Year: 2023

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

The 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Dell’Oro’s Stefan Pongratz recently wrote:

“Even if it is early days in the broader 5G journey, the challenge now is the comparisons are becoming more challenging in the more mature 5G markets and the upside with the slower-to-adopt 5G regions is not enough to extend the growth streak. Meanwhile, growth from new revenue streams including Fixed Wireless Access and enterprise LTE/5G is not ramping fast enough to change the trajectory. With 5G-Advanced not expected to trigger a new capex cycle, the question now is no longer whether RAN will grow. The question now is, rather, how much will the RAN market decline before 6G comes along?”

AT&T, Verizon, T-Mobile and Dish Network broadly spent 50% less on their 5G network build-outs than Crown Castle [1.] CEO Jay Brown expected. As a result, Crown Castle cut $90 million in expected services revenues from its full year 2023 financial forecast.

……………………………………………………………………………………………………………………………………

Note 1. Crown Castle offers services including new cell site development and equipment installation. The company has a nationwide footprint of 40K+ cell towers, ~115K small cell nodes on air or under contract and more than 80K route miles of fiber optic cable.

…………………………………………………………………………………………………………………………………….

“So the back half of 2023, we did see a change relative to what we previously expected,” Brown said last week during his company’s quarterly conference call, as per a Seeking Alpha transcript. “The first half of 2023 came in exactly where we thought it was going to, and we saw the change in activity during the quarter. And that’s what affected our second half of the year, the activity that we’ll see in the – we believe we’ll see in the third and the fourth quarter.”

“I believe this initial surge in tower activity [among U.S. network operators] has ended,” Brown said, arguing that early 5G network buildout programs are coming to an end. “In the second quarter, we saw tower activity levels slowed significantly. As a result, we are decreasing our 2023 outlook primarily as a result of lower tower services margin.”

“From our perspective, this new guidance is as close to a disaster as it gets,” wrote the financial analysts at KeyBanc Capital Markets in a note to investors last week. The analysts said the cell tower industry broadly is very stable, and warnings like those from Crown Castle are few and far between. “We struggle to understand how the … trajectory could change so materially.”

…………………………………………………………………………………………………………………………….

Nokia and Ericsson take a hit:

5G network equipment vendor Nokia experienced a huge revenue drop of 40% from the North America market. Nokia CFO Marco Wiren stated that was “a result of declines across all business groups as inventory digestion continued and [communication service providers] reevaluated their spending plans.”

“The weakness was clearly visible,” Nokia CEO Pekka Lundmark said earlier this month, according to Seeking Alpha.

Nokia’s 5G FWA business has run into some market challenges, specifically tied to the vendor being “highly sensitive to a very small number of customers.” “Especially in North America, now when those deployments are significantly more slow, there is inherently some volatility here,” Lundmark explained.

Likewise, Ericsson’s CEO Borje Ekholm said the vendor’s quarterly sales in North America represented “one of the lowest shares we’ve seen in many years. But on the other hand, we see India growing very, very fast.”

…………………………………………………………………………………………………………………………….

“We believe AT&T is a primary culprit with slow spending, but inventory absorption is occurring with other operators too,” wrote the financial analysts at Raymond James in a recent note to investors. “CommScope has exposure to the same mobile and fixed access projects as well as an operator bias to its business. Ciena has high exposure to the North American operators (fiber backhaul from cell sites), but we think guidance it offered in early June reflected AT&T absorbing inventory. Ciena, Infinera, and Juniper have material cloud exposure that we believe is improving as an offset to slower telcos.”

References:

https://www.sdxcentral.com/articles/analysis/open-ran-growth-slows-to-a-crawl/2023/07/

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

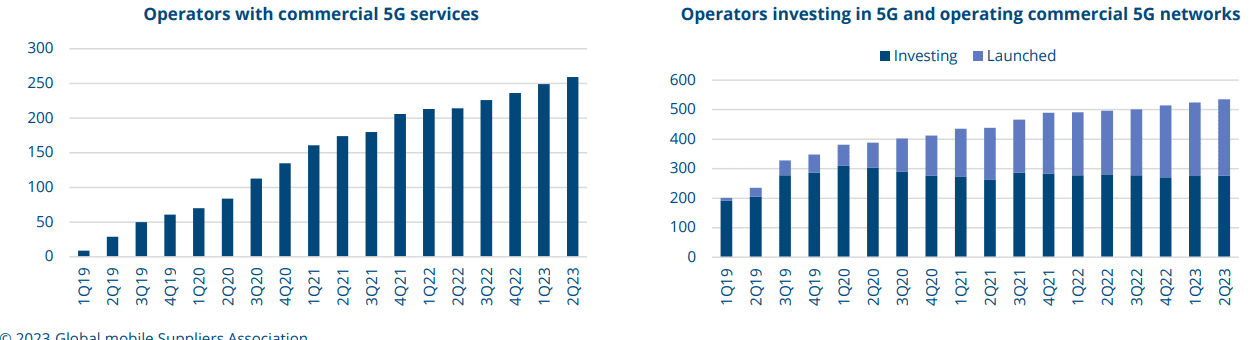

By the end of June 2023, GSA had identified 535 network operators in 162 countries and territories were investing in 5G, including trials, acquisition of licences, planning, network deployment and launches.

This number excludes nearly 200 additional companies awarded priority access licences in the U.S. auction of CBRS spectrum, which could potentially be used for 5G

Of those, a total of 259 operators in 102 countries and territories had launched one or more 3GPP-compliant 5G services 252 operators in 100 countries and territories had launched 5G mobile services 113 operators in 62 countries and territories had launched 3GPP-compliant 5G fixed wireless access services (just over 43% of those with launched 5G services)

13 operators had announced soft launches of their 5G networks that are not counted in the above launch figures 115 operators are identified as investing in 5G standalone (including those evaluating/testing, piloting, planning and deploying, as well as those that have launched 5G standalone networks).

GSA has catalogued 41 operators as having deployed or launched 5G standalone (SA) in public networks.

