AWS, Google, Microsoft, Oracle win $9B DoD cloud computing contract (JWCC)

The U.S. Department of Defense (DoD) finally revealed the awards for its revamped cloud contract “Joint Warfighting Cloud Capability (JWCC),” with Amazon Web Services (AWS), Microsoft, Google and Oracle collectively getting $9 billion to improve the agency’s IT operations. The contracts run through 2028 the Pentagon said in a news release.

JWCC is a multiple-award contract vehicle that will provide the DoD the opportunity to acquire commercial cloud capabilities and services directly from the commercial Cloud Service Providers (CSPs) at the speed of mission, at all classification levels, from headquarters to the tactical edge.

This Indefinite-Delivery, Indefinite-Quantity (IDIQ) contract vehicle offers commercial pricing, or better, and streamlined provisioning of cloud services. With JWCC, warfighters will now have the opportunity to acquire the following capabilities under one contract:

- global accessibility

- available and resilient services

- centralized management and distributed control

- ease of use

- commercial parity

- elastic computing, storage, and network infrastructure

- advanced data analytics

- fortified security

- tactical edge devices

To get started using JWCC or to learn more, visit to contact the Defense Information Systems Agency (DISA) Hosting and Compute Center (HaCC) or to log-in to the JWCC Customer Portal. DISA has developed user-friendly cloud accelerators to make it easier for DOD customers to purchase, provision, and onboard into the cloud.

Photo of the U.S. Pentagon/DoD

The decision to award contracts to four companies was a shift for the Pentagon, three years after it had given a $10 billion cloud-computing contract to Microsoft. That contract, for the Joint Enterprise Defense Infrastructure, known as JEDI, became part of a legal battle over claims that President Donald J. Trump interfered in a process that favored Microsoft over its rival bidder, Amazon. In 2021, the Defense Department said it would not move forward with the Microsoft contract, as it “was developed at a time when the department’s needs were different and our cloud conversancy less mature.”

Instead, the Pentagon said, it would seek bids from multiple technology companies for the Joint Warfighting Cloud Capability. While market research indicated that Microsoft and Amazon would be best positioned to meet the needs, officials said they would also reach out to IBM, Oracle and Google.

“This is the biggest cloud Beltway deal in history and was a key deal to win for all the software vendors in this multiyear soap opera,” Dan Ives, a tech analyst with Wedbush Securities, said in an email. “It’s good to finally end this chapter and get a cloud deal finally done for the Pentagon after years of a roller coaster,” he added.

An AWS spokesperson said in an email, “We are honored to have been selected for the Joint Warfighting Cloud Capability contract and look forward to continuing our support for the Department of Defense. From the enterprise to the tactical edge, we are ready to deliver industry-leading cloud services to enable the DoD to achieve its critical mission.”

References:

Gartner: SASE tops Gartner list of 6 trends impacting Infrastructure & Operations over next 12 to 18 months

At its IT Infrastructure, Operations & Cloud Strategies Conference this week, Gartner identified six trends anticipated to have a significant impact on infrastructure and operations (I&O) over the next 12 to 18 months. Secure Access Service Edge (SASE) topped the list with Sustainable technology coming in second and Wireless Value Innovation (see below) in third place.

SASE is a single-vendor product that is sold as an integrative service which enables digital transformation. This trend connects and secures users, devices, and locations as they work to access applications from anywhere. Gartner forecasts that total worldwide end-user spending on SASE will reach $9.2 billion in 2023, a 39% increase from 2022. Gartner coined SASE as a technology framework for the convergence of network access and security in cloud-native environments. Earlier this year, Gartner released its first Market Guide for Single-Vendor SASE, revealing to I&O leaders that interest in the framework has exploded since its introduction in 2019 – and particularly toward single-vendor solutions.

Gartner VP Analyst Jeffrey Hewitt attributed the fast adoption of SASE to “the need to secure the access of devices and elements at the edge,” as well as hybrid work and a “relentless shift to cloud computing.” Hewitt noted the primary benefits of the framework are that it allows users to securely connect to applications and improves the efficiency of management. “Hybrid work and the relentless shift to cloud computing has accelerated SASE adoption,” said Hewitt. “SASE allows users to connect to applications in a secure fashion and improves the efficiency of management. I&O teams implementing SASE should prioritize single-vendor solutions (1.) and an integrated approach.”

Note 1. Single-vendor SASE means the selected service provider owns and delivers all the essential SASE components—software-defined WAN (SD-WAN), secure web gateway (SWG), cloud access security broker (CASB), network firewalling, and zero trust network access (ZTNA)—using a cloud-centric architecture, according to Gartner, which created the term SASE. The service is meant to address shortcomings of legacy methods of securing access to enterprise resources.

Source: Lanner

“Leaders are going to be looking at this and saying, we want to implement this,” Hewitt told SDxCentral. “They’re going to be assessing and determining what providers can offer.” I&O teams implementing SASE should prioritize single-vendor solutions, Hewitt added.

