Month: November 2021

China plans to triple the number of 5G base stations by end of 2025

China’s Ministry of Industry and Information Technology (MIIT) plans to more than triple the number of 5G base stations over the next four years, targeting a total of 3.64 million by end-2025, local newspaper China Daily reported.

China aims to have about 3.64 million 5G base stations by the end of 2025. That’s 26 5G base stations for every 10,000 people. In comparison, there were only five 5G base stations for every 10,000 people in China in 2020.

Xie Cun, director of MIIT, said the overall goal proposed in a five-year plan for the information and communication industry is to basically build a high-speed, ubiquitous, smart, green, safe and reliable new digital infrastructure by 2025.

The plan also proposed that the penetration rate of 5G users in China will increase from 15 percent in 2020 to 56 percent in 2021, and by then, 80 percent of China’s administrative villages will have 5G signal accessibility.

Xie said that China so far has already built more than 1.15 million 5G base stations, accounting for more than 70 percent of the global total, and 5G network coverage has been achieved in urban areas of all prefecture-level cities, 97 percent of counties and 40 percent of rural towns across the country.

The 5G mobile subscriber accounts in China, numbering some 450 million, make up over 80 percent of the global total, Xie added.

The five-year plan also forecast that by the end of 2025, the information and communication industry will maintain an annual growth rate of about 10 percent to reach a total revenue of 4.3 trillion yuan ($674.2 billion) in 2025. The plan also forecast that the cumulative investment in telecom infrastructure will increase from 2.5 trillion yuan in 2020 to 3.7 trillion yuan in 2025.

Widening the industrial use of 5G will also be a key focus for China. Xie said 5G has already been used in 22 industries. The application of 5G in industrial manufacturing, mining and ports is relatively mature, where 5G has been expanded from production assistance to core businesses such as equipment control and quality control. Meanwhile, a number of 5G-powered applications have also emerged in industries such as medical care, education and entertainment.

“In the next step, we will work with other parties to focus on promoting 5G applications in 15 industries that target information consumption, real economy and people’s livelihood services,” Xie said.

Wang Zhiqin, deputy head of the China Academy of Information and Communications Technology, a government think tank, said China is likely to achieve several breakthroughs in 5G technological evolution, network construction and applications by 2025.

“By the end of the 14th Five-Year Plan period (2021-25), China will have built the world’s largest and most extensive stand-alone 5G network and basically achieve full network coverage in urban and rural areas,” Wang said.

Ding Yun, president of Huawei Technologies carrier business group, said:

“5G is no longer for early adopters. It is improving our daily lives. This year is the first year with large-scale 5G industry applications. Operators will need new capabilities in network planning, deployment, maintenance, optimization and operations, in order to achieve zero to one, and replicate success from one to many.”

……………………………………………………………………………………………………………………………..

Technicians check a 5G base station in Tongling, Anhui province, China

[Photo by Guo Shining/For China Daily]

Chinese operators recorded a net gain of 43.88 million 5G subscribers in September, according to the carriers’ latest available figures.

China Mobile, the world’s largest operator in terms of subscribers, added a total of 27.08 million 5G subscribers in September. The state owned #1 carrier said it ended last month with 331.22 million 5G subscribers, compared to 113.59 million 5G customers in September 2020. China Mobile has added a total of 166.22 million subscribers in the 5G segment since the beginning of the year.

Rival operator China Unicom said it added a total of 7.88 million 5G subscribers during last month. During the first nine months of the year, the carrier added a total of 66.11 million 5G subscribers. The telco ended September with 136.94 million 5G subscribers. China Unicom started to provide 5G statistics earlier this year.

China Telecom added 8.92 million 5G subscribers in September to take its total 5G subscribers base to 155.54 million. During the January-September period, the telco added a total of 69.04 million 5G subscribers.

Leichtman Research Group: U.S. broadband growth returns to pre-pandemic levels in Q3-2021

Leichtman Research Group, Inc. (LRG) found that the largest cable and wireline phone providers in the U.S. – representing about 96% of the market – acquired about 630,000 net additional broadband Internet subscribers in 3Q 2021, compared to a pro forma gain of about 1,525,000 subscribers in 3Q 2020, about 615,000 in 3Q 2019, and about 600,000 in 3Q 2018.

These top broadband providers now account for about 107.9 million subscribers, with top cable companies having about 75.2 million broadband subscribers, and top wireline phone companies having about 32.7 million subscribers.

Findings for the 3rd /quarter include:

- Overall, broadband additions in 3Q 2021 were 41% of those in 3Q 2020

- The top cable companies added about 590,000 subscribers in 3Q 2021 – 45% of the net additions for the top cable companies in 3Q 2020

- The top wireline phone companies added about 40,000 total broadband subscribers in 3Q 2021 – compared to about 200,000 net adds in 3Q 2020. Telcos had about 475,000 net adds via fiber in 3Q 2021, and about 435,000 non-fiber net losses

“Broadband additions returned to pre-pandemic levels in the third quarter of 2021,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “The top broadband providers added significantly fewer subscribers than in last year’s third quarter, but had a similar number of net adds as in 3Q 2019 and 3Q 2018.”

| Broadband Providers/ | Subscribers at end of 3Q 2021// | Net Adds in 3Q 2021/ |

| Cable Companies | ||

| Comcast | 31,688,000 | 300,000 |

| Charter | 29,899,000 | 265,000 |

| Cox* | 5,510,000 | 25,000 |

| Altice | 4,388,100 | (13,200) |

| Mediacom | 1,466,000 | (2,000) |

| Cable One | 1,030,000 | 13,000 |

| Atlantic Broadband^ | 717,000 | 3,000 |

| WOW (WideOpenWest)^ | 509,500 | 1,600 |

| Total Top Cable | 75,207,600 | 592,400 |

| Wireline Phone Companies | ||

| AT&T | 15,510,000 | 29,000 |

| Verizon^^ | 7,337,000 | 74,000 |

| CenturyLink/Lumen | 4,589,000 | (77,000) |

| Frontier | 2,789,000 | (9,000) |

| Windstream | 1,147,000 | 15,200 |

| TDS | 522,800 | 9,200 |

| Cincinnati Bell* | 439,000 | 1,200 |

| Consolidated | 390,661 | (2,819) |

| Total Top Telco | 32,724,461 | 39,781 |

References:

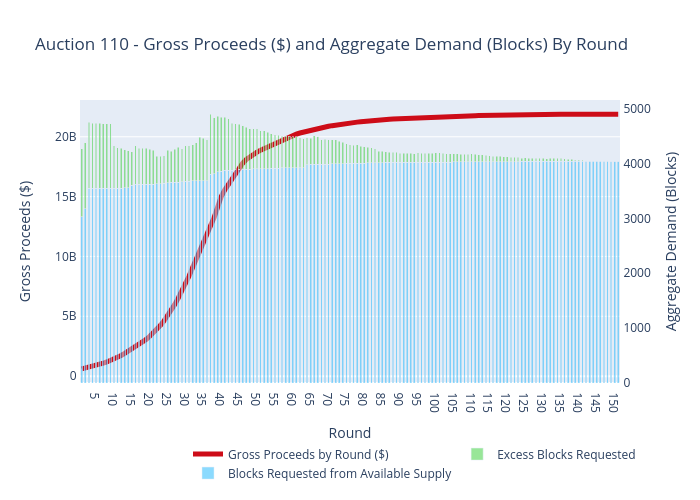

FCC Auction 110 for mid-band 5G spectrum gets $21.9B in winning bids

The latest FCC auction (#110) of mid-band spectrum for 5G ended Tuesday with a total of $21.9 billion in winning bids. That total is roughly in line with pre-auction estimates.

Auction 110 offered 100 megahertz of mid-band spectrum in the 3.45–3.55 GHz band (the 3.45 GHz Service) for flexible use, including 5G wireless. The 100 megahertz of spectrum available in Auction 110 will be licensed on an unpaired basis divided into ten 10-megahertz blocks in partial economic areas (PEAs) located in the contiguous 48 states and the District of Columbia (PEAs 1–41, 43–211, 213–263, 265–297, 299–359, and 361–411). These 10-megahertz blocks are designated as A through J.

The clock phase concluded on November 16, 2021. The FCC will release a public notice within the next few business days announcing details about the assignment phase, including the date and time when bidding in the assignment phase will begin.

See the Auction 110 website for more information.

Highlights:

- Qualified Bidders (Clock Phase)= 33

- Licenses Won=4041

- FCC Held Licenses=19

- Total Licenses=4060

- Gross Proceeds as of Clock Phase=$21,888,007,794

Next up is the auction’s “assignment” phase, wherein winning bidders can select the specific frequencies they want to use. After that phase is over, the FCC will announce the identities of the winning bidders. That might not happen until December or January.

Major participants in the auction included AT&T, Verizon, T-Mobile, Dish Network, Grain Management and Columbia Capital.

The spectrum in this auction is ideal for 5G. Mid-band spectrum is in high demand because it is widely viewed as providing the optimum mix of speed and coverage for 5G. Licenses in Auction 110 sold for an average of $0.666 per MHz per person (MHz pop) in the coverage area, according to Sasha Javid, chief operating officer for BitPath, who has been doing a detailed daily analysis of auction results.

Auction 110 winners will pay less per MHz pop in comparison with what Auction 107 (C-band) winners paid but more than Auction 105 CBRS band winners paid, according to Javid. Those other two auctions also included mid-band spectrum and the C-band auction was record breaking.

Javid notes that the CBRS licenses were subject to power restraints, making them less valuable. He didn’t offer an opinion on why Auction 110 licenses were less costly than Auction 107 licenses (on a MHz-pop basis), but perhaps the disparity is related to license size.

Winning bidders will need to purchase new radio equipment from base station/kit makers Ericsson, Nokia, and Samsung (but not Huawei or ZTE which are banned in the U.S.) to put their spectrum licenses into 5 commercial service.

Unlike past spectrum auctions, cable companies including Comcast and Charter did not participate in the auction. Based on Dish Network’s recent fundraising, the company appears poised to potentially account for as much as a fourth of the auction’s total.

Broadly, the FCC’s 110 auction of spectrum licenses between 3.45GHz and 3.55GHz can be considered a success. The auction started October 5, and bidding crossed the critical $14.8 billion reserve price October 20. That was a necessary milestone considering that reserve price is the cost to move existing, incumbent military users out of the band.

The auction was worth around $0.70 per MHz-POP. The per MHz-POP calculation is applied to most spectrum transactions and reflects the number of people covered compared with the amount of spectrum available, though it can be affected by a wide variety of factors.

In comparison, the recent CBRS auction of mid-band spectrum drew winning bids of just $0.215 per MHz-POP, whereas the massive C-band auction generated winning bids of $0.945 per MHz-POP, a figure that does not account for additional clearing costs.

This FCC auction is the agency’s third-biggest spectrum auction ever. As noted by Next TV, only the $45 billion AWS-3 auction in 2015 and the $81 billion C-band auction earlier this year generated more in winning bids. The auction earlier this month passed the FCC’s broadcast incentive auction of 600MHz licenses, which ended with $19.8 billion in winning bids in 2017.

The value of the spectrum licenses in this auction could rise if interference with aircraft concerns continue to drag on the C-band. However, CTIA President and CEO, Meredith Attwell Baker in response to the bulletin maintained that 5G using C-band won’t cause interference and that timely deployments are key for 5G leadership. “5G networks using C-band spectrum operate safely and without causing harmful interference to aviation equipment.

References:

https://www.fcc.gov/auction/110

https://auctiondata.fcc.gov/public/projects/auction110

https://www.fcc.gov/auction/110/factsheet

https://sashajavid.com/FCC_Auction110.php

FCC Pockets Close to $22B in Auction 110 of 3.45 GHz Band Spectrum

The case for and against AI in telecommunications; record quarter for AI venture funding and M&A deals

Many pundits believe that telcos will need AI driven solutions. Some of the benefits: enable telcos to configure new offers and products in hours and days, fail fast/ learn fast when 5G applications don’t gain market traction, service customers more effectively and radically simplify their operations.

An AI-powered “decisioning engine” might help telcos take the correct action during every interaction in real time with customers, suppliers, and partners.

Proponents say that with AI-driven capabilities in place, telcos can:

Grow revenue through upsell and cross-sell of services: Telecom Providers (aka telcos or network operators) can increase average revenue per user (ARPU) by anticipating customer needs using real-time context, so they can make the right offer on the right channel when it is needed.

Accelerate subscriber growth: Net subscriber additions are critical to success. Key telecom industry partners can build customer interest in preferred channels, guide prospects to find the right bundle, and delight them with a flawless omni-channel experience.

Proactive digital customer service: By combining AI-driven decisioning with end-to-end automation, telcos can deliver proactive, personalized service across channels. This might give customers and agents a guided, intuitive experience that delivers the best outcomes for everyone seamlessly.

Resolve billing enquiries: To avoid costly calls to service centers and keep customers happy, telcos need to stay one step ahead. AI driven capabilities such as real-time monitoring and pattern detection can enable them to sense a potential billing issue, then send a proactive notification to the customer.

Guided service setup: In order to make a great first impression and reduce calls to the service center, AI can drive a self-serve guided setup for services like internet connectivity to make customers’ experience easy and frictionless. Step-by step visual instructions can help to get set up successfully, and troubleshooting tips allow customers to easily navigate challenges along the way.

Intelligent automation: To increase network capacity, efficiently deploy new 5G and fiber networks, or simplify order fulfillment, telecoms providers can use AI in combination with robotics and end-to-end automation to streamline and digitize complex operations, keeping margins high and bringing value to customers fast. With intelligent automation and robotics, telecoms can:

Orchestrate, automate, and deliver customer orders: With a better connection between front and back offices, partners, and customers across all channels, telcos can optimize operations, reduce costs and boost customer satisfaction.

Build and deploy new networks faster: Telecoms providers can accelerate fiber and 5G mobile network rollout with intelligent automation. Case management, robotics, and low-code development capabilities can help them build out critical infrastructure more efficiently and faster at lower cost.

Automatically resolve network outages and events: Telcos can provide end-to-end visibility of complex processes and analyze live data related to business rules, costs, and other criteria. The most effective delivery methods, equipment, vendors, or contractors can be selected to address and resolve problems.

……………………………………………………………………………………………………………………………………………………

However, the AI cheerleaders never talk about the shortcomings of cyclically ultra hyped AI technology. We call attention to the cover story on this month’s IEEE Spectrum (the flagship publication of IEEE). “Why is AI so Dumb?” Here’s an excerpt:

AI has suffered numerous, sometimes deadly, failures. And the increasing ubiquity of AI means that failures can affect not just individuals but millions of people. Increasingly, the AI community is cataloging these failures with an eye toward monitoring the risks they may pose.

“There tends to be very little information for users to understand how these systems work and what it means to them,” says Charlie Pownall, founder of the AI, Algorithmic and Automation Incident & Controversy Repository.

“I think this directly impacts trust and confidence in these systems. There are lots of possible reasons why organizations are reluctant to get into the nitty-gritty of what exactly happened in an AI incident or controversy, not the least being potential legal exposure, but if looked at through the lens of trustworthiness, it’s in their best interest to do so.”

Part of the problem is that the neural network technology that drives many AI systems can break down in ways that remain a mystery to researchers.

“It’s unpredictable which problems artificial intelligence will be good at, because we don’t understand intelligence itself very well,” says computer scientist Dan Hendrycks at the University of California, Berkeley.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………….

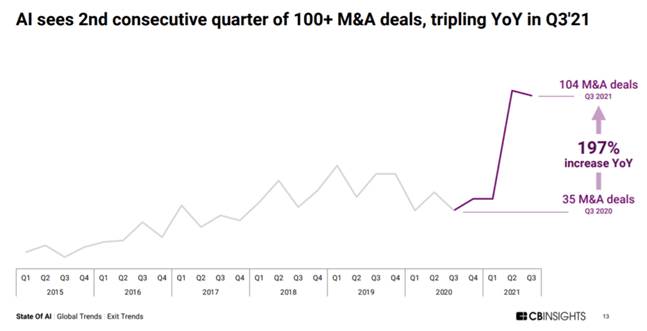

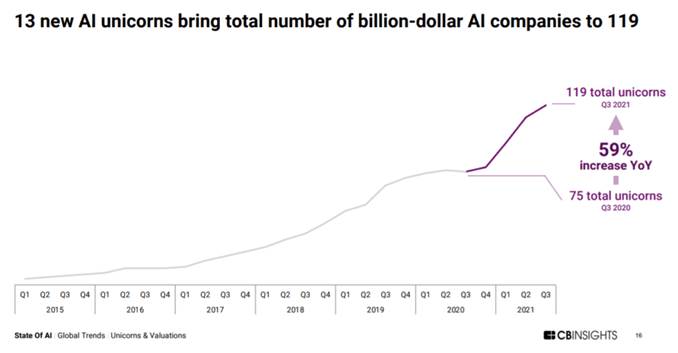

CB Insights: What you need to know about AI venture in Q3-2021:

- New record: $17.9B in global funding for AI startups across 841 deals in Q3-2021. This marks an 8% increase in funding and 43% increase in deals QoQ.

- At $50B, 2021 YTD funding has already surpassed 2020 levels by 55%. 75% Growth in megarounds YTD.

- The number of $100M+ mega-rounds has reached a record-high 138 in 2021 YTD.

- There were 45+ mega-deals in each of the first 3 quarters in 2021 — the highest quarterly numbers ever.

- 100+ AI acquisitions. Quarterly M&A deals have surpassed 100 for 2 consecutive quarters, putting total M&A exits at a record 253 in 2021 YTD.

- Annual IPOs and SPACs are also up this year. In Q3-2021, there were 3 SPACs and 8 IPOs.

- The largest M&A deal of Q3-2021 was PayPal’s acquisition of buy now, pay later startup Paidy for $2.7B — 370% bigger than the next largest deal. Paidy uses machine learning to determine consumer creditworthiness and underwrite transactions instantly.

- 43% QoQ increase in median US deal size. In Q3-2021, global markets saw strong QoQ growth in the median size of funding rounds: 43% in the US, 64% in Asia, and 67% in Europe.

- Across regions, median deal size was $7M, while average deal size reached a record $33M.

References:

https://telecoms.com/opinion/how-is-ai-reshaping-telecoms/

https://spectrum.ieee.org/files/11920/10_Spectrum_2021.pdf

https://www.cbinsights.com/research/report/ai-trends-q3-2021/

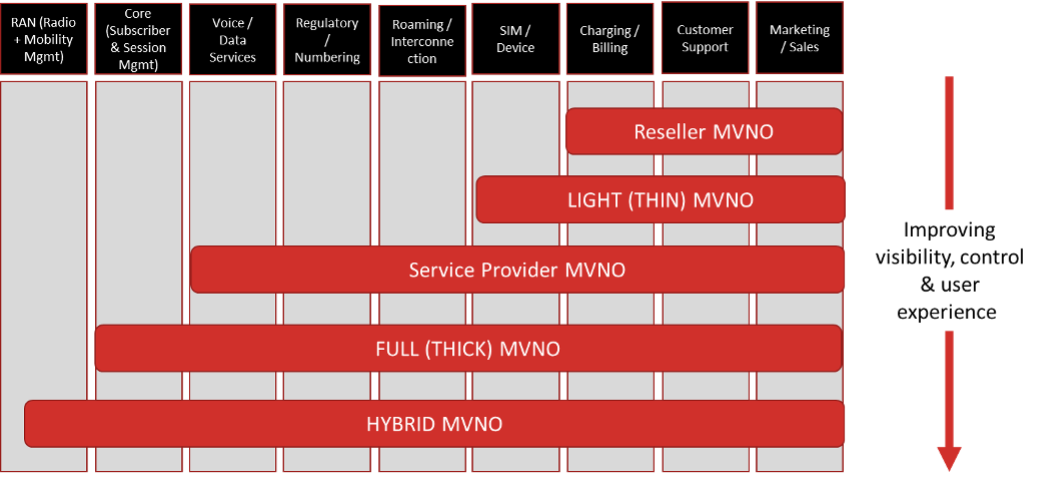

CableLabs Evolved MVNO Architectures for Converged Wireless Deployments

CableLabs and its members (cablecos/MSOs) initiated a technical working group to create an evolved architectural blueprint for mobile virtual network operators (MVNOs). The working group’s aim is to explore new converged architectures that will benefit CableLabs members’ wireless deployments while highlighting the benefits, impacts to existing deployments and features needed to be supported by both mobile network operator (MNO) and MVNO networks.

As cable operators in the US and abroad enter the mobile game or look to enhance their existing mobile services through MVNO partnerships, the working group’s intention is to “create an evolved architectural blueprint for mobile virtual network operators (MVNOs),” Omkar Dharmadhikari, wireless architect at CableLabs, explained this week in a blog post.

Many traditional broadband services providers—also known as multiple system operators (MSOs)—might not own mobile infrastructure but have (or are in the process of negotiating) MVNO arrangements with MNOs. These kinds of arrangements allow them to bundle fixed and mobile broadband services into a single service package. Traditionally, most MSOs adopt a reseller-type “Wi-Fi first” MVNO, where the MVNO doesn’t own any mobile network infrastructure and resells the services leveraging MNO infrastructure.

Source: CableLabs

The MVNO models vary based on the amount of mobile network infrastructure that the MVNO owns and the degree of control over the management of different aspects of MVNO subscriptions and their service offerings. One common aspect of all traditional MVNO models is leveraging the radio access network (RAN) of a partner MNO.

With the advent of 5G and the availability of shared spectrum, many MSOs are actively evaluating offload opportunities for enhancing MVNO economics and are contemplating deploying their own mobile radio infrastructure in specific geographic areas (in addition to their substantial Wi-Fi footprint).

Such MSOs now have to contend with three disparate sets of wireless infrastructures:

- the MSO’s community Wi-Fi network,

- the MNO’s 4G/5G network, and

- the MSO’s own 4G/5G network.

This creates a new type of MVNO model called hybrid-MVNO (H-MVNO) that enables MVNOs to offload their subscribers’ traffic from the MNO network—not just to their Wi-Fi networks but also to the MVNO-owned mobile network when inside the coverage footprint of their wireless network(s).

Maximizing data offload via the H-MVNOs’ own wireless assets—thus ensuring a consistent user experience and enforcing uniform and personalized policies as users move in and out of coverage of these three networks—will require the deployment of new converged network architecture and related capabilities.

While CableLabs working group’s focus on the hybrid MVNO challenge is new, several cable operators, including a group in North America, are already pursuing that initiative.

Comcast and Charter Communications have MVNO deals with Verizon, operate their own metro and in-home Wi-Fi networks, and have secured CBRS licenses in areas where mobile traffic is anticipated to be heaviest. Charter plans to launch a field trial involving “thousands” of CBRS small cells in one market in early 2022, and use that as a blueprint of sorts for deployments in additional markets.

Canada’s Cogeco plans to enter the wireless business in Canada via a proposed H-MVNO framework. Tied into that plan, Cogeco secured 38 spectrum licenses in the 3500MHz band at auction, and says it now has spectrum licenses to cover about 91% of its broadband footprint.

H-MVNOs intend to offload as much traffic as possible to help offset the costs of going to their mobile network operator partners. But they’ll also need a new converged network architecture and related capabilities to ensure a consistent user experience and the enforcement of uniform and personalized policies as customers move in and out of these different networks, Dharmadhikari explained.

The new CableLabs working group is exploring H-MVNO architectures that use dual-SIM and single-SIM approaches.

Unlike architectures with dual SIMs, single-SIM devices allow the H-MVNO network to enable seamless low-latency mobility for data applications across the MNO and H-MVNO networks. An ideal architecture for offering mobile services with single-SIM device usage is to combine the roaming architecture and a mobility interface, both of which are standardized in 3GPP.

However, due to the targeted nature of H-MVNO mobile deployments, the signaling load can increase on MNO mobility management core network elements, as the H-MVNO subscribers move in and out of H-MVNO network coverage.

To overcome this problem, CableLabs evaluated new MVNO architectures that make use of dedicated network elements within the MNO domain to serve H-MVNO subscriber traffic, thereby isolating it from the MNO subscriber traffic and eliminating the increase in signaling load on core network elements that serve MNO subscribers.

In addition, CableLabs evaluated voice handling in scenarios where H-MVNOs don’t want to deploy their own voice platforms. One option is to offer voice via a third-party voice service provider; another is to enable additional interfaces between the MNO and the H-MVNO network to leverage the MNO’s voice platform.

If you have any further questions, please feel free to reach out to the MVNO Interconnect Technical WG Lead, Omkar Dharmadhikari ([email protected]).

References:

https://www.lightreading.com/cable-tech/cablelabs-sizes-up-hybrid-mvno-architectures-/d/d-id/773484?

Deloitte to co-ordinate 5G private network field trial at the largest hospital in Latin America

The Radiology Institute (InRad) of the Hospital das Clínicas, Faculty of Medicine of the University of São Paulo in Brazil is launching their first field trial of a 5G private network. The project will be housed at InovaHC, the Innovation Center of the Hospital das Clínicas, and is coordinated by Deloitte in collaboration with Telecom Infra Project (TIP), Itaú Unibanco, NEC, Brazilian Agency for Industrial Development (ABDI), Inter-American Development Bank (BID) and the Polytechnic School of the University of São Paulo (Poli-USP).

The field trial will assess 5G data transmission capacity, response time, and the feasibility of carrying out remote examinations using the increased speed and lower latency the next-generation 5G private network provides. The proof of concept for the project, OpenCare 5G, will initially focus on the viability of conducting remote ultrasound exams using 5G connectivity with on-premise private network infrastructure.

The project will follow the TIP 5G Private Networks Solution Group framework which brings together a range of industry experts to develop, test and deploy this technology based solution to help advance healthcare for enhanced application performance. The parties involved in the OpenCare 5G tests include:

• Deloitte will coordinate the project, proposing sustainable business models for the ecosystem.

• InovaHC will contribute its research facilities and experience in attracting investors from the technology, telecommunications and pharmaceutical industries to promote academic research and foster national technology.

• Itaú Unibanco will provide its expertise in technology, as the first bank in Brazil to use Open RAN to provide a 5G connection, allocating part of its data center capacity.

• The Telecom Infra Project (TIP) 5G Private Networks Solution Group will support this use case by developing and publishing a blueprint in collaboration with NEC and Deloitte that will help scale the solution for future deployments around the world.

• NEC will act as the systems integrator of the network layer, managing the installation, configuration and commissioning of the indoor 5G network at InovaHC and Itaú Unibanco’s data center.

• The Brazilian Agency for Industrial Development (ABDI) is supporting the project to encourage the adoption of new technologies and new business models, in order to contribute to greater productivity in the industrial sector and competitiveness in the country.

• The Polytechnic School of the University of São Paulo (Poli-USP) will be responsible for the system architecture and research methodology during the implementation of the tests with an eye to the future, aware of how the technology will impact the development of new solutions.

Giovanni Guido Cerri, president of the Innovation Commission (InovaHC) at Hospital das Clínicas and president of the Board of Directors of the Institute of Radiology, said: “This project will positively impact the delivery of patient care -accelerating digitization, personalized medicine, improving access, and reducing costs. Without a doubt, it will be an impetus for new investments in health and technology development, as well as improving access and reducing inequalities. It will also contribute to improving diagnostic quality and digital health.”

Márcia Ogawa, partner and leader of the Technology, Media and Telecom Industry practice at Deloitte Brazil, said: “This project is of significant social and economic relevance. It’s fundamental for public health and the development of research and products in the area of connectivity in Brazil. The use of 5G in healthcare and this trial promotes great positive impacts, attracting investment to the country and the development of new technologies to improve the quality of patient care, expanding access to public health, and better, faster care during emergencies. We are pleased to work with several leading organizations from the technology, telecom, and banking industries, to develop this project within the Hospital das Clínicas, one of Latin America’s top teaching hospitals, which will benefit the wider Brazilian health system (Sistema Único de Saúde).”

Angelo Guerra, president of NEC Brazil said: “The InovaHC use case for mobile ultrasound provides a cutting edge opportunity to showcase NEC’s integration capabilities to develop the solution at scale for several enterprise industry verticals. NEC’s seasoned system integrator capabilities will help incubate all aspects of the solution from onboarding to deployment in addition to building a blueprint collaborating within the ecosystem of TIP’s 5G Private Networks Solution Group.”

“The 5G private network takes the evolution of networks to the next level. Businesses see the potential to reap the benefits of 5G with dedicated infrastructure for an immersive user experience. TIP, in collaboration with Deloitte, NEC, and OEMs (Original Equipment Manufacturer), is providing a platform for all partners to incubate critical Inova healthcare use cases in this field trial, expanding the community’s relevance to enterprise verticals, opening the door to more use cases,” explains Sriram Subramanian, Technical Lead of TIP’s 5G Private Networks Solution Group.

References:

https://www2.deloitte.com/us/en/insights/industry/technology/global-5g-transformation.html

https://www2.deloitte.com/us/en/insights/industry/health-care/future-of-virtual-health.html

India’s 5G auction delayed again to April-May 2022 – Credibility Gap?

The long delayed auction for the 5G spectrum in India is now likely (???) to take place around April-May 2022, Telecommunications minister Ashwini Vaishnaw said on Thursday. While relief measures announced in September this year for telecom operators marked the first set of reforms, the government will bring out a series of further reforms and “telecom regulatory structure should change in coming 2-3 years”, Vaishnaw said at an event in India.

The Telecom Regulatory Authority of India (Trai) is working on the modalities of the auction. “Our estimate is by April-May. I think it will take time because Trai consultations are complex, diverse opinions are coming,” Vaishnaw said.

[Credibility gap: When he announced the government’s big-bang telecom reforms in September, Vaishnaw had said the auctions would be held in February.]

The telecom department has approached Trai for its recommendations on pricing, amount of 5G spectrum for sale and other modalities.

“The (India) government had budgeted for inflows of nearly Rs 54,000 crore from other communication services for the current year, presumably boosted by the expectation of fresh auction inflows,” according to Aditi Nayar, chief economist, Icra. “We now assess the inflows from the telecom sector into the government’s 2021-22 non tax revenues to be limited to Rs 28,000 crore, trailing the budgeted Rs 54,000 crore, which will modestly widen its fiscal deficit, “ she said.

Image Credit: Shutterstock

The government is targeting a fiscal deficit of 6.8 per cent of GDP in 2021-22, a big improvement over the previous year when the fiscal deficit shot up to 9.3 per cent in the Covid-affected economy. The DoT has sought the views of Trai across multiple bands such as 700Mhz, 800 Mhz, 900 Mhz, 1800 Mhz, 2100 Mhz, 2300 Mhz, 2500 Mhz bands as also 3,300-3,600 Mhz that were not put up for auctions in the last round.

On the timeline for 5G auctions, Vaishnaw noted that the Trai is undergoing consultations on the matter. “I think they will submit their report by February-mid is what we are thinking, maybe February-end, maximum to maximum March. Immediately after that, we will have the auctions,” he said.

References:

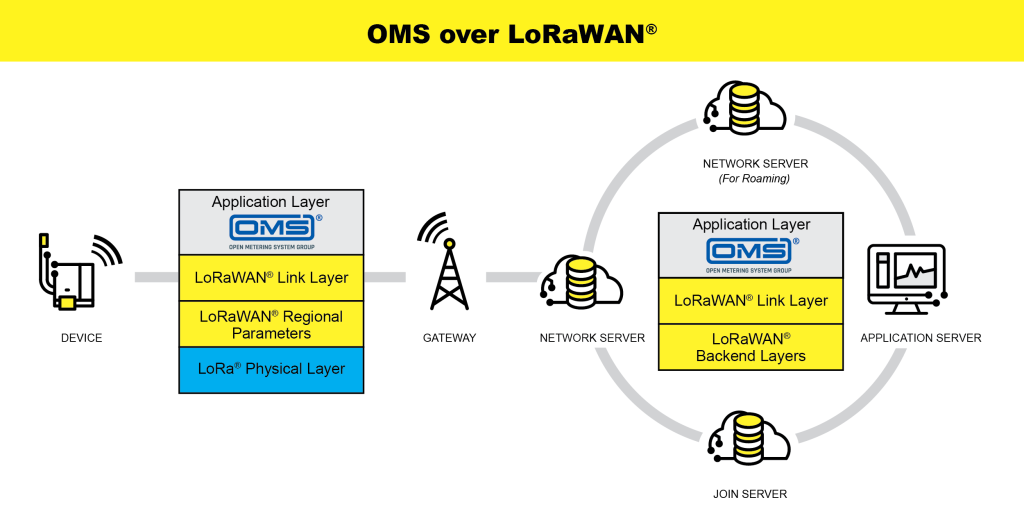

LoRa Alliance and OMS Group integrate smart metering standards which may result in massive scale for IoT

The integration of two smart metering standards by the LoRa Alliance and OMS Group is expected to reduce the cost and complexity of utilities’ smart meter programs. In addition, it will increase the return on investments for utilities’ smart meter projects.

OMS Group will provide its Open Metering System smart metering language for use on LoRa Alliance’s LoRaWAN specification. Proof of concepts conducted by the two organisations have proved the interoperability of the two standards on all levels, including data platforms and connected end devices on the same or different LoRaWAN networks, according to the companies.

Donna Moore, the CEO of the LoRa Alliance, said the combined use of the two standards “…is absolutely essential to achieving massive scale for the IoT.

“Given the large scale of their deployments, gas, water and electric utilities will achieve improved business value from implementing standards-backed technologies like LoRaWAN and OMS due to the interoperability and ease of deployment provided. LoRaWAN is already proven for networking smart utility applications, from metering, to leak detection, automated shut-off, and more.

“Using LoRaWAN with OMS is a game-changer for the European utility market that makes deployments simpler and more cost-effective, while ensuring the interoperability of legacy meters to maximize ROI.”

OMS Group’s Andreas Bolder, added that although utilities have in the past relied on the OMS specification to integrate and optimise acquisition, management, processing, storage and utilization of data from gas, heat, and water meters using a single system, “combining the benefits of the OMS language with those of LoRaWAN networking offers further standardisation of smart metering applications, increasing utilities’ readiness for IoT.”

Due to the integration of these standards, energy companies using OMS will take advantage of LoRaWAN’s standard capabilities including low power consumption, long-range, over-the-air firmware upgrades and deep indoor penetration. The new specification also ensures interoperability with legacy OMS-based systems and frees utilities from the costly burden of deploying and maintaining radio network infrastructure by using existing LoRaWAN third-party networks.

The new specification has been developed jointly by members of the OMS Group and the LoRa Alliance including Birdz, Diehl Metering, Elvaco, Kamstrup, Mainlink, Minol-ZENNER-Group, and Semtech.

LoRa Alliance and the OMS Group will showcase their proof of concept (PoC) at Enlit Europe in Milan from 30 November to 02 December.

References:

LoRa Alliance® and OMS-Group Optimize Smart Utilities Transmissions with OMS Over LoRaWAN®

LoRa Alliance and OMS Group integrate smart metering standards

Samsung partners with Orange to deliver 5G vRAN and O-RAN compliant base stations

Samsung Electronics has announced that it is collaborating with the France headquartered telecom operator Orange, to disaggregate the software and hardware elements of traditional RAN. The South Korea based tech giant will provide its virtualized RAN (vRAN), “which has been proven in the field through commercial deployments with global Tier one operators including the U.S.”

As one of the world’s leading telecommunications operators, Orange provides mobile services to 222 million users in 26 countries along with Europe, Africa, and the Middle East. Through this partnership, Samsung and Orange aim to deploy O-RAN Alliance-compliant base stations beginning with rural and indoor configurations and then, expanding to new deployments in the future.

“Open RAN is a major evolution of radio access that requires deeper cooperation within the industry. With our European peers, we want to accelerate the development of Open RAN solutions that meet our needs. After the publication of common specifications, Orange’s Open RAN Integration Center will support the development and tuning of solutions from a broad variety of actors,” said Arnaud Vamparys, Senior Vice President of Radio Access Networks and Microwaves at Orange.

Samsung’s vRAN solutions can help ensure more network flexibility, greater scalability and resource efficiency for network operation by replacing dedicated baseband hardware with software elements. Additionally, Samsung’s vRAN supports both low and mid-band spectrums, as well as indoor and outdoor solutions. Samsung is the only major network vendor that has conducted vRAN commercial deployments with Tier one operators in North America, Europe and Asia.

“We are pleased to participate in Orange’s innovative laboratory,” said Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics. “Through this collaboration, we look forward to taking networks to new heights in the European market, enabling operators to offer more immersive mobile services to their users.”

By opening its Open RAN Integration Center in Châtillon, near Paris, Orange will enable the testing and deployment of networks capable of operating with innovative technologies, which will serve as the backbone of the operator’s future networks. At the center, Samsung and Orange will conduct trials to verify capabilities and performance of Samsung’s vRAN, radio and Massive MIMO radio.

With a vRAN approach, carriers are able to rapidly shift capacity to address customer needs. For business customers, vRAN can drive more efficient access to private 5G networks through easy deployment of baseband software in Multi-access Edge Computing (MEC) facilities.

“We are committed to providing reliable, secure, and flexible network solutions that deliver the power of 5G around the world,” said Magnus Ojert, Vice President, Networks Division, Samsung Electronics America. “We believe vRAN’s next phase of innovation will accelerate what’s possible for society and look forward to collaborating with an industry-leader like Verizon to make 5G a reality for millions in 2021.”

Samsung says they have “pioneered the successful delivery of 5G end-to-end infrastructure solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.”

References:

https://news.samsung.com/global/samsung-and-orange-collaborate-to-advance-5g-networks-to-a-new-level

https://www.samsung.com/global/business/networks/products/radio-access/virtualized-ran/

Samsung’s 5G vRAN adoption could be a key turning point for the industry

Meta (Facebook) announces 200G/400G switch fabrics and Network OS with open API at 2021 OCP Summit

Next-generation 200G and 400G switch fabrics:

Meta’s data center fabrics have evolved from 100 Gbps to the next-generation 200 Gbps/400 Gbps. Meta has already deployed 200G-FR4 optics at scale in their data centers and contributed to specifications for 400G-FR4 optics that will be deployed in the future.

Meta has developed two next-generation 200G fabric switches, the Minipack2 [1.]. It is the latest version of Minipack, Meta’s own modular network switch) and the Arista 7388X5, in partnership with Arista Networks. Both of which are also backward compatible with previous 100G switches and will support upgrades to 400G.

Note 1. Minipack2 is Facebook’s 200G fabric switch (leaf/spine switch) that provides 128 x 200G Ethernet ports by a single 25.6Tbps switch ASIC. It supports 128 QSFP56 ports or 64 QSFP-DD ports when deployed in Facebook’s F16 data center networks. Similar to Minipack (128x 100G), Minipack2 has a modular architecture that supports multiple port interface types. The specification and the hardware design package of Minipack2 will be contributed to OCP. This workshop will go over hardware architecture of Minipack2 and details on key design decisions, including functional block diagrams, chassis architecture, external and internal interfaces, etc.

The Minipack2 is based on the Broadcom Tomahawk4 25.6T switch ASIC and Broadcom re-timer. The Arista 7388X5 is also based on the Broadcom Tomahawk4 25.6T switch ASIC, with versions of the 7388X5 also utilizing a Credo chipset. They’re high-performance switches that transmit up to 25.6 Tbps and 10.6 Bpps with modular line cards. They support 128x 200G-FR4 QSFP56 optics modules and can maintain a consistent SerDes speed at the switch ASIC, the optics host interface, and on the optics line/wavelength. They simplify connectivity without needing a gearbox to convert data streams. They also have significantly reduced power per bit compared with their previous models (the OCP-accepted Meta Minipack and OCP-Inspired Arista 7368X4, respectively).

Meta has deployed 200G optics (modules pictured above) in their data centers

………………………………………………………………………………………………………………………………………

The Minipack2, Meta’s own modular network switch, developed in partnership with Broadcom

………………………………………………………………………………………………………………………………………….

Meta’s network operating system now powered by an open API:

Meta’s network operating system for controlling the network, Facebook Open Switching System, traditionally used the specific API provided by the chip manufacturer. Now, FBOSS (Meta’s own network operating system for controlling network switches) has been adapted to use the Open Compute Project Switch Abstraction Interface, a standard and open API.

Additionally, Meta has worked with Cisco Systems to support FBOSS with SAI (Switch Abstraction Interface) with their ASICs. Adapting and migrating FBOSS to SAI enables Meta to onboard multiple ASICS from different vendors more quickly and easily onboard new ones in the future. SAI’s API lets engineers configure new networking hardware without needing to delve into the specifics of the underlying chipset’s SDK. Furthermore, SAI has been extended to even the PHY layer, with Credo Semi supporting FBOSS with their own SAI implementation.

That means data centers can quickly and easily migrate FBOSS across multiple ASICs from different manufacturers with greater ease. It also allows engineers to rapidly configure new networking hardware without the need to tinker with chipset development kits.

Meta expects that with hardware being shared through OCP, supporting SAI will also mean closer collaboration with and feedback from the wider industry. Developers and engineers from across the world will have a chance to work with this open hardware and contribute their own software that can be shared with the industry.

The Metaverse and More:

The metaverse will rely on many technologies, including advanced AI at scale. To deliver a diversity of new workloads that will be created as a result, we continue down the path of disaggregated global networks and data centers that will underpin all of this. The technologies that Meta and the wider industry will create will, of course, need to be fast and flexible, but more than that, they will need to operate efficiently and sustainably — from the data center all the way to edge devices. The only way to achieve this will be through collaboration through communities like OCP and other partnerships.

Open hardware drives the innovation necessary to reach these goals. And our collaborations with both long-standing and new vendors to create open designs for racks, servers, storage boxes, motherboards, and more will help push Meta and the wider industry onto the next major computing platform. We’re only about one percent along on the journey, but the road to the metaverse will be paved with open advanced networking hardware.

References:

OCP Summit 2021: Open networking hardware lays the groundwork for the metaverse

https://siliconangle.com/2021/11/09/meta-announces-next-gen-networking-hardware-2021-ocp-summit/