Ericsson Mobility Report: 5G monetization depends on network performance

A special Ericsson Mobility Report – called the Business Review edition – addresses monetization opportunities as they relate to 5G. Flattening revenues have been a challenge for service providers in all parts of the world, often impacting network investment decisions as part of their business growth strategies, known as ‘monetization’ in the industry.

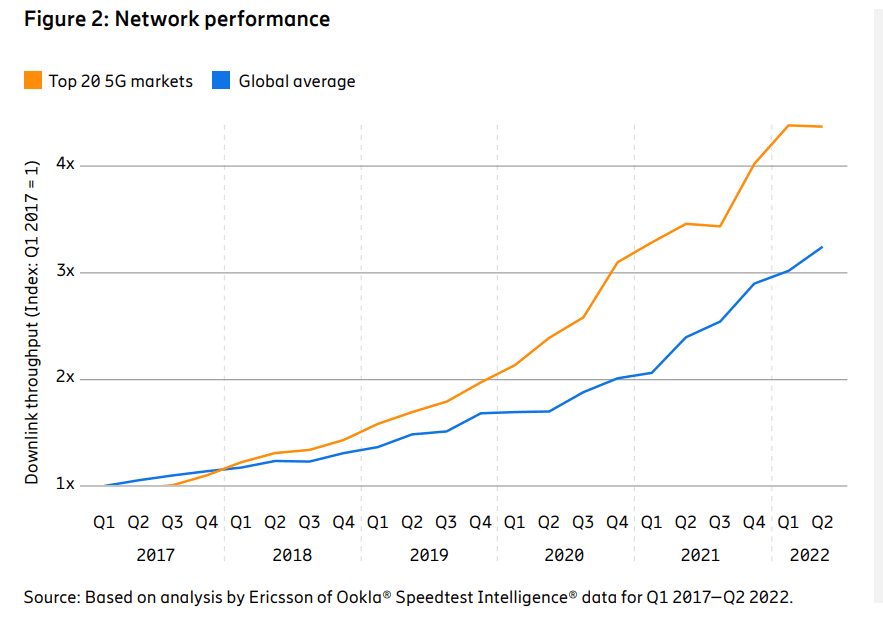

The report highlights a positive revenue growth trend since the beginning of 2020 in the top 20* 5G markets – accounting for about 85 percent of all 5G subscriptions globally – that correlates with increasing 5G subscription penetration in these markets.

The report finds:

- Tiered pricing models are key for service providers, both for effectively addressing the individual needs of each customer and for continuing to drive long-term revenue growth.

- The top 20 5G markets have seen a significant network performance boost following the introduction of 5G services.

- After a period of slow or no growth, wireless service revenue curves are again pointing upwards in these leading markets. This correlate with 5G subscription penetration growth.

- In the top 20 5G markets, the average downlink throughput has increased by 4.3 times over the past 5 years. This is 32 percent more than other markets on a global level, showing the positive impact 5G has had on network performance and user experience. The most significant network performance improvement in the top 20 5G markets was in 2020, following the introduction of 5G NSA network services.

- In the top 20 5G markets, the median downlink throughput of 5G is 5.8 times higher than the throughput of 4G (187 Mbps vs. 32 Mbps) in Q3 2022. This performance boost is what service providers could offer to consumers as an immediate benefit of upgrading to 5G.

Fredrik Jejdling, Executive Vice President and Head of Networks, Ericsson, says: “Meeting our customers’ challenges is at the heart of our R&D efforts and every resulting product we develop. The link between 5G uptake and revenue growth in the top 20 5G markets underlines that not only is 5G a game changer, but that early adopters benefit. What is particularly encouraging about this is that while 5G is still at a relatively early phase, it is growing fast with proven early use cases and a clear path to medium and long-term use cases.”

As expected, Enhanced Mobile Broadband (eMBB) is the main early use case for 5G, driven by increasing geographical coverage and differentiated offerings. More than one billion 5G subscriptions are currently active across some 230 live commercial networks globally. 5G eMBB offers the fastest revenue opportunities for 5G, as it is an extension of service providers’ existing business, relying on the same business models and processes. Even in the top 20 5G markets, about 80 percent of consumers have yet to move to 5G subscriptions – one pointer to the potential for revenue growth.

As highlighted in the November 2022 Ericsson Mobility Report, Fixed Wireless Access (FWA) is the second biggest early 5G use case, particularly in regions with unserved or underserved broadband markets. FWA offers attractive revenue growth potential for CSPs as it largely utilizes mobile broadband assets. FWA connections are forecast to top 300 million within six years.

Beyond consumer subscribers, there are growing opportunities in enterprise and public sector applications across the world. Ericsson sas that 5G enables significant value for enterprises, with private 5G networks and wireless wide area networks being deployed for enterprise and industrial use.

Upgrading existing 4G sites to 5G has the potential to realize increases of 10 times in capacity and reduce energy consumption by more than 30 percent, offering the possibility of growing revenue and lowering costs, while addressing sustainability.

Jejdling adds: “Revenue growth and sustainability are recurring themes in my discussions with customers. In this special Ericsson Mobility Report edition, we have explored how service providers are tapping 5G opportunities. We see initial signs of revenue growth in advanced 5G markets with extensive coverage build-out and differentiated service offerings. An equally crucial aspect of 5G is that it brings cost advantages and helps service providers handle the data growth needed to drive future revenue. This can make 5G the growth catalyst that the market has been waiting for.”

Read the full Ericsson Mobility Report Business Review Edition report here.

*Note: The markets categorized as the Top 20 5G markets in the report are: Australia, Bahrain, China, Denmark, Finland, Hong Kong, Ireland, Japan, Kuwait, Monaco, Norway, Qatar, Saudi Arabia, Singapore, South Korea, Switzerland, Taiwan, the UAE, the UK and the US.

They were selected on the basis of 5G subscription penetration. These markets represent 85 percent of all 5G subscriptions globally – with each market having 5G penetration above 15 percent.

Related links:

Ericsson Mobility Report site

Ericsson 5G

Ericsson 4G and 5G Fixed Wireless Access

Breaking the energy curve

5G the next wave – what does consumers want

Nokia introduces new Wavence microwave solutions to extend 5G reach in both urban and rural environments

Nokia today announced the availability of the UBT-m XP, the latest addition to its Wavence product family designed to support mobile operators and enterprises with premium coverage in both dense urban and rural environments. Nokia’s newest E-Band radio is a high-capacity outdoor unit with a small, light form factor and the highest transmit power available on the market; ideal for urban microwave transport applications.

Nokia SteadEband, a stabilized three-foot antenna that combats common E-Band issues [1.], was also announced to complement UBT-m XP. It includes tower vibrations and movements due to thermal effects. Combined with the UBT-m XP, it can increase the typical E-Band link distance by up to 50 percent, helping mobile operators deliver multi-gigabit 5G connectivity to their customers. These new products address all use cases for improving link distance as well as the energy efficiency of the Wavence portfolio.

Note 1. The E-Band is 71-76 and 81-86 GHz, standardized worldwide, commonly referred to as “80 GHz,” but it’s always that range, said Nokia Microwave Radio Links VP Giuseppe Targia, noting that the E-Band is suitable for both urban and suburban environments.

Urban Coverage Boost:

The UBT-m XP is a single ultra-broadband transceiver with an integrated modem and diplexer, offering best-in-class energy efficiency with twice the transmit power compared to the industry average. In recent tests, Nokia demonstrated a 12-kilometer-long link using the Nokia UBT-m XP and the SteadEband antenna.

Rural Broadband Extension:

Nokia also announced the launch of the Outdoor Channel Aggregator (OCA) to support mobile operators looking to expand the reach and capacity of their networks for rural broadband applications. The OCA aggregates multiple UBT-T XP radios, Nokia’s high-capacity, high-power, outdoor dual-band radio, for N+0 operations and allows for increased throughput with improved system gain of up to 10 dB compared with traditional aggregation methods. This is important in increasing the link distance or to optimize OPEX/CAPEX by removing the requirement for larger antenna or repeater systems.

Nokia is also introducing the Carrier Aggregation High Density (CAHD) card, which adds ‘single pipe’ capacity to the backhaul to support the link distance. The innovative CAHD module enables 10 Gbps backhaul capacity over multiple channels and supports seamless migration from existing low-capacity backhaul to high capacity hence preserving an operator’s investment.

Nokia’s ‘Simplified RAN Transport’ solution optimizes radio access base station and microwave radio transport hardware to the minimum. This provides enhanced serviceability and operations without the need for dedicated indoor microwave equipment. Nokia’s solution saves 30 percent more energy versus a traditional microwave site solution, due to a reduced number of units and less air conditioning requirements. Additionally, it also enables lower TCO and reduced site footprint.

Nokia’s comprehensive Wavence portfolio provides a complete microwave solution for all use cases covering short-haul, long-haul, E-Band, and SDN-based management both for mobile operators and Enterprises. Its zero-footprint implementation for full-outdoor architectures can be integrated directly with RAN and IP devices with common management. This contributes to an overall reduction in network energy consumption and its software features and automation help to achieve further energy-saving targets.

“It’s no secret that capacity and radio efficiency are driving the market, said Emmy Johnson, Chief Analyst, Sky Light Research. “According to Sky Light Research’s latest forecast, the high-capacity E-band market is expected to grow north of 60 percent in 2023. Nokia’s newest products answer this call but with the added benefit of high power and energy efficiency. The sustainability and power metrics are impressive, as they not only lower TCO but also help meet climate change guidelines.”

Giuseppe Targia, Vice President, Microwave Radio Links at Nokia, said: “We are further strengthening our industry-leading Wavence portfolio with the addition of these next-generation products. The winning combination of the UBX-m XP and the SteadEband offers our customers a high-performance transport solution with leading capacity and coverage for both urban and rural environments. Microwave links are cost-efficient and fast to deploy, representing a robust alternative to fiber backhaul.”

Nokia’s Wavence UBT-mX

……………………………………………………………………………………………………………………………………………..

References:

Wavence – Microwave transmission

https://www.nokia.com/networks/mobile-networks/wavence-microwave-transmission/e-band-portfolio/

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

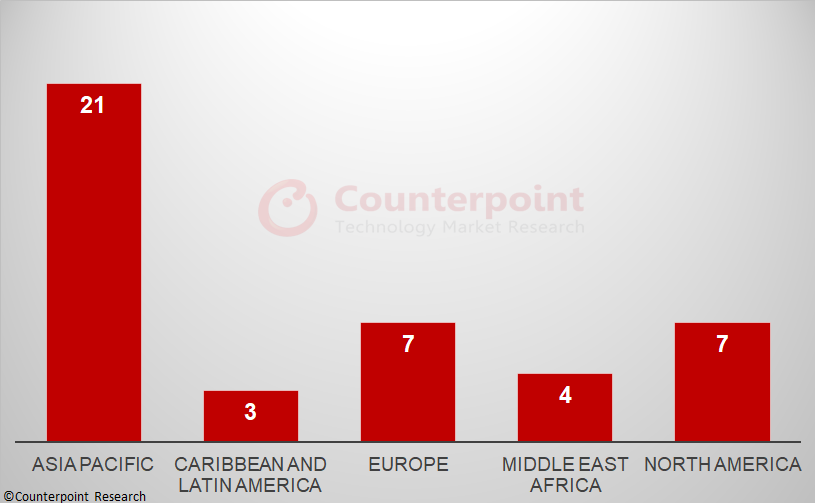

There was steady growth in 5G network coverage in 2022, with the number of subscribers reaching almost 1 billion worldwide. Although most of the 5G deployments in 2022 were in the developed economies of the world, Counterpoint Research expects that the bulk of 5G network roll outs in 2023 will be in emerging markets. This will drive the continuing transition from 5G NSA to 5G SA. To date, 42 network operators have deployed 5G SA commercially.

Counterpoint Research ‘s recently published 5G SA Tracker is a culmination of an extensive study of the 5G SA market. It provides details of all operators with 5G SA cores in commercial operation at the end of 2022, with market share by region, vendor and by frequency band. As shown in Exhibit 1, the Asia-Pacific region led the world at the end of 2022, followed by North America and Europe, with the other regions – Middle East and Africa and Latin America – lagging behind.

Key Points:

Key points discussed in the report include:

- Operators – 42 operators have deployed 5G SA commercially [1.] with many more testing and in trials. Most of the deployments are in the developed economies of the world with those in emerging economies lagging. In some markets, operators have adopted a “wait-and-see” approach and are looking for evidence of successful use cases before switching from 5G NSA to SA. The ongoing economic headwinds might also delay commercial deployment of SA particularly during the first half of 2023.

Note 1. By the end of 2022, Dell’Oro Group had identified 39 MNOs that had deployed 5G SA eMMB networks.

- Vendors – Ericsson and Nokia lead the 5G SA Core market globally and are benefiting from the geopolitical sanctions on Chinese vendors Huawei and ZTE in some markets. Asian vendors Samsung and NEC are mainly focused on their respective domestic markets, but and are expanding their reach to Tier-2 operators and emerging markets, while US vendor Mavenir is active across all regions, with multiple deployments due to become live in 2023, including several with Tier-1 operators.

- Spectrum – most operators are deploying 5G in mid-band frequencies, for example, n78, as it provides faster speeds and good coverage. A small number of operators have also launched commercial services in the sub-1GHz and millimetre wave bands. FWA seems to be the most popular use case at present but there is a lot of interest in edge services and network slicing as well.

Report Overview:

Counterpoint Research’s 5G SA Core Tracker, January 2023 tracker provides an overview of the 5G Standalone (SA) market, highlighting the key trends and drivers shaping the market, plus details of commercial launches by vendor, by region and by frequency band. In addition, the tracker provides details about the 5G SA vendor ecosystem split into two categories: public operator and private network markets.

Table of Contents:

- Overview

- Market Update

- 5G SA Market Deployments

- Commercial Deployment by Operators

- Network Engagements by Region

- Network Engagements by Deployments Status

- Leading 5G Core Vendors

- Mobile Core Vendor Ecosystem

- 5G Core Vendors Market Landscape

- Outlook

………………………………………………………………………………………………………………………………………………………………..

During its recent Q4 2022 earnings call, Nokia CEO Pekka Lundmark was asked about 5G SA core networks. Lundmark said, “Obviously 5G standalone is now the name of the game because you need 5G standalone in terms of getting the full benefits of 5G. There is going to be a lot of investment in 5G core, and operators will be implementing some critical important services like slicing, which require investment in the 5G core.”

That’s an understatement because 5G SA is needed to realize 3GPP defined 5G features and functions, like security and network slicing. 5G NSA, which is mostly deployed today, is actually 4G with 3GPP 5G-NR for the RAN.

References:

Update on 5G Stand-Alone (SA) Core Networks

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

Global Data: Wireless telcos don’t know how to market 5G SA

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Why are 5G SA Core networks taking so long to be commercially deployed?

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

Mobile Core Network & Multi-Access Edge Market—A Look into 2023

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

Ericsson & Mobily enhance network performance through Artificial Intelligence (AI)

Ericsson has developed an AI system for automated network management which has now been included in Saudi Arabia operator Mobily’s wireless network. The companies have successfully deployed the ‘Ericsson AI-based network solution’ into Mobily’s network in Saudi Arabia in order to enable some ‘enhanced and smart end-user experiences.’

This AI system will provide 5G network diagnostics, root cause analysis and recommendations for ‘superior user experiences.’ The network diagnostics capabilities within the cognitive software suite provides ‘proactive network optimization’, allowing the operator to identify and resolve network anomalies and providing reliable connectivity, we are told.

Ericsson’s AI-based network solution delivers comprehensive Machine Learning (ML) based 5G network diagnostics, root cause analysis and recommendations for superior user experiences. The smart, automated network diagnostics capabilities of Ericsson’s cognitive software suite results in proactive network optimization, supporting Mobily, the leading digital partner of the international technical conference LEAP 23, in identifying and resolving network anomalies and constantly providing reliable connectivity.

Ericsson is so excited by the product in fact that it says it ‘redefines the very nature of network operations,’ alongside the presence of Big Data and ‘ever-expanding and more accessible computing power.’

“From people in remote locations to large gatherings, individuals often expect uninterrupted and quality connectivity,” said Alaa Malki, Chief Technology Officer from Mobily. “Ericsson’s Artificial Intelligence (AI)-based solution enables our customers to enjoy superior and uninterrupted 5G connectivity to stay connected with loved ones or to document key moments anytime, anywhere. Our partnership with Ericsson has once more reinforced our commitment to Unlock Possibilities during times that matter most, and we look forward to carrying our mission forward. I want to thank Ericsson for its support which allowed us to use this data-driven concept to make all kinds of changes and optimizations within short timeframes.”

Ekow Nelson, Vice President at Ericsson Middle East and Africa said: “For numerous years, our partnership with Mobily has provided customers with assured and superior connectivity to stream live experiences and benefit from a multitude of services even in the most challenging environments. Our success relied on Ericsson’s Artificial Intelligence-based network solution built with Machine Learning models that learn from the live network using the multiple sources of data to deliver near real-time improvements, thus avoiding interruptions during critical and peak times.”

How AI interacts and disrupts different industries looks likely to be an increasingly prominent issue in the years to come, for all sorts of reasons. In an interview with Telecoms.com recently, Beerud Sheth – CEO of conversational AI firm Gupshup said, “Like almost any industry, telcos will also have to figure out how they see this disruption… it creates opportunities and threats. And I think you have to lean into the opportunities, and maybe mitigate the threats a little bit. It changes a lot of things, it changes consumer expectations, it changes what people expect and what they want to do and can do, and they have to keep pace with all of it. So, there’s a lot of work for telco executives.”

References:

Ericsson, Mobily successfully enhance network performance through Artificial Intelligence

Ericsson warns profit margins at RAN business set to worsen

BT’s CEO: Openreach Fiber Network is an “unstoppable machine” reaching 9.6M UK premises now; 25M by end of 2026

BT’s chief executive said its broadband network is now an “unstoppable machine” that will ultimately “end in tears” for many of its fiber optic competitors. “There is only going to be one national network,” Philip Jansen told the Financial Times. “Why do you need to have multiple providers?” BT said on Thursday that its networking division Openreach had laid fiber to 9.6M premises, with 29% of people in those areas opting to move over to its fiber optic connectivity offering.

BT has long provided the main wholesale network in Britain, giving access to TalkTalk and Sky among other OTT players. BT is ploughing billions of pounds into its network, extending its fiber offerings to 25M premises by end of 2026.

Competitors to Openreach, backed by billions in private capital, are racing to lay full fiber across the UK before the incumbent gets there. They include Virgin Media O2 and more than 100 alternative networks known as “altnets.”

Virgin Media O2 is seeking to upgrade its network to fiber by 2028 and has formed a joint venture between its owners, Spain’s Telefónica and Liberty Global, as well as infrastructure fund Infravia, to lay fiber to an additional 7M premises across the UK and offer wholesale access to other broadband providers. That’s in areas not already covered by the existing Virgin Media network. Industry insiders say network operators need to sign up about 40% of customers in any given location where they are building to make their business viable.

“Building is irrelevant — it’s how many people you’ve got on the network,” Jansen said. “No one else has got a machine anywhere near ours. It’s . . . unstoppable.” He said that the market would probably shake out to be just a “couple of big players” as well as a smattering of specialist providers for things like rural areas and multi-occupancy buildings — a process that would “end in tears” for many of the other operators. Jansen added that while BT had been spending large amounts of cash this year to fund its build efforts, once the construction phase ends he hopes the company will generate “a lot more cash” and could increase the dividend offered to shareholders.

“BT was on the back foot five years ago, we’re unquestionably on the front foot now,” he added. “Investors who own the company need a return.” BT maintained its full-year outlook on Thursday as it posted third-quarter revenue and earnings in line with analysts’ expectations. Revenue fell 3% in the third quarter compared with the same period in the previous year, to £5.2bn, which it attributed in part to lower sales in its global division and a loss of income from BT Sport following the completion of a joint venture with Warner Bros Discovery.

In November BT announced that it would increase its cost-savings target by £500mn to £3bn by 2025 as it sought to mitigate higher energy and inflation costs. As part of the cost-cutting drive, Jansen said there would be fewer people working at BT over the next five years, although he refused to be drawn on numbers. BT has already reduced its net headcount by 2,000 over the past two years, despite significant recruitment at Openreach. It has pushed ahead with inflation-linked price rises in 2023 for the majority of its consumer and wholesale customers in spite of cross-party calls for telecoms companies to reverse the decision during a cost of living crisis. “Right now the [capital expenditure] has to be paid for somehow,” Jansen said. “Hopefully inflation comes down and it won’t be so painful for everyone.”

References:

https://www.ft.com/content/031dcf72-dfaf-4e90-85d2-335ef703dbd1

Openreach on benefit of FTTP in UK; Full Fiber rollouts increasing

Super fast broadband boosts UK business; Calls to break up BT & sell Openreach

China to build ground stations in Antartica to support ocean monitoring satellites

China, only the third country to put a man in space after the Soviet Union and United States, is to build ground stations on Antarctica to back its network of ocean monitoring satellites, state media said on Thursday.

Renders of the 43.95 million yuan ($6.52 million) project show four radome-covered antennas at China’s Zhongshan research base in East Antarctica. It is unknown if these are new and additional to antennas already established at the base.

The antennas will assist data acquisition from Chinese satellites that orbit in polar and near-polar orbits. Satellites in these orbits are visible near the poles multiple times a day, allowing more frequent opportunities for downlink than with stations at lower latitudes.

China has already launched eight Haiyang series ocean observation satellites into sun-synchronous orbits between 2002 and 2021, and plans more in the coming years. The first new-generation Haiyang-3 satellite is scheduled for launch this year, according the China’s main space contractor, CASC.

………………………………………………………………………………………………………………………………………………………………….

China Satellites and Balloons used for Espionage?

China’s global network of ground stations to support a growing number of satellites and outer space ambitions has drawn concern from some nations that it could be used for espionage, a suggestion China rejects.

In 2020, Sweden’s state-owned space company, which had provided ground stations that helped fly Chinese spacecraft and transmit data, declined to renew contracts with China or accept new Chinese business due to “changes” in geopolitics.

The United States military shot down a Chinese spy balloon on Saturday that had spent the last week traversing the country. The balloon, which spent five days traveling in a diagonal southeast route from Idaho to the Carolinas, had moved off the coast by midday Saturday and was shot down within moments of its arrival over the Atlantic Ocean.

