LightCounting: Wireless infrastructure market dropped both YoY and sequentially in 1Q23

In the 1stQ2023, the global wireless infrastructure market declined 3% YoY and 17% sequentially, according to LightCounting. Starting a new year with a sequential decline is typical but a YoY drop is abnormal and suggests a declining pattern is in the making. This trend confirms that we have entered the post-peak era.

While the U.S. market posted its steepest drop, the strong 5G rollouts in India and a 5G rebound in Japan, along with stable and sustained activity in EMEA and China, respectively, were not enough to keep the wireless infrastructure market out of the decline. On the open vRAN front, DISH in the U.S., Rakuten Mobile in Japan, and a few Rakuten Symphony customers kept the market flat YoY and produced double digit sequential growth.

Despite a weak quarter, Huawei retook its lead at the expense of Ericsson, which reported weak 1Q23 results that led to a market share loss. In the meantime, Nokia benefited from the 2 leaders’ market share loss and gained 1% point. ZTE also gained share at the expense of Huawei and Ericsson while Samsung’s share remained stable.

“We have passed the 5G peak and have entered the second year of a disinvestment cycle. The 5G investment cycle that started in 2019 and ended in 2021 was driven by hundreds of communications service providers (CSPs), including the world’s largest cellular footprints (i.e., China). At the moment, India’s massive 5G rollout is preventing the situation from getting worse but this will end soon,” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

As a result, this year, LightCounting expects the wireless infrastructure market to slightly decline in 2023 (compared to 2022) with India in the lead. In the long run, our service provider 20-year wireless infrastructure footprint pattern analysis points to a 2022-2028 CAGR of -3% characterized by low single-digit declines through 2027, which appears to be the bottom leading to flatness or slight growth in 2028. In fact, we expect 5G to slightly pick up in 2027, driven by upgrades needed to prepare networks for 6G. Given the ongoing 6G activity, we believe something labeled 6G will be deployed in 2028.

Highlights from Dell’Oro’s 1Q 2023 RAN report:

- Top 5 RAN 1Q 2023 RAN suppliers include Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Top 4 RAN 1Q 2023 RAN suppliers outside of China include Ericsson, Nokia, Huawei, and Samsung.

- Nokia recorded the highest growth rate among the top 5 suppliers, while Ericsson and Samsung both lost some ground in the first quarter.

- The report also shows that Nokia’s RAN revenue share outside of China has been trending upward over the past five quarters.

- The Asia Pacific RAN market has been revised upward to reflect the higher baseline in India.

Open RAN and vRAN highlights from Dell’Oro’s 1Q 2023 RAN report:

- After more than doubling in 2022, Open RAN revenue growth was in the 10 to 20 percent range in the first quarter while the vRAN market advanced 20 to 30 percent.

- Positive developments in the Asia Pacific region were dragged down by more challenging comparisons in the North America region.

- Short-term projections remain unchanged – Open RAN is still projected to account for 6 to 10 percent of the 2023 RAN market.

- Top 5 Open RAN suppliers by revenue for the 2Q 2022 to 1Q 2023 period include Samsung, NEC, Fujitsu, Rakuten Symphony, and Mavenir.

| Historical data accounts for sales of the following vendors: | ||

| Vendor | Segments | Source of Information |

| Affirmed Networks (acquired by Microsoft, April 2020) | vEPC, 5GC | Estimates |

| Altran | vRAN | Estimates |

| Altiostar | vRAN (CU, DU) | Estimates |

| Amdocs | 5GC | Estimates |

| ASOCS | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Baicell | RAN (RU) | None, supplies other RAN/vRAN vendors |

| Benetel | Open RAN (RU) | None, supplies other RAN/vRAN vendors |

| Cisco | EPC, vEPC, 5GC | Survey data and estimates |

| China Information and Communication Technologies Group (CICT) | RAN | Estimates |

| Comba Telecom | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors |

| CommScope (acquired Phluido vRAN patents, October 2020) | vRAN (RU, DU) | Estimates |

| Corning | vRAN | Estimates |

| Dell | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Enea | 5GC | Estimates |

| Ericsson | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Estimates |

| Fairwaves | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors |

| Fujitsu | RAN | Survey data and estimates |

| HPE | 2G/3G core, 5GC | Estimates |

| Huawei | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates |

| JMA Wireless | vRAN | Estimates |

| KMW | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors |

| Kontron | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Mavenir (acquired ip.access, September 2020) | vEPC, vRAN, 5GC | Survey data and estimates |

| Metaswitch (acquired by Microsoft, May 2020) | 5GC, vEPC and 2G/3G core | Estimates |

| Movandi | RAN/vRAN (RU/repeater) | Estimates |

| MTI Mobile | vRAN (RU) | None, supplies other RAN/vRAN vendors |

| Node-H | vRAN (small cells) | Estimates |

| Nokia | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates |

| NEC (including Blue Danube) | RAN, vRAN (RU), EPC, 5GC | Survey data and estimates |

| Oracle | 5GC | Estimates |

| Parallel Wireless | vRAN (CU, DU) | Estimates |

| Pivotal | RAN/vRAN (RU/mmWave repeater) | Estimates |

| Quanta Cloud Technology (QCT) | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Qucell | RAN, vRAN | Estimates |

| Ribbon Communications | 2G/3G core | Survey data and estimates |

| Samsung | RAN, vRAN, vEPC, 5GC | Estimates |

| Silicom | Open RAN (DU) | None, supplies other RAN/vRAN vendors |

| SuperMicro Computer | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Verana Networks | RAN/vRAN (RU/mmWave) | Estimates |

| ZTE | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates |

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

The number of 5G subscriptions will surge from 934 million in 2022 to 3.1 billion in 2027 -a Compound Annual Growth Rate (CAGR) of 27% – according to a study from ABI Research. Further, 5G traffic is forecast to increase from 293 Exabytes (EB) in 2022 to 2,515 EB in 2027, at a CAGR of 54%.

ABI’s forecast is largely based on an increase in 5G Core (5GC) networks. To date, more than 35 5GC networks are operating in 5G standalone (SA) mode. 5GC is expected to lead to a growth in devices connected to the network and the traffic routed through it.

“5GC holds potential for operators to monetize further existing cellular connectivity for traditional mobile broadband (MBB) use cases but also offers scope for operators to expand cellular capabilities in new domains. Additionally, 5GC also offers innovation potential for committed telcos to establish new operating models for growth outside of the consumer domain,” explains Don Alusha, Senior Analyst, 5G Core and Edge Networks, at ABI Research.

5GC presents Communications Service Providers (CSPs) with a fluid and dynamic landscape. In this landscape, there is no static offering (requirements constantly change), no uniform offering (one shoe does not fit all), and no singular endpoint (one terminal with multiple applications). 5GC guides the industry into edge deployments and topologies. CSPs step out of the four walls of either their virtual Data Center (DC) or physical DC to place network functionality and compute as close to their customers as possible. This constitutes decentralization, a horizontal spread of network assets and technology estate that calls for a ‘spread’ in the operating model.

The shift from a centralized business (e.g. with 4G EPC) to a decentralized business (5G SA core network) stands to be a significant trend in the coming years for the telecoms industry. Against that backdrop, the market will demand that CSPs learn to drive value bottom-up. “What customers need” is the starting point for companies like AT&T, BT, Deutsche Telekom, Orange, and Vodafone. In other words, in this emerging landscape, there will be enterprise-specific, value-based, and niche engagements where the business strategy sets the technology agenda. So, it is rational to conclude that a “bottom-up” approach may be required to deliver unique value and expand business scope. That said, CSPs may be better equipped to drive sustained value creation if they learn to build their value proposition, starting from enterprise and industrial edge and extending to core networks.

“A 5G cloud packet core can potentially unlock new transactions that supplement existing volume-centered modus operandi with a local, bottom-up value play for discrete engagements. But the power of a bottom-up model is not enough. To monetize a 5G cloud packet core at scale, some of the existing top-down intelligence is needed too. Learning how to operate in this hybrid top-down and the emerging bottom-up, horizontally stratified ecosystem is a journey for NTT Docomo, Rakuten Mobile, Singtel, Softbank, and Telstra, among other CSPs. In the impending cellular market, an effective and efficient operating model must contain both control and lack of control, both centralization and decentralization and a hybrid of bottom-up plus some of the ‘standard’ top-down intelligence. The idea is that CSPs’ operating model should flexibly fit and change in line with new growing market requirements, or new growth forays may hit a roadblock,” Alusha concludes.

Editor’s Note:

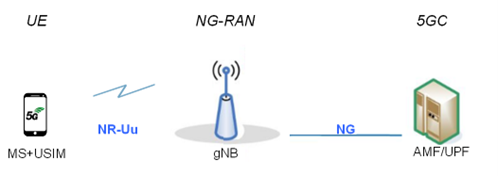

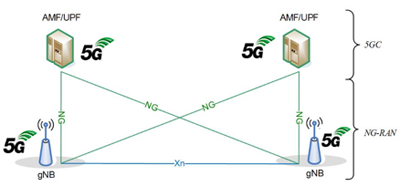

It’s critically important to understand that the 3GPP defined 5G core network protocols and network interfaces enable the entire mobile system. Those include call and session control, mobility management, service provisioning, etc. Moreover, the 3GPP defined 5G features can ONLY be realized with a 5G SA core network. Those include: Network Automation, Network Function Virtualization, 5G Security, Network Slicing, Edge Computing (MEC), Policy Control, Network Data Analytics, etc

Figure 1: Overview of the 5G system

The 5GC architecture relies on a “Service-Based Architecture” (SBA) framework, where the architecture elements are defined in terms of “Network Functions” (NFs) rather than by “traditional” Network Entities. Via interfaces of a common framework, any given NF offers its services to all the other authorized NFs and/or to any “consumers” that are permitted to make use of these provided services. Such an SBA approach offers modularity and reusability.

Figure 2: 5G SA Core Network Architecture

The 5G SA architecture can be seen as the “full 5G deployment,” not needing any part of a 4G network to operate.

Finally, 3GPP has not liased their 5G system architecture specifications to ITU-T so there are no ITU-T standards for 5G SA Core Network or any other 5G non-radio specification. Instead, 3GPP sends their specs to ETSI which rubber stamps them as “ETSI standards.”

……………………………………………………………………………………………………………………………………………………….

These findings are from ABI Research’s 5G Core Market Status and Migration Analysis report. This report is part of the company’s 5G Core & Edge Networks research service, which includes research, data, and analyst insights. Based on extensive primary interviews, Application Analysis reports present an in-depth analysis of key market trends and factors for a specific technology.

About ABI Research

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

References:

https://www.3gpp.org/technologies/5g-system-overview#

https://www.nokia.com/networks/core/5g-core/

A few key 3GPP Technical Specifications (TSs) are listed here:

- TS 22.261, “Service requirements for the 5G system”.

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)

- TS 32.240 “Charging management; Charging architecture and principles”.

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

- TS 38.300 “NR; NR and NG-RAN Overall description; Stage-2”

Big 5 Event: wireless connectivity use cases for healthcare, network slicing, security and private networks

Emerging use cases for wireless telecommunications technology was discussed at the Big 5G event in Austin, TX last week in a panel session titled, “Future connectivity use cases and the Holy Grail: Private networks, metaverse, 6G and beyond.” The questions addressed included:

- Who is monetizing private networks and what are we learning from their experiences?

- Should telcos move past targeting only large enterprise customers for 5G services?

- When will the metaverse take off?

- How are telcos gearing up for 6G and what are the expectations?

Jodi Baxter, vice president for 5G and IoT connectivity at Telus, described the numerous emerging applications of 5G in healthcare. One example is a connected ambulance project carried out with Alberta Health Services, where, thanks to 5G, doctors can remotely issue authorizations necessary for stroke medication, which needs to be administered within a narrow time window.

Some of the applications developed for the healthcare sector can also be included in telcos’ offerings to corporate customers. Baxter said Telus has included remote doctor and nurse consultations in 5G bundles for small businesses, which can help their staff retention rates. Healthcare companies are also looking at more specific applications, with Baxter citing the example of a healthcare company that would wish to track hip and knee replacements with 5G.

While sustainability is often seen as an unprofitable endeavor, Baxter argued technology can help customers see a return on investment. One of Telus’s projects in this area uses drones and 5G for reforestation.

…………………………………………………………………………………………………………………………………..

Omdia’s research has shown that about a fifth of midsized to large enterprises “want to invest in 5G network slicing in the next two years, but most people cannot find a commercial offer,” said Camille Mendler, chief analyst of enterprise services at Omdia. “[It’s] not there yet, which is a problem, right?” she added. Note that 5G network slicing requires a 5G SA core network, which most 5G service providers have yet to deploy.

Baxter noted that network slicing will be a game changer for security and transportation of critical data. The panel pointed to autonomous vehicles as another potential application that will require its own slice. She also said slicing will be important for ensuring applications from private 5G networks also have a macro capability.

Lori Thomas, senior vice president for strategic engagement and transformation at MetTel, pointed out that a lot of government agencies are currently looking to bring specific functionalities from the private network onto the public network, and make them accessible in edge devices such as laptops and tablets.

…………………………………………………………………………………………………………………………………..

William Britton, vice president for information technology and CIO at California Polytechnic State University, said it is not always easy to figure out how products offered by telecom companies apply to specific use cases. The university has been told to “go elsewhere” by providers when it has approached them about possible 5G applications, as the solutions on offer did not meet requirements, he said.

Speaking about the particular needs of his university, he highlighted the significant demand for bandwidth during limited events, such as course registration, as well as ad hoc scenarios like high data throughput during online gaming events.

A big concern for universities in general is cybersecurity. Britton points out that the education sector has become a massive target for cyberattacks, such as malware and ransomware. Indeed, research suggests that attacks on educational organizations grew by 44% in 2022, while data from endpoint protection firm Emsisoft suggests that the number of individual schools impacted by ransomware attacks also grew.

Security is a major priority for organizations everywhere, not just in the education sector. Thomas points to IoT, where vast amounts of data travel at high speeds, which is particularly attractive for bad actors. Once 5G can be coupled with blockchain, she noted, data security will improve.

One way to look at specific use cases is through innovation labs, with Thomas saying in the short term these can accelerate the time to revenue. She pointed to MetTel’s partnership with SpaceX and VMware, which saw the latter company’s software-defined wide area network deployed over Starlink to bring high-bandwidth communications to remote areas.

Thomas also said demand for more bandwidth was one of the key trends in the public sector. Customers are, according to her, looking at technologies including 5G fixed wireless access (FWA) and satellites to secure it.

A lot of innovation has focused on private networks, but the “real money” lies outside of them, said Mendler. No further details were provided.

Omdia’s Camille Mendler says companies cannot find commercial network slicing.

Source: JLeitner Photography

……………………………………………………………………………………………………………………………….

References:

NTT and Cisco launch IoT as a Managed Service for Enterprise Customers

NTT and Cisco have teamed up to launch a suite of repeatable IoT solutions that can be sold as a managed service. The partnership brings together NTT’s edge infrastructure, managed services, and IT systems integration expertise and Cisco’s IoT capabilities. Together, they promise to offer IoT services that encompass real-time data insights, enhanced security, improved decision-making, and reduced operational costs through predictive maintenance, asset tracking, and supply chain management.

NTT and Cisco are targeting opportunities in the manufacturing, transportation, healthcare and utility sectors, where they claim there is growing demand for edge computing and IoT solutions. The team has already begun working with Belgian public water distribution utility, Compagnie Intercommunale Liégeoise des Eaux (CISE). CISE has deployed thousands of LoRaWAN sensors on its infrastructure, giving it the visibility it needs to improve efficiency in the areas of water quality, consumption, distribution, and maintenance. It’s being delivered as a managed service by NTT and Cisco.

“We are accelerating our IoT business initiatives to deliver a powerful portfolio of repeatable services that can be tailored to meet customer demand for these kinds of solutions,” said Devin Yaung, SVP of group enterprise IoT products and services at NTT, in a statement. “We’re doubling down on NTT’s IoT capabilities to meet customer demand,” said Yaung. “What we’re doing is pulling together our collective knowledge and skillsets, and putting the full power of NTT behind it, to better service our customers and the increasing need to outfit or retrofit their organisations with the connectivity and visibility they need to improve day-to-day business operations.”

“We are excited to work together to help transition our customers to this IoT-as-a-service model so they can quickly realise the business benefits across industries and around the globe,” added Samuel Pasquier, VP of product management, industrial IoT networking, at Cisco.

According to IoT Analytics, global enterprise IoT spending is expected to grow 19% to $238 billion in 2023, up from $201 billion in 2022. By 2027, it could reach as high as $483 billion.

References:

https://iot-analytics.com/iot-market-size/?utm_source=IoT+Analytics+Master+People+List

STELLAR Broadband offers 10 Gigabit Symmetrical Fiber Internet Access in Hudsonville, Michigan

STELLAR Broadband, a fiber internet and technology service provider, will provide leading edge technologies and Internet connectivity up to 10Gbps to Elmwood Lake Apartments in Hudsonville, Michigan.

Elmwood Lake Apartments is a suburban haven of elevated comfort, where sweet serenity meets desirable convenience. From cozy interiors and relaxing leisure spaces to an idyllic setting next to private Elmwood Lake, the welcoming apartments in Hudsonville, MI, are ready to deliver a heightened living experience.

“With STELLAR Broadband, residents of Elmwood Lake Apartments will enjoy the fastest and most reliable internet service available. STELLAR Broadband’s fiber optic network provides symmetrical speeds of up to 10Gbps so residents can stream, game, and work from home without any lag or buffering,” said Richard Laing, president of STELLAR Broadband.

“Bosgraaf Homes has been building homes in West Michigan for four generations. Over the years, we’ve seen the industry change dramatically thanks to advances in technology. Construction methods have evolved, and the amenities that homeowners expect have grown more sophisticated. We’re grateful for our partnership with STELLAR Broadband, a company that has been at the forefront of the industry for 22 years. Their experience and leadership have helped us make the transition into multi-family housing,” said Mike Bosgraaf, president of Bosgraaf Homes.

The first in the U.S. to bring 10Gbps Internet to the apartment in student housing, STELLAR today serves over 149 communities totaling over 10,000 residents with a wide range of technology solutions, from managed Wi-Fi, TV, and access control to security.

“DTN is excited to partner with Bosgraaf Homes and STELLAR Broadband to provide Elmwood Lake residents with a unique and enjoyable experience. Bosgraaf is building beautiful homes that will be easy to lease, and STELLAR will provide residents and our office with the best possible internet service,” said Dayle Braden, DTN property manager.

“We’ve seen and have been on the forefront of technology evolving from a desired amenity to a necessity. We are proud to partner with Bosgraaf to provide the high-quality technology that their residents expect and deserve,” Laing stated.

About Spartan Net Co, dba STELLAR Broadband:

STELLAR Broadband is the largest residential fiber internet service provider in Michigan, servicing over 149 communities with multi-Gigabit fiber internet. STELLAR provides technology design and installation services for the full portfolio of technologies for multi-tenant developments, including network design, structured wiring, consulting, door entry and access control, engineered Wi-Fi, security, voice, television services, and various Internet of Things solutions. To learn more, visit: www.stellarbb.com

References:

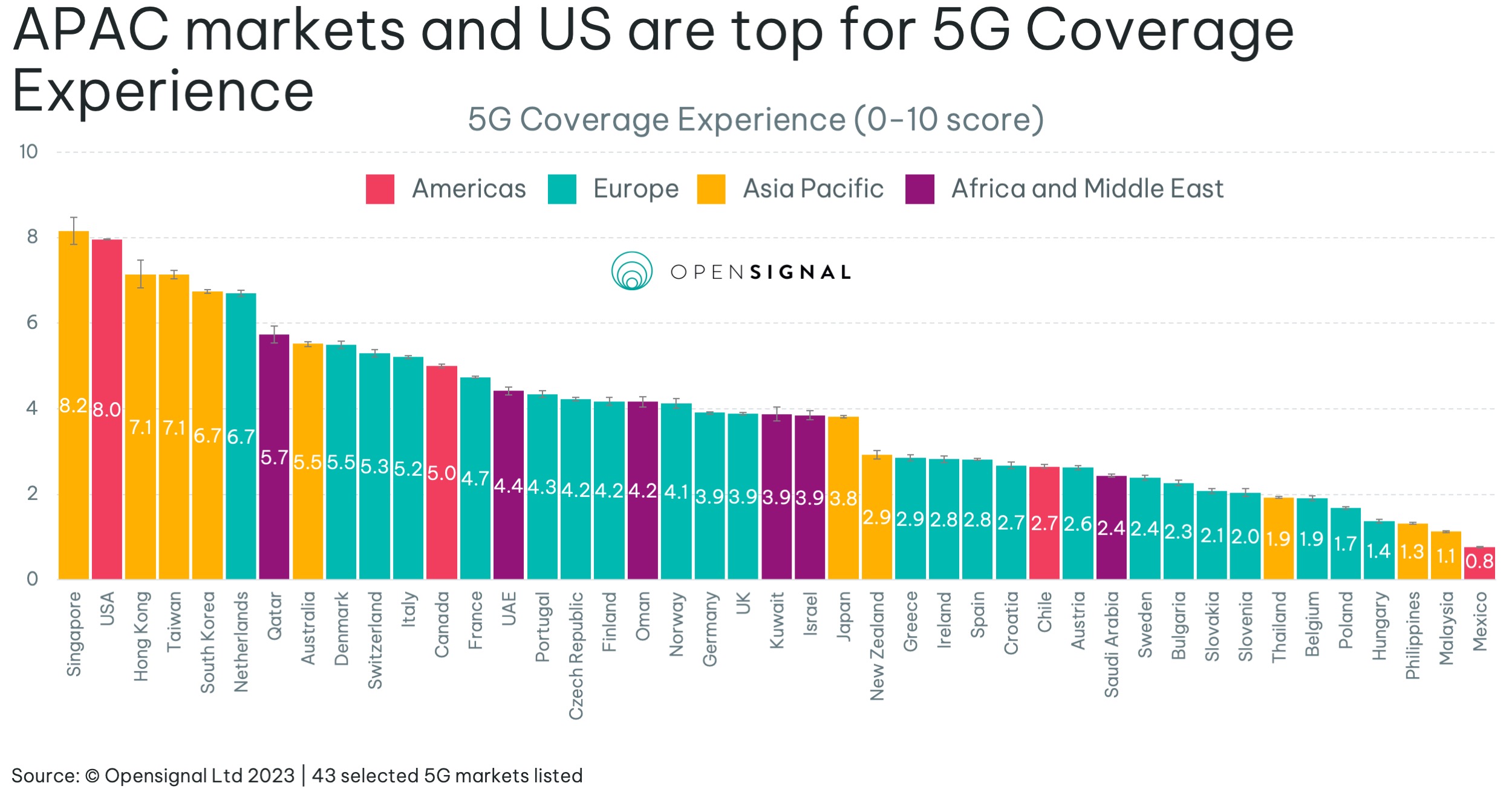

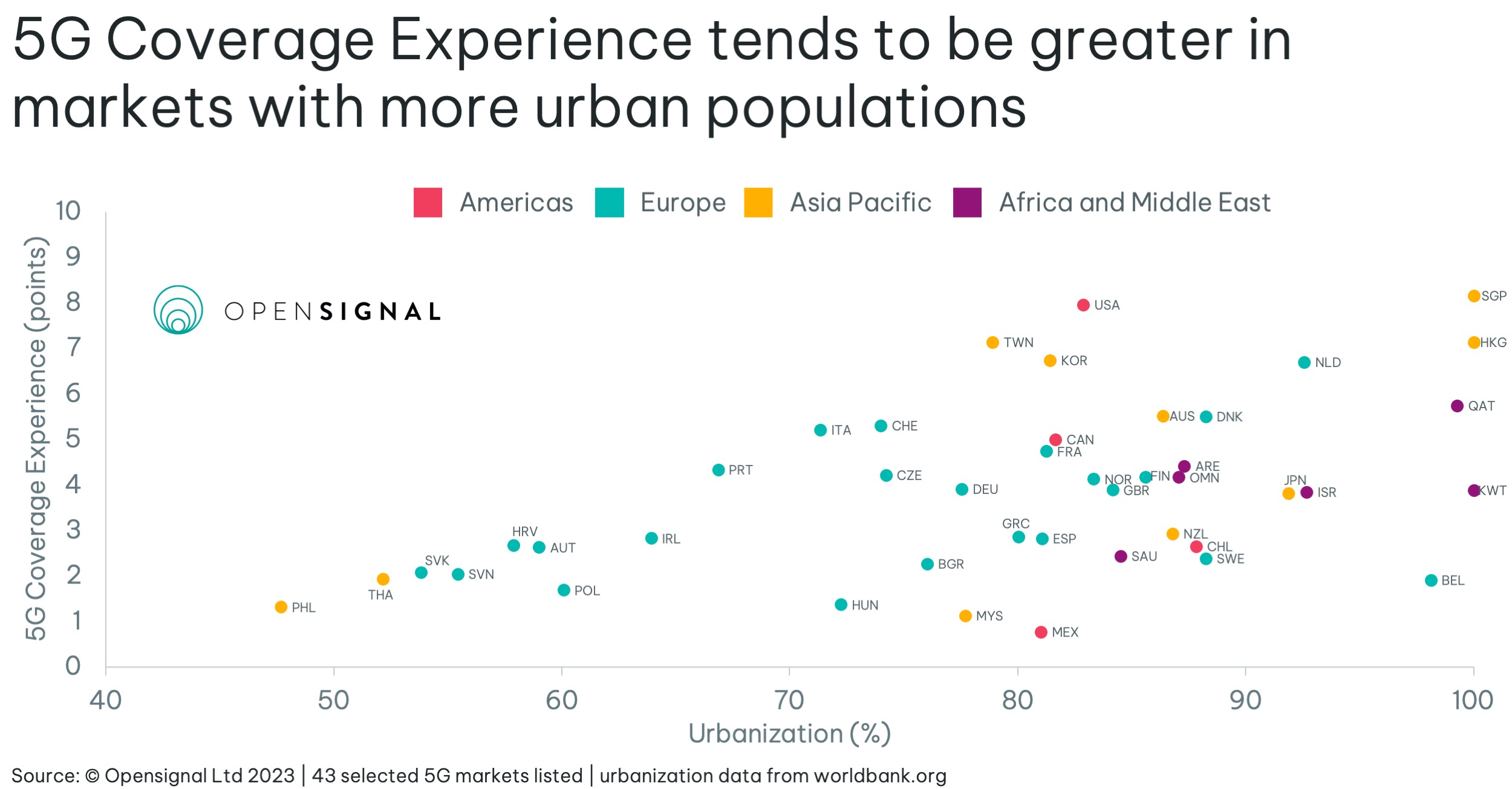

Opensignal’s new Coverage Experience metric finds Singapore #1 in 5G

Opensignal is now measuring coverage experience to track 5G network quality. Their analysts believe coverage more accurately reflects users’ expectations and experience. Opensignal’s new Coverage Experience metric measures the geographic coverage of populated areas on a 10-point scale to represent the experience users receive as they travel around areas where they would reasonably expect to find coverage. The new Coverage Experience metric completes the picture of how expansive a market’s coverage is, along with the coverage experienced by our users on each national operator within the market.

Singapore, which rolled out 5G two years after the USA, is now on par in offering the world’s best experience – both countries rate a 10. In Singapore, Singtel rates 7.9, StarHub 7.1, and M1 7.0 out of 10.

South Korea and the USA score relatively high for 5G Coverage Experience — with the USA statistically tying for the top spot with Singapore. This is due to, in part, more widespread deployments of 5G in the USA on low frequency bands, enabling greater geographic reach compared to many other markets with large land areas.

Hong Kong, Taiwan, South Korea and the Netherlands round out the leaderboard.

Some telcos have opened up a massive lead over their competitors. Australia’s Telstra rates 5.2 points out of 10, almost double both of its rivals. In Japan, NTT Docomo scores 3.3, while newcomer Rakuten (which has just signed a 5G roaming agreement with KDDI) is just 0.4. In Europe, Belgium scores just 1.9, while Sweden, Austria, Spain, Greece and Ireland all tally below 3 points.

A higher percentage of urbanization in a market means that — all else being equal — operators are able to serve proportionally more users with the same number of base stations, which reflects in higher 5G Coverage Experience across such markets. The graph above shows that the score increases along with urbanization percentage, with markets below 65% struggling to score above three points.

Some markets such as Singapore and Hong Kong have nearly 100% of their population living in urban areas. This greatly benefits them when it comes to rolling out infrastructure for 5G. Singapore launched 5G two years after the USA and South Korea, yet it ranks joint first for 5G Coverage Experience.

Coverage is an important metric as it quantifies the extent to which users will be able to use their network in their home market. Opensignal’s new Coverage Experience metric represents the real-world experience users receive as they travel around areas where they would reasonably expect to find coverage.

……………………………………………………………………………………………………………………………………………………..

Robert Clark of Light Reading wrote:

he one shortcoming of the 5G survey is the lack of data from India and China, the Asian giants who by their size are among the biggest drivers of global 5G. India’s absence is understandable as it’s still a nascent 5G market. In the case of China, where not even domestic organizations are allowed to track network performance, it’s hardly a surprise that foreign research efforts are blocked as well.

Chinese telcos and the Ministry for Industry and IT are barely any more informative. Their favored metric is base station population, which reveals nothing about user or geographic reach.

Right now China’s base station total, which is faithfully tallied up monthly, is 2.38 million – supposedly representing more than 60% of the global number. China Mobile and the China Telecom-Unicom partnership account for roughly half each.

The fact that some 600 million customers have signed up for China 5G may suggest they are happy enough with their user experience. On the other hand, that another 600 million have become ‘5G customers’ while remaining on the 4G network may indicate that they think 5G is simply better value.

References:

https://www.opensignal.com/2023/05/17/understanding-5g-and-overall-coverage-worldwide

https://cdn.opensignal.com/public/202305_coverage_operators_charts_5g_0.pdf

UAE’s Du demonstrates 5G VoNR with Huawei and Nokia

Du, the United Arab Emirates (UAE) Integrated Telecommunications Company, has achieved a significant milestone by successfully demonstrating Voice over 5G (3GPP) New Radio (VoNR) capabilities in collaboration with Huawei and Nokia. The demonstration showcases the cutting-edge 5G core network developed in partnership with Huawei and the utilisation of Nokia’s IP Multimedia Subsystem (IMS) Platform.

Du said the successful demonstration of VoNR represents a crucial step towards future immersive calling applications for 5G and the realization of complete 5G Standalone (SA) capabilities. With VoNR, du is able to provide seamless 5G connections, offering enhanced call setup times and uninterrupted high-speed data transmission.

According to the statement, customers connected to VoNR will experience slightly faster call setup times and continued file downloads in the background during a phone call without switching to 4G network technology. 5G Voice calls to conserve battery by eliminating the need to switch to 4G.

Du said, “It is thrilled to announce the upgrade to the most cutting-edge 5G-enabled Network as a Service (NaaS) architecture. This enhanced Network will strengthen Du’s relationship with their partners.”

VoNR leverages the advanced capabilities of 5G SA, such as network slicing, which requires a constant connection to a 5G core. This integration of technologies opens up a world of possibilities for du and its customers, enabling the delivery of innovative services like 3D audio and holographic calls, providing an immersive communication experience.

Saleem AlBlooshi, Chief Technology Officer at Du, said: “The successful demonstration of 5G network VoNR capabilities represents a significant milestone at a time when the digital sector is entering a new era. It enables unprecedented simultaneous voice and data transmissions and provides incredibly rapid connectivity transmission rates. We are thrilled to announce, in collaboration with our key partners, the upgrade to the most cutting-edge 5G-enabled Network as a Service (NaaS) architecture. This enhanced network will strengthen our relationship with our partners while also fostering service innovation to improve the customer experience and push the boundaries of what is possible.”

The successful demonstration of VoNR highlights Du’s commitment to staying at the forefront of technological advancements and delivering superior connectivity solutions to its customers.

As the demand for seamless and immersive 5G experiences grows, du’s continued efforts to enhance its network capabilities will contribute to shaping the future of communication and content consumption.

References:

https://www.nokia.com/networks/core-networks/voice-over-5g-vo5g-core/

No Surprise: AT&T tops leaderboard of commercial fiber lit buildings for 7th year!

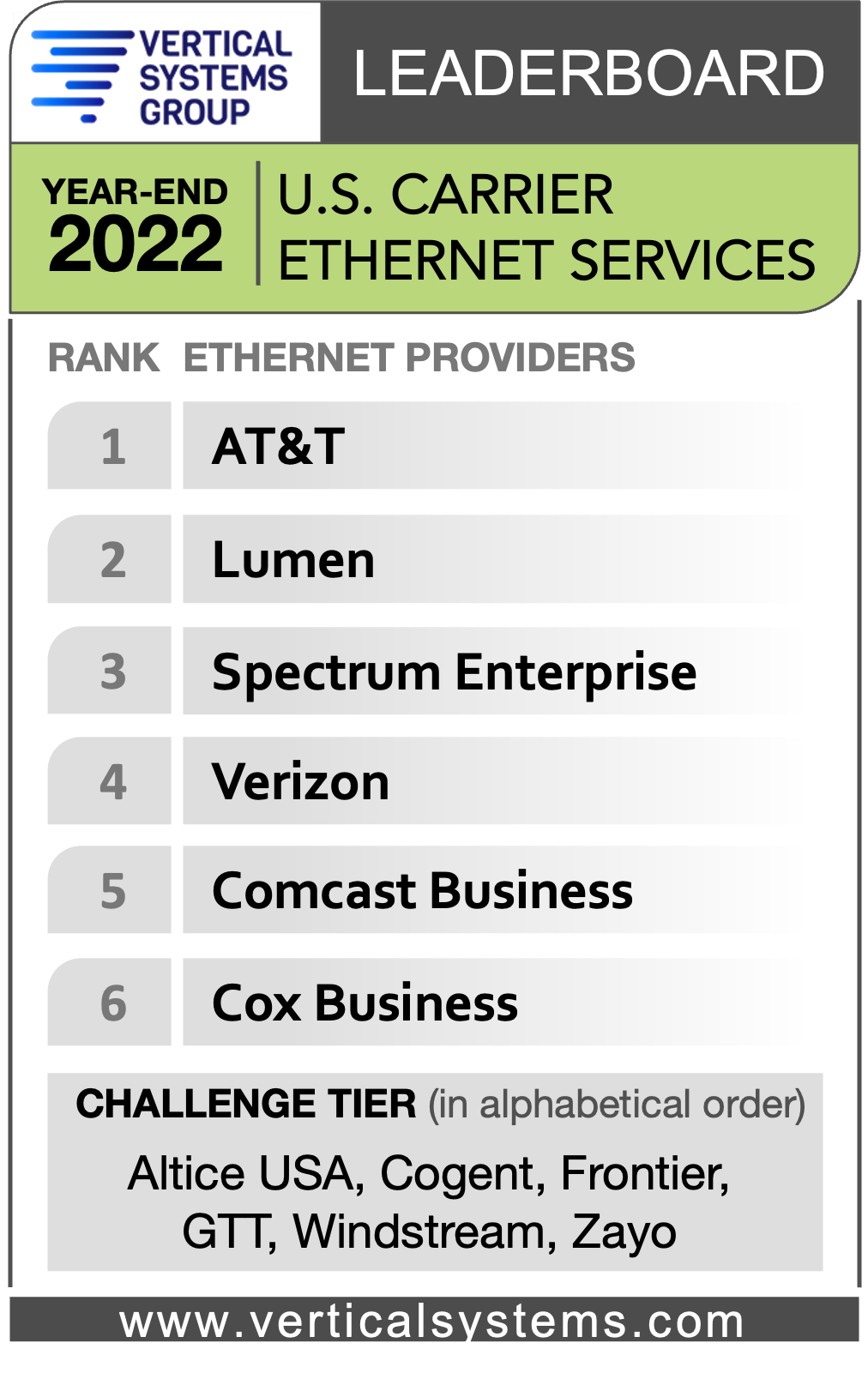

Once again, AT&T ranked #1 in the U.S. Fiber Lit Buildings Leaderboard fromVertical Systems Group (VSG) for a seventh consecutive year. The fiber focused U.S. carrier retained the top spot with the highest number of fiber lit buildings across its footprint in 2022. But there’s a whole lot more AT&T #1 rankings that the carrier has not gotten proper credit for achieving:

- AT&T also holds the #1 ranking in VSG 2022 U.S. Carrier Ethernet LEADERBOARD.

- AT&T ranked #1 for the fifth consecutive year in VSG’s year end 2022 U.S. managed carrier SD-WAN leaderboard.

–>Please see the images below, courtesy of VSG.

Major mobile operators like AT&T and Verizon are actively installing new fiber for their 5G network backhaul, which facilitates new fiber connectivity to nearby commercial sites. T-Mobile no longer has any fiber assets from their Sprint acquisition. They were sold to Cogent along with all other wireline assets in a deal that closed May 1, 2023.

Verizon, Spectrum Enterprise, Lumen, Comcast Business, Cox Business, Zayo, Crown Castle, Frontier, Brightspeed, Breezeline and Optimum followed. Those retail and wholesale fiber providers qualified for the leaderboard with 15,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2022.

-

“Fiber installations at U.S. commercial sites increased in 2022, driven by escalating requirements for gigabit-speed connectivity to support cloud-based services, data centers, 5G rollouts, and other applications,” said Rosemary Cochran, principal of Vertical Systems Group. “New fiber investments in the U.S. will continue to be impacted by pending federal programs and funding initiatives. Opportunities in the commercial segment include monetizing the millions of small buildings underserved.”

U.S. Fiber Lit Buildings LEADERBOARD Highlights:

- The 2022 LEADERBOARD roster increases to twelve commercial fiber providers, up from eleven in 2021.

- AT&T retains the #1 rank on the 2022 U.S. Fiber Lit Buildings LEADERBOARD for the seventh consecutive year.

- Rankings for the top six companies on the 2022 LEADERBOARD are unchanged from 2021, which includes AT&T, Verizon, Spectrum Enterprise, Lumen, Comcast Business, and Cox Business.

- The next six LEADERBOARD provider rankings change as compared to the previous year. Zayo advances to rank seventh ahead of Crown Castle, which dips to eighth. Frontier moves up to ninth position from tenth. Brightspeed debuts in tenth position with fiber assets acquired from Lumen. Breezeline (formerly Atlantic Broadband) falls to eleventh position from ninth. Optimum (Altice USA brand) drops from eleventh to the twelfth and final position.

- The number of 2022 Challenge Tier citations expands from eight to nine with the addition of Ritter Communications.

Market Players include all other fiber providers with fewer than 5,000 U.S. commercial fiber lit buildings. The 2022 Market Players tier covers more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): 11:11 Systems, ACD, Alaska Communications, American Telesis, Armstrong Business Solutions, Astound Business, C Spire, Centracom, Cogent, Conterra, DFN, DQE Communications, Everstream, ExteNet Systems, Fatbeam, FiberLight, First Digital, Flo Networks, Fusion Connect, Google Fiber, GTT, Horizon, Hunter Communications, Logix Fiber Networks, LS Networks, Mediacom Business, MetroNet Business, Midco, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Sonic Business, Sparklight Business, Syringa, T-Mobile, TDS Telecom, TPx, U.S. Signal, Vast Networks, WOW!Business, Ziply Fiber and others.

For this analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

……………………………………………………………………………………………………………………………………..

References:

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

https://www.verticalsystems.com/2023/02/15/2022-u-s-ethernet-leaderboard/

AT&T tops VSG’s U.S. Carrier Managed SD-WAN Leaderboard for 4th year

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

AT&T is expanding its network of fiber-optic cables to deliver fast internet speeds for customers, including those in places where it doesn’t already provide broadband. The plan will cost billions of dollars over the next several years, a price tag that the company—whose debt load outstrips its annual revenue—will not carry alone. AT&T formed a joint venture with BlackRock to fund the project and also wants to access government funding to accelerate the build-out. AT&T and BlackRock have collectively invested $1.5 billion in the venture—named Gigapower—to date, the company said.

Gigapower plans to provide a state-of-the-art fiber network to internet service providers and other businesses in parts of select metro areas throughout the country using a commercial wholesale open access platform. Both companies believe now is the time to create the United States’ largest commercial wholesale open access fiber network to bring high-speed connectivity to more Americans.

AT&T will serve as the anchor tenant of the Gigapower network, but other companies could also provide internet service over the network. That so-called open-access model has become common throughout Europe, but has yet to be widely embraced in the U.S. Gigapower recently introduced plans to build out fiber in Las Vegas, northeastern Pennsylvania and parts of Arizona, Alabama and Florida.

Doubling down on fiber optics sets AT&T on a different path than its rivals Verizon and T-Mobile US, which are relying on improved technology that beams broadband internet service from the same cellular towers that link their millions of mobile smartphone customers. AT&T is testing a similar fixed wireless access service but on a smaller scale, but executives say fiber remains the long-term focus.

AT&T updated shareholders on its vision for fiber internet and 5G cellular networks at its annual meeting, but the documentation/replay was not available at press time. AT&T spent about $24 billion on its fiber and 5G networks last year, and it forecast a similar level of spending this year. The company is confident it will get a very good return on investment (ROI).

The Dallas-based company and its peers face heightened competition in the cellphone business—their core profit engine. After the Covid-19 pandemic brought a surge in new accounts, the cellphone business has cooled, pushing companies to seek alternate paths for growth. AT&T, which has nearly 14 million consumer broadband customers, has provided internet service for years, and executives say that keeping customers plugged in requires faster connections as more data is used.

“We should be putting more fiber out faster, quicker and in more places than anybody else,” AT&T Chief Executive John Stankey said in a recent interview. “If we do that, that means our network is always going to be ahead of anybody else’s.”

Fiber-optic cables, wired directly to or near Americans’ homes, contain easy-to-upgrade glass strands that can carry much more data than radio waves. That higher capacity is crucial for video calls, streaming, videogames and other services, which use more internet data than most smartphone apps. As of last year, fiber was available at some 63 million homes, or more than half of primary residences, according to the Fiber Broadband Association.

AT&T wants its fiber network to cover more than 30 million homes and businesses within its current service area by the end of 2025. In many cases, fiber will replace internet connections over copper wirelines.

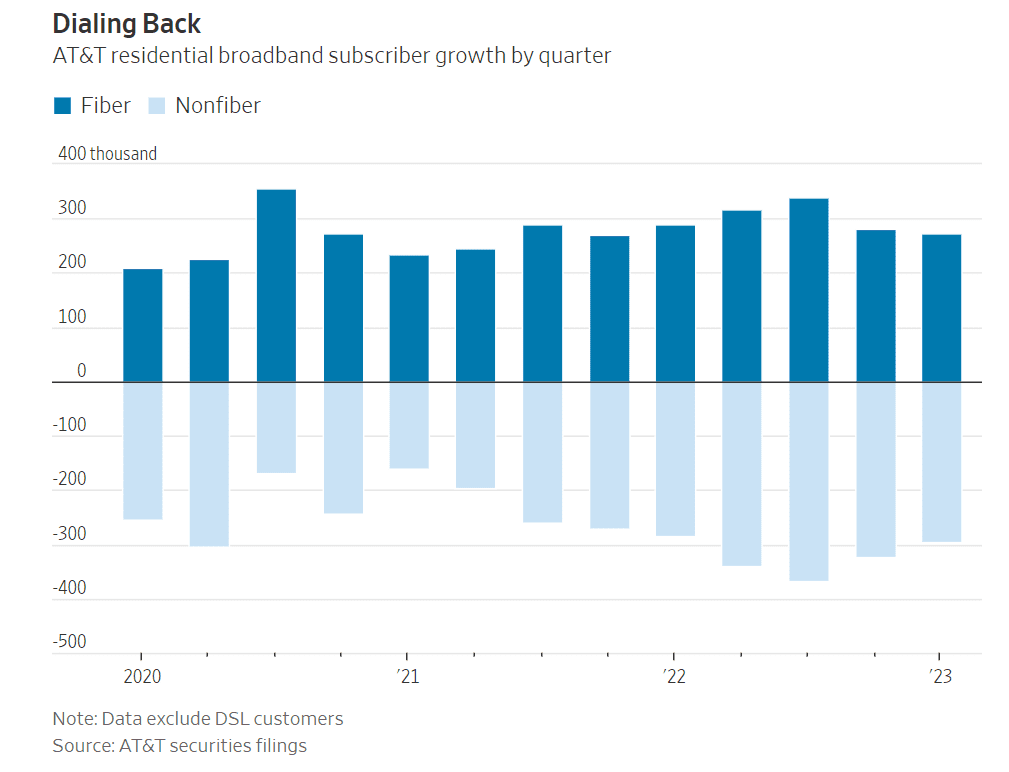

Laying the fiber is one thing, but progress in getting customer sign-ups has been slower than some analysts expected. In the first three months of the year, AT&T signed up 272,000 home fiber subscribers, a deceleration from the December quarter and the same period last year.

The results also marked the fourth straight quarter during which residential fiber sign-ups failed to offset declines in broadband customers overall. Stankey said he isn’t expecting the trend to reverse this year.

AT&T offers its fiber service at various speed tiers, starting at $55 a month for downloads up to 300 megabits a second. Prices run as high as $180 a month for 5-gigabit speeds.

In the March quarter, the average AT&T fiber internet customer paid about $66 a month. That total was up 9% from last year but still slightly less than the sums paid by customers of cable rivals Charter Communications and Comcast, according to Roger Entner, the founder of Recon Analytics.

While AT&T’s fiber build-out continues, it hopes its Internet Air service—which uses cell towers to beam broadband to homes—can stem customer defections in the short term. The service, which costs $55 a month, isn’t yet widely available, said Stankey, who took over as CEO in 2020 and unwound AT&T’s bet on entertainment.

Reuters: Telcos draft proposal to charge Big Tech for EU 5G rollout; Meta offers a rebuttal

Big tech companies accounting for more than 5% of a telecoms provider’s peak average internet traffic should help fund the rollout of 5G and broadband across Europe, according to a draft proposal by the telecoms industry. The proposal is part of feedback to the European Commission which launched a consultation into the issue in February. The deadline for responses is Friday.

Alphabet’s Google, Apple Facebook-owner Meta, Amazon, Netflix and TikTok would most likely be hit with fees, according to industry estimates. Google, Apple, Meta, Netflix, Amazon and Microsoft together account for more than half of data internet traffic.

The document, which was reviewed by Reuters and has not been published, was compiled by telecoms lobbying groups GSMA and ETNO. They represent 160 operators in Europe, including Deutsche Telekom, Orange, Telefonica and Telecom Italia. Telecom operators have lobbied for years for leading technology companies to help foot the bill for 5G and broadband roll-out, saying that they create a huge part of the region’s internet traffic. This is the first time they have tried to define a threshold for who should pay.

“We propose a clear threshold to ensure that only large traffic generators, who impact substantially on operators’ networks, fall within the scope,” the draft stated. “Large traffic generators would only be those companies that account for more than 5% of an operator’s yearly average busy hour traffic measured at the individual network level,” it said. The European Commission declined to comment.

Meta on Wednesday urged Brussels to reject any proposals to charge Big Tech for additional network costs. In a Facebook blog post, Markus Reinisch, Meta’s VP for Public Policy for Europe, described potential fees as a “private sector handout for selected telecom operators” that would disincentivize innovation and investment, and distort competition. “We urge the Commission to consider the evidence, listen to the range of organizations who have voiced concerns, and abandon these misguided proposals as quickly as possible,” he said. Here are Meta’s takeaways:

- Network fee proposals misunderstand the value that content platforms bring to the digital ecosystem.

- We support the Commission’s goal of “ensuring access to excellent connectivity for everyone,” but network fee proposals will hurt European consumers and businesses.

- We urge the Commission to consider the evidence, listen to the range of organizations who have voiced concern, and drop these proposals.

References:

Network Fee Proposals Will Ultimately Hurt European Businesses and Consumers

https://www.euractiv.com/section/5g/news/eu-telcos-call-for-big-tech-to-share-5g-network-costs/

GSMA: Europe’s 5G rollout is too slow at 6% of mobile customer base

European telcos need to address very high 5G energy consumption

Strand Consult: Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries