AI

Microsoft choses Lumen’s fiber based Private Connectivity Fabric℠ to expand Microsoft Cloud network capacity in the AI era

Lumen Technologies and Microsoft Corp. announced a new strategic partnership today. Microsoft has chosen Lumen to expand its network capacity and capability to meet the growing demand on its datacenters due to AI (i.e. huge processing required for Large Language Models, including data collection, preprocessing, training, and evaluation). Datacenters have become critical infrastructure that power the compute capabilities for the millions of people and organizations who rely on and trust the Microsoft Cloud.

Microsoft claims they are playing a leading role in ushering in the era of AI, offering tools and platforms like Azure OpenAI Service, Microsoft Copilot and others to help people be more creative, more productive and to help solve some of humanity’s biggest challenges. As Microsoft continues to evolve and scale its ecosystem, it is turning to Lumen as a strategic supplier for its network infrastructure needs and is investing with Lumen to support its next generation of applications for Microsoft platform customers worldwide.

Lumen’s Private Connectivity Fabric℠ is a custom network that includes dedicated access to existing fiber in the Lumen network, the installation of new fiber on existing and new routes, and the use of Lumen’s new digital services. This AI-ready infrastructure will strengthen the connectivity capabilities between Microsoft’s datacenters by providing the network capacity, performance, stability and speed that customers need as data demands increase.

Art by Midjourney for Fierce Network

…………………………………………………………………………………………………………………………………………………………………………………..

“AI is reshaping our daily lives and fundamentally changing how businesses operate,” said Erin Chapple, corporate vice president of Azure Core Product and Design, Microsoft. “We are focused both on the impact and opportunity for customers relative to AI today, and a generation ahead when it comes to our network infrastructure. Lumen has the network infrastructure and the digital capabilities needed to help support Azure’s mission in creating a reliable and scalable platform that supports the breadth of customer workloads—from general purpose and mission-critical, to cloud-native, high-performance computing, and AI, plus what’s on the horizon. Our work with Lumen is emblematic of our investments in our own cloud infrastructure, which delivers for today and for the long term to empower every person and every organization on the planet to achieve more.”

“We are preparing for a future where AI is the driving force of innovation and growth, and where a powerful network infrastructure is essential for companies to thrive,” said Kate Johnson, president and CEO, Lumen Technologies (a former Microsoft executive). “Microsoft has an ambitious vision for AI and this level of innovation requires a network that can make it reality. Lumen’s expansive network meets this challenge, with unique routes, unmatched coverage, and a digital platform built to give companies the flexibility, access and security they need to create an AI-enabled world.”

Lumen has launched an enterprise-wide transformation to simplify and optimize its operations. By embracing Microsoft’s cloud and AI technology, Lumen can reduce its overall technology costs, remove legacy systems and silos, improve its offerings, and create new solutions for its global customer base. Lumen will migrate and modernize its workloads to Microsoft Azure, use Microsoft Entra solutions to safeguard access and prevent identity attacks and partner with Microsoft to create and deliver new telecom industry-specific solutions. This element alone is expected to improve Lumen’s cash flow by more than $20 million over the next 12 months while also improving the company’s customer experience.

“Azure’s advanced global infrastructure helps customers and partners quickly adapt to changing economic conditions, accelerate technology innovation, and transform their business with AI,” said Chapple. “We are committed to partnering with Lumen to help deliver on their transformation goals, reimagine cloud connectivity and AI synergies, drive business growth, and help customers achieve more.”

This collaboration expands upon the longstanding relationship between Lumen Technologies and Microsoft. The companies have worked together for several years, with Lumen leveraging Copilot to automate routine tasks and reduce employee workloads and enhance Microsoft Teams.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Lumen’s CMO Ryan Asdourian hinted the deal could be the first in a series of such partnerships, as network infrastructure becomes the next scarce resource in the era of AI. “When the world has talked about what’s needed for AI, you usually hear about power, space and cooling…[these] have been the scarce resources,” Asdourian told Fierce Telecom. Asdourian said Lumen will offer Microsoft access to a combination of new and existing routes in the U.S., and will overpull fiber where necessary. However, he declined to specify the speeds which will be made available or exactly how many of Microsoft’s data centers it will be connecting.

Microsoft will retain full control over network speeds, routes and redundancy options through Lumen’s freshly launched Private Connectivity Fabric digital interface. “That is not something traditional telecom has allowed,” Asdourian said.

Asdourian added that Lumen isn’t just looking to enable AI, but also incorporate it into its own operations. Indeed, part of its partnership deal with Microsoft involves Lumen’s adoption of Azure cloud and other Microsoft services to streamline its internal and network systems. Asdourian said AI could be used to make routing and switching on its network more intelligent and efficient.

…………………………………………………………………………………………………………………………………………………………………………………..

About Lumen Technologies:

Lumen connects the world. We are igniting business growth by connecting people, data, and applications – quickly, securely, and effortlessly. Everything we do at Lumen takes advantage of our network strength. From metro connectivity to long-haul data transport to our edge cloud, security, and managed service capabilities, we meet our customers’ needs today and as they build for tomorrow. For news and insights visit news.lumen.com, LinkedIn: /lumentechnologies, Twitter: @lumentechco, Facebook: /lumentechnologies, Instagram: @lumentechnologies and YouTube: /lumentechnologies.

About Microsoft:

Microsoft (Nasdaq “MSFT” @microsoft) creates platforms and tools powered by AI to deliver innovative solutions that meet the evolving needs of our customers. The technology company is committed to making AI available broadly and doing so responsibly, with a mission to empower every person and every organization on the planet to achieve more.

…………………………………………………………………………………………………………………………………………………………………………………..

References:

https://news.lumen.com/2024-07-24-Microsoft-and-Lumen-Technologies-partner-to-power-the-future-of-AI-and-enable-digital-transformation-to-benefit-hundreds-of-millions-of-customers

https://fierce-network.com/cloud/microsoft-taps-lumens-fiber-network-help-it-meet-ai-demand

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

Lumen, Google and Microsoft create ExaSwitch™ – a new on-demand, optical networking ecosystem

ACSI report: AT&T, Lumen and Google Fiber top ranked in fiber network customer satisfaction

Lumen to provide mission-critical communications services to the U.S. Department of Defense

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

Vodafone: GenAI overhyped, will spend $151M to enhance its chatbot with AI

GenAI is probably the most “overhyped” technology for many years in the telecom industry, said Vodafone Group’s chief technology officer (CTO) Scott Petty at a press briefing this week. “Hopefully, we are reaching the peak of those inflated expectations, because we are about to drop into a trough of disillusionment,” he said.

“This industry is moving too quickly,” Petty explained. “The evolution of particularly GPUs and the infrastructure means that by the time you’d actually bought them and got them installed you’d be N minus one or N minus two in terms of the technology, and you’d be spending a lot of effort and resource just trying to run the infrastructure and the LLMs that sit around that.”

Partnerships with hyper-scalers remain Vodafone’s preference, he said. Earlier this year, Vodafone and Microsoft signed a 10-year strategic agreement to use Microsoft GenAI in Vodafone’s network.

Vodafone is planning to invest some €140 million ($151 million) in artificial intelligence (AI) systems this year to improve the handling of customer inquiries, the company said on July 4th. Vodafone said it is investing in advanced AI from Microsoft and OpenAI to improve its chatbot, dubbed TOBi, so that it can respond faster and resolve customer issues more effectively.

The chatbot was introduced into Vodafone’s customer service five years ago and is equipped with the real voice of a Vodafone employee.

The new system, which is called SuperTOBi in many countries, has already been introduced in Italy and Portugal and will be rolled out in Germany and Turkey later this month with other markets to follow later in the year, Vodafone said in a press release.

According to the company, SuperTOBi “can understand and respond faster to complex customer enquiries better than traditional chatbots.” The new bot will assist customers with various tasks, such as troubleshooting hardware issues and setting up fixed-line routers, the company said.

Vodafone is not about to expose Vodafone’s data to publicly available models like ChatGPT. Nor will the UK based telco create large language models (LLMs) on its own. Instead, a team of 50 data scientists are working on fine-tuning LLMs like Anthropic and Vertex. Vodafone can expose information to those LLMs by dipping into its 24-petabyte data “ocean,” created with Google. Secure containers within public clouds ensure private information is securely cordoned off and unavailable to others.

According to Petty’s estimates, the performance speed of LLMs has improved by a factor of 12 in the last nine months alone, while operational costs have decreased by a factor of six. A telco that invested nine months ago would already have outdated and expensive technology. Petty, moreover, is not the only telco CTO wary of plunging into Nvidia’s GPU chips.

“This is a very weird moment in time where power is very expensive, natural resources are scarce and GPUs are extremely expensive,” said Bruno Zerbib, the CTO of France’s Orange, at the 2024 Mobile World Congress in Barcelona, Spain. “You have to be very careful with your investment because you might buy a GPU product from a famous company right now that has a monopolistic position.”

Petty thinks LLM processing may eventually need to be processed outside hyper-scalers’ facilities. “To really create the performance that we want, we are going to need to push those capabilities further toward the edge of the network,” he said. “It is not going to be the hype cycle of the back end of 2024. But in 2025 and 2026, you’ll start to see those applications and capabilities being deployed at speed.”

“The time it takes for that data to get up and back will dictate whether you’re happy as a consumer to use that interface as your primary interface, and the investment in latency is going to be critically important,” said Petty. “We’re fortunate that 5G standalone drives low latency capability, but it’s not deployed at scale. We don’t have ubiquitous coverage. We need to make sure that those things are available to enable those applications.”

Data from Ericsson supports that view, showing that 5G population coverage is just 70% across Europe, compared with 90% in North America and 95% in China. The figure for midband spectrum – considered a 5G sweet spot that combines decent coverage with high-speed service – is as low as 30% in Europe, against 85% in North America and 95% in China.

Non-standalone (NSA) 5G, which connects a 5G radio access network (RAN) to a 4G core (EPC), is “dominating the market,” said Ericsson.

Vodafone has pledged to spend £11 billion (US$14 billion) on the rollout of a nationwide standalone 5G network in the UK if authorities bless its proposed merger with Three. With more customers, additional spectrum and a bigger footprint, the combined company would be able to generate healthier returns and invest in network improvements, the company said. But a UK merger would not aid the operator in Europe’s four-player markets.

Petty believes a “pay for search” economic model may emerge using GenAI virtual assistants. “This will see an evolution of a two-sided economic model that probably didn’t get in the growth of the Internet in the last 20 years,” but it would not be unlike today’s market for content delivery networks (CDNs).

“Most CDNs are actually paid for by the content distribution companies – the Netflixes, the TV sports – because they want a great experience for their users for the paid content they’ve bought. When it’s free content, maybe the owner of that content is less willing to invest to build out the capabilities in the network.”

Like other industry executives, Petty must hope the debates about net neutrality and fair contribution do not plunge telcos into a long disillusionment trough.

References:

Vodafone CTO: AI will overhaul 5G networks and Internet economics (lightreading.com)

Vodafone UK report touts benefits of 5G SA for Small Biz; cover for proposed merger with Three UK?

Big Tech post strong earnings and revenue growth, but cuts jobs along with Telecom Vendors

Tech companies have been consistently laying off employees since late 2022. As of April 25th, some 266 tech companies have laid off nearly 75,000 workers in 2024, according to the independent layoff-tracking site layoffs.fyi. A total of 262,682 workers in tech lost their jobs in 2023 compared with 164,969 in 2022. The volume of layoffs in 2023 — a total of 1,186 companies — also surpassed 2022, when 1,061 companies in tech laid off workers — and that total was more than in 2020 and 2021 combined.

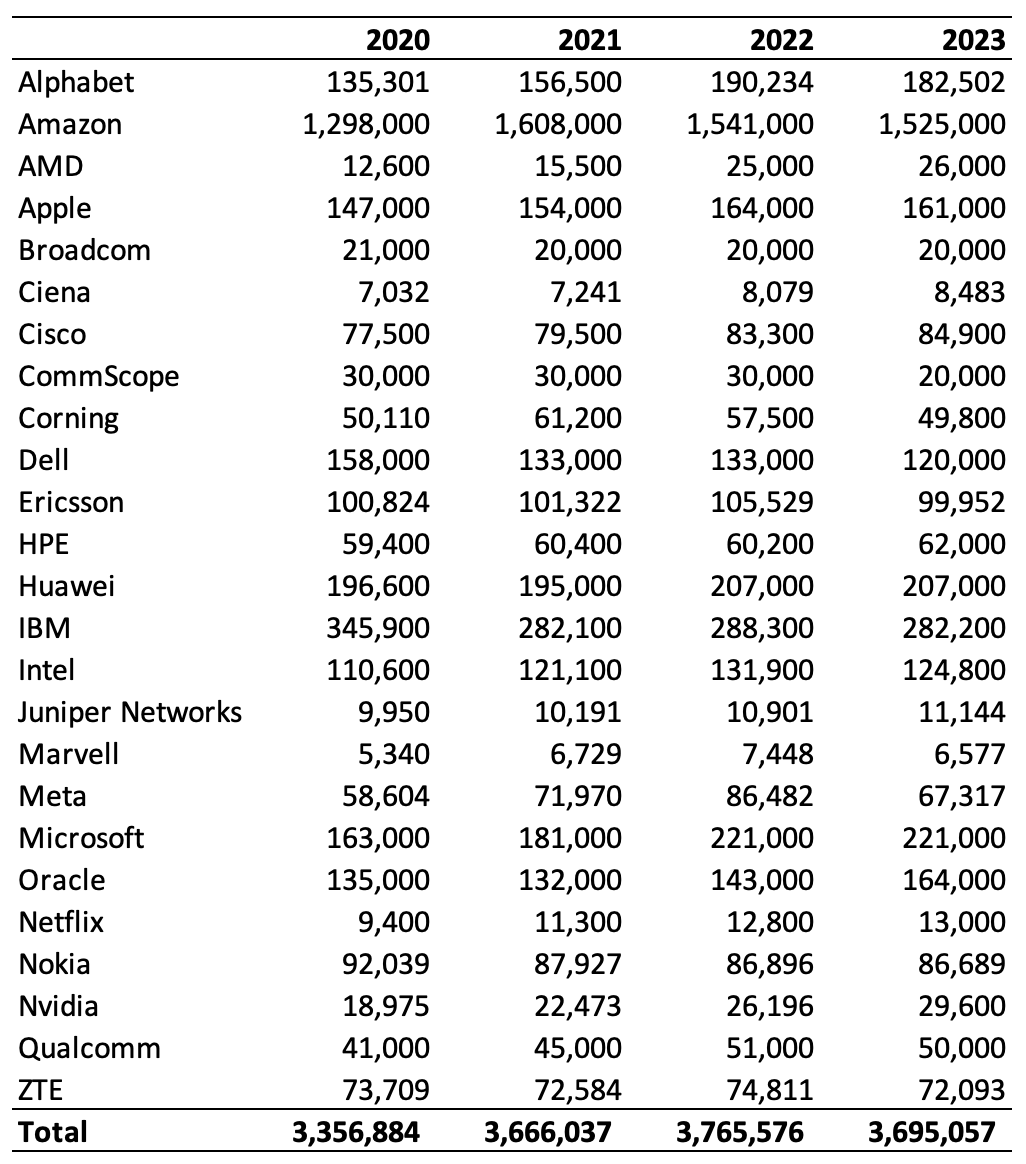

Big Tech companies Alphabet (Google’s parent), Amazon, Apple, Meta, Microsoft and Netflix, collectively cut nearly 45,500 jobs in their most recent full fiscal year. Since 2020, however, they have added more than 358,500, bringing total headcount to nearly 2,170,000. Excluding Amazon, which accounts for 70% of that figure, job numbers fell by around 29,700 last year but have grown by 131,500 since 2020 (data from earnings reports and SEC filings – see chart below).

- Today, Amazon reported better-than-expected earnings and revenue for the first quarter, driven by growth in advertising and cloud computing. Operating income soared more than 200% in the period to $15.3 billion, far outpacing revenue growth, the latest sign that the company’s cost-cutting measures and focus on efficiency is bolstering its bottom line. AWS accounted for 62% of total operating profit. Net income also more than tripled to $10.4 billion, or 98 cents a share, from $3.17 billion, or 31 cents a share, a year ago. Sales increased 13% from $127.4 billion a year earlier.

- Google parent Alphabet also posted robust profits, with net income in the latest quarter soaring 57% to $23.7 billion while revenue grew 15% in the quarter. That’s despite job cuts of 12,115 and net headcount reduction of ~8,000 in 2023.

- Microsoft last week managed 20% year-over-year growth in third-quarter net income, to around $21.9 billion, on 17% growth in sales, to $61.9 billion. The number of Microsoft employees was unchanged in 2023 from the previous year, despite the company laying off 11,158 employees. Future headcount reductions may be necessary to help pay for Microsoft’s multi-billion-dollar splurge on AI and the data centers needed to train the Large Language Models and associated generative AI technology. But few expect job cuts to slow Microsoft down.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

As expected, telecom vendors, which have many fewer employees, than Big Tech had a higher percentage of job reductions. CommScope, Corning, Dell, Ericsson, and Nokia, suppliers to some of the world’s biggest telcos, shed nearly 36,500 jobs last year as large IT customers spent less on new equipment.

The following table shows the total number of jobs per year for many vendors/cloud service providers.

Source: Light Reading & company reports/SEC filings

Huawei was the exception to the telecom vendor layoff craze (even ZTE reduced its workforce in 2023). Despite U.S. sanctions and a European backlash against the company, Huawei gained 12,000 employees in 2022, giving it a workforce of 207,000 that year. The number was unchanged in 2023, according to its recently published annual report. Restrictions have not been as effective at hindering Huawei’s progress as the U.S. had hoped.

On the semiconductor side, Intel experienced a net workforce reduction of 7,100 jobs. Profits have tanked because of market share losses, a downturn in customer spending on equipment (explained partly by the earlier build-up of inventory that happened after the pandemic) and investments in new foundries designed to challenge the Asian giants of TSMC and Samsung. Big Tech moves to build in-house AI augmented processor chips that can substitute for Intel’s microprocessors are among the problems the company faces. Intel’s profits have collapsed, just as they have at the mobile networks business group of silicon customer Nokia, and it is at risk of displacement by chip rivals in important markets.

These big tech layoffs are a peculiar outlier in an otherwise strong employment environment: The unemployment rate has hovered between 3.4% and 3.8% since Feb. 2022, bureau data shows. And quit rates, which reflect a lack of worker confidence, this year are consistently at some of the highest levels in more than 20 years, according to the Federal Reserve Bank of St. Louis.

In summary, Big Tech companies continue to thrive financially, but they are also making strategic adjustments, including job cuts, as they navigate the evolving landscape of technology and generative AI. The emphasis on AI development, large language models, and cloud services remains a key driver for their growth and profitability. Telecom vendors are facing tremendous pain due to continued reduction in telco CAPEX which may persists for many years.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.nerdwallet.com/article/finance/tech-layoffs

US cable and telecom network operators feel the pain

Bloomberg: Higher borrowing costs hurting indebted wireless companies; industry is 2nd largest source of distressed debt

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

High Tech Layoffs Explained: The End of the Free Money Party

NTT & Yomiuri: ‘Social Order Could Collapse’ in AI Era

From the Wall Street Journal:

Japan’s largest telecommunications company and the country’s biggest newspaper called for speedy legislation to restrain generative artificial intelligence, saying democracy and social order could collapse if AI is left unchecked.

Nippon Telegraph and Telephone, or NTT, and Yomiuri Shimbun Group Holdings made the proposal in an AI manifesto to be released Monday. Combined with a law passed in March by the European Parliament restricting some uses of AI, the manifesto points to rising concern among American allies about the AI programs U.S.-based companies have been at the forefront of developing.

The Japanese companies’ manifesto, while pointing to the potential benefits of generative AI in improving productivity, took a generally skeptical view of the technology. Without giving specifics, it said AI tools have already begun to damage human dignity because the tools are sometimes designed to seize users’ attention without regard to morals or accuracy.

Unless AI is restrained, “in the worst-case scenario, democracy and social order could collapse, resulting in wars,” the manifesto said.

It said Japan should take measures immediately in response, including laws to protect elections and national security from abuse of generative AI.

A global push is under way to regulate AI, with the European Union at the forefront. The EU’s new law calls on makers of the most powerful AI models to put them through safety evaluations and notify regulators of serious incidents. It also is set to ban the use of emotion-recognition AI in schools and workplaces.

The Biden administration is also stepping up oversight, invoking emergency federal powers last October to compel major AI companies to notify the government when developing systems that pose a serious risk to national security. The U.S., U.K. and Japan have each set up government-led AI safety institutes to help develop AI guidelines.

Still, governments of democratic nations are struggling to figure out how to regulate AI-powered speech, such as social-media activity, given constitutional and other protections for free speech.

NTT and Yomiuri said their manifesto was motivated by concern over public discourse. The two companies are among Japan’s most influential in policy. The government still owns about one-third of NTT, formerly the state-controlled phone monopoly.

Yomiuri Shimbun, which has a morning circulation of about six million copies according to industry figures, is Japan’s most widely-read newspaper. Under the late Prime Minister Shinzo Abe and his successors, the newspaper’s conservative editorial line has been influential in pushing the ruling Liberal Democratic Party to expand military spending and deepen the nation’s alliance with the U.S.

The two companies said their executives have been examining the impact of generative AI since last year in a study group guided by Keio University researchers.

The Yomiuri’s news pages and editorials frequently highlight concerns about artificial intelligence. An editorial in December, noting the rush of new AI products coming from U.S. tech companies, said “AI models could teach people how to make weapons or spread discriminatory ideas.” It cited risks from sophisticated fake videos purporting to show politicians speaking.

NTT is active in AI research, and its units offer generative AI products to business customers. In March, it started offering these customers a large-language model it calls “tsuzumi” which is akin to OpenAI’s ChatGPT but is designed to use less computing power and work better in Japanese-language contexts.

An NTT spokesman said the company works with U.S. tech giants and believes generative AI has valuable uses, but he said the company believes the technology has particular risks if it is used maliciously to manipulate public opinion.

…………………………………………………………………………………………………………….

From the Japan News (Yomiuri Shimbun):

Challenges: Humans cannot fully control Generative AI technology

・ While the accuracy of results cannot be fully guaranteed, it is easy for people to use the technology and understand its output. This often leads to situations in which generative AI “lies with confidence” and people are “easily fooled.”

・ Challenges include hallucinations, bias and toxicity, retraining through input data, infringement of rights through data scraping and the difficulty of judging created products.

・ Journalism, research in academia and other sources have provided accurate and valuable information by thoroughly examining what information is correct, allowing them to receive some form of compensation or reward. Such incentives for providing and distributing information have ensured authenticity and trustworthiness may collapse.

A need to respond: Generative AI must be controlled both technologically and legally

・ If generative AI is allowed to go unchecked, trust in society as a whole may be damaged as people grow distrustful of one another and incentives are lost for guaranteeing authenticity and trustworthiness. There is a concern that, in the worst-case scenario, democracy and social order could collapse, resulting in wars.

・ Meanwhile, AI technology itself is already indispensable to society. If AI technology is dismissed as a whole as untrustworthy due to out-of-control generative AI, humanity’s productivity may decline.

・ Based on the points laid out in the following sections, measures must be realized to balance the control and use of generative AI from both technological and institutional perspectives, and to make the technology a suitable tool for society.

Point 1: Confronting the out-of-control relationship between AI and the attention economy

・ Any computer’s basic structure, or architecture, including that of generative AI, positions the individual as the basic unit of user. However, due to computers’ tendency to be overly conscious of individuals, there are such problems as unsound information spaces and damage to individual dignity due to the rise of the attention economy.

・ There are concerns that the unstable nature of generative AI is likely to amplify the above-mentioned problems further. In other words, it cannot be denied that there is a risk of worsening social unrest due to a combination of AI and the attention economy, with the attention economy accelerated by generative AI. To understand such issues properly, it is important to review our views on humanity and society and critically consider what form desirable technology should take.

・ Meanwhile, the out-of-control relationship between AI and the attention economy has already damaged autonomy and dignity, which are essential values that allow individuals in our society to be free. These values must be restored quickly. In doing so, autonomous liberty should not be abandoned, but rather an optimal solution should be sought based on human liberty and dignity, verifying their rationality. In the process, concepts such as information health are expected to be established.

Point 2: Legal restraints to ensure discussion spaces to protect liberty and dignity, the introduction of technology to cope with related issues

・ Ensuring spaces for discussion in which human liberty and dignity are maintained has not only superficial economic value, but also a special value in terms of supporting social stability. The out-of-control relationship between AI and the attention economy is a threat to these values. If generative AI develops further and is left unchecked like it is currently, there is no denying that the distribution of malicious information could drive out good things and cause social unrest.

・ If we continue to be unable to sufficiently regulate generative AI — or if we at least allow the unconditional application of such technology to elections and security — it could cause enormous and irreversible damage as the effects of the technology will not be controllable in society. This implies a need for rigid restrictions by law (hard laws that are enforceable) on the usage of generative AI in these areas.

・ In the area of education, especially compulsory education for those age groups in which students’ ability to make appropriate decisions has not fully matured, careful measures should be taken after considering both the advantages and disadvantages of AI usage.

・ The protection of intellectual property rights — especially copyrights — should be adapted to the times in both institutional and technological aspects to maintain incentives for providing and distributing sound information. In doing so, the protections should be made enforceable in practice, without excessive restrictions to developing and using generative AI.

・ These solutions cannot be maintained by laws alone, but rather, they also require measures such as Originator Profile (OP), which is secured by technology.

Point 2: Legal restraints to ensure discussion spaces to protect liberty and dignity, and the introduction of technology to cope with related issues

・ Ensuring spaces for discussion in which human liberty and dignity are maintained has not only superficial economic value, but also a special value in terms of supporting social stability. The out-of-control relationship between AI and the attention economy is a threat to these values. If generative AI develops further and is left unchecked like it is currently, there is no denying that the distribution of malicious information could drive out good things and cause social unrest.

・ If we continue to be unable to sufficiently regulate generative AI — or if we at least allow the unconditional application of such technology to elections and security — it could cause enormous and irreversible damage as the effects of the technology will not be controllable in society. This implies a need for rigid restrictions by law (hard laws that are enforceable) on the usage of generative AI in these areas.

・ In the area of education, especially compulsory education for those age groups in which students’ ability to make appropriate decisions has not fully matured, careful measures should be taken after considering both the advantages and disadvantages of AI usage.

・ The protection of intellectual property rights — especially copyrights — should be adapted to the times in both institutional and technological aspects to maintain incentives for providing and distributing sound information. In doing so, the protections should be made enforceable in practice, without excessive restrictions to developing and using generative AI.

・ These solutions cannot be maintained by laws alone, but rather, they also require measures such as Originator Profile (OP), which is secured by technology.

Point 3: Establishment of effective governance, including legislation

・ The European Union has been developing data-related laws such as the General Data Protection Regulation, the Digital Services Act and the Digital Markets Act. It has been developing regulations through strategic laws with awareness of the need to both control and promote AI, positioning the Artificial Intelligence Act as part of such efforts.

・ Japan does not have such a strategic and systematic data policy. It is expected to require a long time and involve many obstacles to develop such a policy. Therefore, in the long term, it is necessary to develop a robust, strategic and systematic data policy and, in the short term, individual regulations and effective measures aimed at dealing with AI and attention economy-related problems in the era of generative AI.

・However, it would be difficult to immediately introduce legislation, including individual regulations, for such issues. Without excluding consideration of future legislation, the handling of AI must be strengthened by soft laws — both for data (basic) and generative AI (applied) — that offer a co-regulatory approach that identifies stakeholders. Given the speed of technological innovation and the complexity of value chains, it is expected that an agile framework such as agile governance, rather than governance based on static structures, will be introduced.

・ In risk areas that require special caution (see Point 2), hard laws should be introduced without hesitation.

・ In designing a system, attention should be paid to how effectively it protects the people’s liberty and dignity, as well as to national interests such as industry, based on the impact on Japan of extraterritorial enforcement to the required extent and other countries’ systems.

・ As a possible measure to balance AI use and regulation, a framework should be considered in which the businesses that interact directly with users in the value chain, the middle B in “B2B2X,” where X is the user, reduce and absorb risks when generative AI is used.

・ To create an environment that ensures discussion spaces in which human liberty and dignity are maintained, it is necessary to ensure that there are multiple AIs of various kinds and of equal rank, that they keep each other in check, and that users can refer to them autonomously, so that users do not have to depend on a specific AI. Such moves should be promoted from both institutional and technological perspectives.

Outlook for the Future:

・ Generative AI is a technology that cannot be fully controlled by humanity. However, it is set to enter an innovation phase (changes accompanying social diffusion).

・ In particular, measures to ensure a healthy space for discussion, which constitutes the basis of human and social security (democratic order), must be taken immediately. Legislation (hard laws) are needed, mainly for creating zones of generative AI use (strong restrictions for elections and security).

・ In addition, from the viewpoint of ecosystem maintenance (including the dissemination of personal information), it is necessary to consider optimizing copyright law in line with the times, in a manner compatible with using generative AI itself, from both institutional and technological perspectives.

・ However, as it takes time to revise the law, the following steps must be taken: the introduction of rules and joint regulations mainly by the media and various industries, the establishment and dissemination of effective technologies, and making efforts to revise the law.

・ In this process, the most important thing is to protect the dignity and liberty of individuals in order to achieve individual autonomy. Those involved will study the situation, taking into account critical assessments based on the value of community.

References:

‘Joint Proposal on Shaping Generative AI’ by The Yomiuri Shimbun Holdings and NTT Corp.

Major technology companies form AI-Enabled Information and Communication Technology (ICT) Workforce Consortium

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

Cloud Service Providers struggle with Generative AI; Users face vendor lock-in; “The hype is here, the revenue is not”

Amdocs and NVIDIA to Accelerate Adoption of Generative AI for $1.7 Trillion Telecom Industry

Light Source Communications Secures Deal with Major Global Hyperscaler for Fiber Network in Phoenix Metro Area

Light Source Communications is building a 140-mile fiber middle-mile network in the Phoenix, AZ metro area, covering nine cities: Phoenix, Mesa, Tempe, Chandler, Gilbert, Queen Creek, Avondale, Coronado and Cashion. The company already has a major hyperscaler as the first anchor tenant.

There are currently 70 existing and planned data centers in the area that Light Source will serve. As one might expect, the increase in data centers stems from the boom in artificial intelligence (AI).

The network will include a big ring, which will be divided into three separate rings. In total, Light Source will be deploying 140 miles of fiber. The company has partnered with engineering and construction provider Future Infrastructure LLC, a division of Primoris Services Corp., to make it happen.

“I would say that AI happens to be blowing up our industry, as you know. It’s really in response to the amount of data that AI is demanding,” said Debra Freitas [1.], CEO of Light Source Communications (LSC).

Note 1. Debra Freitas has led LSC since co-founding in 2014. Owned and operated network with global OTT as a customer. She developed key customer relationships, secured funding for growth. Currently sits on the Executive Board of Incompas.

……………………………………………………………………………………………………..

Light Source plans for the entire 140-mile route to be underground. It’s currently working with the city councils and permitting departments of the nine cities as it goes through its engineering and permit approval processes. Freitas said the company expects to receive approvals from all the city councils and to begin construction in the third quarter of this year, concluding by the end of 2025.

Primoris delivers a range of specialty construction services to the utility, energy, and renewables markets throughout the United States and Canada. Its communications business is a leading provider of critical infrastructure solutions, including program management, engineering, fabrication, replacement, and maintenance. With over 12,700 employees, Primoris had revenue of $5.7 billion in 2023.

“We’re proud to partner with Light Source Communications on this impactful project, which will exceed the growing demands for high-capacity, reliable connectivity in the Phoenix area,” said Scott Comley, president of Primoris’ communications business. “Our commitment to innovation and excellence is well-aligned with Light Source’s cutting-edge solutions and we look forward to delivering with quality and safety at the forefront.”

Light Source is a carrier neutral, owner-operator of networks serving enterprises throughout the U.S. In addition to Phoenix, several new dark fiber routes are in development in major markets throughout the Central and Western United States. For more information about Light Source Communications, go to lightsourcecom.net.

The city councils in the Phoenix metro area have been pretty busy with fiber-build applications the past couple of years because the area is also a hotbed for companies building fiber-to-the-premises (FTTP) networks. In 2022 the Mesa City Council approved four different providers to build fiber networks. AT&T and BlackRock have said their joint venture would also start deploying fiber in Mesa.

Light Source is focusing on middle-mile, rather than FTTP because that’s where the demand is, according to Freitas. “Our route is a unique route, meaning there are no other providers where we’re going. We have a demand for the route we’re putting in,” she noted.

The company says it already has “a major, global hyperscaler” anchor tenant, but it won’t divulge who that tenant is. Its network will also touch Arizona State University at Tempe and the University of Arizona.

Light Source doesn’t light any of the fiber it deploys. Rather, it is carrier neutral and sells the dark fiber to customers who light it themselves and who may resell it to their own customers.

Light Source began operations in 2014 and is backed by private equity. It did not receive any federal grants for the new middle-mile network in Arizona.

………………………………………………………………………………………………………..

Bill Long, Zayo’s chief product officer, told Fierce Telecom recently that data centers are preparing for an onslaught of demand for more compute power, which will be needed to handle AI workloads and train new AI models.

…………………………………………………………………………………………………………

About Light Source Communications:

Light Source Communications (LSC) is a carrier neutral, customer agnostic provider of secure, scalable, reliable connectivity on a state-of-the-art dark fiber network. The immense amounts of data businesses require to compete in today’s global market requires access to an enhanced fiber infrastructure that allows them to control their data. With over 120 years of telecom experience, LSC offers an owner-operated network for U.S. businesses to succeed here and abroad. LSC is uniquely positioned and is highly qualified to build the next generation of dark fiber routes across North America, providing the key connections for business today and tomorrow.

References:

https://www.lightsourcecom.net/services/

https://www.fiercetelecom.com/ai/ai-demand-spurs-light-source-build-middle-mile-network-phoenix

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

AI sparks huge increase in U.S. energy consumption and is straining the power grid; transmission/distribution as a major problem

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

Backgrounder:

Artificial intelligence (AI) continues both to astound and confound. AI finds patterns in data and then uses a technique called “reinforcement learning from human feedback.” Humans help train and fine-tune large language models (LLMs). Some humans, like “ethics & compliance” folks, have a heavier hand than others in tuning models to their liking.

Generative Artificial Intelligence (generative AI) is a type of AI that can create new content and ideas, including conversations, stories, images, videos, and music. AI technologies attempt to mimic human intelligence in nontraditional computing tasks like image recognition, natural language processing (NLP), and translation. Generative AI is the next step in artificial intelligence. You can train it to learn human language, programming languages, art, chemistry, biology, or any complex subject matter. It reuses training data to solve new problems. For example, it can learn English vocabulary and create a poem from the words it processes. Your organization can use generative AI for various purposes, like chatbots, media creation, and product development and design.

Review of Leading AI Company Products and Services:

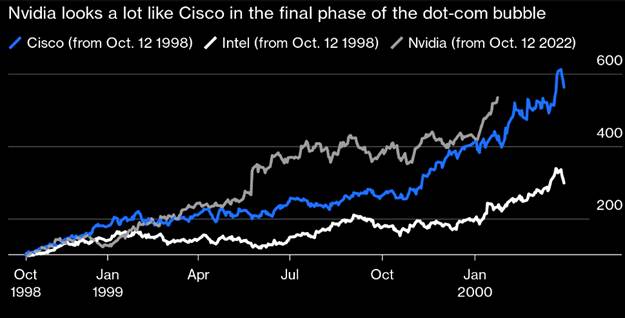

1. AI poster child Nvidia’s (NVDA) market cap is about $2.3 trillion, due mainly to momentum-obsessed investors who have driven up the stock price. Nvidia currently enjoys 75% gross profit margins and has an estimated 80% share of the Graphic Processing Unit (GPU) chip market. Microsoft and Facebook are reportedly Nvidia‘s biggest customers, buying its GPUs last year in a frenzy.

Nvidia CEO Jensen Huang talks of computing going from retrieval to generative, which investors believe will require a long-run overhaul of data centers to handle AI. All true, but a similar premise about an overhaul also was true for Cisco in 1999.

During the dot-com explosion in the late 1990s, investors believed a long-run rebuild of telecom infrastructure was imminent. Worldcom executives claimed that internet traffic doubled every 100 days, or about 3.5 months. The thinking at that time was that the whole internet would run on Cisco routers at 50% gross margins.

Cisco’s valuation at its peak of the “Dot.com” mania was at 33x sales. CSCO investors lost 85% of their money when the stock price troughed in October 2002. Over the next 16 years, as investors waited to break even, the company grew revenues by 172% and earnings per share by a staggering 681%. Over the last 24 years, CSCO buy and hold investors earned only 0.67% per year!

2. Microsoft is now a cloud computing/data-center company, more utility than innovator. Microsoft invested $13 billion in OpenAI for just under 50% of the company to help develop and roll out ChatGPT. But much of that was funny money — investment not in cash but in credits for Microsoft‘s Azure data centers. Microsoft leveraged those investments into super powering its own search engine, Bing, with generative AI which is now called “Copilot.” Microsoft spends a tremendous amount of money on Nvidia H100 processors to speed up its AI calculations. It also has designed its own AI chips.

3. Amazon masquerades as an online retailer, but is actually the world’s largest cloud computing/data-center company. The company offers several generative AI products and services which include:

- Amazon CodeWhisperer, an AI-powered coding companion.

- Amazon Bedrock, a fully managed service that makes foundational models (FMs) from AI21 Labs, Anthropic, and Stability AI, along with Amazon’s own family of FMs, Amazon Titan, accessible via an API.

- A generative AI tool for sellers to help them generate copy for product titles and listings.

- Generative AI capabilities that simplify how Amazon sellers create more thorough and captivating product descriptions, titles, and listing details.

Amazon CEO Jassy recently said the the company’s generative AI services have the potential to generate tens of billions of dollars over the next few years. CFO Brian Olsavsky told analysts that interest in Amazon Web Services’ (AWS) generative AI products, such as Amazon Q and AI chatbot for businesses, had accelerated during the quarter. In September 2023, Amazon said it plans to invest up to $4 billion in startup chatbot-maker Anthropic to take on its AI based cloud rivals (i.e. Microsoft and Google). Its security teams are currently using generative AI to increase productivity

4. Google, with 190,000 employees, controls 90% of search. Google‘s recent launch of its new Gemini AI tools was a disaster, producing images of the U.S. Founding Fathers and Nazi soldiers as people of color. When asked if Elon Musk or Adolf Hitler had a more negative effect on society, Gemini responded that it was “difficult to say.” Google pulled the product over “inaccuracies.” Yet Google is still promoting its AI product: “Gemini, a multimodal model from Google DeepMind, is capable of understanding virtually any input, combining different types of information, and generating almost any output.”

5. Facebook/Meta controls social media but has lost $42 billion investing in the still-nascent metaverse. Meta is rolling out three AI features for advertisers: background generation, image cropping and copy variation. Meta also unveiled a generative AI system called Make-A-Scene that allows artists to create scenes from text prompts . Meta’s CTO Andrew Bosworth said the company aims to use generative AI to help companies reach different audiences with tailored ads.

Conclusions:

Voracious demand has outpaced production and spurred competitors to develop rival chips. The ability to secure GPUs governs how quickly companies can develop new artificial-intelligence systems. Tech CEOs are under pressure to invest in AI, or risk investors thinking their company is falling behind the competition.

As we noted in a recent IEEE Techblog post, researchers in South Korea have developed the world’s first AI semiconductor chip that operates at ultra-high speeds with minimal power consumption for processing large language models (LLMs), based on principles that mimic the structure and function of the human brain. The research team was from the Korea Advanced Institute of Science and Technology.

While it’s impossible to predict how fast additional fabricating capacity comes on line, there certainly will be many more AI chips from cloud giants and merchant semiconductor companies like AMD and Intel. Fat profit margins Nvidia is now enjoying will surely attract many competitors.

………………………………………………………………………………….,……………………………………….

References:

https://www.zdnet.com/article/how-to-use-the-new-bing-and-how-its-different-from-chatgpt/

https://cloud.google.com/ai/generative-ai

https://aws.amazon.com/what-is/generative-ai/

https://www.wsj.com/articles/amazon-is-going-super-aggressive-on-generative-ai-7681587f

Curmudgeon: 2024 AI Fueled Stock Market Bubble vs 1999 Internet Mania? (03/11)

Korea’s KAIST develops next-gen ultra-low power Gen AI LLM accelerator

Telco and IT vendors pursue AI integrated cloud native solutions, while Nokia sells point products

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

Amdocs and NVIDIA to Accelerate Adoption of Generative AI for $1.7 Trillion Telecom Industry

Cloud Service Providers struggle with Generative AI; Users face vendor lock-in; “The hype is here, the revenue is not”

Global Telco AI Alliance to progress generative AI for telcos

Bain & Co, McKinsey & Co, AWS suggest how telcos can use and adapt Generative AI

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

Impact of Generative AI on Jobs and Workers

SK Telecom, DOCOMO, NTT and Nokia develop 6G AI-native air interface

SK Telecom, DOCOMO, NTT and Nokia today announced they have partnered to develop the 6G AI-native air interface (AI-AI), a critical next-generation technology that could greatly boost network performance while increasing energy efficiency. The four companies will show video demonstration of an AI-AI proof of concept at SKT’s booth at Mobile World Congress in Barcelona, Feb. 26-29.

This new 6G collaboration builds on an existing relationship between DOCOMO, NTT and Nokia targeted at 6G innovation. With the addition of SKT, the four companies will be able to expand the scope and scale of 6G AI-AI testing and validation as well as explore a broader range of business use cases for the technology.

The collaboration is developing future proof-of-concept 6G AI-AI systems, which will then be put to the test using selected use cases and real environmental scenarios. These over-the-air validation tests will be conducted both in the lab and outdoors to best simulate real network results. SKT, NTT, DOCOMO and Nokia will cooperate on improving AI model performance by utilizing data generated from real networks or through simulation. This will be instrumental in developing AI training models for a best-in-industry AI-AI solution.

By working together, SKT, DOCOMO, NTT and Nokia will be able to combine their research efforts and bring their core areas of expertise to the table. SKT, DOCOMO and NTT are recognized worldwide for their successful adoption of every generation of networking and their ability to create new business value from advanced technologies, while Nokia’s industrial research arm, Nokia Bell Labs, is a leader in 6G innovation.

Photo Courtesy of SK Telecom

Yu Takki, Vice President and Head of Infra Tech at SKT, said: “ This milestone represents a significant step forward in collaborative efforts towards the development of 6G core technology involving technology leaders from Korea, Japan, Europe and the United States. SKT will maintain its momentum in its R&D efforts of applying AI technology to network infrastructure as we move forward to become a global AI company.”

Takaaki Sato, Executive Vice President and Chief Technology Officer at DOCOMO said: “DOCOMO and NTT are delighted to advance this project with Nokia, a global vendor leading the world, and SKT, a mobile operator co-leading Asia. Through this collaboration, we will take the lead in innovative technology development and standardization of 6G, and focus on building a global ecosystem that includes future industries and technologies.”

Peter Vetter, President of Bell Labs Core Research at Nokia, said: “For Nokia to create a world-class 6G system, it’s critical we get input from the service providers that will one day deploy 6G. SKT, NTT and DOCOMO are among the most innovative service providers in the world, which gives us the perfect partners to design the networks of the future.”

Editor’s Note: This 6G AI initiative has NOT yet been submitted to ITU-R WP 5D for inclusion in any IMT 2030 related draft document.

…………………………………………………………………………………………………

About SK Telecom:

SK Telecom has been leading the growth of the mobile industry since 1984. Now, it is taking customer experience to new heights by extending beyond connectivity. By placing AI at the core of its business, SK Telecom is rapidly transforming into an AI company with a strong global presence. It is focusing on driving innovations in areas of AI Infrastructure, AI Transformation (AIX) and AI Service to deliver greater value for industry, society, and life.

References:

https://www.sktelecom.com/en/press/press_detail.do?idx=1602¤tPage=1&type=&keyword=

https://www.kedglobal.com/tech,-media-telecom/newsView/ked202402220013

https://www.sktelecom.com/en/press/press_detail.do?idx=1601¤tPage=1&type=&keyword=

SK Telecom, Intel develop low-latency technology for 6G core network

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific Large Language Models (LLMs)

China backed Volt Typhoon has “pre-positioned” malware to disrupt U.S. critical infrastructure networks “on a scale greater than ever before”

On Sunday, FBI Director Christopher Wray said Beijing’s efforts to covertly plant offensive malware inside U.S. critical infrastructure networks [1.] is now at “a scale greater than we’d seen before,” an issue he has deemed a defining national security threat. He said that China backed Volt Typhoon was pre-positioning malware that could be triggered at any moment to disrupt U.S. critical infrastructure. “It’s the tip of the iceberg…it’s one of many such efforts by the Chinese,” he said on the sidelines of the security conference.

Wray had earlier told conference delegates, that China was increasingly inserting “offensive weapons within our critical infrastructure poised to attack whenever Beijing decides the time is right.” The FBI chief said the U.S. is particularly focused on the threat of pre-positioning, which some European officials have described as the cyber equivalent of pointing a ballistic missile at critical infrastructure. “Those attacks are now being amplified by artificial intelligence tools. The word ‘force multiplier’ is not really enough,” Wray added.

Note 1. The FBI Director declined to elaborate on what other critical infrastructure had been targeted, stressing that the Bureau had “a lot of work under way.”

Image Credits: imaginima / Getty Images

Machine learning translation has helped Chinese security operatives to more plausibly recruit assets, steal secrets and rapidly process more of the information they are collecting, the Wray said. “They already have built economic espionage and theft of personal and corporate data as a kind of a bedrock of their economic strategy and are eagerly pursuing AI advancements to try to accelerate that process,” Wray added.

FBI Director Christopher Wray PHOTO: KEVIN DIETSCH/GETTY IMAGES

……………………………………………………………………………………………………………………………

Western intelligence officials say China’s scale and sophistication of cyberattacks has accelerated over the past decade. Officials have grown particularly alarmed at Beijing’s interest in infiltrating U.S. critical infrastructure networks, planting malware inside U.S. computer systems responsible for everything from safe drinking water to aviation traffic so it could detonate, at a moment’s notice, damaging cyberattacks during a conflict.

In California, Wray met with counterparts from the Five Eyes intelligence community—which encompasses the U.S., Australia, New Zealand, Canada and the U.K.—to share respective strategies for cyber defense. He has also traveled to Malaysia and India to discuss China’s hacking campaign with authorities in both countries.

“I am seeing more from Europe,” he said. “We’re laser focused on this as a real threat and we’re working with a lot of partners to try to identify it, anticipate it and disrupt it.”

The Netherlands’ spy agencies said earlier this month that Chinese hackers had used malware to gain access to a Dutch military network last year. The agency, considered to have one of Europe’s top cyber capabilities, said it made the rare disclosure to show the scale of the threat and reduce the stigma of being targeted so allied governments can better pool knowledge.

A report released this month by agencies including the FBI, the Cybersecurity and Infrastructure Agency and the National Security Agency said Volt Typhoon hackers had maintained access in some U.S. networks for five or more years, and while it targeted only U.S. infrastructure directly, the infiltration was likely to have affected “Five Eyes” allies.

Author’s Note:

……………………………………………………………………………………………………………………………

Volt Typhoon, the China-sponsored hacking group, has been targeting U.S. critical infrastructure, including satellite and emergency management services and electric utilities, according to a new report from the industrial cybersecurity firm Dragos. That report outlines how the notorious hacking group is positioning themselves to have disruptive or destructive impacts on critical infrastructure in the U.S.

Robert M. Lee, founder and CEO of Dragos, warned during a media briefing that Volt Typhoon is not an opportunistic group, but is instead targeting specific sites that assist U.S. adversaries “trying to hurt or cripple U.S. infrastructure. It’s hitting the specific electric and satellite communication providers that would be important for disrupting major portions of the U.S. electric infrastructure,” Lee added.

The report comes shortly after the National Security Agency, FBI, and Cybersecurity and Infrastructure Security Agency, revealed that Volt Typhoon has been in some critical infrastructure networks for at least five years. That alert warned of Volt Typhoon operations that targeted the aviation, railways, mass transit, highway, maritime, pipeline, and water and sewage sectors.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The NSA, CISA and FBI said in a joint advisory report that Volt Typhoon has been burrowing into the networks of aviation, rail, mass transit, highway, maritime, pipeline, water and sewage organizations — none of which were named — in a bid to pre-position themselves for destructive cyberattacks, published on February 7th. The release of the advisory, which was co-signed by cybersecurity agencies in the United Kingdom, Australia, Canada and New Zealand, comes a week after a similar warning from FBI Director Christopher Wray. Speaking during a U.S. House of Representatives committee hearing on cyber threats posed by China, Wray described Volt Typhoon as “the defining threat of our generation” and said the group’s aim is to “disrupt our military’s ability to mobilize” in the early stages of an anticipated conflict over Taiwan, which China claims as its territory.

According to Wednesday’s technical advisory, Volt Typhoon has been exploiting vulnerabilities in routers, firewalls and VPNs to gain initial access to critical infrastructure across the country. The China-backed hackers typically leveraged stolen administrator credentials to maintain access to these systems, according to the advisory, and in some cases, they have maintained access for “at least five years.”

This access enabled the state-backed hackers to carry out potential disruptions such as “manipulating heating, ventilation, and air conditioning (HVAC) systems in server rooms or disrupting critical energy and water controls, leading to significant infrastructure failures,” the advisory warned. In some cases, Volt Typhoon hackers had the capability to access camera surveillance systems at critical infrastructure facilities — though it’s not clear if they did.

Volt Typhoon also used living-off-the-land techniques, whereby attackers use legitimate tools and features already present in the target system, to maintain long-term, undiscovered persistence. The hackers also conducted “extensive pre-compromise reconnaissance” in a bid to avoid detection. “For example, in some instances, Volt Typhoon actors may have abstained from using compromised credentials outside of normal working hours to avoid triggering security alerts on abnormal account activities,” the advisory said.

Earlier this year, the FBI and U.S. Department of Justice announced that they had disrupted the “KV Botnet” run by Volt Typhoon that had compromised hundreds of U.S.-based routers for small businesses and home offices. The FBI said it was able to remove the malware from the hijacked routers and sever their connection to the Chinese state-sponsored hackers.

According to a May 2023 report published by Microsoft, Volt Typhoon has been targeting and breaching U.S. critical infrastructure since at least mid-2021.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

Volt Typhoon targeted emergency management services, per report

US disrupts China-backed hacking operation amid warning of threat to American infrastructure

https://www.controlglobal.com/home/blog/11293192/information-technology

“SK Wonderland at CES 2024;” SK Group Chairman: AI-led revolution poses challenges to companies

On Tuesday at CES 2024, SK Group [1.] displayed world-leading Artificial Intelligence (AI) and carbon reduction technologies under an amusement park concept called “SK Wonderland.” It provided CES attendees a view of a world that uses the latest AI and clean technologies from SK companies and their business partners to a create a smarter, greener world. Highlights of the booth included:

- Magic Carpet Ride in a flying vehicle embedded with an AI processor that helps it navigate dense, urban areas – reducing pollution, congestion and commuting frustrations

- AI Fortune Teller powered by next-generation memory technologies that can help computers analyze and learn from massive amounts of data to predict the future

- Dancing Car that’s fully electric, able to recharge in 20 minutes or less and built to travel hundreds of miles between charges

- Clean Energy Train that’s capable of being powered by hydrogen, whose only emission is water

- Rainbow Tube that shows how plastics are finding a new life through a technology that turns waste into fuel

Note 1. SK Group is South Korea’s second-largest conglomerate, with Samsung at number one.

SK’s CES 2024 displays include participation from seven SK companies — SK Inc., SK Innovation, SK Hynix, SK Telecom, SK E&S, SK Ecoplant and SKC. While the displays are futuristic, they’re based on technologies that SK companies and their global partners have already developed and are bringing to market.

SK Group Chairman Chey Tae-won said that companies are facing challenges in navigating the transformative era led by artificial intelligence (AI) due to its unpredictable impact and speed. He said AI technology and devices with AI are the talk of the town at this year’s annual trade show and companies are showcasing their AI innovations achieved through early investment.

“We are on the starting line of the new era, and no one can predict the impact and speed of the AI revolution across the industries,” Chey told Korean reporters after touring corporate booths on the opening day of CES 2024 at the Las Vegas Convention Center in Las Vegas. Reflecting on the rapid evolution of AI technologies, he highlighted the breakthrough made by ChatGPT, a language model launched about a year ago, which has significantly influenced how AI is perceived and utilized globally. “Until ChatGPT, no one has thought of how AI would change the world. ChatGPT made a breakthrough, and everybody is trying to ride on the wave.”

SK Group Chairman Chey Tae-won speaks during a brief meeting with Korean media on the sidelines of CES 2024 at the Las Vegas Convention Center in Las Vegas on Jan. 9, 2024

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

SK Hynix Inc., SK Group’s chipmaking unit, is one of the prominent companies at CES 2024, boasting its high-performance AI chips like high bandwidth memory (HBM). The latest addition is the HBM3E chips, recognized as the world’s best-performing memory product. Mass production of HBM3E is scheduled to begin in the first half of 2024.

SK Telecom Co. is also working on AI, having Sapeon, an AI chip startup under its wing. Chey stressed the importance of integrating AI services and solutions across SK Group’s diverse business sectors, ranging from energy to telecommunications and semiconductors. “It’s crucial for each company to collaborate and present a unified package or solution rather than developing them separately,” Chey said. “But I don’t think it is necessary to set up a new unit for that. I think we should come up with an integrated channel for customers.”

SK Telecom and Deutsche Telekom are jointly developing Large Language Models for generative AI to be used by telecom network providers.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://en.yna.co.kr/view/AEN20240110001900320#

https://eng.sk.com/news/ces-2024-sk-to-showcase-world-class-carbon-reduction-and-ai-technologies

SK Telecom inspects cell towers for safety using drones and AI

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific Large Language Models (LLMs)

SK Telecom and Thales Trial Post-quantum Cryptography to Enhance Users’ Protection on 5G SA Network

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

Ever since Generative (Gen) AI burst into the mainstream through public-facing platforms (e.g. ChatGPT) late last year, its promising capabilities have caught the attention of many. Not surprisingly, telecom industry execs are among the curious observers wanting to try Gen AI even as it continues to evolve at a rapid pace.

MTN Consulting says the telecom industry’s bond with AI is not new though. Many telcos have deployed conventional AI tools and applications in the past several years, but Gen AI presents opportunities for telcos to deliver significant incremental value over existing AI. A few large telcos have kickstarted their quest for Gen AI by focusing on “localization.” Through localization of processes using Gen AI, telcos vow to eliminate language barriers and improve customer engagement in their respective operating markets, especially where English as a spoken language is not dominant.

Telcos can harness the power of Gen AI across a wide range of different functions, but the two vital telco domains likely to witness transformative potential of Gen AI are networks and customer service. Both these domains are crucial: network demands are rising at an unprecedented pace with increased complexity, and delivering differentiated customer experiences remains an unrealized ambition for telcos.

Several Gen AI use cases are emerging within these two telco domains to address these challenges. In the network domain, these include topology optimization, network capacity planning, and predictive maintenance, for example. In the customer support domain, they include localized virtual assistants, personalized support, and contact center documentation.

Most of the use cases leveraging Gen AI applications involve dealing with sensitive data, be it network-related or customer-related. This will have major implications from the regulatory point of view, and regulatory concerns will constrain telcos’ Gen AI adoption and deployment strategies. The big challenge is the mosaic of complex and strict regulations prevalent in different markets that telcos will have to understand and adhere to when implementing Gen AI use cases in such markets. This is an area where third-party vendors will try to cash in by offering Gen AI solutions that are compliant with regulations in the respective markets.

Vendors will also play a key role for small- and medium-sized telcos in Gen AI implementation, by eliminating constraints due to the lack of technical expertise and HW/SW resources, skilled manpower, along with opex costs burden. Key vendors to watch out for in the Gen AI space are webscale providers who possess the ideal combination of providing cloud computing resources required to train large language models (LLM) coupled with their Gen AI expertise offered through pre-trained models.

Other key points from MTN Consulting on Gen AI in the telecom industry:

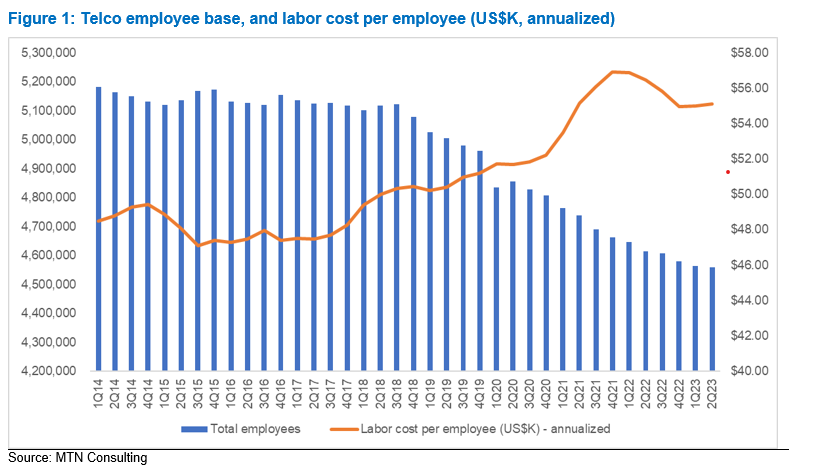

- Network operations and customer support will be key transformative areas.

- Telco workforce will become leaner but smarter in the Gen AI era.

- Strict regulations will be a major barrier for telcos.

- Vendors key to Gen AI integration; webscale providers set for more telco gains.

- Lock-in risks and rising software costs are key considerations in choosing vendors.

………………………………………………………………………………………………………………………………

Separately, MTN Consulting’s latest forecast called for $320B of telco capex in 2023, down only slightly from the $328B recorded in 2022. Early 3Q23 revenue reports from vendors selling into the telco market call this forecast into question. The dip in the Americas is worse than expected, and Asia’s expected 2023 growth has not materialized.

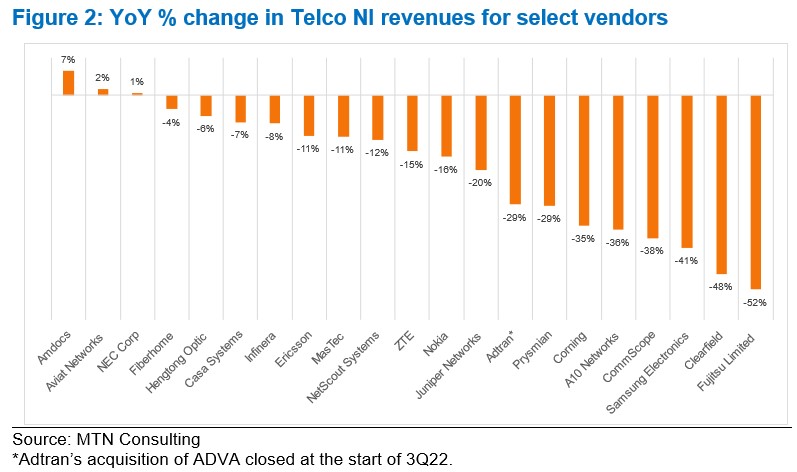

Key vendors are reporting significant YoY drops in revenue, pointing to inventory corrections, macroeconomic uncertainty (interest rates, in particular), and weaker telco spending. Network infrastructure sales to telcos (Telco NI) for key vendors Ericsson and Nokia dropped 11% and 16% YoY in 3Q23, respectively, measured in US dollars. By the same metric, NEC, Fujitsu and Samsung saw +1%, -52%, and -41% YoY growth; Adtran, Casa, and Juniper declined 29%, 7%, and 20%; fiber-centric vendors Clearfield, Corning, CommScope, and Prysmian all saw double digit declines.

MTN Consulting will update its operator forecast formally next month. In advance, this comment flags a weaker spending outlook than expected. Telco capex for 2023 is likely to come in around $300-$310B.