FCC grants Amazon’s Kuiper license for NGSO satellite constellation for internet services

On February 8th, the U.S. Federal Communications Commission (FCC) approved, subject to conditions, the application [1.] of Amazon’s Kuiper Systems LLC (Kuiper) for modification of its license for a non-geostationary orbit (NGSO) satellite constellation providing Fixed-Satellite Service (FSS) and Mobile Satellite Service (MSS) using Ka-band radio frequencies.

Specifically, the FCC granted Kuiper’s request for approval of its updated orbital debris mitigation plan, thereby satisfying a condition of our action in 2020 conditionally granting Kuiper’s request to deploy and operate its NGSO system. This FCC action will allow Kuiper to begin deployment of its satellite constellation in order to bring high-speed broadband connectivity to customers around the world.

Note 1. See Kuiper Systems Request for Modification of the Authorization for the Kuiper NGSO Satellite System, IBFS File No. SAT-MOD-20211207-00186 (filed Dec. 7, 2021). Kuiper is a wholly-owned subsidiary of Amazon.com Services (Amazon).

………………………………………………………………………………………………………………………………………………………………………….

In 2020, the FCC had granted Amazon’s Project Kuiper permission to deploy 3,236 satellites aimed at closing the digital divide. But the project has been delayed due to concerns about its orbital debris. This week the FCC said it is requiring Kuiper to comply with a series of orbital debris conditions.

The FCC announcement also contained reference to an apparent objection to the order by satellite rival Space X and others that seemed to want to limit an expansion of Kuiper’s constellation, but the regulator apparently wasn’t having nay of it: “When the Commission applied the 100 object-years condition in the SpaceX’s Gen2 Starlink Order, SpaceX had already launched thousands of satellites and had data reflecting its actual satellite failures, which was used to inform the Commission’s approach to satellite reliability monitoring for the Gen2 Starlink system.”

“The Commission noted that the 100 object-years metric was new and untested, but reasoned that an incremental approach based on a clear benchmark was appropriate in the context of a planned deployment that is at a scale not previously undertaken and also untested. As Kuiper has not started deploying or operating its constellation, we find it is not be necessary to impose such a condition at this time.”

Last October, Amazon switched the launch of its first Kuiper satellites – Kuipersat-1 and Kuipersat-2 -from the RS1 rocket in development by ABL Space to the debut flight of the Vulcan rocket from United Launch Alliance, the joint venture of Boeing and Lockheed Martin. That delayed the launch till 2023 (it still hasn’t happened), but with this legal hurdle now overcome it looks set to launch satellites unabated using any rocket it choses, including from Jeff Bezos owned Blue Origin.

References:

DA-23-114A1.docx – Federal Communications Commission

https://www.fcc.gov/document/international-bureau-grants-kuiper-satellite-modification

https://telecoms.com/519860/fcc-gives-nod-to-amazon-kuiper-broadband-satellite-deployment/

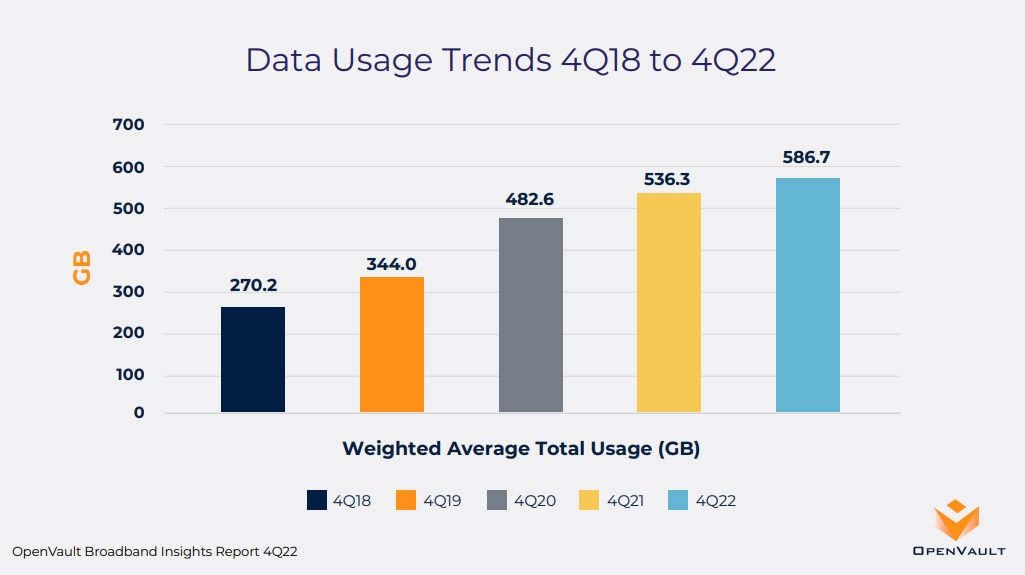

OpenVault: U.S. broadband users on 1-Gig tiers climbed to 26% in Q4 2022

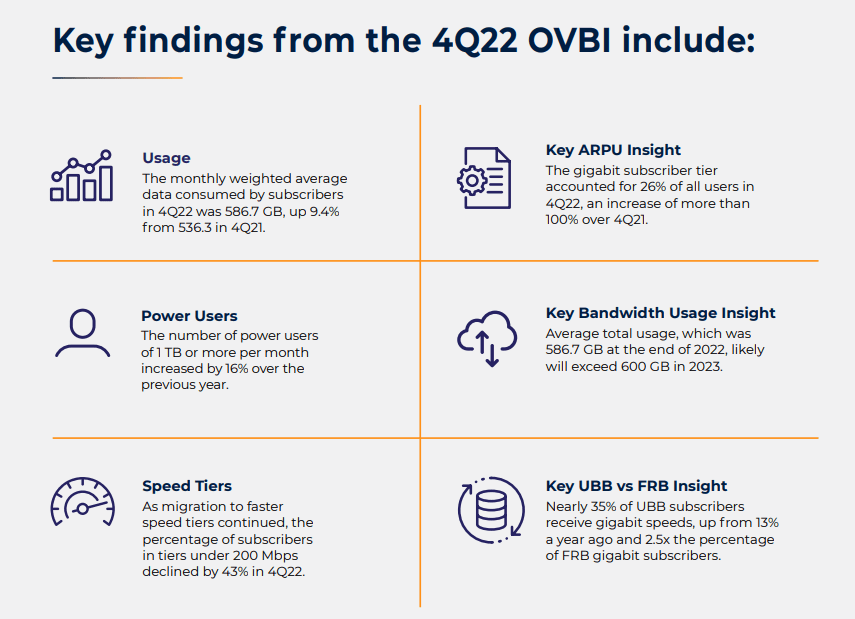

The 4Q22 edition of the OpenVault Broadband Insights (OVBI) report indicates that average household broadband consumption neared 600 GB per month, the percentage of subscribers on gigabit tiers more than doubled, and usage by participants in the FCC’s Affordable Connectivity Program (ACP) continued to outpace that of the general population. OpenVault expects household data usage to surpass 600GB by Q4 2023 and possibly reach 1 terabyte by the end of 2028.

Editor’s Note: OpenVault bases its findings on data from “millions” of individual broadband subscribers that are collected and aggregated from a software-as-a-service broadband service management tool in use by a wide range of ISPs. The data is used to pinpoint usage patterns, including the differences between two key categories: subscribers on flat-rate billing (FRB) plans that offer unlimited data usage and those on usage-based billing (UBB) plans, on which subscribers are billed based on their bandwidth consumption. OpenVault data is used for benchmarking purposes by the Federal Communications Commission (FCC) in specific comparative analyses.

…………………………………………………………………………………………………………………………………….

With broadband consumption on the rise, there’s been an increase in “power users” – households that use more than 1TB of data per month. The percentage of users at that level rose 18.7% year-over-year. “Super power users” – those consuming 2TB or more per month – climbed 25%, from 2.7% to 3.4%. That’s a nearly 30x increase within the past five years, OpenVault said.

- European average data usage (268.1 GB) grew 12.5% from a year ago, a faster pace than the North American annual growth rate of 9.4%.

- North American median data usage (396.6 GB) was more than 2.5x that of European median data usage (148.2 GB) in 4Q22, a slightly smaller difference than observed in 4Q21.

………………………………………………………………………………………………………………………………………………………………………………..

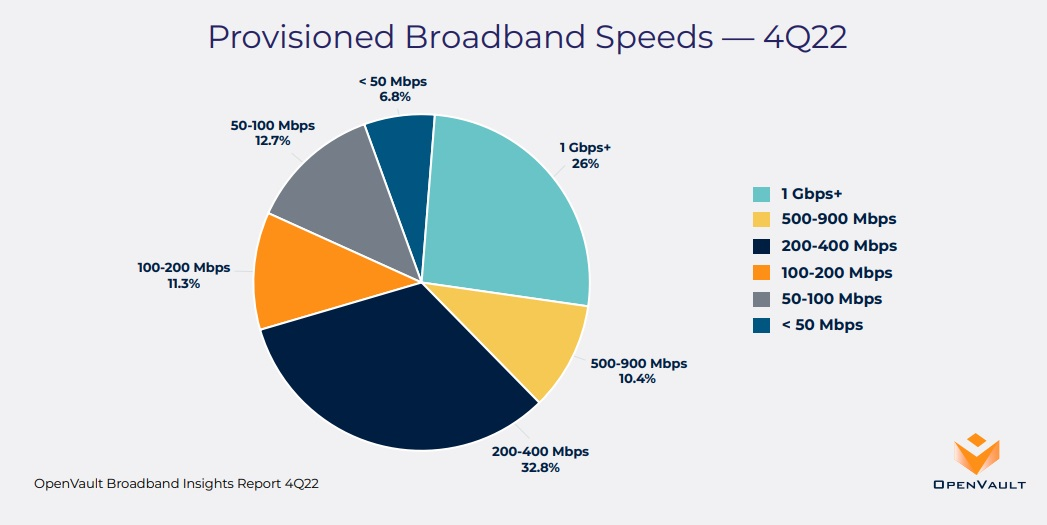

The percentage of U.S. broadband subs on 1-Gig (or higher speed) tiers climbed to 26% in Q4 2022, more than double the 12.2% observed in the year-ago period, OpenVault. As broadband speeds increase, the percentage of broadband customers provisioned for speeds of 200 Mbit/s or less is on the decline – 31% at the end of 2022, down 43% year-over-year, OpenVault found. Adoption of gigabit speeds has jumped significantly among Usage Based Billing (UBB) subscribers, increasing to almost 35% in 4Q22 from 13.4% in 4Q21.

OpenVault found that average data usage in households on the FCC’s Affordable Connectivity Plan (ACP) continues to outpace the field. In Q4, average usage in ACP households was 688.7GB, 17% higher than the broader average of 586.7GB. OpenVault has observed that some households in the ACP program use the funds to upgrade to faster speed packages.

References:

https://openvault.com/resources/ovbi/ (register to download the report)

OpenVault: Broadband data usage surges as 1-Gig adoption climbs to 15.4% of wireline subscribers

Ookla: Fixed Broadband Speeds Increasing Faster than Mobile: 28.4% vs 16.8%

MoffettNathanson: 87.4% of available U.S. homes have broadband; Leichtman Research: 90% of U.S. homes have internet

ITU-R M.2150-1 (5G RAN standard) will include 3GPP Release 17 enhancements; future revisions by 2025

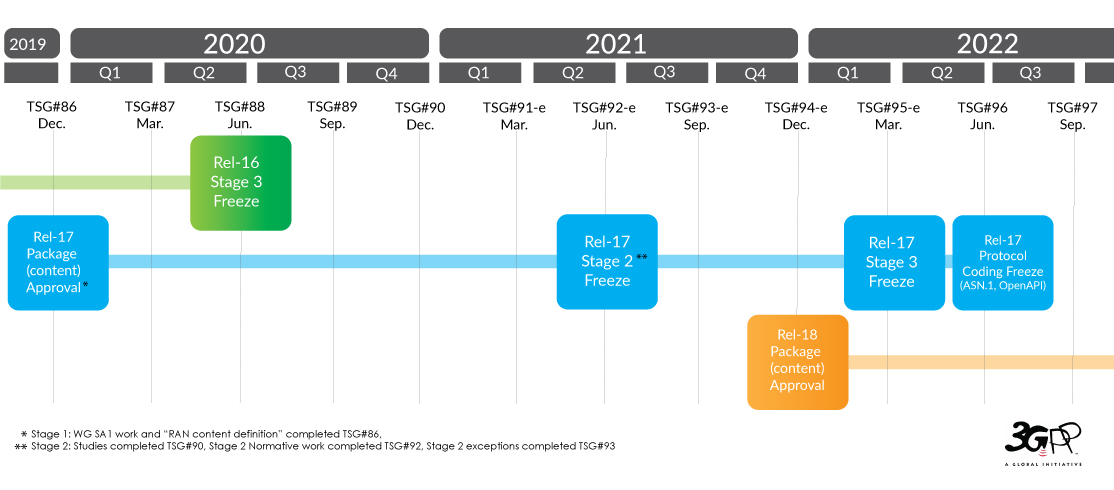

ITU-R Recommendation M.2150 (previously known as IMT 2020) is being updated with new features for the 3GPP and ETSI-DECT 5G radio interface specifications in Annex 1, 2 and 4. This updated recommendation has been given the temporary name “M.2150-1.”

The main changes include the addition of enhanced capabilities for 3GPP 5G-SRIT (Set of Radio Interface Technologies), 3GPP 5G-RIT (Radio Interface Technology), DECT 5G-SRIT, and some consequential changes to the overview sections of the text, as well as to the Global Core Specifications.

This M.2150-1 revision is expected to be completed at ITU-R WP 5D meeting #44 which is June 13-22, 2023 in Geneva.

Annex 1: 3GPP 5G SRIT

The main purpose of this update is to align Rec. ITU-R M.2150 to the Release 17 December 2022 version of the 3GPP Specifications of 3GPP 5G-SRIT. The main features introduced in this update are:

– Addition of new modulation schemes for NB-IoT and LTE-M (LPWANs for IoT connectivity)

– The addition of new numerologies for NR;

– New logical channels and their mapping to physical channels;

– Reduced Capability (RedCap) NR devices.

Annex 2: 3GPP 5G RIT- aka “5G-NR”

The main purpose of this update is to align Rec. ITU-R M.2150 to the Release 17 December 2022 version of the 3GPP Specifications of 3GPP 5G-RIT. The main features introduced in this update are:

– The addition of new numerologies for NR

– New logical channels and their mapping to physical channels

– Reduced Capability (RedCap) NR devices.

IMPORTANT NOTE: Since 3GPP Release 16 5G-NR URRLC in the RAN spec has not been completed yet, it was not submitted to 5D for inclusion in M.2150-1. Therefore, ITU M.2150-1 still does not meet the URLLC Minimum Performance Requirements specified in ITU-R M.2410. In particular, 3GPP Rel 16 URRLC in the RAN:

| 1335 | 830074 | Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC) | NR_L1enh_URLLC | 1 | Rel-16 | R1 | 6/15/2018 | 12/22/2022 | 96% | RP-191584 |

Annex 4: DECT 5G – SRIT

The DECT 5G – SRIT consists of two components: 1.] DECT-2020 NR and 2.] 3GPP 5G-NR. The followings contain the information for each of the component RITs.

– DECT-2020 NR component RIT The original submission contained the layers up to the ‘Medium Access Control’ layer. In this update the ‘Data Link Control’ (DLC) and ‘Convergence’ (CVG) layers have been added.

– 3GPP 5G- NR component RIT. The changes are identical to those in Annex 2. The main purpose of this update is to align Rec. ITU-R M.2150 to the Release 17 December 2022 version of the 3GPP Specifications of 3GPP 5G-RIT.

• The addition of new numerologies for NR

• New logical channels and their mapping to physical channels

• Reduced Capability (RedCap) NR devices.

………………………………………………………………………………………………………………………………………..

ITU-R WP5D meeting #43 considered future revisions of Recommendations ITU-R M.2150 (and ITU-R M.2012) after year 2023 and prepared initial and preliminary revision schedules in which revisions of both Recommendations would be completed by the end of 2025. That may or may not include what pundits label “5G-Advanced,” which is coming from 3GPP Release 18.

………………………………………………………………………………………………………………………………………..

Objectives for WP5D – WG Technology Aspects at the 44th WP 5D meeting (June 12-23, 2023 in Geneva):

i) finalize preliminary draft revision “after year 2021” of Recommendation ITU-R M.2150;

ii) finalize preliminary draft revision of Recommendation ITU-R M.2012-5;

iii) finalize the Report ITU-R M.[IMT.ABOVE 100GHz];

iv) finalize preliminary draft revisions of Recommendations ITU-R M.2070-1 and ITU‑R M.2071-1 “Generic unwanted emission IMT‑Advanced”;

v) continue working on OOBE BS/MS for IMT-2020 “Generic unwanted emissions IMT‑2020.”

………………………………………………………………………………………………………………………………………………………………………….

References:

IMT 2020.SPECS approved by ITU-R but may not meet 5G performance requirements; no 5G frequencies (revision of M.1036); 5G non-radio aspects not included

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

Executive Summary: IMT-2020.SPECS defined, submission status, and 3GPP’s RIT submissions

https://www.itu.int/pub/R-REP-M.2410-2017

ETSI DECT-2020 approved by ITU-R WP5D for next revision of ITU-R M.2150 (IMT 2020)

https://www.itu.int/en/mediacentre/Pages/PR-2022-02-24-5G-Standards.aspx

https://www.3gpp.org/specifications-technologies/releases/release-17

Alaska Communications uses XGS-PON, FWA, DSL in ~5K homes including Fairbanks and North Pole

That build was funded, in part, through the Connect America Fund II (CAF II) program.

“While we consider fiber to be the gold standard, Alaska’s vast geography, weather conditions and existing middle mile network infrastructure make it hard to deploy a one-size-fits all technology,” the spokesperson said in the email.

Fixed wireless also underlies a project completed in 2022 that made gigabit service available to more than 1,200 homes at Fort Wainwright.

“Our network upgrades on Fort Wainwright use fiber-fed mesh wireless as the last mile delivery,” the spokesperson explained. “Our mesh networks use fiber and radios to create a redundant mesh of connectivity around the customer. We selected mesh because it’s fast to deploy, gives the customer a fiber-like experience and allows rapid deployment on military installations.”

The backhaul infrastructure underlying the Alaska Communications network expansion also used a wide spectrum of technologies.

On one end of the spectrum, the XGS-PON deployment is supported by the company’s core packet switched and optical transport networks. At the other end of the spectrum for lower-speed deployments, the company in “minimal cases” uses bonded copper for backhaul, the spokesperson said. For some of those lower-speed deployments, the company also relies on a combination of fixed wireless and fiber.

Interestingly, Alaska Communications fiber installations use a combination of aerial and buried cable. The use of buried cable is a bit of a surprise, recognizing that the ground in Alaska is frozen solid for a considerable portion of the year.

The company plans further expansion into the Interior in 2023 and beyond, according to a press release about the broadband expansion.

Fort Wainwright family housing equipped with an Alaska Communications receiver. Mesh networks use fiber and radios to create a redundant mesh of connectivity around the customer. (Photo: Business Wire)

Contact:

Heather Marron, Manager, Corporate Communications

[email protected]

……………………………………………………………………………………………………………………………………………….

Qualcomm Introduces the World’s First “5G NR-Light” Modem-RF System for new 5G use cases and apps

Qualcomm Technologies, Inc. today announced Snapdragon® X35 5G Modem-RF System, the world’s first “5G NR-Light” [1.] modem-RF system. NR-Light, a new class of 5G, fills the gap in between high-speed mobile broadband devices and extremely low-bandwidth NB-IoT devices. NR-Light devices, powered by Snapdragon X35, can be smaller, more cost-efficient, and provide longer battery life than traditional mobile broadband devices.

Note 1. 5G NR-Light is not an ITU-R recommendation, but rather a subset of 5G-NR in 3GPP Release 17, which was “frozen” on June 10, 2022. In 5G NR Release 17, 3GPP introduced a new tier of reduced capability (RedCap) devices, also known as NR-Light. It is a new device platform that bridges the capability and complexity gap between the extremes in 5G today with an optimized design for mid-tier use cases. When compared to 5G enhanced mobile broadband (eMBB) devices that can support gigabits per second of throughput in the downlink and uplink, NR-Light devices can efficiently support 150 Mbps and 50 Mbps in the downlink and uplink, respectively, due to the designed optimizations:

- narrower bandwidths, i.e., 20 MHz in sub-7 GHz or 100 MHz in millimeter wave (mmWave) frequency bands,

- a single transmit antenna,

- a single receive antenna, with 2 antennas being optional,

- optional support for half-duplex FDD,

- lower-order modulation, with 256-QAM being optional, and

- support for lower transmit power

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

In a briefing provided in advance to journalists, Gautam Sheoran, Qualcomm’s vice president of product management, defined the X35’s target market as “entry-level devices that may not necessarily need multi-gigabit speeds.” The X35 doesn’t support millimeter wave (mmWave) connections, even though Qualcomm continues to praise mmWave. But the X35 can support theoretical peak download speeds of 220 Mbit/s, with best-case uploads of 100 Mbit/s. “We should look at it as bringing all of the benefits of 5G at a much smaller data rate,” Sheoran said.

“The chipset is not only NR-Light, it also supports 4G fallback,” Sheoran added. “It’s really a future proof product that will last a number of years.” Sheoran emphasized that IoT gear built on its new systems was not that far off. “We expect devices to come out in the market around the first half of next year,” he said. “Sampling is actually happening as we speak.”

Snapdragon X35 offers a device platform that bridges the complexity and capability gap between the extremes in 5G today and addresses the need for mid-tier use cases. This lower cost option provides device makers with a long-term migration path to replace LTE CAT4+ devices, ultimately increasing 5G adoption and allowing for faster transition to a unified 5G network. In addition to Snapdragon X35, Qualcomm Technologies also announced Snapdragon® X32 5G Modem-RF System, a modem-to-antenna solution built to lower complexity and fuel cost-efficient NR-Light devices.

“Snapdragon X35 brings together key 5G breakthroughs expected from the world’s leading wireless innovator,” said Durga Malladi, senior vice president and general manager, cellular modems and infrastructure, Qualcomm Technologies, Inc. “The world’s first 5G NR-Light modem features a cost-effective, streamlined design with leading power efficiency, optimized thermal, and reduced footprint. Snapdragon X35 is poised to power the next wave of connected intelligent edge devices and empower a wide spectrum of uses. We look forward to working with industry leaders to unleash what’s possible with a unified 5G platform.”

World’s first 5G NR-Light modem-RF with a new streamlined architecture:

Snapdragon X35, a 3GPP Release 17 RedCap modem with optimized RFIC and PMIC modules, offers OEMs new 5G capabilities to create next-generation devices for a new era of use cases. The flexible, streamlined architecture and high-level modem-RF integration deliver superior power and thermal efficiency while enabling a small form factor design tailored to fit in compact devices.

Expansion of 5G ecosystem to new wave of use cases:

Snapdragon X35 brings a unique mix of capabilities in data rates, power consumption, complexity, and reduced footprint needed to cost-effectively enable new use cases such as entry-level industrial IoT devices, mass tier fixed wireless access consumer premise equipment, mass tier connected PCs, and first generation 5G consumer IoT devices like direct-to-cloud glasses and premium wearables.

With support for both LTE and 5G NR-Light, Snapdragon X35 is backwards compatible and future-proof enabling OEMs to develop devices which coexist with a wide range of 4G and 5G device classes helping scale 5G NR-Light services.

Breakthrough performance with advanced Modem-RF feature set:

Snapdragon X35 is equipped with advanced modem-RF technologies aimed to significantly reduce power consumption, enhance 5G coverage, lower latency, increase battery life, and improve uplink speeds:

– Qualcomm® QET5100 Envelope Tracking

– Qualcomm® Smart Transmit™ Technology

– Qualcomm® 5G Ultra-Low Latency Suite

– Qualcomm® 5G PowerSave Gen 4

In addition, Snapdragon X35 supports dual-frequency GNSS (L1+L5) to offer precise positioning suited to enable new industrial use cases and applications. With its global RF-band support, Snapdragon X35 supports all spectrum bands within Sub-6GHz, FDD, and TDD, to satisfy the needs of various markets.

These innovations and other improvements in Snapdragon X35 are designed to power a new generation of use cases and applications. Qualcomm suggested the company’s new chipset could be used in such gadgets as fixed-wireless consumer premise equipment as well as mobile hotspots, smartwatches and other upmarket wearables, connected cameras, industrial sensors, and augmented-reality glasses running what Sheoran called “glass-to-cloud” apps.

Customer sampling of Snapdragon X35 and X32 are expected to begin in the first half of 2023 and commercial mobile devices are expected to be launched by the first half of 2024. For additional details, please visit the Snapdragon X35 webpage.

…………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/iot/qualcomm-starts-connecting-dots-on-5g-nr-light-/d/d-id/783124?

https://www.3gpp.org/specifications-technologies/releases/release-17

https://portal.3gpp.org/Home.aspx?tbid=373&SubTB=373#/55934-releases

Juniper Research: 5G to Account for 80% of Operator Revenue by 2027; 6G Requires Innovative Technologies

5G to Account for 80% of Operator Revenue by 2027:

Juniper Research has forecast that communications operators are likely to generate $625B from 5G services globally by 2027, a substantial rise from the $310bn predicted for the end of 2023. The new report, Operator revenue strategies: Business models, emerging technologies & market forecasts 2023-2027, forecasts that 80% of global operator-billed service revenue will be attributable to 5G by 2027; allowing operators to secure a return on investment into their 5G networks. However, the increasing implementation of eSIMs into new devices will drive global cellular data traffic to grow by over 180% between 2023 and 2027, as data traffic is offloaded from fixed and Wi-Fi networks to 5G.

Juniper Research noted that the increasing implementation of embedded subscriber identity modules (eSIMs) into new devices would drive global cellular data traffic to grow by over 180% between 2023 and 2027, as data traffic is offloaded from fixed and Wi-Fi networks to 5G. Previous Juniper studies have observed that after spending more than a decade offering a potential breakthrough in mobile communications, embedded eSIM technology has enjoyed noticeable growth in the past 12 months, making its way from smartphones to smart devices. The report also calculated that, driven by Apple’s innovation disrupting the smartphone sector, the value of the global eSIM market was expected increase from $4.7bn in 2023 to $16.3bn by 2027.

Juniper Research author Frederick Savage commented: “eSIM-capable devices will drive significant growth in cellular data, as consumers leverage cellular networks for use cases that have historically used fixed networks. Operators must ensure that networks, including 5G and upcoming 6G networks, are future‑proofed by implementing new technologies across the entirety of networks.”

6G Development Necessitates Innovative Technologies:

To prepare for this increasing demand in cellular data, the report predicts that 6G standards must adopt innovative technologies that are not currently used in 5G standards. It identified NTNs (Non‑terrestrial Networks) and sub-1THz frequency bands as key technologies that must be at the center of initial trials and tests of 6G networks, to provide increased data capabilities over existing 5G networks.

However, the research cautions that the increased cost generated by the use of satellites for NTNs and the acquisition costs of high-frequency spectrum will create longer timelines for securing return on 6G investment for operators. As a result, it urges the telecommunications industry to form partnerships with specialists in non-terrestrial connectivity; thus benefitting from lower investment costs into 6G networks.

………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.juniperresearch.com/pressreleases/operator-5g-revenue-to-reach-$625bn-by-2027

Juniper Research: CPaaS Gobal Market to Reach $29 Billion by 2025

Juniper Research: 5G connectivity opportunity for the connected car market

Juniper Research: 5G Fixed Wireless Access to Generate $2.5 Billion in Operator Revenue by 2023

ITU-R report in progress: Capabilities of the terrestrial component of IMT-2020 (5G) for multimedia communications

Introduction:

ITU-R WP5D is working on a preliminary draft of a report that addresses the capabilities of IMT-2020 to distribute multimedia content such as video, audio, text and graphics, including support for real-time multimedia interactive applications. The new report also addresses the capabilities of IMT-2020 user devices and base stations to support such multimedia communications with low latency and wider transmission bandwidth. It complements Report ITU-R M.2373 on “Audio-visual capabilities and applications supported by terrestrial IMT systems,” which addresses the capabilities of IMT systems for delivering audio-visual services to the consumers and also covers some aspects of production of audio-visual content.

Multimedia applications include network video, digital magazine, digital newspaper, digital radio, social media, mobile TV, digital TV, touch media, etc., that are enabled by IMT-2020 technologies. Beyond the traditional media service, the new media application not only supports accurate delivery of content, but also supports real-time interaction and real-time uploading of user-generated content. The users can be both consumers and producers of new media content.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Editor’s Note:

Ultra low latency is needed to support almost any type of multimedia applications. In particular, the URLLC performance requirements must meet those specified in ITU-R M.2410 –Key requirements related to the minimum technical performance of IMT-2020 candidate radio interface technologies. The current version of IMT 2020 (ITU-R M.2150) doesn’t meet the M.2410 ultra low latency requirement of <1ms in the data plane and <10msec in the control plane. Until 3GPP Release 16 URLLC in the RAN spec is completed and performance tested, we don’t expect any serious use of 5G for multimedia applications.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Applications for multimedia content include but are not limited to:

– audio-visual applications,

– network video applications,

– digital online magazine applications,

– digital online newspaper applications,

– internet radio applications,

– social media applications,

– mobile internet TV applications,

– touch media applications,

– online information distribution applications,

– on-demand video applications

– imaging and audio distribution applications

– content dissemination applications

– file delivery application

_ Real time uploading of multimedia content

_ Electronic classroom presentation technology

_ Full motion video conferencing

This report covers the application of IMT technology to the specific applications mentioned above. For details of applications of the Broadcasting service for multimedia, please refer to the list of ITU‑R Recommendations and ITU-R Reports below.

Relevant ITU-R Recommendations and Reports:

- Recommendation ITU-R BT.1833 – Broadcasting of multimedia and data applications for mobile reception by handheld receivers

- Recommendation ITU-R BT.2016 – Error-correction, data framing, modulation and emission methods for terrestrial multimedia broadcasting for mobile reception using handheld receivers in VHF/UHF bands

- Recommendation ITU-R M.2083 – Framework and overall objectives of the future development of IMT for 2020 and beyond

- Recommendation ITU-R M.2150 – Detailed specifications of the terrestrial radio interfaces of International Mobile Telecommunications-2020 (IMT-2020)

- Report ITU-R BT.2049 – Broadcasting of multimedia and data applications for mobile reception

- Report ITU-R BT.2295 – Digital terrestrial broadcasting systems

- Report ITU-R M.2373 – Audio-visual capabilities and applications supported by terrestrial IMT systems

Multimedia Use cases:

- Ultra-high-definition multimedia content

- Virtual reality (VR) panoramic video

- Augmented Reality (AR)

- Entertainment live streaming

- Live eCommerce (use of live webcast technology to carry out new sales methods)

- Smart venue (new viewing experiences at live events or activities)

- Live streaming production and distribution of events

IMT-2020 capabilities for real-time multimedia interaction and media content uploading:

Interactive multimedia allows the user to control, combine and manipulate a variety of media types, such as text, computer graphics audio and video materials, animation and virtual reality.

To enable interactive task completion during voice conversation, IMT-2020 is capable of supporting low-delay speech coding for interactive conversational services (refer 3GPP TS22.261, 100 ms, one-way mouth-to-ear).

Table 1. below (from 3GPP TS 22.261 Table 7.1-1.) gives a capability example of IMT-2020 to support high data rate and traffic density scenario for an interactive audio and video application in indoor hotspot.

Table 1. High data rate and traffic density scenario of IMT-2020 for an interactive audio and video application

| Scenario | Experienced data rate (DL) | Experienced data rate (UL) | Area traffic capacity (DL) | Area traffic capacity (UL) | Overall user density | Activity factor | UE speed | Coverage |

| Indoor hotspot | 1 Gbit/s | 500 Mbit/s | 15 Tbit/s/km2 | 2 Tbit/s/km2 | 250 000/km2 | Note 2 | Pedestrians | Office and residential (Note 1) |

| NOTE 1: A certain traffic mix is assumed; only some users use services that require the highest data rates. | ||||||||

Conclusions:

This report (in progress) summarizes various capabilities of terrestrial component of IMT-2020 for Multimedia communications. Multimedia is an immersive technological way of presenting information that combines audio, video, images, and animations with textual data. Multimedia applications include network video, digital magazine, digital newspaper, digital radio, social media, touch media, etc., and can be easily enabled using IMT-2020. New emerging technologies such as Virtual Reality (VR) and Augmented Reality (AR) are becoming key technologies to upgrade the traditional multimedia industries.

The IMT-2020 capabilities can support the evolving interactive multimedia communication with the capabilities not only broader bandwidth, higher data rate, but also lower latency and higher reliability.

The typical technologies are flexible and dynamic resources allocation, uplink enhancement e.g. UL MIMO, UL Carrier Aggregation and Dual connectivity, and related architecture improvement, which can connect the user to a high-definition video, real-time multimedia interaction virtual world on their mobile device.

Live events with high definition and ultra-high definition content can be streamed via IMT-2020 radio network with higher throughput. HD and UHD content (e.g. news, sport event) can be real-time produced and on demand distributed to mobile devices without any interruptions through IMT-2020 higher user experienced data rate and low latency. The entertainment industry will hugely benefit from IMT-2020 wireless networks, which are expected to enable HD virtual reality games with a better real-time interactive gaming experience, and high dynamic range video streaming without interruption. Cloud AR and Cloud VR with HD or UHD video can be supported with higher user experienced data rate and low latency supported by IMT-2020. It is foreseeable that with the support of IMT-2020 technology, it will gradually bring consumers more amazing virtual experiences.

References:

Evaluating Multimedia Protocols on 5G Edge for Mobile Augmented Reality

https://www.routledge.com/5G-Multimedia-Communication-Technology-Multiservices-and-Deployment/Bojkovic-Milovanovic-Fowdur/p/book/9780367561154

https://www.rcrwireless.com/20220413/5g/what-is-the-5g-multimedia-priority-service-mps

IMT 2020.SPECS approved by ITU-R but may not meet 5G performance requirements; no 5G frequencies (revision of M.1036); 5G non-radio aspects not included

Ericsson Mobility Report: 5G monetization depends on network performance

A special Ericsson Mobility Report – called the Business Review edition – addresses monetization opportunities as they relate to 5G. Flattening revenues have been a challenge for service providers in all parts of the world, often impacting network investment decisions as part of their business growth strategies, known as ‘monetization’ in the industry.

The report highlights a positive revenue growth trend since the beginning of 2020 in the top 20* 5G markets – accounting for about 85 percent of all 5G subscriptions globally – that correlates with increasing 5G subscription penetration in these markets.

The report finds:

- Tiered pricing models are key for service providers, both for effectively addressing the individual needs of each customer and for continuing to drive long-term revenue growth.

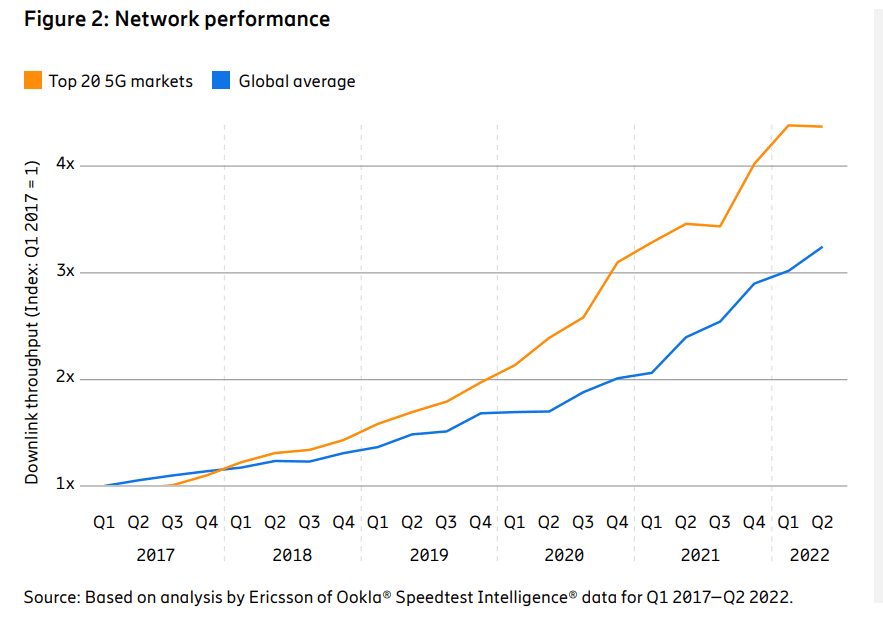

- The top 20 5G markets have seen a significant network performance boost following the introduction of 5G services.

- After a period of slow or no growth, wireless service revenue curves are again pointing upwards in these leading markets. This correlate with 5G subscription penetration growth.

- In the top 20 5G markets, the average downlink throughput has increased by 4.3 times over the past 5 years. This is 32 percent more than other markets on a global level, showing the positive impact 5G has had on network performance and user experience. The most significant network performance improvement in the top 20 5G markets was in 2020, following the introduction of 5G NSA network services.

- In the top 20 5G markets, the median downlink throughput of 5G is 5.8 times higher than the throughput of 4G (187 Mbps vs. 32 Mbps) in Q3 2022. This performance boost is what service providers could offer to consumers as an immediate benefit of upgrading to 5G.

Fredrik Jejdling, Executive Vice President and Head of Networks, Ericsson, says: “Meeting our customers’ challenges is at the heart of our R&D efforts and every resulting product we develop. The link between 5G uptake and revenue growth in the top 20 5G markets underlines that not only is 5G a game changer, but that early adopters benefit. What is particularly encouraging about this is that while 5G is still at a relatively early phase, it is growing fast with proven early use cases and a clear path to medium and long-term use cases.”

As expected, Enhanced Mobile Broadband (eMBB) is the main early use case for 5G, driven by increasing geographical coverage and differentiated offerings. More than one billion 5G subscriptions are currently active across some 230 live commercial networks globally. 5G eMBB offers the fastest revenue opportunities for 5G, as it is an extension of service providers’ existing business, relying on the same business models and processes. Even in the top 20 5G markets, about 80 percent of consumers have yet to move to 5G subscriptions – one pointer to the potential for revenue growth.

As highlighted in the November 2022 Ericsson Mobility Report, Fixed Wireless Access (FWA) is the second biggest early 5G use case, particularly in regions with unserved or underserved broadband markets. FWA offers attractive revenue growth potential for CSPs as it largely utilizes mobile broadband assets. FWA connections are forecast to top 300 million within six years.

Beyond consumer subscribers, there are growing opportunities in enterprise and public sector applications across the world. Ericsson sas that 5G enables significant value for enterprises, with private 5G networks and wireless wide area networks being deployed for enterprise and industrial use.

Upgrading existing 4G sites to 5G has the potential to realize increases of 10 times in capacity and reduce energy consumption by more than 30 percent, offering the possibility of growing revenue and lowering costs, while addressing sustainability.

Jejdling adds: “Revenue growth and sustainability are recurring themes in my discussions with customers. In this special Ericsson Mobility Report edition, we have explored how service providers are tapping 5G opportunities. We see initial signs of revenue growth in advanced 5G markets with extensive coverage build-out and differentiated service offerings. An equally crucial aspect of 5G is that it brings cost advantages and helps service providers handle the data growth needed to drive future revenue. This can make 5G the growth catalyst that the market has been waiting for.”

Read the full Ericsson Mobility Report Business Review Edition report here.

*Note: The markets categorized as the Top 20 5G markets in the report are: Australia, Bahrain, China, Denmark, Finland, Hong Kong, Ireland, Japan, Kuwait, Monaco, Norway, Qatar, Saudi Arabia, Singapore, South Korea, Switzerland, Taiwan, the UAE, the UK and the US.

They were selected on the basis of 5G subscription penetration. These markets represent 85 percent of all 5G subscriptions globally – with each market having 5G penetration above 15 percent.

Related links:

Ericsson Mobility Report site

Ericsson 5G

Ericsson 4G and 5G Fixed Wireless Access

Breaking the energy curve

5G the next wave – what does consumers want

Nokia introduces new Wavence microwave solutions to extend 5G reach in both urban and rural environments

Nokia today announced the availability of the UBT-m XP, the latest addition to its Wavence product family designed to support mobile operators and enterprises with premium coverage in both dense urban and rural environments. Nokia’s newest E-Band radio is a high-capacity outdoor unit with a small, light form factor and the highest transmit power available on the market; ideal for urban microwave transport applications.

Nokia SteadEband, a stabilized three-foot antenna that combats common E-Band issues [1.], was also announced to complement UBT-m XP. It includes tower vibrations and movements due to thermal effects. Combined with the UBT-m XP, it can increase the typical E-Band link distance by up to 50 percent, helping mobile operators deliver multi-gigabit 5G connectivity to their customers. These new products address all use cases for improving link distance as well as the energy efficiency of the Wavence portfolio.

Note 1. The E-Band is 71-76 and 81-86 GHz, standardized worldwide, commonly referred to as “80 GHz,” but it’s always that range, said Nokia Microwave Radio Links VP Giuseppe Targia, noting that the E-Band is suitable for both urban and suburban environments.

Urban Coverage Boost:

The UBT-m XP is a single ultra-broadband transceiver with an integrated modem and diplexer, offering best-in-class energy efficiency with twice the transmit power compared to the industry average. In recent tests, Nokia demonstrated a 12-kilometer-long link using the Nokia UBT-m XP and the SteadEband antenna.

Rural Broadband Extension:

Nokia also announced the launch of the Outdoor Channel Aggregator (OCA) to support mobile operators looking to expand the reach and capacity of their networks for rural broadband applications. The OCA aggregates multiple UBT-T XP radios, Nokia’s high-capacity, high-power, outdoor dual-band radio, for N+0 operations and allows for increased throughput with improved system gain of up to 10 dB compared with traditional aggregation methods. This is important in increasing the link distance or to optimize OPEX/CAPEX by removing the requirement for larger antenna or repeater systems.

Nokia is also introducing the Carrier Aggregation High Density (CAHD) card, which adds ‘single pipe’ capacity to the backhaul to support the link distance. The innovative CAHD module enables 10 Gbps backhaul capacity over multiple channels and supports seamless migration from existing low-capacity backhaul to high capacity hence preserving an operator’s investment.

Nokia’s ‘Simplified RAN Transport’ solution optimizes radio access base station and microwave radio transport hardware to the minimum. This provides enhanced serviceability and operations without the need for dedicated indoor microwave equipment. Nokia’s solution saves 30 percent more energy versus a traditional microwave site solution, due to a reduced number of units and less air conditioning requirements. Additionally, it also enables lower TCO and reduced site footprint.

Nokia’s comprehensive Wavence portfolio provides a complete microwave solution for all use cases covering short-haul, long-haul, E-Band, and SDN-based management both for mobile operators and Enterprises. Its zero-footprint implementation for full-outdoor architectures can be integrated directly with RAN and IP devices with common management. This contributes to an overall reduction in network energy consumption and its software features and automation help to achieve further energy-saving targets.

“It’s no secret that capacity and radio efficiency are driving the market, said Emmy Johnson, Chief Analyst, Sky Light Research. “According to Sky Light Research’s latest forecast, the high-capacity E-band market is expected to grow north of 60 percent in 2023. Nokia’s newest products answer this call but with the added benefit of high power and energy efficiency. The sustainability and power metrics are impressive, as they not only lower TCO but also help meet climate change guidelines.”

Giuseppe Targia, Vice President, Microwave Radio Links at Nokia, said: “We are further strengthening our industry-leading Wavence portfolio with the addition of these next-generation products. The winning combination of the UBX-m XP and the SteadEband offers our customers a high-performance transport solution with leading capacity and coverage for both urban and rural environments. Microwave links are cost-efficient and fast to deploy, representing a robust alternative to fiber backhaul.”

Nokia’s Wavence UBT-mX

……………………………………………………………………………………………………………………………………………..

References:

Wavence – Microwave transmission

https://www.nokia.com/networks/mobile-networks/wavence-microwave-transmission/e-band-portfolio/

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

There was steady growth in 5G network coverage in 2022, with the number of subscribers reaching almost 1 billion worldwide. Although most of the 5G deployments in 2022 were in the developed economies of the world, Counterpoint Research expects that the bulk of 5G network roll outs in 2023 will be in emerging markets. This will drive the continuing transition from 5G NSA to 5G SA. To date, 42 network operators have deployed 5G SA commercially.

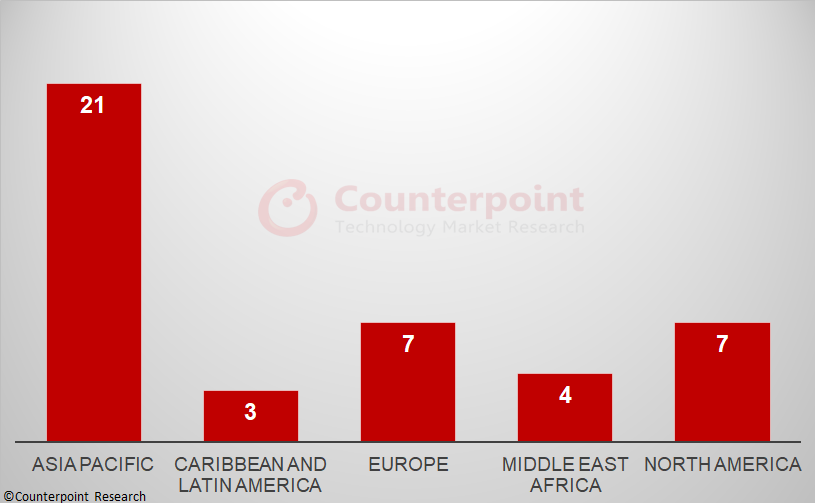

Counterpoint Research ‘s recently published 5G SA Tracker is a culmination of an extensive study of the 5G SA market. It provides details of all operators with 5G SA cores in commercial operation at the end of 2022, with market share by region, vendor and by frequency band. As shown in Exhibit 1, the Asia-Pacific region led the world at the end of 2022, followed by North America and Europe, with the other regions – Middle East and Africa and Latin America – lagging behind.

Key Points:

Key points discussed in the report include:

- Operators – 42 operators have deployed 5G SA commercially [1.] with many more testing and in trials. Most of the deployments are in the developed economies of the world with those in emerging economies lagging. In some markets, operators have adopted a “wait-and-see” approach and are looking for evidence of successful use cases before switching from 5G NSA to SA. The ongoing economic headwinds might also delay commercial deployment of SA particularly during the first half of 2023.

Note 1. By the end of 2022, Dell’Oro Group had identified 39 MNOs that had deployed 5G SA eMMB networks.

- Vendors – Ericsson and Nokia lead the 5G SA Core market globally and are benefiting from the geopolitical sanctions on Chinese vendors Huawei and ZTE in some markets. Asian vendors Samsung and NEC are mainly focused on their respective domestic markets, but and are expanding their reach to Tier-2 operators and emerging markets, while US vendor Mavenir is active across all regions, with multiple deployments due to become live in 2023, including several with Tier-1 operators.

- Spectrum – most operators are deploying 5G in mid-band frequencies, for example, n78, as it provides faster speeds and good coverage. A small number of operators have also launched commercial services in the sub-1GHz and millimetre wave bands. FWA seems to be the most popular use case at present but there is a lot of interest in edge services and network slicing as well.

Report Overview:

Counterpoint Research’s 5G SA Core Tracker, January 2023 tracker provides an overview of the 5G Standalone (SA) market, highlighting the key trends and drivers shaping the market, plus details of commercial launches by vendor, by region and by frequency band. In addition, the tracker provides details about the 5G SA vendor ecosystem split into two categories: public operator and private network markets.

Table of Contents:

- Overview

- Market Update

- 5G SA Market Deployments

- Commercial Deployment by Operators

- Network Engagements by Region

- Network Engagements by Deployments Status

- Leading 5G Core Vendors

- Mobile Core Vendor Ecosystem

- 5G Core Vendors Market Landscape

- Outlook

………………………………………………………………………………………………………………………………………………………………..

During its recent Q4 2022 earnings call, Nokia CEO Pekka Lundmark was asked about 5G SA core networks. Lundmark said, “Obviously 5G standalone is now the name of the game because you need 5G standalone in terms of getting the full benefits of 5G. There is going to be a lot of investment in 5G core, and operators will be implementing some critical important services like slicing, which require investment in the 5G core.”

That’s an understatement because 5G SA is needed to realize 3GPP defined 5G features and functions, like security and network slicing. 5G NSA, which is mostly deployed today, is actually 4G with 3GPP 5G-NR for the RAN.

References:

Update on 5G Stand-Alone (SA) Core Networks

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

Global Data: Wireless telcos don’t know how to market 5G SA

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Why are 5G SA Core networks taking so long to be commercially deployed?

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

Mobile Core Network & Multi-Access Edge Market—A Look into 2023

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

?$QC_Responsive$&fmt=png-alpha&wid=640)