Nokia

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Network is just a month into the commercial launch of its cloud native based 5G core network, but is already planning how it will expand that architecture to take advantage of multi-cloud and hybrid cloud environments. DIsh is using Nokia’s cloud-native, 5G standalone core software which is deployed on the AWS cloud. This includes software for subscriber data management, device management, packet core, voice and data core, and integration services

During a Dish-Nokia fireside chat this Tuesday (sponsored by Nokia) on LinkedIn, Jitin Bhandari – CTO and VP, Cloud and Network Services, Nokia interviewed Sidd Chenumolu, VP of technology development and network services at Dish Wireless, provided some insight into the carrier’s current use of Amazon Web Services (AWS) public cloud resources.

Chenumolu said Dish’s 5G core was currently using three of AWS’ four public regions, was deployed in “multiple availability zones and almost all the local zones, but most were deployed with Nokia applications across AWS around the country.”

[AWS Outposts GM Joshua Burgin had previously explained to SDxCentral that Dish would be using a mixture of AWS Regions, Local Zones, and Outposts, specifically the smaller form factor AWS Outposts servers, to power its network. This includes the deployment of single 1U Outpost servers, some with an accelerator card, to run network functions in single-digit milliseconds at cell sites, he said in a phone interview.]

AWS Local Zones, which are built on Outpost racks and span 15 locations around the U.S., some of which were deployed to meet Dish’s demands, run Dish’s less latency-sensitive functions, Burgin explained. Dish’s operations and business support systems will run on AWS Regions.

“How to we deploy 5G SA core network on multi-cloud,” Sidd asked but did not answer. He then started to turn the tables and interview Jitin via a series of questions.

Chenumolu did not provide an update on Dish’s use of AWS’ Wavelength platform, which the cloud giant initially launched in partnership with Verizon to marry the network operators’ 5G networks with AWS’ edge compute service. Burgin had previously stated that support “could come down the line.”

The usual hype and back slapping/praise with glib expressions like “disintegrated disruptor, uncharted territory, automate learning with AI, cloud RAN,” etc. characterized the session.

References:

https://www.linkedin.com/video/event/urn:li:ugcPost:6945794807772438528/

https://www.sdxcentral.com/articles/news/dish-eyes-5g-multicloud-hybrid-cloud-expansion/2022/07/

Virgin Media O2 deploys UK’s first 5G-connected hospital to transform healthcare

Virgin Media O2 (VMO2) and the NHS have collaborated to build the UK’s ‘first 5G connected hospital,’ which they say will transform healthcare. The Maudsley Smart Hospital and Maudsley Smart Pharmacy trials are funded by NHS digital with tech provided by VMO2 and Nokia, and are designed to explore the efficiency, safety and security benefits of using 5G-connected technologies in hospitals, across the usual catch-all 5G adjacent sectors of IoT, AR and AI.

Two wards at al Bethlem Royal Hospital in South London are now using dedicated, near-real-time connectivity to power e-Observations, where clinicians use handheld devices to update patient records, saving valuable time and improving accuracy. It seems to be implied interacting with the equipment over 5G will be more efficient than using the hospital’s WiFi network.

The 5G trials will also include an IoT innovation lab and platform, in partnership with Bruhati (South London and Maudsley has made Bruhati its partner for providing IoT technology to the Trust). This will look at smart, connected use cases – including remotely monitoring medicine fridges to ensure drugs are stored at the optimum temperature and thereby reducing expensive waste, tracking the air quality inside wards, and monitoring occupancy of desks and meeting rooms in the hospital.

An Augmented Reality (AR) tool called Remote Expert will allow maintenance workers in other hospitals to pop on a helmet and remotely help fix problems in some way, while an AI tool called Spatial Insights generates anonymised heat maps of crowd movement from CCTV footage, which will apparently help them to better plan layouts in the future. There is also talk of smart devices and monitoring to reduce medicine waste and track the air quality in wards, which sounds useful enough.

Mike Smith, Large Enterprise & Public Sector Director at Virgin Media O2 Business said: “The NHS has been a cornerstone of British society for nearly 75 years, and today, we’re proud to announce the switch-on of the UK’s first 5G-connected hospital – showing how next-generation technology can help create a smarter, modern healthcare service for everyone. Our aim is to map out the rollout of wireless and smart hospital connectivity across the NHS estate over the next three to five years. Trials like this are the embodiment of our mission to upgrade the UK, and a clear sign of the role we can play in helping to shape the NHS of the future.”

Stuart MacLellan, Acting Chief Information Officer at South London and Maudsley Foundation Trust said: “Exploring and using the latest technology supports our core strategic aim to deliver outstanding mental health care for people who use our services, their carers and families. We are proud to be partnering with Virgin Media O2 Business to create the UK’s first 5G-connected hospital, which enables us to use digital innovations to improve patient outcomes. This is a very exciting step forward.”

Kester Mann, technology analyst and Director, Consumer and Connectivity at CCS Insight, said: “This is a landmark moment for the UK telecoms and healthcare sectors. Dedicated 5G in hospitals can open the door to a range of new applications such as real-time tracking of patients’ conditions, remote support and round-the-clock monitoring of medicines and equipment. Its high throughput and low-latency characteristics can also improve the efficiency and security of existing operations, making healthcare services smarter, more accurate and more effective.”

…………………………………………………………………………………………………………………………

If the NHS trials can demonstrate how the implementation of AI heatmaps for planning layouts and AR headsets for maintenance workers can start taking chunks out of how long it takes to be treated for immediate and long term conditions, then everyone will surely be behind rolling it out elsewhere.

References:

VMO2 and Nokia help create UK’s ‘first 5G connected hospital’

Nokia and Antofagasta Minerals deploy private wireless network to accelerate digital transformation in Chile

Nokia and Antofagasta Minerals deploy private wireless network to accelerate digital transformation of Minera Centinela operations in Chile.

Nokia said it has won a contract to provide industrial-grade private wireless network capability in one of the four copper mines run by Antofagasta Minerals in Chile.

- Nokia industrial-grade private wireless network to provide reliable, high-capacity and low latency connectivity for sensors and vehicles at the Centinela mine

- Private 4.9G/LTE network, deployed within four months, will support operations, including an autonomous fleet of trucks, as part of a five-year digitalization plan

- Antofagasta Minerals, one of the world’s leading copper miners, has four operations in Chile, Minera Centinela being one of them

The Minera Centinela facility mines sulphide and oxide deposits 1,350km north of Santiago in the Antofagasta region, one of Chile’s most important mining areas. Centinela produces copper concentrate (containing gold and silver) through a milling and flotation process, as well as molybdenum and gold. It also produces copper cathodes, using the solvent extraction and electrowinning (SX-EW) process.

In August 2021, Centinela obtained the Copper Mark, which certifies that the company operates under strict internationally recognised sustainable production standards.

The new 5G network is designed to not only support secure and reliable operations at the mine, but also to enable the mining group to accelerate its digital transformation.

A Nokia-sponsored IDC infobrief revealed that safety is a key consideration when identifying initiatives for transformation, and that sustainability tops miners’ strategic objectives. The report quotes IDC’s 2021 Worldwide mining decision maker survey, which highlighted the increasing adoption of digital transformation strategies in mining, with 86% of mining companies planning to invest in wireless infrastructure in the next 18 months.

Image Credit: Minera Centinela

……………………………………………………………………………………………………….

Gino Ivani, Technology Manager for Antofagasta Minerals, said: “We are transforming the way mining is done. We want to deliver excellence in everything we do, leveraging operational efficiencies to achieve the best results. We are committed to sustainable mining and to providing the safest and most efficient facilities. We are very pleased to leverage Nokia industrial-grade private wireless solutions and its experience in mining automation to support our efforts.”

Leonardo Serra, corporate head of IT projects at Antofagasta Minerals, said: “Copper is critical for the delivery of clean energy and consequently to reduce emissions. As demand for copper increases, we are deploying technology innovations, such as Nokia private wireless connectivity, allowing us to enhance productivity in a smart and sustainable way.”

Marcelo Entreconti, Head of Enterprise for Latin America at Nokia, said: “We are witnessing the first wave of Industry 4.0 projects in Latin America and it is very exciting to watch them become a reality for mining companies like Antofagasta Minerals. Nokia industrial-grade private wireless delivers the robust, secure, predictable and deep wireless coverage that mines require for large outdoor areas or underground complexes. Deploying these networks is considered the first and most important step in the digitalization journey of mining companies, and lays the groundwork for an expansion beyond connectivity where Nokia is already proposing solutions to the global mining community.”

Nokia designed and deployed the industrial-grade network based on a private 4.9G/LTE solution, including Nokia AirScale radio equipment, mobile packet core, IP/MPLS service aggregation routers, and Wavence microwave transmission.

Antofagasta’s Centinela open pit mine is located approximately 1,350 kilometers north of Santiago at an important mining zone with sulfur and oxides. The mine produces copper concentrate and cathodes, as well as molybdenum and gold. In August 2021, Centinela obtained the Copper Mark, which certifies that the company operates under strict internationally recognized sustainable production standards.

Additional resources:

Webpage: Nokia solutions for the mining industry

White paper: Mining and mission-critical wireless connectivity

References:

https://finance.yahoo.com/news/nokia-antofagasta-minerals-deploy-private-150600139.html

https://www.computerweekly.com/news/252514632/Nokia-Antofagasta-Minerals-dig-deep-for-private-5G-wireless-network

Nokia and Mavenir to build 4G/5G public and private network for FSG in Australia

Australian rural carrier Field Solutions Holdings (FSG) has selected Nokia and Mavenir as its primary technology vendors to build Australia’s fourth mobile network.

As part of the deal, the technology partners will supply 4G and 5G radio access networks and the mobile core network. Mavenir will provide 4G/5G Converged Packet core, as well as IMS voice and messaging services.

FSG plans to deliver 4G and 5G services in rural, regional and remote areas of the country. FSG will also be delivering private 4G LTE and 5G service offerings. FSG, has secured 5G spectrum holdings to ensure that rural, regional and remote Australia is not left behind in the rollout of 5G services.

FSG CEO Andrew Roberts, said FSG’s 5G service will cover 85% of Australia’s landmass.

“FSG has run a comprehensive 6-month RFP process to select the most appropriate technology partners for the rollout of the Regional Australia Network. FSG has selected these partners to ensure we have the cost-effective, future proof and globally proven technology platform needed to deliver Australia’s 4th mobile network.”

“The demand for private 4G and 5G networks is gaining momentum, FSG will be delivering cost-effective, carrier-grade private solutions for agri-business, mining and government. We expect to be announcing several private 4G and 5G private network deployments in the coming weeks,” said FSG CEO Andrew Roberts.

“Together with our new partners, Nokia and Mavenir, FSG is primed to deliver connectivity to regions, whilst offering capability for carriers to join the solution using Active Neutral host RAN, inbound roaming or ‘old school’ passive co-location on our purpose-built infrastructure,” Roberts added.

By embracing new models, the cost to deliver these solutions can be kept to a minimum, further supporting the committee’s desire to ensure that affordability is not forgotten. FSG are in the process of delivering 19 new place-based networks across Australia. These networks, comprising over 100 sites, each of which will be 4G and 5G capable, Neutral Host and Roaming ready when delivered in FY 23/24. “The Regional Australia Network is a dedicated network supporting rural Australia. Today, we operate Australia’s largest non-NBN fixed wireless network, which delivers fixed wireless broadband across rural, regional and remote Australia. The Regional Australia Network (RAN(TM)) will see these current and all new networks being enabled to delivery 4G and 5G data and voice services, fixed wireless broadband together with NB-IoT and CatM1 services”, Roberts stated.

FSG also said that the company is in the process of delivering 19 new “place-based” networks across Australia. These networks comprise more than 100 sites, each of which will be 4G and 5G capable, neutral host and roaming-ready when delivered in fiscal year 2023/24.

Anna Perrin, Nokia’s managing director for Australia and New Zealand, said, “As a world-leading provider of mobile technology, we have championed the development of Neutral Host networks around the world and we’re excited to bring this global expertise to our partnership with FSG. Supporting the creation of new and innovative solutions and business models for rural and remote coverage across Australia.”

“Mavenir is excited to partner with FSG to deliver a cost-effective, future proof and globally proven 4G/5G Cloud-native Converged Packet Core, IMS and messaging services to enable Australia’s 4th mobile network,” said Dereck Quinlan, Mavenir regional VP.

“Mavenir continues to drive forward with advanced cloud-native solutions that our customers and the industry recognise. Our Cloud-native Converged Packet Core solution embraces a disruptive technology architecture and business model that drive network agility, deployment flexibility, and service velocity,” Quinlan added.

Over the next 18 months, FSG, in partnership with the Australian Federal Government and mobile operator Optus, will be trialing the deployment of what it says is Australia’s first “Active Neutral Host” network. The neutral-host model enables FSG to build and operate infrastructure and a single set of electronics that all mobile network operators in Australia can utilize and will be ready for PSMB services, the company says.

“The more carriers subscribe to the model, the more valuable and impactful it is for Australian Rural communities and Australia as a whole. We look forward to welcoming the other Australian Carriers to the program, to make the neutral host model a reality for rural, regional and remote Australia,” Roberts added.

References:

https://www.bloomberg.com/press-releases/2022-02-20/selects-nokia-and-mavenir-as-technology-partners

FSG selects Nokia, Mavenir to rollout Australia’s fourth mobile network

Nokia survey finds CSPs are not monetizing 5G services- BSS must be improved

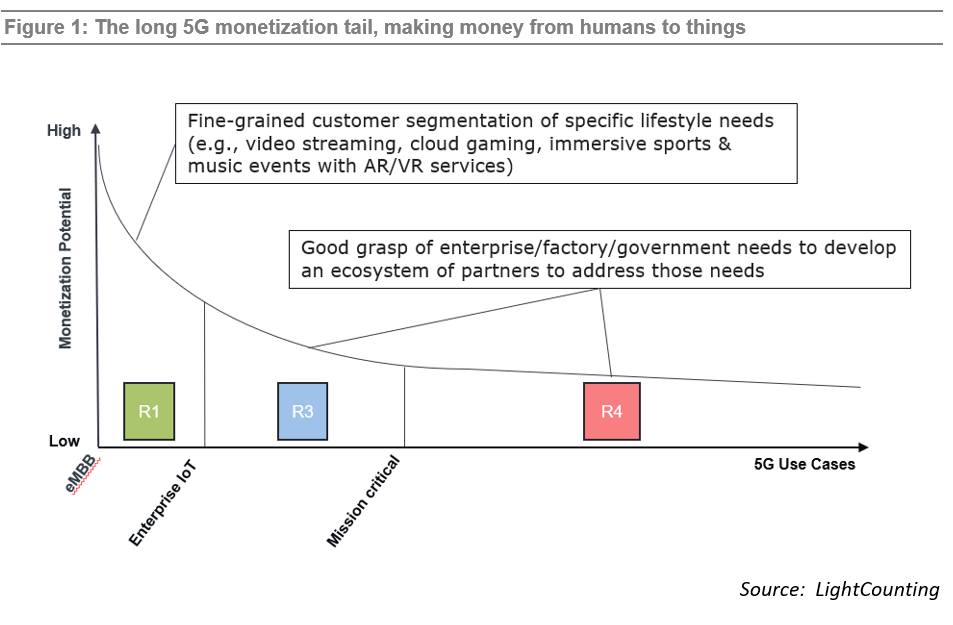

A Nokia-commissioned survey of 100 communication service providers (CSPs) around the world found only 11% have sufficient Business Support Systems (BSS) in place for effective 5G monetization. Yet this author believes such BSS are not the key issue in monetizing 5G. The IEEE Techblog which has repeatedly stated there are currently no compelling 5G use cases without URLLC in the RAN/core and cloud native 5G SA Core networks deployed. Also, a cloud-native software architecture is key to achieving a 5G-ready monetization system, with many benefits that include limitless scalability, and an ideal platform for AI, analytics, and edge computing capabilities for ultra-low latency use cases.

An overwhelming number of survey respondents, at 98%, indicated they would have to alter their BSS in the coming years in order to put proper, up-to-date monetization tools in place.

The survey also found that nearly 70% of CSPs are now considering deploying cloud-based monetization solutions. In addition, two-thirds of respondents indicated they believe that real-time charging is essential for 5G monetization, in part because of its ability to help CSPs respond quickly to customer demands.

More details on the research can be found here.

John Abraham, Principal Analyst at Analysys Mason, said: “Most Service Providers are ill-prepared to effectively engage and monetize emerging 5G-enabled use cases and need to urgently transform their BSS. With Service Providers looking to get that ROI on 5G, now is the time for them to invest in flexible monetization systems especially as 5G brings to the forefront the importance of real-time charging capabilities. Given Nokia’s portfolio and expertise, they are well placed to support CSPs on this journey.”

Hamdy Farid, Senior Vice President, Business Applications at Nokia, said: “To unlock 5G revenues and move beyond the traditional data plan model, a major shift among CSPs is needed toward adaptable monetization systems that utilize cloud-native, scalable and flexible infrastructure and open APIs for easy integration and deployment; and I think this survey highlights the work still to be done.”

…………………………………………………………………………………………………………………………………………………………………….

Nokia’s Head of Digital Business within CNS Jonah Pransky shared with RCR Wireless News that moving to cloud-native BSS “is becoming increasingly important to ensure greater business agility.”

“This is particularly true when it comes to efficiently monetizing 5G and capturing new revenue streams that 5G makes possible, including differentiated pricing, network slicing, and flexible product offerings, such as IoT and B2B2X. The 5G Standalone [SA] network is built on cloud-native network functions that provide the flexibility and agility to define, create and launch new services faster than ever before. 5G monetization systems, starting with the 5G charging function, need to be based on the same agile technology, or risk becoming a bottleneck in the release of new offers to the market, and ultimately slow the ROI that service providers must see sooner rather than later.”

Pransky also indicated that real-time charging is important for 5G-ready monetization systems, but provided a longer view of what capabilities are necessary, including support for open APIs, the enablement of new network-sliced based services easily and efficiently, meeting the CX demands of digital users for simple, transparent digital first commerce and finally, and being designed with no-code configurability.

While CSPs are still behind in their 5G monetization journeys, Pransky said that because the industry is moving away from large software monoliths and towards modular microservices-based applications, there is an opportunity for service providers to take a phased approach to transforming their monetization systems for 5G.

“That means they can begin with the most urgent need, which in this case is the 5G Converged Charging system,” he continued. “There is definitely still time with the roll out of 5G SA accelerating in some regions, but with many still only beginning to prepare for this. The advice [Nokia] would give would be to look for a monetization partner that has actual experience implementing 5G Charging in 5G SA networks in order to avoid potential pitfalls and hit the ground running, prepared for what will be necessary for effective monetization.”

…………………………………………………………………………………………………………………………………………………..

References:

CSPs are behind in 5G monetization, according to Nokia survey

https://www.rajarshipathak.com/2020/01/requirements-for-5g-network-monetization-solution.html

Nokia delivers private 4G fixed-wireless access (FWA) network for underserved students living in rural California

Nokia completed the first of a two-phase deployment of 4G fixed-wireless access (FWA) network with partner AggreGateway, to provide broadband internet connectivity to underserved students in the Dos Palos Oro Lomo (DPOL) school district of California.

The district comprises five campuses and serves a population of 5,000 residents. The Nokia platform will provide internet access to the homes of 2,400 students using Nokia Private 4.9G/LTE Digital Automation Cloud (NDAC) operating in the CBRS/On-Go GAA spectrum, and customer premises equipment including Nokia FastMile 4G Gateways and WiFi Beacons.

The DPOL technology team will operate its new LTE network through the centrally secure Nokia DAC Cloud monitoring application. DPOL will also provision LTE / Wi-Fi hotspots to students to be used with any standard laptop or tablet to access broadband internet.

The project’s first phase was completed in November 2021. Nokia and AggreGateway will complete the second phase in 2022.

The Federal Communications Commission (FCC) has reported nearly 17 million school children in the USA lack internet access at home, creating a nationwide ‘homework gap’ (Federal Communications Commission). This became even more pronounced during the pandemic as schools closed and distance learning became the new normal.

Image Credit: Nokia

Paoze Lee, Technology Systems Director of the Dos Palos-Oro Loma school district, said: “As we put a plan in place for distance learning during the pandemic we found we could only provide coverage for approximately 50% of DPOL students via commercial wireless network providers. Working with Nokia and AggreGateway, we are taking the next steps to level the field and ensure every student has the same access to our learning facilities.”

Octavio Navarro, President of AggreGateway, said: “Growing up in a rural small town like Dos Palos-Oro Loma, I experienced the digital divide firsthand. Being able to implement a Nokia private wireless solution for the students has been beyond rewarding. The IT staff from DPOL, AggreGateway, and Nokia worked seamlessly together to achieve this goal. We are excited, proud, and look forward to the continued success.”

Matt Young, Head of Enterprise for North America at Nokia, said: “We are pleased to help close the digital divide in the Dos Palos-Oro Loma school district. For many rural areas of the US it’s not commercially viable to build out networks, and often families on the lowest income suffer. Leveraging our DAC and FastMile FWA technologies we can enable the delivery of much needed internet connectivity to students in the area.”

The project’s first phase was completed in November 2021. Nokia and AggreGateway will complete the second phase in 2022.

About Nokia:

As a trusted partner for critical networks, we are committed to innovation and technology leadership across mobile, fixed and cloud networks. We create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs.

Adhering to the highest standards of integrity and security, we help build the capabilities needed for a more productive, sustainable and inclusive world.

About AggreGateway:

Based in San Diego, California, AggreGateway is a unique group of network and wireless engineers that are experienced in designing networks within the private, public safety, transportation, utilities, government, and educational verticals. AggreGateway provides network consulting services, wireless solutions, LAN/WAN design and implementation, network security, systems integration, and managed services. Our goal is to provide a range of robust and flexible network solutions that are customized to each individual network.

References:

Mobile Experts: Ericsson #1 in RAN market; Huawei falls to #3

According to a new report from analyst firm Mobile Experts, Ericsson leapt into the #1 position in the RAN market for 2021. Ericsson (see Table 1. at bottom of this article), which achieved a 26.9% share of a market that grew by about 3% in value to be worth in the region of $45 billion last year.

Sanctions hit Huawei very hard as the Chinese tech giant dropped to third place in the RAN market in terms of the value of sales with a 20.4% market share. Huawei had a shortfall of roughly $4B last year due to the company’s inability to produce high-capacity TDD base stations. That was because of U.S. Government sanctions on the critical components needed. As a result, Huawei achieved much lower dollar value than their western competitors.

Nokia (21.9% market share) placed third while ZTE achieved fourth place (14.5%) ahead of Samsung (8% market share).

“Our approach to forecasting is deeply analytical, using data from more than 100 sources, rather than simply the inputs of five OEMs. Our approach works. This analyst team has been creating some of the most accurate, detailed forecasting on the market for over a decade,” commented Chief Analyst of Mobile Experts, Joe Madden. “We have developed relationships with suppliers, operators, and vendors that give us data for a three-pronged approach to triangulation on mobile infrastructure revenue.”

Mobile Experts’ models show the RAN market growing at a CAGR (Cumulative Annualized Growth Rate) of 3%, with -1% growth in macro base stations and 25%-35% growth in millimeter wave and software segments. The analyst firm, known for their unmatched accuracy, leverage over a decade of ear-to-ground experience in this market to present this detailed market forecast that presents last year’s findings concisely and completely as well as presenting what’s next for the RAN market and its players.

“Overall, the RAN market is looking up. After 30 years of boom-and-bust cycles, the market is currently reaching a peak with 5G deployment in its active mode this year. In coming years, we see new revenue coming in from private enterprises to offset the natural drop in CSP sales; specifically, the private LTE/5G market will grow by 19%, accounting for more than $4 billion in 2026. As a result, the total RAN market will remain near its 5G peak for a few years, with the possibility for growth in the longer term,” commented Chief Analyst Joe Madden.

Total Year Review for 2021 – Global RAN Revenue:

This pre-earnings report offers a comprehensive overview of the RAN market with Mobile Experts’ signature accuracy and detailed breakdowns. This quarter’s report includes revenue estimates for the top 25 vendors in the RAN market for 2021. This is the first of a series of quarterly updates, and it is available today for instant download with purchase at www.mobile-experts.net.

For more about this research and buy the report, click here.

About Mobile Experts Inc.:

Mobile Experts provides insightful market analysis for the mobile infrastructure and mobile handset markets. Our analysts are true Experts, who remain focused on topics where each analyst has 25 years of experience or more. Research topics center on technology introduction for radio frequency (RF) and communications innovation. Recent publications include: RAN Revenue, Cellular V2X, Fixed Mobile Convergence, Edge Computing, In-Building Wireless, CIoT, URLLC, Macro Base Station Transceivers, Small Cells, VRAN, and Private LTE.

……………………………………………………………………………………………..

Table 1: Ericsson’s headline figures (Swedish Krona-SEK billions)

| 2021 | 2020 | Change | |

| Net sales | 232.3 | 232.4 | 0% |

| Gross income | 100.7 | 93.7 | 7% |

| Gross margin | 43.4% | 40.3% | – |

| Research and development expenses | -42.1 | -39.7 | – |

| Selling and administrative expenses | -27.0 | -26.7 | – |

| Impairment losses on trade receivables | 0.0 | 0.1 | -134% |

| Other operating income and expenses | 0.4 | 0.7 | -45% |

| Share in earnings of JV and associated companies | -0.3 | -0.3 | – |

| EBIT | 31.8 | 27.8 | 14% |

| – of which networks | 37.3 | 30.9 | 21% |

| – of which digital services | -3.6 | -2.2 | – |

| – of which managed services | 1.5 | 1.6 | -6% |

| – of which emerging business and other | -3.4 | -2.4 | – |

| EBIT margin | 13.7% | 12.0% | – |

| Financial income and expenses, net | -2.5 | -0.6 | – |

| Income tax | -6.3 | -9.6 | 30% |

| Net income | -0.5 | -1.3 | – |

| Source: Ericsson | |||

Orange installs Private 4G/5G Network at Nokia factory in Poland

Orange Poland has announced that it has been selected as the partner in the creation of a private 4G and 5G network at Nokia’s factory and R&D facility at Bydgoszcz, Poland, which includes a factory and three R&D centers. Orange said the 5G private network will benefit from various innovations and edge computing applications.

The network will cover the entire 13,000 square metre facility, providing the location’s 6,000 employees with access to faster, more reliable communications. This, in turn, will enable numerous efficiency improvements within the factory itself, including facilitating automated guided vehicles to transport products internally, drones for surveillance and monitoring, and the widespread deployment of IoT devices. The network will also allow for greater reliability when it comes to inter-facility communications, including group push-to-talk and push-to-video applications. As a private network, it will not be incorporated with Orange Polska’s wider network.

“Private 5G networks are undoubtedly the future of an effective industry. I am glad that we can boast a unique experience on the Polish market, collected during the implementation of already operating implementations of this type, which pay off in subsequent projects, such as the one with Nokia,” said Julien Ducarroz, president of Orange Polska.

“It is a solution enabling the maximum adjustment of communication to the customer’s needs, safe and increasing the efficiency of processes.”

Orange has had a busy couple of months when it comes to 5G. Last month, the company launched its first 5G Lab in Antwerp, the Netherlands, a move that further expands the operator’s presence in the city. Orange has a well-established private 5G standalone network set up in Port of Antwerp, set up back in 2020, where they have been trialling a variety of 5G use cases. At around the same time, Orange was also launching their first Open RAN lab in Paris, with CTO Michael Trabbia notably arguing that interoperable RAN tech would be central to creating a stronger European vendor ecosystem and offering the continent greater technical sovereignty. Further 5G developments are going on in Orange’s other markets too. Just yesterday, Orange Spain announced a new 5G fixed wireless access trial in Galicia, as part of Orange’s wider commitment to the Spanish government’s National 5G plan.

References:

Nokia to provide 5G SA core network for Volkswagen (private) and KDDI (public)

Nokia has deployed a 5G standalone (SA) core network at Volkswagen’s plant in Wolfsburg, Germany. The 5G private campus network covers the production development center and pilot hall at the plant. This network uses the Nokia Digital Automation Cloud (DAC) system to provide reliable and secure connectivity. Nokia’s DAC provides high-bandwidth and low-latency connectivity for sensors, machines, vehicles and other equipment.

Volkswagen will use the network to improve efficiency in production. The company is initially testing the wireless upload of data to manufactured vehicles and intelligent networking of robots and wireless assembly tools.

“By deploying private wireless to explore and develop its potential in manufacturing, Volkswagen underscores its leading position in leveraging digitalization to enhance efficiency and productivity,” commented Chris Johnson, head of Global Enterprise business for Nokia. “We are delighted to support this effort with the Nokia Digital Automation Cloud and our extensive experience in private wireless networks.”

The pilot network will allow Volkswagen to test whether 5G technology helps the company meet the demanding requirements of vehicle production, as well as increases efficiency and flexibility in series production of the future.

“Predictable wireless performance and the real-time capabilities of 5G have great potential for smart factories in the not-so-distant future. With this pilot deployment, we are exploring the possibilities 5G has to offer and are building our expertise in operating and using 5G technology in an industrial context,” said Dr.-Ing. Klaus-Dieter Tuchs, network planning at Volkswagen.

Nokia’s work with Volkswagen at its main German plant aligns with the vendor’s private 5G ambitions, as reported by German newspaper Handelsblatt in 2019. The company said at the time that it expects to provide 5G networks for German companies following the opening of the application procedure for local firms intending to use 5G frequencies on industrial campuses, highlighting not only its intention to offer its service for network planning, but also aims to operate the networks.

Nokia’s private network reach extends beyond Germany of course. The vendor has worked with industrial-type partners on LTE, 5G-ready and IP/MPLS networks around the world including at the Zeebrugge port in Belgium, the Irish Aviation Authority and the Société du Grand Paris (SGP), the state owned industrial company responsible for the Grand Paris Express metro project.

Resources:

Nokia Industrial Private Wireless

https://www.nokia.com/networks/industry-solutions/private-wireless/industry/

Nokia Digital Automation Cloud | Nokia

……………………………………………………………………………………………………………………….

On December 2nd, Nokia announced that Japanese network operator KDDI selected Nokia’s 5G Core and Converged Charging software to support its transition to a fully automated, cloud-native 5G SA Core network architecture.

Nokia’s cloud-native 5G Core’s near zero-touch automation capabilities help operators drive greater scale and reliability. Following the evolution of KDDI’s networks to 5G standalone core, subscribers will experience lower latency, increased bandwidth and higher capacity.

Nokia’s open 5G Core architecture gives KDDI the flexibility to be responsive to market demands while controlling costs by streamlining operations and unlocking crucial capabilities, such as network slicing. Developed around DevOps principles, Nokia’s 5G Core will automate the lifecycle management of KDDI’s networks, as well as enable continuous software delivery and integration.

Nokia will also deploy 5G monetization and data management software solutions including cloud-native Converged Charging, Signaling, Policy Controller, Mediation and Registers to capture new 5G revenue opportunities, enhance business velocity and agility, and streamline the operator’s network operations.

References:

Nokia deploys 5G private network at Volkswagen plant in Germany

Orange and Nokia demo 600Gb/sec transmission over a 914 km optical network; Nokia 25G PON

Nokia and Orange announced the completion of a network trial using the Nokia PSE-Vs, its fifth generation super coherent optics. With this field trial, Orange has successfully validated a planned upgrade of its long-haul backbone networks to support new high-bandwidth 400 Gb/sec services, and the ability to scale fiber capacity up to 600Gb/sec. This represents an increase in spectral efficiency by 50% compared to prior technologies on its long distance optical network.

The trial was performed in real-world conditions using Nokia PSE-Vs super coherent optics in production-ready optical transport hardware, just 16 months after the lab prototype trial done on Orange’s live network. Orange and Nokia demonstrated error-free performance at a data rate of 600Gb/sec over a 914 km network between Paris and Biarritz, under challenging live network conditions. The fiber network consisted of 13 spans of Orange’s existing network, through multiple cascaded reconfigurable optical add/drop multiplexers (ROADM), using 100GHz WDM spectrum channels.

Jean-Luc Vuillemin, Vice President of International Networks and Services at Orange, said: “With the booming market bandwidth requirement and need for scalability and flexibility, it is important that Orange continues to support an ever-greater network scale and new high-bandwidth services across our terrestrial and subsea global footprint.

Validating super coherent optics with Nokia represents an important enabler for future-proof networks which will bring spectral efficiency and operational deployment flexibility to our customer solutions. Furthermore this technology will allow for power savings by nearly 50%, which is key to our objective of developing greener networks for our customers. ”

James Watt, Head of Optical Networks Division, Nokia, said: “We are delighted to work with Orange in continued support of their network upgrade plans. With the introduction of the PSE-Vs super coherent capabilities across our entire 1830 portfolio, Nokia enables spectrally-efficient transport at 600Gb/sec over real-world long haul networks, and 400Gbps services over ultra long haul networks spanning multiple 1000’s of kilometers.”

Nokia 1830 Photonic Service Interconnect (PSE)

The Nokia PSE-V

The Nokia PSE-V is the industry’s most advanced family of digital coherent optics (DCO), powering the next generation of Nokia high-performance, high-capacity transponders, packet-optical switches, disaggregated compact modular and subsea terminal platforms. The PSE-V Super Coherent DSP (PSE-Vs) implements the industry’s only 2nd generation probabilistic constellation shaping (PCS) with continuous baud rate adjustment, and supports higher wavelength capacities over longer distances – including support for 400G over any distance – over spectrally efficient 100GHz WDM channels while further reducing network costs and power consumption per bit.

Further resources:

• Web page: Nokia 1830 Photonic Service Interconnect (PSI)

• Web page: Nokia Photonic Service Engine (PSE) Coherent DSPs

• Web page: 400G Everywhere

……………………………………………………………………………………………………………………..

Earlier this week, Nokia and Bell Canada announced the first successful test of 25G PON fiber broadband technology in North America at Bell’s Advanced Technical Lab in Montréal, Québec.

The trial validates that current GPON and XGS-PON broadband technology and future 25G PON can work seamlessly together on the same fiber hardware, which is being deployed throughout the network today. 25G PON delivers huge symmetrical bandwidth capacity that will support new use cases such as premium enterprise service and 5G transport. Nokia’s 25G PON solution utilizes the world’s first implementation of 25G PON technology and includes Lightspan and ISAM access nodes, 25G/10G optical cards and fiber modems.

For the past decade, Bell has been rolling out fiber Internet service to homes and businesses across the country, a key component in the company’s focus on connecting Canadians in urban and rural areas alike with next-generation broadband networks. With this successful trial, Bell can be confident that its network will absorb the increased capacity of future technologies and connect Canadians for generations to come.

Stephen Howe, EVP & Chief Technology Officer, Bell, said:

“As part of Bell’s purpose to advance how Canadians connect with each other and the world, we embrace next-generation technologies such as 25G PON to ensure we remain at the forefront of broadband innovation. Our successful work with Nokia to deliver the first 25G PON trial in North America will help ensure we maximize the Bell fiber advantage for our customers in the years to come.”

Jeffrey Maddox, President of Nokia Canada, said: “Nokia innovations powered the fiber networks and the connectivity lifeline that carried Canadian homes and businesses through the pandemic. 25G PON innovations will drive the next generation of advances in our connected home experience.”

Bell and Nokia have closely collaborated over the years on many industry breakthroughs, such as the first Canadian trial of 5G mobile technology in 2016. Bell continues to work with Nokia to build and expand its 5G network across Canada.

References:

FSG CEO Andrew Roberts, said FSG’s 5G service will cover 85% of Australia’s landmass.

FSG CEO Andrew Roberts, said FSG’s 5G service will cover 85% of Australia’s landmass.