GSMA: China’s 5G market set to top 1 billion this year

China’s state sponsored 5G market is expected to add almost US$260 billion to its gross domestic product in 2030, with its 5G connections accounting for nearly a third of the worldwide total according to a recent GSMA report.

The report forecasts that more than half of Chinese mobile connections will be 5G by the end of 2024. 5G’s contribution to GDP in China is expected to reach almost $260 billion in 2030, which is 23% of the overall annual economic impact of mobile in China. Also by 2030, 5G connections in China will account for nearly a third of the global total, with 5G adoption in China reaching almost 90%, making it one of the leading markets globally.

The mobile industry contributed to 5.5% of China’s GDP last year, and in each of the coming years through 2030, nearly a quarter of that contribution will come from 5G – the highest echelon of current cellular technology – per the results of a study issued on Tuesday by the Group System for Mobile communications Association (GSMA).

Overall, the mobile market’s contribution to the Chinese economy will reach around US$1.1 trillion in 2030, GSMA said. Mats Granryd, Director General of the GSMA, said:

“It is great to see China, the world’s largest 5G market, commit so enthusiastically to the GSMA’s Open Gateway initiative to help drive the growth and maturity of the technology. As China surpasses 1 billion 5G connections this year, we expect to see further investment and potential in evolutions such as 5G-Advanced, 5G New Calling and 5G RedCap to improve user experience and unlock new revenue streams for operators.”

Photo credit: Shutterstock

GSMA’s Mobile Economy China 2024 report said the country’s entire mobile sector has so far provided a total of nearly 8 million jobs directly and indirectly, and generated US$110 billion in tax revenue in 2023 alone. According to that report:

- There are now 1.28 billion unique mobile subscribers in China – a penetration rate of 88%

- Mobile’s overall contribution to the Chinese economy in 2023 reached $970 billion, or 5.5% of GDP

- 5G is expected to reach 1.6bn connections in 2030, representing a third of the world’s total, and forecast to contribute $260 billion to China’s GDP

- An additional 290 million people in China now use mobile internet compared to eight years ago (2015), closing the country’s Usage Gap from 43% to just 16%

- Mobile data traffic in China is expected to quadruple by the end of the decade

China has the world’s most mobile phone users by a wide margin. As of the end of last year, there were 122.5 mobile phones for every 100 people, according to figures from the National Bureau of Statistics. The number of 5G base stations was nearly 3.38 million – a surge of 46% from a year earlier.

“China continues to set the pace for cutting-edge 5G technology standards,”the GSMA said, adding the country’s operators are “leading the way in the transition to 5G-advanced and 5G reduced capability networks. This is anticipated to kick-start a new round of 5G investment in 2024 and beyond.”

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

Omdia: China’s 5G network co-sharing + cloud will create growth opportunities for Chinese service providers

5G Americas/Omdia: 2023 global 5G connections reach 1.76 billion

5G connections accelerated in 2023, reaching 1.76 billion globally by end-December, following the addition of 700 million connections in the 12-month period, according to a report from 5G Americas, with data provided by Omdia.

Of course, most of those connections were 5G NSA, which does not offer any 3GPP defined 5G features (including 5G Security and Network Slicing). According to a Dell’Oro Group report, 12 new 5G SA core networks were deployed in 2023, down from 18 in 2022. The report also notes that AT&T, Verizon, British Telecom EE, Deutsche Telekom, and other Mobile Network Operators (MNOs) did not deploy 5G SA networks in 2023.

Chris Pearson, President of 5G Americas, said, “The wireless telecommunications industry stands at the cusp of a new era, driven by innovation, collaboration, and a shared vision for a connected future. With Fixed Wireless Access (FWA) continuing to drive consumer broadband demand, new technology milestones are advancing unparalleled connectivity experiences worldwide.”

North America emerged as a leader in 5G adoption, with connections in the region comprising 29% of all North American connections by the end of 2023. Notably, the region experienced a staggering 64% year-over-year growth in 5G connections, adding 77 million new connections to its network. By the end of 2023, North American 5G connections totaled 197 million.

–>This author believes that most of the new 5G connections in the U.S. were FWA from Verizon and T-Mobile.

Latin America also witnessed substantial progress in both 4G LTE and 5G connections, with LTE connections reaching 582 million by the close of 2023, adding 40 million new connections year over year. Moreover, the region embraced the 5G revolution, with 39 million 5G connections established by year-end, setting the stage for further expansion in the years to come.

“4G LTE is still the strongest technology across the region,” said Jose Otero, Vice President of Latin America, and the Caribbean for 5G Americas. “Although various factors, including 5G handset mass market availability and completion of spectrum auctions will see an increase in 5G coverage, and subscriber growth in the coming year.”

Looking ahead, Omdia forecasts paint a picture of the telecommunications landscape we can expect to see throughout this decade. Global 5G connections are projected to skyrocket to 7.9 billion by 2028, with North America forecasted to boast an impressive 700 million 5G connections by the same year.

Omdia principal analyst Kristin Paulin points out, “With this forecast, 5G will reach the global milestone of accounting for more than half of all connections by 2028. For North America, as an early leader, 5G will be more than 80% of connections.”

Additionally, 5G data traffic is expected to be 76% of all technology data traffic as it reaches a staggering 2.6 billion TB (or 2600 EB), with all technology data traffic reaching 3.4 billion TB (or 3400 EB) by 2028, reflecting the exponential growth trajectory of 5G connectivity.