One of two F-22 fighter jets from Langley Air Force Base fired a Sidewinder air-to-air missile, downing the balloon, which was flying at an altitude of 60,000 to 65,000 feet. The F-22s were at 58,000 feet, with other American fighters in support.

In announcing the cancellation of his trip to China, U.S. Secretary of State, Antony J. Blinken said the entry of the spy balloon was a “clear violation of U.S. sovereignty and international law.”

………………………………………………………………………………………………………………………………………………………………….

China Aerospace Science and Technology Group Co. is to build the stations at the Zhongshan research base, one of two permanent Chinese research stations on Antarctica, after winning the tender with its 43.95 million yuan ($6.53 million) bid, state-controlled China Space News reported.

Liftoff of a Long March 2C from Taiyuan carrying the Haiyang-1D ocean observation satellite on June 10, 2020. Image Credit: CASC

No technical details of the project were given in the report, though China Space News published two accompanying illustrations of an artist’s rendering that shows four ground stations at Zhongshan, located by Prydz Bay in East Antarctica, south of the Indian Ocean.

The project was part of broader initiatives aimed at building China’s marine economy and turning China into a marine power, according to China Space News.

References:

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Ericsson, Intel and Microsoft successfully demonstrating end-to-end 5G standalone (SA) network slicing capabilities on a Windows laptop at Ericsson’s Lab in Sweden. This pioneering trial demonstrates the applicability of the technology on devices beyond smartphones, paving the way for new business/enterprise opportunities and for consumer use cases such as mobile gaming and collaboration applications for 5G cellular-connected laptops.

The trial used User Equipment Route Selection Policy (URSP), which enables devices to automatically select between different slices according to which application they are using. It also used Ericsson’s Dynamic Network Slicing Selection, Ericsson’s dual-mode 5G Core, and Ericsson’s RAN Slicing capabilities to ‘secure end-user service differentiation.’

Network slicing has long been seen as vital to capturing the value that a 5G network can provide for communications service providers (CSPs) and enterprises. The market for network slicing alone in the enterprise segment is projected at USD 300 billion by 2025, according to the GSMA. By demonstrating a single Windows 11 device can make use of multiple slices, which are used according to the on-device usage profiles and network policies defined at the CSP level, the partners show the flexibility and range of potential use cases available using this technology.

This trial illustrates the opportunities for 5G monetization beyond smartphone devices and opens the door to a wider 5G device ecosystem, allowing CSPs and other members of the telecoms and IT world to expand their horizons when considering opportunities to generate profitable use cases for 5G. Laptop type devices, in particular, are vital to enterprise productivity. The inclusion of Windows 11 laptops in the ranks of devices that can be used for commercializing 5G network slicing is a sign of the ecosystem maturing. Network slicing capabilities will benefit consumer and enterprise segments by defining specific Service Level Agreement per slice for existing and emerging Windows applications and use cases, such as real-time enterprise applications like Microsoft Teams and Office365, game/media streaming, and emerging AI and augmented reality/extended reality (AR/XR) applications.

Sibel Tombaz, Head of Product Line 5G RAN at Ericsson, said: “Expanding the range of devices for network slicing to include laptops will allow new business segments to create a variety of use cases for consumer and enterprises. We have shown, together with Intel and Microsoft, how ecosystem collaboration can open new possibilities. We will continue to strengthen Ericsson’s network slicing capabilities and work with industry partners to enable more applications on several devices, spreading the benefits of 5G in the consumer and enterprise segments.”

Ian LeGrow, Microsoft Corporate Vice-President of Core OS Innovation said: “We are thrilled to showcase our cutting-edge technology and its ability to deliver fast, dependable and secure 5G connectivity on Windows 11. Partnering with Intel and Ericsson only further solidifies our commitment to innovation and openness in our platform.”

This ground-breaking network slicing demo will be showcased jointly with Intel and Microsoft in the Ericsson Hall during MWC Barcelona 2023 from February 27 to March 2.

Andrew Wooden of telecoms.com wrote:

“There are so many tests and trials going on, and while technically seem to signal a bit of incremental progress each time, it can be easy to lose the context of what is supposed to be offered while digging around in the weeds of experimental telecoms architecture. That said if trials like this can keep the emphasis on how they provide some extra money-making opportunities for those in the business of flogging 5G, and some genuine benefits for the rest of us, perhaps it will gain some traction when they show it off in Barcelona.”

Source: Viavi Solutions

…………………………………………………………………………………………………………………………………………………………………..

References:

https://www.ericsson.com/en/news/2023/2/ericsson-intel-and-microsoft-show-network-slicing-capabilities-on-a-laptop-for-consumer-and-enterprise-applications

https://www.ericsson.com/en/network-slicing#dynamicnetworksliceselection

https://www.ericsson.com/en/core-network/5g-core

https://telecoms.com/519733/ericsson-intel-and-microsoft-slice-up-a-network-and-feed-it-to-a-laptop/

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

https://www.viavisolutions.com/en-us/5g-network-slicing

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

China is global IoT Superpower with 1.8 billion connections as of Dec 2022

As of December 2022, the number of connections for cellular Internet of Things (IoT) services hit 1.8 billion in China, accounting for 70 percent of the world’s total, according to the country’s Ministry of Industry and Information Technology (MIIT).

MIIT’s figures, which are based on data from three major telecommunication companies in China, show that the total number of terminal connections for mobile network have reached 3.528 billion, among which 1.845 billion are cellular IoT end users. The biggest proportion of the IoT services in China are using NB-IoT (the most popular 3GPP and ITU-R standard for cellular IoT), rather than LTE-M or other cellular IoT variant.

The ministry says four NB-IoT use cases have scaled to more than 10 million connections: water meters, gas meters, smoke detectors and tracking. Another seven, including agriculture and streetlights, have crossed the 1 million mark. The MIIT has also issued a breakdown of end-user terminal numbers, with 496 million deployed in public services, 375 million in internet of vehicles, 350 million in smart retail and 192 million in smart home. In area without service coverage, NB-IoT is deployed to achieve connectivity, such as soil sensors for smart agriculture.

China’s cellular IoT end users, for the first time, have surpassed that of mobile phone users by 161 million, accounting for 52.3 percent of the total, MIIT said.

Cellular IoT connects a wide variety of machines and devices, allowing them to communicate with each other by piggybacking on the cellular networks often used. Simply put, it facilitates massive data streams among sensors, actuators, etc., without building additional physical infrastructure.

While the IoT services are heavily applied across a myriad of industries, such as manufacturing, logistics, agriculture and transportation, cellular IoT modules fulfill a critical role as part of IoT systems or products in serving as the gateway for data transfer through 5G, 4G and LTE.

Government think tank CAICT predicts that by 2030 China will have tens of billions mobile IoT connections. The three operators, with their monopoly over communications infrastructure, will be at the center of this growth story.

In 2021 China Mobile reported 11.4 billion Chinese yuan (US$1.57 billion) in revenue from its IoT business, a 21% year-over-year (YoY) rise, with the number of connections 20% higher. It hasn’t yet reported revenue from 2022 but says total connections rose 14% to 1.2 billion, website C114 reported.

China Telecom’s 2021 IoT revenue was 2.9 billion yuan, while in the first three quarters of 2022, China Unicom claimed 366 million connections and 6.2 billion yuan in revenue, up 26% YoY.

