Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

The global 5G fixed wireless access (FWA) market is expected to grow from $1642.62 million in 2021 to $3074.07 million in 2022 at a compound annual growth rate (CAGR) of 87.1%, according to a new Research & Markets report. The change in growth trend is mainly due to the companies stabilizing their output after catering to the demand that grew exponentially during the COVID-19 pandemic in 2021. The market is expected to reach $38173.20 million in 2026 at a CAGR of 87.1%.

The main types of 5G fixed wireless access are hardware and services. Hardware refers to physical parts that enable fixed wireless access such as mobile phones and devices that have MIMO antenna technology built into the device for the mmWave frequencies. 5G small cell networks and RAN towers are the most important hardware elements of 5G technology infrastructure. The different demographics include urban, semi-urban and rural. It is implemented in various market segments such as residential, commercial, industrial and government.

North America was the largest region in the 5G fixed wireless access market in 2021. Europe was the second largest market in 5G fixed wireless access market. The regions covered in this report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Image Credit: Everything RF

The increasing adoption of 5G networks is expected to fuel the growth of the 5G fixed wireless access market in the coming years. 5G is the fifth generation of mobile data technology designed to significantly improve wireless network speed and flexibility. With the introduction of 5G, mobile technology can meet the demands of fixed-line networks and price ranges. According to Future Networks, a UK-based telecommunications company 5G will account for 1.2 billion connections by the end of 2025. Moreover, according to vXchnge, a US-based company that offers data centers and colocation services, 5G networks will cover 40% of the world and handle 25% of all mobile traffic data by 2024. Therefore, the increasing adoption of 5G networks drives the growth of the 5G fixed wireless access.

Technological innovations are shaping the 5G fixed wireless access market. Major companies operating in the 5G fixed wireless access sector is focused on developing technological solutions for 5G fixed wireless access. For instance, in February 2020, Huawei, a China-based telecommunications equipment company launched LampSite EE based on Huawei’s 5G technology. LampSite EE is the business version of 5G LampSite for industrial scenarios. The version is an update from Huawei’s pioneer LampSite 5G indoor radio connectivity solution, and it is geared toward smart manufacturing, smart hospitals, smart transportation, and smart warehouses, among other industries.

References:

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

Juniper Research: 5G Fixed Wireless Access (FWA) to Generate $2.5 Billion in Global Network Operator Revenue by 2023

https://www.everythingrf.com/community/what-is-fixed-wireless-access

Sony Semiconductor Israel unveils new chipset for LPWAN market

This low-power IEEE 802.15.4 standard covers Wi-Sun, U-Bus Air, and wireless M-Bus, for either point-to-point or mesh-based local-area sensor networking. The ALT1350’s microcontroller unit (MCU), AI acceleration, and sensor hub are all geared for low-power IoT operations, for low-power data collection and processing at the edge, in sensor devices and edge gateways. Sony Semiconductor called it the “most advanced cellular IoT solution on the market.”

The ALT1350 “resolves… power consumption concerns”, said the Israel-based firm on the grounds it enables an optimized standby mode (eDRX) to reduce power consumption by 80 percent, overall, compared to current-generation cellular IoT units, and by 85 percent even in active mode, when sending short messages. It “power-optimized” concurrent LTE and GNSS positioning, to boot, for location accuracy and battery efficiency.

It includes a secure element for application usage and integrated SIM (iSIM), which meets Eurosmart’s new PP-0117 protection profile, in line with GSMA requirements. Sony Semiconductor said: “Overall improvements in… power consumption will enable four times longer battery life for a typical device”. The unit is pitched at IoT tracking and monitoring cases in the utilities, logistics, transportation, and ‘smart cities’ markets.

It includes a secure element for application usage and integrated SIM (iSIM), which meets Eurosmart’s new PP-0117 protection profile, in line with GSMA requirements. Sony Semiconductor said: “Overall improvements in… power consumption will enable four times longer battery life for a typical device”. The unit is pitched at IoT tracking and monitoring cases in the utilities, logistics, transportation, and ‘smart cities’ markets.

The ALT1350 offers Release 15-level LTE-M/NB-IoT functions, and future compatibility with Release 17-level 5G networks. The device is currently being tested by customers, with a full commercial launch pegged for some time in 2023.

Use cases in connected vehicles and connected healthcare services were also cited. Nohik Semel, chief executive at Sony Semiconductor Israel, said that the ALT1350 “will enable IoT deployments” involving “universal connectivity on edge processing and multiple location technologies.”

“The market demand for this multiprotocol, ultra-low power IoT chipset is intensifying, and Sony’s ALT1350 chipset meets that demand. This is the game changer we’ve been waiting for, which will enable IoT deployments, utilizing universal connectivity on edge processing and multiple location technologies,” Semel added.

References:

https://www.altair-semi.com/products/alt1350/

Sony preps “first” LTE-M/NB-IoT chipset – as “most advanced” cellular IoT solution

SK Telecom launches its metaverse platform ‘ifland’ in 49 countries and regions

SK Telecom (“SKT”) today announced that its metaverse platform ‘ifland’ simultaneously launched in 49 countries and regions throughout the world. With the global launch of ifland, SKT will actively utilize K-pop content, develop attractive content with overseas partners, and strengthen communication features to shape ifland into a global leading social metaverse platform.

The global version of ifland supports English, Chinese (Traditional Chinese, Simplified Chinese) and Japanese, and is available for both Android and iOS smartphone users. The existing ifland app will be upgraded to the new global version. For instance, the app will automatically activate in the Korean mode when accessed from Korea, and the global mode when accessed from overseas countries.

This global expansion of ifland comes after SKT launched its existing Korean language service in July 2021. Since then, it has experienced 8.7 million downloads in its first year of operation. As of October 2022, Ifland had 12.8 million users.

Under the slogan, “The New Way of Socializing,” ifland will deliver a differentiated communication experience within the metaverse.

SKT will effectively expand ifland’s global reach through partnerships with major telecommunications companies in each continent. The company is working with e& (formerly known as Etisalat Group) in the Middle East, Africa and Asia, and Singtel in South East Asia.

On November 18, 2022, SKT signed a memorandum of understanding (MOU) with NTT Docomo, the largest mobile operator in Japan, to cooperate in areas of content, technology and service to further advance their metaverse services. Through the MOU, the two companies will forge strategic partnership in three key areas –metaverse, mobile network infrastructure and media business. They will also create greater synergies by cooperating with other SK ICT affiliates like SK Hynix and Contents Wavve (a joint venture between Korean terrestrial broadcasters KBS, MBC, and SBS and SKT).

First, SKT and NTT DOCOMO will work together in the areas of content, technology and service to further advance their metaverse services. SKT has been operating its metaverse service ‘ifland’ since July 2021, while NTT DOCOMO launched its metaverse service in March 2022.

Partnership discussions with other telecommunications companies are also underway. Together with its overseas partners, SKT plans to develop specialized features tailored to each different region. They will also promote various metaverse-related events and business cooperation, including joint production of popular local content.

Moreover, SKT plans to offer content targeting the “MZ generation (Millennials and Generation Z)” through partnerships with diverse players including overseas universities and international brands.

Early this month, SKT signed a memorandum of understanding (MOU) with Thailand’s Bansomdejchaopraya Rajabhat University (BSRU) and Korea’s Dong-ah Institute of Media and Arts (DIMA) – which is providing a variety of programs including ‘Teen Teen Audition’ in ifland since the beginning of this year – to create a global metaverse campus. SKT will actively support BSRU and DIMA to overcome the limitations stemming from the physical distance between the two schools through ifland.

In addition, the company is working with Birger Christensen, a Copenhagen-based fashion company with over 150 years of history, to launch digital skins for avatars in ifland within this year to enable the MZ generation to better express themselves.

SKT has also updated key features of ifland. The company opened a global lounge within ifland to help those new to the metaverse to experience the new world with greater ease, and introduced avatars of many different colors.

In addition, to facilitate communication between hosts and participants of gatherings in ifland, SKT applied features like ‘one-on-one direct messaging’ and ‘3D speech bubble.’ ‘Live voting’ feature was also introduced to check the opinions of participants in real time, and ‘ifme motion sharing’ feature was adopted to apply the user’s facial expressions to his/her avatar.

To celebrate the global launch of ifland, SKT will be showcasing a wide variety of live K-pop content every week. Original metaverse K-pop content titled “The Fan Live Talkon” will target K-pop fans overseas, with over 50% of content provided in English. Every week, ifland will offer live content related to K-pop – e.g. auditions for K-pop trainees and nurturing of K-pop idols – for global fans to enjoy.

Within this year, through ifland’s SNS account, SKT plans to hold events to give out diverse artists’ goods and gifts to overseas users who participate in the meet-ups of K-pop content.

Meanwhile, ifland has surpassed 12.8 million of cumulative users as of October 2022, which represents a four-fold increase compared to 3 million early this year thanks to differentiated content offerings like original metaverse content.

“Since its launch in Korea in July 2021, ifland has grown rapidly to become the best social metaverse in Korea by attracting users of diverse age groups as well as many different organizations,” said Yang Maeng-seok, Head of Metaverse Office at SKT. “Now, we will go beyond Korea to expand our reach in the global market to take customers metaverse experience to the next level.”

List of countries in which ifland launched:

Argentina, Azerbaijan, Belgium, Brazil, Cambodia, Canada, Chile, Denmark, Deutschland, Finland, France, Ghana, Greece, Hong Kong, India, Indonesia, Ireland, Italy, Japan, Jordan, Kenya, Lebanon, Macau, Malaysia, Mexico, Myanmar, New Zealand, Norway, Palau, Poland, Portugal, Qatar, Rwanda, Singapore, Spain, Sri Lanka, Sweden, Switzerland, Taiwan, Thailand, the Dominican Republic, the Netherlands, the Philippines, the United Arab Emirates, the United Kingdom, the United States, Tunisia, Turkey, Vietnam

References:

https://www.sktelecom.com/en/press/press_detail.do?idx=1550

https://www.sktelecom.com/en/press/press_detail.do?idx=1549¤tPage=1&type=&keyword=

TIP launches Metaverse-Ready Networks Project Group

Is AI the driving force behind the metaverse?

CB Insights: The Metaverse Explained & Companies Making it Happen

NTT Docomo will use its wireless technology to enter the metaverse

Credit Suisse: Metaverse to push data usage by 20 times worldwide by 2032

Analysys Mason: few private networks include edge computing, despite the synergies between the two technologies

In a report on Private LTE/5G network deployments, Analysys Mason said that “Only 58 of the 363 private network announcements in our tracker explicitly mention that the private network is working with edge computing.” That’s no surprise as per our recent IEEE Techblog post that edge computing has not lived up to its promise and potential.

The number of announced private networks increased from 256 during the third quarter of last year, to 363 announced deployments during Q3 of this year. Most of that growth is coming from more advanced countries and China “where the IoT markets are mature and are driving demand for private networks.” Private networks using 4G LTE technology continue to dominate the overall market “because it is able to meet the connectivity requirements of most private network applications.” However, 5G is gaining ground with more than 70% of new networks announced this year stating the use of 5G technology.

Private networks and edge computing are complementary as each adds value to the other. When combined, the technologies can support applications that have requirements for low latency and high bandwidth or that need to be located on site for security purposes.

The adoption of edge computing with private networks has been limited thus far due to several factors, such as the relative immaturity of edge technology. The drivers of private network adoption are also different to those of edge computing adoption.

Private LTE/5G networks are often introduced to replace existing Wi-Fi or fibre access networks, and no other changes are made. Nevertheless, the share of private network announcements that mention edge is growing, and more than 20% of the private networks that have been publicly announced in 2022 so far include edge. We expect that more private networks will include edge computing in the next 18–24 months. Some vendors are promoting edge as part of a packaged private network solution (such as Nokia with its NDAC solution).

A few operators, such as Verizon, Vodafone and the Chinese MNOs, are promoting the combination, and many other service providers have trials that combine the technologies.

Verizon Business CEO Sowmyanarayan Sampath who during a recent NSR & BCG Innovation Conference explained that private 5G network momentum was outpacing demand for the carrier’s mobile edge computing (MEC) services.

“On the MEC, what we are finding is demand is taking a little longer to go,” Sampath said. “And part of that is we are having to work back and integrate deeper into their operating system. So it’s going to be much stickier when it does happen [but] it’s going to take a little longer. We’ve got loads of proof of concepts and early commercial deployments, but we shouldn’t see revenue till the back half of next year and into 2024.”

References:

https://www.sdxcentral.com/edge/definitions/what-multi-access-edge-computing-mec/

Has Edge Computing Lived Up to Its Potential? Barriers to Deployment

Analysys Mason: Telecoms industry faces challenging conditions in 2023

Analysys Mason has warned of the challenges facing the telecoms industry in the year ahead. Like many other industries, the biggest issue facing the sector in 2023 is how it copes with the impact of inflation, particularly rising energy costs, and the reaction to any price rises that are passed on to customers. In addition, this is set against a backdrop of existing market challenges that are already testing the industry’s ability to deliver services, open up new revenue streams and return value to shareholders.

The industry is experiencing a mix of declining revenue and increasing investment costs. The sector has underperformed compared to the market index over the past decade, reporting a low return in 2021 (7 percentage points below the European market, and a similar performance against the markets in North America and Asia), and it has some of the highest capital expenditure thanks to network and infrastructure investments, particularly relating to deploying 5G, the further evolution of 5G architecture and the prospect of 6G.

“After a decade of low inflation and low interest rates, the telecoms sector faces the uncertainty of how it will be affected by these cost increases and the degree to which it can increase its own prices in response,” said Larry Goldman, Chief Analyst at Analysys Mason. “Combined with high investment costs and questions about potential returns, the market outlook is challenging as the telecoms industry tries to steer its path through price rises, rolling out network availability and launching new services.”

Here are Analysys Mason’s 10 most-compelling predictions for the telecoms, media and technology (TMT) sector in 2023. These predictions will be supported by more detailed predictions for specific areas; consumer and enterprise services, networks and software, and satellite.

The biggest issue for telecoms operators in 2023 will be coping with inflation and particularly rising energy costs. After a decade of low inflation and low interest rates, telecoms operators, like other businesses face the problem of managing rising costs and uncertainty about how much they can increase their own prices to cope.

Price rises for telecoms services will become a political issue

Elected officials have largely left pricing issues up to regulators for the past decade. Operators and regulators will be under pressure to moderate price increases, especially on consumer services. Operators will also be pushed to introduce, and publicise, ‘social’ tariffs for consumers in financial hardship, especially for fixed broadband services. We believe that operators will be able to raise retail prices, but it is possible that ARPU will not keep pace with inflation, meaning a cut in real terms. However, it is worth remembering that telecoms services are a relatively small part of any household budget and the annual price increases will be far lower than those for other products and services, such as food and energy.

Telecoms operators were relatively unscathed in the pandemic but must now cut costs

Some cost cutting will come from the automation that telcos have invested in in the past few years, but they must focus on reducing energy costs. One particular area will be decommissioning older networks more rapidly than previously planned.

Telecoms operators will maintain 5G investment plans despite few prospects of short-term returns

FTTP investment will continue to grow and infraco joint ventures will shoulder a greater share of the financial burden. Telcos will move to FTTP pushed by competition from other technologies and pulled by an increasing number of consumers demanding high-bandwidth services that are not adequately supported by current broadband connections or preferring FTTP for reasons such as its better reliability. Traditional telco capex budgets are constrained by the need to invest in 5G, but the long-term value of fibre (and utility-like models) will continue to attract outside investors.

The metaverse will not materialise in 2023, but many more telecoms operators will align their roadmap to fit the vision of an xR-centric future

Meta will continue to spend billions in R&D in 2023 with little return on investment in that timeframe: 2030 will be increasingly framed as ‘the year of the metaverse’. However, operators will take xR use-cases (like VR immersive calls, 3D video calling or digital twin technology) more seriously in 2023 and most will formulate a specific metaverse strategy (internally, if not externally) this year. Apple’s long-rumoured xR headsets may be launched in 2023 but are more likely in 2024.

Telecoms operators will not give up on digital services despite some mixed results

Some high-profile operators have recently left digital services areas (in particular, AT&T and Verizon sold their advertising divisions) and some are rumoured to be planning to divest assets (for example, Orange’s reported plans to sell Orange Bank), but these decisions should not be taken as signals that all operators in high-income countries are rethinking involvement in digital economy services. The US cable operators continue to invest in advertising initiatives, and European operators are likely to follow. TELUS is expected to generate more than 10% of its revenue from health services in 2023. Others are looking at digital education as a growth opportunity.

Private networks take-up will continue, but progress will not be smooth

Take-up of new private networks has been led by large organisations with networking teams and significant internal expertise. We expect this to continue in 2023, but if take-up is to be strong in the next tier of organisations, private networking solutions will need to be simpler and easier to buy. Suppliers will need to offer networks, devices, edge computing, spectrum and other capabilities as a package. Some form of opex/as-a-service pricing will need to be offered. If these developments do not happen, it is possible that adoption will stall.

Demand for multi-cloud connectivity will drive the launch of new solutions

Enterprise demand for SLA-based, on-demand multi-cloud connectivity and network-as-a-service (NaaS) platforms will accelerate because it will be imperative for many businesses to have cloud interconnection, app-to-app networking, zero-trust security and data-sovereignty-compliant traffic management across multiple public clouds and SaaS providers. Telecoms operators with large enterprise/B2B divisions will increasingly prioritise multi-cloud network investments using software-defined networking (SDN) and cloud-native IP networking technologies to gain ground against the alternative service providers that are dominating the market today.

Open RAN will expand in rural and enterprise environments but the crucial massive MIMO challenge will remain inadequately addressed

An ecosystem is developing around Open RAN in areas that are poorly addressed by traditional cellular architecture and operator models, namely rural extension and enterprise small cells. These deployments will gather momentum in 2023 as organisations such as the Telecom Infra Project address issues such as common testing models. However, significant challenges remain to achieve optimum performance in urban macro networks using Open RAN architecture, especially those incorporating massive MIMO. These challenges will take several more years to address to the satisfaction of large operators, and a separate and parallel ecosystem is likely to be established for macro Open RAN.

The use of SaaS deployment models will grow by 19% in the telecoms industry in 2023

This growth will come from both BSS and OSS application areas as operators use hosted applications to help them to transform their current IT stacks to support new 5G services or use them to transform legacy systems to cloud-native, cloud-delivered hosted applications. Application vendors that previously sold on-premises applications will launch increasing numbers of delivery options that will include SaaS.

Direct satellite-to-device connectivity will enter a second wave

Apple, Globalstar, SpaceX/Starlink and T-Mobile have made the first moves in this market, and we expect significant developments in 2023 from the likes of Inmarsat, Iridium, Samsung, other LEO/MEO satellite providers and major telecoms operators. The Apple/Globalstar and SpaceX/T-Mobile propositions are narrowband SoS/emergency-type services, but the competitive edge in this second wave of deals or partnerships will be announcements of two-way wideband or broadband propositions, as well as non-US coverage. Direct satellite-to-device connectivity will have more than 25 million subscribers by the end of 2023, whether it be through mobile satellite services or mobile operators’ terrestrial spectrum, making it a milestone year for this technology.

About Analysys Mason:

Analysys Mason is the world’s leading management consultancy focused on TMT, a critical enabler of economic, environmental and social transformation.

www.analysysmason.com

………………………………………………………………………………………………………………………………………

References:

https://www.analysysmason.com/press/research-predictions-2023/

https://www.analysysmason.com/research/content/articles/research-predictions-2023/

https://www.analysysmason.com/research/content/short-reports/private-network-deployments-rma17/

Ciena acquires 2 privately held companies: Tibit Communications and Benu Networks

Ciena® Corporation, a networking systems, services and software company, today announced that it has entered into a definitive agreement to acquire Tibit Communications, Inc., a privately-held company headquartered in Petaluma, California, and that it has acquired Benu Networks, Inc., a privately-held company headquartered in Burlington, Massachusetts. Tibit and Benu are focused on simplifying broadband access networks through next-generation PON technologies and advanced subscriber management, respectively.

Individually and together, Tibit and Benu will complement Ciena’s existing portfolio of solutions for broadband access use cases, including residential broadband, enterprise business services, and fixed-wireless access, which represent a significant addressable market for Ciena. In addition, the acquisitions will strengthen Ciena’s expertise in these areas, with the addition of a combined 60+ talented engineers with significant experience in access technologies.

“The acquisitions of Tibit Communications and Benu Networks will extend our ability to support customers’ next-generation metro and edge strategies as service providers globally accelerate investments to modernize their networks and improve connectivity at the network edge,” said Scott McFeely, Senior Vice President, Global Products and Services, Ciena. “Tibit’s high-speed PON technologies and Benu’s subscriber management products, combined with Ciena’s current access and edge portfolio, will enable us to offer broader, more complete, and fully integrated broadband access solutions that combine routing, subscriber management, and PON features and functionality.”

Tibit Communications:

Tibit combines PON-specific hardware and OS into a micro pluggable transceiver that can be easily integrated into a carrier-grade Ethernet switch. Unlike the closed and proprietary approaches of traditional Optical Line Terminal (OLT) vendors, Tibit’s open, microplug OLT technology enables rapid PON deployment in any environment.

The acquisition will enable Ciena to build on its market traction and accelerate its time to market, specifically with more vertically integrated, next-generation PON solutions that support residential, enterprise, and mobility use cases, including 10G XGS-PON with development paths to deliver 25G and higher PON in the future.

“The global PON market is growing at a rapid pace and this acquisition will provide the opportunity to take Tibit’s differentiated products to market at scale through Ciena’s extensive service provider customer base. And, as a combined team, we will continue to support and leverage Tibit’s existing network of relationships with system integrators and other equipment vendors,” said Edward Boyd, Vice President of Engineering and Chief Technology Officer of Tibit Communications.

Ciena and Tibit have a strong existing relationship. Ciena has been an investor in Tibit since its initial funding round in 2016 and is currently Tibit’s largest shareholder. Ciena is also Tibit’s largest customer, successfully leveraging Tibit’s products and technology within its portfolio of broadband access solutions.

Under the terms of the agreement, Ciena will acquire the remaining shares of Tibit that it does not already own in a cash-free, debt-free transaction currently valued at approximately $210 million, with the merger consideration to be paid in cash. In addition, Ciena will enter into certain employee retention arrangements in connection with the transaction. The Tibit transaction has been approved by the boards of directors of both companies as well as Tibit’s shareholders. The transaction is expected to close during Ciena’s fiscal first quarter 2023, subject to customary closing conditions.

Benu Networks:

Benu has developed a portfolio of field-proven, cloud-native software solutions, including a virtual Broadband Network Gateway ((v)BNG), which are highly complementary to Ciena’s existing portfolio of broadband access solutions. Benu will provide Ciena with the ability to deliver a single solution that integrates routing, OLT, subscriber management and network services, thereby reducing both capital and operating expenses and improving sustainability for our customers.

“Ciena and Benu have already successfully partnered in the market, including as part of an award-winning joint Proof of Concept (POC) with other residential broadband ecosystem vendors, as well as on active work on customer trials and POCs globally. As part of Ciena, we will be in a stronger position to further extend the market reach and continued development of our software solutions,” said Ajay Manuja, CEO of Benu Networks. The Benu transaction closed during Ciena’s fiscal first quarter 2023.

Ciena:

Ciena (NYSE: CIEN) is a networking systems, services and software company. We provide solutions that help our customers create the Adaptive NetworkTM in response to the constantly changing demands of their end-users. By delivering best-in-class networking technology through high-touch consultative relationships, we build the world’s most agile networks with automation, openness and scale. For updates on Ciena, follow us on Twitter @Ciena, LinkedIn, the Ciena Insights blog, or visit www.ciena.com.

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

From Light Reading: These are positive moves for Ciena, according to Rosenblatt Securities Analyst Mike Genovese, who wrote about the deal in a note to clients on Tuesday. Ciena is looking to use its switching and routing platforms to win more business in the edge networking and fiber broadband markets, “which are in a strong and long multi-year growth cycle,” he wrote.

Genovese noted that one of Ciena’s primary customers, AT&T, intends to continue growing fiber access, even as it fights through mounting debt and economic headwinds. The carrier aims to pass 3 million to 4 million more homes with fiber between 2023 and 2025.

“We believe AT&T is the largest customer for Ciena’s PON [passive optical networking] solutions and there are good opportunities to win share at other Tier 1 telcos and cable MSOs [multiple system operators] where Ciena has switches and routers deployed,” Genovese wrote.

“Ciena has already announced a number of product enhancements and customer wins specifically using 10G PON transceivers housed within their access and aggregation switches,” wrote Kyle Hollasch, Cignal AI’s lead analyst for optical and routing hardware, in an email to Light Reading. “The Tibit acquisition brings a degree of vertical integration into an application that Ciena considers an important differentiator.”

“Traditional edge routers include tightly integrated subscriber management, but virtual and/or cloud-based BNG [broadband network gateway] functionality is gaining traction, and this is where Ciena sees its opening,” wrote Cignal AI’s Hollasch. “The Benu acquisition bolsters Ciena’s expertise in this area as they increase scale and move up the stack to become a more full-featured router vendor.”

Since 2015, Ciena has bought seven companies, and a few of those have included virtual routing and switching, network performance management, and other tools to help communications service providers of all types better control, automate and manage their networks.

Routing and switching were 12% of Ciena’s revenues in its fiscal third quarter and grew 45% year over year, according to Catharine Trebnick, a managing director at MKM Partners (and a former Light Reading editor). According to Ciena and analysts, the addressable market of the entire metro networking and edge (excluding China) has grown to $22 billion. Fiber broadband access is seen as the biggest driver in that segment.

“We view these two acquisitions as broadening its market reach into rural broadband infrastructure opportunities that are funded through the Infrastructure bill,” Trebnick wrote in a note to clients on Tuesday.

Heavy Reading Analyst Sterling Perrin, in a note to Light Reading, said that the global pandemic hit the accelerator for fiber broadband and – even with all the expected delays and bureaucracy – the massive government funding bill lessens a lot of the risk companies like Ciena would face by investing and making more bets in this space.

…………………………………………………………………………………………………………………………………………………………………………………………….

References:

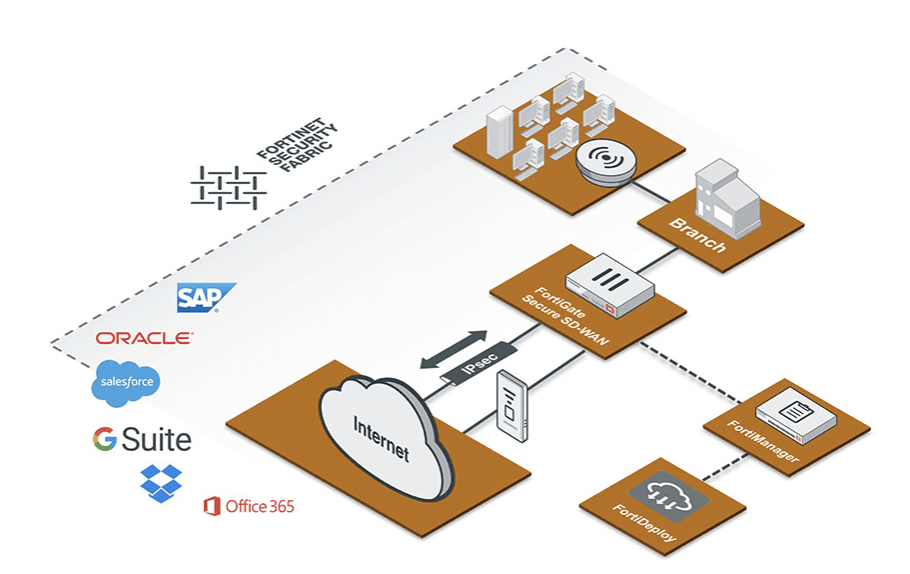

Enterprises Deploy SD-WAN but Integrated Security (SASE) Needed

A new IDC study, commissioned by GTC, reveals that over 95% of enterprises have deployed software-defined wide area networks (SD-WANs) or plan to do so within the next 24 months. However, nearly half (42%) reported they either don’t have security integrated with SD-WAN or have no specific SD-WAN security at all.

Enterprises today are facing what IDC calls “storms of disruption:” waves of economic, political, and social disruptions that are hampering companies’ efforts to become “truly digital enterprises” – like the Russia-Ukraine war, global recession, and industry-wide skills gaps. Networks need to support businesses in their move toward a cloud-native, digital-first, hybrid-working model of operation, and SD-WAN is now a cornerstone of network transformation, IDC stated in its GTT-commissioned study.

When asked to list the challenges they faced when taking a do-it-yourself (DIY) approach to SD-WAN, respondents cited difficulties related to hiring and retaining a skilled in-house workforce, keeping up with technology developments and the ability to negotiate favorable terms with technology vendors.

“Now that SD-WAN has matured and has been widely adopted, the complexity of deployments has grown, challenging enterprises on multiple fronts and compromising their ability to realize the full benefits of the technology,” said James Eibisch, research director, European Infrastructure and Telecoms, IDC.

“Enterprises are increasingly reliant on the resources and expertise of a managed service provider to ensure they deploy SD-WAN in a way best suited to their meet their organizations’ objectives. Security approaches like Secure Access Service Edge (SASE) [1.] that combine the benefits of SD-WAN with zero trust network access and content filtering features are well poised to dominate the next phase of SD-WAN enhancements as enterprises continue to enable the cloud IT model and a hybrid workforce.”

Note 1. SASE, when combined with a SD-WAN overlay network, is seen as a less expensive way to get circuits exactly where they are needed — especially to remote locations — than using traditional architectures like IP-MPLS. Scaling the enterprise WAN out to more user devices and more locations also becomes easier, a necessity at a time when hybrid and remote working continues to be popular.

…………………………………………………………………………………………………………………………………………………………..

The IDC survey found that more than 80% of respondents worldwide have either made SASE a priority (39%) or have recognized its benefits and are already incorporating it into company initiatives (42%). Only 19% of respondents worldwide reported they do not view SASE as a priority.

Despite this widespread recognition of the value of integrating security and SD-WAN, the survey found that many enterprises have not been able to leverage these benefits. In the U.S., 45% of respondents said they either don’t have security integrated with SD-WAN or have no specific SD-WAN security at all. In some countries, such as Switzerland and France, that figure was more than 50%. This trend held across vertical industries such as manufacturing (47%), retail (46%), healthcare (47%) and transportation (49%). Financial and business services were exceptions, with only 32% and 34%, respectively. Seven out of 10 respondents (71%) worldwide expect to use integrated security in the next 12 months.

Image Credit: Fortinet

“This IDC study highlights the critical role of expert managed services support for enterprises deploying SD-WAN. Experienced managed services providers can help integrate technology, connectivity and security, while also managing costs and increased complexity,” said Lisa Brown, CMO at GTT. “The research shows that a DIY approach to SD-WAN presents a number of challenges that can be addressed by teaming with a managed services provider.”

When respondents who were adopting a managed services approach to SD-WAN were asked for their reasons, many said they wanted to outsource day-to-day management tasks. The top reason cited by respondents globally for using a managed services provider was the benefit of always-on help desk support in local languages, with 36% citing this as a reason. Running a close second, 35% cited visibility, insights and control without the need for technology certification as a benefit. In addition, 34% cited ease of configuration management; the ability to manage, maintain and facilitate technology upgrades; and better protection against security threats.

Todd Kiehn, SVP at GTT, told SDxCentral, “There will be a continued evolution to SD-WAN integrated with cloud security over the coming year. The IT organization is going to require ever-increasing visibility into the actions of the end user. Consistently through our customers, prospects, CIO roundtables and through this recent research, the biggest obstacle enterprises are having in implementing new security solutions is finding and securing a staff with the necessary skills. The cybersecurity skill shortage particularly is a global problem.”

Companies that have no position on SD-WAN-specific security yet face the challenge of adopting these new technologies on their own or through managed service provider partnerships — either of which take time and resources.

“Enterprises can view SASE as a security architecture transformation alongside the deployment of SD-WAN. Our customers are deploying security to support their varied digital transformation initiatives such as work from anywhere, branch transformation or cloud migrations,” Kiehn noted.

“Security solutions based on the SASE framework provide choice and a roadmap to address the specific business needs of the enterprise such as enhancing the security posture of mobile users by replacing legacy VPN technology, improving security for guests and employees at brick and mortar locations, and developing a more comprehensive posture to support a hybrid cloud model,” Kiehn added.

About GTT:

GTT is a managed network and security services provider to global organizations. We design and deliver solutions that leverage advanced cloud, networking and security technologies. We complement our solutions with a suite of professional services and exceptional sales and support teams in local markets around the world. We serve thousands of national and multinational companies with a portfolio that includes SD-WAN, security, Internet, voice and other connectivity options. Our services are uniquely enabled by our top-ranked, global, Tier 1 IP backbone, which spans more than 260 cities on six continents. The company culture is built on a customer-first service experience reinforced by our commitment to operational excellence and continuous improvement in our business, environmental, social and governance practices. For more information, visit www.gtt.net.

References:

https://www.sdxcentral.com/networking/sd-wan/definitions/software-defined-sdn-wan/

https://www.sdxcentral.com/articles/news/sd-wan-security-needs-a-refresh-idc-says/2022/11/

MEF survey reveals top SD-WAN and SASE challenges

Omdia: VMware and Versa Networks are SD-WAN revenue leaders; SD-WAN market to hit $6.7B by 2026

AT&T tops VSG’s U.S. Carrier Managed SD-WAN Leaderboard for 4th year

Dell’Oro: SD-WAN market grew 45% YoY; Frost & Sullivan: Fortinet wins SD-WAN leadership award

MEF New Standards for SD-WAN Services; SASE Work Program

VSG Global SD-WAN Leaderboard Rankings and Results

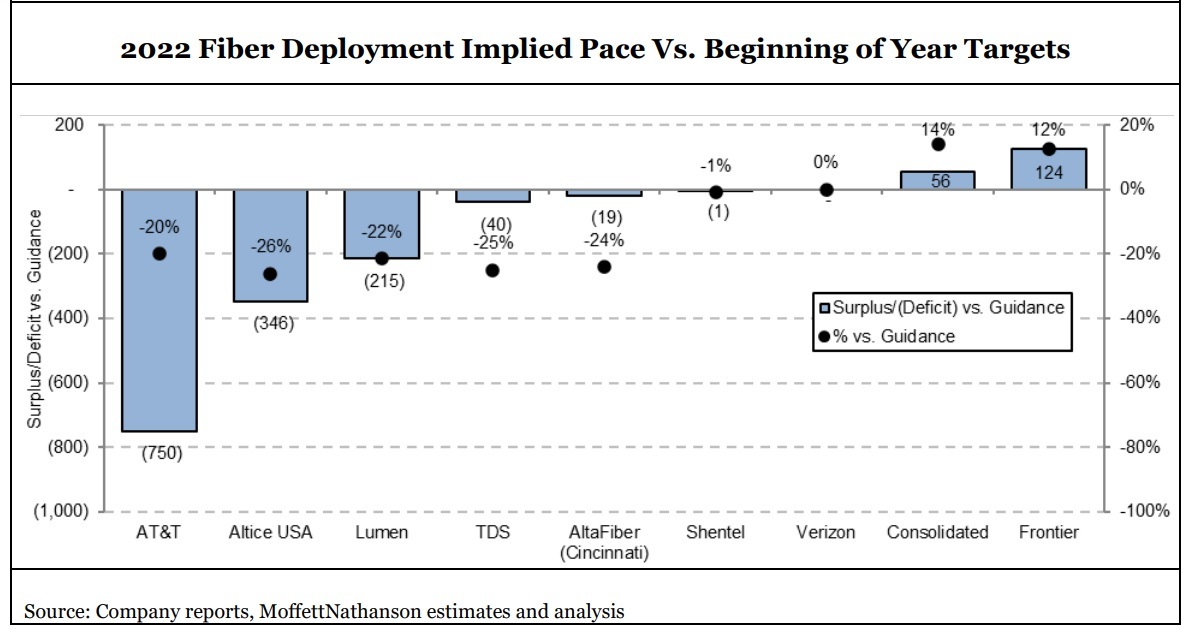

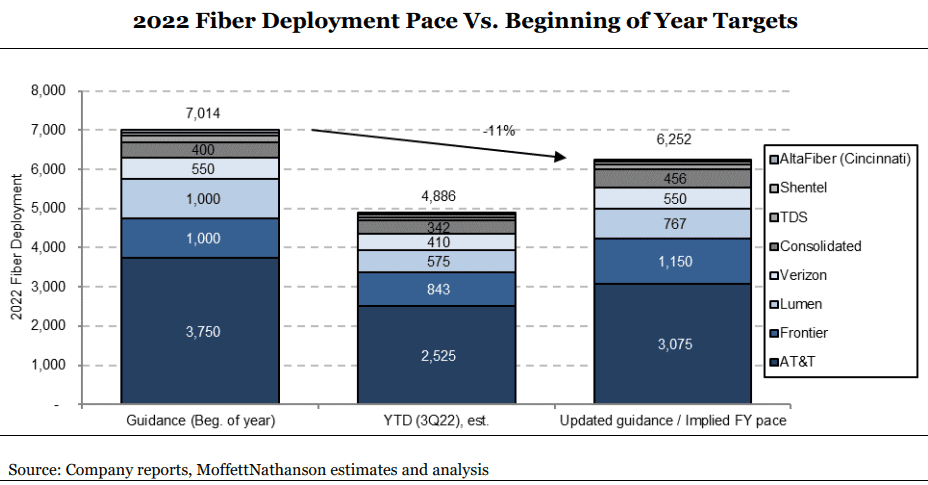

MoffettNathanson: Fiber Bubble May Pop; AT&T is by far the largest (fiber) overbuilder in U.S.

Fiber network build-outs are still going strong, even as the pace of those builds slowed a bit in 2022. Our colleague Craig Moffett warns that the fiber future isn’t looking quite as bright due to an emerging set of economic challenges that could reduce the overall rate of return on those build-outs. Rising costs, reflecting labor cost inflation, equipment cost inflation, and higher cost of capital, all point to diminished investment returns for fiber overbuilds. Craig wrote in a note to clients:

Our by-now familiar tally of planned competitive fiber builds for 2022 started the year at to 6M or so homes passed. By early Spring it had climbed to 7M. It currently sits at ~8M. Next year’s number is flirting with 10M. All for an industry that has never built even half that many in a single year. As we approach the end of the year, however, it is clear that the actual number, at least for this year, will fall short. The number is still high, to be sure… but lower.

There does not appear to be a single explanation for the construction shortfall; some operators blame labor supply, some permitting delays. And some, of course, are actually doing just fine. For the industry as a whole, however, notably including AT&T, by far the nation’s largest (fiber) overbuilder, the number will almost certainly end the year meaningfully below plan. Costs appear to be rising, as well. Here again, there is no single explanation. Labor costs are frequently cited, but equipment costs are rising as well. For example, despite construction shortfalls, AT&T’s capital spending show no such shortfall, suggesting higher cost per home passed. Higher cost per home passed, coupled with a higher cost of capital, portend lower returns on invested capital.

If, as we expect, investment returns for fiber overbuilds increasingly prove to be inadequate, the capital markets will eventually withdraw funding. Indeed, this is how all bubbles ultimately pop. There are already signs of growing hesitancy. To be sure, we don’t expect a near-term curtailment; operators’ plans for the next year or two are largely locked in. Our skepticism is instead about longer-term projections that call for as much as 70% of the country to be overbuilt by fiber. We believe those kinds of forecasts are badly overstated.

As recent as its Q3 2022 earnings call, AT&T has reiterated that it’s on track to expand its fiber footprint to more than 30 million locations by 2025. The company deployed fiber to about 2.3 million locations through the third quarter of this year, but appears hard-pressed to meet its guidance to build 3.5 million to 4 million fiber locations per year.

Given that the fourth quarter is typically a slow construction period, AT&T “looks to be well behind its deployment goals,” Moffett wrote. “If the company retains the pace of deployment in Q3, they will end the year 675K homes short of their goal, or an 18% shortfall compared to the midpoint of their target.”

But AT&T isn’t alone. Lumen has also fallen behind its target, as has TDS and altafiber (formerly Cincinnati Bell) and Altice USA. Those on track or ahead of pace include Frontier Communications, Consolidated Communications and Verizon.

The analysts at Wells Fargo recently lowered their fiber buildout forecasts for 2022 and 2023. They cut their 2022 forecast for the US to about 8 million new fiber locations, down from 9 million. For 2023, they expect the industry to build about 10 million locations, cut from a previous expectation of 11 million.

Though overall buildout figures are still relatively high, some operators recently have blamed a blend of reasons for the recent slowdown in pace, including a challenging labor supply, permitting delays and rising costs for capital and equipment.

“Labor costs are frequently cited, but equipment costs are rising as well,” Moffett noted. “For example, despite construction shortfalls, AT&T’s capital spending show no such shortfall, suggesting higher cost per home passed.”

And, like the pace of buildouts, the cost situation is clearly not the same for all operators. While Consolidated is seeing the cost per home passed rising to a range of $600 to $650 (up from $550 to $600), Frontier expects its costs to remain at the expected range of $900 to $1,000.

But more generally, Moffett believes the returns on those investments “will only weaken further as buildouts are necessarily pushed out to less attractive, lower density, markets.”

One takeaway from that, Craig warns, is that fiber overbuilding is poised not only to generate lower returns that originally hoped, but that there also will be upward, not downward, pressure on broadband prices.

With respect to the pace of fiber build-outs, there’s heavy demand for labor for today’s overbuilding plans, and it will only get heavier as the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program gets started.

With respect to the pace of fiber build-outs, there’s heavy demand for labor for today’s overbuilding plans, and it will only get heavier as the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program gets started.

Remedies are out there, with Moffett pointing to the Fiber Broadband Association’s rollout of its OpTICs Path fiber technician training program earlier this year as one example. ATX Networks, a network tech supplier, is contributing with the recent launch of a Field Personnel Replenishment Program.

But they might not completely bridge the gap. “These efforts may help expand capacity, but they are unlikely to fully meet demand, and they are almost certainly not going to forestall near-term labor cost inflation, in our view,” Moffett wrote.

With rising equipment costs and the cost of capital also factoring in, Moffett views a 20% rise in fiber deployment (for both passing and connecting homes) a “reasonable range” in the coming two to three years.

Moffett wonders if network operators will be forced to raise prices to help restore returns to the levels anticipated when fiber buildout plans were first conceived. While it’s unclear if competitive dynamics will allow for that, “it does appear to us that expectations of falling ARPU [average revenue per user] are misplaced,” Craig wrote.

But the mix of higher cost of capital and deployment for fiber projects, paired with deployment in lower density markets or those with more buried infrastructure, stand to reduce the value of such fiber projects further.

“Capital markets will sniff out this dynamic long before the companies themselves do, and they will withdraw capital. This is, of course, how bubbles are popped,” Moffett warned.

The MoffettNathanson’s report also provided an update on broadband subscriber metrics. US cable turned in a modest gain of 38,000 broadband subs in Q3 2022, an improvement from cable’s first-ever negative result in Q2. Cable saw broadband subscriber growth of 1.2% in Q3, down from +4.4% in the year-ago quarter. U.S. telcos saw broadband subscriber growth fall to -0.5% in Q3, versus +.06% in the year-ago quarter.

Meanwhile, fixed wireless additions set a new record thanks to continued growth at both Verizon and T-Mobile. However, T-Mobile’s 5G Home business posted 578,000 FWA subscriber adds in Q3, up just 3.2% from the prior quarter.

References:

EU to launch IRIS – a new satellite constellation for secure connectivity

Following an agreement with the Council of the European Union and the European Parliament, the European Commission is to go ahead with its plan to build a third strategic satellite constellation to add to the existing Galileo and Copernicus networks. The network is called IRIS (Infrastructure for Resilience, Interconnection & Security by Satellites) and will be part-funded with €2.4bn of European Union cash, though the total cost of building the network is expected to be about €6bn.

The framework defined today is as fpllows:

– IRIS² will be a sovereign constellation, which imposes strict eligibility criteria and security requirements.

– IRIS² will be a constellation focused on government services, including defence applications.

– IRIS² will provide connectivity to the whole of Europe, including areas that do not currently benefit from broadband Internet, as well as to the whole of Africa, using the constellation’s North-South orbits.

– IRIS² will be a “new space” constellation the European way, integrating the know-how of the major European space industries – but also the dynamism of our start-ups, who will build 30% of the infrastructure.

– IRIS² will be a constellation at the cutting edge of technology, to give Europe a lead, for example in quantum encryption. It will be a vector of innovation.

– IRIS² will be a multi-orbit constellation, capable of creating synergies with our existing Galileo and Copernicus constellations. The objective here is to reduce the risk of space congestion.

European Parliament and the Council have supported this initiative to create Europe’s third pillar in space. After satellite positioning and earth observation, Europe will now have a secure European connectivity infrastructure.

“Secure and efficient connectivity will play a key role in Europe’s digital transformation and make us more competitive”, said EU digital chief Margrethe Vestager.

“Through this programme, the EU will be at the forefront of secure satellite communications.”

“IRIS² establishes space as a vector of our European autonomy, a vector of connectivity and resilience. It heightens Europe’s role as a true space power”, Internal Market Commissioner and the real driver of the initiative, Thierry Breton, wrote in a LinkedIn post.

Allowing the private sector to facilitate the rollout of high-speed broadband to “dead zones” that currently lack connectivity is also listed as a critical goal of the project.

“IRIS² will provide connectivity to the whole of Europe”, said Breton, “including areas that do not currently benefit from broadband Internet, as well as to the whole of Africa, using the constellation’s North-South orbits.”

Inspired by Iris, goddess of Greek mythology, messenger of the gods to humans… Iris² will bring secure European connectivity to all!

References:

Brussels to launch new satellite constellation for secure connectivity – EURACTIV.com

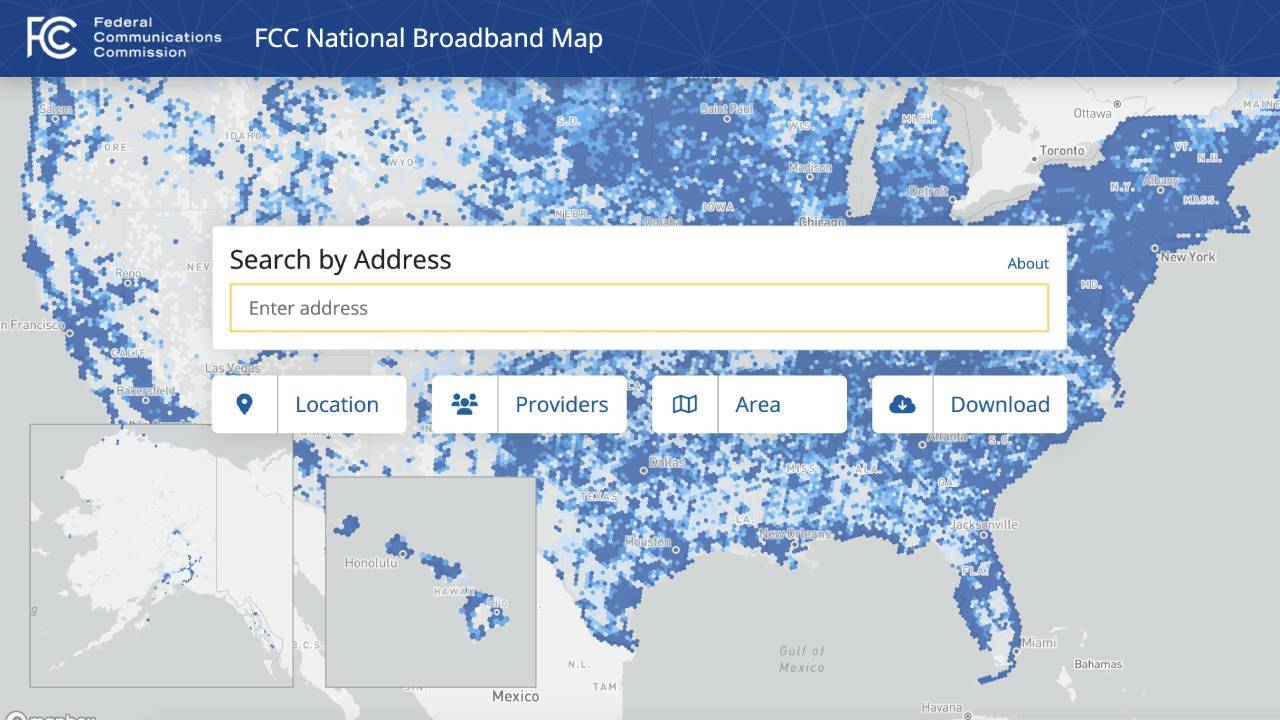

FCC Releases New National Broadband Maps & FCC Speed Test App

At long last, the FCC has released the first public version of its National Broadband Map. The new map is consequential as it will inform how many millions or billions of dollars each state and territory gets from the federal government for broadband infrastructure.

The broadband map’s release follows an effort that began in September to give Internet service providers (ISPs) and local governments an opportunity to review and challenge broadband data findings. That followed an initial FCC broadband data collection process that began in June. IEEE Techblog summarized that and more in this post.

“Today is an important milestone in our effort to help everyone, everywhere get specific information about what broadband options are available for their homes, and pinpointing places in the country where communities do not have the service they need,” said Chairwoman Rosenworcel. “Our pre-production draft maps are a first step in a long-term effort to continuously improve our data as consumers, providers and others share information with us. By painting a more accurate picture of where broadband is and is not, local, state, and federal partners can better work together to ensure no one is left on the wrong side of the digital divide.”

The public will be able to view the maps at broadbandmap.fcc.gov and search for their address to see information about the fixed and mobile services that internet providers report are available there. If the fixed internet services shown are not available at the user’s location, they may file a challenge with the FCC directly through the map interface to correct the information.

Map users will also be able correct information about their location and add their location to the map if it is missing. The draft map will also allow users to view the mobile wireless coverage reported by cellular service providers.

The FCC also announced the launch of an updated version of the FCC Speed Test App that will enable users to quickly compare the performance and coverage of their mobile networks to that reported by their provider. The app allows users to submit their mobile speed test data in support of a challenge to a wireless service provider’s claimed coverage.

Today’s debut marks the start of the public’s ability to offer challenges as well. The FCC has asked for challenges to the map data to be submitted between now and January 13, 2023, so that corrections can be included in a finalized version of the map.

The final version of the map will be used to distribute funding from the Broadband, Equity, Access and Deployment (BEAD) program in summer 2023. As determined by the Department of Commerce last year, each state will get an initial $100 million from the $42.5 billion BEAD program, with additional funding to be distributed based on the number of unserved and underserved locations, according to the new national broadband map.

Members of the public, along with local governments and providers, will now be able to submit two different types of challenges: location (for example, incorrect location address, incorrect location unit count, etc.) and availability (for example, if the map incorrectly lists a certain provider or broadband technology as available).

While the FCC will continue collecting crowdsourced speed data for fixed speeds, that data is not part of the challenge process. Rather, the map is relying on maximum available advertised speeds.

References:

https://www.fcc.gov/document/fcc-releases-new-national-broadband-maps

https://broadbandmap.fcc.gov/home

Additional information sources:

- New users can download the FCC Speed Test App in both the Apple App Store and Google Play Store.

- Existing app users should update the app to gain these new features.

- A video tutorial and more information on how to submit challenges is available at fcc.gov/BroadbandData/consumers.

- For more information about the BDC, please visit the Broadband Data Collection website at fcc.gov/BroadbandData.