Optical Network Equipment Market

Orange and Nokia demo 600Gb/sec transmission over a 914 km optical network; Nokia 25G PON

Nokia and Orange announced the completion of a network trial using the Nokia PSE-Vs, its fifth generation super coherent optics. With this field trial, Orange has successfully validated a planned upgrade of its long-haul backbone networks to support new high-bandwidth 400 Gb/sec services, and the ability to scale fiber capacity up to 600Gb/sec. This represents an increase in spectral efficiency by 50% compared to prior technologies on its long distance optical network.

The trial was performed in real-world conditions using Nokia PSE-Vs super coherent optics in production-ready optical transport hardware, just 16 months after the lab prototype trial done on Orange’s live network. Orange and Nokia demonstrated error-free performance at a data rate of 600Gb/sec over a 914 km network between Paris and Biarritz, under challenging live network conditions. The fiber network consisted of 13 spans of Orange’s existing network, through multiple cascaded reconfigurable optical add/drop multiplexers (ROADM), using 100GHz WDM spectrum channels.

Jean-Luc Vuillemin, Vice President of International Networks and Services at Orange, said: “With the booming market bandwidth requirement and need for scalability and flexibility, it is important that Orange continues to support an ever-greater network scale and new high-bandwidth services across our terrestrial and subsea global footprint.

Validating super coherent optics with Nokia represents an important enabler for future-proof networks which will bring spectral efficiency and operational deployment flexibility to our customer solutions. Furthermore this technology will allow for power savings by nearly 50%, which is key to our objective of developing greener networks for our customers. ”

James Watt, Head of Optical Networks Division, Nokia, said: “We are delighted to work with Orange in continued support of their network upgrade plans. With the introduction of the PSE-Vs super coherent capabilities across our entire 1830 portfolio, Nokia enables spectrally-efficient transport at 600Gb/sec over real-world long haul networks, and 400Gbps services over ultra long haul networks spanning multiple 1000’s of kilometers.”

Nokia 1830 Photonic Service Interconnect (PSE)

The Nokia PSE-V

The Nokia PSE-V is the industry’s most advanced family of digital coherent optics (DCO), powering the next generation of Nokia high-performance, high-capacity transponders, packet-optical switches, disaggregated compact modular and subsea terminal platforms. The PSE-V Super Coherent DSP (PSE-Vs) implements the industry’s only 2nd generation probabilistic constellation shaping (PCS) with continuous baud rate adjustment, and supports higher wavelength capacities over longer distances – including support for 400G over any distance – over spectrally efficient 100GHz WDM channels while further reducing network costs and power consumption per bit.

Further resources:

• Web page: Nokia 1830 Photonic Service Interconnect (PSI)

• Web page: Nokia Photonic Service Engine (PSE) Coherent DSPs

• Web page: 400G Everywhere

……………………………………………………………………………………………………………………..

Earlier this week, Nokia and Bell Canada announced the first successful test of 25G PON fiber broadband technology in North America at Bell’s Advanced Technical Lab in Montréal, Québec.

The trial validates that current GPON and XGS-PON broadband technology and future 25G PON can work seamlessly together on the same fiber hardware, which is being deployed throughout the network today. 25G PON delivers huge symmetrical bandwidth capacity that will support new use cases such as premium enterprise service and 5G transport. Nokia’s 25G PON solution utilizes the world’s first implementation of 25G PON technology and includes Lightspan and ISAM access nodes, 25G/10G optical cards and fiber modems.

For the past decade, Bell has been rolling out fiber Internet service to homes and businesses across the country, a key component in the company’s focus on connecting Canadians in urban and rural areas alike with next-generation broadband networks. With this successful trial, Bell can be confident that its network will absorb the increased capacity of future technologies and connect Canadians for generations to come.

Stephen Howe, EVP & Chief Technology Officer, Bell, said:

“As part of Bell’s purpose to advance how Canadians connect with each other and the world, we embrace next-generation technologies such as 25G PON to ensure we remain at the forefront of broadband innovation. Our successful work with Nokia to deliver the first 25G PON trial in North America will help ensure we maximize the Bell fiber advantage for our customers in the years to come.”

Jeffrey Maddox, President of Nokia Canada, said: “Nokia innovations powered the fiber networks and the connectivity lifeline that carried Canadian homes and businesses through the pandemic. 25G PON innovations will drive the next generation of advances in our connected home experience.”

Bell and Nokia have closely collaborated over the years on many industry breakthroughs, such as the first Canadian trial of 5G mobile technology in 2016. Bell continues to work with Nokia to build and expand its 5G network across Canada.

References:

STL Launches Accellus End-To-End Fiber Broadband And 5G Wireless Solution; India’s PLI scheme explained

India based telecom equipment company STL (Sterlite Technologies Limited) has launched Accellus, its flagship solution for 5G-ready, open and programmable networks. This new product line raises the position of STL as a provider of disruptive solutions for Access and Edge networks. For the past 5 years, STL has been investing in research and development to expand its capabilities in converged networks based on fiber optic broadband and Open RAN.

………………………………………………………………………………………………………………………………………………

India’s PLI Scheme

The Cellular Operators Association of India (COAI), which represents service providers and network equipment vendors, said that the production-linked incentive (PLI) scheme will boost local manufacturing, exports and also create employment opportunities. STL plans to take advantage of that initiative. Nokia (through its India subsidiary) said the guidelines were an encouraging initiative by the government towards making India a global manufacturing hub. “Nokia is committed to this vision with our Chennai factory that manufactures telecom equipment from 2G to 5G-making for India and the world.”

“India is already the second largest telecom market globally and this will go a long way in making the country a global hub for telecom innovation,” said SP Kochhar, director general, COAI.

………………………………………………………………………………………………………………………………………………..

STL’s Accellus is built on this industry-leading converged optical-radio architecture. The company expects the global adoption of this decision to accelerate at a rate of 250% on an annual basis, stimulating better TCO for customers and gross margin for shareholders. Accellus will allow four main benefits for network builders – scalable and flexible operations, faster time to market, lower TCO and greener networks.

Accellus will lead the industry’s transition from tightly integrated, proprietary products to neutral and programmable converged wireless and optical networking solutions. It offers wireless and fiber-based solutions:

1. 5G multiband radios: Exhaustive portfolio of RAN radios with single and multiband macro radios. Co-developed in partnership with Facebook Connectivity to build total availability for Open RAN-based radios

2. Internal small cells: O-RAN compliant, highly efficient internal 5G small cell solution, with level 1 edge treatment

3. Wi-Fi 6 access solutions: Outdoor Wi-Fi 6 solutions providing carrier-class public connectivity in dense environments

4. Intelligent RAN Controller (RIC): An Open RAN 5G operating system that allows the Open RAN ecosystem to use third-party applications to improve performance and save costs

5. Programmable FTTx (pFTTx): A complete solution that offers programmability and software-defined networks in large-scale FTTH, business and cellular sites (FTTx) networks

Commenting on the launch of Accellus, Philip Leidler, Partner and Consulting Director, STL Partners, said: “One of the goals of the O-RAN alliance was to expand the RAN ecosystem and encourage innovation from a wider base of technology companies worldwide. the message is the last indication that this goal has been achieved. “

Commenting on the launch of Accellus, Chris Rice, CEO of Access Solutions at STL, said: “Disaggregated 5G and FTTx networks based on open standards are becoming more common for both greenfield and brownfield deployments. These networks will require unprecedented scalability and flexibility, possible through an open and programmable architecture. STL’s Accellus will unlock business opportunities for our customers and provide a immersive digital experience worldwide.”

Optical fiber has evolved in its maturity and in its form factors to drive the infrastructure medium for the “wireline” side of the network. It continues to be the preferred medium for high-speed network delivery, Rice said.

“What network infrastructure is needed for 5G to become a reality and deliver expected Performance?”

Answer: “Upgrade the network backhaul and core IP infrastructure for the expected growth in bandwidth that 5G Applications will enable. The necessity of wireline 5G upgrades sometimes does not get the attention it deserves; this includes IP equipment (e.g. cell site routers) and the necessary fiber upgrades to the cell sites.

Perform the network planning for the new cell site builds required to get the coverage and capacity required for ubiquitous 5G at the speeds users expect. For 5G to pay off for Telcos, there have to be new capabilities and services to sell that deserve higher price points from consumers and business users.

Ensure that operational automation is available to keep operating costs reasonable, especially as the number of cell sites grows. CAPEX is typically only 20 to 25% of the Total Cost of Ownership (TCO) for a RAN, meaning that operating costs are 3X to 4X what CAPEX is. The RAN Intelligent Controller (RIC) is an example in ORAN / Open RAN that helps Telcos fulfil this need in an open way. It is essentially the operating system for Open RAN. It provides a platform for third-party applications to deliver these operational benefits and automation.”

How Is STL Helping Industry Stakeholders to Explain to Government Officials the Importance of Fiber for 5G or High-Speed Broadband?

Answer: “Network speed in the RAN air interface is essentially meaningless without the ability to ensure that the connected IP network can backhaul the required bandwidth. This fact necessitates additional fiber deployments to the existing cell sites (where it does not exist) and to new cells sites.”

In conclusion, Rice opined, “Our (STLs) newest business unit, the Access Solutions BU, focuses on fiber broadband and 5G wireless products. These products are based on open networking principles and give STL the opportunity to participate in the disruption that is occurring in the open networking markets, like ORAN and Open RAN initiatives. While Access Solutions BU is new, it has an R&D and innovation heritage of almost four years. During that time, a top talent team has been put in place, fundamental technology and innovation have been developed and matured, and now a well-defined product roadmap has been put in place as the BU launches many new products in its Accellus product line.”

References:

https://telecomtalk.info/5g-ecosystem-in-india-to-pli-scheme/468656/

Cignal AI: NA Optical Network Spending to Accelerate; IEEE 802.3ct; NeoPhotonics 400G Multi-Rate Transceiver

|

||

|

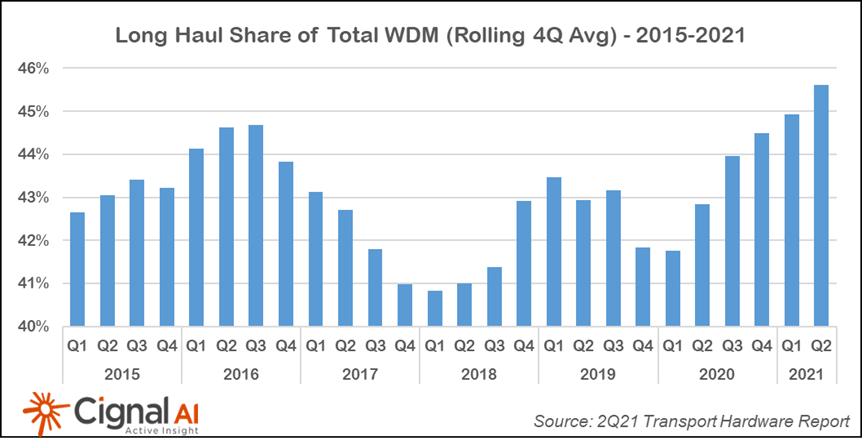

Additional 2Q21 Transport Hardware Report Findings:

- The spending mix between long-haul and metro WDM reached a record level following 5 quarters of investment in advanced coherent and line system technology. Carriers may be deferring metro expenditures considering the imminent availability of transport system upgrades utilizing 400G coherent pluggables.

- Chinese optical and packet hardware spending collapsed, resulting in the largest single quarterly decline on record and the first instance of consecutive quarters with YoY declines.

- Sales of optical hardware in EMEA were up significantly YoY as the region continues to produce steady single-digit growth. Despite strategic wins by Nokia and observations of increasing replacement activity from Ciena, Huawei’s footprint in EMEA shows no noticeable impact from geopolitical factors.

- North American packet transport sales were up slightly, with market leader Cisco realizing gains in Core as its 8000 series routers ramp.

- Component shortages weighed on smaller equipment manufacturers as constrained global semiconductor production increased lead times. ADVA and Infinera quantified the effect on sales (10% and 6% of revenue, respectively), though larger vendors reported minimal impact on their sales. Vendors do not anticipate resolution of these issues until 2022.

Editor’s Note: IEEE 802.3ct and 100GBASE‑ZR

It will be interesting to see if optical packet transport will evolve from to Ethernet MAC frames directly over DWDM systems. IEEE 802.3ct “Physical Layers and Management Parameters for 100 Gb/s Operation over DWDM Systems” standard was approved in June 2021 for that purpose.

Extended reach (i.e., 80 km ~50 miles or longer) optical Ethernet solutions primarily support television distribution (e.g., cable and direct-broadcast satellite) and mobile/cellular backhaul aggregation networks. A need was identified to not only support 100 Gb/s extended reach operation for these applications, but also to support up to 48 multiplexed 100 Gb/s channels over a single lane of single-mode optical fiber cabling. This amendment defines one Physical Layer (PHY) specification and management parameter for extended reach 100 Gb/s operation.

The new PHY specification is 100GBASE-ZR: A Physical layer specification supporting 100 Gb/s operation on a single wavelength capable of at least 80 km over a DWDM system. Specifically, 100 Gb/s transmission using 2‑level pulse amplitude modulation and dual polarization differential quadrature phase shift keying (DP-DQPSK) modulation over single‑mode fiber (2 fibers total), with reach up to at least 80 km.

In addition, 100GBASE-ZR is specified as part of a Dense Wavelength Division Multiplexed (DWDM) system. In this system, up to 48 100GBASE‑ZR optical signals, transmitting between the 1528.77 nm and 1566.31 nm wavelengths, can be multiplexed for operation over 2‑fiber single‑mode optical cabling referred to as a “black link”. Black link refers to a link where only the input and output link and transfer characteristics (e.g., chromatic dispersion, optical return loss, and inter-channel crosstalk) are specified, with interoperability ensured at these locations. The amendment does not specify how the black link is designed, constructed, configured, or operated. DWDM network elements inside the black link may include an optical multiplexer, an optical de‑multiplexer, and one or more optical amplifiers and no assurance of interoperability at these multichannel points is provided.

…………………………………………………………………………………………………………………………………………..

Separately, NeoPhotonics Corporation, a leading developer of silicon photonics and advanced hybrid photonic integrated circuit-based lasers, modules and subsystems for bandwidth-intensive, high speed communications networks, today announced a new, high output power version of its 400G Multi-Rate CFP2-DCO coherent pluggable transceiver with 0 dBm output power and designed to operate in metro, regional and long haul ROADM based optical networks.

“Our newest CFP2-DCO coherent pluggable module, with high output power, robust ROADM filtering tolerance and demonstrated transmission over 1500 km, allows customers to use one coherent pluggable solution to cover essentially all metro ROADM use cases, simplifying network design, enabling disaggregation, and lowering inventory costs.” said Tim Jenks, Chairman and CEO of NeoPhotonics. “The key to achieving line card equivalent performance in a pluggable module, but with significantly lower power than a line card, is the vertical integration of our optical solution and Nano tunable laser,” concluded Mr. Jenks.

References:

https://www.neophotonics.com/press-releases/?newsId=12741

Analysts: Combined ADTRAN & ADVA will be a “niche player”

ADTRAN is positioning its acquisition of ADVA as building a complementary combination of assets that can better capitalize on what it sees as an unprecedented investment cycle in fiber. However, analysts argue that the new combined company would still be just a “niche player” in the market.

On Monday, ADTRAN wrote in an email to this author (and many others):

ADTRAN has entered into a business combination agreement with ADVA, a Germany-based global leader in business ethernet, metro WDM, Data Center Interconnect and network synchronization solutions, to combine our two companies.We believe our combination will create many opportunities to better serve end-to-end fiber networking solutions spanning metro edge, aggregation, access and subscriber connectivity. Additionally, we anticipate that by utilizing our collective world-class R&D teams, we will be better positioned to accelerate innovation and offer differentiated solutions.Going forward, it will be business as usual and all existing customer, partner and supplier relationships will remain intact. Until we receive all required regulatory approvals and close the transaction, ADVA and ADTRAN will continue to operate as separate companies. As we integrate the two companies, we will be focused on the best ways to offer our enhanced value proposition and partner with you.

Highlights of the Deal:

- Combination expands product offering and strengthens position as a global fiber networking innovation leader with combined revenue of $1.2B

- Highly complementary businesses create a global, scaled end-to-end provider to better serve customers with differentiated fiber networking solutions, spanning metro edge, aggregation, access and subscriber connectivity

- Creates a stronger and more-profitable company, poised to benefit from the unprecedented investment cycle in fiber, an expanded market opportunity and increased scale

- Meaningful value creation with over $50 million in annual run-rate cost synergies

- All-stock transaction with ADTRAN shareholders to own approximately 54% and ADVA shareholders to own approximately 46% of the combined company, assuming a tender of 100% of ADVA shares

- Combined company to be dual-listed on the NASDAQ and Frankfurt Stock Exchange

The two vendors produced a combined $1.2 billion in revenues last year. However, ADTRAN’s presentation in support of the deal showed that market heavyweights Nokia, Ciena, and smaller player Infinera had much higher revenues over that same time period.

The two vendors produced a combined $1.2 billion in revenues last year. However, ADTRAN’s presentation in support of the deal showed that market heavyweights Nokia, Ciena, and smaller player Infinera had much higher revenues over that same time period.

“It’s not going to reshape the optical networking industry,” John Lively, principal analyst at LightCounting, told SDxCentral about the deal. “ADTRAN and ADVA are going to improve their position in combination, [but] don’t really threaten the large players.”

Companies that are potentially threatened by this deal are smaller competitors such as Infinera ($1.4 billion in 2020 revenues) and Calix ($500 million in 2020 revenues), Lively noted.

“The challenges pressured by the global pandemic have clearly shown that fiber connectivity has become an essential foundation for the modern digital economy,” ADTRAN Chairman and CEO Thomas Stanton explained to investors about the deal. “This transformation will significantly increase the scale of the combined businesses, enhancing our ability to serve as a trusted supplier to our customers and worldwide.”

Stanton added that “our combination will make us one of the largest western suppliers for the markets we serve. Our greater size will increase cross-selling opportunities to existing customers, accelerating our combined growth, and allowing us to further penetrate our target markets.”

Although ADTRAN will remain a mid-tier player after the deal closes, LightCounting’s Lively and Dell’Oro Group VP Jimmy Yu both think in general, “it’s a good move.”

Yu noted that industry mergers can destroy value if too many products and workforces overlap. But in this case, ADTRAN and ADVA are from adjacent markets of fixed access and optical layer, and both sides will help each other grow the product line, so “it seems like a complementary combined company that’s going to come out of this,” he added.

Jimmy had this general comment on optical network trends:

“Disaggregated DWDM systems outperformed the broader market, demonstrating the growing adoption of this platform type. Really what we see is that this type of platform architecture, where transponder units are independent of the line systems, is being more widely embraced beyond the Internet content providers. Also, it is no longer just for metro applications. Recently, the highest growth rates have been from long-haul applications,”

Lively noted that there is almost no overlap in the product line, and “for the networks, the two companies logically fit together [as] ADTRAN makes access to equipment and ADVA makes the gear that connects the access equipment to the core.”

“So if you are a smaller service provider, and you want to upgrade to 10 Gb/s internet service for your customers, you could potentially buy everything you need from the new ADTRAN, from the passive optical networking, all the way through to connect to the core,” he said.

Yu also mentioned that the deal will help increase the scale and diversity in products as ADTRAN will be able to offer access and a backhaul solution, especially in tier-two and tier-three markets where most service providers want to work with one solution company instead of multiple vendors.

“2022 should be positive for sales,” argued the analysts at WestPark Capital in a note to investors earlier this month, following the release of Adtran’s second quarter results.

The WestPark Capital analysts pointed out that ADTRAN stands to gain ground in part from government broadband funding, as well as moves by some American and European network operators away from China’s Huawei.

The Raymond James analysts concurred on the Huawei opportunity. “We believe that the Huawei backlash outside of China presents among the largest opportunities,” they wrote on Monday.

The combined company will maintain ADTRAN’s global headquarters in Huntsville, Alabama. It will maintain ADVA’s headquarters in Munich, Germany, as its European base. Currently, ADTRAN has a geographical revenue split of 74% in the Americas, 21% in Europe, the Middle East, and Africa, and 5% in Asia Pacific, while ADVA is split 62% in EMEA, 29% in the Americas, and 9% in Asia Pacific, according to Stanton.

The deal expands ADVA’s presence in North America and ADTRAN’s ability to reach the European market more effectively, Lively said. One of the drivers for this combination is “we see our customers making significant capital investments to transition their supply chains to trusted vendors with our roots in the U.S. and Germany, our company will be viewed favorably by customers who increasingly specify Western vendors,” Stanton explained.

“It’s kind of a race to build out their digital infrastructure to make the country competitive,” which presents a real opportunity for the new ADTRAN and also its competitors, Lively added.

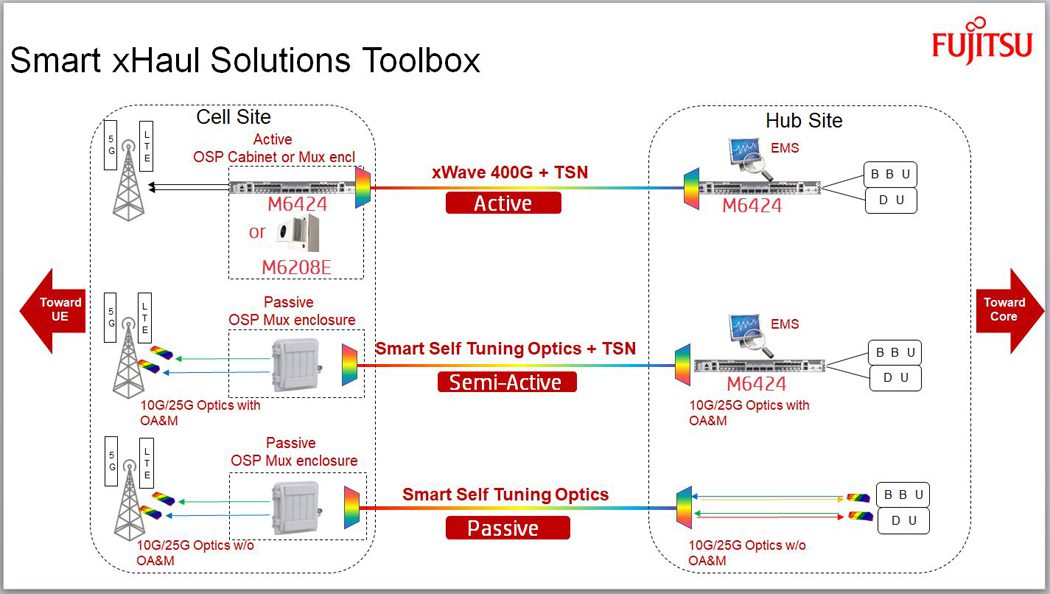

Fujitsu and HFR unveil Smart xHaul optical transport for 5G traffic

Lightpath to deploy 800Gb/sec links using Ciena’s WaveLogic 5 Extreme technology

Fiber-optic network services provider Lightpath has rolled out 800-Gbps capabilities via implementation of Ciena’s WaveLogic 5 Extreme technology. The company also will deploy Ciena’s Waveserver Ai platform, which will pair with a flexible-grid optical transport network based on Ciena’s 6500 RLS platforms.

The Lightpath Network consists of over 18,000 route miles of fiber providing connectivity to over 12,000 service locations. Lightpath provides a variety of connectivity and business services to customers in the metro New York area, including financial services firms (e.g. “Lightpath intros 100-Gbps optical transport service” and “Lightpath raises New York metro fiber-optic network footprint”). Using Ciena’s coherent optical solution, Lightpath’s network becomes more adaptive, allowing it to respond quickly to ever-changing bandwidth demands while maximizing operational efficiencies, providing customers with more reliable, high-speed services.

The enhanced optical transport technology will increase fiber network flexibility and efficiency as well as support Physical Layer encryption for data security. Cable MSO Altice USA owns a controlling interest in the company (see “Altice USA to sell almost 50% of Lightpath fiber enterprise business to Morgan Stanley Infrastructure Partners”).

“In order for our customers to execute on their own digital innovations, we need to provide them with fast and reliable connectivity. With Ciena’s solutions, our customers in the New York and Boston metro areas will now experience next-level digital services with high bandwidth and minimal latency,” commented Phil Olivero, CTO at Lightpath.

“As users consume more digital content, it is crucial for service providers to ensure their network can adapt to these surging and often unpredictable demands. With Ciena’s technology, Lightpath is adding scalability to meet bandwidth demands and also gaining real-time visibility into the performance of its network,” added Kevin Sheehan, CTO, Americas, for Ciena.

WaveLogic 5 Extreme is now available in three different product implementations to meet network architecture preferences: 6500 Packet-Optical Platform, Waveserver 5 compact interconnect platform, and the WaveLogic 5 Extreme 800G transceiver module

The WaveLogic 5 Extreme chip is 12mm x 16mm CMOS device. Here are some of its remarkable features:

- It is the industry’s first commercial 7nm CMOS device for optical networks.

- Based on 7nm FinFET technology, it includes 3km of wiring and contains 800 Trillion operations per second, which is about as much horsepower as 400,000 laptops!

- Some of the capabilities that are packed into the ASIC include nonlinear probabilistic constellation shaping, throughput-optimized forward error correction, frequency division multiplexing, and encryption.

…………………………………………………………………………………………………………………………………………………………………..

About Ciena

Ciena is a networking systems, services and software company. We provide solutions that help our customers create the Adaptive Network™ n response to the constantly changing demands of their end-users. By delivering best-in-class networking technology through high-touch consultative relationships, we build the world’s most agile networks with automation, openness and scale. For updates on Ciena, follow us on Twitter @Ciena, LinkedIn, the Ciena Insights blog, or visit www.ciena.com.

About Lightpath

Lightpath is revolutionizing how customers connect to their digital destinations by combining our next-generation network with our next-generation customer service. Lightpath’s advanced fiber-optic network offers a comprehensive portfolio of custom-engineered connectivity solutions with unparalleled performance, reliability, and security. Our consultative customer service means we work with you to design, deliver, and support the solution for your unique needs, faster and more easily than ever before. For over 30 years, thousands of enterprises, governments, and educators have trusted Lightpath to power their organization’s innovation. Altice USA (NYSE: ATUS) owns a 50.01% controlling interest in Lightpath and Morgan Stanley Infrastructure Partners (MSIP) owns 49.99% of the Company.

………………………………………………………………………………………………………………………………………………………………..

References:

2021 Optical Fiber Conference (OFC) Highlights and Links to Videos

The premier event in optical telecom—the 2021 Optical Fiber Communication Conference and Exhibition (OFC) concluded last week. The virtual event drew over 6,500 registrants from 83 countries.

“OFC 2021 saw technology announcements and technical presentations spanning the optical communications ecosystem, including advancements in optoelectronic devices, packaging and digital signal processing that are all rapidly evolving to achieve 800G and beyond, as well as those in architectures and algorithms towards more intelligent optical networking,” said Jun-ichi Kani, OFC General Chair, NTT, Japan. “OFC is the only event where attendees can access the full spectrum of trends shaping the industry and the way we connect across the globe.”

Speakers presented breakthroughs in many areas, including 400/ZR+, 800G, co-packaged optics, embedded optics, next-gen optical access, silicon photonics, space-division multiplexing, data center networks, automation and intelligence in networks and more. Sessions on quantum science and technologies, sensor applications and free space optics appealed to a large audience and enriched the OFC experience. Recorded sessions are available to registrants as on-demand content for 60 days following the close of the event.

“OFC is the go-to event for the optics industry,” said Jimmy Yu, vice president, Dell’Oro Group. “From the thought-provoking panel discussions to the product announcements, OFC has always been the place where I learn about emerging technologies.”

Technology experts from global leaders II-VI, Broadcom, Ciena, Cisco, Corning, Innolight, Intel, Juniper Networks, Lumentum, NeoPhotonics, Nokia and Ribbon discussed developments in hardware and software-based networking solutions in daily briefings with leading analysts, Sterling Perrin, Heavy Reading; Ian Redpath, OMDIA; Andrew Schmitt, Cignal AI; Jimmy Yu, Dell’Oro Group and Vladimir Kozlov, LightCounting. The videos can be viewed here.

The TIP sub-group said multi-vendor integration and services operations “were achieved through open standard models and APIs supported by the Optical SDN Controller, including Transport-API, OpenConfig and Open REST.”

“This proof of concept is an important milestone in the journey to fully open and disaggregated optical networking. It offers new levels of visibility and a way to manage the entire multi-vendor environment,” commented Christoph Glingener, CTO at ADVA.

Technology Showcases from 3M, AIM Photonics, Corning, EFFECT Photonics, Infinera, Jabil, Juniper Networks, Keysight Technologies, Lumentum, Luna Innovations, Murata, Nokia, Pi, Renesas, Ribbon, Samtec, Sicoya, Synopsys, Tektronix, Telescent and Xilinx gave deep dives into their cutting-edge products.

OFC 2021 exhibitor news announcements are posted to the OFC Newsroom.

Innovations in Optics

Leading researchers from around the world presented technical peer-reviewed papers, including:

- Trans-Atlantic Real-Time Field Trial Using Super-Gaussian Constellation-Shaping to Enable 30 Tb/s+ Capacity — A team of researchers from Infinera Corporation, USA and Facebook demonstrated a record-breaking transatlantic transmission across MAREA.

- A Latency-Aware Real-Time Video Surveillance Demo: Network Slicing for Improving Public Safety — Researchers presented a latency-aware optical metro network having sophisticated monitoring and data analytics capabilities and discussed the network architecture and enabling technologies, as well as a video surveillance case of the system.

- Demonstration of 100Gbit/s Real-Time Ultra High Definition Video Transmission Over Free Space Optical Communication Links — A team of researchers discussed how they achieved real-time FSO transmission of an ultrahigh-definition video stream between two buildings in Beijing.

- 224-Gb/s PAM4 Uncooled Operation of Lumped-electrode EA-DFB Lasers with 2-km Transmission for 800GbE Application — Researchers at Lumentum showed how they developed an optical solution that uses four 200 Gbps wavelength lanes to reach 800 GbE.

Post Deadline Papers looked to the future with developments in high-speed individual LEDs, modulated lasers, record low loss in hollow core fibers for applications in power delivery and sensing and other topic areas important to industry.

Analysts also revealed their recent findings around the sector to coincide with the event. For instance, Cignal AI suggested there have been strong gains in switching and routing spending by operators in the first quarter of the year, but these were offset by the slightly weaker deployment of optical transport gear.

Scott Wilkinson, lead analyst for transport hardware at Cignal AI, noted that “Chinese spending on optical hardware has plateaued as major 5G network builds mature and new projects have not been initiated.” He added that the country’s “extraordinary growth during 2015 to 2018 could not continue long term due to the impracticality of expanding upon the enormous amounts that had been spent in the region.”

In general, analysts reported subdued activity by Chinese operators across all product categories after last year’s strong growth, while most other territories showed a rebound this quarter.

………………………………………………………………………………………………………………………………………………

OFC 2022 will be held 06 – 10 March at the San Diego Convention Center, San Diego, CA.

For more information contact: [email protected]

References:

https://www.ofcconference.org/en-us/home/

https://www.eetindia.co.in/ofc-highlights-open-optical-nets/

Dell’Oro: Optical Transport Equipment Market Stagnant in 1Q 2021; Jimmy Yu’s Take

The Optical Transport equipment market came in roughly flat with the year ago quarter in 1Q 2021, according to a new report by Dell’Oro group. The North American market was the main reason for this stagnant growth rate, offsetting all of the year-over-year growth in the other regions.

“Although the North American region was down this quarter compared to last year, it did improve from last quarter,” said Jimmy Yu, Vice President at Dell’Oro Group. “In fact, the growth quarter-over-quarter was really strong. It grew just a little over 15 percent, and we think this strength will carry forward through the remainder of the year,” added Yu.

Highlights from the 1Q 2021 Quarterly Report:

- The top manufacturers by revenue share were Huawei, Ciena, ZTE, and Nokia. Among the top four, Nokia gained the most revenue share over the year ago quarter.

- Three vendors (Ciena, Huawei, and Infinera) are actively shipping 800 Gbps-capable coherent line cards. However, due to the company’s early entry, Ciena holds the lion share of shipment volume.

- Communication service providers comprised 71 percent of WDM market revenue in the quarter.

- The year-over-year revenue growth in each region was as follows:

| Regions | Growth Rate in 1Q 2021 |

| North America | -15% |

| Europe, Middle East and Africa | 10% |

| Asia Pacific | 0% |

| Caribbean and Latin America | 15% |

In an email to this author, Jimmy Yu provided additional information on the optical transport market:

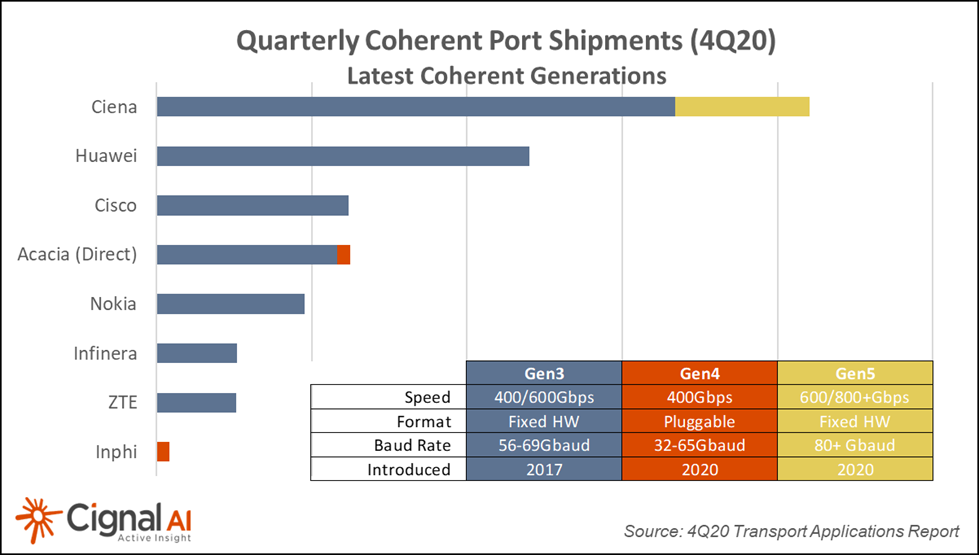

For coherent 400 Gbps, shipment volumes have been growing quite rapidly over the past year. Ciena was first to market with a 400 Gbps coherent solution and was followed by vendors introducing 600 Gbps-capable coherent solutions that can operate at 400 Gbps. The primary buyers of this wavelength speed were the Internet Content Providers (ICPs), often referred to as hyperscale. We think 400 Gbps wavelength shipments will enter the broader market this year (2021) and be a mainstream deployment speed in 2022. So, most if not all vendors have a 400 Gbps offering at this point.

800 Gbps transport has just started with Ciena entering the market first with the WaveLogic 5 based line cards. Other vendors that have a 800 Gbps-capable line card include Huawei and Infinera. (We are expecting only three vendors to have this type of line card in the market.) It is still early days for 800 Gbps, but this technology will be an important driver for delivering longer un-regenerated spans of 400 Gbps and 600 Gbps wavelengths for long haul and subsea applications.

Yes, 5G should drive more optical backhaul and fronthaul. However, with so much optical capacity put in place for 4G, we think the timing for demand generation for 5G backhaul is later. That is, we need 5G roll out to commence outside current 4g coverage areas and for operators to begin 5G densification that will require more fronthaul and backhaul.

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

https://www.delloro.com/news/optical-transport-equipment-market-growth-stagnant-in-1q-2021/

……………………………………………………………………………………………………………………………………

A different Optical Transport Network report from Market Quest states:

The global Optical Transport Network (OTN) equipment market size is expected to gain market growth in the forecast period of 2020 to 2025, with a CAGR of 4.1%% in the forecast period of 2020 to 2025 and will expected to reach USD 18270 million by 2025, from USD 15550 million in 2019.

Coherent WDM shipments surged in 4Q20 with Ciena in the lead; 400 ZR explained

|

||

|

||

Note 1. What is 400ZR?

Aimed predominantly at short-reach, single-span fiber optic links for Data Center Interconnect (DCI), 400ZR is an interoperable networking Implementation Agreement (IA) released by the OIF (Optical Internetworking Forum) in March 2020. It defines a footprint-optimized solution for transporting 400Gb Ethernet over DCI (Data Center Interconnect) links targeting a minimum of 80 km. Enabled by advanced coherent optical technology design targeting small, pluggable form factor modules such as QSFP-DD and OSFP, 400ZR supports high capacity data transport, matched to 400GE switch port market introduction.

……………………………………………………………………………………………………………………………………..

Comments on 400ZR:

The main driver for 400ZR were the cloud giants (AKA hyperscalers) who needed to upgrade their DCI links to 400G b/sec to carry ever increasing data and video traffic. Yet they were very slow to do so, despite IEEE 802.3bs 200/400G b/sec Ethernet standard and 40G b/sec ITU-T OTN recommendations (Optical Physical Interfaces G.959.1, G.695, G.698.x) in place for many years. Up until last year, Ciena was the only optical networking equipment vendor that offered production ready 400G b/sec DWDM gear.

Light Reading’s Sterling Perrin wrote: “Although 400ZR work within the OIF began with hyperscalers, there is already evidence that the architecture also appeals to CSPs (communications service providers).”

“Sweden’s Telia Carrier, Ethiopian internet service provider WebSprix and Windstream in the US have all announced plans to commercial deploy routed optical networks using 400G pluggable coherent optics beginning this year.”

………………………………………………………………………………………………………………

References:

https://cignal.ai/free-articles/

https://www.ciena.com/insights/what-is/What-is-400ZR.html

https://www.itu.int/en/ITU-T/studygroups/2017-2020/15/Documents/OFC2018-1-SG15-Hot-topics-OTN.pdf

https://www.lightreading.com/opticalip/routing/an-ip-over-dwdm-renaissance-at-400g/a/d-id/768513

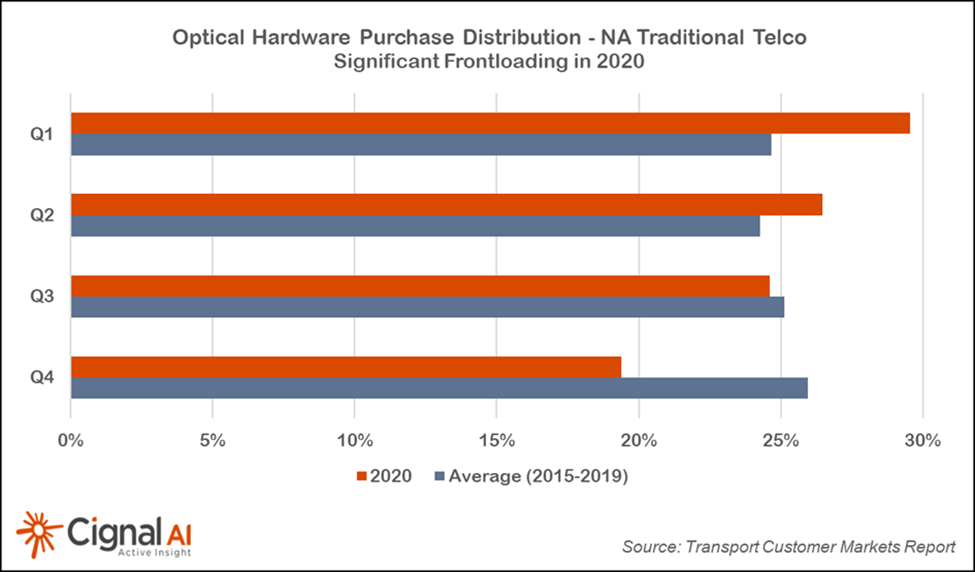

North American Cloud and Traditional Telco CapEx Drops in 4th Quarter 2020

Subhead: Exceptional 4Q Cloud & Colo Operator Spending in APAC

|

||||

|

||||

More Key Findings from the 4Q20 Transport Customer Markets Report:

Separately, Cignal AI said on March 16th that Ciena’s revenue decline this quarter was steeper than forecast, but the company is poised to grow revenues based on the success of its WaveLogic 5e fifth generation coherent technology. On March 2nd, Cignal AI said that Infinera originally expected its ICE6 technology to enter the market in the second half of 2020. The company’s current guidance now indicates a 2H21 arrival. Infinera reports a strong order pipeline, but has not specified exactly when the first ICE6 will ship for revenue. About the Transport Customer Markets Report:

About Cignal AI:

References:https://cignal.ai/opteq-hw-dashboard/https://cignal.ai/free-articles/

|