Author: Alan Weissberger

BT tests 4CC Carrier Aggregation over a standalone 5G network using Nokia equipment

BT announced Monday that it has successfully tested four component-carrier (4CC) carrier aggregation on a 5G Standalone (SA) network in commercial frequencies. Using EE’s live network, BT said it and Nokia were able to combine four low-band and mid-band radio channels in and 2 GHz and 3 GHz range. BT claims to be the first operator in Europe to achieve this feat, calling this particular demonstration of advanced carrier aggregation “a major leap forward” for the evolution of 5G. Carrier aggregation is seen as the key to achieving optimal data transmission speeds for 5G.

“As we migrate to a 5G standalone core network, this technology milestone is vital to giving our customers the best experience” commented Greg McCall, Managing Director of Service Platforms at BT.

Working in collaboration with Nokia, BT’s Networks team have successfully combined four low-band and mid-band radio channels, (2.1, 2.6, 3.4, 3.6 GHz), using Nokia’s 5G Radio Access Network technology in EE’s live network spectrum.

The trial was conducted in two stages; it was first performed in BT’s Radio Lab in Bristol, and then moved outdoors, onto a radio mast at BT’s Adastral Park in Suffolk, where the team successfully achieved 4CC on 5G SA radiating in EE’s regular radio spectrum. Not only is it the first time in Europe that a network operator has achieved 4CC on 5G SA using commercial spectrum, but it is also the first time it has been achieved outside of a lab in Europe.

Most 5G networks today are Non-Standalone (“NSA”), meaning 5G is supported by existing 4G infrastructure. 5G Carrier Aggregation (“CA”) over a standalone 5G network represents a major leap forward in the evolution of 5G infrastructure, effectively combining several transmission bands into one connection. Every new carrier added allows for higher capacity and speed directly to customer devices.

Greg McCall, Managing Director Service Platforms BT, commented: “Our trial with Nokia is another demonstration of building the most advanced network for our customers. 5G Standalone, coupled with edge compute, will unlock new opportunities for customers looking to develop new services. Furthermore, this technology showcases what’s possible for devices in the future in terms of supporting carrier aggregation, which is an important part of customer experience.”

“Carrier Aggregation (CA) means combining or aggregating several carriers within or across available frequency bands – referred to as component carriers – for achieving higher data rates. Each additional component carrier increases the available bandwidth and, therefore, improves throughput. In the case of carrier aggregating Frequency-Division Duplex (FDD) and Time-Division Duplex (TDD) spectrum together, this also enables a value-adding solution that “stretches” the site coverage area that can offer those higher data rates,” said Nokia.

Mark Atkinson, SVP, Radio Access Networks PLM, Nokia, commented: “We are once again delighted to be deepening our partnership with BT, supporting them with our industry-leading Carrier Aggregation technology for this trial. Nokia and BT have a long history in investing in cutting-edge technologies and this trial is another example of what our companies can achieve together.”

Greg McCall, managing director of service platforms at BT, said the test showcases demonstrates his company’s commitment to building out the most advanced mobile network.

“5G Standalone, coupled with edge compute, will unlock new opportunities for customers looking to develop new services,” said McCall.

In May, Australian mobile operator Optus, Nokia, and Samsung Electronics Australia announced a successful test of three-component-carrier (3CC) CA technology over a 5G SA network. At the time, Nokia noted its commitment to prioritize the development of 5G carrier aggregation across the sub-6 GHz 5G spectrum. At the time, Nokia used its latest commercial AirScale Baseband and radio portfolio over Optus’ commercial network. The trial combined the FDD band (2.1 GHz) with the TDD band (2.2 GHz + 3.5 GHz) using CA technology.

References:

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

Frontier Communications reported better than expected 2nd quarter 2022 results on Friday. Operating income was $166 million and net income was $101 million for the 2nd quarter 2022. Adjusted EBITDA was $535 million, representing sequential growth of 5.1% from the first quarter of 2022, driven by the sequential increase in Consumer revenue, accelerating cost reductions, and a one-time $8 million sales tax refund. Adjusted EBITDA declined from $628 million in the second quarter of 2021 primarily due to subsidy-related revenue declines, partially offset by lower operating expenses and cost savings initiatives.

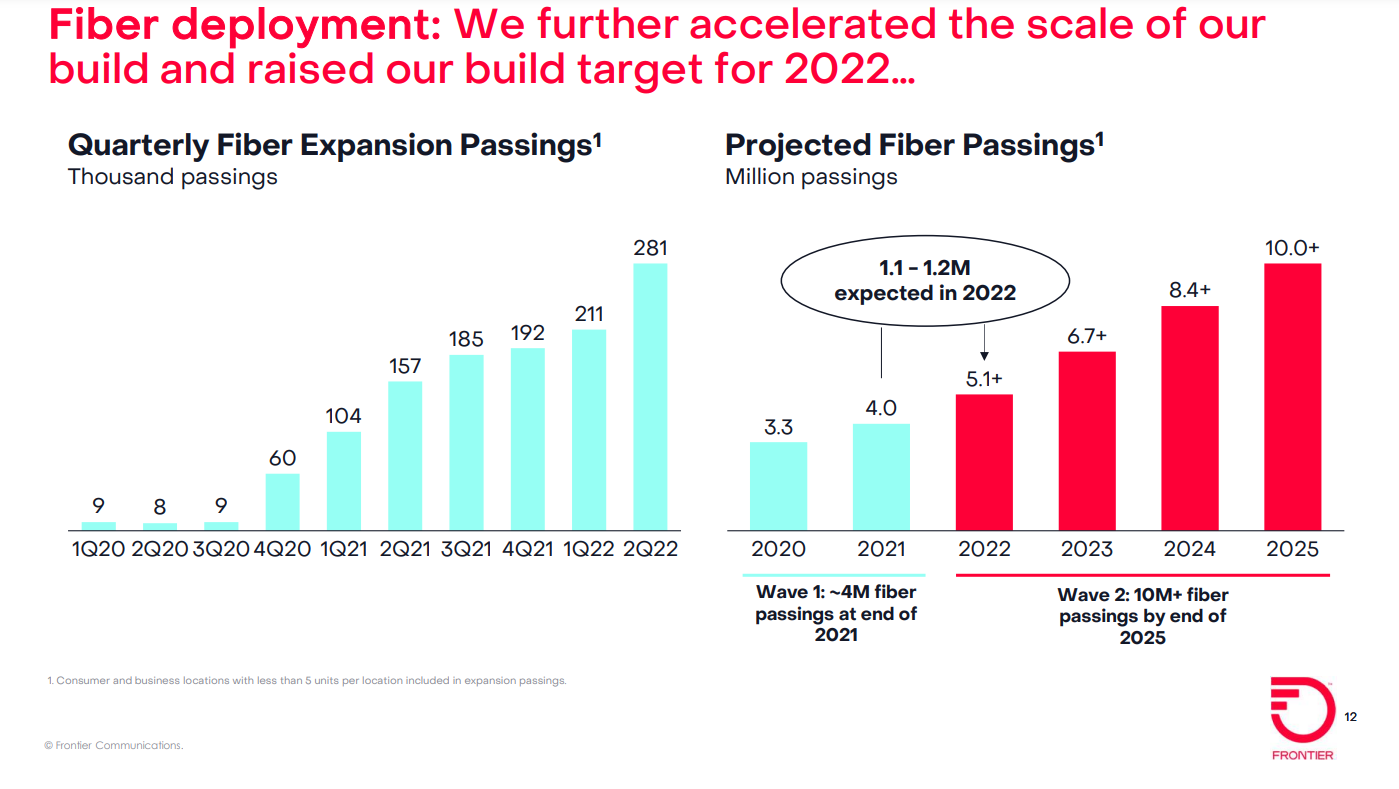

The fiber facilities based telco set another fiber network buildout record in the second quarter of 2022. Frontier also raised its fiber-to-the-premises (FTTP) buildout target for the full year to a range of 1.1 million to 1.2 million locations, up 10% to 20% from an earlier target of about 1 million locations.. Capital expenditures were $641 million, an increase from $385 million in the second quarter of 2021, as fiber expansion initiatives accelerated. Frontier’s fiber network passed 4.4 million locations (out of a total fiber footprint of 15 million locations covering parts of 25 states), a marker on the way to a grander plan to build FTTP to at least 10 million locations by 2025.

“Frontier is Building Gigabit America. We are deploying fiber and connecting people to the digital society at a record pace,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “We have the second-largest fiber build in the country and this expansion is unlocking new opportunities to meet increased consumer demand for blazing-fast fiber broadband while driving efficiencies across our business.”

Mr. Jeffery continued, “In the second quarter, we saw the impact of our operational success translate into financial growth, and we delivered sequential EBITDA growth ahead of schedule. Our team’s operational discipline over the last year has improved Frontier’s financial trajectory and positioned us as the preferred digital partner for customers across our footprint.”

Second-quarter 2022 Highlights:

- Built fiber to a record 281,000 locations

- Added 54,000 fiber broadband customer net additions, resulting in fiber broadband customer growth of 13.4% compared with the second quarter of 2021

- Revenue of $1.46 billion, net income of $101 million, and Adjusted EBITDA of $535 million

- Capital expenditures of $641 million, including $325 million of non-subsidy-related build capital expenditures

- Net cash from operations of $229 million, driven by healthy operating performance and increased focus on working capital management

- Raised $1.20 billion of debt in May, contributing to liquidity of approximately $3.70 billion

Frontier was able to accelerate its Q2 fiber buildout and expand its full 2022 target in the face of a “challenging supply chain and macroeconomic environment,” Jeffery said on the company’s Q2 earnings call on Friday August 5th. Jeffery noted that Frontier has diversified its fiber build into six additional states and plans to be building in at least 12 states by the end of the year. “This geographic diversity expands our opportunity to build fiber and provides redundancy for maintaining our build pace,” he said. Frontier is pairing that with additional contracts for both labor and equipment and realizing cost efficiencies using a blend of “cluster density” and new construction techniques – moves that are helping the company manage through both inflation and labor-related challenges, Jeffery added.

Frontier’s current FTTP buildout plan covering 10 million locations focuses on a portion of its footprint referred to as Wave 1 and Wave 2. The telco is also piecing together a plan for Wave 3 – a portion of its footprint with 5 million locations in rural areas deemed to be financially less attractive to build fiber.

However, Frontier execs said a fresh analysis indicates that between 1 million to 2 million of those Wave 3 locations can be converted to FTTP economically without government subsidies.

John Stratton, Frontier’s executive chairman, said the other 3 million to 4 million remaining locations in Wave 3 could also meet the company’s return-on-investment thresholds depending on how the distribution of some $42 billion in federal infrastructure funding pans out in the coming years. However, the overall funding plan for a Wave 3 build is still being ironed out. Frontier is also exploring other options for Wave 3, including partnerships and joint ventures.

As US cable operators and telcos struggled to gain broadband subs in Q2 2022, Frontier bucked the trend, adding 9,000 total broadband subs in the period when a loss of 41,000 legacy DSL/copper subs were included. Jeffery estimated that between 45% to 50% of all new Frontier fiber subs selected speeds of 1-Gig or more. Frontier launched a symmetrical 2-Gig fiber service in February.

Copper-to-fiber migrations are part of Frontier’s subscriber total, but the “vast majority” of those additions are coming from new customers, CFO Scott Beasley said.

“I think it’s clear to see from recent results that, as we’ve always said, fiber is a superior product to cable,” Jeffery said. “And while the cable and fiber market remains competitive, it’s also worth reminding ourselves that in our specific footprint, we have 84% of that where we have one or fewer competitors today. That said, in this quarter, we gained share against every competitor in every geography we operate in.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Comments from Nick Del Deo, Senior Analyst at MoffettNathanson:

Frontier’s overall results in Q2 were solid, particularly with respect to financial metrics. On the subscriber front, Frontier continues to expand its fiber broadband base, adding 54K total fiber broadband customers (consumer and business), the same as in Q1, with a nice uptick in SMB adds (1K in Q4, 2K in Q1, and 4K in Q2). Gains came from both base markets and expansion markets. Copper losses also ticked up, but the company still added broadband customers overall, the third consecutive quarter it has done so. The company achieved this despite Q2 seasonality (primarily snowbirds in its Florida markets) and churning out nonpaying copper customers with the expiration of COVID-era requirements. Frontier is not seeing any deterioration in bad debt or customer payment trends with shifts in the macro environment.

In Q2, the cable industry posted total broadband net adds that were approximately zero, the first time this has happened since cable broadband was introduced about 25 years ago. Frontier’s telco peers reported weak results, too, with little change in fiber adds and heightened DSL losses. The management teams pegged the performance, to varying degrees, on: low gross connects stemming from low move rates; a return of seasonality that disappeared during the pandemic (e.g., college students); competition, most notably from fixed wireless (though this was not uniformly described as material); a pull-forward of some demand due to COVID over the past couple of years; and disconnects associated with government support programs rolling off. [Rightly or wrongly, market saturation has not been cited as a possible headwind.]

Frontier has banked the future of the company on broadband net adds, with a plan to upgrade a large portion of its footprint to FTTH and take share, primarily from the cable operators. The accelerating growth of Frontier’s fiber footprint offers some protection from market-wide trends, since it should mechanically gain net subscribers where it upgrades from copper to fiber. But Frontier has something else going for it, too: an ongoing transition from a company with weak management, a poorly received brand (to be generous), bad customer service, and no strategic focus to the opposite. These “softer” attributes matter.

Frontier stepped up the pace of its fiber expansion in Q2, adding 281K locations vs. 211K last quarter, and expects to reach 1.1-1.2M homes this year. While it remains early, Frontier’s expansion fiber cohort penetration rates remain encouraging; the 2020 build cohort stands at 22% at 12 months and 44% at 24 months, albeit on a small base of “golden” trials, while its larger 2021 build cohort stands at 17% at 12 months, right in the middle of its target range. While acknowledging “pockets” of expense pressure, the company remains confident in its $900-1,000 cost per location target. Management indicated that it now believes 1-2M of its 5M wave three locations, which have been set aside from an upgrade perspective, can be profitably converted to fiber without government subsidies (the 3-4M latter require support). The company did not announce specific changes to its fiber build plans with this update, but did note that some of these locations may be sprinkled in to the plans it has previously laid out. Management suggested these 1-2M locations would have a somewhat lower return profile than its wave two locations, in mid-teens rather than mid-to-high-teens. Financial results in Q2 were better than expected. Revenue was 0.8% ahead of consensus, with the effects of sustained fiber net adds and a jump in copper broadband ARPU driving the outperformance. EBITDA was 4.7% higher than consensus and was up sequentially.

References:

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

Frontier Communications and Ziply Fiber to raise funds for fiber optic network buildouts

Verizon upgrades fiber optic core network using latest 400 Gbps per port optical technology from Juniper Networks

Verizon is tripling the capacity of its fiber core network by upgrading older router equipment with new equipment, capable of utilizing the latest 400 Gbps per port optical technology. When the overhaul of the fiber core network (the superhighway Verizon uses to move customers’ data) is complete, Verizon will be able to manage 115 Tbps of data, the equivalent of almost 24 billion streaming songs, at any given moment. This upgrade will significantly increase the bandwidth needed to support wireless, home internet, enterprise, small business and FIOS customers.

In addition to providing the increased bandwidth needed for data growth over the next decade, the new equipment provided by Juniper Networks, Inc. offers many additional operational benefits:

- The equipment is half the size of the existing equipment, reducing space requirements in core facilities and driving down both power usage per GB and cost per GB to operate.

- The new equipment offers an advanced level of automation, allowing for automated interfaces with other network systems to make faster decisions and changes, improving reporting telemetry to advance analytics and real-time adjustments to address congestion or other performance improvements, and incorporating protocols like segment routing to make more intelligent routing decisions. These automations will make the Verizon network even more reliable, programmable and efficient.

- Additionally, because this new equipment is so dense with such large capacity, Verizon will be able to redesign its network architecture to spread the equipment out to additional facilities across geographies, building in an additional level of redundancy with the ability to reroute traffic onto a greater number of fiber routes when needed.

Verizon will replace its legacy 100 Gb/s packet network routers with Juniper’s latest PTX10000-series of modular routers. These use Juniper’s Express silicon that will eventually include the Express 5 platform Juniper introduced earlier this year. The Express 5 silicon can support up to 28.8 Tb/s of throughput, or the equivalent of 36, 800 Gb/s interfaces. This represents a 45% improvement in power efficiency over previous chipsets. The packet optical devices place data packets directly onto and receive them from an optical transport network. They are placed onto that network in what Juniper describes as an “optical transport envelope” that allows that data to bypass “much of the other external networking equipment needed to groom or otherwise process electrical or optical signals originating on the router.” This process reduces the chance of data corruption and allows for closer monitoring of that data.

“Our fiber network is the largely invisible foundation that is a key driving force behind providing the scalability and reliability our customers need and expect,” said Kyle Malady, Executive Vice President, President Global Networks & Technology at Verizon. “This new packet core will provide the reliability and capacity we need today, but more importantly will be able to scale to meet the forecasted future demands that will result from the incredible capabilities of our robust 5G network, the platform for 21st century innovation,” he added.

Kevin Smith, VP of planning at Verizon, said the PTX10000-series update will be replacing its legacy Juniper PTX3000 and PTX5000 routers that it deployed a decade ago. That legacy equipment tops out at 100 Gb/s throughput. “The kind of traffic that is on this network is all of our public and private traffic, global FiOS traffic, all of our wireless traffic, as well as our former XO [Communications] network. As we look ahead and we see both from an infrastructure as well as a customer perspective, a lot for 200-gig and 400-gig for both those places, and our current platform just can’t support that level of services,” Smith said. He added that Verizon expects a 10-times improvement in total throughput with the Express 5 silicon and new chassis footprint. Smith also said that the new equipment is upgradeable to support higher-performing optical protocols like 800 Gb/s and 1 Tb/s per-port optical technology. The current 400 Gb/s move can manage up to 115 Tb/s of data, which the carrier expects to meet network demands through 2032. Updating to 800 Gb/s or 1 Tb/s will increase support to 230 Tb/s of data.

Sally Bament, VP of cloud and service provider marketing at Juniper Networks, said those boxes will include the vendor’s four-slot, eight-slot, and 16-slot chassis housing Juniper’s line cards. Those boxes are more power-dense with a footprint half the size of the existing equipment. This results in each box requiring less power, which drives down power usage per gigabyte and the cost per gigabyte to operate.

Smith advised that the upgrades are just getting started and that it will take a couple of years to complete. This will involve overlaying the new equipment into the same locations as the current deployment as well as installing physically smaller options into more edge locations. That legacy equipment will continue to operate for some time after the new network is turned on as it will need to continue supporting the large number of network elements that will eventually be migrated to the new core.

References:

https://www.verizon.com/about/news/verizon-quadruples-capacity-fiber-network-core

Dell’Oro: Secure Access Service Edge (SASE) market to hit $13B by 2026; Gartner forecasts $14.7B by 2025; Omdia bullish on security

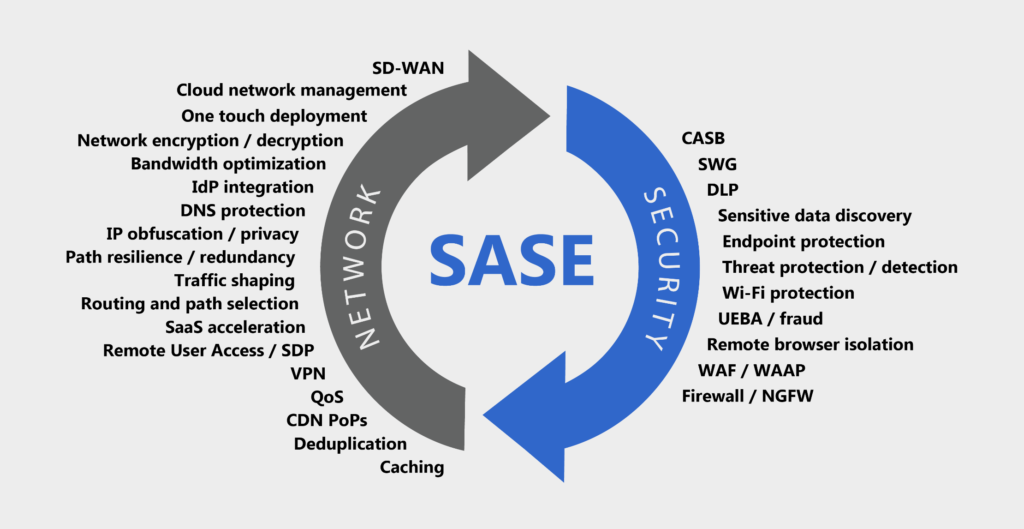

The secure access service edge (SASE) market is expected to triple by 2026, exceeding $13 billion, representing a very healthy CAGR, according to a new forecast by Mauricio Sanchez, Research Director at the Dell’Oro Group. The report further divides the total SASE market into its two technology components, Security Service Edge (SSE) and SD-WAN with SSE expected to double the SD-WAN revenue for SASE. The report further breaks down the SSE market into FWaaS, SWG, CASB, and ZTNA.

Sanchez wrote in a blog post:

“Today, enterprises are thinking differently about networking and security. Instead of considering them as separate toolsets to be deployed once and infrequently changed, the problem and solution space is conceptualized along a continuum in the emerging view. The vendor community has responded with a service-centric, cloud-based technology solution that provides network connectivity and enforces security between users, devices, and applications.

SASE utilizes centrally-controlled, Internet-based networks with built-in advanced networking and security-processing capabilities. By addressing the shortcomings of past network and security architectures and improving recent solutions—in particular, SD-WAN and cloud-based network security—SASE aims to bring networking and security into a unified service offering.

While the networking technologies underpinning SASE are understood to be synonymous with well-known SD-WAN, the security facet of SASE consists of numerous security technologies, such as secure web gateway (SWG), cloud access security broker (CASB), zero-trust network access (ZTNA), and firewall-as-a-service (FWaaS). Recently, a new term, security services edge (SSE), emerged to describe this constellation of cloud-delivered network security services that is foundational in SASE.”

As noted above, Dell’Oro divides the total SASE market into two technology components: Security Service Edge (SSE) and SD-WAN with SSE. Security features such as Firewall-as-a-Service (FWaaS), Secure Web Gateway (SWG), Cloud Access Security Broker (CASB) and Zero Trust Network Access (ZTNA) fall under the umbrella of SSE, according to Dell’Oro. In addition, Dell’Oro predicts that the security component to SASE “will increasingly be the driver and lead SASE’s SSE to exhibit over twice the growth of SASE’s SD-WAN.”

Dell’Oro’s Sanchez wrote, “We see SASE continuing to thrive independent of the ongoing macro-economic uncertainty as enterprises strategically invest for the new age of distributed applications and hybrid work that need a different approach to connectivity and security. We anticipate that security will increasingly be the driver and lead SASE’s SSE to exhibit over twice the growth of SASE’s SD-WAN.”

Additional highlights from SASE and SD-WAN 5-Year Forecast Report:

- Within SSE, Secure Web Gateway (SWG) and Cloud Access Security Broker (CASB) are expected to remain the most significant revenue components over the five-year forecast horizon, but Zero Trust Network Access (ZTNA) and Firewall-as-a-Service (FaaS) are estimated to flourish at a faster rate.

- Unified SASE is expected to exceed disaggregated SASE by almost 6X.

- Enterprise access router revenue is expected to decline at over 5 percent CAGR over the forecast horizon.

Dell’Oro expects that under the umbrella of SSE, Secure Web Gateway and Cloud Access Security Broker will continue as the most significant revenue components over the five-year forecast horizon. However, Zero Trust Network Access and Firewall-as-a-Service are expected to grow at a faster rate.

Unified SASE, which Dell’Oro qualifies as the portion of the market that delivers SASE as an integrated platform, is expected to exceed disaggregated SASE by almost a factor of six over the next five years. The disaggregated type is defined as a multi-vendor or multi-product implementation with less integration than unified type. Dell’Oro also predicts that enterprise access router revenue could decline at over 5% CAGR by 2026.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Gartner has a more optimistic forecast of SASE revenue, predicting the market to reach $14.7 billion as early as 2025. “Gartner predicts that global spending on SASE will grow at a 36% CAGR between 2020 and 2025, far outpacing global spending on information security and risk management,” reported VentureBeat last month. According to Gartner, top SASE vendors include Cato Networks, Fortinet, Palo Alto Networks, Versa Networks, VMware and Zscaler.

These disparate predictions could be a result of the nascent nature of the SASE market, a convergence of networking and security services coined by Gartner in 2019. To address the varying definitions for SASE and resulting confusion on the part of enterprise customers, industry forum MEF plans to release SASE (MEF W117) standards this year. MEF started developing its SASE framework in 2020 to clarify service attributes and definitions. (See MEF adds application, security updates to SD-WAN standard and MEF’s Stan Hubbard on accelerating automation with APIs.)

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Omdia’s [1.]research also shows security is a major driver for SASE adoption, according to Fernando Montenegro, senior principal analyst with Omdia. “Our own research indicates that end-user organizations value secure web browsing use cases (SWG, CASB, browsing isolation) particularly as they go further into their deployments of SASE projects,” said Montenegro in an email to Light Reading.

Note 1. Omdia and Light Reading are owned by Informa in the UK

Security is critical for organizations in what Omdia calls the age of “digital dominance” and by how the “demands on security teams – both in terms of time and expertise – make the delivery of security functionality via a services model particularly attractive,” Montenegro said.

SASE services also provide “good performance characteristics” when compared to enterprises utilizing their own VPN headends, and especially when hybrid work continues to be popular, added Montenegro.

References:

Total SASE Market to Nearly Triple by 2026, According to Dell’Oro Group

https://start.paloaltonetworks.com/gartner-2022-report-roadmap-for-sase-convergence.html

Bharti Airtel to launch 5G services in India this August; Reliance Jio to follow

After numerous delays, India’s government finally completed its 5G spectrum auction on its seventh day. 5G spectrum worth 1.5 trillion Indian rupees (US $18.99 billion) being sold to the country’s three mobile network operators – Reliance Jio, Bharti Airtel, Vodafone Idea – and Adani Group, with Jio emerging as the top bidder, according to media reports.

Bharti Airtel has announced that it has awarded its first 5G contract in the country to Ericsson with 5G deployment to get underway in August 2022. Ericsson is Airtel’s long-standing connectivity partner and pan-India managed services provider, with a partnership spanning more than 25 years. The latest 5G partnership follows the close of 5G spectrum auctions in India. In a statement, Airtel said that it will deploy power-efficient 5G Radio Access Network (RAN) products and solutions from the Ericsson Radio System and Ericsson microwave mobile transport solutions.

The company also signed agreements with Nokia and Samsung to build 5G capacity in India. Under the agreement, Nokia will provide equipment for AirScale portfolio, including modular and scalable baseband as well as high-capacity 5G massive MIMO radios.

Meanwhile, Ericsson will be providing 5G connectivity in 12 circles for Bharti Airtel. In addition to an enhanced user experience for Airtel customers – spanning ultra-high-speeds, low latency and large data handling capabilities – Ericsson 5G network products and solutions will also enable Bharti Airtel to pursue new, innovative use cases with its enterprise and industry customers, claimed the company.

Bharti Airtel has announced that it has acquired 19,800 MHz spectrum by securing a pan-India footprint of 3.5 GHz and 26 GHz bands. This spectrum bank was secured for a total consideration of Rs 43,084 crore in the latest spectrum auction conducted by the Department of Telecom, Government of India. Airtel acquired 19,867.8 MHz spectrum in 900 MHz, 1800 MHz, 2100MHz, 3300 MHz and 26 GHz frequency bands for Rs 43,084 crore. Airtel has secured 5G spectrum for 20 years in this auction.

Airtel CEO Gopal Vittal, MD and chief executive officer said, “As our trusted, long-term technology partner, we are delighted to award our first 5G contract to Ericsson for 5G deployment in India. “5G presents a game-changing opportunity to drive the digital transformation of industries, enterprises and the socio-economic development of India. With our 5G network, we aim to deliver the full benefits of 5G connectivity, fuel India’s journey towards a digital economy and strengthen the country’s position on the world stage.”

“5G presents a game-changing opportunity to drive the digital transformation of industries, enterprises and the socio-economic development of India. With our 5G network, we aim to deliver the full benefits of 5G connectivity, fuel India’s journey towards a digital economy and strengthen the country’s position on the world stage.”

Börje Ekholm, President and CEO, Ericsson, says: “We look forward to supporting Bharti Airtel with its deployment of 5G in India. With Ericsson’s unrivaled, global 5G deployment experience, we will help Bharti Airtel deliver the full benefits of 5G to Indian consumers and enterprises, while seamlessly evolving the Bharti network from 4G to 5G. 5G will enable India to realize its Digital India vision and foster inclusive development of the country.”

Reliance Jio may also launch 5G in August:

It is likely that arch rival Reliance Jio too may launch the 5G services this month. “We will celebrate ‘Azadi ka Amrit Mahotsav’ with a pan India 5G rollout. Jio is committed to offering world-class, affordable 5G and 5G-enabled services. We will provide services, platforms and solutions that will accelerate India’s digital revolution, especially in crucial sectors like education, healthcare, agriculture, manufacturing and e-governance,” said Akash M Ambani, Chairman, Reliance Jio Infocomm.

However, no disclosure of Jio’s 5G vendor(s) over two years after Ambani said Jio was developing its own “homegrown” 5G network equipment. The Business Standard reports that Jio had selected Samsung to build its pan-India 5G network.

References:

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

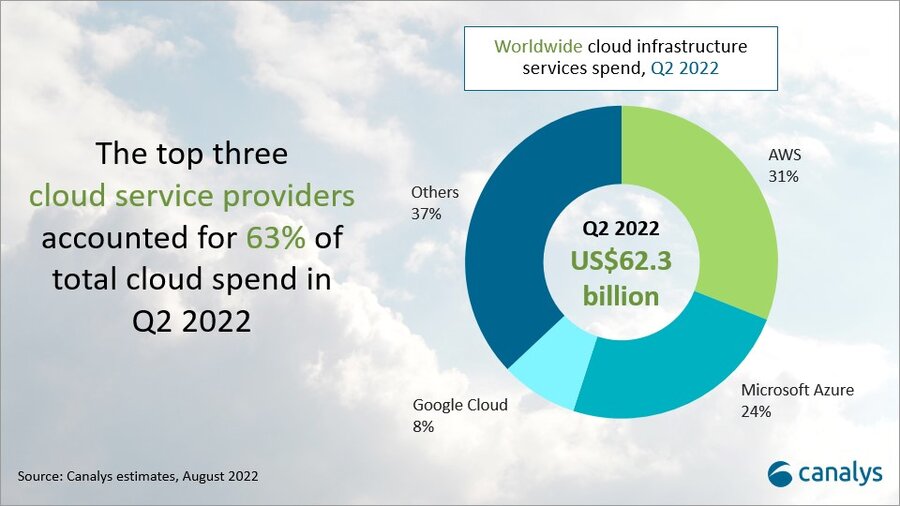

According to market research firm Canalys, cloud infrastructure services continued to be in high demand in Q2 2022. Worldwide cloud spending increased 33% year on year to US$62.3 billion, driven by a range of factors, including demand for data analytics and machine learning, data center consolidation, application migration, cloud-native development and service delivery. The growing use of industry-specific cloud applications also contributed to the broader horizontal use cases seen across IT transformation. The latest Canalys data shows expenditure was over US$6 billion more than in the previous quarter and US$15 billion more than in Q2 2021.

The top three vendors in Q2 2022, Amazon Web Services (AWS), Microsoft Azure and Google Cloud, together accounted for 63% of global spending in Q2 2022 and collectively grew 42%. The key to increasing global market share is continually growing and upgrading cloud data center infrastructure, which all big three cloud service providers are working on.

- AWS accounted for 31% of total cloud infrastructure services spend in Q2 2022, making it the leading cloud service provider. It grew 33% on an annual basis.

- Microsoft Azure was the second largest cloud service provider in Q2, with a 24% market share after growing 40% annually.

- Google Cloud grew 45% in the latest quarter and accounted for an 8% market share.

In the next year, AWS plans to launch 24 new availability zones in eight regions, and Microsoft plans to launch 10 new cloud regions. Google Cloud, which accounted for 8% of Q2 cloud spend, recently announced Latin America expansion plans.

The hyperscale battle between leader AWS and challenger Microsoft Azure continues to intensify, with Azure closing the gap on its rival. Fueling this growth, Microsoft had a record number of larger multi-year deals in both the US$100 million-plus and US$1 billion-plus segments. Microsoft also said it plans to increase the efficiency of its server and network equipment by extending the depreciable useful life from four years to six.

A diverse go-to-market ecosystem, combined with a broad portfolio and wide range of software partnerships is enabling Microsoft to stay hot on the heels of AWS in the race to be #1 in cloud services.

“Cloud remains the strong growth segment in tech,” said Canalys VP Alex Smith. “While opportunities abound for providers large and small, the interesting battle remains right at the top between AWS and Microsoft. The race to invest in infrastructure to keep pace with demand will be intense and test the nerves of the companies’ CFOs as both inflation and rising interest rates create cost headwinds.”

Both AWS and Microsoft are continuing to roll out infrastructure. AWS has plans to launch 24 availability zones across eight regions, while Microsoft plans to launch 10 new regions over the next year. In both cases, the providers are increasing investment outside of the US as they look to capture global demand and ensure they can provide low-latency and high data sovereignty solutions.

“Microsoft announced it would extend the depreciable useful life of its server and network equipment from four to six years, citing efficiency improvements in how it is using technology,” said Smith. “This will improve operating income and suggests that Microsoft will sweat its assets more, which helps investment cycles as the scale of its infrastructure continues to soar. The question will be whether customers feel any negative impact in terms of user experience in the future, as some services will inevitably run on legacy equipment.”

Beyond the capacity investments, software capabilities and partnerships will be vital to meet customers’ cloud demands, especially when considering the compute needs of highly specialized services across different verticals.

“Most companies have gone beyond the initial step of moving a portion of their workloads to the cloud and are looking at migrating key services,” said Canalys Research Analyst Yi Zhang. “The top cloud vendors are accelerating their partnerships with a variety of software companies to demonstrate a differentiated value proposition. Recently, Microsoft pointed to expanded services to migrate more Oracle workloads to Azure, which in turn are connected to databases running in Oracle Cloud.”

Canalys defines cloud infrastructure services as those that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly, but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact: Alex Smith: [email protected] OR Yi Zhang: [email protected]

References:

Barclays: Expect slower growth for cable companies Comcast and Charter; AT&T to benefit

Investors should expect slower growth ahead for cable companies Comcast and Charter Communications, according to Barclays. Analyst Kannan Venkateshwar downgraded shares of Comcast to equal weight, and shares of Spectrum parent company Charter to underweight, pointing to dwindling subscriber numbers.Barclay’s noted dwindling subscriber numbers for the two companies.

A key source of concern among cable investors is the presence of emerging competition in the market for internet services, as wireless companies push forward with fiber and fixed-wireless-access offerings. While Comcast’s and Charter’s management teams made some acknowledgment of the competitive landscape on their earnings calls, they maintained that the biggest factor driving recent performance was that people have been moving homes in smaller numbers than before.

Venkateshwar didn’t seem sold on the cable companies’ explanations. “While cable has gained share vs DSL over time and therefore lower moves would impact growth rates, it is mathematically impossible to get to negative growth as seen last quarter, purely on account of lower move activity,” he wrote. “In addition, the decline in move activity is not new and has been going on for years and tends to worsen during recessions.”

He added that even if move rates were to improve, “there are new elements that are likely to reduce cable’s share of gross adds” — namely the emerging competitive dynamics.

“Charter’s management almost seems in denial of competition in talking down its impact, but if TMUS does grow fixed wireless access (FWA) to the full extent of its guidance range (~500k+/quarter), TMUS alone would be bigger than Altice by the end of next year,” Venkateshwar continued. “It is tough to see this not impacting cable structurally when cable net adds overall have been ~3mm in normal years and TMUS and VZ alone could add 2-2.5mm FWA subs a year.”

Venkateshwar isn’t sure that FWA represents “a viable solution for telecom operators long term” given capacity requirements, but said that for the moment, T-Mobile US Inc.and Verizon Communications Inc. have “low marginal costs due to excess spectrum.”

“Consequently, even if FWA proves unviable long term, it could still be a significant headwind for cable over the next 2-3 years,” he wrote.

Additionally, with the help of government funding, more people could move from DSL over to fiber, which would benefit AT&T which has been laser focused on growing its fiber footprint.

Venkateshwar acknowledged that one criticism of his analysis may be that he isn’t giving the cable companies enough credit for growing their own footprints, but he doesn’t see much correlation between footprint expansion and broadband growth rates for Comcast, Charter, and Altice USA Inc. when looking at the past five years. Accordingly, he expects the companies could get even less marginal benefit in a world with growing competition.

“Overall, these factors imply that the largest cable companies, Comcast and Charter, are likely past peak growth and the debate therefore boils down to the degree of downside to broadband net adds going forward,” he wrote. Venkateshwar said that his analyst suggests “cable providers could be at flat growth next year and potentially negative thereafter unless their pace of footprint expansion and marginal penetration of this expanded base accelerates.”

He noted that the companies have been growing wireless subscribers, though he has questions about the long-term economic potential of their wireless involvement. As it stands, Charter and Comcast have a mobile virtual network operator (MVNO) arrangement with Verizon that allows the companies to leverage Verizon’s network.

This strategy makes sense to test out the market and launch a service, but to anchor long-term strategic pivot of the scale that cable companies are attempting on someone else’s network is not viable in our view,” he wrote. “If cable companies continue to face challenges in broadband, which we think is likely, they may have little choice but to invest in more extensive wireless infrastructure in some form to extract the benefit of scale in wireless.”

References:

India government wants “home-grown” 5G; BSNL and MTNL will emerge as healthy

The Indian government wants to promote local companies and startups for the development of 5G technology in India, said K Rajaraman, secretary, Department of Telecommunications (DoT). Rajaraman urged stakeholders to come together to ensure that the required technology stack for 5G is produced within the country.

India must “strongly promote local companies and try and test out various components; we should set up test pilots and do experiments so that we create local champions,” Rajaraman said at a telecom investor’s roundtable in Mumbai. The Telecom Department will act as a matchmaker to ensure that those who have ideas and seek investment are matched with industry players, after the necessary due diligence, said VL Kantha Rao, additional secretary (T), DoT. Calling for early-stage companies and startups to join the upcoming phase in the telecom industry, Rajaraman also urged stakeholders to share their views about what the government needs to do in terms of taking India to a global presence in the telecom sector.

“We expect that the R&D fund from USOF (Universal Service Obligation Fund) will act as a seed fund for bringing in more investment from the industry. C-DOT (Centre for Development of Telematics) has set up a collaborative platform where industry investment can be leveraged to create technology stack which can be used by industry to approach markets,” he said.

Note that over two years ago, Reliance Jio Chairman Mukesh Ambani said it had developed its own 5G solution “from scratch.” Yet none of that 5G solution has been even trialed, let alone deployed yet.

5G would enable Indian residents to get 100 Mbps speeds on the move, and that the cumulative economic impact of 5G can reach $1 trillion by 2035 in the country. Rajaraman also invited all telecom industry stakeholders to participate in the India Mobile Congress in September to demonstrate the indigenous technologies and market them to foreign investors, adding that there will be a technical session on 6G as well. The government is also looking to radically reform the existing regulatory framework for the telecom industry to encourage investments and advance planning, Telecom Minister Ashwini Vaishnaw had said on Thursday. Vaishnaw had also said that the government was working on a mechanism to provide `500 crore annual R&D support to the industry.

DoT recently floated a consultation paper seeking comments on how to reform the legal framework of telecommunications, to bring it in sync with global developments and changing technologies.

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

The Indian government said on Saturday that state-owned BSNL (Bharat Sanchar Nigam Ltd) and MTNL (Mahanagar Telephone Nigam Limited, Mumbai – a Public Sector Undertaking of the Government of India under the Ministry of Telecommunications) will emerge as healthy entities after receiving the Rs 1.64-lakh crore revival package approved by the Cabinet, while adding that reforms in the telecom sector – including having a contemporary legal set-up – will continue as the market migrates to 5G networks.

Vaishnaw said BSNL and Vodafone Idea will benefit from reforms that were handed out to the industry and thus prevent the chances of a duopoly – with Reliance Jio and Airtel being the only telco providers in India. “With the balance sheet of companies getting cleaned up after the September reforms and de-stressing of their operations, most players are now ready for new capex cycles. The banks are also willing to support investments. The industry is also confident,” Vaishnaw told media persons in Mumbai, where he met top investors and private equity players during the day.

Speaking on speculations around duopoly building up, he said the reforms have ensured that every company gets a chance to grow and become healthy. “Duopoly will not happen. Competition is maintained very clearly. The September reforms have resulted in good stability in the industry. We are looking at newer players who want to enter. We will see healthy competition in the sector.” On BSNL, the minister said that the PSU acts as a “market balancer” and will be a stable company. “Clearly, today the industry is stable, and past concerns don’t exist any more.” On the government’s decision to pick up around 33% stake in Vodafone Idea in lieu of the company’s interest liabilities over a period of four years, he said the company will still be managed as an independent entity.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

All this talk from Telecom Ministers while India has FINALLY commenced its 5G spectrum auction which is apparently going well.

References:

Reliance Jio claim: Complete 5G solution from scratch with 100% home grown technologies

European Commission DESI report reveals broadband network status is lagging

European Union member states are still lagging behind most of the world when it comes to the deployment of 5G networks. That’s one of the findings in the latest Digital Economy and Society Index (DESI), published by the European Commission. “Efforts need to be stepped up to ensure the full deployment of connectivity infrastructure (notably 5G) that is required for highly innovative services and applications,” the Commission wrote. DESI also found that businesses’ adoption of key digital technologies – such as artificial intelligence and “big data” analytics – remains worryingly low.

Mobile broadband is still mainly complementary to fixed broadband, when it comes to subscriptions for households. Europeans primarily use fixed technologies at home to access the internet (even if using a mobile device). In 2021, 13% of EU households accessed the internet only through mobile technologies.

->Finland (34% of households), Latvia (24%), Poland (23%), Romania (22%) and Bulgaria (21%) were the leaders in mobile-only access.

With respect to connectivity, Denmark has the highest score, followed by the Netherlands and Spain. Belgium and Estonia have the weakest performance on this dimension of the DESI. Coverage of Next generation access (NGA) technologies (VDSL, VDSL2 vectoring, FTTP, DOCSIS 3.0, DOCSIS 3.1) capable of delivering download speeds of at least 30 Mbps reached 90% in 2021, following a slight increase of 2.9 percentage points compared to the previous year. This mainly resulted from a 7-point growth in FTTP. VDSL coverage remained stable, while cable DOCSIS 3.0 declined slightly (by 0.8 percentage points).

Fixed very high capacity networks (VHCN) covered 70% of EU homes in 2021, up from 60% in the previous year. FTTP deployments were mainly responsible for this increase. Regarding mobile technologies, while 4G coverage of populated areas is almost universal, reaching 99.8%, 5G commercial services were launched in all but two Member States (Latvia and Portugal) by mid-2021. 5G coverage grew substantially from 14% in 2020 to 66% of populated areas in 2021.

The report further states:

“The connectivity dimension of the DESI looks at both the demand (take-up) and the supply side (coverage) of fixed and mobile broadband. Under fixed broadband, it assesses the take-up of overall, at least 100 Mbps and at least 1 Gbps broadband, the coverage of fast broadband (next generation access of at least 30 Mbps) and of fixed very high capacity networks (VHCNs) . Under mobile broadband, it includes the population coverage of 5G networks, the assignment of radio spectrum for 5G (5G spectrum indicator) as well as the take-up of mobile broadband6 . In addition, it captures the retail prices of fixed and mobile offers (price plans) and also those of converged bundles (consisting of fixed and mobile service components).

Broadband coverage of rural areas remains challenging, as 8.5% of households are not covered by any fixed network, and 32.5% are not served by any NGA technology. However, 4G is widely available also in rural areas (99.6%). On fixed technologies, there was a marked increase in the rural coverage of FTTP (from 26% in 2010 to 34% in 2021).

In the next 10 years a whole generation of new quantum technologies is likely to emerge, with far reaching impacts on many activities. The first devices, in the form of experimental physical platforms or advanced simulators, are already in use. Researchers are starting to build pilot quantum computers to act as accelerators interconnected with supercomputers, forming ‘hybrid’ machines that blend the best of quantum and classical computing technologies. Quantum computing facilitates innovation in complex fields of research (e.g., climate change, health, brain science, biology, sustainable energy, materials, etc.) and industrial development (e.g., simulation sciences, data analytics, AI, digital twins, etc.). The Digital Decade target ist that by 2025, the EU has its first computer with quantum acceleration, paving the way for the EU to be at the cutting edge of quantum capabilities by 2030.”

References:

https://digital-strategy.ec.europa.eu/en/policies/desi-connectivity

FCC launches new 5G mid-band wireless spectrum auction (FCC Auction 108)

The U.S. Federal Communications Commission (FCC) said Friday it had opened bidding in its latest mid-band spectrum auction (FCC Auction 108) to boost next generation 5G wireless services. The new round will auction about 8,000 county-based licenses in the 2.5 GHz spectrum band in mostly rural parts of the U.S. FCC Chairwoman Jessica Rosenworcel said Friday, “We all know there are gaps in 5G coverage, especially in rural America, and this auction is a unique opportunity to fill them in.”

Auction 108, which started at 10am ET on Friday, July 29, utilizes a “clock-1” auction format. This format is similar to the clock phase of past FCC auctions, but rather than offering multiple generic spectrum blocks in a category in a geographic area, it will offer only a single frequency-specific license in a category in a county.

The U.S. Congress last year approved $42.5 billion for Commerce Department grants to expand physical broadband deployment in places like rural areas without access to high-speed service. The FCC has been auctioning spectrum in recent years to help address the rising demand for wireless connectivity as the number of internet-connected devices rises sharply.

In January, AT&T Inc led bidders in the 3.45 GHz mid-band spectrum auction, winning $9.1 billion, while T-Mobile won $2.9 billion and Dish Network spent $7.3 billion. In 2021, the three largest U.S. wireless companies won $78 billion in bids in an FCC C-Band spectrum auction. Verizon Communications ultimately paid $52 billion for 3,511 licenses and to quickly clear its use, while AT&T won $23.4 billion in licenses and T-Mobile won $9.3 billion.

FCC Commissioner Brendan Carr in March said the FCC should move to expand spectrum use and consider auctioning other spectrum including looking at the “Lower 3 GHz band and several additional spectrum bands.”

In February, the FCC and National Telecommunications and Information Administration (NTIA) vowed to improve coordination on spectrum management after a 5G aviation dispute threatened flights earlier this year. The agencies said they will work cooperatively to resolve spectrum policy issues and are holding formal, regular meetings to conduct joint spectrum planning.

Addendum:

Here are the (disappointing) results of FCC Auction 108:

References:

https://www.fcc.gov/document/fcc-announces-next-5g-mid-band-spectrum-auction-start-july-29

https://www.reuters.com/technology/us-launches-new-5g-mid-band-wireless-spectrum-auction-2022-07-29/

https://www.tvtechnology.com/news/fcc-starts-5g-mid-band-spectrum-auction