O-RAN

OpenRAN in 30% of Vodafone European network by 2030; Europe way behind China and South Korea in 5G deployments

Vodafone will use OpenRAN technology in 30% of its masts across Europe by 2030, said Johan Wibergh, Vodafone Group Chief Technology Officer, in a speech at Mobile World Congress (MWC) 2022 in Barcelona.

Around 30,000 Vodafone cell sites across Europe will eventually use OpenRAN, he said, with rural areas the first to benefit from the new 4G and 5G masts that use the more flexible radio technology.

When the roll-out reaches cities, the equipment from any existing 5G masts being replaced will then be reused elsewhere to reduce unnecessary wastage, he said.

Vodafone has been one of the key drivers behind the development and use of OpenRAN, building one of the first-ever live OpenRAN masts in Wales. This was followed by the construction of OpenRAN masts in Cornwall, as well as the UK’s first 5G OpenRAN site.

At MWC 2022, Vodafone announced new smartphone sustainability initiatives, as well as the trial of new Internet of Things technology to enable cars to pay automatically for their own refueling.

……………………………………………………………………………………………………………………………………………………………………………………………..

Earlier this week, Vodafone Group CEO Nick Read addressed MWC 2022 attendees in a keynote speech, highlighting the challenges and opportunities facing the mobile industry. Among them are the following:

Europe needs to be digital to remain globally competitive and maintain its leadership role in key sectors such as automotive, aerospace, defence, and agriculture. The regions that have 5G first, will be the regions that innovate fastest.

Yet, at current rates, it will take until at least the end of the decade, for Europe to match the transformational “full 5G experience” that China will already have achieved this year. If we look at 5G population coverage around the world – South Korea is over 90%, China 60%, USA 45%, and Europe under 10% – and with Africa hardly even at the starting line. Europe will only catch up if we reverse the ill-health and hyper-fragmentation of our sector. We must have local scale to close the investment gap. Otherwise, we will be the passive by-stander of the new tech order.

Local scale is needed to close the investment gap and ensure we can deploy 5G at pace. Regional scale is needed to close the digitalisation gap. The combination of local and regional scale ensures our economies and societies can enjoy the full benefits of digital innovation and industrialisation.

We have all seen the impact of global digital platforms. Platforms that change the way we conduct our daily lives. Vodafone continues to invest in regional platforms – let me just give you a few examples. In Europe we created our IoT platform which connects more than 140m devices, across 180 countries. The SIM based IoT market has tripled in the last five years, – and in the next 5 years, will hit 5bn connections. 62% of Europe’s leading automotive brands rely on Vodafone IOT. And with that scale, we are able to evolve from the “Internet of Things” to the “Economy of Things.”

References:

https://newscentre.vodafone.co.uk/news/openran-in-30-percent-of-vodafone-european-network-by-2030/

https://www.vodafone.com/news/digital-society/mwc22-new-tech-order

https://newscentre.vodafone.co.uk/press-release/switches-on-first-5g-openran-site/

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

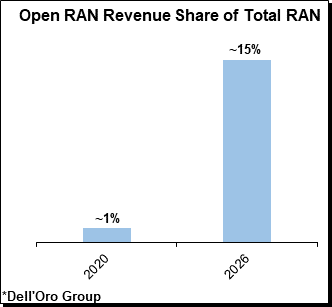

Dell’Oro Group estimates the RAN market is currently generating between $40 billion and $45 billion in annual revenues. The market research firm forecasts that Open RAN will account for 15% of sales in 2026. Research & Markets is more optimistic. They say the Open RAN Market will hit $32 billion in revenues by 2030 with a growth rate of 42% for the forecast period between 2022 and 2030.

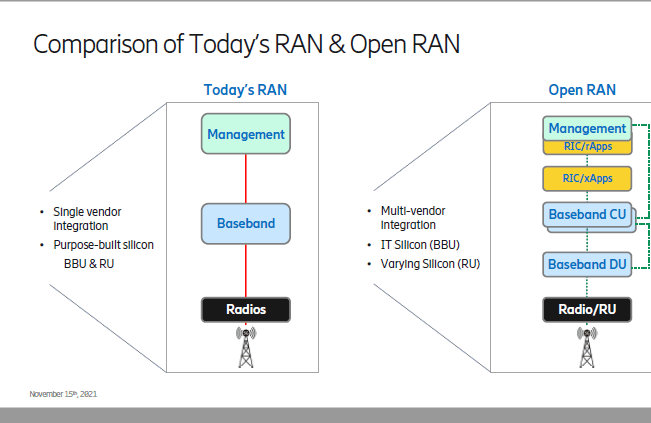

As the undisputed leader of microprocessors for compute servers, it’s no surprise that most of the new Open RAN and virtual RAN (vRAN) deployments use Intel Xeon processors and FlexRAN™ software stack inside the baseband processing modules. FlexRAN™ is a vRAN reference architecture for virtualized cloud-enabled radio access networks.

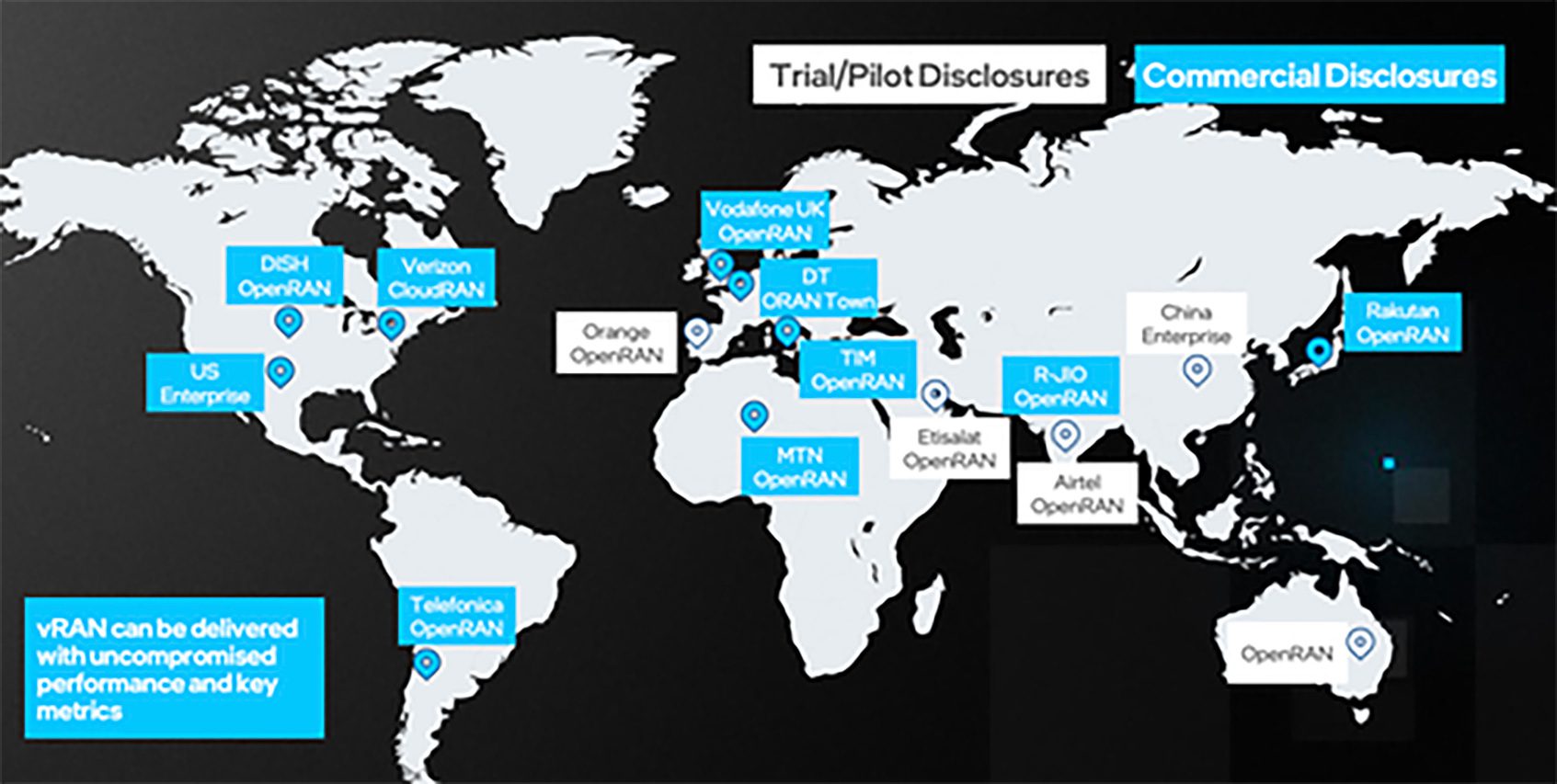

The hardware for FlexRAN™ includes: Intel® Xeon® CPUs 3rd generation Intel® Xeon® Scalable processor (formerly code named Ice Lake scalable processor), Intel® Forward Error Correction Device (Intel® FEC Device), Mount Bryce (FEC accelerator), Network Interface Cards – Intel® Ethernet Controller E810 (code name Columbiaville). Intel says there are now over 100 FlexRAN™ licensees worldwide as per these charts:

Source: Intel

A short video on the FlexRAN™ reference architecture is here.

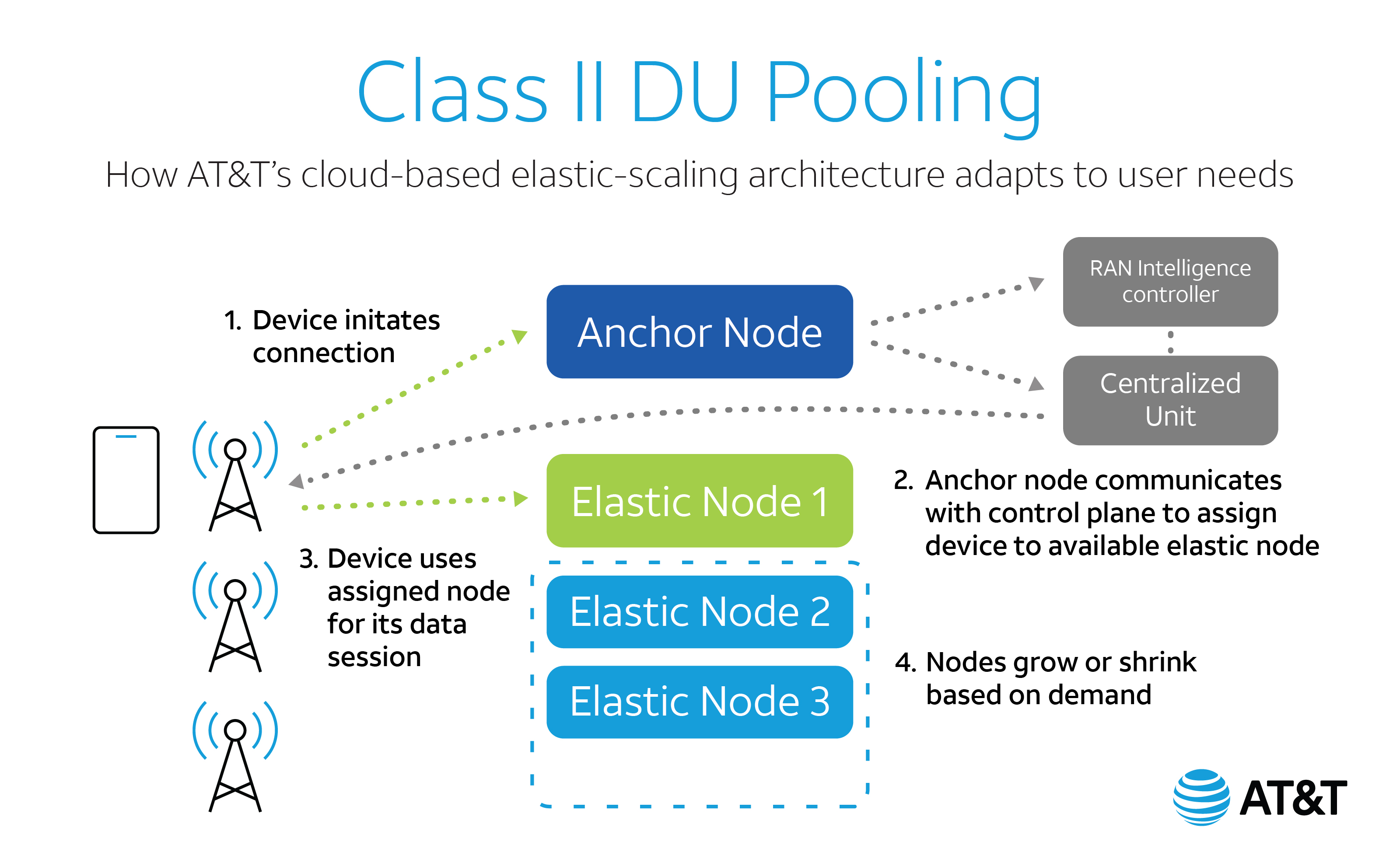

FlexRAN™ got a big boost this week from AT&T. In a February 24, 2022 blog post titled “Cloudifying 5G with an Elastic RAN,” Gordon Mansfield, AT&T VP Mobility Access & Architecture said that “AT&T and Intel had co-developed an industry-leading advanced RAN pooling technology freeing 5G radios from the limitations of dedicated base stations, while enabling more efficient, resilient, and green 5G networks. DU-pooling will eventually be usable by the entire 5G operator community to drive the telecom industry’s goals of green and efficient wireless networks forward.”

DU pooling technology was made possible by combining AT&T’s deep knowledge of Open RAN technologies as one of the co-founders of the O-RAN Alliance with Intel’s expertise in general purpose processors and software-based RAN through its FlexRAN™ software stack running on Intel 3rd generation Intel® Xeon® Scalable processors. The open standards for communications between radios and DUs that were published by O-RAN enabled its development, and the result is a technology demonstrator implemented on FlexRAN™ software.

………………………………………………………………………………………………………………………………………………………………………………..

Intel is now facing new Open RAN competition from several semiconductor companies.

Marvell has just unveiled a new accelerator card that will slot into a Dell compute server (which uses x86 processors). Based on a system called “inline” acceleration, it is designed to do baseband PHY layer processing and do it more efficiently than x86 processors. A Marvell representative claims it will boost open RAN performance and support a move “away from Intel.” Heavy Reading’s Simon Stanley (see below) was impressed. “This is a significant investment by Dell in open RAN and vRAN and a great boost for Marvell and the inline approach,” he said.

Qualcomm, which licenses RISC processors designed by UK-based ARM, has teamed up with Hewlett Packard Enterprise (HPE) on the X100 5G RAN accelerator card. Like Marvel’s offering, it also uses inline acceleration and works – by “offloading server CPUs [central processing units] from compute-intensive 5G baseband processing.”

There is also EdgeQ which is sampling a “Base Station on a Chip” which is targeted at Open RAN and private 5G markets. Three years in the making, EdgeQ has been collaborating with market-leading wireless infrastructure customers to architect a highly optimized 5G baseband, networking, compute and AI inference system-on-a-chip. By coupling a highly integrated silicon with a production-ready 5G PHY software, EdgeQ uniquely enables a frictionless operating model where customers can deploy all key functionalities and critical algorithms of the radio access network such as beamforming, channel estimation, massive MIMO and interference cancellation out of the box.

For customers looking to engineer value-adds into their 5G RAN designs, the EdgeQ PHY layer is completely programmable and extensible. Customers can leverage an extendable nFAPI interface to add their custom extensions for 5G services to target the broad variety of 5G applications spanning Industry 4.0 to campus networks and fixed wireless to telco-grade macro cells. As an industry first, the EdgeQ 5G platform holistically addresses the pain point of deploying 5G PHY and MAC software layers, but with an open framework that enables a rich ecosystem of L2/L3 software partners.

The anticipated product launches will be welcomed by network operators backing Open RAN. Several of them have held off making investments in the technology, partly out of concern about energy efficiency and performance in busy urban areas. Scott Petty, Vodafone’s chief digital officer, has complained that Open RAN vendors will not look competitive equipped with only x86 processors. “Now they need to deliver, but it will require some dedicated silicon. It won’t be Intel chips,” he told Light Reading in late 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Inline vs Lookaside Acceleration:

While Marvell and Qualcomm are promoting the “inline” acceleration concept, Intel is using an alternative form of acceleration called “lookaside,” which continues to rely heavily on the x86 processor, offloading some but not all PHY layer functions. This week, Intel announced its own product refresh based on Sapphire Rapids, the codename for its next-generation server processors.

Simon Stanley, an analyst at large for Heavy Reading (owned by Informa), said there are two key innovations. The first involves making signal-processing tweaks to the Sapphire Rapids core to speed up the performance of FlexRAN™, Intel’s baseband software stack. Speaking on a video call with reporters, Dan Rodriguez, the general manager of Intel’s network platforms group, claimed a two-fold capacity gain from the changes. “In the virtual RAN and open RAN world, the control, packet and signal processing are all done on Xeon and that is what FlexRAN enables,” he said.

The other innovation is the promise of integrated acceleration in future Sapphire Rapids processors. Sachin Katti, who works as chief technology officer for Intel’s network and edge group, said this would combine the benefits of inline acceleration with the flexibility of x86. That is preferable, he insisted, to any solution “that shoves an entire PHY layer into an inflexible hardware accelerator,” a clear knock at inline rivals such as Marvell and Qualcomm. Despite Katti’s reference to inline acceleration, Stanley does not think it is Intel’s focus. “None of this rules out an inline acceleration solution, but it does not seem to be part of the core approach,” he told Light Reading. “The key strategy is to add maximum value to Xeon Scalable processors and enable external acceleration where needed to achieve performance goals.”

Both inline and lookaside involve trade-offs. Inline’s backers have promised PHY layer software alternatives, but Intel has a major head start with FlexRAN™, which it began developing in 2010. That means lookaside may be a lot more straightforward. “The processor is in control of everything that goes on,” said Stanley during a previous conversation with Light Reading. “It is essentially the same software and makes life very easy.”

Larger network operators seemed more enthusiastic about inline during a Heavy Reading survey last year. By cutting out the processor, it would reduce latency, a measure of the delay that occurs when signals are sent over the network. That could also weaken Intel, reducing power needs and allowing companies to use less costly CPUs. “If you use inline, you probably need a less powerful processor and less expensive server platform, which is not necessarily something Intel wants to promote,” Stanley said last year.

References:

https://www.intel.com/content/www/us/en/communications/virtualizing-radio-access-network.html

EdgeQ Samples World’s 1st Software-Defined 5G Base Station-on-a-Chip

RAN growth slowed in 4Q-2021, but full year revenues rose to ~$40B – $45B; Open RAN market highlights

- Global RAN rankings did not change with Huawei, Ericsson, Nokia, ZTE, and Samsung leading the full year 2021 market.

- Ericsson, Nokia, Huawei, and Samsung lead outside of China while Huawei and ZTE continue to dominate the Chinese RAN market.

- RAN revenue shares are changing with Ericsson and Samsung gaining share outside of China.

- Huawei and Nokia’s RAN revenue shares declined outside of China.

- Relative near-term projections have been revised upward – total RAN revenues are now projected to grow 5 percent in 2022.

Open RAN Market – Highlights

- While 5G offers superior performance over 4G, both will coexist comfortably into the 2030s as the bedrock of next-generation mobile networks. There are three perspectives that help to underline this point. Firstly, unlike voice-oriented 2G and 3G (which were primarily circuit-switched networks with varying attempts to accommodate packet-switching principles), 4G is a fully packet-switched network optimized for data services. 5G builds on this packet switching capability. Therefore, 4G and 5G networks can coexist for a long while because the transition from 4G to 5G does not imply or require a paradigm shift in the philosophy of the underlying technology. 5G is expected to dominate the OPEN RAN market with $22B TAM in 2030 with a growth rate of 52% as compared to a 4G growth rate of 31% between 2022 and 2030

- Within OPEN RAN radio unit (RU), Small cells and macrocells are likely to contribute $7.5B and $2.4B TAM by 2030 respectively. It is going to be a huge growth of 46% from the current market size of $327M for such cells in the OPEN RAN market

- The sub-6GHz frequency band is going to lead the market with a 70% share for OPEN RAN although the mmWave frequency band will have a higher CAGR of 67% as compared to 37% CAGR of Sub-6GHz. Most focus has been on the 3.5 GHz range (i.e., 3.3-3.8 GHz) to support initial 5G launches, followed by mmWave awards in the 26 GHz and 28 GHz bands. In the longer term, about 6GHz of total bandwidth is expected for each country across two to three different bands

- Enterprises are adopting network technologies such as private 5G networks and small cells at a rapid rate to meet business-critical requirements. That’s why public OPEN RAN is expected to have the majority share of round ~95% as compared to the small market for the private segment

- At present, it is relatively easy for greenfield service providers to adopt 5G open RAN interfaces and architectures and it is extremely difficult for brownfield operators who have already widely deployed 4G. One of the main challenges for brownfield operators is the lack of interoperability available when using legacy RAN interfaces with an open RAN solution. Still, Mobile network operators (MNOs) throughout the world, including many brownfield networks, are now trialling and deploying Open RAN and this trend is expected to grow with time to have a larger share of brownfield deployments

- Asia Pacific is expected to dominate the OPEN RAN market with nearly 35% share in 2030. OPEN RAN market in the Asia Pacific is expected to reach USD 11.5 billion by 2030, growing at a CAGR of 34% between 2022 and 2030. Japan is going to drive this market in the Asia Pacific although China will emerge as a leader in this region by 2030. North America and Europe are expected to have a higher growth rate of more than 45% although their share will be around 31% and 26% respectively in 2030

References:

Deutsche Telekom demos end to end network slicing; plans ‘multivendor’ open RAN launch in 2023

DT and Ericsson recently demonstrated an impressive proof of concept implementation: they established connectivity with guaranteed quality of service (QoS) between Germany and Poland via 5G end-to-end network slicing. With an SD-WAN solution from Deutsche Telekom, the data connection can be flexibly controlled and managed via a customer portal. The solution ensures that different service parameters in the network can be operated across country borders. At the same time, network resources are flexibly allocated. This approach is being presented for the first time worldwide. It is particularly advantageous for global companies that operate latency-critical applications at different, international locations.

End-to-end network slicing, which requires a 5G SA core network, is a key enabler for unlocking 5G opportunities. It’s been highly touted to drive business model innovation and new use cases across various industry segments. 5G slicing will enable use cases that require specific resources and QoS levels. Globally operating enterprise are more and more seeing the need for uniform connectivity characteristics to serve their applications in different markets. Some of the latency-critical business applications that demand consistent international connectivity performance are related to broadcasting, logistics, and automotive telematics.

In this trial, the QoS connectivity was extended from Germany to Poland using a 5G slicing setup that is based on commercial grade Ericsson 5G Standalone (SA) radio and core network infrastructure and a Deutsche Telekom commercial SD-WAN solution. The home operator-controlled User Plane Function (UPF) is placed in Poland as the visited country and the entire setup is managed by an Ericsson orchestrator integrated with a Deutsche Telekom business support system via open TM Forum APIs. Combining 5G slicing and SD-WAN technology allows flexible connectivity establishment and control, while traffic breakout close to the application server in visited countries enables low latency.

…………………………………………………………………………………………………………………………………..

According to Light Reading, Deutsche Telekom (DT) has already issued a request for quotation (RFQ) to Open RAN vendors and is currently selecting partners for a commercial rollout next year. NEC – a Japanese vendor of radio units (among other things)- and Mavenir -a U.S. developer of baseband software-were mentioned as Open RAN Town participants (and likely DT RFQ respondents). “It is a multivendor setup,” said DT’s Claudia Nemat.

However, there are obstacles that Open RAN must overcome to be widely deployed. In particular, energy efficiency. Deutsche Telekom, along with most other big operators, is determined to reduce its carbon footprint and slash energy bills. Open RAN “is less energy efficient than today’s RAN technology,” Ms. Nemat said. The use of x86 general-purpose microprocessors in virtualized, open RAN deployments seems to be responsible for this inefficiency.

“If you have an ASIC [application-specific integrated circuit] for baseband processing, it is always cheaper than using a general-purpose microprocessor like an Intel processor,” said Alex Choi, Deutsche Telekom’s head of strategy and technology innovation, two years ago.

One option is to use ASICs and other chips as hardware accelerators for more efficient baseband processing. Companies including Marvell, Nvidia and Qualcomm all have products in development for sale as merchant silicon in open RAN deployments. Nemat, noted a breakthroughs with Intel.

“We achieved a reduction of electricity consumption of around minus 30%. For us, that is a big step forward for commercial deployment.”

Light Reading’s Iain Morris, provided this assessment:

Even so, a commercial open RAN deployment involving companies like NEC and Mavenir is hard to imagine. Any widespread rollout of their technologies would mean swapping out equipment recently supplied by Ericsson or Huawei (DT’s current 5G network equipment vendors), unless Deutsche Telekom plans to run two parallel networks. Either option would be costly.

Far likelier is that a 2023 deployment will be very limited. Other operators including the UK’s BT and France’s Orange have talked about using open RAN initially for small cells – designed to provide a coverage boost in specific locations.

A private network for a factory is one possible example. Outside Germany, of course, there may be a bigger short-term opportunity in Deutsche Telekom markets where 5G has not been as widely deployed.

In late June 2021, Deutsche Telekom switched on its ‘O-RAN Town’ deployment in Neubrandenburg, Germany. O-RAN Town is a multi-vendor open RAN network that will deliver open RAN based 4G and 5G services across up to 25 sites. The first sites are now deployed and integrated into the live network of Telekom Germany. This includes Europe’s first integration of massive MIMO (mMIMO) radio units using O-RAN open fronthaul interfaces to connect to the virtualized RAN software.

Ms. Nemat said at the time, “Open RAN is about increasing flexibility, choice and reinvigorating our industry to bring in innovation for the benefit our customers. Switching on our O-RAN Town including massive MIMO is a pivotal moment on our journey to drive the development of open RAN as a competitive solution for macro deployment at scale. This is just the start. We will expand O-RAN Town over time with a diverse set of supplier partners to further develop our operational experience of high-performance multi-vendor open RAN.”

……………………………………………………………………………………………………………………………………………………………………..

In November 2021, Deutsche Telekom announced it was taking the lead in a new Open lab to accelerate network disaggregation and Open RAN. The German Federal Ministry for Transport and Digital Infrastructure (BMVI) is financing the Lab with 17 million Euros and that’s to be matched by approximately a 17 million Euro investment from a consortium under the leadership of Deutsche Telekom (DT).

The lab will furthermore be supported by and working closely with OCP (Open Compute Project), ONF (Open Networking Foundation), ONAP (Open Network Automation Platform), the O-RAN Alliance and the TIP (Telecom Infra Project). Partners and supporters together form the user forum, which is open for participation by other interested companies, especially SMEs, working on applications as well as equipment and development. As an open lab it is built for collaboration within the wider telecommunications community. The i14y Lab Berlin will be the central location and core node of satellite locations such as Düsseldorf and Munich. Other highlights:

- Testing and integrating components of disaggregated networks in the lab to accelerate time to market of open network technology for the multi-vendor network of the future.

- The lab has already started operations at DT Innovation Campus Winterfeldtstraße

- Important foundation for building a European and German ecosystem of vendors and system integrators

A recent Research Nester report predicts a market size of $21 billion for O-RAN in 2028.

[Source: https://www.researchnester.com/reports/open-radio-access-network-market/2781].

References:

https://www.telekom.com/en/media/media-information/archive/telekom-at-mwc-barcelona-2022-647894

https://www.telekom.com/en/media/media-information/archive/global-5g-network-slicing-648218

KDDI claims world’s first 5G Standalone (SA) Open RAN site using Samsung vRAN and Fujitsu radio units

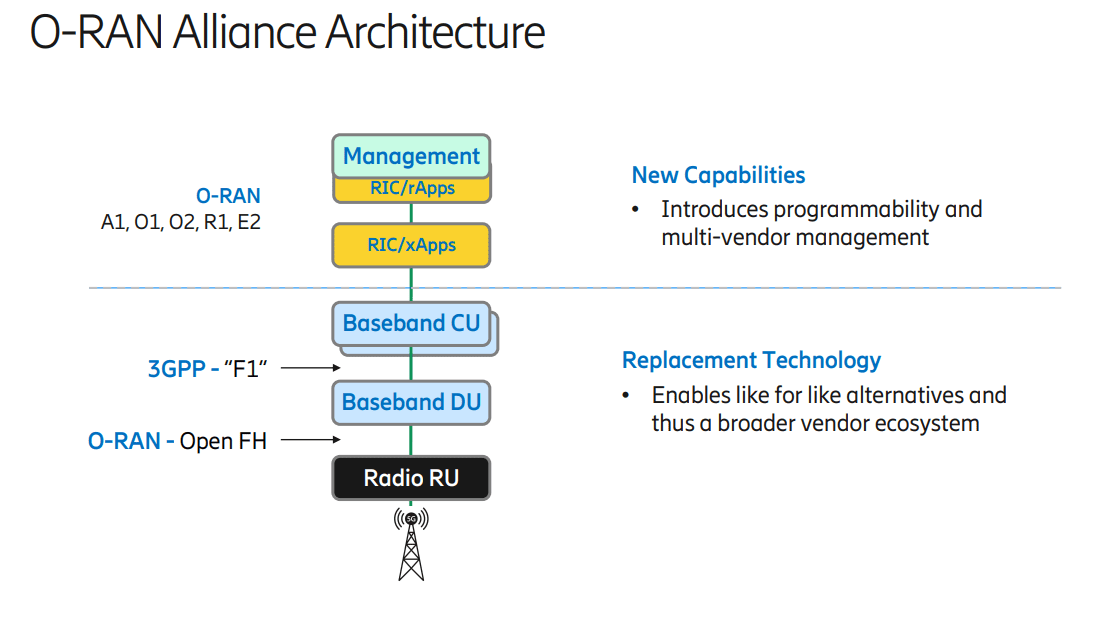

Japan’s KDDI is claiming to have turned on the world’s first commercial 5G Standalone (SA) Open Radio Access Network (Open RAN) site, using equipment and software from Samsung Electronics and Fujitsu. KDDI used O-RAN Alliance compliant [1.] technology, including Samsung’s 5G virtualized CU (vCU) and virtualized DU (vDU) as well as Fujitsu’s radio units (MMU: Massive MIMO Units).

Note 1. O-RAN Alliance specifications are being used for RAN module interfaces that support interoperation between different Open RAN vendors’ equipment.

The first network site went live in Kawasaki, Kanagawa today. KDDI, together with its two partners, will deploy this Open RAN network in some parts of Japan and continue its deployment and development, embracing openness and virtualization in KDDI’s commercial network. Note that both Rakuten-Japan and Dish Network/Amazon AWS have promised 5G SA Open RAN but neither company seems close to deploying it.

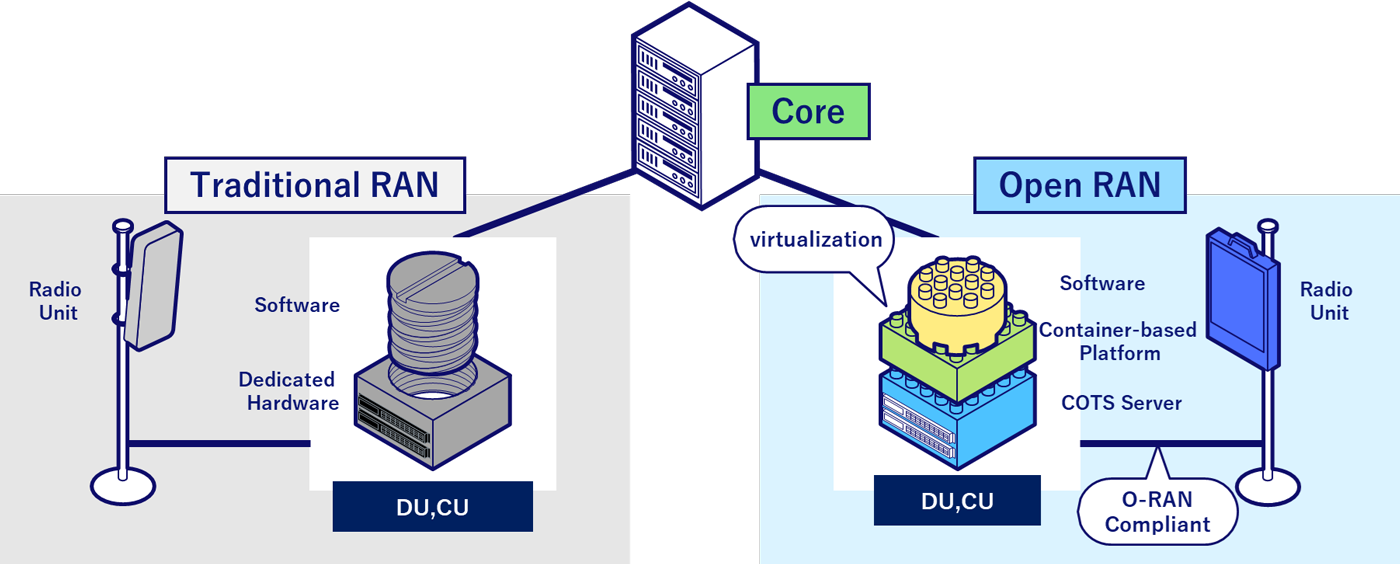

Virtualization and O-RAN technology replaces dedicated hardware with software elements that can run on commercial off-the-shelf (COTS) servers. This brings flexibility and agility to KDDI’s network, allowing the operator to offer enhanced mobile services to its users. KDDI says this architecture will deliver reliability, while accelerating deployment of Open RAN throughout Japan, including in rural areas. Meanwhile, 5G SA will deliver superior performance, higher speeds and lower latency and make possible advanced services/applications, such as network slicing, automation, service chaining and Multi-access Edge Computing (MEC).

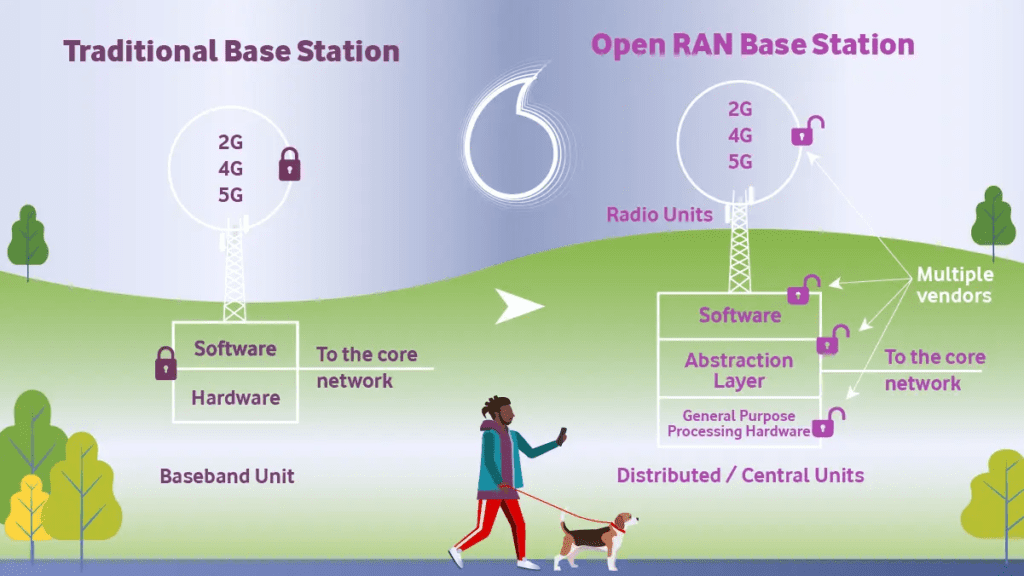

Traditional RAN vs. Open RAN Configuration. Source: KDDI

Characteristics of this site:

This Open RAN site leverages fully-virtualized RAN software, provided by Samsung, that runs on commercial off-the-shelf (COTS) servers. Furthermore, by pursuing an open network approach between radio units and baseband unit, KDDI used Samsung’s baseband and Fujitsu’s Massive MIMO Units, which are connected with an open interface.

- Fully-virtualized 5G RAN software can be swiftly deployed using existing hardware infrastructure, which brings greater flexibility in deployment. New 5G SA technologies―such as network slicing, Multi-access Edge Computing (MEC) and others―powered by 5G vRAN, will deliver superior performance, higher speeds and lower latency, allowing KDDI users to experience a range of new next-generation services and immersive applications.

- Using an open interface between radio units and baseband unit, Open RAN not only ensures security and reliability but also enables operators to implement best-of-breed solutions from different partners and build an optimal network infrastructure for maximized performance.

- The virtualized network allows the use of general-purpose hardware (COTS servers) across the country, which will greatly increase deployment efficiencies. Additionally, by leveraging system automation, fully-virtualized RAN software can reduce deployment time, enabling swift nationwide expansion, including rural areas.

Comments from Kazuyuki Yoshimura, Chief Technology Officer, KDDI Corporation:

“Together with Samsung and Fujitsu, we are excited to successfully develop and turn on the world’s first commercial 5G SA Open RAN site powered by vRAN. Taking a big step, we look forward to continue leading network innovation and advancing our network capabilities, towards our vision of delivering cutting-edge 5G services to our customers.”

Comments from Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics:

“Leveraging our industry-leading 5G capabilities, we are excited to mark another milestone with KDDI and Fujitsu. Samsung stands out for its leadership in 5G vRAN and Open RAN with wide-scale commercial deployment experiences across the globe. While KDDI and Samsung are at the forefront of network innovation, we look forward to expanding our collaboration towards 5G SA, to bring compelling 5G services to users.”

Note: Samsung released its first 5G vRAN portfolio in early 2021 following its blockbuster RAN deal with Verizon, which was the first operator to commercially deploy the new equipment. Samsung also gained a foothold in Vodafone’s plan to deploy 2,500 open RAN sites in the southwest of England and most of Wales. Samsung’s open RAN compliant vRAN hardware and software were previously deployed in 5G NSA commercial networks in Japan and Britain, but this is the first 5G SA deployment. We wonder if it is “cloud native?” Hah, hah, hah!

Comments from Shingo Mizuno, Corporate Executive Officer and Vice Head of System Platform Business (In charge of Network Business), Fujitsu Limited:

“The Open RAN-based ecosystem offers many exciting possibilities and this latest milestone with KDDI and Samsung demonstrates the innovative potential of next-generation mobile services with Massive MIMO Units. Fujitsu will continue to enhance this ecosystem, with the goal of providing advanced mobile services and contributing to the sustainable growth of our society.”

The companies will continue to strengthen virtualized and Open RAN leadership in this space, bringing additional value to customers and enterprises with 5G SA.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

Addendum: As of December 31, 2021 there were only 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

SOURCE: Dave Bolan, Dell’Oro Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://news.kddi.com/kddi/corporate/english/newsrelease/2022/02/18/5896.html

Samsung Electronics wins $6.6B wireless network equipment order from Verizon; Galaxy Book Flex 5G

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

Juniper Networks, Vodafone and Parallel Wireless in RIC Open RAN Trial

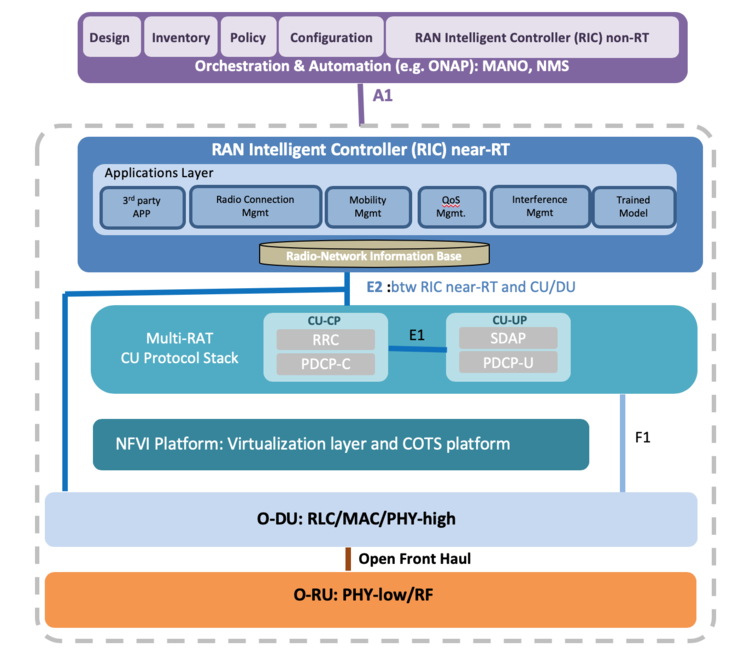

Juniper Networks is working with Vodafone and Parallel Wireless, a pioneer in Open RAN solutions, conducting a multivendor RAN Intelligent Controller (RIC) trial for “tenant-aware admission control” use cases. The trial, initially running in Vodafone’s test labs in Turkey and with plans to move into its test infrastructure, supports O-RAN interfaces and addresses the key business challenges faced by mobile operators around personalized user experience, viable revenue generation and reduction in both CAPEX and OPEX for 4G and 5G services.

The trial is based on an open, software-driven architecture that leverages virtualization to deliver more programmable, automated granular-by-user traffic management. The initial focus is on delivering tenant-aware admission control capability, enabling operators to personalize services and provide superior user experiences. Real-time tracking and enforcement of radio resources across the RAN enables mission-critical users – for example, hospitals and schools – to receive prioritized mobile data services delivery. This capability is enabled by Juniper’s rApp/xApp cloud-based software tools that manage network functions in near real-time, along with Parallel Wireless cloud-native Open RAN functions.

The trial’s design philosophy is focused on demonstrating the potential of enabling open, agile resource management and mobile data delivery in any software-driven RAN environment. This approach enables services and applications to be managed, optimized and mitigated automatically by the RAN, built on real-time data insights from its own performance.

All three organizations are active operators/contributors of the O-RAN ALLIANCE and the Telecom Infra Project (TIP), underlining their shared commitment to industry innovation and standards.

Juniper’s RIC solution is architected as an open platform supporting open interfaces on the north bound and south bound side, enabling easier integration with Open RAN partners in the ecosystem. Juniper’s RIC platform will also enable easy integration of third-party rApps/xApps, using UI-based onboarding and deployment tools coupled with flexibility to select between either network-based or SDK-based APIs (Application Programming Interfaces).

Parallel Wireless brings cloud-native Open RAN solutions – which are now integrated with the leading-edge RAN Intelligent Controller (RIC) based on O-RAN ALLIANCE specifications from Juniper Networks, giving operators more choices to build the best-of-breed RAN.

In January 2022, Vodafone announced that it had teamed with Samsung Networks Europe to switch on the UK’s first Open RAN site to carry live 5G traffic, marking a milestone in the commercial deployment of Open RAN network architectures in Europe, with more than 2,500 additional sites to follow.

Source: The Fast Mode

……………………………………………………………………………………………………………………………………………………………………………

Supporting Quotes:

“Vodafone has a clear vision that all mobile network radio infrastructure should be open – enabling rapid adoption of innovative services. We see this as a key stepping stone to rich innovation and collaboration, the only way that groundbreaking new use cases in 4G and 5G can be developed and cost-effectiveness maximized. In order to accelerate progress in this exciting journey, I am very pleased that Vodafone is hosting a lab and field trial for tenant-aware admission control using O-RAN interfaces, alongside an ecosystem of like-minded technology partners, including Juniper Networks and Parallel Wireless. By working together, we will be able to build smarter networks, better user experiences and drive stronger sustainability measures for B2B use cases.”

– Paco Martin, Head of Open RAN at Vodafone Group

“This multivendor trial at Vodafone has provided the perfect opportunity to demonstrate how Juniper’s RIC, and our focus on enabling seamless application portability, are able to unlock the true potential of Open RAN. By coupling our innovations with those of Parallel Wireless and Vodafone’s operational experience, we are able to achieve a real-world use case that can deliver value and better user experiences with improved economics for operators.”

– Constantine Polychronopoulos, VP, 5G & Telco Cloud at Juniper Networks

“Vodafone has been leading in Open RAN innovation since the early days. As the next stage of Open RAN adoption we are excited to partner with Vodafone and Juniper Networks, integrating our state-of-the-art cloud-native, O-RAN ALLIANCE compliant, Open RAN solutions with the leading edge RAN Intelligent Controller from Juniper. ”

– Keith Johnson, President at Parallel Wireless

Heavy Reading Comments about RIC:

According to Heavy Reading analyst Gabriel Brown, wireless network operators this year will likely be testing RIC technology in the field. He doesn’t expect full-blown products until the end of this year at the earliest. Vendors in the space range from Juniper Networks to VMware to some open source offerings from the likes of the Open Networking Foundation (ONF).

RICs could eventually replace self-organizing networks (SON) in classic RAN architectures. RICs help control base stations from a variety of vendors. Specifically, they can support various dynamic networking features such as switching off radios during non-peak times to cut energy costs. As a result, RICs are key to Open RAN which facilitates the mix and match network elements/base station modules from different vendors, rather than being locked into a tightly integrated stack of components supplied by just one vendor.

RICs come in two flavors: near-real time RICs and non-real time RICS. Brown expects most of the early RIC deployments to be of the non-real time variety because those specifications are farther along and less tightly coupled with the control of baseband scheduling.

About Juniper Networks:

Juniper Networks is dedicated to dramatically simplifying network operations and driving superior experiences for end users. Our solutions deliver industry-leading insight, automation, security and AI to drive real business results. We believe that powering connections will bring us closer together while empowering us all to solve the world’s greatest challenges of well-being, sustainability and equality. Additional information can be found at Juniper Networks (www.juniper.net) or connect with Juniper on Twitter, LinkedIn and Facebook.

Juniper Networks, the Juniper Networks logo, Juniper, Junos, and other trademarks listed here are registered trademarks of Juniper Networks, Inc. and/or its affiliates in the United States and other countries. Other names may be trademarks of their respective owners.

References:

https://www.juniper.net/us/en/research-topics/what-is-ric.html

https://www.lightreading.com/open-ran/growth-in-ric-how-open-ran-could-get-smarter/d/d-id/775108

Juniper to integrate RAN Intelligent Controller with Intel’s FlexRAN platform for Open RAN

Additional Resources:

YouTube: RAN Intelligent Controller (RIC) – Unlocking the True Potential of O-RAN

Open RAN Solutions: Juniper Networks

Research Topic: What is a RAN Intelligent Controller?

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

by John Strand, CEO of Strand Consult with Alan J Weissberger

A recent Dell’Oro Group report suggests that “total Open RAN revenues, including O-RAN and OpenRAN radio and baseband, surprised on the upside both in 2020 and during 2021, bolstering the thesis that Open RAN is here to stay and the architecture will play an important role before 6G.”

The Dell’Oro Group report author Stefan Pongratz added, “So, given where we are today, we can safely conclude that the movement has come much further than expected both from a commitment perspective and from a commercialization perspective.”

I respectfully disagree. The OpenRAN story is not driven by commercial demand for equipment. Instead, it is driven by people who make a living from hype. There is probably more money being made in generating hype about OpenRAN than in the actual purchase of OpenRAN equipment.

While there’s a lot of talk about OpenRAN, it’s still a technology that operators are testing – not deploying.

The hype cycle likely explains the Dell’Oro Group’s recent report that the OpenRAN market will increase. However, for all their unique expertise, Dell’Oro has not committed to publishing how many sites will use OpenRAN in the future (% of installed base) and other vital specifics like what proportion of the mobile companies’ traffic and revenue will go through OpenRAN sites and how much shareholders may gain by operators switching to OpenRAN.

Over 200 5G networks have gone live globally. All of these use 3GPP release 15 and 16 compliant network equipment. None use OpenRAN gear.

Note that neither 3GPP release 15 or 16 5G RAN specs or ITU-R 5G standard (ITU-R M.2150) include any reference to OpenRAN specifications (from either the O-RAN Alliance or TIP OpenRAN project). In fact, the 3GPP website calls out the conundrum of multiple OpenRAN-like specifications:

Open RAN is made possible through standardized (???)open network interfaces, defined in 3GPP, O-RAN Alliance, IEEE (???), and other SDOs (???) and industry fora (e.g. TIP Open RAN project). To cater to all the diverse 5G use cases and operator’s deployment constraints, the standards define multiple NG-RAN architecture options and the associated open network interfaces. While these options are crucial in making 5G suitable to address all the requirements and challenges of the next generation mobile network, figuring out which option fits a particular practical use case is sometimes challenging. This is further exacerbated by the fact that relevant standards are scattered across multiple SDOs.

Rakuten is the only deployed, purpose-built OpenRAN network (4G now, 5G later), and it uses proprietary network equipment, which is not interoperable with any other 4G/5G network. The much advertised 4G/5G OpenRAN Dish Network continues to be delayed with a launch date of sometime in 2022.

There are hundreds, if not thousands, of stories about OpenRAN, but they don’t focus on these key questions:

- How much do telecom stakeholders gain by you switching from classic 3GPP RAN to OpenRAN? At what point does it make sense to shift? In other words, how much do operators save and how does that translate to the bottom line? Strand Consult’s research shows that the operators’ RAN costs make up about 3% of ARPU. In practice, even the most optimistic savings from OpenRAN will not meaningfully affect the mobile operator’s earnings.

- If OpenRAN products win market share of 15% in 2026, what share of that installed base will be OpenRAN in 2025 and 2030? Strand Consult believes that OpenRAN will struggle with market share, barely reach 3% of the installed 5G sites by 2030.

- How will mobile subscribers experience the shift towards OpenRAN? Will they gain access to more features on their smartphones as a result? If OpenRAN achieves 3% market share of mobile sites, what incentives are there for application developers to build for OpenRAN? Imagine that voice and SMS were services that were available on only 3% of an operators’ mobile sites.

There is a need for greater transparency in the OpenRAN market, including testing, operator trials, units sold etc. While it is one thing for an operator to conduct OpenRAN trials and tests, it is quite another for the operator to purchase the equipment. To fuel the hype, some stories have suggested that a trial of OpenRAN equipment was a purchase.

OpenRAN benefits, however good they sound now, remain to be seen. We have yet to see any actual benefits created from the mix and match of OpenRAN modules/components. Moreover, we have yet to see how easy it will be to replace one OpenRAN vendor with another in a large scale commercial 4G/5G network.

For 25 years, Strand Consult has been the opposite of hype. We make our living being critical of pie in the sky scenarios. Our clients are executives and boards members of mobile operators who want credible and critical knowledge.

Strand Consult’s report Debunking 25 Myths of OpenRAN, analyzes the 25 myths that OpenRAN hype machine loves to cultivate. Close to one thousand people have requested that new report. Outside of three emails noting minor typos in our report, Strand Consult has yet to receive feedback to dispute the report’s analyses and conclusions.

John Strand founded Strand Consult in 1995. Since then, hundreds of companies in the telecom, media and technology industries have attended Strand Consult’s workshops, purchased reports, consulted with the company to develop strategy, launch new products, and conduct a dialogue with policymakers.

John Strand sits on the advisory board of a number of Scandinavian and International companies and is a member of the Arctic Economic Council Telecommunications Working Group. He served on the Advisory Board for the 3GSM World Congress, the event known as the Mobile World Congress in Barcelona.

………………………………………………………………………………………………………

References:

Dell’Oro Group, Kenneth Research and Heavy Reading’s optimistic forecasts for Open RAN

https://www.lightreading.com/open-ran/open-ran-moving-faster-than-expected—-delloro/d/d-id/774780?

https://www.3gpp.org/news-events/2150-open_ran

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Dell’Oro Group, Kenneth Research and Heavy Reading’s optimistic forecasts for Open RAN

Dell’Oro Group recently published the January 2022 edition of its Open RAN report. Preliminary findings suggest that total Open RAN revenues, including O-RAN and OpenRAN radio and baseband, surprised on the upside both in 2020 and during 2021, bolstering the thesis that Open RAN is here to stay and the architecture will play an important role before 6G (this author disagrees).

- The Asia Pacific region is dominating the Open RAN market in this initial phase and is expected to play a leading role throughout the forecast period, accounting for more than 40 percent of total 2021-2026 revenues.

- Risks around the Open RAN projections remain broadly balanced, though it is worth noting that risks to the downside have increased slightly since the last forecast update.

- The shift towards Virtualized RAN (vRAN) is progressing at a slightly slower pace than Open RAN. Still, total vRAN projections remain mostly unchanged, with vRAN on track to account for 5 percent to 10 percent of the RAN market by 2026.

-Market.jpg)

The global open radio access network (O-RAN) market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Amongst the market in these regions, the market in the Asia Pacific generated the largest revenue of $70 Million in the year 2020 and is further expected to hit $8200 Million by the end of 2028. The market in the region is further segmented by country into Japan, South Korea, India, and the Rest of Asia Pacific. Amongst the market in these countries, the market in India is expected to grow with the highest CAGR of 102% during the forecast period, while the market in Japan is projected to garner the second-largest revenue of $1900 Million by the end of 2028. Additionally, in the year 2020, the market in Japan registered a revenue of $60 Million.

The market in North America generated a revenue of $50 Million in the year 2020 and is further expected to touch $7000 Million by the end of 2028. The market in the region is further segmented by country into the United States and Canada. Out of these, the market in the United States is expected to display the highest market share by the end of 2028, whereas the market in Canada is projected to grow with the highest CAGR of 137% during the forecast period.

Key companies covered in the Open Radio Access Network (O-RAN) Market Research Report are: Metaswitch Networks, Mavenir, NTT DOCOMO, INC., Sterlite Technologies Limited, Huawei Technologies Co., Ltd., Radisys Corporation, Casa Systems, VIAVI Solutions Inc., Parallel Wireless, Inc., NXP Semiconductors, and other key market players.

Reference:

https://www.kennethresearch.com/report-details/open-radio-access-network-o-ran-market/10352259

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The latest Heavy Reading Open RAN Operator Survey indicates a positive outlook with real signs of momentum over the past year. Network operators and the wider RAN ecosystem are making steady progress, according to the survey results.

The first question in the survey was designed to help understand how operator sentiment toward open RAN has changed over the past year, in light of better knowledge of the technology, experience from trials, the increased maturity of solutions and changes in the policy environment. The figure below shows just over half (54%) of survey respondents say their company has not changed the pace of its planned open RAN rollout in the past year. There has been movement in the other half, split between those accelerating their plans (20%) and those slowing down (27%). This volatility essentially cancels out, and the overall finding is therefore that operators as a group are working at a steady, measured pace toward open RAN.

A steady outlook is a positive outlook at this stage of the market because it recognizes that open RAN is a major change in RAN architecture and is a long-term, multiyear exercise. After several years of inflated expectations, it is encouraging to see a measured perspective on open RAN coming to the fore.

n=82 Source: Heavy Reading

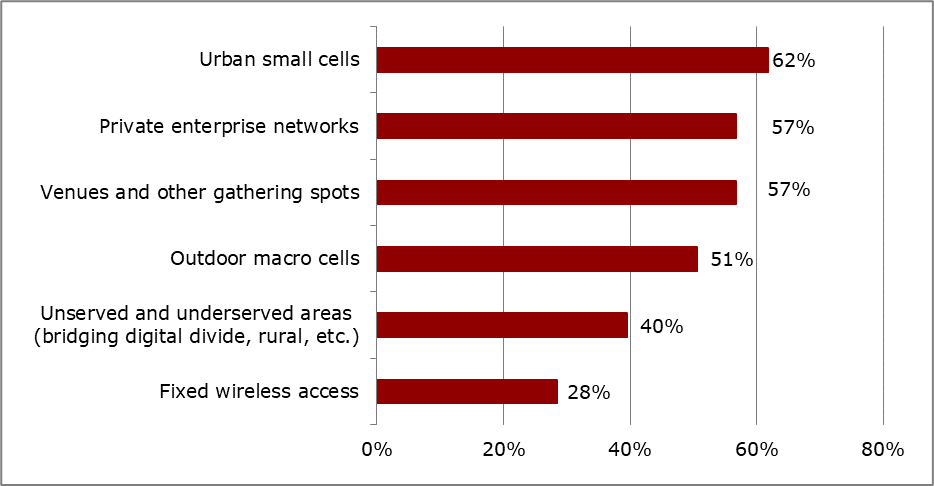

Another area of interest that helps gauge sentiment toward open RAN development relates to operators’ preferred use cases. The figure below reveals that operator intentions for how they will use open RAN are varied. Asked to select their top three use cases, 81 respondents representing 39 operators placed a total of 294 votes for an average of 3.6 per respondent, showing that there is no single open RAN use case or deployment scenario that stands out. Urban small cells (62%), private enterprise networks (57%) and venues and other gathering spots (also 57%) lead the responses.

n=81 Source: Heavy Reading

A positive way to interpret this finding is that open RAN is being pursued across a broad base of mobile communication scenarios. Once these models solidify and become “product ready,” then the market might see widespread adoption. Over time, open RAN could become the predominant mode of operation.

A less positive analysis, but one nevertheless worth considering, is that open RAN is a technology still in search of a solution. That is, the industry has committed to open RAN, and now it needs to find ways to make it work. Pursuing a diversity of use cases will help identify which are most promising and warrant investment and deployment at a wider scale.

It is notable that operator preferences for open RAN use cases have not changed much since Heavy Reading’s first survey in 2018; the same three use cases also led at that time. This reinforces the key message that open RAN progress is steady and consistent.

To download a copy of the 2021 Heavy Reading Open RAN Operator Survey, click here.

— Gabriel Brown, Principal Analyst, Heavy Reading

Reference:

https://www.lightreading.com/open-ran-steady-as-she-goes-/a/d-id/774765?

Ericsson expresses concerns about O-RAN Alliance and Open RAN performance vs. costs

In a letter to the FCC, Jared M. Carlson, Ericsson’s Vice President, Government Affairs and Public Policy expressed his company’s concern with the O-RAN Alliance. In particular, an August report of the European Commission could not determine whether the O-RAN Alliance was complying with various WTO criteria, including transparency and open procedures, and also noted a concern that any one of the five founding members could effectively veto any proposed specification.

Some O-RAN Alliance specifications are proceeding slowly, according to Ericsson. One reason why can be explained simply by the resources devoted to the group. For example, O-RAN front-haul meetings (a more mature O-RAN specification) sees about 60 members attending, with only about ten members actively contributing. In contrast, in a typical 3GPP RAN Plenary, there are approximately 600 members delivering 1000 contributions per quarter.

The lack of completed O-RAN specifications means that any such deployments require individual vendors to come to mutual agreements—a far cry from the “plug-and-play” vision of a complete set of Open RAN network interface standards. Light Reading referred to that months ago as another form of “vendor lock-in.”

Mike Murphy, CTO, Ericsson North America told the FCC that Ericsson has dedicated a number of resources to making O-RAN Alliance specifications successful, delivering about 1000 of 7000 total specifications,” the company told the FCC, citing Murphy’s presentation. “Indeed, without Ericsson’s contributions to the O-RAN Alliance, the timeline for more fully developed standards would likely be even further out in the future.”

Regarding security, Mr. Murphy noted that, again, Ericsson is one the top three contributors to the O-RAN Alliance Security working group. Yet there are no security specifications from the O-RAN Alliance Security group—there is only a set of requirements. He also noted that the performance of Open RAN does not compare to (vendor specific, purpose built) integrated RAN. Even if the so called 40% cost saving estimates were true on a per-unit cost basis, the two different types of RAN equipment would not deliver the same level of performance.

Furthermore, Ericsson’s own estimates have indicated that Open RAN is more expensive than integrated RAN given the need for more equipment to accomplish what purpose-built solutions can deliver and increased systems integration costs. That’s quite shocking considering that many upstarts (e.g. Rakuten, Inland Cellular, etc) have stated Open RAN is cheaper. For example, “Open RAN will allow for cost savings over proprietary architectures,” Open RAN vendor Mavenir declared in its own recent meeting with FCC officials. The company said open RAN equipment can reduce network providers’ operating expenses by 40% and total cost of ownership by 36%.

Ericsson isn’t the only 5G company cautioning the FCC on Open RAN. Nokia – another major 5G equipment vendor – made similar arguments in a recent presentation to the FCC. “While there are some vendors that only offer open RAN architecture and/or limited RAN products, Nokia is able to provide a choice of classical or open RAN depending on the desires of our customers,” Nokia explained. “To date, the vast majority of service providers have chosen classical RAN solutions, deferring investment in open RAN until further commercial maturity has been demonstrated.”

Nokia also took issue with the notion that open RAN equipment is dramatically cheaper than traditional, classic RAN equipment. “The draft cost catalog also demonstrates that there are not cost savings being offered through open RAN equipment estimates compared to integrated RAN estimates,” Nokia wrote to the FCC in April following the release of the agency’s initial, draft pricing catalogue.

Many telecom professionals, like John Strand, argue that open RAN is not yet mature. They contend that government mandates that would require the use of the technology – in a furtherance of geopolitical goals – would be misguided. “The US has clearly demonstrated that open and intense competition, not government mandates, is the most effective way to mobilize the telecom industry to enable unprecedented innovation and value creation,” Ericsson told the FCC. “The US led the world in 4G and the ‘app economy’ not by insisting on any particular network standard, but by creating an open, predictable and attractive investment climate for all industry stakeholders and allowing operators to select the best technology based on their needs.”

Mr. Murphy concluded that the Commission and the U.S. government more generally should continue to “keep their eyes on the prize.” Notably, ensuring that the U.S. continues to smooth the way for 5G deployments will continue to pay dividends for the U.S. economy, with over $500 Billion added to the U.S. economy from 5G-enabled business, is the critical job of the day. The key step the Commission can take is to continue to foster the deployment of 5G.

References:

https://ecfsapi.fcc.gov/file/1117953022367/Ericsson%20Open%20RAN%20ex%20parte%20Nov%2017%20FINAL.pdf

https://ecfsapi.fcc.gov/file/1117953022367/Ericsson%20O-RAN%20Update%20FINAL.pdf

https://www.lightreading.com/open-ran/ericsson-actually-open-ran-is-more-expensive/d/d-id/773617?

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

Addendum -Tuesday 23 November 2021:

German study warns of security risks in Open RAN standards

Open Radio Access Networks (Open RAN) based on the standards of the O-RAN Alliance carry significant security risks in their current form, according to a study commissioned by Germany’s Federal Office for Information Security (BSI). The analysis was carried out by the Barkhausen Institute, an independent research institution, in cooperation with the group Advancing Individual Networks in Dresden and the company Secunet Security Networks.

The implementation of Open RAN standards by the O-RAN Alliance is based on the 5G-RAN specifications developed by the 3GPP. Using a best / worst case scenarios analysis, the German study demonstrated that the Open RAN standards have not yet been sufficiently specified in terms of ‘security by design’, and in some cases carry security risks. The BSI called for the study’s findings to be taken into account in the further development of the Open RAN ecosystem, in order to support the rapid growth of the market with security from the start.

The open RAN project is supported by all three mobile operators in Germany – Deutsche Telekom, Vodafone and Telefonica – as well as the 1&1, which is building a fourth network in the country. The German government also recently awarded EUR 32 million in subsidies to support further development of the open RAN technology.

https://www.telecompaper.com/news/german-study-warns-of-security-risks-in-open-ran-standards–1405252

Samsung partners with Orange to deliver 5G vRAN and O-RAN compliant base stations

Samsung Electronics has announced that it is collaborating with the France headquartered telecom operator Orange, to disaggregate the software and hardware elements of traditional RAN. The South Korea based tech giant will provide its virtualized RAN (vRAN), “which has been proven in the field through commercial deployments with global Tier one operators including the U.S.”

As one of the world’s leading telecommunications operators, Orange provides mobile services to 222 million users in 26 countries along with Europe, Africa, and the Middle East. Through this partnership, Samsung and Orange aim to deploy O-RAN Alliance-compliant base stations beginning with rural and indoor configurations and then, expanding to new deployments in the future.

“Open RAN is a major evolution of radio access that requires deeper cooperation within the industry. With our European peers, we want to accelerate the development of Open RAN solutions that meet our needs. After the publication of common specifications, Orange’s Open RAN Integration Center will support the development and tuning of solutions from a broad variety of actors,” said Arnaud Vamparys, Senior Vice President of Radio Access Networks and Microwaves at Orange.

Samsung’s vRAN solutions can help ensure more network flexibility, greater scalability and resource efficiency for network operation by replacing dedicated baseband hardware with software elements. Additionally, Samsung’s vRAN supports both low and mid-band spectrums, as well as indoor and outdoor solutions. Samsung is the only major network vendor that has conducted vRAN commercial deployments with Tier one operators in North America, Europe and Asia.

“We are pleased to participate in Orange’s innovative laboratory,” said Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics. “Through this collaboration, we look forward to taking networks to new heights in the European market, enabling operators to offer more immersive mobile services to their users.”

By opening its Open RAN Integration Center in Châtillon, near Paris, Orange will enable the testing and deployment of networks capable of operating with innovative technologies, which will serve as the backbone of the operator’s future networks. At the center, Samsung and Orange will conduct trials to verify capabilities and performance of Samsung’s vRAN, radio and Massive MIMO radio.

With a vRAN approach, carriers are able to rapidly shift capacity to address customer needs. For business customers, vRAN can drive more efficient access to private 5G networks through easy deployment of baseband software in Multi-access Edge Computing (MEC) facilities.

“We are committed to providing reliable, secure, and flexible network solutions that deliver the power of 5G around the world,” said Magnus Ojert, Vice President, Networks Division, Samsung Electronics America. “We believe vRAN’s next phase of innovation will accelerate what’s possible for society and look forward to collaborating with an industry-leader like Verizon to make 5G a reality for millions in 2021.”

Samsung says they have “pioneered the successful delivery of 5G end-to-end infrastructure solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.”

References:

https://news.samsung.com/global/samsung-and-orange-collaborate-to-advance-5g-networks-to-a-new-level

https://www.samsung.com/global/business/networks/products/radio-access/virtualized-ran/

Samsung’s 5G vRAN adoption could be a key turning point for the industry