115 network operators are identified as investing in standalone 5G (including those evaluating, testing, piloting, planning and deploying as well as those that have launched standalone 5G networks).

GSA has catalogued 2,039 announced 5G devices, up by more than 62% from 1,257 at the start of 2022 GSA has identified 1,083 announced 5G phones, up more than 76% from 613 at the start of 2022

There are at least 1,650 commercially available 5G devices, up more than 66% annually from 990

References:

GSA: 5G Device Ecosystem June 2023 Summary

GSA FWA Report: 38 commercially launched 5G FWA networks in the EU; Speeds revealed

Zayo expands fiber network infrastructure, including new long-haul dark fiber routes, increased fiber capacity, additional 400 Gbps

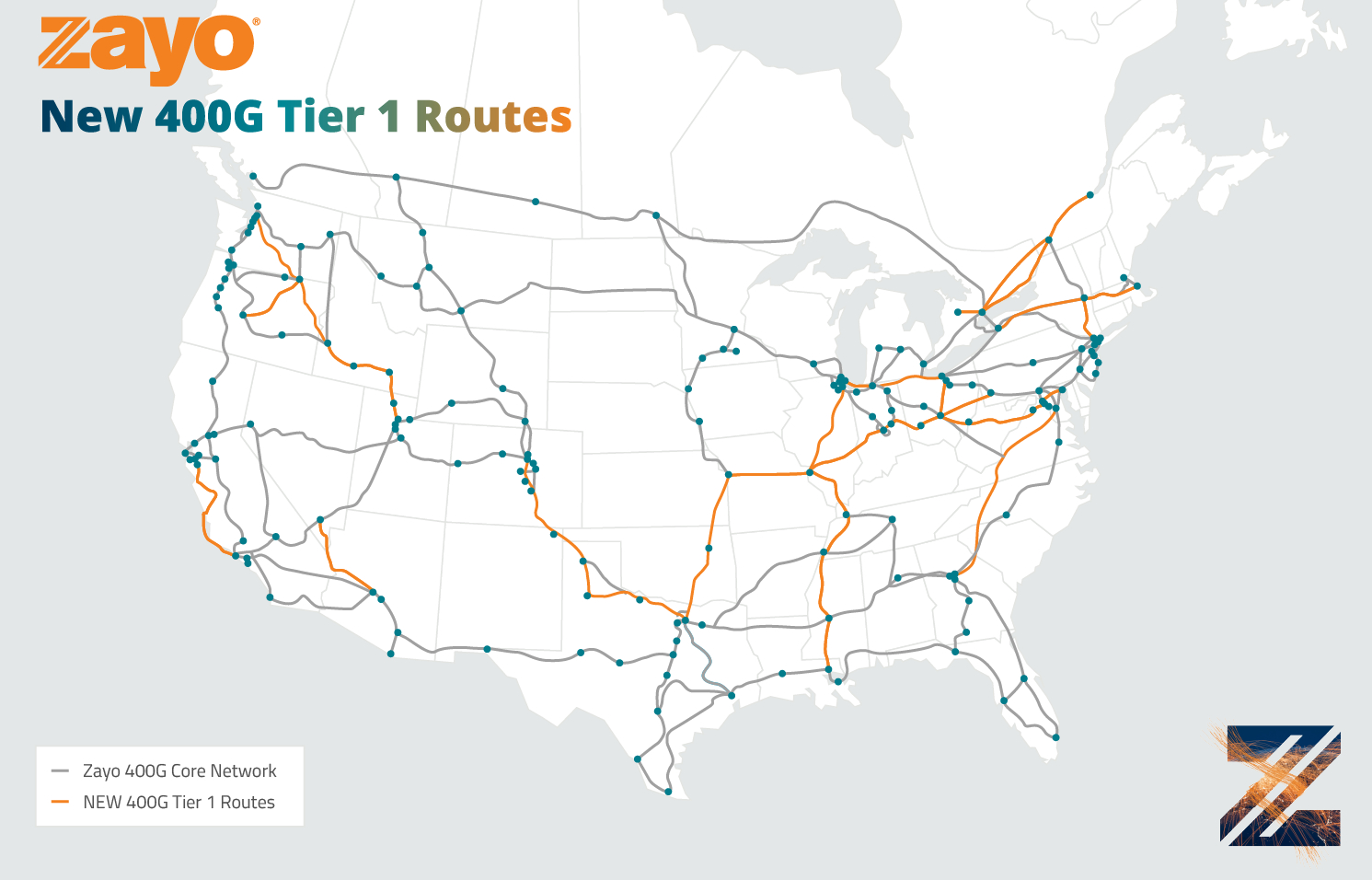

Zayo, a leading global communications infrastructure provider, announced a series of expansions to its independent fiber network infrastructure, including new long-haul dark fiber routes, increased fiber capacity for existing routes, additional 400G-enabled routes and new IP PoPs. A digital-first world requires continued investment in infrastructure, of which Zayo is leading the charge. These updates, which build upon Zayo’s significant plans to grow and modernize its network, will ensure customers have the speed, resilience and flexibility needed to stay ahead of digital demand.

“The network our future requires does not exist today. A digital-first world requires continued and intentional investment in infrastructure, of which Zayo is leading the charge. Our continued expansion and modernization of our long-haul dark fiber, wavelength, and Tier-1 IP infrastructure is critical in ensuring our customers have the speed, resilience and flexibility they need in their network to stay ahead of this increasing digital demand,” said Bill Long, Chief Product Officer at Zayo.

In April, Zayo unveiled significant plans to grow and modernize its network, including the addition of nearly 3,000 route miles and more than 700,000 fiber miles to its global network. The company has begun building these new long-haul dark fiber routes to provide its customers with diverse routing options and a customizable, robust and scalable network. The new routes are built entirely underground to provide the highest level of security and redundancy for customers.

Zayo’s newest long-haul dark fiber routes include:

-

St. Louis to Indianapolis: Expands connectivity in these growing markets, bypassing the heavily trafficked Chicago metro area with four In-Line Amplification (ILA) sites in key markets along the route.

-

Chicago to Omaha Overbuild: Provides the most direct route between Denver and Chicago, including a new high fiber count cable that connects 11 ILA sites in strategic markets, facilitating seamless network connections for customers. As a heavily used route, this overbuild will allow for more capacity.

Network Modernization with 400G:

400G routes provide better routing performance, stability, high bandwidth and reduced pricing for Zayo’s customers. The enhanced capacity from these routes supports customers with exponential growth needs driven by emerging technologies like 5G, generative AI, cloud adoption, IoT and edge computing.

With four new 400G-enabled routes made operational in the second quarter of 2023 and two more slated for completion in Q3, Zayo is expanding high-bandwidth options between key cities, including:

-

Las Vegas to Phoenix

-

Kansas City to Indianapolis

-

Dallas to East St Louis

-

Albany to Boston

-

Denver to Dallas (a direct route scheduled for completion in Q3 2023)

-

Atlanta to DC (scheduled for completion in Q3 2023)

IP Infrastructure Improvements:

To enhance overall customer experience, Zayo has bolstered its infrastructure with new IP PoPs that ensure a more seamless and uninterrupted communication experience for its customers. Zayo has added 14 neutral data centers in Q1 2023 and nine in Q2 2023 across North America, including:

Q1 2023:

-

1050 W Pender St, Vancouver, BC, Canada

-

8636 S Peoria St, Englewood, CO, USA

-

1400 Federal Blvd, Carteret, NJ, USA

-

525 D St NW, Quincy, WA, USA

-

23403 E Mission Ave, Liberty Lake, WA, USA

-

179 Social Hall Ave, Salt Lake City, UT, USA

-

3011 Lafayette St, Santa Clara, CA, USA

-

1 Enterprise Ave N, Secaucus, NJ, USA

-

400 Minuteman Rd, Andover, MA, USA

-

1275 K St NW, Washington, DC, USA

-

2220 De La Cruz Blvd, Santa Clara, CA, USA

-

5660 W Badura Ave (NAP15), Las Vegas, NV, USA

Q2 2023:

-

1250 Boul Rene-Levesque O, Montreal, QC, Canada

-

3015 Winona Ave, Burbank, CA, USA

-

3011 S 52nd St, Tempe, AZ, USA

-

5225 W Capovilla Ave, Las Vegas, NV, USA

-

8375 Dominion Pkwy, Plano, TX

-

6653 Pinecrest Dr, Plano, TX

-

3470 Gabel Rd, Billings, MT, USA

-

6428 Westwood Blvd, Orlando, FL, USA

Zayo is one of the only communications infrastructure providers actively pursuing new building and modernization of its infrastructure. In June, Zayo was awarded a $92.9M grant from the National Telecommunications and Information (NTIA) Middle Mile Program—the only national provider to receive funding—to expand network infrastructure to unserved and underserved communities across eight states. As part of its aggressive growth strategy, Zayo has also continued to expand its global footprint, including new connections for its high-capacity network across Europe, Mexico, and South America.

Zayo says it will continue to invest in future-proofing its network and services to connect what’s next for its customers.

About Zayo Group Holdings, Inc:

For more than 15 years, Zayo has empowered some of the world’s largest and most innovative companies to connect what’s next for their business. Zayo’s future-ready network spans over 16.8 million fiber miles and 141,000 route miles. Zayo’s tailored connectivity and edge solutions enable carriers, cloud providers, data centers, schools, and enterprises to deliver exceptional experiences, from core to cloud to edge. Discover how Zayo connects what’s next at www.zayo.com and follow us on LinkedIn and Twitter.

References:

https://www.zayo.com/newsroom/zayo-future-proofs-network-with-latest-infrastructure-expansions/

Zayo announces “Waves on Demand,” security enhancements, and network growth

Zayo to deploy 400G b/s network across North America and Western Europe

Zayo’s largest capacity wavelengths deal likely for cloud data center interconnection (DCI)

Antel launches 5G service in Florida; 320,000 Uruguayans can now connect to 5G

On Friday, July 21st,Antel- Uruguay [1.] announced the initial deployment of 5G technology in the Florida department of Uruguay (56 miles north of Montevedio). “We are here to connect Florida with the future. The 5G technology generates opportunities in terms of work, it is the most modern technology that is being deployed in cell phones worldwide”, emphasized president of Antel, Gabriel Gurméndez who was accompanied by the mayor Guillermo López and the vice president of the state company, Pablo Lanz, at the headquarters of the departmental government.

Note 1. ANTEL (Spanish: Administración Nacional de Telecomunicaciones, lit. ’National Administration of Telecommunications’) is Uruguay’s government-owned telecommunications network operator, founded in 1974 as a separate legal entity after spinning off the telecommunications division of UTE, which had the monopoly of landline telephony since 1931. The company has a monopoly of landline telephony and data services in the country. They also provide mobile phone services (in direct competition with Claro and Movistar) and Internet-related services, being the only provider of ADSL and land-line data services because of the monopoly situation.

Gurméndez expressed that the deployment of this technology will allow the company to maintain its leadership in the cellular telephony sector. “Antel had to bring 5G to the whole country and this is what we are doing,” he added. Uruguay exports some US$ 1 billion in software development, so having this tool at the service of young people and entrepreneurs makes it possible to triple that figure and generate more jobs. Gurméndez, highlighted that the company has the need to “attend to what we received as a clamor from the people of the interior, who demanded that Antel correct a situation of inequality and equality, in access to telecommunications services. Therefore, the objective is to focus on investments in the interior, as a priority for this management.

He indicated that “bringing 5G technology to Uruguay is giving the country a tool that allows us to stay on the path of growth and competition.” This technology means “the possibility for Floridians not to have to leave the department in search of other opportunities,” she emphasized. He concluded that “to continue to be leaders and to be at the forefront in an increasingly competitive world, Antel had to bring 5G to Uruguay.”

Pablo Lanz, expressed his satisfaction at starting 5G technology in the place where he was born, enunciating that this milestone means “more opportunities for young people to stay where they live”, as well as “opportunities for Floridians who work in Florida, live in Florida.” He added that from the first day, Antel set itself the goal of being “with its eyes on the people and that for us it is a pride to tell you that the Uruguayan company, throughout the national territory, is developing an important investment.”

Mayor Guillermo López expressed his joy at once again receiving the company’s board of directors in Florida, with good news. He thanked Gurméndez and Lanz for addressing the department’s claims and especially for taking decentralization into account and “looking the problem in the eye and providing answers.”

Image Credit: Antel, Uruguay

Last month, Antel announced the activation of 5G services in Uruguay The state owned telco said that its 5G offering is provided via spectrum in the 3.5 GHz band. Antel also noted that in the initial phase, nearly 300,000 customers will have access to 5G in the cities of Montevideo, Colonia, Maldonado and Canelones. In the coming days, the company said its 5G service will be activated in all the capitals of the country’s departments, or state-level geographies.

August 5 2023 Update:

Uruguay’s state-owned telecoms operator, Antel, has significantly expanded its 5G network coverage since commercially launching the service at the end of June 2023. Antel became the first service provider to offer 5G services in Uruguay. At the end of July, 320,000 Uruguayans who can connect to 5G, according to the telco.

In recent weeks, Antel has expanded 5G coverage to cities, including Paysandu on July 06, Fray Bentos, Young, Rio Negro department on July 07, Artigas on July 13, Salto on July 14, Rocha on July 17, Florida on July 21, Rivera on July 28, Treinta y Tres on July 31 and Melo on August 01.

The 5G network is steadily being launched in each of the country’s 19 departmental capitals. Customers within coverage areas and with a 5G-compatible device will be able to trial the service for 30 days for free.

Antel has stated that it has invested about 4 million dollars in the last three years to reach Melo with 5G. By the end of the year, Antel said it will have 200 places with 5G Technology. The Uruguayan state telco will invest in 5G this year to connect 200 localities, while continuing to invest in 4G.

References:

Verizon Point-To-Multipoint network architecture using mmWave Spectrum

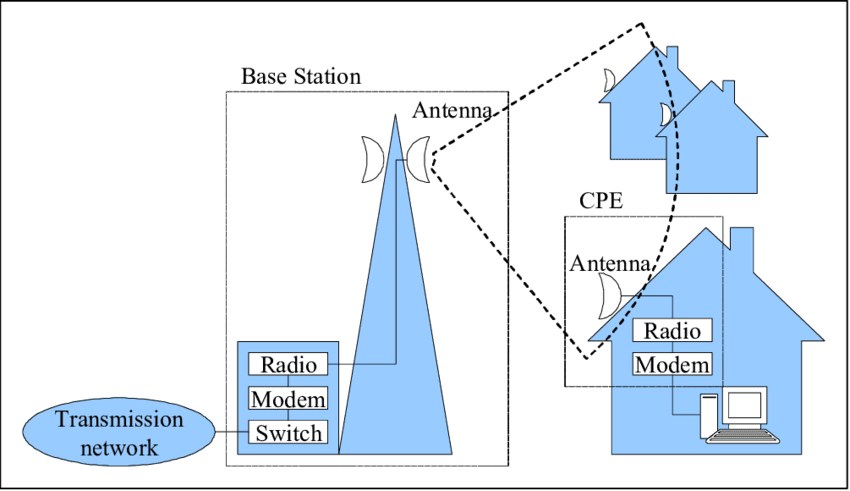

Verizon has unveiled a point-to-multipoint solution to expand high-speed internet access across various locations. According to the press release, a successful proof of concept in Texas showcased the company’s approach, leveraging its extensive mmWave spectrum holdings and fiber infrastructure.

Verizon stated that its point-to-multipoint architecture is designed to cater to multi-dwelling units (MDUs) such as apartment buildings and townhomes, as well as distributed enterprise campuses and high rises. Intending to serve multiple end-user connections from a single origination location, Verizon said this solution promises reliable, secure, and efficient connectivity.

The company claims this network architecture is less expensive to build, quicker to deploy, and addresses the unique complexities of distributed end users in a single facility or small area such as a residential unit with a large population.

In this proof of concept, an airlink over licensed mmWave spectrum was established between a centralized, rooftop radio site and a radio atop a simulated multi end-point building. The signal was then transmitted via coaxial cable throughout the building to a data processing unit along with a corresponding modem. From there, the building’s existing wiring transported the signal to end user routers that provided broadband coverage throughout simulated distributed end points. Instead of transmitting the data through Verizon’s 4G and 5G wireless cores, this unique architecture uses a simplified Broadband Network Gateway to direct the traffic to and from the internet over Verizon’s public IP network. This means that data traffic will not add load on Verizon’s current wireless cores while at the same time providing excellent capacity and latency.

Source: Research Gate Point-to-multipoint FWA network architecture

………………………………………………………………………………………………………………………………….

“Verizon has been building the infrastructure and assets for years to make this new design possible,” said Adam Koeppe, Senior Vice President of Technology Planning for Verizon. “Leveraging our significant fiber footprint in over 70 major markets nationwide and large amounts of ready-to-use mmWave spectrum, this new architecture means we will be able to provide point-to-multipoint architecture in a cost effective and efficient way.”

Leveraging Verizon’s current mmWave spectrum and fiber assets means this point-to-multipoint technology could reduce the cost of providing broadband to many locations. Depending on the various designs of buildings, office complexes and campuses, running fiber connections to individual buildings and individual units within buildings requires complex licensing, significant capital investments, long lead times and can be disruptive, making air links and established indoor cabling appealing alternatives for delivering services. Applications for this type of point to multipoint mmWave based technology could include distributed enterprise campuses, commerce areas, home broadband for multi dwelling units or other areas where air links could easily connect donor sites in the Radio Access Network to facilities with their own internal infrastructure.

Verizon is completing RFPs for the specialized radio access equipment for the licensed 37-39 GHz spectrum and expects to continue developing this technology throughout the year.

References:

https://www.verizon.com/about/news/verizon-develops-new-point-multi-point-use-case-mmwave-spectrum

https://www.verizon.com/about/our-company/5g/what-millimeter-wave-technology

Building out Frontier Communications fiber network via $1.05 B securitized debt offering

Frontier Communications has nearly three million broadband internet subscribers across 25 states, on a network that reaches about 5.5 million homes and businesses via fiber and another 10 million via copper. About a third of Frontier’s potential fiber customers subscribe, three times the rate of those on copper lines. Frontier built fiber to an additional 339,000 locations in Q1 2023, ending the quarter with 5.5 million fiber passings and 15.4 million total passings. The company also added a record 87,000 fiber subs in the period, extending that customer total to 1.76 million (1.65 million residential and 110,000 business customers).

However, building out its fiber network will cost more than Frontier’s management forecast when the company emerged from bankruptcy in early 2021. Its latest two million locations cost an average of $830 to deploy. In May, management said it expects the remainder of this year’s build to cost between $1,000 and $1,100 per location. It costs Frontier another $600 or so to send a technician to a customer’s home to plug in all the necessary equipment and the like.

Light Reading reports that Vikash Harlalka, telecom analyst at New Street Research, estimates that Frontier’s fiber buildout plan faces a funding gap of about $2.3 billion. However, Frontier Communications’ plan to offer $1.05 billion in securitized debt, with the potential to upsize it, will significantly cut down the company’s funding gap to build fiber to 10 million locations by 2025. The company said:

An indirect subsidiary of the Company intends to offer approximately $1.05 billion aggregate principal amount of secured fiber network revenue term notes (the “Notes”), with the potential to upsize, subject to market conditions and other factors. The Notes will be secured by certain of Frontier’s fiber assets and associated customer contracts in the Dallas metropolitan area and constitute the first offering of green bonds by a Frontier subsidiary.

“The offering should close nearly half the gap (more than half, if the offering is upsized. It takes most of the funding risk off the table,” Harlalka explained in a research note, adding that the move also unlocks a new market for Frontier to tap into for its funding needs. Harlalka noted that Frontier had about $2.7 billion in liquidity at the end of the first quarter of 2023 – enough to meet the company’s capital needs until mid-2024. “This new debt raise should extend that beyond 2024,” he added.

Frontier said the debt offer will be secured by a portion of the company’s fiber assets and associated customer contracts in the Dallas metropolitan area, and marks the first offering of “green bonds” by a Frontier subsidiary. The offer will go toward capital expenditures and research and development, “in line with Frontier’s fiber expansion and copper migration strategies,” the company said.

Last week, Frontier stock dropped 21.3% after The Wall Street Journal reported on potential health risks posed by lead-sheathed copper wires in old networks across the U.S. Frontier declined to comment. The stock decline continued on Monday July 17th with FYBR hitting a low of $11.65 on huge volume of 12,063,100 shares. It rebounded 43.95% in the next four trading days to close at $16.77 on Friday July 21st (albeit on very light volume).

New Street analyst Jonathan Chaplin estimates that remediation costs to Frontier could reach $6 billion if it is required to rip out all the lead-covered copper on its own dime within five years. But there’s overlap with upgrading those same lines to fiber, and Chaplin calculates a $75 fair value for the stock in this unlikely scenario. “Even if it comes to pass, we see upside to the stock,” he writes.

Frontier is scheduled to announce Q2 2023 results on Friday, August 4th.

References:

https://www.barrons.com/articles/buy-frontier-communications-stock-price-pick-a2f82599

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Ericsson and O2 Telefónica demo Europe’s 1st Cloud RAN 5G mmWave FWA use case

Ericsson and O2 Telefónica say they have conducted the first demonstration of 5G Cloud RAN (Radio Access Network) [1.] technology in Europe. The Proof of Concept (PoC) deployment at O2 Telefónica’s Wayra innovation hub in Munich utilized a centralized control unit (CU) and harnessed the power of mmWave frequency to achieve an impressive end-to-end speed of more than 4 Gbit/s. The companies validated the use of Cloud RAN for fixed wireless access (FWA), as well as enterprise and industrial use cases.

One FWA case is “Data Shower,” a new concept in the automotive industry that enables the efficient deployment of software updates to vehicles in production lines by using mmWave technology for high-bandwidth transfer.

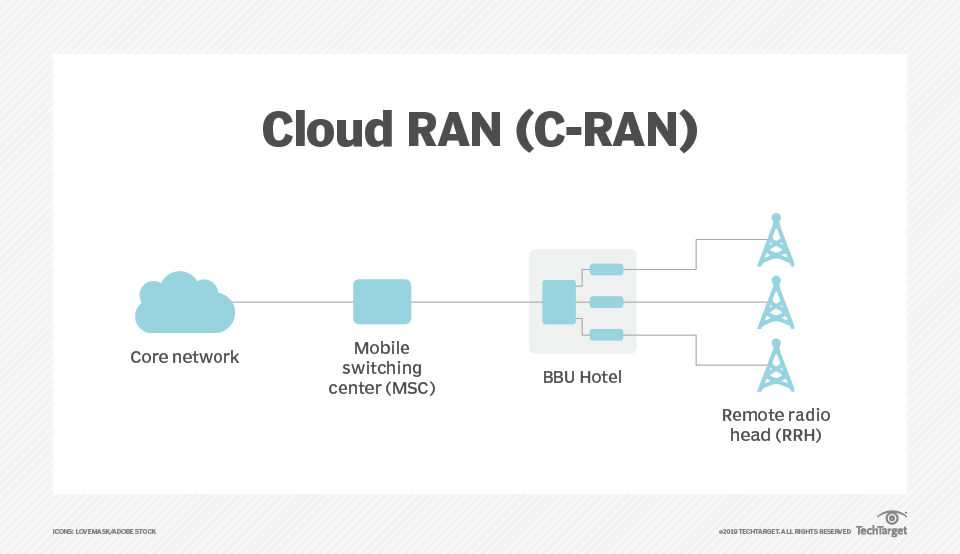

Note 1. A cloud radio access network (Cloud RAN) is a centralized, cloud computing-based architecture for radio access networks. It enables large-scale deployment, collaborative radio technology support and real-time virtualization capabilities.

Ericsson Cloud RAN is a cloud-native software solution handling compute functionality in the RAN. Cloud RAN is a viable option for communications service providers to have increased flexibility, faster delivery of services, and greater scalability in networks. Ericsson Cloud RAN is enhanced with support for 5G mid-band and with Cloud RAN for high performance in combined footprint. More information is below.

…………………………………………………………………………………………………………………

By implementing Ericsson’s cloud-native software solution for 5G Cloud RAN, O2 Telefónica in Germany will experience significant gains in flexibility, service delivery and improved network operations. This initiative also sets the stage for other communication service providers (CSPs) to leverage network automation and RAN programmability, thereby enhancing their overall network flexibility, scalability, and simplification.

Daniel Leimbach, Head of Customer Unit Western Europe at Ericsson, says: “The partnership between Ericsson and O2 Telefónica demonstrates our commitment to achieving significant breakthroughs on our path to build the networks of the future. It is a first for both companies in Europe and shows the potential of Cloud RAN for high performance use cases. It builds upon our work with the cloud-native 5G core we have deployed in O2 Telefónica Germany, enabling a full end-to-end cloud native network. We are very proud to be doing this together with O2 Telefónica.”

Mallik Rao, Chief Technology & Information Officer of O2 Telefónica, says: ” O2 Telefónica is a pioneer in deploying new network technologies such as Cloud RAN. With the introduction of a cloud-based, standardized architecture, we are able to respond quickly to customer needs, introduce new products and services even more flexibly and scale our O2 network better. With Cloud RAN, we combine the benefits of open interfaces with the expertise and product quality of European network equipment supplier Ericsson, whose technology we already use for our high-performance 5G core network.”

Cloud-native deployment plays a pivotal role in the transformation of the telecommunications industry, and the integration of cloud-native architecture into the radio access network (RAN) presents an exceptional opportunity to foster innovation and enhance network efficiency. By virtualizing the RAN and adopting a cloud-native, standardized architecture, O2 Telefónica will gain the ability to respond rapidly to customer needs, introduce new products and services with greater flexibility and agility, and realize benefits such as faster service delivery, improved scalability and enhanced cost efficiency.

Ericsson’s commitment to advancing telecommunications networks is underscored by this collaboration and builds upon the company’s successful Cloud RAN deployments with other leading CSPs in North America and Australia.

The incorporation of Cloud RAN extends the foundation of the ongoing network cloudification efforts by Ericsson and O2 Telefónica in Germany.

Technology overview: Benefits:

Ericsson 5G Cloud RAN, a cloud-native software solution, effectively handles compute functionality in the RAN, offering a range of benefits for CSPs, including the advantage of implementing common operational systems and practices, simplifying deployment and life cycle management of resources for enhanced efficiency. By centralizing processing and management functions, Cloud RAN transforms traditional network architecture to improve resource allocation, scalability and network management. This innovation empowers mobile network operators to dynamically allocate resources, optimizing performance and ensuring a seamless user experience.

Millimeter Wave (mmWave) frequency operates in the high-frequency range, typically above 24 gigahertz (GHz). This spectrum offers immense bandwidth potential, enabling data transfer at unprecedented speeds. By leveraging mmWave, telecommunications companies can deliver ultra-fast internet connections, supporting a wide range of applications such as 5G networks, virtual reality, augmented reality, and high-definition video streaming. With its ability to transmit vast amounts of data over short distances, mmWave frequency paves the way for the realization of futuristic technologies that demand low latency and exceptional performance.

References:

https://www.ericsson.com/en/ran/cloud

https://www.techtarget.com/searchnetworking/definition/cloud-radio-access-network-C-RAN

Dell’Oro: OpenRAN revenue forecast revised down through 2027

No surprise that the global Open RAN market share forecast to 2027 has been revised downward by market research firm Dell’ Oro Group. This is the first downward forecast revision since the firm started tracking Open RAN, reflecting some hesitancy about these next generation architectures.

What is complicating the analysis is the fact that Open RAN adoption has been mixed across the greenfield and the brownfield operators. With greenfield and early adopter brownfield deployments maturing, the reality the industry is now facing is that it will take some time for the other segments to match and offset the more stable trends with the early adopters.

“We can think of this revision more as a near-term calibration than a change in the long-term growth trajectory,” said Stefan Pongratz, Vice President and Analyst at the Dell’Oro Group. “This journey of “re-shaping” the RAN was never expected to be smooth and many challenges remain. Even so, our long-term position has not changed. We continue to believe that Open RAN is here to stay, and the growing support by the incumbent suppliers bolsters this thesis, “continued Pongratz.

Additional highlights from the July 2023 Open RAN Report:

- Cumulative Open RAN revenues have been revised downward by 5 percent to 10 percent through the forecast period.

- Open RAN revenues are projected to account for more than 15 percent of global RAN by 2027.

- The European operators are ahead of the rest of the world when it comes to announcing Open RAN targets, but they have been more cautious with deploying Open RAN, focusing on building out 5G using traditional RAN. The baseline forecast, which assumes more delays in Europe, is for the European Open RAN market to surpass $1 B by 2027 and eventually be one of the leading markets from an Open RAN/RAN perspective.

Light Reading previously reported that prominent greenfield network operator Open RAN deployments to date have failed to impress, leaving many Open RAN equipment and software vendors to look to brownfield operations to make an industry impact. But so far not many have achieved any significant product swaps, nor does it look like there are many progressing at a pace that would accelerate Open RAN maturity among brownfield operators.

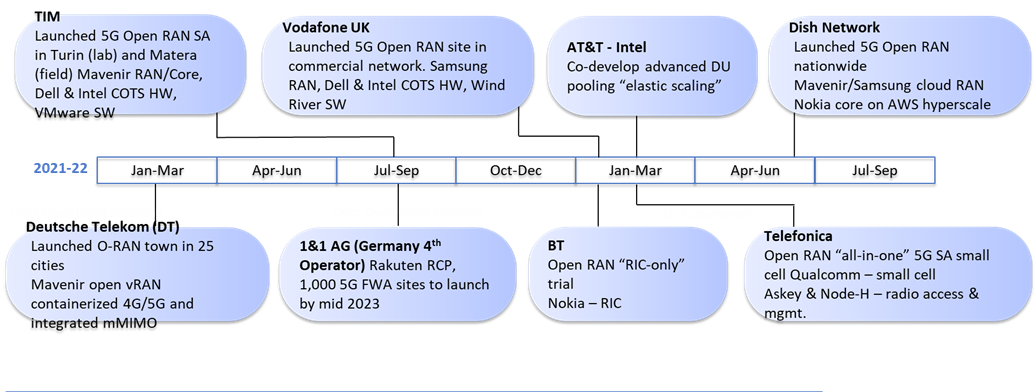

This chart below shows a timeline of Open RAN advances:

Source: 5G Americas

……………………………………………………………………………………………………………………….

Opinion: This author expects further downward revisions to come, mainly because the O-RAN Alliance, which creates the OpenRAN specifications, is not a standards body. Nor have they liaised their specs to ITU-R WP 5D which is responsible for all terrestrial IMT recommendations/standards. They do have an alliance with ATIS which has yet to contribute their specifications to either 3GPP or ITU.

………………………………………………………………………………………………………………..

The Dell’Oro Group Open RAN Advanced Research Report offers an overview of the Open RAN and Virtualized RAN potential with a 5-year forecast for various Open RAN segments including macro and small cell, regions, and baseband/radio. The report also includes projections for virtualized RAN along with a discussion about the vision, the ecosystem, the market potential, and the risks. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, networks, and data center markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

5-Year Open RAN Forecast Revised Downward, According to Dell’Oro Group

https://telecoms.com/522778/global-open-ran-market-share-by-2027-revised-downward/

LightCounting: Open RAN/vRAN market is pausing and regrouping

https://strandconsult.dk/category/open-ran/

Ericsson’s new antenna helps accelerate Vodafone 5G roll-out

Vodafone is rolling out Ericsson’s new compact antenna to bring greater 5G capacity, coverage and performance to locations across the U.K. The Ericsson AIR 3218 combines a radio unit and antenna in a single unit. It can also transmit mobile data over all of the frequencies that Vodafone currently uses in the U.K., without needing additional antenna units, as was the case for previous models.

The combined multiband, Massive MIMO design makes it easier for the operator to add more capacity to a mast without increasing its footprint. It’s also easier to mount on rooftops, towers, walls and poles.

“5G is the UK’s digital future, but we should never underestimate how difficult it is to deliver a future-proofed network at scale across the length and breadth of the UK. Working in partnership with Ericsson, we are constantly exploring new ways to accelerate this transformation, and this is another example of where innovation is delivered through collaboration,” said Ker Anderson, head of Radio and Performance at Vodafone UK, in a statement.

Ericsson noted that the Interleaved AIR 3218 is powered by the latest Ericsson Silicon technology. It also uses beam-through technology where an arbitrary active antenna can be placed behind the passive antenna, reducing the overall footprint in terms of size, weight and wind load.

So far, they’ve calculated a 30% reduction in site acquisition and build time based on results from the first five sites where deployment has already been completed. The AIR 3218 is expected to be deployed across 50 sites within the Vodafone UK network in 2023.

References:

https://www.vodafone.co.uk/newscentre/news/new-ericsson-antenna-helps-accelerate-vfuk-5g-rollout/

Point Topic Comprehensive Report: Global Fixed Broadband Connections at 1.377B as of Q1-2023

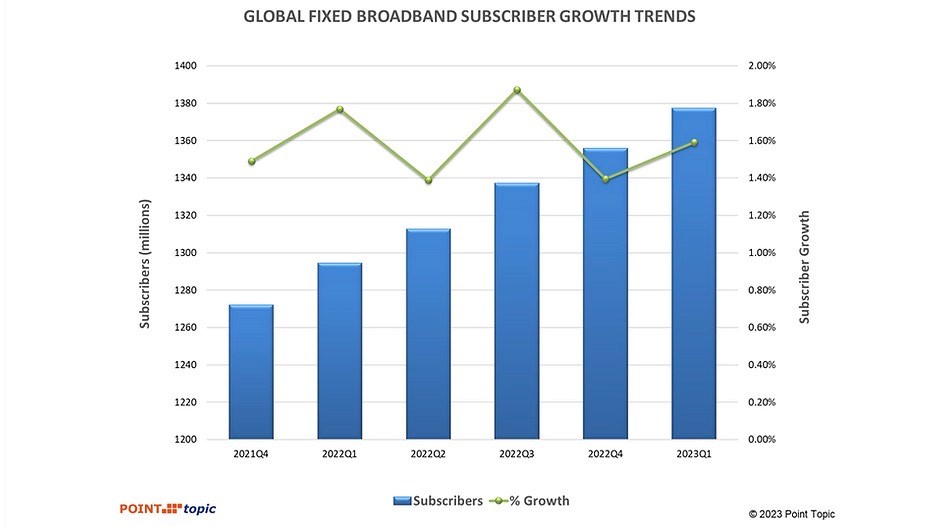

Global fixed broadband connections reached 1.377 billion as of Q1-2023, up by 83 million from a year earlier and reflecting an annual growth rate of 1.59%, according to Point Topic.

There was a decline in fixed broadband subscriptions in 18 countries[1] which mainly include emerging markets, as well as some saturated markets such as Singapore. However, while there were fluctuations in growth rates across regions and markets, the overall trend indicates a steady expansion of global broadband connectivity.

Highlights:

-

Among global regions, Africa, East Asia and America Other saw the fastest growth in broadband connections (2.9%, 2.2% and 1.8%), not least due to healthy increases in broadband subscribers in the vast markets of Egypt, Brazil and China.

-

The share of FTTH/B in the total fixed broadband subscriptions continued to increase and stood at 66.7%. Broadband connections based on other technologies saw their market shares shrink further, with an exception of satellite and wireless (mainly FWA).

-

VDSL subscriber numbers grew in ten countries, while they dropped in at least 22 markets as consumers migrated to FTTH/B.

-

The highest FTTH/B broadband subscriber growth rates in Q1 2023 were in Algeria, Peru and UK.

At 21.6 million, the quarterly net adds were close to the figure we recorded a year ago, though the growth rate (1.59%) was slower, compared to 1.77% in Q1 2022, with global inflation and economic instability having an impact.

East Asia continued to dominate in Q1 2023, maintaining its position as the largest market with a 49.6% share of global fixed broadband subscribers. This substantial market share is primarily driven by China with its vast population.

In Q1 2023, broadband subscriber base grew faster in China, Hong Kong and Korea, compared to Q4 2022. As a result, the region’s net adds share globally went up from 63.2% to 68.8%. Asia Other accounted for 10.8% of the global broadband market, similarly to the previous quarter, though the region’s net adds share went down from 12.8% to 9.4%.

Europe’s market shares remained rather consistent, though Eastern Europe saw their net adds share decline from 3.4% to 0.5%, as a result of slower growth in almost all markets and the decline in broadband subscribers in Russia having an especially significant impact due to its market size.

Similarly, Americas maintained relatively stable market shares of 10.3% and 8.1% respectively, while America – Other’s net adds share increased from 7.8% to 9%, driven by higher growth in such sizeable markets as Brazil, Mexico, Colombia and Chile, to name a few.

Next Point Topic looks at fixed broadband penetration among population, comparing it to growth rates across the regions.

Africa and Asia Other continue to have relatively low fixed broadband penetration rates among their populations. In Q1 2023, this metric in Africa stood at 4.6%, while Asia Other reached 5.6%. These figures indicate the potential for future expansion in these regions. Not surprisingly, Africa also recorded the highest quarterly growth rate of 2.9%.

The markets of East Asia and America Other followed closely with growth rates of 2.2% and 1.8% respectively, despite East Asia already having the highest population penetration at 41.9%. This reflects a widespread adoption of fixed broadband services in East Asia, while America Other showcases steady growth in a region with significant potential, where broadband penetration is among the lowest, at 17.2%.

Eastern Europe displayed a modest growth rate of 0.2% with a population penetration of 24.8%. Some markets in this region still have a lot of headspace when it comes to broadband adoption but the growth was sluggish, likely due to economic pressures. Other European regions showed a slightly higher growth rate, with Europe Other at 0.5%, coupled with the second highest population penetration of 39.4%. These figures indicate a mature market with limited growth opportunities.

Among the largest twenty broadband markets all but one saw fixed broadband subscribers grow in Q1 2023, although in ten of them the growth was slower than in the Q4 2022. There was a slight drop in broadband subscribers in Russia which is under international sanctions.

The less saturated broadband markets of India, Egypt, Brazil and Mexico recorded the highest quarterly growth rates in Q1 2023, all higher than 2%. China recorded an above 2% growth as well. At the other end of the spectrum, the mature markets of Germany, France, Japan, UK, and Italy saw modest growth rates at below 0.5%. At the same time, Italy was among the countries that saw one of the largest improvements in growth rates, from -0.44% in Q4 2022 to 0.04% in Q1 2023, as its GDP growth also went from negative to positive in that period[2]. Mexico, China and Brazil recorded the largest improvements in their growth rates, at +1.14.%, +0.52% and +0.41% respectively.

Between Q4 2022 and Q1 2023, the share of FTTH/B connections in the total fixed broadband subscriptions went up by 0.7% and stood at 66.7%. Broadband connections based on other technologies saw their market shares shrink further, with an exception of satellite and wireless (mainly FWA), which remained stable.

FTTx (mainly VDSL) share stood at 6.7%[3]. VDSL subscriber numbers grew in ten countries (including modest quarterly increase in the large VDSL markets of Turkey, Czech Republic, Greece and Germany, for example), while they fell in 22 other markets as consumers migrated to FTTH/B.

It remains to be seen whether consumers will continue to gravitate toward fibre broadband offerings, particularly as global economies face potential slowdown and inflationary pressures.

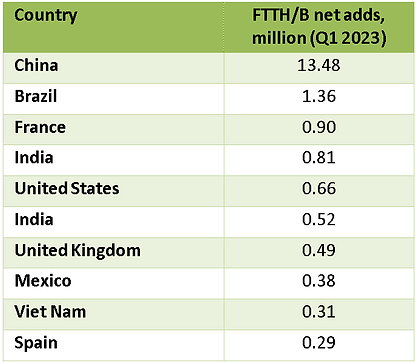

In terms of FTTH/B broadband net additions in Q1 2023, China continued to maintain a significant lead with 13.5 million while Brazil added 1.4 million. Mexico is back in the top ten league, having pushed out Argentina this quarter.

Satellite broadband also saw a modest growth of 1.3% while wireless broadband demonstrated continued relevance with a respectable growth rate of 4.9%. These trends can be attributed to the demand for connectivity in remote or underserved areas where traditional broadband infrastructure is not feasible.

The diverse growth rates among different broadband technologies highlight the dynamic nature of the industry as consumers seek more reliable and high-speed connections. The significant increase in FTTH/B connections and the growth of satellite and wireless broadband underline the ongoing efforts to bridge the digital divide and ensure connectivity for all.

The top ten countries by fixed broadband subscribers remained unchanged (Figure 5). As of Q1 2023, China exceeded 0.6 billion fixed broadband subscribers, having added 14.6 million in the quarter. Also, the country is approaching 1.2 billion 5G subscribers, with the service now being used by 84% of the population.

Overall, the latest fixed broadband subscriber data reveals a clear trend towards advanced, high-speed broadband solutions like FTTH/B, while older technologies such as copper-based broadband (ADSL and VDSL) are experiencing a decline, suggesting that the broadband landscape is continuously evolving to meet the growing demand for faster and more reliable connectivity.

References:

https://www.point-topic.com/post/global-broadband-subscriptions-q1-2023

Point Topic: Global Broadband Tariff Benchmark Report- 2Q-2022

Point Topic: Global fixed broadband connections up 1.7% in 1Q-2022, FTTH at 58% market share