Author: Alan Weissberger

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

Despite being very late to deploy 5G due to tardy licensed spectrum auctions, and with no known indigenous 5G network equipment vendors, India’s Communications Minister Ashwini Vaishnaw believes the country’s indigenous 4G/5G technology stack is “now ready” and the country is poised to emerge as a major telecom technology exporter to the world in the coming three years. Speaking at the Economic Times Global Business Summit 2023, Vaishnaw, who is also the Minister for Railways, categorically said there is no program for the privatization of the national transporter.

The 5G services were launched on October 1, 2022, and within a span of 100 days have been rolled out in 200-plus cities. The sheer speed of rollout has been appreciated by industry leaders globally and is being described in many international forums as the “fastest deployment happening anywhere in the world,” he said. Vaishnaw highlighted the population-scale solutions being tested on India stack, across platforms such as payments, healthcare and identity. Each of these platforms is powerful in itself, but together become a dynamic force that can solve “any major problem in the world.”

The minister said India is set to emerge as a telecom technology exporter to the world in the next three years. “Today there are two Indian companies that are exporting to the world…telecom gear. In the coming three years, we will see India as a major telecom technology exporter in the world,” Vaishnaw said.

The minister talked of the rapid strides taken by India in developing its own 4G and 5G technology stack, a feat that caught the attention of the world. “The stack is now ready. It was initially tested for 1 million simultaneous calls, then for 5 million, and now it has been tested for 10 million simultaneous calls,” he said terming it a “phenomenal success.” At least 9-10 countries want to try it out, he added.

The minister gave a presentation outlining key initiatives under his three ministries of telecom, IT and Railways. For Railways, the focus is on transforming passenger experience, he said as he presented slides on how railways is redeveloping stations and terminals (New Delhi, Ahmedabad, Kanpur, Jaipur among others) with modern and futuristic design blueprint, and in the process creating new urban spaces while also preserving rich heritage.

The minister also gave an overview on the Vande Bharat train, the indigenous train protection system Kavach and progress on the bullet train project. To a question on the past talks around private freight rail corridors to boost logistics, the minister said “there is no program for Railway privatization.” “In a country where we have 1.35 billion people, 8 billion people moving every year on Railways, we thought that it is prudent to learn from the experience of others, and keep it within the Government set-up,” Vaishnaw said.

India’s Communications Minister Ashwini Vaishnaw (Photo Credit: PT)

To another query on dedicated freight corridor for food grains, the minister explained that when it comes to transport economics it is important not to divide assets between different applications.

“Today, the thought process has got very refined, and we are adding close to 4500 km of network every year, which amounts to 12 km of new tracks per day. So we have to increase the capacity to such a large extent that there is enough capacity for food grains, enough for coal, small parcels, and every kind of cargo,” he said. While Railways had been consistently losing market share over the last 50-60 years, it has started clawing it back.

“The lowest point was 27 per cent. I am happy to share that from the 27 per cent level, last year Railways increased to 28 per cent, this year we are doing close to 29-29.5 per cent, and in the coming 2-3 years Railways will go towards 35 per cent market share,” he added.

People will choose between transport via road, railways or air based on the distance to be travelled, and “there will be enough for everybody”. “The country will have enough for everybody, is my point. Up to 250 kilometres road is very good, 250 to 1000 kilometres railway is the ideal mode. Beyond 1000 kilometres air will be the ideal mode. So there will be enough for everybody,” the minister said.

References:

Info-Tech: Cloud Network Design Must Evolve to Meet Both Current and Future Organizational Needs

