Author: Alan Weissberger

Deloitte’s 2022 telecom industry outlook, questions and recommendations for telcos

Executive Summary:

In 2022, the telecom industry will face new opportunities and challenges presented by a dynamic regulatory, technological, and competitive environment. Deloitte’s annual telecom outlook dials into the biggest trends shaping the telecommunications industry, from more competitive broadband markets to cybersecurity in the 5G era.

The telecom sector continued to make progress in augmenting its network capacity with additional fiber and wireless deployments to meet the constant demand for higher-speed networks in 2021. However, as we start the new year, we see an emerging set of issues and opportunities presented by a dynamic regulatory, technological, and competitive environment that may influence the sector’s progress in the coming year:

- The potential for more competitive broadband markets. Faster mobile and fixed wireless connections create more viable alternatives to wired connections and new opportunities for bundled service offerings and business models for service providers. With ever-expanding options for high-quality communication and internet services from telecom, cable, wireless, and satellite internet providers, consumers will enjoy enhanced flexibility in purchasing and consuming services in the new year. However, these trends may also lead to a more competitive environment in 2022.

- A shift to more decentralized government broadband infrastructure funding. The $1 trillion Infrastructure Investment and Jobs Act (IIJA) passed in November earmarks $65 billion for continued broadband adoption and deployment. While government programs dedicated to expanding and improving telecommunication infrastructure and services have traditionally been managed at the federal level, it appears the bulk of the bill’s federally allocated broadband dollars will flow through more decentralized state-based models.

- Rising interest in multi-access edge computing (MEC) and private cellular networks. The enterprise market for private cellular networks and edge computing is gaining momentum. The market is still nascent but promises to be competitive, with many different players vying for their share. Network operators will have to compete against other players, who may prove key partners in delivering their solutions. Ecosystem players will likely begin to stake out and define their role in this emerging but rapidly evolving market in the coming year.

- The need to reassess cybersecurity and risk management in the 5G era. While the widespread adoption of 5G offers many benefits, it also creates new security concerns and challenges. As operators have taken steps to evaluate and minimize threats arising from 5G and software-centric networks in their own organizations, they are in a unique position to offer 5G security services to enterprises seeking to deploy their own advanced wireless networks.

Strategic Questions for telcos to consider:

• With spectrum being a scarce resource, how can operators prioritize its use to maximize its value? • How can operators use FWA to create additional synergies between their wireless and fiber asset deployments to improve their cost structure and benefit customers?

• While telcos may initially benefit as a wholesale provider of wireless capacity, what are the long term consequences if mobile virtual network operators begin using their wireless scale to build out their own networks?

• What should the telco’s role be in developing and delivering 5G private cellular networks and enterprise-oriented edge solutions? Will it take the form of spectrum leases, fiber backbone, and backhaul, or something more?

• What are the telco’s core competencies and value proposition in delivering 5G enterprise networks? Which business models will allow telcos to optimize value?

• What capabilities are required to execute on a given strategy or business model? Can telcos develop new capabilities internally? To what extent should they do so?

• How can telcos use their approach to cybersecurity as an opportunity to differentiate themselves and capture value in the 5G enterprise market?

• Where can telcos switch from reactive security mechanisms to more proactive ones?

• As telcos migrate from legacy networks to modern architectures, do they have appropriate risk management and governance organizations in place?

Recommendations for Telcos:

• Reassess core value proposition in an evolving competitive landscape with more players vying for the same customers.

• Reevaluate how and where to participate in terms of both service offerings and geographies. • Look for ways to differentiate services on non-performance attributes since consumers perceive minor differences among provider offerings.

• Determine organizational effectiveness in monitoring and responding to more distributed, state-based mechanisms for awarding federally allocated broadband funds.

• Monitor ecosystem and business model development in the emerging 5G enterprise edge compute and private cellular network markets.

• Build on the unique position to offer differentiated 5G security and risk management services to enterprises seeking to deploy advanced wireless networks.

References:

LEO satellite status report, Starlink’s progress, dealing with space junk

There are currently 4,852 operating satellites in Low Earth Orbit (LEO) from some eighty nations, though roughly half are U.S. commercial and government/military satellites. They are essential for everything from nuclear command and control, climate observation to GPS, and the internet, streaming video, and ATMs. Moreover, an already crowded earth orbit is getting worse. The private sector is driving the new space economy enabled by new technologies to miniaturize satellites, like the aforementioned cubesats. Google and Elon Musk’s SpaceX alone plan to launch some 50,000 cubesats in this decade.

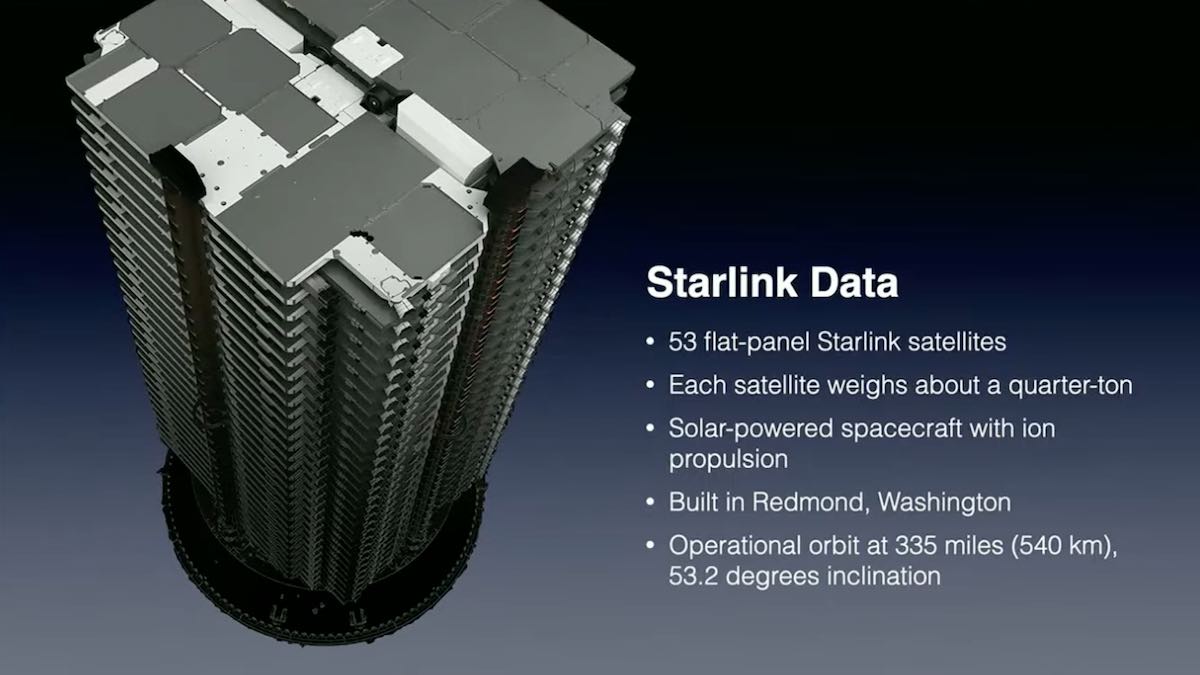

Currently, Starlink (owned by SpaceX) has approximately 2,200 small satellites in LEO and working. That’s about half of SpaceX’s planned first-generation network of 4,408 Starlink satellites.

The 4,400 satellites will be spread among five different orbital “shells” at different altitudes and inclinations. SpaceX, founded and led by Elon Musk, has stated it eventually intends to launch as many as 42,000 satellites.

An explosion of private-sector space business—from satellite launches and space shuttles to the quest for mining asteroids and planets—has blurred the line between civilian and military activities, racing ahead of any duly considered global regulation. Dealing with space junk, however, is the most promising area for cooperation. The threat of space debris to all nations’ vital economic and national security assets in space—democracy-autocracy polarization notwithstanding—would, like climate change, seem such an instance.

Last November, Russia shot a missile into space to test its anti-satellite technology to see if it could destroy or incapacitate one of its own orbiting satellites. It did. The U.S. State Department says that missile smashed the Russian spacecraft into 1,500 large pieces and hundreds of thousands of smaller fragments, which resulted in a dangerous cloud of debris. That forced the crew aboard the ISS (International Space Station) to take shelter in their escape pops, SpaceX’s Dragon capsule. The resulting debris passed close to the ISS, but didn’t hit it. The crew was fine, but the incident highlighted just how big of a problem space debris can be.

In mid April, U.S. vice president Kamala Harris said the US would not conduct tests like this and called on other countries to do the same, but that promise won’t reduce the space junk already out there. Missile tests are just one way that space debris is created. Sometimes used rockets and old satellites are intentionally left up in space threatening to hit satellites or space rockets. And the more of it that space junk floating around, the harder it will be to avoid.

The U.S. Department of Defense’s Space Surveillance Network is the premier mechanism for monitoring space junk. Russia has some orbital monitoring capacity, but few other states do. Moreover, in addition to its unrivaled space surveillance capacity to monitor debris, the United States already has Spacing Sharing Agreements with over 100 nations to provide data and notifications to avoid collisions. These are important global public goods that can provide diplomatic leverage for shaping space rules and standards on space debris. The United States had given a heads-up to China about such risks during the Obama administration, according to well-placed sources.

In addition, private sector firms and startups in Japan, the United States, and Europe are devising ways to remove space debris, in what appears to be a coming sector of the space economy. The U.S. Space Force’s technology arm is already exploring the possibility of funding private firms to remove space debris. There are a range of methods of space junk removal being developed from satellite magnets, nets, harpoons, and even spider-like webs. These are all likely future contractors, bearing the risks of research and development.

International cooperation will be needed to effectively clean up space junk. There are only a handful of high-performance space-faring states—the United States, Russia, China, the EU, Japan, and India. As discussed above, the United States is well-positioned as first among equals to launch an ad hoc public-private coalition of space powers partnering with the private sector to pool resources and (non-national security-sensitive) capabilities to better monitor and clean up space debris and seek mutually acceptable codes of conduct and rules for such activities.

Robert Manning and Peter Wilson suggest the methods and procedures should be based an open architecture with adherence to the principle of form follows function: open to emerging space powers—South Korea, Brazil, Israel, and others.

References:

https://www.ucsusa.org/resources/satellite-database

https://nationalinterest.org/feature/coming-anarchy-outer-space-201934

https://arstechnica.com/video/watch/the-space-junk-problem

Synergy Research: public cloud service and infrastructure market hit $126B in 1Q-2022

According to a new report from Synergy Research Group, public cloud service and infrastructure service provider and vendor revenues for the 1st quarter of 2022 reached $126 billion, having grown by 26% (YoY) from the 1st quarter of 2021.

As expected, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud led public cloud service providers (CSPs) in revenue growth. Those three CSPs powered a robust 36% growth rate in the infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) public cloud segments, which hit $44 billion in revenues during the quarter.

In the other main service segments, managed private cloud services, enterprise SaaS and CDN (Content Delivery Networks) added another $54 billion in service revenues, having grown by an average 21% from last year. In order to support both these and other digital services, public cloud providers spent $28 billion on building, leasing and equipping their data center infrastructure, which was up 20% from Q1 of last year. Across the whole public cloud ecosystem, companies that featured the most prominently were Microsoft, Amazon, Salesforce and Google. Other major players included Adobe, Alibaba, Cisco, Dell, Digital Realty, IBM, Inspur, Oracle, SAP and VMware. In aggregate these companies accounted for 60% of all public cloud-related revenues.

Amazon, IBM, and Microsoft led in managed private cloud revenue during the quarter; Microsoft, Salesforce, and Adobe powered similar growth in enterprise software-as-a-service (SaaS) revenues; and Akamai, Amazon, and Cloudflare headed up a 14% increase in content delivery network (CDN) revenues for the quarter. Those three segments in total generated $54 billion in revenues during the first three months of the year.

While cloud markets are growing strongly in all regions of the world, the United States remains a center of gravity. In Q1 it accounted for 44% of all cloud service revenues and 51% of hyperscale data center capacity. Across all service and infrastructure markets, the vast majority of leading players are US companies, with most of the rest being Chinese (e.g. Alibaba, Tencent and Huawei). China accounted for 8% of all Q1 cloud service revenues and 15% of hyperscale data center capacity.

Editor’s Note:

In China, Alibaba Cloud remains the leader with a 37% market share, ranking first in the cloud market in 2021, Huawei Cloud and Tencent Cloud second and third respectively, and Baidu AI cloud fourth. In 2021, the four cloud providers jointly accounted for 80% of the market share.

…………………………………………………………………………………………………………………

“Public cloud-related markets are typically growing at rates ranging from 15% to 40% per year, with PaaS and IaaS leading the charge. Looking out over the next five years the growth rates will inevitably tail off as these markets become ever-more massive, but we are still forecasting annual growth rates that are generally in the 10% to 30% range,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “To enable cloud service markets to keep up with demand by doubling in size in the next 3-4 years, the major cloud providers need an ever larger footprint of hyperscale data centers and more raw computing power, which then drives the markets for data center hardware and software. For sure the competition will be tough, but up and down the cloud ecosystem there will be a bright future for companies that bring the right products to market in a timely fashion.”

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database SIA ™, which enables easy access to complex data sets. Synergy’s Competitive Matrix ™ and CustomView ™ take this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

Synergy Research Group helps marketing and strategic decision makers around the world via its syndicated market research programs and custom consulting projects. For nearly two decades, Synergy has been a trusted source for quantitative research and market intelligence.

References:

https://www.srgresearch.com/articles/public-cloud-ecosystem-quarterly-revenues-leap-26-to-126-billion-in-q1

5G Emerge: ESA & European Broadcast Union agreement for satellite enabled 5G media market

Recently, the European Space Agency (ESA) announced that it will seek to boost the satellite-enabled 5G media market. The ESA signed an agreement to work with the European Broadcast Union – an alliance of public service media organizations – that will enable Europe to gain a lead in media content delivery as well as maintaining its technical autonomy.

The agreement – called 5G Emerge – is a partnership between ESA and the European Broadcast Union, plus 20 companies from Italy, Luxembourg, the Netherlands, Norway, Sweden and Switzerland. Under the agreement, the partners will define, develop and validate an integrated satellite and terrestrial system which will leverage on the structural advantages of satellite-based infrastructures combined with the flexibility of 5G and beyond 5G technologies to reach anyone, anywhere.

The media industry has been quick to embrace 5G technologies, which offer ultra-high-quality videos as well as extra fast games with very low lag times. Telecommunications satellites will play a crucial role in enabling the seamless and ubiquitous connectivity on which 5G and 6G networks rely.

Under the 5G Emerge agreement, the partners will define, develop and validate an integrated satellite and terrestrial system based on open standards [1.] to efficiently deliver high-quality content distribution services. The system will leverage on the structural advantages of satellite-base infrastructures combined with the flexibility of 5G and beyond 5G technologies to reach anyone and anywhere.

Note 1. There are no ITU-R standard or 3GPP approved specs on 5G Satellite RANs- only terrestrial.

The agreement was signed between Antonio Arcidiacono, Director of Technology and Innovation at the European Broadcast Union, Jean-Pierre Choffray of satellite operator SES, Matteo Ainardi of consultants Arthur D Little and Elodie Viau, Director of Telecommunications and Integrated Applications at ESA.

Antonio Arcidiacono said: “Together we will build a solution that combines all satellite and terrestrial IP-based network infrastructures, guaranteeing sustainability and quality of service. It also guarantees that the network will cover 100% of the population, no matter where they are located. This is a critical requirement for public service media organisations.”

Elodie Viau said: “It is crucial for Europe to protect and enhance its autonomy when it comes to media and communications infrastructure. The 5G-Emerge project will support the digital transformation of European society, enabling new applications and services.”

References:

Altice Portugal MEO signs landing party agreement for Medusa subsea cable in Lisbon

The Medusa cable system now has its landing station in Portugal confirmed. They have signed a memorandum of understanding (MoU) with Altice Portugal’s MEO [1.] for a CLS in Carcavelos near Lisbon. MEO will provide the ducts from the beach into the cable landing station as well as the necessary space, power, operations, maintenance, and connectivity on to international connection points. As currently envisioned, MEDUSA will consist of 24 fiber pairs through the Mediterranean, connecting both east to west and north to south.

Note 1. MEO is a mobile and fixed telecommunications service and brand from Altice Portugal (formerly Portugal Telecom), managed by MEO – Serviços de Comunicações e Multimédia. The service was piloted in Lisbon in 2006 and was later extended to Porto and Castelo Branco.

……………………………………………………………………………………………………………………………………………

“The Portuguese coast has always been strategic to generate connections, as it is the gateway to the Atlantic and West Africa,” said Norman Albi, managing director and CEO of AFR-IX telecom, the company sponsoring Medusa.

“It was decisive for Medusa that the start of its route was Portuguese and Carcavelos offers optimal conditions for this.”

The agreement was signed during the Subsea World 2022 in Marseille by Albi, managing director joined by Alexander Freese, COO of Altice Portugal.

Under the terms of the agreement, Altice Portugal (MEO) will provide landing services for the cable system, which includes ducts from the beach to the cable landing station (CLS), space and power at the CLS, operation and maintenance services, as well as connectivity between the CLS and other international connection points, namely data centres, other subsea cable stations and teleports.

“Altice Portugal, as the leader of the communications sector in Portugal, is proud to help create a gateway to Europe of such relevant assets in the communications sector as Medusa, also reinforcing its commitment to the global economy,” added Freese.

The Carcavelos landing station will serve as the western point of the 8,700+km Medusa cable system, connecting 9 countries in Africa and Europe through its landing points in Portugal, Morocco, Spain, France, Algeria, Tunisia, Italy, Greece, Egypt and Cyprus.

Speaking to Capacity during the event, Albi explained that the collaboration was a continuation of long-standing working partnership between the two companies.

“As AFR-IX we have a long story of collaboration with MEO Altice Portugal for many years and that will only continue,” he said.

“So, when we were looking for a landing location in Lisbon, we selected Carcavelos for many several but the main one was because of its close to data centres and has a lot of longstanding infrastructure managed by MEO Altice for many years, backed by solid know-how to manage a subsea cable.”

Freese echoed these sentiments, saying: “As Norman said, we’ve had this partnership for years, we know each other, we trust each other and we’re very happy to have been chosen as partners again for this ambitious project.”

With an investment value of €326 million, the Medusa cable, which will be built by Alcatel Submarine Networks (ASN), will boast segments of up to 24 fibre pairs with a total design capacity of 20Tbs per fibre pair.

The benefits of landing in Lisbon are clear to Albi and the AFR-IX team, “to have Lisbon, is a gateway to the Mediterranean. All the cables that land there, either go North but also with the Medusa creates the possibility to interconnect Lisbon with Marseille, Africa etc or even to the other side of the Med through the various landing points of the system. With MEO Altice, who is the main landing operator in Lisbon, the opportunities are all there.”

“We also have some customers on the West African coast they want to reach Europe,” adds Freese. “And now we have a diverse route adding to the Lisbon gateway so they can reach places like London, Paris and Marseille or even to Barcelona, so its definitely a benefit to both of us.”

The collaboration will enable the first segment of the cable linking the cities of Cascais-Lisbon, through the Carcavelos landing station, Barcelona and Marseille to be delivered, with the cable due to reach Carcavelos in Q2 of 2024.

With permitting already underway and steps being taken to finalise this in Carcavelos, Albi says the next step is the project survey which he expects “before the end of this year” starting in Carcavelos towards the Med.

With much talk during the conference of Portugal as one of the next big subsea cable hubs, Capacity asked Freese if sees it going that way as well, he said: “we’re certainly seeing a lot of activity and new cables coming in there. Its growing a lot”, so watch this space.

References:

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

China Mobile, the world’s largest telecom carrier by mobile subscribers, unveiled its overall architecture design for 6G in a white paper on Tuesday, as it steps up its push into research and development of the next-generation wireless technology. China Mobile’s 6G network architecture is claimed to be the first systematic 6G architecture design in the telecom industry, according to the company. However, state owned China Unicom published a similar white paper for 6G tech in April 2021.

China Mobile’s 6G architecture is based on both a systems design and networking design of architecture implementation. The “White Paper” proposes a three-body, four-layer and five-sided 6G overall architecture design, which is the industry’s first systematic 6G network architecture design. Among them, the “three bodies” are the network ontology, the management orchestration body, and the digital twin; the “four layers” are the resource and computing power layer, the routing and connection layer, the service-oriented function layer, and the open enabling layer, and the “five layers” are the control layer. face, user face, data face, intelligent face, security face. On this basis, the “White Paper” also proposes that a virtual twin should be created digitally to realize a digital twin network architecture with network closed-loop control and full life cycle management; so as to realize plug-and-play, flexible deployment and other characteristics of the network architecture. Distributed homemade network.

The 6G architecture creates a virtual twin through digital means to realize a digital twin network architecture (DTN) with network closed-loop control and full lifecycle management; The service defines the end-to-end system to realize the full service system architecture (HSBA); In the group network, the distributed autonomous network (Dan) with distributed, autonomous and self-contained features is implemented, which supports on-demand customization, plug and play and flexible deployment.

According to the latest data, the total number of China Mobile customers has reached 967 million, with a net increase of 202,000 this month and a cumulative net increase of 9.706 million this year. The cumulative number of China Mobile’s “5G package users” has reached 4.95 million. Note that the “5G package” statistic counts those on 5G plans who have NOT yet upgraded to 5G service. The three state owned operators reported a total of 899.3 million subs at end-May. They have added 241 million since the start of the year and at this rate will run down the 1 billion mark themselves by the middle of August. But the real number of 5G users is just over half that – 410 million, according to the MIIT. That’s up from 355 million in December and, taking into account the debut of the fourth operator, China Broadcast Network, as early as this month, China’s total should easily pass 460 million by the end of the year.

References:

https://equalocean.com/briefing/20220621230145638

The first in the industry!China Mobile released the overall architecture design of 6G network

Dell’Oro: Small Cells Still Growing Faster Than Macro RAN in 1Q 2022

Dell’Oro Group says the demand for small cells remains strong. Preliminary findings suggest small cell radio access network (RAN) revenues advanced 15% year-over-year in the first quarter, growing at a faster pace than the broader small cell plus macro RAN market.

“The fact that small cell investments are still advancing at a rapid pace even as the operators are intensifying their 5G macro roll out efforts show that small cells are now an essential part of the broader RAN toolkit,” said Stefan Pongratz, Vice President at Dell’Oro Group. “Helping to explain this output acceleration is the shift towards 5G and the shrinking gap between macro and small cell deployments, especially with upper mid-band 5G,” continued Pongratz.

Additional small cell highlights from the 1Q 2022 RAN report:

- Top 5 suppliers in the quarter include Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Nearly all the small cell growth is driven by public 5G – small cell LTE revenues declined in the quarter and private 5G small cell investments are still negligible.

- Global small cell RAN revenues remain on track to surpass $5 B in 2022.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-6 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, enterprise networks, data center infrastructure, and network security markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

Small Cells Still Growing Faster Than Macro RAN in 1Q 2022, According to Dell’Oro Group

AT&T introduces 5G Flying COWs (Cell on Wings) drones

AT&T has announced it is introducing a drone-based 5G network. The drones, named 5G Flying COWs (Cell on Wings), are the first of their kind to provide 5G network speeds, although similar technology has been used for years to provide LTE coverage.

According to Ethan Hunt, AT&T Unmanned Aircraft Systems principal program manager, the Flying Cows can transmit strong coverage up to approximately 10 sq miles (16 sq km).

“We had intermittent, weak LTE signal at the flight location before we launched the 5G Flying COW,” he said of the test flight in Missouri that happened in April.

In other words, those in the area attempting to stream video could have found they suddenly had access to 5G speeds where they previously did not.

That means, customers with a capable 5G phone in the area could have gone from no service to super-fast wireless connections in seconds. In the future, this could help first responders in a search and rescue mission.

“Drones may use 5G for command and control or to stream video, but the AT&T 5G Flying COW® is the only drone that provides a 5G network,” Ethan said.

Getting 5G into remote areas is notoriously difficult. Dependent on very densely deployed small cells, 5G coverage outside towns is expensive; infrastructure needs are immense and its reach is limited to devices in close proximity of towers. Flying COWs could provide a solution to this issue, and could also be a huge help to first responders in search and rescue missions.

AT&T has been using this technology for years to provide LTE coverage to customers during big events, such as this year’s Super Bowl and disasters. While other companies may use 5G signals to communicate with drones, the Flying COW will act as a cell site actually located on a drone.

Art Pregler, Unmanned Aircraft Systems program director at AT&T, said of the project: “We are currently working through many exciting technical challenges to expand the capabilities of our Flying COWs. We’re working to autonomously fly without tethers for months without landing, using solar power to provide secure, reliable, and fast 5G connectivity to large numbers of users over wide geographic areas. This solution may one day help bring broadband connectivity to rural and other underserved communities across the US and elsewhere.”

“Our focus within the drone world is connectivity. All of our drone solutions have that focus,” said Art “5G brings a lot of new capability to the table. We can connect a lot larger number of devices with 5G. When we put that up, we can share with a larger population.”

That, in turn, can lead to a more seamless experience, better network performance and an overall better experience. “It’s enabling a lot more solutions, including human-to-machine interface that are now capable that wasn’t previously possible,” Pregler said.

………………………………………………………………………………………………

This launch is just one of several ground-breaking AT&T drone projects in the works right now.

- Beyond Visual Line of Sight (BVLOS) flight operations, GEOCAST air operations

- The Drone team is testing BVLOS – which would allow the pilot to operate a drone from a completely different location. We currently have an AT&T-patented flight control system that allows our operators and our tethered Flying COWs® to be separated by thousands of miles. In this sense, we can already operate our tethered Flying COWs® BVLOS. We are also working on a next phase to launch untethered Flying COWs® from the operator’s location to fly many miles away to provide 5G connectivity at BVLOS locations.

- RoboDogs

- We are building a litter of “RoboDogs” that can be used for a number of situations, from search and rescue to bomb disablement. Our teams are constantly working to improve connectivity for these devices, including outfitting them with 5G technology.

………………………………………………………………………………………………………………………………………………..

References:

https://about.att.com/story/2022/5G-drone-program.html

https://www.datacenterdynamics.com/en/news/att-introduces-drone-transmitted-5g-network/

AT&T CFO sees inflation as main threat, but profits and margins to expand in 2nd half 2022

U.S. utility operators see a bright future in fiber broadband

Leaders from three rural utility providers discussed their expansions into deploying fiber and how their organizations are getting involved with delivering broadband on a webinar hosted last week by the Fiber Broadband Association, In Holland, Michigan, for example, the Holland Board of Public Works (HBPW) started building fiber 30 years ago for “enhanced connectivity for monitoring and control” to its systems, said Pete Hoffswell, superintendent of broadband services at HBPW, which operates a power plant, water treatment plant and water reclamation plant.

“Fiber is absolutely essential for very reliable, high-performance connectivity for all that equipment,” said Hoffswell. “If we lose contact with one of our substations and the power goes down, that’s a bad day in our town. And fiber helps us keep that up.”

Katie Espeseth, vice president of new products at EPB, a municipally owned electric power distributor in Chattanooga, Tennessee, that started delivering fiber in 2008 and today has roughly 11,000 miles of fiber deployed, shared Hoffswell’s sentiment and added a number to it. “We have about 11,000 miles of fiber in our footprint. We serve about 125,000 customers with our broadband services,” said EPB’s Espeseth.

“The cost of power outages in Chattanooga was nearly $100 million a year,” she said, referring to costs to the community (“the cash register or the point of sale terminals not working and that sort of thing,” she explained). Today, the fiber network has reduced power outages by 65% and outage minutes by 52%, which the utility estimates as a $50 million return to the community, she added.

“A lot of our local offices are relying on the local Internet. And so the systems that we have, from a corporate standpoint, some of our field engineers can’t even run those systems because the Internet connection in those local areas is so poor,” he said. “It’s significant to know that you do not have a limitation from a communication standpoint.”

EPB, Alabama Power and HBPW, which all began deploying fiber to support their power grids, have each expanded into delivering fiber broadband either directly or indirectly. EPB – which turned Chattanooga into “the first gigabit community in the world,” according to Gary Bolton, CEO of the Fiber Broadband Association – operates its own ISP called Fi-Speed. Today, Fi-Speed delivers residential service speeds of 300 Mbit/s, 1 Gbit/sec and 10 Gbit/sec.

In Michigan, Holland BPW delivers fiber to local businesses, municipalities and community institutions and works in partnership with six ISPs: 123.net, Everstream, Sirus, Merit Network, US Signal and The ISERV Group.

“When we started the fiber, we decided any excess capacity in our network would be made available to our community,” said HBPW’s Hoffswell. “We did that and have provided lit services and dark fiber services to our greater community for 30 years now.”

Similar to HBPW, Alabama Power started its fiber build 30 years ago but did not expand into fiber distribution until “three or four years ago,” said Stegall. Rather than looking to serve as an ISP (“that’s outside of our scope,” he said), Alabama Power is delivering middle mile fiber and currently has service provider partnerships in seven of the 14 markets where its fiber distribution networks are active.

“The other seven are in more rural areas and [it is] harder to find those partners,” Stegall said. “So, we’re very interested and excited to see what the infrastructure bill is going to do in terms of enabling business cases for some areas that did not have traditional telecom business cases.”

Service and infrastructure ‘decoupling’

Indeed, the multi-billion-dollar broadband grant programs in the Biden administration’s infrastructure law specifically reference electric utilities’ role in the future of fiber and broadband delivery.

The $1 billion middle mile program calls out “electric utilities that increasingly recognize their capability to transform the communications market.” And the $42.45 billion Broadband, Equity, Access and Deployment (BEAD) grant program names electric utilities among the “non-traditional providers” as eligible subgrantees and encourages funding open access networks.

That push toward funding open access networks, and recognizing electric utilities and cooperatives as well placed to close broadband infrastructure gaps in the rural US, is enabling new business and delivery models.

In Arkansas, for example, a group of 13 electric co-ops has recently banded together to form Diamond State Networks, a wholesale fiber network, to deliver broadband across the state.

Conexon, a consultancy that works with electric co-ops on fiber delivery, is another example; its newer ISP arm Conexon Connect operates broadband services for electric co-ops that don’t want to take on the role of service provider. (“We help people design and build networks, and we are interested – when an electric co-op is not – in operating the network,” Jonathan Chambers, partner at Conexon, told Broadband World News.)

Alabama Power’s Stegall expects the federal government’s focus on open access to push more utility providers that were previously hesitant to compete with service providers into delivering fiber infrastructure. “What I see in a sense is the decoupling of an infrastructure play and a services play. It’s the future,” he said.

References:

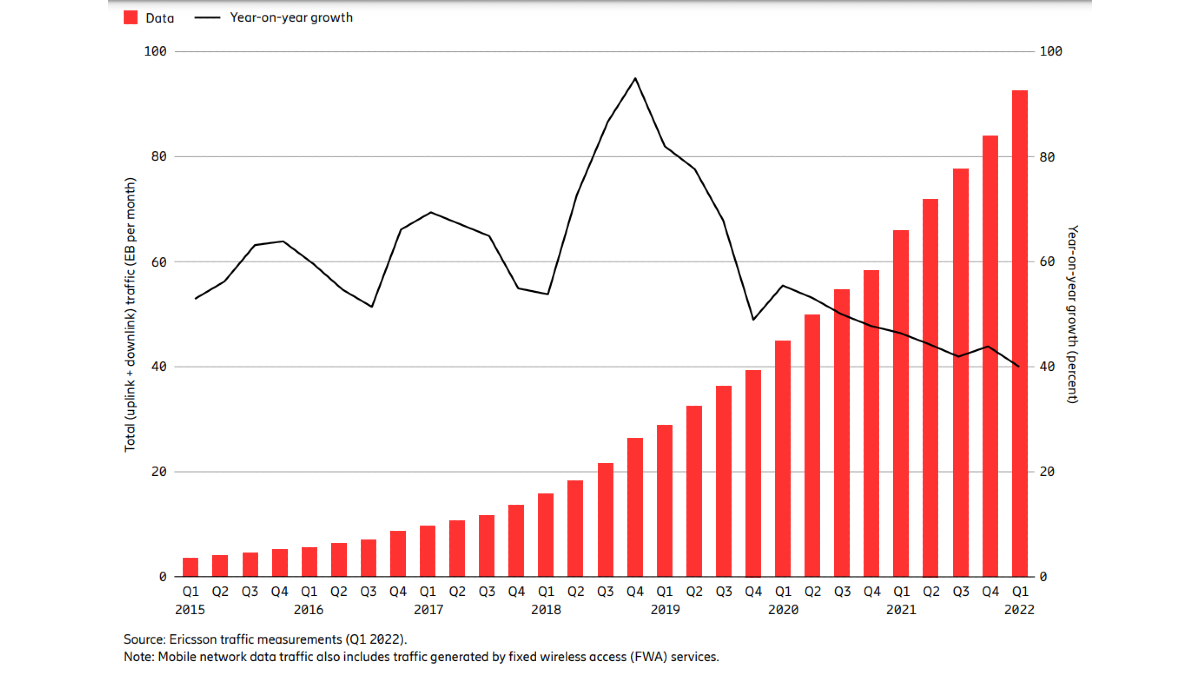

June 2022 Ericsson Mobility Report: 5G subscriptions increased by 70 million in Q1-2022 to reach 620 million

Ericsson new Mobility Report [1.] states that mobile network data traffic grew 10% between the 4th quarter of 2021 and the 1st quarter of 2022. For the year-over-year comparison, growth reached 40%. “In absolute numbers, this means that it has doubled in just two years (since Q1 2020),” the company wrote in its Mobility Report, released June 20th. “Over the long term, traffic growth is driven by both the rising number of smartphone subscriptions and an increasing average data volume per subscription, fueled primarily by increased viewing of video content,” the company added.

The figures are important considering that mobile network operators are rushing to add new spectrum to their networks while upgrading their networks to support 5G, especially 5G SA Core Network. Purchasing both spectrum and 5G equipment is expensive. In the US, for example, mobile network operators are collectively spending an estimated $275 billion to improve their networks with more spectrum, cell sites and 5G.

Note 1. The Ericsson Mobility Report started in 2011, when Ericsson decided to share data and insights openly to all those interested in understanding our industry’s development. Since then, the report and featured articles have seen a continuous evolution and an expanding scope.

………………………………………………………………………………………………………………………………………………………………………………………………………….

Speaking during a webinar to discuss the report’s findings, Richard Möller, senior market analyst at Ericsson, noted that the number of 5G subscribers worldwide had been expected to reach 660 million by the end of 2021. It now seems that the figure was less than forecast: Ericsson is now saying that 5G subscriptions increased by 70 million in Q1 2022 to reach 620 million. The 40 million shortfall is due to changes in how China’s mobile operators are reporting their 5G subscriber figures. Indeed, it has become noticeable over the past year that the Chinese operators are starting to split out “5G package customers” from actual 5G network customers.

“Now we have official numbers and we’ve adjusted our estimates accordingly,” Möller said. “China is early and so large that it affects the global number.” He noted that this adjustment does not “materially affect” the five-year growth forecast. Ericsson is therefore sticking to its estimate of 4.4 billion 5G subscribers by the end of 2027, meaning that 5G will account for almost half of all mobile subscriptions by that point. 5G subscriber growth is expected to accelerate in 2022, reaching around one billion subscribers by the end of the year. The report noted that North America and North East Asia currently have the highest 5G subscription penetration, followed by the Gulf Cooperation Council countries and Western Europe. In 2027, it is projected that North America will have the highest 5G penetration at 90%. In India, where 5G deployments have yet to begin, 5G is expected to account for nearly 40% of all subscriptions by 2027.

At the same time, Möller warned that the war in Ukraine, supply chain constraints and rising inflation will affect future growth. “That’s made us take 100 million subscriptions off the current forecast. However, history has shown that mobile telephony is one of the things that people hang on to … even if the economic world turns negative,” he said.

The report’s executive editor Peter Jonsson said the current uncertainties mean that Ericsson has to be especially careful with its forecasts. However, he reiterated the point that global 5G uptake “is about two years ahead of 4G” on a comparative basis. In addition, 5G rollout “reached 25% of the world’s population about 18 months faster than 4G.”

Global mobile network data traffic and year-over-year growth:

According to Ericsson, mobile subscribers are making use of the additional network capacity and faster speeds provided by those investments. The company said that, globally, the average smartphone user is expected to consume 15GB per month in 2022. Indeed, the 5G share of mobile data traffic is growing, but not as fast as FWA (3G/4G/5G). Continued strong smartphone adoption and video consumption are driving up mobile data traffic, with 5G accounting for around 10 percent of the total in 2021.

In North America, the company estimated that average monthly mobile data usage per smartphone could reach as high as 52GB in 2027. “The data traffic generated per minute of use will increase significantly in line with the expected uptake of new XR and video-based apps,” the company wrote. “This is due to higher video resolutions, increased uplink traffic, and more data from devices off-loaded to cloud compute resources.”

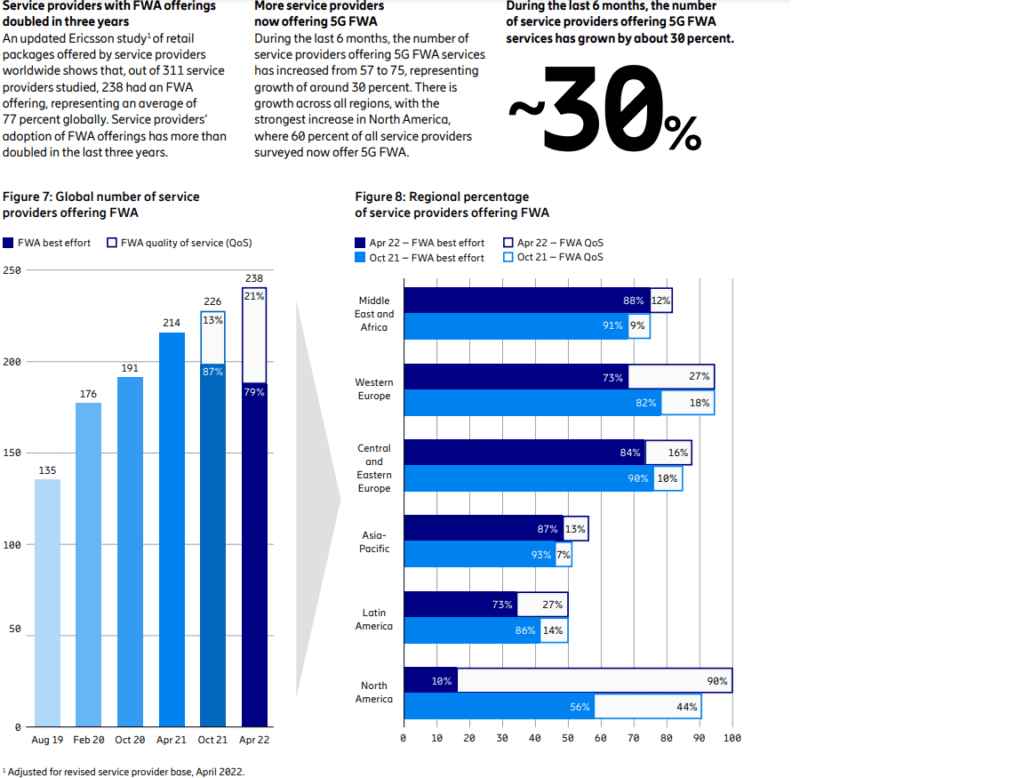

Also, Fixed Wireless Access (FWA) in on the rise as per this graphic:

Over 100 million FWA connections in 2022:

More than 75 percent of service providers surveyed in over 100 countries are offering fixed wireless access (FWA) services. Around 20 percent of these service providers apply differential pricing with speed-based tariff plans.

OpenVault, another vendor that tracks data traffic on wired networks in North America, recently reported similar findings. According to OpenVault, the average wired Internet customer consumed a total of 536.3GB in the fourth quarter of 2021, an increase of 165% over the firm’s findings from the fourth quarter of 2017, when consumption was 202.6GB.

Taken together, the companies’ findings paint a picture of a dramatic expansion in data demand on wired and wireless networks in North America and globally. Indeed, such increases have already sparked unprecedented demand in vendors’ networking equipment to keep pace with demands. Further, such demand has already withstood several price increases among many leading vendors.

The situation reflects the importance of telecom networks globally following a pandemic that pushed many to work and school remotely from home. And in response to the situation, governments globally have begun pushing network operators to construct networks in underserved areas, and to Internet users themselves who may struggle to afford such connections.

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report

https://www.lightreading.com/5g/china-effect-dampens-interim-5g-subs-says-ericsson/d/d-id/778394?

https://www.ctia.org/the-wireless-industry/the-5g-economy

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

https://viodi.com/2020/05/05/openvault-broadband-usage-47-in-q1-2020-power-users-are-the-new-normal/