Month: January 2025

Empresa de Telecomunicaciones de Cuba in its worst ever state; saddled with worthless Cuban pesos

Cuba’s national monopoly telco, Etecsa (Empresa de Telecomunicaciones de Cuba) is chronically starved of the foreign currency which it needs to buy telecom infrastructure equipment, such as cables and network hardware. Etecsa only has Cuban pesos, which are completely worthless outside its borders. No company in any other country will accept pesos in payment for anything.

Translating Cuba, which has translated and published a 14ymedio article in English, we have learned that the state-owned telco has been fined by the government for failing to spend its entire 2024 peso budget, even though it tried to do so. The island’s network operator had already told the authorities that it had underspent by many millions of pesos because no foreign company will accept them in payment either for goods or services.

The proposed solution was to designate the underspent cash as profit and then divide it up between Etecsa employees, but the Cuban government objected, fined the telco, and sequestered the cash.

To prevent the scenario from being repeated this year, Etecsa is preparing new payment methods for its services to collect as much hard currency as it can.

“Several scenarios have been evaluated, and so far the one that seems the best is to limit the number of recharges in national currency for the same customer. When he gets down to a certain monthly amount, he will have to recharge in dollars,” clarifies the administrator. “Together with the recharges from abroad, the purchase in Cuba will be enabled, directly in dollars or with a Classic card.”

“What happens now is that mobile phone customers sometimes have thousands of pesos left and can buy as many navigation packages as they want. They can even make transfers of that money so that others can buy a connection package. It will remain limited, because there’s not much Etecsa can do with that Cuban money. It’s worthless for investments and purchasing infrastructure.”

“We are just now restructuring everything, and that is one of the reasons why we are removing some monthly offers of recharges with a bonus, because there are many customers whose relatives abroad buy the recharge for them, which includes a balance and a recharge package, but then they resell it to others who pay them in Cuban pesos, and these in turn buy new navigation packages. We even know that many relatives send them dollars, and they change them on the black market and buy the packages in national currency. So Etecsa doesn’t earn foreign exchange and can’t go on like this because this is a telecommunications company and has to earn a lot of money.”

“We are tying pieces of cables together to repair the breaks,” one Etecsa employee told 14ymedio, adding that the company is going through “the worst crisis since its creation.” As a result of the foreign currency crisis, in 2022 the telco was unable to “fulfill its financial commitment to Nokia,” the island’s mobile data infrastructure supplier.

For the 2025 budget, the Minister of Finance and Prices, Vladimir Regueiro Ale, has warned that a “special tax on telecommunications services” will be implemented. According to the owner, “this will generate a tax in addition to the invoices from the Cuban Telecommunications Company of more than 13 billion pesos,” a sea of national currency for some dollar-thirsty coffers. That sounds like a lot, but it’s currently the equivalent of $542m and it’s useless Cuban pesos…That won’t help Etecsa which is in its worst ever state, unable to make basic repairs or replace the batteries that power mobile network sites.

“There are no land lines to replace, we lack the boxes for home installation, and there are also many problems with supplying cables.”

The lack of liquidity has been taking its toll on Etecsa for years, especially with its foreign investors. In 2022, for the first time in 15 years, the company could not fulfill its financial commitment to Nokia, the Finnish company that has worked on the Island implementing the data service for mobile telephony.

References:

Etecsa Will Start Charging for Some Services in Dollars Inside Cuba

Telecom data traffic in Cuba grows 10% due to COVID-19; Free access to EnZona e-commerce platform

What’s the real status of Internet access in Cuba?

Cuba-Google agreement to speed up Internet access on the island

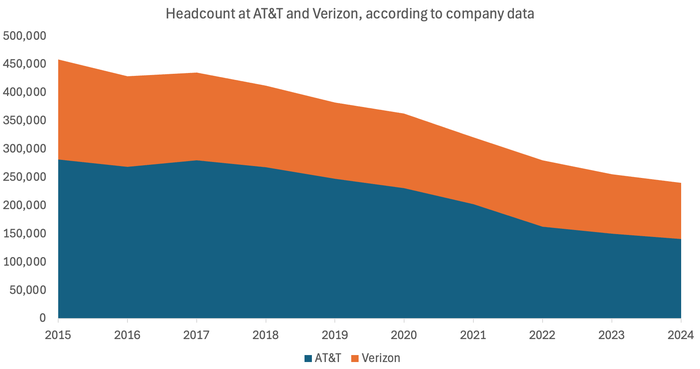

AT&T and Verizon cut jobs another 6% last year; AI investments continue to increase

In 2018, after AT&T acquired Time Warner, the enlarged AT&T had approximately 230,000 employees and annual revenues of about $172 billion. Both figures have declined subsequently, but headcount has been reduced at a much sharper rate. Data published this week, after AT&T reported full-year sales of $122.3 billion, shows another 9,500 jobs were cut in 2024, decreasing the total to 141,000 workers. Back in 2017, counting the Time Warner business it was then trying to buy, AT&T had as many as 280,000 employees. Is AI being used to replace jettisoned employees at AT&T?

During Monday’s earnings call, AT&T’s CEO John Stankey said AI is already powering a variety of functions at the telco. “What we’ve been able to do in our call centers and how we operate within our customer base, a lot of that has been driven by AI tool applications. And it’s not that we’re necessarily exclusively replacing individuals with the technology, but we’re making them a lot more effective and efficient,” Stankey said, adding that AT&T is also using AI to develop its computer code. “We’re spending less right now to develop new code internally … and it’s through the application of AI and technology.”

Stankey added that AT&T plans to invest more heavily in AI this year, including by using its customer data to more effectively target customers with promotions and other offerings. “If I were to say I had a goal for 2025, I would like to … be talking about good momentum we’ve received in business as a result of executing on some of those things moving forward.”