Hewitt noted SASE is still an “immature” market and technology framework. “It’s not something that you can just run out and have a large list of vendors – at this point – that you could select from,” he said. While many vendors still can only supply components of SASE, Gartner recognizes nine that offer complete solutions with both networking and Secure Service Edge (SSE) capabilities – Cato Networks, Cisco, Citrix, Forcepoint, Fortinet, Netskope, Palo Alto Networks, Versa Networks, and VMware.

The biggest benefits of a single-vendor solution are improved security posture, administrative simplicity with fewer consoles to manage and troubleshoot, and traffic efficiency due to single-pass encryption and optimal routing decisions instead of needing to integrate between two pieces, Analyst Andrew Lerner told SDxCentral in an earlier interview. Lerner recommended I&O leaders look for single-vendor SASE offerings that provide single-pass scanning, a single unified console, and data lakes covering all functions to improve user experience and staff efficacy.

By 2025, Gartner predicts 65% of enterprises will have consolidated individual SASE components into one or two explicitly partnered SASE vendors, up from 15% in 2021.

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Regarding Wireless Value Innovation, Gartner wrote: I&O can leverage multiple wireless technologies to extend business disruption opportunities beyond connectivity. Overlaps between various technologies including Wi-Fi, 5G, Bluetooth and high frequency (HF) facilitates connectivity solutions and creates innovation opportunities.

Hewitt said, “Wireless value innovation creates a scalable return on wireless investment and makes networks a strategic innovation platform. However, there is significant complexity at play and several new skills that are required to achieve this innovation, such as wireless integration capabilities and wireless tracking implementation experience.”

At its recent IT Symposium/Xpo 2022 Gartner included wireless among in its 10 top strategic technology trends for 2023. In that report, Gartner stated that no single wireless technology will dominate, but enterprises will use a variety of them to support a range of environments, including Wi-Fi in the office, services for mobile devices, low-power protocols, and even radio connectivity, Gartner stated. Gartner predicts that by 2025, 60% of enterprises will be using five or more wireless technologies simultaneously.

“We’re going to see a spectrum of solutions in the enterprise—that includes 4G, 5G, LTE, WIFI 5, 6, 7—all of which will create new data enterprises can use in analytics, and low-power systems will harvest energy directly from the network,” Gartner stated.

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Gartner’s top six trends impacting I&O in 2023:

Trend No. 1: Secure Access Service Edge (SASE)

Trend No. 2: Sustainable Technology

Trend No. 3: Platform Engineering

Trend No. 4: Wireless Value Innovation

Trend No. 5: Industry Cloud Platforms

Trend No. 6: Heated Skills Competition

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.sdxcentral.com/articles/news/sase-tops-gartners-io-trends-for-2023/2022/12/

Secure Access Service Edge – SASE Appliances Enable the Most Agile Edge Security

Dell’Oro: Secure Access Service Edge (SASE) market to hit $13B by 2026; Gartner forecasts $14.7B by 2025; Omdia bullish on security

MEF survey reveals top SD-WAN and SASE challenges

New Findings in Aryaka’s 2022 State of the WAN Report: Cloud Adoption, Hybrid Workplaces, Convergence of Network and Security with SASE

Shift from SDN to SD-WANs to SASE Explained; Network Virtualization’s important role

Enterprises Deploy SD-WAN but Integrated Security Needed

MEF New Standards for SD-WAN Services; SASE Work Program

Bharti Airtel and Meta extend 2Africa Pearls subsea cable system to India

Bharti Airtel (“Airtel”) and Meta Platforms, Inc. (“Meta” – previously Facebook) today announced a collaboration to support the growth of India’s digital ecosystem. Airtel and Meta will jointly invest in global connectivity infrastructure and Communications Platform as a Service (CPaaS) based new-age digital solutions to support the emerging requirements of customers and enterprises in India.

Foundational connectivity infrastructure such as subsea cable systems are crucial for supporting the rising demand for high-speed data and digital services as India prepares to roll out 5G networks later this year. With the constant endeavor to augment the nation’s infrastructure, Airtel will partner with Meta and STC to extend 2Africa Pearls to India.

2Africa is the world’s longest subsea cable system and is expected to provide faster internet connectivity to almost 3 billion people globally. Airtel and Meta will extend the cable to Airtel’s landing station in Mumbai and also pick up dedicated capacity to further strengthen its submarine network portfolio. The 2Africa cable will significantly boost India’s cable capacity and empower global hyper-scalers and businesses to build new integrated solutions and provide a high-quality seamless experience to customers.

Airtel says the 2Africa cable will significantly boost India’s cable capacity and ‘empower global hyper-scalers and businesses to build new integrated solutions and provide a high-quality seamless experience to customers.’

Facebook/Meta announced it was building out a subsea cable extension called 2Africa Pearls last year, and that it would connect Africa, Europe, and Asia. This new bit of cable brings the total length of the 2Africa system to more than 45,000 kms, which is apparently the longest subsea cable system ever deployed. The goal of the wider project is certainly ambitious – with the addition of Pearls we’re told it will provide connectivity to an additional 1.8 billion people – 3 billion in total.

As members of the Telecom Infra Project (TIP) Open RAN project group, Airtel and Meta have been pioneers of Open RAN technologies with the shared goal of increasing ecosystem diversity, driving innovation, and cost-efficiency in connectivity networks. Airtel has signed an agreement to help increase operational efficiency of Open RAN and facilitate energy management and automation in radio networks using advanced analytics and AI/ML models. Airtel is currently conducting trials for 4G and 5G Open RAN solutions on select sites in the state of Haryana and will commercially deploy the solution across several locations in India over the next few quarters. Airtel will share its learnings with wider ecosystem partners within the TIP community, including Meta, to help accelerate the deployment of Open RAN based networks across the world.

Businesses in India are rapidly shifting to cloud-based solutions to serve their customers digitally. Airtel IQ, the world’s first network embedded Communications Platform as a Service (CPaaS) ecosystem, offers cloud communication across voice, messaging and video channels to help enterprises transform their customer engagement and drive profitability by leveraging automation and boosting revenue. Airtel will integrate Meta’s WhatsApp within its CPaaS platform. With this integration, businesses will now be able to use WhatsApp’s rich features and reach to provide an unparalleled omni-channel customer engagement to enterprises.

Vani Venkatesh, CEO – Global Business, Bharti Airtel said: “We, at Airtel, are delighted to deepen our partnership with Meta to serve India’s digitally connected economy by leveraging the technology and infrastructure strengths of both companies. With our contributions to the 2Africa cable and Open RAN, we are investing in crucial and progressive connectivity infrastructure which is needed to support the increasing demand for high-speed data in India. We look forward to working closely with Meta to deliver best-in-class digital experiences to our customers in India.”

Francisco Varela, vice president of mobile partnerships for Meta said: “Subsea cables and open, disaggregated networks continue to play a huge role in the foundational infrastructure needed to support network capacity and fuel innovation. We look forward to continuing our collaboration with Airtel to further advance the region’s connectivity infrastructure that will enable a better network experience for people and businesses across India.”

About Bharti Airtel:

Headquartered in India, Airtel is a global communications solutions provider with over 500 Mn customers in 17 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its networks cover over two billion people. Airtel is India’s largest integrated communications solutions provider and the second largest mobile operator in Africa. Airtel’s retail portfolio includes high speed 4G/5G mobile broadband, Airtel Xstream Fiber that promises speeds up to 1 Gbps with convergence across linear and on-demand entertainment, streaming services spanning music and video, digital payments and financial services. For enterprise customers, Airtel offers a gamut of solutions that includes secure connectivity, cloud and data centre services, cyber security, IoT, Ad Tech and cloud based communication. For more details, visit www.airtel.com

About Meta:

Meta builds technologies that help people connect, find communities, and grow businesses. When Facebook launched in 2004, it changed the way people connect. Apps like Messenger, Instagram and WhatsApp further empowered billions around the world. Now, Meta is moving beyond 2D screens toward immersive experiences like augmented and virtual reality to help build the next evolution in social technology.

References:

Echo and Bifrost: Facebook’s new subsea cables between Asia-Pacific and North America

https://mobile-magazine.com/connectivity/2africa-cable-become-longest-ever-latest-expansion

AWS enabling edge computing, supports mobile & IoT devices, 5G core network and new services

In an AWS re-Invent Leadership session titled “AWS Wherever You Need It,” [1.] Wayne Duso, vice president of engineering and product at AWS, expressed similar goals. “Today, customers want to use AWS services in a growing range of applications, operating wherever they want, whenever they require. And they’re striving to do so to deliver the best possible customer experience they can, regardless of where their customers or users happen to be located. One way AWS helps customers accomplish this is by bringing the AWS value to our regions, to metro areas, to on-premises, and to the furthest and evolving edge.”

Note 1. You can watch the 1 hour “AWS Wherever You Need It” session here (top right).

“We’re helping customers by providing the same experience from cloud to on-prem to the evolving edge, regardless of where your application may need to reside,” Duso explained. “AWS is enabling customers to use the same infrastructure, services and tools to accomplish that. And we do that by providing a continuum of consistent cloud-scale services that allow you to operate seamlessly across this range of environments.”

Duso explained how AWS is enabling edge computing by adding capabilities for mobile and IoT devices. “There are more than 14 billion smart devices in the world today. And it’s often in things we think about, like wristwatches, cameras, cellphones and speakers,” he said.

“But more often, it’s the stuff that you don’t see every day powering industries of all types and for all types of customers.” Duso cited the example of Hilcorp, a leading energy producer, which is using smart devices to monitor the health of its wells, optimize production and proactively predict failures so it can minimize capital expenditures.

With IoT devices becoming common among energy providers, edge computing is on the rise to handle the volume of data these devices generate. “Now, AWS IoT provides a deep and broad set of services and partner solutions to make it really simple to build secure, managed and scalable IoT applications,” Duso added.

Duso pointed to Couchbase as a use case for flexible AWS services: “Couchbase is a non-SQL database company that uses AWS hybrid edge services such as Local Zones, Wavelength, Outposts and the Snow Family to deploy its applications and highly scalable, reliable and performant environments to reduce latency by over 18 percent for its customers.” Each of these AWS managed services enables Couchbase to move data from the edge to the cloud or manage and process it where it’s generated.

“What we built on these AWS compute environments was a highly distributed, managed or self-managed database,” Duso explained. “For the cloud, an internet gateway for accessing that data securely over the web and synchronizing that data down to the edge. And that works across cloud, edge and on the offline, first-compute environments.”

“Our goal is I want to make AWS the best place to run 5G networks. That is the overarching objective. How can I make AWS, whether we are running it in the region, in a Local Zone, on an Outposts, on a Snow device, how do we make it the best place to run a 5G network, and then provide that infrastructure.”

AWS’ 5G network efforts include a cloud architecture that can support an operator’s 5G SA core network and applications, similar to what AWS is doing with greenfield U.S. wireless network operator Dish Network. Sidd Chenumolu, VP of technology development and network services at Dish Network, recently explained that the wireless carrier’s 5G core network was using three of AWS’ four public regions, was deployed in “multiple availability zones and almost all the Local Zones, but most were deployed with Nokia applications across AWS around the country.”

AWS is also working with Verizon to support a part of that carrier’s public MEC system. This includes use of AWS’ Outposts and Wavelengths, the latter of which AWS recently expanded in the United Kingdom with Vodafone.

Hofmeyr continued, “I think you have a spectrum (of different wireless carrier networks), from the total greenfields like what we did with Dish to the large tier-ones. The one thing that’s common across the board is the desire to modernize and become more cloud-like. That is common. Everyone wants that. Each one has a very unique job. There’s not one way that they all are executing in the same way. They’re taking this one workload and then building, so all of them are focusing on different workloads in the network and put it in the cloud.”

In conclusion Hofmeyr said, “I think all over the edge we find these use cases for which purpose-built systems were designed to handle that. And our goal is how do you make that available in the cloud.”

References:

https://reinvent.awsevents.com/leadership-sessions/

https://reinvent.awsevents.com/on-demand/?trk=www.google.com#leadership-sessions

https://www.sdxcentral.com/articles/analysis/aws-wants-to-be-the-best-place-for-5g-edge/2022/12/

https://biztechmagazine.com/article/2022/12/aws-reinvent-2022-harvesting-data-cloud-edge

IDC: Global smartphone market will remain challenged through 1st half of 2023

An updated forecast for the worldwide smartphone market from International Data Corporation (IDC) is showing a more prolonged recovery than previously expected. According to the latest Worldwide Quarterly Mobile Phone Tracker forecast, shipments of smartphones will decline 9.1% in 2022, a reduction of 2.6 percentage points from the previous forecast. As a result, IDC expects smartphone shipment volumes to total 1.24 billion units in 2022. While a recovery of 2.8% is still anticipated in 2023, IDC did reduce its 2023 smartphone forecast by roughly 70 million units, given the ongoing macroeconomic environment and its overall impact on demand.

“We believe the global smartphone market will remain challenged through the first half of 2023, with hopes that recovery will improve around the middle of next year and growth across most regions in the second half,” said Ryan Reith, group vice president with IDC’s Worldwide Mobility and Consumer Device Trackers. “Rising costs are an obvious concern for the smartphone market and adjacent consumer technology categories, but we believe most of this reduced demand will be pushed forward and will support global growth in late 2023 and beyond. A device refresh cycle continues to build in many challenged emerging markets while developed markets have offset rising costs with increased promotional activity, more attractive trade-in offers, and extended financing plans. This has supported growth in the high-end of the market despite the economic headwinds.”

5G continues to build out globally and will account for just over half of smartphones shipped worldwide in 2022, rising to 80% by 2026. In addition, market momentum continues to build around foldable phones. While this category is only about 1-2% of the global market in 2022, it still accounts for roughly 15-16 million smartphones. This number will only grow as costs decrease and more OEMs get behind the form factor transition.

“Despite the market slowdown, average selling prices (ASPs) continue to grow as consumers opt for premium devices that can last three to four years as refresh rates elongate in both developed and emerging markets,” said Anthony Scarsella, research director with IDC’s Worldwide Mobility and Consumer Device Trackers. “Smartphone ASPs are expected to grow for the third consecutive year as average selling prices will reach $413, up 6.4% from $388 in 2021. The last time the market witnessed ASPs surpass $400 was in 2011 ($425), when the market displayed over 60% shipment growth. Moreover, iOS unit share will reach 18.7% (the highest of any forecast year), which is a driving force behind the high ASP growth we currently see in 2022.”

| Worldwide Smartphone Forecast by OS, 2023 and 2026 Shipments, Year-Over-Year Growth, and 5-Year CAGR (shipments in millions) | |||||

| OS | 2023 Shipments | 2023/2022 Growth | 2026 Shipments | 2026/2025 Growth | 5-Year CAGR |

| Android | 1036.9 | 3.1% | 1145.7 | 2.5% | 0.4% |

| iOS | 233.5 | 1.3% | 247.5 | 1.9% | 1.0% |

| Total | 1270.3 | 2.8% | 1393.2 | 2.3% | 0.5% |

| Source: IDC Quarterly Mobile Phone Tracker, December 2nd, 2022 | |||||

IDC previously lowered its 2022 smartphone outlook in June, from an initial expectation of 1.6% growth in the space.

Broadly, the global sale of smartphones this year has been affected by a variety of macroeconomic trends including rising costs. For wireless network operators, that means fewer sales of smartphones and fewer opportunities to gain new customers who might switch providers amid the purchase of a new phone.

The trend could also affect 5G specifically. That’s because consumers globally may be holding onto 4G phones longer in order to avoid the purchase of a costly 5G phone.

IDC’s latest forecast follows similar warnings from other players in the space. For example, Qualcomm last month provided a revenue forecast fully $2 billion below market estimates. Qualcomm supplies core silicon to the likes of Apple, Samsung and others.

At the time, Qualcomm also reduced its projections for global 5G handset sales in 2022 to around 650 million, down from earlier forecasts of up to 750 million units

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Kathy Nagamine at 650-350-6423 or [email protected].

Click here to learn about IDC’s full suite of data products and how you can leverage them to grow your business.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,300 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS49927022

IDC: Global Smartphone Shipments +7.4% in 2021, led by Emerging Markets

Omdia and IDC: Samsung regains lead in global smartphone market

Trendforce: Global Smartphone Market to Reach 1.36 Billion Units in 2021 as Samsung regains #1 position

Counterpoint & Canalys: Global Smartphone Market Shows Signs of Recovery in Q3-2020

LightCounting: 1H-2022 Wireless Infrastructure softness lingered in 3Q-2022

by Stéphane Téral, Chief Analyst at LightCounting Market Research

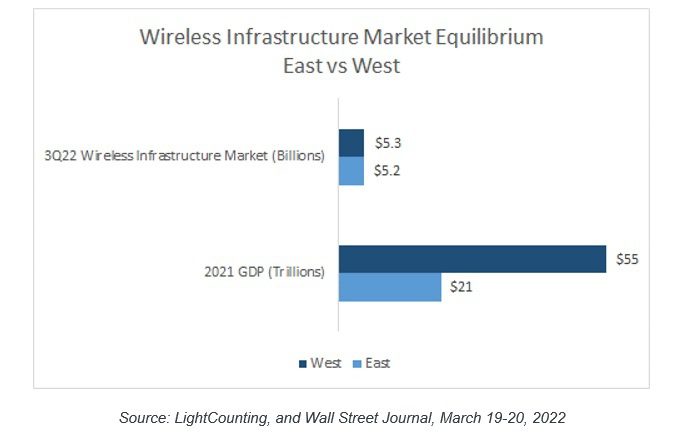

3Q22 was almost a carbon copy of 2Q22, which signals that the 5G-driven wireless infrastructure market is reaching its peak as the first wave of 5G rollouts wane.

Global uncertainties, lingering supply chain constraints, and forex headwinds contributed to another soft 3Q22 that followed an already sluggish 1H22. In the meantime, the wireless infrastructure market continued to operate at its equilibrium reached in 2021: the 2 opposite spheres of influence, the East led by China versus the West defined as the U.S. and its allies, are becoming more balanced.

We found that the West accounted for 50.5% of the global wireless infrastructure market while the East made up for the rest, with China accounting for more than 80% of the East.

| Historical data accounts for sales of the following vendors: | |||

| Vendor | Segments | Source of Information | |

| Affirmed Networks (acquired by Microsoft, April 2020) | vEPC, 5GC | Estimates | |

| Altran | vRAN | Estimates | |

| Altiostar | vRAN (CU, DU) | Estimates | |

| Amdocs | 5GC | Estimates | |

| ASOCS | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Baicell | RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Benetel | Open RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Cisco | EPC, vEPC, 5GC | Survey data and estimates | |

| China Information and Communication Technologies Group (CICT) | RAN | Estimates | |

| Comba Telecom | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| CommScope (acquired Phluido vRAN patents, October 2020) | vRAN (RU, DU) | Estimates | |

| Corning | vRAN | Estimates | |

| Dell | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Enea | 5GC | Estimates | |

| Ericsson | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Estimates | |

| Fairwaves | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Fujitsu | RAN | Survey data and estimates | |

| HPE | 2G/3G core, 5GC | Estimates | |

| Huawei | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| JMA Wireless | vRAN | Estimates | |

| KMW | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Kontron | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Mavenir (acquired ip.access, September 2020) | vEPC, vRAN, 5GC | Survey data and estimates | |

| Metaswitch (acquired by Microsoft, May 2020) | 5GC, vEPC and 2G/3G core | Estimates | |

| Movandi | RAN/vRAN (RU/repeater) | Estimates | |

| MTI Mobile | vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Node-H | vRAN (small cells) | Estimates | |

| Nokia | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| NEC (including Blue Danube) | RAN, vRAN (RU), EPC, 5GC | Survey data and estimates | |

| Oracle | 5GC | Estimates | |

| Parallel Wireless | vRAN (CU, DU) | Estimates | |

| Pivotal | RAN/vRAN (RU/mmWave repeater) | Estimates | |

| Quanta Cloud Technology (QCT) | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Qucell | RAN, vRAN | Estimates | |

| Ribbon Communications | 2G/3G core | Survey data and estimates | |

| Samsung | RAN, vRAN, vEPC, 5GC | Estimates | |

| Silicom | Open RAN (DU) | None, supplies other RAN/vRAN vendors | |

| SuperMicro Computer | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Verana Networks | RAN/vRAN (RU/mmWave) | Estimates | |

| ZTE | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

References:

https://www.lightcounting.com/report/december-2022-wireless-infrastructure-3q22-177

Verizon joins AT&T and T-Mobile in 3G network shutdown

Verizon is the last of the Big 3 wireless carriers in the U.S. to shut down its 3G network and repurpose the spectrum for newer technology. AT&T was first, shutting its 3G network down in February. T-Mobile’s shuttered its 3G network over the summer but probably drew the most attention with the decommissioning of Sprint’s old 3G CDMA network earlier this year because it created such a big impact for Dish Network, its Ting Mobile and Boost Mobile customers.

………………………………………………………………………………………………………………………………….

Personal Note: After T-Mobile shut down Sprint’s 3G network, this author’s Samsung Galaxy A50 phone did not work with T-Mobile’s 4G-LTE network, even though Samsung claims it’s compatible with 4G-LTE. Currently, I don’t have mobile Internet access via Ting/Dish Network/T-Mobile service! I also can’t receive incoming cellular calls which go directly to voice mail even though call forwarding is disabled!

………………………………………………………………………………………………………………………………….

Verizon is telling customers that if they’re still using a 3G CDMA or 4G (non-VoLTE) phone that does not support its newer network technologies, “your line will be suspended without billing and will lose the ability to call, text, or use data.”

initially said it was closing its 3G network in 2019. Then they extended it to the end of 2020 and finally, to the end of 2022. In March 2021, Verizon made it clear they were sticking with the 2022 end date and advised customers still accessing the 3G network that they may experience a degradation or complete loss of service.

Earlier this year, the Alarm Industry Communications Committee (AICC) tried unsuccessfully to get AT&T to delay its 3G network shutdown, citing pandemic-related chip shortages, supply chain issues and labor shortages that meant they couldn’t make necessary upgrades. The group has not made those kinds of demands of Verizon, but AT&T also boasts a larger contingent of alarm connectivity customers.

Schulz said that in addition to migrating 3G devices onto 4G LTE or 5G, Verizon developed migration plans with most of its business customers to ensure any 3G devices they have in vehicles and equipment have been migrated to 4G LTE or 5G.

Verizon sent a letter to customers which states:

“Starting the day before your December 2022 bill cycle begins, if you are a Verizon customer using a 3G CDMA or 4G phone device that does not support our newer network technologies, your line will be suspended without billing and will lose the ability to call, text, or use data.”

Until January 1, 2023, impacted phones will still be able to make 911 emergency calls and calls to Verizon Customer Service (at 611) while the line is suspended, the letter says, adding: “Starting the day before your February 2023 bill cycle begins, any remaining impacted lines that are still suspended without billing will be disconnected.”

For those customers who didn’t get letters or don’t read them, they could be in for a surprise.

References:

https://www.fiercewireless.com/wireless/verizon-tells-3g-customers-upgrade-they-lose-service

Light Counting on Silicon Photonics and Optical Switching at SC22

Silicon photonics continues to progress but is yet to be adopted for high-performance computing and server architectures, according to market research firm Light Counting.

However, the Super Compute 2022 (SC22) conference hosted two silicon photonics firsts:

- Professor Keren Bergman of Columbia University reported a working 5Tbit/s transmitter optical chiplet implemented using 80 channels and 3D packaging. The accompanying receiver chip is working and is being lab-tested.

- Ayar Labs demonstrated its 2Tbit/s TeraPHY chiplet in an end-to-end link, sending and receiving data.

During the panel discussion on high-performance computing and silicon photonics, Intel’s Fabrizio Petrini addressed head-on why optics had such a low profile at the show. “The reality is there is a lot of skepticism about this technology. The adoption is not going to happen anytime soon,” he said.

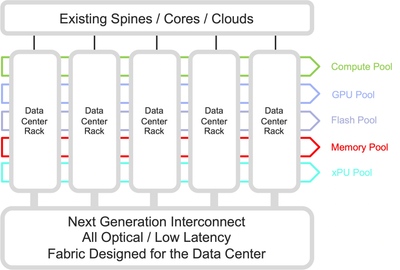

Systems designers don’t see the implications until they embrace this technology. But factors are aligning for change, and a transition point is being approached in how systems are built, he says; the implications for systems and disaggregation are enormous.

Optical switching is another technology that has been on the fringes of the market for decades. It was all the rage from 1998-2001, but then fizzled out as there weren’t any large scale commercial deployments of photonic switches.

LightCounting reported in August that Google had been using photonic circuit switching in its cloud resident data centers for several years. The 136×136 port optical circuit switch is Google’s own design.

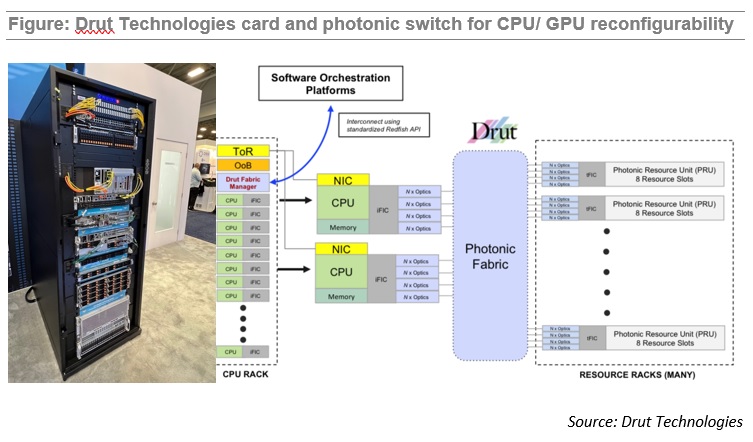

At SC22, a start-up, Drut Technologies, demonstrated its interface card working with a photonic switch at the top of a SuperMicro server rack. The system allows the server’s CPUs to dynamically configure the resources they need (memory, GPUs) tailored for workloads.

Samsung in OpenRAN deal with NTT DOCOMO; unveils 28GHz Radio Unit (RU)

Samsung Electronics announced the company is supplying a variety of 5G radios to support NTT DOCOMO’s Open Radio Access Network (Open RAN) expansion. Samsung will now provide a range of Open RAN-compliant 5G radios covering all of the Time Division Duplex (TDD) spectrum bands held by the operator.

This builds upon the two companies’ 5G agreement previously-announced in March 2021, in which NTT DOCOMO selected Samsung as its 5G network solutions provider. Samsung now adds new radios — including 3.7GHz, 4.5GHz and 28GHz — to its existing 3.4GHz radio support for NTT DOCOMO.

This expanded portfolio from Samsung will enable NTT DOCOMO to leverage its broad range of spectrum across Japan to build a versatile 5G network for diversifying their services offered to consumers and businesses. The companies have also been testing the interoperability of these new radios with basebands from various vendors in NTT DOCOMO’s commercial network environment.

“We have been collaborating with Samsung since the beginning of 5G and through our Open RAN expansion, and we are excited to continue extending our scope of vision together,” said Masafumi Masuda, Vice President and General Manager of the Radio Access Network Development Department at NTT DOCOMO. “Solidifying our global leadership, we will continue to build momentum around our Open RAN innovation and to provide highly scalable and flexible networks to respond quickly to the evolving demands of our customers.”

“Japan is home to one of the world’s most densely populated areas with numerous skyscrapers and complex infrastructure. Samsung’s industry-leading 5G radios portfolio meets the demands of low-footprint, low-weight solutions, while also ensuring reliable service quality,” said Satoshi Iwao, Vice President and Head of Network Division at Samsung Electronics Japan. “As NTT DOCOMO continues to accelerate its Open RAN innovation, we look forward to working together to deliver a richer experience to consumers and generating new business opportunities.”

With this announcement, Samsung introduces its new 28GHz Radio Unit (RU) for the first time — as a new addition to its portfolio of leading mmWave solutions. This RU, which weighs less than 4.5kg (~10lbs), features a light and compact form factor with very low power consumption, enabling flexible deployments in various scenarios. Additionally, Samsung’s 3.4GHz, 3.7GHz and 4.5GHz radios are also Open RAN-compliant and designed to deliver high performance and reliability.

Last month, Samsung won a contract with NTT East to provide cloud-native 5G core and RAN equipment to the provider’s private 5G network platform. That deal followed on an agreement earlier this year for Samsung to power the operator’s private 5G network services in the east areas of Japan, and followed trials of Samsung’s 5G standalone (SA) network core in test environments.

Samsung also secured a deal with Comcast to activate the cable giant’s deep spectrum holdings and become an infrastructure-owning 5G cellular operator targeting market heavyweights Verizon, AT&T, and T-Mobile US. Comcast will use Samsung’s 5G RAN equipment for its Xfinity Mobile service, including a newly developed 5G Strand Small Cell that is designed to be mounted on Comcast’s existing aerial cable lines. This all-in-one piece of equipment is central to the deployment as it will allow Comcast to mount cellular antennas where it’s already running cable connections for wireless backhaul.

A recent Dell’Oro Group report noted the vendor has been gaining RAN market share at the expense of its China-based rivals Huawei and ZTE outside of their home country. This could accelerate as the U.S. Federal Communications Commission adopted new rules prohibiting domestic telecommunication operators from acquiring and using networking and other equipment from China-based vendors, including Huawei.

“While commercial Open RAN revenues continue to surprise on the upside, the underlying message that we have communicated now for some time now has not changed and remains mixed,” said Stefan Pongratz, Vice President with the Dell’Oro Group. “Early adopters are embracing the movement towards more openness but at the same time, there is more uncertainty when it comes to the early majority operator and the implications for the broader RAN supplier landscape now with non-multi vendor deployments driving a significant portion of the year-to-date Open RAN market,” continued Pongratz.

Additional Open RAN highlights from the Dell’Oro’s 3Q 2022 RAN report:

- Top 4 Open RAN revenue suppliers for the 1Q22-3Q22 period include Samsung, Fujitsu, NEC, and Mavenir.

- Trials are on the rise globally, however, North America and the Asia Pacific regions are still dominating the commercial revenue mix over the 1Q22-3Q22 period, accounting for more than 95 percent of the market.

- More than 80 percent of the year-to-date growth is driven by the North America region, supported by large scale non-Massive MIMO and Massive MIMO macro deployments.

- The rise of Open RAN has so far had a limited impact on the broader RAN (proprietary and Open RAN) market concentration. The data contained in the report suggest that the collective RAN share of the top 5 RAN suppliers (Huawei, Ericsson, Nokia, ZTE, and Samsung) declined by less than one percentage point between 2021 and 1Q22-3Q22.

- Short-term projections have been revised upward to reflect the higher baseline – Open RAN is now projected to account for 6 to 10 percent of the RAN market in 2023. Open RAN growth rates, however, are expected to decelerate next year, reflecting the likelihood that the sum of new brownfield deployments will be able to offset more challenging comparisons with the early adopters.

Samsung says they have pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.

………………………………………………………………………………………………………………………………………………………

NTT DOCOMO began commercial 5G services in early 2020, and included open RAN-compliant equipment provided by Fujitsu, NEC, and Nokia. The carrier more recently signed a partnership with South Korea’s SK Telecom (SKT) to develop new 5G and 6G cellular technologies and deployment plans taking advantage of open and virtualized RAN (vRAN) technology.

NTT DOCOMO is Japan’s leading mobile operator with over 85 million subscriptions, is one of the world’s foremost contributors to 3G, 4G and 5G mobile network technologies. Beyond core communications services, DOCOMO is challenging new frontiers in collaboration with a growing number of entities (“+d” partners), creating exciting and convenient value-added services that change the way people live and work. Under a medium-term plan toward 2020 and beyond, DOCOMO is pioneering a leading-edge 5G network to facilitate innovative services.

References:

https://news.samsung.com/global/samsung-electronics-expands-5g-radio-support-for-ntt-docomo

https://www.sdxcentral.com/articles/news/docomo-deepens-samsung-5g-ran-drive/2022/12/

https://www.docomo.ne.jp/english/

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

According to Ericsson, total global FWA [1.] subscriptions will grow at 19 percent year-on-year during the 2022 to 2028 period to reach more than 300 million by 2028, the vast majority of which will be based on 5G.

Note 1. FWA is a connection that provides primary broadband access through mobile network-enabled customer premises equipment (CPE). This includes various form factors of CPE, such as indoor (desktop and window) and outdoor (rooftop and wall-mounted). It does not include portable battery-based Wi-Fi routers or dongles.

………………………………………………………………………………………………………………………………………………………..

The use of FWA for home and even business broadband is proving to be a major early use case for 5G, especially in regions where the fixed broadband market is lacking. FWA growth is in part driven by India and will also come in other emerging markets. Its data shows that almost 40 percent of 5G FWA launches came in emerging markets in the past year, with services now on offer in densely populated countries like Mexico, South Africa and the Philippines.

Key findings:

- More than three-quarters of service providers surveyed in over 100 countries are now offering Fixed Wireless Access (FWA) services.

- Nearly one-third of service providers now offer FWA over 5G, compared to one-fifth a year ago.

- The number of 5G FWA connections are expected to grow to around 235 million by 2028, representing almost 80 percent of the total FWA connections.

Source: Ericsson

“Following the 5G spectrum auction in India in July, a major service provider has expressed a goal to serve 100 million homes and millions of businesses with 5G FWA services,” Ericsson stated. 5G has only just come to market in India; its big operators launched services in early October. But operators are rolling out the technology at pace and with the price of 5G smartphones coming down, customer numbers will go up. 5G subscriptions in the India region – which includes Nepal and Bhutan – should reach 31 million by the end of this year and 690 million by end-2028, accounting for more than half of all mobile subscriptions – 1.3 billion – by that date.

“Higher volumes of 5G FWA in large high-growth countries such as India have the potential to drive economies of scale for the overall 5G FWA ecosystem, resulting in affordable CPE that will have a positive impact across low-income markets,” Ericsson added.

Globally, 5G subscriptions will hit 5 billion by the end of 2028, Ericsson predicts, despite the economic challenges much of the world is facing.

Service providers together added 110 million 5G subscriptions in the July-September period, bringing the worldwide total to around 870 million. With that sort of uptake, the 1 billion by year-end figure looks comfortably attainable, and will come two years earlier than the same milestone following the launch of 4G. Growth is being driven by device availability, falling prices and large-scale deployments in China, Ericsson said.

Ericsson added that North East Asia as a whole and North America are witnessing strong 5G growth, with penetration in those markets likely to reach around the 35 percent mark by the end of this year. Given that the world’s first 5G launches came in the US and in Korea back in 2019, it makes sense that those areas are leading the way in terms of uptake.

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report/dataforecasts/fwa-outlook

https://www.ericsson.com/en/fixed-wireless-access#

Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

Juniper Research: 5G Fixed Wireless Access (FWA) to Generate $2.5 Billion in Global Network Operator Revenue by 2023

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia