Reports: Huawei wins 5G contracts with Vodafone-Italy and Malaysia

Reuters reports that Vodafone’s Italian division has secured conditional approval from Rome to use equipment made by China’s Huawei in its 5G radio access network, two sources close to the matter said.

Italy can block or impose tough conditions on deals involving non EU vendors under “golden powers,” which have been used three times since 2012 to block foreign interest in industries deemed to be of strategic importance.

The government of national unity led by Prime Minister Mario Draghi authorized the deal between Vodafone and Huawei on May 20, one of the two sources told Reuters, asking not to be named due to the sensitivity of the matter.

As in similar deals, the government imposed a set of prescriptions including restrictions on remote intervention by Huawei to fix technical glitches and an extremely high security threshold, the source added. Vodafone and Huawei declined to comment.

The United States has lobbied Italy and other European allies to avoid using Huawei equipment in their next generation telecoms networks and to closely scrutinize rival ZTE, saying the companies could pose a security risk. Huawei and ZTE strongly deny the allegations.

In the last 12 months, Italy has adopted a tougher stance on Huawei, while not banning it entirely from 5G infrastructure.

Under previous Prime Minister Giuseppe Conte, Rome prevented telecoms group Fastweb in October from signing a deal with Huawei to supply equipment for its 5G core network, where highly sensitive data is processed.

……………………………………………………………………………………………………………………………………..

In Malaysia a former deputy minister of international trade and industry, Kian Ming Ong, told Sydney Morning Herald it hadn’t seen any proof of vulnerabilities in Huawei’s network equipment. He said the government was likely to select Huawei as prime supplier to its national wholesale 5G network.

Huawei would be selected by a specially formed 5G government agency as the majority provider for Malaysia’s so-called single wholesale network. Fellow Chinese company ZTE and Scandinavian heavyweights Ericsson and Nokia are among seven other potential vendors who have been asked to bid for the deal.

In a Nikeii Asia op-ed Huawei’s Vincent Peng wrote:

Huawei is caught in a rivalry between two great powers. Although U.S.-China relations may not thaw any time soon, it seems clear that the current administration is taking a more multilateral approach to the world than its predecessor did.

This gives us hope that there may eventually be a change in how the U.S. government chooses to treat Huawei and other global technology companies headquartered outside of the United States.

To register for Huawei’s Finance Summit 2021:

https://e.huawei.com/topic/2021-event-fsi-summit/en-ap/index.html

…………………………………………………………………………………………………………………………………………..

References:

https://asia.nikkei.com/Opinion/Huawei-to-Joe-Biden-Let-s-talk

https://e.huawei.com/topic/2021-event-fsi-summit/en-ap/index.html

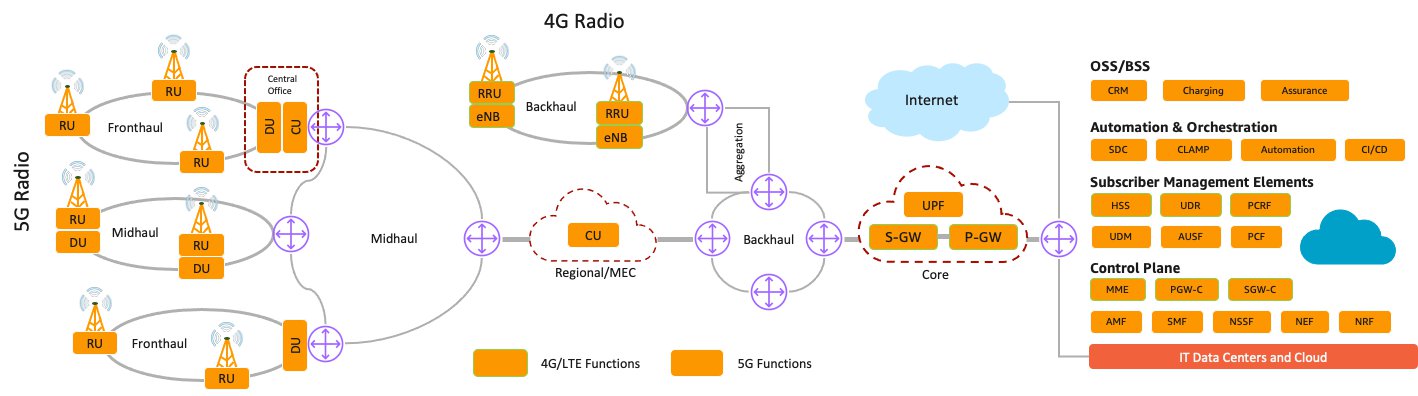

Mavenir to deploy cloud-based 4G/5G radio units & telco software on Amazon Web Services

Less than one month after Dish Network disclosed it is collaborating with Amazon Web Services, Inc. (AWS) for its “cloud native” 5G core network [1.], Mavenir has announced support for deployments and integration of its “cloud-native” telecom network functions with telco infrastructure solutions on AWS.

Mavenir’s collaboration with AWS allows Communications Service Providers (CSPs) to deploy Mavenir’s 4G and 5G products and applications with AWS’s computing infrastructure, state of the art container deployment and management technologies, and big data analytics services.

Note 1. Both Mavenir and AWS are vendors for Dish Network’s (DISH) greenfield 5G wireless network which is comprised of a virtualized RAN (vRAN) and a “cloud native” 5G core network (which includes highly touted functions such as network slicing, orchestration/automation, virtualization, etc).

……………………………………………………………………………………………………………………………………………

Mavenir’s “cloud-native” Open RAN, 5G packet core, IMS, and messaging will be combined with Amazon Elastic Kubernetes Service (Amazon EKS) anywhere, supporting AWS Outposts. There will also be options for existing deployments to migrate Mavenir’s IMS core, voice, and messaging to Amazon EKS and Amazon Elastic Compute Cloud (Amazon EC2) infrastructure.

AWS will also be able to run Mavenir’s orchestration and network slicing solutions. The two companies will combine their technologies to centrally manage data for network-wide insights and optimization. Mavenir and AWS will also work together to provide private networks and edge deployments.

The solution is designed to scale and leverages the same tools and technologies offered by AWS to enterprise applications today. These tools are the backbone for visibility and automation for any AWS-based offering and generally referred to as Platform-as-a-Service (PaaS).

That, in effect, results in offloading some of the telco application business to cloud functions. Mavenir says that will reduce complexity, put service providers at par with organizations which are realizing cost savings from cloud migrations without losing insight, performance, and control on their networks.

Opinion: The above claims remain to be proven! Time will tell. However, this partnership provides a well respected host environment (AWS) for Mavenir’s cloud resident 4G/5G software. That certainly lowers the risk for service providers that want to deploy Mavenir’s products and applications.

Another key element from this collaboration is the enablement of Private Networks and Edge deployments on AWS, powered by Mavenir’s Digital Enablement platform. With a digital app store for enterprise and various industry 4.0 applications such as IVA, AR/VR, IIoT and Robotics control, Mavenir’s Edge AI application suite is empowering an ecosystem of developers, service providers, partners, and enterprises to create and deploy applications in AWS to power digitalization and industry 4.0 with 5G.

This collaboration also lowers the network deployment time and cost for Mobile Network Operators and enterprises equally fulfilling use cases of either adding 5G and edge capabilities to an existing network or a greenfield 4G/5G network launch leveraging public clouds.

“The collaboration with Mavenir and AWS allows us to build out our 5G network and messaging platforms in a true cloud-native manner, harnessing the speed and agility that the AWS cloud brings along with Mavenir’s expertise in deploying and operating cloud-native network functions,” said Sidd Chenumolu, Vice President of Technology Development, DISH. “Together, we will enable our customers to take full advantage of the potential of 5G, reimagining wireless connectivity and giving our customers the ability to customize their network experience.”

“Working with AWS enables us to bring new customer-focused 5G use cases and 5G deployments to the market faster and with unique capabilities to realize true 5G potential,” said Bejoy Pankajakshan, Mavenir’s Chief Strategy Officer. “Mavenir’s solutions are designed to support full public cloud as well as hybrid cloud deployments.”

“We’re delighted to collaborate with Mavenir to offer voice and messaging solutions for core network and RAN customers along with AI/ML solutions for orchestration and observability.” said Amir Rao, General Manager Telco Solution Portfolio and Tech Alliances, AWS. “Together, we are providing true cloud native benefits to CSP customers, combining Mavenir’s expertise in the NFV market with the global scale of the AWS infrastructure to meet industry challenges of agility, scaling, slicing, and resiliency.”

Mavenir’s 4G and 5G deployments on AWS provides unique capabilities, including:

- Integration of Mavenir’s cloud-native Open RAN (vDU, vCU-CP, vCU-UP), Converged 4G/5G Packet Core, IMS, and Messaging with Amazon Elastic Kubernetes Service (Amazon EKS) anywhere supporting AWS Outposts.

- Use of AWS platform services and tools to deploy and manage cloud native network functions.

- Options for existing deployments to migrate Mavenir’s IMS core, voice, and messaging solutions to Amazon EKS and Amazon Elastic Compute Cloud (Amazon EC2) infrastructure.

- Mavenir’s Orchestration and Network Slicing solutions to manage hybrid cloud workloads running on AWS.

- Adoption of AWS for centrally managed telco workloads on far-edge, network edge and core simultaneously.

- Deployment of Mavenir’s standards compliant observability framework, RIC, NWDAF, AIOps and Analytics platform in AWS to collect the data from various AWS nodes in a centrally managed data lake and process the data using AI/ML for network wide insights and optimization.

- Integration of Mavenir’s telecom adaptation layer (Telco PaaS) as a common open source-based platform adaptation layer designed for telco specific workloads to support various carrier grade requirements on top of Amazon EKS and AWS PaaS functions.

Chart Courtesy of Amazon Web Services

……………………………………………………………………………………………………………………………………………..

References:

https://www.mavenir.com/press-releases/mavenir-to-deliver-cloud-based-5g-solutions-on-aws/

Mavenir’s In-House Radio Units Show Open RAN Ecosystem’s Growing Pains

https://partners.amazonaws.com/partners/0010L00001u5BBiQAM/Mavenir

https://www.fiercewireless.com/tech/mavenir-aws-deliver-cloud-based-5g-functions-to-telcos

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

https://docs.aws.amazon.com/whitepapers/latest/cicd_for_5g_networks_on_aws/5g-networks-on-aws.html

India’s DoT WPC allocates 5G trial spectrum in 3.5 Ghz, 26 Ghz and 700 Mhz bands

In the seemingly never-ending saga of “5G delayed in India,” the Department of Telecom (DoT) has allotted 5G trial spectrum in the 700 Mhz, 3.5 Ghz and 26 Ghz bands. That paves the way for the Big 3 — Reliance Jio, Bharti Airtel and Vodafone Idea (Vi) to partner with non-Chinese network vendors and develop India-relevant use cases for 5G networks (forget about URLLC which doesn’t meet 5G performance requirements in 3GPP Release 16 or IMT 2020 RITs).

The DoT’s wireless planning & coordination (WPC) wing late Thursday evening allotted “100, 800 and 10 units of experimental 5G airwaves to the Big 3 telcos in the 3.5 Ghz, 26 Ghz and 700 Mhz bands respectively,” a senior telco executive told ET. The 5G trial airwaves have been allocated for six months, he added.

Earlier this month, India’s DoT said telcos would be given experimental airwaves in mid-band (3.2-3.67 Ghz), sub-Ghz (700 Mhz) and mmWave band (26 Ghz) to run 5G trials for six months. So far, only mid-band spectrum in the 3.3-3.6 Ghz bands have been earmarked by the government for 5G services. The department had also said that telcos would also be allowed to use their own airwaves in the 800 Mhz, 900 Mhz, 1800 Mhz and 2500 Mhz bands to conduct 5G trials.

Huawei and ZTE were missing from the original list of applications from the Indian telcos that were approved by the government earlier this month, sending a clear signal that the two Chinese network equipment vendors would not be part of India’s 5G deployments as well.

Allotment of 5G trial spectrum is particularly crucial for Jio and Airtel, who already have 5G-ready networks and have recently bulked up on crucial airwaves in the recent auction to cater to the surge in data usage amid Covid and also future-proof themselves ahead of 5G rollouts.

DoT’s decision also marks the first official allocation of 5G trial spectrum in the coveted 26 Ghz millimeter wave (mmWave) band that ranges from 24.25-to 28.5 Ghz frequencies. Telcos have repeatedly underlined the criticality of the 26 Ghz mm wave band for bolstering the 5G business case, without which deployment costs of fifth- generation fast wireless broadband networks could jump several-fold and make 5G services unaffordable to consumers in India.

Industry executives said the latest allotment of experimental 5G airwaves is also set to pave the way for inclusion of the coveted 26 Ghz mmWave band and mid-band 5G spectrum (read: 3.3-3.67 Ghz) in the updated National Frequency Allocation Plan (NFAP-2021) — a key spectrum policy document that is undergoing revision. This is aimed to underline the government’s plans to go for a comprehensive auction of multiple 5G bands. DoT is yet to schedule a 5G spectrum sale.

It, though, is set to send a referral to the Telecom Regulatory Authority of India (Trai) to suggest reserve prices for all spectrum bands cleared for 5G trials, including 26 Ghz, 3.3-3.67 Ghz and 700 Mhz in the run up to the next auction. This could lead to Trai cutting the earlier base prices of the premium-sub-Ghz 700 Mhz band that went unsold for the second auction in succession in March as well as mid-band 5G spectrum that have been termed by telcos as exorbitant.

The DoT is also likely to ask the regulator to set a base price for the 600 Mhz sub-Ghz band, which has not been auctioned previously.

References:

India ramps up supply chain for 5G service launch in 2021 pending spectrum auction

Economic Times: India’s big bet on 5G in 2021 starts with 5G spectrum auction

India telecom revenue to slow through March 2021; 5G spectrum auction delayed yet again

At long last: India Telecom Minister gives go ahead for 5G trials

Dell CTO: Fragmented U.S. 5G deployments; Unified Nationwide 5G Ecosystem Needed

John Roese, Dell Technologies’ chief technology officer (CTO), urges private companies and the public sector to collaborate on creating a unified nationwide 5G ecosystem. He advocates domestic production of equipment, commitment to open radio access network infrastructure and additional tower construction.

U.S. efforts to develop a 5G network have been fragmented, with many regions of our country seeing no 5G deployment at all. This can threaten digital inclusion work in our communities, restrict innovation-based economic development, and put the U.S. at a competitive disadvantage. Broad accessibility is also critical to the high-tech industry contributing to an open 5G ecosystem, which in turn will grow the digital economy.

Telecom companies are already investing significantly in their 5G networks, with $81 billion of spectrum auctioned off in January and billions more expected in another auction slated for October. But as companies commit to major debt-funded purchases of spectrum they may lack the capital and incentives to build the infrastructure needed to ensure inclusivity.

The real solution lies with investment to modernize the core digital infrastructure, devices and services, centered on a modern open architecture for 5G, but the current industry structure is not aligned with this goal, and the existing ecosystem to enable it is limited.

It’s important to recognize that 5G is much more than just an evolution of 4G. Since 5G has new, higher performance technologies in addition to more traditional wireless access, it has the potential to deliver true Gigabit speed low latency mobile access. To accomplish that, a multitude of additional cellular towers along with a sophisticated network of virtual infrastructure is needed. This will generate a 5G network that is readily accessible, especially to the communities that need it the most.

The Dell CTO says that the U.S. risks falling behind other nations that are making large scale investments in their own 5G networks at a brisk pace. We have the resources and talent to catch up and lead the world in 5G, but first the government and the private sector must work collaboratively to create a foundational 5G wireless ecosystem in the U.S.

In summary, Roese states that “connectivity is economic opportunity and the key to a diverse, competitive workforce. We must come together to provide the equal access to technology and advanced connectivity that will ensure all are empowered to lead the country forward.”

Dell and 5G:

In an October 2020 CUBE interview with Dell’s COO and vice chairman Jeff Clarke said:

“5G is the next data fabric for the data era. We see the world of edge, cloud and 5G, those three circles, intersecting to a high degree. What we have is the first opportunity to bring a cloud environment to the telco space that hasn’t happened before, and the opportunity is large for us; it’s one of the single biggest opportunities that we see for Dell.”

…………………………………………………………………………………………………………………………………

References:

https://thehill.com/opinion/technology/555595-5gs-segmentation-may-create-another-digital-divide

https://events.technologyreview.com/video/watch/dell-technologies-5g-journey-john-roese/

Dell Technologies’s 5G Vision Embraces Shifting Network Architectures

Speedcheck’s Speed-Price Index (SPI) For Mobile Data in 89 Countries

By Gerard Kearney, Telecoms Consultant and Dr. Frederik Lipfert, CEO of Speedcheck (edited by Alan J Weissberger)

Speedcheck analyzed the mobile broadband speed experienced by the users of their speed test service in 89 countries across five continents and compared them against the prices consumers are paying for data in each country. The results are documented in a new Speed-Price Index (SPI) international ranking – a strong indicator of the value-for-money that consumers are getting for their mobile data when compared internationally.

The index increases as the speed increases and/or as the cost of data reduces. Thus, the higher the index the more value for money the mobile user enjoys.

The results could serve to lobby both governments and mobile telco operators to consider removing the artificial barriers that prevent operators from providing affordable mobile data to consumers worldwide, but without compromising performance.

Critical comparisons between speed (Mbps) and price ($/GB) from 89 countries were analyzed and converted into a unique Speed-Price Index (SPI) expressed in Mbps/$/GB. This service metric represents the most significant one that consumers depend on once connected to a network.

The various prices per GB across all 89 countries are sourced from Cable.co.uk’s1 worldwide mobile data price comparison for 2021 . For this present study, Speedcheck has adjusted these prices with the Purchasing Power Index (PPI) for each country2 which delivers a far more realistic international pricing comparison.

Countries Analyzed by Speedcheck for Value-For-Money Mobile Broadband Data:

|

Country

|

Download Speed [Mbps]

|

Average Price Per GB [$US]

|

Speed-Price Index (SPI) [Mbps/$/GB]

|

SPI Ranking (Global)

|

|---|

|

Country

|

Download Speed [Mbps]

|

Average Price Per GB [$US]

|

Speed-Price Index (SPI) [Mbps/$/GB]

|

SPI Ranking (Global)

|

|---|---|---|---|---|

| Israel | 7.12 | $0.09 | 82.3 | 1 |

| Italy | 18.2 | $0.41 | 44.2 | 2 |

| Fiji | 22.25 | $0.51 | 43.4 | 3 |

| Denmark | 28.68 | $0.90 | 31.8 | 4 |

| France | 17.97 | $0.57 | 31.6 | 5 |

| Australia | 22.4 | $0.88 | 25.5 | 6 |

| Finland | 28.13 | $1.26 | 22.3 | 7 |

| Austria | 26.98 | $1.34 | 20.1 | 8 |

| Russia | 8.67 | $0.67 | 13 | 9 |

| Sweden | 21.42 | $1.66 | 12.9 | 10 |

| Lithuania | 30.32 | $2.61 | 11.6 | 11 |

| Poland | 14.67 | $1.30 | 11.3 | 12 |

| The Netherlands | 36.76 | $3.54 | 10.4 | 13 |

| Kuwait | 9.62 | $0.95 | 10.1 | 14 |

Countries In The Americas Analyzed by Speedcheck for Value-For-Money Mobile Broadband Data:

|

Country

|

Download Speed [Mbps]

|

Average Price Per GB [$US]

|

Speed-Price Index (SPI) [Mbps/$/GB]

|

SPI Ranking (Regional)

|

SPI Ranking (Global)

|

|---|---|---|---|---|---|

| United States | 16.99 | $3.33 | 5.1 | 1 | 31 |

| Chile | 2.97 | $1.08 | 2.7 | 2 | 41 |

| Argentina | 7.43 | $3.16 | 2.3 | 3 | 45 |

| Puerto Rico | 15.49 | $6.90 | 2.2 | 4 | 46 |

| Brazil | 9.01 | $4.04 | 2.2 | 5 | 47 |

| Canada | 15.67 | $7.73 | 2 | 6 | 54 |

| Guatemala | 15.17 | $9.37 | 1.6 | 7 | 59 |

| Paraguay | 17.11 | $12.59 | 1.4 | 8 | 63 |

| Ecuador | 7.46 | $6.31 | 1.2 | 9 | 65 |

| Costa Rica | 8.13 | $7.76 | 1 | 10 | 66 |

| Dominican Rep. | 7.58 | $8.07 | 0.9 | 11 | 68 |

| Honduras | 5.32 | $5.72 | 0.9 | 12 | 69 |

| Mexico | 9.35 | $13.56 | 0.7 | 13 | 73 |

| Panama | 9.67 | $16.45 | 0.6 | 14 | 74 |

| El Salvador | 5.95 | $10.90 | 0.5 | 15 | 77 |

| Colombia | 5.17 | $12.33 | 0.4 | 16 | 80 |

| Peru | 1.03 | $6.32 | 0.2 | 17 | 85 |

Probably most surprising of all is Canada, with a disappointingly low SPI of just 2. It is ranked 6th place regionally and only 54th in the world. This is primarily due to the considerable price Canadian consumers must pay for their mobile data, at $7.73/GB(PPI-adjusted). In the region, Chile, Argentina, Puerto Rico and Brazil, as well as the U.S., all beat Canada for better value for money.

Looking at it from a purely speed metric only, Paraguay, with an average speed of 17.11 Mbps, beats the United States with 16.99 Mbps. But what is more concerning is the overall average speed for the Americas is considerably lower than that of Europe where, as we shall see in the next section, consumers in Bulgaria, Switzerland and The Netherlands are enjoying speeds of 46.63, 43 and 36.76 Mbps, respectively.

This combination of relatively slow speeds coupled with high prices keeps the countries of the Americas generally low on the global SPI ranking table.

Conclusions:

National governments and telecommunications regulators worldwide have had three opportunities over the past 20 years to get the spectrum auctions right for the government, right for the mobile telcos, and, above all, right for the consumer of essential mobile services. And yet, it seems few lessons have been learned from past mistakes.

Instead of focusing on allowing mobile network operators to grow and advance their network infrastructure to provide near-ubiquitous quality data connectivity to consumers, which is an essential backbone of the digital economy, unfortunately, many governments still seem fixated on trying to artificially maximize their revenues while displaying a lack of genuine concern for the fate of the mobile telcos and the consumer.

This has forced mobile telcos to pay exorbitant prices to use what is essentially a national resource that should be made readily available to every citizen. And this cost is undoubtedly being passed on by too many telcos to the consumer as essentially just another government value-added tax.

Consumers gladly pay a reasonable fee for clean water to be delivered to our homes. We do not expect governments to force water companies to pay billions of dollars for rainfall, only to pass that cost onto us! There would be a national uproar if such a thing were to happen.

So why should it be any different for another national resource, radio spectrum, which has now become an essential part of daily life and the furtherance of the digital economy in the form of mobile telecommunications? So, where is the uproar with this?

It is still not too late for national governments to review how they assign the national resource of radio spectrum to mobile telcos, even for the remaining 5G spectrum blocks that have yet to be awarded, and certainly for 6G going forward.

For example, one suggestion might be to use a combination of allocating reasonable fixed prices for blocks of spectrum to be sold to mobile operators based on the so-called “beauty contest” method. In this case, each company would submit its best tender to buy the spectrum resource at the fixed fee.

The spectrum fee would serve several purposes. First, it would eliminate unsuitable or speculative applicants who would never qualify for a mobile network license anyway while also promoting quality competition among the real key players. And second, it would assist in the smooth running of the spectrum allocation process.

The fee should be capped at a price that the operator can reasonably take on as a sunk capital investment or else readily recoup by passing on a small marginal cost to the consumer. It would therefore be up to the economists to determine the optimal market price for such spectrum. And if that should yet again turn out to be in the multiple billions of dollars, then, again, there is something seriously wrong. The market cannot sustain that level of overhead.

This proposed method also leaves the operator with more reserve capital funds to build out their future 5G and 6G network infrastructures and services for the benefit of the consumer.

With this, governments still get their moderate revenue, while operators do not end up saddled with enormous debt or strapped for cash for decades to come that shackles them from rolling out 5G or 6G services promptly. Also, consumers would not need to be unfairly burdened with exorbitant indirect “taxes.”

Whatever the way forward is, what is clear is government regulators must learn from the past. They must avoid policies that artificially inflate the price of radio spectrum for mobile telcos. They should also do away with measures that serve only to encourage unbridled and frenetic bidding sprees for blocks of spectrum that are deliberately released piecemeal as if they are as scarce as hen’s teeth when that is not the case.

Finally, to those mobile operators who do provide great value for money to data consumers despite the poorly managed auctions that have taken place in the past, we salute you. We mark you out as examples that others should be encouraged to follow. Special mention in this regard must go to Denmark, Finland and Australia.

But possibly the most outstanding example in this regard worldwide is a small island in the South Pacific where you can get 22.25 Mbps at only $0.51/GB. In Fiji, at least, the mobile customer still appears to be king.

Sources:

1 https://www.cable.co.uk/mobiles/worldwide-data-pricing/ Mobile data prices are the average within each country for consumer plans, expressed in $/GB.

2 Purchasing Power Index (PPI) reflects the cost of living coupled with the typical income in a country. It is normalised against a reference country, which here is the United States and the U.S. dollar. Our primary source for this index is https://www.worlddata.info, and our secondary source is https://www.numbeo.com.

3 https://www.mobileworldlive.com/featured-content/top-three/italian-regulator-defends-5g.auction/ 11 Oct., 2018.

4 GSMA Spectrum: “Effective Spectrum Pricing In Europe: Policies to support better quality and a more affordable mobile services”, Sept., 2017, Figure 1: Coverage Spectrum Prices by Category (2007-2016), Page 7 (sourced by NERA Economic Consulting). Note: spectrum prices are expressed and categorized in the price paid per MHz of bandwidth, per head of population ($/MHz/pop).

……………………………………………………………………………………………………………………………………………

About Frederik Lipfert, PhD:

Frederik is the CEO and Co-Founder of Speedcheck. He is interested in increasing transparency around internet performance through data-driven analysis. Dr. Lipfert received a PhD in Physics from University of Münster (WWU) in 2014 and a MS in Physics from Technical University Munich (TUM) in 2010.

…………………………………………………………………………………………………………………………………………

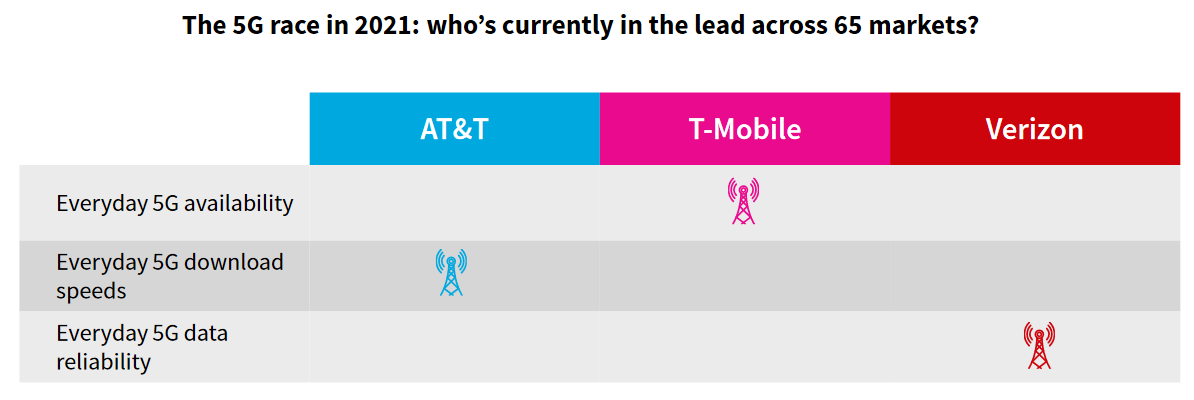

Addendum from RootMetrics:

U.S. 5G scorecard: Who’s leading the 5G race so far in 2021?

Our 5G Scorecard also breaks out results from 20 recently tested cities to show trends and demonstrate just how quickly the 5G leaderboard can shift.

We’re also pleased to introduce a new way of looking at 5G performance that captures the most typical user experience of switching between 5G-only and “5G mixed mode,” an increasingly common user experience of switching between 5G and 4G LTE during the same data activity. By combining results on 5G-only technology with those on 5G mixed mode, our Everyday 5G results show the most accurate view of a user’s typical experience when connected to 5G for any amount of time.

https://www.zdnet.com/article/rootmetrics-5g-scorecard-t-mobile-leads-in-everyday-5g-availability/

…………………………………………………………………………………………………………………………………………..

References:

https://www.speedcheck.org/price-of-speed-mobile-data/

https://www.speedcheck.org/5g-in-the-us-network-of-the-future/

Performance analysis of big 3 U.S. mobile operators; 5G is disappointing customers

Fastest 5G network in the U.S.? T-Mobile vs Verizon; Nokia’s fastest 5G claim

China Telecom: NB-IoT Users Exceed 100 Million -World’s Largest Number of 5G NB-IoT

China Telecom reached a new milestone as its 5G narrow-band Internet of Things (NB-IoT) [1.]user base grew to more than 100 million. This is the largest number of 5G NB-IoT connections the industry has ever acquired, making China Telecom the world’s largest carrier for NB-IoT and the world’s first carrier to have developed such a large user base. News of this achievement came during the 2021 World Telecommunication & Information Society Day (WTISD) commemoration on May 17, in which e-Surfing Internet of Things Technology (e-Surfing IoT) released the latest 5G IoT achievements on behalf of China Telecom.

Note 1. NB-IoT is a narrow band radio access technology designed for the IoT, allowing connections between IoT devices that is faster and on a wider range. The connection is for devices requiring small amounts of data, over long periods and consumes less energy.

……………………………………………………………………………………………………………………………………….

In July 2020, NB-IoT was officially endorsed as one of the global 5G standard technologies by ITU-R IMT 2020, paving the way for it to become an important part of 5G’s three major use cases.

A recent forecast by the Global System for Mobile Communications Association (GSMA) concludes that medium- and low-speed IoT connections will account for 90% of the total IoT connectivity by the end of 2025.

China Telecom was one of the world’s first carriers to start NB-IoT deployment, launching its services as early as 2017. After five years of extensive development, China Telecom has made breakthroughs in network coverage, user scale, platform services, chip modules, and industrial applications, demonstrating the role that NB-IoT has to play in forming the foundation for the digital economy.

China Telecom has built the world’s first and largest commercial NB-IoT network that delivers continuous coverage. With more than 400,000 NB-IoT base stations, users can leverage the most suitable spectrum resources, facilitating continuous network upgrades, network tests and service provisioning based on NB-IoT Release 14. Multi-carrier capacity expansion is also supported, adding extra flexibility to fulfil requirements for higher rate and larger capacity.

China Telecom has seen its IoT services used to support smart firefighting, security surveillance, urban facility management, smart homes, passenger car, charging device management, and smart appliances, with the total number of connections exceeding 100 million. It is the first time a carrier has acquired more than 100 million 5G NB-IoT users worldwide, making it an industry trailblazer. The company also leads in industry-specific use cases, with NB-IoT smart gas and water users numbering almost 30 million, making it the world’s largest provider of NB-IoT smart water and gas meter services.

China Telecom has deployed the industry’s first remote all-active NB-IoT device service platform to more than 100 million IoT devices with a 99% success rate of NB device data reporting. Its IoT Openness Platform, now in its fifth version — CTWing 5.0, offers a plethora of enhancements in smart congestion scheduling, remote upgrades, base station positioning, low power consumption, and quasi-real-time services. This means users benefit from massive-connectivity and low-power access, reducing overall terminal R&D costs while shortening R&D periods and improving NB-IoT experiences. The number of IoT device connections on the CTWing platform has exceeded 60 million, with an average of nearly 20 billion calls per month.

China Telecom has launched the industry’s first batch of NB-IoT chip modules which offer improved module performance, production efficiency, and reliability at reduced development costs, making them a powerful enabler of digital transformation.

China Telecom has also expanded NB-IoT applications to many other fields, from COVID-19 prevention and control to social governance, people’s livelihood, smart appliances, smart city, and smart agriculture, in the goal of evolving the “Internet of Everything” to evolve to “the Intelligent Internet of Everything.”

According to e-Surfing IoT, China Telecom’s NB-IoT technology has been applied in various industries, becoming a powerful enabler of industry digitalization and digital industrialization as part of the digital China vision.

To help contain the spread of COVID-19, China Telecom developed a smart door sensor, which has been adopted in several provinces across China, such as Heilongjiang, Guangdong, and Yunnan.

When it comes to social governance, China Telecom provides an array of smart community applications, such as NB-IoT smart smoke detectors, door status sensors, gas alarms, and manhole covers. These solutions improve the efficiency of community governance and property management while also encouraging the modernization of community governance systems, helping to support the digital economy.

In terms of people’s livelihood, China Telecom has rolled out tens of millions of NB-IoT smart water and gas meters. These meters enable automatic readings and alert solitary elderly to safety risks. China Telecom has also partnered with Goldcard Smart Group to turn Guangzhou into the world’s first city with over one million IoT gas meters.

China Telecom’s NB-IoT smart gas meters are now used by users reaching nearly 30 million people

As for smart home appliances, China Telecom and Haier Group have built the world’s first NB-IoT self-cleaning air conditioner, closing the gap of shared air conditioners for smart campuses and creating a new appliance consumption model for the sharing economy. China Telecom is also working with several home appliance giants in China to build a shared air conditioner leasing solution based on the NB-IoT technology, which is set to provide intelligent services for college students. These shared NB-IoT air conditioners have already been deployed in hundreds of colleges and universities in China.

China Telecom has helped build the country’s first city-level IoT platform in Xiong’an, a new national district in China. This platform is now the foundation for the city to build a digital replica.

In the smart agriculture, China Telecom is providing NB-IoT water quality monitoring services for an orchard town in Hunan Province. This helps to monitor water quality in real-time and implement intelligent agricultural breeding. Additionally, China Telecom’s NB-IoT technology is being used to enable smart cow services for a ranch in Xinjiang autonomous region.

With CTWing, its IoT Openness Platform, e-Surfing IoT will continue to advance the maturity of the IoT ecosystem, promote the scaled implementation of IoT applications, and enable digital industrialization and industry digitalization for the digital economy.

China Telecom media contact: [email protected]

Aruba Introduces Industry’s 1st Enterprise-Grade Wi-Fi 6E Access Point

HPE subsidiary Aruba today announced the first commercially available, enterprise-grade Wi-Fi 6E [1.] solution set – the 630 Series of campus access points (APs), starting with the AP-635.

Note 1. Wi-Fi 6E refers to IEEE 802.11ax (Wi-Fi 6) products that support 6GHz wireless spectrum. Wi-Fi 6E enables faster speeds and lower latencies than Wi-Fi 6 and earlier iterations of WiFi (IEEE 802.11). WiFi 6 products are starting to appear in routers [2.] and silicon. Cisco has been selling a WiFi AP for enterprises since 2019.

Note 2. List of best WiFi 6 routers:

- Asus RT-AX86U. The best Wi-Fi 6 router overall. …

- Netgear Nighthawk RAXE500. The Wi-Fi 6e speed demon. …

- Netgear Orbi with Wi-Fi 6 (RBK852) Best Wi-Fi 6 mesh router. …

- Netgear Nighthawk XR1000. …

- Eero Pro 6. …

- Netgear Nighthawk AX8 (RAX80) …

- TP-Link Deco X20. …

- Linksys Max Stream MR9600

In April 2020, the Federal Communications Commission (FCC) allocated 1,200 megahertz of spectrum in the 6 GHz band for unlicensed WiFi use. That was the largest swath of spectrum approved for WiFi since 1989. Opening the 6 GHz band more than doubles the amount of RF spectrum available for Wi-Fi use, allowing for less congested airwaves, broader channels, and higher-speed connections and enabling a range of innovations across industries. Since the FCC decision to open the 6 GHz band, 39 additional countries that are home to over 1.3 billion people have opened the 6 GHz unlicensed band for Wi-Fi 6E. (Source: Wi-Fi Alliance)

The industry’s first enterprise-grade Wi-Fi 6E solution, the new Aruba 630 Series delivers greater performance, lower latency, and faster data rates to support high-bandwidth applications and use cases. The new Aruba 630 Series APs will be available in calendar third quarter 2021.

Currently, as organizations increase their use of bandwidth-hungry video, cope with increasing numbers of client and IoT devices connecting to their networks, and speed up their transition to cloud, the demand for Wi-Fi continues to rise. As a result, wireless networks are becoming oversubscribed, throttling application performance. This frustrates all network users by negatively impacting the user experience, reduces productivity, puts digital initiatives at risk, and stifles innovation.

“The Aruba 630 Series campus access points are the first enterprise-grade WiFi 6E access points to be introduced by any of the main enterprise networking providers,” Gayle Levin, marketing manager at Aruba, wrote in response to questions. “We’re seeing the most interest from large public venues, such as airports, stadiums, and lecture halls, as well as healthy interest from health care and higher education,” she added.

“With connectivity demands growing exponentially, Wi-Fi 6E can take advantage of up to seven, super wide 160 MHz channels and uncongested bandwidth in the 6 GHz band to deliver unprecedented multi-gigabit and low latency connectivity,” said Kevin Robinson, SVP of Marketing at Wi-Fi Alliance. “Wi-Fi 6E will spur enhanced innovations and exciting new services. Wi-Fi Alliance is pleased to see longtime member Aruba bringing Wi-Fi 6E solutions to market that will help organizations better support critical activities like videoconferencing, telemedicine, and distance learning.”

According to leading market intelligence research firm 650 Group, Wi-Fi 6E will see rapid adoption in the next couple of years, with over 350M devices entering the market in 2022 that support 6 GHz. 650 Group expects over 200% unit growth of Wi-Fi 6E enterprise APs in 2022.

The new Aruba Wi-Fi 6E solutions are part of Aruba ESP (Edge Services Platform), the industry’s first AI-powered, cloud-native platform designed to unify, automate, and secure the Edge. Able to predict and resolve problems at the network edge before they happen, Aruba ESP’s foundation is built on AIOps, Zero trust network security, and a unified campus to branch infrastructure to deliver an automated, all-in-one platform that continuously analyzes data across domains, tracks SLAs, identifies anomalies, and self-optimizes, while seeing and securing unknown devices on the network.

With Aruba’s new Wi-Fi 6E offerings, organizations can take advantage of the increased capacity, wider channels in 6 GHz, and significantly reduced signal interference with 3.9 Gbps maximum aggregate throughput to support high bandwidth, low latency services and applications such as high definition video, next-generation unified communications, augmented reality/virtual reality (AR/VR), IoT, and cloud. Additionally, with a new ultra tri-band filtering capability, which minimizes interference between the 5 GHz and 6 GHz bands, organizations can truly maximize use of the new spectrum.

“As we progress in our digital transformation, we are continually adding an increasing number of IoT devices to our network and transitioning to Wi-Fi as our primary network connection rather than Ethernet. We are being asked to support an expanded array of mission-critical, high bandwidth applications that support research as well as hyflex learning and entertainment, like streaming video, video communications, and AR/VR for our students, professors, and staff,” said Mike Ferguson, network manager and enterprise architect at Chapman University.

“With Aruba’s Wi-Fi 6E APs, we’re confident that we’ll be able to not just support our short-term needs, but we’ll have room to grow as well, which will keep all of our users happy, increase our competitiveness, and allow us to extend the lifecycle of this network deployment by 50%,” he added.

Aruba 630 Series Access Point Key Features:

- Comprehensive tri-band coverage across 2.4 GHz, 5 GHz, and 6 GHz with 3.9 Gbps maximum aggregate data rate and ultra-triband filtering to minimize interference

- Up to seven 160 MHz channels in 6 GHz to better support low-latency, high bandwidth applications like high-definition video and AR/VR

- Operates on existing IEEE 802.3at standards for PoE power so there is no need to rip and replace existing power supplies

- Advanced security with WPA3 and Enhanced Open to better protect passwords and data

- Flexible failover with two HPE Smart Rate Ethernet ports for 1-2.5 Gbps, offering true hitless failover from one port to another for both data and power

- Application assurance to guarantee stringent application performance for latency sensitive and high bandwidth uses by dynamically allocating and adjusting radio resources

- Cloud, controller, or controllerless operation modes to address campus, branch, and remote deployments

“Consumer appetite for ubiquitous wireless connectivity is limitless, whether at home or traveling the world,” said Mike Kuehn, president at Astronics CSC. “As a leading global provider of advanced technologies for the aerospace and defense industries – including some of the largest major airlines in the world – Aruba’s new Wi-Fi 6E AP gives us the ability to offer compelling and unique solutions that deliver a new, enhanced and more secure wireless experience to our customers.”

“Aruba has two decades of leadership in Wi-Fi innovations, backed by an unwavering commitment to providing our customers with the reliable, fast, high capacity, and secure connectivity they need to pursue and exceed their organizational objectives,” said Chuck Lukaszewski, vice president and wireless chief technology officer at Aruba.

“Since 2016 we have helped lead the advocacy effort that has led to the 6 GHz band being opened all over the world. As such, we are extremely proud to be the first vendor to bring enterprise-grade Wi-Fi 6E solutions to market so our customers can take advantage of the huge increase in capacity that 6 GHz delivers,” he added.

Aruba is also framing the new WiFi 6E access points as “an important element of Aruba’s Edge Services Platform (ESP)” because the equipment will sit at the edge of the network, Levin added. “By virtue of their position and role within the network, access points are vital in collecting edge data from client devices and IoT that feeds back into Aruba ESP.”

The vendor entered the edge services market with the cloud-native platform last year to target campuses, data centers, branches, and remote workers, but it only works with Aruba’s access points, switches, and SD-WAN gateways.

…………………………………………………………………………………………………………………………………….

References:

https://www.businesswire.com/news/home/20210525005243/en/

https://www.sdxcentral.com/articles/news/aruba-claims-first-enterprise-wifi-6e-aps/2021/05/

https://www.tomsguide.com/news/wi-fi-6e-explained

North Carolina School District deploys WiFi 6 from Cambium Networks; WiFi 6 vs 6E Explained

FCC to open up 6 GHz band for unlicensed use – boon for WiFi 6 (IEEE 802.11ax)

Nokia and Proximus (Belgium) demonstrate 1st implementation of 25GS-PON

Nokia and Proximus turned on what they call the world’s fastest fiber access network at a media event in Antwerp attended by the Belgian Minister of Telecommunications, the Mayor of Antwerp and executives and engineers from the two companies.

Operating over existing fiber with Nokia equipment deployed in the Proximus network, the first ever 25G PON live network connects the Havenhuis building in the Port of Antwerp with the Proximus central office in the middle of the city. The network speed exceeded 20 Gbps, making it the fastest fiber network in the world.

Proximus is the leading provider of fixed broadband networks in Belgium with 45.9% market share. The operator is accelerating the move to fiber, adding 10% coverage each year and is on target to reach at least 70% of homes and business by 2028. As part of its inspire 2022 vision, it is creating a high capacity open network which will be available to all operators, eliminating the need for fiber overbuild.

Rupert Wood, Research Director for Fiber Networks at Analysys Mason, said: “Today’s 25G PON achievement demonstrates the unlimited potential of fiber. This next evolution in fiber technology will provide enterprises with greater than 10 Gbs connectivity and the capacity needed to support 5G transport along with future next generation services such as massive scale Virtual Reality and real time digital twins.”.

Guillaume Boutin, CEO Proximus, said: “The activation of the first 25G PON network worldwide shapes our bold ambition to be a trendsetter, to become a reference operator in Europe and, why not, across the globe. Together with Nokia, we have achieved a technological leap forward that will become a key enabler of the digital and economy and society that we stand for. Today’s announcement is also an occasion to stand still and look at the pace at which we connect the citizens of Antwerp to the technology of the future. Thanks to huge investments, we are realizing an acceleration that is unseen in Europe, and I am convinced this will be crucial to remain competitive for us as a company, but also for Antwerp as a city and for our entire economy.”

Federico Guillén, President Network Infrastructure Nokia, said: “10 years ago our companies launched the technology which enabled a switch to HD TV. Today we make history again with a network that is 200x faster. We are proud to support Proximus in enabling the world’s first 25G PON network, powered by Nokia’s Quillion chipset, which supports three generations of PON technologies. Quillion has been adopted by more than 100 operators since its launch last year and all operators deploying the Quillion based GPON and XGS-PON solution today have the capabilities to easily evolve to 25G PON.”

Nokia’s 25G PON solution utilizes the world’s first implementation of 25GS-PON technology and includes Lightspan access nodes, 25G/10G optical cards and fiber modems.

Nokia Lightspan FX and MX are high-capacity access nodes for massive scale fiber roll-outs. Usually located in telecom central office, they connect thousands of users via optical fibre, aggregate their broadband traffic and send it deeper in the network. The fiber access nodes can support multiple fiber technologies including GPON, XGS-PON, 25GS-PON and Point-to-Point Ethernet to deliver l wide range of services with the best fit technology..

Nokia ONT (Optical Network Termination) devices, or fiber optic modems, are located at the user location. They terminate the optical fiber connection and delivers broadband services within the user premises or cell sites.

Nokia supplied PON line cards with their Quillion chipset, which can handle 25 Gbps. The chipset can grow with gradual updates on an operator’s network. Nokia is already shipping the technology to 100 customers worldwide.

Nokia executives admitting during a webcast press conference today that its 25G PON tech still needed some work for large-scale deployments, but that it would be ready for large, prime-time rollouts in 2022, with enterprise and 5G backhaul applications expected to fuel initial demand.

PON (Passive Optical Networking) eliminates the need for active equipment on the connection, between the control panel and the end user’s network connection point. On the last mile, there is system of optical splitters that breaks the light signal into different wavelengths. This means the 25G connection can be shared by up to 32 households. Since end users do not constantly use the full connection, a high bandwidth per connection is still achievable.

Media Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: [email protected]

References:

Singtel starts limited deployment of 5G SA; only 1 5G SA endpoint device; state of 5G SA?

Singtel 5G SA:

Singtel is boasting that it is the first operator to launch a 5G standalone (5G SA) network in Singapore. Their 5G SA is in partnership with South Korean-based vendor Samsung.

The operator said it has deployed over a thousand 5G sites across Singapore in strategic locations such as Orchard Road, the Central Business District, Marina Bay, Harbourfront and Sentosa, as well as major residential areas including Sengkang, Punggol, Pasir Ris, Jurong East, Woodlands, and more.

However, it appears that service availability will be fairly limited at first. Indeed, Singtel indicated that only “selected customers” are being given “early access” to the new 5G SA network. The ONLY 5G SA device currently available is the Samsung Galaxy S21 Ultra 5G smartphone, said to be running a “Singtel-exclusive beta release of Samsung’s 5G SA software.”

“We are thrilled to introduce supercharged connectivity on Singapore’s most powerful 5G network. Our customers will be among the first in the world to enjoy the benefits that 5G SA can deliver. Wherever they are, consumers can stream 4K videos seamlessly, share favorite photos and moments with friends instantaneously, and enjoy lag-free gameplay and video conferencing. 5G SA will also fuel new innovations, being a key enabler of the digital transformation across industry sectors,” said Ms. Anna Yip, CEO, Consumer Singapore, Singtel.

Customers can register their interest at www.singtel.com/5GSAearlyaccess to be one of the first customers to experience Singtel’s 5G SA network. Customers with creative entries on how 5G will transform their lives will be selected to receive a “5G Power Up” kit that comprises a 5G SA SIM card, a Samsung Galaxy S21 Ultra 5G handset and cool accessories.

Winners who receive the 5G Power Up Kit will need to perform just TWO tasks to be eligible to exchange their test phone for a brand New Samsung Galaxy S21 Ultra 5G:

- Test the Samsung Galaxy S21 Ultra 5G SA-ready handset on Singtel 5G and provide feedback at singtel.com/5gfeedback

- Post a video of yourself on either Facebook or Instagram with a caption on how Singtel 5G transforms the way you live, work and play. Remember to make the post public, tag @singtel and hashtag #FirstonSingtel5GSA #galaxy5G #Galaxy5GxSingtel

Since September 2020, Singtel claims to have been operating Singapore’s fastest 5G NSA network under a market trial, offering 5G speeds of up to 1.2 Gbps. Within a year of receiving its 5G licence, Singtel has now turned on 5G SA and deployed over a thousand 5G sites across Singapore in strategic locations such as Orchard Road, the Central Business District, Marina Bay, Harbourfront and Sentosa, as well as major residential areas including Sengkang, Punggol, Pasir Ris, Jurong East, Woodlands, and more. It is the only telco in Singapore to roll out in-building 5G, covering popular malls such as VivoCity and Ngee Ann City, and will continue to expand its indoor 5G footprint in the coming months.

Singtel is focused on accelerating 5G innovation and 5G adoption in enterprises, launching Genie, the world’s first portable 5G-in-a-box platform and expanding its 5G ecosystem with 5G Multi-access Edge Compute trials in collaboration with Microsoft Azure and Amazon Web Services.

Samsung’s 5G Core Network has been developed and verified in a cloud native environment. Designed based on ‘Micro-services’, ‘Containers’ and ‘Stateless’ architectures,’ it will take full advantage of the cloud, acting as the key enabler for the rapid realization of 5G innovation. Samsung says it will boost 5G Core network function development and verification capabilities as well as enable automatic service upgrades and deployments for optimized operational efficiency.

Samsung vCore for 5G SA:

Image courtesy of Samsung

…………………………………………………………………………………………………………………………..

Other 5G SA networks coming to Singapore:

Antina Pte. Ltd. (Antina), the #2 mobile operator in Singapore has selected Nokia for its 5G SA network deployment. Antina is a very new telco which was incorporated on September 3 , 2020 in Singapore. It has been operating for 256 days before that.

Nokia has already laid claim to launching the first 5G RAN and SA network for the M1-StarHub Joint Venture, although the commercial deployment of the network has not yet been announced.

Nokia will provide equipment from its comprehensive AirScale portfolio and CloudRAN solution to build the Radio Access Network (RAN) for the 5G SA infrastructure, utilizing the 3.5GHz spectrum band. Nokia will supply 5G base stations and its small cells solution for indoor coverage, as well as other radio access products. Nokia’s 5G SA technology will provide Singaporean enterprises with the opportunity to explore multiple new use cases due to the network’s higher bandwidth, higher uplink speeds and lower-latency.

M1 and StarHub plan to jointly build a 5G network but will offer services independently. In April 2020, the Singapore regulator awarded two 5G licenses to Singtel and Antina, the joint venture (JV) between the second- and third-largest telcos, StarHub and M1.

Singtel and the JV were assigned 100MHz of 3.5GHz spectrum, while Singtel, StarHub and M1 each received 800MHz of mmWave spectrum for “localized coverage.”

All three operators nevertheless decided to offer 5G NSA in the meantime, in order to give users an early taste of 5G services.

………………………………………………………………………………………………………………………………………..

State of 5G SA Networks:

5G SA network rollouts remain scarce and underwhelming (e.g. T-Mobile US) as most operators around the world are initially focusing on the less complicated 5G NSA.

That’s really a no brainer: 5G NSA is based on 4G LTE core network (EVC), signaling and network management, while 5G SA. 5G Core Network implementation has not been standardized and there is no definitive spec that will lead to similar implementations. Hence, 5G SA/5G Core network is proprietary to each network operator and requires a UNIQUE 5G SA software update for each 5G endpoint (smartphone, tablet, laptop, IoT, robot, etc). Most 5G network operators say they will implement 5G SA in a “cloud native core network,” whatever that is?

According to a March 2021 update from the Global Mobile Suppliers Association (GSA), about 68 operators in 38 countries have been investing in public 5G SA networks in the form of trials, planned or actual deployments. This compares with over 400 operators known to be investing in 5G licenses, trials or deployments, the GSA said.

………………………………………………………………………………………………………………………………

References:

https://www.samsung.com/global/business/networks/products/core/cloud-core/

https://www.lightreading.com/asia/singtel-trumpets-launch-of-standalone-5g/d/d-id/769752?

Cloud Service Providers Increase Telecom Revenue; Telcos Move to Cloud Native

https://www.sgpbusiness.com/company/Antina-Pte-Ltd

Dell’Oro: Optical Transport Equipment Market Stagnant in 1Q 2021; Jimmy Yu’s Take

The Optical Transport equipment market came in roughly flat with the year ago quarter in 1Q 2021, according to a new report by Dell’Oro group. The North American market was the main reason for this stagnant growth rate, offsetting all of the year-over-year growth in the other regions.

“Although the North American region was down this quarter compared to last year, it did improve from last quarter,” said Jimmy Yu, Vice President at Dell’Oro Group. “In fact, the growth quarter-over-quarter was really strong. It grew just a little over 15 percent, and we think this strength will carry forward through the remainder of the year,” added Yu.

Highlights from the 1Q 2021 Quarterly Report:

- The top manufacturers by revenue share were Huawei, Ciena, ZTE, and Nokia. Among the top four, Nokia gained the most revenue share over the year ago quarter.

- Three vendors (Ciena, Huawei, and Infinera) are actively shipping 800 Gbps-capable coherent line cards. However, due to the company’s early entry, Ciena holds the lion share of shipment volume.

- Communication service providers comprised 71 percent of WDM market revenue in the quarter.

- The year-over-year revenue growth in each region was as follows:

| Regions | Growth Rate in 1Q 2021 |

| North America | -15% |

| Europe, Middle East and Africa | 10% |

| Asia Pacific | 0% |

| Caribbean and Latin America | 15% |

In an email to this author, Jimmy Yu provided additional information on the optical transport market:

For coherent 400 Gbps, shipment volumes have been growing quite rapidly over the past year. Ciena was first to market with a 400 Gbps coherent solution and was followed by vendors introducing 600 Gbps-capable coherent solutions that can operate at 400 Gbps. The primary buyers of this wavelength speed were the Internet Content Providers (ICPs), often referred to as hyperscale. We think 400 Gbps wavelength shipments will enter the broader market this year (2021) and be a mainstream deployment speed in 2022. So, most if not all vendors have a 400 Gbps offering at this point.

800 Gbps transport has just started with Ciena entering the market first with the WaveLogic 5 based line cards. Other vendors that have a 800 Gbps-capable line card include Huawei and Infinera. (We are expecting only three vendors to have this type of line card in the market.) It is still early days for 800 Gbps, but this technology will be an important driver for delivering longer un-regenerated spans of 400 Gbps and 600 Gbps wavelengths for long haul and subsea applications.

Yes, 5G should drive more optical backhaul and fronthaul. However, with so much optical capacity put in place for 4G, we think the timing for demand generation for 5G backhaul is later. That is, we need 5G roll out to commence outside current 4g coverage areas and for operators to begin 5G densification that will require more fronthaul and backhaul.

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

https://www.delloro.com/news/optical-transport-equipment-market-growth-stagnant-in-1q-2021/

……………………………………………………………………………………………………………………………………

A different Optical Transport Network report from Market Quest states:

The global Optical Transport Network (OTN) equipment market size is expected to gain market growth in the forecast period of 2020 to 2025, with a CAGR of 4.1%% in the forecast period of 2020 to 2025 and will expected to reach USD 18270 million by 2025, from USD 15550 million in 2019.