Fiber deployments

Shentel joins Frontier and Altice USA with 5-gig broadband service

Shenandoah Telecommunications (Shentel) became the latest wireline network operator to roll out a symmetrical 5 Gbps internet tier, making it available to all 147,000 passings where it currently offers Glo Fiber service. Over 147,000 homes across Virginia, West Virginia, Maryland and Pennsylvania will have access to the fastest fiber speeds available in these markets.

The average U.S. household now has approximately 20 connected devices, and that number is expected to continue to grow. In addition, with more consumers working remotely long-term, video conferencing is here to stay. Multi-gig speeds are designed for these growing demands and will provide more bandwidth to run a multitude of connected devices at once.

“Adding 5 Gig internet service to our multi-gig product portfolio allows Glo Fiber to meet the demands of our customers and communities. 5 Gig is a premium residential service designed to connect multiple devices at their fastest possible speeds over a reliable, 100% fiber optic network,” said Ed McKay, Shentel Chief Operating Officer.

As of the end of Q4 2022, Glo Fiber was live in 17 markets across four states, including Maryland, Pennsylvania, Virginia and West Virginia. Jeff Manning, Shentel’s VP of Product and Network Strategy, said that by the end of 2023, Glo Fiber and the new 5-gig offering will be available to just under 250,000 passings across 23 markets.

“It feels like the right time to launch,” Manning said. “When you look at the number of devices in homes, the average is well over 20 devices in every home now. So, 5-gig service gives you the capability to ensure every device in the home is fully supported with the capacity it needs.”

The regional network operator already offers 600 Mbps, 1.2 Gbps and 2.4 Gbps service tiers at price points ranging from $65 to $135. The new 5-gig tier will cost $285 per month and require customers to bring their own router.

Manning said the reason it is asking 5-gig customers to bring their own router is because that will enable them to select a device with the level of performance they need. That and there aren’t routers on the market yet which are fully capable of delivering 5 gigs over Wi-Fi. When that changes, he said, Shentel will look at options to package routers with the 5-gig plan.

As a leading broadband internet provider in the Mid-Atlantic region, Glo Fiber takes great pride in several key differentiators compared to their competitors:

- Fiber-to-the-home technology with exceptional reliability

- Symmetrical download and upload speeds

- Easy, straight-forward pricing

- Prompt local customer service

Frontier has 125,000 fiber passings in West Virginia and recently announced plans to build another 100,000 there this year. It also provides fiber service in parts of Pennsylvania, including near Harrisburg and Lancaster, areas Shentel is eyeing for its expansion.

Altice also offers its Optimum fiber service in parts of Pennsylvania, including the areas west of Carlisle, which are similarly situated in the general area of a market Shentel is targeting. AT&T and Google Fiber offer 5-gig service tiers as well but don’t appear to operate within Shentel’s footprint. Frontier’s 5-gig service currently runs $164.99 per month while Altice’s costs $180 per month.

Watkins said the majority of Glo Fiber customers today are landing in its 1-gig and 2-gig buckets, though only around 10% fall into the latter. Thus, it’s not expecting huge take rates for the 5-gig product. Instead of mass market appeal, he said it’s designed to cater to select segments of the population with high bandwidth needs.

About Glo Fiber:

Glo Fiber (Glo) provides next-generation fiber-to-the-home (FTTH) multi-gigabit broadband internet access, live streaming TV, and digital home phone service powered by Shentel (Nasdaq: SHEN). Glo provides the fastest available service to residents leveraging XGS-PON, a state-of-the-art technology capable of symmetrical internet speeds up to 10 Gbps. To learn more about Glo Fiber, please visit www.glofiber.com or 1-800-IWANTGLO (1-877-492-6845).

About Shenandoah Telecommunications:

Shenandoah Telecommunications Company (Shentel) provides broadband services through its high speed, state-of-the-art fiber-optic and cable networks to customers in the Mid-Atlantic United States. The Company’s services include: broadband internet, video, and voice; fiber optic Ethernet, wavelength and leasing; and tower colocation leasing. The Company owns an extensive regional network with over 8,300 route miles of fiber and over 220 macro cellular towers. For more information, please visit www.shentel.com.

References:

https://www.fiercetelecom.com/broadband/shentel-targets-power-users-5-gig-broadband-plan

Shentel plots launch of fiber in 6 greenfield markets in 2023

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Ziply® Fiber agrees to acquire Ptera as U.S. fiber buildouts slow

Ziply® Fiber [1.] has announced an agreement to acquire Ptera, Inc, a fiber internet and fixed wireless internet service provider (WISP) serving four counties across Eastern Washington and Northern Idaho. The acquisition, Ziply’s fourth since June 2022, is scheduled to close later this year, pending regulatory approvals. Financial terms of the buyout were not disclosed.

Note 1. Ziply was created in May 2020 after Frontier Communications sold its operations and assets in Washington, Oregon, Idaho and Montana to WaveDivision Capital in partnership with Searchlight Capital Partners for $1.35 billion. Ziply won just over $57 million in Rural Digital Opportunity Fund (RDOF) support to build fiber to more than 21,000 locations. It has also been working with state and local broadband officials on additional opportunities and plans to participate in the Broadband Equity, Access, and Deployment (BEAD) Program.

Image Credit: Ziply® Fiber

……………………………………………………………………………………………………………………

Founded in 2001 and headquartered in Liberty Lake, WA, Ptera serves more than 4,000 customers in the cities of Airway Heights, Cheney, Liberty Lake, Medical Lake, Otis Orchards and more. All Ptera employees will join the Ziply Fiber team as part of the acquisition.

“Both Ptera and Ziply Fiber were born here in the Northwest, and both of our companies have been focused on a similar mission to connect communities that have been underserved when it comes to reliable, high-speed internet,” said Harold Zeitz, CEO of Ziply Fiber. “We look forward to having the Ptera employees join the Ziply Fiber team and continue the work underway to expand their fiber network to reach more addresses in the region.”

Zeitz told Fierce Wireless the deal will not only help fill in a gap in its fiber map, but will also give it fixed wireless access expertise which may help it secure more customers in the future. Zeitz said, “We’re not going to build fiber generally where there is fiber. So, rather than skip those areas that we think fit what we ultimately want as our network, it makes sense ultimately to join forces rather than skip an area or build over fiber.”

Zeitz told Fierce Wireless on Friday that it now serves fiber to approximately 800,000 locations – and remains on track to hit its goal to deploy fiber to 80% to 85% of its territory. But for the 15% to 20% of locations that fall outside its economic threshold for building fiber, Zeitz said it will either use grants to help fund its build or just use fixed wireless. Its recent acquisitions “give us an opportunity to have teams that are experienced with that.”

“There’s definitely a part of the footprint that’s just too expensive to get to but they deserve better internet, so fixed wireless is a good alternative for that cross section of the population,” he said. “We may build fiber where there is fixed wireless [today] but we’ll likely have some fixed wireless and we may extend the fixed wireless. We’re in the process of thinking through how we would do that.”

Steven Wilson, CEO of Ptera, said, “Ptera has been a family-owned business for more than 20 years, and I’m very proud of the work our team has done to earn the trust and support of our customers across the Inland Northwest. I’m excited about this next chapter for the company and our future together with Ziply Fiber.”

Current Ptera customers will not see any immediate changes to their service or working relationships. Once the acquisition officially closes (which can take months), customers will benefit from expanded customer service capabilities and access to new products such as SD-WAN and improved network management capabilities.

……………………………………………………………………………………………………………………………

Meanwhile, the fiber buildout boom shows signs of slowing due to inflationary pressures for labor and equipment with a higher interest rates (i.e. cost of capital). In a new report to MoffettNathanson clients, Craig Moffett found that incremental telco fiber passings in 2022 were about 500,000, roughly 8% below year-ago expectations. Meanwhile, combined guidance for 2023 has dipped by 3.1 million, or 40%, he added, noting that this doesn’t include the build activities of private companies such as Windstream, Brightspeed, Ziply Fiber and Cincinnati Bell (altafiber).

AT&T has reduced the pace of future fiber buildouts to 2 million to 2.5 million per year, down from the prior suggested run-rate of 3.5 million to 4 million. That doesn’t include the AT&T-BlackRock joint venture initially targeting the buildout of 1.5 million fiber locations outside AT&T’s current footprint.

Lumen’s build also dropped about 33% from its year-ago guidance amid a broader company “reset”. Frontier Communications’ expected 2023 build has been cut back by about 300,000 passings, though its target to build fiber to 10 million locations by 2025 hasn’t changed.

Altice USA has also reduced its original fiber upgrade plans, putting more emphasis on DOCSIS upgrades in rural footprint.

Moffett doesn’t see any near-term relief as more government funds are released to support rural builds. “We expect labor cost pressures, in particular, to worsen,” he wrote. “We are inching ever closer to the allocation of rural subsidy BEAD [Broadband Equity, Access, and Deployment] funds to states, and then to individual grantees. Those projects will introduce an enormous new source of demand for labor (and for crews from contract builders such as Dycom).”

……………………………………………………………………………………………………………………………….

About Ziply Fiber:

Ziply Fiber is local in the Northwest, headquartered in Kirkland, Washington, and has major offices in Everett, Washington; Beaverton, Oregon; and Hayden, Idaho. Most of Ziply Fiber’s executive team, which consists of former executives from AT&T, CenturyLink, and Wave Broadband, either grew up in the Northwest or have spent the better part of 30 years living here. That local ownership and market familiarity is an important part of the company mindset and culture. Ziply Fiber’s primary service offerings are Fiber Internet and phone for residential customers, Business Fiber Internet and Ziply Voice services for small businesses, and a variety of Internet, networking, and voice solutions for enterprise customers. The company also continues to support Ziply Internet (DSL) customers and its TV customers in Washington and Oregon.

Ziply Fiber has committed to invest hundreds of millions of dollars to build an advanced, 100-percent fiber network to both suburban and rural communities across the Northwest that have been underserved when it comes to internet access. The company has been actively building fiber across the Northwest since June 2020 and has plans to build and deploy new fiber-optic cables, local hubs, new offices, and new hardware to run the network as part of hundreds of additional projects across its 250,000-square-mile footprint.

A full listing of products and services can be found at ziplyfiber.com.

About Ptera:

Ptera, a Liberty Lake, WA based telecommunications corporation, was founded in 2001 as a family-owned business. Today, Ptera is a pioneering wireless internet service provider operating a network with coverage in four counties across Eastern Washington and Northern Idaho. Ptera also offers hosted voice over IP phone solutions serving customers across the country. The company’s service has no data caps on fiber internet and the lowest latency in town, even lower than DSL or cable providers. Ptera’s VoIP service offers crystal clear digital phone calls over an Internet connection utilizing your current handset or Cisco office phone.

For more, visit ptera.com.

References:

https://www.fiercetelecom.com/telecom/ziply-buys-ptera-fiber-expansion-rolls-mulls-fwa-strategy

https://www.lightreading.com/broadband/spotlight-turns-to-arpu-in-us-broadband-battle/d/d-id/783742?

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

Frontier Communications Parent, Inc. (“Frontier”) reported impressive 4th quarter and full-year 2022 results today. The fiber facilities based carrier added a record 76,000 fiber subs in the last quarter, more than two times what it added in the year-ago quarter. The bulk of those fiber subscriber gains are coming from cable competitors, execs said.

Frontier ended 2022 with 1.7 million fiber customers, a figure that represents the majority of its total base of 2.8 million broadband subs. Frontier also built out a record 381,000 new fiber locations in Q4, ending 2022 with 5.2 million fiber locations. That gets Frontier past the halfway point toward a goal of building fiber-to-the-premises to 10 million locations by 2025.

Total revenues were down year-over-year, but consumer fiber revenues rose 7.7% to $436 million versus the prior year period, offsetting declines in video. Consumer fiber broadband revenues surged 15.5%, to $283 million.

“We ended the year strong with another quarter of record operational results. We now have the fiber engine we need to power our growing digital infrastructure business. This is how we advance our purpose of Building Gigabit America,” said Nick Jeffery, President and Chief Executive Officer of Frontier.

“This year, we will accelerate our fiber build and give customers more reasons to choose the un-cable provider. The team is fired up and ready to return to growth in 2023.”

Frontier expects to accelerate its fiber build to 1.3 million homes in 2023 – about 20% faster than its 2022 pace – and end the year with 6.5 million fiber locations. Frontier is also exploring fiber builds beyond its initial goal of 10 million. The company has identified 1 million to 2 million copper locations where it can upgrade to fiber cost-effectively. There’s another 3 million to 4 million locations in its footprint that remain financially unattractive but could get over the hump with government subsidies or partnerships.

Even with its faster build pace, Frontier expects 2023 capital expenditures to reach $2.8 billion, essentially flat versus 2022’s $2.74 billion. Frontier anticipates its fiber buildout costs will stay in its envelope of $900 to $1,000 per location passed.

Frontier believes it’s set to grow its average revenue per user (ARPU) by 2% to 3% in 2023. Tied in, it’s updating its pricing and looking to upsell customers to higher speeds (more than half of new subs are choosing speeds of 1-Gig or more) while also reducing its reliance on perks such as gift cards.

Source: Frontier Q4 2022 earnings presentation

……………………………………………………………………………………………………………………………………………………………………

On the wholesale side, Frontier has fiber tower deals with AT&T, Verizon and T-Mobile and recently inked an expanded deal with AT&T to connect it to Frontier’s central offices. Company President and CEO Nick Jeffery suggested that the same model could apply to the likes of Amazon, Microsoft and other cloud companies that are distributing data and could make use of cache locations where data is being consumed.

But that handwork with wireless network operators has yet to drive Frontier toward deals that could enable it to add mobile services to the bundle, and follow the path being taken by major cable operators such as Comcast and Charter Communications.

Jeffery reiterated a position that Frontier is keeping close watch on potential MVNO partnerships but that no such agreement is imminent. Such a deal could be a “distraction of our capital,” he said.

“For the moment, we don’t see the need to launch with an MVNO and bundle with our core broadband offer,” Jeffery explained. “We think it’s something we could spin up relatively quickly and efficiently if we needed to.”

Full-Year 2022 Highlights:

- Built fiber to 1.2 million locations, bringing total fiber passings to 5.2 million by the end of 2022 – more than halfway to our target of 10 million fiber locations.

- Added a record 250,000 fiber broadband customer net additions, resulting in fiber broadband customer growth of 17.5% from 2021.

- Revenue of $5.79 billion, net income of $441 million, and Adjusted EBITDA of $2.08 billion.

- Capital expenditures of $2.74 billion, including $1.52 billion of non-subsidy-related build capital expenditures and $0.06 billion of subsidy-related build capital expenditures.

- Surpassed our $250 million gross annualized cost savings target more than one year ahead of plan and raised our target to $400 million by the end of 2024.

4th-Quarter 2022 Highlights:

- Built fiber to a record 381,000 locations

- Added a record 76,000 fiber broadband customers

- Revenue of $1.44 billion, net income of $155 million, and Adjusted EBITDA of $528 million

- Capital expenditures of $878 million, including $517 million of non-subsidy-related build capital expenditures and $33 million of subsidy-related build capital expenditures

- Net cash from operations of $360 million, driven by strong operating performance and increased focus on working capital management

- Achieved annualized run-rate cost savings of $336 million

4th-Quarter 2022 Consolidated Financial Results:

- Frontier reported revenue for the quarter ended December 31, 2022, of $1.44 billion, a 6.9% decline compared with the quarter ended December 31, 2021, as growth in consumer, business and wholesale fiber was more than offset by declines in copper and subsidy.

- Revenue growth was negatively impacted by the expiration of CAF II funding at the end of the fourth quarter of 2021.

- Excluding subsidy-related revenue, revenue for the quarter ended December 31, 2022, declined 2.5% compared with the quarter ended December 31, 2021, an improvement in the year-over-year rate of decline reported for the quarter ended September 30, 2022.

- Fourth-quarter 2022 operating income was $136 million and net income was $155 million.

- Capital expenditures were $878 million, an increase from $559 million in the fourth quarter of 2021, as fiber expansion initiatives accelerated.

4th-Quarter 2022 Consumer Results:

- Consumer revenue of $764 million declined 2.3% from the fourth quarter of 2021, as strong growth in fiber broadband was more than offset by declines in legacy video and voice.

- Consumer fiber revenue of $436 million increased 7.7% over the fourth quarter of 2021, as growth in consumer broadband, voice, and other more than offset declines in video.

- Consumer fiber broadband revenue of $283 million increased 15.5% over the fourth quarter of 2021, driven by growth in fiber broadband customers.

- Consumer fiber broadband customer net additions of 73,000 resulted in consumer fiber broadband customer growth of 17.9% from the fourth quarter of 2021.

- Consumer fiber broadband customer churn of 1.32% was flat with the fourth quarter of 2021.

- Consumer fiber broadband ARPU of $61.20 declined 1.6% from the fourth quarter of 2021, as price increases and speed upgrades were more than offset by the autopay and gift-card incentives introduced in the third quarter of 2021.

- Excluding the impact of gift-card incentives, consumer fiber broadband ARPU increased 0.9% over the fourth quarter of 2021.

4th-Quarter 2022 Business and Wholesale Results:

- Business and wholesale revenue of $659 million declined 2.6% from the fourth quarter of 2021, as growth in our fiber footprint was more than offset by declines in our copper footprint.

- Business and wholesale fiber revenue of $285 million increased 5.5% over the fourth quarter of 2021, driven by growth in both business and wholesale.

- Business fiber broadband customer churn of 1.33% increased from 1.23% in the fourth quarter of 2021.

- Business fiber broadband ARPU of $107.68 increased 0.8% from the fourth quarter of 2021.

…………………………………………………………………………………………………………………………………………………..

Separately, Frontier introduced its Fiber Innovation Labs yesterday – National Innovation Day – designed for inventing and testing new patents, technologies and processes that will advance its fiber-optic network. Improving the customer experience and driving efficiencies are key to accelerating Frontier’s fiber-first strategy. Frontier’s labs serve as a testing ground to find new technologies and procedures to advance the way it delivers blazing-fast fiber internet to consumers and businesses across the country.

“The work we are doing in our Fiber Innovation Labs will change the way we serve our customers and will ultimately change the industry,” said Veronica Bloodworth, Frontier’s Chief Network Officer. “We have the best team in the business – they live and breathe innovation. They have been awarded several patents and are in the process of bringing those new inventions to life to deliver the best ‘un-cable’ internet experience to our customers. Be prepared to be amazed.”

As part of Frontier’s Fiber Innovation Labs, the company has launched its first-ever outside plant facility in Lewisville, Texas. The facility is designed as a miniature suburban neighborhood that mimics the real-life experiences of its techs serving customers every day. It features roads, sidewalks, a state-of-the-art central office, a small house and a reconstructed manhole system. It also simulates weather elements and temperature changes. Here, the Frontier team can test and learn new methods in real-world environments to install and maintain its fiber-optic network.

References:

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

\

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications and AT&T today announced a deal that will enable AT&T cell towers to connect to Frontier’s ultra-fast fiber network. Specifically, AT&T will use Frontier’s fiber infrastructure [1.] in areas where AT&T doesn’t currently own fiber. This will improve the resiliency, reliability and speed of the wireless service that AT&T offers to its customers. AT&T is the first tenant to rent space in Frontier’s hyper-local offices and will utilize Frontier’s fiber-optic network to connect with its cell towers that are in Frontier’s network.

Note 1. Frontier’s fiber network is available in 25 states.

Frontier’s footprint is complementary to AT&T’s existing network, which will help accelerate the company’s 5G deployment. AT&T will tap into Frontier’s fiber-to-the-tower (FTTT) infrastructure to connect to AT&T’s wireless cell towers. AT&T is the first tenant to rent space in Frontier’s local central office facilities, they said.

This deal is an extension of AT&T and Frontier’s 2021 agreement that brought the two complementary fiber networks together to power business customers nationwide. That multi-year agreement, focused on Frontier service territories in parts of 25 states, also mentioned support for deployment of AT&T’s 5G network.

The deal comes together as Frontier pushes ahead with a fiber upgrade and buildout plan. Frontier announced late last year that it had neared the halfway point toward a goal of reaching at least 10 million locations with fiber by the end of 2025. While a good portion of that work is focused on delivering services to Frontier’s own residential and business customers, the agreement with AT&T highlights the buildout’s wholesale opportunity.

Fiber backhaul is increasingly critical to support the data demands of wireless networks, including 5G. This agreement enables AT&T to stay ahead of those demands and build on an existing relationship between the two companies. Also, fiber backhaul could help spark a wholesale business that’s been in decline. Frontier’s overall business and wholesale revenues dropped 7.5% in Q3 2022 year-over-year, primarily due to declines in its copper footprint. Meanwhile, business and wholesale fiber revenues rose 1.1%, to $267 million, sequentially.

As illustrated in the figure below, backhaul comprises the Transport network, that connects the Tower / Access Point (mobile base station), which is part of the Radio Access Network (RAN), to the Core Network, where most computing resources are located.

“We’re excited to collaborate with AT&T in strengthening their wireless service with our fiber infrastructure,” said Vishal Dixit, Frontier’s Chief Strategy Officer & EVP Wholesale. “As one of the largest fiber builders in the country, our fiber infrastructure offers an attractive opportunity for tech companies to use this future-proof foundation for their wireless services. This is another example of how innovation is helping to transform Frontier.”

”Fiber is central to our wireless strategy and to our overall connectivity approach,” said Cheryl Choy, Senior Vice President, Network Planning & Engineering, AT&T. “This expanded collaboration with Frontier is a win for both companies, as they can fully utilize their fiber infrastructure, and we can continue to ensure our wireless services are powered by the unparalleled capacity of fiber optic networks.”

About Frontier:

Frontier is a leading communications provider offering gigabit speeds to empower and connect millions of consumers and businesses in 25 states. It is building critical digital infrastructure across the country with its fiber-optic network and cloud-based solutions, enabling connections today and future proofing for tomorrow. Rallied around a single purpose, Building Gigabit America™, the company is focused on supporting a digital society, closing the digital divide, and working toward a more sustainable environment. Frontier is preparing today for a better tomorrow. Visit frontier.com.

About AT&T:

We help more than 100 million U.S. families, friends and neighbors, plus nearly 2.5 million businesses, connect to greater possibility. From the first phone call 140+ years ago to our 5G wireless and multi-gig internet offerings today, we @ATT innovate to improve lives. For more information about AT&T Inc. (NYSE:T), please visit us at about.att.com. Investors can learn more at investors.att.com.

Media Contacts:

Chrissy Murray

VP, Corporate Communications

[email protected]

Anne Tidrick

Director, Corporate Communications

+1 469-516-5862

[email protected]

References:

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Google Fiber making a 5-gig internet tier available in 12 markets after expanding service in CO and TX

Google Fiber is making a 5-gig internet tier available to customers in four of its 12 existing metro markets. Customers in West Des Moines, Iowa; Kansas City, Kansas/Missouri; and Salt Lake City and Provo, Utah can now sign up for the symmetrical service for $125 per month. That cost compares to $70 per month for its symmetrical 1-gig plan and $100 per month for its asymmetrical 2-gig offering.

In particular, Google Fiber’s 5 Gig tier offers symmetrical upload and download speeds with a Wi-Fi 6 router (or you can easily use your own), up to two mesh extenders and professional installation, all for $125 a month. Installation also includes an upgraded 10 Gig Fiber Jack, which means your home will be prepared for even more internet when the time comes.

As homes get “smarter” and every device is set up to stream, having access to higher speed, higher bandwidth internet becomes even more important. 5 Gig is designed to handle the demands of heavy internet users — for example, creative professionals, people working in the cloud or with large data, households with large shared internet demands. 5 Gig will make it easier to upload and download simultaneously, no matter the file size, and will make streaming a dream even with multiple devices.

The 5 Gig tier will be expanded to additional cities later this year and Google Fiber reiterated plans to debut an 8-gig offering in the near future as well. Google noted in a blog that those who opt for the 5-gig plan will be upgraded to a 10-gig fiber jack during installation, teeing customers up to receive “even more internet when the time comes.”

Here’s their Valentine’s Day message:

.jpg)

The operator is the latest to move up the multi-gig stack, following in the footsteps of AT&T, Altice USA, Frontier Communications, Greenlight Networks and Ziply Fiber. Once it launches its 8-gig service, it will join the likes of Lumen Technologies, TDS Telecom and Frontier Communications as per this post.

Earlier this week Google Fiber announced that it will expand services to Westminster, Colorado, and Chandler, Arizona. The move will pit Google Fiber up against incumbents that include Comcast and Lumen in Colorado, and Cox Communications and Lumen in Arizona. Data from BroadbandNow notes that Google Fiber competes with AT&T in Kansas City, Kansas and Missouri.

References:

https://fiber.google.com/blog/2023/02/fall-in-love-with-fast-5-gig-is-here.html

https://fiber.google.com/blog/2023/02/google-fiber-continues-to-grow-next-up.html

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

BT’s CEO: Openreach Fiber Network is an “unstoppable machine” reaching 9.6M UK premises now; 25M by end of 2026

BT’s chief executive said its broadband network is now an “unstoppable machine” that will ultimately “end in tears” for many of its fiber optic competitors. “There is only going to be one national network,” Philip Jansen told the Financial Times. “Why do you need to have multiple providers?” BT said on Thursday that its networking division Openreach had laid fiber to 9.6M premises, with 29% of people in those areas opting to move over to its fiber optic connectivity offering.

BT has long provided the main wholesale network in Britain, giving access to TalkTalk and Sky among other OTT players. BT is ploughing billions of pounds into its network, extending its fiber offerings to 25M premises by end of 2026.

Competitors to Openreach, backed by billions in private capital, are racing to lay full fiber across the UK before the incumbent gets there. They include Virgin Media O2 and more than 100 alternative networks known as “altnets.”

Virgin Media O2 is seeking to upgrade its network to fiber by 2028 and has formed a joint venture between its owners, Spain’s Telefónica and Liberty Global, as well as infrastructure fund Infravia, to lay fiber to an additional 7M premises across the UK and offer wholesale access to other broadband providers. That’s in areas not already covered by the existing Virgin Media network. Industry insiders say network operators need to sign up about 40% of customers in any given location where they are building to make their business viable.

“Building is irrelevant — it’s how many people you’ve got on the network,” Jansen said. “No one else has got a machine anywhere near ours. It’s . . . unstoppable.” He said that the market would probably shake out to be just a “couple of big players” as well as a smattering of specialist providers for things like rural areas and multi-occupancy buildings — a process that would “end in tears” for many of the other operators. Jansen added that while BT had been spending large amounts of cash this year to fund its build efforts, once the construction phase ends he hopes the company will generate “a lot more cash” and could increase the dividend offered to shareholders.

“BT was on the back foot five years ago, we’re unquestionably on the front foot now,” he added. “Investors who own the company need a return.” BT maintained its full-year outlook on Thursday as it posted third-quarter revenue and earnings in line with analysts’ expectations. Revenue fell 3% in the third quarter compared with the same period in the previous year, to £5.2bn, which it attributed in part to lower sales in its global division and a loss of income from BT Sport following the completion of a joint venture with Warner Bros Discovery.

In November BT announced that it would increase its cost-savings target by £500mn to £3bn by 2025 as it sought to mitigate higher energy and inflation costs. As part of the cost-cutting drive, Jansen said there would be fewer people working at BT over the next five years, although he refused to be drawn on numbers. BT has already reduced its net headcount by 2,000 over the past two years, despite significant recruitment at Openreach. It has pushed ahead with inflation-linked price rises in 2023 for the majority of its consumer and wholesale customers in spite of cross-party calls for telecoms companies to reverse the decision during a cost of living crisis. “Right now the [capital expenditure] has to be paid for somehow,” Jansen said. “Hopefully inflation comes down and it won’t be so painful for everyone.”

References:

https://www.ft.com/content/031dcf72-dfaf-4e90-85d2-335ef703dbd1

Openreach on benefit of FTTP in UK; Full Fiber rollouts increasing

Super fast broadband boosts UK business; Calls to break up BT & sell Openreach

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

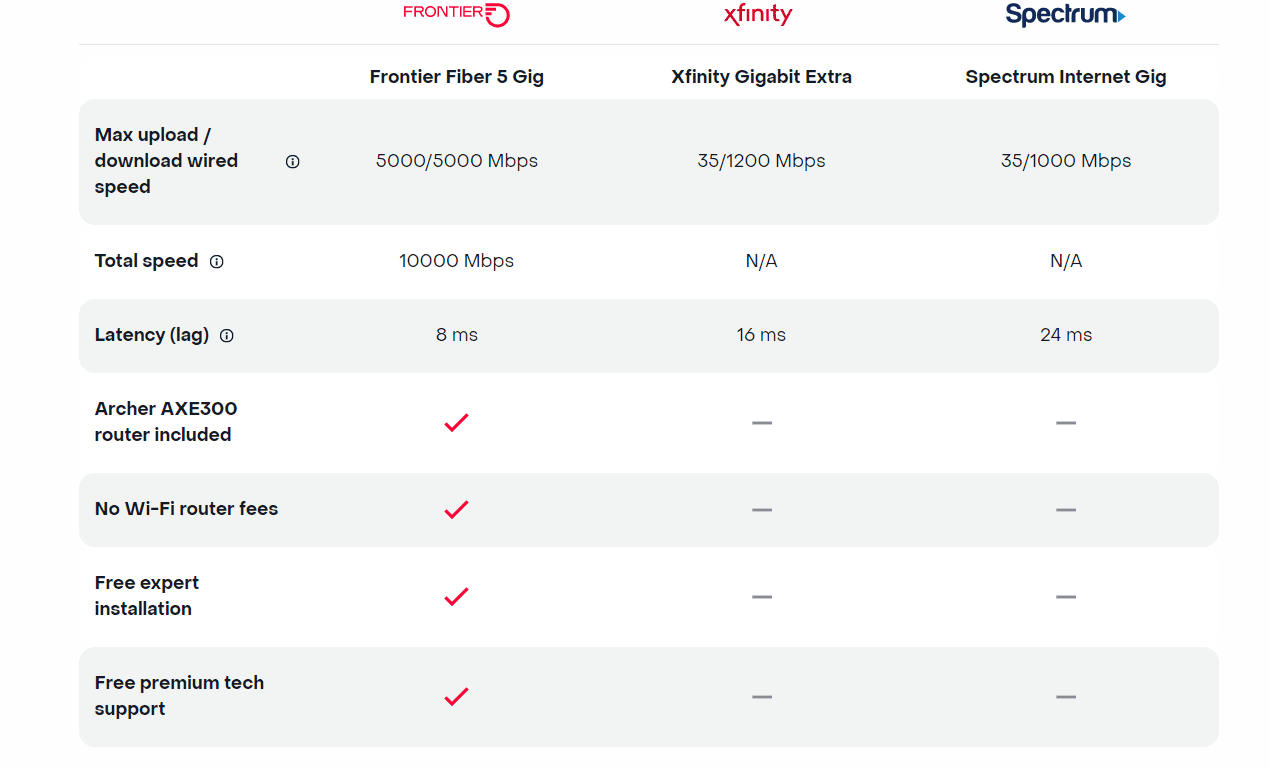

Today, Frontier Communications launched the nation’s only network-wide 5 Gig fiber internet service. With the launch of 5 Gig, Frontier will provide customers across its 25 state fiber network – not just select markets – the opportunity to sign up for the new premium service with blazing-fast speeds. The company says that 5 Gig internet has 125x faster upload speeds, 5x faster download speeds and 2.5x less latency than cablecos [1.], but they don’t specify the cable network speeds or latency.

Note 1. Comcast currently offers 1 and 2 Gig Internet. The company announced a successful trial of the world’s first live, multigigabit symmetrical Internet connection powered by 10 Gbps and Full Duplex DOCSIS 4.0 last December. Charter Communications is also planning a DOCSIS 4.0 upgrade to deliver download speeds of 5 Gbps and 10 Gbps over the coming years, but isn’t currently planning to bring symmetrical service offerings to market.

Frontier’s 5 Gig fiber internet service enables customers to run multiple connected devices at their fastest possible speeds. This means:

- Symmetrical download and upload speeds at up to 5 gigabits per second

- 125x faster upload speed than cable

- 1.6 seconds to download Adobe Photoshop on PC (1GB)

- <36 seconds to download a House of Dragons episode in 4K (22 GB)

- <2 minutes to download a 100-minute 8K movie (67 GB)

- 99.9% network reliability

The 5 Gig internet offer starts at $154.99 a month with autopay and includes uncapped data + Wi-Fi router + free installation + premium tech support. There are no additional Wi-Fi or router fees, no data caps or overage charges. The inclusion of a Archer AXE300 Wi-Fi 6E router is a major advantage, because most installed WiFi routers are WiFi 5= IEEE 802.11ac which won’t support giga bit speeds.

Frontier also dropped the price of its 2-gig internet service, which debuted in February 2022 at a cost of $149.99 per month. That service is now priced at $109.99 per month.

New Street Research stated that Frontier’s 5-gig rollout will “help establish Frontier as a leader in network capabilities and drive the message that this is a new Frontier.” The analysts added, “It also helps drive the message that they are delivering a product that Cable can’t.” Furthermore, New Street noted the move could contribute to growth in average revenue per user (ARPU) given the price drop for the 2-gig plan could “drive some incremental demand for that too.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

On Frontier’s Q3 2022 earnings call, CEO Nick Jeffrey noted 45% to 50% of new customers were taking its 1 Gbps and 2 Gbps plans. Among its installed base, uptake of 1-gig or faster speeds stood at 15% to 20%. That was up sequentially from 10% to 15% in Q2, Jeffrey said at the time.

Frontier is set to report Q4 2022 earnings on February 24th. In a 4Q 2022 earnings preview, the ISP disclosed it added 75,000 new fiber customers and 8,000 total broadband subscribers in the quarter. That was 17% more fiber broadband customers than it had at the end of 2021. For the fifth consecutive quarter, fiber broadband customer additions outpaced copper broadband customer losses, resulting in 8,000 total broadband customer net additions in the fourth quarter of 2022.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Other Competition:

AT&T, Altice USA, Lumen Technologies and Ziply Fiber all already provide symmetrical speeds of 5 Gbps or faster. And Google Fiber has announced plans to debut 5-gig and 8-gig plans early this year. But Frontier claimed it is the only operator thus far to roll out such speeds networkwide.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

About Frontier Communications:

Frontier is a leading communications provider offering gigabit speeds to empower and connect millions of consumers and businesses in 25 states. It is building critical digital infrastructure across the country with its fiber-optic network and cloud-based solutions, enabling connections today and future proofing for tomorrow. Rallied around a single purpose, Building Gigabit America™, the company is focused on supporting a digital society, closing the digital divide, and working toward a more sustainable environment. Frontier is preparing today for a better tomorrow. Visit frontier.com.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Media Contact:

Chrissy Murray, VP, Corporate Communications

+1 504-952-4225 [email protected]

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://frontier.com/shop/internet/fiber-internet/5-gig

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

On AT&T’s earnings call this week, CEO John Stankey provided these highlights:

- AT&T network teams have also consistently outpaced our mid-band 5G spectrum rollout objective. In fact, we now reach 150 million mid-band 5G POPs, more than double our initial 2022 year-end target. Our goal remains to deploy our spectrum efficiently and in a manner that supports traffic growth. In the markets where we have broadly deployed mid-band 5G, 25% of our traffic in these areas already takes advantage of our mid-band spectrum.

- We also expect to continue our 5G expansion, reaching more than 200 million people with mid-band 5G by the end of 2023.

- AT&T had more than 1.2 million AT&T Fiber net adds last year. The fifth straight year we’ve totaled more than 1 million AT&T Fiber net adds. And after 2.9 million AT&T Fiber net adds over the last 2.5 years, we’ve now reached an inflection point where our fiber subscribers outnumber are non-fiber DSL subscribers. The financial benefits of our fiber focus are also becoming increasingly apparent as full year fiber revenue growth of nearly 29% has led to sustainable revenue and profit growth in our Consumer Wireline business. As we scale our fiber footprint, we also expect to drive margin expansion.

- AT&T has the nation’s largest and fastest-growing fiber Internet, and we expect continued healthy subscriber growth as we grow our fiber footprint. As we keep expanding our subscriber base will drive efficiencies in everything we do. AT&T considers fiber a multiyear opportunity that will transform the way consumers’ and businesses’ growing connectivity needs are met in the ensuing decade and beyond.

- AT&T Fiber will be passing 30 million-plus consumer and business locations within our existing wireline footprint by the end of 2025. We finished last year with approximately 24 million fiber locations passed, including businesses, of which more than 22 million locations are sellable, which we define as our ability to serve. We remain on track to reach our target of 30 million plus passed locations by the end of 2025. The simple math would suggest 2 million to 2.5 million consumer and business locations passed annually moving forward. As we previously shared, build targets will vary quarter-to-quarter in any given year based on how the market is evolving.

- AT&T’s Gigapower joint venture announcement with a BlackRock infrastructure fund has not yet closed, we’re very excited about the expected benefit. Through this endeavor, Gigapower plans to use a best-in-class operating team to deploy fiber to an initial 1.5 million locations, and I would expect that number to grow over time. This innovative risk-sharing collaboration will allow us to prove out the viability of a different investment thesis that expanding our fiber reach not only benefits our fiber business, but also our mobile penetration rates. But what makes me most enthusiastic about this endeavor is that we believe Gigapower provides us long-term financial flexibility and strategic optionality and what we believe is the definitive access technology for decades to come, all while sustaining near-term financial and shareholder commitments.

- AT&T sees huge opportunities to connect people who previously did not have access to best-in-class technologies through broadband stimulus and Broadband Equity, Access, and Deployment (BEAD) funding. As I shared before, we truly believe that connectivity is a bridge to possibility in helping close the digital divide by focusing on access to affordable high-speed Internet is a top priority of AT&T. The intent of these government programs is to provide the necessary funding and support to allow both AT&T and the broader service provider community that means to invest alongside the government at the levels needed to achieve the end state of a better connected America.

- Our commitment to fiber is at the core of our strategy. In footprint, we’re on track to deliver our 30 million plus location commitment and we’re building the strategic and financial capabilities to take advantage of further opportunities as they emerge.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

AT&T’s open disaggregated core routing platform was carrying 52% of the network operators traffic at the end of 2022, according to Mike Satterlee, VP of AT&T’s Network Core Infrastructure Services in an interview with SDxCentral. Satterlee described this platform as the carrier’s “common” or “core backbone,” which supports about 594 petabytes of data traffic per day. This core backbone is a multi-part architecture spanning from AT&T’s nationwide network switch and cloud provider connections to its consumer- and enterprise-facing broadband and mobility services.

AT&T’s core platform uses Broadcom’s Jericho2 hardware design and Ramon switching chips, the carrier’s distributed disaggregated chassis (DCC) white box router architecture, and Israel based DriveNets Network Cloud (DNOS) software. It’s fed by AT&T’s edge router platform that sits in regional connection points. It uses the Broadcom silicon, Cisco software platform, and hardware from UfiSpace.

Satterlee said AT&T is running a nearly identical architecture in its core and edge environments, though the edge system runs Cisco’s disaggregates software. Cisco and DriveNets have been active parts of AT&T’s disaggregation process, though DriveNets’ earlier push provided it with more maturity compared to Cisco.

“DriveNets really came in as a disruptor in the space,” Satterlee said. “They don’t sell hardware platforms. They are a software-based company and they were really the first to do this right.”

AT&T began running some of its network backbone on DriveNets core routing software beginning in September 2020. The vendor at that time said it expected to be supporting all of AT&T’s traffic through its system by the end of 2022.

“It’s completely open in the sense that either vendor software could run in either places of the network,” Satterlee explained, adding that this was very helpful during the COVID-19 pandemic. “By having a common platform it’s just a matter of switching out the [network operating system] so we were able to very quickly redirect equipment for different use cases within AT&T and it was just a simple software change controlled by SDN.”

AT&T is targeting 65% of its traffic running on the disaggregated architecture by the end of this year. This will be important to support AT&T’s fiber and 5G push, which was enhanced late last year through a deal the carrier struck with BlackRock to expand its fiber footprint.

John Gibbons, assistant VP for AT&T’s Network Infrastructure Services, added that this also paves the way for the carrier to roll out 800-gigabit support for its backbone. “We don’t have to swap out the core router to get to 800-gig,” Gibbons said. “We can actually add to the current chassis. … We can add the new box to start growing it out from there. That’s the flexibility. It’s like the building-block model.

“Pretty much everything we spoke about supports our two biggest initiatives, which is growing the AT&T fiber broadband as well as 5G, and it’s all the underpinnings of those services,” Gibbons said.

References:

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T Deploys Dis-Aggregated Core Router White Box with DriveNets Network Cloud software

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

According to a recent forecast report by Dell’Oro Group, the Optical Transport equipment demand is forecast to increase at a 3 percent compounded annual growth rate (CAGR) for the next five years, reaching $17 billion by 2027. The cumulative revenue during that five year period is expected to be $81 billion.

“We expect annual growth rates to fluctuate in the near term before stabilizing to a more typical 3 percent growth rate,” said Jimmy Yu, Vice President at Dell’Oro Group. “There is still a large amount of market uncertainty this year due to the economic backdrop—economists are predicting a high chance of a recession in North America and Europe. However, at the same time, most optical systems equipment manufacturers are reporting record levels of order backlog entering the year, and we expect that most of this backlog could convert to revenue when component supply improves this year,” added Yu.

Additional highlights from the Optical Transport 5-Year January 2023 Forecast Report:

- Optical Transport market expected to increase in 2023 due to improving component supply.

- WDM Metro market growth rates in next five years are projected to be lower than historic averages due to the growing use of IP-over-DWDM.

- DWDM Long Haul market is forecast to grow at a five-year CAGR of 5 percent.

- Coherent wavelength shipments on WDM systems forecast to grow at 11 percent CAGR, reaching 1.2 million annual shipments by 2027.

- Installation of 400 Gbps wavelengths expected to dominate for most of forecast period.

About the Report

The Dell’Oro Group Optical Transport 5-Year Forecast Report offers a complete overview of the Optical Transport industry with tables covering manufacturers’ revenue, average selling prices, unit shipments, wavelength shipments (by speed up to 1.2+ Tbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers, optical switch, Disaggregated WDM, DCI, and ZR Optics.

……………………………………………………………………………………………………………………………………………………

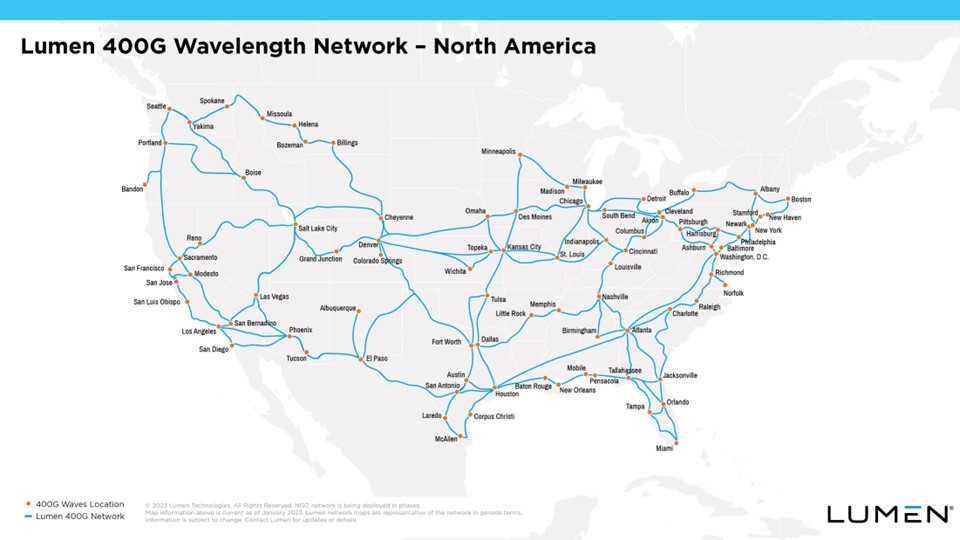

Separately, Lumen Technologies is expanding its 400G wavelength network across North America. Lumen said it has now deployed the network in 70 markets. More than 240 data centers have access to Lumen’s 400G Wavelength Services, and the network has over 800 Tbit/s of capacity.

Lumen said it plans to continue its intercity 400G expansion this year, pushing the network “deeper into the metro edge.” The company noted that wavelength services will assist customers in moving workloads to the cloud, and provide private, dedicated connections.

Enterprise customers can also examine network options, plan out their wavelengths and get cost estimates with Lumen’s Topology Viewer.

References:

https://www.prnewswire.com/news-releases/lumen-kicks-up-its-400g-offering-across-the-us-301730126.html

Fiber Build-Out Boom Update: GTT & Ziply Fiber, Infinera in Louisiana, Bluebird Network in Illinois

This week GTT Communications, Infinera, and Bluebird Network all announced network expansions within the U.S. The various announcements follow AT&T’s deal last month with venture capital firm BlackRock to deploy a multi-gigabit fiber network to 1.5 million customer locations using a commercial open access platform.

GTT Communications, Inc., a leading global provider of managed network and security services to multinational organizations, has announced that it has expanded its partnership with Ziply Fiber, a provider of fiber networks purpose-built for the internet, to establish a new network Point of Presence (PoP) to serve the fast-growing data center market in Portland, Oregon. The two companies linked in hopes to “serve the fast-growing data center market” in the city, according to the announcement.

The new PoP is providing an initial 400G of capacity to customers in the U.S. Pacific Northwest region and will expand the power of GTT’s global Tier 1 IP network by offering an additional option for customers to connect in 11 major data centers and the Hillsboro subsea cable landing station, expanding the reach of GTT via Ziply Fiber’s high-count Silicon Forest fiber cross connection service.

“We are pleased to expand our partnership with GTT to establish a new network PoP in Portland to help customers in the region and beyond to connect to area data centers as well as other geographies,” said Mike Daniel, vice president of Enterprise Sales at Ziply Fiber. “Our regional fiber network, combined with GTT’s global Tier 1 network and suite of leading managed networking and security services, will give enterprises new options to improve connectivity securely and reliably.”

GTT’s global Tier 1 IP backbone is ranked among the largest in the industry1 and connects more than 260 cities on six continents. With the addition of the new Portland PoP, GTT customers in the region can benefit from the improved connectivity, security and scalability available through GTT’s suite of managed connectivity services.

Ziply Fiber’s network was architected to meet today’s increasing digital demands and was engineered to be fully redundant, with a dual infrastructure that maintains customer connections even when issues arise. Ziply Fiber maintains a four-state footprint in Washington, Oregon, Idaho and Montana and has built redundancies into its network to avoid service interruptions, while updating routing to steer clear of congestion across the broader internet. This ensures content is accessible directly on the fiber backbone and can be accessed more quickly.

“This new PoP deployment creates an exciting opportunity to use the Ziply Fiber network to allow our regional data center customers to easily connect to and take advantage of GTT’s global Tier 1 IP network and our full suite of managed services offerings,” said Jim Delis, president, Americas Division, GTT. “Our work with Ziply Fiber demonstrates GTT’s continued focus on investment to expand the reach of our network for customers with locations in the Pacific Northwest.”

GTT will offer additional customer options to connect in 11 data centers and the Hillsboro subsea cable landing station. Jim Delis, president for GTT’s Americas Division, stated the PoP deployment will enable the network provider’s data center customers to link into its tier-one IP network.

………………………………………………………………………………………………………………………………………………..

Infinera announced today that the Louisiana Board of Regents, acting on behalf of the statewide Louisiana Optical Network Infrastructure (LONI) and the Board of Supervisors of Louisiana State University (LSU) and Agricultural and Mechanical College, has selected and deployed Infinera’s advanced coherent optical networking solutions to upgrade LONI. Also announced today is the initial deployment of four 400G optical channels along a 220-mile intrastate route in Louisiana.

LONI connects 38 university campuses and data centers and provides connectivity to additional research and education networks in other states. The solution, which increases LONI’s network capacity by a factor of 10, comprises Infinera’s XTM Series open line system and GX Series transponders. The upgraded network expands the ability for the research and education community to share and access information, resources, and remote instruments in real time.

LONI promotes scientific computing and technology across Louisiana and is the backbone infrastructure to the state’s heroic research efforts. These efforts are made possible by utilizing cutting-edge technology to push the limits of scientific discovery at leading university campuses and achievable with LONI’s high-bandwidth optical network. Infinera’s XTM Series line system coupled with GX Series high-performance transponders equips LONI with a 200G/400G/600G solution that offers unmatched high-bandwidth services to its customers today and is scalable to 800G in the future. Infinera’s combined solution delivers superior performance, increasing LONI’s service offering with more bandwidth, greater flexibility, and faster data transfer capabilities.

“A high-capacity state-of-the-art network is critical to enabling breakthrough discoveries that can only be achieved through multi-site collaboration and cloud connectivity,” said Lonnie Leger, LONI’s Executive Director. “We are committed to offering our members up to 100G and deploying Infinera’s innovative solutions, which exceeded both our expectations and commitment, enabling us to exceed what other state universities can offer.”

“LONI operates with a small staff, which requires a highly automated network and cost-effective solution that enables them to meet their bandwidth growth requirements,” said Nick Walden, Senior Vice President, Worldwide Sales, Infinera. “The Infinera team worked closely with LONI to deliver a solution that met their needs now and positions them to meet future bandwidth needs with minimal maintenance and manpower to operate.”

“As bandwidth continues its relentless growth driven by new high-speed applications such as 5G, [augmented reality], [virtual reality], and cloud services, legacy copper-based networks – such as DSL and cable – are simply not capable [of] meeting the bandwidth requirements,” Robert Shore, SVP of marketing at Infinera, told SDxCentral.

Shore added that the current fiber boom “reinforces Infinera’s focus on continuing to innovate and manufacture optical transport solutions that can help network operators effectively leverage their fiber deployments from the core of their network all the way to the very edge.”

Infinera also announced that its ICE6 solution was deployed along the trans-Pacific Unity Submarine Cable System connecting Japan and the U.S., doubling the capacity of that connection.

……………………………………………………………………………………………………………………………………………………….

Bluebird Network completed a 126-mile fiber buildout in Illinois. The route connects the towns of Aurora, Dixon, DeKalb, Sterling, and Rock Falls to Bluebird’s network and services, and provides a “diverse route” to Chicago, the company stated.

Bluebird’s management noted the deployment builds on its recently acquired middle-mile fiber network assets from Missouri Telecom, and expansion into Salina, Kansas, and Waterloo, Iowa.

“Bluebird has no plans to slow down its fiber expansions any time soon,” Bluebird Network President and CEO Michael Morey stated in the release tied to its Kansas and Iowa expansion. “To foster even more growth and strengthen connectivity for businesses in the Midwest, we have builds underway for additional expansions coming online this summer.”

Those moves come on the heels of the AT&T/BlackRock JV that is looking to deploy fiber to more than 30 million locations within AT&T’s 21-state wireline footprint by the end of 2025, and positions the newly created Gigapower entity to boost its reach outside of those initial 21 states.

The deal also prompted a predication from Analysys Mason, saying the move further indicates “that the [U.S.] wireline market is entering a period of profound transformation that will leave it more aligned with the market structures seen in Europe.”

…………………………………………………………………………………………………………………………………………………

References:

https://www.sdxcentral.com/articles/news/us-fiber-build-booms/2023/01/

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape