Dell’Oro: Worldwide Telecom Equipment Market Growth +3% in 2022; MTN: +2% Network Infrastructure Growth in 2022

by Stefan Pongratz, VP Dell’Oro Group

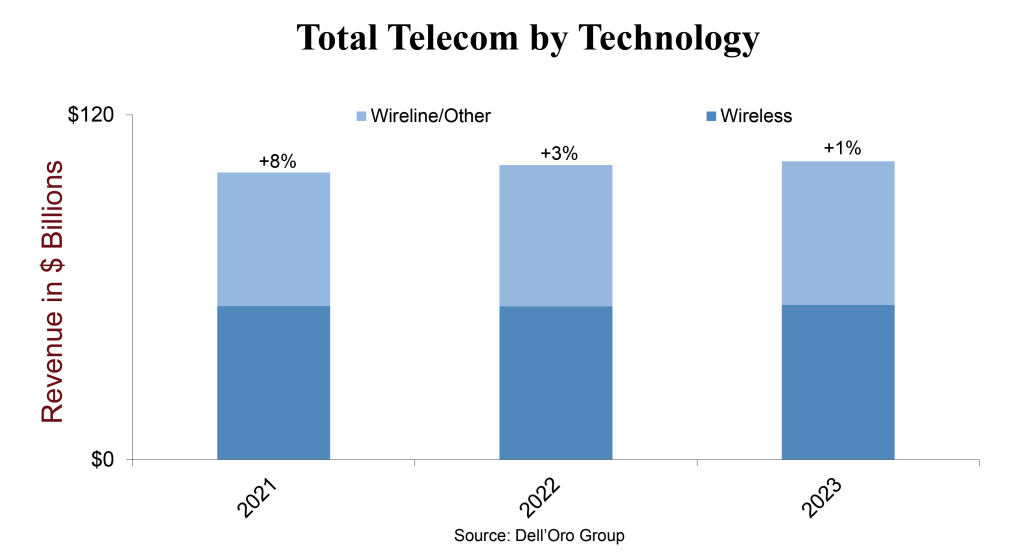

Following four consecutive years of modest telecom equipment growth across the six telecom programs tracked at the Dell’Oro Group, preliminary findings show that the aggregate telecom equipment market moderated somewhat from the 8% revenue increase in 2021 to 3% year-over-year (Y/Y) in 2022.

Looking back at the full year, the results were slightly lower than the 4% growth rate we projected a year ago going into 2022. In addition to more challenging comparisons in the advanced 5G markets and the supplier exits in Russia, the strengthening USD weighed on the broader telecom equipment market. Supply issues also impacted the market negatively during 1H22 but eased somewhat in the second half.

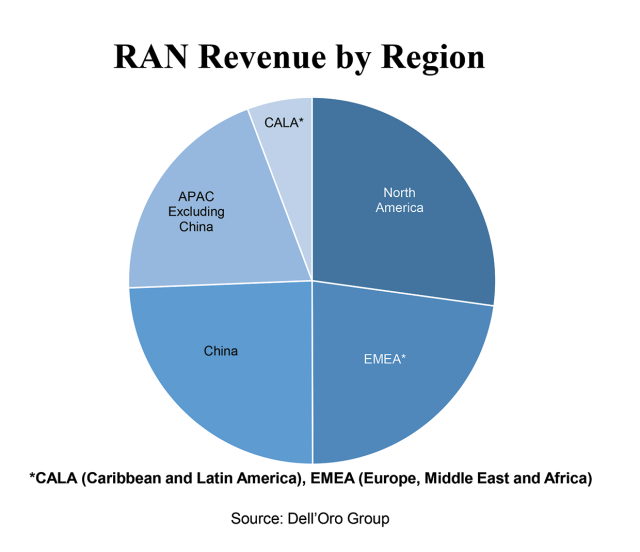

Regional developments were mixed, underpinned by strong growth in North America and CALA, which was enough to offset more challenging conditions in EMEA and the Asia Pacific. With China growing around 4%, we estimate global telecom equipment revenues excluding China increase around 3% in 2022.

From a technology perspective, there is a bit of capex shift now underway between wireless and wireline. Multiple indicators suggest Broadband Access revenues surged in 2022, however, this double-digit growth was offset by stable or low-single-digit growth across the other five segments (Microwave Transport, Mobile Core Network, Optical Transport, RAN, SP Router & Switch).

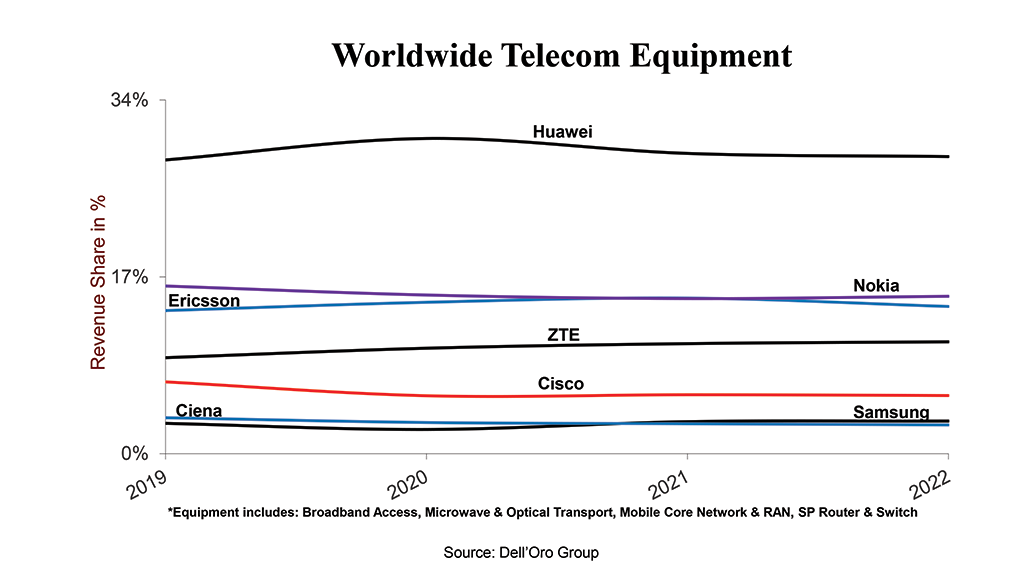

Vendor dynamics were relatively stable between 2021 and 2022, with the top 7 suppliers (Huawei, Ericsson, Nokia, ZTE, Cisco, Ciena and Samsung) driving around 80% of the overall market. Despite on-going efforts by the US government to limit Huawei’s TAM and access to the latest silicon, our assessment is that Huawei still leads the global telecom equipment market, in part because Huawei remains the #1 supplier in five out of the six telecom segments we track. At the same time, Huawei has lost some ground outside of China. Still, Nokia, Ericsson, and Huawei were the top 3 suppliers outside of China in 2022, accounting for around 20%, 18%, and 18% of the market, respectively.

Editor’s Note:

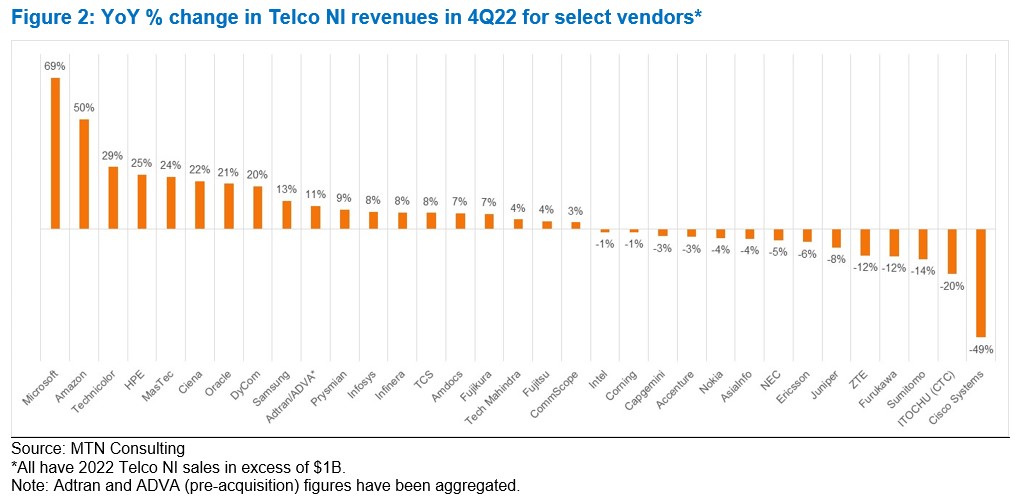

MTN Consulting recently noted that network spending was starting to flatten in the telco segment. In 3Q22, telco capex dipped 5% YoY, the first decline since 4Q20. The vendor market also weakened in 3Q22, as Telco Network Infrastructure (NI) vendor revenues grew just 2% after seven straight quarters of much stronger growth. Now we have a solid set of preliminary results for 2022’s final three months, 4Q22. For the 105 vendors available, Telco NI revenues fell by 1% YoY in 4Q22; this is the first decline for this group of Telco NI vendors since 2Q20, when COVID shut down economies. For CY2022, Telco NI grew just 2% YoY, down from +9% in 2021, when telcos splurged post-COVID, and the 5G RAN market saw a nice run-up. Among the larger reporting vendors, the best 4Q22 Telco NI growth was recorded at the three cloud providers (AWS, Azure, and GCP); engineering services companies Dycom and MasTec; NEPs Calix, Ciena, Samsung, and Technicolor (now Vantiva). New vendor Rakuten Symphony recorded the best overall growth rate in 4Q-2022, with revenues of $180M up 193% YoY. On the other side, Cisco, Ericsson, and ZTE saw the worst declines in 4Q-2022, due in part to a downswing in spending among their largest customers.

For the overall market, some of the decline seen in 4Q-2022 was inevitable, as telcos slow down their initial 5G network buildouts. Other negatives include higher interest rates, higher energy costs, weak economic growth, cloud alternatives to network builds, and 5G’s inability to deliver services revenue growth. Revenue guidance for 2023 from key vendors suggests a flat to slightly down market, as telcos absorb capacity and continue to wrestle with these challenges. Capex guidance from telcos is consistent.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Following five consecutive years of growth, the Dell’Oro Group believes there is more room left in the tank. Collectively the analyst team is forecasting the overall telecom equipment market to increase 1% in 2023 and record a sixth consecutive year of growth. Risks are broadly balanced and the analysts will continue to monitor the 5G rollouts in India, capex cuts in the US, and 5G slowdown in China (preliminary data by MIIT suggest new 5G BTS volumes will drop by a third in 2023 relative to 2022), wireless and broadband investments in Europe, forex fluctuations, and inventory optimization.

*Telecommunications Infrastructure programs covered at Dell’Oro Group, include Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch.

References:

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

FCC proposes regulatory framework for space-mobile network operator collaboration

The U.S. Federal Communications Commission (FCC) has proposed a new regulatory framework meant to support collaboration between satellite and wireless terrestrial network operators. In a statement last week, the FCC noted it’s aiming to leverage the growth in space-based services to connect smartphone users in remote, unserved, and underserved areas. The FCC hopes to establish a more transparent process to support supplemental coverage from space.

Numerous such collaborations have launched recently, and the FCC seeks to establish clear and transparent processes to support supplemental coverage from space. Connecting consumers to essential wireless services where no terrestrial mobile service is available can be life-saving in remote locations and can open up innovative opportunities for consumers and businesses.

“We will not be successful in our effort to make … always-on connectivity available to everyone, everywhere if we limit ourselves to using only one technology. We are going to need it all—fiber networks, licensed terrestrial wireless systems, next-generation unlicensed technology, and satellite broadband,” said FCC Chair Jessica Rosenworcel, calling this type of seamless migration among networks the “Single Network Future.” She referenced the availability of emergency SMS service on smartphones via satellite and added, “We are starting to see direct satellite-to-smartphone communication move from sci-fi fantasy to real-world prospect. … For this innovation to have a chance to deliver at scale—and for us to move toward a full Single Network Future with more providers, in more spectrum bands, and a global footprint—regulators will need to develop frameworks that support its development.”

The Notice of Proposed Rulemaking’s suggested framework plans to see satellite operators collaborating with terrestrial service providers while being able to obtain FCC authorization to operate space stations on certain currently licensed, flexible-use spectrums allocated to terrestrial services. According to the FCC, it’s also looking to add a mobile-satellite service allocation on some terrestrial flexible-use bands.

“The FCC proposes allowing authorized non-geostationary orbit satellite operators to apply to access terrestrial spectrum if certain prerequisites are met, including a lease from the terrestrial licensee within a specified geographic area. A satellite operator could then serve a wireless provider’s customers should they need connectivity in remote areas, for example in the middle of the Chihuahuan Desert, Lake Michigan, the 100-Mile Wilderness, or the Uinta Mountains,” said the FCC in its statement.

The FCC will also seek comment on how this framework might best support access to emergency response systems like 911 and Wireless Emergency Alerts when a consumer is connected via supplemental coverage from space. The new proceeding will also seek to build a record on whether the framework can be extended to other bands, locations, and applications that might be supported by such collaborations.

“By providing clear rules, I believe we can kick start more innovation in the space economy while also expanding wireless coverage in remote, unserved, and underserved areas. We can make mobile dead zones a thing of the past. But even better, we have an opportunity to bring our spectrum policies into the future and move past the binary choices between mobile spectrum on the one hand or satellite spectrum on the other. That means we can reshape the airwave access debates of old and develop new ways to get more out of our spectrum resources,” Rosenworcel said.

…………………………………………………………………………………………………………………………………………………………………………………………..

Satellite to smartphone connectivity is expected to be crucial for emergency response systems, with the FCC noting that it is seeking input from the emergency services on how its new framework can best support these services. Companies such as SpaceX, Lynk, and AST SpaceMobile are prominent in this space.

- Apple provides emergency SOS services when it announced its iPhone 14, with the company working with Globalstar to provide satellite connectivity through emergency SOS via satellite.

- T-Mobile linked up with Elon Musk’s SpaceX to provide mobile signal connectivity from space, promising speeds of 2-4Mbps through Starlink satellites and eliminating dead zones, using T-Mobile’s mid-band spectrum.

- A number of telcos have recently penned satellite connectivity agreements with satellite operators including Vodafone, Globe, Zain, and TIM Brazil.

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://docs.fcc.gov/public/attachments/DOC-391794A1.docx

U.S. military sees great potential in space based 5G (which has yet to be standardized)

\

Qualcomm and Iridium launch Snapdragon Satellite for 2-Way Messaging on Android Premium Smartphones

Bullitt Group & Motorola Mobility unveil satellite-to-mobile messaging service device

U.S. military sees great potential in space based 5G (which has yet to be standardized)

Some analyst say that space-based 5G (which has yet to be standardized) will enable enhanced service to cities but also connects remote regions, including areas without traditional mobile service, ships off-shore, through natural disasters and in contested battlefields. Features of 5G from Space might include: connecting massive numbers of Internet of Things (IoT) sensors and devices.

From a March 14, 2023 Congressional Research Service In Focus report, National Security Implications of 5G Mobile Technologies:

5G mobile technologies will increase the speed of data transfer and improve bandwidth over existing fourth generation (4G) technologies, in turn enabling new military and commercial applications. 5G technologies are expected to support interconnected or autonomous devices, such as smart homes, self-driving vehicles, precision agriculture systems, industrial machinery, and advanced robotics. 5G for the military could additionally improve intelligence, surveillance, and reconnaissance (ISR) systems and processing; enable new methods of command and control (C2); and streamline logistics systems for increased efficiency, among other uses. As 5G technologies are developed and deployed, Congress may consider policies for spectrum management and national security, as well as implications for U.S. military operations.

U.S. military leaders are telling the wireless and satellite industries they see great potential in 5G, and they’re asking for standards, open interfaces and simple devices.

“I am excited to see what the next couple of years will bring,” said Brigadier General Steve Butow, space portfolio director at the U.S. Defense Innovation Unit. “It is important to take advantage of technologies produced at scale.” Butow joined Colonel Joseph Roberts, assistant program executive officer, PEO C3T, U.S. Army, on a panel at SATELLITE 2023 entitled “The Role of Space-Based 5G in Military Communications.” Executives from defense contractor Lockheed Martin and satellite giant Hughes were also on the panel.

Roberts said space-based 5G can be a “game changer” because it creates “the opportunity to connect every soldier on the battlefield.” Butow encouraged the wireless industry to “migrate to open architectures.” He said that if the industry adopts open interfaces it will “create an environment where we can do lots of business with you.”

Source: Getty Images

At least one satellite operator is also advocating for open interfaces for the wireless infrastructure industry. Open RAN is a top priority for HughesNet® in its work with Dish Network, explained Rick Lober, VP and GM at Hughes’ government and defense division. “We are pushing that very hard,” he said, adding “I’m not sure everyone is on board.”

Lober added that he hopes users of network infrastructure will take full advantage of open RAN by working with a diverse set of vendors. “If you are going to have a program that is about open standards, do not award it to one company,” he said.

Dawna Morningstar, director, next generation solutions at Lockheed Martin, said industry standards are “the critical underpinning” that enables interoperability and scalability. She said Lockheed Martin is actively engaged with wireless industry standards boards. She highlighted 3GPP Release 17’s (not a standard) inclusion of interoperability with non-terrestrial networks. “We can now have these open solutions for air and space that can integrate seamlessly with the terrestrial networks,” she said. “We can get the intelligence down where it needs to be, and back up and distributed.”

Verizon’s Cory Davis, AVP Public Safety at Frontline, said the military is interested in portable 5G private network solutions. Verizon’s Tactical Humanitarian Operations Response (THOR) 5G on wheels has the capabilities the military wants, Davis said, but the form factor is too big for some use cases. “They want to put THOR in a backpack and take it to the desert,” Davis said.

References:

https://www.lockheedmartin.com/5gfromspace

https://www.fiercewireless.com/tech/ericsson-qualcomm-test-space-based-5g-thales

Gartner: changes in WAN requirements, SD-WAN/SASE assumptions and magic quadrant for network services

Global network service providers are responding to clients’ transformational WAN requirements to support greater agility and reliability for digital business initiatives. In its review and analysis of global network services providers, Gartner makes the following assumptions:

-

By 2025, 50% of new software-defined WAN (SD-WAN) purchases will be part of a single-vendor secure access service edge (SASE) offering, which is a major increase from 10% in 2022.

-

By the end of 2025, at least 30% of enterprises will employ software-defined cloud interconnect (SDCI) services to connect to public communication service providers (CSPs), which is an increase from approximately 10% in 2020.

-

By 2026, 70% of enterprises will have implemented software-defined wide-area networks (SD-WANs), compared with approximately 45% in 2021.

-

By 2026, 45% of the enterprise locations will use only internet services for their WAN connectivity.

-

Growing interest in services like managed SD-WAN and SASE are transforming the enterprise networking market. These are additional ways, rapidly deployed, that organizations can help improve the agility of providers’ network solutions and differentiate themselves to the enterprise audience.

-

Enhancements to flexible networking technologies, such as NoD and bring your own (BYO) access, offer greater support for self-service. They also offer the rapid accommodation of new endpoints and new applications (including cloud services and the Internet of Things [IoT]) while controlling the organization’s WAN expenditure.

-

Flexible sourcing approaches, such as network as a service (NaaS), are gaining interest, although offers are still emerging and should be closely examined against alternatives.

-

The growing use of internet services for WAN transport remains strong and has forced providers to reevaluate their own internet service offerings as well as the extent they partner to peer with local ISPs for greater geographic reach and differentiation.

-

Gartner has also observed an increased demand for Ethernet and wavelength services to effectively address regional requirements for data center connectivity and very high bandwidth circuits, which are integral to the hybrid solution.

Leader in this global Magic Quadrant for network services include: NTT, AT&T, Orange Business Services, Tata Communications, Vodafone, BT and Verizon.

Figure 1: Magic Quadrant for Network Services, Global

Source: Gartner (February 2023)

Some enterprises are moving to internet services for cost reasons as outdated WAN equipment requires the replacement of traditional branch routers, according to Gartner Analyst Danielle Young. Legacy equipment is often being replaced with SD-WAN appliances and solutions, which Young said is “causing a relook at the WAN overall.”

“SD-WAN provides dynamic path selection based on business or application policy, centralized policy and management of appliances, virtual private network, and zero-touch configuration,” she told SDxCentral.

SD-WAN products are WAN transport- and carrier-agnostic, and notably can create secure paths across all WAN connections, including private, public, and wireless. SD-WAN products can also be hardware- or software-based and either managed directly by enterprises or embedded in a managed service offering, Young noted.

“Most often, enterprises are migrating from private networks to create hybrid networks, which utilize a range of connectivity options depending on bandwidth, reliability, and necessity, including using more readily available internet services,” she said. “Security will need to be addressed regardless of WAN connectivity (private or internet-based); and can be addressed through a variety of different approaches.”

………………………………………………………………………………………………………………………………………………………………………

Market Overview:

Gartner forecasts that the market for enterprise fixed data networking services in 2023 will be nearly $134 billion, an increase of approximately 2.6% from 2022 for a compound annual growth rate (CAGR) of 1.9% from 2021 through 2026. The number of global NSPs included in this research has decreased, and many more are operating in the broader market and did not meet all our inclusion criteria. In addition to large global providers, enterprises are increasingly willing to consider smaller or regional providers, including managed service providers, with little or no network infrastructure of their own, but who resell network services to their enterprise clients where needed.

Network Transport (“Underlay”) Trends:

WAN transport services (frequently called “underlay” services) continue to see rapid change, especially in terms of migrations and changes to primary connectivity. MPLS — the mainstay of enterprise networks for over two decades — is being augmented and often displaced by internet (transport) services. And while MPLS still brings benefits in terms of high availability and stable performance, it commands a slight premium in price to standard internet services. MPLS is still preferred as the primary link for the most critical locations and in places where internet performance is poor or variable, which includes emerging markets and those where the internet is heavily restricted, resulting in poor performance. The net result is a smaller number of higher-capacity MPLS lines being retained or deployed in new network designs.

Gartner has witnessed that many enterprises using a hybrid of internet and MPLS usually have more and larger internet lines than MPLS lines. Direct internet connectivity allows direct access to SaaS and general internet traffic and offers a wider variety of access types than MPLS, including dedicated internet access (DIA) over Ethernet, as well as broadband and cellular. DIA lines are typically priced similarly to MPLS lines of comparable capability, but can easily be sourced from multiple providers, while MPLS links generally need to be sourced from a single provider.

For global network deployments, traversing the internet brings additional challenges not found in national networks, including the risk of suboptimal routing and congestion as the traffic traverses multiple ISPs. There are a number of ways of overcoming this, including:

-

Sourcing all internet services from a single provider

-

Federations of ISPs that offer controlled routing among their members

-

Network-based SD-WAN gateways terminating the SD-WAN tunnels and passing the traffic over the provider’s backbone

-

Enhanced internet services that control routing in a way that is agnostic to ISPs and specific SD-WAN technology

Different providers have adopted different approaches from these options and may have multiple options available. Providers who have developed a differentiated internet approach include BT, Deutsche Telekom, NTT, Tata Communications and Vodafone.

Enterprises’ pace of adoption of cloud IT service delivery remains key to transforming their WAN architectures. Fortunately for enterprises, global NSPs have deployed a range of capabilities to address enterprises’ cloud connectivity needs (see How to Optimize Network Connectivity Into Public Cloud Providers The providers in this Magic Quadrant all offer CBCI service directly from their MPLS and Ethernet networks to the top three leading cloud service providers at a minimum. The key differentiators are with the connected specific cloud providers and cities, and the ability to add virtualized services (such as security) into the cloud connection points.

These CBCI services typically allow for the adjustment of capacity — and in some cases, the addition of new cloud endpoints — on demand under portal and/or API control. Such on-demand services may also be extended beyond cloud connectivity to larger enterprise locations and even used for the creation of extranet connections between enterprises. These “network on demand” services typically support bandwidth changes and policy modifications and allow multiple services such as internet and MPLS to be provisioned over a single access line and adjusted as required.

Access Technology Trends:

Traditional leased-line access, such as T1 or E1 lines, to internet services or MPLS are no longer proposed in new deals, except in very rare instances, such as in rural locations or some emerging markets. Pricing for these legacy service types is increasing, and in many cases, the services are reaching the end of their life (see Quick Answer Quick Answer: My Legacy Telecom Service Is Being Shut Down, So What Should I Do?) thereby forcing enterprises to be proactive in identifying new services and potentially new providers.

These legacy access lines have largely been replaced by optical Ethernet access to MPLS and internet, at 10 Mbps, 100 Mbps, 1 gigabit per second (Gbps) or 10 Gbps. The economics of Ethernet access remain attractive, resulting in a tenfold increase in speed, but typically increasing cost by only two to three times. In fact, in developed markets, enterprises now tend to purchase access lines with much higher speeds than they initially require, with the port capacity limited to their current needs. This allows them to easily and quickly upgrade capacity in response to changing requirements.

For smaller, less critical or remote locations, broadband (increasingly, “superfast broadband,” such as VDSL, cable modem or passive optical network [PON]) is the access technology of choice, despite having no SLAs or poorer SLAs than Ethernet access. In some geographies, including the U.S., internet providers have also introduced new access options labeled “business broadband” that offer only incremental SLA improvements compared with consumer offerings. When enterprises require large numbers of broadband connections, they can sometimes find that they are able to get better pricing than that offered by global service providers by sourcing broadband access directly or from aggregators. Many providers now support “bring your own broadband,” which refers to the service provider delivering managed services over broadband sourced by the enterprise.

Gartner is also seeing a renewed and growing demand for Ethernet WAN and wavelength services, in addition to the hybrid network needs. These services have started to regain traction as opportunities to meet very large bandwidth needs (100G) and be utilized more efficiently in a regional or metro environment to support local data centers. Although custom priced, overall pricing continues to decline as the supply of the underlying facilities are more readily available.

Finally, cellular connectivity (4G and emerging 5G) increasingly is being used for backup, rapid deployment or temporary locations, although it does not typically offer network performance or availability SLAs. As with broadband, enterprises may be able to get attractive deals for data-only mobile services themselves, which will then be managed by their global provider.

Network Overlay Trends:

New global network proposals are almost exclusively based on managed SD-WAN services with either a hybrid mix on MPLS and internet or all-internet-based underlay links. The global network providers have most commonly developed a portfolio of three to six SD-WAN vendors because the market is more fragmented and differentiated than the legacy CPE market it is replacing. In fact, Gartner believes that providers should support at least two SD-WAN vendors, offer strong integration and demonstrate a strong customer base. Providers that support a large number of SD-WAN vendors (10-plus) but have limited integration and fewer customers could present higher risks to the enterprise.

Some providers offer network-based SD-WAN gateways, allowing for easier migration to SD-WAN and improved scalability. Such gateways allow the network to use the internet for access and use the providers’ higher-quality backbones for the long haul, greatly improving reliability and performance. A similar outcome can be achieved by using stand-alone enhanced internet backbone services on ISP federations.

Managed SD-WAN services typically offer the option of local internet access (split tunneling) from every site, which is especially useful for access to SaaS applications, such as Microsoft Office 365. Perimeter security can be provided on-site or as a cloud-based service and is increasingly integrated into the WAN design that Gartner calls the secure access service edge (SASE).

An increasing number of global WANs incorporate managed application visibility, with some providers now offering application-level visibility by default. SD-WAN services, which operate based on application-level policies, also typically offer inherently higher levels of application visibility. WAN optimization is still deployed for some specific use cases where bandwidth is either limited (e.g., very small aperture terminal [VSAT]) or expensive (e.g., the Persian Gulf region).

Network functions such as edge routing, SD-WAN, security, WAN optimization and visibility can be delivered as on-site appliances. However, many providers prefer a uCPE VNF approach versus POP VNFs to support greater geographic breadth to the enterprise. Whether VNFs are running in NFV service nodes in the provider’s POPs or via on-premises uCPEs, which are essentially industry-standard servers deployed at the customers’ locations, either approach can support one or more virtual functions. This makes it easy to rapidly change the functions deployed in the network, which are also usually consumed as-a-service with a monthly subscription fee for each function. Some providers allow customers to run their own software, including edge compute applications, on these platforms. Ideally, a provider will offer both options to the enterprise.

All providers evaluated in this Magic Quadrant offer uCPE. The average number of unique uCPE vendors per provider remained the same at 2.6, and the average number of unique CPE-based VNF functions (typically consisting of SD-WAN, router, firewall and WAN optimization) has increased to 6.2. Many providers have added more vendors to a VNF, especially in the case of security. The average number of countries where uCPE and premises-based VNFs are offered is 144. In contrast, network-based VNFs are available in a much smaller number of countries (34 on average), although the number of average unique VNFs is similar to uCPE-based functions (5.9).

The network service providers are continuing to roll out managed SASE offerings as either best-of-breed dual vendor or single-vendor SASE solutions. This can eliminate the need to service chain and orchestrate SD-WAN functionality and several network security functions, thereby simplifying management and, often, offering better overall performance due to less complexity.

Automation and Operational Trends:

Global networks are also becoming more complex because transport is becoming a hybrid of MPLS and internet with cloud endpoints and a variety of backbone options. SD-WAN and NFV technologies add even more complexity. In addition, the internet, especially using broadband or cellular access, is an inherently less predictable service than MPLS. Visibility capabilities — sometimes referred to as performance analytics — can help by enabling enterprises to see the actual performance of their applications. Enhancements continue around performance reporting tools and portals, enabling the enterprise with improved visibility at the network application layers. And with a focus on continuing to enhance the customer experience, customer satisfaction with global NSPs is improving.

NSPs remain focused on improving their lead times, although they remain constrained by the lead times of third-party/local access providers. The increasing speeds of cellular services are making this technology more useful as a rapid deployment (interim) solution to bridge the gap of waiting for fixed connectivity. In addition, it provides a truly diverse backup option. However, the hype around 5G cellular replacing fixed connectivity should be treated with caution, due to maturity issues — especially lack of SLAs and coverage limitations (see Quick Answer: 3 Questions to Answer Before Buying Enterprise 5G).

Providers continue to improve their SLAs with more realistic objectives and more meaningful penalties for failing to meet those objectives. They are increasingly improving to include the right to cancel the contract in the event of chronic breach, ensure on-time delivery, require proactive notification, and complete timely change requests.

In a new trend Gartner has seen this year, many providers have begun adopting artificial intelligence for IT operations (AIOps) and network automation for service onboarding and customer experience improvements. AI is also being leveraged to simulate issues and provide predictive analytics for service improvement and reduced downtime or service degradation (see CSP Tech Trends for 2022: Implications for Network Infrastructure Providers).

Sourcing Trends:

Providers are increasingly focused on providing the managed network service “overlay” platform typically using SD-WAN, and optionally security (SASE), which can be delivered from cloud-native platforms or (less often) by using NFV/uCPE. The providers are more willing to support “bring your own access” and other flexible sourcing approaches for the “underlay” network transport components.

However, the majority of enterprises still buy most of their underlay services from their overlay provider, especially when using a hybrid underlay — that is, mixing MPLS and internet access. This integrated sourcing approach is the primary focus of this Magic Quadrant. Enterprises focused specifically on enterprise network operations services can consider most of the providers evaluated in this research, and also those in Magic Quadrant for Managed Network Services.

Most global network service providers are continuing to move toward a more platform-based approach using a software-driven, as-a-service model leveraging rich visibility and self-service via portals and APIs. A benefit of this approach is the ability to offer enterprises the opportunity for co-management where they can themselves manage aspects of the network, such as application and security policies, with benefits in terms of enhanced agility.

In addition, newer NaaS offerings offer a simplified consumption model with usage or subscription-based pricing, which may appeal from a sourcing perspective. However, NaaS appeals to only a small subset of enterprise customers that, among other things, don’t want to own hardware, perceive subscription-based pricing as optimal and have variable bandwidth needs (see What Is NaaS, and Should I Adopt It?).

Pricing Trends:

Downward pressure on global network service prices remains steady during the pandemic, and managed services pricing has also remained steady, though it will be carefully watched as the economy fluctuates and the talent crunch remains in play. To address cost containment amid providers’ investment strategies, some are focusing on extending their own networks, especially internet services, while others rely heavily on expanded partnerships with local providers. Most providers are making greater use of carrier-neutral communication hubs, such as those operated by Equinix, to cost-effectively interconnect with multiple access, backbone and cloud providers.

These hubs, particularly when combined with NFV and/or SD-WAN, have dramatically reduced the level of investment required to be competitive in the global network service market. This has allowed smaller providers to offer solutions competitive with those of the largest providers. However, maintaining a consistent set of service features and user experiences across these different elements remains a challenge.

Managed Services Trends:

Most global WANs are delivered on a managed service basis, with the on-site devices, such as routers and security appliances, provided and managed by the service provider. Transport links are usually sourced from the managed service provider, but might also be separately sourced by the enterprise, which would then give the managed service provider operational responsibility for them. The U.S. is different because, although a substantial fraction of U.S.-headquartered multinationals do use managed network services, a significant number still manage their networks in-house and only source the network underlay from their global providers.

At the same time, networks are moving more to a co-managed reality because more network functions — such as SD-WAN application policies, security policies and NoD bandwidth — are controllable by the enterprise via the providers’ portals and APIs. In this case, responsibilities for various network management functions are divided between the provider and the enterprise. This is especially true when network perimeter security functions are integrated into the SD-WAN solution (SASE), where a separate organization will often control the security policies and actions.

References:

Magic Quadrant for Network Services, Global, Published 22 February 2023 – ID G00766979 (Gartner subscription required to access)

https://www.sdxcentral.com/articles/is-the-future-of-wan-connectivity-internet-first/2023/03/

AWS and OneWeb agreement to combine satellite connectivity with cloud and edge computing

Amazon Web Services (AWS) has signed an agreement this week with LEO satellite internet provider OneWeb to explore potential horizontal and vertical use cases that arise from bundling satellite connectivity with cloud and edge compute resources.

The objective is to develop a satellite constellation management solution as a service, making it available to both corporate clients and those already working in the space sector. OneWeb and AWS will work closely together on four key initiatives:

• Business Continuity: Bundling connectivity with cloud services and edge computing services, delivering continuity and resiliency through an integrated infrastructure backed by the LEO constellation.

• Virtualization of Mission Operations: Supporting virtual mission operations for customers through integrated and customizable solutions.

• Space Data Analytics: Aggregating and fusing new levels of predictive and trending big data analytics through data lakes to support space and ground operations.

• User Terminals & Edge Integration: Deploying seamless cloud to edge solutions with a LEO connected user terminal.

Image Credit: OneWeb

“We are incredibly excited to begin working with AWS to see cloud services extended even closer to the edge thanks to OneWeb’s network. This global agreement will change the market dynamics, with OneWeb’s high-speed, low-latency services powering connectivity that will enable customers to reach even the most remote edges of the world and everywhere in between,” said Maurizio Vanotti, VP for new markets at OneWeb, in a statement.

“We are excited to work with OneWeb in their efforts to provide cloud-based connectivity and deliver innovative services to customers worldwide. AWS is committed to helping customers reimagine space systems, accelerate innovation, and turn data into useful insights quickly. We look forward to working with OneWeb in their efforts to push the edge closer to where their customers need it most,” added Clint Crosier, director of aerospace and satellite solutions at AWS.

The agreement serves to highlight the importance of seamless connectivity to enterprise applications and data from just about anywhere. It also underscores just how far behind Amazon is with its own satellite strategy, Project Kuiper.

Its aim is to launch 1,500 LEO satellites over the next five years, increasing to precisely 3,236 over the longer term. So far though, it has launched zero. Amazon was due to launch a couple of prototypes late last year, but a last-minute change of rocket company pushed everything back. It was also waiting on the US Federal Communications Commission (FCC) to approve its ‘orbital debris mitigation plan’, which it eventually got in February.

Amazon’s new launch partner, United Launch Alliance (ULA), plans to include those two Kuiper prototypes on the inaugural flight of its brand new Vulcan Centaur rocket, but lift-off won’t take place until 4 May (May the fourth – geddit?) at the earliest.

This is a fairly long-winded way of saying Amazon is still a long way off from offering commercial LEO satellite broadband and cloud services via its own network, and so this OneWeb deal should give it some valuable real-world experience until its own constellation is ready.

This announcement is the latest effort by OneWeb in its mission to bridge the digital divide and bolster innovation through industry collaboration with best-in-class service providers, serving customers from government, telecommunications, airline, and shipping industries.

Meanwhile, AWS and OneWeb will need to have cloud security high on their mutual agenda, judging by some recent rumblings from the U.S. According to a Politico report last week, the White House plans to draw up cloud security regulations designed to prevent hackers from attacking cloud infrastructure. It will also roll out rules that aim to make it harder for foreign hackers to use US-based cloud providers as a staging point from which to conduct attacks.

With so many government bodies and private enterprises becoming increasingly reliant on public cloud for hosting their data and applications, the underlying infrastructure makes for a juicy target. The fear is that a successful attack could cause widespread disruption if important clients like hospitals and ports are suddenly and unexpectedly cut off.

“In the United States, we don’t have a national regulator for cloud. We don’t have a Ministry of Communication. We don’t have anybody who would step up and say, ‘it’s our job to regulate cloud providers,’” said Rob Knake, the deputy national cyber director for strategy and budget, in the Politico report, adding that this needs to change.

While the White House cracks on with working out how to regulate cloud security, it is also pushing ahead with implementing rules drawn up by the previous administration. The Trump-era executive order will impose ‘Know Your Customer’ (KYC) rules on cloud providers in an effort to stop foreign hackers from using US cloud infrastructure as a platform for their attacks.

References:

https://oneweb.net/resources/oneweb-announces-global-agreement-aws

https://telecoms.com/520618/oneweb-bags-aws-deal-as-cloud-security-comes-under-scrutiny/

China seeks to control Asian subsea cable systems; SJC2 delayed, Apricot and Echo avoid South China Sea

Several offshore Asian subsea cable systems have been delayed and, in some cases, re-routed because of Chinese efforts to exert control over them. The Financial Times (paywall) reported Tuesday:

China has begun to impede projects to lay and maintain subsea internet cables through the South China Sea, as Beijing seeks to exert more control over the infrastructure transmitting the world’s data.long delays in approvals permitting and stricter Chinese requirements” have driven cable builders to design routes that avoid the South China Sea.

Long approval delays and stricter Chinese requirements, including permits for work conducted outside its internationally recognised territorial waters, have pushed companies to design routes that avoid the South China Sea, according to multiple sources inside the industry.

China has asserted the right to approve cable construction outside its 12-mile exclusive zone, applying its ‘nine dash-line‘ claim that covers almost the entire sea and has been rejected by all its neighbors.

One of the most prominent projects affected is the 10,500 km Singapore-Japan Cable 2 (SJC2), which has been delayed by more than a year because of Chinese objections and lengthy permit issues – despite the fact that China Mobile International is a consortium partner.

Two new cables being built from Singapore to the U.S. via Japan have been redesigned to avoid the South China Sea by circling around Indonesia. The Apricot cable system, backed by Google, Facebook and several Asian telcos, and the Google- and Facebook-invested Echo, are being built on new paths that are much more expensive design because of the additional length and the need for extra sheathing in the shallower waters.

- Apricot subsea cable system is a 12,000-kilometer subsea cable connecting Japan, Taiwan, Guam, the Philippines, and Singapore. NTT is responsible for operating and managing three cable landing stations for the Apricot cable system: Minamiboso CLS in Japan, Tuas CLS in Singapore and a cable landing station in Indonesia. PLDT will build new cable landing stations in Luzon and Mindanao as part of the Apricot cable system.

- Echo will run from Eureka, California to Singapore, with a stop-over in Guam, with plans to also land in Indonesia. It will be the first-ever cable to directly connect the U.S. to Singapore with direct fiber pairs over an express route. It will decrease latency for users connecting to applications running the Google Cloud Platform (GCP) regions in the area, home to some of the world’s most vibrant financial and technology centers.

‘Nine-dash-line’ used by China to show the maximum extent of its claimed territorial waters:

……………………………………………………………………………………………………………………………………………………………….

References:

https://www.ft.com/content/89bc954d-64ed-4d80-bb8f-9f1852ec4eb1

https://www.submarinenetworks.com/en/systems/intra-asia/apricot

https://cloud.google.com/blog/products/infrastructure/introducing-the-echo-subsea-cable

Echo and Bifrost: Facebook’s new subsea cables between Asia-Pacific and North America

New Southeast Asia-Japan 2 Cable to Link 9 Asian Countries

DoJ: Google to operate undersea cable connecting U.S. and Asia

New Southeast Asia-Japan 2 Cable to Link 9 Asian Countries

Google Expands Cloud Network Infrastructure via 3 New Undersea Cables & 5 New Regions

Sabotage or Accident: Was Russia or a fishing trawler responsible for Shetland Island cable cut?

PwC report on Monetizing 5G should be a wake up call to network operators!

A PwC report titled, “The challenge of monetizing 5G,” states that capital expenditures and operating expenses will likely be very high with the deployment of 5G standalone networks and their fully virtualized, cloud-native architectures. Yet returns have been anemic across all generations, ranging from 1.5% to 4.5% of return on assets.

PwC’s 26th Annual Global CEO Survey found that 46% of telco CEOs believe that if their companies continue on their current paths, their businesses would not be economically viable in 10 years.

Source: PwC

As 5G becomes an everyday reality for both investors and consumers, carriers are going to face increasing pressure on two fronts:

1. Improve return on assets

As capital markets and stakeholders begin to focus on investment returns in a high-inflation environment, there will be growing scrutiny on telcos and wireless carriers, especially in comparison to other capital-intensive investment opportunities. An exemplar cloud services provider (CSP) has demonstrated ROA of 17% to 20%+ over the past five years, which compares to the 2% to 3% ROA range of MNOs. The ROA of MNOs approximates that of regulated entities like utilities, which explains investor angst.

2. Deliver on demanding service-level agreements to support 5G “killer apps,” such as metaverse applications (really?)

Improving ROA is intrinsically tied to successfully managing the costs and revenues of 5G applications. Many operators face a growing clamor from application providers and up-stack players to create “metaverse-capable networks,” without much clarity on how application revenue will be shared with them. Network operators risk becoming trapped in a “give more, get less” scenario of providing pure-play connectivity, while up-stack companies monetize the 5G applications.

……………………………………………………………………………………………………………………………………………………………………

For those who believe 5G FWA is the way to monetize 5G, PwC warned that’s not likely. The market research firm’s analysis showed FWA services could cost more than 22-times as much as mobile connectivity services. That’s due to costs associated with delivering data tied to specific latency or QoS service-level agreements (SLAs). Immersive and augmented experiences — such as virtual-reality apps, mobile metaverse and gaming — could cost three to four times as much. Network costs related to the Internet of Things (IoT) are even more challenging to estimate and track, primarily because of the extremely wide range of connected devices and applications available.

The report also found that FWA services could have up to 40-times less revenue potential. This is due to FWA services being price limited by competing fiber or cable internet options.

“Most FWA subscribers are willing to pay only as much as wireline plans cost, yet they expect a similar quality of service for internet connectivity,” the report notes.

PwC Partner Dan Hays explained during an interview with SDx Central at the MWC Barcelona 2023 event that operators should approach FWA and other alternative 5G connection services like IoT with reasonable financial and operational expectations. “Fixed-wireless access is a great way to fill out excess capacity, if you have it,” Hays said. “You see some of the carriers making that play.”

“It’s not a cure all by any means,” Hays said, explaining, “we look at it as not a business model but really a technology. It’s a technology choice that you can use.”

Hays said that operators are indeed being “really thoughtful” in managing capacity to serve FWA customers, but that can potentially run into a problem down the road where a particular site can no longer support a high-bandwidth FWA connection. “Do they fire you as a customer at some point,” he said.

In conclusion, PwC states:

Carriers will be increasingly challenged to demonstrate better returns on invested capital for massive 5G capital outlays, while simultaneously meeting the demanding service-level agreements of future 5G applications. Network costs are likely higher — and revenue potential is likely lower — than carriers understand for these applications. Critical strategies for improving ROA and monetizing 5G successfully involve accurately valuing network features, quantifying network costs and communicating them to all stakeholders, as well as improving 5G offer management, pricing and service evolution.

References:

https://www.pwc.com/us/en/tech-effect/emerging-tech/5g-monetization.html

TM and ZTE Malaysia to develop next-gen hybrid cloud 5G core network

Telekom Malaysia Berhad (TM) and ZTE have entered into a new strategic partnership to build out a hybrid cloud 5G core network in Malaysia which is designed for future technologies and will lead the way for next-generation networks. It’s a three year strategic partnership and the hybrid cloud aspect is part of a plan to ‘foster innovation and advancement of state-of-the-art technologies’ for TM’s 5G Core project, which includes bare metal containers, SDN-based architecture, hardware acceleration, CUPS, and 3-layer decoupling.

As well as generally improving network bandwidth and speed in Malaysia, it’s also pitched as a means to which TM can provide new connectivity services to healthcare, finance, transportation, and education, develop smart city and IoT applications, and it is ‘anticipated to revolutionize Malaysia’s telecommunications industry.

The integration of this converged network will strengthen TM’s capabilities to provide seamless connectivity and exceptional network performance, serving a diverse range of industries, including healthcare, finance, transportation, and education. Additionally, the hybrid cloud 5G core network will aid in the growth of smart cities, Internet of Things (IoT), and other next-generation technologies that necessitate rapid, low-latency connectivity.

This collaboration marks a significant achievement in the advancement of 5G technology in Malaysia, with the novel hybrid cloud 5G core network anticipated to revolutionize Malaysia’s telecommunications industry. With the deployment of these sophisticated technologies, customers will gain unparalleled user experience, while also improving the network’s dependability, safety, and efficiency.

Source: Jordi Boixareu/Alamy Live News

“TM is pleased to partner ZTE in building a hybrid cloud 5G core network that is designed to meet the rising needs for future technologies,” said Jasmine Lee Sze Inn, TM’s Executive Vice President for Mobile. “This strategic partnership will transform 5G-enabled networks to deliver innovative solutions and services through our state-of-the-art network and infrastructure, and enable seamless connectivity and exceptional network performance.”

Steven Ge, ZTE Malaysia’s Chief Executive Officer added: “We’re excited to strengthen our partnership with TM through the development of a hybrid cloud 5G core network. This will accelerate the launch of 5G network across Malaysia, which will bring forth new innovation into the market. As a global leading provider of information and communication technology solutions, we are confident that the advancement of our hybrid cloud 5G core network will be the model for future networks. ZTE is committed in this collaboration that will put Malaysia as one of the leading countries in the region to roll-out its 5G network.”

It’s broadly the same pitch as was delivered in places where the 5G rollout is more advanced, such as the US and Western Europe. While we don’t appear to be much closer to the utopian vision of smart cities over here, there has been some progress in private 5G networks in enterprise and industry settings – though much the emphasis now is on things like 5G SA and mmWave to bring the initial promises over the line.

East Asian contracts may be increasingly important for ZTE following U.S. led bans on Chinese vendor (Huawei and ZTE) equipment and phones. As a result of sanctions, ZTE has become more reliant on its home market. It increased domestic sales 9.2% last year compared to 3.4% offshore, with the China market now accounting for 69% of the total, up from 64% three years ago.

Chairman Li Zixue said 2022 was the start of ZTE’s “strategic expansion phase.” He said the company had achieved good growth from innovative products including server and storage, 5G industry applications, auto electronics, digital energy and smart home. “We firmly grasped the opportunities presented by the global trend of digitalization and low-carbon green principles,” he said.

The company further ramped up R&D spending. Research outlays rose 14.9%, mostly on 5G-related products, chip, server and storage businesses. R&D spending accounts for 17.6% of revenue, up from 13.8% three years ago, with the research division now totaling 49% of total headcount.

Li added that ZTE would seek opportunities for industrial transformation presented by new energy and digitalized industries. While the external environment would likely become more unpredictable, “the digital economy has grown into an irreversible trend.” He also said ZTE would “persist in an approach of precision and pragmatism in 2023,” targeting domestic opportunities in the digital economy and seeking breakthroughs in large telco customers offshore.

“We will strengthen our corporate resilience and control operating risks to achieve prudent growth,” Li concluded.

References:

https://telecoms.com/520567/tm-and-zte-team-up-on-hybrid-cloud-5g-core-network-in-malaysia/

https://www.lightreading.com/asia/zte-hikes-full-year-earnings-by-19-/d/d-id/783787?

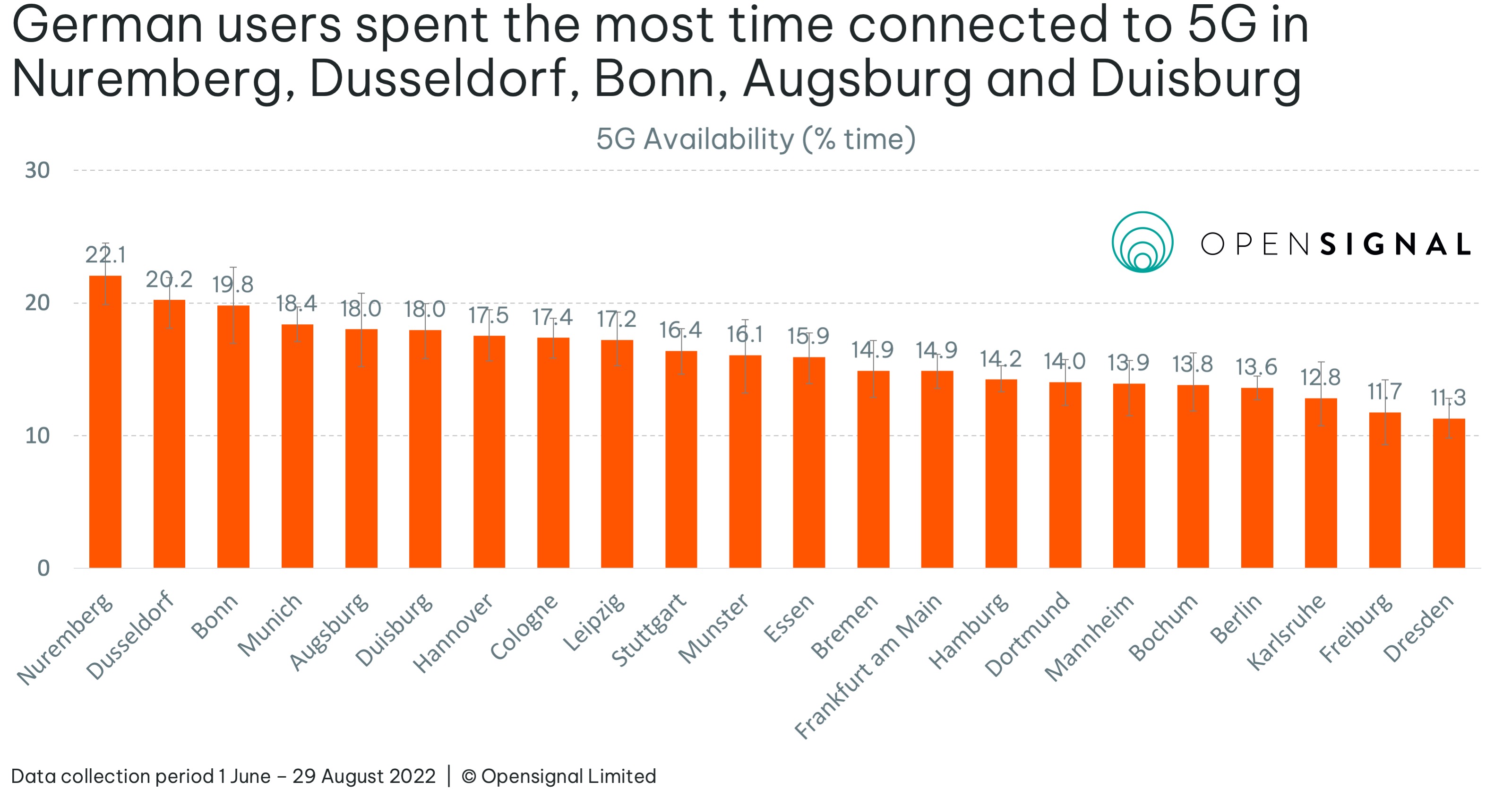

With 85% 5G coverage in Germany; only 40% have used a 5G network

At least half of the population in Germany has never used a 5G mobile network. That is the result of a representative opinion poll published on Saturday by Innofact AG, which was commissioned by comparison portal Verivox. In the survey, 40 percent of people in Germany said they had already used the 5G network once or several times. 49 percent have never been on the 5G network, and 10 percent are not sure. They have either been in the 5G network unknowingly or belong to the group that has not yet transmitted data in a 5G network.

The 5G mobile network is faster than previous network generations (LTE or UMTS). It also has lower latency, which means that the connection responds faster when accessing websites or apps. This plays a role in online gaming, for example. 5G also allows for a greater number of devices to be connected simultaneously. This is important, for example, at major events such as a soccer match, when many fans in the stadium are uploading or watching videos at the same time.

According to the latest statistics from the Federal Network Agency, around 85 percent of Germany is currently covered by 5G networks. In the city states of Berlin, Hamburg and Bremen there is virtually full coverage, while in the territorial states the figures are lower. Baden-Württemberg, Hesse, Rhineland-Palatinate and Thuringia have the lowest rollout rates, at just under 80 percent. Deutsche Telekom recently said its 5G network already reaches 94% of the overall population in Germany. During 2022, Germany’s largest operators have been focusing on the expansion of their 5G networks, with some operators already offering coverage to more than 80% of the country’s population.

The expansion rate also varies among the four 5G network providers. As stated, Deutsche Telekom reported 94 percent household coverage for 5G. Vodafone ‘s 5G household coverage is 80 percent, while Telefónica (O2) is at 75 percent. New entrant 1&1 operates only a few of its own 5G radio masts so far. Large discounter brands such as Aldi Talk, which mainly operate on Telefónica networks, do not yet offer any 5G rates.

“That 5G network usage remains below its potential is no surprise in times of high inflation,” said Jens-Uwe Theumer, Vice President Telecommunications at Verivox. “After all, anyone who wants to surf via 5G needs an appropriate smartphone as well as a 5G-compatible rate plan. Both components are comparatively expensive.” Recently, however, prices for 5G smartphones had dropped sharply. Entry-level models are available from around 200 euros.

The Verivox survey showed no urban-rural divide in 5G usage, although the 5G network is better developed in urban regions than in rural areas. For example, 20 percent of residents of rural communities and smaller towns say they have already been on the 5G network several times – among residents of large cities (100,000 inhabitants or more), the figure is only slightly higher at 25 percent. There is also a small difference in the number of non-users, which is 50 percent in smaller towns and communities and 47 percent in large cities.

However, 5G use declines with increasing age. Young people under 30 say they have already used the 5G network at least once. Among respondents over 70, this figure is only 17 percent. Among respondents aged 50 to 69, 29 percent say they have already surfed via 5G. Across age groups, more than one in four men use the 5G network more often, but only 17 percent of women.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

UAE’s “etisalat by e&” announces first software defined quantum satellite network

Dubai’s etisalat by e& today announced the implementation of the Eutelsat quantum satellite solution, becoming the first telco in the country to expand “5G” network capabilities (NOTE: there are no standards for satellite 5G RAN- only for terrestrial RAN, e.g. ITU-R M.2150 and 3GPP Release 15-17) over a software-defined satellite network.

This deployment was a result of rigorous testing with customers for over a year to rapidly scale up the 5G mobile network deployment. etisalat by e& implemented Eutelsat’s latest technology Quantum satellite with the recently installed state-of-the-art Newtech Dialog Hub enhancing the mobile network capability.

“With the demand for ‘always-on’ connectivity as technologies like IoT, AI and blockchain make a bigger impact on consumer lives, satellite connectivity can empower communities and business in this rapidly evolving digital landscape,” said Khalid Murshed, Chief Technology and Information Officer, etisalat by e& UAE. “With the deployment of this satellite solution and technology, our customers will be able to access their data at 5G speeds even when terrestrial connectivity is unavailable, marking another important step towards the regions’ 5G adoption and bridging the digital divide,” he added.

Image Credit: e&, formerly known as Etisalat Group

………………………………………………………………………………………………………………………………………………………………………

“Eutelsat are proud to partner with etisalat by e& to deploy this 5G use case on the world’s first Software Defined satellite network,” said Ghassan Murat, Head of Connectivity Business Unit for Middle East, Africa and Asia Pacific, Eutelsat. “Our fully steerable beams are capable of meeting the most rigorous demands of Next Generation mobile and satellite networks.”

Oscar Garcia, Business Marketing and Product Innovation, etisalat by e&, said, “The need for connectivity has grown beyond traditional communications with customers wanting to access the highest speeds in the network to meet their requirements and demands for bandwidth-intensive applications such as GSM services, Remote IT, Unified communications, OTT, and media streaming among others.. The testing and implementation of this satellite solution greatly enhances the mobile network capability to address the futuristic development of new age applications while being able to build and deploy 5G use cases for various industry verticals and business.”

References:

https://eand.com/en/etisalat-uae.jsp

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

European Space Agency & UK Space Agency chose EnSilica to develop satellite communications chip for terminals

FCC grants Amazon’s Kuiper license for NGSO satellite constellation for internet services

Bullitt Group & Motorola Mobility unveil satellite-to-mobile messaging service device