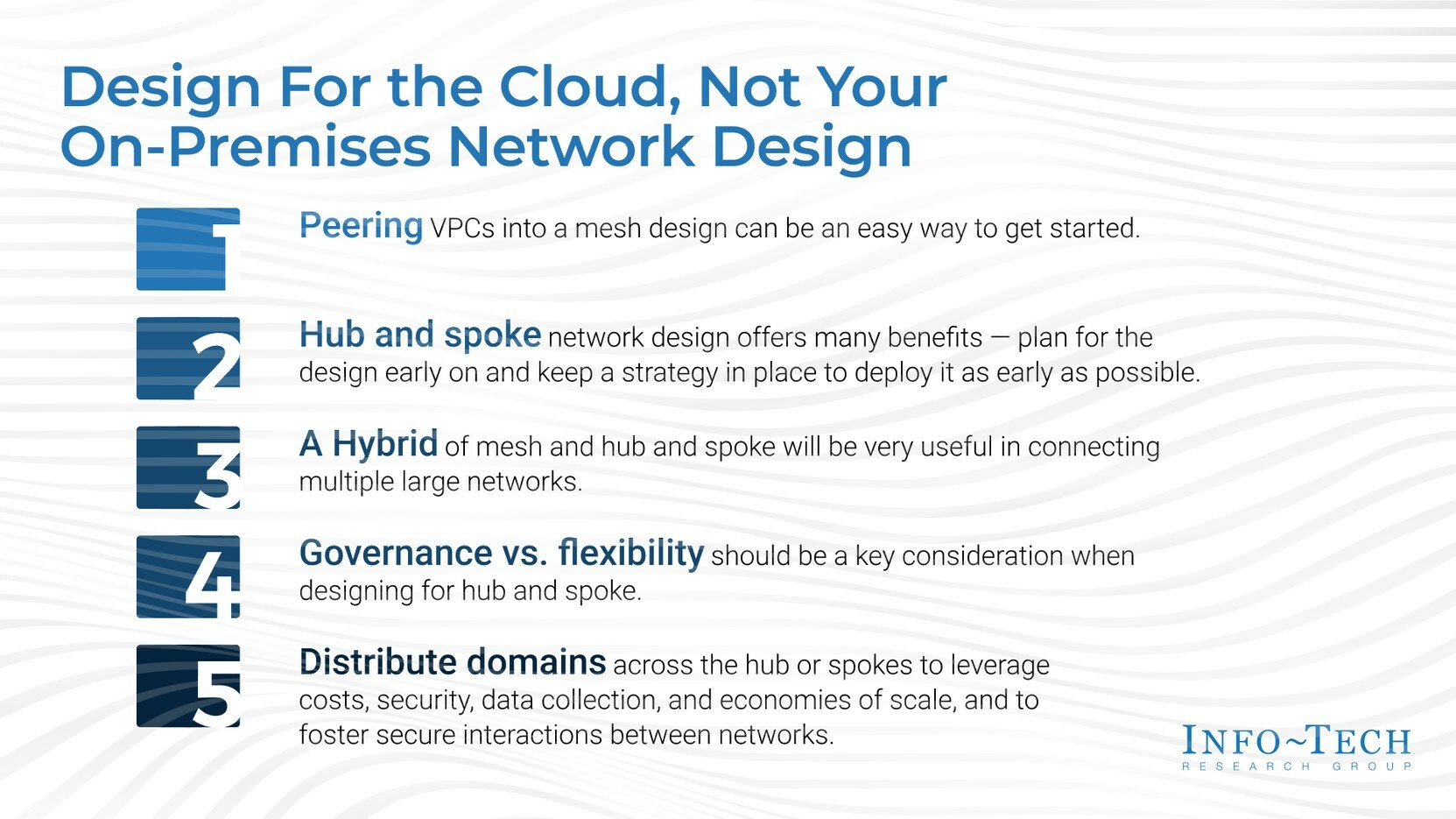

Cloud adoption among organizations has increased dramatically over the past few years, both in the range of services used and the extent to which they are employed. However, network builders tend to overlook the vulnerabilities of network topologies, which leads to complications down the road, especially since the structures of cloud network topologies are not all of the same quality. To help organizations build a network design that suits their current needs and future state, global IT research and advisory firm Info-Tech Research Group has published its latest advisory deck, Considerations for a Hub and Spoke Model When Deploying Infrastructure in the Cloud.

The new research deck states that for organizations considering migrating their resources to the cloud, careful planning and decision making is required. This includes selecting the right topology, designing the cloud infrastructure for efficient management, and providing access to shared services. The advisory deck further highlights that one of the main challenges of cloud infrastructure planning is finding the right balance between governance and flexibility, which is often overlooked.

“Evaluating and selecting the right cloud network topology is crucial for optimizing performance. It also enables easier management and resource provisioning,” says Nitin Mukesh, senior research analyst at Info-Tech Research Group. “An ‘as the need arises’ strategy will not work efficiently since network design changes can significantly impact data flows and application architectures, which becomes more complicated as the number of cloud-hosted services grows. Designing a network strategy early on will give more control over networks and prevent the need for significant infrastructure changes later.”

Info-Tech’s research indicates that when organizations move to the cloud, many often retain the mesh networking topology from their on-prem design, or they choose to implement the mesh design using peering technologies in the cloud without considering the potential changes in business needs. Although there are various network topologies for on-prem infrastructure, the network design team may not be aware of the best approach in cloud platforms for their requirements, or a cloud networking strategy may even go overlooked during the migration.

The new resource explores a hub and spoke model for organizations deciding between governance and flexibility in network design. A hub and spoke network design involves connecting multiple networks to a central network, or a hub, that facilitates intercommunication between them. The hub can be used by multiple workloads for hosting services and managing external connectivity.

Other networks connected to the hub through network peering are called spokes and host workloads. Communications between workloads, servers, or services on the spokes pass through the hub, where they are inspected and routed. The spokes can be centrally managed from the hub using IT rules and processes. This design allows for a larger number of virtual networks to be interconnected, with only one peered connection needed to communicate with any other network in the system.

Organizations that choose to deploy the hub and spoke model face a dilemma in choosing between governance and flexibility for their networks. Info-Tech recommends that organizations consider the following design options when developing a cloud network strategy:

- PEERING: Peering Virtual Private Clouds (VPCs) into a mesh design can be an easy way to get onto the cloud, but it shouldn’t be the networking strategy for the long run.

- HUB AND SPOKE: Hub and spoke network design offers more benefits than any other network strategy to be adopted only when the need arises. Organizations should plan for the design and strategize to deploy it as early as possible.

- HYBRID: A mesh and hub and spoke hybrid can be instrumental in connecting multiple large networks, especially when they need to access the same resources without having to route the traffic over the internet.

- GOVERNANCE VS. FLEXIBILITY: Governance vs. flexibility should be a key consideration when designing for hub and spoke to leverage the best out of the infrastructure.

- DOMAINS: Distribute domains across the hub or spokes to leverage costs, security, data collection, and economies of scale and foster secure interactions between networks.

The firm advises that the advantages of using a hub and spoke model far exceed those of using a mesh topology in the cloud. However, organizations, especially large ones, are complex entities, and choosing only one model may not serve all business needs. In such cases, a hybrid approach may be the best strategy.

To learn more, download the complete Considerations for a Hub and Spoke Model When Deploying Infrastructure in the Cloud advisory deck.

Info-Tech Research Group is one of the world’s leading information technology research and advisory firms, proudly serving over 30,000 IT professionals. The company produces unbiased and highly relevant research to help CIOs and IT leaders make strategic, timely, and well-informed decisions. For 25 years, Info-Tech has partnered closely with IT teams to provide them with everything they need, from actionable tools to analyst guidance, ensuring they deliver measurable results for their organizations.

Media professionals can register for unrestricted access to research across IT, HR, and software and over 200 IT and Industry analysts through the ITRG Media Insiders Program. To gain access, contact [email protected].

SOURCE Info-Tech Research Group

……………………………………………………………………………………………………………………

References:

For more information about Info-Tech Research Group or to access the latest research, visit infotech.com and connect via LinkedIn and Twitter.

European Space Agency & UK Space Agency chose EnSilica to develop satellite communications chip for terminals

UK based EnSilica, a fabless ASIC and mixed signal chip maker, has announced a contract to develop a new chip to address the next generation of mass market satellite broadband user terminals.

The contract has been awarded through the European Space Agency’s (ESA) Advanced Research in Telecommunications Systems Core Competitiveness program (“ARTES CC”), through the support of the UK Space Agency.

The chip in development will enable a new generation of lower-cost, low-power satellite broadband user terminals, which track the relative movement of low-earth orbit satellites and allow users to access high bandwidth connectivity when out of reach of terrestrial networks.

Use cases include satellite communication-on-the-move (SOTM) for automotive, maritime, and aerospace connectivity as well as extending broadband access to users without internet access.

Dietmar Schmitt, Head of Technologies & Products Division at ESA, said “ESA is pleased to continue our collaboration with EnSilica through the ARTES Core Competitiveness programme and to support this important technology development, which will facilitate the provision of high capacity connectivity across a wide range of use cases.”

Henny Sands, Head of Telecoms at the UK Space Agency, described EnSilica’s satellite broadband user terminals chip as “a brilliant example of the diversity of expertise in the UK’s leading satellite communications sector.”

Henny added: “Through the ARTES CC programme the UK Space Agency aims to champion UK companies that have the right expertise and ambition to become global players in this market and lead on ground-breaking technologies that will enhance the wider UK space sector, create jobs and generate further investment. That’s why we recently announced £50 million of funding for ambitious and innovative projects that will supercharge the UK’s satellite communications industry.”

Paul Morris, VP RF and Communications BU, commented: “We are delighted to be continuing our successful partnerships with both UKSA and ESA to further develop innovative semiconductor solutions for the next generation of satellite broadband user terminals.”

…………………………………………………………………………………………………………………………………………………………………

About EnSilica:

EnSilica is a leading fabless design house focused on custom ASIC design and supply for OEMs and system houses, as well as IC design services for companies with their own design teams. The company has world-class expertise in supplying custom RF, mmWave, mixed signal and digital ICs to its international customers in the automotive, industrial, healthcare and communications markets. The company also offers a broad portfolio of core IP covering cryptography, radar, and communications systems. EnSilica has a track record in delivering high quality solutions to demanding industry standards. The company is headquartered near Oxford, UK and has design centres across the UK and in India and Brazil.

Recent ASICs and Case Studies:

- 40nm Ka-band transceiver and beamformer for satellite terminals

- 180nm BCD H-bridge controller for automotive chassis control

- 55nm low-power mobile phone sensor interface

- 180nm BCD industrial MCU for safety critical applications

- 180nm BCD multi-channel 2GHz phase controller 600nm gyro sensor amplifier

- 28nm audio processor for smart microphone

- 28nm multi-standard GNSS receiver

- 40nm multi-standard analog and digital broadcast receiver

- 40nm 60GHz Radar sensor 65nm medical vital signs sensor with 2.4GHz radio

- 40nm NFC energy harvesting processor

About ESA’S ARTES Core Competitiveness Program:

ESA’s ARTES (Advanced Research in Telecommunications Systems)

program is unique in Europe and aims to support the competitiveness of European and Canadian industry on the world market. Core Competitiveness is dedicated to the development, qualification and demonstration of products (“Competitiveness and Growth”), or long-term technology development (“Advanced Technology”). Products in this context can be equipment for the platform or payload of a satellite, a user terminal, or a full telecom system integrating a network with its space segment.

Highlights of Qualcomm 5G Fixed Wireless Access Platform Gen 3; FWA and Cisco converged mobile core network

With 5G deployed in more than 90 countries globally, network operators are increasingly considering 5G Fixed Wireless Access (FWA) to enable more homes and businesses can connect and enjoy the power of connected broadband experiences.

This week, Qualcomm unveiled its 5G Fixed Wireless Access Platform Gen 3, the world’s first fully-integrated 5G advanced-ready FWA platform. Besides benefitting from Snapdragon X75 capabilities, Qualcomm FWA Gen 3 key features include:

- Extended-range mmWave and Sub-6 GHz

- Qualcomm Tri-Band Wi-Fi 7 with expert Multi-Link operation for blazing-fast lower latency, reliable connections, and mesh capability for seamless coverage

- Quad-core central processing unit (CPU) and hardware acceleration boosts

- Self-install capabilities facilitated by Qualcomm Dynamic Antenna Steering technology

- Qualcomm RF Sensing Suite to enable indoor mmWave Customer Premises Equipment (CPE) deployments

- Support for 5G Dual-SIM Dual Active (DSDA) and Dual-SIM Dual Standby (DSDS) configurations

Qualcomm FWA Gen 3 is claimed to be the world’s first fully-integrated 5G advanced (???)-ready FWA platform, which includes support for Sub-6 GHz, mmWave, and Wi-Fi 7 connectivity, and boosted with quad-core CPU and hardware acceleration to drive a wide range of applications and value-added services.

The new platform features:

- The recently announced Snapdragon X75 5G Modem-RF, enabling breakthrough 5G performance to achieve unmatched speeds, coverage, and link robustness

- Qualcomm QTM567 mmWave Antenna Module, providing reliable and extended mmWave coverage

- Wi-Fi 7 with 10Gb ethernet, delivering multi-gigabit speeds and wire-like latency to virtually every device in the home

- Converged mmWave-sub 6 hardware architecture, reducing footprint, cost, board complexity, and power consumption

These capabilities will help OEMs accelerate time to launch, improve performance, and lower development effort for building cutting-edge FWA CPEs at scale. The Qualcomm FWA Gen 3 provides a fully-integrated solution that enables product development for multiple mobile broadband product categories and enables OEMs to offer a diverse product portfolio to their customers.

Qualcomm FWA Gen 3 includes the following features:

- Increased coverage through extended range mmWave and extended-range sub-6GHz with eight receiver antennas and support for power class 1.5 (PC 1.5)

- Enhanced self-install capabilities with Qualcomm Dynamic Antenna Steering Gen2

- Qualcomm RF Sensing Suite to help accelerate indoor mmWave CPEs deployments

- Flexible software architecture with support for multiple frameworks, including OpenWRT and RDK-B

- The Qualcomm FWA Gen 3 encapsulates the next-gen modem-RF system technologies intended to springboard 5G forward with superior 5G speeds and flexibility. This breakthrough connectivity is enabled by several capabilities including:

- Unrivalled spectrum aggregation

- Multi-Gigabit speed

- Improved uplink coverage with FDD uplink MIMO and uplink carrier aggregation (CA)

- Significant performance increase with Wi-Fi 7 advanced features:

- Tri-Band support in the 2.4GHz, 5GHz, and 6GHz spectrum bands with 320MHz and 4K QAM modulation

- Multi-Link technology enabling lower latency in heavily congested home environments

With WiFi 7 (IEEE 802.11be) and 5G connectivity, the platform offers consumers a faster and more reliable internet connection in the home. They can tap into the increased capacity and bandwidth offered by Wi-Fi and 5G to deliver multi-gigabit speeds, enabling consumers to connect all their devices and enjoy improved user experiences.

Qualcomm Resources:

Learn more about Fixed Wireless Access and its benefits here and here. Additionally, check out more on our latest Snapdragon X75 5G Modem-RF System enabling this technology here. Solutions such as this, powered by our one technology roadmap, including foundational 5G technologies, further position Qualcomm as the edge partner of choice for the cloud economy. Qualcomm makes an intelligently connected world possible.

…………………………………………………………………………………………………………………………………

FWA and a Converged Mobile Core Network:

In a blog post today, Matt Price of Cisco states that FWA is a great tool for reducing the digital divide when it comes to accessibility and affordability. The economics for providing Internet services were in need of a change and FWA offers some good ones – reducing trenching requirements, increasing serviceable area, offering self-install customer equipment (CPE), and even providing a common wireless network architecture that can serve both Fixed Wireless Access and Mobile Access services. To achieve these goals, Cisco strongly recommends 5G service providers deploy 5G SA core networks, which the vendor has implemented as a converged 4G/5G core for T-Mobile US.

Other carriers, like Verizon [1.] have deployed a 5G NSA FWA network.

Note 1. Verizon has increasingly come to view FWA as an integral part of their broadband access offering everywhere that FiOS isn’t available. At the same time, the telco has argued (with increasing confidence) that the often-assumed capacity constraints on FWA are not only addressable, but that they are not an issue. Verizon views 5G FWA as a major growth opportunity- much more so than 5G mobile services, according to Sowmyanarayan Sampath, Executive Vice President and CEO of Verizon Business. It’s also interesting that Telkom in South Africa and Safaricom in Kenya have deployed 5G NSA networks for FWA but NOT yet for 5G mobile service.

……………………………………………………………………………………………………………………………………………………………..

5G SA’s network architecture can flexibly deploy User Plane Function (UPF) nodes to anchor a FWA subscriber’s user plane traffic for peering at the nearest edge aggregation point. Unlike a typical mobile device such as a cell phone, fixed wireless devices are meant to be always-on and connected for serving end user devices. Meaning that the latency and reliability we commonly expect from traditional wireline services is expected from fixed wireless services too.

In 2022, T-Mobile US became the fastest growing U.S. Internet Service Provider—doubling their number of FWA customers in the past six months. With over 2 million FWA subscribers and counting, the scalability and flexibility of having a Converged Core has proven invaluable to T-Mobile. Being able to deploy UPF nodes for Fixed Wireless Access in remote locations while managing the Session Management Function (SMF) nodes at a central site(s) is effective for scaling the network, optimizing the usage of the transport infrastructure to deliver better end-user latency.

Scaling and extending Fixed Wireless Access with the flexible deployment of UPF nodes, optimizing the routing for user plane traffic. Source: Cisco

…………………………………………………………………………………………………………………………………………………………………

It’s estimated that around 70% of communication service providers today offer a form of Fixed Wireless Access services, most of them still using 4G LTE, which delivers a fraction of the performance of fiber. Upgrading network architectures to meet the needs of new 5G services needs a smooth plan for the transition. Cisco believes that can begin in the mobile core network. With a Converged 4G/5G Core, communication service providers can migrate from 4G to 5G without disruption while scaling to serve the needs of millions of new subscribers.

For More Information:

Learn more about the Cisco Converged Core, and how we are helping rural communities bridge the digital divide. Find out how T-Mobile and Cisco Launched the World’s Largest Cloud Native Converged Core Gateway, read the December 2022 press release.

……………………………………………………………………………………………………………………….