While 5G technology continues to dominate headlines, the Internet of Things (IoT) ecosystem remains a vital component of the digital revolution. Currently, global IoT subscriptions stand at 3.1 billion, complemented by 6.6 billion smartphone subscriptions. Forecasts suggest that IoT subscriptions will reach 4.5 billion, while smartphone subscriptions will surge to 7.4 billion by 2026, highlighting the evolving nature of connectivity and the interconnectedness of our digital world.

Globally, the number of deployed 5G networks shows strength compared to 4G LTE deployments, and in the case of North America almost matches 4G LTE networks deployed. Currently, there are 314 commercial 5G networks worldwide, and this number is anticipated to grow to 450 by 2025, reflecting significant investments in 5G infrastructure worldwide.

The number of 5G and 4G LTE network deployments as of March 18, 2024, are summarized below:

5G:

- Global: 314

- North America: 17

- Latin America and Caribbean: 39

4G LTE:

- Global: 714

- North America: 18

- Latin America and Caribbean: 135

Visit www.5GAmericas.org for more information, statistical charts, and a list of LTE and 5G deployments by operator and region. Subscriber and forecast data is provided by Omdia and deployment data by 5G Americas and TeleGeography (GlobalComm).

About 5G Americas: The Voice of 5G and Beyond for the Americas

5G Americas is an industry trade organization composed of leading telecommunications service providers and manufacturers.

The organization’s mission is to facilitate and advocate for the advancement of 5G and beyond toward 6G throughout the Americas. 5G Americas is invested in developing a connected wireless community while leading 5G development for all the Americas. 5G Americas is headquartered in Bellevue, Washington. More information is available at 5G Americas’ website.

5G Americas’ Board of Governors Members include Airspan Networks Inc., Antel, AT&T, Ciena, Cisco, Crown Castle, Ericsson, Liberty Latin America, Mavenir, Nokia, Qualcomm Incorporated, Rogers Communications, Samsung, T-Mobile US, Inc., Telefónica, and WOM.

…………………………………………………………………………………………………………………….

References:

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

GSMA Intelligence: 5G connections to double over the next two years; 30 countries to launch 5G in 2023

Bundenetzagentur: 5G was 28.5% of broadband speed measurements in Germany (Oct 2022 thru Sept 2023)

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

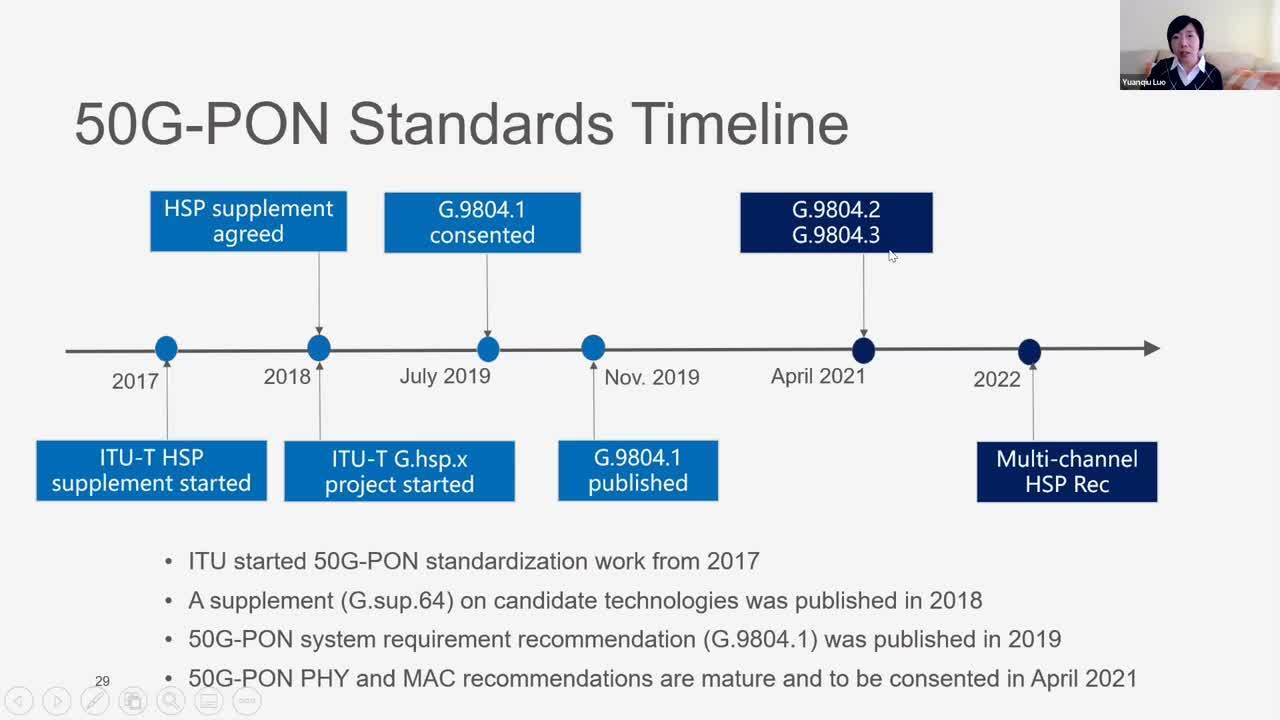

HKT is first to deploy 50G PON technology in Hong Kong

HKT [1.] has become the first telecommunication service provider in Hong Kong to adopt the latest 50G PON technology, as the telco prepares to ramp up the delivery of applications that require ultra-high-speed broadband Internet connections for both home and commercial customers.

Note 1. HKT Limited is a company incorporated in the Cayman Islands with limited liability.

50G fiber based broadband offers a significant step up in speed, with a specification download speed of up to 50Gbps. Paired with the latest Wi-Fi 7 technology, the remarkable increase in bandwidth supports smooth simultaneous multi-device connectivity of all kinds for users both at home and in a commercial setting. Latency also improves by a substantial 27% on average compared to that of a 10G fiber network. [The above latency is only applicable to designated servers. Network latency in other areas will vary depending on the operational load of individual servers as well as network traffic.]

Bruce Lam, CEO, Consumer, HKT, said, “NETVIGATOR has always been at the forefront of the market. We are delighted to become the first telecommunication service provider in Hong Kong to adopt 50G PON technology. With the development of smart homes, demand for high-speed multi-device connections has been increasing to cater for activities such as 8K video streaming, large video file transfer and sharing at home, online gaming and even real-time financial market monitoring and trading. We will continue to explore cutting-edge technologies to meet our customers’ future connectivity needs.”

Steve Ng, Managing Director, Commercial Group, HKT, said, “HKT Enterprise Solutions has consistently provided diverse digital solutions for our commercial customers. As AI and cloud applications become ubiquitous, enterprise customers’ demand for bandwidth, speed and low latency have continued to elevate.

For example, employees need to use cloud services, collaboration tools, and AI solutions within the office environment. Schools are actively implementing e-learning and remote teaching. Large-scale events such as exhibitions and concerts generate high demands for live streaming or AR/VR experience solutions. Through this latest technology, we are preparing ourselves for the network needs of different customers.”

By applying the innovative 50G PON technology HKT is able to further enhance the performance of its existing fiber network with ease. Currently, HKT’s 10G fiber broadband network covers over 2.4 million households across 50,000 residential buildings, as well as 8,000 commercial buildings in Hong Kong.

About HKT:

HKT is a technology, media, and telecommunication leader with more than 150 years of history in Hong Kong. As the city’s true 5G provider, HKT connects businesses and people locally and globally.

Our end-to-end enterprise solutions make us a market leading digital transformation partner of choice for businesses, whereas our comprehensive connectivity and smart living offerings enrich people’s lives and cater for their diverse needs for work, entertainment, education, well-being, and even a sustainable low-carbon lifestyle. Together with our digital ventures which support digital economy development and help connect Hong Kong to the world as an international financial centre, HKT endeavours to contribute to smart city development and help our community tech forward.

For more information, please visit www.hkt.com.

References:

Ooredoo Qatar is first operator in the world to deploy 50G PON

Türk Telekom and ZTE trial 50G PON, but commercial deployment is not imminent

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

ZTE, along with China Mobile’s Yunnan Branch, have created an accurate 3D model of the lineside infrastructure along the KunchuDali railway in China and used it to improve network performance. The companies introduced 5G-Advanced digital twin technology to build two core capabilities of digital site twinning and wireless channel twinning.

KunchuDali high-speed railway involves a large number of network planning challenges such as cross-bridge coverage, tunnel coverage, mountain-splitting area shielding, and abundant vegetation. It forms a vital segment of the China-Myanmar International Railway and the Trans-Asian Railway west line, connecting the key cities of Kunming, Chuxiong, Dali, and Lijiang in Yunnan Province. Serving as the backbone of the region’s transportation infrastructure, this route facilitates the daily movement of approximately 61,000 passengers, earning its reputation as the “golden tourism route.”

However, the railway’s construction and operation face formidable obstacles due to the rugged terrain characterized by fluctuating mountain ranges, perilous topography, and dense vegetation. Notably, a significant portion of the route traverses areas with a high concentration of bridges and tunnels, accounting for 64% of its total length. Moreover, many construction sites are situated in abnormal mountain zones, posing challenges to the efficiency and quality of surveying efforts.

China Mobile’s Yunnan Branch and ZTE introduced the 5G-Advanced digital twin technology to build two core capabilities of digital site twinning and wireless channel twinning. The 3D site twinning is achieved through UAV automatic flight control acquisition, thus implementing inspection survey of engineering parameters and AI identification of antenna assets, and guaranteeing engineering implementation quality with high efficiency and high quality.

- In June 2022, China Mobile unveiled a 6G network architecture which creates a virtual twin through digital means to realize a digital twin network architecture (DTN) with network closed-loop control and full lifecycle management; The service defines the end-to-end system to realize the full service system architecture (HSBA); In the group network, the Distributed Autonomous Network (DAN) with distributed, autonomous and self-contained features is implemented, which supports on-demand customization, plug and play and flexible deployment.

- ZTE’s RAN digital twin leverages digital twin, big data and artificial intelligence technologies, drastically enhancing network deployment and operation efficiency by minimizing resources and time needed for trial-and-error procedures of radio network deployment and optimization, making them more versatile, flexible and autonomous.

In addition, channel twinning is built in mountainous areas to achieve coverage prediction and optimization. The optimization elements required for mountainous areas, namely the azimuth, downtilt, power, and beam weights of antennas, are twinned and optimized beforehand. In this way, with the first-in-place construction of the pre-planning, the construction quality of the high-speed railway network is guaranteed faster and better, and the optimization period is shortened. Before the Spring Festival of 2024, the KunchuDali high-speed railway fully achieved the target of high-quality lines, with a coverage rate of 98.5% and a 5G download rate of more than 300Mbps. Compared with traditional planning and optimization methods, the KunchuDali high-speed railway saved more than RMB1.6 million and shortened the optimization period for nearly one month.

During the Spring Festival, China Mobile’s Yunnan Branch ensured an excellent internet experience for users with its high-quality high-speed railway network. The implementation of digital twin technology for high-speed railways enables efficient site surveys and coverage optimization to achieve higher efficiency and quality. This advancement fosters the deep integration of various industries with digital twin technology, paving the way for new industries, ecosystems, and operational modes. Furthermore, it lays a solid digital foundation for the future evolution towards 6G.

………………………………………………………………………………………………………………………………………………………….

According to Gartner, global digital twin revenues are expected to reach $183 billion by 2031. And when it comes to adoption, railway operators are at the forefront, using these virtual models to improve real-time asset management, reduce delays, and improve journey times.

In the UK, Transport for London (TfL) in 2022 announced plans to roll out a digital twin of the London Underground network so it can virtually monitor tracks and tunnels. Network Rail also offers a catalogue of training simulations built on digital twin technology.

According to an article in Mobility Innovators, bullet train operator JR East has deployed digital twins to monitor tracks, bridges and tunnels to enable predictive maintenance, while Hong Kong’s MTR (Mass Transit Railway) uses them to improve scheduling.

UAV automatic flight control acquisition implements 3D site twinning along the KunchuDali railway. Photo Credit: ZTE

……………………………………………………………………………………………………………………………………………………………………………………………………………..

ABOUT ZTE:

ZTE helps to connect the world with continuous innovation for a better future. The company provides innovative technologies and integrated solutions, and its portfolio spans all series of wireless, wireline, devices and professional telecommunications services. Serving over a quarter of the global population, ZTE is dedicated to creating a digital and intelligent ecosystem, and enabling connectivity and trust everywhere. ZTE is listed on both the Hong Kong and Shenzhen Stock Exchanges. www.zte.com.cn/global

……………………………………………………………………………………………………………………………………………………………………………………………………………..

https://www.zte.com.cn/global/about/news/china-mobile-zte-revolutionize-high-speed-railway-with-5g-a-digital-twin.html

https://www.zte.com.cn/global/solutions_latest/5g-advanced/digital_twin.html

https://www.telecoms.com/5g-6g/china-mobile-zte-use-digital-twin-to-improve-lineside-5g

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

What is 5G Advanced and is it ready for deployment any time soon?

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

DriveNets and Ciena Complete Joint Testing of 400G ZR/ZR+ optics for Network Cloud Platform

DriveNets and Ciena have

The successful tests demonstrate how the integrated solution optimizes service provider networks and builds more efficient converged infrastructures. The solution also includes enhanced network configuration and management software capabilities and ensures the Ciena WaveLogic 5 Nano (WL5n) pluggables can be tuned, configured, and managed by DriveNets Network Cloud software.

This solution will be on display at OFC Conference, March 26-28 in San Diego, CA, as part of the University of Texas in Dallas (UTC) – OpenLab OFCnet demonstration.

Last year, DriveNets announced that Network Cloud was the first Disaggregated Distributed Chassis/Backbone Router (DDC/DDBR) to support ZR/ZR+ optics as native transceivers for Network Cloud-supported white boxes. Today’s announcement demonstrates that two market leaders and innovators are working together to offer a fully tested and validated solution that advances and expands the adoption of open, disaggregated networking solutions.

Efficient Converged Infrastructure:

“Today’s announcement is another step in the growing adoption of disaggregated networking solutions, supporting operators’ desire to lower their operational costs by simplifying the network architecture and building networks like cloud,” said Dudy Cohen, Vice President of Product Marketing at DriveNets. “Operators are looking for open solutions that allow them to mix and match elements from multiple vendors as well as reduce the number of networks they need to support. The converged IP/Optical solution enabled by this announcement delivers on both goals.”

“As a leading provider of both optical networks and coherent optical modules, Ciena continues to innovate and give our customers greater choice in how they create open and robust networks, without compromise,” said Joe Shapiro, Vice President, Product Line Management, Ciena. “The combined solution – a converged IP/Optical white box – can achieve longer unregenerated reaches while also being simple to manage, resulting in improved cost and operational efficiencies.”

Simplifying the network by collapsing network layers:

The integrated solution delivers significant cost savings by collapsing Layer-1 to Layer-3 communications into a single platform. The use of ZR/ZR+ also eliminates the need for standalone optical transponders, lowering the number of boxes in the solution and reducing operational overhead, floorspace, and power requirements.

This collaboration ensures that the DriveNets NOS (DNOS) supports the WL5n coherent pluggable transceivers beyond simply plugging them into the box. It will support multiple modes of operation, including 400ZR, ZR+, as well as higher performance modes to extend 400G connectivity across more links in the network. The combined solution was tested across a Ciena open line system, representing a real networking environment.

This integration goes beyond interoperability validation. DriveNets Network Cloud will offer software support for Ciena’s optical solution, including configuration (channel and power), monitoring and troubleshooting for Ciena transceivers.

Future planned enhancements involve standards-based integration with Ciena’s end-to-end intelligent network control system – the Ciena Navigator Network Control Suite (NCS) – for better visibility and optimization of the optical infrastructure.

About DriveNets:

DriveNets is a leader in high-scale disaggregated networking solutions. Founded in 2015, DriveNets modernizes the way service providers, cloud providers and hyperscalers build networks, streamlining network operations, increasing network performance at scale, and improving their economic model. DriveNets’ solutions – Network Cloud and Network Cloud-AI – adapt the architectural model of hyperscale cloud to telco-grade networking and support any network use case – from core-to-edge to AI networking – over a shared physical infrastructure of standard white-boxes, radically simplifying the network’s operations and offering telco-scale performance and reliability with hyperscale elasticity. DriveNets’ solutions are currently deployed in the world’s largest networks. Learn more at www.drivenets.com

References:

KDDI Deploys DriveNets Network Cloud: The 1st Disaggregated, Cloud-Native IP Infrastructure Deployed in Japan

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

DriveNets raises $262M to expand its cloud-based alternative to core network routers

AT&T Deploys Dis-Aggregated Core Router White Box with DriveNets Network Cloud software

DriveNets Network Cloud: Fully disaggregated software solution that runs on white boxes

5G Open Innovation Lab: update & progress report

The 5G Open Innovation (OI) Lab is a collaborative, development-focused ecosystem approach unlike traditional models, bringing together visionary startups, industry leaders, technical experts, and investors to break down silos that hamper innovation and build what’s next.

Intel was the 5G OI Lab’s first signed partner, followed by T-Mobile US. The list now includes 17 partners from AT&T, Comcast (who replaced T-Mobile US as founding partners), Accenture, Nokia, Microsoft, Dell Technologies, Palo Alto Networks, Spirent Communications and more.

Jim Brisimitzis – Founder & General Partner, 5G OI Lab:

“The opportunity for developers to impact the potential of edge and 5G is fundamentally bigger than connectivity. To realize this potential, we need a bold approach to experimenting, learning, and unleashing the transformational impact software is capable of. People like to refer to us as a startup accelerator, because on the surface it looks like that. But we’re really not.” He prefers the moniker “innovation broker.”

The lab team scouts for intriguing new technologies in enterprise, networking, applications, big data, AI, security and so on that present intriguing technology with market potential, and participating classes are selected by the lab’s partners (including CSPs), based on their priorities.

5G OI Lab now includes more than 118 multi-stage enterprise startups who have collectively raised more than $2 billion in venture capital. A few of the success stories:

- Private network software specialist Expeto, which worked with Dell, Rogers and Ericsson on a private 5G network that operates in a Canadian gold mine.

- Network observability start-up MantisNet partnered with Palo Alto Networks on a joint effort to work around quirks of how mobile networks are architected in order to identify mobile devices and implement security policies.

- Canadian start-up DarwinAI, recently acquired by Apple is moving ahead with a generative AI initiative later this year.

5G OI Lab has built 5G private networks that are used as testbeds for use cases that could serve particular industries well. The most recently announced is at the Tacoma Tideflats port area, and it supports five enterprise with use cases ranging from worker safety and worker communications such as push-to-talk capabilities to streaming surveillance video, to better supply chain visibility through faster data offloading via ship-to-shore connectivity; companies involved include Comcast, Dell Technologies, VMware by Broadcom, Intel, Expeto, Ericsson and others.

Brisimitzis comments: “What we have seen is that these internally run accelerators or labs—no offense to anyone—they end up being internal navel-gazing, because they are just about that company, and therefore the conversation is just about that company,” he explains. “Well, as large as Microsoft is, or Amazon, or AT&T, they’re part of a bigger ecosystem. And enterprises don’t buy from just one company, they buy from ecosystems.”

5G OI Lab endeavors to be part of an ecosystem that works together to bring new solutions from the lab to the field to the market.

Author’s Note:

The IEEE 5G/6G Innovation Testbed is a cloud-based, end-to-end 5G network emulator that enables testing and experimentation of 5G products and services. Secure, easily-accessible and “always on,” this platform brings 5G network testing and development to your fingertips and paves the way for speedier and smoother real world deployments.

References:

5G Open Innovation Lab: Relationships, resources and the road to innovation

Another 5G Open Innovation Lab: AT&T, Comcast, Nokia, Intel, Microsoft, Dell assist 118 startups in search of 5G Killer Apps

IBM: 5G use cases that are transforming the world (really ?)

mmWave Coalition on the need for very high frequency spectrum; DSA on dynamic spectrum sharing in response to NSF RFI

According to the mmWave Coalition, most 5G and 6G discussions to date are focused on lower frequencies. “A key reason for this is that it is hard to justify a business case for sub-THZ mobile spectrum use at present as there are now basic technical questions, technological hurdles, and cost issues, yet these are fertile and active areas of research which may eventually lead to compelling opportunities for mobile use in this spectrum.”

Policymakers shouldn’t forget the potential of very high frequency spectrum [1.], the Coalition said last week in response to the National Science Foundation’s request for information (RFI) on the national spectrum research and development plan, which is part of the U.S. national spectrum strategy. The Coalition wrote:

“5G and 6G in US policy deliberations addresses both fixed and mobile users, and the 5G and 6G mobile uses are dependent on fronthaul and backhaul which are essentially fixed services. While these fixed links are often implemented in non-spectrum fiber optic links, there is a vast, growing need for wireless backhaul, especially in rural, underserved areas often where fixed wireless access is vital for rural households, and often backhaul requirements cannot always be implemented in fiber technology, due to installation urgency requirements, local terrain features that delay or block installation, cost, or short term requirements that make fiber optic installation uneconomical”

Note 1. ITU-R Report R M.2376 contains studies of frequency ranges (6-100 GHz) for International Mobile Telecommunications (IMT) technologies. It is envisioned that future IMT systems will need to support very high throughput data links to cope with the growth of the data traffic, new extremely bandwidth demanding use cases, as well as new capabilities of integrated sensing and communication (ISAC). There has been academic and industry research and development ongoing related to suitability of mobile broadband systems in frequency bands above 92 GHz to enable services requiring tera-bit per second speeds. This has prompted researchers to consider the technical feasibility of higher frequency bands in IMT.

An ITU-R preliminary draft new report in progress provides information on the technical feasibility of IMT in bands between 92 GHz and 400 GHz. This draft report complements the studies carried in Report ITU-R M.2376.

……………………………………………………………………………………………………………………….

The Dynamic Spectrum Alliance (DSA) said the RFI is on target in the areas it suggests for research. “Efficiency, dynamic spectrum access and management, automated interference mitigation, and coexistence modeling are all areas in which the DSA and our members have keen interest and extensive experience. We also fully support efforts to study the economic-, market-, social-, and human-centric aspects of increasing spectrum access.”

DSA called on the NSF to take into account innovative licensing frameworks that are already working, including the citizens broadband radio service band and 6 GHz. “Given the historical success of the variety of spectrum sharing techniques in different bands designed to protect different incumbents … there is no one size fits all solution to spectrum sharing,” DSA said.

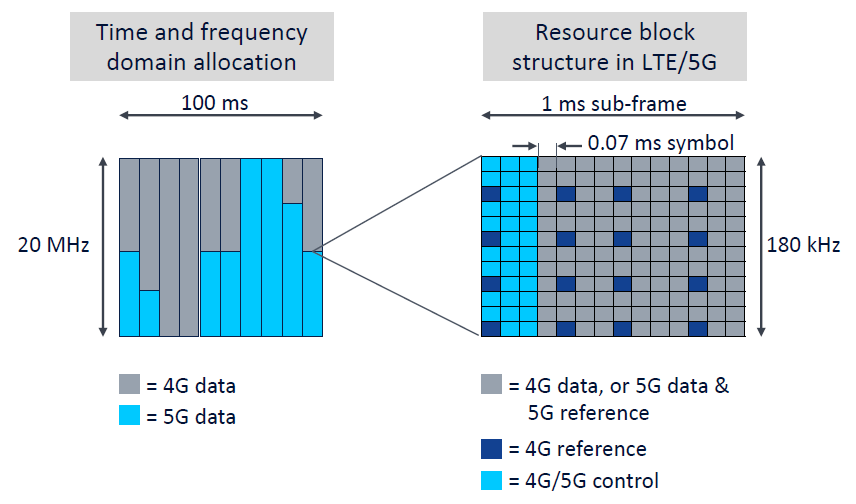

One term of interest is ‘‘Dynamic Spectrum Sharing’’ which is a focus of the National Spectrum Strategy but was not defined. The DSA defines Dynamic Spectrum Sharing as the use of both innovative licensing frameworks, such as those that enable opportunistic access, and automated dynamic spectrum management tools to coordinate spectrum assignments, increase spectrum efficiency, and expand spectrum access for a wide range of new users while also protecting incumbent operations.

Dynamic Spectrum Sharing between 4G and 5G Networks

………………………………………………………………………………………………………

AT&T urged the administration to more clearly define the term dynamic spectrum sharing. The definition should include an “examination of full-power licensed use” and “development of a basis for predictable times and/or geographies in which dynamically shared spectrum can be used,” AT&T said.

The U.S. carrier urged more work on interference mitigation techniques and not restricting research to “mere ‘on/off’ spectrum access controls.” The definition should seek “to define co-channel and adjacent channel interference environments to incorporate into network design and operation.”

References:

https://communicationsdaily.com/article/view?search_id=838690&id=1914125

https://s3.amazonaws.com/warren-news.com/pdf/916759

https://dynamicspectrumalliance.org/2024/DSACommentstoNSFonSpectrumRnDPlanRFI.pdf

New ITU report in progress: Technical feasibility of IMT in bands above 100 GHz (92 GHz and 400 GHz)

ITU-R WP5D: Studies on technical feasibility of IMT in bands above 100 GHz

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

Vodafone tests 5G Dynamic Spectrum Sharing (DSS) in its Dusseldorf lab

Keysight Technologies, Qualcomm extend 5G Collaboration to Dynamic Spectrum Sharing (DSS) Technology

Ericsson 5G data call using dynamic spectrum sharing with Qualcomm 5G Modem-RF System

Bundenetzagentur: 5G was 28.5% of broadband speed measurements in Germany (Oct 2022 thru Sept 2023)

German Federal Network Agency Bundenetzagentur (BNetzA) annual report said that 5G readings made up 28.5% of the broadband speed measurements up from 6% in the previous (2020/2021) reporting period.

“I’m pleased that the network operators are pushing ahead rapidly with the 5G rollout. More and more mobile customers are benefiting from very high speeds. This trend will pick up even more in the coming years,” said Klaus Müller, President of the Bundesnetzagentur.

It’s possible to achieve very high data transmission rates with 5G (?), which are sometimes well over the contractually agreed estimated maximum of the relevant tariff. This year’s annual report includes a special examination of such measurements.

Results for fixed broadband connections

The proportion of fixed broadband users whose connection had a download speed of at least half their contractually agreed maximum speed was 85.5% (2021/2022: 84.4%). The proportion of users whose connection had a speed equivalent to or higher than their contractually agreed maximum speed was 43.5% (2021/2022: 42.3%). Slight improvements on the previous year were thus evident.

Most end-users (79.1%; 2021/2022: 78.2%) were satisfied with the performance of their provider (rating of 1 to 3 on a scale of 1 to 6, with 1 being the highest). 10.4% of customers (2021/2022: 10.9%) gave their connection a rating of 5 or 6. These results show that customer satisfaction was slightly higher than in the previous year. The actual speeds measured by satisfied end-users were closer to the contractually agreed maximum speeds.

Results for mobile broadband connections

For mobile broadband connections, general performance was again considerably lower than for fixed broadband. The proportion of users across all bandwidth categories and providers whose connection had at least half their contractually agreed estimated maximum speed was 25.5% (2021/2022: 23.2%). The proportion of users whose connection had a speed equivalent to or higher than their contractually agreed estimated maximum speed was 4% (2021/2022: 3%).

The large majority of end-users (70.4%) once again gave their providers a rating of 1 to 3. This is a very small decline on the previous 12-month period (2021/2022: 70.8%). The fact that at the same time the broadband speeds measured as a percentage of the contractually agreed estimated maximum speeds were again low still suggests that mobile broadband users rated mobility and absolute speeds higher than actually receiving their contractually agreed maximum speeds.

Speed test results do not allow conclusions on broadband coverage

The test results depend on the tariffs agreed between the users and their providers. It is therefore not possible to draw conclusions from the broadband speed checker results about broadband coverage or the availability of broadband internet access. Rather, the tests show if the providers supply their customers with the contractually agreed bandwidth.

Annual report on broadband speed tests

The eighth annual report covers the period from 1 October 2022 to 30 September 2023. A total of 305,035 valid tests were made using the desktop app (2021/2022: 398,747 valid tests). For the mobile sector, the number of valid tests was 563,363 (2021/2022: 623,581).

References:

https://breitbandmessung.de/interaktive-darstellung

Nokia plans to investment €360 million in microelectronics & 5G Advanced/6G technology in Germany

Vodafone Germany deploys Ericsson 5G radio to cut energy use up to 40%

With 85% 5G coverage in Germany; only 40% have used a 5G network

Vodafone Germany plans to activate 2,700 new 5G cell sites in 1H 2023

Deutsche Telekom launches 5G private campus network with Ericsson; Sovereign Cloud for Germany with Google in Spring 2022

Germany and France to fund private 5G projects with ~EUR 18 million

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

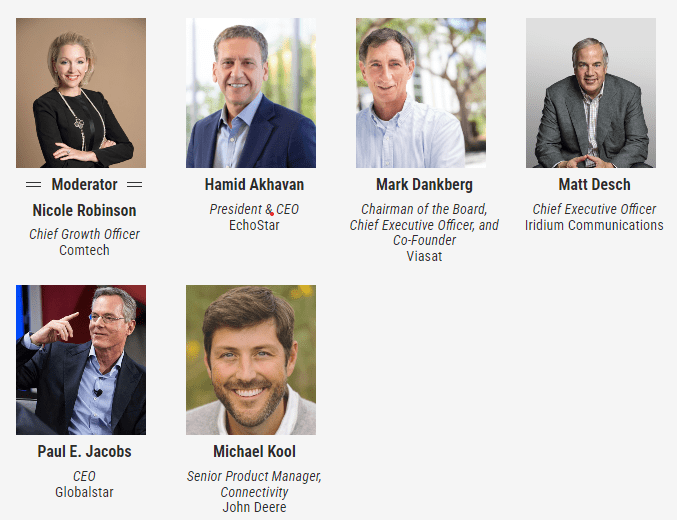

Converged terrestrial and satellite connectivity is a given, but the path is strewn with unknowns and sizable technological and business challengers, according to satellite operator CEOs. Hopefully, 3GPP Release 18 will contain the necessary specifications for it to be implemented as we explained in this IEEE Techblog post.

During Access Intelligence’s Satellite 2024 conference in Washington DC this week, Viasat CEO Mark Dankberg said satellite operators must start thinking and acting like mobile network operators, creating an ecosystem that allows seamless roaming among them. Terrestrial/non-terrestrial network (NTN) convergence requires “a complete rethinking” of space and ground segments, as well as two to three orders of magnitude improvement in data pricing, Dankberg said. Standards will help get satellite and terrestrial to fit together, but that evolution will happen slowly, taking 10 to 15 years, Iridium CEO Matt Desch said. It remains to be seen how direct-to-device services will make money, he added. Satellite-enabled SOS messaging on smartphones “is becoming free, and our satellites are not free — we need to make money on it some way,” Desch added.

The regulatory environment around satellite has changed tremendously during the past decade, with the FCC very oriented toward mobile networks’ spectrum needs and now satellite matters making up most of the agenda for the 2027 World Radiocommunication Conference, Desch said. However, there will be regulatory challenges to resolve in satellite/terrestrial convergence, he predicted. There are significant synergies in having a 5G terrestrial network and satcom assets under one roof, he said. Blurring the lines between terrestrial and non-terrestrial makes it easier for manufacturers to build affordable equipment that operates in both modes, Desch concluded.

That inevitable convergence is being driven by declining launch costs, maturing technologies and improved manufacturing, all of which make non-terrestrial network connectivity more economically competitive, said EchoStar CEO Hamid Akhavan. He said the EchoStar/Dish Network combination (see 2401020003) was driven in part by that convergence, consolidating EchoStar’s S-band spectrum holdings outside the U.S. with Dish’s S-band holdings inside the country. The deal also melds Dish’s network operator expertise with Hughes’ satellite expertise.

Wednesday Opening General Session: Are Satellite and Cellular Worlds Converging or Colliding?

To ensure space’s sustainability, missions must follow the mantra of “leave nothing behind,” sustainability advocates said. Space operators should have more universal protocols and vocabulary when exchanging space situational awareness data, as well as more uniformity in what content gets exchanged, said Space Data Association Executive Director Joe Chan. When it comes to space sustainability, clutter isn’t necessarily dangerous, and any rules fostering sustainability should avoid restricting the use of space, he said. Space lawyer Stephanie Roy of Perkins Coie said a mission authorization framework covering space operations that fall outside the regulatory domain of the FCC, FAA and NOAA is needed. Space operators and investors see sustainability rules as inevitable and want to ensure they allow flexibility and don’t mandate use of any particular technology, she added. Many speakers called for a “circular economy” in space, with more reuse of materials via refueling, reuse or life extension.

Separately, space sustainability advocates urged a mission authorization regulatory framework and universal use of design features such as docking plates enabling on-orbit serving or towing. Meanwhile, conference organizers said event attendance reached 14,000.

Also, ITU Secretary-General Doreen Bogdan-Martin urged the satellite industry to join ITU’s Partner2Connect digital coalition aimed at addressing digital divide issues, particularly in the least-developed nations and in landlocked and small island developing countries. The digital divide “is right up there” with climate change as a pressing issue for humanity, said Bogdan-Martin. She noted the coalition has received $46 billion in commitments, with a target of $100 billion by 2026.

References:

https://communicationsdaily.com/article/view?BC=bc_65fb60473d5de&search_id=836928&id=1911572

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

https://www.3gpp.org/specifications-technologies/releases/release-18

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

China Mobile increased revenue 7.7% to 1.009 trillion Chinese yuan (US$140 billion) in 2023, with earnings up 3.7%. China Mobile’s biggest growth drivers were cloud computing and storage, which grew 66% to RMB83 billion ($11.5 billion), and 5G enterprise, which hiked sales by 30% to RMB47.5 billion ($6.6 billion). It also revealed it had earned RMB5.4 billion ($750 million) in 5G private networking revenue, up 113%. Its “new business” segment, which covers international, investments and applications, expanded 28% to RMB49.3 billion ($6.9 billion).

China Mobile’s capital spending was RMB180.3 billion ($25 billion), a 2.6% decrease from 2022. It gave no guidance for 2024, but CAPEX will surely decrease in 2024 and coming years due to a recent change to retain existing 5G network equipment longer than previously planned.

China Mobile’s Board on Thursday voted to extend the depreciable life of its 5G assets from seven years to ten years, based on the belief that much of its 5G network equipment will continue to be deployed after the arrival of 6G (IMT 2030) at the end of this decade (or later). The state owned telco said it expects “that 5G network investments shall be reused in 6G network infrastructure to the maximum extent, and therefore it is expected that 5G/6G networks will coexist after commercialization of 6G and 5G equipment will have a relatively long life cycle.”

The immediate effect of this decision will be to cut a massive 18 billion yuan ($2.5 billion) out of China Mobile’s depreciation bill this year. It’s the first time any major telco has formally declared that not only is it reluctant to spend on new 6G equipment, but that it also intends to keep its 5G assets as long as possible. That sends a clear warning that in the aftermath of the 5G capex binge, telcos have little appetite for big technology bets without a clear ROI.

…………………………………………………………………………………………………………………..

Meanwhile, China Unicom boosted net profit by 11.8% and topline revenue by 5.0%. Unicom said it had grown its cloud business by 42% to RMB51 billion ($7.1 billion), while its new computing and digital services business recorded RMB75 billion ($10.4 billion) in sales, up 13%.

“With 5G network coverage nearing completion, the Company’s investment focus is shifting from stable Connectivity and Communications (CC) business to high-growth Computing and Digital Smart Applications (CDSA) business. CAPEX was RMB73.9 billion in 2023. Network investment saw an inflection point.”

In 2023, Connectivity and Communications (CC) business, which encompasses mobile connectivity, broadband connectivity, TV connectivity, leased line connectivity, communications services as well as information services, achieved revenue of RMB244.6 billion. It contributed to three quarters of the service revenue of CC and CDSA combined. The Company’s connectivity scale further expanded, with the total number of CC subscribers exceeding one billion, representing an increase of about 140 million from the end of 2022.

China Unicom capital spending was flat at RMB73.9 billion ($10.3 billion), and it revealed it will slash CAPEX this year by RMB8.9 billion ($1.2 billion) or 12%.

References:

https://www.lightreading.com/5g/china-mobile-unicom-raise-red-flags-on-network-spend

https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0321/2024032100246.pdf

https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0319/2024031900241.pdf

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

China Mobile verifies optimized 5G algorithm based on universal quantum computer

Omdia: China Mobile tops 2023 digital strategy benchmark as telcos develop new services

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China