The revenue numbers are low and will probably remain relatively so, but with this sort of growth rate, and with no external competitors, the telcos will be expecting their IoT portfolios to become a healthy niche income stream. However, while the growth numbers are good, we have no insight into the underlying cost or profitability of these IoT services. The obvious parallel is 5G, where the telcos have built networks and user numbers at huge scale but with limited returns so far.

China also leads in IoT silicon:

China also leads the world in supply of IoT chips. Counterpoint Research data shows that three Chinese companies – Quectel, Fibocom and Sunsea – accounted for half of the global mobile IoT module market in Q3. The no. 5 supplier is China Mobile, which has developed two types of RISC-V chips, and has shipped more than 100 million IoT chips. It has also sold more than 30 million OneOS operating system terminals.

With the expansion of 5G coverage, China is set to expand its IoT industry that covers chips, modules, terminals, software, platform and service. Meanwhile, its NB-IoT has been applied for smart metering, sensing, tracking and smart agriculture.

References:

Using a distributed synchronized fabric for parallel computing workloads- Part II

by Run Almog Head of Product Strategy, Drivenets (edited by Alan J Weissberger)

Introduction:

In the previous part I article, we covered the different attributes of AI/HPC workloads and the impact this has on requirements from the network that serves these applications. This concluding part II article will focus on an open standard solution that addresses these needs and enables these mega sized applications to run larger workloads without compromising on network attributes. Various solutions are described and contrasted along with a perspective from silicon vendors.

Networking for HPC/AI:

A networking solution serving HPC/AI workloads will need to carry certain attributes. Starting with scale of the network which can reach thousands of high speed endpoints and having all these endpoints run the same application in a synchronized manner. This requires the network to run like a scheduled fabric that offers full bandwidth between any group of endpoints at any given time.

Distributed Disaggregated Chassis (DDC):

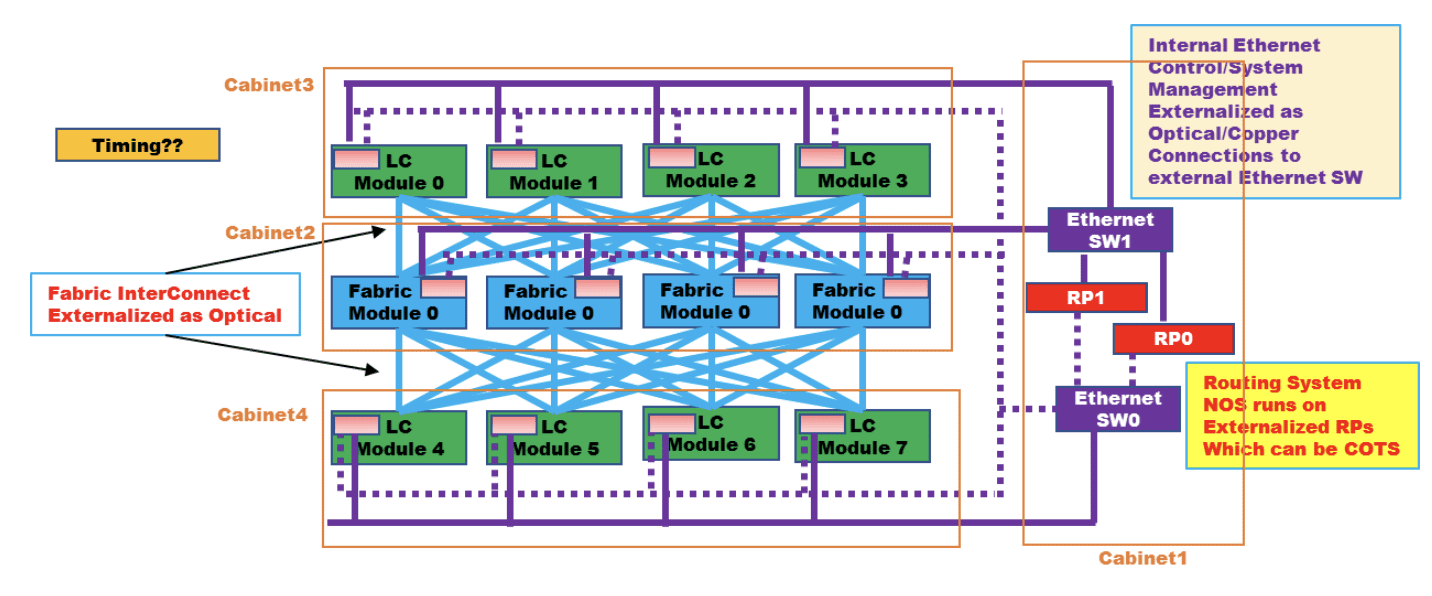

DDC is an architecture that was originally defined by AT&T and contributed to the Open Compute Project (OCP) as an open architecture in September 2019. DDC defines the components and internal connectivity of a network element that is purposed to serve as a carrier grade network router. As opposed to the monolithic chassis-based router, the DDC defines every component of the router as a standalone device.

- The line card of the chassis is defined as a distributed chassis packet-forwarder (DCP)

- The fabric card of the chassis is defined as a distributed chassis fabric (DCF)

- The routing stack of the chassis is defined as a distributed chassis controller (DCC)

- The management card of the chassis is defined as a distributed chassis manager (DCM)

- All devices are physically connected to the DCM via standard 10GbE interfaces to establish a control and a management plane.

- All DCP are connected to all DCF via 400G fabric interfaces in a Clos-3 topology to establish a scheduled and non-blocking data plane between all network ports in the DDC.

- DCP hosts both fabric ports for connecting to DCF and network ports for connecting to other network devices using standard Ethernet/IP protocols while DCF does not host any network ports.

- The DCC is in fact a server and is used to run the main base operating system (BaseOS) that defines the functionality of the DDC

Advantages of the DDC are the following:

- It’s capacity since there is no metal chassis enclosure that needs to hold all these components into a single machine. This allows building a wider Clos-3 topology that expands beyond the boundaries of a single rack making it possible for thousands of interfaces to coexist on the same network element (router).

- It is an open standard definition which makes it possible for multiple vendors to implement the components and as a result, making it easier for the operator (Telco) to establish a multi-source procurement methodology and stay in control of price and supply chain within his network as it evolves.

- It is a distributed array of components that each has an ability to exist as a standalone as well as act as part of the DDC. This gives a very high level of resiliency to services running over a DDC based router vs. services running over a chassis-based router.

AT&T announced they use DDC clusters to run their core MPLS in a DriveNets based implementation and as standalone edge and peering IP networks while other operators worldwide are also using DDC for such functionality.

Figure 1: High level connectivity structure of a DDC

……………………………………………………………………………………………………………………………………………………..

LC is defined as DCP above, Fabric module is defined as DCF above, RP is defined as DCC above, Ethernet SW is defined as DCM above

Source: OCP DDC specification

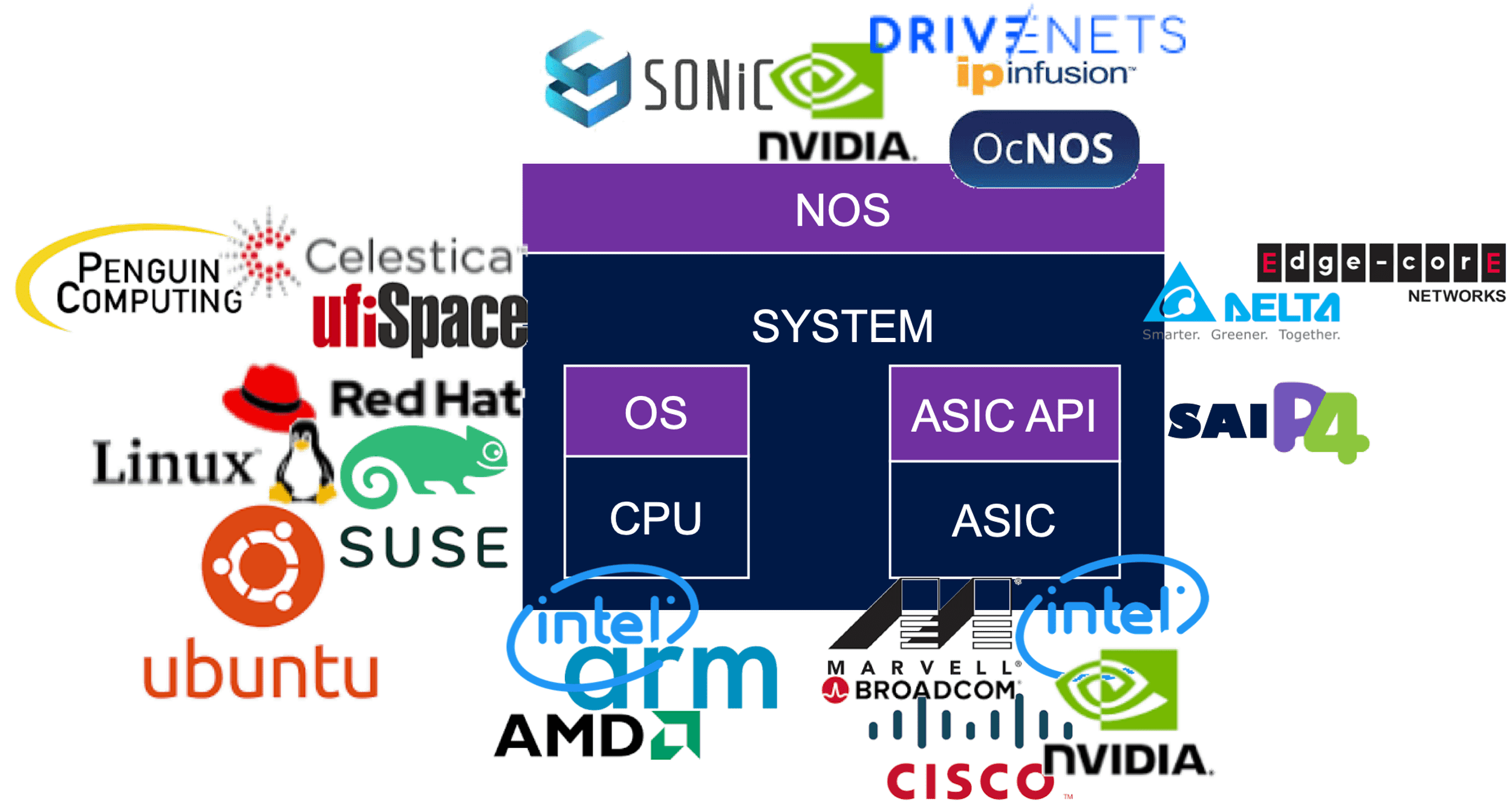

DDC is implementing a concept of disaggregation. The decoupling of the control plane from data plane enables the sourcing of the software and hardware from different vendors and assembling them back into a unified network element when deployed. This concept is rather new but still has had a lot of successful deployments prior to it being used as part of DDC.

Disaggregation in Data Centers:

The implementation of a detached data plane from the control plane had major adoption in data center networks in recent years. Sourcing the software (control plane) from one vendor while the hardware (data plane) is sourced from a different vendor mandate that the interfaces between the software and hardware be very precise and well defined. This has brought up a few components which were developed by certain vendors and contributed to the community to allow for the concept of disaggregation to go beyond the boundaries of implementation in specific customers networks.

Such components include open network install environment (ONIE) which enables mounting of the software image onto a platform (typically a single chip 1RU/2RU device) as well as the switch abstraction interface (SAI) which enable the software to directly access the application specific integrated circuit (ASIC) and operate directly onto the data plane at line rate speeds.

Two examples of implementing disaggregation networking in data centers are:

- Microsoft which developed their network operating system (NOS) software Sonic as one that runs on SAI and later contributed its source code to the networking community via OCP and he Linux foundation.

- Meta has defined devices called “wedge” who are purpose built to assume various NOS versions via standard interfaces.

These two examples of hyperscale companies are indicative to the required engineering effort to develop such interfaces and functions. The fact that such components have been made open is what enabled other smaller consumers to enjoy the benefits of disaggregation without the need to cater for large engineering groups.

The data center networking world today has a healthy ecosystem with hardware (ASIC and system) vendors as well as software (NOS and tools) which make a valid and widely used alternative to the traditional monolithic model of vertically integrated systems.

Reasons for deploying a disaggregated networking solution are a combination of two. First, is a clear financial advantage of buying white box equipment vs. the branded devices which carry a premium price. Second, is the flexibility which such solution enables, and this enables the customer to get better control over his network and how it’s run, as well as enable the network administrators a lot of room to innovate and adapt their network to their unique and changing needs.

The image below reflects a partial list of the potential vendors supplying components within the OCP networking community. The full OCP Membership directory is available at the OCP website.

Between DC and Telco Networking:

Data center networks are built to serve connectivity towards multiple servers which contain data or answer user queries. The size of data as well as number of queries towards it is a constantly growing function as humanity grows its consumption model of communication services. Traffic in and out of these servers is divided to north/south that indicates traffic coming in and goes out of the data center, and east/west that indicates traffic that runs inside the data center between different servers.

As a general pattern, the north/south traffic represent most of the traffic flows within the network while the east/west traffic represent the most bandwidth being consumed. This is not an accurate description of data center traffic, but it is accurate enough to explain the way data center networks are built and operated.

A data center switch connects to servers with a high-capacity link. This tier#1 switch is commonly known as a top of rack (ToR) switch and is a high capacity, non-blocking, low latency switch with some minimal routing capabilities.

- The ToR is then connected to a Tier#2 switch that enables it to connect to other ToR in the data center.

- The Tier#2 switches are connected to Tier#3 to further grow the connectivity.

- Traffic volumes are mainly east/west and best kept within the same Tier of the network to avoid scaling the routing tables.

- In theory, a Tier#4/5/6 of this network can exist, but this is not common.

- The higher Tier of the data center network is also connected to routers which interface the data center to the outside world (primarily the Internet) and these routers are a different design of a router than the tiers of switching devices mentioned earlier.

- These externally facing routers are commonly connected in a dual homed logic to create a level of redundancy for traffic to come in and out of the datacenter. Further functions on the ingress and egress of traffic towards data centers are also firewalled, load-balanced, address translated, etc. which are functions that are sometimes carried by the router and can also be carried by dedicated appliances.

As data centers density grew to allow better service level to consumers, the amount of traffic running between data center instances also grew and data center interconnect (DCI) traffic became predominant. A DCI router on the ingress/egress point of a data center instance is now a common practice and these devices typically connect over larger distance of fiber connectivity (tens to hundreds of Km) either towards other DCI routers or to Telco routers that is the infrastructure of the world wide web (AKA the Internet).

While data center network devices shine is their high capacity and low latency and are built from the ASIC level via the NOS they run to optimize on these attributes, they lack in their capacity for routing scale and distance between their neighboring routers. Telco routers however are built to host enough routes that “host” the Internet (a ballpark figure used in the industry is 1M routes according to CIDR) and a different structure of buffer (both size and allocation) to enable long haul connectivity. A telco router has a superset of capabilities vs. a data center switch and is priced differently due to the hardware it uses as well as the higher software complexity it requires which acts as a filter that narrows down the number of vendors that provide such solutions.

Attributes of an AI Cluster:

As described in a previous article HPC/AI workloads demand certain attributes from the network. Size, latency, lossless, high bandwidth and scale are all mandatory requirements and some solutions that are available are described in the next paragraphs.

Chassis Based Solutions:

This solution derives from Telco networking.

Chassis based routers are built as a black box with all its internal connectivity concealed from the user. It is often the case that the architecture used to implement the chassis is using line cards and fabric cards in a Clos-3 topology as described earlier to depict the structure of the DDC. As a result of this, the chassis behavior is predictable and reliable. It is in fact a lossless fabric wrapped in sheet metal with only its network interfaces facing the user. The caveat of a chassis in this case is its size. While a well-orchestrated fabric is a great fit for the network needs of AI workloads, it’s limited capacity of few hundred ports to connect to servers make this solution only fitting very small deployments.

In case chassis is used at a scale larger than the sum number of ports per single chassis, a Clos (this is in fact a non-balanced Clos-8 topology) of chassis is required and this breaks the fabric behavior of this model.

Standalone Ethernet Solutions:

This solution derives from data center networking.

As described previously in this paper, data center solutions are fast and can carry high bandwidth of traffic. They are however based on standalone single chip devices connected in a multi-tiered topology, typically a Clos-5 or Clos-7. as long as traffic is only running within the same device in this topology, behavior of traffic flows will be close to uniform. With the average number of interfaces per such device limited to the number of servers physically located in one rack, this single ToR device cannot satisfy the requirements of a large infrastructure. Expanding the network to higher tiers of the network also means that traffic patterns begin to alter, and application run-to-completion time is impacted. Furthermore, add-on mechanisms are mounted onto the network to turn the lossy network into a lossless one. Another attribute of the traffic pattern of AI workloads is the uniformity of the traffic flows from the perspective of the packet header. This means that the different packets of the same flow, will be identified by the data plane as the same traffic and be carried in the exact same path regardless of the network’s congestion situation, leaving parts of the Clos topology poorly utilized while other parts can be overloaded to a level of traffic loss.

Proprietary Locked Solutions:

Additional solutions in this field are implemented as a dedicated interconnect for a specific array of servers. This is more common in the scientific domain of heavy compute workloads, such as research labs, national institutes, and universities. As proprietary solutions, they force

the customer into one interconnect provider that serves the entire server array starting from the server itself and ending on all other servers in the array.

The nature of this industry is such where a one-time budget is allocated to build a “super-computer” which means that the resulting compute array is not expected to further grow but only be replaced or surmounted by a newer model. This makes the vendor-lock of choosing a proprietary interconnect solution more tolerable.

On the plus side of such solutions, they perform very well, and you can find examples on the top of the world’s strongest supercomputers list which use solutions from HPE (Slingshot), Intel (Omni-Path), Nvidia (InfiniBand) and more.

Perspective from Silicon Vendors:

DSF like solutions have been presented in the last OCP global summit back in October-2022 as part of the networking project discussions. Both Broadcom and Cisco (separately) have made claims of superior silicon implementation with improved power consumption or a superior implementation of a Virtual Output Queueing (VOQ) mechanism.

Conclusions:

There are differences between AI and HPC workloads and the required network for each.

While the HPC market finds proprietary implementations of interconnect solutions acceptable for building secluded supercomputers for specific uses, the AI market requires solutions that allow more flexibility in their deployment and vendor selection. This boils down to Ethernet based solutions of various types.

Chassis and standalone Ethernet based solutions provide reasonable solutions up to the scale of a single machine but fail to efficiently scale beyond a single interconnect machine and keep the required performance to satisfy the running workloads.

A distributed fabric solution presents a standard solution that matches the forecasted industry need both in terms of scale and in terms of performance. Different silicon implementations that can construct a DSF are available. They differ slightly but all show substantial benefits vs. chassis or standard ethernet solutions.

This paper does not cover the different silicon types implementing the DSF architecture but only the alignment of DSF attributes to the requirements from interconnect solutions built to run AI workloads and the advantages of DSF vs. other solutions which are predominant in this space.

–>Please post a comment in the box below this article if you have any questions or requests for clarification for what we’ve presented here and in part I.

References:

Using a distributed synchronized fabric for parallel computing workloads- Part I

Using a distributed synchronized fabric for parallel computing workloads- Part I

by Run Almog Head of Product Strategy, Drivenets (edited by Alan J Weissberger)

Introduction:

Different networking attributes are needed for different use cases. Endpoints can be the source of a service provided via the internet or can also be a handheld device streaming a live video from anywhere on the planet. In between endpoints we have network vertices that handle this continuous and ever-growing traffic flow onto its destination as well as handle the knowhow of the network’s whereabouts, apply service level assurance, handle interruptions and failures and a wide range of additional attributes that eventually enable network service to operate.

This two part article will focus on a use case of running artificial intelligence (AI) and/or high-performance computing (HPC) applications with the resulting networking aspects described. The HPC industry is now integrating AI and HPC, improving support for AI use cases. HPC has been successfully used to run large-scale AI models in fields like cosmic theory, astrophysics, high-energy physics, and data management for unstructured data sets.

In this Part I article, we examine: HPC/AI workloads, disaggregation in data centers, role of the Open Compute Project, telco data center networking, AI clusters and AI networking.

HPC/AI Workloads, High Performance Compute Servers, Networking:

HPC/AI workloads are applications that run over an array of high performance compute servers. Those servers typically host a dedicated computation engine like GPU/FPGA/accelerator in addition to a high performance CPU, which by itself can act as a compute engine, and some storage capacity, typically a high-speed SSD. The HPC/AI application running on such servers is not running on a specific server but on multiple servers simultaneously. This can range from a few servers or even a single machine to thousands of machines all operating in synch and running the same application which is distributed amongst them.

The interconnect (networking) between these computation machines need to allow any to any connectivity between all machines running the same application as well as cater for different traffic patterns which are associated with the type of application running as well as stages of the application’s run. An interconnect solution for HPC/AI would resultingly be different than a network built to serve connectivity to residential households or a mobile network as well as be different than a network built to serve an array of servers purposed to answers queries from multiple users as a typical data center structure would be used for.

Disaggregation in Data Centers (DCs):

Disaggregation has been successfully used as a solution for solving challenges in cloud resident data centers. The Open Compute Project (OCP) has generated open source hardware and software for this purpose. The OCP community includes hyperscale data center operators and industry players, telcos, colocation providers and enterprise IT users, working with vendors to develop and commercialize open innovations that, when embedded in product are deployed from the cloud to the edge.

High-performance computing (HPC) is a term used to describe computer systems capable of performing complex calculations at exceptionally high speeds. HPC systems are often used for scientific research, engineering simulations and modeling, and data analytics. The term high performance refers to both speed and efficiency. HPC systems are designed for tasks that require large amounts of computational power so that they can perform these tasks more quickly than other types of computers. They also consume less energy than traditional computers, making them better suited for use in remote locations or environments with limited access to electricity.

HPC clusters commonly run batch calculations. At the heart of an HPC cluster is a scheduler used to keep track of available resources. This allows for efficient allocation of job requests across different compute resources (CPUs and GPUs) over high-speed networks. Several HPC clusters have integrated Artificial Intelligence (AI).

While hyperscale, cloud resident data centers and HPC/AI clusters have a lot of similarities between them, the solution used in hyperscale data centers is falling short when trying to address the additional complexity imposed by the HPC/AI workloads.

