Uncategorized

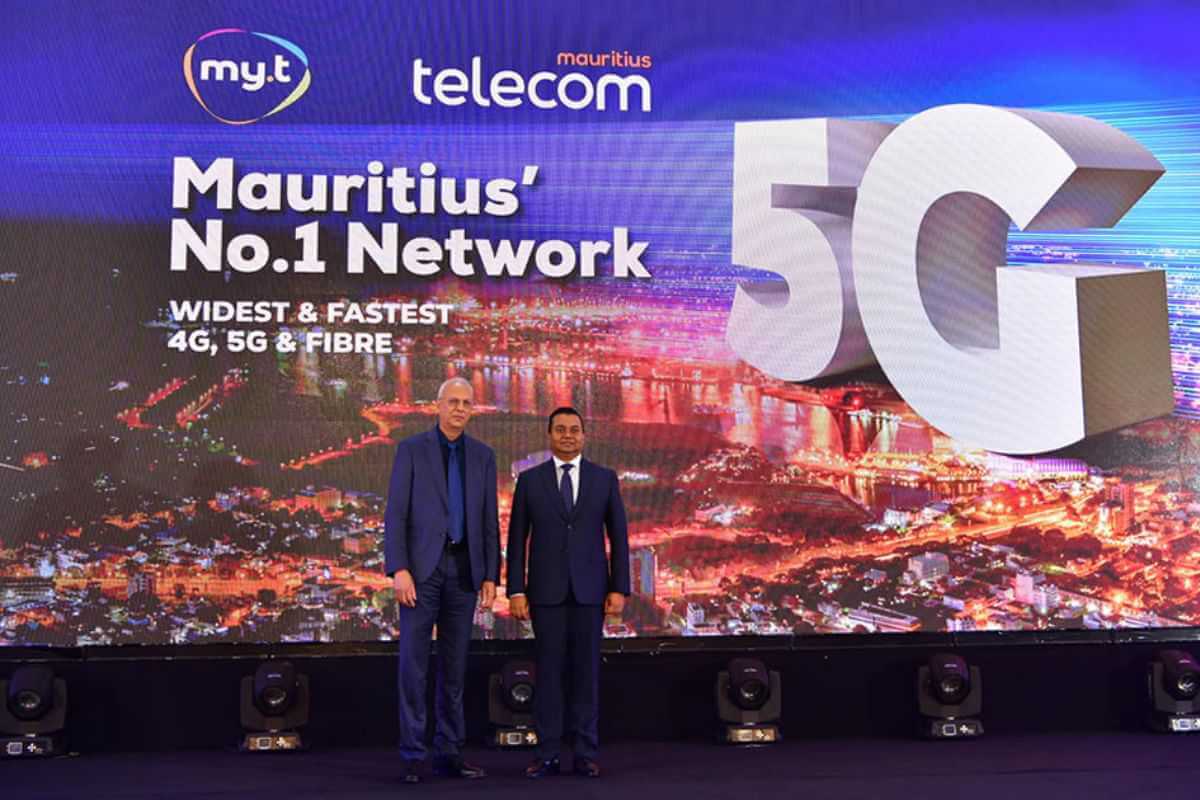

Mauritius Telecom Expands 5G Network Across the Island

Mauritius Telecom announced that its 5G network is now available island-wide. The company made this announcement during an event on June 18th, in the presence of the Minister of Information Technology, Communication, and Innovation. This nationwide deployment represents a major step forward in the digital transformation of the country, offering unprecedented technological prospects for individuals and businesses. It follows the initial deployment of its 5G network in 2021 [1.].

Up until now, the telco’s footprint was limited to six locations. With this expansion across populated areas, the mobile portfolio has been revamped to include 5G access under the my.t brand.

Note 1. Mauritius Telecom launched 5G in five specific areas in July 2021. Later, in April 2024, MT extended the 5G network to Rodrigues, expanding the operator’s 5G footprint to six locations.

………………………………………………………………………………………………………………

With this announcement, the company is now expanding the deployment of the 5G mobile network throughout the island, investing several billion Mauritian Rupees (1 Rp=$0.021). As part of this expansion into populated areas, the mobile portfolio has been revamped to include 5G access under the my.t brand.

Under my.t 5G, Mauritius Telecom promises download speeds of up to 1 Gbps, improved latency, and seamless connectivity, enabling multiple devices to connect simultaneously. The technology will also support innovations such as Augmented Reality (AR), Virtual Reality (VR), and the Internet of Things (IoT), the company said.

“The deployment of 5G island-wide is a significant step in enhancing the digital landscape of our country and transforming not only our personal digital experiences but our entire lives,” Mauritius Telecom said.

References:

https://www.telecom.mu/mediacentre/pdf/press-release-5g.pdf

https://mitci.govmu.org/News/SitePages/Mauritius-Telecom-launches-first-5G-network.aspx

Harnessing the Power of 5G

Revolutionizing Telecom with Programmable Networks and APIs

By Ameer Shohail L with Ajay Lotan Thakur

Ameer Shohail is an experienced ICT Solutions Design Specialist and IEEE Senior Member at a Tier 1 telecom operator in the Middle East, specializing in advanced wireless technologies.

Ajay Lotan Thakur is a Senior IEEE Member, IEEE Techblog Editorial Board Member (who edits/adds to blog posts), BCS Fellow, TST Member of ONF’s open source Aether (Private 5G) Project, Cloud Software Architect at Intel Canada.

Abstract

The telecom industry is on the verge of a significant transformation driven by the convergence of 5G/Beyond 5G and programmable networks. This article explores the immense potential of these advancements, emphasizing the shift from rigid infrastructures to dynamic platforms that offer their capabilities as services. We delve into the importance of programmable networks, the Network as a Service (NaaS) model, and the critical role of APIs. The article highlights the Network Exposure Function (5G CORE – NEF) and its role in creating new revenue streams for CSPs and fostering a thriving digital ecosystem. The TM (TeleManagement) Forum’s emphasis on service lifecycle management and the collective effort towards a digitally interconnected future are key themes, inviting all stakeholders to embrace this transformative journey.

Introduction: The Paradigm Shift in Telecom

The telecom industry is undergoing a profound transformation from traditional infrastructures to more dynamic and flexible systems. This shift is essential to meet the increasing demands for faster, more reliable, and scalable network services. Innovation and collaboration are now crucial drivers of industry growth, enabling communication service providers (CSPs) to leverage cutting-edge technologies to enhance their offerings and stay competitive.

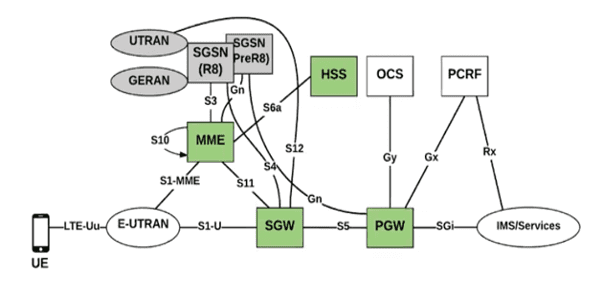

Figure1: EPS Architecture

Figure2: 5GS Architecture

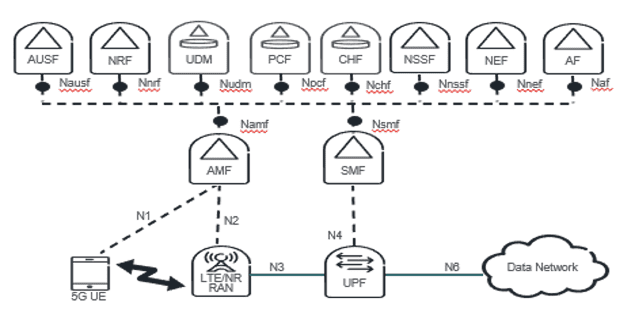

Programmable Networks and NaaS: The New Frontier

Programmable networks and Network as a Service (NaaS) represent the next frontier in telecom innovation. These technologies allow CSPs to offer network capabilities as customizable services, enhancing flexibility and efficiency. The TM Forum’s Open Digital Architecture (ODA) is central to this transformation, providing a standardized framework for the seamless integration of network services. By adopting ODA, CSPs can decouple network functions from the underlying hardware, enabling greater agility and innovation

Figure3: NaaS function wheel, depicting various NaaS functions offered to consumers, REF[1]

APIs: The Engine of Innovation

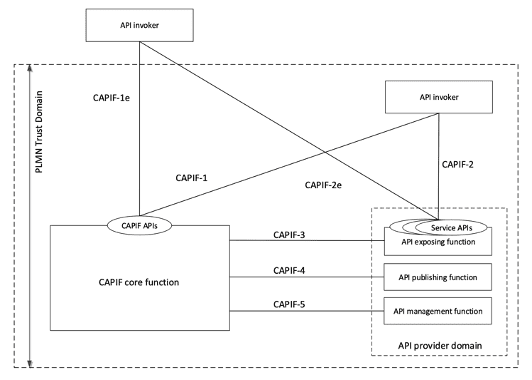

APIs are fundamental to the telecom industry’s transformation, empowering developers to create innovative services that leverage network capabilities. The Common API Framework (CAPIF) by 3GPP standardizes API usage across various network functions, ensuring smooth and secure communication. This framework acts as a universal language, facilitating collaboration and enhancing security across diverse applications and industries.

Figure4: Functional model for the CAPIF

Network Exposure Function (NEF): Unlocking New Potential

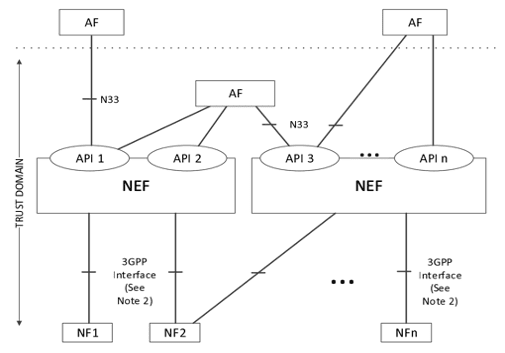

3GPP 5G Core architecture

5GC (Figure2) is the new 3GPP standard for core networks defining how the core network should evolve to support the needs of 5G New Radio (NR) and the advanced use cases enabled by it. The figure below depicts NEF representation in the non-roaming architecture, using 5G reference point representation.

Figure5: Network Exposure Function in reference point representation REF[4]

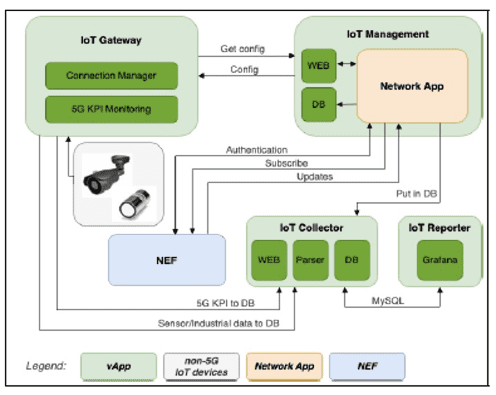

The Network Exposure Function (NEF) provides a secure, standardized method for exposing APIs, enabling CSPs to broaden their service offerings and explore new revenue streams. NEF is essential for fostering a thriving digital ecosystem, driving innovation, and economic growth in the telecom sector. Figure below depicts how NEF plays a role with the IoT ecosystem in enabling the communication exchange through API.

Figure6: Illustrates NEF and its role in enabling the network and external applications to exchange information, REF[5]

CAMARA Project: Accelerating Innovation through Standardized APIs

The CAMARA project, an open-source initiative hosted by the Linux Foundation, is pivotal in advancing the telecom industry’s move towards programmable networks and Network as a Service (NaaS). CAMARA aims to develop standardized APIs for network services, enabling seamless integration and interoperability across diverse network functions and applications.

This initiative promotes community-driven development and open-source principles, fostering collaboration among CSPs, technology vendors, and developers. Supported by leading industry players, CAMARA drives the adoption of robust, secure, and widely accepted APIs, facilitating new business models and revenue streams. By focusing on the needs of future technologies, CAMARA ensures that the telecom sector is well-equipped to leverage the unique capabilities of 5G, B5G, and beyond. REF[8]

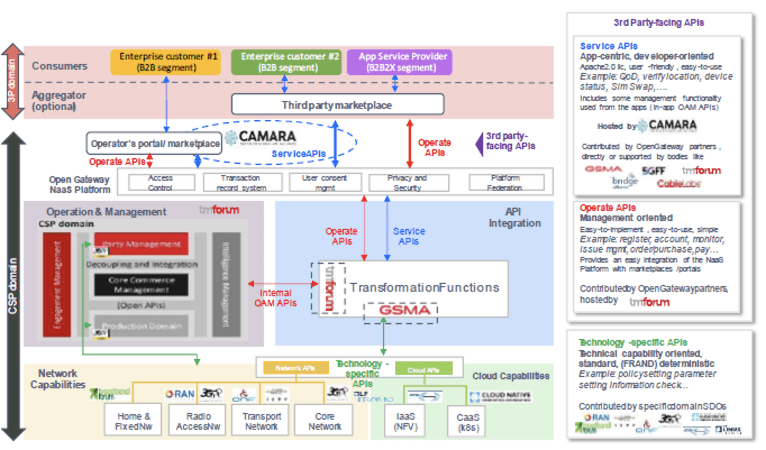

Transition to a Service-Centric Model

The TM Forum’s focus on NaaS and service lifecycle management underscores the industry’s shift towards a service-centric model. This approach emphasizes managing the entire lifecycle of network services, from design and deployment to operation and optimization. By adopting a service-centric mindset, CSPs can deliver more personalized and efficient services, improving customer satisfaction and driving business growth. This approach also helps CSPs optimize operations and reduce costs by streamlining processes and improving resource utilization.

Figure7: Open Gateway NaaS Architecture and contributing stakeholders REF[7]

Conclusion

The telecom industry’s shift to programmable networks and NaaS marks a pivotal moment in its evolution. By embracing APIs, NEF, and service lifecycle management, CSPs can unlock new opportunities for innovation and growth. The collective efforts of industry stakeholders, supported by initiatives from TM Forum, GSMA, and CAMARA, will pave the way for a digitally interconnected future where collaboration and innovation are the norms. As the industry continues to evolve, embracing these advancements will be crucial for CSPs to stay competitive and meet the ever-growing demands of the digital age.

This journey is not just about technological advancement; it’s a collective endeavor towards a digitally interconnected future. It’s an invitation for all stakeholders, from telecom operators and technology providers to developers, to contribute to and reap the benefits of the expanding digital economy. Let’s embrace this transformative time, shaping the way we connect and interact in the digital world.

References

- IG1224 NaaS Transformation v12.0.0″: https://www.tmforum.org/resources/reference/ig1224-naas-transformation-v12-0-0/

- “Northbound exposure – how NEF and CAMARA can enable telecom’s platform play” by James Crawshaw, Practice Leader: https://omdia.tech.informa.com/om028769/northbound-exposure–how-nef-and-camara-can-enable-telecoms-platform-play

- ETSI TS 129 522 V16.4.0 (2020-08) – 5G; 5G System; Network Exposure Function Northbound APIs; Stage 3.

- 3GPP TS 23.501 version 15.3.0 Release 15; System Architecture for the 5G System

- “Common Framework for 5G Northbound APIs”: https://www.etsi.org/deliver/etsi_ts/123200_123299/123222/15.03.00_60/ts_123222v150300p.pdf

- “5G and B5G NEF exposure capabilities towards an Industrial IoT use case” : https://scholar.google.com/scholar?q=5G+and+B5G+NEF+exposure+capabilities+towards+an+Industrial+IoT+use+case&hl=en&as_sdt=0&as_vis=1&oi=scholart

- “The-Ecosystem-for-Open-Gateway-NaaS-API-development”: https://www.gsma.com/solutions-and-impact/gsma-open-gateway/gsma_resources/naas-ecosystem-whitepaper/

- https://camaraproject.org/; APIs enabling seamless access to Telco network capabilities

Ameer Shohail, Experienced ICT Solutions Design Specialist and IEEE Senior Member at a Tier 1 telecom operator in the Middle East, specializing in advanced wireless technologies

InterSAT extends Pan-African satellite services via Ku-band on Eutelsat 70B satellite

Eutelsat Group has extended its partnership with African satellite network service provider InterSat to support its growth in the pan-African enterprise and retail segments. Under the new multi-year deal, InterSAT will add Ku-Band capacity over Central and Eastern Africa on Eutelsat’s Eutelsat 70B satellite to its current portfolio, which already includes Ka-Band capacity on the Eutelsat Konnect satellite. The Eutelsat 70B offers wide beam coverage and four high-performance fixed beams, with a high degree of on-board connectivity. The partnership extension highlights the role of VSAT services delivered through powerful, geostationary capacity to reach remote areas.

“We are delighted to be able to rely on Eutelsat capacity once again to support our growth ambitions in Africa, home to some of the world’s most remote and underdeveloped regions which represent a challenging environment for building terrestrial communication networks. Leveraging our VSAT service expertise and our teleport infrastructure, we are able to use satellite communication to deliver reliable and cost-effective connectivity to remote and underserved areas while assuring a high-end user experience for our customers,” said Hanif Kassam, Chief Executive Officer of InterSAT.

“We are honoured to be selected by our long-standing partner, InterSAT, to accompany the further roll-out of its services in Africa. The growth of VSAT services in Africa is a testament to the potential of this technology to transform the continent’s ICT landscape, connecting more people and businesses than ever before, as well as the ongoing relevance of our powerful geostationary in-orbit assets to deliver a compelling and reliable connectivity service to the remotest areas,’’ commented Ghassan Murat, Eutelsat’s Regional Vice President (RVP) of the Africa, Middle East, and Asia (AMEA) region

Image Credit: EUTELSAT GROUP

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

On May 22nd, YahClick (the data solutions’ arm of UAE’s Al Yah Satellite Communications Company PJSC) and Eutelsat signed a Memorandum of Understanding (MOU) for YahClick to leverage capacity on Eutelsat’s geostationary satellite, EUTELSAT KONNECT. The collaboration between the two leading satellite operators is in line with Yahsat’s efforts to elevate its offerings and drive growth across its satellite broadband footprint in Africa to provide enhanced services and expand into new markets in Africa and beyond. As part of the agreement. Yahsat will enjoy exclusive rights to Eutelsat’s KONNECT capacity over Ethiopia, one of the fastest-growing African markets.

Sulaiman Al Ali, Chief Commercial Officer of Yahsat said: ‘We are delighted to partner with Eutelsat and have access to state-of-the-art orbital assets, to support our satellite network. This partnership shall enable us to further enhance our portfolio and drive growth of our ‘YahClick’ broadband services to consumer and enterprise markets. Yahsat supported Eutelsat in the early years of its African Broadband journey, and we are happy to be collaborating once again to ensure our existing and future customers benefit from the highest level of service and availability.”

Ghassan Murat, Eutelsat’s RVP of the AMEA region added: “We are honoured to further deepen our ties with our long-standing partner, Yahsat. Yahsat’s strong presence in Africa and the Middle East through the successful deployment of its YahClick satellite broadband service, together with the uptake we are seeing as we progressively transfer EUTELSAT KONNECT capacity to Africa highlight the buoyant demand for robust broadband services in the market, and the pertinence of satellite in connecting users, even in the most remote locations.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

About Eutelsat Group:

Eutelsat Group is a global leader in satellite communications, delivering connectivity and broadcast services worldwide. The Group was formed through the combination of the Company and OneWeb in 2023, becoming the first fully integrated GEO-LEO satellite operator with a fleet of 36 Geostationary satellites and a Low Earth Orbit (LEO) constellation of more than 600 satellites. The Group addresses the needs of customers in four key verticals of Video, where it distributes more than 6,500 television channels, and the high-growth connectivity markets of Mobile Connectivity, Fixed Connectivity, and Government Services. Eutelsat Group’s unique suite of in-orbit assets and ground infrastructure enables it to deliver integrated solutions to meet the needs of global customers. The Company is headquartered in Paris and the Eutelsat Group employs more than 1,700 people across more than 50 countries. The Group is committed to delivering safe, resilient, and environmentally sustainable connectivity to help bridge the digital divide.

References:

Hubble Network Makes Earth-to-Space Bluetooth Satellite Connection; Life360 Global Location Tracking Network

U.S. startup Hubble Network has claimed Bluetooth-based satellite communications is possible after transmitting data from standard Bluetooth devices to its new satellite constellation, launched in March. The firm, with a $20 million funding round behind it, reckons it will extend Bluetooth transmissions from 10 meters to hundreds of kilometers. It wants to “connect a billion devices” on the “world’s first truly global, cost-efficient, and low-power network,” the company said in a press release.

“We’ve disproved thousands of skeptics,” claims Hubble Network co-founder and chief executive officer Alex Haro of his company’s milestone achievement. “By showcasing that we can send signals directly from Bluetooth chips and receive them in space 600km [around 370 miles] away, we’ve opened a new realm of possibilities.”

Hubble Network has successfully proven the core concept on which the company was founded: that a Bluetooth connection, typically thought of as exclusively for short-range wireless connectivity, can be made between a device on Earth and an orbiting satellite.

“We’ve disproved thousands of skeptics,” claims Hubble Network co-founder and chief executive officer Alex Haro of his company’s milestone achievement. “By showcasing that we can send signals directly from Bluetooth chips and receive them in space 600km [around 370 miles] away, we’ve opened a new realm of possibilities.”

“Our innovative approach allows existing Bluetooth-enabled devices to be retrofitted to transmit data to the Hubble Network without any hardware modifications,” explains co-founder and chief technology officer, “ushering in a new era of connectivity.”

Two satellites, granted, is a somewhat limited constellation. Following its first successful Earth-to-space Bluetooth link, the company has stated that it will focus on increasing the number of satellites in orbit in order to boost capacity and increase coverage — and has opened a waitlist for those interested in experimenting with its official developer’s kit.

Separately, Life360, a family connection and safety company, has announced a signed non-binding letter of intent with Hubble Network to become the exclusive consumer application of their groundbreaking satellite Bluetooth technology. Through this strategic partnership, Life360 will leverage Hubble’s global satellite infrastructure and Life360’s global network of over 66 million smartphones to introduce “Find with Life360,” a global location-tracking network. Hubble’s breakthrough achievement of connecting Bluetooth devices to a satellite tracking network avoids previous limitations of Bluetooth location-tracking devices. Find with Life360 has the potential to herald a new era in location tracking and surpass the finding network capabilities of Apple and Google.

References:

Part-2: Unleashing Network Potentials: Current State and Future Possibilities with AI/ML

By Vinay Tripathi with Ajay Lotan Thakur

Introduction

In the dynamic realm of networking, AI/ML has emerged as a transformative force to reshape the networking world by making it more secure, reliable, efficient and optimized. In this blog we will dive into characteristics, possibilities, use cases and challenges of AI/ML in the networking.

About AI and ML

Definitions of AL/ML

AI and ML are often used interchangeably, but there are some key differences between the two.

- AI is the ability of machines to perform tasks that would normally require human intelligence, such as understanding natural language, recognizing objects, and making decisions.

- ML is a subfield of AI that allows machines to learn from data and improve their performance over time.

- DL = Uses neural networks for complex structured models and greater insights.

Types of AI/ML

AI/ML encompass a wide range of techniques and algorithms that can be used to solve a variety of problems. In the context of networks, AI/ML technologies can be broadly categorized into the following types:

Key Points:

- AI/ML taxonomy is continuously evolving due to industry growth and various methodologies and algorithms.

- The choice of AI/ML algorithm significantly influences business outcomes, including training time, prediction accuracy, and resource usage.

- The selection of algorithms depends on the type and volume of available data for a specific use case.

Popular ML Types:

- Supervised/Unsupervised: When available data is simple or significant pre-processing has resulted in high data quality:

- Neural Networks and Deep Learning: When you have substantial amounts of unstructured/structured data or unclear features these may offer superior accuracy over Classical ML methods

- AutoML: When you need to streamline machine learning model development, especially with limited expertise, time, or resources.

- NLP: When tasks involve text or language data and require automation, understanding, or generation of natural language content.

- Reinforcement learning: Suitable when you need to train agents to make sequential decisions in dynamic environments, optimizing for long-term rewards, and when there is a need for autonomous decision-making, such as in robotics, game playing, or autonomous systems.

Figure-1: Hierarchy of AI, ML and DL

Applications of AI/ML

AI and ML technologies provide a diverse array of applications in networks, encompassing security, engineering, capacity planning, and operations. These technologies have the capability to augment network security, optimize network design and performance, forecast traffic demand, and automate network tasks. This leads to enhanced efficiency, reliability, and overall network performance. Here are some specific examples:

Network Security

- Intrusion Detection System (IDS): AI-powered IDS can detect and respond to cyberattacks in real-time, providing a more robust defense against threats.

- Thread Detection and Prevention (TDP): AI can analyze network traffic to identify and prevent threats before they can cause damage.

- Anomaly Detection: AI can detect deviations from normal network behavior, indicating potential security incidents.

Network Engineering

- Quality of Service (QoS): AI can optimize network resources to ensure consistent and reliable performance for critical applications.

- Routing and Traffic Management: AI can optimize routing decisions and manage traffic flow to avoid congestion and improve network performance.

- Optimized Traffic Flow: AI can analyze traffic patterns and make real-time adjustments to optimize traffic flow, reducing latency and improving overall network performance.

- Load Balancing: AI can distribute traffic across multiple servers or network links to balance the load and prevent bottlenecks.

Network Capacity Planning

- Improved Capacity Forecasting: AI can analyze historical data and predict future traffic demand, enabling network operators to plan for future capacity needs.

- Efficient Uses of Resources: AI can identify and allocate network resources more efficiently, reducing costs and improving network performance.

Network Maintenance, Troubleshooting, Operations and Monitoring

- Real-time Monitoring: AI can continuously monitor network performance and identify potential issues before they cause outages or disruptions.

- Quicker Resolutions of Vendor/Hardware Issues: AI can diagnose and resolve vendor and hardware issues more quickly, minimizing downtime.

- Faster Root Cause Analysis: AI can analyze large amounts of data to identify the root cause of network issues, enabling faster resolution.

- Quick Mitigations of Network Issues: AI can automatically implement mitigations for network issues, reducing the impact on users and applications.

AI/ML Based Network in Action

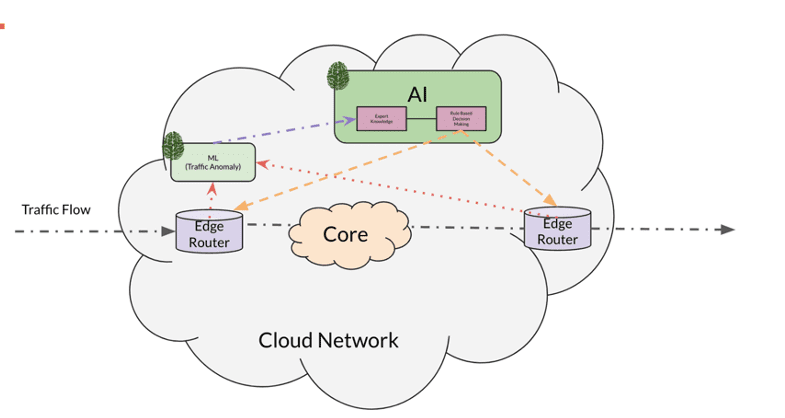

The seamless integration of AI/ML components at various levels of the network (edge, core, management, etc.) enhances its reliability, efficiency, and security by optimizing performance and safeguarding against vulnerabilities.

The diagram illustrates a practical application of AI/ML within one of the extensive networks.

Figure-2: AI/ML in action in a cloud network

Trends in AI/ML

AI/ML are revolutionizing the field of networks. These technologies are being used to improve the performance, security, and reliability of networks.

Here are some of the key trends in AI/ML for networks:

- Simplify and scale data operations.

AI/ML can be used to automate and simplify many of the tasks involved in managing and analyzing network data. This can free up network administrators to focus on more strategic tasks.

- Increase accuracy of forecasts.

AI/ML can be used to predict network traffic patterns, identify potential problems, and plan for future capacity needs. This can help organizations to avoid costly downtime and improve the quality of service for their users.

- Decrease time to market.

AI/ML can be used to automate the process of designing, deploying, and managing new network services. This can help organizations to bring new products and services to market faster.

- Enable insights on otherwise unusable data

AI/ML can be used to extract insights from network data that would otherwise be too complex or voluminous to analyze manually. This can help organizations to identify security threats, optimize network performance, and improve customer experience.

Figure-3: Trends in ML

AI/ML Use Cases

The introduction of AI/ML use cases in network functions has revolutionized the field of networking. AI/ML technologies are being leveraged to enhance network security, optimize network design and performance, anticipate traffic demand, and automate network tasks. This integration leads to improved efficiency, reliability, and overall network performance.

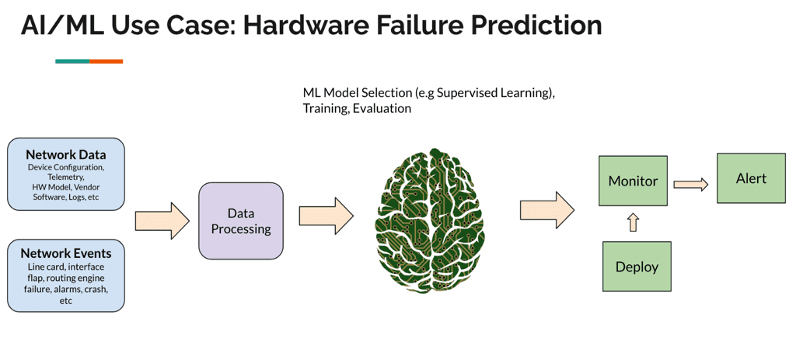

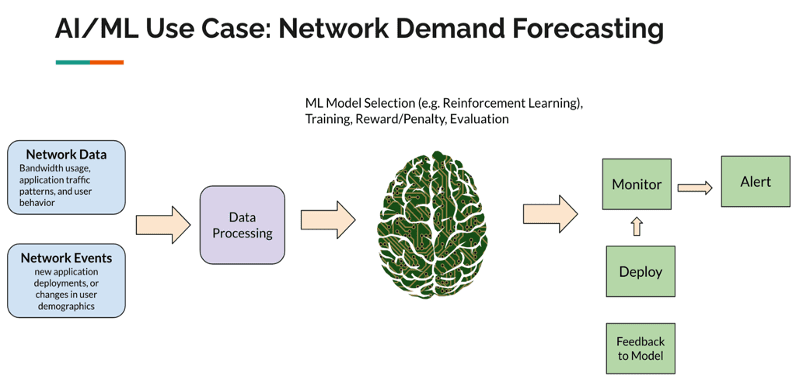

Examples of the popular use cases of AI/ML in large networks.

Figure-4: AI/ML Use Case: Hardware Failure Prediction

Figure-5: AI/ML Use Case: Network Demand Forecasting

ML vs Non-ML Networks

The comparison of ML-based and non-ML-based networks provides valuable insights into the advantages and limitations of each approach. By examining the key aspects such as scalability, flexibility, accuracy, and security, organizations can make informed decisions about the most suitable solution for their specific networking needs. This comparison can guide network engineers, architects, and decision-makers in selecting the optimal approach to meet their performance, efficiency, and security requirements.

A comparison between ML-based and non-ML-based solutions is provided in the followingtable:

Figure-6: Comparison of ML and non-ML solutions

Reasons Not to Use AI/ML

While AI/ML technologies offer significant benefits for networks, there are certain scenarios where their application may not be suitable or feasible. Several factors, such as data availability, use case definition, cost considerations, the need for customized models, and the effectiveness of existing automation, can influence the decision to refrain from using AI/ML in networks. Understanding the limitations and potential drawbacks of AI/ML is crucial for organizations to make informed choices about the most appropriate approach for their specific networking needs.

- Not enough data sets to train the model:

- AI/ML models require large amounts of high-quality data to train effectively. In the context of networks, it may be challenging to collect and prepare sufficient data. Factors such as network size, traffic patterns, and security considerations can make data collection a complex and time-consuming process.

- The lack of adequate data can lead to models that are not well-generalized and may not perform well in real-world scenarios.

- Use case is not defined well:

- AI/ML models are designed to solve specific problems or achieve specific goals. If the use case for AI/ML in networks is not clearly defined, it can be difficult to develop a model that effectively addresses the desired outcomes.

- A poorly defined use case can lead to misalignment between the model’s capabilities and the actual requirements of the network.

- High cost is a problem:

- Implementing AI/ML solutions in networks can be expensive. Factors such as hardware requirements, software licenses, and the cost of hiring skilled professionals contribute to the overall cost.

- Organizations need to carefully evaluate the cost-benefit analysis before investing in AI/ML for their networks. In some cases, the cost of deploying and maintaining an AI/ML solution may outweigh the potential benefits.

- Customized AI/ML model is required:

- Off-the-shelf AI/ML solutions may not always be suitable for specific network scenarios. Organizations may require customized models that are tailored to their unique requirements.

- Developing customized AI/ML models requires specialized expertise and resources, which can further increase the cost and complexity of the project.

- Existing automation is already serving the requirement:

- Many networks already have existing automation solutions in place, such as network management systems (NMS) and configuration management tools. These solutions provide a range of automation capabilities that may already be sufficient for the organization’s needs.

- Implementing AI/ML in such scenarios may not offer significant additional benefits or may require a substantial investment to achieve incremental improvements.

AI/ML Challenges in Networks

AI/ML in networks has benefits but also challenges. Complexity arises from numerous interconnected components and interactions, which AI/ML further complicates. Data limitations and algorithmic bias are additional concerns. Regulatory compliance adds another layer of complexity. Some of the challenges are described in detail below:

Complexity

- As networks become increasingly complex, it can be difficult to troubleshoot issues that arise. This is due to the large number of interconnected components and the complex interactions between them.

- For example, a problem with a single router can have a cascading effect on the entire network, making it difficult to identify the root cause of the issue.

- Additionally, the use of AI and ML in networks can further increase complexity by introducing new layers of abstraction and decision-making.

Data Requirements

- AI and ML algorithms require large amounts of data to train and operate effectively. This can be a challenge for networks, as they may not have access to sufficient data to train their models.

- For example, a network security system may not have enough data on recent attacks to train a model to detect and prevent future attacks.

- Additionally, the data that is available may be biased or incomplete, which can lead to inaccurate or unfair models.

Algorithmic Bias

- AI and ML algorithms can be biased, which can lead to unfair or discriminatory outcomes. This is because the algorithms are trained on data that may contain biases, such as racial or gender bias.

- For example, a facial recognition system may be biased towards certain ethnicities, leading to false identifications or denials of service.

- It is important to address algorithmic bias in networks to ensure that AI and ML are used in a fair and responsible manner.

Regulatory Compliances

- Networks are subject to a variety of regulatory compliance requirements, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA).

- These regulations impose strict requirements on how data is collected, stored, and used.

- AI and ML can add additional complexity to compliance, as they can introduce new data processing and decision-making processes.

- Organizations need to carefully consider the regulatory implications of using AI and ML in networks to ensure that they are compliant with all applicable regulations.

Ethical Concerns

- The use of AI and ML in networks raises several ethical concerns, such as the misuse of data and job replacement.

- For example, AI-powered surveillance systems could be used to track and monitor people without their consent, raising concerns about privacy and civil liberties.

- Additionally, AI and ML could lead to job automation, which could displace workers and have a negative impact on the economy.

- It is important to consider the ethical implications of using AI and ML in networks to ensure that they are used in a responsible and ethical manner.

Networks: AI/ML Benefits

In today’s digital world, networks are becoming increasingly complex and interconnected. To manage and operate these networks effectively, organizations are turning to AI/ML. AI/ML can automate repetitive tasks, identify, and mitigate network threats, and optimize network performance. AI/ML can also help organizations to gain more insights from their network data, which can lead to better decision-making and improved business outcomes. Some of the top benefits are described below:

Lower Cost:

- Automated tasks: AI/ML can automate repetitive and time-consuming network tasks, such as configuration, monitoring, and troubleshooting. This can free up staff to focus on more strategic initiatives.

- Efficient customer support: AI/ML-powered chatbots and virtual assistants can provide 24/7 customer support, answering common questions and resolving simple issues. This can reduce the need for human customer support representatives, saving costs.

- Improved performance: AI/ML can be used to optimize network performance by identifying and resolving bottlenecks and inefficiencies. This can lead to reduced latency, improved throughput, and better overall network performance while minimizing the network operation cost.

Reduced Network Risk:

- Resilient network: AI/ML can be used to create more resilient networks that are better able to withstand outages and attacks. This can be done by predicting and preventing network failures, and by quickly identifying and resolving issues.

- Identify and mitigate threats: AI/ML can be used to detect and mitigate network threats, such as malware, DDoS attacks, and phishing attempts. This can help to protect sensitive data and systems from being compromised.

- Accurate network trends and forecast: AI/ML can be used to analyze network data to identify trends and forecast future needs. This information can be used to make informed decisions about network planning and investment.

- Network outage prediction: AI/ML can be used to predict network outages before they occur. This can help to prevent downtime and lost productivity.

More Revenue:

- Enhanced network and capacity planning: AI/ML can be used to optimize network and capacity planning, ensuring that the network has the resources it needs to meet current and future demands. This can help to avoid costly over-provisioning or under-provisioning of network resources.

- Faster time to market: AI/ML can help to accelerate time to market for new network services and applications. This can be done by automating the testing and deployment process, and by identifying and resolving potential issues early on.

- Better customer experience: AI/ML can be used to improve the customer experience by providing personalized and proactive support. This can lead to increased customer satisfaction and loyalty.

Networks: AI/ML Innovation Catalysts

The convergence of AI/ML with networks is revolutionizing various industries. Here are some key factors driving this transformation:

- Increase in Data/Compute and Storage:

- The proliferation of IoT devices has led to an exponential growth in data generation, fueling AI/ML innovation.

- High-performance computing (HPC) clusters and cloud platforms provide the necessary compute and storage resources for complex AI/ML models.

- Edge Computing:

- Edge computing brings AI/ML capabilities closer to data sources, enabling real-time decision-making.

- Edge devices, such as sensors and gateways, collect and process data locally, reducing latency and bandwidth requirements.

- Cloud Infrastructure:

- Cloud platforms offer scalable and elastic infrastructure for deploying and managing AI/ML workloads.

- Cloud-based AI/ML services provide pre-built tools and frameworks for developers, accelerating the development and deployment of AI/ML applications.

- Increase in Devices Running AI:

- Smartphones, smart home devices, and autonomous vehicles are increasingly equipped with AI capabilities.

- These devices generate vast amounts of data and use AI to perform tasks such as image recognition, natural language processing, and predictive analytics.

- Pre-trained Models:

- Pre-trained models, such as open-source BERT and ResNet, provide a starting point for developing custom AI models.

- These models have been trained on large datasets and can be fine-tuned for specific tasks, reducing the time and resources required for model development.

- Human and AI Cooperation:

- AI/ML is augmenting human capabilities, enabling collaboration between humans and machines.

- Human-AI teams can leverage their respective strengths to solve complex problems and make better decisions.

Conclusion

AI and ML are revolutionizing the field of networking, bringing efficiency, automation, and significant performance improvements. As networks continue to grow and complexity, traditional management methods are becoming increasingly ineffective. AI and ML offer a powerful solution by enabling networks to self-configure, self-optimize, and self-heal, leading to a more agile, resilient, and cost-effective network infrastructure. The use of AI and ML in networks is still in its early stages, but it has the potential to transform the way networks are designed, built, and operated. As AI and ML technologies continue to evolve, we can expect to see even more innovative applications that will further unleash the potential of networks.

References

- https://cloud.google.com/blog/products/infrastructure/google-network-infrastructure-investments

- https://www.cisco.com/c/en/us/solutions/collateral/executive-perspectives/ai-ml-overview-of-industry-trends.html

**** This blog post was written with the assistance of Google’s Gemini. The AI was used to generate initial draft, rephrasing, and brainstorming, which I then refined, edited, and expanded upon.

Part1: Unleashing Network Potentials: Current State and Future Possibilities with AI/ML

By Vinay Tripathi with Ajay Lotan Thakur

Introduction

We live in an era of rapid digitization and ubiquitous connectivity where networks touch every aspect of our lives. From the global telecommunication infrastructure enabling seamless voice and data communication to the diverse social media platforms facilitating instant global interactions, the way we collaborate, communicate, and access information is heavily dependent on the seamless operation of networks. However, as networks continue to evolve, expanding in size and complexity, managing, provisioning, and optimizing them efficiently poses significant challenges.

Introducing Artificial Intelligence (AI) and Machine Learning (ML), offering a transformative solution to simplify network provisioning, streamline operations, enhance network performance, and unlock valuable insights from the vast amounts of network data. AI and ML empower network administrators, architects, planners, engineers, and managers with a range of capabilities that significantly improve network efficiency and effectiveness.

Type of Networks

Networks can be classified into various types based on their purpose, size, and geographical coverage. Some common types of networks include:

1. Core Networks:

- Form the backbone of the internet, connecting large geographical regions and major network providers.

- Characterized by high-speed data transmission, typically fiber optic cables, and redundant paths for reliability.

- Responsible for routing traffic between different parts of the internet and carrying large amounts of data.

2. Data Center Networks:

- Designed to support the infrastructure of data centers, where large amounts of data are processed and stored.

- Highly interconnected and optimized for low latency and high bandwidth to facilitate efficient communication between servers and storage systems.

- Often utilize specialized networking technologies such as Ethernet and InfiniBand.

3. Enterprise Networks:

- Connect devices and resources within an organization or company.

- Include local area networks (LANs) for devices within a building or campus and wide area networks (WANs) for connecting geographically dispersed sites.

- Provide secure and reliable connectivity for employees, customers, and partners.

4. Cellular Networks:

- Provide wireless connectivity for mobile devices such as smartphones, tablets, and IoT devices.

- Consists of cellular towers or base stations that communicate with mobile devices using radio waves.

- Offer various cellular technologies such as 2G, 3G, 4G, and 5G, each providing different levels of speed and capacity.

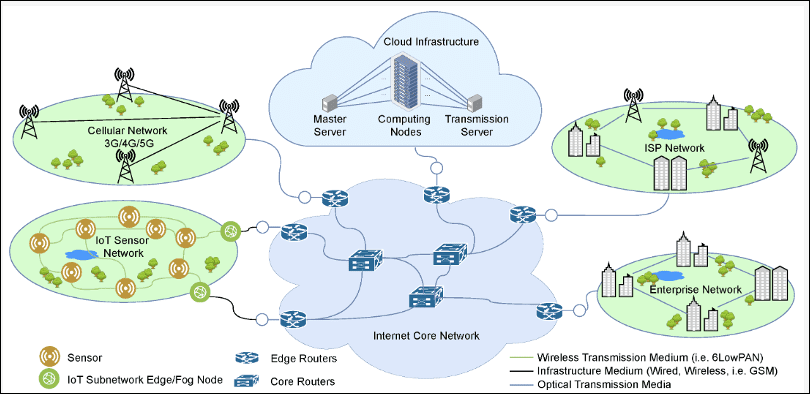

Here’s an example that demonstrates various types of networks:

Figure-1: Various types of Networks

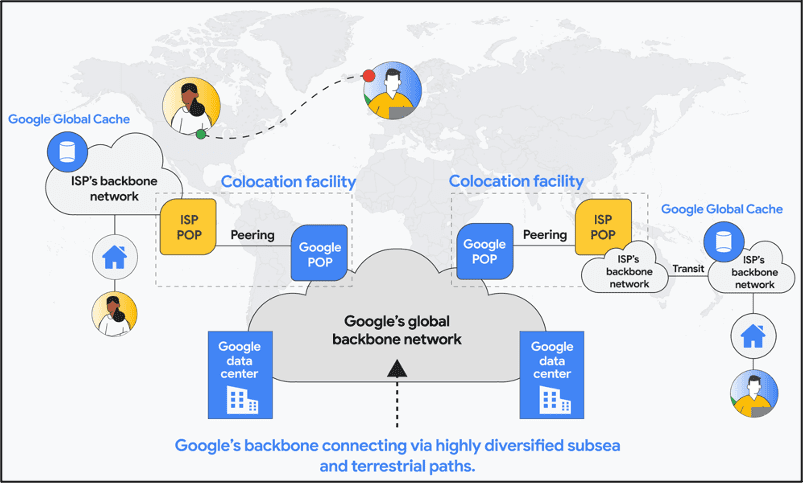

Figure-2: Google Network Infrastructure

Network Functions

Networks are designed to achieve specific goals, for example, edge networks can have very different routing and switching requirements when compared to core networks. However, there are some functions which are common to all networks.

- Engineering:Deals with design, optimization, provision and development of the network infrastructure and services. Engineering teams ensure the network operates efficiently, reliability and meets all the performance and scale requirements.

- Capacity Planning & Forecasting:Estimates future demand of network resources such as routers, switches, servers, storage and bandwidth. It helps in network planning and scaling by analyzing history consumptions and future demand.

- Implementation:Physically deploys the network components like routers, switches, servers, etc. It integrates the systems to the rest of the network and services based on the designs and plans developed by the engineering team.

- Monitoring:Another critical function of network infrastructure which provides vital insights to the current state of network infrastructure. Data collected from the systems can be used by other network functions to improve network performance, reliability, and security.

- Operation:A crucial function of the network which focuses on day-to-day management, maintenance and support of network infrastructure and services. It ensures the network operates smoothly, efficiently and with least disruptions.

- Security:Maintains confidentiality and integrity of information and systems. It uses firewall, intrusion detection systems and access control lists to keep the network secure.

Network Without AI/ML

Many large-scale network outages result from human manual errors or automated system malfunctions. Avoiding such issues is difficult when humans are involved in daily operational decision-making. Many network functions have been automated in recent years, but they still rely on predefined values or actions that require continuous system or service updates. Additionally, there are still many networks or functions that are not automated due to a lack of expertise, resources, or willingness. Even in automated networks, operators must perform manual operations in certain situations, such as tooling infrastructure failures or recoveries. Some scenarios where automated and/or manual operations are performed in a network include:

- Manual/automated security provisions:

- Manual security provisions involve tasks such as manually configuring firewalls, intrusion detection systems, and other security devices.

- Automated security provisions involve using software tools to automate security tasks, such as vulnerability scanning, patch management, and threat detection.

- Manual/automated configuration of network devices (switches, routers, etc.):

- Manual configuration involves manually configuring network devices, such as switches and routers, using command-line interfaces or web-based interfaces.

- Automated configuration involves using software tools to automate the configuration of network devices, which can save time and reduce errors.

- Manual/automated monitoring dashboard with predefined values:

- Manual monitoring involves manually monitoring network performance and security metrics using technologies such as Telemetry, SNMP, and syslog.

- Automated monitoring involves using software tools to automate the monitoring of network metrics and generate alerts when predefined thresholds are exceeded.

- Manual/automated troubleshooting of network issues:

- Manual troubleshooting involves manually diagnosing and resolving network issues, such as connectivity problems, performance issues, and security breaches.

- Automated troubleshooting involves using software tools to automate the diagnosis and resolution of network issues, which can reduce the time it takes to resolve problems.

- Manual/automated mitigation of network events:

- Manual mitigation involves manually responding to network events, such as security breaches, denial-of-service attacks, and natural disasters.

- Automated mitigation involves using software tools to automate the response to network events, which can help to minimize the impact of these events.

- Manual/automated capacity planning process:

- Manual capacity planning involves manually forecasting network traffic demand and planning for future capacity needs.

- Automated capacity planning involves using software tools to automate the forecasting of network traffic demand and the planning of future capacity needs, which can help to ensure that the network has sufficient capacity to meet future demand. Automated solutions can save time, reduce errors, and improve efficiency.

NextGen Network Requirements

Next-generation networks must meet diverse use cases and deliver exceptional customer experiences. Network applications and use cases constantly evolve, necessitating adjustments in network design, technologies, and operations. Continuous optimization is needed to unleash the network’s full potential. For example, existing data center networks require redesign and optimization to meet the demands of AI/ML applications. Critical requirements that must be fulfilled by next-generation networks are as follows:

- Increased performance, reliability, and security: Networks must handle massive data volumes and complex workloads with high performance and low latency. Reliability and security are paramount, ensuring uninterrupted operations and safeguarding sensitive information.

- Customer-centric focus: Delivering a seamless and delightful customer experience is crucial. Networks must facilitate seamless coordination across business functions, enabling personalized services and addressing customer needs effectively.

- Managing massive complexity: The convergence of 5G, Internet of Things (IoT), AI/ML loads and edge computing introduces unprecedented complexity. Networks need to be equipped with advanced orchestration and management capabilities to handle this complexity efficiently.

- Value beyond connectivity: Networks should not be limited to providing mere connectivity. They must deliver value-added services and capabilities such as real-time analytics, edge computing, and network slicing to meet diverse customer requirements.

- Improved service assurance and issue prediction: Networks must proactively monitor and analyze network performance to predict potential issues before they impact customers. Fault detection and self-healing mechanisms are essential to ensure uninterrupted service availability.

- Measuring and optimizing customer experience: Networks should have built-in capabilities to measure and analyze customer experience metrics such as latency, packet loss, and jitter. This data can be leveraged to optimize network performance and rectify areas of improvement.

- Understanding customer expectations: Networks must provide insights into customer expectations and evolving needs. This can be achieved through surveys, feedback mechanisms, and real-time monitoring of customer interactions.

- Increased efficiency and intelligence: Networks should incorporate AI and ML technologies to automate tasks, optimize resource allocation, and enhance overall network efficiency and intelligence.

Conclusions

Future networks need AI/ML integration to fulfill the next generation of requirements. AI/ML can make networks more efficient, secure, reliable, and scalable. AI/ML can effectively monitor and alert operators, utilizes resources efficiently, make network customer centric and faster delivery of services. In the next blog, we will discuss AI/ML use cases, benefits, limitations, and projections.

References

- https://www.mdpi.com/1424-8220/21/11/3898

- https://cloud.google.com/blog/products/infrastructure/google-network-infrastructure-investments

**** This blog post was written with the assistance of Google’s Gemini. The AI was used to generate initial draft, rephrasing, and brainstorming, which I then refined, edited, and expanded upon.

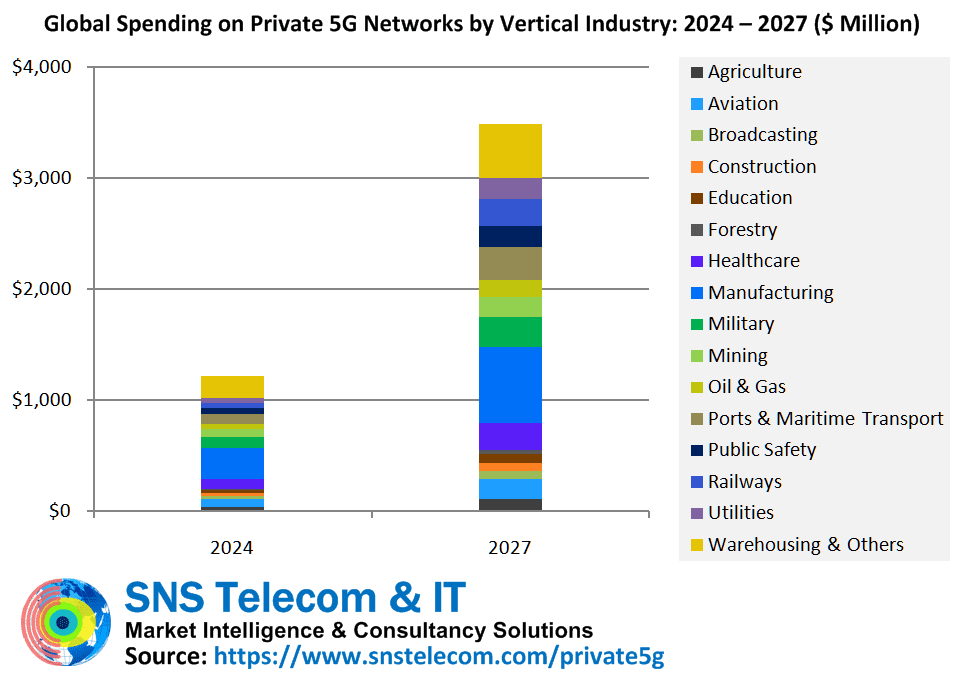

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT’s new “Private 5G Networks: 2024 – 2030” report exclusively focuses on the market for private networks built using the 3GPP-defined 5G specifications (there are no ITU-R recommendations for private 5G networks or ITU-T recommendations for 5G SA core networks). In addition to vendor consultations, it has taken us several months of end user surveys in early adopter national markets to compile the contents and key findings of this report. A major focus of the report is to highlight the practical and tangible benefits of production-grade private 5G networks in real-world settings, as well as to provide a detailed review of their applicability and realistic market size projections across 16 vertical sectors based on both supply side and demand side considerations.

The report states report that the real-world impact of private 5G networks – which are estimated to account for $3.5 Billion in annual spending by 2027 – is becoming ever more visible, with diverse practical and tangible benefits such as productivity gains through reduced dependency on unlicensed wireless and hard-wired connections in industrial facilities, allowing workers to remotely operate cranes and mining equipment from a safer distance and significant, quantifiable cost savings enabled by 5G-connected patrol robots and image analytics in Wagyu beef production.

SNS Telecom & IT estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 42% between 2024 and 2027, eventually accounting for nearly $3.5 Billion by the end of 2027. Although much of this growth will be driven by highly localized 5G networks covering geographically limited areas for Industry 4.0 applications in manufacturing and process industries, sub-1 GHz wide area critical communications networks for public safety, utilities and railway communications are also anticipated to begin their transition from LTE, GSM-R and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G Advanced becomes a commercial reality. Among other features for mission-critical networks, 3GPP Release 18 – which defines the first set of 5G Advanced specifications – adds support for 5G NR equipment operating in dedicated spectrum with less than 5 MHz of bandwidth, paving the way for private 5G networks operating in sub-500 MHz, 700 MHz, 850 MHz and 900 MHz bands for public safety broadband, smart grid modernization and FRMCS (Future Railway Mobile Communication System).

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Private LTE networks are a well-established market and have been around for more than a decade, albeit as a niche segment of the wider cellular infrastructure segment – iNET’s (Infrastructure Networks) 700 MHz LTE network in the Permian Basin, Tampnet’s offshore 4G infrastructure in the North Sea, Rio Tinto’s private LTE network for its Western Australia mining operations and other initial installations date back to the early 2010s. However, in most national markets, private cellular networks or NPNs (Non-Public Networks) based on the 3GPP-defined 5G specs are just beginning to move beyond PoC (Proof-of-Concept) trials and small-scale deployments to production-grade implementations of standalone 5G networks, which are laying the foundation for Industry 4.0 and advanced application scenarios.

Compared to LTE technology, private 5G networks – also referred to as 5G MPNs (Mobile Private Networks), 5G campus networks, local 5G or e-Um 5G systems depending on geography – can address far more demanding performance requirements in terms of throughput, latency, reliability, availability and connection density. In particular, 5G’s URLLC (Ultra-Reliable, Low-Latency Communications) and mMTC (Massive Machine-Type Communications) capabilities, along with a future-proof transition path to 6G networks in the 2030s, have positioned it as a viable alternative to physically wired connections for industrial-grade communications between machines, robots and control systems. Furthermore, despite its relatively higher cost of ownership, 5G’s wider coverage radius per radio node, scalability, determinism, security features and mobility support have stirred strong interest in its potential as a replacement for interference-prone unlicensed wireless technologies in IIoT (Industrial IoT) environments, where the number of connected sensors and other endpoints is expected to increase significantly over the coming years.

It is worth noting that China is an outlier and the most mature national market thanks to state-funded directives aimed at accelerating the adoption of 5G connectivity in industrial settings such as factories, warehouses, mines, power plants, substations, oil and gas facilities and ports. To provide some context, the largest private 5G installations in China can comprise hundreds to even thousands of dedicated RAN (Radio Access Network) nodes supported by on-premise or edge cloud-based core network functions depending on specific latency, reliability and security requirements. For example, home appliance manufacturer Midea’s Jingzhou industrial park hosts 2,500 indoor and outdoor 5G NR access points to connect workers, machines, robots and vehicles across an area of approximately 104 acres, steelmaker WISCO (Wuhan Iron & Steel Corporation) has installed a dual-layer private 5G network – spanning 85 multi-sector macrocells and 100 small cells – to remotely operate heavy machinery at its steel plant in Wuhan (Hubei), and Fujian-based manufacturer Wanhua Chemical has recently built a customized wireless network that will serve upwards of 8,000 5G RedCap (Reduced Capability) devices, primarily surveillance cameras and IoT sensors.

As end user organizations in the United States, Germany, France, Japan, South Korea, Taiwan and other countries ramp up their digitization and automation initiatives, private 5G networks are progressively being implemented to support use cases as diverse as wirelessly connected machinery for the rapid reconfiguration of production lines, distributed PLC (Programmable Logic Controller) environments, AMRs (Autonomous Mobile Robots) and AGVs (Automated Guided Vehicles) for intralogistics, AR (Augmented Reality)-assisted guidance and troubleshooting, machine vision-based quality control, wireless software flashing of manufactured vehicles, remote-controlled cranes, unmanned mining equipment, BVLOS (Beyond Visual Line-of-Sight) operation of drones, digital twin models of complex industrial systems, ATO (Automatic Train Operation), video analytics for railway crossing and station platform safety, remote visual inspections of aircraft engine parts, real-time collaboration for flight line maintenance operations, XR (Extended Reality)-based military training, virtual visits for parents to see their infants in NICUs (Neonatal Intensive Care Units), live broadcast production in locations not easily accessible by traditional solutions, operations-critical communications during major sporting events, and optimization of cattle fattening and breeding for Wagyu beef production.

Despite prolonged teething problems in the form of a lack of variety of non-smartphone devices, high 5G IoT module costs due to low shipment volumes, limited competence of end user organizations in cellular wireless systems and conservatism with regards to new technology, early adopters are affirming their faith in the long-term potential of private 5G by investing in networks built independently using new shared and local area licensed spectrum options, in collaboration with private network specialists or via traditional mobile operators. Some private 5G installations have progressed to a stage where practical and tangible benefits – particularly efficiency gains, cost savings and worker safety – are becoming increasingly evident. Notable examples include but are not limited to:

- Tesla’s private 5G implementation on the shop floor of its Giga-factory Berlin-Brandenburg plant in Brandenburg, Germany, has helped in overcoming up to 90 percent of the overcycle issues for a particular process in the factory’s GA (General Assembly) shop. The electric automaker is integrating private 5G network infrastructure to address high-impact use cases in production, intralogistics and quality operations across its global manufacturing facilities.

- John Deere is steadily progressing with its goal of reducing dependency on wired Ethernet connections from 70% to 10% over the next five years by deploying private 5G networks at its industrial facilities in the United States, South America and Europe. In a similar effort, automotive aluminum die-castings supplier IKD has replaced 6 miles of cables connecting 600 pieces of machinery with a private 5G network, thereby reducing cable maintenance costs to near zero and increasing the product yield rate by ten percent.

- Lufthansa Technik’s 5G campus network at its Hamburg facility has removed the need for its civil aviation customers to physically attend servicing by providing reliable, high-resolution video access for virtual parts inspections and borescope examinations at both of its engine overhaul workshops. Previous attempts to implement virtual inspections using unlicensed Wi-Fi technology proved ineffective due to the presence of large metal structures.

- The EWG (East-West Gate) Intermodal Terminal’s private 5G network has increased productivity from 23-25 containers per hour to 32-35 per hour and reduced the facility’s personnel-related operating expenses by 40 percent while eliminating the possibility of crane operator injury due to remote-controlled operation with a latency of less than 20 milliseconds.

- The Liverpool 5G Create network in the inner city area of Kensington has demonstrated significant cost savings potential for digital health, education and social care services, including an astonishing $10,000 drop in yearly expenditure per care home resident through a 5G-connected fall prevention system and a $2,600 reduction in WAN (Wide Area Network) connectivity charges per GP (General Practitioner) surgery – which represents $220,000 in annual savings for the United Kingdom’s NHS (National Health Service) when applied to 86 surgeries in Liverpool.

- NEC Corporation has improved production efficiency by 30 percent through the introduction of a local 5G-enabled autonomous transport system for intralogistics at its new factory in Kakegawa (Shizuoka Prefecture), Japan. The manufacturing facility’s on-premise 5G network has also resulted in an elevated degree of freedom in terms of the factory floor layout, thereby allowing NEC to flexibly respond to changing customer needs, market demand fluctuations and production adjustments.

- A local 5G installation at Ushino Nakayama’s Osumi farm in Kanoya (Kagoshima Prefecture), Japan, has enabled the Wagyu beef producer to achieve labor cost savings of more than 10 percent through reductions in accident rates, feed loss, and administrative costs. The 5G network provides wireless connectivity for AI (Artificial Intelligence)-based image analytics and autonomous patrol robots.

- CJ Logistics has achieved a 20 percent productivity increase at its Ichiri center in Icheon (Gyeonggi), South Korea, following the adoption of a private 5G network to replace the 40,000 square meter warehouse facility’s 300 Wi-Fi access points for Industry 4.0 applications, which experienced repeated outages and coverage issues.

- Delta Electronics – which has installed private 5G networks for industrial wireless communications at its plants in Taiwan and Thailand – estimates that productivity per direct labor and output per square meter have increased by 69% and 75% respectively following the implementation of 5G-connected smart production lines.

- An Open RAN-compliant standalone private 5G network in Taiwan’s Pingtung County has facilitated a 30 percent reduction in pest-related agricultural losses and a 15 percent boost in the overall revenue of local farms through the use of 5G-equipped UAVs (Unmanned Aerial Vehicles), mobile robots, smart glasses and AI-enabled image recognition.

- JD Logistics – the supply chain and logistics arm of online retailer JD.com – has achieved near-zero packet loss and reduced the likelihood of connection timeouts by an impressive 70 percent since migrating AGV communications from unlicensed Wi-Fi systems to private 5G networks at its logistics parks in Beijing and Changsha (Hunan), China.

- Baosteel – a business unit of the world’s largest steelmaker China Baowu Steel Group – credits its 43-site private 5G deployment at two neighboring factories with reducing manual quality inspections by 50 percent and achieving a steel defect detection rate of more than 90 percent, which equates to $7 Million in annual cost savings by reducing lost production capacity from 9,000 tons to 700 tons.

- Dongyi Group Coal Gasification Company ascribes a 50 percent reduction in manpower requirements and a 10 percent increase in production efficiency – which translates to more than $1 Million in annual cost savings – at its Xinyan coal mine in Lvliang (Shanxi), China, to private 5G-enabled digitization and automation of underground mining operations.

- Sinopec’s (China Petroleum & Chemical Corporation) explosion-proof 5G network at its Guangzhou oil refinery in Guangdong, China, has reduced accidents and harmful gas emissions by 20% and 30% respectively, resulting in an annual economic benefit of more than $4 Million. The solution is being replicated across more than 30 refineries of the energy giant.

- Since adopting a hybrid public-private 5G network to enhance the safety and efficiency of urban rail transit operations, the Guangzhou Metro rapid transit system has reduced its maintenance costs by approximately 20 percent using 5G-enabled digital perception applications for the real-time identification of water logging and other hazards along railway tracks.

Some of the most technically advanced features of 5G Advanced – 5G’s next evolutionarily phase – are also being trialed over private wireless installations. Among other examples, Chinese automaker Great Wall Motor is using an indoor 5G Advanced network for time-critical industrial control within a car roof production line as part of an effort to prevent wire abrasion in mobile application scenarios, which results in production interruptions with an average downtime of 60 hours a year.

In addition, against the backdrop of geopolitical trade tensions and sanctions that have restricted established telecommunications equipment suppliers from operating in specific countries, private 5G networks have emerged as a means to test domestically produced 5G network infrastructure products in controlled environments prior to large-scale deployments or vendor swaps across national or regional public mobile networks. For instance, Russian steelmaker NLMK Group is trialing a private 5G network in a pilot zone within its Lipetsk production site, using indigenously built 5G equipment operating in Band n79 (4.8-4.9 GHz) spectrum.

To capitalize on the long-term potential of private 5G, a number of new alternative suppliers have also developed 5G infrastructure offerings tailored to the specific needs of industrial applications. For example, satellite communications company Globalstar has launched a 3GPP Release 16-compliant multipoint terrestrial RAN system that is optimized for dense private wireless deployments in Industry 4.0 automation environments while German engineering conglomerate Siemens has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers.

The “Private 5G Networks: 2024 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents an in-depth assessment of the private 5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, operational and business models, vertical industries, application scenarios, key trends, future roadmap, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2024 to 2030. The forecasts cover three infrastructure submarkets, two technology generations, 16 vertical industries and five regional markets. The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 7,000 global private cellular engagements – including more than 2,200 private 5G installations – as of Q2’2024.

The key findings of the report include:

- SNS Telecom & IT estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 42% between 2024 and 2027, eventually accounting for nearly $3.5 Billion by the end of 2027. Much of this growth will be driven by highly localized 5G networks covering geographically limited areas for high-throughput and low-latency Industry 4.0 applications in manufacturing and process industries.

- Sub-1 GHz wide area critical communications networks for public safety, utilities and railway communications are also anticipated to begin their transition from LTE, GSM-R and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G Advanced – 5G’s next evolutionarily phase – becomes a commercial reality.

- As end user organizations ramp up their digitization and automation initiatives, some private 5G installations have progressed to a stage where practical and tangible benefits are becoming increasingly evident. Notably, private 5G networks have resulted in productivity and efficiency gains for specific manufacturing, quality control and intralogistics processes in the range of 20 to 90%, cost savings of up to 40% at an intermodal terminal, reduction of worker accidents and harmful gas emissions by 20% and 30% respectively at an oil refinery, and a 50% decrease in manpower requirements for underground mining operations.

- Some of the most technically advanced features of 5G Advanced are also being trialed over private wireless installations. Among other examples, Chinese automaker Great Wall Motor is using an indoor 5G Advanced network for time-critical industrial control within a car roof production line as part of an effort to prevent wire abrasion in mobile application scenarios, which results in production interruptions with an average downtime of 60 hours a year.

In addition, against the backdrop of geopolitical trade tensions and sanctions that have restricted established telecommunications equipment suppliers from operating in specific countries, private 5G networks have emerged as a means to test domestically produced 5G network infrastructure products in controlled environments prior to large-scale deployments or vendor swaps across national or regional public mobile networks. For example, Russian steelmaker NLMK Group is trialing a private 5G network in a pilot zone within its Lipetsk production site, using indigenously built 5G equipment operating in Band n79 (4.8-4.9 GHz) spectrum.

To capitalize on the long-term potential of private 5G, a number of new alternative suppliers have also developed 5G infrastructure offerings tailored to the specific needs of industrial applications. For example, satellite communications company Globalstar has launched a 3GPP Release 16-compliant multipoint terrestrial RAN system that is optimized for dense private wireless deployments in Industry 4.0 automation environments while German engineering conglomerate Siemens has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers.

Spectrum liberalization initiatives – particularly shared and local spectrum licensing frameworks – are playing a pivotal role in accelerating the adoption of private 5G networks. Telecommunications regulators in multiple national markets – including the United States, Canada, United Kingdom, Germany, France, Spain, Netherlands, Switzerland, Finland, Sweden, Norway, Poland, Slovenia, Bahrain, Japan, South Korea, Taiwan, Hong Kong, Australia and Brazil – have released or are in the process of granting access to shared and local area licensed spectrum.

By capitalizing on their extensive licensed spectrum holdings, infrastructure assets and cellular networking expertise, national mobile operators have continued to retain a significant presence in the private 5G network market, even in countries where shared and local area licensed spectrum is available. With an expanded focus on vertical B2B (Business-to-Business) opportunities in the 5G era, mobile operators are actively involved in diverse projects extending from localized 5G networks for secure and reliable wireless connectivity in industrial and enterprise environments to sliced hybrid public-private networks that integrate on-premise 5G infrastructure with a dedicated slice of public mobile network resources for wide area coverage.

New classes of private network service providers have also found success in the market. Notable examples include but are not limited to Celona, Federated Wireless, Betacom, InfiniG, Ataya, Smart Mobile Labs, MUGLER, Alsatis, Telent, Logicalis, Telet Research, Citymesh, Netmore, RADTONICS, Combitech, Grape One, NS Solutions, OPTAGE, Wave-In Communication, LG CNS, SEJONG Telecom, CJ OliveNetworks, Megazone Cloud, Nable Communications, Qubicom, NewGens and Comsol, and the private 5G business units of neutral host infrastructure providers such as Boldyn Networks, American Tower, Boingo Wireless, Crown Castle, Freshwave and Digita.

NTT, Kyndryl, Accenture, Capgemini, EY (Ernst & Young), Deloitte, KPMG and other global system integrators have been quick to seize the private cellular opportunity with strategic technology alliances. Meanwhile, hyperscalers – most notably AWS (Amazon Web Services), Google and Microsoft – are offering managed private 5G services by leveraging their cloud and edge platforms.

Although greater vendor diversity is beginning to be reflected in infrastructure sales, larger players are continuing to invest in strategic acquisitions as highlighted by HPE’s (Hewlett Packard Enterprise) acquisition of Italian mobile core technology provider Athonet.

The service provider segment is not immune to consolidation either. For example, Boldyn Networks has recently acquired Cellnex’s private networks business unit, which largely includes Edzcom – a private 4G/5G specialist with installations in Finland, France, Germany, Spain, Sweden and the United Kingdom.

Among other examples, specialist fiber and network solutions provider Vocus has acquired Challenge Networks – an Australian pioneer in private LTE and 5G networks, while mobile operator Telstra – through its Telstra Purple division – has acquired industrial private wireless solutions provider Aqura Technologies.

The report will be of value to current and future potential investors into the private 5G network market, as well as 5G equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem.

About SNS Telecom & IT:

Part of the SNS Worldwide group, SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 5G, LTE, Open RAN, private cellular networks, IoT (Internet of Things), critical communications, big data, smart cities, smart homes, consumer electronics, wearable technologies and vertical applications.

References:

https://www.snstelecom.com/private5g

What is 5G Advanced and is it ready for deployment any time soon?

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

https://www.kyndryl.com/us/en/about-us/news/2024/02/it-ot-convergence-in-manufacturing

India Telcos say private networks will kill their 5G business

WSJ: China Leads the Way With Private 5G Networks at Industrial Facilities

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

Verizon Consumer:

Verizon reported better-than-expected wireless customer results for the Q1-2024, but still lost subscribers. The U.S. #2 telco consumer revenue the quarter was $25.1 billion, an increase of 0.8% YoY as gains in service revenue were partially offset by declines in wireless equipment revenue.

While Verizon lost 158,000 wireless retail postpaid phone customers in the first quarter, that was an improvement over the 263,000 losses the company reported in the same quarter a year ago. Verizon had been expected to lose around 201,000 postpaid phone customers in its consumer division in the first quarter. Thus, the difference between expectations and what Verizon reported is likely due to the estimated 35,000 customers who signed up for a $10 per month second line of wireless service and not necessarily new customers paying full price for a standard wireless subscription.

“It gives customers flexibility,” explained Verizon CFO Tony Skiadas this week during Verizon’s first quarter earnings call, according to Seeking Alpha. “They can add and remove it as desired. The adoption so far has been good.”

“Despite Verizon Consumer Group postpaid phone net adds beating consensus, Verizon stated that ‘a very low single-digit percentage of phone gross adds’ came from Verizon ‘second number,’ which was announced in early March,” wrote the financial analysts with KeyBanc Capital Markets in a note to investors following the release of Verizon’s earnings. “Implied by this is ~35,000 net adds from ‘second number’ without which investors could say Verizon Consumer Group postpaid phone net adds were in line.”

AT&T and T-Mobile offer similar second line wireless plans. T-Mobile has been offering its $10 per month Digits service for years, allowing customers to move their numbers around to various devices, including having two numbers on one phone. AT&T charges users $30 a month to add a line.

………………………………………………………………………………………………

Verizon FWA & Wireline:

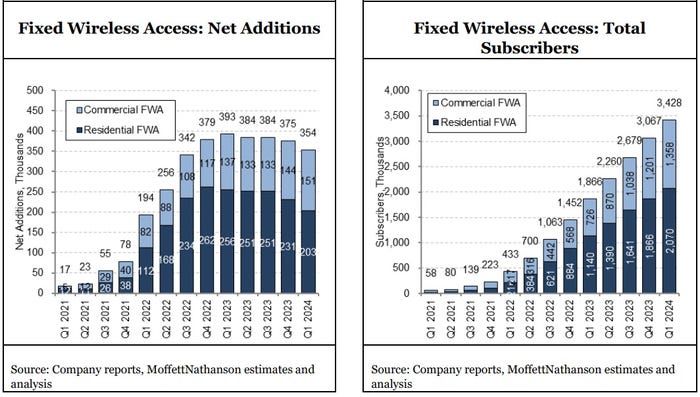

Verizon added 354,000 fixed wireless access (FWA) customers in Q1 2024, ending the period with 3.42 million. Record additions of business FWA subs were offset by a slowdown in the residential category.

Verizon’s overall FWA results “remain a puzzle,” MoffettNathanson analyst Craig Moffett explained in a research note (registration required).

“Growth [in FWA] is still relatively strong, but their quarterly results continue to decelerate, something we wouldn’t have expected given the early stage of their Band 76 C-Band footprint,” he noted.

Still, Verizon’s FWA offering continues to provide a solid alternative to cable broadband in the residential segment, despite some “muted activity,” CFO Tony Skiadas said on Monday’s earnings call. “We continue to be comfortable with this pace of [subscriber] growth.”

With respect to wireline, Verizon added 49,000 residential FiOS Internet customers, down from a gain of 63,000 a year earlier. Verizon ended the quarter with 7.02 million residential Fios Internet subs. With DSL losses included, Verizon added 36,000 wireline broadband customers in the period, extending its total to 7.22 million.

Verizon Business:

- Total Verizon Business revenue was $7.4 billion in first-quarter 2024, a decrease of 1.6% year over year, as increases in wireless service revenue were more than offset by decreases in wireline revenue and wireless equipment revenue.

- Business wireless service revenue in first-quarter 2024 was $3.4 billion, an increase of 2.7% year over year. This was driven by continued strong net additions in the quarter for both mobility and fixed wireless, as well as benefits from pricing actions implemented in recent quarters.

- Business reported 178,000 wireless retail postpaid net additions in first-quarter 2024, including 90,000 postpaid phone net additions.

- Business wireless retail postpaid churn was 1.51 percent in first-quarter 2024, and wireless retail postpaid phone churn was 1.13 percent.

- Business reported 151,000 fixed wireless net additions in first-quarter 2024, representing a 10.2 percent increase from first-quarter 2023. This marked their best quarterly result to date.

- In first-quarter 2024, Verizon Business operating income was $399 million, a decrease of 27.6 percent year over year, and segment operating income margin was 5.4 percent, a decrease from 7.4 percent in first-quarter 2023. Segment EBITDA in first-quarter 2024 was $1.5 billion, a decrease of 7.2 percent year over year, driven by wireline revenue declines. Segment EBITDA margin in first-quarter 2024 was 20.7 percent, a decrease from 22.0 percent in first-quarter 2023.

References:

https://www.lightreading.com/fixed-wireless-access/verizon-s-fwa-business-loses-some-steam-in-q1

Verizon’s 2023 broadband net additions led by FWA at 375K

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

du (UAE) deploys Microchip’s TimeProvider 4100 Grandmaster clock for advanced 5G network services