Telecom in India

India 4G Spectrum Auction Raises 778 billion Rupees

After much delay, India’s 4G spectrum auction has ended in just two days, raising Indian Rupee (INR) 778 billion (US $10.6 billion) for the government. The auction was held on March 1st and 2nd by India’s Department of Telecommunications. The airwaves acquired will help India’s telecom network operators add 4G capacity and get ready for 5G.

India auctioned spectrum in the 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz and 2500 MHz frequency bands. However, the 700MHz spectrum remained unsold because of the high reserve price.

India telecom network operators Reliance Jio, Bharti Airtel, and Vodafone Idea won spectrum in the government’s latest auction.

India’s largest telco, Reliance Jio announced it has acquired the right to use spectrum in all 22 circles across India in the auction. The upstart network operator secured spectrum in the 800 MHz, 1800 MHz and 2300 MHz frequency bands, which increases Jio’s spectrum footprint by 55 percent to 1,717 MHz.

Jio will pay INR 571.23 billion for the right to use this spectrum for a period of 20 years. Payments can be made over a period of 18 years (2-year moratorium plus 16-year repayment period), with interest at 7.3 percent per year.

Reliance Jio now claims to have the highest amount of sub-GHz spectrum with 2×10 MHz contiguous spectrum in most circles. It also has at least 2×10 MHz in the 1800 MHz band and 40 MHz in the 2300 MHz band in each of the 22 circles. The operator also reports it has achieved complete spectrum derisking, with average life of owned spectrum of 15.5 years. Reliance Jio will acquire the spectrum with an effective cost of INR 608 million per MHz. Jio also says the acquired spectrum can be used for provision of 5G services.

“The acquired spectrum can be utilized for transition to 5G services at the appropriate time, where Jio has developed its own 5G stack,” says the Jio press release.

India’s second-largest network service provider, Bharti Airtel acquired 355.45 MHz of spectrum across sub-GHz, mid-band and 2300 MHz bands for a total price of INR 186.99 billion. Airtel will use this spectrum to upgrade its deep indoor and in-building coverage in urban towns. In addition, this spectrum will also help improve its coverage in villages by offering the superior Airtel experience to an additional 90 million customers in India. Airtel also plans to use this spectrum to deliver 5G services in future.

An Airtel statement mentioned that the “the reserve pricing of these bands [700MHz and 3.5GHz] must be addressed on priority in future. This will help the nation to benefit from the digital dividend that will inevitably arise out of this.”

“Airtel has now secured pan-India footprint of sub GHz spectrum that will help improve its deep indoor and in building coverage in every urban town,” as per the company’s statement.

Vodafone Idea entered this spectrum auction “holding the largest quantum of spectrum with a very small fraction, which was administratively allocated and used for GSM services, coming up for renewal”.

As a result, Vodafone Idea acquired spectrum in only five circles for INR 19.93 billion. The operator said it has used this opportunity to optimize spectrum holdings post-merger to create further efficiencies in a few circles. Vodafone Idea expects the spectrum it has acquired in five circles to help it enhance its 4G coverage and capacity.

India’s just completed spectrum auction does not contain any airwaves for 5G

……………………………………………………………………………………………

Reliance Jio’s decision to be the biggest spenders at the auction comes shortly after its holding company, Jio Platforms, reported ₹22,858 crore in revenue during the quarter to December, which was a 30% improvement from the year prior.

Last year, Jio Platforms sold a third of itself to others for ₹152,056 crore. Buyers included Google, Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala, ADIA, TPG, L Catterton, PIF, Intel Capital, and Qualcomm Ventures.

References:

https://www.telecompaper.com/news/india-completes-spectrum-auction-raises-inr-778-billion–1374417

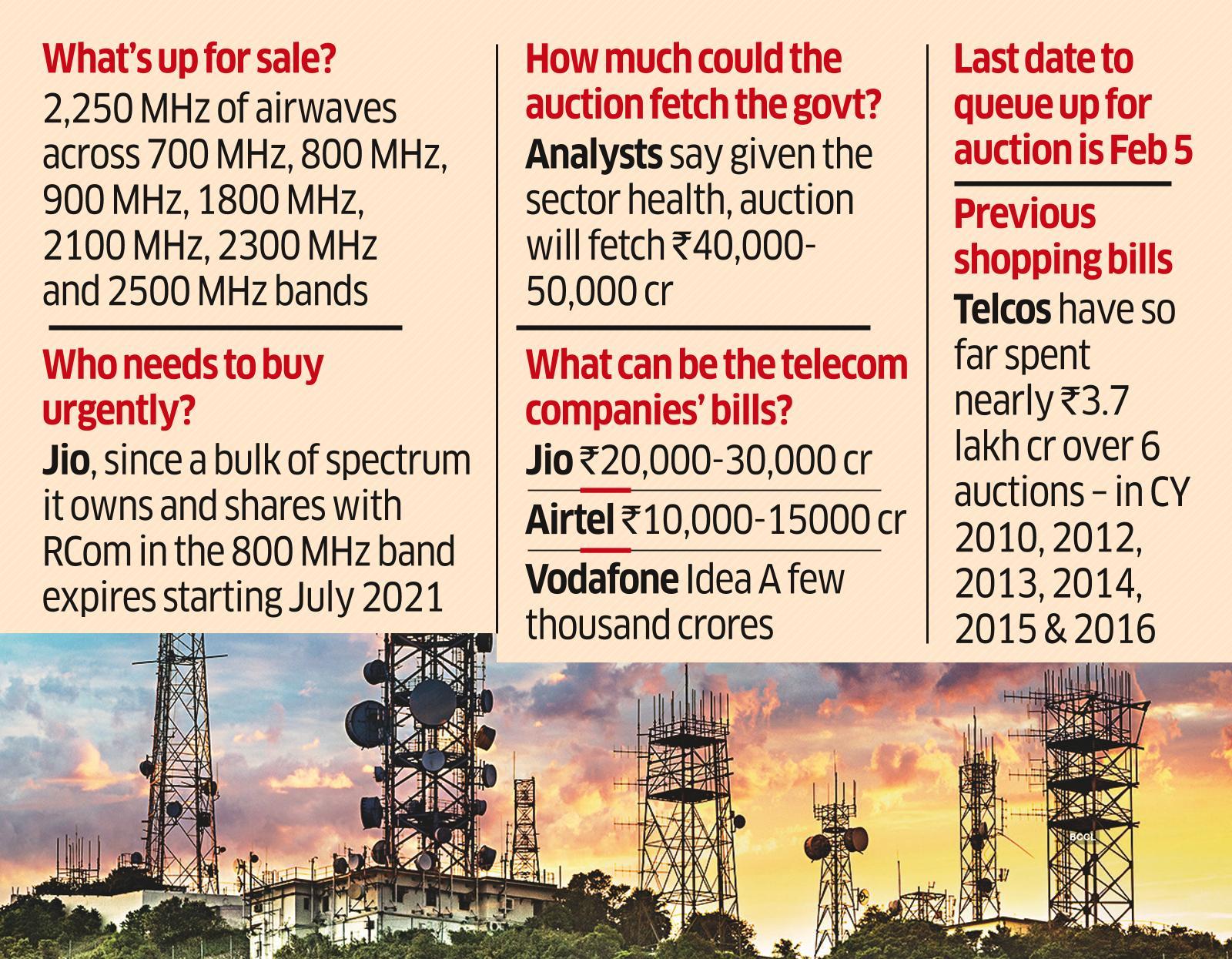

India to start long delayed spectrum auction on March 1st

India is FINALLY set to hold its first spectrum auction for four years on March 1st when it offers up 2,250 MHz of spectrum across seven bands ranging from 700 MHz to 2.5 GHz. Reliance Jio, Bharti Airtel and Vodafone Idea (Vi) are expected to bid for airwaves worth Rs 3.92 lakh crore at base price. Industry analysts see a muted response, given the strained condition of the telecom sector, and expect the government to generate only Rs 40,000-50,000 crore from the sale.

Editors Note:

One rupee crore, as of 2014, is approximately equivalent to $163,720, using the exchange rate of 61.07 rupees per U.S. dollar. In the south Asian numbering system, a crore is equivalent to 10 million.

A lakh is a unit in the Indian numbering system equal to one hundred thousand (

………………………………………………………………………………………………………………………………………………………………………………………………

The sale will help Reliance Jio renew a chunk of expiring spectrum permits and offer Bharti Airtel and Vi a chance to add to their bandwidth holdings as data usage rises. Experts expect Jio, the only profit-making carrier, to be the main buyer and spend close to Rs 20,000-30,000 crore, followed by Airtel at Rs 10,000-15,000 crore, and Vi pitching in with a few thousand crores by bidding for only some airwaves. The spending will add to the telcos’ debt, making tariff hikes more likely.

SOURCE: Economic Times of India

…………………………………………………………………………………………………………………………………………………………………………………………..

The main objectives of the auction were to obtain a “market-determined price for the spectrum on offer, ensure efficient use of spectrum and avoid hoarding,” stimulate competition in the sector and maximize revenue proceeds, the Department of Telecommunications (DoT) said in the NIA.

The government is putting on sale 660 MHz in the 700 MHz band, 230 MHz in 800 MHz band, 81.4 MHz in 900 MHz band, 313.6 MHz in 1800 MHz band, 175 MHz in 2100 MHz band, 560 MHz in 2300 MHz band and 230 MHz in 2500 MHz band. Indian telcos have spent nearly Rs 3.7 lakh crore over six spectrum auctions since 2010. But this is the first time there are likely to be only three bidders.

COAI, the industry body that represents the telcos, said the government had addressed the requirement for availability of more spectrum. But lower reserve prices would have provided additional resources for network expansion for the telcos. “High reserve prices (in the past) have resulted in large amounts of spectrum remaining unsold,” said COAI in a statement.

COAI said the auction will enable the industry to cater to the exponential increase in data usage which will facilitate in supporting the Digital India vision. “While the government has addressed the requirement for the availability of more spectrum, lowering the reserve prices would have provided additional resources for network expansion to the telcos. High reserve prices in past auctions have resulted in large amounts of spectrum remaining unsold. We hope the Govt. will take additional measures to boost the financial health of the industry, which is the backbone of a digitally connected India,” COAI DG SP Kochhar said.

In the premium 4G spectrum (700 MHz), Trai had reduced the reserve price by 43% compared to 2016 auctions, at Rs 6,568 crore per MHz, for a pan-India 5 MHz block, still, operators would have to shell out Rs 32,840 crore, which is seen as quite high. In the 2016 auctions, the government had mopped a total amount of Rs 65,789 crore, 4% over the reserve price, from the country’s six operators who participated in the bidding. However, this was a lukewarm response as only 965 MHz spectra got sold against a total of 2,353 MHz put up on sale, meaning that only 40% got sold.

According to analysts, Reliance Jio may be the only buyer of some airwaves in the premium 700 MHz band, with its rivals likely giving it a miss, despite a 43% cut in the base price from the 2016 sale, when they went unsold. This band alone is valued at Rs 2.3 lakh crore, with the rest of the bands worth Rs 1.62 lakh crore, at base price, according to brokerage Motilal Oswal.

While the NIA has clauses to factor in new entrants, including foreign players, industry experts say it’s unlikely that any new player will join the fray, given the dire state of the industry with debt of over Rs 8 lakh crore, weak pricing power and only one profit-making telco.

“Jio will focus on 800 MHz for renewal and adding capacity as its market share increases. Vi may look at optimization of spectrum since it has surplus airwaves in the 1800 MHz while Airtel will look at 1800 MHz as well,” said Rajiv Sharma, a telecom expert. “…this auction will further add to the operators’ debt, which in turn gets them closer to tariff hikes.”

The base rate of airwaves in the efficient 800 MHz band was pegged at Rs 4,745 crore a unit, which is around 20% less than the previously recommended minimum of Rs 5,819 crore a unit for 2016. The starting price for 1800 MHz spectrum though was set higher at Rs 3,291 crore a unit, compared with Rs 2,873 crore a unit previously.

A substantial portion of Jio’s own airwaves and those it shares with Reliance Communications in the 800 MHz band expires in 12 and 14 circles, respectively, starting July 2021. Without these airwaves, Jio’s services in these circles will be impacted, making it imperative that the telco bid for them, analysts said. Jio, with over 406 million subscribers, also needs additional airwaves to cater to surging data demand and a rapidly growing user base that it expects to touch 500 million.

Airtel and Vi – with about 294 and 272 million users, respectively – own less expensive spectrum, mostly in the 1800 MHz band, set to expire across eight circles each from July. Both of those telcos have backup airwaves in most service areas. Airtel CEO Gopal Vittal has previously said that the company will look mainly for for sub-1 GHz spectrum.

For spectrum which isn’t immediately available and which will be assigned beyond one month of the close of this auction, the component of the upfront payment payable will be 10% of the bid amount for sub-1 GHz bands, and 20% of the bid amount for other bands. “…and the balance component of upfront payment (total of which is 25% for sub-1 GHz and 50% for other bands) shall be made one month prior to the ‘effective date’,” the DoT said.

References:

https://www.financialexpress.com/industry/government-to-hold-spectrum-auction-on-march-1/2165852/4

India ramps up supply chain for 5G service launch in 2021 pending spectrum auction

India ramps up supply chain for 5G service launch in 2021 pending spectrum auction

There is excitement about the anticipated launch of 5G telecom services in India, but the government’s spectrum pricing strategy may be a damper. While the evolving ancillary segments are working on the backbone infrastructure for the 5G roll-out following Reliance Industries Ltd chairman Mukesh Ambani’s assurance that Reliance Jio Infocomm Ltd will launch 5G wireless service in the second half of 2021, experts, however, said that India is not 100% ready.

India telecom equipment company Sterlite Technologies Ltd (STL) said India has been developing 5G infrastructure, but a pan-India roll out will require improving the device, spectrum, wireless and fiber optic ecosystem. “India has the capability of rolling out 5G as we have been building the infrastructure for years now. However, for a countrywide end-to-end deployment, India is not 100% ready… At STL, we will start commercial deployment of open-RAN (open radio access) that is required for 5G by second half of 2021,” said Anand Agarwal, group chief executive at STL. The primary impact of 5G roll-out will be on the commercial ecosystem. According to Agarwal, global supply chains have already matured and are 5G-ready, which makes it easier to import raw material (this author finds that very difficult to believe).

Experts said stressed financials of Bharti Airtel Ltd and Vodafone Idea Ltd (Vi) could discourage them to participate in the 5G launch, in view of the costs involving fiberization and the pricing of spectrum. Airtel and Vi are sitting on massive debts but continue to offer among the lowest tariffs in the world. The telcos have also called for affordable spectrum.

Analysts said the spectrum auction in March may see limited participation from Airtel and Vi due to high reserve prices. Jio, however, is likely to buy spectrum in the 700 megahertz (MHz) band, which is best suited for 5G.

Meanwhile, phone makers have also started producing 5G devices too. Faisal Kawoosa, the founder of techARC, said that India imported nearly two million 5G smartphones in 2020. “While most of these were in ultra-premium range, this year, any new smartphone priced above ₹30,000 should support 5G,” Kawoosa said, adding that 7-9% of all smartphones sold in India in 2021 are likely to support 5G, making it nearly four times the imports. However, will those so called “5G” users actually get 5G service, especially when roaming?

………………………………………………………………………………………………………………………………………………………………….

The big 3 Indian telcos are likely to voice their concerns to the Department of Telecommunications (DoT) as the National Frequency Allocation Plan (NFAP-2018) has not been updated by the department’s wireless planning cell (WPC) more than a year after several new airwave bands, including the 26 Ghz spectrum, were identified by the ITU-R WRC 19 for 5G deployments worldwide, including in India.

The NFAP is a central policy roadmap that defines future spectrum usage by all bodies in the country, including DoT, the Department of Space and the defence ministry. Telcos want it revised quickly as any further delay could potentially hinder the auctioning of the premium millimetre-wave 5G bands.

“The NFAP-2018 needs to be revised expeditiously by the WPC to align different stakeholders if a meaningful 5G auction is to happen later this year, and the industry will take up the matter with DoT,” a senior industry executive told ET.

In November 2019, WRC-19 identified a set of new airwaves, including the 24.25-27.5 Ghz (popularly known as the 26 Ghz band), 37-43.5 Ghz, 45.5-47 Ghz, 47.2-48.2 Ghz and 66-71 Ghz bands for 5G services. However, none of these bands (primarily the mm waves) have been included in India’s NFAP. Note also that ITU-R WP5D has not yet agreed on a revision of ITU-R M.1036 which would include the new frequency arrangements agreed during WRC 19 for terrestrial IMT deployments.

Economic Times: India’s big bet on 5G in 2021 starts with 5G spectrum auction

Earlier this month K. Ramchand, Member (Technology), India’s Department of Telecommunications (DoT) said that it would soon announce 5G spectrum bands for auction. That’s a clear indication that adopting 5G is now a priority for the government. Most Indian telecom service providers currently lack the financial resources to invest and build a 5G ecosystem, but the government has indicated that it is willing to start the process.

Lt. Gen Dr. S.P. Kochhar, Director General of COAI said:

“5G technology is poised to open up a plethora of possibilities in terms of business models, and overall, enhanced lifestyles for one and all. We seek the support of the government in enabling the industry to play its role as an enabler of horizontal growth and a boost to the nation’s economy. The 5G potential is immense and can turn the game for India and be a catalyst for the government’s campaigns such as Make in India, Digital India, Atmanirbhar Bharat.”

Enterprises are at an inflection point in partnering with companies focusing on technical skills and turnkey solutions to drive efficiencies and building efficient and future-ready networks.

According to Karthik Natarajan, President and COO, Cyient, “We are seeing significant investments in the communication network space. The current digital transformation will lead to enhanced user experience, increased operational efficiency and a competitive edge for the enterprise businesses. Our experience in design, delivery, deployment, migration, and support of network infrastructure globally makes us an ideal partner for 5G rollouts.”

Over the past few years, many global technology companies have set up a manufacturing base in India. Samsung got the nod from the Uttar Pradesh government to make OLED at its Noida factory recently. Though such investments are significant but investment in R&D, semiconductors and future technology need a lot of impetus. The big challenge that India faces in electronics manufacturing is the lack of a world-class semiconductor fabricating unit (FAB). It’s time the government either gets global players to invest in a Fab in India or start the work to build a domestic version.

Anku Jain, Managing Director, MediaTek India told Economic Times: “2020 has set the stage for 5G to go mainstream and in 2021 this will also lead to an increase in demand for next-gen 5G smartphones, newer applications and smart devices like smart TVs, tablets, phones integrated with voice interface, etc. 5G will drive innovation across sectors such as remote working, gaming, healthcare, manufacturing, video, and data consumption which will drive the smart devices ecosystem.”

“This will also lead to an increase in demand for next-gen 5G smartphones, newer applications and smart devices like smart TVs, tablets, phones integrated with voice interface etc,” Jain added. Jain also believes that 2021 will tilt towards improved remote working capabilities and 5G chipsets will take “smartphone and smart device experience to the next level.”

Jain added that pandemic has catalyzed the growth of adoption of transformative technologies such as artificial intelligence (AI), Internet of Things (IoT), robotics, and cloud computing, among others. MediaTek envisions a wide range of applications and devices driven by the Internet of Things (IoT) in the 5G era.

The Taiwanese fabless chip maker became the world’s #1 smartphone chipset vendor with a 31% market share in Q3 2020 helped by its growth in regions like India and China, and a strong performance in the $150-200 price band, as per market research firm Counterpoint Research’s estimates.

Last year, MediaTek launched a new gaming-based G-series, while Dimensity chipsets have helped in bringing 5G to affordable categories, according to Counterpoint Research.

It will be interesting and crucial to see how India can attract investments in future technologies with 5G making a tectonic shift in the TMT industry and presenting a range of economic opportunities in the next three to five years.

……………………………………………………………………………………………………………………………………………………………………

5G technology is expected to launch in the latter half of 2021 and will drive new business models, better education, healthcare, enable smart cities, smart manufacturing, among others, said SP Kochhar, director-general of the Cellular Operators Association of India (COAI) in a statement. That New Delhi-based group represents Jio, Airtel and Vodafone Idea as well as telecom gear makers such as Ericsson, Huawei, Nokia and Cisco.

“The Atmanirbhar Bharat initiative will lead to revenue growth to $26.38 billion by 2020 while the number of internet subscribers in the country is expected to double by 2021 to 829 million, and overall IP traffic is expected to grow four times at a CAGR of 30% by 2021,” he added.

In the first quarter of this fiscal year through June, customer spending on voice and data services increased 16.6% year-on-year, amounting to Rs. 35,642 crore ($4.80 billion), on account of use of OTT platforms for voice communications, chat, online meetings, webinars, among others, Kochhar further said.

India plans to auction 2,251 MHz with a total valuation of Rs 3.92 trillion in March 2021. It will sell spectrum in 700MHz, 800MHz, 900MHz, 1800MHz, 2100MHz, 2300 MHz and 2500 MHz bands which couldfetch Rs 55,000 – 60,000 crore to the exchequer and even at this participation, the industry will have to shelve out around Rs. 20,000-25,000 crore upfront, ICRA had said in a statement.

………………………………………………………………………………………………………………………………………………………………….

References:

https://telecom.economictimes.indiatimes.com/news/india-bets-big-on-5g-in-2021/79989257

https://telecom.economictimes.indiatimes.com/news/5g-launch-likely-in-h2-2021-telco-group/79987664

Reliance Jio may deploy 5G SA while Bharti Airtel to trial both 5G NSA and SA

Reliance Jio may launch its much touted 5G services using the next generation 5G standalone (GSMA Option 2) architecture for its network, Business Standard reported.

The telco may skip the current non-standalone 5G. The NSA 5G architecture enables operators to leverage their existing investments in their 4G LTE networks and reduce capital costs. Mukesh Ambani recently said that Jio intends to roll-out 5G services in India in the second half of 2021.

Image Credit: Reliance Jio

Conversely, Sunil Mittal of Bharti Airtel said that 5G will take 2-3 years to reach mass scale in India’s market. Nonetheless, Airtel recently applied for both NSA and SA 5G trials to test its network architecture.

“Even though the majority of countries are offering 5G using NSA, SA is also being used for 5G services. Airtel feels it’s a good time to test its network using both modes,” a person familiar with the development told ETTelecom.

Airtel is planning to do Standalone 5G trials in Karnataka and Kolkata using Nokia and Ericsson 5G gear, respectively. In both circles, ZTE and Huawei currently power the Sunil Mittal-led telco’s 4G network.

Non-standalone (NSA) and standalone (SA) are two 5G tracks that communication service providers can opt for when transitioning from 4G to the next-generation mobile technology. In NSA, the existing 4G LTE network is used for everything except the 5G data plane, which is usually based on 3GPP Release 15 version of 5G NR. 5G NSA enables operators to leverage their existing investments in their 4G LTE networks and reduce capital costs, but it can’t support new 5G features such as network slicing.

Reliance Jio, Bharti Airtel, Vodafone Idea, and BSNL recently submitted a list of “preferred vendors” which includes European and American companies for 5G field trials with the telecom department (DoT).

Jio had submitted fresh applications for 5G trials with Samsung, Nokia, Ericsson, and for its own 5G technology. The largest Indian telco recently submitted an application trial of its own 5G technology in South Mumbai and Navi Mumbai areas, while it intends to do trials with Samsung in other areas like Bandra Kurla complex, Kamothe Navi Mumbai, and Solapur with Maharashtra.

Jio intends to 5G trials with Nokia in Pune and Ahmednagar, and with Ericsson in Delhi areas like Chandani chowk and Shashtri Nagar and in Dabwali in Haryana.

References:

Ambani: Reliance Jio to deploy 5G network in second half of 2021

India’s Telco and Infrastructure Groups: Fiber Optic Network Growth Essential

Growth in fiber optic network deployments are essential to further improve the quality of telecom services and support the surging mobile Internet demand as well as have potential to bring substantial social and economic benefits to consumers, businesses and state governments, India’s telco and infrastructure groups said. The Delhi-based telecom body represents Reliance Jio, Bharti Airtel and Vodafone Idea.

“Growth of fibre is the foremost priority for the ongoing exponential increase in data demand and improved quality of services,” the Cellular Operators Association of India (COAI) director-general SP Kochhar told ETTelecom.

Currently, India has an optical fiber-based network spanning across 28 lakh (100,000) kilometres as against the target set up by the National Broadband Mission to deploy as much as 50 lakh kilometres of optical fiber by 2024.

Kochhar’s views were seconded by the Towers and Infrastructure Providers Association (Taipa) that lobbies for companies such as Bharti Infratel, American Tower Corporation (ATC) India, Ascend Telecom Infrastructure, Indus Towers and Sterlite Technologies.

“The fiberisation of existing telecom infrastructure has the potential to bring substantial social and economic benefits to governments, citizens and businesses through an increase in productivity, competitiveness, improvements in service delivery, and optimal use of scarce resources like spectrum,” Tilak Raj Dua, director-general at Taipa said.

Editor’s Note:

The National Optical Fibre Network (NOFN) is a project initiated in 2011 and funded by Universal Service Obligation Fund to provide broadband connectivity to over 200,000 gram panchayats of India at an initial cost of ₹200 billion (US$2.8 billion). This is to be achieved utilizing the existing optical fiber and extending it to the Gram Panchayats and Bharat Broadband Network Limited (BBNL), is a special Purpose Vehicle (SPV), PSU set up under companies act by Govt of India under Rule 1956 has been registered on Feb 25, 2012 for management and Operation of NOFN. More info at: http://www.bbnl.nic.in/index1.aspx?lsid=13&lev=1&lid=13&langid=1

Indian Railways Fiber Optic Network Map

……………………………………………………………………………………………………………………………………………………………………………………………………….

The pan India average of fiber to the tower ratio presently stands at 32% as against the target of 70% by 2024, envisaged by the Department of Telecommunications (DoT), according to Taipa statistics.

Following the progression in the fourth-generation (4G) network deployments over the last couple of years, and the upcoming fifth-generation (5G) cellular technology, experts caution that low fiberization would eventually impact the service delivery, and a uniform policy across the country is much needed.

“In the last four years we have not had an increase in backhaul spectrum, hence, we are dealing with constrained factors and have to manage the quality of services based on existing capacity, for everybody’s good,” Kochhar said.

Coai said that the increased fiberization would meet the present requirement of bandwidth and future technologies such as 5G, and other emerging technologies,” Kochhar said and added that the early allocation of E and V bands to meet the backhaul requirements is also being considered by the government.

Dua further said that in order to address the increased data consumption in rural and urban areas and remote working following the Covid-19 outbreak, the role of fiberisation to propel digitalisation has increased multifold.

India, according to Crisil needs a tectonic shift in the fiberization landscape, and investment in fiberised backhaul infrastructure providing unlimited capacity and higher data speeds has to gain further traction if 5G has to become a reality.

Sandeep Aggarwal, co-chairman of the Telecom Equipment and Services Export Promotion Council (Tepc) believes that it is imperative to have a robust fibre infrastructure in the country to complement the next-generation or 4G and 5G technologies in line with the National Digital Communications Policy (NDCP) unveiled in 2018.

Former telecom secretary Shyamal Ghosh-headed Tepc represents Aksh Optifibre, Birla Cables, Paramount Wires & Cables, Himachal Futuristic Communications, Finolex Cables and Polycab Wires.

“With nearly 3 million kilometres of optic fibre cable (OFC) presently deployed, India will need to further enhance the footprint with an average of 2-kilometre of fibre per person,” Aggarwal said and added that more than 1 million kilometres of cable TV (CATV) fibre has been laid over the last one year in the country.

Private and public sector entities such as Reliance Jio, Bharti Airtel, Vodafone Idea, Bharat Sanchar Nigam Limited (BSNL), Mahanagar Telephone Nigam Limited (MTNL) and RailTel majorly contribute to the current fibre footprint in the country in addition to Centre’s ambitious BharatNet program that further aims to deploy nearly 8 lakh kilometres of fibre network separately.

There is a need to adopt new business models such as hiving off fibre assets via the Infrastructure Investment Trust (InvIT) model that will help in reducing capital expense requirements and allowing telecom operators to focus on topline growth opportunities, according to Aggarwal.

Billionaire Mukesh Ambani-owned Reliance Jio and Sunil Mittal-driven Bharti Airtel have already sold-off their fiber verticals to become financially-nimble pure-play telecom services companies.

Taipa’s Dua feels that the upcoming cities would be built on the basis of readily available optical fiber cables, and next-generation telecom infrastructure and technologies like 5G.

…………………………………………………………………………………………………………………………………………………………………………………………………….

References:

ICRA: Indian Telecom Industry Must Migrate from Copper to Dense Fiber Optic Networks

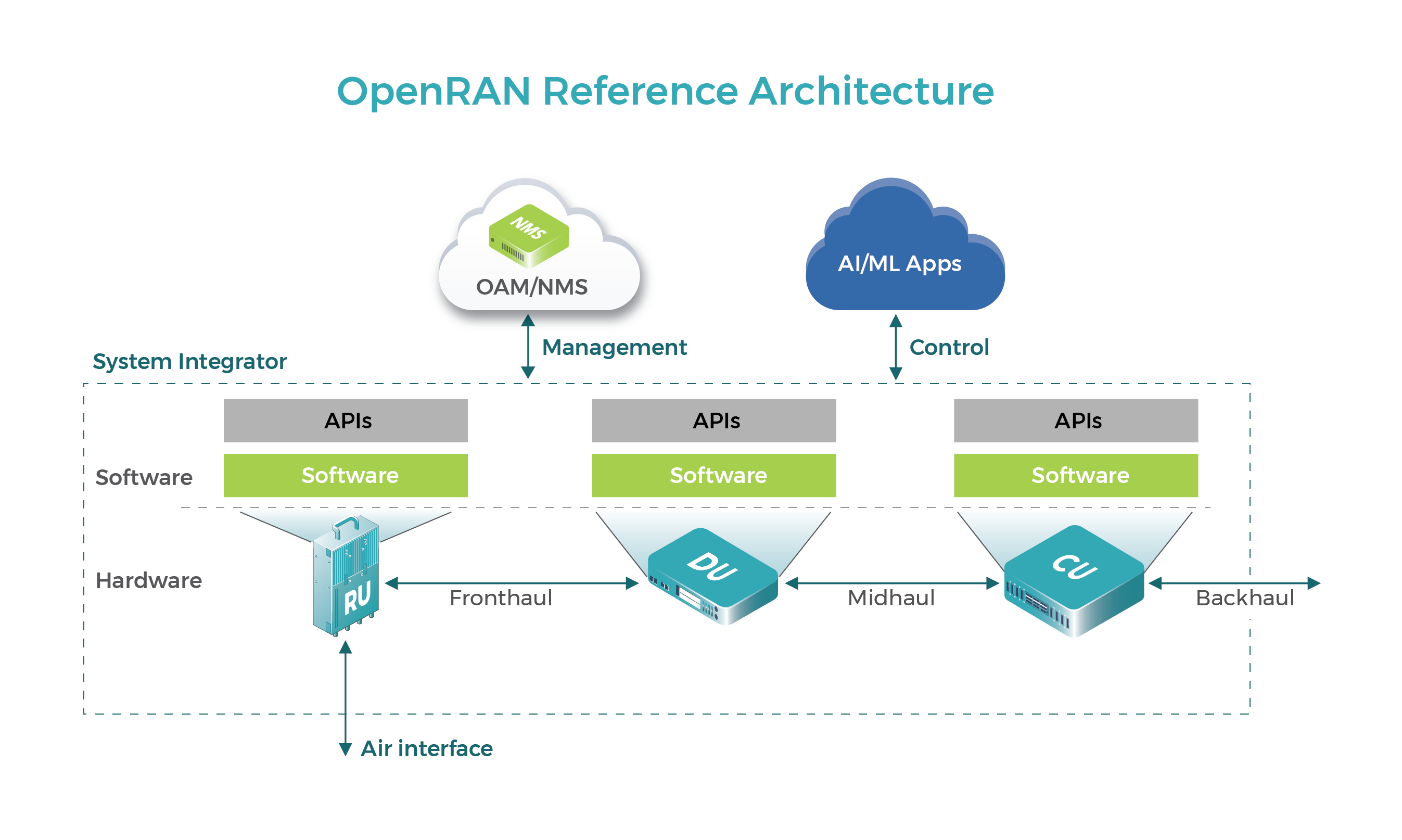

Altiostar and NEC demonstrate front haul at India’s first O-RAN Alliance plugfest hosted by Bharti Airtel

Altiostar and NEC today said that they participated in the first plugfest event in the India region for the O-RAN ALLIANCE. Hosted by Bharti Airtel (“Airtel”), India’s largest integrated telecommunications services provider, the goal of the O-RAN Plugfest was to test and demonstrate the growing maturity of the O-RAN ecosystem.

Bharti Airtel plugfest was in partnership with telecom players like Altiostar, Altran, ASOCS, Mavenir, NEC, Sterlite Technologies (STL), VVDN, among others to demonstrate emerging technologies such as 5G.

“We are committed to evolving our network through an open architecture and are delighted to partner with the O-RAN community. This offers a great opportunity to Indian organizations with innovative hardware, software, and services capabilities to build a “’ Make in India – O-RAN solution’ – for Indian and global markets.” said Randeep Sekhon, CTO, Bharti Airtel.

The Indian telco is currently working with various US and Japanese vendors like Altiostar and NEC to develop OpenRAN based 5G telecom equipment, ETTelecom exclusively reported recently.

Airtel revealed that it is engaging with “Disruptive Telecom Equipment Vendors” to develop innovative solutions customized to Airtel’s requirements based on OpenRAN technology. “As a TSDSI Member, Airtel has proposed a new study Item on “Adoption of O-RAN Specification by TSDSI and contribution towards the development of India.

Specific use cases within the TSDSI Network Study Group (SG-N). Airtel will be submitting contributions in the form of a Study Report on O-RAN in SGN, and will also be collaborating with industry partners on the subject,” the telco had said.

“Testing and integration are crucial for developing a commercially available open RAN ecosystem and that’s why the O-RAN Alliance provides its member companies with an efficient global plugfest framework, which complements the O-RAN specification effort as well as the O-RAN Software Community,” said Andre Fuetsch, Chairman of the O-RAN Alliance and Chief Technology Officer of AT&T.

The telco has been a member of the O-RAN Alliance since its establishment in 2018. The first India edition of O-RAN Plugfest is part of Airtel’s commitment to building an open technology ecosystem, including O-RAN-based deployments, said the telco in an official statement.

It was also the first operator in India to commercially deploy a virtual RAN solution based on disaggregated and open architecture defined by the O-RAN Alliance.

Airtel, Altiostar and NEC teamed up for this project to demonstrate the world’s first interoperability testing and integration of massive MIMO radio units (O-RU) and virtualized distributed units (O-DU) running on commercial-off-the-shelf (COTS) servers. The project featured a commercial end-to-end Open Fronthaul interface based on O-RAN specifications. This demonstration was comprised of control, user, synchronization and management plane protocols, including 3GPP RCT and performance cases.

The purpose and scope of this demonstration was to show O-RAN option 7.2x split integration between a virtualized O-DU from Altiostar and an NR O-RU (i.e. 5G radio unit) from NEC. The demonstration also showed how this integrated setup can be used in an end-to-end EN-DC network setup (i.e. 5G non standalone architecture).

Going forward, Altiostar and NEC will continue to jointly drive new levels of openness in radio access networks (RAN) and across next-generation 5G networks.

“Today’s 4G and 5G radio access networks are undergoing a profound transformation, as the wireless industry is shifting to an open and cloud-native architecture that is being driven by vendors such as Altiostar and NEC, who are at the forefront of providing software and radio solutions based on O-RAN standards,” said Anil Sawkar, Vice President of Engineering and Operations at Altiostar. “Dozens of greenfield and brownfield wireless operators worldwide are trialling and deploying O-RAN networks as they realize the benefits of this new approach, including reduced costs, increased automation, and faster time to market with services.”

“Providing open innovations that conform to industry standards in the radio access network is critical to accelerating our customers’ journey towards Open RAN deployment and provisioning of more flexible and efficient networks that meet the requirements of cutting edge 5G use cases,” said Kazuhiko Harasaki, Deputy General Manager, Service Provider Solutions Division, NEC Corporation. “It is NEC’s honor to contribute to interoperability verification initiatives in India towards Open RAN innovation.”

Airtel has been a member of the O-RAN ALLIANCE since its inception in 2018. Airtel was the first operator in India to commercially deploy a virtual RAN solution based on a disaggregated and open architecture defined by O-RAN. “We are delighted to partner with the global O-RAN community. Our engagement with Altiostar and NEC for demonstrating O-RAN O-DU and O-RU, 5G RCT and E2E performance is another step forward towards building 5G systems with open network architecture,” said Randeep Sekhon, CTO at Bharti Airtel.

…………………………………………………………………………………………………………………………………………………………………………………………

About Altiostar:

Based outside Boston, Altiostar provides 4G and 5G open virtualized RAN (Open vRAN) software that supports open interfaces and virtualizes the baseband unit to build a disaggregated multi-vendor, web-scale, cloud-native mobile network. Operators can add intelligence, quickly adapt the network for different services and automate operations to rapidly scale the network and reduce Total Cost of Ownership (TCO). Altiostar collaborates with a growing ecosystem of partners to support a diverse Open RAN supply chain. The Altiostar Open vRAN solution based on O-RAN standards has been deployed globally, including the world’s first cloud-native commercial-scale mobile network with Rakuten Mobile in Japan. For more information, visit www.altiostar.com.

About NEC Corporation:

NEC Corporation has established itself as a leader in the integration of IT and network technologies while promoting the brand statement of “Orchestrating a brighter world.” NEC enables businesses and communities to adapt to rapid changes taking place in both society and the market as it provides for the social values of safety, security, fairness and efficiency to promote a more sustainable world where everyone has the chance to reach their full potential. For more information, visit NEC at http://www.nec.com.

About Airtel:

Headquartered in India, Airtel is a global telecommunications company with operations in 18 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its mobile network covers a population of over two billion people. Airtel is India’s largest integrated telecom provider and the second largest mobile operator in Africa. At the end of September 2020, Airtel had approx. 440 mn customers across its operations.

Airtel’s portfolio includes high speed 4G/4.5G mobile broadband, Airtel Xstream Fiber that promises speeds up to 1Gbps, converged digital TV solutions through the Airtel Xstream 4K Hybrid Box, digital payments through Airtel Payments Bank as well as an integrated suite of services across connectivity, collaboration, cloud and security that serves over one million businesses.

Airtel’s OTT services include Airtel Thanks app for self-care, Airtel Xstream app for video, Wynk Music for entertainment and Airtel BlueJeans for video conferencing. In addition, Airtel has forged strategic partnerships with hundreds of companies across the world to enable the Airtel platform to deliver an array of consumer and enterprise services.

References:

Deloitte: India rural broadband penetration at 29.1%; fixed broadband at 7.5%; Challenges noted

Broadband penetration in India’s rural areas continues to be quite low at 29.1% against national average of 51% with 687 million subscribers as of March 2020, according to a new report by Deloitte titled “Broadband for inclusive development—social, economic, and business.” Also noteworthy, fixed broadband penetration in India.

“Broadband penetration has grown at an impressive CAGR of 35% in India over the past three years (2017-2020). However, existing levels of broadband penetration in rural areas (29.1% penetration) and fixed broadband penetration (7.5% of Indian households) across the country offer significant opportunities for growth,” the report said.

Sathish Gopalaiah, Partner and Telecom Sector Leader Deloitte Touche Tohmatsu India LLP said, “This report briefly highlights the state of broadband in our country, how critical and transformative broadband can be for us, the key challenges holding back its growth potential, and certain key interventions that can be made through government policies, government spending, impetus to R&D and product development, and effective on-ground implementation of large initiatives.”

Gopalaiah said the country has witnessed significant progress in broadband in the last three years, primarily on the back of smartphone growth and low data prices. “In the next innings, broadband penetration in rural areas and mass adoption of fixed broadband hold the anchor to continue and accelerate this growth trajectory,” he added.

The Deloitte report also cited statistics from the International Telecommunication Union (ITU) that an increase of 10 percent in fixed broadband penetration yields an increase of 0.8 percent in GDP, and an increase of 10 percent in mobile broadband penetration yields an increase of 1.5 percent in GDP.

According to Deloitte, key challenges holding back the potential growth and mass adoption of broadband in India are right of way issues, cost of infrastructure deployment, levels of digital literacy, and access to affordable devices.

Photo Credit: Mint

……………………………………………………………………………………………………………………………………………………………………………….

Harnessing the full power of broadband is a multi-stage process that would involve availability of stable and high-speed broadband connectivity; accessibility to not only internet but affordable devices such as computers and mobiles; and usability (digital skills and applications/websites for users to rely on, that too, in the relevant vernacular languages).

While India has made significant development in broadband speeds over the years, “there is a large scope for growth in speeds” to enable further growth of technology platforms, social development programmes, businesses, and economic growth.

“As identified by TRAI (Telecom Regulatory Authority of India) significant improvements can be achieved in broadband speeds in the country. An important step is to pursue increasing the minimum broadband speed from 512 kbps to 2 mbps,” it said.

“Significant increase in demand for fixed broadband is estimated to continue, as a result of the pandemic, with extension in work-from-home for most corporates and permanent changes in digital behavior of people in the new normal. The broadband penetration has positive correlation with GDP growth and employment. According to a World Bank report, a 10 per cent increase in broadband penetration levels in developing countries is estimated to lead to 1.38 per cent GDP growth,” the report stated.

………………………………………………………………………………………………………………………………………………………………….

The cloud computing market in India has almost doubled from US$2.5 billion in 2018 to US$4.5 billion in 2020 and is set to grow to approximately US$7 billion by 2023. Meanwhile, “IoT connected devices in the Indian market have grown from only 60 million in 2016 to an estimated 1.9 billion in 2020. This growth is expected to continue for both consumer and industrial IoT with multiple sectors adopting IoT,” the report said.

………………………………………………………………………………………………………………………………………………………………………………….

References:

https://in.news.yahoo.com/covid-19-pandemic-accelerated-pace-082101954.html

Tech Mahindra: “We can build and run an entire 4G and 5G or any enterprise network”

India based IT services provider Tech Mahindra says it has the capability to build and run an entire 4G or 5G network in India. The company’s partnership with Japanese greenfield telco Rakuten Mobile [1.] will help it get more meaningful business in India’s telecom industry, a senior executive said.

Note 1. Rakuten Mobile, together with NEC, is building a 5G Open RAN and cloud native 5G core network based on their own specifications. Open RAN and cloud native 5G core network are two different and independent initiatives.

“We can build and run an entire 4G and 5G or any enterprise network. We have done that already. We bring to the table our ability to design, to plan, to integrate and deploy and then to manage the entire suite of network capabilities, including designing various parts to it in a disaggregated world,” Manish Vyas – President, Communications, Media & Entertainment Business, and the CEO, Network Services, Tech Mahindra, told the Economics Times of India.

In August, the company announced German telecoms company Telefonica Deutschland had selected it for its network and services operations, in addition to further developing 5G, artificial intelligence, and machine learning use cases.

“We are pleased to announce this partnership with Tech Mahindra. We are supported by a globally experienced service provider to consistently drive forward the development of our network and services operations, thus leading to further enhancement of 5G, artificial intelligence and data analysis use cases,” said Mallik Rao, Chief Technology & Information Officer of Telefonica Deutschland.

“This strategic partnership strengthens our long-standing relationship with Telefonica, in which we support the company in realizing its vision of becoming the ‘Mobile Customer and Digital Champion’ by 2022,” said Vikram Nair, President, Europe, Middle East and Africa (EMEA) of Tech Mahindra.

In October 2019, the company launched a 5G enabled Factory of the Future solution. Nilesh Auti, Global Head Manufacturing Industry unit, Tech Mahindra, said:

“Factory equipment holds a great deal of meaningful data which is key to any successful Industry 4.0 project. Tech Mahindra’s solution in partnership with Cisco, will enable us to leverage this data and empower manufacturers to build factories of the future. As part of our TechMNxt charter we are focused on leveraging 5G technologies to address our customer’s evolving and dynamic needs, and enable them to RISETM.”

Tech Mahindra is also looking for strategic investments and acquisition in companies to further bolster its telecom product and services portfolio. The company says the following about their 5G capabilities and experience:

Tech Mahindra provides range of services that enable enterprises to establish private wireless network to span areas of operations & enable a plethora of IoT use cases. Our services remove inefficiencies related to slow, insufficient wireless connectivity & have a strong roadmap to support growing traffic demands for 5G establishment. From media to medicine we believe 5G is “The NXT of Everything.”

Tech Mahindra ccomplishments listed are these:

- 1M+ carrier grade cellular sites designed, delivered and managed

- Enabling 3 of the first 5 carrier 5G introductions in the world

- Strong Telco partnership/reach (80+ Global Tier 1 Telcos)

- 4 smart cities projects launched, Largest WIFI deployments in the world

- 5 connected vehicles engagements, 40+ Connected factories, 12000+ factory Assets

- 600+ Turbines and 100+ aircrafts connected; 2000+ remote healthcare patients supported

…………………………………………………………………………………………………………………………………………………………………………………….

References:

TSDSI’s 5G Radio Interface spec advances to final step of IMT-2020.SPECS standard

Telecommunications Standards Development Society of India (TSDSI)’s 5G Radio Interface Technology (RIT) has met step 7 of an 8 step process of ITU-R WP5D, thereby paving the way for its inclusion in the IMT-2020.SPECS. That impressive accomplishment was achieved at the ITU-R WP5D virtual meeting #35e which concluded on July 9, 2020. From the WP 5D Technology WG meeting report: “The RIT proposed in IMT-2020/19(Rev.1) (TSDSI) also passed Step 7 as “TSDSI RIT.”

As a penultimate step, the description of the TSDSI technology has been included in the draft IMT-2020 specification document. The TSDSI RIT is specified in Annex III. of the draft IMT-2020.SPECS standard, which is expected to be finalized at the WP5D meetings to be held in October and November 2020. Final approval is expected at the ITU-R SG 5 meeting November 23-24, 2020.

The TSDSI 5G RIT specification was described in a July 5, 2019 IEEE Techblog post. The ITU-R had earlier adopted the Low-Mobility-Large-Cell (LMLC) use case proposed by TSDSI as a mandatory 5G requirement in 2017. This test case addresses the problem of rural coverage by mandating large cell sizes in a rural terrain and scattered areas in developing as well as developed countries. Several countries supported this as they saw a similar need in their jurisdictions as well.

LMLC fulfills the requirements of affordable connectivity in rural, remote and sparsely populated areas. Enhanced cell coverage enabled by this spec, will be of great value in countries and regions that rely heavily on mobile technologies for connectivity but cannot afford dense deployment of base stations due to lack of deep fiber penetration, poor economics and challenges of geographical terrain.

Photo Credit: TSDSI

TSDSI successfully introduced an indigenously developed 5G candidate Radio Interface Technology (RIT), compatible with 3GPP’s 5G NR IMT-2020 RIT submission, at the ITU-R WP5D meeting in July, 2019 (as noted in the above referenced IEEE Techblog post). TSDI’s RIT incorporates India-specific technology enhancements that can enable larger coverage for meeting the LMLC requirements. It exploits a new transmit waveform that increases cell range developed by research institutions in India (IIT Hyderabad, CEWiT and IIT Madras) and supported by several Indian tech companies. It enables low-cost rural coverage and has additional features which enable higher spectrum efficiency and improved latency.

From TSDSI: Acceptance of TSDSI RIT as a 5G radio interface standard, a first for India, catapults India into the elite club of countries with expertise in defining global standards. It is a trailblazer that establishes India’s potential to deliver more such solutions that are appropriate to the specific requirements of the developing world and rely on indigenously developed technologies – Design Local, Deploy Global.

…………………………………………………………………………………………………………..

Addendum: Overview of TSDSI RIT

TSDSI RIT is a versatile radio interface that fulfills all the technical performance requirements of IMT 2020 across all the different test environments. This RIT focuses on connecting the next generation of devices and providing services across various sectors. In particular, this RIT focuses on:

1. Enhanced spectral efficiency and broadband access

2. Low latency communication

3. Support millions of IOT devices

4. Power efficiency

5. High speed connectivity

6. Large Coverage (in particular for Rural areas)

7. Support multiple frequency bands including mmWave spectrum

While, the current specifications provide a robust RIT, the specification also provides a framework on which future enhancements can be supported, providing a future-proof technology. In the following sections, we provide a basic description of the RIT. The complete details of the RIT can be found in the specification document IMT-2020/20 (ITU TIES account required for access).

References:

Executive Summary: IMT-2020.SPECS defined, submission status (?), and 3GPP’s 2 RIT submissions

Reliance Jio claim: Complete 5G solution from scratch with 100% home grown technologies