Large data center implementations may scale to thousands of connected compute servers. Those servers are used for an array of different application and traffic patterns shift between east/west (inside the data center) and north/south (in and out of the data center). This variety boils down to the fact that every such application handles itself so the network does not need to cover guarantee delivery of packets to and from application endpoints, these issues are solved with standard based retransmission or buffering of traffic to prevent traffic loss.

An HPC/AI workload on the other hand, is measured by how fast a job is completed and is interfacing to machines so latency and accuracy are becoming more of a critical factor. A delayed packet or a packet being lost, with or without the resulting retransmission of that packet, drags a huge impact on the application’s measured performance. In HPC/AI world, this is the responsibility of the interconnect to make sure this mishaps do not happen while the application simply “assumes” that it is getting all the information “on-time” and “in-synch” with all the other endpoints it shares the workload with.

–>More about how Data centers use disaggregation and how it benefits HPC/AI in the second part of this article (Part II).

Telco Data Center Networking:

Telco data centers/central offices are traditionally less supportive of deploying disaggregated solutions than hyper scale, cloud resident data centers. They are characterized by large monolithic, chassis based and vertically integrated routers. Every such router is well-structured and in fact a scheduled machine built to carry packets between every group of ports is a constant latency and without losing any packet. A chassis based router would potentially pose a valid solution for HPC/AI workloads if it could be built with scale of thousands of ports and be distributed throughout a warehouse with ~100 racks filled with servers.

However, some tier 1 telcos, like AT&T, use disaggregated core routing via white box switch/routers and DriveNets Network Cloud (DNOS) software. AT&T’s open disaggregated core routing platform was carrying 52% of the network operators traffic at the end of 2022, according to Mike Satterlee, VP of AT&T’s Network Core Infrastructure Services. The company says it is now exploring a path to scale the system to 500Tbps and then expand to 900Tbps.

“Being entrusted with AT&T’s core network traffic – and delivering on our performance, reliability and service availability commitments to AT&T– demonstrates our solution’s strengths in meeting the needs of the most demanding service providers in the world,” said Ido Susan, DriveNets founder and CEO. “We look forward to continuing our work with AT&T as they continue to scale their next-gen networks.”

Satterlee said AT&T is running a nearly identical architecture in its core and edge environments, though the edge system runs Cisco’s disaggregates software. Cisco and DriveNets have been active parts of AT&T’s disaggregation process, though DriveNets’ earlier push provided it with more maturity compared to Cisco.

“DriveNets really came in as a disruptor in the space,” Satterlee said. “They don’t sell hardware platforms. They are a software-based company and they were really the first to do this right.”

AT&T began running some of its network backbone on DriveNets core routing software beginning in September 2020. The vendor at that time said it expected to be supporting all of AT&T’s traffic through its system by the end of 2022.

Attributes of an AI Cluster:

Artificial intelligence is a general term that indicates the ability of computers to run logic which assimilates the thinking patterns of a biological brain. The fact is that humanity has yet to understand “how” a biological brain behaves, how are memories stored and accessed, how come different people have different capacities and/or memory malfunction, how are conclusions being deduced and how come they are different between individuals and how are actions decided in split second decisions. All this and more are being observed by science but not really understood to a level where it can be related to an explicit cause.

With evolution of compute capacity, the ability to create a computing function that can factor in large data sets was created and the field of AI focuses on identifying such data sets and their resulting outcome to educate the compute function with as many conclusion points as possible. The compute function is then required to identify patterns within these data sets to predict the outcome of new data sets which it did not encounter before. Not the most accurate description of what AI is (it is a lot more than this) but it is sufficient to explain why are networks built to run AI workloads different than regular data center networks as mentioned earlier.

Some example attributes of AI networking are listed here:

- Parallel computing – AI workloads are a unified infrastructure of multiple machines running the same application and same computation task

- Size – size of such task can reach thousands of compute engines (e.g., GPU, CPU, FPGA, Etc.)

- Job types – different tasks vary in their size, duration of the run, the size and number of data sets it needs to consider, type of answer it needs to generate, etc. this as well as the different language used to code the application and the type of hardware it runs on contributes to a growing variance of traffic patterns within a network built for running AI workloads

- Latency & Jitter – some AI workloads are resulting a response which is anticipated by a user. The job completion time is a key factor for user experience in such cases which makes latency an important factor. However, since such parallel workloads run over multiple machines, the latency is dictated by the slowest machine to respond. This means that while latency is important, jitter (or latency variation) is in fact as much a contributor to achieve the required job completion time

- Lossless – following on the previous point, a response arriving late is delaying the entire application. Whereas in a traditional data center, a message dropped will result in retransmission (which is often not even noticed), in an AI workload, a dropped message means that the entire computation is either wrong or stuck. It is for this reason that AI running networks requires lossless behavior of the network. IP networks are lossy by nature so for an IP network to behave as lossless, certain additions need to be applied. This will be discussed in. follow up to this paper.

- Bandwidth – large data sets are large. High bandwidth of traffic needs to run in and out of servers for the application to feed on. AI or other high performance computing functions are reaching interface speeds of 400Gbps per every compute engine in modern deployments.

The narrowed down conclusion from these attributes is that a network purposed to run AI workloads differs from a traditional data center network in that it needs to operate “in-synch.

There are several such “in-synch” solutions available. The main options are: Chassis based solutions, Standalone Ethernet solutions, and proprietary locked solutions.–>These will be briefly described to their key advantages and deficiencies in our part II article.

Conclusions:

There are a few differences between AI and HPC workloads and how this translates to the interconnect used to build such massive computation machines.

While the HPC market finds proprietary implementations of interconnect solutions acceptable for building secluded supercomputers for specific uses, the AI market requires solutions that allow more flexibility in their deployment and vendor selection.

AI workloads have greater variance of consumers of outputs from the compute cluster which puts job completion time as the primary metric for measuring the efficiency of the interconnect. However, unlike HPC where faster is always better, some AI consumers will only detect improvements up to a certain level which gives interconnect jitter a higher impact than latency.

Traditional solutions provide reasonable solutions up to the scale of a single machine (either standalone or chassis) but fail to scale beyond a single interconnect machine and keep the required performance to satisfy the running workloads. Further conclusions and merits of the possible solutions will be discussed in a follow up article.

………………………………………………………………………………………………………………………………………………………………………………..

About DriveNets:

DriveNets is a fast-growing software company that builds networks like clouds. It offers communications service providers and cloud providers a radical new way to build networks, detaching network growth from network cost and increasing network profitability.

DriveNets Network Cloud uniquely supports the complete virtualization of network and compute resources, enabling communication service providers and cloud providers to meet increasing service demands much more efficiently than with today’s monolithic routers. DriveNets’ software runs over standard white-box hardware and can easily scale network capacity by adding additional white boxes into physical network clusters. This unique disaggregated network model enables the physical infrastructure to operate as a shared resource that supports multiple networks and services. This network design also allows faster service innovation at the network edge, supporting multiple service payloads, including latency-sensitive ones, over a single physical network edge.

References:

https://drivenets.com/resources/events/nfdsp1-drivenets-network-cloud-and-serviceagility/

https://www.run.ai/guides/hpc-clusters/hpc-and-ai

https://drivenets.com/news-and-events/press-release/drivenets-network-cloud-now-carries-more-than-52-of-atts-core-production-traffic/

https://techblog.comsoc.org/2023/01/27/att-highlights-5g-mid-band-spectrum-att-fiber-gigapower-joint-venture-with-blackrock-disaggregation-traffic-milestone/

AT&T Deploys Dis-Aggregated Core Router White Box with DriveNets Network Cloud software

DriveNets Network Cloud: Fully disaggregated software solution that runs on white boxes