Paradise Mobile’s Open RAN 4G/5G core network to run on AWS cloud

Paradise Mobile, a new Mobile Network Operator (MNO) building a greenfield, cloud-native, Open RAN (oRAN) 4G/5G mobile network from the ground up in Bermuda, today announced the selection of Amazon Web Services, Inc. (AWS) as its preferred cloud provider to help build an Open RAN 4G/5G network and bring innovative services to Bermuda for the first time.

Paradise Mobile will leverage AWS for digital platform workloads, with agreements to roll out AWS edge services on island to host the wireless core and Open RAN DU and CU workloads. Paradise Mobile is also working to bring AWS services to the island, which will provide local businesses and innovators in the IoT industry the necessary tools and infrastructure to rapidly develop, test and deploy cutting edge products and services. The new environment will provide the ability for a secure, scalable, and high-performance network, optimized for businesses to develop and launch their next big thing.

Sam Tabbara, Co-Founder and CEO, Paradise Mobile, said: “We see Amazon as a strategic long-term collaborator who shares our vision and values, and has the ability to significantly accelerate our roadmap of innovative new products and services we want to launch in Bermuda. This relationship will allow us to provide our customers with the best possible experience and create a hub for IoT innovation in Bermuda and beyond.”

Tabbara said Paradise plans to run its 5G network operations – including management software from Mavenir – directly inside a Kubernetes stack running on AWS. To do so, Tabbara explained that Paradise will install an instance of AWS inside a LinkBermuda data center and will run AWS at the base of each of its roughly two dozen planned cell towers. “The opportunity for us with AWS is to accelerate that [5G] future,” Tabbara told Light Reading.

The new IoT environment will also provide businesses with access to a wide range of AWS services. These services will give businesses the ability to process and analyze vast amounts of data in real-time, enabling them to create new and innovative products and services.

Sameer Vuyyuru, head of worldwide business development at AWS, said: “Leveraging AWS helps reduce time-to-market as well as create a new path to deliver innovation to customers. Our work with Paradise Mobile will not only help Paradise Mobile rapidly build, scale, and manage its mobile network but also offer secure solutions to accelerate innovation across Bermuda.”

Paradise intends to build specific network-based applications and services that can be used by other operators. Drone operations is one of the first 5G use cases that Paradise plans to support. Tabbara said that the company is in discussions with an unnamed drone startup that may use the Paradise 5G network for testing.

AWS will play a key role in that strategy, according to Tabbara. He explained that enterprise developers are already familiar with AWS’ cloud computing platform and therefore will be able to add networking into the mix as Paradise lights up its 5G operations. “Anyone who knows how to code applications … if you are able to code within that [AWS] ecosystem, then there’s value add for us to be in that same ecosystem,” Tabbara said. The drone startup plans to do its development work inside the relatively familiar confines of Amazon’s cloud computing platform. “We’re already co-developing some of these solutions,” Tabbara said.

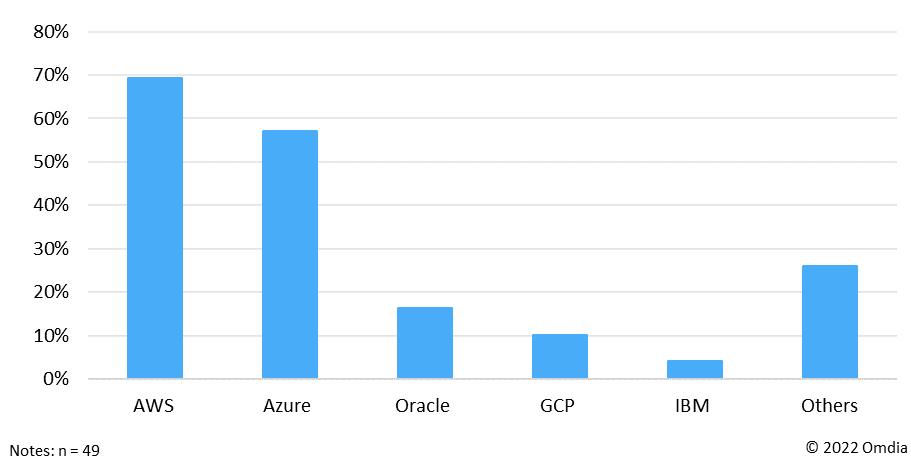

The announcement is yet another win for AWS as the hyperscaler competes against Oracle, Microsoft and Google Cloud for the telecom business. Omdia asked 49 telecom executives to list which public cloud or clouds their company is currently using to run any network functions, and respondents could select all that apply. Here was their response:

Note: Azure is Microsoft’s cloud offering, Google Cloud Platform is Google/Alphabet’s

…………………………………………………………………………………………………………………………………

Paradise Mobile is building a next generation wireless net network in Bermuda, followed by other CARICOM markets to be announced in the near future.

About Paradise Mobile:

Paradise Mobile is building a world of effortless connection with a next generation wireless network launching in multiple markets and countries, starting with Bermuda in 2023. Visit www.paradisemobile.com to learn more.

References:

China to introduce early 6G applications by 2025- way in advance of 3GPP specs & ITU-R standards

Liu said early 6G “application scenarios” will be introduced by 2025 in China, home to the world’s largest internet user population and biggest smartphone market, which has been conducting research and development on the technology since 2019. He said the commercial launch of 6G in China is expected to start from 2030, according to a report by local media National Business Daily.

At the same event, China’s Minister of Industry and Information Technology Jin Zhuanglong said in his speech that China was leading the pace of 6G research and development worldwide. He said the country is already ahead in rolling out 5G mobile networks and applications.

The statements made at the CDF about China’s 6G efforts have come after the Global 6G Conference, held from March 22 to 24 in Nanjing, where telecommunications industry experts reached a consensus that 6G mobile services in the country will start to roll out by early 2030.

The country’s three telecoms network operators – China Mobile, China Telecom and China Unicom – have all been reported to be involved in early 6G research and development, as they also expedited the roll-out of 5G infrastructure and services across the country.

Tensions between Beijing and Washington, however, have led to major telecoms equipment suppliers Huawei Technologies Co and ZTE Corp being handicapped by various US sanctions, including access to advanced IC’s used in smartphones and networking gear.

In spite of the disruptions caused by US pressure and the coronavirus pandemic, China has already built the world’s largest 5G mobile network, with more than 2.31 million 5G base stations deployed at the end of last year, according to MIIT data.

This year will mark the beginning of a long journey for 6G, as new studies are initiated by more countries and organisations around the world, according to a report last month by the non-profit telecoms industry body the GSMA.

The ITU-R World Radiocommunication Conference in November (WRC 23) is expected to set the spectrum foundations for 6G, the GSMA report said. Spectrum refers to the radio frequencies allocated to the mobile industry and other sectors for communications over the airwaves.

References:

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

India unveils Bharat 6G vision document, launches 6G research and development testbed

NTT DOCOMO & SK Telecom Release White Papers on Energy Efficient 5G Mobile Networks and 6G Requirements

Summary of ITU-R Workshop on “IMT for 2030 and beyond” (aka “6G”)

SEACOM telecom services now on Equiano subsea cable surrounding Africa

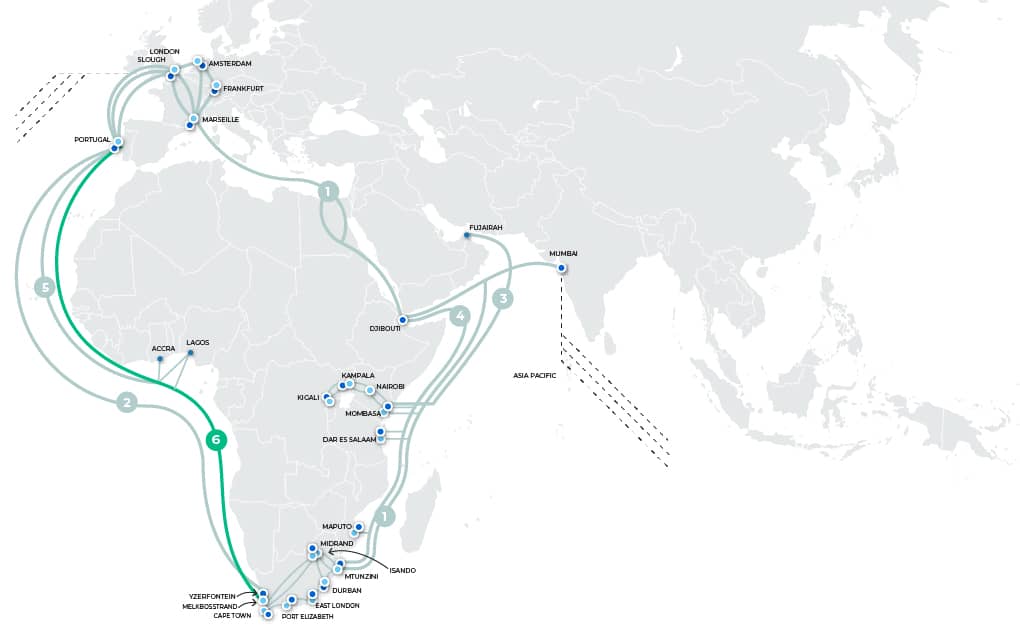

SEACOM, Africa’s leading telecommunications and managed services provider, announced that it has launched its services on the Equiano subsea cable, which landed in Cape Town, South Africa, in August 2022. As a result, the company now provides Private Line services, with an impressive latency speed of approximately 110 milliseconds (ms) between South Africa and Europe, making it the fastest direct route between the two continents.

The cable now forms part of SEACOM’s subsea cable ecosystem surrounding Africa, supported by a continent-wide IP-MPLS network. SEACOM fulfilled the necessary equipment and installation requirements with the help of its technology partner, Infinera.

Google announced the Equiano subsea cable in 2019, which is among Africa’s most high-capacity cables. The cable spans 15,000 kilometers from Portugal to South Africa, has twelve fibre pairs, and has a design capacity of 144 Tbps. The cable has a landing station in Melkbosstrand, Cape Town, as well as in other African locations, including Rupert’s Bay, St. Helena; Lome, Togo; Lagos, Nigeria; and Swakopmund, Namibia. Branching units from these stations will further extend connectivity to other African countries.

SEACOM’s Subsea Cable Ecosystem, Image courtesy: SEACOM

The company said, “The launch comes after SEACOM has completed extensive work to support the new connection, including upgrades to its transmission and IP network both locally and internationally. As part of the service available to wholesale and enterprise clients from March, SEACOM will offer an express route from Cape Town to Lisbon. This means clients will enjoy high-speed connectivity without having their data rerouted to other countries during transmission.”

“This launch results from years of project negotiations and planning, driven by a goal to be ready to offer quality service to our customers from day one. The Equiano subsea cable represents a new stage in Africa’s digital transformation, meeting Africa’s growing data requirements, enabling cross-border digital trade, and offering citizens and enterprises new opportunities,” says Prenesh Padayachee, SEACOM’s Group Chief Digital Officer.

“Infinera is delighted to partner with SEACOM to light the Equiano subsea cable with our industry-leading ICE6 800G technology,” said Nick Walden, Infinera Senior Vice President, Worldwide Sales. “With the industry’s highest spectral efficiency, ICE6 enables SEACOM to maximise the number of high-speed services they can offer, providing multiple terabits of capacity on this critical subsea link.”

According to a Regional Economic Impact Assessment by Africa Practice, commissioned by Google and published in 2021, the cable will increase South Africa’s GDP by USD 5.8 billion and create 180,000 indirect jobs by 2025.

SEACOM has acquired a full fiber pair with a capacity of 12 Tbps on the Express Route, which results in reduced latency between Africa and Europe. As a result, the SEACOM Express Route provides the quickest and most direct path between Africa and Europe, with the lowest possible latency. This route enables Operators, ISPs, Telcos, Content Providers, and Enterprises with the fastest direct path between Africa and Europe with the lowest latency, connecting to key South African and European data centers.

References:

https://seacom.com/media-centre/seacom-goes-live-on-equiano-subsea-cable/

https://telecomtalk.info/seacom-services-now-live-equiano-subsea-cable/689226/

ABI Research joins the chorus: 5G FWA is a competitive alternative to wired broadband access

5G Fixed Wireless Access (FWA) allows Mobile Network Operators (MNOs) to provide Quality of Service (QoS) offerings with higher speeds and unlimited data, creating a demand for 5G FWA, which will continue to grow over the next few years. Global technology intelligence firm ABI Research forecasts that 5G FWA subscriptions will reach 72 million by 2027, representing 35% of the total FWA market in 2027.

Although LTE FWA services have already been widely deployed worldwide, they often cannot provide the speed needed to compete with wired broadband connections. 5G FWA is set to offer data rates rivaling the range of fiber, making it a competitive alternative to wired broadband solutions. “FWA is one of the few use cases that utilize 5G Massive Multiple-Input Multiple-Output (mMIMO) networks to their full extent, with a typical monthly utilization that could be as high as 1TB per subscriber. Many MNOs that have launched 5G are expected to offer FWA services, driving 5G FWA market growth,” explains Fei Liu, 5G and Mobile Network Infrastructure Industry Analyst at ABI Research.

Both developed and emerging markets benefit from 5G FWA. North America, Western Europe, and Asia Pacific are driving 5G FWA deployments. In North America and Western Europe, MNOs are using 5G FWA to compete with DSL broadband services. Major U.S. operators, like T-Mobile, see a huge opportunity with 5G FWA because two-thirds of its residential customers living in urban and suburban areas are dissatisfied cable customers, making up a significant amount of its 5G FWA customers. In Western Europe, EE UK launched 5G FWA in 2019 and plans to cover 90% of the UK with 5G by 2028. Fastweb in Italy launched 5G FWA in 2020 and plans to cover 12.5 million homes and businesses by 2025. There is growing interest in the Asia Pacific as Reliance Jio eyes 100 million homes through 5G FWA.

“MNOs should launch 5G FWA to utilize their network capacity to make additional revenue. However, they need to be vigilant on how many FWA subscribers they can support, and which type of service they wish to offer (best effort or QoS). In the long term, MNOs need to apply Artificial Intelligence (AI) techniques such as Machine Learning (ML) to evaluate their network resource, network capacity, and spectrum to ensure a steady 5G FWA growth,” Liu recommends. “When the 5G FWA service starts to challenge their network capacity, these MNOs may have to deploy millimeter wave (mmWave) to guarantee the quality of their FWA services and overall network capacity,” Liu concludes.

These findings are from ABI Research’s Fixed Wireless Access market data report. This market data is part of the company’s 5G & Mobile Network Infrastructure research service, which includes research, data, and analyst insights. Market Data spreadsheets comprise deep data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight into where opportunities lie.

Fixed-wireless access antennas can be placed near windows or on roofs as shown in this diagram:

Image credit: Qualcomm

……………………………………………………………………………………………………………………………………………….

Other Market Rearch Firm Findings and Forecasts for 5G FWA:

A study published by Leichtman Research Group earlier this month claimed that FWA services accounted for 90% of U.S. net broadband additions last year, compared to 20% in 2021. Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,170,000 subscribers in 2022 – compared to about 730,000 net adds in 2021.

Verizon VP Sampath Sowmyanarayan recently said that Verizon’s FWA is winning 50 to 60% of its consumer segment customers and about half of its business segment customers from cablecos, with only a minority of subscribers coming from unserved and/or rural areas. The rural percentage may rise in the future due to growing availability and C Band deployment in rural markets, but not because capacity constraints are limiting it in urban and suburban markets. Outside the U.S.:

- EE UK launched 5G FWA in 2019 and plans to cover 90 percent of the UK with 5G by 2028.

- Fastweb in Italy launched 5G FWA in 2020 and plans to cover 12.5 million homes and businesses by 2025.

- “There is growing interest in the Asia Pacific as Reliance Jio eyes 100 million homes through 5G FWA.” Admittedly Jio has yet to offer a time frame for hitting that target, but if it makes good on its pledge to offer nationwide 5G coverage by the end of this year, 100 million FWA customers by 2027 seems eminently achievable.

Other bullish forecasts for the global 5G FWA market from JC Market Research and Research & Markets are here and here.

Regarding, telco 5G FWA revenues, a Juniper Research forecast last September was $2.5 billion globally this year, up from $515 million in 2022. It expects that number to climb to $24 billion by 2027 driven by consumers switching from fixed broadband.

About ABI Research:

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

…………………………………………………………………………………………………………………………………………………

References:

https://telecoms.com/520843/5g-fwa-emerging-as-a-competitive-alternative-to-fixed-broadband/

https://telecoms.com/517535/telco-5g-fixed-wireless-revenues-set-to-rocket/

Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

Nokia IP router chosen by CANARIE for ultra-high-capacity backbone network for Canadian research, education and innovation

Nokia today announced that CANARIE, the high-speed backbone of Canada’s National Research and Education Network (NREN), has chosen the Nokia 7750 Service Router as the IP/MPLS platform to support its more than 34,000 km network connecting 13 provincial and territorial networks to each other and to more than 100 NRENs around the world.

Nokia was chosen over core routers from Cisco, Juniper, and DriveNets network cloud software running over disaggregated white box/bare metal switches.

CANARIE and its partner networks enable breakthrough research from scientists across disciplines such as high-energy physics, biology, medicine, the environment, and astronomy, where, for example, data is gathered on millions of galaxies dating back billions of years. With a proliferation of instruments – like telescopes, sensors, and detectors – that gather more data with greater precision, sensitivity and speed, supercomputers must process petabytes of raw data. Additionally, because research collaboration happens across the globe, that data must be transferred rapidly, reliably, and securely, while containing costs.

The 7750 SR platform is designed to solve this monumental challenge with 100 Gb/s and 400 Gb/s services over an IP/MPLS network capable of supporting more than 46 Tb/s of capacity. This equates to transmitting about 30 terabytes of data in just 10 minutes, equivalent to sharing 5,000 two-hour Netflix movies in 1080p HD. This kind of massive capacity also makes network automation and DDoS security paramount, which the Nokia 7750 SR supports with advanced telemetry streams of flow-level data and insights in near-real time.

Mark Wolff, CTO at CANARIE, said: “We are pleased to work with Nokia as we continually improve the capabilities of Canada’s National Research and Education Network. Nokia networking technology will allow CANARIE to better connect Canada’s researchers, educators, and innovators to each other and to global data, technology, and colleagues.”

Dr. Vach Kompella, Vice President, IP Networks Division at Nokia, said: “We are thrilled to work with CANARIE and equip the scientific community across Canada and globally with proven IP technology. This more than triples CANARIE’s wide area network capabilities from 100G to 400G, while enhancing their resiliency, security, and flexibility.”

Nokia has deployed mission-critical networks to more than 2,600 leading enterprise customers in the transport, energy, large enterprise, manufacturing, webscale, and public sector segments around the globe. It has also extended its footprint to more than 560 private wireless customers worldwide across an array of industrial sectors and has been cited by numerous industry analysts as the leading provider of private wireless networking worldwide.

Resources and additional information:

Website: 7750 Service Router | Nokia Networks

https://www.nokia.com/networks/ip-networks/7750-service-router/

GSMA vision for more mobile spectrum in advance of WRC 23 this November

The GSMA, which represents the worldwide mobile communications industry, says their mission is to ensure mobile operators have timely and affordable access to appropriate spectrum. Without it, mobile operators can’t meet the growing demand for high-speed, mobile broadband services with good coverage in all parts of the world.

Mobile spectrum is a critical national resource for countries worldwide, playing a central role as an enabler of socio-economic development, social mobility, and the fight against climate change. Future allocations of spectrum at national level are guided by decisions made at the International Telecommunication Union (ITU)’s quadrennial WRC conference. At WRC 23 (November 2023) decisions will be made to guide national allocations of spectrum.

However, it should be noted that with respect to 5G frequencies, WRC 19 was a failure: WRC-19 requested ITU-R WP 5D to complete the IMT frequency arrangements (revision 6 of ITU-R M.1036 recommendation) for the new mmW frequencies it authorized for 5G. That has not happened yet! In other words, there is NO STANDARD for IMT frequency arrangements!

Today GSMA released two reports discussing future spectrum allocation and its economic implications. The speed and quality of mobile services are directly linked to spectrum, and decisions taken at WRC-23 have the potential to deliver affordable 5G across the world.

The GSMA’s vision ‘For the Benefit of Billions’ explains how governments and regulators can use WRC-23 to develop thriving and competitive communications markets and help to ensure that no one is left behind in a digital age, concluding that:

- Increasing capacity for mobile at WRC-23 will lead to better services delivered from less costly, more sustainable networks.

- Additional low-band spectrum can deliver broad and affordable connectivity, building bridges towards digital inclusion.

- Mid-band expansion can drive city-wide 5G, transforming industries and delivering mobile services that are an asset to their countries, ensuring their industrial agility in the global marketplace.

Mats Granryd, Director General of the GSMA, said: “WRC-23 is a critical inflection point for every government, every business and every person worldwide that use mobile communications. More than five billion people rely on mobile every day, and the evidence is clear: increasing mobile capacity will deliver the maximum socio-economic benefit for billions worldwide, and provide the biggest boost to national economies. Future growth, future jobs and future innovation all depend on policymakers making choices at WRC-23 that give 5G the room to grow and allow it to play a transformational role across all sectors of our societies and economies.”

The GSMA’s vision paper is accompanied by the association’s latest report: The ‘Socio-Economic Benefits of 5G: The importance of low-band spectrum’. This examines how low-band spectrum is a driver of digital equality, reducing the gap between urban and rural areas and delivering affordable connectivity. It concludes that:

- Low-band 5G is expected to drive around $130 billion in economic value in 2030.

- Half of the impact will come from massive IoT (mIoT). Many existing and future IoT use cases require wide area coverage, in addition to population coverage, which low-band spectrum is best suited to provide.

- MIoT applications are set to play an important role in digital transformation across a range of economic sectors, including manufacturing, transport, smart cities and agriculture.

- The rest of the economic impact will be driven by enhanced mobile broadband (eMBB) and fixed wireless access (FWA), as low bands will play a critical role in delivering high-speed broadband connectivity in areas underserved by fixed networks.

- Without sufficient low-band spectrum, the digital divide is likely to widen, and those living in rural areas will be excluded from the latest digital technologies.

The latest report complements the GSMA’s assessments of the socio-economic benefits of high-band, mid-band and low-band spectrum.

In summary, the GSMA says that freeing up more spectrum will have the duel benefits of letting 5G realize its potential and that there are socio-economic consequences for those not already well connected if this isn’t done.

Note on 5G Deployments:

At the end of 2022, there were already 252 commercial 5G networks in 86 countries around the world, serving more than 1 billion 5G connections. By 2030, more than 5 billion 5G connections are forecast worldwide, driving almost $1 trillion in GDP growth. While 5G is forecast to reach maturity by 2030 in North America, Europe, China and the GCC countries, it will continue to grow in many low- and middle-income countries (LMICs) well into the 2030’s.

References:

https://www.gsma.com/spectrum/wp-content/uploads/2023/03/WRC-23-IMT-AI-Infographic.pdf

https://www.gsma.com/spectrum/

https://telecoms.com/520807/gsma-makes-case-for-more-mobile-spectrum-availability/

India unveils Bharat 6G vision document, launches 6G research and development testbed

Despite being very late in rolling out 5G [1.], without TSDSI’s 5Gi ITU-R standard, India is ONCE AGAIN talking up 6G. Prime Minister Narendra Modi opened the new United Nations’ ITU area office and Innovation Centre on Wednesday and revealed the Bharat 6G Vision document and launched the 6G R&D Test Bed.

Note 1. Indian telecom service providers started to deploy 5G services in October 2022.

The Indian government’s Bharat 6G vision document was prepared by the Technology Innovation Group on 6G (TIG-6G), which was formed in November 2021 to build a roadmap and action plans for 6G in India, according to an official statement. Officials from Ministries/Departments, experts from research and development institutions, academia, standardisation bodies, telecom service providers, and business are among the members.

The 6G Test Bed will provide a platform for academic institutions, industry, start-ups, MSMEs, and industry, among others, to test and verify evolving ICT technologies.

The Bharat 6G Vision Document and 6G Test Bed, according to Centre, will create an enabling environment for innovation, capacity building, and faster technology adoption in India.

India PM Modi unveiling Bharat 6G vision document (Photo – PM Modi/YouTube)

………………………………………………………………………………………………………………………………………………….

“Today India is the fastest 5G rollout country in the world. In just 120 days, 5G has been rolled out in more than 125 cities. Today 5G services have reached about 350 districts of the country. Moreover, today we are talking about 6G only after six months of 5G rollout and this shows India’s confidence,” Modi said, according to a transcript of his address at the inauguration of a new ITU Area Office & Innovation Center in New Delhi. “Today we have also presented our vision document. This will become a major basis for 6G rollout in the next few years,” Modi added.

The Bharat 6G vision document foresees 6G services launched in India by the second or third quarter of 2024. That would enable India to move ahead from 5G services in just 2 short years. According to government sources, India’s 6G mission will be completed in two phases- 1] from 2023 to 2025 and 2] from 2026 to 2030.

………………………………………………………………………………………………………………………………………………….

References:

Arista’s WAN Routing System targets routing use cases such as SD-WANs

Arista Networks, noted for its high performance Ethernet data center switches, has taken its first direct step into WAN routing with new software, hardware and services, an enterprise-class system designed to link critical resources with core data-center and campus networks. The Arista WAN Routing System combines three new networking offerings: enterprise-class routing platforms, carrier/cloud-neutral internet transit capabilities, and the CloudVision® Pathfinder Service to simplify and improve customer wide area networks.

Based on Arista’s EOS® routing capabilities, and CloudVision management, the Arista WAN Routing System delivers the architecture, features, and platforms to modernize federated and software-defined wide area networks (SD-WANs. The WAN Routing introduction is significant because it is Arista’s first official routing platform.

The introduction of the WAN Routing System enables Arista’s customers to deploy a consistent networking architecture across all enterprise network domains from the client to campus to the data center to multi-cloud with a single instance of EOS, a consistent management platform, and a modern operating model.

Brad Casemore, IDC’s research vice president, with its Datacenter and Multicloud Networks group said:

“In the past, their L2/3 data-center switches were capable of and deployed for routing use cases, but they were principally data-center switches. Now Arista is expressly targeting an expansive range of routing use cases with an unambiguous routing platform.” By addressing SD-WAN use cases, WAN Routing puts Arista into competition in the SD-WAN space, Casemore noted.

“Arista positions the platform’s features and functionalities beyond the parameters of SD-WAN and coverage of traditional enterprise routing use cases, but it does SD-WAN, too, and many customers will be inclined to use it for that purpose. SD-WAN functionality was a gap in the Arista portfolio, and they address it with the release of this platform.”

Doug Gourlay, vice president and general manager of Arista’s Cloud Networking Software group wrote in a blog about the new package:

“Routed WAN networks, based on traditional federated routing protocols and usually manually configured via the CLI, are still the most predominant type of system in enterprise and carrier wide-area networks.”

“Traditional WAN and SD-WAN architectures are often monolithic solutions that do not extend visibility or operational consistency into the campus, data-center, and cloud environment,” Gourlay stated. “Many SD-WAN vendors developed highly proprietary technologies that locked clients into their systems and made troubleshooting difficult.”

“We took this feedback and client need to heart and developed an IP-based path-computation capability into CloudVision Pathfinder that enables automated provisioning, self-healing, dynamic pathing, and traffic engineering not only for critical sites back to aggregation systems but also between the core, aggregation, cloud, and transit hub environments.”

Modern WAN Management, Provisioning, and Optimization:

A new Arista WAN Routing System component is the CloudVision Pathfinder Service, which modernizes WAN management and provisioning, aligning the operating model with visualization and orchestration across all network transport domains. This enables a profound shift from legacy CLI configuration to a model where configuration and traffic engineering are automatically generated, tested, and deployed, resulting in a self-healing network. Arista customers can therefore visualize the entire network, from the client to the campus, the cloud, and the data center.

“As an Elite Partner and Arista Certified Services Provider (ACSP), we have been using Arista EOS and CloudVision for years and testing the Arista WAN Routing System in production environments for several quarters. The software quality and features within the system are ideal for enterprise network architectures embracing modern distributed application architectures across a blend of edge, campus, data center, cloud and SaaS environments,” stated Jason Gintert, chief technology officer at WAN Dynamics.

Arista WAN Platform Portfolio:

An enterprise WAN also requires modern platforms to interconnect campus, data center, and edge networks, as well as a variety of upstream carriers and Internet-based services. In addition to CloudEOS for cloud connectivity, the new Arista 5000 Series of WAN Platforms, powered by Arista EOS, offer high-performance control and data-plane scaling fit-to-purpose for enterprise-class WAN edge and aggregation requirements. Supporting 1/10/100GbE interfaces and flexible network modules while delivering from 5Gb to over 50Gbps of bidirectional AES256 encrypted traffic with high VRF and tunnel scale, the Arista 5000 Series sets the standard for aggregation and critical site interconnect with multiple use cases such as:

- Aggregation and High-Performance Edge Routing – The Arista 5500 WAN System, supporting up to 50Gbps of encrypted traffic, is ideal for data center, campus, high-performance edge, and physical transit hub architectures.

- Flexible Edge Routing – The Arista 5300 WAN System is suited for high-volume edge connectivity and transitioning WAN locations to multi-carrier, 5G, and high-speed Internet connectivity with performance rates of up to 5Gbps of encrypted traffic.

- Scalable Virtual Routing – Arista CloudEOS is a binary-consistent virtual machine implementing identical features and capabilities of the other Arista WAN systems. It is often deployed in carrier-neutral transit hub facilities or to provide scale-out encryption termination capabilities.

- Public Cloud Edge Routing – Arista CloudEOS is also deployable through public cloud marketplaces and enables Cloud Transit routing and Cloud Edge routing capabilities as part of the end-to-end WAN Routing System. CloudEOS is available on AWS, Azure, Google Cloud, and through Platform Equinix.

- CPE Micro Edge – In addition to the fully integrated, dynamically configured, and adaptive Arista WAN Routing System platforms, the Arista Micro Edge is capable of small-site interoperability with the WAN Routing System to provide simple downstream connectivity options.

Cloud and Carrier Neutral Transit Hubs:

The Arista WAN Routing System also embraces a new implementation of the traditional WAN core – the Transit Hub. These are physical or virtual routed WAN systems deployed in carrier-neutral and cloud-neutral facilities with dense telecommunications interconnections.

Artista has partnered with Equinix so Transit Hubs can be deployed on Equinix Network Edge and Bare Metal Cloud platforms via Arista CloudEOS software. CloudEOS is available on AWS, Azure, Google Cloud, and Equinix. As a result, Arista’s WAN Routing System will be globally deployable in Equinix International Business Exchange™ (IBX®) data centers. This enables customers to access a distributed WAN core leveraging multi-carrier and multi-cloud transit options – all provisioned through the CloudVision Pathfinder Service.

“Arista Pathfinder leverages Equinix’s Network Edge, Equinix Metal, and Equinix Fabric services to deliver scalable routing architectures that accelerate customers with cloud and carrier-neutral networking,” stated Zachary Smith, Global Head of Edge Infrastructure Services at Equinix. “Pathfinder’s ability to scale, in software, from a single virtual deployment to a multi-terabit globally distributed core that reallocates paths as network conditions change is a radical evolution in network capability and self-repair.”

“The Arista Transit Hub Architecture and the partnership with Equinix positions Arista for growth in hybrid and multicloud routing,” Casemore added.

Pricing and Availability:

The Arista WAN Routing system is in active customer trials and deployments with general availability in the summer of 2023. The following components are part of the Arista WAN Routing System:

- The Arista 5510 WAN Routing System for high-performance aggregation, transit hub deployment, and critical site routing which starts at $77,495.

- The Arista 5310 WAN Routing System for high-performance edge routing which starts at $21,495.

- Arista CloudEOS software for transit hub and scale-out routing in a virtual machine form factor.

- Arista CloudEOS, delivered through the public cloud for Cloud Edge and Cloud Transit routing, is available on AWS, Azure, Google Cloud Platform, and Platform Equinix.

- The CloudVision Pathfinder Service and CloudVision support for the Arista WAN Routing System is in field trials now and will generally be available in the second half of 2023.

About Arista Networks:

Arista Networks is an industry leader in data-driven client to cloud networking for large data center, campus, and routing environments. Arista’s award-winning platforms deliver availability, agility, automation, analytics, and security through an advanced network operating stack. For more information, visit www.arista.com.

ARISTA, EOS, CloudVision, NetDL and AVA are among the registered and unregistered trademarks of Arista Networks, Inc. in jurisdictions worldwide. Other company names or product names may be trademarks of their respective owners. Additional information and resources can be found at www.arista.com.

References:

Arista’s Doug Gourlay’s blog here

Deep dive into many of the technologies and innovations available with this video from the product and engineering leaders.

https://www.arista.com/en/solutions/enterprise-wan

https://blogs.arista.com/blog/modernizing-the-wan-from-client-to-cloud

https://www.networkworld.com/article/3691113/arista-embraces-routing.html

Huawei says 5.5G is necessary with fully converged cloud native core network

Huawei maintains that a new 5.5G core network is needed to address a plethora of new use cases and new opportunities. That despite of the very limited deployment of 3GPP’s 5G SA Core network architecture specs. The company is calling on partners to promote industry consensus and commercial deployments for the era of 5.5G, an evolution of 5G technology.

Yang Chaobin, senior vice-president of Huawei, said: “The rapid growth of 5G has led to new service requirements that are becoming more diverse and complex. Such changes demand stronger 5G capabilities.”

Yang said that as 6G is still in the early stages of research, 5.5G is a necessary and natural evolution of 5G, which has become an industry consensus.

According to GSA, 35 network operators in 20 countries have launched commercial public 5G SA networks. In addition to those, GSA identified 77 other operators that are currently investing in 5G SA for public networks (including those evaluating/testing, piloting, planning, or deploying).

In 2020, containers and micro-services were introduced as key components of cloud-native network design and migration path to 5G core networks with high degree of much needed automation. At this point, intent-driven algorithms are used to automate large-scale cloud-native 5G telecom networks.

Figure 1. Huawei at MWC 2023

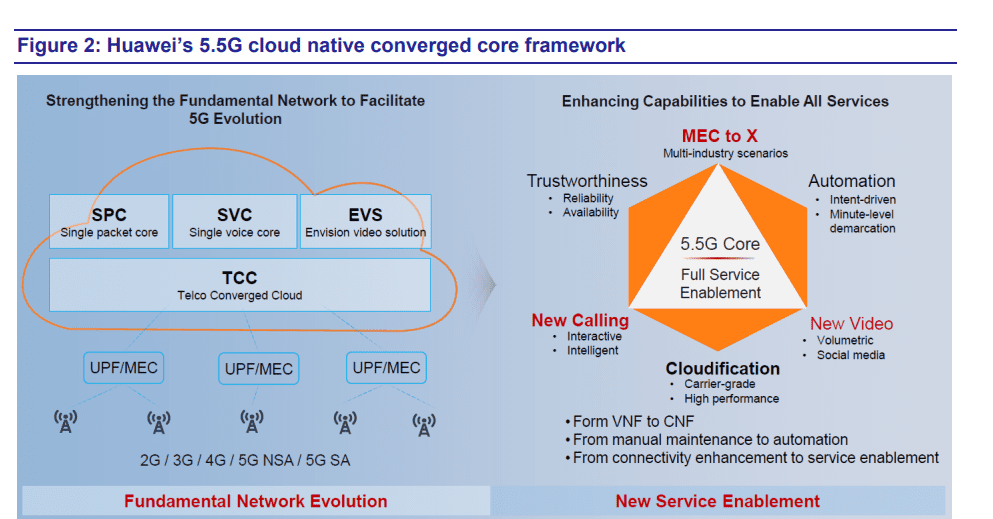

Figure 2. below illustrates Huawei’s complete 5.5G cloud-native converged core strategy that is based on strengthening the current networking building blocks that paved the way to where we are today, and continuously adding new capabilities and enhancing them to enable all services needed to address the plethora of new 5G use cases.

Source: Huawei

……………………………………………………………………………………………………………………………………………………………

Backgrounder on 5G Advanced:

3GPP initiated the 5G-Advanced project in early 2021 and started the formulation of Release 18 specs to enhance the existing mobile network capabilities. Case in point: UPF (User Plane Function) Mesh and MEC (Multi-access Edge Computing) enhancements were introduced to enable 5G to cover more industry scenarios, which in the new 5.5G core platform, is addressed through the “MEC to X” concept to accelerate the digital transformation of industries.

In addition, the Rel. 18 NG-RTC (Next Generation Real-Time Communications) feature enhances the communication capability and enriches the communication services, including calling and video, or “New Calling” and “New Video” in 5.5G core (see Figure 2. above).

……………………………………………………………………………………………………………………………………………………………

Huawei laid out five major characteristics of the 5.5G era – 10 Gbps experiences, full-scenario interconnection, integrated sensing and communication, autonomous networks and green information communications technology.

Yang called on the global telecom industry to jointly promote 5.5G development in four areas including setting clear roadmaps for industry standardization and a clear strategy for spectrum, which is fundamental to wireless networks.

Huawei and Saudi Arabian telecommunications operator Zain KSA signed a memorandum of understanding (MoU) last month for the”5.5G City” joint innovation project.

Under the MoU, both parties will work together to promote technological innovation for 5.5G evolution and expand scalable offerings to individuals, enterprises and government customers. Additionally, they will strengthen the digital infrastructure and build a global 5.5G evolution pioneer network, providing a strong engine to achieve the national digitalization goals outlined in Saudi Vision 2030.

Abdulrahman Al-Mufadda, chief technology officer of Zain KSA, said, “Our commitment to driving digital transformation has been made possible by combining innovative technology investments with pioneering digital solutions across multiple fields, including cloud computing, fintech, business support and drone technologies.”

The cooperation came as 5G is now in the fast lane after three years of commercial use. By the end of 2022, global 5G users exceeded 1 billion, gigabit broadband users reached 100 million, and more than 20,000 industry applications were put into use, according to data compiled by Huawei.

Leading operators in China, South Korea, Switzerland, Finland and Kuwait have already achieved 5G user penetration rates of more than 30 percent with more than 30 percent of their traffic coming from 5G, Huawei said.

Network intelligence and connectivity insights provider Ookla’s latest 5G City Benchmark Report showed Huawei has played an important role in 5G network construction in all of the top 10 cities among the world’s 40 most 5G-enabled cities. Performance results in these 10 cities show 5G networks constructed by Huawei offer the best experience.

Last month, Huawei also revealed a collaboration with Botswana’s Debswana Diamond Co (Pty) Ltd on the world’s first 5G smart diamond mine project.

Debswana’s Head of Information Management Molemisi Nelson Sechaba said that the Huawei-enabled smart mine solution has been deployed at Debswana’s Jwaneng open-pit diamond mine. The project started operation in December 2021.

At present, Huawei’s 4G eLTE, an advanced version of 4G technology, provides stable connectivity for the Jwaneng mine, connecting more than 260 pieces of equipment, including drilling rigs, excavators, heavy trucks and pickup trucks. This enables interconnection between the mine’s production, safety and security systems, Sechaba said.

The Jwaneng mine is the world’s first 5G-oriented smart diamond mine, which means the hardware equipment such as base stations used in the mine’s digital transformation support network has upgraded to 5G, Huawei said.

Huawei claims they’ve seamlessly migrated their existing and dedicated core network platforms (e.g., SPC, SVC, EVS in Figure 2) as well as its telco converged cloud to a fully converged cloud-native 5.5G core that features full-service enablement. In other words, the company says the transition from virtual network functions (VNF) to cloud native network functions (CNF), from manual operation to automation and from connectivity provisioning and enhancement to full-service enablement has been completed.

–>That’s all in advance of 3GPP Release 18 specs on 5G Advanced (which won’t be frozen till March 2024)?

…………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.chinadaily.com.cn/a/202303/20/WS6417b0a5a31057c47ebb55b2.html

Huawei’s blueprint to lay the foundation for 5.5G and the “intelligent world”

Virtual Network Function Orchestration (VNFO) Market Overview: VMs vs Containers

AT&T realizes huge value from AI; will use full suite of NVIDIA AI offerings

Executive Summary:

AT&T Corp. and NVIDIA today announced a collaboration in which AT&T will continue to transform its operations and enhance sustainability by using NVIDIA-powered AI for processing data, optimizing service-fleet routing and building digital avatars for employee support and training.

AT&T is the first telecommunications provider to explore the use of a full suite of NVIDIA AI offerings. This includes enhancing its data processing using the NVIDIA AI Enterprise software suite, which includes the NVIDIA RAPIDS Accelerator for Apache Spark; enabling real-time vehicle routing and optimization with NVIDIA cuOpt; adopting digital avatars with NVIDIA Omniverse Avatar Cloud Engine and NVIDIA Tokkio; and utilizing conversational AI with NVIDIA Riva.

“We strive each day to deliver the most efficient global network, as we drive towards net zero emissions in our operations,” said Andy Markus, chief data officer at AT&T. “Working with NVIDIA to drive AI solutions across our business will help enhance experiences for both our employees and customers.” He said it’s AT&T’s goal to make AI part of the fabric of the company, to have “all parts of the business leveraging AI and creating AI” rather than limit its use to creation of AI by its specialist data scientists.

“Industries are embracing a new era in which chatbots, recommendation engines and accelerated libraries for data optimization help produce AI-driven innovations,” said Manuvir Das, vice president of Enterprise Computing at NVIDIA. “Our work with AT&T will help the company better mine its data to drive new services and solutions for the AI-powered telco.”

The Data Dilemma:

AT&T, which has pledged to be carbon neutral by 2035, has instituted broad initiatives to make its operations more efficient. A major challenge is optimizing energy consumption while providing network infrastructure that delivers data at high speeds. AT&T processes more than 590 petabytes of data on average a day. That is the equivalent of about 6.5 million 4K movies or more than 8x the content housed in the U.S. Library of Congress if all its collections were digitized.

Telecoms aiming to reduce energy consumption face challenges across their operations. Within networks, the radio access network (RAN) consumes 73% of energy, while core network services, data centers and operations use 13%, 9% and 5%, respectively, according to the GSMA, a mobile industry trade group.

AT&T first adopted NVIDIA RAPIDS Accelerator for Apache Spark to capitalize on energy-efficient GPUs across its AI and data science pipelines. This helped boost its operational efficiency across everything from training AI models and maintaining network quality and optimization, to reducing customer churn and improving fraud detection.

Of the data and AI pipelines targeted with Spark-RAPIDS, AT&T saves about half of its cloud computing spend and sees faster performance, while enabling reductions in its carbon footprint.

Enhanced Field Dispatch Services:

AT&T, which operates one of the largest field dispatch teams to service its customers, is currently testing NVIDIA cuOpt software to enhance its field dispatch capabilities to handle more complex technician routing and optimization challenges. AT&T has a fleet of roughly 30,000 vehicles with over 700 million options in how they can be dispatched and routed. The operator would run dispatch optimization algorithms overnight to get plans for the next day, but it took too long and couldn’t account for the realities that would crop up the next morning: Workers calling in sick, vehicles breaking down, and so on.

“It wasn’t as good at noon as it was at 8 in the morning,” Markus said. Using Nvidia GPUs and software, he said, AT&T was able to speed up its processing 60x so that it could run the scenario in near-real-time, as often as it needed to and achieve more jobs in a day (as well as reduce its cloud-related costs by 40%).

Routing requires trillions of computations to factor in a variety of factors, from traffic and weather conditions to customer change of plans or a technician’s skill level, where a complicated job might then require an additional truck roll.

In early trials, cuOpt delivered solutions in 10 seconds, while the same computation on x86 CPUs took 1,000 seconds. The results yielded a 40% reduction in cloud costs and allowed technicians to complete more service calls each day. NVIDIA cuOpt allows AT&T to run nearly continuous dispatch optimization software by combining NVIDIA RAPIDS with local search heuristics algorithms and metaheuristics such as Tabu search.

Pleasing Customers, Speeding Network Design:

As part of its efforts to improve productivity for its more than 150,000 employees, AT&T is moving to adopt NVIDIA Omniverse ACE and NVIDIA Tokkio, cloud-native AI microservices, workflows and application frameworks for developers to easily build, customize and deploy interactive avatars that see, perceive, intelligently converse and provide recommendations to enhance the customer service experience.

For conversational AI, the carrier also uses the NVIDIA Riva software development kit and is examining other customer service and operations use cases for digital twins and generative AI.

AT&T also is taking advantage of fast 5G and its fiber network to deliver NVIDIA GeForce NOW™ cloud gaming at 120 frames per second on mobile and 240 FPS at home.

Markus added that AI-powered Nvidia tools are also helping AT&T to both serve its customers better through various channels, from sales recommendations to customer care; and that its internal processes are leveraging AI as well, to help employees be more efficient. The company is embracing Nvidia’s AI solutions as a foundation for development of interactive and intelligent customer service avatars.

In the past 12 months, AI has created more than $2.5 billion in value for AT&T. About half of that came via Marcus’ team, but the other half came from what he calls “citizen data scientists” across the company who have been able to leverage AI to solve problems in their respective areas, whether than was marketing, network operations, software development or finance.

“As we mobilize that citizen data-scientist across the company, we’re doing that via a self-service platform that we call AI-as-a-service, where we’re bringing a unified experience together. But behind the experience, we’re allowing those users to leverage AI in a curated way for their use case,” he explained. “So they bring their subject matter expertise to the problem that they’re trying to solve, and we … enable the technology [and processes for them to create] robust AI. But we also govern it with some guardrails, so the AI we’re creating is ethical and responsible.”

In AT&T’s automation development, 92% of its automation is created by employees via self-service to solve a problem. “The goal is that over time, we bake in incredible functionality like Nvidia, so that AI-as-a-service is delivering that self-service functionality so that we do most of our routine AI creation via the platform, where you don’t have to have a professional data scientist, a code warrior, to be your sherpa,” Markus concluded.

References:

https://nvidianews.nvidia.com/news/at-t-supercharges-operations-with-nvidia-ai