Author: Alan Weissberger

Quartet launches “Open Telecom AI Platform” with multiple AI layers and domains

At Mobile World Congress 2025, Jio Platforms (JPL), AMD, Cisco, and Nokia announced the Open Telecom AI Platform, a new project designed to pioneer the use of AI across all network domains. It aims to provide a centralized intelligence layer that can integrate AI and automation into every layer of network operations.

The AI platform will be large language model (LLM) agnostic and use open APIs to optimize functionality and capabilities. By collectively harnessing agentic AI and using LLMs, domain-specific SLMs and machine learning techniques, the Telecom AI Platform is intended to enable end-to-end intelligence for network management and operations. The founding quartet of companies said that by combining shared elements, the platform provides improvements across network security and efficiency alongside a reduction in total cost of ownership. The companies each bring their specific expertise to the consortium across domains including RAN, routing, AI compute and security.

Jio Platforms will be the initial customer. The Indian telco says it will be AI-agnostic and use open APIs to optimize functionality and capabilities. It will be able to make use of agentic AI, as well as large language models (LLMs), domain-specific small language models (SLMs), and machine learning techniques.

“Think about this platform as multi-layer, multi-domain. Each of these domains, or each of these layers, will have their own agentic AI capability. By harnessing agentic AI across all telco layers, we are building a multimodal, multidomain orchestrated workflow platform that redefines efficiency, intelligence, and security for the telecom industry,” said Mathew Oommen, group CEO, Reliance Jio.

“In collaboration with AMD, Cisco, and Nokia, Jio is advancing the Open Telecom AI Platform to transform networks into self-optimising, customer-aware ecosystems. This initiative goes beyond automation – it’s about enabling AI-driven, autonomous networks that adapt in real time, enhance user experiences, and create new service and revenue opportunities across the digital ecosystem,” he added.

On top of Jio Platforms’ agentic AI workflow manager is an AI orchestrator which will work with what is deemed the best LLM. “Whichever LLM is the right LLM, this orchestrator will leverage it through an API framework,” Oomen explained. He said that Jio Platforms could have its first product set sometime this year.

Under the terms of the agreement, AMD will provide high-performance computing solutions, including EPYC CPUs, Instinct GPUs, DPUs, and adaptive computing technologies. Cisco will contribute networking, security, and AI analytics solutions, including Cisco Agile Services Networking, AI Defense, Splunk Analytics, and Data Center Networking. Nokia will bring expertise in wireless and fixed broadband, core networks, IP, and optical transport. Finally, Jio Platforms Limited (JPL) will be the platform’s lead organizer and first adopter. It will also provide global telecom operators’ initial deployment and reference model.

The Telecom AI Platform intends to share the results with other network operators (besides Jio).

“We don’t want to take a few years to create something. I will tell you a little secret, and the secret is Reliance Jio has decided to look at markets outside of India. As part of this, we will not only leverage it for Jio, we will figure out how to democratize this platform for the rest of the world. Because unlike a physical box, this is going to be a lot of virtual functions and capabilities.”

AMD represents a lower-cost alternative to Intel and Nvidia when it comes to central processing units (CPUs) and graphics processing units (GPUs), respectively. For AMD, getting into a potentially successful telco platform is a huge success. Intel, its arch-rival in CPUs, has a major lead with telecom projects (e.g. cloud RAN and OpenRAN), having invested massive amounts of money in 5G and other telecom technologies.

AMD’s participation suggests that this JPL-led group is looking for hardware that can handle AI workloads at a much lower cost then using NVIDIA GPUs.

“AMD is proud to collaborate with Jio Platforms Limited, Cisco, and Nokia to power the next generation of AI-driven telecom infrastructure,” said Lisa Su, chair and CEO, AMD. “By leveraging our broad portfolio of high-performance CPUs, GPUs, and adaptive computing solutions, service providers will be able to create more secure, efficient, and scalable networks. Together we can bring the transformational benefits of AI to both operators and users and enable innovative services that will shape the future of communications and connectivity.”

Jio will surely be keeping a close eye on the cost of rolling out this reference architecture when the time comes, and optimizing it to ensure the telco AI platform is financially viable.

“Nokia possesses trusted technology leadership in multiple domains, including RAN, core, fixed broadband, IP and optical transport. We are delighted to bring this broad expertise to the table in service of today’s important announcement,” said Pekka Lundmark, President and CEO at Nokia. “The Telecom AI Platform will help Jio to optimise and monetise their network investments through enhanced performance, security, operational efficiency, automation and greatly improved customer experience, all via the immense power of artificial intelligence. I am proud that Nokia is contributing to this work.”

Cisco chairman and CEO Chuck Robbins said: “This collaboration with Jio Platforms Limited, AMD and Nokia harnesses the expertise of industry leaders to revolutionise networks with AI.

“Cisco is proud of the role we play here with integrated solutions from across our stack including Cisco Agile Services Networking, Data Center Networking, Compute, AI Defence, and Splunk Analytics. We look forward to seeing how the Telecom AI Platform will boost efficiency, enhance security, and unlock new revenue streams for service provider customers.”

If all goes well, the Open Telecom AI Platform could offer an alternative to Nvidia’s AI infrastructure, and give telcos in lower-ARPU markets a more cost-effective means of imbuing their network operations with the power of AI.

References:

https://www.telecoms.com/ai/jio-s-new-ai-club-could-offer-a-cheaper-route-into-telco-ai

Does AI change the business case for cloud networking?

For several years now, the big cloud service providers – Amazon Web Services (AWS), Microsoft Azure, and Google Cloud – have tried to get wireless network operators to run their 5G SA core network, edge computing and various distributed applications on their cloud platforms. For example, Amazon’s AWS public cloud, Microsoft’s Azure for Operators, and Google’s Anthos for Telecom were intended to get network operators to run their core network functions into a hyperscaler cloud.

AWS had early success with Dish Network’s 5G SA core network which has all its functions running in Amazon’s cloud with fully automated network deployment and operations.

Conversely, AT&T has yet to commercially deploy its 5G SA Core network on the Microsoft Azure public cloud. Also, users on AT&T’s network have experienced difficulties accessing Microsoft 365 and Azure services. Those incidents were often traced to changes within the network’s managed environment. As a result, Microsoft has drastically reduced its early telecom ambitions.

Several pundits now say that AI will significantly strengthen the business case for cloud networking by enabling more efficient resource management, advanced predictive analytics, improved security, and automation, ultimately leading to cost savings, better performance, and faster innovation for businesses utilizing cloud infrastructure.

“AI is already a significant traffic driver, and AI traffic growth is accelerating,” wrote analyst Brian Washburn in a market research report for Omdia (owned by Informa). “As AI traffic adds to and substitutes conventional applications, conventional traffic year-over-year growth slows. Omdia forecasts that in 2026–30, global conventional (non-AI) traffic will be about 18% CAGR [compound annual growth rate].”

Omdia forecasts 2031 as “the crossover point where global AI network traffic exceeds conventional traffic.”

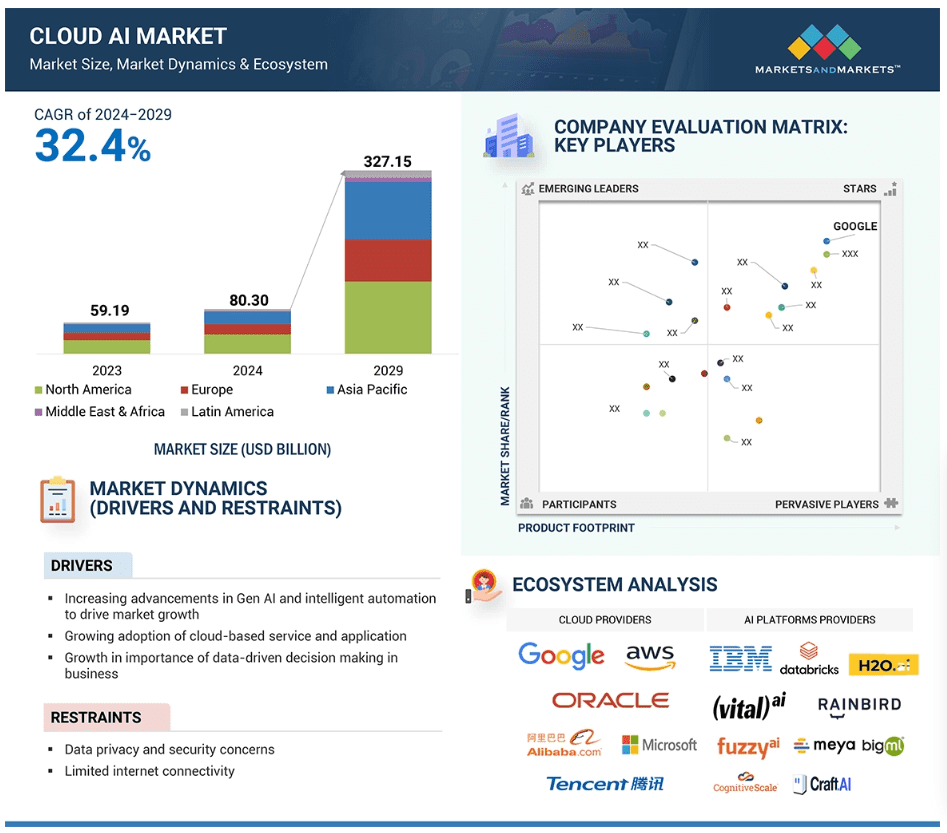

Markets & Markets forecasts the global cloud AI market (which includes cloud AI networking) will grow at a CAGR of 32.4% from 2024 to 2029.

AI is said to enhance cloud networking in these ways:

- Optimized resource allocation:

AI algorithms can analyze real-time data to dynamically adjust cloud resources like compute power and storage based on demand, minimizing unnecessary costs. - Predictive maintenance:

By analyzing network patterns, AI can identify potential issues before they occur, allowing for proactive maintenance and preventing downtime. - Enhanced security:

AI can detect and respond to cyber threats in real-time through anomaly detection and behavioral analysis, improving overall network security. - Intelligent routing:

AI can optimize network traffic flow by dynamically routing data packets to the most efficient paths, improving network performance. - Automated network management:

AI can automate routine network management tasks, freeing up IT staff to focus on more strategic initiatives.

The pitch is that AI will enable businesses to leverage the full potential of cloud networking by providing a more intelligent, adaptable, and cost-effective solution. Well, that remains to be seen. Google’s new global industry lead for telecom, Angelo Libertucci, told Light Reading:

“Now enter AI,” he continued. “With AI … I really have a power to do some amazing things, like enrich customer experiences, automate my network, feed the network data into my customer experience virtual agents. There’s a lot I can do with AI. It changes the business case that we’ve been running.”

“Before AI, the business case was maybe based on certain criteria. With AI, it changes the criteria. And it helps accelerate that move [to the cloud and to the edge],” he explained. “So, I think that work is ongoing, and with AI it’ll actually be accelerated. But we still have work to do with both the carriers and, especially, the network equipment manufacturers.”

Google Cloud last week announced several new AI-focused agreements with companies such as Amdocs, Bell Canada, Deutsche Telekom, Telus and Vodafone Italy.

As IEEE Techblog reported here last week, Deutsche Telekom is using Google Cloud’s Gemini 2.0 in Vertex AI to develop a network AI agent called RAN Guardian. That AI agent can “analyze network behavior, detect performance issues, and implement corrective actions to improve network reliability and customer experience,” according to the companies.

And, of course, there’s all the buzz over AI RAN and we plan to cover expected MWC 2025 announcements in that space next week.

https://www.lightreading.com/cloud/google-cloud-doubles-down-on-mwc

Nvidia AI-RAN survey results; AI inferencing as a reinvention of edge computing?

The case for and against AI-RAN technology using Nvidia or AMD GPUs

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Deutsche Telekom and Google Cloud partner on “RAN Guardian” AI agent

Deutsche Telekom and Google Cloud today announced a new partnership to improve Radio Access Network (RAN) operations through the development of a network AI agent. Built using Gemini 2.0 in Vertex AI from Google Cloud, the agent can analyze network behavior, detect performance issues, and implement corrective actions to improve network reliability, reduce operational costs, and enhance customer experiences.

Deutsche Telekom says that as telecom networks become increasingly complex, traditional rule-based automation falls short in addressing real-time challenges. The solution is to use Agentic AI which leverages large language models (LLMs) and advanced reasoning frameworks to create intelligent agents that can think, reason, act, and learn independently.

The RAN Guardian agent, which has been tested and verified at Deutsche Telekom, collaborates in a human-like manner, detecting network anomalies and executing self-healing actions to optimize RAN performance. It will be exhibited at next week’s Mobile World Congress (MWC) in Barcelona, Spain.

–>This cooperative initiative appears to be a first step towards building autonomous and self-healing networks.

In addition to Gemini 2.0 in Vertex AI, the RAN Guardian also uses CloudRun, BigQuery, and Firestore to help deliver:

- Autonomous RAN performance monitoring: The RAN Guardian will continuously analyze key network parameters in real time to predict and detect anomalies.

- AI-driven issue classification and routing: The agent will identify and prioritize network degradations based on multiple data sources, including network monitoring data, inventory data, performance data, and coverage data.

- Proactive network optimization: The agent will also recommend or autonomously implement corrective actions, including resource reallocation and configuration adjustments.

“By combining Deutsche Telekom’s deep telecom expertise with Google Cloud’s cutting-edge AI capabilities, we’re building the next generation of intelligent networks,” said Angelo Libertucci, Global Industry Lead, Telecommunications, Google Cloud. “This means fewer disruptions, faster speeds, and an overall enhanced mobile experience for Deutsche Telekom’s customers.”

“Traditional network management approaches are no longer sufficient to meet the demands of 5G and beyond. We are pioneering AI agents for networks, working with key partners like Google Cloud to unlock a new level of intelligence and automation in RAN operations as a step towards autonomous, self-healing networks” said Abdu Mudesir, Group CTO, Deutsche Telekom.

Mr. Mudesir and Google Cloud’s Muninder Sambi will discuss the role of AI agents in the future of network operations at MWC next week.

References:

https://www.telecoms.com/ai/deutsche-telekom-and-google-cloud-team-up-on-ai-agent-for-ran-operations

Nvidia AI-RAN survey results; AI inferencing as a reinvention of edge computing?

The case for and against AI-RAN technology using Nvidia or AMD GPUs

AI RAN Alliance selects Alex Choi as Chairman

AI sparks huge increase in U.S. energy consumption and is straining the power grid; transmission/distribution as a major problem

Ookla: Europe severely lagging in 5G SA deployments and performance

According to a new joint study from Omdia and Ookla, Europe has had the poorest 5G SA availability and performance among major regions. In Q4 2024, China (80%), India (52%), and the United States (24%) led the world in 5G SA availability based on Speedtest® sample share, markedly ahead of Europe (2%).

The European region also lagged behind its peers in performance, with the median European consumer experiencing 5G SA download speeds of 221.17 Mbps—lower than those in the Americas (384.42 Mbps) and both Developed (237.04 Mbps) and Emerging (259.73 Mbps) Asia Pacific. The interplay of earlier deployments, a more diversified multi-band spectrum strategy, and greater operator willingness to invest in the 5G core to monetize new use cases have driven rollouts at a faster pace in regions outside Europe.

The European Commission has championed measures to accelerate private investment in 5G SA, highlighting network slicing—a flagship capability of cloud-native core networks—as a key potential driver of its broader industrial strategy in sectors such as precision manufacturing, defense and clean energy. Up until this point, high-quality public data examining Europe’s progress in 5G SA—and benchmarking its competitive position relative to other global regions—has been scarce. In its latest annual report, Connect Europe, the trade body representing Europe’s telecoms operators, noted that “there is limited information available about the extent of operators’ rollout of 5G SA.”

Advanced network capabilities enabled by the technology remain stubbornly limited to just a few operators in leading markets such as the U.S., according to the study, while Europe lags behind its peers on several 5G SA performance indicators, “raising concerns about the bloc’s competitiveness in the technology.”

Network operator investment per capita also lags in Europe as per the below chart:

When faced with choices among investments in fiber, 5G RAN, and 5G SA core, the latter frequently loses out, since operators can still launch a “5G” network by leveraging alternative technologies. There is also a lack of 5G SA-compatible devices, especially devices with User Equipment Routing Selection Policy (URSP) technology, which allows a device to dynamically select a slice (or multiple slices) provisioned by an operator. However, only Android 12/iOS 17 mobile devices support that largely unknown technology.

While capital spending on the 5G core transition is now increasing rapidly, European network operators will remain committed to strict cost discipline Based on Omdia’s Q3 2024 quarterly core software market share and forecast, the research firm believes that the global core market revenue from both 4G and 5G network functions will grow with a five-year CAGR of 3.2% between 2023 and 2028. When considering the spending in 5G core software, the forecasted growth with a five-year CAGR during the same period is of 17.0%.

Omdia now forecasts that 5G SA core spending in EMEA will grow with a five-year CAGR of 26.2% between 2023 and 2028. Nonetheless, as a prerequisite, deploying the 5G core also requires a good 5G radio coverage, to avoid a degraded experience where the 5G coverage is limited or nonexistent, and where the user falls back on 4G-LTE or 2G/3G. This means operators must invest in 5G RAN, which is usually considered the highest capex draining activity for an operator. While 5G is known for very high throughput speeds using mid-band (and particularly C-band) spectrum, these bands need to be complemented by sub-GHz spectrum deployment, in order to offer improved in-building and wide area coverage. This rollout has been slow in many European markets, with 5G availability in all countries outside the Nordics remaining significantly lower than that in the United States and China, according to Ookla’s Q4 2024 Speedtest Intelligence® data.

One bright spot is that Europe has made progress on achieving low latency on its 5G networks. In Q4 2024, the average country-wide median latency in Europe was 32 milliseconds (ms) compared to 35 ms in the Americas and 36 ms in Emerging Asia Pacific region.

References:

https://www.lightreading.com/5g/eurobites-europe-behind-on-5g-sa-study

https://www.ookla.com/s/media/2025/02/ookla_omdia-5GSA_0225.pdf

Building and Operating a Cloud Native 5G SA Core Network

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

GSA 5G SA Core Network Update Report

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

Vision of 5G SA core on public cloud fails; replaced by private or hybrid cloud?

Nokia and Eolo deploy 5G SA mmWave “Cloud RAN” network

Nokia, BT Group & Qualcomm achieve enhanced 5G SA downlink speeds using 5G Carrier Aggregation with 5 Component Carriers

Broadband Forum new work areas to enable broadband services & apps

The Broadband Forum has realigned its work areas to ensure every new project and specification focuses on enabling services-led and intelligent broadband that provides the applications and services most demanded by users.

The Forum’s five work areas will cover topics including access networks, connected users and subscriber networks, network architecture, cloud and autonomous networks, and most importantly service requirements helping to direct that work. They will be supported by an advisory group providing the necessary expertise to produce high-quality YANG data models and management specifications.

The work areas and advisory group will be led by directors from Adtran, Calix, China Mobile, Deutsche Telekom, Huawei, Nokia, QA Cafe, Vantiva, and Vodafone.

Overview of the New Work Areas:

- Access Work Area – Focuses on delivering multi-vendor interoperability for last-mile broadband deployments across fiber, copper, and wireless networks.

- Connected User Work Area – Develops specifications for the deployment, management, and consumption of services by end-users.

- Network Architecture Work Area – Develops the architecture and nodal requirements for end-to-end broadband deployments across traditional and converged networks to ensure the best possible quality of experience for users.

- Provider Cloud Work Area – Develops frameworks and specifications to enable broadband services and networks to utilize cloud-based deployment approaches, including automation and autonomous systems that leverage machine learning and AI.

- Service Requirements Work Area – Defines user-centric, actionable service requirements and specifications for subscriber, access, and Broadband Service Providers’ (BSPs’) core networks.

The first official meetings of the new work areas will take place at the Broadband Forum’s Spring Meeting in Hong Kong on March 11-14, 2025.

Quotes:

“The broadband industry’s focus remains firmly on delivering a richer, more tailored broadband experience for the end-user rather than fast speeds alone,” said Broadband Forum CEO Craig Thomas. “Our new work areas reflect this, giving members from across the globe the opportunity to come together and develop the most relevant readily-adoptable broadband specifications. The intention is to simplify the organization and how our members can integrate in standards work to deliver a more effective and services driven broadband user experience. We invite companies, small and large, to join our efforts.”

Manual Paul (BBF Board President, Service Requirements Work Area Director, and Squad Lead Network Convergence at Deutsche Telekom) from his blog post about the importance of this new Work Area aligning with the Services-led focus of the Broadband Forum:

“Broadband Forum’s Service Requirements Work Area has been established to identify user needs and the technical innovation required to address them, to ultimately help BSPs deliver greater value to their customers. Aligned with the Broadband Forum’s strong focus on services-led broadband, the work area aims to guide the industry in driving innovation and adapting to evolving needs – such as a move away from the speed-first approach and place greater focus on QoE.”

At the bottom of that post, there is a link to the webinar that he led where he talks about the Service Requirements Work Area

………………………………………………………………………………………………………………….

About the Broadband Forum:

The Broadband Forum is an industry-driven global standards development organization helping operators, application providers, and vendors deliver better, services-led broadband.

As the industry-recognized center of competence, the Broadband Forum provides an accessible, efficient, and effective community where all broadband stakeholders can collaborate on, develop, and promote open standards and open software. This provides the basis for deployable solutions for the global broadband industry.

The forum publishes interoperable standards and open software, has launched certification programs, and promotes industry education. These best practices and models can be adopted to help realize an effective broadband ecosystem that drives a thriving, services-led broadband industry based on global collaboration, open standards, and open source, maximizing value for all stakeholders.

For more information, visit https://www.broadband-forum.org/

References:

2025.02.19 – Broadband Forum renews commitment to services-led broadband with new work areas

Bridging the gap between user needs and technical innovation for services-led broadband

https://broadband-forum.org/download/2025_02_18_BBF%20Service%20Requirements%20WA_webinar.pdf

https://wiki.broadband-forum.org/display/RESOURCES/Broadband+Forum+Published+Resources

Broadband Forum SDN/NFV Work Area launches four new projects at Bangkok Q4-2023 meeting

Broadband Forum and LAN Laboratory Expand Certification Program to include XGS-PON

Nvidia AI-RAN survey results; AI inferencing as a reinvention of edge computing?

An increasing focus on deploying AI into radio access networks (RANs) was among the key findings of NVIDIA’s third annual “State of AI in Telecommunications” survey of 450 telecom professionals, as more than a third of respondents indicated they’re investing or planning to invest in AI-RAN. The survey polled more than 450 telecommunications professionals worldwide, revealing continued momentum for AI adoption — including growth in generative AI use cases — and how the technology is helping optimize customer experiences and increase employee productivity. The percentage of network operators planning to use open source tools increased from 28% in 2023 to 40% in 2025. AvidThink Founder and Principal Roy Chua said one of the biggest challenges network operators will have when using open source models is vetting the outputs they get during training.

Of the telecommunications professionals surveyed, almost all stated that their company is actively deploying or assessing AI projects. Here are some top insights on impact and use cases:

- 84% said AI is helping to increase their company’s annual revenue

- 77% said AI helped reduce annual operating costs

- 60% said increased employee productivity was their biggest benefit from AI

- 44% said they’re investing in AI for customer experience optimization, which is the No. 1 area of investment for AI in telecommunications

- 40% said they’re deploying AI into their network planning and operations, including RAN

The percentage of respondents who indicated they will build AI solutions in-house rose from 27% in 2024 to 37% this year. “Telcos are really looking to do more of this work themselves,” Nvidia’s Global Head of Business Development for Telco Chris Penrose [1.] said. “They’re seeing the importance of them taking control and ownership of becoming an AI center of excellence, of doing more of the training of their own resources.”

With respect to using AI inferencing, Chris said, “”We’ve got 14 publicly announced telcos that are doing this today, and we’ve got an equally big funnel.” Penrose noted that the AI skills gap remains the biggest hurdle for operators. Why? Because, as he put it, just because someone is an AI scientist doesn’t mean they are also necessarily a generative AI or agentic AI scientist specifically. And in order to attract the right talent, operators need to demonstrate that they have the infrastructure that will allow top-tier employees to do amazing work. See also: GPUs, data center infrastructure, etc.

Note 1. Penrose represented AT&T’s IoT business for years at various industry trade shows and events before leaving the company in 2020.

Rather than the large data centers processing AI Large Language Models (LLMs), AI inferencing could be done more quickly at smaller “edge” facilities that are closer to end users. That’s where telecom operators might step in. “Telcos are in a unique position,” Penrose told Light Reading. He explained that many countries want to ensure that their AI data and operations remain inside the boundaries of that country. Thus, telcos can be “the trusted providers of [AI] infrastructure in their nations.”

“We’ll call it AI RAN-ready infrastructure. You can make money on it today. You can use it for your own operations. You can use it to go drive some services into the market. … Ultimately your network itself becomes a key anchor workload,” Penrose said.

Source: Skorzewiak/Alamy Stock Photo

Nvidia proposes that network operators can not only run their own AI workloads on Nvidia GPUs, they can also sell those inferencing services to third parties and make a profit by doing so. “We’ve got lots of indications that many [telcos] are having success, and have not only deployed their first [AI compute] clusters, but are making reinvestments to deploy additional compute in their markets,” Penrose added.

Nvidia specifically pointed to AI inferencing announcements by Singtel, Swisscom, Telenor, Indosat and SoftBank.

Other vendors are hoping for similar sales. “I think this vision of edge computing becoming AI inferencing at the end of the network is massive for us,” HPE boss Antonio Neri said last year, in discussing HPE’s $14 billion bid for Juniper Networks.

That comes after multi-access edge computing (MEC) has not lived up to its potential, partially because a 5G SA core network is needed for that and few have been commercially deployed. Edge computing disillusionment is clear among hyperscalers and also network operators. For example, Cox folded its edge computing business into its private networks operation. AT&T no longer discusses the edge computing locations it was building with Microsoft and Google. And Verizon has admitted to edge computing “miscalculations.”

Will AI inferencing be the savior for MEC? The jury is out on that topic. However, Nvidia said that 40% of its revenues already come from AI inferencing. Presumably that inferencing is happening in larger data centers and then delivered to nearby users. Meaning, a significant amount of inferencing is being done today without additional facilities, distributed at a network’s edge, that could enable speedier, low-latency AI services.

“The idea that AI inferencing is going to be all about low-latency connections, and hence stuff like AI RAN and and MEC and assorted other edge computing concepts, doesn’t seem to be a really good fit with the current main direction of AI applications and models,” argued Disruptive Wireless analyst Dean Bubley in a Linked In post.

References:

https://blogs.nvidia.com/blog/ai-telcos-survey-2025/

State of AI in Telecommunications

https://www.fierce-network.com/premium/whitepaper/edge-computing-powered-global-ai-inference

https://www.fierce-network.com/cloud/are-ai-services-telcos-magic-revenue-bullet

The case for and against AI-RAN technology using Nvidia or AMD GPUs

Ericsson’s sales rose for the first time in 8 quarters; mobile networks need an AI boost

AI RAN Alliance selects Alex Choi as Chairman

Markets and Markets: Global AI in Networks market worth $10.9 billion in 2024; projected to reach $46.8 billion by 2029

AI sparks huge increase in U.S. energy consumption and is straining the power grid; transmission/distribution as a major problem

Tata Consultancy Services: Critical role of Gen AI in 5G; 5G private networks and enterprise use cases

Omdia: Huawei increases global RAN market share due to China hegemony

Due to China’s enormous mobile network market (where foreign vendors are mostly shut out), Huawei remained the world’s largest vendor of radio access network (RAN) equipment – a market worth about $35 billion last year – according to Omdia (an Informa owned company). In 2023, the Chinese behemoth had a 31.3% share of the global RAN market. Omdia says Huawei’s market share was up by an unspecified amount in 2024, due to “a more favorable regional mix as well as market share gains in emerging markets,” according to Remy Pascal, principal analyst at Omdia.

Huawei recently reported a 22% increase in sales last year, to 860 billion Chinese yuan (US$ 118.6 billion), and it looks in better shape than its ailing western rivals. Its share of the global 5G networks market appears to have grown, according to the market research firm.

Omdia’s findings seems further to highlight the futility of U.S. sanctions against Huawei, originally imposed by Donald Trump in his first term as U.S. President and then expanded by President Joe Biden.

Image Credit: Huawei

China still lacks the ability to make the most advanced chips featuring the tiniest transistors. But technical workarounds or loopholes in trade rules have enabled Huawei to revive its smartphone business and remain competitive in networks. Late last year, telco executives who spoke on condition of anonymity said there had been no discernible impact on the quality of its products. And Ericsson continues to regard Huawei as its chief rival.

……………………………………………………………………………………………………………………………………….

“After two years of significant acceleration and exceptionally high investment in 2021 and 2022, and two years of steep decline in 2023 and 2024, Omdia expects 2025 to be a year of stabilization for the RAN market,” said Remy Pascal of Omdia. “Different regions will follow different trajectories, but at a global level, the market is expected to be flattish. North America has returned to growth in 2024 and we expect this to continue, we also expect a positive trajectory in some emerging markets.”

……………………………………………………………………………………………………………………………..

Other results and forecasts from Omdia:

- The total global RAN market (which includes hardware and software but not services) was just over $35 billion last year, which represented a 12 percent decline on the previous year.

- There was a very slight drop in the aggregate market share of the top five RAN equipment vendors – Huawei, Ericsson, Nokia, ZTE and Samsung. In 2023, Omdia had that figure at about 95%. In 2024, it was roughly 94%.

- Ericsson was one of the main gainers last year thanks to its huge AT&T (non) OpenRAN contract.

- As a result, Nokia lost market share in the U.S., but claims that its global RAN footprint grew by 18,000 sites in 2024.

- Tejas Networks, an Indian RAN equipment vendor (not in the top five) that landed a large 4G contract with state-owned BSNL was another winner.

- Global RAN revenue will be “essentially flat” this year and marked by “low single digit percentage growth” outside China.

- A “positive trajectory” in emerging Asian markets as well as Africa, the Middle East and Latin America is forecast. Europe risks falling behind other parts of the world in mobile network markets.

Top RAN vendors, full year 2024 RAN revenue:

|

Global |

Global ex-China |

|---|---|

|

Huawei |

Ericsson |

|

Ericsson |

Nokia |

|

Nokia |

Huawei |

|

ZTE |

Samsung |

|

Samsung |

ZTE |

Top RAN vendors, full year 2024 RAN revenue, top 3 by region:

|

North America |

Asia & Oceania |

Europe |

Middle East and Africa |

Latin America & the Caribbean |

|---|---|---|---|---|

|

Ericsson |

Huawei |

Ericsson |

Huawei |

Huawei |

|

Nokia |

ZTE |

Nokia |

Nokia |

Ericsson |

|

Samsung |

Ericsson |

Huawei |

Ericsson |

……………………………………………………………………………………………………………………………………….

Dell’Oro Group’s most recent RAN report a few weeks ago stated that the global RAN market is expected to improve slightly over the short term, but the long-term outlook remains subdued. “The underlying message we have communicated for some time has not changed,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “Regional imbalances will impact the market dynamics over the short term while the long-term trajectory remains flat. This is predicated on the assumption that new RAN revenue streams from private wireless and FWA, taken together with MBB-based capacity growth, are not enough to offset slower MBB coverage-based capex,” said Dell’Oro’s Stefan Pongratz.

References:

https://www.lightreading.com/5g/huawei-defies-us-to-grow-market-share-as-ran-decline-ends-omdia

RAN Equipment Market to Remain Uninspiring, According to Dell’Oro Group

Network equipment vendors increase R&D; shift focus as 0% RAN market growth forecast for next 5 years!

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

vRAN market disappoints – just like OpenRAN and mobile 5G

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

ITU-R WP 5D reports on: IMT-2030 (“6G”) Minimum Technology Performance Requirements; Evaluation Criteria & Methodology

Introduction:

Recommendation ITU R M.2160 ‒ “Framework and overall objectives of the future development of IMT for 2030 and Beyond” identifies IMT-2030 capabilities which aim to make IMT-2030 (6G) more capable, flexible, reliable and secure than previous IMT systems when providing diverse and novel services in the intended six usage scenarios, including immersive communication, hyper reliable and low latency communication (HRLLC), massive communication, ubiquitous connectivity, artificial intelligence and communication, and integrated sensing and communication (ISAC).

IMT-2030 can be considered from multiple perspectives, including users, manufacturers, application developers, network operators, verticals, and service and content providers. Therefore, it is recognized that technologies for IMT-2030 can be applied in a variety of deployment scenarios and can support a range of environments, service capabilities, and technology options.

IMT-2030 is also expected to be built on overarching aspects which act as design principles commonly applicable to all usage scenarios. These distinguishing design principles of the IMT‑2030 are including, but are not limited to sustainability, security and resilience, connecting the unconnected for providing universal and affordable access to all users independent of the location, and ubiquitous intelligence for improving overall system performance.

ITU-R WP 5D February 2025 Meeting Highlights:

1. At its ITU-R WP5D February 2025 meeting, a large number of ITU-R WP 5D contributions were discussed on the development of a draft report titled, “Minimum technical performance requirements (TPRs) for IMT‑2030 (“6G”) radio interface(s) [IMT-2030.TECH PERF REQ].” That work is being done in the Technology Aspects WG along with all other IMT-2030 projects.

This Report describes key requirements related to the minimum technical performance of IMT-2030 candidate radio interface technologies. It also provides the necessary background information about the individual requirements and the justification for the items and values chosen. Provision of such background information is needed for a broader understanding of the requirements. After discussion of the contributions, a preliminary list of minimum TPRs is created, and the working document is updated. In total eleven sessions were used including three Drafting Groups to address requirements related to artificial intelligence, energy efficiency and joint requirements. This Report is based on the ongoing development activities of external research and technology organizations.

IMT 2030 performance requirements are to be evaluated according to the criteria defined in Report ITU-R M.[IMT‑2030.EVAL] and Report ITU-R M.[IMT-2030.SUBMISSION] for the development of IMT-2030 recommendations.

2. This WP5D meeting also discussed contributions on “Evaluation criteria and methodology for IMT-2030″ [IMT-2030.EVAL] and updated the working document. The discussion focused on a number of subjects including test environments, mapping between TPR and test environments, and a high-level view of TPR evaluation methodologies.

3. WP5D SWG Coordination started the work of revision of the Document IMT-2030/2 – Submission, evaluation process and consensus building, in order to incorporate decisions to be made on criterial related to test environments and other subjects.

4. At its next meeting (July 2025 in Japan), WP5D Technology Aspects WG will:

- continue working on revision of IMT-2030/2 “Process” – submission, evaluation process and consensus building process for IMT-2030;

- start to work on candidate technology submission template for IMT-2030;

- continue working on ITU-R M.[IMT-2030.TECH PERF REQ] – minimum requirements related to technical performance for IMT-2030 radio interface(s);

- continue working on M.[IMT-2030.EVAL] – Guidelines for evaluation of radio interface technologies for IMT-2030;

……………………………………………………………………………………………………………………….

During 3GPP Technical Specification Group RAN’s meeting RAN#106, in Madrid on December 12th, an important 6G study item was approved. The study represents a significant milestone in 3GPP’s interactions with ITU on 6G technical performance requirements (TPRs) as future, deployment scenarios, requirements and potential directions of 6G radio access technologies are further identified and investigated in 3GPP. The 3GPP study item (Details in RP-243327) aims to investigate a candidate set of items for minimum TPRs based on the Recommendation ITU-R M.2160 and, where applicable, the associated target values and key assumptions for the identified minimum TPRs.

The outcome is expected to be shared by Liaison Statement with ITU-R WP5D and used as a baseline for the subsequent 6G study in RAN.

Expected Output and Time scale: A 38 series Technical Report ‘Study on 6G Scenarios and requirements’ scheduled for RAN#112 in June, 2026.

…………………………………………………………………………………………………………………

References:

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

ITU-R WP5D invites IMT-2030 RIT/SRIT contributions

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

https://www.3gpp.org/news-events/3gpp-news/ran-6g-study1

Ericsson and e& (UAE) sign MoU for 6G collaboration vs ITU-R IMT-2030 framework

Cisco CEO sees great potential in AI data center connectivity, silicon, optics, and optical systems

It’s no surprise to IEEE Techblog readers that Cisco’s networking business – still its biggest unit, generating nearly half its total sales – reported <$6.9 billion in revenue for the three-month period ending in January (Cisco’s second fiscal quarter). That was down 3% compared with the same quarter the year before. For its first half year, networking sales dropped 14% year-over-year, to about $13.6 billion.

However, total second-quarter revenues grew 9% year-over-year, to just less than $14 billion, boosted by the Splunk (security company) acquisition in March 2024. Thanks to that deal, Cisco’s security revenues more than doubled for the first half, to about $4.1 billion. But net income fell 8%, to roughly $2.4 billion, due partly to higher costs for research and development, as well as sales and marketing expenses.

Cisco groused about an “inventory correction” as networking customers digested stock they had already bought, but that surely is not the case now as that inventory has been worked off by its customers (ISPs, telcos, enterprise & government end users). Cisco CFO Richard Scott Herren now says “The demand that we’re seeing today a function of extended lead times like we saw a couple of years ago. That’s not the case. Our lead times are not extending.”

Currently, Cisco firmly believes that Ethernet connectivity sales to owners of AI data centers is an “emerging opportunity.” That refers to Cisco’s data center switching solutions for “web-scale” and enterprise customer intra-data center communications. The company’s AI strategy is described here.

Image Courtesy of Cisco Systems

………………………………………………………………………………………………………………………………………

AI investments “will lead to our networking equipment being combined with Nvidia GPUs, and that’s how we’ll accomplish that in the future,” CEO Chuck Robbins told industry analysts on a call to discuss second-quarter results, according to a Motley Fool transcript. “There’s so much change going on right now from a technology perspective that there’s both excitement about the opportunity, and candidly, there’s a little bit of fear of slowing down too much and letting your competition get too much ahead of you. So, we saw solid demand,” he said.

However, Cisco will face mighty competition in that space.

- Nokia is targeting the same opportunity and last month said it would spend an additional €100 million (US$104 million) on its Internet Protocol unit annually with the goal of generating another €1 billion ($1.04 billion) in data center revenues by 2028.

- Arista Networks is another rival in this market, selling high performance Ethernet switches to cloud service providers like Microsoft.

- Nvidia, whose $7 billion acquisition of Mellanox in 2019 gave it effective control of InfiniBand, an alternative to Ethernet that had represented the main option for connecting GPU clusters when analysts published research on the topic in August 2023. Just as important, the Mellanox division of Nvidia also is a leader in Ethernet connectivity within data centers as described in this IEEE Techblog post.

- Juniper Networks (being acquired by HPC) is also focusing on networking the AI data center as per a white paper you can download after filling out this form.

During the Q & A, Robbins elaborated: “On the $700 million in AI orders, it’s a combination of systems, silicon, optics, and optical systems. And I think if you break it down, it’s about half is in silicon and systems. And it continues to accelerate. And I’d say the teams have done a great job on the silicon front. We’ve invested heavily in more resources there. The team is running parallel development efforts for multiple chips that are staggered in their time frames. They’ve worked hard. They were increasing the yield, which is a positive thing. And so, we feel good about it, but it’s a combination of all those things that we’re selling to the customers.”

…………………………………………………………………………………………………………………………………………………………………………………………

Enterprise AI:

“What we’re seeing on the enterprise side relative to AI is it’s still — customers are still in the very early days, and they all realize they need to figure out exactly what their use cases are. We’re starting to see some spending though on specific AI-driven infrastructure. And we think as we get AI pods out there — we got Hyperfabric coming. We got AI defense coming.

We have Hypershield in the market. And we got this new DPU switch, they are all going to be a part of the infrastructure to support these AI applications. So, we’re beginning to see it happen, but I think it’s also really important to understand that as the enterprises leverage their private data, their proprietary data, and they’ll do some training on that and then they’ll run inference obviously against that. We believe that opportunity is an order of magnitude higher than what we’ve seen in training today. We’re going to continue to innovate and build capabilities to put ourselves in a better position to be a real beneficiary as this continues to accelerate. But as of today, we feel like we’re in pretty good shape.”

“If you look at AI defense with the AI Summit that we did recently, there’s — I think there’s about 20-some-odd customers who are interested in going to proof of concept with us right now on it. We had almost half the Fortune 100 there for that event. So, I feel good about where we are. It will turn into greater demand as we just continue to scale these products.”

Telco use of AI Edge Applications:

“We see some of the European network operators are looking at delivering AI as a service,” said Robbins. “We see a lot of them planning for AI edge applications that are sitting at the edge of their networks that they’re managing for customers.”

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,………………………………………………

Cisco raised its guidance and now expects revenues for the full year of between $56 billion and $56.5 billion, up from its earlier range of $55.3 billion to $56.3 billion.

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,………………………………………………

References:

https://www.cisco.com/site/uk/en/solutions/artificial-intelligence/index.html

https://www.juniper.net/content/dam/www/assets/white-papers/us/en/networking-the-ai-data-center.pdf

Nokia selects Intel’s Justin Hotard as new CEO to increase growth in IP networking and data center connections

Initiatives and Analysis: Nokia focuses on data centers as its top growth market

Nvidia enters Data Center Ethernet market with its Spectrum-X networking platform

Nokia selects Intel’s Justin Hotard as new CEO to increase growth in IP networking and data center connections

Nokia today announced that their President and Chief Executive Officer, Pekka Lundmark will be replaced on April 1st by 50 year old Justin Hotard who currently leads Intel’s Data Center & AI Group. Hotard joins Nokia with more than 25 years’ experience with global technology companies, driving innovation, technology leadership and delivering revenue growth. Prior to Intel, he held several leadership roles at large technology companies, including Hewlett Packard Enterprise (more below) and NCR Corporation. He will be based at Nokia’s headquarters in Espoo, Finland.

“Leading Nokia has been a privilege. When I returned to Nokia in 2020, I called it a homecoming, and it really has felt like one. I am proud of the work our brilliant team has done in re-establishing our technology leadership and competitiveness, and positioning the company for growth in data centers, private wireless and industrial edge, and defense. This is the right time for me to move on. I have led listed companies for more than two decades and although I do not plan to stop working, I want to move on from executive roles to work in a different capacity, such as a board professional. Justin is a great choice for Nokia and I look forward to working with him on a smooth transition,” said Nokia’s President and CEO Pekka Lundmark.

“I am delighted to welcome Justin to Nokia. He has a strong track record of accelerating growth in technology companies along with vast expertise in AI and data center markets, which are critical areas for Nokia’s future growth. In his previous positions, and throughout the selection process, he has demonstrated the strategic insight, vision, leadership and value creation mindset required for a CEO of Nokia,” said Sari Baldauf, Chair of Nokia’s Board of Directors.

“I am honored by the opportunity to lead Nokia, a global leader in connectivity with a unique heritage in technology. Networks are the backbone that power society and businesses, and enable generational technology shifts like the one we are currently experiencing in AI. I am excited to get started and look forward to continuing Nokia’s transformation journey to maximize its potential for growth and value creation,” said Justin Hotard.

Rumors started to swirl in September, after a report in the Financial Times newspaper, that Nokia was seeking a replacement for Lundmark, who by then had been its CEO for about four years. Nokia said in a statement: “The Board fully supports President and CEO Pekka Lundmark and is not undergoing a process to replace him.”

–>How seriously should the FT and all other media now take the company’s public statements?

Lundmark had told Nokia’s board months earlier, in the spring of 2024, that he would consider stepping down once “the repositioning of the business was in a more advanced stage.” This author certainly does not think that “advanced stage” has been reached yet. “The current CEO has not got to grips with the growth problem. The top line has not increased since the Alcatel-Lucent takeover,” said a shareholder.

Nokia’s share price is now only 10% of its peak $260 Billion valuation in 2000 peak (that’s a 90% decline in price over almost 25 years- buy and hold?). However, the company has gained almost 40% in the last year after operational improvements and signs that construction of AI data centers could be a significant growth opportunity for Nokia’s network infrastructure business group, its second-biggest unit. In his leaving video, Lundmark drew attention to the sales growth rate of 9% for the final quarter of 2024 and the operating margin of 19.1%, Nokia’s best in a decade.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

“We’re at the start of a super cycle with AI,” said Hotard. “One that I see [as] very similar to the one we saw a couple of decades ago with the internet. In these major market transitions new winners are created and incumbents either reinvent themselves or fail… My focus will be to accelerate the transformation journey.”

During the Nokia conference call Q&A Hotard was defensive to questions about his plans for the company. He did say that networking comes second only to compute hardware when it comes to share of AI datacenter investment and he looks forward to the completion of the $2.1 billion Infinera acquisition. “The hundreds of billions of dollars being invested in data centers today from a technology standpoint of course start with compute accelerators and GPUs [graphical processing units], but the second thing is the network and the connectivity and further it is not just the connectivity inside the data center but the connectivity across data centers,” said Hotard on today’s call. That implies an increased emphasis Nokia will place on optical networking within and between data centers.

Indeed, IP networking and data center connectivity are becoming a fast-growing part of Nokia’s network infrastructure unit that provides the connectivity inside those data centers, recently landing deals with Microsoft and UK-headquartered Nscale. The hoped-for return is an additional €1 billion ($1.03 billion) in revenues by 2028. The Infinera acquisition, announced in June 2024 and expected to be finalized in the next few weeks, is also partly a data center play, bolstering Nokia’s portfolio of optical networking assets.

On Nokia’s Q3 2024 earnings call in October, Lundmark said, “Across Nokia, we are investing to create new growth opportunities outside of our traditional communications service provider market. We see a significant opportunity to expand our presence in the data center market and are investing to broaden our product portfolio in IP Networks to better address this. There will be others as well, but that will be the number one. This is obviously in the very core of our strategy.” At that time, Lundmark said Nokia’s telco total addressable market (TAM) is €84 billion, while its data center total addressable market is currently at €20 billion. “I mean, telco TAM will never be a significant growth market,” he added to no one’s surprise.

On today’s call, Lundmark drew attention to its revival and strength when asked to compare Nokia with Ericsson. “Of course, we respect them as a competitor in radio networks. We are slightly behind them in terms of market share, but we have had great deal momentum recently – you’ll have seen some of the deal announcements – and, very importantly, the feedback we are receiving from our customers is that we are now fully competitive in terms of our portfolio.”

Justin Hotard, slated to be Nokia’s new boss on April 1, 2025

During the past year Hotard has headed up Intel’s Datacenter & AI Group. Prior to that he was at HPE for nine years heading up the High Performance Computing, AI & Labs group.

“Networks are the backbone that power society and businesses, and enable generational technology shifts like the one we are currently experiencing in AI. I am excited to get started and look forward to continuing Nokia’s transformation journey to maximize its potential for growth and value creation,” said Justin Hotard.

What will Hotard led Nokia’s future commitment be to a shrinking market for mobile networks? Revenues generated by the global mobile market are estimated to have fallen about $5 billion last year, to $35 billion, after a $5 billion drop in 2023, according to Omdia (an Informa owned market research firm), as network operators cut spending. But an exit would rid Nokia of a business still responsible for 40% of total sales just as smaller rivals appear to be struggling.

Nokia seems to value Hotard’s U.S. background and experience in the data center and AI market. “If you look at the market and look at the world, the U.S. is an important market for us and so that is one element we consider – experience from that technology business there,” said Sari Baldauf, Nokia’s chair, when asked on today’s call why an external candidate was preferred to an internal appointment.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

Telecoms.com Scott Bicheno offered his opinion: “Hotard reckons Nokia’s telco customer base gives it an advantage when it comes to AI datacenters, which are increasingly built near to sources of power, often in remote locations. So, while this does feel like a promising strategic pivot for Nokia, those telco customers might be worried about mobile being deprioritized as a consequence. The appointment of someone from a company with an appalling track record in that sector is unlikely to ease that concern.”

……………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecoms.com/ai/nokia-signals-a-move-away-from-mobile-and-europe-with-new-ceo

https://www.ft.com/content/5f086aee-91b9-421a-9f32-c33e67b1af7f

Initiatives and Analysis: Nokia focuses on data centers as its top growth market

Nokia to acquire Infinera for $2.3 billion, boosting optical network division size by 75%