Month: August 2024

Cisco to lay off more than 4,000 as it shifts focus to AI and Cybersecurity

Reuters reports that Cisco Systems will cut thousands of jobs in its second round of layoffs this year. The number of people affected could be similar to or slightly higher than the 4,000 employees Cisco laid off in February, and will likely be announced as early as Wednesday with the company’s fourth-quarter results.

The San Jose, CA headquartered networking company plans to shift its product focus to higher-growth areas, such as AI and cybersecurity. It’s current set of products and services are listed here.

Cisco has been contending with weakening demand and persistent supply chain issues in its core business – routers and switches – that are used by ISPs and enterprise private networks. Two reasons for that are: 1.] the major cloud service providers design their own switch/routers or use bare metal switches (made by ODMs in Taiwan and China), and 2.] enterprise private/virtual private networks are being replaced by cloud network solutions.

- Global enterprise network sales have been declining. Dell’Oro Group reported sales contractions in Branch Routing and Campus Switching in 4Q-2023 and that is expected to continue throughout most of 2024. On premises data centers (which use Cisco Ethernet switches) are not growing. In its place……

- Enterprise spending on cloud infrastructure services is growing by leaps and bounds. It’s now nearing $80 billion per quarter. Cloud customers increased their spending on cloud services by $14.1 billion to $79.1 billion in the 2Q-2024, an increase of 22% year-over-year. It’s the third consecutive quarter in which the year-over-year growth rate was 20% or more, with generative AI being one of the factors behind the market acceleration.

……………………………………………………………………………………………………………………………………………

As a result of stagnant sales of its core networking products, Cisco has been pursuing a strategy aimed at diversifying its revenue streams. One of the most significant moves in this direction was the $28 billion acquisition of Splunk, a cybersecurity firm, which was finalized in March. This purchase is expected to boost Cisco’s subscription-based services, reducing its dependence on one-time hardware sales, which have been increasingly susceptible to market volatility.

Cisco’s major shift towards AI is a key part of its long-term strategy. In May, the company reiterated its ambitious goal of achieving $1 billion in AI-related product orders by 2025. This target is supported by a $1 billion fund launched in June, aimed at investing in AI startups such as Cohere, Mistral AI, and Scale AI. Over the past few years, Cisco has made over 20 AI-focused acquisitions and investments, highlighting its commitment to integrating AI into its product offerings.

……………………………………………………………………………………………………………………………………………..

Over 126,000 employees have been laid off across 393 tech companies since the start of the year, according to data from tracking website Layoffs.fyi. That surely reflects their need to cut costs to balance huge investments in AI, analytics and related technologies.

……………………………………………………………………………………………………………………………………………..

References:

https://www.cisco.com/c/en/us/products/index.html#~products-by-technology

Cisco to Implement Second Round of Layoffs Amidst Strategic Shift to AI and Cybersecurity

Worldwide Enterprise Network Spending Follows Roller Coaster Trajectory

Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products

Nokia’s 760 global private networking contracts are mostly 4G-LTE Advanced

Backgrounder:

Private Wireless Radio Access Network (RAN) revenue growth slowed in the fourth quarter of 2023 on a year-over-year basis. However, full-year revenues accelerated by approximately 40% in 2023, propelling private wireless to comprise around 2% of the overall RAN market.

“Private wireless RANs are now growing at a formidable pace, in contrast to public RAN and enterprise WLAN – both segments are projected to contract in 2024,” said Stefan Pongratz, Vice President at Dell’Oro Group in April.

The top 3 Private Wireless RAN suppliers in 2023 were Huawei, Nokia, and Ericsson. Excluding China, they were Nokia, Ericsson, and Samsung.

……………………………………………………………………………………………………………………………………………..

Nokia leads in Private RANs:

Nokia recently told Fierce Network that it signed 30 new private networking contracts in the second quarter of 2024. Nokia has said that it has signed more than 760 private network contracts around the world. NGIC, Sigma Lithium and Solis are some of the most recent names it has signed.

Nokia said that 78% of its private network business is based on 4G LTE-Advanced [1.], compared to 18% being 5G only, and the remaining 4% combining the two broadband cellular technologies.

Note 1. In October 2010, LTE-Advanced successfully passed the ITU-R’s evaluation process and was found to meet or exceed IMT-Advanced requirements. It was standardized a “IMT Advanced,” which support low to high mobility applications and a wide range of data rates in accordance with user and service demands in multiple user environments. IMT Advanced also has capabilities for high quality multimedia applications within a wide range of services and platforms, providing a significant improvement in performance and quality of service.

Image courtesy of Research Gate

…………………………………………………………………………………………………………………………………………….

David de Lancellotti, VP of enterprise campus edge business at Nokia talked to Fierce about Nokia’s performance in the private networking space. “Thirty in Q2, and roughly 50 — a little more than 50 — in the first half,” he said of contracts signed.

“We kind of jumped into this a bit earlier than anybody else,” Nokia’s de Lancellotti explained. “I think we’ve always taken a real service provider approach in terms of quality, in terms of feature set [and] in terms of roadmap,” while noting Nokia’s “real drive to pick up the enterprise space.”

Industry verticals – transportation, energy and manufacturing – continue to “lead the way” for private networking contracts in Q2. “When we talk about transportation, I think that’s the port side of business, which continues to be strong for us,” David said.

References:

https://www.fierce-network.com/wireless/nokia

Private Wireless RAN Revenues up ~40 Percent in 2023, According to Dell’Oro Group

https://en.wikipedia.org/wiki/LTE_Advanced

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-adv/Pages/default.aspx

https://www.researchgate.net/figure/Network-architecture-of-LTE-Advanced_fig1_333886291

Highlights of FiberConnect 2024: PON-related products dominate

The Fiber Broadband Association’s flagship conference, FiberConnect 2024, concluded July 31, 2024, in Nashville, Tennessee. It featuring 275 speakers and 286 exhibitors in the Expo Hall, with about half the attendees from operators and half representing vendors. The show provided a great opportunity to gauge the pulse of the fiber based broadband industry in North America.

China Unicom-Beijing and Huawei build “5.5G network” using 3 component carrier aggregation (3CC)

Huawei says it has deployed an “ultra large-scale 5.5G network” (there is no definition, 3GPP approved specs, or ITU-R recommendations/standards for 5.5G) operated by China Unicom in Beijing. The network uses three component carrier (3CC) aggregation to provide 70 percent coverage within Beijing’s 4th urban ring road. Huawei says China Unicom will offer comprehensive 5.5G service (again undefined) across stadiums, metro stations and tunnels, residential areas, scenic spots, business districts, and universities in key areas within the city’s 4th Ring Road and Beijing Municipal Administrative Center.

Editor’s Note: At the 5G Advanced Forum during MWC Shanghai 2023, Huawei’s President of ICT Products & Solutions, Yang Chaobin said, “In 2024, Huawei will launch a complete set of commercial 5.5G network equipment to be prepared for the commercial deployment of 5.5G.” Many believe that 5.5G is another name for 3GPP defined 5G Advanced, which is expected to bring new wireless technology innovations that improve speed, coverage, mobility, power efficiency, and sustainability. 3GPP Release 18 in 2024 is the beginning of 5G Advanced. The second and major release of 5G Advanced, Release 19, will be completed by the end of 2025. This release will focus on enhanced performance and the 5G system’s ability to meet commercial deployment needs.

In the Beijing Action Plan for Promoting 5G-A Technology Evolution and Application Innovation (2024-2026), Beijing Municipal Communications Administration hammered home the importance of Beijing’s role in pioneering 5.5G development. China Unicom Beijing is striving to do its part, with a large-scale 5.5G network demonstration at the beginning of 2024 followed by the ultra-large-scale commercial 5.5G network deployment of recent months, in helping Beijing become a “dual 10 Gbps” city that sets the bar for network construction, device development, and industry enablement. With the first version of 5.5G standards frozen in June 2024 and more than 20 commercial 5.5G devices now on the market, a mature 5.5G industry ecosystem is taking shape.

“Full 5.5G coverage” in Beijing’s core urban areas and the Beijing Municipal Administrative Center. Photo: Huawei

……………………………………………………………………………………………………………………………………………………..

In August 2022, China Unicom Beijing and Huawei commercialized the world’s largest 3.5 GHz 2CC network, which has brought 200 MHz 2CC coverage to more than 85% of Beijing’s urban area while providing comprehensive coverage for Beijing’s core areas and the Beijing Municipal Administrative Center. In 2023, this was further augmented when China Unicom Beijing and Huawei completed a 2.1 GHz band deployment targeting key urban scenarios. These deployments substantially improved the network experience of users in Beijing while laying a solid foundation for the future evolution to 5.5G, and this year’s 5.5G 3CC deployment paves the way for larger-scale 5.5G deployments in the coming years.

The ultra-large commercial 5.5G 3CC network consists of more than 4,000 base stations and covers well-known landmarks in Beijing, such as Wukesong, Capital Indoor Stadium, Workers’ Stadium, Beijing Railway Station, Guijie Street, Panjiayuan, and Beijing University of Technology. Featuring 5.5G capabilities, the network provides powerful support for services such as immersive video, UHD live streaming, and cloud gaming. In addition to consumer scenarios, China Unicom Beijing is proactively pursuing innovations in UHD shallow compression encoding, IoT, and XR split rendering, unlocking the full potential of 5.5G networks to enable various industries.

Yang Lifan, Deputy General Manager of China Unicom Beijing, remarked: “We have the world’s largest 200 MHz 5G network and it makes our 3CC carrier aggregation much easier. 5.5G 3CC coverage will be extended to match that of our current 200 MHz 5G network. With Huawei’s advanced technologies and our smart operations, we will provide users with a much better network experience.”

David Li, President of Huawei Wireless Network 5G<E TDD Product Line, said: “We are honored to mark a groundbreaking milestone in 5.5G network construction with China Unicom Beijing — large-scale commercial 5.5G. We will continue to innovate and provide more efficient, smarter, and greener network solutions, enabling users to enjoy a superior, smooth experience with 5.5G networks.”

References:

https://www.huawei.com/en/news/2024/7/5ga-beijing-3cc#

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

https://blog.huawei.com/en/post/2023/11/14/5-5g-whats-in-a-number

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

Nokia, BT Group & Qualcomm achieve enhanced 5G SA downlink speeds using 5G Carrier Aggregation with 5 Component Carriers

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

Finland’s Elisa, Ericsson and Qualcomm test uplink carrier aggregation on 5G SA network

Verizon Business sees escalating risks in mobile and IoT security

Verizon Business released its 2024 Mobile Security Index (MSI) report outlining the top threats to mobile and IoT device security. This year’s report, in its seventh iteration, goes beyond employee-level mobile usage and extends into the usage of IoT devices and sensors and the security concerns the growth of these devices can present especially as remote work continues to be a trend. This expanded view of mobile security concerns for organizations showcases the evolving threat landscape that CIOs and other IT decision makers must contend with.

This annual report surveyed 600 people responsible for security strategy, as well as employee-level mobile usage, the report looked at the use of IoT devices and sensors and the security concerns that come with them as remote work continues to be a trend.

Highlights:

- 80% of responding organizations consider mobile devices critical to their operations, while 95% are actively using IoT devices.

- 96% of critical infrastructure respondents use IoT devices, with % having experienced a significant mobile or IoT device-related security incident.

- 77% of respondents anticipate that AI-assisted attacks, such as deep fakes and SMS phishing, are likely to succeed.

Employees are using more mobile and IoT devices, leading to increased cyber risks

The survey finds that 80% of respondents consider mobile devices critical to their operations, while 95% are actively using IoT devices. However, this heavy reliance comes with significant security concerns. In critical infrastructure sectors, where 96% of respondents report using IoT devices, more than half state that they have experienced severe security incidents that led to data loss or system downtime.

“These findings highlight the continued friction that employers face as more and more work is done on personal mobile devices,” said Phil Hochmuth Research VP, enterprise mobility at IDC. “This is why we are seeing more and more employers move from a pure bring-your-own-device model to employer provided devices where CIO’s can have greater governance to protect critical infrastructure from cyber attacks.”

Additionally, Hochmuth says, organizations should adopt robust frameworks such as Zero Trust and the National Institute of Standards and Technology’s Cybersecurity Framework (NIST CSF) 2.0, and comply with mandates like the European Union’s NIS2 Directive.

Emerging AI cyberthreats meet new AI defenses

Emerging artificial intelligence (AI) technologies are expected to exacerbate the mobile threat landscape, but it also presents opportunities for defense. A striking 77% of respondents anticipate that AI-assisted attacks, such as deepfakes and SMS phishing, are likely to succeed. At the same time, 88% of critical infrastructure respondents acknowledge the growing importance of AI-assisted cybersecurity solutions.

Accounting for IoT growth in cybersecurity planning

With companies increasingly deploying IoT devices, their digital landscapes are evolving, creating a need for cybersecurity strategies to evolve in kind.

“The Industrial Internet of Things (IIoT) is giving rise to a massive expansion in mobile device technology that goes well beyond phones, tablets and laptops. Enterprise networks now include all sorts of sensors and purpose-built devices that monitor, measure, manage and control commercial tasks and data flow,” said TJ Fox, SVP of Industrial IoT and Automotive, Verizon Business. “That IIoT growth brings with it a proportionate need for more knowledge, awareness and IT solutioning to ensure the security of those increasingly sophisticated networks. The growing importance that IoT plays in our customer’s technology ecosystem underscores why it should be a component in any sound cybersecurity program.”

What business leaders should know

The 2024 MSI helps inform cybersecurity decisions for leaders of businesses of all sizes and in key sectors. As mobile and IoT threats rise, the need for robust security measures has never been greater. In response to these growing threats, 84% of respondents have increased their mobile device security spending over the past year, with 89% of critical infrastructure respondents planning further increases.

This year’s MSI includes contributions from Verizon’s partners including Ivanti, Lookout, Jamf among others. Help your organization lower cyber risks by deploying comprehensive security protections, continuous employee education and advanced threat detection capabilities.

……………………………………………………………………………………………………………………………………….

Quotes:

Phil Hochmuth Research VP at IDC said: “These findings highlight the continued friction that employers face as more and more work is done on personal mobile devices. This is why we are seeing more and more employers move from a pure bring-your-own-device model to employer-provided devices where CIOs can have greater governance to protect critical infrastructure from cyber attacks.”

TJ Fox, SVP of Industrial IoT and Automotive, Verizon Business added: “The Industrial Internet of Things (IIoT) is giving rise to a massive expansion in mobile device technology that goes well beyond phones, tablets and laptops. Enterprise networks now include all sorts of sensors and purpose-built devices that monitor, measure, manage and control commercial tasks and data flow.

“That IIoT growth brings with it a proportionate need for more knowledge, awareness and IT solutions to ensure the security of those increasingly sophisticated networks. The growing importance that IoT plays in our customer’s technology ecosystem underscores why it should be a component in any sound cybersecurity program.”

References:

Verizon Business 2024 Mobile Security Index

https://www.telecoms.com/security/verizon-warns-of-escalating-risks-in-mobile-and-iot-security

IEEE/SCU SoE Virtual Event: May 26, 2022- Critical Cybersecurity Issues for Cellular Networks (3G/4G, 5G), IoT, and Cloud Resident Data Centers

IoT Sensor Standards Are Absolutely Essential for Security

IoT Disappoints: Security, Connectivity and Device Onboarding Cited as Top Challenges

AI winner Nvidia faces competition with new super chip delayed

The Clear AI Winner Is: Nvidia!

Strong AI spending should help Nvidia make its own ambitious numbers when it reports earnings at the end of the month (it’s 2Q-2024 ended July 31st). Analysts are expecting nearly $25 billion in data center revenue for the July quarter—about what that business was generating annually a year ago. But the latest results won’t quell the growing concern investors have with the pace of AI spending among the world’s largest tech giants—and how it will eventually pay off.

In March, Nvidia unveiled its Blackwell chip series, succeeding its earlier flagship AI chip, the GH200 Grace Hopper Superchip, which was designed to speed generative AI applications. The NVIDIA GH200 NVL2 fully connects two GH200 Superchips with NVLink, delivering up to 288GB of high-bandwidth memory, 10 terabytes per second (TB/s) of memory bandwidth, and 1.2TB of fast memory. The GH200 NVL2 offers up to 3.5X more GPU memory capacity and 3X more bandwidth than the NVIDIA H100 Tensor Core GPU in a single server for compute- and memory-intensive workloads. The GH200 meanwhile combines an H100 chip [1.] with an Arm CPU and more memory.

Photo Credit: Nvidia

Note 1. The Nvidia H100, sits in a 10.5 inch graphics card which is then bundled together into a server rack alongside dozens of other H100 cards to create one massive data center computer.

This week, Nvidia informed Microsoft and another major cloud service provider of a delay in the production of its most advanced AI chip in the Blackwell series, the Information website said, citing a Microsoft employee and another person with knowledge of the matter.

…………………………………………………………………………………………………………………………………………

Nvidia Competitors Emerge – but are their chips ONLY for internal use?

In addition to AMD, Nvidia has several big tech competitors that are currently not in the merchant market semiconductor business. These include:

- Huawei has developed the Ascend series of chips to rival Nvidia’s AI chips, with the Ascend 910B chip as its main competitor to Nvidia’s A100 GPU chip. Huawei is the second largest cloud services provider in China, just behind Alibaba and ahead of Tencent.

- Microsoft has unveiled an AI chip called the Azure Maia AI Accelerator, optimized for artificial intelligence (AI) tasks and generative AI as well as the Azure Cobalt CPU, an Arm-based processor tailored to run general purpose compute workloads on the Microsoft Cloud.

- Last year, Meta announced it was developing its own AI hardware. This past April, Meta announced its next generation of custom-made processor chips designed for their AI workloads. The latest version significantly improves performance compared to the last generation and helps power their ranking and recommendation ads models on Facebook and Instagram.

- Also in April, Google revealed the details of a new version of its data center AI chips and announced an Arm-based based central processor. Google’s 10 year old Tensor Processing Units (TPUs) are one of the few viable alternatives to the advanced AI chips made by Nvidia, though developers can only access them through Google’s Cloud Platform and not buy them directly.

As demand for generative AI services continues to grow, it’s evident that GPU chips will be the next big battleground for AI supremacy.

References:

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

https://www.nvidia.com/en-us/data-center/grace-hopper-superchip/

https://www.theverge.com/2024/2/1/24058186/ai-chips-meta-microsoft-google-nvidia/archives/2

https://news.microsoft.com/source/features/ai/in-house-chips-silicon-to-service-to-meet-ai-demand/

AI wave stimulates big tech spending and strong profits, but for how long?

Big tech companies have made it clear over the last week that they have no intention of slowing down their stunning levels of spending on artificial intelligence (AI), even though investors are getting worried that a big payoff is further down the line than most believe.

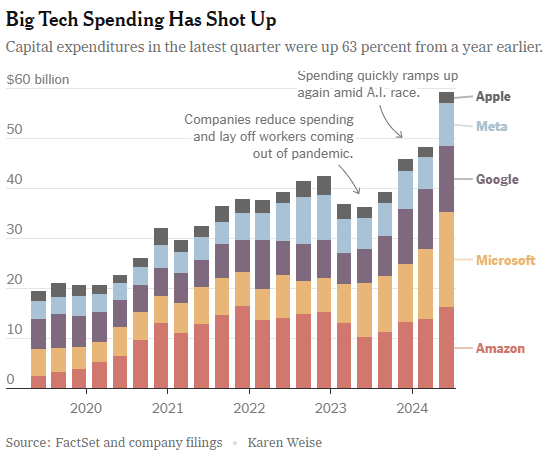

In the last quarter, Apple, Amazon, Meta, Microsoft and Google’s parent company Alphabet spent a combined $59 billion on capital expenses, 63% more than a year earlier and 161 percent more than four years ago. A large part of that was funneled into building data centers and packing them with new computer systems to build artificial intelligence. Only Apple has not dramatically increased spending, because it does not build the most advanced AI systems and is not a cloud service provider like the others.

At the beginning of this year, Meta said it would spend more than $30 billion in 2024 on new tech infrastructure. In April, he raised that to $35 billion. On Wednesday, he increased it to at least $37 billion. CEO Mark Zuckerberg said Meta would spend even more next year. He said he’d rather build too fast “rather than too late,” and allow his competitors to get a big lead in the A.I. race. Meta gives away the advanced A.I. systems it develops, but Mr. Zuckerberg still said it was worth it. “Part of what’s important about A.I. is that it can be used to improve all of our products in almost every way,” he said.

………………………………………………………………………………………………………………………………………………………..

This new wave of Generative A.I. is incredibly expensive. The systems work with vast amounts of data and require sophisticated computer chips and new data centers to develop the technology and serve it to customers. The companies are seeing some sales from their A.I. work, but it is barely moving the needle financially.

In recent months, several high-profile tech industry watchers, including Goldman Sachs’s head of equity research and a partner at the venture firm Sequoia Capital, have questioned when or if A.I. will ever produce enough benefit to bring in the sales needed to cover its staggering costs. It is not clear that AI will come close to having the same impact as the internet or mobile phones, Goldman’s Jim Covello wrote in a June report.

“What $1 trillion problem will AI solve?” he wrote. “Replacing low wage jobs with tremendously costly technology is basically the polar opposite of the prior technology transitions I’ve witnessed in my 30 years of closely following the tech industry.” “The reality right now is that while we’re investing a significant amount in the AI.space and in infrastructure, we would like to have more capacity than we already have today,” said Andy Jassy, Amazon’s chief executive. “I mean, we have a lot of demand right now.”

That means buying land, building data centers and all the computers, chips and gear that go into them. Amazon executives put a positive spin on all that spending. “We use that to drive revenue and free cash flow for the next decade and beyond,” said Brian Olsavsky, the company’s finance chief.

There are plenty of signs the boom will persist. In mid-July, Taiwan Semiconductor Manufacturing Company, which makes most of the in-demand chips designed by Nvidia (the ONLY tech company that is now making money from AI – much more below) that are used in AI systems, said those chips would be in scarce supply until the end of 2025.

Mr. Zuckerberg said AI’s potential is super exciting. “It’s why there are all the jokes about how all the tech C.E.O.s get on these earnings calls and just talk about A.I. the whole time.”

……………………………………………………………………………………………………………………

Big tech profits and revenue continue to grow, but will massive spending produce a good ROI?

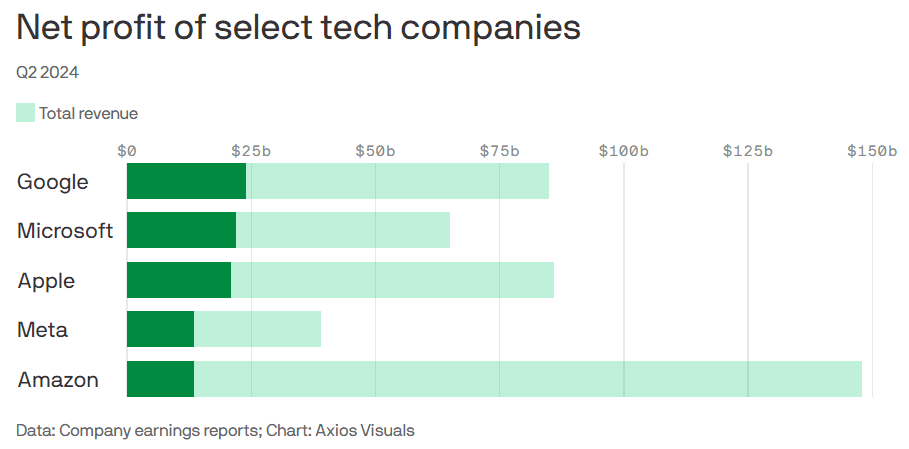

Last week’s Q2-2024 results:

- Google parent Alphabet reported $24 billion net profit on $85 billion revenue.

- Microsoft reported $22 billion net profit on $65 billion revenue.

- Meta reported $13.5 billion net profit on $39 billion revenue.

- Apple reported $21 billion net profit on $86 billion revenue.

- Amazon reported $13.5 billion net profit on $148 billion revenue.

This chart sums it all up:

………………………………………………………………………………………………………………………………………………………..

References:

https://www.nytimes.com/2024/08/02/technology/tech-companies-ai-spending.html

https://www.axios.com/2024/08/02/google-microsoft-meta-ai-earnings

https://www.nvidia.com/en-us/data-center/grace-hopper-superchip/

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

Massive layoffs and cost cutting will decimate Intel’s already tiny 5G network business

Huge Loss & Restructuring:

In its August 1st press release detailing a $1.6 billion 2Q-2024 loss (mainly from it’s foundry business) [1.] Intel announced it was cutting more than 15% of its workforce by 2025 with most of those coming by year end. The company is also suspending its dividend starting in the fourth quarter of 2024.

Note 1. Intel Foundry, which reported a $2.5bn operating loss during the first quarter of 2024, lost an additional $2.8bn in Q2-2024. That business is seen as a U.S. strategic asset in a major move to bring back chip making to the U.S. from Taiwan, China and South Korea.

“Our Q2 financial performance was disappointing, even as we hit key product and process technology milestones. Second-half trends are more challenging than we previously expected, and we are leveraging our new operating model to take decisive actions that will improve operating and capital efficiencies while accelerating our IDM 2.0 transformation,” said Pat Gelsinger, Intel CEO. “These actions, combined with the launch of Intel 18A next year to regain process technology leadership, will strengthen our position in the market, improve our profitability and create shareholder value.”

CEO/CFO Earnings Call prepared remarks:

“We are targeting a headcount reduction of greater than 15% by the end of 2025, with the majority of this action completed by the end of this year. We do not do this lightly, and we have carefully considered the impact this will have on the Intel family. These are hard but necessary decisions. Our actions will reduce OpEx (operating expenses) to approximately $20 billion in 2024, and we see a bigger impact next year, with 2025 OpEx targeted at $17.5 billion, more than 20% below prior estimates. We expect further benefits in 2026, with OpEx to decline in absolute dollars yet again. Even as we lower overall spending, we will continue to fund the investments needed to deliver our strategy.”

The company’s latest filing with the Securities and Exchange Commission (SEC) stated there were 124,800 employees as of December 2023, down from 131,900 a year before. Therefore, a 15% reduction could translate to the loss of 18,720 employees and we wouldn’t be surprised by total job cuts exceeding 20,000! In addition to layoffs, Intel is pushing older employees to retire.

CEO Pat Gelsinger wrote in a letter to Intel employees:

“Next week, we’ll announce a companywide enhanced retirement offering for eligible employees and broadly offer an application program for voluntary departures. I believe that how we implement these changes is just as important as the changes themselves, and we will adhere to Intel values throughout this process.”

The objective is to greatly reduce various operational costs (research and development plus marketing, general and administrative expenses) to about $20 billion this year and $17.5 billion in 2025, “with further reductions planned in 2026,” said Intel. That $17.5 billion would be about $4.2 billion less than Intel booked for these expenses in 2023, according to its last annual SEC filing, and a reduction of $7 billion compared with the figure for 2022.

Fitch Ratings downgraded Intel’s Long-Term Issuer Default Rating to ‘BBB+’ from “A-,” citing execution risks and potential negative rating actions. Fitch also affirmed Intel’s Short-Term IDR and commercial paper rating at ‘F2’. Fitch believes execution risk remains significant for Intel and that missteps could result in further negative rating actions.

……………………………………………………………………………………………………………………………………

Analyst Comments:

Rosenblatt Securities analyst Hans Mosesmann reiterated his sell rating on Intel stock with a price target of 17. “We anticipate that the company (Intel) will continue to lose share to AMD as its manufacturing roadmap is tepid compared to that of the leading-edge player,” Mosesmann said in a client note.

Bernstein analyst Stacy Rasgon was particularly grim about Intel’s prospects.

“The company’s issues are now approaching the existential,” he said in a client note. “In other circumstances we believe we would now be having ‘going concern’ conversations with clients.”

Impact on Intel’s 5G Business:

The company’s website states: “From Cloud to Network to Edge: 5G Is Powered by Intel Intel-powered 5G networks deliver a powerful data-centric future where compute is fluid, intelligent, and pervasive—creating an evolutionary leap in agility and scalability.”

PHOTO Credit: Intel

Intel incorrectly states, “Intel is embedded throughout the 5G value chain, offering flexible performance, Intel® Xeon® Scalable processors, custom RAN configurations, accelerators, software, and a common toolchain.” Does anyone really believe that?

Intel wants 5G network equipment vendors to switch from custom ASIC silicon they design to its general-purpose processors (GPPs). But there has been very limited adoption of those processors in the radio access network (RAN) to date. Many telco executives remain unconvinced GPPs, especially based on x86, can measure up. Arguments about using the same platforms for multiple needs look spurious when most RAN compute is at the mast site, where it cannot realistically be shared with anything else.

Of the big three 5G kit vendors, only Ericsson says Intel is a good option for Layer 1 (PHY), the category of most demanding RAN software. Huawei and Nokia remain vehemently opposed to using Intel silicon in this area. As expected, most of Ericsson’s 5G products today are based on its own custom silicon, not Intel’s GPPs.

References:

https://www.intel.com/content/www/us/en/newsroom/news/actions-accelerate-our-progress.html#gs.d2jtpn

https://download.intel.com/newsroom/2024/corporate/Earnings-Call-2Q2024-080124.pdf

https://www.intel.com/content/www/us/en/wireless-network/5g-overview.html

AT&T’s leads the pack of U.S. fiber optic network service providers

AT&T and Verizon are spending billions of dollars to grow their existing fiber-optic networks and add to the millions of broadband clients they already serve, mostly in regions covered by their historical landline-telephone infrastructure. Meanwhile, T-Mobile has five partnerships with fiber-optic internet providers that could serve millions of customers in the coming years. There are other fiber based internet providers that mostly serve business customers. Those include Comcast Business, Frontier Communications, Lumen, and Google Fiber (which also serves residential customers).

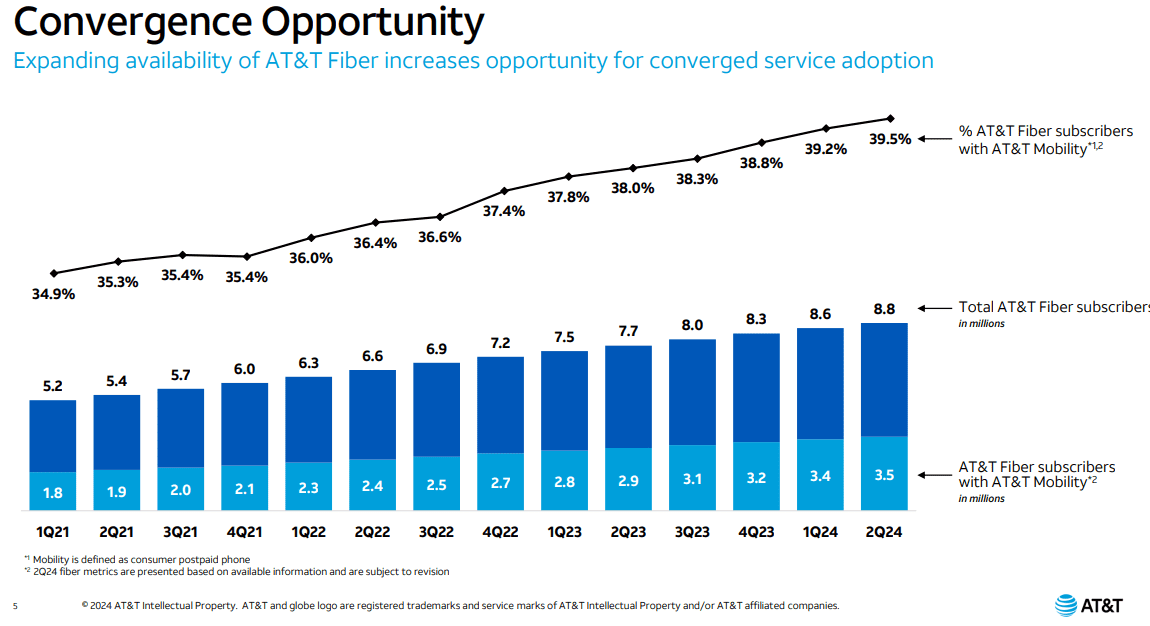

AT&T’s fiber business has remained incredibly strong, with fiber revenues growing almost 18% YoY. That led to strong top line EBITDA and EBITDA margin growth in 2Q-2024. There were 239,000 AT&T Fiber net adds in the quarter. AT&T has posted 200,000+ net fiber adds for 18 consecutive quarters – quite an enviable record. The company has managed to grow to 8.8 million total fiber subscribers, as average fiber revenue has gone up to almost $2 billion quarterly.

According to Seeking Alpha (subscription required), AT&T is substantially more reliable than Comcast, offers symmetric up and down bandwidth, and has no data caps. That makes it a much more pleasing experience. The company has worked to chase synergies with its AT&T mobility business, with not only fiber subscriptions growing, but the % of customers with AT&T mobility has grown as well. That ratio is now almost 40%.

“For the past four years, we’ve delivered consistent, positive results that have repositioned AT&T. Our solid performance this quarter demonstrates the durable benefits of our investment-led strategy,” said John Stankey, AT&T CEO. “AT&T is leading the way in converged connectivity as customers increasingly seek one provider who can seamlessly connect them in their home, at work and on the go. This is proving to be a winning strategy. Today, nearly four of every 10 AT&T Fiber households also choose AT&T wireless service. As the nation’s largest consumer fiber builder, we see this as an opportunity to continue to grow subscribers and revenues, while deepening customer relationships.”

Fiber investment drives valuable convergence opportunities:

• Wireless penetration of fiber subscribers has increased more than 400 bps since 2Q21

• Expansion of fiber footprint enables increased opportunities to sell into high quality cohort

• Converged customers are valuable and durable, with longer customer lives

“Our combined customers are happier customers,” AT&T CEO John Stankey said on a call with analysts. “Why a race to convergence? Because that’s a good way to make money, and it’s a good way to keep customers in the fold.”

AT&T CEO John Stankey meeting with fiber-optic workers at an Evansville, Ind., job site in 2022. Photo: Scotty Perry/Bloomberg News

References:

https://www.labs.att.com/story/2024/q2-earnings.html

https://seekingalpha.com/article/4708956-att-earnings-highlights-continued-recovery-potential

https://www.wsj.com/business/telecom/t-mobile-fiber-optic-internet-connection-380957ef