Month: January 2024

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

According to a new report by Dell’Oro Group, the Radio Access Network (RAN) market is now in a downward trajectory. That’s no surprise to readers of the IEEE Techblog, as we forecasted the “5G train wreck” many years ago and continued the drumbeat due to the scarcity of 5G SA core networks, without which there are NO 5G features/functions. Also that URLLC performance requirements were not met by either the 3GPP Release 16 Enhancements for URLLC in the RAN spec or the ITU M.2150 recommendation which is the official standard for 5G NR.

Following the >40 percent ascent between 2017 and 2021, RAN revenues stabilized in 2022, and are on target to decline sharply in 2023. Market conditions are expected to remain challenging in 2024 as the Indian RAN market pulls back, though the pace of the global decline this year and for the remainder of the forecast period should be more moderate.

“The big picture has not changed. MBB-based investments are now slowing and the upside with new growth areas including FWA and private wireless is still too small to change the trajectory,” said Stefan Pongratz, Vice President at Dell’Oro Group. “Also weighing on the MBB market is the fact that the upper mid-band capacity boost is rather significant relative to current data traffic growth rates in some markets, which could impact the timing for capacity upgrades,” continued Pongratz.

Additional highlights from the Mobile RAN 5-Year January 2024 Forecast Report:

- Worldwide RAN revenues are projected to decline at a 1 percent CAGR over the next five years.

- The Asia Pacific region is expected to lead the decline, while easier comparisons following steep contractions in 2023 will improve the growth prospects in the North America region.

- 5G-Advanced is expected to play an important role in the broader 5G journey, however, it is not expected to fuel another major capex growth cycle.

- RAN segments that are expected to grow over the next five years include: 5G NR, FWA, mmWave, Massive MIMO, Open RAN, private wireless, small cells, and Virtualized RAN.

Dell’Oro said in November said it was optimistic about the long-term growth prospects of the RAN space, but simultaneously noted that after a peak in 2021, RAN revenues will track downwards until the second half of the current decade; overall it predicted a 1% compound annual growth rate between 2020 and 2030. That forecast will now have to be revised DOWN significantly as 6G- the next big RAN mover- won’t be standardized till 2031 at the earliest.

RAN remains a concentrated market, with the top 8 RAN suppliers accounting for more than 98% of the 1Q23-3Q23 RAN market. New technologies, architectures, and segments can in some cases present opportunities for vendors with smaller footprints. Still, the track record for new entrants is far from perfect.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the RAN market by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 7 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact us by email at [email protected].

References:

RAN Decline to Extend Beyond 2023, According to Dell’Oro Group

https://techblog.comsoc.org/2024/01/18/where-have-you-gone-5g-midband-spectrum-fwa-decline-in-capex-and-ran-revenue-in-2024/

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: OpenRAN revenue forecast revised down through 2027

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

https://www.sdxcentral.com/articles/contributed/what-to-expect-from-ran-in-2024/2024/01/

Telstra International partners with: Trans Pacific Networks to build Echo cable; Google and APTelecom for central Pacific Connect cables

Telstra International, the global arm of leading telecommunications and technology company Telstra, and Trans Pacific Networks (TPN) have partnered to build the Echo cable, the first subsea cable to directly connect the U.S. to Singapore, creating a new route and delivering vital connectivity in the Trans-Pacific.

Echo’s subsea system is a unique express route connecting California, Jakarta, Singapore, and Guam. The system creates a new path and offers low latency, high-speed, resilient network infrastructure connecting South Asia to the US. The first Echo segments (Guam-US) will launch in mid-2024, with the remaining segments in 2025. Telstra will become TPN’s operating partner to provide secure, long-term stability on an efficient route.

In addition, Telstra will be delivering cable landing station services for Echo in Singapore and the Network Operations Centre services. XL Axiata is landing the cable in Indonesia and our partner for delivering services into Indonesia. Telstra International CEO said the geographical area the new cable would be built in was one of the more challenging regions globally in terms of regulation as well as subsea cable cuts. “Our subsea network scale makes Telstra International uniquely placed to successfully navigate the complexity of these environments to ensure the stability of the world’s digital connectivity,” said Roary Stasko, CEO Telstra International.

In the Trans-Pacific, demand for bandwidth is growing at one of the fastest rates in the world, with forecasts showing it will increase by 39% year on year until 2029[1]. As our lives become increasingly digital and new technologies like AI, IoT and cloud computing continue to evolve, bandwidth plays a critical role in supporting these and is set to soar further as the need for reliable, low latency connectivity grows to serve businesses and consumers.

“Trans Pacific Networks is thrilled to partner with industry leader Telstra to expand telecommunication access between the US and Asia. To be partially funded by the US International Development Finance Corporation, the Echo subsea cable system will be a critical element of the Indo-Pacific’s digital infrastructure, ultimately strengthening networks and increasing capacity while reducing internet costs in the region,” said Aaron Knapik, CFO TPN.

“The Trans-Pacific is a critical connection point to reach the US, and the geography of these regions means they will rely on new submarine cable routes like Echo for international connectivity. We’re delighted to partner with TPN to launch capacity via Echo which will significantly enhance the vital data demands of people and businesses and provide much needed diversity, resiliency and reliability which has become critical to keep our everyday lives connected.”

“We’re accelerating growth in our international digital infrastructure with investments in subsea fibre capacity on unique, diverse routes – helping to move more traffic around the world and strengthening connections from Asia to the US. Echo’s cable system has the ability to allow other countries to take advantage of its redundancy. In addition, we’ve recently added 3Tbps of capacity through the SEA-US cable connecting US mainland to Hawaii, Guam and Philippines which complements our existing Trans-Pacific cables like AAG, UNITY, FASTER, NCP and JUPITER,” Roary said.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

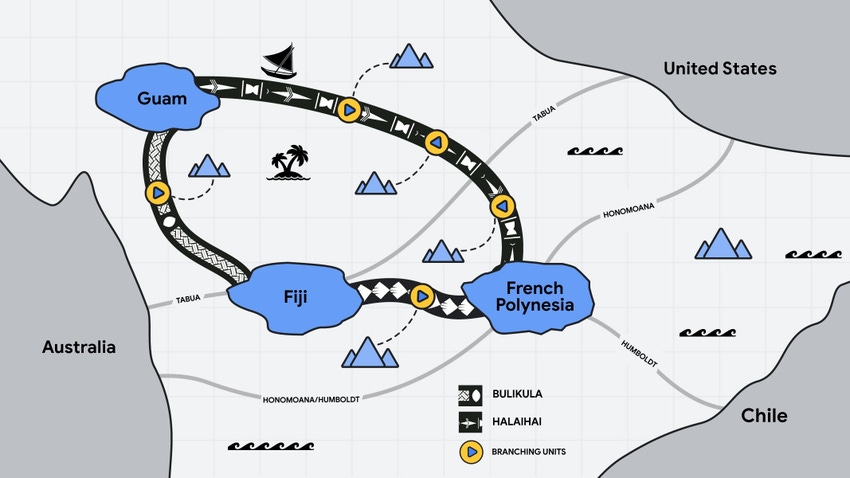

In addition, Telstra International will be partnering with Google and APTelecom to deliver the new central Pacific Connect initiative which will significantly uplift connectivity for people and businesses of the Pacific. The two cables – which make up the central Pacific Connect initiative – Bulikula will connect Guam and Fiji, and Halaihai will connect and Guam and French Polynesia.

Telstra will be one of the key telecommunications providers of central Pacific Connect and will own and operate a fiber pair on the core trunk on the Bulikula cable connecting Guam and Fiji. Bulikula is the Fijian word for “golden cowrie,” a rare shell found in the Pacific Ocean often worn by local chieftains as a badge of rank. The next step will be partnering with other carriers and governments to assist in building and operating branches to the Pacific islands. These branches will power access to vital digital services across the region and will improve network performance, redundancy and reliability.

Bulikula and Halaihai cable systems

“Telstra has decades of experience providing international connectivity in the Pacific, and with our network scale and local expertise, we are looking forward to partnering with Google and APTelecom to build reliable, high-performance connectivity for island countries. We’re committed to improving infrastructure across the region which will support the future growth of local economies,” said Roary Stasko, CEO Telstra International.

In addition, Telstra is partnering with Google on the Tabua cable which combined with the central Pacific Connect initiative, will dramatically improve the diversity of paths between Guam to Australia via Fiji and other Pacific islands, and between the US mainland and Australia.

About Telstra International:

Telstra is a leading telecommunications and technology company with a proudly Australian heritage and a longstanding, growing international business. Telstra International provides services to thousands of business, government, carrier and OTT customers. Over several decades we have established the largest wholly-owned subsea cable network in the Asia-Pacific, with a unique and diverse set of infrastructure that offers access to the most intra-Asia lit capacity. We empower businesses with innovative technology solutions including data and IP networks, and network application services such as managed networks, unified communications, cloud, industry solutions, integrated software applications and services. These services are underpinned by our subsea cable network, with licenses in Asia, Europe and the Americas and access to more than 2,000 Points of Presences (PoPs) in more than 200 countries and territories globally. In July 2022 Telstra completed the acquisition of Digicel Pacific, the largest mobile operator in the South Pacific region.

For more information, please visit www.telstra.com/global.

References:

https://www.telstra.com.au/aboutus/telstra-international

https://www.telecoms.com/fixed-networks/google-preps-for-more-island-hopping-with-telstra

Infinera trial for Telstra InfraCo’s intercity fiber project delivered 61.3 Tbps between Melbourne and Sydney, Australia

Telstra partners with Starlink for home phone service and LEO satellite broadband services

Nokia to exit TD Tech joint venture with Huawei due to U.S.-China tensions

According to a January 21,2024 article in the South China Morning Post, Nokia is set to exit its joint venture with Huawei in the telecommunications sector due to US-China tensions. Nokia has found new buyers for its majority stake in a Beijing-based joint venture with Huawei Technologies, after a proposed deal fell through last year following strong protest by the Chinese partner. The article states that Nokia will sell its majority stake in TD Tech [1.] to a group that will be jointly controlled by Huawei and a group of entities that include the government-owned Chengdu High-Tech Investment Group and Chengdu Gaoxin Jicui Technology Co, as well as venture capital firm Huagai, according to a disclosure published on Friday by the State Administration for Market Regulation (SAMR).

Huawei had a 14% share in the Chinese smartphone market in the third quarter 2023, putting it in fifth place behind its spin-off Honor and rivals Oppo, Vivo and Apple, data from market intelligence firm Counterpoint Research showed. According to Statista, Huawei had a 58% share of all 5G base stations in China as of the 3rd quarter 2023. Its closest competitor was ZTE with a market share of 31%. Nokia had only a 2% market share.

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

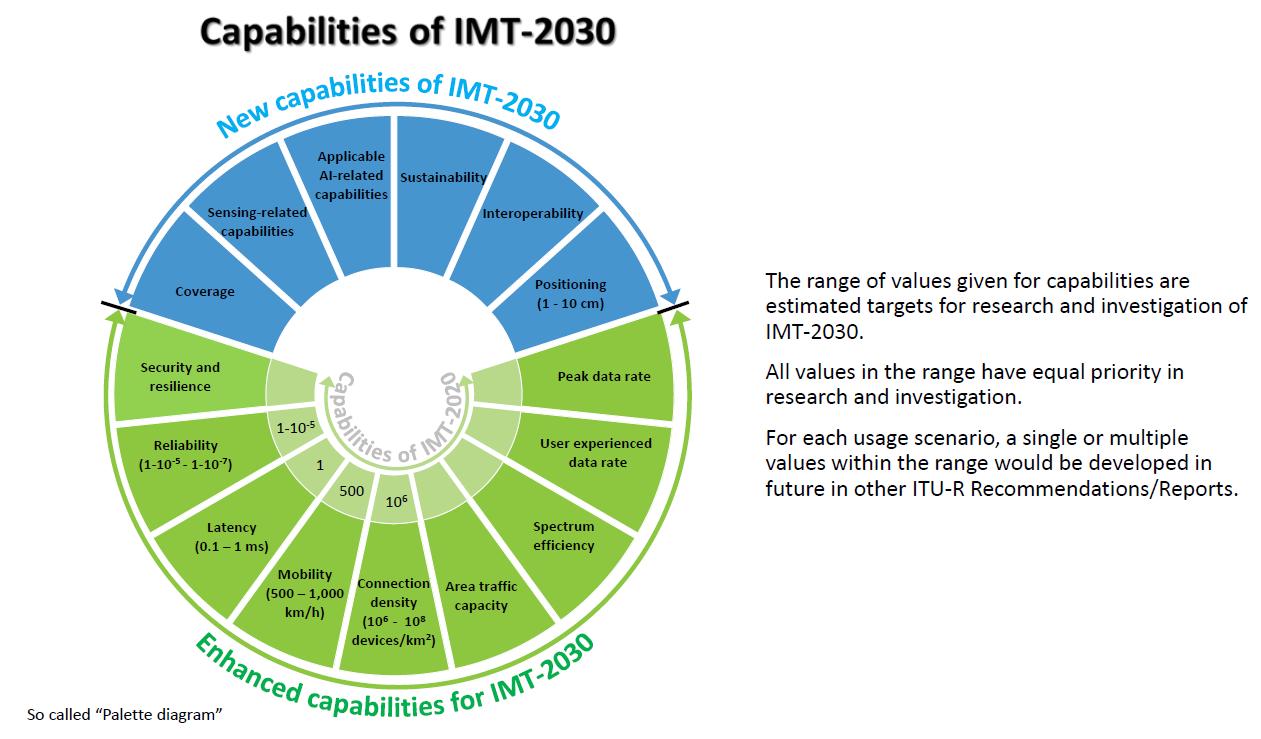

As defined in Resolution ITU-R 56-3, International Mobile Telecommunications-2030 (IMT-2030) systems are mobile systems that include new radio interface(s) which support enhanced capabilities and new capabilities beyond IMT‑2020, IMT-Advanced and IMT-2000. In Recommendation ITU-R M.2160 ‒ Framework and overall objectives of the future development of IMT for 2030 and beyond, the capabilities of IMT-2030 are identified, which aims to make IMT-2030 more capable, flexible, reliable and secure than previous IMT systems when providing diverse and novel services in the intended six usage scenarios (see figure below), including immersive communication, hyper reliable and low‑latency communication (HRLLC), massive communication, ubiquitous connectivity, artificial intelligence and communication, and integrated sensing and communication (ISAC).

IMT-2030 is expected to support enriched and potential immersive experience, enhanced ubiquitous coverage, and enable new forms of collaboration. Furthermore, IMT-2030 is envisaged to support expanded and new usage scenarios compared to those of IMT-2020, while providing enhanced and new capabilities. In accordance with the IMT-2030 (6G) timeline within ITU-R, development of IMT-2030 Technical Performance Requirements (TPR) is expected to start in ITU-R Working Party 5D (WP 5D) at the February 2024 meeting in Geneva.

- The IMT-2030 performance requirements are to be evaluated according to the criteria defined in Report ITU-R M.[IMT‑2030.EVAL] and Report ITU-R M.[IMT-2030.SUBMISSION] for the development of IMT-2030.

- Recommendation ITU-R M.2160 defines fifteen key “Capabilities of IMT-2030,” which form a basis for the [x] technical performance requirements to be specified in the forthcoming draft document.

In order to facilitate the work of this important phase of IMT-2030 development, Apple, China, and India separately proposed outlines or suggestions for a working document towards a preliminary draft new report on technical performance requirements of IMT-2030. Those contributions will be presented and discussed at the February 2024 ITU-R WP 5D meeting in Geneva, Switzerland.

The proposed technical performance parameters include:

Peak data rate, Peak spectral efficiency, User experienced data rate, 5th percentile user spectral efficiency, Average spectral efficiency, Area traffic capacity, Latency, User plane latency, Control plane latency, Connection density, Energy efficiency, Reliability, Mobility, Mobility interruption time, Bandwidth, Coverage, Positioning, Sensing, AI, Security, Sustainability, and Interoperability.

This work will certainly refer to IMT-2030 set of expected capabilities are outlined in ITU-R M.2160 Framework and overall objectives of the future development of IMT for 2030 and beyond, which was approved in November 2023. A broad variety of capabilities associated with envisaged usage scenarios, are described in that recommendation.

Huge caveat: It’s important to note that the IMT 2020 (5G) Technical Performance Parameters specified in ITU-R M.2410 for URLLC use case have STILL NOT BEEN achieved. Furthermore, the 3GPP spec for URLLC in the RAN has not been performance tested or submitted to ITU-R WP5D, even though it was “frozen” June 2020 in 3GPP Rel 16. Hence, one must wonder if this proposed IMT 2030 Performance Parameter spec will be yet another “paper tiger?”

References:

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2030/Pages/default.aspx

Draft new ITU-R recommendation (not yet approved): M.[IMT.FRAMEWORK FOR 2030 AND BEYOND]

IMT Vision – Framework and overall objectives of the future development of IMT for 2030 and beyond

IMT 2020.SPECS approved by ITU-R but may not meet 5G performance requirements; no 5G frequencies (revision of M.1036); 5G non-radio aspects not included

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

The “5G Train Wreck” we predicted five years ago has come to pass. With the possible exception of China and South Korea, 5G has been an unmitigated failure- for carriers, network equipment companies, and subscribers/customers. And there haven’t been any significant performance advantages over 4G. I’ve had a 5G Samsung phone for almost 2 years and I don’t notice any difference in performance from my previous 4G Samsung phone.

Jennifer Fritzsche, managing director at investment bank Greenhill & Company wrote on January 16th:“As carriers pulled back on capex and focused on Free Cash Flow, “5G” mentions saw a precipitous decline on almost every carrier earnings call last year.” However, she is somewhat optimistic for 2024, “2024 will be the year when carriers will need to justify the spectrum spend they paid billions of dollars for only a few short years ago. Although the 5G consumer killer app may already be here (FWA [1.]), the key trend to watch is the development of enterprise solutions for 5G. If carriers can tap into their deep enterprise relationships to play ball here – this 5G thing becomes a lot more real.”

Note 1. It’s quite surprising that Fixed Wireless Access (FWA) has emerged as the most popular 5G deployment, especially from T-Mobile US and Verizon. That’s because it was NOT one of the three 5G use cases defined by ITU-R (Enhanced Mobile Broadband, Machine to Machine Communications and URLLC).

Midband spectrum is a key element supporting the fixed wireless access (FWA) services from all of the big US wireless network operators. FWA promises to supplant wired Internet connections inside homes and offices with 5G connections. Yet network operators aren’t boasting about their midband network buildouts like they were a few years ago. Instead, they’re talking about plans to reduce spending (CAPEX) on their networks in order to boost revenues.

“We’ve been telling you [in 2024] our capital intensity was going to tail off from kind of the peak levels we’ve been at the last couple of years,” AT&T CEO John Stankey said at a recent UBS investor conference. “I expect that’s going to be the case,” he added. AT&T officials have said the company will spend between $21 billion and $22 billion on capital expenses (capex) during 2024, down from $24 billion in 2023. Other operators are signaling similar drawdowns.

“We’ve spent a lot of money over the past five years, a lot of money building the world’s best 5G plant, and it’s time to be able to enjoy having that in the ground and be able to realize the benefits of that,” Sievert, T-Mobile’s CEO, explained.

Financial analysts at Evercore recently wrote that they expect U.S. capex to decline “as the 5G investment cycle tapers off. There should not be another capex cycle for the next few years adding some comfort to the FCF [free cash flow] outlook in a world of fundamental uncertainty.”

RAN revenue continues to decline Year-over-Year. Dell’Oro’s preliminary findings from 1Q23-3Q23 data reveal that the North America RAN market is declining at a much steeper rate than anticipated. Interestingly, the capex decline in the U.S. aligns with operators’ communications, but the North America wireless RAN/capex ratio is on track to reach the sub-15% range, highlighting the disconnect lies not in capex decline but in the proportion allocated to the RAN. Yet RAN excluding North America is actually coming in stronger than what we outlined going into 2023, in part because of the incredible 5G ascent in India. Putting things together, it appears that the surprise on the downside in the U.S. is more than enough to offset the stronger-than expected showing in the Asia Pacific region.

Looking ahead, Dell’Oro is forecasting global RAN to record a second consecutive year of RAN contractions in 2024, though the pace of the decline should be more moderate. The regional dynamics will change as the pendulum swings towards the negative in India. Wireless capex in the US is still on track to decline. Yet we are forecasting the North America RAN market to grow, implying a greater portion of the capex will be allocated towards the RAN segment in 2024

Dell’Oro’s Stefan Pongratz concludes:

In summary, 2024 is unlikely to emerge as the most exhilarating year from a broader RAN revenue growth perspective. Even so, within the market, there will be pockets undergoing significant changes. While some of the upcoming growth areas will remain relatively small, 2024 is poised to be an important transition year for various wireless sub-segments. As always, the competitive RAN landscape will continue to be fierce. Despite the anticipated decline in certain aspects of the RAN market, it should be an eventful year.

References:

https://www.igr-inc.com/communications-infrastructure/fritzsches-forum/240116/

https://www.lightreading.com/5g/america-s-5g-buildouts-move-into-unknown-territory

https://www.sdxcentral.com/articles/contributed/what-to-expect-from-ran-in-2024/2024/01/

Dell’Oro: RAN revenues declined sharply in 2023 and remain challenging in 2024

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

https://www.delloro.com/news/worldwide-telecom-capex-to-drop-7-percent-by-2025/

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

https://www.sdxcentral.com/articles/contributed/what-to-expect-from-ran-in-2024/2024/01/

https://www.lightreading.com/fixed-wireless-access/fwa-to-remain-biggest-disruptor-through-2024

https://www.lightreading.com/5g/what-they-re-saying-about-5g-capex-in-2023-and-2024

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

China Unicom Jilin, the local affiliate of China Unicom in the Jilin province, has completed the deployment of a 2.1 GHz 8T8R 5G network for a segment of the national Harbin-Dalian high-speed railway with 5G network equipment from Huawei.

Tests show that 8T8R AAUs increase the coverage area by 44% compared with 4T4R, and 5G user experience improves by 5.2 times compared with 4G. The train passengers can heartily access the network for entertainment such as HD video, live streaming, and New Calling as well as for work on-the-move such as remote video conferencing.

In 2023, China Unicom embarked on a 5G coverage project along China’s sixteen trunk high-speed railways. Its affiliate in Jilin province contributed to its share of constructing the province’s premium 5G network for high-speed railways within the provincial borders. At first, this network construction project was daunted by four serious challenges. To begin with, the distance between sites is large. What’s worse, the penetration loss was greater with high-speed railways than common railways. Additionally, high-speed mobility increased the Doppler shift, a direct cause of performance deterioration. Lastly, user experience was poor due to short camping time caused by frequent handovers (every 3–4 seconds) on trains running at a high speed of 300 km/hr.

To address these challenges, in this project, China Unicom Jilin deployed the 2.1 GHz 8T8R AAU, and activated the High-speed Railway Excellent Experience feature and Cell Combination feature.

The 2.1 GHz 8T8R AAU solution integrates with technologies like multi-antenna, integrated high-gain array, intelligent beamforming, and precise and fast beam sweeping. Compared with 4T4R, it improves coverage by 7.5 dB, user experience by an impressive 55%, and capacity by 85%. This solution solves the problem of poor coverage caused by large distances and large insertion loss on high-speed railways. It also uses the same antenna as the legacy 4G 1.8 GHz network, simplifying site deployment and reducing tower rental by 10%. This series of solutions with Huawei FDD beamforming technology took home the GSMA GLOMO award for “Best Mobile Technology Breakthrough” and was listed in the “Guangdong Province Energy Saving Technology and Equipment (Product) Recommendation Catalogue”, issued by the Guangdong Energy Bureau in July 2023, for its excellent performance in energy saving.

After the High-Speed Railway Excellent Experience feature is enabled, the 5G base station proactively adjusts the signal frequency to offset the negative impact caused by frequency offset. This solves the Doppler shift problem in high-speed railway continuous coverage scenarios. After Cell Combination feature is enabled, the number of inter-cell handovers can be reduced in a cell combination network, which solves the problems of fast handovers and short camping time on high-speed railways. Test results show that after this feature is enabled, the access success rate increases to 99.4% and the call drop rate decreases by 57%. This overcomes the difficulties of difficult network access in ultra-high-speed scenarios.

This commercial deployment of the 2.1 GHz 8T8R AAU solution will greatly facilitate the operator’s future plans for similar 5G rollouts. China Unicom Jilin will continue to explore 5G network deployments in different scenarios as well as innovative applications of 2.1 GHz 8T8R in order to build differentiated 5G advantages based on service requirements in various 5G scenarios.

China Unicom to deploy Huawei’s 64T64R MetaAAU product-an upgrade of Huawei MetaAAU

China’s telecom industry business revenue at $218B or +6.9% YoY

Huawei’s comeback: 2023 revenue approaches $100B with smart devices gaining ground

ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

Omdia: China’s 5G network co-sharing + cloud will create growth opportunities for Chinese service providers

Nokia plans to investment €360 million in microelectronics & 5G Advanced/6G technology in Germany

Nokia plans to invest €360 million (US$391 million) on the development of energy-efficient software, hardware and high-performance microelectronics for use in future mobile communications systems based on future 5G-Advanced and 6G specs from 3GPP and ITU-R standards.

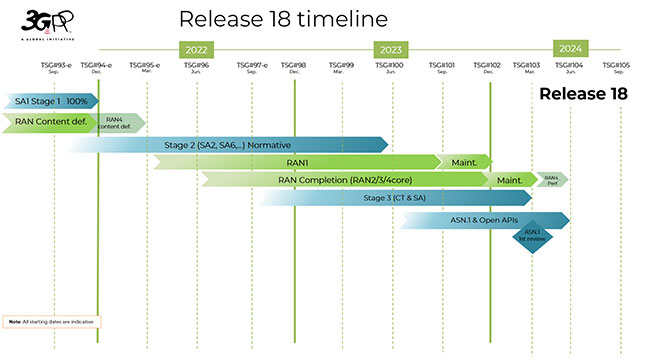

Nokia wrote that “3GPP Release 18 will mark another major evolution in 5G technology that will lead the industry into the 5G-Advanced era. 5G-Advanced is set to evolve 5G to its fullest, richest capabilities. It will create a foundation for more demanding applications and a wider range of use cases than ever before with a truly immersive user experience based on extended reality (XR) features. It will also introduce AI and ML enhancements across the RAN, Core, and network management layer for improved performance, network optimization, and energy efficiency.”

Source: Nokia

…………………………………………………………………………………………………………………………

Editors Note: 3GPP Release 18 is scheduled to be completed in June 2024

Source: 3GPP

……………………………………………………………………………………………………………………

The project will focus on the integrated development of software, hardware and high-performance systems-on-chips based on a digital twin. These will be used in radio and optical products in future mobile communications systems based on the 5G-Advanced and 6G standards. Nokia is further expanding its extensive experience in chip design and strengthening the European value chain.

This development work will be carried out at Nokia’s Ulm and Nuremberg sites in Germany, and will be funded by Nokia, the German Federal Ministry of Economics and Climate Protection and the German states of Baden-Württemberg and Bavaria.

Another focus area is on the energy efficiency of the systems to support European climate targets under the Green Deal. Nokia is closely cooperating with research institutes and universities to achieve this objective.This cooperation will be strengthened by the long-term IPCEI investment and funding. The microelectronics systems developed as part of the project will help to make networks more energy-efficient and more powerful at the same time.

Nokia hopes that the project will strengthen Europe’s competitiveness, especially in the field of microelectronics for nascent technologies such as 6G and artificial intelligence.

Tommi Uitto, President of Mobile Networks at Nokia, said:

“This important funding will support our efforts to advance the telecommunications industry in Germany and in Europe, helping to drive innovation and strengthen competitiveness. In particular, it will help our research into microelectronics that will power future technologies such as 6G, artificial intelligence and the metaverse as well as develop networks that are more energy-efficient and powerful. Germany is an important market for Nokia, and we look forward to working with the government to produce cutting-edge technology that is ‘Made in Germany’.”

References:

https://www.nokia.com/about-us/newsroom/articles/5g-advanced-explained/

https://www.3gpp.org/specifications-technologies/releases/release-18

Nokia exec talks up “5G Advanced” (3GPP release 18) before 5G standards/specs have been completed

Nokia and du (UAE) complete 5G-Advanced RedCap trial

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

ABI Research: 5G-Advanced (not yet defined by ITU-R) will include AI/ML and network energy savings

Nokia will manufacture broadband network electronics in U.S. for BEAD program

OFC 2024: Researchers achieve 12-spatial-channel WDM/SDM transmission over transoceanic distance

Researchers have achieved wave/space-division multiplexed (WDM/SDM) transmission across a transoceanic distance of 7280 km with an unprecedented 12 spatial channels using a coupled multi-core fiber with a standard cladding diameter. This accomplishment opens new possibilities for increasing the capacity of current submarine cabling technology using fiber technology that doesn’t take up more space.

This research, collaborated with NEC Corporation and NTT Corporation in Japan, will be presented by Manabu Arikawa from NEC Corporation at OFC, the premier global event for optical communications and networking, which will take place as a hybrid event 24 – 28 March 2024 at the San Diego Convention Center.

“Submarine cable systems are vital infrastructure for our lives, connecting the world across oceans; future cables require more and more capacity because of the exponentially growing global traffic demand,” said Arikawa. “This research result can lead to higher capacity submarine cables, reduced cost per transmitted bit, and more efficient connectivity by significantly increasing the number of spatial channels for the same amount of optical fibers in the cables.”

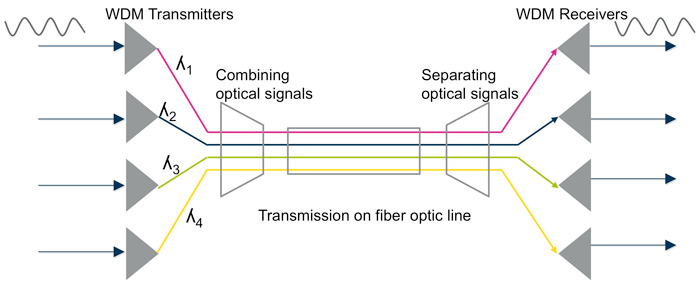

WDM and SDM are used to maximize the capacity and efficiency of optical fiber communication systems. WDM works by transmitting multiple signals simultaneously over a single optical fiber by assigning each channel a unique wavelength of light whereas SDM uses separate spatial paths or fiber cores to transmit multiple data streams within a single optical fiber or across different fibers.

For submarine cables, achieving more than 10 spatial channels has only been demonstrated for transmission distances of up to 1001 km with a 15-mode fiber or 1560 km with a 10-mode fiber. The challenge to achieving high spatial count transmission over transoceanic distances is to find a way to reduce the spatial mode dispersion (SMD) and mode-dependent loss (MDL) of the transmission line. Multi-core fibers are good candidates for this because their multiple individual cores can each carry an optical communication channel, allowing parallel data transmission. Compared to the uncoupled version, coupled multi-core fibers can accommodate many more cores in a standard 125-µm diameter cladding.

In the new work, the researchers carried out WDM/SDM transmission using a 32-G baud PDM-QPSK modulation format over a recirculating loop consisting of a single 52-km length of coupled 12-core fiber (C12CF) with a standard cladding diameter. After determining the optimum span input power, they evaluated transmission performance at three wavelength ranges in the C-band.

They observed error-free transmission after forward error correction for wavelengths up to 7280 km (140 loops) for 1536.6 nm and up to 9360 km (180 loops) for 1550.9 nm and 1560.6 nm in a single-span loop configuration. They also demonstrated a spatial mode dispersion of 0.1 ns and mode-dependent loss of 0.3 dB per 52-km C12CF span, together with relatively low wavelength dependence.

“One of the following important steps is the evaluation of large-scale multiple-input multiple-output (MIMO) processing in real-time implementation from the point of view of the future realization of a MIMO transceiver for optical communication,” said Arikawa. Another important topic is the impact and scalability of the MDL of the fibers with the number of spatial channels to characterize and overcome this capacity limitation in the future.

………………………………………………………………………………………………………………………………………………………………………………………………………….

Wave Division Multiplexing (WDM) is one of the optical multiplexing techniques that increases bandwidth by multiplexing a variety of optical carrier signals onto a single optical fiber by using different wavelengths. Each signal at WDM wavelengths is independent of any protocol and any speed. WDM technology allows bidirectional communications simultaneously over a single optical fiber. The foundation of WDM simplifies the network to a single virtual optical fiber network instead of using multiple forms of signals with different fibers and services. In this way, WDM increases the bandwidth and lowers the networking cost by reducing the needed fibers.

There are two different wavelength patterns of WDM system, coarse wave division multiplexing (CWDM) and dense wavelength division multiplexing (DWDM). CWDM and DWDM are based on the same concept of using multiple light wavelengths on a single fiber, but differ in the spacing of the wavelengths, numbers of channels, and the ability to amplify the multiplexed signals in the optical space. In a WDM system, different optical signals are combined (multiplexed) together at one end of the optical fiber and separated (demultiplexed) into different channels at the other end.

………………………………………………………………………………………………………………………………………………………………….

About OFC:

OFC, the premier global event for optical communications and networking, attracts attendees from around the world to a conference and exhibition that showcases the latest industry advancements and emerging technologies. This global event serves as the platform for start-ups to make their debut and industry leaders to set the pace for what’s to come. A compelling series of exciting programs and events will cover the entire ecosystem with a focus on inclusivity.

About Optica:

Optica (formerly OSA), Advancing Optics and Photonics Worldwide, is the society dedicated to promoting the generation, application, archiving and dissemination of knowledge in the field. Founded in 1916, it is the leading organization for scientists, engineers, business professionals, students and others interested in the science of light. Optica’s renowned publications, meetings, online resources and in-person activities fuel discoveries, shape real-life applications and accelerate scientific, technical and educational achievement. Discover more at: Optica.org

References:

https://opg.optica.org/jocn/fulltext.cfm?uri=jocn-11-3-1&id=404247

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

SNS Telecom & IT’s Q1-2024 Public safety LTE/5G report is a significant update from previous versions. The “Public Safety LTE & 5G Market: 2023 – 2030” report features a database of over 1,300 global public safety LTE/5G engagements – as of Q1’2024, in addition to detailed market analysis and forecasts for public safety broadband infrastructure, devices, applications and connectivity services.

Along with other unique content, the report covers a comprehensive review of public safety LTE/5G engagements across 86 countries, detailed case studies of 18 nationwide public safety broadband projects and additional case studies of 50 dedicated, hybrid, secure MVNO/MOCN and commercial operator-supplied systems, public safety spectrum allocation and usage, 3GPP standardization and commercial availability of critical communications-related features, analysis of public safety broadband application scenarios, practical examples of 5G era use cases, ongoing deployments of 3GPP standards-compliant MCX services and interworking functionality for LMR-broadband interoperability, recent advances in 5G NR sidelink-based device-to-device communications capabilities and other trends such as the emergence of portable 5G networks and 5G network slicing services (which require a 5G SA core network) for first responder agencies.

Report Summary:

With the commercial availability of 3GPP-specification compliant MCX (Mission-Critical PTT, Video & Data), HPUE (High-Power User Equipment), IOPS (Isolated Operation for Public Safety) and other critical communications features, LTE and 5G NR (New Radio) networks are increasingly gaining recognition as an all-inclusive public safety communications platform for the delivery of real-time video, high-resolution imagery, multimedia messaging, mobile office/field data applications, location services and mapping, situational awareness, unmanned asset control and other broadband capabilities, as well as MCPTT (Mission-Critical PTT) voice and narrowband data services provided by traditional LMR (Land Mobile Radio) systems. Through ongoing refinements of additional standards – specifically 5G MBS/5MBS (5G Multicast-Broadcast Services), 5G NR sidelink for off-network D2D (Device-to-Device) communications, NTN (Non-Terrestrial Network) integration, and support for lower 5G NR bandwidths – 3GPP networks are eventually expected to be in a position to fully replace legacy LMR systems by the late 2020s. National public safety communications authorities in multiple countries have already expressed a willingness to complete their planned narrowband to broadband transitions within the second half of the 2020 decade.

A myriad of fully dedicated, hybrid government-commercial and secure MVNO/MOCN-based public safety LTE and 5G-ready networks are operational or in the process of being rolled out throughout the globe. The high-profile FirstNet (First Responder Network) and South Korea’s Safe-Net (National Disaster Safety Communications Network) nationwide public safety broadband networks have been successfully implemented. Although Britain’s ESN (Emergency Services Network) project has been hampered by a series of delays, many other national-level programs have made considerable headway in moving from field trials to wider scale deployments – most notably, New Zealand’s NGCC (Next-Generation Critical Communications) public safety network, France’s RRF (Radio Network of the Future), Italy’s public safety LTE service, Spain’s SIRDEE mission-critical broadband network, Finland’s VIRVE 2.0 broadband service, Sweden’s Rakel G2 secure broadband system and Hungary’s EDR 2.0/3.0 broadband network. Nationwide initiatives in the pre-operational phase include but are not limited to Switzerland’s MSK (Secure Mobile Broadband Communications) system, Norway’s Nytt Nødnett, Germany’s planned hybrid broadband network for BOS (German Public Safety Organizations), Netherlands’ NOOVA (National Public Order & Security Architecture) program, Japan’s PS-LTE (Public Safety LTE) project, Australia’s PSMB (Public Safety Mobile Broadband) program and Canada’s national PSBN (Public Safety Broadband Network) initiative.

Other operational and planned deployments range from the Halton-Peel region PSBN in Canada’s Ontario province, New South Wales’ state-based PSMB solution, China’s city and district-wide Band 45 (1.4 GHz) LTE networks for police forces, Hong Kong’s 700 MHz mission-critical broadband network, Royal Thai Police’s Band 26 (800 MHz) LTE network, Qatar MOI (Ministry of Interior), ROP (Royal Oman Police), Abu Dhabi Police and Nedaa’s mission-critical LTE networks in the oil-rich GCC (Gulf Cooperation Council) region, Brazil’s state-wide LTE networks for both civil and military police agencies, Barbados’ Band 14 (700 MHz) LTE-based connectivity service platform, Zambia’s 400 MHz broadband trunking system and Mauritania’s public safety LTE network for urban security in Nouakchott to local and regional-level private LTE networks for first responders in markets as diverse as Laos, Indonesia, the Philippines, Pakistan, Lebanon, Egypt, Kenya, Ghana, Cote D’Ivoire, Cameroon, Mali, Madagascar, Mauritius, Canary Islands, Spain, Turkey, Serbia, Argentina, Colombia, Venezuela, Bolivia, Ecuador and Trinidad & Tobago, as well as multi-domain critical communications broadband networks such as MRC’s (Mobile Radio Center) LTE-based advanced MCA digital radio system in Japan, and secure MVNO platforms in Mexico, Belgium, Netherlands, Slovenia, Estonia and several other countries.

Even though critical public safety-related 5G NR capabilities defined in the 3GPP’s Release 17 and 18 specifications are yet to be commercialized, public safety agencies have already begun experimenting with 5G for applications that can benefit from the technology’s high-bandwidth and low-latency characteristics. For example, the Lishui Municipal Emergency Management Bureau is using private 5G slicing over China Mobile’s network, portable cell sites and rapidly deployable communications vehicles as part of a disaster management and visualization system.

In neighboring Taiwan, the Kaohsiung City Police Department relies on end-to-end network slicing over a standalone 5G network to support license plate recognition and other use cases requiring the real-time transmission of high-resolution images. The Hsinchu City Fire Department’s emergency response vehicle can be rapidly deployed to disaster zones to establish high-bandwidth, low-latency emergency communications using a satellite-backhauled private 5G network based on Open RAN standards. The Norwegian Air Ambulance is adopting a similar private 5G-based NOW (Network-on-Wheels) system for enhancing situational awareness during search and rescue operations.

In addition, first responder agencies in Germany, Japan and several other markets are beginning to utilize mid-band and mmWave (Millimeter Wave) spectrum available for local area licensing to deploy portable and small-scale 5G NPNs (Non-Public Networks) to support applications such as UHD (Ultra-High Definition) video surveillance, control of unmanned firefighting vehicles, reconnaissance robots and drones. In the near future, we also expect to see rollouts of localized 5G NR systems – including direct mode communications – for incident scene management and related use cases, potentially using up to 50 MHz of Band n79 spectrum in the 4.9 GHz frequency range (4,940-4,990 MHz), which has been designated for public safety use in multiple countries including but not limited to the United States, Canada, Australia, Malaysia and Qatar.

SNS Telecom & IT estimates that annual investments in public safety LTE/5G infrastructure and devices reached $4.3 Billion in 2023, driven by both new projects and the expansion of existing dedicated, hybrid government-commercial and secure MVNO/MOCN networks. Complemented by an expanding ecosystem of public safety-grade LTE/5G devices, the market will further grow at a CAGR of approximately 10% over the next three years, eventually accounting for more than $5.7 Billion by the end of 2026. Despite the positive outlook, some significant challenges continue to plague the market. The most noticeable pain point is the lack of a D2D communications capability.

The ProSe (Proximity Services) chipset ecosystem failed to materialize in the LTE era due to limited support from chipmakers and terminal OEMs. However, the 5G NR sidelink interface offers a clean slate opportunity to introduce direct mode D2D communications for public safety broadband users, as well as coverage expansion in both on-network and off-network scenarios using UE-to-network and UE-to-UE relays respectively. Recent demonstrations of 5G NR sidelink-enabled MCX services by the likes of Qualcomm have generated renewed confidence in 3GPP technology for direct mode communications.

Until recently, another barrier impeding the market was the non-availability of cost-optimized RAN equipment and terminals that support operation in spectrum reserved for PPDR (Public Protection & Disaster Relief) communications – most notably Band 68 (698-703 / 753-758 MHz), which has been allocated for PPDR broadband systems in several national markets across Europe, including France, Germany, Switzerland, Austria, Spain, Italy, Estonia, Bulgaria and Cyprus. Other countries such as Greece, Hungary, Romania, Sweden, Denmark, Netherlands and Belgium are also expected to make this assignment. Since the beginning of 2023, multiple suppliers – including Ericsson, Nokia, Teltronic and CROSSCALL – have introduced support for Band 68.

The “Public Safety LTE & 5G Market: 2023 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents an in-depth assessment of the public safety LTE and 5G market, including the value chain, market drivers, barriers to uptake, enabling technologies, operational models, application scenarios, key trends, future roadmap, standardization, spectrum availability/allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2023 to 2030, covering public safety LTE/5G infrastructure, terminal equipment, applications, systems integration and management solutions, as well as subscriptions and service revenue.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a list and associated details of over 1,300 global public safety LTE/5G engagements – as of Q1’2024.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.snstelecom.com/public-safety-lte

SNS Telecom & IT: Shared Spectrum 5G NR & LTE Small Cell RAN Investments to Reach $3 Billion

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

Aramco Digital and Intel establish Open RAN Development Center in Saudi Arabia

On January 15th, Aramco [1.] Digital and Intel announced their intent to establish Saudi Arabia’s inaugural Open RAN (Radio Access Network) Development Center. The facility is expected to drive innovation, foster technological advancements and contribute to the digital transformation landscape in the Kingdom.

Note 1. Aramco Digital is a subsidiary of Aramco, which made a net profit of $94.5 billion on revenues of $372.6 billion for the first nine months of 2023. Aramco spent $806 million on research and development (R&D) for the first 9 months of 2023 – all of which was likely related to its oil and gas business.

………………………………………………………………………………………………………………….

The collaborative effort aims to accelerate the development and deployment of Open RAN technologies, helping to enable the Kingdom to build robust and agile telecommunication infrastructure focused on accelerating digitization across industries. This collaboration aims to align with Saudi Arabia’s Vision 2030, which focuses on technological advancements and economic diversification.

Open RAN, an evolving paradigm in wireless network architecture, allows for greater flexibility, interoperability and innovation. Aramco Digital brings a deep understanding of the development needs and ambitions of the Kingdom and the opportunities for Open RAN technology deployment, along with a unique perspective of the Kingdom’s economic landscape. Intel, a pioneer in computing and communication technologies, brings its expertise in Open RAN technologies to the collaboration.

According to figures provided in December by analyst firm Omdia, an Informa company, the global RAN market is likely to have generated sales of about $40.2 billion last year. That would represent an 11% decline compared with revenues in 2022. Noting the reluctance of major telcos to spend money on equipment, Nokia recently announced plans to cut up to 14,000 jobs, which would equal 16% of the current total. In February last year, Ericsson, which has also recently complained of a market slowdown, said it would cut 8,500 jobs.

Highlights of the collaboration:

1. **Innovation Hub:** The Open RAN Development Center aims to serve as an innovation hub, fostering collaboration between Aramco Digital and Intel engineers, researchers and industry experts.

2. **Local Talent Development:** The Center aims to contribute to the development of local talent by providing training and hands-on experience in the rapidly evolving field of Open RAN and Edge computing technology.

3. **Economic Impact:** The collaboration aims to contribute to the local economy through technology-driven initiatives, aligning with the broader objectives of Vision 2030.

4. **Global Collaboration:** The collaboration on Open RAN between Aramco Digital and Intel is expected to extend beyond borders, connecting Saudi Arabia to the global landscape of Open RAN and Edge development and deployment.

Aramco Digital’s CEO Tareq Amin (formerly with Rakuten Symphony) said: “This collaboration is a testament to our commitment to helping drive innovation in the Kingdom. The Open RAN Development Center is expected to be a catalyst for digital evolution, providing a platform for collaboration, skill development and the creation of a vibrant technology ecosystem. At the heart of this collaboration is the creation of a vibrant pool of local capabilities for advanced 5G and future 6G technologies.”

“We are pleased to collaborate on Open RAN with Aramco Digital and to combine Intel’s technological prowess in network and edge computing and software with the local insights and industry leadership of Aramco Digital. Together, we aim to accelerate the deployment of edge-native Open RAN solutions in Saudi Arabia and beyond,” said [Sachin Katti, Intel senior vice president and general manager of the Network and Edge Group].

The Open RAN Development Center is planned to commence operations in 2024, marking a milestone in Saudi Arabia’s journey towards a technology-driven future.

……………………………………………………………………………………………………………….

Light Reading’s Iain Morris was not optimistic about this initiative. He wrote:

To the people responsible for telecom and tech in Saudi Arabia, open RAN must seem like a decent bet on diversification. After all, that is exactly how the concept is pitched in other countries. If Aramco can produce homegrown 5G goods, Saudi Arabian operators could theoretically spend their money on a local supplier instead of using only Chinese and European ones. Saudi Arabia, moreover, would gain something besides oil to sell overseas.

Aramco Digital’s chances of becoming an international RAN force – if such are its ambitions – are not great. In the west, Saudi Arabia’s dodgy image and reputation do not help. Realpolitik might have recently driven western leaders into an accommodation with Saudi rulers. But network products, in contrast to fossil fuels, can be obtained from other more likeable sources. And protectionist zeal has thrown up dozens of open RAN initiatives. If countries aren’t buying from Nordic or Chinese vendors, many would also rather buy at home. Aramco Digital is unlikely to be high on the list of preferred suppliers.

Evidence so far suggests big operators would also prefer to continue buying most of their products from a single vendor after open RAN is introduced. Doing so leaves “one throat to choke” and means avoiding the hassle and expense of systems integration. But it is prompting former specialists to develop a more comprehensive portfolio of RAN products and more thinly spread their R&D funds. Flush as Aramco Digital is with oil money, the enduring appeal of the single RAN contract will make competing in this market even harder.

Operators lauding open RAN will also appreciate how important economies of scale have been to the development of relatively low-cost but extremely sophisticated network products. Even if companies like Aramco Digital can acquire some market share, the net effect of adding players to a shrinking sector would be market fragmentation, squeezed R&D budgets and greater inefficiency.

With its resources and government backing, Aramco cannot simply be dismissed. But it may be the latest to find that telecom is stubbornly impervious to change.

About Aramco Digital:

Aramco Digital is the digital and technology subsidiary of Aramco, a global integrated energy and chemicals company. Aramco Digital aims to help drive digital transformation and technological innovation across various sectors.

About Intel:

Intel (NASDAQ: INTC) is a world leader in computing innovation. The company designs and builds the essential technologies that serve as the foundation for the world’s computing devices.

*Source: AETOSWire

References:

https://www.lightreading.com/open-ran/saudi-aramco-has-slim-open-ran-chance-in-shrinking-5g-market