Broadband Status

Leichtman Research Group: Top U.S. Broadband Providers Add; PayTV Providers Lose Subscribers in 2020

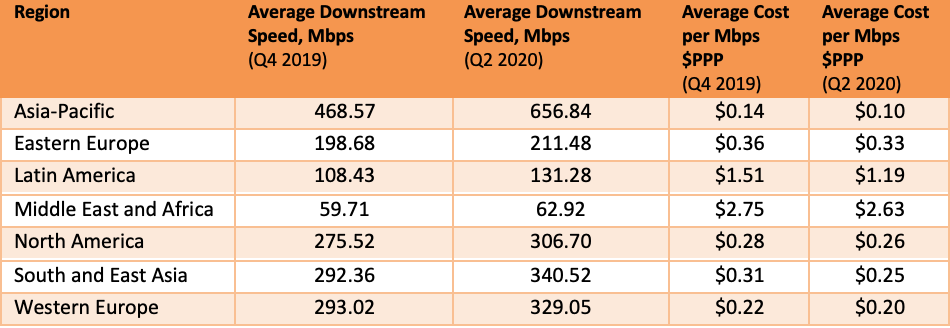

Leichtman Research Group reports that largest U.S. broadband network providers added almost twice as many fixed subscribers in 2020 as they did the previous year, largely due to the Covid-19 pandemic. However, some large broadband providers (like AT&T) lost customers.

The largest cable and wireline phone providers in the U.S. – representing about 96% of the market – acquired about 4,860,000 net additional broadband Internet subscribers in 2020, compared to a pro forma gain of about 2,550,000 subscribers in 2019.

These top broadband providers now account for 105.8 million subscribers, with top cable companies having 72.8 million broadband subscribers, and top wireline phone companies having 33 million subscribers.

Comcast and Charter accounted for 4.19 million, or 86%, of the total number of net additions, with the other six cablecos’ adds coming in significantly lower, ranging from 210,000 for Cox to just under 38,000 for Atlantic Broadband.

For wireline telcos, the best performance came from Verizon, which added a fairly respectable 173,000 fixed broadband customers, but three of the eight posted net customer losses. In particular, AT&T’s net broadband losses came in at 5,000 while CenturyLink and Frontier both lost well over 100,000 customers.

[As per the report below, AT&T’s DirecTV lost more than 3.26 million subscribers which was ~60% of all U.S. pay TV losses in 2020.]

Notes:

* LRG estimate

** Includes recent small acquisitions/sales and LRG pro forma estimates

^ Frontier’s total for 4Q 2020 is an LRG estimate due to later year-end reporting

TDS includes 283,900 wireline broadband subscribers, and 209,400 cable broadband subscribers

…………………………………………………………………………………….

Key findings for the year 2020 include:

- Overall, broadband additions in 2020 were 190% of those in 2019, and more than in any year since 2008

- Top cable and wireline phone companies represent approximately 96% of all subscribers

- The top cable companies added about 4,820,000 subscribers in 2020 – compared to about 3,145,000 net adds in 2019, and the most in any year since 2006

- Charter’s 2,215,000 net broadband additions in 2020 were more than any company had in a year since 2006

- The top wireline telecom companies added about 40,000 subscribers in 2020 – compared to a loss of about 590,000 subscribers in 2019

- Telcos had positive net annual broadband adds for the first year since 2014

- At the end of 2020, cable had a 69% market share vs. 31% for Telcos

“With the impact of the coronavirus pandemic, there were more net broadband additions in 2020 than in any year since 2008,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc (LRG). “The top cable and Telco broadband providers in the U.S. cumulatively added about 4,860,000 subscribers in 2020, compared to about 5,100,000 subscribers in 2018 and 2019 combined.”

Separately, LRG found that the largest pay-TV providers in the U.S. – representing about 95% of the market – lost about 5,120,000 net video subscribers in 2020, compared to a pro forma net loss of about 4,795,000 in 2019.

The top pay-TV providers now account for about 81.3 million subscribers – with the top seven cable companies having 43.9 million video subscribers, satellite TV services having about 21.8 million subscribers, the top telephone companies having 7.9 million subscribers, and the top publicly reporting Internet-delivered (vMVPD) pay-TV services having 7.7 million subscribers.

AT&T had a net loss of about 3,260,000 subscribers across its four pay-TV services (DIRECTV, AT&T U-verse, AT&T TV, and AT&T TV NOW) in 2020 – compared to a net loss of about 4,095,000 subscribers in 2019.

AT&T “Premium TV” services (not including the vMVPD service AT&T TV NOW) lost 15.3% of subscribers in 2020 – compared to a 4.6% loss among all other traditional pay-TV services.

Key findings for the year include:

- Satellite TV services lost about 3,440,000 subscribers in 2020 – compared to a loss of about 3.700,000 subscribers in 2019

- The top seven cable companies lost about 1,915,000 video subscribers in 2020 – compared to a loss of about 1,560,000 subscribers in 2019

- The top telco TV companies lost about 405,000 video subscribers in 2020 – compared to a loss of about 630,000 subscribers in 2019

- The top publicly reporting Internet-delivered (vMVPD) services (Hulu + Live TV, Sling TV, AT&T TV NOW, and fuboTV) added about 640,000 subscribers in 2020 – compared to about 1,095,000 net adds in 2019

- Traditional pay-TV services (not including vMVPDs) lost about 5,765,000 subscribers in 2020 – compared to a net loss of about 5,890,000 in 2019

“Net pay-TV losses of over 5 million subscribers in 2020 were slightly higher than in 2019, and more than in any previous year,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Overall, the top pay-TV providers lost 5.9% of subscribers in 2020, compared to 5.2% in 2019.”

About Leichtman Research Group, Inc.

Leichtman Research Group, Inc. (LRG) specializes in research and analysis on broadband, media and entertainment industries. LRG combines ongoing consumer surveys with industry tracking and analysis, to provide companies with a richer understanding of current market conditions, and the potential impact and adoption of new products and services. For more information about LRG, please call (603) 397-5400 or visit www.LeichtmanResearch.com.

References:

https://www.leichtmanresearch.com/about-4860000-added-broadband-from-top-providers-in-2020/

https://www.leichtmanresearch.com/major-pay-tv-providers-lost-about-5120000-subscribers-in-2020/

https://telecoms.com/508907/pandemic-provided-a-shot-in-the-arm-for-us-fixed-broadband/

After 9 years Alphabet pulls the plug on Loon; Another Google X “moonshot” bites the dust!

After nine years as the high-flyer of the Google X lab, Alphabet is ending Loon, which was one of the company’s high-profile, cutting-edge efforts. Loon aimed at providing Internet access to rural and remote areas, creating wireless networks with up to 1 Mbit/second speeds using high-altitude balloons at altitudes between 18 and 25 km (11 and 16 miles). As for so many of Google X labs “moonshots,” it was difficult to turn Loon into a business.

“The road to commercial viability has proven much longer and riskier than hoped. So we’ve made the difficult decision to close down Loon,” Astro Teller, who heads Google X, wrote in a blog post. Alphabet said it expected to wind down operations in “the coming months” with the hope of finding other positions for Loon employees at Alphabet.

Sadly, despite the team’s groundbreaking technical achievements over the last 9 years — doing many things previously thought impossible, like precisely navigating balloons in the stratosphere, creating a mesh network in the sky, or developing balloons that can withstand the harsh conditions of the stratosphere for more than a year — the road to commercial viability has proven much longer and riskier than hoped. So we’ve made the difficult decision to close down Loon. In the coming months, we’ll begin winding down operations and it will no longer be an Other Bet within Alphabet.

From the farmers in New Zealand who let us attach a balloon communications hub to their house in 2013, to our partners who made it possible to deliver essential connectivity to people following natural disasters in Puerto Rico and Peru, to our first commercial partners in Kenya, to the diverse organizations working tirelessly to find new ways to deliver connectivity from the stratosphere — thank you deeply. Loon wouldn’t have been possible without a community of innovators and risk-takers who are as passionate as we are about connecting the unconnected. And we hope we have reason to work together again before long.

The idea behind Loon was to bring cellular connectivity to remote parts of the world where building a traditional mobile network would be too difficult and too costly. Alphabet promoted the technology as a potentially promising way to bring internet connectivity to not just the “next billion” consumers but the “last billion.”

The giant helium balloons, made from sheets of polyethylene, are the size of tennis courts. They were powered by solar panels and navigated by flight control software that used artificial intelligence to drift efficiently in the stratosphere. While up in the air, they act as “floating cell towers,” transmitting internet signals to ground stations and personal devices.

Credit…Loon LLC, via Associated Press

………………………………………………………………………………………………………………………………………………………………………………………

Google started working on Loon in 2011 and launched the project with a public test in 2013. Loon became a stand-alone subsidiary in 2018, a few years after Google became a holding company called Alphabet. In April 2019, it accepted a $125 million investment from a SoftBank unit called HAPSMobile to advance the use of “high-altitude vehicles” to deliver internet connectivity.

Last year, Google announced the first commercial deployment of the Loon technology with Telkom Kenya to provide a 4G LTE network connection to a nearly 31,000-square-mile area across central and western Kenya, including the capital, Nairobi. Before then, the balloons had been used only in emergency situations, such as after Hurricane Maria knocked out Puerto Rico’s cellular network. In closing down this pilot service in Kenya, Loom said it would pledge $10 million to Kenyan non-profits and businesses offering “connectivity, internet, entrepreneurship, and education.”

Loon was starting to run out of money and had turned to Alphabet to keep its business solvent while it sought another investor in the project, according to a November report in The Information.

The decision to shut down Loon is another signal of Alphabet’s recent austerity toward its ambitious and costly technology projects. Under Ruth Porat, Alphabet’s chief financial officer since 2015, the company has kept a close watch over the finances of its so-called Other Bets, fledgling business ventures aimed at diversifying from its core advertising business.

Alphabet has aggressively pushed its “Other Moonshot Bets” like Waymo and Verily, a life sciences unit, to accept outside investors and branch out on their own. Projects that failed to secure outside investment or show enough financial promise have been discarded, such as Makani, a project to produce wind energy kites that Alphabet shut down last year.

That austerity has been a notable change from a time when units like X, which had been a favored vanity project of Google’s co-founders Larry Page and Sergey Brin, had autonomy to spend freely to pursue ambitious technology projects even if the financial outlook remained unclear.

……………………………………………………………………………………………………………………………………………………………………….

Facebook’s efforts have likewise stumbled, with Mark Zuckerberg’s company deciding in 2018 to ground Aquila, its gigantic, solar-powered drone designed to deliver Internet by laser. “Surprisingly, it’s just not practical,” drolly commented Techcrunch. Instead, it is efforts to beam the net from satellites that seem to be meeting with higher-flying fortunes.

Starlink, the satellite network being built by Elon Musk’s SpaceX, appears to be making fast progress – with 800 satellites, including 60 launched in November.

Its launch of services in the rural UK this month is bad news for OneWeb – which only just emerged from bankruptcy in November with new owners, the UK Government and Bharti Global. Analysts, though, think neither will provide too much of a threat to established Internet providers in urban are

For all that was innovative about its technology, Loon never turned a profit, and the company was tight-lipped about precisely how many users it ever had. It was never a matter of providing free Internet to the masses, but instead, of amplifying the reach of existing telecoms companies to rural populations, via the balloon network. Once connected, clients paid for the Internet, just like anybody else. It just seems there were not enough of them who did.

Its technical advances concerned a type of ballet, using its software system to predict how weather events could move its balloons, then adapting the balloons’ height in accord with wind currents to manipulate their position. The balloons usually lasted a few hundred days, after which they were directed to a landing zone – though the landings weren’t always as accurate as its engineers would have hoped.

References:

https://blog.x.company/loons-final-flight-e9d699123a96

https://medium.com/loon-for-all/loon-draft-c3fcebc11f3f

https://www.lightreading.com/services/google-pops-loon-balloon/d/d-id/766855?

Deloitte: India rural broadband penetration at 29.1%; fixed broadband at 7.5%; Challenges noted

Broadband penetration in India’s rural areas continues to be quite low at 29.1% against national average of 51% with 687 million subscribers as of March 2020, according to a new report by Deloitte titled “Broadband for inclusive development—social, economic, and business.” Also noteworthy, fixed broadband penetration in India.

“Broadband penetration has grown at an impressive CAGR of 35% in India over the past three years (2017-2020). However, existing levels of broadband penetration in rural areas (29.1% penetration) and fixed broadband penetration (7.5% of Indian households) across the country offer significant opportunities for growth,” the report said.

Sathish Gopalaiah, Partner and Telecom Sector Leader Deloitte Touche Tohmatsu India LLP said, “This report briefly highlights the state of broadband in our country, how critical and transformative broadband can be for us, the key challenges holding back its growth potential, and certain key interventions that can be made through government policies, government spending, impetus to R&D and product development, and effective on-ground implementation of large initiatives.”

Gopalaiah said the country has witnessed significant progress in broadband in the last three years, primarily on the back of smartphone growth and low data prices. “In the next innings, broadband penetration in rural areas and mass adoption of fixed broadband hold the anchor to continue and accelerate this growth trajectory,” he added.

The Deloitte report also cited statistics from the International Telecommunication Union (ITU) that an increase of 10 percent in fixed broadband penetration yields an increase of 0.8 percent in GDP, and an increase of 10 percent in mobile broadband penetration yields an increase of 1.5 percent in GDP.

According to Deloitte, key challenges holding back the potential growth and mass adoption of broadband in India are right of way issues, cost of infrastructure deployment, levels of digital literacy, and access to affordable devices.

Photo Credit: Mint

……………………………………………………………………………………………………………………………………………………………………………….

Harnessing the full power of broadband is a multi-stage process that would involve availability of stable and high-speed broadband connectivity; accessibility to not only internet but affordable devices such as computers and mobiles; and usability (digital skills and applications/websites for users to rely on, that too, in the relevant vernacular languages).

While India has made significant development in broadband speeds over the years, “there is a large scope for growth in speeds” to enable further growth of technology platforms, social development programmes, businesses, and economic growth.

“As identified by TRAI (Telecom Regulatory Authority of India) significant improvements can be achieved in broadband speeds in the country. An important step is to pursue increasing the minimum broadband speed from 512 kbps to 2 mbps,” it said.

“Significant increase in demand for fixed broadband is estimated to continue, as a result of the pandemic, with extension in work-from-home for most corporates and permanent changes in digital behavior of people in the new normal. The broadband penetration has positive correlation with GDP growth and employment. According to a World Bank report, a 10 per cent increase in broadband penetration levels in developing countries is estimated to lead to 1.38 per cent GDP growth,” the report stated.

………………………………………………………………………………………………………………………………………………………………….

The cloud computing market in India has almost doubled from US$2.5 billion in 2018 to US$4.5 billion in 2020 and is set to grow to approximately US$7 billion by 2023. Meanwhile, “IoT connected devices in the Indian market have grown from only 60 million in 2016 to an estimated 1.9 billion in 2020. This growth is expected to continue for both consumer and industrial IoT with multiple sectors adopting IoT,” the report said.

………………………………………………………………………………………………………………………………………………………………………………….

References:

https://in.news.yahoo.com/covid-19-pandemic-accelerated-pace-082101954.html

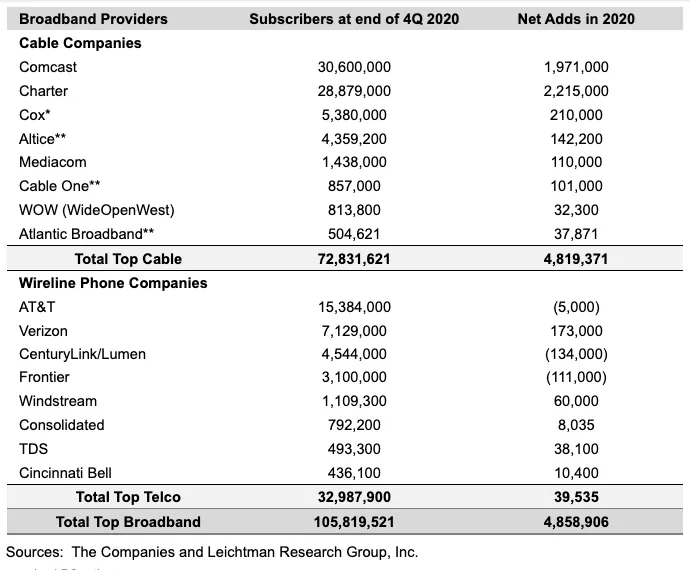

Comcast Earnings Report: Record Broadband Growth; 3 Core Strategy Tenets; Wireless Expansion

Comcast added a record 633,000 residential and business broadband Internet customers in the Q3-2020, but lost another 273,000 video customers. Cable Communications total customer relationship net additions of 556,000, were the best quarterly result ever for the company.

Xfinity Mobile, Comcast’s mobile service via Verizon MVNO agreement, added 187,000 wireless subscriber in Q3-2020. That was down from additions of 204,000 lines in the year-ago quarter. There were 2.58 million mobile subs at the end of the quarter.

“We are nearly eight months into this pandemic – and despite many harsh realities, I couldn’t be more pleased and proud of how our team has worked together across the company to find safe and creative solutions to successfully operate in this environment. We are executing at the highest level; and perhaps, most importantly, accelerating innovation, which will drive long-term future growth. This third quarter, we delivered the best broadband results in our company’s history. Driven by our industry-leading platform and strategic focus on broadband, aggregation and streaming, we added a record 633,000 high-speed internet customers and 556,000 total net new customer relationships. At the same time, we’re growing our entertainment platforms with the addition of Flex, which has a significant positive impact on broadband churn and customer lifetime value. Our integrated strategy is also driving results in streaming with nearly 22 million sign-ups for Peacock to date, and we are exceeding our expectations on all engagement metrics in only a few months. And Sky continues to add customer relationships at higher prices while reducing churn to all-time lows in our core UK business. Going forward, and as we emerge from the pandemic, we believe we are extremely well positioned to provide seamless and integrated experiences for our customers and to deliver superior long-term growth and returns for our shareholders,” said Brian L. Roberts, Chairman and Chief Executive Officer of Comcast Corporation.

Cable Communications revenue increased 2.9% to $15.0 billion in the third quarter of 2020, driven by increases in high-speed internet, business services, wireless and advertising revenue, partially offset by decreases in video, voice and other revenue. These results were negatively impacted by accrued customer regional sports network (RSN) fee adjustments related to canceled sporting events as a result of COVID-19. Excluding these adjustments5, Cable Communications revenue increased 3.9%. High-speed internet revenue increased 10.1%, due to an increase in the number of residential high-speed internet customers and an increase in average rates.

Comcast defined three “core tenets” that will drive its strategy focused on broadband Internet, content aggregation and scaling up its tech platforms for video streaming.

Source: Comcast

Xfinity Flex, Comcast’s free streaming video/smart home product for broadband-only customers, has helped the company retain its broadband base. Flex, which has about 1 million active users, has cut churn rates by 15% to 20% among new broadband customers that engage with the platform. Flex has also helped to offset Comcast’s pay-TV subscriber losses for the past two quarters.

“The goal of our common tech stack is to build once and deploy as many times in as many markets and in as many ways as possible on our network or through wholesale distribution,” Brian Roberts, Comcast’s chairman and CEO, said on the company’s earnings call. He noted that the approach generates “good margins” for the company.

Indeed, cable profit margins of 42.7% were up 290 bps YoY, continuing a steady uptrend and beating analyst consensus of 41.7% by 100 bps. Absent wireless, margins would have been 44.3%, the highest ever and fully 300 bps above the levels a year ago.

Meanwhile, Capital Expenditures (CAPEX) decreased 4.9% to $2.4 billion in the third quarter of 2020. Cable Communications’ capital expenditures decreased 2.5% to $1.8 billion. NBCUniversal’s capital expenditures decreased 29.3% to $357 million. Sky’s capital expenditures increased 127.3% to $237 million. For the nine months ended September 30, 2020, capital expenditures decreased 7.6% to $6.3 billion compared to 2019.

“We’re committed to accelerating the wireless business,” Dave Watson, CEO of Comcast Cable, said on today’s earnings call. Comcast may build out its own cellular infrastructure, at least on a targeted basis, which would effectively complement its MVNO arrangement with Verizon. Notably, Comcast was one of several cable operators that bid for and won CBRS spectrum, which it could use to offload mobile traffic in high-traffic areas. “We have the ability to evolve this [mobile] offering over time to where we choose to include our own wireless network with cellular infrastructure to generate even greater profitability in the most highly trafficked mobile areas,” Roberts said.

……………………………………………………………………………………………………………………………………………………………………………

Analyst Assessment:

Craig Moffett, principal of MoffettNathanson asks: Where are all the broadband subscribers coming from?

Verizon, AT&T, and now Comcast have all beaten expectations, and blown away historical growth rates. But it could also be asked of wireless, where, again, Verizon, AT&T, and now Comcast have all grown (Comcast a bit more slowly than expected, but it was solid growth nonetheless). It could even be asked of video, where, yes, Verizon, AT&T, and now Comcast have all lost fewer subscribers than expected. We, and the market, will be grappling with these questions for the next three months or longer. Let’s start by acknowledging the obvious: Comcast’s subscriber metrics in Q3 were absolutely stellar, whatever the explanation.

……………………………………………………………………………………………………………………………………………………………………………

References:

https://www.cmcsa.com/news-releases/news-release-details/comcast-reports-3rd-quarter-2020-results

https://www.cmcsa.com/events/event-details/q3-2020-comcast-corporation-earnings-conference-call

AT&T ends DSL sales while CWA criticizes AT&T’s broadband deployments

AT&T: DSL is Dead:

According to a message board post on DSL Reports, AT&T notified customers on billing statements in August that effective Oct. 1 it would no longer accept new orders for its copper-based DSL service. The notice also said that existing DSL subs will no longer be able to make speed changes to their respective DSL service.

The message board author wrote:

“On my August AT&T statement, traditional DSL is officially grandfathered effective October 1st. No new orders (moves, installs, speed change, etc.). Hopefully they will still allow promos….”

That’s no surprise to this author. AT&T’s DSL subscriber base has been eroding steadily – losing almost 350,000 subs over the past couple of years. In Q2 2020, AT&T shed 23,000 DSL subs, ending the period with just 463,000.

“We are focused on enhancing our network with more advanced, higher speed technologies like fiber and wireless, which consumers are demanding,” AT&T said in a statement. “We’re beginning to phase out outdated services like DSL and new orders for the service will no longer be supported after October 1. Current DSL customers will be able to continue their existing service or where possible upgrade to our 100% fiber network.”

……………………………………………………………………………………………………………………….

AT&T Fiber Update:

AT&T also announced three new price points for its AT&T Fiber tiers and said that all new and existing AT&T Fiber Internet 100, Internet 300 and Internet 1000 subscribers would enjoy unlimited data without additional charges. AT&T Fiber started offering the new deals as a standalone product with no annual contracts for new customers on Sunday.

As of Q2-2020, AT&T had 4.3 million AT&T Fiber customers with nearly two million of them on 1-gigabit speeds. Overall, AT&T has about 15.3 million broadband subscribers while Charter has 28 million and Comcast has over 29 million.

AT&T’s fiber tier announcement comes after AT&T CEO John Stankey told a Goldman Sachs investor conference in September that “priority number one” is investing in fiber for 5G and FTTP services.

The new prices are also an indication that AT&T intends to ramp up its drive on FTTP sales in the wake of a recent study showing that many of AT&T’s new subs were coming from existing customers upgrading to fiber rather than from gaining market share from cable Internet operators (MSOs).

………………………………………………………………………………………………….

CWA Calls Out AT&T’s broadband efforts:

Coincidently today, the Communications Workers of America (CWA) criticized AT&T’s lack of fiber deployments. The report, co-authored with the National Inclusion Alliance (NDIA) stated:

AT&T is making the digital divide worse and failing its customers and workers by not investing in crucial buildout of fiber-optic infrastructure that is the standard for broadband networks worldwide. The company’s recent job cuts — more than 40,000 since 2018 — are devastating communities and hobbling the company’s ability to meet the critical need for broadband infrastructure.

An in-depth analysis of AT&T’s network shows the company has made fiber available to fewer than a third of households in its footprint, halting most residential deployment after mid-2019. The analysis also shows that 28% of households in AT&T’s footprint do not have access to service that meets the FCC’s standard for high-speed internet, and in rural counties 72% of households lack this access. In some places, AT&T is decommissioning its outdated DSL networks and leaving customers with no option but wireless service, which is not a substitute for wireline service.

In all, AT&T has made fiber-to-the-home available for fewer than one-third of the households in its network. AT&T’s employees — many of whom are Communications Workers of America (CWA) members — know that the company could be doing much more to connect its customers to high-speed Internet if it invested in upgrading its wireline network with fiber. They know the company’s recent job cuts — more than 40,000 since 2018 — are devastating communities and hobbling the company’s ability to meet the critical need for broadband infrastructure.

CWA recommends that AT&T dedicate a substantial share of its free cash flow to investment in next-generation networks across rural and urban communities, make its low-income product offerings available widely, and stop laying off its skilled, unionized workers and outsourcing work to low-wage, irresponsible subcontractors.

Editor’s Note:

According to CWA, AT&T has deployed fiber-to-the-home (FTTH) to only 28% of the households in its fiber coverage area as of the end of June 30, 2019.

……………………………………………………………………………………………………………………………………………………………………………………………………..

The CWA/NDIA report said AT&T has targeted more affluent, non-rural areas for its fiber upgrades. Houses with fiber have a median income that’s 34% higher than those with DSL only. Across the rural counties in AT&T’s 21-state footprint, only a miniscule 5% have access to fiber, according to the report.

According to the report, 14.93 million—out of almost 53 million households—have access to AT&T’s fiber service. Among states, AT&T’s FTTH build out is the lowest in Michigan with 14% have access followed by Mississippi (15%) and Arkansas (16%).

“AT&T is also failing to make fiber available to the majority of its customer base in cities,” according to the report. “While most of AT&T’s fiber build has focused on urban areas—96 percent of households with access to fiber in AT&T’s footprint are in predominantly urban counties—the company hasn’t built enough fiber to reach the majority of urban residents. Seventy percent of households in urban counties still lack access to fiber from AT&T because the company has made fiber available to only 14.7 million households out of 48.4 million total households in these counties.”

The report also said there were many areas in AT&T’s footprint where it doesn’t offer the Federal Communications Commission’s “broadband” definition of 25 Mbps downstream and 3 Mbps upstream.

“For 28% of the households in its network footprint, AT&T’s internet service does not meet the FCC’s 25/3 Mbps benchmark to be considered broadband,” the report said. A key recommendation is that “AT&T must upgrade its network in rural communities to meet the FCC’s broadband definition, at least, and renew its efforts to deploy next-generation fiber.”

The report noted that in some areas where AT&T doesn’t provide faster speeds, cable operators, such as Comcast and Charter do.

“Even where that access is available from another provider—typically a cable provider—consumers are deprived of the benefits of competition in price, choice and service quality,” the report said.

…………………………………………………………………………………………………………

AT&T is counting on fiber for both residential and commercial services, including AT&T TV. In order to win over customers from cable operators, AT&T has paired its 1-Gig service with AT&T TV.

Regarding DSL, the report states: “AT&T’s poor maintenance of its DSL networks, with limited capacity for new connections, results in would-be new customers in some areas being denied service entirely or told they can only subscribe to fixed wireless service (a 4G wireless connection for home use, designed for rural areas).”

As expected, AT&T refuted the claims made in the CWA/NDIA report in a statement to FierceTelecom and Broadband World News on Monday afternoon.

“Our investment decisions are based on the capacity needs of our network and demand for our services. We do not ‘redline’ internet access and any suggestion that we do is wrong. We have invested more in the United States over the past 5 years (2015-2019) than any other public company. We have spent more than $125 billion in our U.S. wireless and wireline networks, including capital investments and acquisition of wireless spectrum and operations. Our 5G network provides high-speed internet access nationwide, our fiber network serves more 18 million customer locations and we continue to invest to expand both networks.”

……………………………………………………………………………………………………………………………………………………..

New Fiber Optics Market Report:

Finally, a new report by Technavio forecasts that the global fiber optics market size will grow by USD 2.44 billion during 2020-2024, progressing at a CAGR of almost 5% throughout the forecast period.

Image Credit: Technavio

The increase in the number of FTTH homes and subscribers is the key factor driving the market growth. A higher number of customers are opting for fiber optic connections to leverage broadband services. This reduces the requirements for customer premises equipment (CPE) and distribution point unit (DPU).

References:

https://cwa-union.org/sites/default/files/20201005attdigitalredlining.pdf

https://www.fiercetelecom.com/telecom/cwa-calls-out-at-t-s-lack-fiber-its-dsl-footprint

http://www.broadbandworldnews.com/document.asp?doc_id=764417

AT&T CEO: Fiber, Stories and (Video) Content to drive future revenues and growth

https://www.businesswire.com/news/home/20201005005444/en/

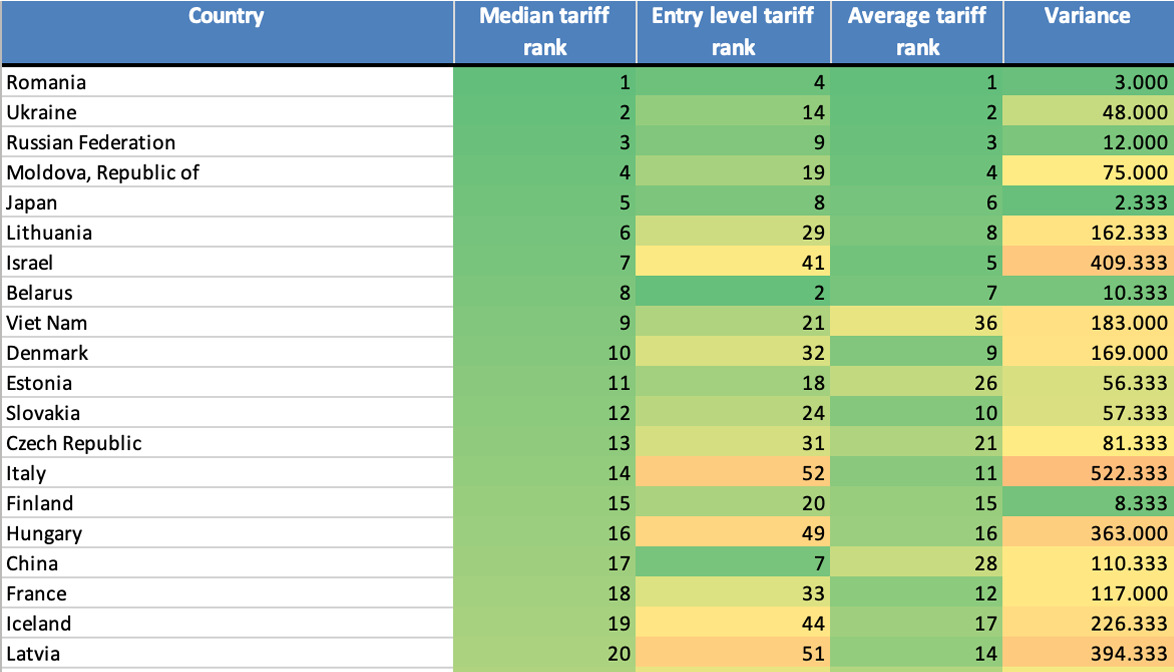

Point Topic Analysis of Fixed Broadband Tariffs from 300 Operators in 90 Countries

|

|

|

|

|

Cogent Communications service revenues and connections increase; uncertain COVID-19 impact

Backgrounder:

Cogent Communications offers a variety of data communications services which include:

Dedicated Internet Access, Ethernet Point-to-Point, Ethernet VPLS, and Colocation Services to Enterprise customers, Carrier & Service Providers and Application & Content Providers.

For more information about the Cogent, please refer to this IEEE Techblog post.

1Q 2020 Earnings Report:

Today, the company reported first-quarter service revenues up 5.1 percent to $140.9 million for the quarter, up 5.6 percent on a constant currency basis. Total customer connections increased by 5.7% from March 31, 2019 to 87,213 as of March 31, 2020 and increased by 0.8% from December 31, 2019. Gross margins increased to an all time high of 60.5 percent in the quarter, which was a 70 percent YoY increase. Traffic growth was 36 percent YoY.

On-net [1.] revenue was up 6.5 percent to $103.5 million, as the company increased the number of on-net buildings by 117 over the year and 22 since December to 2,823 at end-December. On-net customer connections increased by 5.8% from March 31, 2019 to 75,163 as of March 31, 2020 and increased by 0.8% from December 31, 2019.

Note 1. On-net customers are located in buildings that are physically connected to Cogent’s network by Cogent facilities.

…………………………………………………………………………………………………………………………………

- Off-net customer connections increased by 5.2% from March 31, 2019 to 11,721 as of March 31, 2020 and increased by 0.5% from December 31, 2019.

- Net cash provided by operating activities decreased to $28.5 million for Q1 2020.

- EBITDA decreased by 4.4% from Q4 2019 to $50.4 million for Q1 2020 and increased by 6.0% from Q1 2019 to Q1 2020.

According to Zacks, the current consensus EPS estimate is $0.26 on $145.68 million in revenues for the second quarter and $1.05 on $586.21 million in revenues for the current fiscal year.

…………………………………………………………………………………………………………………………………..

COVID-19 Impact:

During the first quarter, the impact of the Covid-19 pandemic on Cogent was limited, the company said. In the last two weeks of March, it saw a positive impact on net-centric revenue but a slight slowdown in corporate installs. There was also a material increase in traffic on the network. Most of its staff have transitioned to remote working. Field engineers continue to install, maintain and upgrade Cogent’s wireline (mostly fiber) network.

The ultimate impact of COVID-19 is unknown as this time due to uncertainty, said Cogent Communications CEO David Schaeffer on the company’s 1Q-2020 earnings call:

We hope everyone remains safe and healthy during these times. We value our employee safety and take all of the necessary precautions to keep our Cogent colleagues safe in these difficult times. While we believe we are a beneficiary of a stay at home model, we are uncertain about the long-term implications for economies around the world. With the large number of employees staying at home and the increased rate of unemployment globally.

On the previous (4Q 2019) earnings call, Mr. Schaeffer said:

The Cogent Network remains the most interconnected networks in the world, with direct connectivity to 6,950 networks. Less than 30 of these networks that connect to Cogent are settlement free peers with the remaining over 6,920 networks being paying Cogent transit customers. We are currently utilizing approximately 29% of the lit capacity in our network. We routinely augment this capacity, as portions of our network need those augmentations to maintain these low utilization rates.

Cogent’s Network Scope, Scale and Traffic Growth:

On the May 7th (1Q-2020) earnings call, Dave talked about the scope and scale of Cogent’s network:

At quarter end, we had over 961 million square feet of multi-tenant office buildings connected to the Cogent network.

Our network consists of over 36,000 metro fiber miles and over 58,000 intercity route miles of fiber. The Cogent network remains the most interconnected in the world, and we directly connect to over 7,040 networks. Of these networks, less than 30 are settlement-free peers. The remaining networks that we connect to are Cogent customers.

We are currently utilizing approximately 35% of the lit capacity in our network. We routinely augment capacity on parts of our network as we see increases in traffic to maintain these low utilization rates. For the quarter, we achieved sequential traffic growth of 12% and year-over-year traffic growth of 36%. We operate 54 Cogent-controlled data centers with over 606,000 feet of space and those facilities are operating at approximately 33% capacity.

Our business remains completely focused on the Internet and IP connectivity services, as well as data center co-location. Each of these services are a necessary utility for our customer. Our multiyear constant-currency long-term growth target of approximately 10% and our long-term EBITDA margin expansion rate of approximately 200 basis points should continue for the foreseeable future. Our board of directors approved our 31st consecutive increase in our regular quarterly dividend.

During the Q&A, Dave answered a question related to trends in data (non-voice) traffic growth:

We support a number of key applications, video conferencing, audio conferencing, and all of that traffic has materially increased as we’ve gone to a more work from home environment. People will eventually return to their offices, and there will be a reduction, maybe not a complete revert to where we were before, but a reduction in that type of traffic. That traffic is de minimis compared to streaming video traffic, which is the primary driver of unit volume growth.

We see this broad mix of OTT business models, accelerating their displacement of linear television. That is a permanent trend, not a temporary trend. What is temporary as people may be watching more minutes a day of video, but what is permanent is the migration from linear to over the top. And while we saw a material spike up in the rate of acceleration, that rate of acceleration has returned to a more normalized rate of acceleration, but we’re off of a higher base.

And we do expect our rate of traffic growth for the full-year 2020 to be above that of 2019.

……………………………………………………………………………………………………………………………………..

About Cogent Communications

Cogent Communications (NASDAQ: CCOI) is a multinational, Tier 1 facilities-based ISP. Cogent specializes in providing businesses with high-speed Internet access, Ethernet transport, and colocation services. Cogent’s facilities-based, all-optical IP network backbone provides services in over 200 markets globally.

Cogent Communications is headquartered at 2450 N Street, NW, Washington, D.C. 20037. For more information, visit www.cogentco.com. Cogent Communications can be reached in the United States at (202) 295-4200 or via email at [email protected].

…………………………………………………………………………………………………………………………………..

References:

https://www.cogentco.com/en/news/events/1392-cogent-communications-first-quarter-2020-earnings-call

https://www.cogentco.com/files/docs/news/media_kit/cogent_fact_sheet.pdf

Cogent Communications still growing strongly -18 years after the Fiber Optic Bust

Cisco’s Annual Internet Report (2018–2023) forecasts huge growth for IoT and M2M; tepid growth for Mobile

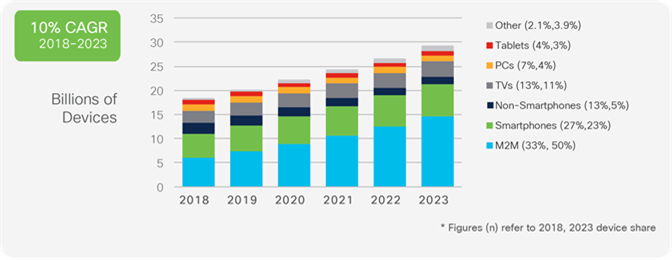

According to Cisco’s newly renamed Annual Internet Report [1.], networked devices around the globe will total 29.3 billion in 2023, outnumbering humans by more than three to one. The number of overall connected devices: 29.3 billion networked devices by 2023, compared to 18.4 billion in 2018.

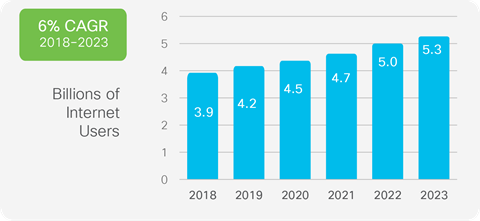

The report also anticipates that the internet of things (IoT) will spread to 50% of all networked devices through machine-to-machine (M2M) technology and that the internet will reach 5.3 billion people, compared to 3.9 billion in 2018.

“There is a lot of growth that still can happen from a user perspective,” said Shruti Jain, senior analyst with Cisco. “Machine-to-machine is going to grow phenomenally,” she added.

Note 1. Cisco’s Annual Internet Report was formerly titled Visual Networking Index or VNI)

………………………………………………………………………………………………….

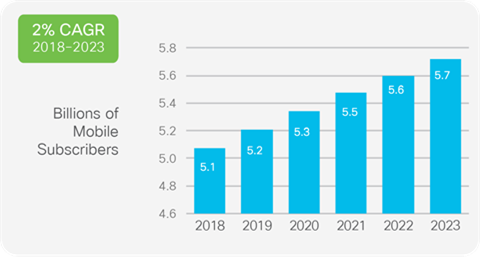

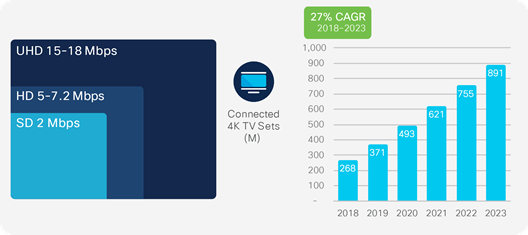

Cisco said that about 70% of the global population will have mobile-network-based connectivity by 2023, with the total number of mobile subscribers growing from 66% of the population in 2018 to 71% of the population (5.7 billion) by 2023. Of those, about 10% will be 5G connections by the end of the forecast period, with the number of global mobile devices rising from 8.8 billion in 2018 to 13.1 billion, with 1.4 billion of those being 5G-capable.

5G speeds are anticipated to be 13-times faster than the average mobile connection speed: 575 Mbps by 2023. Ms. Jain noted that as mobile network speeds approach those of wireline networks, it opens up new possibilities for mobile applications.

“Soon, those speeds are going to get very close to WiFi and [wired] broadband speeds, and be able to support a lot of new applications and experiences,” she said.

…………………………………………………………………………………………………………….

Other key findings from the 2020 Cisco AIR:

-The number of devices per person will continue to rise, from 2.4 networked devices per-capita in 2018 to 3.6 devices by 2023.

-The number of public WiFi hot spots will increase fourfold by 2023, to nearly 628 million.

-Almost 300 million mobile applications will be downloaded by 2023, with the most popular ones being social media, gaming and business applications.

-Power users’ impact is dwindling. Cisco found that globally, the top 1% of mobile data users accounted for 5% of mobile data in 2019. That has dropped significantly since 2010, when the top 1% of mobile users accounted for 52% of mobile data usage.

………………………………………………………………………………………………………

Summary: Multi-domain innovation and integration redefines the Internet

Throughout the forecast period (2018 – 2023), network operators and IT teams will be focused on interconnecting all the different domains in their diverse infrastructures – access, campus/branch, IoT/OT, wide-area, data center, co-los, cloud providers, service providers, and security. By integrating these formerly distinct and siloed domains, IT can reduce complexity, increase agility, and improve security. The future of the Internet will establish new connectivity requirements and service assurance levels for users, personal devices and IoT nodes, all applications (consumer and business), via any network access type (fixed broadband, Wi-Fi, and cellular) with dynamic security. Through our research and analysis, we anticipate innovation and growth in the following strategic areas.

Applications: Across virtually every business sector, there is an increased demand for new or enhanced applications that improve customer experiences. The Internet of Things (IoT), Artificial Intelligence (AI), Machine Learning (ML) and business analytics are changing how developers build smart applications to simplify customer transactions and deliver new business insights. Businesses and service organizations need to understand evolving demands and deliver exceptional customer experiences by leveraging technology.

Infrastructure transformation: The rapid growth of data and devices is outpacing many IT teams’ capabilities and manual approaches won’t allow them to keep up. Increased IT automation, centrally and remotely managed, is essential for businesses to keep pace in the digital world. Service providers and enterprises are exploring software-defined everything, as well as intent-driven and context-powered infrastructures that are designed to support future application needs and flexibility.

Security: Cybersecurity is a top priority for all who rely on the Internet for business and personal online activities. Protect every surface, detect fast and remediate confidently. Protecting digital assets and content encompasses an ever-expanding digital landscape. Organizations need the actionable insights and scalable solutions to secure employees’ devices, IoT connections, infrastructure and proprietary data.

Empowering employees and teams: To achieve business agility and prepare employees for the future, empowering global work forces with the right tools is a must. Automation, collaboration and mobility are essential for managing IT complexity and new customer expectations and demands. Business teams, partners and groups in all types of organizations need to collaborate seamlessly across all application mediums that are relevant to various roles and responsibilities. Employees and teams need accurate and actionable data to solve problems and create new growth strategies.

…………………………………………………………………………………………..

For more information:

Several interactive tools are available to help you create custom highlights and forecast charts by region, by country, by application, and by end-user segment (refer to the Cisco Annual Internet Report Highlights tool). Inquiries can be directed to [email protected].

……………………………………………………………………………………………………..

References:

Point Topic: Fixed Broadband Tariff Report for Q4 2019

|

Dell’Oro: Cable Broadband Access Equipment Revenue to Decline from $13B in 2019 to $11B in 2024

According to a newly published report by Dell’Oro Group, sales of cable broadband access equipment will decrease with a meager 2 percent CAGR from 2019 to 2024. The virtualization of network infrastructure, which is already playing out in the cable market, will extend to other equipment areas, thereby reducing traditional hardware revenue.

The cable broadband category includes both network infrastructure and consumer premises equipment.

That expected decline will be driven by multiple factors, including a saturating broadband services market in regions such as North America and Europe. Another key factor is the lack of a near-term need for many cable operators to move ahead with big access network upgrades following their recent migrations to DOCSIS 3.1, a technology that gives cablecos the ability to deliver 1-Gig services, Jeff Heynen, senior research director at Dell’Oro Group, said.

“For the North American cable operators, there isn’t a competitive incentive for them to really force upgrades at this point,” Heynen said. “Virtualization, coupled with subscriber saturation in some mature markets will result in gradually declining revenue for broadband access equipment globally,”Heynen added .

Additional highlights from the Broadband Access 5-Year Forecast Report:

- Virtual CMTS/CCAP revenue will grow from $90 Million in 2019 to $418 Million worldwide in 2024, as cable operators move to these platforms to expand broadband capacity.

- Mesh-capable routers and broadband CPE units will reach 30 Million units in 2020.

Although AT&T is pushing FTTP and having some success in upgrading some of its existing customers, that has not had much of an impact on major US cable operators such as Comcast and Charter Communication, which added 424,000 and 313,000 broadband subs, respectively, in Q4 2019.

“There has to be a driver for them to spend, and I really don’t see it,” Heynen said.

The cable industry is fast at work on DOCSIS 4.0, a next-gen specification that will support multi-gigabit speeds alongside lower latency capabilities and a higher level of network security. An even longer-term target being pursued is “10G,” a cable industry initiative that’s aiming for 10-Gig symmetrical speeds on multiple types of access networks, including hybrid fiber/coax (HFC), FTTP and even wireless.

Speaking on the company’s Q4 earnings 2019 call last week, Tom Rutledge, Charter’s chairman and CEO, made it clear that these are longer-term initiatives that include features and capabilities that can be added on an incremental basis. “There’s no immediate need to deploy a new upgrade to the marketplace today,” Rutledge said. Charter wrapped up its D3.1 network upgrade in late 2018.

That scenario also gives operators time to push ahead with related projects, including migrations to distributed access architectures and network virtualization.

Even as the move to D4.0 is still out on cable’s horizon, virtualization efforts are expected to ramp up in the next few years. Dell’Oro expects virtual cable modem termination system (CMTS) and converged cable access platform (CCAP) revenues to climb from just $90 million in 2019 to $418 million worldwide in 2024. Heynen said the 2019 total represents about 12% of the total for the CMTS/CCAP core market.

Comcast, along with some small and midsize operators in the US and Western Europe, has begun to deploy virtualized access networks. Harmonic, a lead partner for Comcast’s virtual CMTS rollout, is set to announce Q4 2019 results later today and is expected to offer an update on its vCCAP business.

The bigger broadband picture

And cable isn’t the only market feeling some pain. Dell’Oro projects that revenues for the broader access equipment market, including DSL and PON technologies, will decline from $13 billion in 2019, to $11 billion in 2024.

A big culprit there is the ongoing decline of DSL spending, Heynen said. Another contributor to the decline in hardware revenues will come as the PON market starts to virtualize the OLT (optical line terminal), he added.

Dell’Oro’s forecast currently does not include opportunities around fixed wireless. Fixed wireless will have a role in the broadband market, but “I’m still reluctant that fixed wireless will be as big as others predicted it to be,” Heynen said.

References: