Month: January 2022

Deutsche Telekom launches 5G private campus network with Ericsson; Sovereign Cloud for Germany with Google in Spring 2022

Overview:

Ericsson and Deutsche Telekom have partnered to deliver a new 5G Standalone (5G SA) private campus network offering, aimed at on-site business communications infrastructure. The new campus network offering is based on a local 5G infrastructure that is exclusively available for the customer’s digital applications. The 5G SA technology works without LTE anchors (as in 5G NSA) and offers all the technical advantages of 5G – even for particularly demanding and safety-critical use cases: fast data transmission rates, maximum network capacity and highly reliable connectivity with low latency.

With the advanced 5G SA technology, Deutsche Telekom and Ericsson support companies from a wide range of industries in developing innovative digital applications and making existing processes more efficient.

The newly offered 5G SA Campus network – powered by the Ericsson Private 5G portfolio – operates completely separated from the public mobile network: all components of the infrastructure from the antennas to the standalone core network to the network server are located on the customer’s premises. This ensures that sensitive data remains exclusively within the local campus network. The local connection of the customer infrastructure also enables particularly simple and fast processing of data via the private network. This standalone 5G architecture of “short distances” is most suitable for supporting business-critical applications that require ultra-short response times in the millisecond range. The 5G SA network operates on frequencies in the 3.7 to 3.8 GHz range that are specifically allocated to the enterprise. Thus, up to 100 MHz bandwidth is available for the exclusive use within the private campus network.

The new 5G private campus network is being launched in Germany under the name “Campus-Netz Private” – and will be offered to business customers in other European countries.

……………………………………………………………………………………………………………………………………………………………………………………..

Analysis: It is quite interesting that Deutsche Telekom chose Ericsson as it’s 5G SA Core network vendor, rather than hyper-scalers like Amazon AWS or Microsoft Azure who are building 5G SA core networks for Dish Network and AT&T respectively. Amazon also offers its own private 5G network directly to enterprise customers. So does Microsoft which offers Azure private multi-access edge compute. Earlier this year, Fierce Wireless reported that Google did NOT have a private 5G network offering, but was partnering with other companies to offer one.

……………………………………………………………………………………………………………………………………………………………………………………..

Sidebar:

Deutsche Telekom’s T-Systems has partnered with Google Cloud to build and deliver sovereign cloud services to German enterprises, healthcare firms and the public. The two companies say that the goal of this sovereign cloud is to allow customers to host their sensitive workloads while still being able to leverage all the benefits of the public cloud, such as scalability and reliability. The launch of the new Sovereign Cloud for Germany will take place ahead of schedule: Telekom’s business customer arm T-Systems and Google Cloud are launching their new sovereign cloud service in spring 2022. It will be available for all clients, initially out of the Frankfurt Google Cloud Region. Telekom and Google confirmed that they will jointly drive innovation for the cloud, closely aligned with the new German government’s digital plans which aims to build a public administration cloud based on a multi-cloud strategy and open interfaces, as well as meeting strict sovereignty and transparency requirements. To this end, the partners are setting up a Co-Innovation Center in Munich as announced in November 2021. In addition, executive briefing facilities in Munich and one in Berlin will be established for close collaboration with customers.

“Many companies in Germany state that sovereignty matters to them when choosing their Cloud provider. This is particularly important for key sectors such as public, healthcare and automotive,” Höttges said. “That’s why we’re delighted to offer a Sovereign Cloud that addresses additional European compliance requirements.”

In this new joint offering, T-Systems will manage a set of sovereignty controls and measures, including encryption and identity management. In addition, T-Systems will exercise a control function over relevant parts of the German Google Cloud infrastructure. Any physical or virtual access to facilities in Germany (such as routine maintenance and upgrades) will be under the supervision of T-Systems and Google Cloud.

……………………………………………………………………………………………………………………………………………………………………………………..

5G SA Campus Network: Full Control & Flexible Deployment:

Customers can adapt their private 5G SA network flexibly according to their own requirements as well as manage it independently: Whether for real-time communication of robots in factories or for connecting automated vehicles on company premises. Customers can prioritize data traffic within their campus network for specific applications as needed.

The mobile network is administered on site via a cloud-based network management portal by the customer’s IT staff – for example, the administration of users, 5G modules and SIM cards to access the 5G-SA campus network or to the machine control system. The closed system is characterized by its particularly high data security and reliability: Due to the redundant architecture of the local core network, the 5G SA campus network continues to function reliably even in the event of an interruption to the cloud-based management portal.

Managed service by Deutsche Telekom:

If business customers decide to deploy their own 5G SA network, Deutsche Telekom analyzes with them the critical business applications and the requirements for the private mobile network. Due to the simplified local infrastructure, the network can be built from planning to the handover to the customer within just three months. Network equipment supplier Ericsson provides the required modern 5G SA technology, while Telekom takes on the planning, deployment, operation as well as maintenance and optimization. Telekom also provides the set-up and updates so that companies can focus on their core business.

“When it comes to digitalization, industry and SMEs need a reliable partner,” says Hagen Rickmann, Managing Director Business Customers at Telekom Deutschland GmbH. “Together with Ericsson, we help business customers in every industry to increase their productivity and exploit their full potential using 5G standalone technology.”

Arun Bansal, Executive Vice President and Head of Market Area Europe & Latin America at Ericsson says: “Deutsche Telekom and Ericsson share a long-standing partnership in innovation, technology and services. Together, we offer secure, reliable and high-performance network solutions tailored to the specific business needs of our customers.”

Image Credit: Deutsche Telekom

5G Campus Network Private – Available for testing on site:

Deutsche Telekom has already been offering campus network solutions for enterprises since the beginning of 2019 and by now operates more than ten of such local networks based on 5G non-standalone technology or LTE across Germany. With the new fully private 5G SA Campus network solution, the company is expanding its business customer offering with the next development stage of 5G. The new product is being launched in Germany from now on under the name “Campus-Netz Private” – and is also offered to business customers in further European countries. For interested customers, mobile Campus 5G SA test systems are available to test their own use cases on site.

Use Cases and Industry Verticals:

There is currently a huge drive to get private 5G networks onto factory floors for manufacturing. There are some interesting examples of using IoT technology, feeding information back via high speed wireless connections, and analyzing data with machine learning/AI tools to optimize operations and do new things like predictive maintenance. Ericsson touts several industry verticals as candidates for its 5G private network offerings: Airports, Energy Utilities, Airports, Mining, Manufacturing, Ports, Offshore and Processing.

The drive towards business 5G adoptions is reflected In Ericsson’s Q4 2021 financials, in which private networks for enterprise were cited as one of the key drivers of its 41% YoY jump in profit. Evidently, Ericsson and Deutsche Telekom see a lot of potential in private 5G for industrial applications.

References:

https://www.telekom.com/en/media/media-information/archive/new-5g-standalone-campus-networks-645348

https://telecoms.com/513200/dt-and-ericsson-launch-new-5g-sa-campus-offering/

FCC announces $1.2 billion fund for broadband deployment in rural areas

The Federal Communications Commission (FCC) has announced over $1.2 billion in funding through the Rural Digital Opportunity Fund [1.] to expand broadband service across 32 U.S. states. The FCC calls this “the largest funding round to date,” and notes 23 broadband companies will provide service to more than one million new areas.

Note 1. A total of $20.4 billion to be awarded by the FCC over 10 years. Up to $16 billion will be made available for Phase I of the Rural Digital Opportunity Fund auction, and the remaining Phase I budget, along with $4.4 billion, will be awarded for Phase II of the auction.

………………………………………………………………………………………………………………

In addition, the FCC also introduced the Rural Broadband Accountability Plan, which will double the number of audits and verifications performed this year in comparison to 2021. It will also require the FCC to make the results of verifications, audits as well as speed and latency tests public on the Universal Service Administration Company’s (USAC) website.

The pandemic only amplified the gaps in connectivity affecting rural America, as employees transitioned to working from home and kids attended class virtually. To help remedy the issue, President Joe Biden signed off on a $1 trillion infrastructure package in November that allocates $65 billion to providing broadband to every American household. The FCC also launched a program that provides cheaper internet to low-income households late last year.

In December 2020, the FCC awarded companies a total of $9.2 billion under the Rural Digital Opportunity fund, and that included an $886 million subsidy for SpaceX. The Elon Musk-owned company was supposed to deploy its satellite internet network in rural areas, but last year, the FCC warned SpaceX and other providers to stop misusing these funds to provide service to well-connected areas.

References:

https://www.theverge.com/2022/1/29/22908024/fcc-rural-broadband-deployment-funding

Architecting a Software-Defined Base Station-on-a-Chip for 5G Wireless Infrastructure

by Vinay Ravuri, CEO and Founder of EdgeQ Inc. (edited for clarity by Alan J Weissberger)

Introduction:

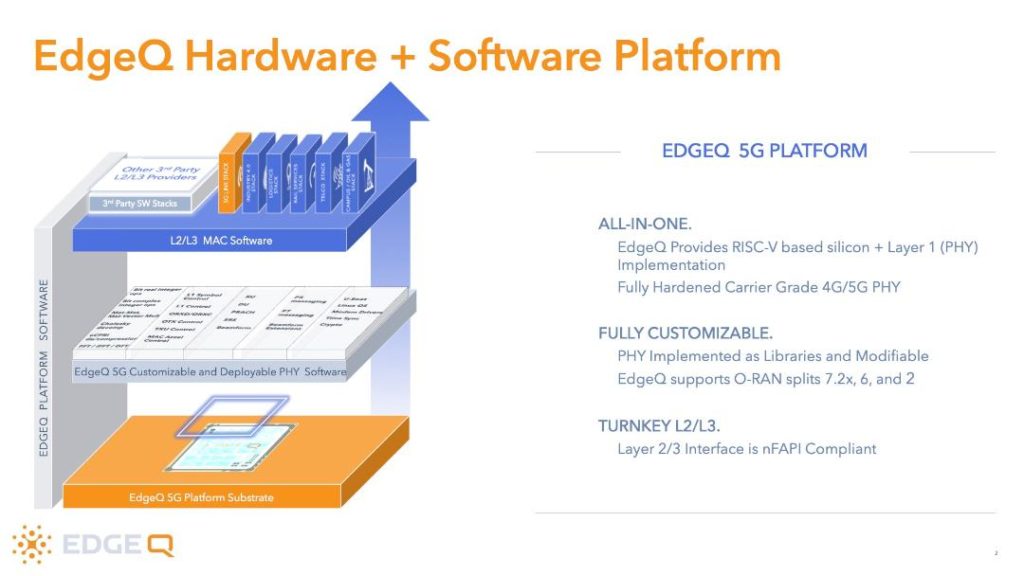

EdgeQ emerged from stealth mode in late 2020 as one of the very few semiconductor companies addressing 5G wireless infrastructure with a clean slate design. We wanted to approach 5G as a platform (chip hardware + RAN software) that allows fluidity and scale as customers migrate through new spectrum, new ITU-R standards/ 3GPP specifications, and new endpoints. Our vision is to reconstitute the wireless infrastructure in a manner that is intelligent, agile, and cloud-native.

Removing the Friction Points in 5G:

The success of any silicon design can be premised on three fundamentals: Flexibility, Power, and Cost. 5G is no exception. The industry’s challenge with 5G design can be parsed as follows:

- Flexibility — Very few merchant silicon suppliers can provide a fully production readied L1. With 5G, there is an added complexity where the L1 needs to be adaptive and programmable to the multitude of workloads and use cases.

- Power — At EdgeQ, we are guided by the 50:50 principle. 50% of a base station TCO is related to power. 50% of the power is related to baseband processing. Just changing the power profile of the baseband profoundly impacts the total system.

- Cost – Cost will be a byproduct of the above two. With the anticipated bandwidth and explosion of new end point connections, linear scaling of OpEx and CapEx costs is not sustainable.

Design for Flexibility and Openness: 5G with a Customizable, Deployable PHY:

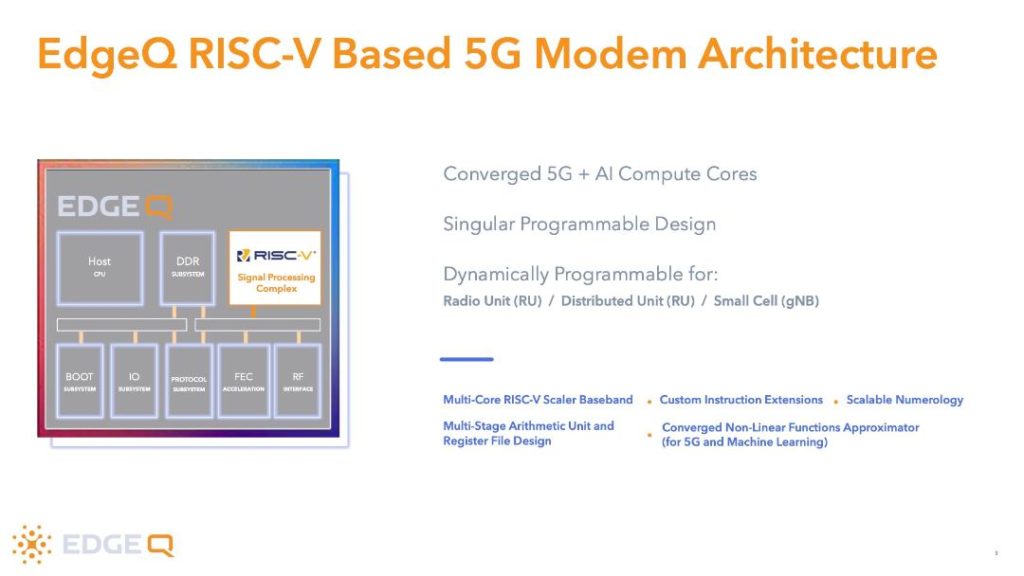

EdgeQ’s approach is to provide a RISC-V based SoC with a production-grade RAN that is fully customizable via C/C++. This would enable the market with the ability to differentiate 5G at the PHY level. This contrasts with traditional solutions which offer a reference stack for 5G RAN algorithms.

Hardening of the PHY layer is both an intensive and extensive process that typically requires 2-3 years of knowledgeable expertise. The level of integration and development is where most companies struggle or fail. EdgeQ offers an open, production-readied PHY out of the box.

By softwardizing the RAN, we can provide a chip that is dynamically programmable to any of the ORAN splits. New 3GPP standards (like REL16, REL 17, REL 18 upgrade) can be rolled out over-the-air. New features (like URLLC or massive MIMO) can be deployed on the fly. Multiple protocols can be simultaneously instantiated and coherently parallelized. Whether it is 4G, 5G, or AI, each network protocol can be turned on-or-off in the field.

EdgeQ’s “5G Base Station-on-a-Chip” is based on an unique hybrid architecture where a RISC-V compute complex is responsible for baseband processing. Our thesis is to enable the ecosystem access to open-source tools to develop on top of our extended RISC-V instruction sets. For the first time in communications history, the market can capitalize on GNU tool chains (compilers, tracers, debuggers, JTAG ….) for wireless communications.

Design for Low Power: Aggressive 5G Power Management for Wireless Infrastructure:

When EdgeQ instrumented its SoC, all the core functionalities of a base station (baseband processor, host CPU, NPU, FEC Acceleration, NIC, Data Converters, Timing Sync, and Machine Learning) are condensed into a single silicon. Depending on the uploaded PHY firmware, the EdgeQ SoC can be function as a small cell (gNB), or a Radio Unit (RU), or Distributed Unit (DU) – please see illustration below.

This highly integrative approach is particularly meaningful for all-in-one access points, where customers may want to converge all the O-RAN splits onto a single chip, and yet run the entire system over Power over Ethernet (PoE). Equally, with such a low power profile, customers can contemplate new macro base station topologies where densely packed PCIe cards within distributed Units (DU) can be dynamically swapped or “spun up” to scale with real-time performance and functional needs.

Design for Cost: Flexibility + Low Power:

One vector to reducing the overall system TCO is by substantially reducing the power envelop. Through integration, advanced power management techniques, and unique design, all L1 baseband processing functions at EdgeQ run in the low teens, thereby significantly reducing a customer’s TCO.

Secondarily, by creating a fully programmable 5G Base Station-on-a-Chip, features and performance points are now all cloud managed and activated over-the-air via a SaaS subscription model. Operators and service providers can now deploy systems at scale and effect wholesale upgrades without ripping and replacing.

As 5G becomes the “lingua franca” of connectivity, edge demands will impact the fluidity and constructs of 5G infrastructure. Foundational to any wireless infrastructure will be a programmable 5G SoC, capable of adapting to infrastructural demands with a production deployable cellular stack that is customizable. The idea is to present a scalable 5G platform in which customers and developers can leverage open-source tools and C/C++ to configure the chip.

About EdgeQ:

EdgeQ is a leading innovator creating the industry’s first 5G Base-Station-on-a-Chip. Led by seasoned executives from Qualcomm, Intel, and Broadcom who have delivered industry-transforming technologies (4G/5G, WiFi, Wimax, Artificial Intelligence, Cloud Servers) for the last few decades, EdgeQ is inventing a new paradigm in 5G wireless infrastructure.

The company’s vision is to reconstitute wireless infrastructure into a fluid, cloud-based form that would extend robust internet access and communications to remote and dense areas, as well as to the next trillion of interconnected devices.

EdgeQ is backed by world-renown investors, as well as luminary advisors Paul Jacobs, Matt Grob, Ajit Pai, and Rene Hass.

About Vinay Ravuri:

Mr. Ravuri obtained a Masters of Engineering (Major: Electrical Engineering Minor: Computer Science) from Georgia Institute of Technology in 1996, and a Bachelors of Engineering from City University of New York in 1994. He also attended Université de Montréal Deep Learning Summer School in 2016.

References:

EdgeQ Samples World’s 1st Software-Defined 5G Base Station-on-a-Chip

SoC start-up EdgeQ comes out of stealth mode with 5G/AI silicon for 5G private networks/IIoT

Picocom PC802 SoC: 1st 5G NR/LTE small cell SoC designed for Open RAN

Nokia, China Mobile, MediaTek speed record of ~3 Gbps in 3CC carrier aggregation trial

Nokia, China Mobile [1.] and MediaTek have announced a speed record in a test of the world’s first 3 Components (3CC) Carrier Aggregation (CA) technology in Shanghai. The converged 700 MHz/2.6 GHz network reached a peak downlink speed rate of 2.94 Gbps. The trial used Nokia’s AirScale 5G baseband and MediaTek’s Dimensity 9000 5G mobile platform on China Mobile’s 5G SA network. The tests will continue, using China Mobile’s network in Shanghai.

Note 1. China Mobile was banned from the U.S. in 2019.

Nokia said it is the first time the n28 (700MHz band; 30MHz) and n41 (2.6GHz band; 100+60MHz) frequency bands have been successfully combined to reach 190 MHz bandwidth (n28 + n41) with carrier aggregation technology.

CA combines frequency bands for higher data rates and increased coverage, delivering superior network capacity by maximizing the spectral efficiency of 5G networks. The combination of 5G FDD and TDD bands, supplemented by carrier aggregation, can give full play to the advantages of spectrum synergy, greatly reducing the cost of network construction while improving network coverage and user experience. The result is faster data speeds, increased coverage area, and better indoor performance.

The combination of 5G FDD and TDD bands, supplemented by carrier aggregation, augment the advantages of spectrum synergy, cutting the cost of network construction and improving network coverage and service to users.

Nokia has been a partner for over 20 years of China Mobile, which is expanding its network with the convergence of the 700 MHz and 2.6 GHz bands.

JS Pan, General Manager, Wireless Communication Technology at MediaTek, said: “Through this tripartite collaboration we have successfully demonstrated the technical advantages of DL 3CC CA using FDD+TDD. Smartphones powered by the new Dimensity 9000 flagship 5G mobile platform, and forthcoming Dimensity 5G mobile platforms, will be able to take advantage of this cutting-edge 5G connectivity feature, and MediaTek will continue to work closely with industry partners to set new milestones for 5G development.”

Ding Haiyu, Vice President of the Research Institute of China Mobile Communications Co., Ltd.), said: “China Mobile has been fully promoting the evolution and development of 5G technology. CMRI emphasizes that new technology verification provides a technical basis for the improvement of network performance and services, and forms a technical cornerstone for future network planning. China Mobile is also committed to building a 5G multi-frequency collaborative network; This 3CC CA verification can provide users with better throughput and user experience, and provide good technical foundations for new services. China Mobile is willing to work with all vendors to contribute to the 5G evolution.”

Mark Atkinson, SVP, Radio Access Networks PLM at Nokia said: “Nokia has put a strong focus on leading in 5G Carrier Aggregation. This new speed record, using commercially available hardware and software, highlights how Nokia’s pioneering approach continues to drive important innovation in the market. 5G Carrier Aggregation is a critical technology for mobile operators around the world to maximize the impact of their spectrum holdings and deliver enhanced coverage and capacity to subscribers. Nokia will keep pushing the boundaries of 5G to deliver industry-leading performance.”

Resources:

Nokia AirScale

Nokia 5G RAN

Nokia 5G Core

Nokia achieves first 5G carrier aggregation call in standalone architecture with Taiwan Mobile

Spectrum Explained

References:

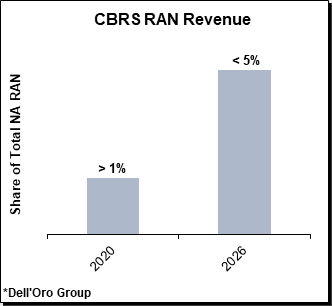

Dell’Oro: CBRS RAN is Behind Schedule: <5% of NA RAN by 2026

With all the air coming out of the next gen cellular hype balloon, Dell’Oro’s report that CBRS RAN is not living up to expectations comes as no surprise. Think about the failed promise of 5G since there is no standard or spec for URLLC in the RAN. Or all the terrific 5G functions and features (including network slicing and security) which are ONLY made possible with a 5G SA core network (very few have been deployed). Or that there is no standard (revision of M.1036) for the mmWave frequencies to be used for 5G.

Dell’Oro says that CBRS adoption continues to increase, but it is significantly below expectations. That’s driven primarily by diverging trends between fixed wireless access (FWA) and non-FWA including public and private LTE/5G NR.

“Adoption gaps across the various CBRS segment remained significant in 2021,” said Stefan Pongratz, Vice President and analyst with Dell’Oro Group. “We have again revised the CBRS RAN projections downward to reflect the lower baseline and slower-than-expected uptake with non-FWA segments. This adjustment does not change the long-term vision—we continue to believe that there is an opportunity to improve spectrum utilization while at the same time stimulating innovation for both public and private networks across various industry segments. So we see this downward revision more as a calibration to reflect the current state of the market and the fact that there is still a significant gap between registered SAS APs and LTE/5G NR base stations,” continued Pongratz.

Source: Counterpoint Research

Other highlights from the CBRS RAN Advanced Research Report:

- LTE is projected to drive the lion share of the investments over the near term while 5G NR based CBRS capex will dominate by 2026.

- CBRS RAN revenues are expected to account for less than 5 percent of North America RAN by 2026.

- Fixed Wireless Access and capacity augmentation for Mobile Broadband (MBB) applications are dominating the CBRS RAN capex mix initially while the enterprise share is expected to improve in the outer part of the forecast period.

Pongratz’s comments were echoed by Norman Fekrat of CBRS vendor Imagine Wireless. In a recent YouTube presentation, Fekrat said that sales of CBRS-based private wireless networking equipment and services to enterprises have been sluggish.

He attributed that in part on the complexities around the technology to use CBRS spectrum. He said the telecom industry in general needs to smooth the sales process for enterprises looking to build their own private wireless networks using CBRS spectrum.

According to Pongratz, there’s a wide range of vendors selling CBRS-capable hardware and software. He said companies like Baicells, BliNQ Networks, Airspan Networks, Telrad Networks and Cambium Networks sell equipment into the FWA market, while companies like Ericsson, Nokia and Samsung have been supplying CBRS equipment into the market for mobile networks.

Verizon was the biggest spender during the FCC’s 3.5GHz CBRS spectrum auction (#105) in 2020, paying almost $1.9 billion for 557 licenses in markets across the U.S. We reported that they planned to test carrier aggregation in the CBRS band, but don’t know if that ever happened. Instead, Verizon’s attention has since shifted following the massive $53 billion it spent in the FCC’s C-band spectrum auction last year. Verizon recently lit up C-band services that covers ~ 95 million people.

Dish Network was another major CBRS spectrum buyer, but they too have not started a major buildout of its CBRS spectrum holdings.

Among the cablecos/MSOs, Comcast, Charter Communications, Cox Communications and others spent millions of dollars on licenses in the auction. However, Charter is the only cable company that has discussed any major efforts to construct a network in the spectrum. Charter may provide additional details on its CBRS efforts during its fourth quarter earnings conference call scheduled for Friday (January 28th).

Financial analysts at New Street Research believe that’s a mistake. “Deployed spectrum has strong long-term strategic benefits. Developing expertise in wireless networking will take years,” they wrote in a note to investors this week. “We think Comcast should be making hard investments in wireless infrastructure now.”

Dell’Oro Group’s Advanced Research: Citizen Broadband Radio Service (CBRS) Report offers an overview of the CBRS LTE and 5G NR potential with a 5-year forecast for the CBRS RAN market by technology, location, and market. For more information about the report, please contact us at [email protected].

References:

https://www.lightreading.com/5g/cbrs-isnt-living-up-to-expectations—delloro-group/d/d-id/774899?

FCC CBRS Auction for 5G mid-band spectrum in the 3.5GHz band

FCC permits Verizon to test 5G and carrier aggregation in CBRS spectrum band

Why are 5G SA Core networks taking so long to be commercially deployed?

by Tim Sylvester, Founder and CEO of Integrated Roadways, a smart infrastructure technology provider, with Alan J Weissberger (editor)

5G SA deployments have significantly lagged market expectations for the same reason that 5G NSA has been so rapidly deployed. 5G NSA uses existing 4G LTE signaling , core network, macro-site infrastructure, requiring only updates to its software and hardware at existing tower sites .

On the other hand, 5G SA requires a completely new Distributed Antenna System (DAS) architecture for microcell / nano or small cell deployments that need significant infrastructure with nontraditional requirements.

Unlike macro-cell deployments for 4G LTE, the position of the 5G SA millimeter wave antenna is not very negotiable – with a 5-mile service radius, a 4G LTE antenna can move considerable distances without significant changes to the service area, while a 5G millimeter wave antenna needs to be in exactly the correct spot to deliver service in a significantly smaller radius. The small cell size of 5G SA means that covering the same territory as a macro-site is essentially impossible, restricting deployments of 5G SA to dense urban areas and along highly trafficked interstate and highway routes.

5G SA requires a new core network infrastructure. Prior cell service models were iterations on technologies used in POTS and internet services that were ported to IP networks and only the final link mode changed from wired to wireless, with an emphasis on coverage area and bandwidth. But 5G SA is more than a new, higher-bandwidth link, incorporating new focuses on reliability and ultra-low latency for ehealth, autonomy, M2M services, augmented reality and other real-time or near-real time applications. This requires more than the wireless link improvements as it makes the easy “cloud” data abstraction obsolete, as these applications and databases physical storage location is relevant to maintaining reliability and ultra-low latency.

5G SA also promises network slicing, network function virtualization, cloud-native service management, distributed microservices at the edge, and software defined networking. Delivery of 5G SA has many more moving parts and stakeholders than 5G NSA and requires collaboration of many industries including automotive, tech, and health. It does not permit a monolithic delivery from a handful of parties. At the same time, the business models for ehealth, autonomy, AR, and other key 5G enabled applications are still unproven and in development, meaning that the carriers are expected to take input from many new parties and make investments in markets that are still at-risk.

Aside from the industry risks and complications, the property owners that will permit 5G SA delivery are not aligned to traditional cell service incentives or priorities. Delivering widespread millimeter wave antennas required for 5G SA networks through a DAS requires a utility or municipal license to attach equipment to each required attachment point, or development of countless private owner site leases to install antennas on private property adjacent to the desired service area. The private-owner approach is functional primarily in urban areas. It can’t be relied upon for primary delivery in non-urban interstate and highway routes that lack the necessary power and fiber drops, or in areas that traditionally only have longitudinal transmission or distribution lines, without further increasing costs to implement frequent new utility drops that service a single user. The outcome is existing approaches are very expensive and time consuming.

Regardless of FCC 1TMR requirements, municipalities and utilities are reluctant to give up that number of pole attachments and accept the visual and safety implications of accommodating that amount of visible equipment mounted overhead. These complications have resulted in permitting fees as high as $10K per antenna, as reported by Sprint in San Diego during early 5G trials (before being absorbed by T-Mobile), which makes the costs and complications of deploying infrastructure daunting to the extent of being nearly impossible. Even when tolerated, there’s no guarantee that existing poles are in the correct locations, which is why AT&T has been deploying its own utility poles to ensure they have attachment points where they need them.

There’s also the significant obstacle of locating distributed micro datacenter space proximate to the antenna attachment points as required to deploy the edge services that are natively required by 5G SA.

The hard to swallow reality for 5G deployment is public agencies are the easiest means to deploy the system, as it conceptually allows a single construction and operations contract per municipal area or interstate/highway route, instead of thousands of independently negotiated agreements with individual property owners. However, municipalities have no obligation to issue these permits, and the mandate for public works is to provide roadways and utility easements, with an institutional preference towards preserving aesthetics and limiting safety issues from overhead mounted hardware. Public agencies are responsible for roads, not responsible for delivering cell services, regardless of the desires of the cell companies. Municipal obligations are not aligned to the preferences of the 5G SA delivery industry, and there is no clear or obvious resolution available using the traditional network MSP approaches.

That said, solutions are readily available, despite their non-obvious nature and departure from traditional network MSP approaches. What the cell industry needs to deploy 5G SA widely is:

● An approach that aligns municipal incentives with 5G SA DAS needs by ensuring 5G SA deployments result in improvements to core urban infrastructure that is the obligation and primary concern of public agencies who are required to permit such improvements

● Leveraging delivery of those necessary infrastructure improvement needs alongside 5G SA capabilities in a “dig once” approach to streamline deployment and lower costs

● Incorporating the edge networking and 5G antenna delivery infrastructure into an invisible infrastructure delivery that does not occupy poles or other overhead assets

As with so many technology obstacles, the solution isn’t found within the technology itself, but found with a change in perspective and better understanding the needs of the stakeholders.

If there were a smart infrastructure technology firm that had the capacity to deploy 5G SA infrastructure as a byproduct of improving core urban infrastructure, hiding all of the antennas and edge networking assets, enabling the delivery of a fully virtualized, sliceable, edge-enabled but cloud-native open access network, the obstacles to 5G SA delivery would be resolved in a manner that is agreeable to the network MSPs, municipal authorities, utilities, and citizens.

Now that the needs for a solution have been identified, the only remaining obstacle is to identify a company that is capable of delivering on these requirements and developing partnerships between the network MSPs and the municipalities to begin widespread deployments.

About Tim Sylvester:

Tim is a computer and electrical engineer. He is the Founder, CEO and Chief Technology Officer of Integrated Roadways, a smart infrastructure technology provider. Smart infrastructure is the integration of data, communications, power, and networking systems into core infrastructure like roads, highways, and bridges.

Smart Pavement system from Integrated Roadways

………………………………………………………………………………………………………………….

Feb 8, 2022 Update from Dave Bolan of Dell’Oro Group:

As of December 31, 2021 there were 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

Mobile Experts: Ericsson #1 in RAN market; Huawei falls to #3

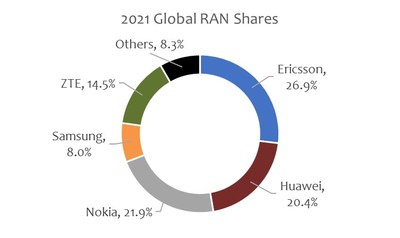

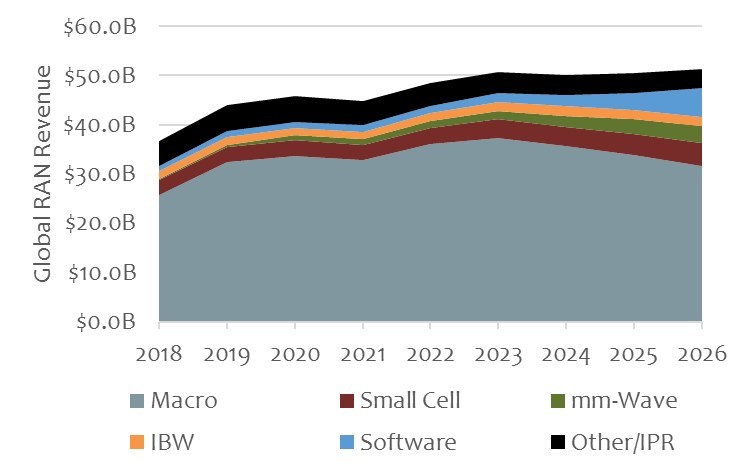

According to a new report from analyst firm Mobile Experts, Ericsson leapt into the #1 position in the RAN market for 2021. Ericsson (see Table 1. at bottom of this article), which achieved a 26.9% share of a market that grew by about 3% in value to be worth in the region of $45 billion last year.

Sanctions hit Huawei very hard as the Chinese tech giant dropped to third place in the RAN market in terms of the value of sales with a 20.4% market share. Huawei had a shortfall of roughly $4B last year due to the company’s inability to produce high-capacity TDD base stations. That was because of U.S. Government sanctions on the critical components needed. As a result, Huawei achieved much lower dollar value than their western competitors.

Nokia (21.9% market share) placed third while ZTE achieved fourth place (14.5%) ahead of Samsung (8% market share).

“Our approach to forecasting is deeply analytical, using data from more than 100 sources, rather than simply the inputs of five OEMs. Our approach works. This analyst team has been creating some of the most accurate, detailed forecasting on the market for over a decade,” commented Chief Analyst of Mobile Experts, Joe Madden. “We have developed relationships with suppliers, operators, and vendors that give us data for a three-pronged approach to triangulation on mobile infrastructure revenue.”

Mobile Experts’ models show the RAN market growing at a CAGR (Cumulative Annualized Growth Rate) of 3%, with -1% growth in macro base stations and 25%-35% growth in millimeter wave and software segments. The analyst firm, known for their unmatched accuracy, leverage over a decade of ear-to-ground experience in this market to present this detailed market forecast that presents last year’s findings concisely and completely as well as presenting what’s next for the RAN market and its players.

“Overall, the RAN market is looking up. After 30 years of boom-and-bust cycles, the market is currently reaching a peak with 5G deployment in its active mode this year. In coming years, we see new revenue coming in from private enterprises to offset the natural drop in CSP sales; specifically, the private LTE/5G market will grow by 19%, accounting for more than $4 billion in 2026. As a result, the total RAN market will remain near its 5G peak for a few years, with the possibility for growth in the longer term,” commented Chief Analyst Joe Madden.

Total Year Review for 2021 – Global RAN Revenue:

This pre-earnings report offers a comprehensive overview of the RAN market with Mobile Experts’ signature accuracy and detailed breakdowns. This quarter’s report includes revenue estimates for the top 25 vendors in the RAN market for 2021. This is the first of a series of quarterly updates, and it is available today for instant download with purchase at www.mobile-experts.net.

For more about this research and buy the report, click here.

About Mobile Experts Inc.:

Mobile Experts provides insightful market analysis for the mobile infrastructure and mobile handset markets. Our analysts are true Experts, who remain focused on topics where each analyst has 25 years of experience or more. Research topics center on technology introduction for radio frequency (RF) and communications innovation. Recent publications include: RAN Revenue, Cellular V2X, Fixed Mobile Convergence, Edge Computing, In-Building Wireless, CIoT, URLLC, Macro Base Station Transceivers, Small Cells, VRAN, and Private LTE.

……………………………………………………………………………………………..

Table 1: Ericsson’s headline figures (Swedish Krona-SEK billions)

| 2021 | 2020 | Change | |

| Net sales | 232.3 | 232.4 | 0% |

| Gross income | 100.7 | 93.7 | 7% |

| Gross margin | 43.4% | 40.3% | – |

| Research and development expenses | -42.1 | -39.7 | – |

| Selling and administrative expenses | -27.0 | -26.7 | – |

| Impairment losses on trade receivables | 0.0 | 0.1 | -134% |

| Other operating income and expenses | 0.4 | 0.7 | -45% |

| Share in earnings of JV and associated companies | -0.3 | -0.3 | – |

| EBIT | 31.8 | 27.8 | 14% |

| – of which networks | 37.3 | 30.9 | 21% |

| – of which digital services | -3.6 | -2.2 | – |

| – of which managed services | 1.5 | 1.6 | -6% |

| – of which emerging business and other | -3.4 | -2.4 | – |

| EBIT margin | 13.7% | 12.0% | – |

| Financial income and expenses, net | -2.5 | -0.6 | – |

| Income tax | -6.3 | -9.6 | 30% |

| Net income | -0.5 | -1.3 | – |

| Source: Ericsson | |||

Germany and France to fund private 5G projects with ~EUR 18 million

The German and French governments are funding four 5G projects with a total of EUR 17.7 million.

- The 5G-OPERA project will create a Franco-German ecosystem for private 5G campus networks with open and virtualized hardware and software based on an open architecture. Partners for this project include Fraunhofer IIS, Fraunhofer HHI, IABG, NXP and Smart Systems Hub, among others.

- The 5G4BP project aims to implement a European set-up for sovereignty and establish open 5G networks in business parks and communities that are not yet covered by public mobile networks. The 5G networks are based on an open architecture (?). The partners in the project include Highstreet Technologies, Xelera Technologies, 6Wind, Alsatis, AW2S and Spectronite.

- Under the 5G OR project, the partners will work on developing wirelessly connected operating theatres in a private 5G network environment for minimally invasive surgery. The partners in the project are the Mannheim Hospital, Charite Hospital in Berlin, Institute Fraunhofer IPA, Karl Storz, Sectorcon, IHU Strasbourg, IRT b-com and RDS.

- Finally, under the 5G FORUM project, French and German industrial and academic parties will develop 5G wireless systems for operating theatres. Partners include RWTH Aachen University, Surgitaix, Uniklinik RWTH Aachen, AMA and Haventure. The goal of the projects is to reinforce the European ecosystem for private networks in 5G telecommunications using innovative methods.

5G private network architectures:

Under the program, the selected consortia will work on projects to make progress in 5G private networks, thus taking another big step towards digital sovereignty of 5G in Europe, said German Federal Minister for Economic Affairs and Climate Action Robert Habeck.

“I am looking forward to an intensive collaboration between France and Germany,” said Robert Habeck. “This is an important step in order to drive the economy forward with the help of state-of-the-art technologies,” he added.

“The constitution of a Franco-German sovereign ecosystem on 5G and future telecommunications network technologies will play a key role to position Europe at the forefront of innovation in 5G and its evolutions,” France’s Minister for the Economy, Finance and Recovery Bruno Le Maire said.

References:

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

by John Strand, CEO of Strand Consult with Alan J Weissberger

A recent Dell’Oro Group report suggests that “total Open RAN revenues, including O-RAN and OpenRAN radio and baseband, surprised on the upside both in 2020 and during 2021, bolstering the thesis that Open RAN is here to stay and the architecture will play an important role before 6G.”

The Dell’Oro Group report author Stefan Pongratz added, “So, given where we are today, we can safely conclude that the movement has come much further than expected both from a commitment perspective and from a commercialization perspective.”

I respectfully disagree. The OpenRAN story is not driven by commercial demand for equipment. Instead, it is driven by people who make a living from hype. There is probably more money being made in generating hype about OpenRAN than in the actual purchase of OpenRAN equipment.

While there’s a lot of talk about OpenRAN, it’s still a technology that operators are testing – not deploying.

The hype cycle likely explains the Dell’Oro Group’s recent report that the OpenRAN market will increase. However, for all their unique expertise, Dell’Oro has not committed to publishing how many sites will use OpenRAN in the future (% of installed base) and other vital specifics like what proportion of the mobile companies’ traffic and revenue will go through OpenRAN sites and how much shareholders may gain by operators switching to OpenRAN.

Over 200 5G networks have gone live globally. All of these use 3GPP release 15 and 16 compliant network equipment. None use OpenRAN gear.

Note that neither 3GPP release 15 or 16 5G RAN specs or ITU-R 5G standard (ITU-R M.2150) include any reference to OpenRAN specifications (from either the O-RAN Alliance or TIP OpenRAN project). In fact, the 3GPP website calls out the conundrum of multiple OpenRAN-like specifications:

Open RAN is made possible through standardized (???)open network interfaces, defined in 3GPP, O-RAN Alliance, IEEE (???), and other SDOs (???) and industry fora (e.g. TIP Open RAN project). To cater to all the diverse 5G use cases and operator’s deployment constraints, the standards define multiple NG-RAN architecture options and the associated open network interfaces. While these options are crucial in making 5G suitable to address all the requirements and challenges of the next generation mobile network, figuring out which option fits a particular practical use case is sometimes challenging. This is further exacerbated by the fact that relevant standards are scattered across multiple SDOs.

Rakuten is the only deployed, purpose-built OpenRAN network (4G now, 5G later), and it uses proprietary network equipment, which is not interoperable with any other 4G/5G network. The much advertised 4G/5G OpenRAN Dish Network continues to be delayed with a launch date of sometime in 2022.

There are hundreds, if not thousands, of stories about OpenRAN, but they don’t focus on these key questions:

- How much do telecom stakeholders gain by you switching from classic 3GPP RAN to OpenRAN? At what point does it make sense to shift? In other words, how much do operators save and how does that translate to the bottom line? Strand Consult’s research shows that the operators’ RAN costs make up about 3% of ARPU. In practice, even the most optimistic savings from OpenRAN will not meaningfully affect the mobile operator’s earnings.

- If OpenRAN products win market share of 15% in 2026, what share of that installed base will be OpenRAN in 2025 and 2030? Strand Consult believes that OpenRAN will struggle with market share, barely reach 3% of the installed 5G sites by 2030.

- How will mobile subscribers experience the shift towards OpenRAN? Will they gain access to more features on their smartphones as a result? If OpenRAN achieves 3% market share of mobile sites, what incentives are there for application developers to build for OpenRAN? Imagine that voice and SMS were services that were available on only 3% of an operators’ mobile sites.

There is a need for greater transparency in the OpenRAN market, including testing, operator trials, units sold etc. While it is one thing for an operator to conduct OpenRAN trials and tests, it is quite another for the operator to purchase the equipment. To fuel the hype, some stories have suggested that a trial of OpenRAN equipment was a purchase.

OpenRAN benefits, however good they sound now, remain to be seen. We have yet to see any actual benefits created from the mix and match of OpenRAN modules/components. Moreover, we have yet to see how easy it will be to replace one OpenRAN vendor with another in a large scale commercial 4G/5G network.

For 25 years, Strand Consult has been the opposite of hype. We make our living being critical of pie in the sky scenarios. Our clients are executives and boards members of mobile operators who want credible and critical knowledge.

Strand Consult’s report Debunking 25 Myths of OpenRAN, analyzes the 25 myths that OpenRAN hype machine loves to cultivate. Close to one thousand people have requested that new report. Outside of three emails noting minor typos in our report, Strand Consult has yet to receive feedback to dispute the report’s analyses and conclusions.

John Strand founded Strand Consult in 1995. Since then, hundreds of companies in the telecom, media and technology industries have attended Strand Consult’s workshops, purchased reports, consulted with the company to develop strategy, launch new products, and conduct a dialogue with policymakers.

John Strand sits on the advisory board of a number of Scandinavian and International companies and is a member of the Arctic Economic Council Telecommunications Working Group. He served on the Advisory Board for the 3GSM World Congress, the event known as the Mobile World Congress in Barcelona.

………………………………………………………………………………………………………

References:

Dell’Oro Group, Kenneth Research and Heavy Reading’s optimistic forecasts for Open RAN

https://www.lightreading.com/open-ran/open-ran-moving-faster-than-expected—-delloro/d/d-id/774780?

https://www.3gpp.org/news-events/2150-open_ran

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Telenor expands cloud-based core network with AWS to deliver 5G and edge services for customers

Nordic network operator Telenor signed a strategic collaboration agreement with Amazon Web Services (AWS) to help expand its 5G core transformation, the telco said in a press release.

Telenor said that the new deal will allow it to deliver new 5G and edge services to enterprise customers worldwide. As part of the agreement, Telenor and AWS will invest in joint go-to-market activities in select industries—such as manufacturing, supply chain and logistics, and automotive—to enable more 5G and edge services for customers. Working with existing customers to demonstrate the possibilities of cloud-based resources, Telenor will scale its cloud footprint, while innovating to develop new services that use a combination of the most advanced and secure cloud technologies from AWS.

The agreement further expands the existing collaboration between both companies, with Telenor also becoming a member of the AWS Partner Network. Working with AWS, Telenor has already implemented an entire mobile core, running in the cloud, for Vimla, which is Telenor’s virtual mobile network operator (MVNO) brand in Sweden.

Running on AWS, Vimla’s mobile core is scalable, programmable, and employs self-service APIs, enabling Vimla to create new services for its customers. Vimla uses a wide range of AWS services, including Amazon ElastiCache, AWS Lambda and AWS Transit Gateway, among others.

The new cloud-based mobile core at Vimla is developed and managed as-a-service by Working Group Two, a company incubated by Telenor. The Nordic operator also said it plans to expand the work at Vimla to other areas in the company’s worldwide network.

As part of their collaboration, Telenor and AWS will continue to innovate in the areas of 5G edge for mobile private networks (MPNs) and edge computing. For example, Telenor 5G enabled a “network on wheels (NOW)” prototype powered by AWS. The NOW gives customers the ability to set up an autonomous private 5G network wherever it is needed. The NOW prototype is currently being used by the Norwegian defense material agency and the Norwegian Public Service broadcaster Norsk Rikskringkasting (NRK) for critical communication and remote production use cases, respectively. Internationally, Telenor’s Thailand brand dtac, launched a 5G private network proof-of-concept for Thai enterprises based on edge computing and the AWS Snow Family. This solution helps customers process real-time, artificial intelligence (AI)-based video analytics and other applications in remote locations.

Working with AWS, Telenor has already implemented an entire mobile core, running in the cloud, for Vimla—Telenor’s virtual mobile network operator brand in Sweden. Running on AWS, Vimla’s mobile core is scalable, programmable, and employs self-service APIs, enabling Vimla to create simple, innovative and valuable services for its customers. Vimla uses a wide range of AWS services, including Amazon ElastiCache, AWS Lambda, AWS Transit Gateway, and others to help scale elastically and provide a better service to more customers. The new cloud-based mobile core at Vimla is developed and managed as-a-service by Working Group Two, a company incubated by Telenor. As a result of driving network transformation on AWS, Telenor plans to expand the work at Vimla to other areas in the company’s worldwide network.

“Working with AWS, we are continuing to advance and modernize the telecoms industry—digitalizing and expanding our offerings beyond connectivity. Together, we are building on our individual strengths and scaling secure, robust, and advanced cloud services, alongside the latest networking technology, for our customers much faster than we could ever do before. Our shared ambition is to use scalable and flexible building blocks from AWS to continuously raise the bar for what’s possible,” said Sigve Brekke, president and CEO of Telenor Group.

“Telenor is pushing the boundaries of innovation by running their Vimla core on AWS. Cloud technology is allowing Telenor to scale their network in a way that was not possible before and is allowing them to experiment and develop new experiences for customers to keep them engaged, entertained, and online. We are pleased to collaborate with Telenor as they continue to expand this innovative work to other parts of their business,” said Adam Selipsky, CEO of AWS.

%20resized.jpg)

In addition to its home market in Norway and MVNO in Sweden, Telenor has operations in Denmark, Finland, Bangladesh, Pakistan, Thailand and Malaysia (and Myanmar, but it is trying to exit that market), but currently Telenor is not disclosing the details of which markets will be next or when the next deployment might happen.

Telenor and AWS have developed what they call a ‘Network On Wheels’ (NOW), which “gives customers the ability to set up an autonomous private 5G network wherever it is needed.” This model is already being used by the Norwegian Defence Material Agency for critical communications needs and by Norway’s public service broadcaster, Norsk Rikskringkasting (NRK), for remote production use cases.

In Thailand, Telenor group operator dtac has developed a 5G private network proof-of-concept for local enterprises using AWS Snow Family edge compute devices.

“This solution helps customers process real-time, artificial intelligence (AI)-based video analytics and other applications in remote locations, even in areas with intermittent connectivity,” Telenor said.

Ray Le Maistre of Telecom TV wrote: “Telenor has clearly identified AWS as the cloud partner that can help it with its specific need in both the consumer and enterprise markets, so this will be a relationship well worth tracking as the operational models are innovative.”

This author wonders what has become of Telenor’s deal with Nokia to launch a new cloud-native core solution in Denmark, Norway and Sweden. When it was announced in May 2020, Nokia said the deployment will “enhance performance and reliability and drive mobile broadband service agility as Telenor prepares for the introduction of 5G.”

………………………………………………………………………………………………………………………

References: