special rights over OneWeb as part of the deal. Those rights include a veto over certain customers deemed undesirable for national security reasons as well as a say on supply chain and launch decisions. One UK official said that Eutelsat would seek a secondary listing on the London market. By merging with Eutelsat, OneWeb’s backers will have support for the huge amount of funding still required to deliver the company’s second generation satellite network.

The greater financial firepower will be needed in the competition with Elon Musk’s Starlink and Jeff Bezos’ Project Kuiper for low earth orbit, the new frontier for commercial space. OneWeb, which has 428 satellites in orbit, was a pioneer in the field but its current technology is acknowledged to be out of date. Musk’s Starlink has more than 2,000 satellites in orbit with newer technology. “The deal recognises that this is a highly competitive global race. It will allow the two companies to compete with SpaceX and emerging rivals from China as well. This is a good story for Britain,” the official said. Falling launch costs and cheaper satellites are enticing hundreds of private companies into a global space market estimated to be worth $1tn by 2040. The UK’s initial investment into OneWeb in 2020 was highly controversial and championed by Johnson’s former adviser Dominic Cummings.

The government ignored advice from senior officials when it decided to invest $500mn alongside $500mn from Bharti Global, part of the conglomerate controlled by Mittal, to bring the business out of Chapter 11 bankruptcy in the US. OneWeb collapsed in 2020 after its main backer SoftBank refused to fund yet another financing round, in a sign of significant cash funding requirements needed to take low earth orbit constellations to commercial operation. SoftBank still remains a substantial shareholder in OneWeb. Since its bankruptcy the group has raised $2.7bn. Eutelsat paid $550mn for a 24 per cent stake in OneWeb last year. Rothschild is working with Eutelsat, while Barclays is advising OneWeb, people close to the deal said. Bloomberg earlier reported on this deal.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

From Bloomberg:

Musk’s Starlink fleet of more than 1,500 satellites launched in the past three years by SpaceX has created an unprecedented challenge for rivals, leading to a wave of consolidation in the sector.

Last year, Viasat Inc. agreed to purchase Inmarsat Group Holdings Ltd. for $4 billion, creating the world’s biggest geostationary satellite company. Eutelsat itself rejected a takeover bid from billionaire Patrick Drahi that valued it at 2.8 billion euros.

OneWeb emerged from bankruptcy in 2020 in bailout by the UK with the help of Mittal, signaling a more interventionist industrial strategy by the government after Brexit. A deal with Eutelsat would be a rare example of a UK and a French company merging, and one that involves two state-backed companies shows how much the two governments are getting involved in the telecommunications industry.

The company was established in 2012 to build a constellation of small satellites in low-earth orbit, beaming internet connections to isolated places. OneWeb raised $3.4 billion from SoftBank Group Corp., Airbus SE and other big names before collapsing when lead investors pulled their money at the height of the coronavirus pandemic.

References:

https://www.ft.com/content/47219d82-1995-4555-ba13-48223364fa15

Verizon’s 2Q-2022 weak subscriber growth results in lower forecasts

Highlights of Verizon’s 2Q-2022 Earnings Report:

Total Broadband:

- Total broadband net additions of 268,000, including 256,000 fixed wireless net additions. Total broadband net additions increased 39,000 from first-quarter 2022, and fixed wireless net additions increased 62,000 from first-quarter 2022.

- 36,000 Fios Internet net additions.

Total Wireless:

- Total wireless service revenue of $18.4 billion, a 9.1 percent increase year over year.

- Total retail postpaid churn of 1.03 percent, and retail postpaid phone churn of 0.81 percent.

- Postpaid phone net additions of 12,000.

………………………………………………………………………………………………………………………………………..

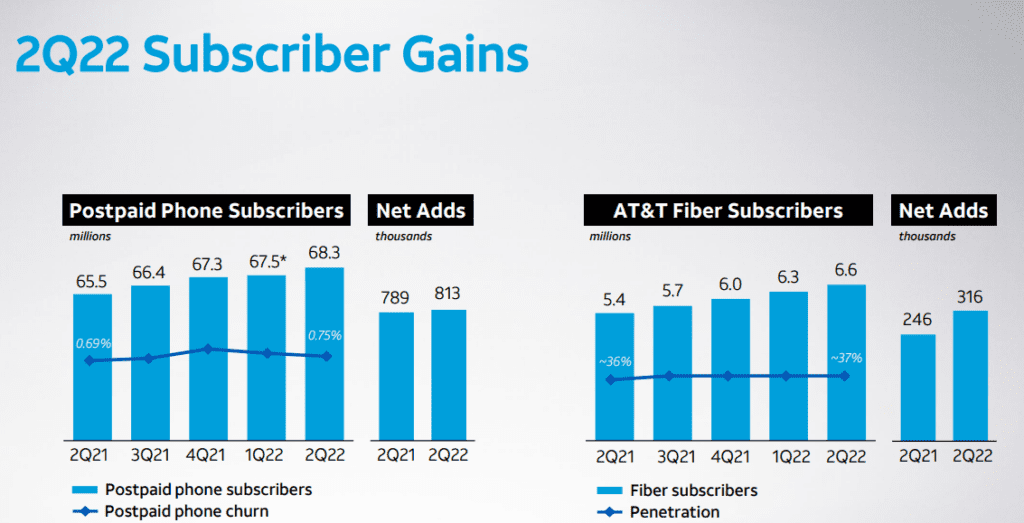

Verizon gained 12,000 postpaid wireless connections in the second quarter, a sign of relatively weak growth in its core customer base. Rival AT&T Inc. reported a net gain of 813,000 equivalent connections over the same span. Investors tend to track subscribers on postpaid mobile plans, which charge customers for monthly service after it is rendered, to measure wireless-company growth.

The weaker-than-expected customer additions prompted executives to raise rates for some midprice plans in June. The company also raised the monthly cost of some metered-data plans by $6 to $12 and boosted some consumer-plan fees. It added another monthly “economic adjustment charge” of up to $2.20 per line for business plans.

In the June quarter, Verizon’s net income decreased to $5.2 billion, down from $5.8 billion from the same period one year ago. On a per-share basis, its profit slipped to $1.24 from $1.40 a year earlier. Operating revenue was roughly flat from the previous year at $33.79 billion.

The company added 268,000 total broadband users in the second quarter, up 39,000 from the previous quarter. Verizon’s consumer segment struggled in the quarter, losing 215,000 postpaid phone subscribers due to an increase in churn and year-over-year decline in gross phone additions. Consumer operating income for the quarter fell 4.6% year over year to $7.2 billion.

Verizon’s business segment reported 430,000 wireless retail postpaid net additions, including 227,000 postpaid phone adds. Still, operating income for the segment was down 21.1% on an annual basis as wireless revenue declined.

Verizon said it expects wireless-service revenue growth of 8.5% to 9.5% in 2022, down from its earlier forecast of a 9% to 10% increase. The company also predicted its adjusted earnings would be flat to negative instead of growing this year.

In contrast, AT&T raised its wireless service revenue target, a sign it could be claiming some business from its rival. But its results also reflected some strain in consumers’ budgets. The company on Thursday lowered its free cash-flow target for 2022 due to costly smartphone promotions and customers taking slightly longer to pay their bills.

Verizon CFO Matt Ellis told analysts Friday that the company hadn’t seen “any noticeable change in the payment patterns from customers,” crediting the carrier’s “high-quality customer base.”

“We believe Verizon is currently between a rock and a hard place,” wrote CFRA Research analyst Keith Snyder. “On the one side you have AT&T, which is being extremely aggressive with promotions, and on the other, you have T-Mobile, who has a vastly superior 5G network currently.”

References:

https://www.verizon.com/about/news/verizon-reports-2q-and-first-half-2022-results

https://www.barrons.com/articles/verizon-earnings-guidance-51658490741

U.S. wireless carrier groups ask FCC for much larger 5G subsidies

U.S. rural wireless carriers want increased funding for 5G in the areas they serve. The FCC is planning to allocate $9 billion in the next few years to help finance the construction of 5G networks in rural parts of the U.S. However, rural carriers want more. A lot more.

“For many carriers, upgrading to 5G in remote areas will not generate new revenues from existing customers, and likely will not attract many new ones,” wrote the Coalition of Rural Wireless Carriers in a recent filing to the FCC. “Accordingly, the commission should include in any proceeding it opens a proposal to develop a mechanism for providing support for operations and maintenance, to ensure that facilities in remote areas remain operational and that carriers have an opportunity to upgrade them.”

The Coalition of Rural Wireless Carriers membership is comprised of Bristol Bay Cellular Partnership; Carolina West Wireless, Inc.; Cellular Network Partnership, a Limited Partnership, d/b/a Pioneer Cellular; Cellular South Licenses, LLC d/b/a C Spire; East Kentucky Network, LLC, dba Appalachian Wireless; NE Colorado Cellular, Inc. d/b/a Viaero Wireless; Nex-Tech Wireless, LLC; Smith Bagley, Inc.; Union Telephone Company dba Union Wireless; United States Cellular Corporation; and United Wireless Communications, Inc.. A number of these operators have already embarked on 5G deployments.

The Coalition asked the FCC to recommend that Congress update the universal service contribution mechanism, as per this statement in their FCC filing:

“It its upcoming report, the FCC should recommend that Congress enact urgently needed revisions to the universal service contribution mechanism. While the Coalition agrees that the Commission likely has authority to assess broadband under the current classification of broadband service, use of that authority is certain to be challenged in court, delaying a final resolution of the matter for years to come. Congress is best positioned to update the contribution mechanism, including addressing the issue of whether edge providers should contribute to universal service.”

“It is clear that consumers view access to wireless connectivity as vital. Unfortunately, many parts of the United States, especially rural America, are at risk of being left behind,” wrote the Competitive Carriers Association (CCA) [1.] in its filing to the FCC. The CCA represents many of the nation’s smaller wireless network operators. The group argued that more FCC funding is needed to address what it calls the “5G gap.”

Note 1. CCA was founded in 1992 by nine rural and regional wireless carriers as a carrier centric organization. Since its founding, CCA has grown to become the nation’s leading association for competitive wireless providers serving all areas of the United States. CCA is committed to being the premier advocacy organization for competitive wireless carriers and stakeholders. CCA will use advocacy, leadership, education, and networking opportunities to help competitive carriers grow and thrive in the wireless industry.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Both the CCA and the Coalition of Rural Wireless Carriers pointed to a recent 5G network buildout model released by financial analysis firm CostQuest. That firm’s report found that $36 billion is needed to support ubiquitous 5G connectivity in the US – far more than the $9 billion the FCC set aside in 2020 for its 5G Fund.

“Establishing the 5G Fund further secures United States leadership in 5G and will close the digital divide and bring economic opportunities to rural America,” the agency argued at the time.

However, FCC officials have said that they plan to wait to allocate the 5G Fund until after the agency finishes developing updated maps that show where broadband is available in the US – and where it is not. The Coalition wrote in their FCC Filing:

“With respect to the 5G Fund, we urged the Commission to rectify the prior Commission’s premature decision to adopt a rule providing that areas currently receiving unsubsidized 4G LTE service are ineligible for inclusion in the 5G Fund auction. Under the current rule, a rural area that has unsubsidized service at, for example, 5/1, 6/1, or 7/1 Mbps (downstream/upstream bit rates) will be ineligible for universal service investment for a decade. To say to rural citizens that their current service — which is well below typical 5G standards — is what they can expect to receive until the mid-2030s, directly contradicts Section 254(b)(3) of the Act which requires the Commission to develop policies that make rural service quality reasonably comparable to that in urban areas.”

The FCC is aware of this conundrum. “For too long, our broadband maps have been a patchwork with information gaps that impeded the ability of policymakers to assure that critical funding efforts could be precisely targeted to deploying broadband facilities to consumers and communities most in need,” according to FCC Chairwoman Jessica Rosenworcel.

“We asked the commission to report to Congress that it intends to open a proceeding to develop a record on whether the size of the 5G Fund should be substantially increased to accelerate and sustain mobile broadband investment. We also asked the commission to consider in such a proceeding whether it should develop a middle-mile fiber funding program to increase fiber connectivity to cell towers located in remote areas,” the Coalition of Rural Wireless Carriers concluded.

References:

https://www.fcc.gov/ecfs/search/search-filings/filing/10719203442014

https://www.fcc.gov/ecfs/search/search-filings/filing/106302599815573

https://irp.cdn-website.com/cd1ed710/files/uploaded/CostQuest%20National%205G%20Model.pdf

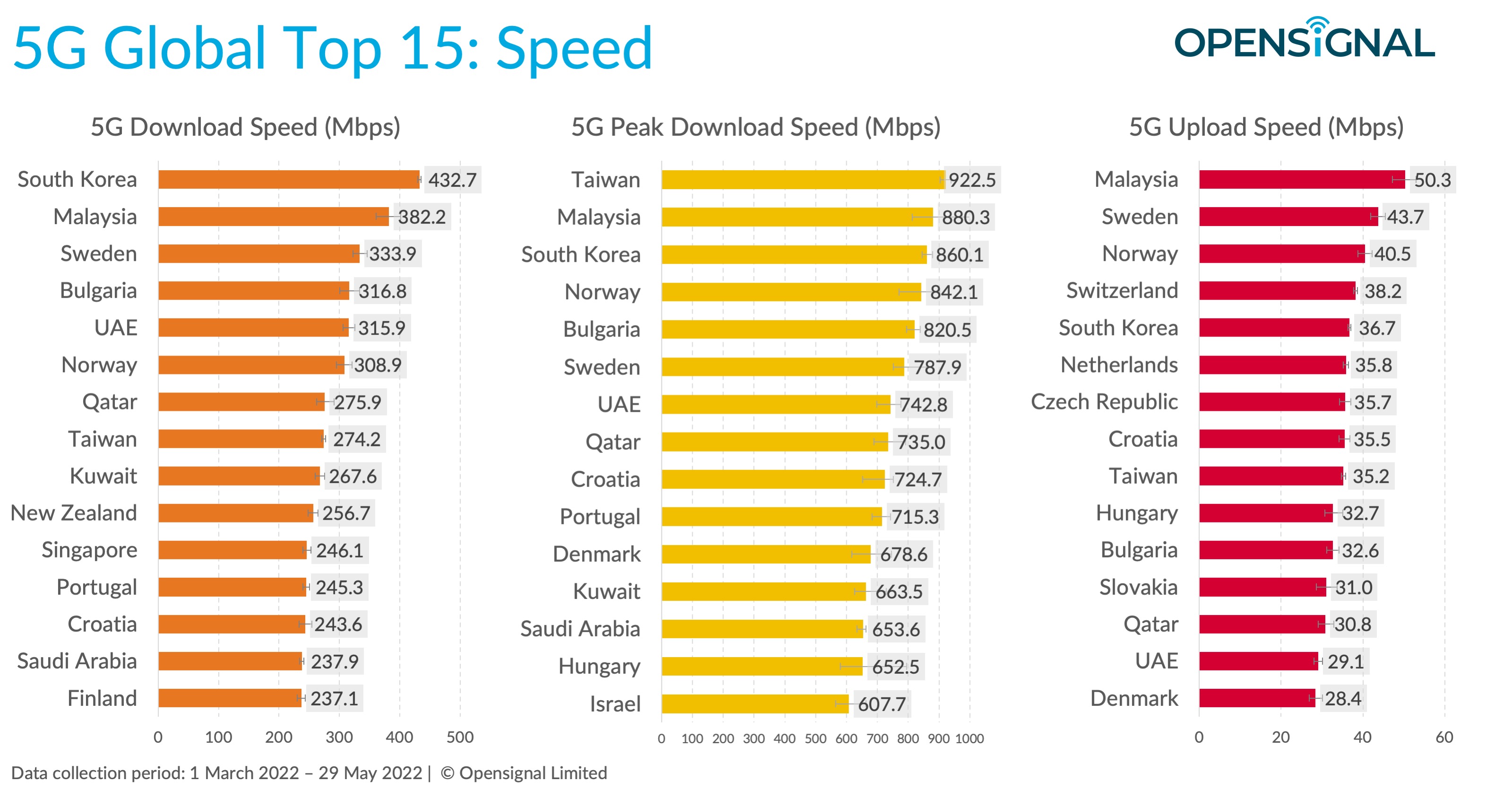

Opensignal: South Korea leads in 5G download speed; Philippines posts highest improvement in 5G video experience

Among the 15 markets with 5G improvements ranked by Opensignal, South Korea’s 432.7 Mbps was first, followed by Malaysia’s 382.2 Mbps and Sweden’s 333.9 Mbps (see table below). The Philippines maintains the second lowest 5G speed of 138.6 Mbps, only ahead of Thailand’s 122.7 Mbps. Malaysia led all markets on the ratio of download speed improvement with its 5G about 26 times faster than its 4G, but Opensignal said there are only a few subscribers in the country and 5G speed could decline when adoption increases.

The Philippines has recorded the highest improvement in 5G video experience in the world as telco giants continue to invest heavily in network expansion to enhance internet speed. Opensignal said the country topped all markets worldwide in terms of improvement in mobile video streaming experience using 5G.

“The Philippines continues to see a tremendous uplift with the shift from 4G to 5G by topping the 5G Video Experience uplift category with a 79 percent increase in its score,” Opensignal said.

The Philippines bested the 73 percent boost in 5G video experience in Malaysia, 64 percent in Chile and Thailand and 61 percent in Indonesia.

5G usage for video would continue to increase due to the superiority of its streaming quality when compared to 4G. “With Opensignal’s new video streaming tests including higher resolutions that are more suited to a 5G world, we see greater difference in video streaming experience using 5G compared with 4G. The uplift with 5G is now considerably higher,” Opensignal said.

According to Opensignal, the Philippines ranked third on the difference in internet speed between the two technologies, with 5G here nearly nine times faster than 4G. “Excluding Malaysia, Chile continues to top the 5G download speed uplift table, followed by the Philippines with the same position as in the last benchmark comparison,” Opensignal said.

In the Philippines, Smart Communications and Globe Telecom offer 5G to subscribers, leaving behind telco newcomer Dito Telecommunity in the competition.

For the year, Smart’s parent PLDT Inc. is spending P85 billion for its capital expenditures to be used for the firm’s increased commitment in 5G roll out.

Meanwhile, Globe installed 380 new 5G sites in the first quarter as part of efforts to hook up as many users to 5G as possible.

References:

https://www.opensignal.com/reports/2022/04/philippines/mobile-network-experience

https://www.opensignal.com/2022/06/22/benchmarking-the-global-5g-experience-june-2022

AT&T added 813K mobile postpaid subscribers & >300K net fiber subs during 2Q-2022

AT&T remains committed to investing in its network operations, including a focus on its 5G and fiber-optic related assets. AT&T gained 813,000 mobile postpaid subscribers during the quarter that ended in June, more than doubling analyst predictions and raising its wireless revenue forecast for 2022.

AT&T posted flat results for its now dominate communications segment, which includes its 5G wireless, wireline, and fiber operations. Segment revenues increased 2% year over year to $28.7 billion. However, increased costs and a loss of wireline customers dropped segment operating income by 2.1% to $7.2 billion.

AT&T CEO John Stankey said on today’s earnings call:

“In Fiber, we continue to invest in building out a premium network, drive a great build velocity and deliver on our stated expectations for accelerated customer growth through improved penetration rates. We’re finding success in serving more customers in new and existing markets with what we believe is the best wired Internet offering available. This is evidenced by our more than 300,000 second quarter AT&T Fiber net adds, marking our 10th straight quarter with more than 200,000 Fiber net adds.

The strength and value of the AT&T Fiber experience is enabling us to increase share in our Fiber footprint and convert more IP broadband Internet subscribers to Fiber subscribers. Ultimately, our Fiber strategy is a sustainable and long-term technology play that will support key macro trends.

We expect to see a continuation of favorable ARPU trends as we expand the availability of what we believe is a best-in-class network with a multi-decade lifespan. So I’m very pleased with the strong customer growth we’re seeing.

Our success only reinforces the improved value proposition we’re providing, and we expect our investment in top-tier technology to translate into strong resiliency for our services for years to come.

Over the last eight quarters, we’ve achieved an industry-best six million postpaid phone net adds while adding nearly 2.3 million AT&T Fiber customers, increasing our Fiber subscriber base by more than 50%. I’m also very proud with the progress our teams have made in rapidly expanding our 5G and fiber footprints.

I’m pleased to say that we’ve achieved our target of covering 70 million mid-band POPs 2 quarters ahead of our year-end target, and are now on track to approach 100 million mid-band POPs by the end of this year.”

……………………………………………………………………………………………………………………………………………..

AT&T reduced its free cash flow expectations (FCF), saying that customers were paying bills later than usual due to economic stress. AT&T said it now expects 2022 free cash flow of $14 billion. About $1 billion of the difference was tied to the “timing of customer collections.”

The gloomier FCF outlook overshadowed second-quarter results that topped estimates for profit and wireless subscriber growth.

…………………………………………………………………………………………………………………………………

AT&T CFO Pascal Desroches told investors that AT&T was bracing for a delay in consumers paying their bills due to surging recession concerns. He explained that “it’s taking about two more days than last year to collect customer receivables,” which resulted in a $1 billion impact in Q2, and that AT&T had around $130 million in higher bad debt expense.

“While bad debt is now slightly higher than pre-pandemic levels, it is being offset by better than expected customer revenue growth,” Desroches said, citing recent price increases.

Desroches also warned that AT&T was cutting its full-year free-cash-flow guidance from $16 billion down to $14 billion due to ongoing economic and recession uncertainty. That cut looked modest next to the carrier only posting $4 billion in free cash flow for the first half of the year, which was well below expectations.

The executive explained that AT&T had front-loaded its $24 billion in full-year capex due to its mid-band 5G and fiber deployments. This will lessen second-half spend needs, though AT&T remains committed to spending another $24 billion on capex in 2023.

“It underscores the importance of transitioning to our own operating connectivity services as well as rolling 5G and fiber integrated solutions,” Desroches said of its capex push. “In fact, our connectivity services revenue growth continues to accelerate as we are up nearly 15% year over year. Both areas, business 5G and fiber, continue to perform well.”

AT&T has previously stated that its ability to tie together its 5G and fiber networks allow it to better support enterprise SD-WAN, secure access service edge (SASE), and security needs. The carrier has struck a number of deals with vendors like Cisco, Fortinet, and Palo Alto Networks to power these SD-WAN, SASE, and security initiatives.

“As people migrate away from VPN and we have a more dense fiber base, we’re selling more fundamental underlying transport, frankly, at higher speeds and therefore higher connection values in that segment of the market, and that’s where our future is,” added AT&T CEO John Stankey on the Q2 call.

Analyst Craig Moffett Comments:

To be sure, AT&T’s results in Mobility haven’t been bad. They’ve walked a tightrope of heavy promotions in return for good-enough subscriber growth, and, up to now. On the back

of those passably good results in Mobility, the company has (arguably) provided at least some degree of confidence that they can sustain their new, lowered, dividend.

Meanwhile, they’ve promised faster capital spending on fiber deployment in their Consumer Wireline segment, something they have promised will result in at least positive longer-term growth in a segment that accounts for about 10% of revenues. (They’ve largely been silent about their much larger Business Wireline segment, which is shrinking badly and still getting worse).

AT&T’s consolidated growth prospects rest entirely on their Mobility segment. Their Business Wireline segment, which represents nearly 20% of revenues, is shrinking by high single digits, while their Consumer Wireline segment is at best marginally better than flat. Their Mobility segment has maintained modest service revenue growth through a mix of relatively rapid subscriber growth, offset by shrinking ARPU. Mobility is AT&T’s largest and most important business, accounting for two-thirds of consolidated pro forma revenues.

Subscriber growth trends remain very strong:

• AT&T added 1.06M post-paid subscribers, much better than the Street consensus expectation of 804K, in line with last year’s 1.16M.

• Better still, they added 813K post-paid phone subscribers on an as-reported basis, and with migrations (for comparability to the reporting of the other carriers), would have been a still-impressive 793K. Reported post-paid phone net additions were much better than consensus of 562K, and better than last year’s 789K.

• Pre-paid net additions of 231K also beat Street consensus of 131K, but were down from last year’s 297K gain.

We won’t know the industry’s growth rate until everyone else has reported, but it seems clear that AT&T is gaining unit market share. At their heart of their subscriber gain story is low churn. AT&T’s “best deals for all” promotion continues to keep churn very low.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

According to Seeking Alpha, six analysts rate AT&T stock (“T”) a Strong Buy, while seven have a Buy rating on the stock. 15 analyst rate “T” as a Hold, while there are 0 Sell recommendations.

References:

https://investors.att.com/financial-reports/quarterly-earnings/2022