AI was also highlighted during recent calls about financial results as something that would help to sharpen the axe. Those updates came after AT&T said in December 2024 that its latest aim was to slash another $3 billion in annual costs by the end of 2027. “In 2025, we will make progress on this goal by further integrating AI throughout our operations,” said Stankey this week. AT&T has also put AI to use on writing code and adapting the capabilities of the mobile network based on analysis of traffic patterns.

AT&T officials have previously discussed the possibility that AT&T central offices could host AI capabilities. During a recent analyst event, AT&T CTO Jeremy Legg said that some of the company’s central offices could be used for AI, but that the company would have to address the power requirements for those AI computing functions.

……………………………………………………………………………………………………………………………………………………………………………………….

Job cuts at Verizon have also been dramatic. Under CEO Hans Vestberg, it has managed to grow sales while axing jobs. Annual revenues at the company rose by $6.5 billion between 2020 and 2024, to about $134.8 billion, just as 32,600 jobs were slashed over this period. Workforce shrinkage left Verizon with fewer than 100,000 employees at the end of 2024. The rate of Verizon job cuts was relatively low in 2024, when fewer than 6,000 positions were eliminated, down from the nearly 12,000 that were scrapped in 2023. Yet Verizon employs about 78,000 fewer people today than it did ten years ago, and there has been no sign the trend might go into reverse.

At Verizon, “driving down costs in our operations” is part of a “three-pronged strategy for AI,” Vestberg told analysts. AI Connect, which should be the most exciting prong, positions AI in the same way edge computing was positioned years ago. The idea is to host the resources needed for AI applications in the network facilities that dot the US – some 16,000 “near net” enterprise locations, according to Verizon, along with between 100 and 200 acres of land partially “zoned” for data center build – and then charge for the privilege.

“If you think about where we are on generative AI today, it’s where large language modules are trained at large data centers and that require enormous capacities. Over time, that will, of course, come much closer to the edge of the network,” Verizon CEO Hans Vestberg explained on the operator’s quarterly conference call.

Kyle Malady, head of Verizon Business and the executive leading the operator’s AI efforts, offered more details: “Power, space and cooling are the currencies that are in demand right now, and we have all three,” he said in discussing the AI sector. “As we look across our assets, take inventory and compare against other players in the market, we believe that we are in a leadership position when it comes to usable power and space. We have facilities across the United States that either have spare power, space and cooling, or can be retrofitted. As we sit here today, we have 2-10+ megawatts of usable power across many of our sites. … In addition, we have between 100 and 200 acres of undeveloped land, some currently zoned for data center builds, and much of it in prime, data center-friendly areas.” Malady added that Verizon would deploy Vultr’s GPU-as-a-Service (GPUaaS) in its data centers in order to support the AI computing applications that require those kinds of high-performance graphical processing units (GPUs).

Malady added that Verizon sees a total addressable market (TAM) of $40 billion or more in this new area.

……………………………………………………………………………………………………………………………………………………………………………………………………

CEO’s Stankey and Vestberg have made cost cutting a priority, but most of the attendant layoffs so far are not due to the impact of AI. Stankey said, “It’s not that we’re necessarily exclusively replacing individuals with the technology, but we’re making them a lot more effective and efficient in how they handle customer needs and then complementing that with customer-supported AI.”

If AI does create new types of job, as many AI cheerleaders say, they have clearly not increased the headcount at AT&T or Verizon. A key take-away is that over the last few years, telcos were able to operate a business of roughly the same size with just a fraction of the workforce they previously employed. Average revenues per employee rose 6% at Verizon last year, to about $1.35 million, and have soared from less than $717,000 a decade ago. At AT&T, they grew 7% in 2024, to nearly $868,000, and are up from less than $544,000 in 2014.

References:

https://www.lightreading.com/ai-machine-learning/at-t-and-verizon-cut-another-15-3k-jobs-in-2024-as-ai-advanced

Verizon and AT&T cut 5,100 more jobs with a combined 214,350 fewer employees than 2015

https://www.verizon.com/about/news/verizon-unveils-ai-strategy-power-next-gen-ai-demands

https://www.lightreading.com/the-edge-network/at-t-and-verizon-are-pivoting-into-the-landlord-biz-for-ai

AT&T to deploy Fujitsu and Mavenir radio’s in crowded urban areas

AT&T’s leads the pack of U.S. fiber optic network service providers

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

U.S. Cellular to Sell Spectrum Licenses to Verizon in $1 Billion Deal

Verizon to buy Frontier Communications

Verizon Business sees escalating risks in mobile and IoT security

Ericsson’s sales rose for the first time in 8 quarters; mobile networks need an AI boost

Ericsson today said sales in its key networks unit grew 4% in the 4th quarter as contract wins and network investments by some large customers contributed to a 70% jump in North America (NA) sales, but its cloud software and enterprise units both saw sales and earnings decline. Revenue in the NA region rebounded sharply in the third quarter and continued to do so in the fourth quarter, helped by deliveries under a major AT&T “Open RAN” contract that began last year and will continue into 2025. AT&T’s Open RAN plan is for 70% of its wireless network traffic to flow across open-capable platforms by late 2026.

India has largely completed a rapid phase of network upgrades that saw deployments peak in 2023, and operator investments in the country have now normalized, Ericsson said. Total sales rose 1.4% to 72.91 billion kronor, after declining at double-digit rates in both 2023 and 2024.

“The near-term market recovery is in the hands of our customers, but our confidence in the stabilizing market is growing,” Chief Executive Borje Ekholm said on an analyst call Friday. “We are starting to see a change in sentiment.” He later said, “5G has not been built out. If you take the North American market, 5G standalone is not rolled out [1.]. London in Europe has very limited buildout. Most of the time when you get the 5G icon on your phone, you are basically on dynamic spectrum sharing using 4G spectrum.”

Note 1. Not true. Both T-Mobile and Dish Network have deployed 5G SA networks.

“I think the whole world is moving from a cost-optimized supply chain to resilience. You need to factor in resilience in the supply chain and that is why we built a US factory, and we are investing to increase capacity in the U.S. as well,” said Ekholm.

On that analysts call, Chief Financial Officer Lars Sandstrom said the company has production in North America, Latin America, Europe, Asia and India, so it has the opportunity to move production between different sites depending on President Trump’s plans. “Of course tariffs could have an impact going into 2025, but I think we’re all waiting a little bit to what is going to happen there,” he said, adding that there might also be tariff exemptions for critical products.

Ericsson said restructuring charges rose to 1.6 billion kronor in the quarter, mainly related to redundancies, efficiency measures and right-sizing operations to align with lower demand in some markets. The company said that restructuring charges for 2025 are expected to remain at elevated levels. Indeed, Ericsson has heavily cut costs, eliminating 9,400 “internal and external” jobs in 2024. The net reduction leaves the company with 94,236 employees, down from 99,952 a year earlier and more than 111,000 back in 2017, when Ekholm first took charge. Over this period, it has retreated from various activities in TV and cloud hardware to concentrate on 5G, although its $6.2 billion takeover of Vonage in 2022 brought additional staff into the business.

Ekholm acknowledged what IEEE Techblog readers already know – that mobile network data traffic growth has slowed down, which reduces demand for Ericsson’s products. Ericsson’s response has included putting heavy emphasis on the concept of programmability, whereby 5G networks could be dynamically adapted to support different services and scenarios, including artificial intelligence (AI) applications.

“The network needs to be prepared for the AI traffic,” said Ekholm. “It’s going to require more uplink. It’s going to require a different performance of the network. That, I think, may be more important in the next few years as a traffic definition. So yes, overall traffic is probably going to continue to taper down. But I think the demand coming from the new applications on top will materially impact the way you need to invest in the network.” However, that AI RAN initiative is in its infancy and yet to be commercially deployed.

References:

https://www.lightreading.com/5g/ericsson-boosted-by-us-but-axed-9-400-jobs-last-year

https://about.att.com/story/2023/commercial-scale-open-radio-access-network.html

vRAN market disappoints – just like OpenRAN and mobile 5G

The case for and against AI-RAN technology using Nvidia or AMD GPUs

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Latest Ericsson Mobility Report talks up 5G SA networks (?) and FWA (!)

Beyon partners with Ericsson to build energy-efficient wireless networks in Bahrain

Ericsson and e& (UAE) sign MoU for 6G collaboration vs ITU-R IMT-2030 framework

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Ericsson on 5G use cases: remote surgery, augmented and virtual reality with AI agent all depend on 3GPP URLLC specs

Nokia (like Ericsson) announces fresh wave of job cuts; Ericsson lays off 240 more in China

Swisscom (with Ericsson) to offer the world’s best and most sustainable mobile network

Gartner: Gen AI nearing trough of disillusionment; GSMA survey of network operator use of AI

Global IT spending is expected to total $5.61 trillion in 2025, an increase of 9.8% from 2024, according to the latest forecast by Gartner, Inc.

“While budgets for CIOs are increasing, a significant portion will merely offset price increases within their recurrent spending,” said John-David Lovelock, Distinguished VP Analyst at Gartner. “This means that, in 2025, nominal spending versus real IT spending will be skewed, with price hikes absorbing some or all of budget growth. All major categories are reflecting higher-than-expected prices, prompting CIOs to defer and scale back their true budget expectations.”

GenAI will Influence IT Spending, but IT Spending Won’t Be on GenAI Itself:

Segments including data center systems, devices and software will see double-digit growth in 2025, largely due to generative AI (GenAI) hardware upgrades (see Table 1). However, these upgraded segments will not differentiate themselves in terms of functionality yet, even with new hardware.

Table 1. Worldwide IT Spending Forecast (Millions of U.S. Dollars)

2024 Spending |

2024 Growth (%) |

2025 Spending |

2025 Growth (%) |

|

| Data Center Systems | 329,132 | 39.4 | 405,505 | 23.2 |

| Devices | 734,162 | 6.0 | 810,234 | 10.4 |

| Software | 1,091,569 | 12.0 | 1,246,842 | 14.2 |

| IT Services | 1,588,121 | 5.6 | 1,731,467 | 9.0 |

| Communications Services |

1,371,787 |

2.3 | 1,423,746 | 3.8 |

| Overall IT | 5,114,771 | 7.7 | 5,617,795 | 9.8 |

Source: Gartner (January 2025)

“GenAI is sliding toward the trough of disillusionment which reflects CIOs declining expectations for GenAI, but not their spending on this technology,” said Lovelock. “For instance, the new AI ready PCs do not yet have ‘must have’ applications that utilize the hardware. While both consumers and enterprises will purchase AI-enabled PC, tablets and mobile phones, those purchases will not be overly influenced by the GenAI functionality.”

Spending on AI-optimized servers easily doubles spending on traditional servers in 2025, reaching $202 billion dollars.

“IT services companies and hyperscalers account for over 70% of spending in 2025,” said Lovelock. “By 2028, hyperscalers will operate $1 trillion dollars’ worth of AI optimized servers, but not within their traditional business model or IaaS Market. Hyperscalers are pivoting to be part of the oligopoly AI model market.”

Gartner’s IT spending forecast methodology relies heavily on rigorous analysis of the sales by over a thousand vendors across the entire range of IT products and services. Gartner uses primary research techniques, complemented by secondary research sources, to build a comprehensive database of market size data on which to base its forecast.

More information on the forecast can be found in the complimentary Gartner webinar “IT Spending Forecast, 4Q24 Update: GenAI’s Impact on a $7 Trillion IT Market.”

………………………………………………………………………………………………………….

Gartner’s 2025 forecast for IT spending is consistent with the market research firm’s predictions from late last year that the move to AI is driving a surge in spending on data center infrastructure and IT services in Europe. IT spending across the continent will come in at US$1.28 trillion in 2025 they said. Presumably it takes a little longer to gather up the data necessary for predictions across the whole world.

……………………………………………………………………………………………………

Separately, Citi analysts expect 2025 growth to be largely driven by continued AI spending as data center capital expenditure for the biggest cloud service providers is forecasted to increase by 40% this year.

……………………………………………………………………………………………………

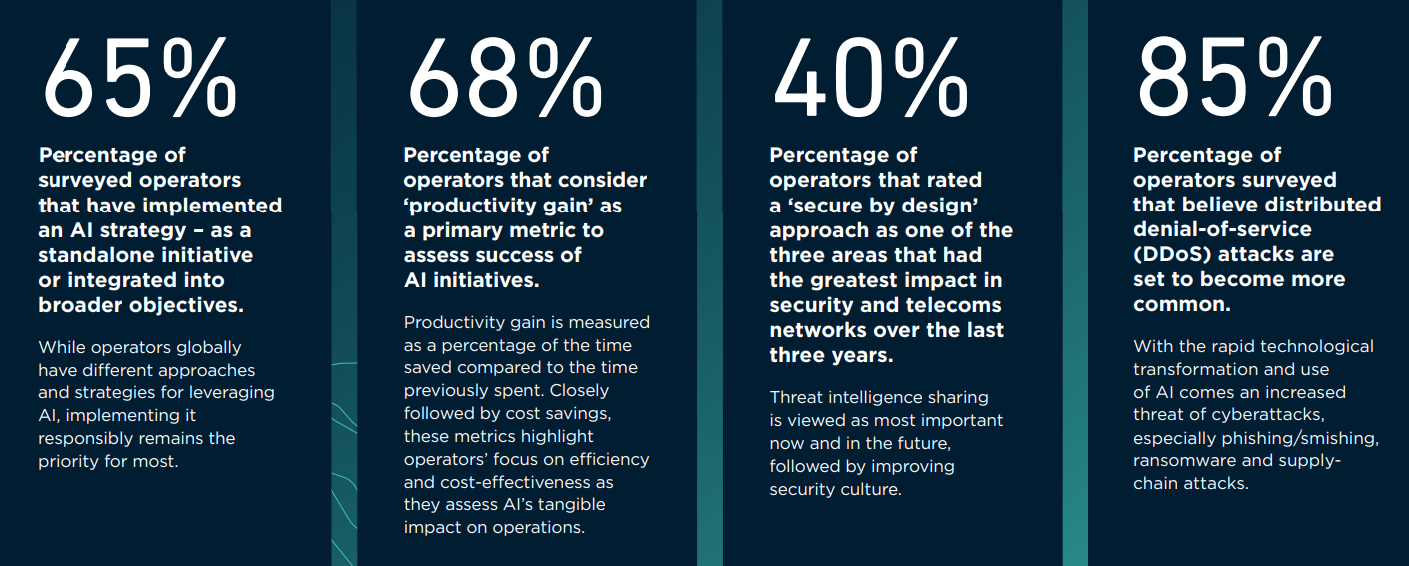

In a recent survey of network operators, GSMA found that telcos are allocating more resources to in-house and out-of-house AIs capabilities and projects, but only a subset are spending more than 15% of their digital budgets on AI. Nearly half of operators are dedicating 5% to 15% of their digital budgets towards AI, covering a range of categories, including data systems, large language models and infrastructure upgrades, the GSMA survey found. That AI money is also being allocated toward AI teams, tools and partnerships, said GSMA. The association, which primarily represents mobile operators, has been asked for more details about the size, scope and methodology of its latest study.

AI Status at Network Operators:

References:

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Canalys & Gartner: AI investments drive growth in cloud infrastructure spending

AI Echo Chamber: “Upstream AI” companies huge spending fuels profit growth for “Downstream AI” firms

AI wave stimulates big tech spending and strong profits, but for how long?

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Rakuten Mobile partners with NTIA for commercial deployment of Open Radio Units in the U.S.

Rakuten Mobile today announced it will support the commercial deployment of open radio units (RUs) developed by U.S.-based vendors, as part of the National Telecommunications and Information Administration’s (NTIA) project to advance Open RAN development with funding by the Public Wireless Supply Chain Innovation Fund.

Rakuten Mobile has already built a nationwide mobile network based on Open RAN (O-RAN Alliance) specs in Japan. Leveraging this expertise, the company will collaborate with RU vendors selected by NTIA’s project, including Battelle Memorial Institute, Microelectronics Technology, Eridan Communications and Airspan Networks.

Rakuten Mobile will assist these vendors in the verification and integration processes required for the commercial deployment of their open RUs and support proof-of-concept trials in commercial networks. These trials will utilize Rakuten Symphony’s Open RAN-compatible distributed units (DUs) and centralized units (CUs).

The Public Wireless Supply Chain Innovation Fund aims to support the development of Open RAN, promote competition in the wireless market and strengthen the global supply chain. Each RU vendor will work toward the development and commercial deployment of RUs that comply with international standards, including those defined by the 3rd Generation Partnership Project (3GPP), a global body that develops technical standards for mobile telecommunications, and the O-RAN specifications established by the O-RAN Alliance, a worldwide community promoting the development of Open RAN specifications.

……………………………………………………………………………………………………………………….

Rakuten Mobile’s Benefits:

Despite huge losses, Rakuten CEO Hiroshi Mikitani said the benefits of the mobile business to Rakuten’s ecosystem are “huge.” Users on the Rakuten mobile network spend almost 50% more on Rakuten’s online shopping mall, with benefits spilling over into its credit card, travel, banking and brokerage operations, the 59-year-old CEO said. The amount of exclusive data Rakuten gathers from its users is “extremely powerful,” Mikitani said in an interview with Bloomberg TV. “We have no intent to compete against OpenAI or Google. But we will actively build a more vertically integrated, specialized AI.”

It’s been a costly gamble, however. The mobile business has stretched the company’s balance sheet, prompting the online retailer to sell a roughly 15% stake in its profit-churning credit card arm to Mizuho Financial Group Inc. It’s also raised funds by taking its banking business public in 2023.

References:

https://corp.mobile.rakuten.co.jp/english/news/press/2025/0120_01/

Biden-Harris Administration Awards $273 Million For Wireless Innovation (December 13, 2024)

Biden-Harris Administration Awards $117 Million For Wireless Innovation (January 10, 2025)

India’s Data Transmission Capacity to Quadruple in 2025 via New Submarine Cables

India’s data transmission capacity is projected to increase fourfold by 2025 with the activation of new submarine cable systems connecting the country to key global markets, said TRAI Chairman Anil Kumar Lahoti at the Digicom Summit. Currently, India hosts 17 international subsea cables across 17 landing stations.

“As of the end of 2023, the total lit capacity and activity and activated capacity of these cables stood at 180 TBPS (terabit per second) and 132 TBPS, respectively. Multiple next-generation systems are due to become operational in 2025, replacing ageing cables. Once the new systems are fully operational, India’s data transmission capacity is projected to quadruple with additional crucial routes,” Lahoti said.

Lahoti highlighted the telecom sector’s role in driving India’s digital economy, which contributes 12% to GDP and is expected to reach 20% by 2026-27. The telecom user base in India has expanded to approximately 1.2 billion users, with 944 million having broadband access.

“Since the current growth rate of the digital economy is 2.8 times the GDP growth rate. Accordingly, the government aims for a USD 1 trillion digital economy by 2027-28. The Indian telecom sector, which is the backbone of a digital economy, has witnessed significant development in recent years, setting the stage for a transformative era given unprecedented data consumption, a vast user base, and a policy-type friendly environment. India continues to foster industry growth and digital connectivity,” Lahoti said.

“One of the hallmarks is achieving over 100 times growth in rural broadband subscriptions in the last decade. In license service areas such as Assam, Bihar, Himachal Pradesh, Odisha and Uttar Pradesh East, the aggregate count of rural broadband connections is significantly higher than the aggregate count of urban broadband connections,” he added.

India’s telecom user base has expanded to 1.2 billion, including 944 million broadband subscribers. Rural broadband subscriptions have surged 100-fold over the past decade, outpacing urban growth in states such as Assam, Bihar, and Uttar Pradesh East.

Lahoti also reportedly acknowledged the effort of telecom operators in providing 4G coverage across 97% of the villages and 5G connectivity in over 99 per cent of districts in the country. The upgraded submarine cable network is expected to further strengthen India’s global connectivity and drive the next phase of its digital transformation.

References:

India’s Data Transmission Capacity to Quadruple in 2025 with New Submarine Cables: Report

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

India Mobile Congress 2024 dominated by AI with over 750 use cases

Reliance Jio vs Starlink: administrative process or auction for satellite broadband services in India?

Challengers & Leaders in Gartner’s Magic Quadrant for 4G and 5G Private Mobile Network Services?

Here’s the chart from the Gartner report:

This author is astonished and perplexed that Gartner lumped service providers, network equipment makers and systems integrators into the same set of leaders and challengers. That’s like comparing apples to oranges to pineapples?

Steve Saunders strongly criticized the report, noting that “Five companies lead the private 5G network (equipment/software) market: Ericsson, Huawei, Nokia, Samsung, and ZTE. Challengers include Cisco, IBM, Juniper, and Mavenir (though none of them make their own 5G chips or have the same level of 5G juju as the 5G Big 5). Gartner’s new Magic Quadrant omits six (!) of these vendors, including Huawei, whose technology underlies literally hundreds of private 5G networks.”

…………………………………………………………………………………………………………………………….

Inclusion and Exclusion Criteria:

-

At least 20 direct, deployed commercial contracts or 20 direct, deployed commercial sites (excluding POCs) for 4G and 5G private mobile network services managed by the vendor, where it is the prime contractor with the enterprise (end user)

-

At least 25% of commercial contracts (excluding POCs) for 4G and 5G private mobile

-

Commercial contracts in two or more regions where the vendor is the prime contractor, (excluding POCs) for 4G and 5G private mobile network services provided by the vendor. Regions are defined as follows:

-

North America

-

Latin America

-

Western Europe

-

Eastern Europe

-

Eurasia

-

Greater China

-

Emerging Asia/Pacific

-

Mature Asia/Pacific

-

Middle East and North Africa

-

Sub-Saharan Africa

-

Other

-

-

At least two or more commercial contracts won where the vendor is the prime contractor, (excluding POCs) for 4G and 5G private mobile network services managed by the vendor in the last 12 months

-

Provide the following capabilities defined in this Magic Quadrant as prime contractor or through a third party:

-

Network end-to-end sourcing

-

Network design

-

Implementation and integration

-

Service management and support

-

……………………………………………………………………………………………..

-

Scope of the offering, and planned or ongoing investments in the following segments in terms of capabilities covered in this Magic Quadrant and specific offerings per segment, preintegrated functions with ecosystem partners, productized versus project-based offering for each segment, and geographical availability of each of the offerings (global/regional/local):

-

Dedicated/stand-alone

-

Hybrid PMN

-

PMN with core network slicing

-

Campus and level of integration with WLAN solutions

-

PMN for industrial sites including OT security capabilities and compliance

-

Multisite, including management capabilities to provide a centralized life cycle management experience for all included sites

-

PMN offering for small and midsize businesses

-

-

PMN-related acquisitions or strategic partnerships to add capabilities to the PMN offering

-

Radio planning and site survey capabilities

-

Modularity of the offer

-

Flexibility to offer an open partner ecosystem for core PMN elements (radio, core network, monitoring and life cycle management, edge/cloud computing infrastructure stack, SIM management)

-

Public network integration (private/public handover features)

-

Service management options (self-service, co-managed, fully managed service)

-

API capabilities

-

Bundling capabilities with other related prepackaged technologies and services such as IoT, MEC, managed mobility, cloud, security, industry-edge application

-

The design, logic and execution of the vendor’s business proposition to achieve continued success

-

The value proposition, revenue models, customer segmentation, distribution channels, etc.

-

Appropriate use of build/buy/partner options to maximize profitability

-

Management of customization costs

-

Use of automation to improve cost-efficiency

-

Scope of the spectrum offered: regulated and industrial spectrum (CBRS type)

-

Proof of concept models

-

Flexibility offering capex and opex models

-

Flexibility to bring your own partners

References:

https://www.gartner.com/doc/reprints?id=1-2J9ZQDL4&ct=241105&st=sb

https://www.fierce-network.com/wireless/op-ed-gartner-biffs-its-new-4g5g-magic-quadrant

https://www.cisco.com/c/en/us/solutions/private-5g-networks.html

https://www.celona.io/the-state-of-private-wireless

SNS Telecom & IT: Private 5G and 4G LTE cellular networks for the global defense sector is a $1.5B opportunity

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

Highlights of GSA report on Private Mobile Network Market – 3Q2024

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

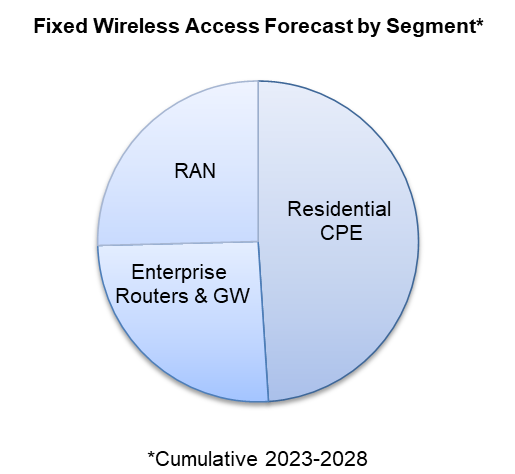

According to Dell’Oro Group, Fixed Wireless Access (FWA) has surged in recent years to support both residential and enterprise connectivity due to its ease of deployment along with the more widespread availability of 4G LTE and 5G Sub-6GHz networks. Preliminary findings suggest total FWA revenues, including RAN equipment, residential CPE, and enterprise router and gateway revenue remain on track to advance 7% in 2024, driven largely by residential subscriber growth in North America and India, as well as growing branch office connectivity more globally.

“Initially viewed as a way to monetize under-utilized spectrum, FWA has grown to become a major tool for connecting homes and businesses with broadband,” said Jeff Heynen, Vice President with the Dell’Oro Group. “What started in the U.S. is now expanding to India, Southeast Asia, Europe, and the Middle East, as mobile operators continue to expand their 5G-based FWA offerings to both residential and enterprise customers,” added Heynen.

Additional highlights from the Fixed Wireless Access Infrastructure and CPE Advanced Research Report:

- Total FWA equipment revenue for the 2023-2027 period have been revised upward by 17 percent, reflecting continued positive subscriber growth in North America and India.

- Long-term subscriber growth is expected to occur in emerging markets in Southeast Asia and MEA, due to upgrades to existing 3G and LTE networks and a need to connect subscribers economically.

- The Satellite Broadband market will also be a key enabler of broadband connectivity in emerging markets as well as rural markets where existing infrastructure either doesn’t exist or is cost-prohibitive to deploy. Subscriber growth will generally come from LEOS-based providers including Starlink, OneWeb, and Project Kuiper.

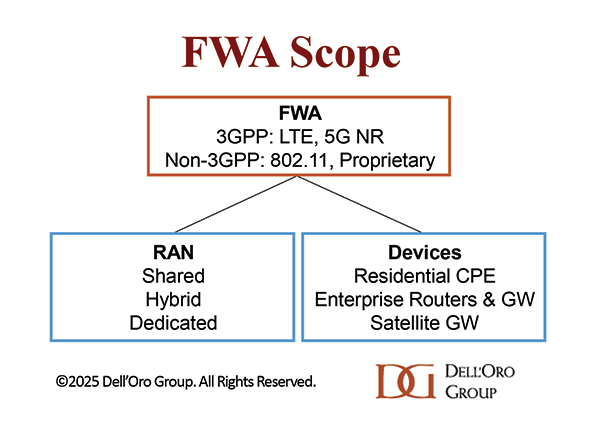

The Dell’Oro Group Fixed Wireless Access Infrastructure and CPE Report includes 5-year market forecasts for FWA CPE (Residential and Enterprise) and RAN infrastructure, segmented by technology, including 802.11/Other, 4G LTE, CBRS, 5G sub-6GHz, 5G mmWave, and 60GHz technologies. The report also includes regional subscriber forecasts for FWA and satellite broadband technologies, as well as Residential Gateway forecasts for satellite broadband deployments. To purchase this report, please contact us by email at [email protected].

In a related Dell’Oro post, Stefan Pongratz wrote that Dedicated FWA RAN < $1B:

The market opportunity for DSL and fiber replacements or alternative solutions is vast. According to the ITU and Ericsson’s Mobility Report, approximately 35% of the world’s two billion households remain underserved, lacking broadband connectivity. Beyond these unconnected households, FWA technologies can also address the needs of secondary homes and small businesses. With nearly half of 5G operators supporting 5G FWA (GSA), fixed wireless is already a mature technology, boosting both the RAN and the broadband markets.

Despite these advancements, the fundamental economics driving FWA are not expected to shift significantly in 2025. While technological improvements are expanding the TAM, the business case remains constrained by the mobile network’s capacity and the ROI of dedicated FWA RAN deployments. Operators continue refining their targets, but the existing mobile network infrastructure offers the most favorable RAN economics.

Although operators are gradually increasing their investments in dedicated RAN solutions for high-traffic areas, mobile networks are expected to maintain dominance in the near term. According to our latest FWA report, which covers the broader FWA ecosystem—including 3GPP and non-3GPP RAN and devices—dedicated FWA RAN investments are projected to stay below $1 billion in 2025.

…………………………………………………………………………………………………………………

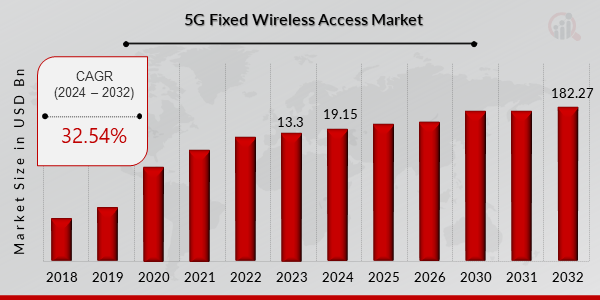

Separately, MRFR says the FWA market will be worth $182.27 Billion by 2032. Here’s a chart of 5G Fixed Wireless Access Market Growth:

FWA Growth Drivers:

Rising Demand for High-Speed Internet: With the increasing reliance on digital infrastructure and applications, there is a surging demand for high-speed and reliable internet connectivity. 5G FWA solutions offer ultra-fast broadband to underserved and remote areas, addressing connectivity gaps effectively.

Growing Adoption of IoT and Advanced Technologies: The proliferation of IoT devices and the need for seamless connectivity are driving the adoption of 5G FWA solutions. Additionally, advancements in mmWave technology enhance bandwidth efficiency, boosting market adoption.

Cost-Effective Alternative to Fiber Networks: 5G FWA provides a cost-efficient and rapid deployment option compared to traditional fiber-based internet, making it an attractive solution for internet service providers and enterprises.

References:

https://www.delloro.com/what-to-expect-from-ran-in-2025/

https://www.marketresearchfuture.com/reports/5g-fixed-wireless-access-market-7561

Latest Ericsson Mobility Report talks up 5G SA networks (?) and FWA (!)

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

WiFi 7: Backgrounder and CES 2025 Announcements

Backgrounder:

Wi-Fi 7, also known as the IEEE 802.11be-2024 [1.], is the latest generation of Wi-Fi technology, offering significantly faster speeds, increased network capacity, and lower latency compared to previous versions like Wi-Fi 6, by utilizing features like wider 320MHz channels, Multi-Link Operation (MLO), and 4K-QAM modulation across all frequency bands (2.4GHz, 5GHz, and 6GHz). Wi-Fi 7 is designed to use huge swaths of unlicensed spectrum in the 6 GHz band, first made available in Wi-Fi 6E standard, to deliver a maximum data rate of up to 46 Gbps.

Note 1. The Wi-Fi Alliance began certifying Wi-Fi 7 devices in January 2024. The IEEE approved the IEEE 802.11be standard in 2024 on September 26, 2024. The standard supports at least one mode of operation capable of supporting a maximum throughput of at least 30 Gbps, as measured at the MAC data service access point (SAP), with carrier frequency operation between 1 and 7.250 GHz, while ensuring backward compatibility and coexistence with legacy IEEE Std 802.11 compliant devices operating in the 2.4 GHz, 5 GHz, and 6 GHz bands.

………………………………………………………………………………………………………………………………………………………………………………………………..

The role of 6 GHz Wi-Fi in delivering connectivity is changing, and growing. A recent report from OpenSignal, found that smartphone users spend 77% to 88% of their screen-on time connected to Wi-Fi. Further, the latest generations of Wi-Fi (largely due to the support of 320 MHz channels and critical features like Multi-Link Operation) are increasingly more reliable and deterministic, making them viable options for advanced applications like extended reality in both the home and the enterprise.

New features:

- 320MHz channels: Double the bandwidth compared to Wi-Fi 6E.

- Multi-Link Operation (MLO): Allows devices to connect using multiple channels across different bands simultaneously.

- K-QAM modulation: Enables more data to be transmitted per signal.

1. TP-Link unveiled the Deco BE68 Whole Home Mesh Wi-Fi 7 solution, which is claims delivers speeds of up to 14 Gbps, covering 8,100 sq. ft. and supporting up to 200 connected devices. “Featuring 10G, 2.5G, and 1G ports, it ensures fast, reliable wired connections. With Deco Mesh technology, the system delivers seamless coverage and uninterrupted performance for streaming, gaming, and more,” stated the company.

TP-Link also announced an outdoor mesh system to address the increasing demand for outdoor Wi-Fi connectivity. The Deco BE65-Outdoor and Deco BE25-Outdoor nodes are equipment with weather, water and dust proof enclosures. When combined with the Deco indoor models, a cohesive and reliable indoor-outdoor mesh network that allows a user to move seamlessly between the two environments can be achieved.

2. Intel Core Ultra Series 2) are all equipped with Wi-Fi 7 capabilities integrated into the silicon, Intel has made Wi-Fi its standard choice. On its website, the company explained that a “typical” Wi-Fi 7 laptop is a potential maximum data rate of almost 5.8 Gbps. “This is 2.4X faster than the 2.4 Gbps possible with Wi-Fi 6/6E and could easily enable high quality 8K video streaming or reduce a massive 15 GB file download to roughly 25 seconds vs. the one minute it would take with the best legacy Wi-Fi technology,” Intel added.

3. ASUS New Wi-Fi 7 Router Lineup

ASUS unveiled a range of new networking products at CES 2025, including the ASUS RT-BE58 Go travel router and ASUS 5G-Go mobile router – both recipients of the CES 2025 Innovation Award – alongside the ROG Rapture GT-BE19000AI gaming router and the ZenWiFi Outdoor series for home Wi-Fi setups.

- The RT-BE58 Go – is a dual-band, Wi-Fi 7-capable mobile router supports three use cases: 4G/5G mobile tethering, public Wi-Fi hotspot (WISP), and conventional home router. It also supports VPN from up to 30 service providers and subscription-free Trend Micro security for online protection, while AiMesh compatibility allows for the router to be paired with other ASUS routers to provide wider signal coverage.

- The ROG Rapture GT-BE19000AI is the iteration of the GT-BE19000 router released last year, this time with an NPU onboard coupled with CPU and MCU. This tri-core combination enables features like ROG AI Game Booster and Adaptive QoS 2.0 to reduce network latency by up to 34% for supported games, plus 46% power savings through its AI Power Saving mode that saves power based on usage patterns. Additional features include advanced ad and tracker blocking, network insights, and RF scanning.

References:

https://standards.ieee.org/ieee/802.11be/7516/

https://en.wikipedia.org/wiki/Wi-Fi_7

https://www.mathworks.com/help/wlan/ug/overview-of-wifi-7-or-ieee-802-11-be.html

WiFi 7 and the controversy over 6 GHz unlicensed vs licensed spectrum

Telstra selects SpaceX’s Starlink to bring Satellite-to-Mobile text messaging to its customers in Australia

Australia’s Telstra currently works with Space X’s Starlink to provide low-Earth orbit (LEO) satellite home and small business Internet services. Today, the company announced it will be adding direct-to-device (D2D) text messaging services for customers in Australia. We wrote about that in this IEEE Techblog post. Telstra’s new D2D service is currently in the testing phase and not yet available commercially. Telstra forecasts it will be available from most outdoor areas on mainland Australia and Tasmania where there is a direct line of sight to the sky.

Telstra already has the largest and most reliable mobile network in Australia covering 99.7% of the Australian population over an area of 3 million square kilometres, which is more than 1 million square kilometres greater than our nearest competitor. But Australia’s landmass is vast and there will always be large areas where mobile and fixed networks do not reach, and this is where satellite technology will play a complementary role to our existing networks. As satellite technology continues to evolve to support voice, data and IoT Telsa plans to explore opportunities for the commercial launch of those new services.

Telstra previously teamed up with satellite provider Eutelsat OneWeb to deliver OneWeb low-Earth orbit (LEO) mobile backhaul to customers in Australia. The telco said the D2D text messaging service with Starlink will provide improved coverage to customers in regional and remote areas. Telstra’s mobile network covers 99.7% of the Australian population over an area of 3 million square kilometers. The company said it has invested $11.8 billion into its mobile network in Australia over the past seven years. As satellite technology advances, Telstra plans to look into voice, data and IoT services.

T-Mobile, AT&T and Verizon are all working on satellite-based text messaging services. Many D2D providers such as Starlink have promised text messaging services initially with plans to add more bandwidth-heavy applications, including voice and video, at a later date. “The first Starlink satellite direct to cell phone constellation is now complete,” SpaceX’s Elon Musk wrote on social media in December 2024. That’s good news for T-Mobile, which plans to launch a D2D service with Starlink in the near future. Verizon and AT&T and working with satellite provider AST SpaceMobile to develop their own D2D services.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

What is Satellite-to-Mobile technology?

Satellite-to-Mobile is one of the most exciting areas in the whole telco space and creates a future where outdoor connectivity for basic services, starting with text messages and, eventually, voice and low-rates of data, may be possible from some of Australia’s most remote locations. You may also hear it referred to as Direct to Handset or DTH technology.

What makes this technology so interesting is that for many people, they won’t need to buy a specific compatible phone to send an SMS over Satellite-to-Mobile, as it will take advantage of technology already inside modern smartphones.

Satellite-to-Mobile will complement our existing land-based mobile network offering basic connectivity where people have never had it before.* This technology will continue to mature and will initially support sending and receiving text messages, and in the longer term, voice and low speed data to smartphones across Australia when outdoors with a clear line of site to the sky. Just as mobile networks didn’t replace fibre networks, it’s important to realise the considerable difference between the carrying capacity of satellite versus mobile technology.

Who will benefit most from Satellite-to-Mobile technology?

Satellite-to-Mobile is most relevant to people in regional and remote areas of the country that are outside their carrier’s mobile coverage footprint.

Currently, Satellite-to-Mobile technology allows users to send a message only.

This is currently really a “just-in-case” connectivity layer that allows a person to make contact for help or let someone know they are ok when they are outside their own carrier’s mobile coverage footprint.

……………………………………………………………………………………………………………………………………………………………

References:

https://www.telstra.com.au/internet/starlink

https://www.telstra.com.au/exchange/telstra-to-bring-spacex-s-starlink-satellite-to-mobile-technolog

https://www.lightreading.com/satellite/telstra-taps-starlink-for-d2d-satellite-messaging-service

https://www.lightreading.com/satellite/amazon-d2d-offerings-are-in-development-

Telstra partners with Starlink for home phone service and LEO satellite broadband services

AT&T deal with AST SpaceMobile to provide wireless service from space

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

AST SpaceMobile achieves 4G LTE download speeds >10 Mbps during test in Hawaii

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array