References:

Next-level connectivity: Unveiling our new 5G FWA Platform | Qualcomm

https://blogs.cisco.com/sp/getting-to-the-core-of-the-digital-divide-with-5g-fixed-wireless-access

https://www.verizon.com/about/blog/fixed-wireless-access

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

Taiwan’s 5G services assisting in manufacturing and arts

Although the consumer penetration rate of 5G services remains low, more businesses are using 5G technology to develop applications that offer more diverse content and facilitate production processes, according to Taiwan’s National Communications Commission.

Kaohsiung Music Center has become the nations first exhibition venue to offer performances combining music and 5G artificial intelligence (AI) of things, the commission said. The V Future Party this year is set to become the nations largest performance integrating virtual reality and real-time performance, the commission said. The performances are to combine Chunghwa Telecoms 5G network, AI technology and high-end facilities at the center, it added. Participants in the V Future Party would see AI manga characters perform with live dancers.

The party integrates online and offline performances by utilizing high-speed and low-latency characteristics of the 5G system and multiple high-speed cameras to capture real-time actions in three dimensions, it said. The new form of performance brings new possibilities to performing arts, it added.

Meanwhile, China Steel Corp has used the 5G enterprise private network technology developed by Chunghwa Telecom to monitor its operations along a 900m-long steel slag transportation track and remote-control slag receiving operations, the commission said. This assists greatly in avoiding industrial safety accidents, it said. Through the 5G system, on-site images and data can be sent immediately to the vehicle dispatch center. In addition, the safety of the steel factory is enhanced by the driving safety assistance system.

“When the slag-receiving vehicle is moving for a long distance in the factory area, a foreign object intruding after a level crossing is lowered would immediately trigger a warning sound and automatically notify the slag-receiving vehicle to stop,” the commission said.

Previously, Taiwan network operator Far EasTone Telecommunications expects its 5G subscriber penetration rate to reach 40% by the end of this year from more than 30% last year, Taipei Times reported. It would be reasonable to see an increase of 10 percentage points this year, Far EasTone president Chee Ching (井琪)

References:

https://www.taipeitimes.com/News/taiwan/archives/2023/02/17/2003794528

https://www.ncc.gov.tw/english/

https://www.taipeitimes.com/News/biz/archives/2023/01/14/2003792552

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications and AT&T today announced a deal that will enable AT&T cell towers to connect to Frontier’s ultra-fast fiber network. Specifically, AT&T will use Frontier’s fiber infrastructure [1.] in areas where AT&T doesn’t currently own fiber. This will improve the resiliency, reliability and speed of the wireless service that AT&T offers to its customers. AT&T is the first tenant to rent space in Frontier’s hyper-local offices and will utilize Frontier’s fiber-optic network to connect with its cell towers that are in Frontier’s network.

Note 1. Frontier’s fiber network is available in 25 states.

Frontier’s footprint is complementary to AT&T’s existing network, which will help accelerate the company’s 5G deployment. AT&T will tap into Frontier’s fiber-to-the-tower (FTTT) infrastructure to connect to AT&T’s wireless cell towers. AT&T is the first tenant to rent space in Frontier’s local central office facilities, they said.

This deal is an extension of AT&T and Frontier’s 2021 agreement that brought the two complementary fiber networks together to power business customers nationwide. That multi-year agreement, focused on Frontier service territories in parts of 25 states, also mentioned support for deployment of AT&T’s 5G network.

The deal comes together as Frontier pushes ahead with a fiber upgrade and buildout plan. Frontier announced late last year that it had neared the halfway point toward a goal of reaching at least 10 million locations with fiber by the end of 2025. While a good portion of that work is focused on delivering services to Frontier’s own residential and business customers, the agreement with AT&T highlights the buildout’s wholesale opportunity.

Fiber backhaul is increasingly critical to support the data demands of wireless networks, including 5G. This agreement enables AT&T to stay ahead of those demands and build on an existing relationship between the two companies. Also, fiber backhaul could help spark a wholesale business that’s been in decline. Frontier’s overall business and wholesale revenues dropped 7.5% in Q3 2022 year-over-year, primarily due to declines in its copper footprint. Meanwhile, business and wholesale fiber revenues rose 1.1%, to $267 million, sequentially.

As illustrated in the figure below, backhaul comprises the Transport network, that connects the Tower / Access Point (mobile base station), which is part of the Radio Access Network (RAN), to the Core Network, where most computing resources are located.

“We’re excited to collaborate with AT&T in strengthening their wireless service with our fiber infrastructure,” said Vishal Dixit, Frontier’s Chief Strategy Officer & EVP Wholesale. “As one of the largest fiber builders in the country, our fiber infrastructure offers an attractive opportunity for tech companies to use this future-proof foundation for their wireless services. This is another example of how innovation is helping to transform Frontier.”

”Fiber is central to our wireless strategy and to our overall connectivity approach,” said Cheryl Choy, Senior Vice President, Network Planning & Engineering, AT&T. “This expanded collaboration with Frontier is a win for both companies, as they can fully utilize their fiber infrastructure, and we can continue to ensure our wireless services are powered by the unparalleled capacity of fiber optic networks.”

About Frontier:

Frontier is a leading communications provider offering gigabit speeds to empower and connect millions of consumers and businesses in 25 states. It is building critical digital infrastructure across the country with its fiber-optic network and cloud-based solutions, enabling connections today and future proofing for tomorrow. Rallied around a single purpose, Building Gigabit America™, the company is focused on supporting a digital society, closing the digital divide, and working toward a more sustainable environment. Frontier is preparing today for a better tomorrow. Visit frontier.com.

About AT&T:

We help more than 100 million U.S. families, friends and neighbors, plus nearly 2.5 million businesses, connect to greater possibility. From the first phone call 140+ years ago to our 5G wireless and multi-gig internet offerings today, we @ATT innovate to improve lives. For more information about AT&T Inc. (NYSE:T), please visit us at about.att.com. Investors can learn more at investors.att.com.

Media Contacts:

Chrissy Murray

VP, Corporate Communications

[email protected]

Anne Tidrick

Director, Corporate Communications

+1 469-516-5862

[email protected]

References:

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

Following their first partnership one year ago, Nokia and Kyndryl have extended it for three years after acquiring more than 100 customers for automating factories using 4G/5G private wireless networks as well as multi-access edge computing (MEC) technologies. Nokia is one of the few companies that have been able to get any traction in the private 4G/5G business which is expected to grow by billions of dollars every year. The size of the global private 5G network market is expected to reach $41.02 billion by 2030 from 1.38 billion in 2021, according to a study by Grand View Research.

The companies said some customers were now coming back to put private networks into more of their factories after the initial one. “We grew the business significantly last year with the number of customers and number of networks,” Chris Johnson, head of Nokia’s enterprise business, told Reuters.

According to the companies, 90% of those engagements—which span “from advisory or testing, to piloting, to full implementation”—are with manufacturing firms. In Dow Chemical’s Freeport, Texas, manufacturing facility which is leveraging a private LTE network using CBRS frequencies to cover 40 production plants over 50-square-kilometers. The private wireless network increased worker safety, enabled remote audio and video collaboration, personnel tracking, and vehicle telematics, the companies said. Dow Chemical is now planning to expand the same coverage to dozens of its factories, said Paul Savill, Kyndryl’s [1.] global practice leader. “Our pipeline has been growing fundamentally faster than it has been in the last 12 months,” he said. “We now have over 100 customers that we’re working with in the private wireless space … in around 24 different countries.”

Note 1. After getting spun off from IBM in 2021, Kyndryl has focused on building its wireless network business and has signed several agreements with cloud providers.

The current active engagements are across more than 24 countries, including markets like the U.S. where regulators have set aside spectrum assets for direct use by enterprises; this means it’s increasingly possible for buyers to access spectrum without the involvement of mobile network operators.

“As enterprises seek to accelerate and deliver on their journeys towards Industry 4.0 and digitalization, the effective integration and deployment of advanced LTE and 5G private wireless networking technologies becomes instrumental to integrate all enterprise operations in a seamless, reliable, efficient and built in a secure manner,” said Alejandro Cadenas, Associate Vice President of Telco and Mobility Research at IDC. “This expanding, powerful, relationship between Nokia and Kyndryl is a unique combination of vertical and horizontal capabilities, and offers IT, OT and business leaders access to the innovation, tools, and expert resources they need to digitally transform their operations. The partnership offers a compelling shared vision and execution that will enable customers across all industries and geographies to access the ingredients they need to deliver against the promise of digital acceleration, powered by network and edge computing.”

The expanded effort will be enhanced with Kyndryl’s achievement of Nokia Digital Automation Cloud (DAC) Advanced accreditation status, which helps ensure that enterprise customers benefit from an expanded lineup of expert resources and skilled practitioners who have extensive training and deep understanding of Nokia products and solutions. In addition, customers will gain access to Kyndryl’s accelerated network deployment capabilities and support of Nokia cellular radio expertise in selected markets.

In response to a question about how direct enterprise access to spectrum has informed market-by-market activity, Kyndryl Global Practice Leader of Network and Edge Paul Savill told RCR Wireless News in a statement, “Spectrum availability is rapidly becoming less of a barrier, with governments allocating licensed spectrum for industrial use and the emergence of unlicensed wireless networking options (such as CBRS in the US, and MulteFire).”

The companies have also developed automated industrial drones that can monitor a site with different kinds of sensors such as identifying chemicals and video recognition as part of surveillance. While drones have not yet been deployed commercially yet, customers are showing interest in rugged, industrialized non-stop automated drone surveillance, Johnson said.

References:

Google Fiber making a 5-gig internet tier available in 12 markets after expanding service in CO and TX

Google Fiber is making a 5-gig internet tier available to customers in four of its 12 existing metro markets. Customers in West Des Moines, Iowa; Kansas City, Kansas/Missouri; and Salt Lake City and Provo, Utah can now sign up for the symmetrical service for $125 per month. That cost compares to $70 per month for its symmetrical 1-gig plan and $100 per month for its asymmetrical 2-gig offering.

In particular, Google Fiber’s 5 Gig tier offers symmetrical upload and download speeds with a Wi-Fi 6 router (or you can easily use your own), up to two mesh extenders and professional installation, all for $125 a month. Installation also includes an upgraded 10 Gig Fiber Jack, which means your home will be prepared for even more internet when the time comes.

As homes get “smarter” and every device is set up to stream, having access to higher speed, higher bandwidth internet becomes even more important. 5 Gig is designed to handle the demands of heavy internet users — for example, creative professionals, people working in the cloud or with large data, households with large shared internet demands. 5 Gig will make it easier to upload and download simultaneously, no matter the file size, and will make streaming a dream even with multiple devices.

The 5 Gig tier will be expanded to additional cities later this year and Google Fiber reiterated plans to debut an 8-gig offering in the near future as well. Google noted in a blog that those who opt for the 5-gig plan will be upgraded to a 10-gig fiber jack during installation, teeing customers up to receive “even more internet when the time comes.”

Here’s their Valentine’s Day message:

.jpg)

The operator is the latest to move up the multi-gig stack, following in the footsteps of AT&T, Altice USA, Frontier Communications, Greenlight Networks and Ziply Fiber. Once it launches its 8-gig service, it will join the likes of Lumen Technologies, TDS Telecom and Frontier Communications as per this post.

Earlier this week Google Fiber announced that it will expand services to Westminster, Colorado, and Chandler, Arizona. The move will pit Google Fiber up against incumbents that include Comcast and Lumen in Colorado, and Cox Communications and Lumen in Arizona. Data from BroadbandNow notes that Google Fiber competes with AT&T in Kansas City, Kansas and Missouri.

References:

https://fiber.google.com/blog/2023/02/fall-in-love-with-fast-5-gig-is-here.html

https://fiber.google.com/blog/2023/02/google-fiber-continues-to-grow-next-up.html

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Orange-Spain deploys 5G SA network (“5G+”) in Madrid, Barcelona, Valencia and Seville

Orange-Spain has deployed a commercial 5G SA network in several cities, with more to follow this year. The network will be available in Madrid, Barcelona, Valencia and Seville. The network operator claims it is the first network operator to deploy a commercial 5G SA network in Spain which is called 5G+. 90% coverage is promised in these cities, and more locations are going to be plugged in over the course of 2023.

There will be no extra charge for Orange users to use 5G+, but initially at least they’ll need either a Samsung S22, Xiaomi 12, Xiaomi 12T, S22+, S22 Ultra or Xioami 12 Pro series handset to connect to it.

Orange says it has spent €531 million buying up 5G frequencies in all bands throughout the various auctions from 2016 to the most recent one in December 2022, and we’re told it is the operator with the most spectrum in the 3.5 GHz band.

Orange already deployed 5G services in 1,529 towns and cities in 52 provinces across Spain, surpassing its initial target for the full year. The telco has chosen the following 5G SA vendors:

- Ericsson’s 5G SA core network for Belgium, Spain, Luxembourg and Poland

- Nokia’s 5G SA core network for France and Slovakia, and Nokia’s Subscriber Data Management for all countries

- Oracle Communications for 5G core signaling and routing in all countries

Opinion:

Orange-Spain refers to its 5G SA network as 5G+, implying an enhanced form of 5G which it is not! It is true 5G because you don’t get any 5G features/functions with 5G NSA. The Orange press release describes 5G SA as a ‘standard that completes the deployment of 5G technology’ – which is only partially true, because there is no standard for 5G SA.

5G+ is also good news for business customers, as per the press release:

“In addition, for enterprises, 5G+ meets the need for flexible, scalable, reliable and secure connectivity for real-time applications. Through its network slicing capability, Orange’s network will be able to offer virtual networks that will be responsible for allocating the necessary network resources to guarantee the provision of critical services or meet specific customer needs, offering different levels of quality, availability, privacy and security.”

Orange Spain is currently offering 5G services through frequencies in the 3.5 GHz and 700 MHz bands. Last year, when Orange announced its deployment of 5G in the 700 MHz band, it said it would offer this technology progressively over the course of 2022 in more than 1,100 towns and cities, 820 of them having between 1,000 and 50,000 citizens.

In the last spectrum auction, Orange secured 2×10 megahertz in the 700 MHz band, which adds to the 110 megahertz in the 3.5 GHz band already owned by Orange. The company invested a total of 523 million euros (currently $559 million) in the acquisition of these frequencies.

Why have 5G SA rollouts been so slow?

The move from NSA to SA 5G architecture is incredibly complex – seemingly more so than initially anticipated by operators around the world. In the UK, for example, BT’s CTO Howard Watson described the shift as a “sea change in the underlying architecture” late last year, telling journalists the company would take their time to ensure a smooth transition.

Meanwhile, the global economic situation is making network rollouts more expensive and reducing customer spending, leaving operators unsure if they will be able to get a quick return on investment.

As a result, we are left with a mobile industry in no major hurry to upgrade to 5G SA, but is instead happy to bide its time and wait to learn lessons from early adopters – including Orange. For these reasons, the marketing around 5G SA and also mmWave is going to be tricky for wireless network operators who are not familiar with the inner workings of the industry and the particulars of how this roll out was executed, and who may simply assume they already bought 5G years ago.

References:

https://telecoms.com/519893/orange-spain-switches-on-5g-sa-network-dubbed-5g/

https://totaltele.com/5g-orange-launches-5g-standalone-in-spain/

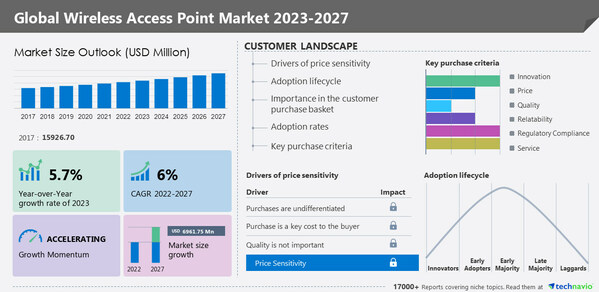

Technavio: Wireless access point market to grow at a CAGR of 6% 2022-2027

According to Technavio, the global wireless access point market size is estimated to grow by USD 6,961.75 million from 2022 to 2027. The market is estimated to grow at a CAGR of 6% during the forecast period. Moreover, the growth momentum will accelerate. North America will account for 32% of the growth of the global market during the forecast period. The report includes historic market data from 2017 to 2021.

The report also provides a comprehensive analysis of growth opportunities at regional levels, new product launches, the latest trends, and the post-pandemic recovery of the global market.

Market Definition:

- A wireless access point is a computer networking device that connects a wireless device and a wired network using a wireless standard such as Wi-Fi or Bluetooth.

- As a standalone device, a wireless access point is often linked to a router through a cable

- An access point is a networking hardware device that delivers and receives data on a wireless network

- An access point links users to other users on the network and acts as the point of connection between the WLAN and a fixed wire network

- Within a given network region, each access point can serve numerous users

- When a person goes outside the range of one access point, they are unavoidably handed over to the next access point

- A single access point is needed for a tiny WLAN

- The number required grows in direct proportion to the number of network users and the structural size of the network.

Key factor driving market growth:

- The increase in the development of smart cities is driving the growth of the global wireless access point market.

- Governments of various countries are investing large amounts in the construction of smart cities.

- These cities require public Wi-Fi networks to provide services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare.

- As a result, there will be a high demand for wireless access points in smart cities.

- Hence, the development of smart cities is expected to fuel the growth of the market during the forecast period.

The report provides actionable insights and estimates the contribution of all regions to the growth of the global wireless access point e growth of the global market during the forecast period. This growth is attributed to factors such as the increase in the use of the Internet and smartphones. The demand for bring-your-own-device (BYOD) solutions is also increasing in the region. In addition, the rising demand for 5G network acceleration has enabled firms and telecom component providers to develop advanced telecom infrastructure and related components. These factors will fuel the growth of the wireless access point market in the region during the forecast period.

Leading trends influencing the market:

1. The increase in the development of smart cities is driving the growth of the global wireless access point market.

- Governments of various countries are investing large amounts in the construction of smart cities.

- These cities require public Wi-Fi networks to provide services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare.

- As a result, there will be a high demand for wireless access points in smart cities.

- Hence, the development of smart cities is expected to fuel the growth of the market during the forecast period

2. The increase in 5G investments is a key trend in the global wireless access point market.

- The rise in these investments in 5G is creating a demand for 5G network infrastructure.

- Telecom service providers and network equipment providers will have to offer routers that will enable carriers to provide 5G services.

- Thus, an increase in investments in 5G will increase the adoption of devices such as wireless routers, which, in turn, will support the growth of the market during the forecast period.

The increase in the development of smart cities is a key factor driving the growth of the global wireless access point market. Across the world, governments are investing billions of dollars in the construction of smart cities or linked cities. This necessitates the use of public Wi-Fi networks to provide customers with services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare. It also offers LBS to city planners in order to obtain insight into how its residents live and how a smart city operates in order to deliver better services to people living in smart cities. As a result, there will be a high demand for wireless access points to be deployed in smart cities.

The government of China is focusing more on urbanization and the development of smart cities in its five-year plan. The development of a smart city includes identifying an urban area and facilitating economic growth and improved quality of life with technologies such as Wi-Fi connectivity. The databases and network systems here are connected to cameras, sensors, and control systems, where technology would be used for allocating services, managing traffic, and inventory, and managing and transferring information. Hence, with the development of smart cities, the market is expected to witness growth during the forecast period

The increase in 5G investments is the primary trend in the global wireless access point market growth. 5G is the next generation of communication technology, following 4G, and on commercialization, 5G will support data download speeds of 10,000 Mbps. There have been numerous investments in 5G across the world. The increasing investments in 5G are creating demand for 5G network infrastructure.

This is expected to accelerate the growth of the market during the forecast period. Such product launches enable telecom service providers and network equipment providers to offer routers, enabling carriers to provide 5G services. Thus, an increase in investments in 5G will propel the adoption of devices, including wireless routers, which will result in the growth of the market during the forecast period.

Major challenges hindering market growth:

- Latency issues are challenging the growth of the global wireless access point market.

- In remote areas, the quality of networks is low. Hence, mobile network operators need to build solutions to offer connectivity to IoT devices.

- This can impact the consumer segment, as individual consumers do not have access to high-speed Internet everywhere.

- Moreover, in countries with low internet speeds, such as Yemen, Cuba, and Sudan, the adoption of wireless APs is slow.

- Hence, low internet speeds and latency issues are negatively impacting the adoption of routers and APs.

- These factors will impede the market growth during the forecast period.

The latency issues are a major challenge for the growth of the global wireless access point market. The Internet is the backbone of the IoT devices market. IoT devices require reliable, high-speed internet connectivity to function effectively. Although many countries have advanced internet infrastructure, but in suburban areas and highways, where the quality of the network is usually poor, mobile network operators need to build solutions to offer connectivity to IoT devices in these areas. This challenge has the highest impact on the consumer segment, as individual consumers cannot have access to high-speed Internet everywhere.

Low internet speeds and latency (time taken by the data packet to travel between devices in a network) are affecting the adoption of routers and APs among consumers. Singapore has the fastest average download rate at 256 Mbps, followed by Hong Kong at 254 Mbps and Romania at 232 Mbps. Hence, the adoption of wireless APs is expected to be high in these countries. However, in countries with lower internet speeds, such as Yemen, Cuba, and Sudan, the adoption of wireless APs is slow, which creates latency issues and is expected to hinder the growth of the market during the forecast period.

Key Wireless Access Point Market Customer Landscape:

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

………………………………………………………………………………………………………………………………………

Methodology:

Technavio categorizes the global wireless access point market as a part of the global communications equipment market within the overall global information technology sector. The parent global communications equipment market covers manufacturers of enterprise networking products, including LANs, WANs, routers, telephones, switchboards, and exchanges. Technavio also includes communications infrastructure or telecom equipment market within the scope of the communications equipment market. Our research report has extensively covered external factors influencing the parent market growth during the forecast period.

……………………………………………………………………………………………………………………………………….

References: